| Writer's Direct Number | Writer's E-mail Address |

| 212.756.2376 | Eleazar.Klein@srz.com |

December 18, 2020

VIA E-MAIL AND EDGAR

Mr. Joshua Shainess Special Counsel Office of Mergers and Acquisitions U.S. Securities and Exchange Commission 100 F Street, NE Washington, D.C. 20549 | |

| | | Re: | Exxon Mobil Corporation DFAN14A Filed December 8, 2020 by Engine No. 1 LLC; Engine No. 1 LP; Christopher James; Charles Penner; Gregory J. Goff; Kaisa Hietala; Alexander Karsner; and Anders Runevad File No. 001-02256 |

| | | | | |

Dear Mr. Shainess:

On behalf of Engine No. 1 LLC and its affiliates (collectively, "Engine No. 1") and the other filing persons (together with Engine No. 1, the "Filing Persons") we are responding to your letter dated December 10, 2020 (the "SEC Comment Letter") in connection with the DFAN14A filed on December 8, 2020 with respect to Exxon Mobil Corporation ("ExxonMobil" or the "Company"). We have reviewed the comments of the staff (the "Staff") of the Securities and Exchange Commission (the "SEC") and respond below. For your convenience, the comments are restated below in italics and numbered and bulleted in the order in which they were listed. We acknowledge the Staff's comments and provide our respective responses following each one of the bullets, individually.

1. In future filings, please explain how you intend to effectuate the changes described in your letter given your plans to nominate directors to four out of ten seats on the board.

The Filing Persons affirm that in future filings they will explain to shareholders in greater detail how they intend to effectuate the changes described in Engine No. 1's letter, dated December 7, 2020 (the "December 7 Letter"), to the board of directors of the Company (the "Board"). For the benefit of the Staff, the Filing Persons note that a minority board slate, especially one that if elected would comprise 40% of a 10-person board, can effectuate significant change to company policy. In particular, as discussed in the December 7 Letter, we note that Engine No. 1's prospective nominees provide a diverse set of successful energy sector experience that the Filing Persons believe is currently lacking on the Board. As set forth in bolded bullet points in the

Mr. Shainess

Page 2

December 18, 2020

December 7 Letter (and explained throughout the letter), if elected Engine No. 1's nominees would attempt to (i) steer the Company towards more disciplined long-term capital allocation, including revising the Company's approval criteria for new capital expenditures, (ii) implement a plan for sustainable value creation by fully exploring growth areas to help the Company profitably diversify and ensure it can commit to emission reduction targets, including more significant investment in clean energy and infrastructure, and (iii) revise management compensation to include utilizing preset weightings and targets, employing more cost management and balance sheet-focused metrics, and measuring value creation not just by reference to the oil and gas industry but to broader metrics.

The Filing Persons acknowledge that a minority presence in a boardroom cannot unilaterally make sweeping Company change, but the Filing Persons expect that a substantial 40% Boardroom minority comprised of individuals with strong and diverse track records of success in the energy sector and in building, developing, operating, and/or investing in successful, large-scale, global energy operations, will persuade other Board members—sufficient to constitute a majority of the Board—to act to effectuate change, as the Filing Persons intend to make clear to all shareholders in future filings.

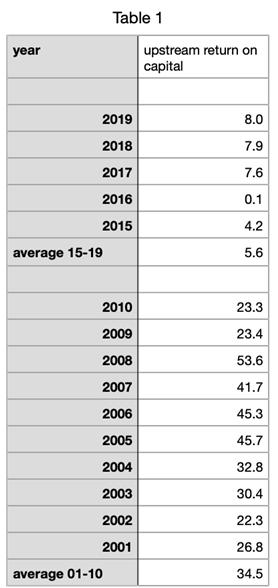

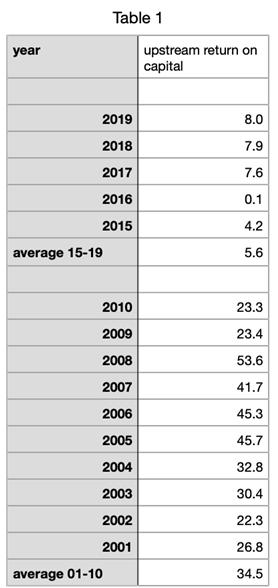

2. We note that you cite generally to "Exxon's public filings" as support for the assertion that Exxon's Return on Capital Employed for Upstream projects has fallen from an average of ~35% from 2001-10 to ~6% from 2015-2019. With a view toward providing Exxon shareholders with sufficient information such that they can assess these measures, and to the extent you make similar references in future filings, please identify the specific filings that support this assertion.

In response to the Staff's comment, the Filing Persons clarify, and will note in future filings, that the numbers referenced were taken directly from the Company's Form 10-K filings for each of the years cited—2001-2010 and 2015-2019. For the benefit of the Staff's understanding regarding how those figures were calculated, the Filing Persons have provided a breakdown of annual returns in Exhibit A attached hereto.

3. Given the relationships among the Engine No. 1 participants in the solicitation described here, please revise the statements that certain of these participants "may be deemed" the beneficial owner of the common stock owned by certain other participants to remove the uncertainty.

The Filing Persons will revise future filings to remove the "may be deemed" language.

4. In your next filing, please affirmatively disclose that other than Mr. Goff and Mr. Karsner, your nominees do not own any shares of Exxon. Refer to Rule 14a-12(a)(1)(i). Additionally, explain how you intend to address any perception by shareholders of the alignment of interests, or lack thereof, of the Company and your nominees given their lack of ownership of shares in the Company.

In response to the Staff's comment, the Filing Persons will affirmatively disclose in future filings as long as that is the case that Ms. Hietala and Mr. Runevad do not beneficially own any shares of the Company.

Mr. Shainess

Page 3

December 18, 2020

We also will note that such nominees expect to be granted ExxonMobil stock awards upon and after their election to the Board. As a result, Engine No. 1's disclosure will be consistent with the Company's 2020 Proxy Statement in which it states that "a significant portion of director compensation is granted in the form of restricted stock to align director interests with the interests of our long-term shareholders" and that a "new non-employee director receives a one-time grant of 8,000 shares of restricted stock upon first being elected to the Board."1 We expect that the Company will continue to follow its long-standing policy of granting its directors Company stock and that if Engine No. 1's potential nominees were to be elected, they would be granted Company stock as well, thereby providing the alignment of interests referenced by the Staff in its comment.

Nevertheless, while the Filing Persons are pleased that half of their potential nominees currently own Company stock, we do not believe that the lack of current ownership of Company stock by any potential nominee of Engine No. 1 would result in them being any less aligned with shareholder interests than most of the current directors of the Company. In this regard, the Filing Persons note that, as is calculable from the 2020 Proxy Statement, seven out of nine of the Company's incumbent non-employee directors own only restricted shares granted to them by the Company.2

***

Thank you for your attention to this matter. Should you have any questions or comments, or require any further information with respect to the foregoing, please do not hesitate to call me at (212) 756-2376.

Very truly yours,

/s/ Eleazer Klein

Eleazer Klein

_______________________________

1 Page 25 of the Company's 2020 Proxy Statement, filed on Form DEF 14A on April 9, 2020 (the "2020 Proxy Statement").

2 Excluding a de minimis 206 shares owned by one director prior to joining the Board. See page 26 of the 2020 Proxy Statement.

Exhibit A