launched a management-level committee, known as the ESG Oversight Council, in the second quarter of 2020, which reports to the Corporate Governance and Nominating Committee. The ESG Oversight Council is comprised of key internal ESG stakeholders, including representatives of legal, investor relations, credit, facilities, vendor procurement, human resources, compliance and risk management, among others, as well as our Lead Director as an advisory member. In addition, we conducted an extensive discovery process to identify ESG risks and opportunities and made progress in our ESG reporting and disclosure, including closer alignment with the Sustainable Accounting Standards Board’s Accounting Standards for Commercial Banks. Moreover, we published an ESG website in January 2021, and our Chief Executive Officer, who will transition to the role of Executive Chairman on April 21, 2021, will focus his time in part on developing and advancing our ESG activities and initiatives. We believe that this structure and the process improvements best position us to monitor, manage and oversee all ESG-related risks and opportunities within the Company.

Our Sustainability Commitments

Environmental

Energy efficiency and conservation: Our conservation and energy efficiency efforts in 2020 included fitting approximately 25% of our branches and offices with LED lighting and fitting most of our buildings with automatic lighting fixtures to adapt to room activity and avoid excess energy. We are working to reduce our energy footprint by upgrading hardware, including replacement of more energy intensive desktop computers with new laptops.

Environmental lending, investments and considerations: We had more than $165 million in solar energy loans outstanding as of year-end 2020, and renewable energy credits earned in the year totaled more than $12 million. Moreover, our loan policies consider a customer’s practices and policies related to environmental issues as part of the credit underwriting process. Our environmental procedures are administered by a third party with expertise in environmental due diligence.

Social Capital

Community relations and philanthropy: Team members and leaders serve on charitable organizations and support community endeavors throughout our footprint. In 2020, Synovus team members volunteered approximately 24,000 hours through 4,200 Here Matters opportunities. Team member and company contributions totaled more than $1 million to United Way chapters throughout our footprint, and team members provided $110,500 in scholarships to 132 students through the Jack Parker Scholarship Fund. Philanthropic giving surpassed $3.0 million to more than 500 non-profits and other agencies across our footprint.

Financial education: In 2020, Synovus team members invested 270 hours in financial literacy education at five schools in our hometown of Columbus, Georgia. Team members also invested nearly 100 hours with students who participate in the Columbus Mayor’s Summer Youth Employment Program, and approximately 40 hours with service members at Fort Benning.

Access, affordability, and financial inclusion: Synovus Mortgage has committed $400 million to an Affordable Mortgage Program, with approximately $370 million funded through the end of 2020. Synovus made 426 community development loans in 2020 (including PPP loans) totaling approximately $709 million, and our affordable housing team made more than $110 million in project loans and more than $100 million in tax credit equity. We also have affordable housing specialists throughout our footprint focused solely on financial education and mortgage loan origination. Our most recent Community Reinvestment Act rating, from November 2017, was “Satisfactory.” We partner with Operation Hope to provide financial literacy and credit counseling to those in need, and our consumer products include no-fee retail checking options and a range of other products with flexible fee structures. As a buyer of goods and services, it is the policy of Synovus to engage a diverse network of vendors, including qualified minority vendors.

Small Business Lending: We are focused on supporting small businesses throughout our communities. Synovus made approximately 19,000 PPP loans totaling nearly $2.9 billion in 2020. Through the end of 2020, PPP loan forgiveness totaled approximately $540 million for around 3,100 loans. With the re-authorization and extension of PPP in 2021, we had over 8,000 new loan requests totalling $1 billion as of February 24, 2021. Finally, our bankers and team members remain very active and engaged in supporting the business community through their involvement with over 100 chambers of commerce, which we support through sponsorships, programs and activities.

Human Capital

Culture and workplace: Synovus has been recognized by Forbes as one of America’s best employers for women and by the AJC as a top workplace in Atlanta in 2020 and 2021. We strive to provide competitive compensation and benefits that meet the varying needs of our team members, including market- competitive pay, healthcare benefits, short and long-term incentive packages, an employee stock purchase plan, tuition assistance, and wellness and employee assistance programs. Our short and long-term incentive programs are aligned with our strategy and key business objectives and are intended to motivate strong performance.

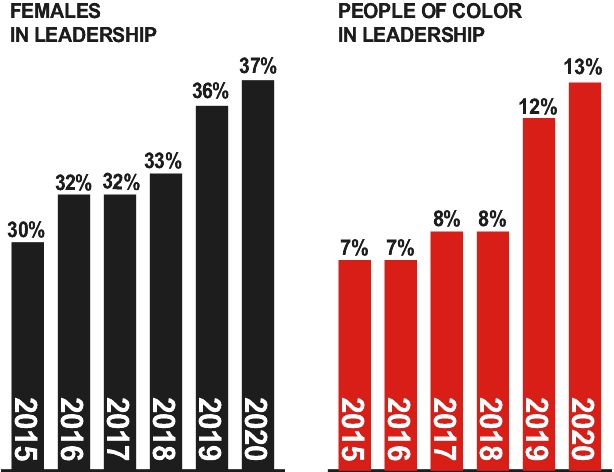

Synovus is committed to attracting and retaining the brightest and best talent. Of the approximately 1,200 open positions filled in 2020, 43% were filled by internal hires. In addition, employee turnover for 2020 was 15.5%, 4% lower than in 2019. Approximately 10% of our workforce received a promotion in 2020, consisting of 67% females and 30% people of color. Our commitment to our employees has resulted in a long-term workforce, with an average tenure of 8 years of service. We attribute our ability to attract and retain talent to several factors, including impactful work that affects the communities in which our employees live, strong leadership, availability of career advancement opportunities and competitive and equitable total rewards.

Synovus has created internal programs to support the development and retention of our employees, including internal development programs designed to train our leaders. In 2020, over 200 courses were offered to employees on such topics as leadership, compliance and professional development and an average of approximately 27 hours of training per employee was completed. During 2020, we also communicated new leadership expectations and training development tools for our employees and launched a new leadership development program. Synovus supports

— 2021 Proxy Statement

— 2021 Proxy Statement