- PWSC Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

-

ETFs

- Insider

- Institutional

- Shorts

-

SC 13E3 Filing

PowerSchool (PWSC) SC 13E3Going private transaction

Filed: 23 Jul 24, 5:29pm

Exhibit (c)(iv) Project Picasso Tax Receivable Agreement

Disclaimer This presentation is intended to provide a discussion of the transaction described herein. It should not be viewed as an opinion, nor should it be used in place of professional advice. This presentation does not address any issue not expressly identified herein, such as taxes not specifically identified; jurisdictions not discussed (e.g., state, local and foreign taxing jurisdictions); and legal or non-tax issues such as corporate law or securities law matters. Our views are based on our understanding of the Internal Revenue Code (“IRC”), regulations, court decisions, rulings and procedures issued by the IRS, and other authorities we deemed relevant, as of the date hereof. The applicable law and its interpretation are subject to change, potentially retroactive in effect, and any such change could adversely affect this presentation. Should there be such a change, including a change having retroactive effect, our conclusions would need to be reevaluated. This document reflects our analysis of the applicable authorities as of the date hereof, and we are not obligated to inform any person of a change, or otherwise update the conclusions herein, for changes subsequent to the date hereof. Accordingly, Ernst & Young LLP (“EY” or “we”) accepts no responsibility for any action taken or not taken by anyone using this document. The information in this presentation is solely for your benefit and may not be relied upon by any other person or entity and we shall not have any responsibility to anyone in respect of the information contained in this document. In preparing the analysis that follows, we have relied on information provided by client. The information has not been validated by EY at this time. All references to Section(s) or § in this slide deck are to the IRC or to Treasury regulations, unless otherwise specified. Page 2 9 April 2024 Project Picasso – Tax Receivable Agreement

Overview of Picasso TRA • The Picasso TRA provides that Picasso will pay to the pre-IPO shareholders 85% of cash tax savings from the use of covered tax attributes (listed below) at current effective tax rate • Tax attributes covered: • Amortizable tax basis at the time of the IPO and tax basis step-ups created by subsequent exchanges and payments on the TRA • Net operating losses, capital losses, disallowed interest expense carryforwards and credit carryforwards of the Blockers that existed at the time of the IPO date • Deductions attributable to the portion of TRA payments treated as imputed interest or guaranteed payments • As is customary with TRAs, upon a change in control of Picasso, Picasso becomes obligated to make an early termination payment to the TRA holders (which is similar to a make-whole payment). The early termination payment is the present value, discounted at LIBOR plus 5.5%, of all the TRA payments required to be paid by Picasso, calculated based on certain “valuation assumptions” (see below) • At a high level, the valuation assumptions include: • Picasso has taxable income sufficient to fully utilize the deductions arising from the covered tax attributes in the taxable years in which such deductions would become available; • any covered loss, capital loss, disallowed interest expense, credit or similar carryovers as of the early termination will be utilized by Picasso in the earliest possible taxable year permitted by tax law; • the US federal, state and local income tax rates in effect as of the early termination will hold constant (but taking into account any future changes in tax rates that have been enacted at the time of the early termination); • any non-amortizable assets will be sold for cash at their fair market value in a fully taxable transaction on an assumed timeline; and • if, as of the change of control date, there are exchangeable units that have not been transferred in an exchange, then all exchangeable units and (if applicable) shares of Class B Common Stock shall be deemed to be transferred in an exchange effective as of the change of control date Page 3 9 April 2024 Project Picasso – Tax Receivable Agreement

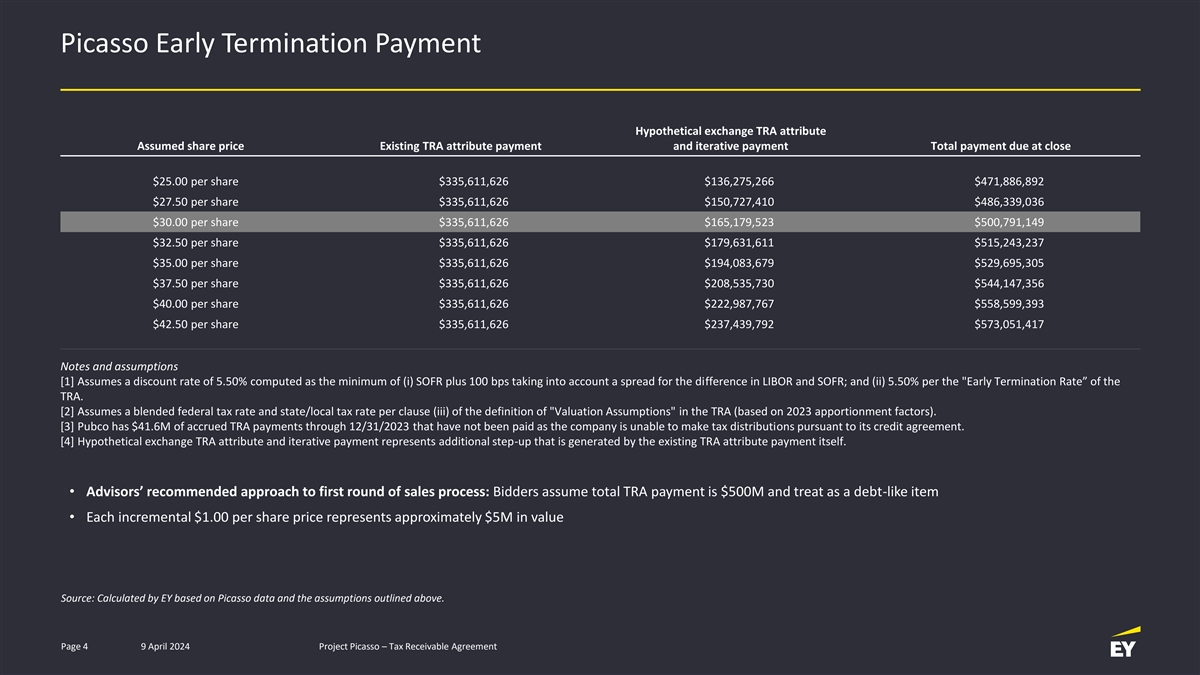

Picasso Early Termination Payment Hypothetical exchange TRA attribute Assumed share price Existing TRA attribute payment and iterative payment Total payment due at close $25.00 per share $335,611,626 $136,275,266 $471,886,892 $27.50 per share $335,611,626 $150,727,410 $486,339,036 $30.00 per share $335,611,626 $165,179,523 $500,791,149 $32.50 per share $335,611,626 $179,631,611 $515,243,237 $35.00 per share $335,611,626 $194,083,679 $529,695,305 $37.50 per share $335,611,626 $208,535,730 $544,147,356 $40.00 per share $335,611,626 $222,987,767 $558,599,393 $42.50 per share $335,611,626 $237,439,792 $573,051,417 Notes and assumptions [1] Assumes a discount rate of 5.50% computed as the minimum of (i) SOFR plus 100 bps taking into account a spread for the difference in LIBOR and SOFR; and (ii) 5.50% per the Early Termination Rate” of the TRA. [2] Assumes a blended federal tax rate and state/local tax rate per clause (iii) of the definition of Valuation Assumptions in the TRA (based on 2023 apportionment factors). [3] Pubco has $41.6M of accrued TRA payments through 12/31/2023 that have not been paid as the company is unable to make tax distributions pursuant to its credit agreement. [4] Hypothetical exchange TRA attribute and iterative payment represents additional step-up that is generated by the existing TRA attribute payment itself. • Advisors’ recommended approach to first round of sales process: Bidders assume total TRA payment is $500M and treat as a debt-like item • Each incremental $1.00 per share price represents approximately $5M in value Source: Calculated by EY based on Picasso data and the assumptions outlined above. Page 4 9 April 2024 Project Picasso – Tax Receivable Agreement

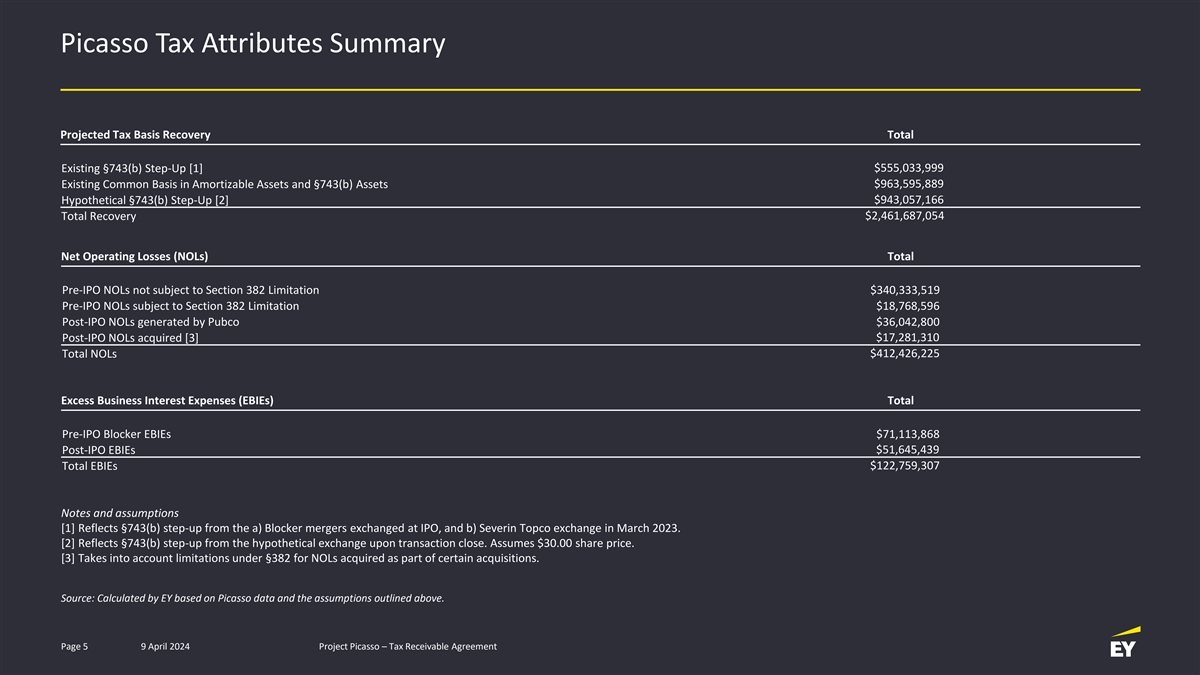

Picasso Tax Attributes Summary Projected Tax Basis Recovery Total Existing §743(b) Step-Up [1] $555,033,999 $963,595,889 Existing Common Basis in Amortizable Assets and §743(b) Assets Hypothetical §743(b) Step-Up [2] $943,057,166 Total Recovery $2,461,687,054 Net Operating Losses (NOLs) Total Pre-IPO NOLs not subject to Section 382 Limitation $340,333,519 Pre-IPO NOLs subject to Section 382 Limitation $18,768,596 Post-IPO NOLs generated by Pubco $36,042,800 $17,281,310 Post-IPO NOLs acquired [3] Total NOLs $412,426,225 Excess Business Interest Expenses (EBIEs) Total Pre-IPO Blocker EBIEs $71,113,868 Post-IPO EBIEs $51,645,439 Total EBIEs $122,759,307 Notes and assumptions [1] Reflects §743(b) step-up from the a) Blocker mergers exchanged at IPO, and b) Severin Topco exchange in March 2023. [2] Reflects §743(b) step-up from the hypothetical exchange upon transaction close. Assumes $30.00 share price. [3] Takes into account limitations under §382 for NOLs acquired as part of certain acquisitions. Source: Calculated by EY based on Picasso data and the assumptions outlined above. Page 5 9 April 2024 Project Picasso – Tax Receivable Agreement

EY refers to the global organization, and may refer to one or more, of the EY | Building a better working world member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients. Information about how EY collects and uses EY exists to build a better working world, helping to personal data and a description of the rights individuals have under data protection legislation are available via ey.com/privacy. EY member firms do not create long-term value for clients, people and society practice law where prohibited by local laws. For more information about our and build trust in the capital markets. organization, please visit ey.com. © 2024 Ernst & Young LLP. Enabled by data and technology, diverse EY teams in All Rights Reserved. over 150 countries provide trust through assurance and help clients grow, transform and operate. ey.com Working across assurance, consulting, law, strategy, tax and transactions, EY teams ask better questions to find new answers for the complex issues facing our world today.