| Writer’s Direct Number | Writer’s E-mail Address |

| 212.756.2376 | Eleazar.Klein@srz.com |

VIA EDGAR AND ELECTRONIC MAIL

Mr. Daniel F. Duchovny Special Counsel Office of Mergers and Acquisitions Securities and Exchange Commission 100 F Street, NE Washington, D.C. 20549 | |

| | Re: | Exxon Mobil Corporation PREC14A Filed March 2, 2021 by Engine No. 1 LLC; Engine No. 1 LP; Engine No. 1 NY LLC; Christopher James; Charles Penner; Gregory J. Goff; Kaisa Hietala; Alexander Karsner; and Anders Runevad File No. 001-02256 |

Dear Mr. Duchovny:

On behalf of Engine No. 1 LLC and its affiliates (collectively, “Engine No. 1”) and the other filing persons (together with Engine No. 1, the “Filing Persons”) we are responding to your letter dated March 9, 2021 (the “SEC Comment Letter”) in connection with the Preliminary Proxy Statement on Schedule 14A filed on March 2, 2021 (the “Preliminary Proxy Statement”) with respect to Exxon Mobil Corporation (“ExxonMobil” or the “Company”). We have reviewed the comments of the staff (the “Staff”) of the Securities and Exchange Commission (the “SEC”) and respond below. For your convenience, the comments are restated below in italics in the order in which they were listed, and are followed by our respective responses.

Concurrently with this letter, Engine No. 1 is delivering to your attention a revised Preliminary Proxy Statement on Schedule 14A (the “Revised Proxy Statement”) and intends to file the Revised Preliminary Proxy Statement with the SEC on EDGAR as of the date of this letter. The Revised Proxy Statement reflects revisions made to the Preliminary Proxy Statement in response to the comments of the Staff. Unless otherwise noted, the page numbers in the italicized headings below refer to pages in the Preliminary Proxy Statement, while the page numbers in the responses refer to pages in the Revised Proxy Statement. Capitalized terms used but not defined herein have the meaning ascribed to such terms in the Revised Proxy Statement.

Cover Page

| 1. | Each statement or assertion of opinion or belief must be clearly characterized as such, and a reasonable factual basis must exist for each such opinion or belief. Support for opinions or beliefs should be self-evident, disclosed in the proxy statement or provided to the staff on a supplemental basis. Provide support for your belief that “Over the past decade, the Company has failed to evolve in a rapidly changing world, resulting in significant underperformance to the detriment to shareholders…” |

In response to the Staff’s Comment, the Filing Persons have revised the statement in question to provide support for the foregoing statement on the cover page of the Revised Preliminary Proxy Statement.

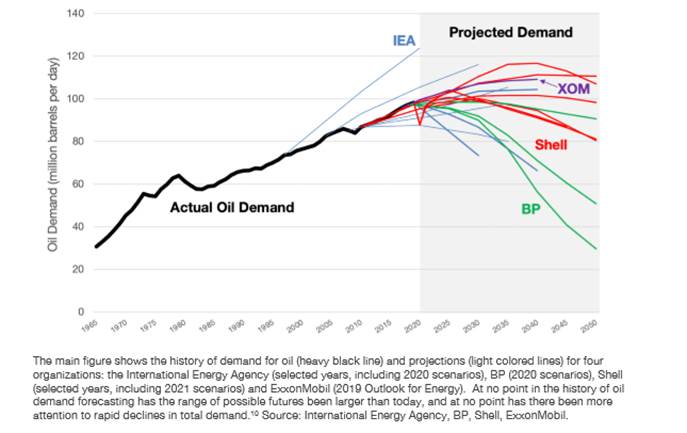

Supplementally, the Filing Persons note that statements regarding the Company’s failure to evolve are supported by the fact that the Company has failed to account for what many analysts anticipate to be a large decline in oil demand during this decade and next decade. In fact, the Company has, in public presentations, pursued production growth at the expense of returns and a lack of adaptability to changing industry dynamics, including higher production costs and growing long-term oil and gas demand uncertainty.

For instance, during its annual investor day in March 2020, which was held as the COVID-19 pandemic started gripping the world economy, ExxonMobil anticipated rising demand for oil and a big gap in necessary investment in oil and gas-producing infrastructures.[1] In addition, while ExxonMobil continues to plan for long-term growth in oil and gas production (and thus increased overall emissions growth) for decades to come, this plan carries significant risk of further long-term shareholder value destruction because approximately 2/3 of world greenhouse gas (GHG) emissions come from countries that have net zero targets for emissions (mostly for 2050), and achieving those goals (or even coming close) will likely cause an implosion in fossil fuel demand. Even ExxonMobil’s recent 2021 Investor Day presentation does not explore this widely-known range of possible outcomes.[2]

Nevertheless, OPEC, which has a strong interest in painting a future of higher demand, now offers credible scenarios with little growth for oil demand and a steady decline in demand in the 2030s.[3] BP, which has a long and transparent history of sharing data and forecasts, published new projections in October 2020 that are consistent with a long and accelerating decline in oil demand.[4] Shell has offered similar futures of waning need for oil.[5] Additional information illustrating this discrepancy in forecasting is attached hereto as Annex A.

______________________

[1] See slides 15, 20 and 22, ExxonMobil “2020 Investor Day,” New York Stock Exchange (5 March 2020); available at https://corporate.exxonmobil.com/-/media/Global/Files/investor-relations/analyst-meetings/2020-ExxonMobilInvestor-Day.pdf.

[2] ExxonMobil “2021 Investor Day,” New York Stock Exchange (3 March 2021); available at https://corporate.exxonmobil.com/-/media/Global/Files/investor-relations/analyst-meetings/2021-ExxonMobil-Investor-Day.pdf.

[3] See OPEC, 2020, World Oil Outlook 2045. (Vienna: OPEC); available at https://woo.opec.org/index.php.

[4] Two out of BP’s three scenarios see 2019 as the peak for total liquids consumption (at approximately 100 million barrels per day). One scenario predicts small rises in oil demand before a long slow slide. See BP Energy Outlook 2020; available at https://www.bp.com/en/global/corporate/energy-economics/energy-outlook.html

[5] See Shell, “Sky” scenario, which is designed as a plausible vision for a future, not a projection, and thus be design assigns no probability to that vision; available at https://www.shell.com/energy-and-innovation/the-energyfuture/scenarios/shell-scenario-sky.html.

In addition, statements regarding the Company’s underperformance are supported by the fact that, as of December 4, 2020, which was the last trading day before Engine No. 1 sent its first public letter to the Board, the Company’s total shareholder return, including dividends, over the previous 10 years was -14.8%, versus +271% for the S&P 500. In addition, the Company’s total shareholder return for the prior 3-, 5- and 10-year periods trails each of the Company’s self-selected proxy peers—which includes BP, Chevron, Shell, and Total—and the S&P 500, both before (calculated for the period ending February 18, 2020) and after the onset of the COVID-19 pandemic.

Background to this Proxy Solicitation, page 3

| 2. | Please expand each subsection to describe in detail your interactions with the company and any specific plans you have to create value. |

In response to the Staff’s Comment, the Filing Persons have revised the subsections in the Background to this Proxy Solicitation to describe the Filing Persons' interactions with the Company and their plans to create value.

Proposal 1. Election of Directors, page 4

| 3. | Refer to the last paragraph on page 7 above the caption “Vote Required.” There appears to be a discrepancy between the second and third sentence in that the second sentence describes your ability to exercise discretionary authority to vote for a substitute nominee in certain events, as set forth in Rule 14a-4(c)(5), but the third sentence appears to expand upon the circumstances under which you could exercise discretionary authority. Please revise or advise. |

In response to the Staff’s Comment, the Filing Persons have revised the paragraph on page 7 of the Revised Preliminary Proxy Statement to remove the second sentence in order to alleviate any potential discrepancy regarding Engine No. 1's ability to exercise discretionary authority.

Proposal 3. Advisory Vote on the Compensation of Named Executive Officers, page 10

| 4. | Please revise this section to explain why you recommend that shareholders vote against the proposal. |

In response to the Staff’s Comment, the Filing Persons have revised this section in order to provide an explanation as to why the Filing Persons recommend that shareholders vote against the proposal.

* * *

Thank you for your attention to this matter. Should you have any questions or comments, or require any further information with respect to the foregoing, please do not hesitate to call me at (212) 756-2376.

Very truly yours,

/s/ Eleazer Klein

Eleazer Klein

Annex A