Exhibit 99.93

VICINITY MOTOR CORP.,

formerly Grande West Transportation Group Inc.

ANNUAL INFORMATION FORM

FOR THE FINANCIAL YEAR ENDED

DECEMBER 31, 2020

March 30, 2021

TABLE OF CONTENTS

| EXPLANATORY NOTES | 1 |

| Date of Information | 1 |

| Presentation of Financial Information | 1 |

| Defined Terms | 1 |

| Forward-Looking Statements | 1 |

| BACKGROUND AND CORPORATE STRUCTURE | 3 |

| Name, Address and Incorporation | 3 |

| Inter-Corporate Relationships | 3 |

| DEVELOPMENT OF THE BUSINESS | 4 |

| Three Year History | 4 |

| BUSINESS OF THE COMPANY | 6 |

| Summary | 6 |

| Employees | 11 |

| RISK FACTORS | 11 |

| DIVIDENDS AND DISTRIBUTIONS | 19 |

| DESCRIPTION OF CAPITAL STRUCTURE | 19 |

| MARKET FOR SECURITIES | 20 |

| Trading Price and Volume | 20 |

| ESCROWED SECURITIES AND SECURITIES SUBJECT TO CONTRACTUAL RESTRICTION ON TRANSFER | 25 |

| DIRECTORS AND OFFICERS | 25 |

| Name, Occupation and Security Holding | 25 |

| Cease Trade Orders and Bankruptcies | 26 |

| Penalties or Sanctions | 27 |

| Conflicts of Interest | 27 |

| PROMOTERS | 27 |

| LEGAL PROCEEDINGS AND REGULATORY ACTIONS | 27 |

| INTEREST OF MANAGEMENT AND OTHERS IN MATERIAL TRANSACTIONS | 27 |

| Related Party Transactions | 28 |

| AUDITOR AND REGISTRAR AND TRANSFER AGENT | 28 |

| MATERIAL CONTRACTS | 28 |

| INTERESTS OF EXPERTS | 28 |

| ADDITIONAL INFORMATION | 28 |

| APPENDIX “A” GLOSSARY OF TERMS | 29 |

EXPLANATORY NOTES

Date of Information

Unless otherwise stated, the information in this AIF is stated as at December 31, 2020. Presentation of Financial Information

The Company presents its financial statements in Canadian dollars. All dollar figures in this AIF are in Canadian dollars, unless otherwise indicated. All of the financial data contained in this AIF relating to the Company have been prepared in accordance with International Financial Reporting Standards as issued by the International Accounting Standards Board (“IFRS”).

Defined Terms

For an explanation of the capitalized terms and expressions and certain defined terms, please refer to the “Glossary of Terms” at Appendix “A” of this AIF.

Forward-Looking Statements

Certain statements (collectively, “forward-looking statements”) in this AIF about the Company’s current and future plans, expectations and intentions, results, levels of activity, performance, goals or achievements or any other future events or developments constitute forward-looking information and/or forward-looking statements within the meaning of applicable securities legislation, securities regulation and securities rules, as amended, and the policies, notices, instruments and blanket orders in force from time to time that are applicable to an issuer (collectively, “Securities Laws”). The words “may”, “will”, “would”, “should”, “could”, “expects”, “plans”, “intends”, “trends”, “indications”, “anticipates”, “believes”, “estimates”, “predicts”, “likely” or “potential” or the negative or other variations of these words or other comparable words or phrases, are intended to identify forward-looking statements, although not all forward-looking statements contain these words.

Discussions containing forward-looking statements include, among other places, those under “Business of the Company” and “Risk Factors”. Forward-looking statements are based on certain assumptions and estimates made by us in light of the experience and perception of historical trends, current conditions, expected future developments including projected growth in the security and related industries, and other factors we believe are appropriate and reasonable in the circumstances, but there can be no assurance that such assumptions and estimates will prove to be correct.

Many factors could cause our actual results, level of activity, performance or achievements or future events or developments to differ materially from those expressed or implied by the forward-looking statements, including, without limitation, the factors, which are discussed in greater detail in the “Risk Factors” section of this AIF.

The purpose of the forward-looking statements is to provide the reader with a description of management’s expectations regarding the Company’s financial performance and may not be appropriate for other purposes. Readers should not place undue reliance on forward-looking statements made herein. Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause actual results to differ materially from those anticipated in such forward-looking statements. Actual results and developments are likely to differ, and may differ materially, from those expressed or implied by forward-looking statements contained in this AIF. Furthermore, unless otherwise stated, the forward-looking statements contained in this AIF are made as of the date of this AIF, and we have no intention and undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law. The forward-looking statements contained in this AIF are expressly qualified by this cautionary statement.

BACKGROUND AND CORPORATE STRUCTURE

Name, Address and Incorporation

The Company was incorporated under the Business Corporations Act (British Columbia) on December 4, 2012 under the name “Grande West Transport Group Inc.”. On August 7, 2013, the Company changed its name to “Grande West Transportation Group Inc.”. On March 29, 2021, the Company changed its name to “Vicinity Motor Corp.” to reflect the Company’s increasing focus on the commercialization of its next-generation electric buses and consolidated its share capital on the basis of three (3) common shares pre-consolidation to one (1) common share post-consolidation (the “Consolidation”). The information in this AIF related to securities issuances before March 29, 2021 is on a pre-Consolidation basis, except where noted.

The Company’s common shares (the “Common Shares”) are publicly traded on the TSX Venture Exchange (“TSXV”) under the symbol “VMC”, the OTCQX under the symbol “BUSXF” and the Frankfurt Stock Exchange (the “FSE”) under the symbol “6LG”.

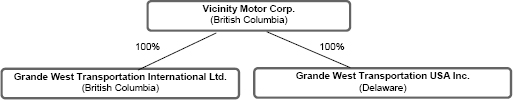

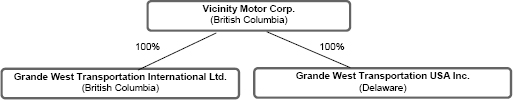

The Company conducts its active operations in Canada through its wholly owned operating subsidiary, Grande West Transportation International Ltd. (“GWTI”), which was incorporated on September 2, 2008 under the Business Corporations Act (British Columbia). The Company conducts its active operations in the United States through its wholly owned operating subsidiary, Grande West Transportation USA Inc. (“GWTUSA”), which was incorporated on April 8, 2014 under the laws of the State of Delaware.

The Company’s head office is located at 3168, 262nd Street, Aldergrove, British Columbia, V6B 1R4, and its registered and records office is located at 400 – 725 Granville Street, Vancouver, BC V7Y 1G5.

Inter-Corporate Relationships

As of the date hereof, the Company has two 100% wholly-owned subsidiaries: GWTI and GWTUSA.

The current organization structure of the Company is as follows:

DEVELOPMENT OF THE BUSINESS

Three Year History

Financial Year Ended December 31, 2018

On July 3, 2018, the Company announced that Alliance Bus Group (“ABG”), the Company’s U.S. distributor, had been awarded a state contract to purchase in the Georgia State Public Mass Transit & Transportation bid for the Vicinity 30’ and 35’ heavy-duty buses.

In October of 2018, the Company announced a new contract to purchase the Company’s Vicinity buses by a group of Mississippi-based transit authorities. The Company, along with ABG, was the winning bid for a five-year contract for 30’ heavy-duty low floor buses. The order was for up to 63 Vicinity buses over the term of the contract. As of March 26, 2021, the Company has delivered seven buses from this contract and is currently producing further buses for delivery.

On November of 2018, the Company announced new Canadian orders to purchase Vicinity buses for approximately $6,000,000 from the city of Medicine Hat, the county of Grande Prairie and a private operator in Quebec. In addition, ABG was awarded an Iowa Department of Transportation state contract to purchase Vicinity buses.

Financial Year Ended December 31, 2019

In March of 2019, the Company announced a purchase order with BC Transit for over 30 compressed natural gas (“CNG”) powered Vicinity buses for approximately $13,000,000.

In May of 2019, the Company announced it had entered into a vehicle assembly agreement with Spartan Specialty Chassis and Vehicles, a business unit of Spartan Motors Inc., the North American Leader in specialty vehicle manufacturing and assembly for the commercial and retail vehicle industries.

In August of 2019, the Company announced that William Trainer was appointed as Chief Executive Officer of the Company. Mr. Trainer founded the Company in 2008 and held the role of President and CEO throughout the development and initial high growth stages of the Company. Mr. Trainer had stepped down from the CEO position in February 2018 for personal reasons.

Financial Year Ended December 31, 2020

In February of 2020, the Company announced that it received a new contract from ABG for Vicinity bus orders with an aggregate value of approximately $40 million to replace an old fleet operating throughout multiple locations in the USA.

Beginning in March 2020, the Company’s business and operations began to adapt to changes brought about by the COVID-19 global pandemic. As an essential business manufacturing on behalf of the transit industry, the Company was able to maintain production, although levels were at times reduced compared to prior to the COVID-19 pandemic. Some of the Company’s suppliers and contract manufacturers temporarily suspended or reduced their production levels, and the Company’s internal staffing levels in production were temporarily reduced in order to comply with government regulations and maintain physical distancing in order to protect the health of its staff, customers and other stakeholders. While the Company has maintained sales and production since the start of the COVID-19 pandemic, the Company has done so at a reduced rate in order to comply with physical distancing requirements and government health regulations. The Company was able to secure government business grants in Canada to support our business through this period, including aid from the Canadian government in the amount of $543,654 during the nine months ended September 30, 2020. The Company’s management continues to monitor and adapt to the current economic realities that have resulted from the COVID-19 pandemic, however the ultimate impacts and duration of current conditions remain uncertain.

On March 4, 2020, the Company announced that the Vicinity LT shuttle bus (the “Vicinity LT”) was finishing production and that demo buses would be made available for the US and Canadian markets. See “Business of the Company – Vicinity Buses” for more information on the Vicinity LT.

On March 20, 2020, the Company announced the closing of its previously announced non brokered financing of unsecured convertible debenture units by issuing 1,750 debenture units (“Debenture Units”) for gross proceeds of approximately CAD$ 1,750,000, each Debenture Unit sold at a price of $980.00 per Debenture Unit and consisting of one 10.0% unsecured convertible debenture of the Company in the principal amount of $1,000 (each, a “Debenture”) with interest payable upon maturity being 12 months from the date the Debentures are issued, and 600 common share purchase warrants (“Warrants”) expiring 12 months after the date of issuance of such Warrants, the Debentures to be repaid in cash at maturity and each Warrant entitling the holder thereof to purchase one Common Share (a “Warrant Share”) at an exercise price of $0.38 per Warrant Share at any time up to 12 months following the closing date of the debenture financing.

On October 8, 2020, the Company announced that it had received a purchase order from the Region of Waterloo for four Vicinity buses for a total purchase price of approximately $2,000,000. The Company also announced the delivery of a 34 CNG Vicinity bus order.

On October 26, 2020, the Company announced that it had renewed its $20,000,000 credit facility with the Royal Bank of Canada, to be used for ongoing working capital requirements.

On November 18, 2020, the Company announced that it had closed the first tranche of its previously announced private placement of Units, the first tranche consisting of 7,816,118 Units for gross proceeds of $7,816,118. Each Unit consists one Common Share and one-half of one share purchase warrant. Each whole warrant (a “Private Placement Warrant”) entitles the holder to acquire an additional Common Share at a price of $1.50 per share for a period of two years from the date of closing of the first tranche of the private placement. 389,100 Finder’s warrants (non-transferable) having the same terms as the Private Placement Warrants were also issued in compensation.

On November 19, 2020, the Company announced that it had received an order from Keolis Canada for thirteen Vicinity buses for delivery in 2021.

On November 20, 2020, the Company announced that it had closed the second tranche of its previously announced private placement, the second tranche consisting of 843,000 Units for gross proceeds of $843,000. Each Unit consists one Common Share and one-half of one Private Placement Warrant. Each Private Placement Warrant entitles the holder to acquire an additional common share of the Company at a price of $1.50 per share for a period of two years from the date of closing of the second tranche of the private placement. 33,780 Finder’s warrants (non-transferable) having the same terms as the Private Placement Warrants were issued in compensation.

On November 24, 2020, the Company announced that its Vicinity Lightning electric bus (the “Vicinity Lightning”) was now offered for sale in Canada and the United States.

On December 1, 2020, the Company announced that it has entered into a contract with Hinduja Tech Inc., an integrated engineering and digital technology & solutions provider, for the design and engineering plans for its new American operational facility and headquarters in Washington State.

Subsequent Events

On February 22, 2021, the Company announced that it has entered into a strategic U.S. distribution agreement with ABC Companies, a leading provider of motorcoach and transit equipment in North America. See “Business of the Company – Strategic Relationships” for more information. The Company also announced that the State of New Mexico had selected Vicinity buses in a statewide purchasing contract that gives State transit agencies the right to purchase directly from the Company’s diverse bus portfolio. Vehicles for selection will be produced from the Company’s assembly facility in Washington State, which will be capable of producing 1,000 electric, CNG, gas and clean diesel units annually across all sizes and powertrains.

On March 8 2021, the Company announced the hiring of Manuel Achadinha as Chief Operating Officer. For over 25 years, Mr. Achadinha has built a reputation within the transportation industry for his strong work ethic, results-oriented drive and exceptional ability to forge and maintain strategic alliances. Mr. Achadinha was previously President and CEO of BC Transit from 2008 to 2018, where he led the development and implementation of BC Transit’s evolving business strategy. Mr. Achadinha has also held the position of Vice President, Terminal Operations, at BC Ferry Services Inc., where he was responsible for overseeing the operations of 48 terminals along the coast of British Columbia.

On March 25, 2021, the Company announced that it had received a $5 million order for seventeen CNG powered Vicinity buses for delivery in Q4 2021. The Company also announced that the Consolidation and the change of its corporate name to Vicinity Motor Corp. would be completed effective at market open on March 29, 2021.

On March 29, 2021, the Company announced that it had received initial orders for 10 Vicinity Lightning buses from ABC Companies.

BUSINESS OF THE COMPANY

Summary

The Company designs, builds and distributes a full suite of transit buses for public and commercial use, including electric, CNG, gas and clean diesel buses (collectively, the “Vicinity Buses”). The Company has been successful in supplying Canadian municipal transportation agencies and private operators with Vicinity Buses. The Company, with its strong distribution chain in the U.S., is actively pursuing opportunities in public and private transit fleet operations that would benefit from the Company’s vehicles.

The Company has world class strategic partnerships to manufacture its Vicinity bus products in Europe, Asia, Canada, and the United States. The Company is currently completing the construction of an assembly plant in Washington State, a cost-effective location in proximity to the border between Canada and the USA. The Washington State facility will produce buses to be compliant with the “Buy American” Act and is expected to be capable of producing up to 1,000 electric, CNG, gas and clean diesel units annually across all sizes and powertrains.

In a large and unsaturated market segment, the Company is poised to capture sales growth from both the replacement of cut-away buses and the need for transit fleets to find the appropriate balance of vehicle sizes across Canada and the United States.

Products

Vicinity Buses

General

The Vicinity Buses were born from a need expressed by transit systems looking for a durable, reliable, customer oriented mid-size vehicle at a reasonable price point. The Company designs the Vicinity Buses with affordability, accessibility and global responsibility in mind. The Vicinity Buses cost significantly less than a 40’ bus and are considerably more durable than cut-away buses which are based on a truck chassis.

The flagship Vicinity bus delivers significant fuel savings, lower upfront costs with low operating costs, and offers a smoother ride when compared with competitors. The Vicinity Buses are designed to meet North America’s onerous operating environment, and were tested and ranked “Best in Class” in the FTA’s Bus Test Program at Altoona, Pennsylvania.

The Vicinity Buses’ features include:

| ● | Big bus technology in a compact, affordable platform; |

| | |

| ● | Worry-free two-year bumper to bumper warranty; |

| | |

| ● | Galvanized steel monocoque structure; |

| | |

| ● | Bonded windows; |

| | |

| ● | Fiberglass body panels; |

| | |

| ● | Cummins engine; |

| | |

| ● | ZF, Allison or Voith transmission; |

| | |

| ● | Front entry ramp; and |

| | |

| ● | Multiple electronic technical features. |

Vicinity LT

The Vicinity LT, a purpose-built true low floor bus, has a monocoque-body with a rear-engine and is available in 26’ and 28’ lengths.

The Vicinity LT, powered with an automotive powertrain, has a longer service life than the average competitor’s cutaway bus and addresses accessibility issues for passengers with mobility issues, all while being competitively priced for the market segment.

The Vicinity LT will provide the Company with access to the high-end cutaway bus market segment. Municipalities of all sizes across Canada and the U.S. along with private operators in multiple sectors are looking for a more robust low floor accessible bus to replace their cutaways.

Vicinity Lightning

The EV version of the Vicinity LT, the Vicinity Lightning, is the Company’s first fully electric bus, and is the newest model in the Company’s bus portfolio. The Vicinity Lightning is an environmentally friendly alternative to diesel vehicles currently used in this segment. The Vicinity Lightning will place the Company in an excellent position to capture market share as the demand for zero emission buses grows.

The Vicinity Lightning is a low-floor transit bus, scaled down for a diverse range of uses including community shuttles, para-transit, university shuttles and other applications. The Vicinity Lightning is designed from the ground up and purpose-built to use commercially available, high-volume and reliable components from the automotive industry. It features 19.5” tires and hydraulic disc brakes, high-power AC direct on-board charging and DC fast charging options. Its design allows it to fit into any standard transit garage with no major infrastructural electrical upgrades.

The Vicinity Lightning will use proven zero emission technology to support a cleaner and more sustainable planet and community prosperity. The size and design of the bus provides maximum versatility to support multiple transportation applications utilizing high quality, proven and commercially available technology and industry standardized charging solutions. The Vicinity Lightning delivers ease of use without high-cost proprietary technology and charging systems.

The first five Vicinity Lightning bus deliveries are scheduled for 2021 with further additional customer orders expected shortly. The Company currently has 25 Vicinity Lightning EV buses in production to meet near term demand.

Parts Sales

The Company earns additional recurring revenues by selling aftermarket parts. Aftermarket parts sales are expected to continue to increase as the existing Vicinity bus fleet ages and new vehicles are placed into service.

Marketing

The Company’s sales team is focused on the goal of securing purchase orders from commercial transportation companies, transit operators, government agencies and universities.

The Company’s priority is to generate customers across all of the sectors targeted by the Company including, but not limited to, transit, shuttle, universities, government and commercialsectors. Many of the customers that the Company has deployed or is targeting have other buses in their fleet that the Company can replace with the Vicinity, Vicinity Lightning and the Vicinity LT. Ultimately, the Company intends to be the best choice for buses in this segment regardless of the fuel type that the customer chooses. The Company’s sales plan is to meet with the top potential customers and obtain purchase orders for new buses for their production vehicle requirements.

Strategic Relationships

Spartan Specialty Chassis and Vehicles

In May of 2019, the Company announced it had entered into a vehicle assembly agreement (the “Assembly Agreement”) with Spartan Specialty Chassis and Vehicles, a business unit of Spartan Motors Inc., the North American Leader in specialty vehicle manufacturing and assembly for the commercial and retail vehicle industries, as well as for the emergency response and recreational vehicle markets.

Under the terms of the Assembly Agreement, Spartan will manufacture the Vicinity Buses, which will continue to satisfy the FTA’s Buy America requirements and reduce potential tariff exposures.

ABC Companies

In February of 2021, the Company entered into a strategic U.S. distribution agreement with ABC Companies, a leading provider of motorcoach and transit equipment in North America. The ABC distributorship supports the Company’s focus on U.S. expansion as it begins marketing the Vicinity Lightning and the Vicinity LT to new and existing customers.

Under the distribution agreement, ABC Companies will distribute the Vicinity, Vicinity Lightning and the Vicinity LT throughout the Western United States from Texas to California. The Vicinity line fills in key transit and private shuttle markets within the ABC portfolio of new vehicles for these locations, enhancing the offering to current customers while expanding to other sectors.

Alliance Bus Group LLC

Alliance Bus Group LLC has been a US distributor for the Company since 2015.

Components

The Company utilizes a global supply chain for component parts for buses ensuring world class quality and cost-effective products with the highest safety standards. Wherever possible there are multiple suppliers for components to ensure there is no economic dependence on any individual supplier.

As a result of the COVID-19 global pandemic, some of the Company’s suppliers have suspended or scaled back their operations. The supply chain for the Company is currently able to provide the necessary components for production and aftermarket parts but there is a risk of potential supply chain disruption.

Intangibles

The Company has invested significant resources in developing its suite of Vicinity Buses. The Company created and owns the rights to the design of its buses and ongoing product development. The Company has intellectual property agreements in place where necessary with partners and developers ensuring oversight over maintaining internally created or developed intellectual property. The Vicinity Buses use key components from established third

party suppliers. The Company does not currently have patents, and licenses, but may choose to obtain patents and licenses on our designs, processes or inventions in the future.

Cycles

The Company does not expect the market for transit buses to experience cyclical or seasonal changes.

Economic Dependence

The Company’s sales have been concentrated on a small number of customers and therefore the Company’s revenues are reliant on a small number of customers. However, on a year-to year basis the customers have changed and are not the same small number of customers on a repeated basis.

Environmental Protection

Environmental laws and regulations may affect the operations of the Company. The Company is subject to numerous environmental and health and safety laws, including statutes, regulations, bylaws and other legal requirements. These laws relate to the generation, use, handling, storage, transportation and disposal of regulated substances, including hazardous substances, dangerous goods and waste, emissions or discharges into soil, water and air, including noise and odors (which could result in remediation obligations), and occupational health and safety matters, including indoor air quality. Failure to dispose of these in a manner compliant with local environmental regulation could expose the Company to penalties and clean-up costs. These legal requirements vary by location and can arise under federal, provincial, state or municipal laws. Any breach of such laws, regulations or requirements may negatively effect on our company and its operating results.

Specialized Skill and Knowledge

There is a specialized skill required for the development, operations, maintenance, sales and marketing of the Company’s technology and buses. The Company’s current staff possesses the necessary skills, knowledge, and expertise required for the Company’s business. As additional employees are added to the company, they will be trained by existing Company staff as needed.

As the Company expands operations and continues to grow, ensuring that all of our employees possess the necessary skills, educations, and appropriate licenses as required by regulatory agencies will be important in sustaining the Company’s growth.

Changes to Contracts

The Company does not reasonably expect any material changes to contracts or business relationships in the current financial year.

Employees

As at the date of this AIF, the Company has approximately 53 employees, who are responsible for assisting the management of the Company and its day to day operations. The Company relies heavily on its senior management team. Operations could be impacted if one or more members of the senior management team were to depart unless the Company has in place sufficient safeguards. The Company has developed a succession plan to ensure continuity and mitigate any potential disruptions from any departures in the senior management team.

Foreign Operations

The Company has world class strategic partnerships to manufacture its products in Europe, Asia, Canada, and the United States. See “Three Year History” and “Business of the Company” for details of our foreign operations. As the Company continues to grow, the Company expects to expand our United States operations with the development of an assembly plant in Washington State.

There are risks associated with foreign operations, including currency risk and regulatory risk. In the event there is a dispute, the Company may be unable to obtain legal remedy or legal proceedings may be prohibitively expensive.

Lending

The Company’s operations generally do not include any lending operations. Invoices paid by customers must be paid in a reasonable time period.

RISK FACTORS

You should carefully consider the risks described below, which are qualified in their entirety by reference to, and must be read in conjunction with, the detailed information appearing elsewhere in this AIF, and all other information contained in this AIF. The risks and uncertainties described below are those we currently believe to be material, but they are not the only ones we face. If any of the following risks, or any other risks and uncertainties that we have not yet identified or that we currently consider not to be material, actually occur or become material risks, our business, prospects, financial condition, results of operations and cash flows and consequently the price of the Company’s common shares could be materially and adversely affected.

Operational Risks

The Company is exposed to many types of operational risks that affect all companies. Operational risk is the risk of loss resulting from inadequate or failed internal processes, people and/or systems or from external events. Operational risk is present in all of the Company’s business activities, and incorporates exposure relating to fiduciary breaches, regulatory compliance failures, legal disputes, business disruption, pandemics, floods, technology failures, processing errors, business integration, damage to physical assets, employee safety and insurance coverage. Such risks also include the risk of misconduct, theft or fraud by employees or others, unauthorized transactions by employees, operational or human error or not having sufficient levels or quality of staffing resources to successfully achieve the Company’s strategic or operational objectives. The occurrence of an event caused by an operational risk that is material could have a material adverse effect on the Company’s business, financial condition, liquidity and operating results.

Dependence on limited sources or unique sources of supply

The Company enters into long-term agreements with certain of its suppliers, and typically purchases supplies on an order-by-order basis depending on the material requirements to build customers’ buses. Certain raw materials and components used in the bus manufacturing industries are obtained from a limited group of suppliers. In some cases, there is only a single source of supply of components to the industry, such as engines. The Company’s reliance on a sole supplier, limited groups of suppliers or raw materials and components that may be available in limited supply and purchasing components from suppliers that have been specifically named by customers involves several risks, including increased risk of inability to obtain adequate supplies (due to accidents, strikes, shortage of raw materials or other events affecting a supplier, including a supplier having financial or operational issues or discontinuing to supply a product or a component), costs arising from poor quality of the materials or components supplied, increased risk of being forced to suspend production of certain of its products, and reduced control over pricing and timely delivery. Although the availability, timeliness, quality and pricing of deliveries from the Company’s suppliers have historically been acceptable and although management believes that additional sources of supply for most components and materials should be available on an acceptable basis, there are no assurances that this dependence on a sole supplier or a limited group of suppliers or on certain raw materials and components that may be available in limited supply will not have a materially adverse effect on the Company’s business, financial condition, liquidity and operating results.

The Company’s profitability can be adversely affected by increases in raw material and component costs

Raw materials and components represent a significant majority of the Company’s production cost structure. The Company’s operating results may be affected by the cost of carbon and stainless steel, aluminum, copper, resins and oil-based products that are the primary raw material and component inputs for its products. Although certain raw material and component prices may be fixed on a quarterly basis, or for longer periods if possible, if raw material or component prices increase significantly, there may be a resulting increase in the Company’s supply costs and it may not be able to pass on these higher costs to its customers.

Increases in the prices paid for raw materials and components that are not recoverable by the Company, particularly in situations where prices under multi-year bus purchase contracts have been quoted to customers as firm and fixed, could materially adversely affect the Company’s profit margins and impair the Company’s ability to compete. These matters could have a material adverse effect on the Company’s business, financial condition, liquidity and operating results.

Catastrophic events may lead to production curtailments or shutdowns

The Company’s facilities are subject to the risk of catastrophic loss due to unanticipated events such as floods, fires, pandemics, explosions or violent weather conditions. Unexpected interruptions in the Company’s production capabilities would adversely affect its productivity and results of operations. As a means of guarding against these measures, contracts contain force majeure provisions wherever possible. Some customer contracts may not have force majeure provisions and, if there are unexpected interruptions or long-term disruptions to the production and delivery of transit buses due to catastrophic losses or unanticipated events, liquidated damages payable to customers under these contracts may be significant. Moreover, any interruption in production capability may require the Company to make significant capital expenditures to remedy the problem, which would reduce the amount of cash available for its operations. The Company’s insurance may not cover its losses. In addition, longer-term business disruption could harm the Company’s reputation and result in a loss of customers. The occurrence of any of these events could materially adversely affect the Company’s business, financial condition, liquidity and operating results.

The Company’s operations are subject to risks and hazards that may result in monetary losses and liabilities not covered by insurance or which exceed its insurance coverage

The Company’s business is generally subject to a number of risks and hazards, including pollution and other environmental risks and changes in the regulatory environment. Although the Company maintains general liability insurance and property and business interruption insurance, because of the nature of its industry hazards, it is possible that liabilities for occurrences such as pollution and other environmental risks, property and equipment damage or injury or loss of life arising from a major or unforeseen occurrence may not be covered by the Company’s insurance policies or could exceed insurance coverages or policy limits. Any significant losses which are not adequately covered by insurance could materially adversely affect the Company’s business, financial condition, liquidity and operating results.

The Company may be adversely affected by rising insurance costs

The Company’s cost of maintaining liability, personal injury, property damage, workers’ compensation and other types of insurance is significant. The Company could experience materially higher insurance premiums as a result of adverse claims experience or because of general increases in premiums by insurance carriers for reasons unrelated to its own claims experience. Generally, the Company’s insurance policies must be renewed annually. The Company’s ability to continue to obtain insurance at affordable premiums and reasonable deductibles or self-insured retentions also depends upon its ability to continue to operate with an acceptable safety record and claims history. A significant increase in the number or value of claims against the Company, the assertion of one or more claims in excess of its policy limits or the inability to obtain adequate insurance coverage for reasonable premiums, with reasonable deductibles or self-insured retentions or at acceptable levels, or at all, could have a material adverse effect on the Company’s business, financial condition, liquidity and operating results.

The Company is subject to litigation in the ordinary course of business and may incur material losses and costs as a result of product liability claims

In the ordinary course of business, the Company is subject to various claims and litigation. Any such claims, whether with or without merit, could be time consuming and expensive to defend and could divert management’s attention and resources. In addition, the Company faces an inherent risk of exposure to product liability claims if the use of its products result, or are alleged to result, in personal injury and/or property damage. If the Company manufactures a defective product or if component failures or component fires result in damages that are not covered by warranty provisions, it may experience material product liability losses in the future. In addition, the Company may incur significant costs to defend product liability claims. The Company could also incur damages and significant costs in correcting any defects, lose sales and suffer damage to its reputation. The Company’s product liability insurance coverage may not be adequate for any liabilities it could incur and may not continue to be available on terms acceptable to it. The Company may elect not to obtain insurance if it believes that the cost of available insurance is excessive relative to the risks presented. If any significant accident, judgment, claim or other event is not fully insured or indemnified against, it could have a material adverse effect on the Company’s business, financial condition, liquidity and operating results. Moreover, the adverse publicity that may result from a product liability claim or perceived or actual defect with the Company’s products could have a material adverse effect on the Company’s ability to successfully market and sell its products.

Due to the worldwide COVID-19 outbreak, material uncertainties may come into existence that could materially and adversely affect the business of the Company

Due to the worldwide COVID-19 outbreak, material uncertainties may come into existence that could materially and adversely affect the business of the Company. The Company cannot accurately predict the future impact COVID-19 may have on, among others, the financial ability of the Company’s customers to purchase the Company’s buses, the Company’s suppliers ability to deliver products used in the manufacture of the Company’s buses, if at all, in the Company’s employees’ ability to manufacture the Company’s buses and to carry out their other duties in order to sustain the Company’s business, and in the Company’s ability to collect certain receivables owing to the Company.

Despite global vaccination efforts, it is not possible to reliably estimate the length and severity of these developments and the impact on the financial results and condition of the Company in the future.

Developments in alternative technologies may materially adversely affect the demand for the Company’s vehicles

Significant developments in alternative technologies, such as advanced diesel, ethanol, fuel cells or compressed natural gas, or improvements in the fuel economy of the internal combustion engine, may materially and adversely affect the Company’s business and prospects in ways the Company does not currently anticipate. Any failure by the Company to develop new or enhanced technologies or processes, or to react to changes in existing technologies, could materially delay the Company’s development and introduction of new and enhanced vehicles, which could result in the loss of competitiveness of the Company’s vehicles, decreased revenue and a loss of market share to competitors.

If the Company is unable to keep up with advances in electric vehicle technology, the Company may suffer a decline in its competitive position

The Company may be unable to keep up with changes in electric vehicle technology and, as a result, may suffer a decline in its competitive position. Any failure to keep up with advances in electric vehicle technology would result in a decline in the Company’s competitive position which would materially and adversely affect the business, prospects, operating results and financial condition of the Company. The Company’s research and development efforts may not be sufficient to adapt to changes in electric vehicle technology. As technologies change, the Company plans to upgrade or adapt its vehicles and introduce new models to continue to provide vehicles with the latest technology. However, the Company’s vehicles may not compete effectively with alternative vehicles if the Company is not able to source and integrate the latest technology into its vehicles at a competitive price.

The Company may need to defend itself against intellectual property infringement claims, which may be time consuming and could cause us to incur substantial costs.

Others, including the Company’s competitors, may hold or obtain patents, copyrights, trademarks or other proprietary rights that could prevent, limit or interfere with the Company’s ability to make, use, develop, sell or market its products and services, which could make it more difficult for the Company to operate its business. From time to time, the holders of such intellectual property rights may assert their rights and urge the Company to take licenses, and/or may bring suits alleging infringement or misappropriation of such rights. The Company may consider the entering into licensing agreements with respect to such rights, although no assurance can be given that such licenses can be obtained on acceptable terms or that litigation will not occur, and such licenses could significantly increase the Company’s operating expenses. In addition, if the Company is determined to have infringed upon a third party’s intellectual property rights, it may be required to cease making, selling or incorporating certain components or intellectual property into the goods and services the Company offers, to pay substantial damages and/or license royalties, to redesign its products and services, and/or to establish and maintain alternative branding for its products and services. In the event that the Company is required to take one or more such actions, the Company’s business, prospects, operating results and financial condition could be materially adversely affected. In addition, any litigation or claims, whether or not valid, could result in substantial costs, negative publicity and diversion of resources and management attention.

The Company depends on certain key personnel, and the success of the Company will depend on the Company’s continued ability to retain and attract such qualified personnel

The Company’s success depends on the efforts, abilities and continued service of its executive officers and management. A number of these key employees have significant experience in the transit and electric vehicle industry, and valuable relationships with the Company’s suppliers, customers, and other industry participants. A loss of service from any one of these individuals may adversely affect the Company’s operations, and the Company may have difficulty or may be unable to locate and hire a suitable replacement.

The Company is subject to numerous environmental and health and safety laws and any breach of such laws may have a material adverse effect on the Company’s business and operating results

The company is subject to numerous environmental and health and safety laws, including statutes, regulations, bylaws and other legal requirements. These laws relate to the generation, use, handling, storage, transportation and disposal of regulated substances, including hazardous substances (such as batteries), dangerous goods and waste, emissions or discharges into soil, water and air, including noise and odors (which could result in remediation obligations), and occupational health and safety matters, including indoor air quality. These legal requirements vary by location and can arise under federal, provincial, state or municipal laws. Any breach of such laws, regulations or requirements could have a material adverse effect on the Company and its operating results.

The Company’s vehicles are subject to motor vehicle standards and the failure to satisfy such mandated safety standards would have a material adverse effect on the Company’s business and operating results.

All vehicles sold by the Company must comply with federal, state and provincial motor vehicle safety standards. In both Canada and the United States, vehicles that meet or exceed all federally mandated safety standards are certified under federal regulations. In this regard, Canadian and U.S. motor vehicle safety standards are substantially the same. Rigorous testing and the use of approved materials and equipment are among the requirements for achieving federal certification. Failure by the Company to have its current or future vehicles satisfy motor vehicle standards would have a material adverse effect on the Company’s business and operating results.

If the Company’s vehicles fail to perform as expected, the Company’s ability to continue to develop, market and sell its vehicles could be harmed

The Company’s vehicles may contain defects in design and manufacture that may cause them not to perform as expected or that may require repair. While the Company has performed extensive testing of its vehicles, the Company currently has a limited frame of reference to evaluate the performance of its vehicles in the hands of its customers under a range of operating conditions.

If the Company fails to manage future growth effectively, the Company may not be able to market and sell its vehicles successfully.

Any failure to manage the Company’s growth effectively could materially and adversely affect the business, prospects, operating results and financial condition of the Company. The Company is expecting significant growth in sales, and are currently expanding its employees, facilities and infrastructure in order to accommodate this growth.

The Company’s future operating results depend to a large extent on its ability to manage this expansion and growth successfully. Risks that the Company faces in undertaking this expansion include:

| | ● | training new personnel; |

| | ● | forecasting production and revenue; |

| | ● | controlling expenses and investments in anticipation of expanded operations; |

| | ● | establishing or expanding manufacturing, sales and service facilities; |

| | ● | implementing and enhancing administrative infrastructure, systems and processes; and |

| | ● | addressing new markets. |

The Company intends to continue to hire a number of additional personnel. There is significant competition for individuals with experience manufacturing and servicing vehicles, and we may not be able to attract, assimilate, train or retain additional highly qualified personnel in the future. The failure to attract, integrate, train, motivate and retain these additional employees could harm the Company’s business and prospects.

The Company’s business may be adversely affected by labour and union activities.

Today none of our employees are currently represented by a labour union, however, the Company is directly and indirectly dependent upon other companies with unionized work forces, such as parts suppliers, and work stoppages or strikes organized by such unions could have a material adverse impact on the Company’s business, financial condition or operating results. If a work stoppage occurs within the Company’s business or in one of its key suppliers, it could delay the manufacture and sale of the Company’s vehicles and have a material adverse effect on the business, prospects, operating results and financial condition of the Company.

The Company’s credit facility contains covenant restrictions that may limit its ability to access funds on the credit facility or engage in other commercial activities.

The terms of the Company’s credit facility contains, and future debt agreements the Company enters into may contain, covenant restrictions that limit the Company’s ability to incur additional debt or issue guarantees, create liens, and make certain dispositions of property or assets. As a result of these covenants, the Company’s ability to respond to changes in business and economic conditions and engage in beneficial transactions, including obtaining additional

financing as needed, may be restricted. Furthermore, the Company’s failure to comply with its debt covenants could result in a default under its credit facility, which would permit the lender to demand repayment.

It may be difficult for non-Canadian investors to obtain and enforce judgments against the Company because of its Canadian incorporation and presence.

The Company exists under the laws of British Columbia, Canada. Some of the Company’s directors and officers named in this AIF, are residents of Canada, and all or a substantial portion of their assets, and a substantial portion of the Company’s assets, are located outside the United States. Consequently, it may be difficult for holders of Common Shares who reside in the United States to effect service within the United States upon the Company’s directors and officers who are not residents of the United States. It may also be difficult for holders of Common Shares who reside in the United States to realize in the United States upon judgments of courts of the United States predicated upon the Company’s civil liability and the civil liability of its directors and officers under the United States federal securities laws. Investors should not assume that Canadian courts (i) would enforce judgments of United States courts obtained in actions against the Company or its directors and officers predicated upon the civil liability provisions of the United States federal securities laws or the securities or “blue sky” laws of any state within the United States or (ii) would enforce, in original actions, liabilities against the Company or its directors and officers predicated upon the United States federal securities laws or any such state securities or “blue sky” laws.

The Company’s shareholders may experience dilution in the future.

The Company is authorized to issue an unlimited number of Common Shares. The Board has the authority to cause the Company to issue additional Common Shares without the consent of the Company’s shareholders. The issuance of any such securities may result in a reduction of the book value or market price of the Common Shares. Given the fact that the Company operates in a capital-intensive industry with significant working capital requirements, the Company may be required to issue additional common equity or securities that are dilutive to existing Common Shares in the future in order to continue its operations. The Company’s efforts to fund its intended business plan may result in dilution to existing shareholders. Further, any such issuances could result in a change of control or a reduction in the market price for our common shares.

The market price of the Common Shares may be volatile and may fluctuate in a way that is disproportionate to the Company’s operating performance.

The Common Shares are listed on the TSXV. Trading of shares on the TSXV is often characterized by wide fluctuations in trading prices, due to many factors that may have little to do with the Company’s operations or business prospects.

The price of the Common Shares has fluctuated significantly. This volatility could depress the market price of the Common Shares for reasons unrelated to operating performance. The market price of the Common Shares could decline due to the impact of any of the following factors upon the market price of our common shares:

| | ● | sales or potential sales of substantial amounts of the Common shares; |

| | ● | announcements about the Company or the Company’s competitors; |

| | ● | litigation and other developments relating to the Company or those of our suppliers; |

| | ● | conditions in the automobile industry; |

| | ● | governmental regulation and legislation; |

| | ● | variations in the Company’s anticipated or actual operating results; |

| | ● | change in securities analysts’ estimates of the Company’s performance, or our failure to meet analysts’ expectations; |

| | ● | change in general economic conditions or trends; |

| | ● | changes in capital market conditions or in the level of interest rates; and |

| | ● | investor perception of the Company’s industry or prospects. |

Many of these factors are beyond the Company’s control. The stock markets in general, and the market price of common shares of vehicle companies in particular, have historically experienced extreme price and volume fluctuations. These fluctuations often have been unrelated or disproportionate to the operating performance of these companies. These broad market and industry factors could reduce the market price of the Common Shares, regardless of our actual operating performance.

A prolonged and substantial decline in the price of the Common Shares could affect the Company’s ability to raise further working capital, thereby adversely impacting the Company’s ability to continue operations.

A prolonged and substantial decline in the price of the Common Shares could result in a reduction in the liquidity of the Common Shares and a reduction in the Company’s ability to raise capital. Because the Company plans to acquire a significant portion of the funds it needs in order to conduct its planned operations through the sale of equity securities, a decline in the price of the Common Shares could be detrimental to the Company’s liquidity and its operations because the decline may cause investors not to choose to invest in the Common Shares. If the Company is unable to raise the funds it requires for all its planned operations and to meet its existing and future financial obligations, the Company may be forced to reallocate funds from other planned uses and may suffer a significant negative effect on its business plan and operations, including its ability to develop new products and continue its current operations.

DIVIDENDS AND DISTRIBUTIONS

The Company has not declared or paid dividends since incorporation and has no present intention to declare or pay any dividends in the foreseeable future. Dividends paid by the Company would be subject to tax and, potentially, withholdings. Any decision to declare or pay dividends will be made by the Company’s Board of Directors based upon the Company’s earnings, financial requirements and other conditions existing at such future time.

DESCRIPTION OF CAPITAL STRUCTURE

Common Shares

As at the date hereof, giving effect to the Consolidation, the Company’s authorized capital consists of an unlimited number of Common Shares of which 29,307,435 Common Shares are issued and outstanding.

The holders of common shares of the Company are entitled to dividends, if, as and when declared by the Board of Directors of each respective company, to receive notice of and attend all meetings of shareholders of each respective company, to one vote per common share at such meetings and, upon liquidation, to rateably receive such assets of each respective company as are distributable to the holders of the common shares. There are no conversion or exchange rights attaching to the Common Shares, nor are there any sinking or purchase fund provisions, provisions permitting or restricting the issuance of additional securities or any other material restrictions, nor are there any provisions requiring a shareholder to contribute additional capital. All issued and outstanding common shares of the Company are fully paid and non-assessable.

Options

The stock option plan of the Company (the “Stock Option Plan”) provides for the grant of incentive stock options (“Options”) to eligible individuals in accordance with the terms of the Stock Option Plan. The Stock Option Plan was approved by the Company’s shareholders at its annual general meeting held on December 4, 2020.

The Stock Option Plan is a 10% rolling stock option plan implemented to provide effective incentives to directors, senior officers, employees, consultants, consultant company or management company employees of the Corporation and its subsidiaries, or an eligible charitable organization (collectively “Eligible Persons”) and to provide Eligible Persons the opportunity to participate in the success of the Company by granting to such individuals options, exercisable over periods of up to ten years, as determined by the Board, to buy shares of the Company at a price equal to the Market Price (as defined in the Stock Option Plan) prevailing on the date the option is granted less applicable discount, if any, permitted by the policies of the TSXV and approved by the Board.

The Stock Option Plan provides that the aggregate number of Common Shares which may be available for issuance under the Stock Option Plan will not exceed 10% of the total number of Common Shares issued and outstanding from time to time, less the number of Common Shares issuable pursuant to the Restricted Stock Unit Plan (the “RSU Plan”) and Deferred Share Unit Plan (the “DSU Plan”).

A copy of the Stock Option Plan is included as Schedule “A” to the Management Information Circular dated October 3, 2020, filed and available on SEDAR at www.sedar.com.

As at the date of this Annual Information Form, the Company has 1,413,323 Options outstanding on a post-Consolidation basis.

Restricted Share Units

As at the date of this Annual Information Form, there were nil restricted share units (“RSUs”) issued and outstanding and 166,666 RSUs are reserved for issuance under the Company’s RSU Plan on a post-Consolidation basis (subject to fractional rounding). A description of the principal aspects of the RSU plan is included in the Management Information Circular dated October 3, 2020, filed and available on SEDAR at www.sedar.com

Deferred Share Units

As at the date of this Annual Information Form, there were 95,142 deferred share units (“DSUs”) issued and outstanding and 166,666 DSUs are reserved for issuance under the Company’s DSU Plan on a post-Consolidation basis. A description of the principal aspects of the DSU plan is included in the Management Information Circular dated October 3, 2020, filed and available on SEDAR at www.sedar.com

Warrants

The Company may issue share purchase warrants from time to time entitling the holder thereof to purchase Common Shares. As at the date of this Annual Information Form, the Company has 1,512,415 common share purchase warrants outstanding on a post-Consolidation basis.

MARKET FOR SECURITIES

Trading Price and Volume

The Common Shares are listed on the TSXV under the symbol “VMC”, the OTCQX under the symbol “BUSXF” and the FSE under the symbol “6LG”. On March 29, 2021, the last trading day before the date of this AIF, the closing price of the Common Shares on the TSX-V was $7.49. The following tables sets forth information relating to the trading of the Common Shares on the TSXV for the dates indicated (pre-Consolidation and post-Consolidation).

| TSXV Price Range(1) |

| Month | | High | | Low | | Total Volume |

| | March 29, 2021 | | | | 7.75 | | | | 7.27 | | | | 32,140 | |

Notes:

(1) Presented on a post-Consolidation basis.

| TSXV Price Range(1) |

| Month | | High | | Low | | Total Volume |

| | March 1 - March 26, 2021 | | | | 3.20 | | | | 2.08 | | | | 8,933,594 | |

| | February 2021 | | | | 4.00 | | | | 2.81 | | | | 10,596,680 | |

| | January 2021 | | | | 4.59 | | | | 1.61 | | | | 27,694,885 | |

| | December 2020 | | | | 1.93 | | | | 1.41 | | | | 7,669,284 | |

| | November 2020 | | | | 2.14 | | | | 1.05 | | | | 18,584,336 | |

| | October 2020 | | | | 1.29 | | | | 0.65 | | | | 7,350,619 | |

| | September 2020 | | | | 0.79 | | | | 0.38 | | | | 5,908,164 | |

| | August 2020 | | | | 0.43 | | | | 0.30 | | | | 1,197,481 | |

| | July 2020 | | | | 0.395 | | | | 0.285 | | | | 720,543 | |

| | June 2020 | | | | 0.4 | | | | 0.25 | | | | 1,253,343 | |

| | May 2020 | | | | 0.295 | | | | 0.24 | | | | 518,752 | |

| | April 2020 | | | | 0.33 | | | | 0.24 | | | | 697,209 | |

| | March 2020 | | | | 0.455 | | | | 0.23 | | | | 2,323,382 | |

Notes:

(1) Presented on a pre-Consolidation basis. Prior to the Consolidation, the Common Shares were trading on the TSXV under the symbol “BUS”.

Prior Sales

Within the most recently completed financial year and also more recently, the Company issued the following securities (all reflected on a pre-Consolidation basis):

| Issue Date | | Number of Securities(1) | | Type of Security | | Issue Price per Security | | Aggregate Issue Price | | Nature of consideration |

| March 29, 2021 | | | 52,724 | | | | Common Shares | | | $ | 1.50 | | | $ | 79,086 | | | Warrant Exercise |

| March 24, 2021 | | | 2,500 | | | | Common Shares | | | $ | 1.50 | | | $ | 3,750 | | | Warrant Exercise |

| March 22, 2021 | | | 30,000 | | | | Common Shares | | | $ | 1.50 | | | $ | 45,000 | | | Warrant Exercise |

| March 19, 2021 | | | 14,400 | | | | Common Shares | | | $ | 1.50 | | | $ | 21,600 | | | Warrant Exercise |

| March 18, 2021 | | | 17,700 | | | | Common Shares | | | $ | 1.50 | | | $ | 26,550 | | | Warrant Exercise |

| March 18, 2021 | | | 750,000 | | | | Common Shares | | | $ | 0.38 | | | $ | 285,000 | | | Warrant Exercise |

| March 17, 2021 | | | 3,750 | | | | Common Shares | | | $ | 1.50 | | | $ | 5,625 | | | Warrant Exercise |

| March 10, 2021 | | | 300,000 | | | | Common Shares | | | $ | 0.38 | | | $ | 114,000 | | | Warrant Exercise |

| March 10, 2021 | | | 25,000 | | | | Common Shares | | | $ | 1.50 | | | $ | 37,500 | | | Warrant Exercise |

| March 8, 2021 | | | 300,000 | | | | Options(2) | | | | n/a | | | | n/a | | | Option Award to Officer |

| March 8, 2021 | | | 50,000 | | | | Common Shares | | | $ | 0.52 | | | $ | 26,000 | | | Option Exercise |

| March 3, 2021 | | | 6,500 | | | | Common Shares | | | $ | 1.50 | | | | 49,750 | | | Warrant Exercise |

| March 1, 2021 | | | 100,000 | | | | Common Shares | | | $ | 0.58 | | | $ | 58,000 | | | Option Exercise |

| February 22, 2021 | | | 62,500 | | | | Common Shares | | | $ | 1.50 | | | $ | 93,750 | | | Warrant Exercise |

| February 2, 2021 | | | 15,000 | | | | Common Shares | | | $ | 1.44 | | | $ | 21,600 | | | Option Exercise |

| February 1, 2021 | | | 125,000 | | | | Options(3) | | | | n/a | | | | n/a | | | Investor Relations |

| January 28, 2021 | | | 50,000 | | | | Common Shares | | | $ | 0.78 | | | $ | 39,000 | | | Option Exercise |

| January 27, 2021 | | | 15,000 | | | | Common Shares | | | $ | 1.44 | | | $ | 21,600 | | | Option Exercise |

| January 20, 2021 | | | 25,000 | | | | Common Shares | | | $ | 0.50 | | | $ | 12,500 | | | Option Exercise |

| January 20, 2021 | | | 150,000 | | | | Common Shares | | | $ | 0.58 | | | $ | 87,000 | | | Option Exercise |

| January 15, 2021 | | | 50,000 | | | | Common Shares | | | $ | 0.78 | | | $ | 39,000 | | | Option Exercise |

| January 12, 2021 | | | 25,000 | | | | Common Shares | | | $ | 0.40 | | | $ | 10,000 | | | Option Exercise |

| January 12, 2021 | | | 200,000 | | | | Common Shares | | | $ | 0.80 | | | $ | 160,000 | | | Option Exercise |

| January 12, 2021 | | | 1,000,000 | | | | Options(4) | | | | n/a | | | | n/a | | | External Consulting Fees |

| January 12, 2021 | | | 15,000 | | | | Common Shares | | | $ | 0.78 | | | $ | 11,700 | | | Option Exercise |

| January 7, 2021 | | | 10,000 | | | | Common Shares | | | $ | 0.50 | | | $ | 5,000 | | | Option Exercise |

| December 31, 2020 | | | 14,004 | | | | Deferred Share Units(5) | | | | n/a | | | | n/a | | | Director’s Fees |

| December 29, 2020 | | | 10,000 | | | | Common Shares | | | $ | 0.78 | | | $ | 7,800 | | | Option Exercise |

| December 1, 2020 | | | 15,000 | | | | Common Shares | | | $ | 1.44 | | | $ | 21,600 | | | Option Exercise |

| November 26, 2020 | | | 250,000 | | | | Common Shares | | | $ | 0.75 | | | $ | 187,500 | | | Option Exercise |

| November 25, 2020 | | | 200,000 | | | | Common Shares | | | $ | 0.80 | | | $ | 160,000 | | | Option Exercise |

| November 23, 2020 | | | 200,000 | | | | Options(6) | | | | n/a | | | | n/a | | | Option Award to Certain Directors |

| November 20, 2020 | | | 843,000 | | | | Units(7) | | | $ | 1.00 | | | $ | 843,000 | | | Cash |

| November 20, 2020 | | | 422,880 | | | | Finder Warrants(8) | | | | n/a | | | | n/a | | | Finder Services |

| November 17, 2020 | | | 7,816,118 | | | | Units(7) | | | $ | 1.00 | | | $ | 7,816,118 | | | Cash |

| October 28, 2020 | | | 50,000 | | | | Common Shares | | | $ | 0.52 | | | $ | 26,000 | | | Option Exercise |

| October 23, 2020 | | | 28,580 | | | | Deferred Share Units(5) | | | | n/a | | | | n/a | | | Director’s Fees |

| October 8, 2020 | | | 400,000 | | | | Options(9) | | | | n/a | | | | n/a | | | External Consulting Fees |

| September 30, 2020 | | | 300,000 | | | | Common Shares | | | $ | 0.67 (deemed) | | | | n/a | | | Director’s Fees |

| September 21, 2020 | | | 200,000 | | | | Options(10) | | | | n/a | | | | n/a | | | Investor Relations |

| September 21, 2020 | | | 300,000 | | | | Restricted Share Units(11) | | | | n/a | | | | n/a | | | Employment Incentive to Certain Officers |

| September 21, 2020 | | | 134,465 | | | | Deferred Share Units(5) | | | | n/a | | | | n/a | | | Director’s Fees |

| May 26, 2020 | | | 100,000 | | | | Options(12) | | | | n/a | | | | n/a | | | Employment Incentive to an Officer |

| May 20, 2020 | | | 150,000 | | | | Options(13) | | | | n/a | | | | n/a | | | Employment Incentive to Certain Officers |

| March 20, 2020 | | | 1,750 | | | | Debenture Units(14) | | | $ | 980.00 | | | $ | 1,715,000 | | | Cash |

| March 9, 2020 | | | 19,556 | | | | Common Shares | | | $ | 0.38 (deemed) | | | | n/a | | | Interest on Debentures |

| March 9, 2020 | | | 1,818,180 | | | | Common Shares | | | $ | 0.33 (deemed) | | | | n/a | | | Debenture Conversion |

| January 7, 2020 | | | 100,000 | | | | Common Shares | | | $ | 0.495 (deemed) | | | | n/a | | | Director’s Fees |

| January 1, 2020 | | | 40,537 | | | | Deferred Share Units(5) | | | | n/a | | | | n/a | | | Director’s Fees |

Notes:

| | (1) | Presented on a pre-Consolidation basis. |

| | (2) | Each five year option is exercisable at a price of $2.40 per Common Share. 1/6 of these options will vest every six months over three years. |

| | (3) | Each five year option is exercisable at a price of $3.12 per Common Share. These options vest in 5 increments over one year. |

| | (4) | Each five year option is exercisable at a price of $2.17 per Common Share. These options vested on the date of issuance. |

| | (5) | Directors have the option of being compensated with DSUs rather than cash. Each DSU will vest into one Common Share upon retirement from the Company. |

| | (6) | Each five year option is exercisable at a price of $2.17 per Common Share. These options vested on the date of issuance. |

| | (7) | Each unit (“Unit”) is comprised of one Common Share and one-half of one common share purchase warrant, each whole common share purchase warrant entitling the holder thereof to acquire one Common Share for a period of two (2) years from the date of issuance thereof at a price of $1.50 per Common Share. In circumstances where the closing trading price of the Company’s Common Shares is greater than $1.75 per share for a period of 20 consecutive trading days, the Company may give notice accelerating the expiry date and the share purchase warrants will expire 30 days thereafter. |

| | (8) | Finders’ warrants issued in connection with the Company’s November 2020 private placement of Units. Each finders’ warrant is exercisable at a price of $1.50 for a period of two years, subject to certain acceleration provisions. |

| | (9) | Each five year option is exercisable at a price of $0.80 per Common Share. These options vested on at the date of issuance. |

| | (10) | Each two year option is exercisable at a price of $0.475 per Common Share. 1/4 of these options will vest every four months over a one year period. |

| | (11) | Each RSU will vest into common shares upon the achievement of certain individual performance milestones. |

| | (12) | Each five year option is exercisable at a price of $0.40 per Common Share. 1/6 of these options will vest every six months over three years. |

| | (13) | Each five year option is exercisable at a price of $0.40 per Common Share. 1/2 of these options every six months over one year. |

| | (14) | Each debenture unit is comprised of one 10.0% unsecured convertible debenture of the Company in the principal amount of $1,000 (a “Debenture”) with interest payable upon maturity being 12 months from the date the Debentures are issued, and 600 common share purchase warrants (each, a “Warrant”) expiring 12 months after the date of issuance of such Warrants. The Debentures will be repaid in cash at maturity. Each Warrant entitles the holder thereof to purchase one Common Share (a “Warrant Share”) at an exercise price of $0.38 per Warrant Share at any time up to 12 months following the closing date of the Offering subject to adjustment in certain events. |

ESCROWED SECURITIES AND SECURITIES SUBJECT TO CONTRACTUAL RESTRICTION ON TRANSFER

As at the date hereof, none of the Company’s securities are subject to escrow or subject to contractual restrictions on transfer.

DIRECTORS AND OFFICERS

Name, Occupation and Security Holding

The following table sets out, as at the date hereof, for each of the directors and executive officers of the Company, the person’s name, province and country of residence, their respective positions and offices held, the date on which the person became a director, his or her principal occupation and previously held positions for the last five years, and the number and percentage of Common Shares beneficially owned, controlled or directed, directly or indirectly. Our directors are expected to hold office until our next annual meeting of shareholders. Our directors are elected annually and, unless re-elected, retire from office at the end of the next annual general meeting of shareholders.

| Name and Municipality of Residence | | Principal Occupations for the Last Five Years | | Period(s) during which each director has served as a director of the Company | | Number and Percent of Voting Securities(3) |

| William Trainer Langley, BC, Canada Chief Executive Officer, President and Director | | Chief Executive Officer of the Company | | December 4, 2012 to present | | | 1,415,041 | (4) | | | 4.83 | % |

| Joseph Miller(1)(2) Surrey, BC, Canada Chairman and Director | | Commercial Real Estate Developer | | December 4, 2012 to present | | | 1,908,819 | (5) | | | 6.51 | % |

| John LaGourgue(1) Surrey, BC, Canada VP Corporate Development and Director | | VP Corporate Development and Director of the Company | | June 21, 2016 to present | | | 241,374 | (6) | | | 0.82 | % |

| Andrew Imanse Orange County, CA, USA Director | | Independent Corporate Advisor | | October 13, 2015 to present | | | 91,133 | (7) | | | 0.31 | % |

| Christopher Strong (1)(2) Fort Worth, TX, USA Director | | Independent Corporate Advisor | | May 29, 2018 to present | | | Nil | (8) | | | N/A | |

| James White Toronto, ON, Canada Director | | Managing Partner, Baynes & White, Toronto, ON | | September 23, 2019 to present | | | 270,871 | (9) | | | 0.92 | % |

| Danial Buckle Vancouver, BC, Canada Chief Financial Officer | | Chief Financial Officer of the Company (2018- 2021) Finance Director and Corporate Secretary of Fortress Paper Ltd. (2009 – 2017) | | December 4, 2020 to present | | | 99,300 | (10) | | | 0.34 | % |

| Manuel Achadinha Victoria, BC, Canada Chief Operating Officer | | Chief Operating Officer of the Company (March 2021) President and CEO of BC Transit from 2008 to 2018 | | March 8, 2021 | | | Nil | (11) | | | N/A | |

Notes:

| | (1) | Denotes a member of the Audit Committee. |

| | (2) | Denotes a member of the Compensation Committee. |

| | (3) | Based on 29,307,435 Common Shares issued and outstanding as of the date of this AIF. |

| | (4) | In addition, Mr. Trainer holds 283,333 Options and 16,666 Warrants. |

| | (5) | In addition, Mr. Miller holds 31,751 DSUs and 83,333 Options. |

| | (6) | In addition, Mr. LaGourgue holds 8,211 DSUs and 16,666 Options. |

| | (7) | In addition, Mr. Imanse holds 16,666 Options. |

| | (8) | In addition, Mr. Strong holds 99,999 Options and 34,097 DSUs |

| | (9) | In addition, Mr. White holds 21,083 DSUs, 33,332 Options and 45,000 Warrants. |

| | (10) | In addition, Mr. Buckle holds 99,999 Options. |

| | (11) | In addition, Mr. Achandinha holds 100,000 Options. |

Cease Trade Orders and Bankruptcies

None of our directors or executive officers is, as at the date of this AIF, or has been within 10 years before the date of this AIF, a director, chief executive officer or chief financial officer of any company (including us) that, while that person was acting in that capacity, or after that person ceased to act in such capacity but resulting from an event that occurred while that person was acting in such capacity, was the subject of a cease trade order, an order similar to a cease trade order, or an order that denied the company access to any exemption under securities legislation in each case for a period of more than 30 consecutive days.

Except as disclosed herein, none of our directors, or executive officers, or to our knowledge, our shareholders holding a sufficient number of securities to affect materially the control of our Company (i) is as at the date of this AIF, or has been within 10 years before the date of this AIF, a director or executive officer of any company (including us) that, while that person was acting in that capacity, or within a year of that person ceasing to act in such capacity, became bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency, or subject to or instituted any proceedings, arrangement or compromise with creditors or had a receiver, receiver manager or trustee appointed to hold its assets; or (ii) has, within 10 years before the date of this AIF, become bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency, or subject to or instituted any proceedings, arrangement or compromise with creditors or had a receiver, receiver manager or trustee appointed to hold the assets of such director, executive officer or shareholder.

Penalties or Sanctions

None of our directors or executive officers, or to our knowledge, our shareholders holding a sufficient number of securities to affect materially the control of our Company, has been subject to (i) any penalties or sanctions imposed by a court relating to securities legislation or by a securities regulatory authority or has entered into a settlement agreement with a securities regulatory authority; or (ii) any other penalties or sanctions imposed by a court or regulatory body that would likely be considered important to a reasonable investor in making an investment decision.

Conflicts of Interest

To the best of our knowledge, there are no known existing or potential conflicts of interest between us and our directors, executive officers or other members of management as a result of their outside business interests as at the date of this AIF. However, as certain of our directors and officers also serve as directors and officers of other companies, it is possible that a conflict of interest may arise between their duties to us and their duties to such other companies. See “Directors and Officers” and “Interest of Management and Others in Material Transactions”.

PROMOTERS

No person will be, or has been within the two most recently completed financial years or during the current financial year, a promoter of the Company.

LEGAL PROCEEDINGS AND REGULATORY ACTIONS

The Company is not party to any legal proceedings or regulatory actions and no such proceedings are known to the Company to be contemplated as at the date of this AIF.

INTEREST OF MANAGEMENT AND OTHERS IN MATERIAL TRANSACTIONS

Other than as disclosed herein, none of (i) the directors or executive officers of the Company, (ii) the shareholders who beneficially own, control or direct, directly or indirectly, more than 10% of the voting securities of the Company, or (iii) any associate or affiliate of the persons referred to in (i) and (ii), has or has had any material interest, direct or indirect, in any transaction within the three years before the date of this AIF or in any proposed transaction that has materially affected or is reasonably expected to materially affect the Company or any of its subsidiaries. See “Material Contracts”.

Related Party Transactions

The Company has not engaged in any Non-Arm’s Length Party transactions since its incorporation, other than those set out in the Financial Statements.

AUDITOR AND REGISTRAR AND TRANSFER AGENT