UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_______________

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. )

_______________

| | |

Filed by the Registrant þ |

|

Filed by a party other than the Registrant o |

|

| Check the appropriate box: |

|

o Preliminary Proxy Statement |

|

o Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

þ Definitive Proxy Statement |

|

o Definitive Additional Materials |

|

o Soliciting Materials under §240.14a-12 |

|

| | |

| SYNOVUS FINANCIAL CORP. |

| (Name of Registrant as Specified In Its Charter) |

|

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check all boxes that apply): | | | | | |

þ No fee required |

| |

o Fee paid previously with preliminary materials |

| |

o Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

| |

March 12, 2024

Dear Fellow Shareholder:

On behalf of the Board of Directors, we are pleased to cordially invite you to attend the 2024 Annual Meeting of Shareholders of Synovus Financial Corp. at 10:00 a.m. on Wednesday, April 24, 2024. You are receiving this invitation and this Proxy Statement as a shareholder of record as of February 22, 2024.

This meeting will be completely virtual, conducted via live webcast. You will be able to attend the Annual Meeting online, vote your shares electronically, and submit questions during the meeting by visiting www.virtualshareholdermeeting.com/SNV2024. Details regarding how to attend the meeting online and the business to be conducted are more fully described in the accompanying Notice of the 2024 Annual Meeting of Shareholders.

We entered 2023 stronger and more efficient, eager to expand on our success in 2022 and to continue to focus on broad-based growth and performance. The year brought a host of external developments and challenges - from continued economic uncertainty and inflationary pressures to unexpected industry volatility resulting from several U.S. bank failures in the first half of the year. Despite these pressures, we remained focused on the execution of our strategic plan while growing total deposits, accessing contingent liquidity sources out of an abundance of caution, maintaining overall credit vigilance, enhancing industry and sector monitoring, and optimizing capital management. We also continued to invest in key client-benefiting growth initiatives related to commercial banking, wealth services, and expanded our capabilities related to banking-as-a-service, automation, digital, and analytics. While we are aware of the here and now, we remain committed to balancing temporary industry and economic disruptions with investing in the long-term success of our company.

Our Board works diligently to oversee the development and execution of Synovus’ strategy and to align decisions accordingly. Further, our Board actively and regularly engages with the management team and conducts robust oversight of the Company through the Audit, Compensation and Human Capital, Corporate Governance and Nominating, and Risk Committees, enhancing our commitment to corporate governance transparency. Our Board represents a wide range of backgrounds, experiences, and perspectives, and this diversity enables our directors to contribute ongoing value to the Company and our shareholders. The trust and relationship between our Board and company leadership is strong, and we are unwavering in our commitment to ensuring long-term Board composition that is centered on engagement, oversight, and independence and that appropriately reflects our stakeholders.

Finally, as we execute on our strategic line of business initiatives, we consider our long-standing commitment to responsible corporate citizenship to be fundamental to our long-term growth and to fulfilling our purpose in every area and with every constituency we serve. We continued making impactful workforce investments and meaningful contributions to our communities and practicing good environmental stewardship and strong governance of our business. The external landscape may be dynamic in many respects, but we remain steadfast in our 135-plus year commitment of doing the right thing for our stakeholders and shareholders. To learn more about these efforts, please visit www.synovus.com/ESG.

Once again, we are providing proxy materials to our shareholders primarily through the Internet. We believe this process contributes to our efficiency and sustainability efforts while offering our shareholders a convenient way to access important information about the matters on which we will vote at our Annual Meeting.

Your vote is important to us. Even if you plan to attend the meeting virtually, we encourage you to vote your shares in advance by following the voting instructions provided.

Thank you for your continued support of Synovus.

Sincerely,

| | | | | | | | | | | | | | | | | | | | |

| | Kevin S. Blair Chairman of the Board, Chief Executive Officer, and President | | | |  Tim E. Bentsen Tim E. BentsenLead Director |

Notice of the 2024 Annual Meeting of Shareholders

Wednesday, April 24, 2024

10:00 a.m.

www.virtualshareholdermeeting.com/SNV2024

Items of Business:

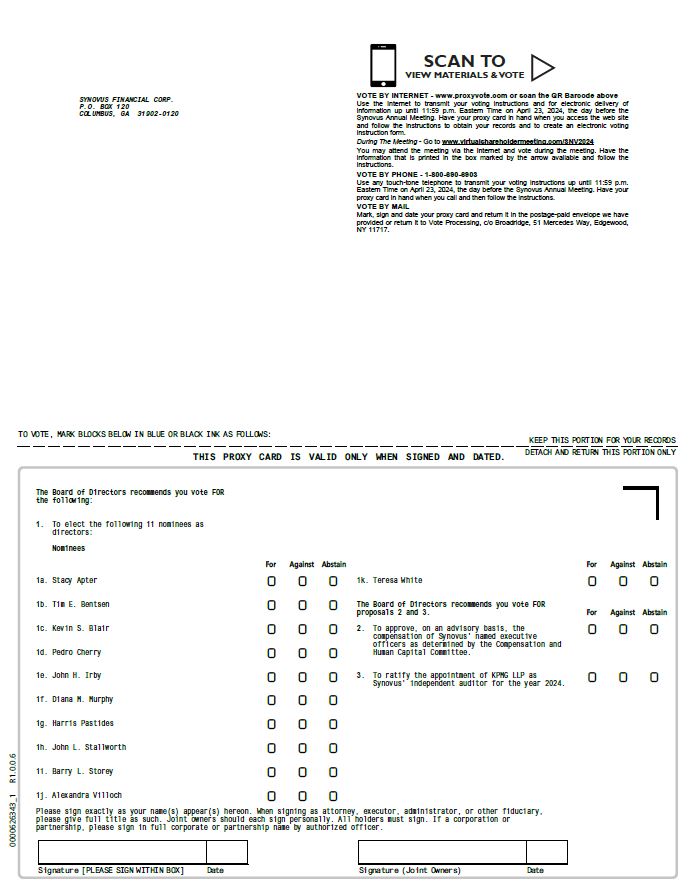

1.To elect as directors the 11 nominees named in this Proxy Statement;

2.To hold an advisory vote on the compensation of Synovus’ named executive officers as determined by the Compensation and Human Capital Committee;

3.To ratify the appointment of KPMG LLP as Synovus’ independent auditor for the year 2024; and

4.To transact such other business as may properly come before the meeting and any adjournment thereof.

Who may vote:

You can vote if you were a shareholder of record on February 22, 2024.

Annual Report:

A copy of the 2023 Annual Report accompanies this Proxy Statement.

Virtual Event:

We will host the 2024 Annual Meeting of Shareholders, or the Annual Meeting, via webcast. If you were a shareholder of record on February 22, 2024, or you hold a valid proxy for the Annual Meeting, you may attend virtually at www.virtualshareholdermeeting.com/SNV2024 and vote online at the Annual Meeting. Detailed instructions on how to attend and participate via the Internet are provided below.

Your vote is important. Please vote in one of the following ways:

1.Call 1-800-690-6903 and follow the recorded instructions. You will need to enter the 16-digit control number that appears on your proxy card;

2.Visit www.proxyvote.com and enter the 16-digit control number that appears on your proxy card;

3.Mark, sign, date, and promptly return the enclosed proxy card in the postage-paid envelope provided; or

4.Vote at the meeting by visiting www.virtualshareholdermeeting.com/SNV2024 and entering the 16-digit control number that appears on your proxy card, your Notice of Internet Availability, or the instructions included with your proxy materials.

This Notice of the 2024 Annual Meeting of Shareholders and the accompanying Proxy Statement are sent by order of the Board of Directors.

March 12, 2024

Mary Maurice Young

Secretary

YOUR VOTE IS IMPORTANT. WHETHER YOU PLAN TO ATTEND THE ANNUAL MEETING VIRTUALLY, PLEASE VOTE YOUR SHARES PROMPTLY BY TELEPHONE OR INTERNET OR BY SIGNING AND RETURNING YOUR EXECUTED PROXY CARD.

TABLE OF CONTENTS

PROXY STATEMENT SUMMARY

This summary highlights information contained elsewhere in this Proxy Statement and in our Annual Report on Form 10-K for the year ended December 31, 2023 (the “2023 Annual Report”) which accompanies this Proxy Statement. You should read the entire Proxy Statement and our 2023 Annual Report carefully before voting. We are first furnishing the proxy materials to our shareholders on or about March 12, 2024. In this Proxy Statement, the words “Synovus,” “the Company,” “we,” “us,” and “our” refer to Synovus Financial Corp., together with Synovus Bank and Synovus’ other wholly-owned subsidiaries, except where the context requires otherwise.

| | |

| Annual Meeting of Shareholders |

•Time and Date: 10:00 a.m. on Wednesday, April 24, 2024

•Location: Virtual format only via www.virtualshareholdermeeting.com/SNV2024

•Record Date: February 22, 2024

•Voting: Shareholders as of the record date are entitled to vote

You can vote by any of the following methods:

•Call 1-800-690-6903 and follow the recorded instructions. You will need to enter the 16-digit control number that appears on your proxy card;

•Visit www.proxyvote.com and enter the 16-digit control number that appears on your proxy card;

•Mark, sign, date, and promptly return the enclosed proxy card in the postage-paid envelope provided; or

•Vote at the meeting by visiting www.virtualshareholdermeeting.com/SNV2024 and entering the 16-digit control number that appears on your proxy card, your Notice of Internet Availability, or the instructions included with your proxy materials.

| | |

| How to Participate in the Virtual Annual Meeting |

•If you were a shareholder of record as of February 22, 2024, or if you hold a legal proxy or broker’s proxy card for the Annual Meeting provided by your bank, broker, or nominee, you can attend virtually, vote, and submit questions at the Annual Meeting. To attend virtually and participate in the Annual Meeting as a shareholder, go to www.virtualshareholdermeeting.com/SNV2024 and, when prompted, enter the 16-digit control number that appears on your proxy card, your Notice of Internet Availability, or the instructions included with your proxy materials. Once you are admitted to the meeting as a shareholder, you may vote during the Annual Meeting and also submit questions by following the instructions available on the virtual meeting website during the meeting. We encourage you to log into this website and access the virtual meeting at least 15 minutes before the start of the meeting.

•Those without a 16-digit control number may attend virtually the 2024 Annual Meeting as guests, but they will not have the option to vote shares or submit questions during the virtual meeting. Go to www.virtualshareholdermeeting.com/SNV2024 and, when prompted, register as a guest in order to listen to the meeting.

•Election of 11 directors;

•Advisory vote on the compensation of our named executive officers as determined by the Compensation and Human Capital Committee;

•Ratification of KPMG LLP, or KPMG, as our independent auditor for the year 2024; and

•Transaction of such other business as may properly come before the meeting.

| | | | | | | | |

| Matter | Board Vote Recommendation | Page Reference (for more information) |

| FOR each director nominee | Page 20 |

| FOR | Page 26 |

| FOR | Page 27 |

| | |

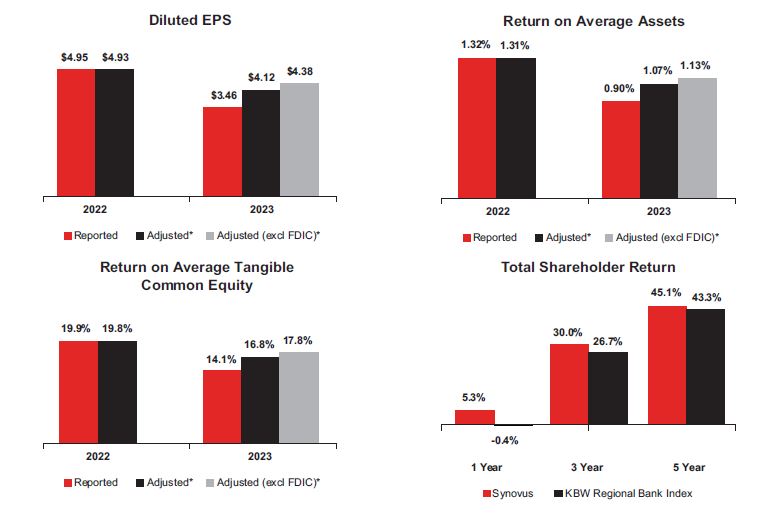

| 2023 Financial Performance |

Synovus exhibited solid financial performance against a challenging industry environment in 2023. Bank failures and continued increases in short-term interest rates helped to drive more deposit competition, which resulted in a year-over-year decline in net interest income. However, despite these industry-wide headwinds, revenue increased 1%, while adjusted revenue* increased 3%. Our efficiency ratio-taxable equivalent of 60.01% was impacted by a FDIC special assessment, realized losses on strategic loan sales, and one-time restructuring charges associated with a voluntary early retirement program. Excluding the FDIC special assessment, our adjusted tangible efficiency ratio* of 52.70% reflects disciplined expense management.

Reported non-interest revenue declined 1%, but adjusted non-interest revenue* increased 11% on a year-over-year basis, primarily driven by continued growth in wealth management revenue as well as treasury and payments solutions-related revenue.

We executed disciplined expense management throughout the year while continuing to invest in key areas to grow the bank. We divested our asset management firm GLOBALT and sold our medical office buildings and third-party automobile loan portfolios, which improved key risk, capital, and liquidity metrics and provided expense and capital capacity to redeploy to higher return opportunities.

The overall increase in the provision for credit losses was the predominant driver of the year-over-year decline in earnings per share, or EPS. The increase in provision in 2023 was driven by higher levels of charge-offs and a nine basis point increase in our allowance for credit losses, or ACL.

We increased our common equity tier 1 capital, or CET1, ratio by 59 basis points and ended the year at 10.22%, while also improving our overall liquidity profile as reflected in both our reduced level of wholesale borrowings and overall increase in contingent liquidity. We believe our capital and liquidity positions, along with our strong earnings potential, positions us well to execute on our strategic growth initiatives.

The following metrics are used in the short- and long-term incentives detailed further in the Proxy Statement. Metrics are shown excluding the FDIC special assessment in the fourth quarter for comparative purposes.

* For a reconciliation of the foregoing non-GAAP financial measures to the most comparable GAAP measures, please refer to Appendix B of this Proxy Statement.

For additional information relating to our business and our subsidiaries, including a detailed description of our operating results and financial condition for 2023 and 2022, please refer to the summary on page 33 of this Proxy Statement and our 2023 Annual Report that accompanies this Proxy Statement.

Despite continued environmental pressures around inflation and interest rates in 2023, as compounded by the bank failures in the first half of 2023, we continued to perform well across key profitability metrics and continued to execute on our corporate and individual performance goals.

Base Salaries

Kevin S. Blair, our Chairman of the Board, Chief Executive Officer, and President, received a 5% base salary increase to $1,025,000, effective March 5, 2023, based upon the Compensation and Human Capital Committee’s review of market comparisons of compensation levels among CEOs at peer companies. The Compensation and Human Capital Committee also reviewed market comparisons for other executives and recognized that some base salaries for other named executive officers were below the market median. As a result, Andrew J. Gregory, Jr., Kevin J. Howard, D. Zachary Bishop, and D. Wayne Akins, Jr. received base salary increases of 4%, 10%, 5%, and 10%, respectively, effective March 5, 2023.

Short-Term Incentives

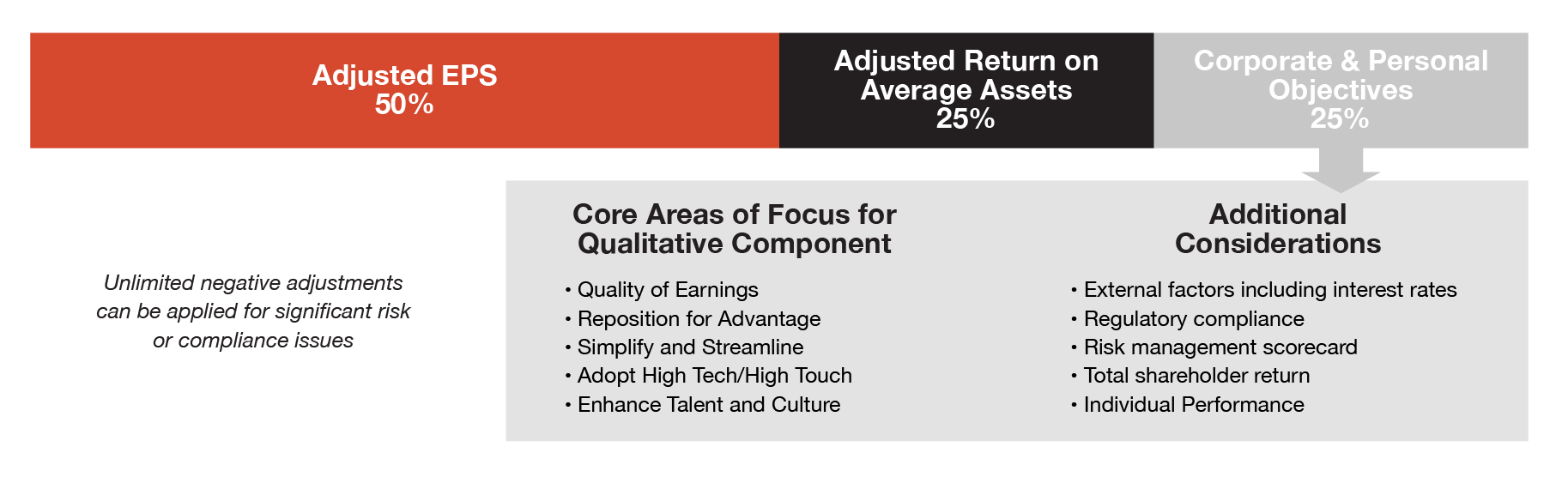

•Consistent with prior years, our annual incentive plan included a combination of financial and corporate and personal objectives. For 2023, the Compensation and Human Capital Committee established financial goals for adjusted EPS and adjusted return on average assets, or adjusted ROAA, as well as a component based on corporate and personal objectives.

•The following chart summarizes the provisions of our short-term award incentive plan for 2023:

| | | | | | | | |

| Form of Award | Measures and Weightings | Payout Features |

| Cash | Adjusted EPS (50%)

Adjusted ROAA (25%)

Corporate and Personal Objectives (25%) | Payouts from 0% to 175% of target based upon adjusted EPS, adjusted ROAA, and performance on corporate and personal objectives |

In 2023, for purposes of the short-term incentive plan, each of adjusted EPS and adjusted ROAA excluded the FDIC special assessment.

•Our 2023 adjusted EPS and adjusted ROAA results under the annual incentive plan were between the threshold and target goals established by the Compensation and Human Capital Committee. The Compensation and Human Capital Committee assessed performance on the corporate and personal objectives as being above target. Based on these results and the Compensation and Human Capital Committee’s review of individual performance, the Compensation and Human Capital Committee approved payouts of 85% to 95% of target for the named executive officers. For more information regarding the Compensation and Human Capital Committee’s annual incentive determination, including details on its review of the corporate and personal objectives component, please see “Payout Determination” on page 40 of this Proxy Statement.

Long-Term Incentives

•Our long-term incentive program for executive officers is comprised of two equity vehicles which link our executives’ compensation to performance results: performance stock units, or PSUs, and restricted stock units, or RSUs. The following chart summarizes the key provisions of our long-term grants made in 2023:

| | | | | | | | | | | | | | |

Form of Award | | Vesting | | Payout Features |

| PSUs (60% of ongoing annual award value) | | 100% after 3 years | | Payouts from 0% to 150% of target based upon weighted return on average tangible common equity (as adjusted) and relative total shareholder return |

| RSUs (40% of ongoing annual award value) | | ⅓ per year over 3 years (33⅓% per year) | | Time-based vesting based upon continued employment with Synovus |

The PSU awards are subject to possible downward discretionary adjustment based upon risk considerations—see page 41 of this Proxy Statement. The PSUs and RSUs are also subject to the Company’s mandatory and discretionary clawback policies.

Because of our stock ownership guidelines, executive officers hold a meaningful amount of Synovus common stock, further aligning their interests with shareholders’ interests.

We believe that the compensation delivered to each named executive officer in 2023 was fair, reasonable, and aligned with our performance and our corporate and personal objectives.

VOTING INFORMATION

You received this Proxy Statement and the accompanying proxy card because the Board of Directors of Synovus is soliciting proxies to be used at the Annual Meeting, which will be held virtually on April 24, 2024 at 10:00 a.m. at www.virtualshareholdermeeting.com/SNV2024. Proxies are solicited to give all shareholders of record an opportunity to vote on matters to be presented at the Annual Meeting. In the following pages of this Proxy Statement, you will find information on matters to be voted upon at the Annual Meeting or any adjournment of that meeting.

| | |

| Internet Availability of Proxy Materials |

As permitted by the federal securities laws, Synovus is making this Proxy Statement and its 2023 Annual Report available to its shareholders via the Internet instead of mailing printed copies of these materials to each shareholder. On March 12, 2024, we mailed to our shareholders (other than those who previously requested electronic or paper delivery and other than those holding a certain number of shares) a Notice of Internet Availability, or Notice, containing instructions on how to access our proxy materials, including this Proxy Statement and the accompanying 2023 Annual Report. These proxy materials are being made available to our shareholders on or about March 12, 2024. The Notice also provides instructions regarding how to access your proxy card to vote through the Internet or by telephone. The Proxy Statement and 2023 Annual Report are also available on our website at investor.synovus.com/2024annualmeeting.

If you received a Notice by mail, you will not receive a printed copy of the proxy materials by mail unless you request printed materials. If you wish to receive printed proxy materials, you should follow the instructions for requesting such materials contained on the Notice.

If you receive more than one Notice, it means that your shares are registered differently and are held in more than one account. To ensure that all shares are voted, please either vote each account over the Internet or by telephone or sign and return by mail all proxy cards.

You are entitled to one vote per share if you were a shareholder of record of Synovus common stock as of the close of business on February 22, 2024. Your shares can be voted at the meeting only if you are present or represented by a valid proxy.

If your shares are held in the name of a bank, broker, or other holder of record, you will receive voting instructions from such holder of record. You must follow the voting instructions of the holder of record in order for your shares to be voted. Telephone and Internet voting will also be offered to shareholders owning shares through certain banks, brokers, and other holders of record. If your shares are not registered in your own name and you plan to vote your shares at the Annual Meeting, you should contact your broker or agent to obtain a legal proxy or broker’s proxy card in order to vote at the Annual Meeting.

| | |

| Quorum and Shares Outstanding |

A majority of the votes entitled to be cast by the holders of the outstanding shares of Synovus common stock must be present, either in person virtually or represented by proxy, in order to conduct the Annual Meeting. This is referred to as a quorum. On February 22, 2024, 146,416,777 shares of Synovus common stock were issued and outstanding and entitled to vote.

The Board has designated two individuals to serve as proxies to vote the shares represented by proxies at the Annual Meeting. If you properly submit a proxy but do not specify how you want your shares to be voted, your shares will be voted by the designated proxies in accordance with the Board’s recommendations as follows:

(1)FOR the election of each of the 11 director nominees named in this Proxy Statement;

(2)FOR the approval of the advisory vote on the compensation of Synovus’ named executive officers as determined by the Compensation and Human Capital Committee; and

(3)FOR the ratification of the appointment of KPMG as Synovus’ independent auditor for the year 2024.

The designated proxies will vote in their discretion on any other matter that may properly come before the Annual Meeting. At this time, we are unaware of any matters, other than as set forth above, that may properly come before the Annual Meeting.

The number of affirmative votes required to approve each of the proposals to be considered at the Annual Meeting is described below:

Proposal 1 – Election of 11 Directors

To be elected, each of the 11 director nominees named in this Proxy Statement must receive more votes cast “for” such nominee’s election than votes cast “against” such nominee’s election. If a nominee who currently is serving as a director does not receive the required vote for re-election, Georgia law provides that such director will continue to serve on the Board of Directors as a “holdover” director. However, pursuant to Synovus’ Corporate Governance Guidelines, each holdover director has tendered an irrevocable resignation that would be effective upon the Board’s acceptance of such resignation. In that situation, our Corporate Governance and Nominating Committee would consider the resignation and make a recommendation to the Board of Directors about whether to accept or reject such resignation and publicly disclose its decision within 90 days following certification of the shareholder vote.

All Other Proposals

For all of the other proposals described in this Proxy Statement, the affirmative vote of a majority of the votes cast is required to approve each such proposal.

| | |

| Abstentions and Broker Non-Votes |

Under certain circumstances, including the election of directors, matters involving executive compensation, and other matters considered non-routine, banks and brokers are prohibited from exercising discretionary authority for beneficial owners who have not provided voting instructions to the bank or broker. This is generally referred to as a “broker non-vote.” In these cases, as long as a routine matter is also being voted on, and in cases where the shareholder does not vote on such routine matter, those shares will be counted for the purpose of determining if a quorum is present, but will not be included as votes cast with respect to those matters. Whether a bank or broker has authority to vote its shares on uninstructed matters is determined by stock exchange rules. We expect that brokers will be allowed to exercise discretionary authority for beneficial owners who have not provided voting instructions only with respect to Proposal 3 but not with respect to any of the other proposals to be voted on at the Annual Meeting.

For all proposals, abstentions, and broker non-votes will have no effect on the proposal to be considered at the Annual Meeting.

If you hold shares in your own name, you may vote by proxy or virtually at the Annual Meeting at www.virtualshareholdermeeting.com/SNV2024. To vote by proxy, you may select one of the following options:

Vote by Telephone

You can vote your shares by telephone by calling 1-800-690-6903. Telephone voting is available 24 hours a day, seven days a week, until 11:59 P.M., Eastern Time, on April 23, 2024. Easy-to-follow voice prompts allow you to vote your shares and confirm that your instructions have been properly recorded. Our telephone voting procedures are designed to authenticate the shareholder by using individual control numbers. If you vote by telephone, you do NOT need to return your proxy card.

Vote by Internet

You can also choose to vote by visiting www.proxyvote.com. Internet voting is available 24 hours a day, seven days a week, until 11:59 P.M., Eastern Time, on April 23, 2024. You will be given the opportunity to confirm that your instructions have been properly recorded, and you can consent to view future proxy statements and annual reports on the Internet instead of receiving them in the mail. If you vote on the Internet, you do NOT need to return your proxy card.

Vote by Mail

If you choose to vote by mail, simply mark your proxy card, date, and sign it, and return it in the postage-paid envelope provided.

Vote at the Annual Meeting

You can vote your shares at the Annual Meeting by visiting www.virtualshareholdermeeting.com/SNV2024 and following the instructions described below.

If your shares are held in the name of a bank, broker, or other holder of record, you will receive instructions from such holder of record that you must follow for your shares to be voted. Please follow their instructions carefully. Also, please note that if the holder of record of your shares is a broker, bank, or other nominee and you wish to vote at the Annual Meeting, you must request a legal proxy or broker’s proxy from your bank, broker, or other nominee that holds your shares and present that proxy at the Annual Meeting.

Synovus Stock Plans

If you participate in the Synovus Dividend Reinvestment and Direct Stock Purchase Plan, the Synovus Employee Stock Purchase Plan, and/or the Synovus Director Stock Purchase Plan, your proxy card represents shares held in the respective plan, as well as shares you hold

directly in certificate form registered in the same name. If you hold shares of Synovus common stock through a 401(k) plan, you will receive a separate proxy card representing those shares of Synovus common stock.

If you are a shareholder of record and vote by proxy, you may revoke that proxy at any time before it is voted at the Annual Meeting. You may do this by (1) signing another proxy card with a later date and returning it to us prior to the Annual Meeting, (2) voting again by telephone or on the Internet prior to 11:59 P.M., Eastern Time, on April 23, 2024, or (3) attending the Annual Meeting virtually and casting a ballot.

If your Synovus shares are held by a bank, broker, or other nominee, you must follow the instructions provided by the bank, broker, or other nominee if you wish to change or revoke your vote.

| | |

| Attending the Annual Meeting |

The Annual Meeting will be held on Wednesday, April 24, 2024 via a virtual format by live webcast.

To attend the Annual Meeting virtually and participate as a shareholder, you will need to go to www.virtualshareholdermeeting.com/SNV2024 and, when prompted, enter the 16-digit control number included in your proxy card, your Notice, or the instructions included with your proxy materials.

If your shares are registered in your name and you received proxy materials by mail, your control number is attached to your proxy card. If you hold shares through an account with a bank or broker, you will need to contact your bank or broker and request a legal proxy. A legal proxy is an authorization from your bank or broker for you to vote the shares it holds in its name on your behalf. It also serves as your control number.

Once you are admitted to the meeting as a shareholder, you may vote during the meeting and also submit questions by following the instructions available on the virtual meeting website during the meeting. Those without a 16-digit control number may attend the 2024 Annual Meeting as guests, but they will not have the option to vote shares or submit questions during the virtual meeting.

If you are unable to attend the meeting, you can listen to it later and view the slide presentation over the Internet at investor.synovus.com/2024annualmeeting. We will maintain copies of the slides and audio of the presentation for the Annual Meeting on our website for reference after the meeting. Information included on Synovus’ website, other than the Proxy Statement and form of proxy, is not a part of the proxy soliciting material.

You can find the voting results of the Annual Meeting in Synovus’ Current Report on Form 8-K, which Synovus will file with the SEC no later than April 30, 2024.

CORPORATE GOVERNANCE AND BOARD MATTERS

Corporate Governance Philosophy

The business affairs of Synovus are managed under the direction of the Board of Directors in accordance with the Georgia Business Corporation Code, as implemented by Synovus’ Articles and bylaws. The role of the Board of Directors, or the Board, is to effectively govern the affairs of Synovus for the benefit of its shareholders. The Board strives to ensure the success and continuity of Synovus’ business through the appointment of qualified executive management. It is also responsible for ensuring that Synovus’ activities are conducted in a responsible and ethical manner. Synovus and its Board of Directors are committed to following sound corporate governance.

Corporate Governance Highlights

Synovus’ Board and management believe that good corporate governance practices promote the long-term interests of all shareholders and strengthen Board and management accountability. Highlights of such practices include:

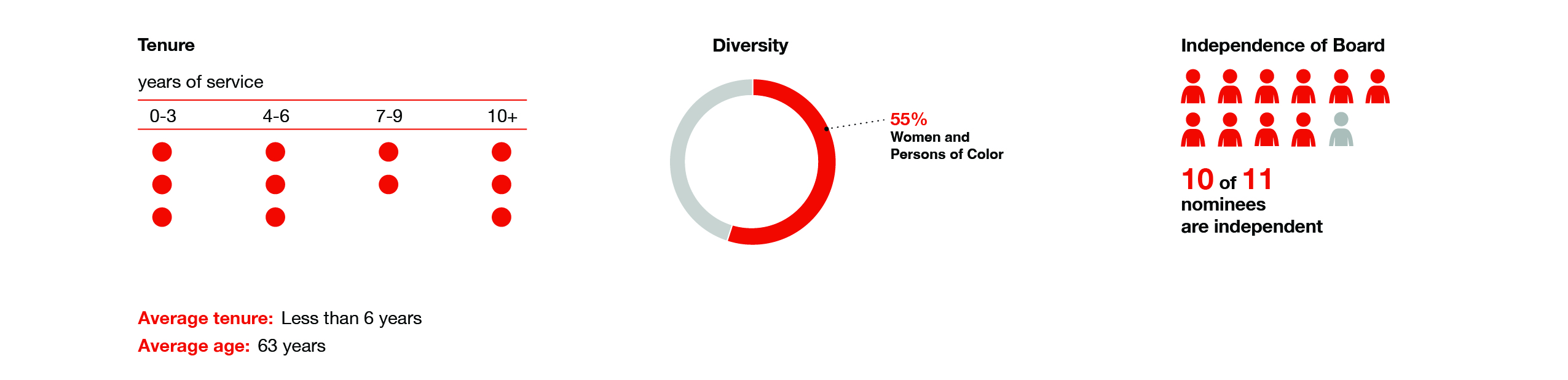

•On-going focus on Board refreshment, with more than half of our nominees first elected or nominated to our Board within the last 5 years;

•Continuous attention to the importance of Board diversity, with 36% of our directors being women, 36% of our directors being persons of color, and all of our directors representing diverse and varied backgrounds, geographies, qualifications, and perspectives;

•One vote per share voting structure;

•An independent Lead Director;

•Audit, Compensation and Human Capital, Risk, and Corporate Governance and Nominating Committees comprised entirely of independent directors;

•Robust ESG and enterprise risk oversight by the Board and its committees;

•Board focus on strategic planning and direction, with oversight and guidance of Synovus’ long-term strategy within approved risk appetite parameters;

•Annual elections of all directors;

•Majority voting for director elections;

•Periodic and regular rotation of Board committee leadership and composition;

•Open and transparent shareholder engagement, with involvement from Synovus’ Lead Director and other independent directors as appropriate;

•Frequent and comprehensive education programs to keep directors apprised of such evolving issues as business and banking trends; risks and compliance issues; cybersecurity best practices; laws, regulations, and requirements applicable to Synovus and to the banking industry generally; and corporate governance best practices;

•Policies prohibiting the hedging, pledging, and short sale of shares of Synovus stock by directors and executive officers;

•Regular and robust Board and committee self-evaluations, facilitated by an independent third party;

•Mandatory retirement of our directors upon attaining the later of age 72 or 7 years of Board service (but in no event later than age 75);

•Executive compensation driven by a pay-for-performance policy;

•Meaningful stock ownership guidelines for Board members and executive officers; and

•Implementation of a mandatory clawback policy for incentive compensation paid to Synovus’ executive officers.

In addition, the Board, under the leadership of the Corporate Governance and Nominating Committee, continues to actively monitor and consider additional and evolving changes to our corporate governance practices for the future.

Independence

The NYSE listing standards provide that a director does not qualify as independent unless the Board of Directors affirmatively determines that the director has no material relationship with Synovus. The Board has established categorical standards of independence to assist it in determining director independence which conform to the independence requirements in the NYSE listing standards. The categorical standards of independence are incorporated within our Corporate Governance Guidelines, are attached to this Proxy Statement as Appendix A, and are also available in the Corporate Governance section of our website at investor.synovus.com.

The Board has affirmatively determined that a majority of its members are independent as defined by the listing standards of the NYSE and the categorical standards of independence set by the Board. Synovus’ Board has determined that, as of January 1, 2024, the following ten directors are independent: Stacy Apter; Tim E. Bentsen; Pedro Cherry; John H. Irby; Diana M. Murphy; Harris Pastides; John L. Stallworth; Barry L. Storey; Alexandra Villoch; and Teresa White. Please see “Certain Relationships and Related Transactions” on page 53 of this Proxy Statement for a discussion of certain relationships between Synovus and its independent directors. These relationships have been considered by the Board in determining a director’s independence from Synovus under Synovus’ Corporate Governance Guidelines and the NYSE listing standards and were determined to be immaterial.

Board Meetings and Attendance

The Board of Directors held twelve meetings in 2023 and one joint meeting with the Risk Committee in 2023. All directors attended at least 75% of Board and committee meetings held during their tenure during 2023. The average attendance by incumbent directors at the aggregate number of Board and committee meetings they were scheduled to attend was 97%. Although Synovus has no formal policy with respect to Board members’ attendance at its annual meetings, it is customary for all Board members to attend the annual meeting. All of Synovus’ then-current directors attended Synovus’ 2023 annual meeting of shareholders.

Board meetings regularly include educational presentations and training to enable our directors to keep abreast of business and banking trends and market, regulatory, and industry issues. These sessions are often conducted by outside experts in such subject areas as cybersecurity, evolving regulatory standards, risk management, emerging products and trends, economic conditions, digital, technology, and effective corporate governance. In addition, the Board is provided business-specific training on products and services and special risks and opportunities to Synovus. Moreover, our directors periodically attend industry conferences, meetings with regulatory agencies, and educational sessions pertaining to their service on the Board and its committees.

Committees of the Board

Synovus’ Board of Directors has five principal standing committees—an Audit Committee, a Corporate Governance and Nominating Committee, a Compensation and Human Capital Committee, a Risk Committee, and an Executive Committee. Each committee has a written charter adopted by the Board of Directors that complies with the applicable listing standards of the NYSE pertaining to corporate governance. Copies of the committee charters are available in the Corporate Governance section of our website at investor.synovus.com. The Board has determined that each member of the Audit, Corporate Governance and Nominating, Compensation and Human Capital, and Risk Committees is an independent director as defined by the listing standards of the NYSE and our Corporate Governance Guidelines. The following table shows the membership and leadership of the various committees as of the date of this Proxy Statement.

| | | | | | | | | | | | | | | | | |

| Audit Committee | Corporate Governance and Nominating Committee | Compensation and Human Capital Committee | Risk Committee | Executive Committee |

| Stacy Apter | | |

|

|

|

| Tim E. Bentsen | | | |

| |

| Kevin S. Blair | | | | | |

| Pedro Cherry | | | | | |

| John H. Irby | | | | | |

| Diana M. Murphy | | | | | |

| Harris Pastides | | | | | |

| John L. Stallworth | | | | | |

| Barry L. Storey | | | | | |

| Alexandra Villoch | | | | | |

| Teresa White | | | | | |

Following the election of directors at the Annual Meeting, composition and leadership of the foregoing committees will be reconstituted after giving effect to any changes to the current composition of the Board.

Synovus’ Audit Committee held twelve meetings in 2023. The Audit Committee’s report is on page 31 of this Proxy Statement. The Board has determined that all five members of the Committee are independent and financially literate under the rules of the NYSE and that each of the five members of the Audit Committee is an “audit committee financial expert” as defined by the rules of the SEC. The primary functions of the Audit Committee include:

•Monitoring the integrity of Synovus’ financial statements, Synovus’ systems of internal controls, and Synovus’ compliance with regulatory and legal requirements;

•Overseeing the risks relating to financial reporting, litigation, credit, and related matters;

•Reviewing and discussing with Synovus’ management and the independent auditor Synovus’ financial statements and related information, including non-GAAP financial information, critical audit matters, and other disclosures included in Synovus’ earnings releases and quarterly and annual reports on Form 10-Q and Form 10-K prior to filing or furnishing with the SEC;

•Monitoring the independence, qualifications, and performance of Synovus’ independent auditor and internal audit function; and

•Providing an avenue of communication among the independent auditor, management, internal audit, and the Board of Directors.

| | |

| Corporate Governance and Nominating Committee |

Synovus’ Corporate Governance and Nominating Committee held three meetings in 2023. The primary functions of Synovus’ Corporate Governance and Nominating Committee include:

•Identifying qualified individuals to become Board members;

•Recommending to the Board the director nominees for each annual meeting of shareholders and director nominees to be elected by the Board to fill interim director vacancies;

•Recommending to the Board the leadership structure of the Board and the composition and leadership of Board committees;

•Overseeing the annual review and evaluation of the performance of the Board and its committees;

•Developing and recommending to the Board updates to our corporate governance documents;

•Reviewing and assessing shareholders’ feedback related to our governance practices and shareholder engagement process; and

•Overseeing the Company’s ESG strategy, initiatives, and policies.

| | |

| Compensation and Human Capital Committee |

Synovus’ Compensation and Human Capital Committee held six meetings in 2023. Its report is on page 45 of this Proxy Statement. The primary functions of the Compensation and Human Capital Committee include:

•Approving and overseeing Synovus’ executive compensation program;

•Reviewing and approving annual corporate goals and objectives for the Chief Executive Officer, evaluating the CEO’s performance in light of those goals and objectives, and determining the CEO’s compensation level based on such evaluation;

•Approving non-CEO executive compensation, including base salary and short-term and long-term compensation;

•Overseeing all compensation and benefit programs in which broad-based employees of Synovus are eligible to participate;

•Reviewing Synovus’ incentive compensation arrangements to confirm that incentive pay does not encourage unnecessary risk-taking and reviewing and discussing, at least annually, the relationship between risk management and incentive compensation;

•Developing and recommending to the Board compensation for non-employee directors;

•Monitoring and reviewing the talent management and succession planning processes for the CEO and Synovus’ other key executives;

•Providing oversight of Synovus’ broader talent management and diversity, equity, and inclusion processes and initiatives;

•Assisting the Board in its oversight of all other human capital management strategies, practices, and risks; and

•Coordinating as necessary with the Corporate Governance and Nominating Committee in its oversight role of ESG.

Information regarding the Compensation and Human Capital Committee’s processes and procedures for considering and determining executive officer compensation is provided in the “Executive Compensation—Compensation Discussion and Analysis” section of this Proxy Statement. Except to the extent prohibited by law or regulation, the Compensation and Human Capital Committee may delegate matters within its power and responsibility to individuals or subcommittees when it deems appropriate.

In addition, the Compensation and Human Capital Committee has the authority under its charter to retain outside advisors to assist the Committee in the performance of its duties. During 2023, the Committee retained the services of Meridian Compensation Partners, LLC, or Meridian, to:

•Provide ongoing recommendations regarding executive and director compensation consistent with Synovus’ business needs, pay philosophy, market trends, and the latest legal and regulatory considerations;

•Provide market data for base salary, short-term incentive, and long-term incentive decisions; and

•Advise the Compensation and Human Capital Committee as to best practices and market developments.

The Compensation and Human Capital Committee evaluated whether the work provided by Meridian raised any conflict of interest. The Compensation and Human Capital Committee considered various factors, including the six factors mandated by SEC rules, and determined that no conflict of interest was raised by the work of Meridian described in this Proxy Statement. Meridian was engaged directly by the Compensation and Human Capital Committee, although the Compensation and Human Capital Committee also directed that Meridian work with Synovus’ management to facilitate the Compensation and Human Capital Committee’s review of compensation practices and management’s recommendations. Synovus’ Chief Human Resources Officer developed executive compensation recommendations for the

Compensation and Human Capital Committee’s consideration in conjunction with Synovus’ CEO and with the advice of Meridian. Meridian did not provide any other services to Synovus during 2023.

In 2023, Synovus’ Chief Human Resources Officer worked with the Chair of the Compensation and Human Capital Committee to establish the agenda for committee meetings. Management also prepared background information for each committee meeting. Synovus’ Chief Human Resources Officer and CEO generally attend committee meetings by invitation of the Compensation and Human Capital Committee. However, the Compensation and Human Capital Committee regularly meets in executive session without members of management in attendance, and the CEO and other members of management do not have authority to vote on committee matters. Meridian attended all of the committee meetings held during 2023 at the request of the Compensation and Human Capital Committee.

Synovus’ Risk Committee held eight meetings in 2023 and one joint meeting with the Board of Directors in 2023. The primary functions of Synovus’ Risk Committee include:

•Monitoring and reviewing the enterprise risk management and compliance framework policies and processes;

•Monitoring and reviewing emerging risks and the adequacy of risk management and compliance functions;

•Overseeing ESG risk management initiatives and activities including management of risks pertaining to climate change and sustainability in coordination with the Corporate Governance and Nominating Committee;

•Monitoring the independence and authority of the enterprise risk management function and reviewing the qualifications and background of the Chief Risk Officer and other senior risk officers; and

•Providing recommendations to the Board in order to effectively manage risks.

The Executive Committee, which is comprised of the chairs of the principal standing committees of the Board and Board of Directors of Synovus Bank, the Chief Executive Officer, the Chairman of the Board (if different from the Chief Executive Officer), and the Lead Director, did not meet in 2023. During the intervals between meetings of the Board, the Executive Committee possesses and may exercise any and all of the powers of the Board in the management and direction of the business and affairs of Synovus with respect to which specific direction has not been previously given by the Board, unless Board action is required by Synovus’ governing documents, law, or rule.

| | |

| Compensation and Human Capital Committee Interlocks and Insider Participation |

Messrs. Bentsen, Irby, and Storey, Ms. Murphy, and Ms. White served on the Compensation and Human Capital Committee during 2023. In addition, F. Dixon Brooke, Jr., Stephen T. Butler, and Joseph J. Prochaska, Jr. served on the Compensation and Human Capital Committee until each of his retirements in April 2023. None of these individuals is or has been an officer or employee of Synovus. In 2023, none of our executive officers served on the board of directors or compensation committee of any entity that had one or more of its executive officers serving on Synovus’ Board or Compensation and Human Capital Committee.

Strategic Direction

One of our Board’s most important functions is to provide oversight and direction as to Synovus’ strategy, including business and organizational initiatives, potential growth opportunities, risks, and challenges. As such, the Board incorporates strategic topics into each meeting agenda and monitors strategic progress and emerging risks quarterly through the Risk Committee. Management provides the Board with a detailed review of the strategic plan, including the short-term and long-term initiatives and targets. As a part of this process, the Board and its committees carefully consider whether the strategic plan aligns with Synovus’ risk appetite and risk profile. Moreover, the Board has at least one extended session annually focused on a deeper dive into emerging industry trends and the correlation to Synovus’ strategic direction.

Throughout 2023, Synovus' core strategic focus remained on expanding and diversifying the franchise in terms of revenue, profitability, and asset size while maintaining a relationship-based approach to banking. In a year fraught with industry instability, economic uncertainty, inflationary pressures, and enhanced regulatory scrutiny, we made deliberate adjustments to our businesses and business model to drive sustained franchise value while retaining our legacy focus on our people and our clients. We also continued to embrace the acceleration of technology and adoption of digital and data capabilities.

Synovus began 2023 with a continued focus on a streamlined strategic plan centered on growth and performance through four core pillars: reposition for advantage, simplify and streamline, adopt high-tech meets high touch, and enhance talent and culture. Various strategic initiatives supported each of these pillars, with a prioritization on such matters as investing in commercial growth, fortifying consumer banking, optimizing wealth, refreshing the brand, re-imagining the client journey, automating systems and processes, using advanced analytics, enhancing modern core enabled banking products, developing diverse leaders, and establishing a growth based culture. With the bank failures beginning in March and continuing into May 2023, however, Synovus refocused its strategy to robustly manage through the crisis, focusing on safety and soundness through additional liquidity and deposit generation initiatives across all lines of business, overall credit vigilance, enhanced industry and sector monitoring, and optimized capital management.

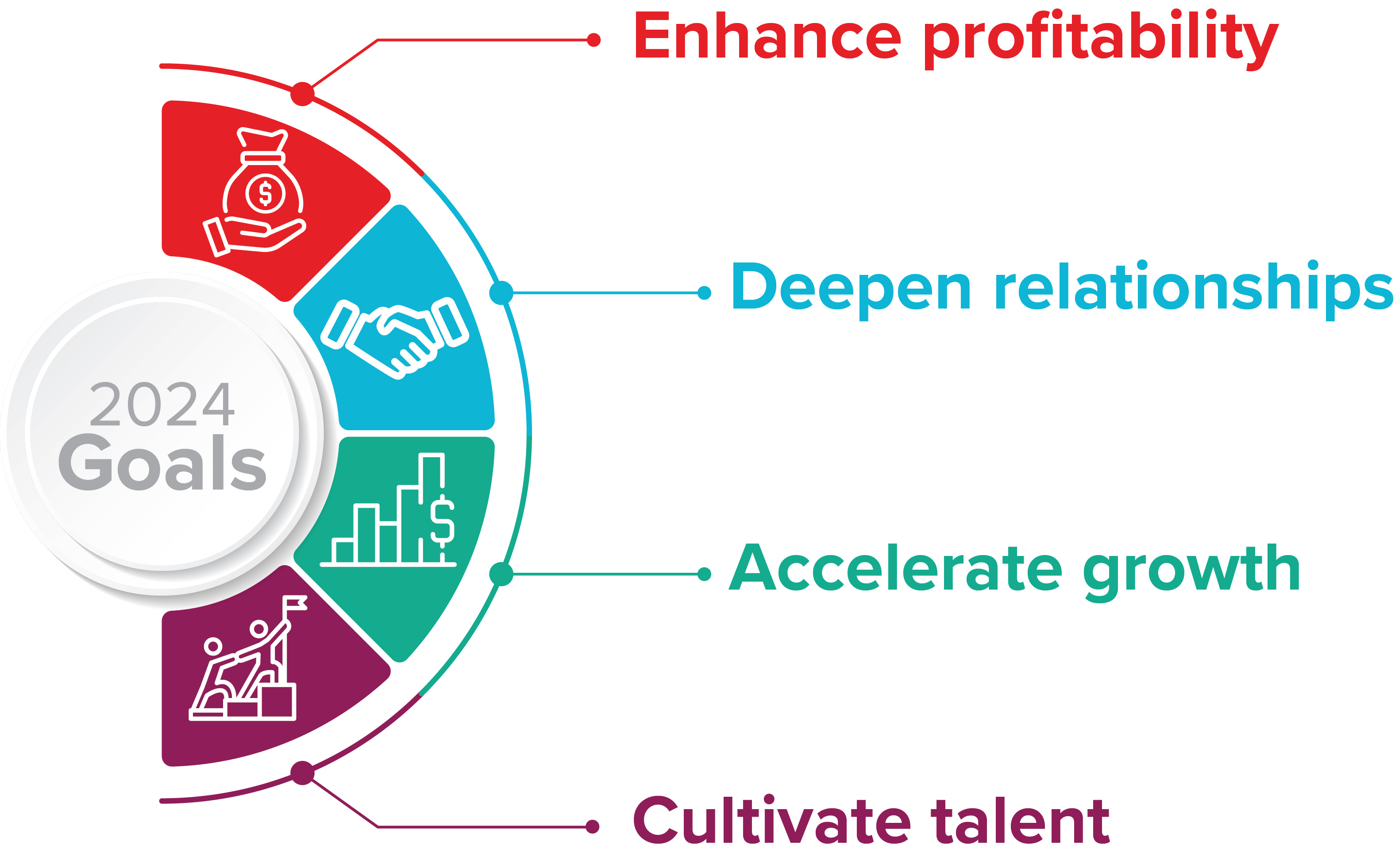

In 2024, Synovus' streamlined strategic plan will focus on four fundamentals - enhancing profitability, deepening relationships, accelerating growth, and cultivating talent.

These goals are supported by such initiatives as banking-as-a-service capabilities, deposit generation strategies, expansion in strategic growth verticals such as middle market commercial banking and Corporate and Investment Banking, additional Treasury and Payments solutions, certain investments in the bank of the future through automation, digital, and analytics, and certain enhancements related to talent acquisition, management, development, and engagement. Underlying each of the four fundamentals is a culture that is focused on safety and soundness, continually building upon many of the risk enhancements implemented in reaction to the challenging environment in 2023.

The Board monitors the execution of the strategic plan throughout the year at its regularly scheduled meetings and continually assesses and guides management on the strategic direction and initiatives.

Risk Oversight

Under Synovus’ Corporate Governance Guidelines, the Board is charged with providing oversight of Synovus’ risk management processes. The Board does not view risk in isolation and considers risk in virtually every business decision and as part of the Company’s overall business strategy. While the Board oversees risk management, the Company’s management is charged with managing risk. The Board’s role in risk oversight is an integral part of Synovus’ overall enterprise risk management framework.

The Risk Committee fulfills the overarching oversight role for the enterprise risk management and compliance processes, including approving the risk appetite of the Company, risk tolerance levels, and risk policies and limits, monitoring key and emerging risks, and reviewing risk assessments. In carrying out its responsibilities, the Risk Committee works closely with Synovus’ Chief Risk Officer and other members of Synovus’ enterprise risk management team. The Risk Committee meets periodically with the Chief Risk Officer and other members of management and receives a comprehensive report on enterprise risk management matters, including management’s assessment of risk exposures (including risks related to strategy, reputation, credit, market/interest rates, liquidity, legal, compliance, and operations, among others) and the processes in place to monitor and control such exposures. The Risk Committee is also responsible for overseeing the investment policy and strategy and contingency funding plan of the Company. Between meetings, as needed or appropriate, the Chair of the Risk Committee receives updates relating to risk oversight matters from the Chief Risk Officer and the CEO. The Risk Committee provides a report on risk management to the full Board on at least a quarterly basis.

In addition, oversight of risk is allocated to all other committees of the Board, who meet regularly and report back to the Board. The Audit Committee oversees risks related to financial reporting, internal controls over financial reporting, valuation of investment securities, internal and independent audit functions, capital adequacy, legal matters, tax matters, credit matters, and reputational risks relating to these areas. The Compensation and Human Capital Committee oversees risks related to incentive compensation, executive and director compensation, executive succession planning, talent retention, human capital, and reputational risks relating to these areas. As a part of the risk governance process, the Chief Risk Officer provides an annual update on risk management of our incentive compensation plans to the Compensation and Human Capital Committee. For a discussion of the Compensation and Human Capital Committee’s review of Synovus’ senior executive officer compensation plans and employee incentive compensation plans and the risks associated with these plans, see “Compensation Framework: Compensation Policies, Compensation Process, and Risk Considerations—Risk Considerations” on page 44 of this Proxy Statement. In coordination with the Risk Committee, the Corporate Governance and Nominating Committee oversees ESG-related risks and corporate governance-related risks, such as board composition and effectiveness, board succession planning, corporate governance policies, related party transactions, ethics, and reputational risks relating to these areas.

The Company believes that its enterprise risk framework, including the active engagement of management with the Board in the risk oversight function, supports the risk oversight function of the Board. For more information on the risks facing the Company, see the risk factors in “Part I—Item 1A. Risk Factors” in the 2023 Annual Report.

Cybersecurity

Information security is a significant operational risk for financial institutions which may lead not only to financial losses, but may also negatively affect the reputation of and confidence in the Company. Synovus continues to enhance our information security program and capabilities to identify, assess, manage, mitigate, and respond to threats to the confidentiality, availability, and integrity of our information systems. Our Board recognizes and appreciates the seriousness of cybersecurity-related risks and as such, supports the continuous development of and investment in our information security program and capabilities to identify and mitigate existing and emerging threats to confidentiality, availability, and integrity of our information systems. Below are some highlights of the elements of our information security program:

•Our Board is actively engaged in the oversight of Synovus’ information security risk management and cybersecurity programs. The Risk Committee receives quarterly updates from the Company’s Chief Information Security Officer on our information security and cyber risk strategy, cyber defense initiatives, cyber event preparedness, and cybersecurity risk assessments. The Risk Committee annually approves the Company’s information security program. In addition to an annual report on these issues with the full Board, the Board consults, from time to time and on a regular basis, with outside parties with an expertise in cybersecurity.

•Synovus follows widely accepted cybersecurity policies and best practices to define and measure our security program. We are externally audited on an annual basis and certified on information security standards, including System and Organizational Controls (SOC) and Payment Card Industry Data Security Standard (PCI DSS). Our program is reviewed on a periodic basis against the Federal Financial Institutions Examination Council's (FFIEC) Cybersecurity Assessment Tool and the National Institute of Standards and Technology Cybersecurity Framework in order to measure our cybersecurity preparedness, evaluate whether cybersecurity preparedness is aligned with risks, determine risk management practices and controls that are needed or need enhancement, and to inform our risk management strategies.

•We engage and retain independent third-parties to review and assess our information security program, and these updates are reviewed with the Risk Committee and executive leadership. We keep computer forensics, legal, and security firms on retainer in case of a cyber breach event. We engage independent third-parties to perform annual penetration tests against our network.

•We employ a risk management framework to identify, assess, monitor, and test cyber risk and controls. This formal process of risk assessment, risk treatment, risk acceptance, communication, consultation, monitoring, and review is designed in accordance with the ISO 27005 Standard.

•We perform comprehensive due diligence and ongoing oversight of third-party relationships, including vendors.

•We are members of financial sector organizations, including the Financial Services Information Sharing and Analysis Center (FS-ISAC), which facilitates the sharing of cyber and physical threat, vulnerability, and incident information for the good of the membership.

•Our information security program employs a wide variety of technologies that are intended to secure our operations and proprietary information. This in-depth defense strategy focuses on protecting our networks, systems, data, and facilities from attacks or unauthorized access. We have a dedicated Cybersecurity Fusion Center for monitoring and responding to cyber events.

•We make ongoing investments in developing and enhancing our security processes and controls and in maintaining our technology infrastructure.

•Synovus has a Business Continuity/Disaster Recovery program in place which is tested on a regular basis. Our Incident Response program is tested regularly, including independent third-party review and assessments.

•We provide annual education and training to our Board on cybersecurity risks and awareness, including participation in tabletop exercises related to cybersecurity. We have a robust program of education for our employees on cybersecurity and social engineering to mitigate risk including required annual training, quarterly training on critical topics, and bimonthly security awareness communications. We conduct exercises to test their effectiveness on a monthly basis throughout the year.

•We maintain a risk management insurance policy related to our cybersecurity and information security risks which is intended to defray the costs and losses of any related loss.

For more information on our cybersecurity risk management, strategy, and governance, see “Part I - Item 1C. Cybersecurity” in the 2023 Annual Report.

Leadership Structure of the Board

Our current Board leadership structure consists of:

•A non-independent Chairman of the Board;

•An independent Lead Director;

•Committees chaired by independent directors; and

•Active engagement by all directors.

Our Corporate Governance Guidelines and governance framework provide the Board with flexibility to select the appropriate leadership structure for Synovus. In making leadership structure determinations, the Board considers many factors, including the specific needs of the business and what is in the best interests of Synovus’ shareholders. In accordance with Synovus’ bylaws, our Board of Directors elects our Chairman and CEO, and both of these positions may be held by the same person or may be held by two persons. Under our Corporate Governance Guidelines, the Board does not have a policy, one way or the other, on whether the roles of the Chairman and CEO should be separate and, if it is to be separate, whether the Chairman should be selected from the non-employee directors or be an employee. However, our Corporate Governance Guidelines require that, if the Chairman of the Board is not an independent director, the Corporate Governance and Nominating Committee shall nominate, and a majority of the independent directors shall elect, a Lead Director. Under its

charter, the Corporate Governance and Nominating Committee periodically reviews and recommends to the Board the leadership structure of the Board and, if necessary, nominates the Lead Director candidate from the independent directors. Currently, one individual serves as both our Chairman and CEO, and, as a result, Synovus also has a Lead Director. The Board currently believes that the combination of these two roles provide consistent communication and coordination throughout the organization, which results in a more effective and efficient implementation of corporate strategy and is important in unifying Synovus’ strategy behind a single vision.

The Chairman of the Board is responsible for chairing Board meetings and meetings of shareholders, setting the agendas for Board meetings in consultation with the Lead Director, and providing information to Board members in advance of meetings and between meetings.

Pursuant to Synovus’ Corporate Governance Guidelines, the duties of the Lead Director include the following:

•Working with the Chairman of the Board, Board, and Corporate Secretary to set the agenda for Board meetings;

•Calling meetings of the independent and non-management directors, as needed;

•Ensuring Board leadership in times of crisis;

•Developing the agenda for and chairing executive sessions of the independent directors and executive sessions of the non-management directors;

•Acting as liaison between the independent directors and the Chairman of the Board on matters raised in such executive sessions;

•Chairing Board meetings when the Chairman of the Board is not in attendance;

•Attending meetings of the committees of the Board, as necessary or at his/her discretion, and communicating regularly with the chairs of the principal standing committees of the Board;

•Working with the Chairman of the Board to ensure the conduct of Board meetings provides adequate time for serious discussion of appropriate issues and that appropriate information is made available to Board members on a timely basis;

•Performing such other duties as may be requested from time-to-time by the Board, the independent directors, or the Chairman of the Board; and

•Being available, upon request, for consultation and direct communication with major shareholders.

After careful consideration, the Corporate Governance and Nominating Committee has determined that Synovus’ current Board structure is the most appropriate leadership structure for Synovus and its shareholders at this time. Moreover, as part of the Board’s annual self-evaluation, the performance of the Chairman of the Board and Lead Director are evaluated, and the Board continues to believe that the current Board structure is appropriate and effective.

Meetings of Non-Management and Independent Directors

The non-management and independent directors of Synovus meet separately after each regularly scheduled meeting of the Board of Directors and at such other times as may be requested by the Lead Director or any director. During 2023, Mr. Bentsen, as Lead Director, presided at the meetings of non-management and independent directors.

Board and Committee Self-Evaluations

The Board’s annual self-evaluation is a key component of its director nomination process and succession planning. In fact, the Corporate Governance and Nominating Committee uses the input from these self-evaluations, as facilitated by an independent third-party facilitator in 2023, to recommend changes to Synovus’ corporate governance practices and areas of focus for the following year and to plan for an orderly succession of the Board and its committees. The Board values the contributions of directors who have developed extensive experience and insight into Synovus during the course of their service on the Board and as such, the Board does not believe arbitrary term limits on directors’ service are appropriate. At the same time, the Board recognizes the importance of Board refreshment to help ensure an appropriate balance of experience and perspectives on the Board.

Consideration of Director Candidates

Synovus’ Corporate Governance Guidelines contain Board membership criteria considered by the Corporate Governance and Nominating Committee in recommending nominees for a position on Synovus’ Board. The Committee believes that, at a minimum, a director candidate must possess personal and professional integrity, sound judgment, and forthrightness. A director candidate must also have sufficient time and energy to devote to the affairs of Synovus, must be free from conflicts of interest with Synovus, must not have reached the retirement age for Synovus directors, and must be willing to make, and be financially capable of making, the required investment in Synovus’ stock pursuant to Synovus’ Director Stock Ownership Guidelines. The Committee also considers the following criteria when reviewing director candidates and existing directors:

•The extent of the director’s/potential director’s educational, business, non-profit, or professional acumen and experience;

•Whether the director/potential director assists in achieving a mix of Board members that represents a diversity of background, perspective, and experience, including with respect to age, gender, race, place of residence, and specialized experience;

•Whether the director/potential director meets the independence requirements of the listing standards of the NYSE and the Board’s director independence standards;

•Whether the director/potential director has the financial acumen or other professional, educational, or business experience relevant to an understanding of Synovus’ business;

•Whether the director/potential director would be considered a “financial expert” or “financially literate” as defined in the listing standards of the NYSE or applicable law;

•Whether the director/potential director, by virtue of particular technical expertise, experience, or specialized skill relevant to Synovus’ current or future business, will add specific value as a Board member; and

•Whether the director/potential director possesses a willingness to challenge and stimulate management and the ability to work as part of a team in an environment of trust.

The Committee does not assign specific weights to particular criteria and no particular criterion is necessarily applicable to all prospective nominees. In addition to the criteria set forth above, the Committee considers how the skills and attributes of each individual candidate or incumbent director work together to create a board that is collegial, engaged, and effective in performing its duties. Although the Board does not have a formal policy on diversity, the Board and the Committee believe that the background and qualifications of the directors, considered as a group, should provide a significant mix of experience, knowledge, and abilities that will contribute to Board diversity and allow the Board to effectively fulfill its responsibilities. For a discussion of the specific backgrounds and qualifications of our director nominees, see “Proposals to be Voted on: Proposal 1—Election of 11 Directors—Nominees for Election as Director” beginning on page 20 of this Proxy Statement.

| | |

| Identifying and Evaluating Nominees |

The Corporate Governance and Nominating Committee has two primary methods for identifying director candidates (other than those proposed by Synovus’ shareholders, as discussed below). First, on a periodic basis, the Committee solicits ideas for possible candidates from a number of sources, including members of the Board, Synovus’ executives, and individuals personally known to the members of the Board. Second, the Committee, as authorized under its charter, retains at Synovus’ expense one or more search firms to identify candidates.

The Committee will consider all director candidates identified through the processes described above, as well as any candidates identified by shareholders through the process described below, and will evaluate each of them, including incumbents, based on the same criteria. The director candidates are evaluated at regular or special meetings of the Committee and may be considered at any point during the year. If based on the Committee’s initial evaluation a director candidate continues to be of interest to the Committee, the Chair of the Committee will interview the candidate and communicate his or her evaluation to the other Committee members and executive management. Additional interviews are conducted, if necessary, and ultimately the Committee will meet to finalize its list of recommended candidates for the Board’s consideration.

The Corporate Governance and Nominating Committee will consider candidates for nomination as a director submitted by shareholders. Although the Committee does not have a separate policy that addresses the consideration of director candidates recommended by shareholders, the Board does not believe that such a separate policy is necessary, as Synovus’ bylaws permit shareholders to nominate candidates and as one of the duties set forth in the Corporate Governance and Nominating Committee charter is to review and consider director candidates submitted by shareholders. The Committee evaluates individuals recommended by shareholders for nomination as directors according to the criteria discussed above and in accordance with Synovus’ bylaws and the procedures described under “Shareholder Proposals and Nominations” on page 54 of this Proxy Statement.

Communicating with the Board

Synovus’ Board provides a process for shareholders and other interested parties to communicate with one or more members of the Board, including the Lead Director or the non-management or independent directors as a group. Shareholders and other interested parties may communicate with the Board as follows:

•by writing the Board of Directors, Synovus Financial Corp., c/o General Counsel’s Office, 1111 Bay Avenue, Suite 501, Columbus, Georgia 31901;

•by emailing: synovusboardofdirectors@synovus.com; and

•by phoning: (706) 644-2748.

Relevant communications are distributed to the Board, or to any individual director or directors, as appropriate, depending upon the facts and circumstances outlined in the communication. In that regard, the Board has requested that certain items that are unrelated to its duties and responsibilities be excluded, such as: business solicitations or advertisements; junk mail and mass mailings; resumes and other forms of job inquiries; spam; and surveys. In addition, material that is unduly hostile, threatening, illegal, or similarly unsuitable will be excluded. Any communication that is filtered out is made available to any director upon request.

These procedures are also available in the Corporate Governance section of our website at investor.synovus.com. Synovus’ process for handling shareholder and other communications to the Board has been approved by Synovus’ independent directors.

Shareholder Engagement

Synovus and our Board believe that accountability to our shareholders is key to sound corporate governance principles, and as such, regular and transparent communication with our shareholders is essential to our long-term success. Throughout the year, members of our management team meet regularly with a significant number of our shareholders to discuss our corporate strategy, financial performance, long-term objectives, credit risks, capital management, enterprise risk management, corporate governance, ESG related matters, and executive compensation. In regularly engaging with our shareholders, we provide perspective on our governance policies and executive compensation practices and seek input from these shareholders to ensure that we are addressing their questions and concerns.

Our on-going shareholder engagement program encompasses a number of initiatives, including:

•Regularly scheduled in-person and virtual meetings with our larger institutional shareholders;

•In-person and virtual meetings with certain large institutional shareholders, with participation by our Lead Director and Chair of the Compensation and Human Capital Committee and certain other members of our Board as appropriate;

•Responses to institutional and retail shareholder correspondence and inquiries;

•Engagement with proxy advisory services such as Glass Lewis and ISS;

•Attendance and participation at approximately eight to ten industry conferences each year;

•In-person and telephonic meetings with rating agencies including Standard & Poor’s, Fitch, and Moody’s;

•Regular engagement with sell-side analysts who cover Synovus to reinforce key themes related to our business strategy and financial performance. This communication helps to ensure that written reports about Synovus, including earnings projections, are reasonable and consistent with our stated objectives; and

•Regularly scheduled non-deal road shows in certain larger markets.

Throughout the year, we contacted, virtually and telephonically, many of Synovus’ largest shareholders. This allowed us to better understand and address shareholder questions and concerns related to such issues as our financial performance, the interest rate environment, our strategic objectives, and our long-term growth strategy. Feedback and perspectives shared during these engagement meetings were discussed by executive management and the Board and influenced several changes and disclosure enhancements.

We look forward to continued enhancement of our shareholder engagement program in 2024. We are committed to an open dialogue where investor views and priorities may be gathered and discussed, thereby informing and guiding a deliberative decision-making process with a diverse shareholder base in mind.

Additional Information about Corporate Governance

Synovus has adopted Corporate Governance Guidelines which are regularly reviewed by the Corporate Governance and Nominating Committee. We have also adopted a Code of Business Conduct and Ethics which is applicable to all directors, officers, and employees. In addition, we maintain procedures for the confidential, anonymous submission of any complaints or concerns about Synovus, including complaints regarding accounting, internal accounting controls, or auditing matters. Shareholders may access Synovus’ Corporate Governance Guidelines, Code of Business Conduct and Ethics, each committee’s current charter, procedures for shareholders and other interested parties to communicate with the Lead Director or with the non-management or independent directors individually or as a group, and procedures for reporting complaints and concerns about Synovus, including complaints concerning accounting, internal accounting controls, and auditing matters, in the Corporate Governance section of our website at investor.synovus.com.

CORPORATE RESPONSIBILITY

Our Purpose

Our purpose is to enable people to reach their full potential - our shareholders, clients, employees, and communities.

The Board is fully engaged in the Company’s corporate responsibility-related strategies, initiatives, and policies. At the committee level, the Compensation and Human Capital Committee assists the Board with oversight of diversity, equity, and inclusion, or DEI, strategies and initiatives and human capital management at all levels, as outlined above, and the Risk Committee provides guidance and oversight on ESG-related risk management, including risks related to climate change and sustainability. The Corporate Governance and Nominating Committee is charged with overall oversight responsibility for these ESG-related strategies and initiatives, supported by a management-level committee, known as the ESG Oversight Council, which reports to the Corporate Governance and Nominating Committee. The ESG Oversight Council is comprised of key internal stakeholders, including representatives from legal, investor relations, credit, facilities, vendor procurement, human resources, compliance, risk management, and the lines of business, as well as the Chair of our Corporate Governance and Nominating Committee who serves as an advisory member.

We have a structured corporate responsibility program that monitors, manages, and oversees all corporate responsibility-related risks and opportunities within the Company. In 2023, we continued to enhance our ESG reporting and disclosures, including our alignment with the Sustainable Accounting Standards Board’s Accounting Standards for Commercial Banks and Task Force on Climate-Related Financial Disclosures framework.

For more information on our framework, strategies, and initiatives, please see our website at www.synovus.com/ESG.

Our Sustainability Commitments

Environmental considerations: As we worked to respond to the evolving regulatory environment in 2023, we continued to evaluate our enterprise-wide environmental impact, including, among other useful data points, our Scope 1 and Scope 2 greenhouse gas emissions. We are committed to being good environmental stewards and, as such, have continued to make strides in reducing our carbon footprint. Since the completion of our three-year baseline assessment of our carbon footprint in 2022, we have disclosed emission results on our website. Various strategic initiatives, including specific branch rationalization and energy efficiency efforts, have resulted in a 9% reduction in our total Scope 1 and Scope 2 greenhouse gas emission since 2019. We have accomplished this reduction, in part, by reducing our real estate square footage by approximately 40,000 square feet year over year.

Community relations and philanthropy: Employees and leaders serve charitable organizations and support community endeavors throughout our footprint. During 2023, we contributed nearly $3 million to approximately 300 organizations doing impactful work across our footprint. We made a $1 million commitment to Children’s Healthcare of Atlanta to improve the health of children in rural Georgia.