- PWSC Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

-

ETFs

- Insider

- Institutional

- Shorts

-

SC 13E3 Filing

PowerSchool (PWSC) SC 13E3Going private transaction

Filed: 23 Jul 24, 5:29pm

Exhibit (C)(vii)

*** For Discussion Purposes Only *** Project Picasso Tax Receivable Agreement Discussion May 1, 2024

*** For Discussion Purposes Only *** Overview of TRAs ◾ A Tax Receivable Agreement (TRA) is a contractual agreement between a public company and the company’s pre-IPO owners that requires payments from the former to the latter related to tax attributes held by the company ◾ These tax attributes are most often found in IPOs, in which selling pre-IPO shareholders recognize a taxable gain that also triggers a valuable tax basis step-up at the newly public company – In essence, the TRA forces the company to compensate these parties for the step-up as a distinct asset – Additionally, TRAs can be found in a wide range of other settings and cover other tax attributes, such as NOLs ◾ As the relevant tax attributes are used by the company, a TRA obligates the company to make periodic cash payments to the pre-IPO owners party to the TRA for a portion of the achieved savings – TRAs often require that 85% of the cash tax benefit realized by the company be paid to pre-IPO owners ◾ TRAs were introduced in the 1990s and have recently become much more common in IPOs (both traditional and de-SPAC transactions); they have a number of practical implications in financial analyses and M&A transactions – Relatedly, an Up-C is a corporate structure that is often encountered in conjunction with a TRA and will require additional consideration as compared to a typical C-corp structure (the most common public company form) 1 Source: Company materials, academic research and other public sources.

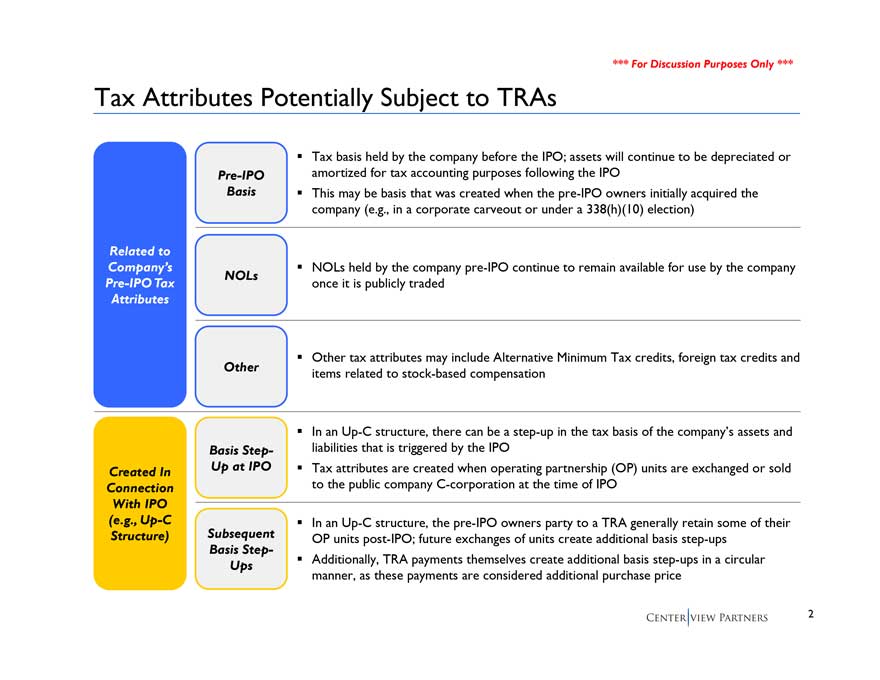

*** For Discussion Purposes On ly *** Tax Attributes Potentially Subject to TRAs ◾ Tax basis held by the company before the IPO; assets will continue to be depreciated or Pre-IPO amortized for tax accounting purposes following the IPO Basis◾ This may be basis that was created when the pre-IPO owners initially acquired the company (e.g., in a corporate carveout or under a 338(h)(10) election) Related to Company’s ◾ NOLs held by the company pre-IPO continue to remain available for use by the company NOLs Pre-IPO Tax once it is publicly traded Attributes ◾ Other tax attributes may include Alternative Minimum Tax credits, foreign tax credits and Other items related to stock-based compensation ◾ In an Up-C structure, there can be a step-up in the tax basis of the company’s assets and Basis Step- liabilities that is triggered by the IPO Created In Up at IPO◾ Tax attributes are created when operating partnership (OP) units are exchanged or sold Connection to the public company C-corporation at the time of IPO With IPO (e.g., Up-C ◾ In an Up-C structure, the pre-IPO owners party to a TRA generally retain some of their Structure) Subsequent OP units post-IPO; future exchanges of units create additional basis step-ups Basis Step- Ups◾ Additionally, TRA payments themselves create additional basis step-ups in a circular manner, as these payments are considered additional purchase price

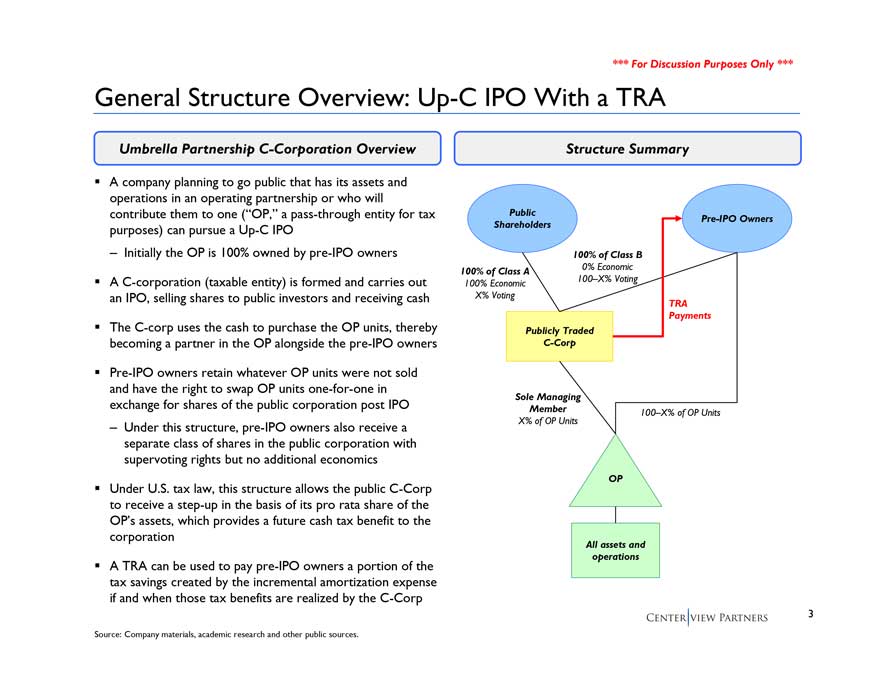

*** For Discussion Purposes Only *** General Structure Overview: Up-C IPO With a TRA Umbrella Partnership C-Corporation Overview Structure Summary ◾ A company planning to go public that has its assets and operations in an operating partnership or who will contribute them to one (“OP,” a pass-through entity for tax Public Pre-IPO Own ers purposes) can pursue a Up-C IPO Shareholders – Initially the OP is 100% owned by pre-IPO owners 100% of Class B 100% of Class A 0% Economic ◾ A C-corporation (taxable entity) is formed and carries out 100% Economic 100–X% Voting an IPO, selling shares to public investors and receiving cash X% Voting TRA the OP units, thereby Payments◾ The C-corp uses the cash to purchase Publicly Traded becoming a partner in the OP alongside the pre-IPO owners C-Corp ◾ Pre-IPO owners retain whatever OP units were not sold and have the right to swap OP units one-for-one in Sole Managing exchange for shares of the public corporation post IPO Member 100–X% of OP Units X% of OP Units – Under this structure, pre-IPO owners also receive a separate class of shares in the public corporation with supervoting rights but no additional economics OP ◾ Under U.S. tax law, this structure allows the public C-Corp to receive a step-up in the basis of its pro rata share of the OP’s assets, which provides a future cash tax benefit to the corporation All assets and operations ◾ A TRA can be used to pay pre-IPO owners a portion of the tax savings created by the incremental amortization expense if and when those tax benefits are realized by the C-Corp Source: Company materials, academic research and other public sources.

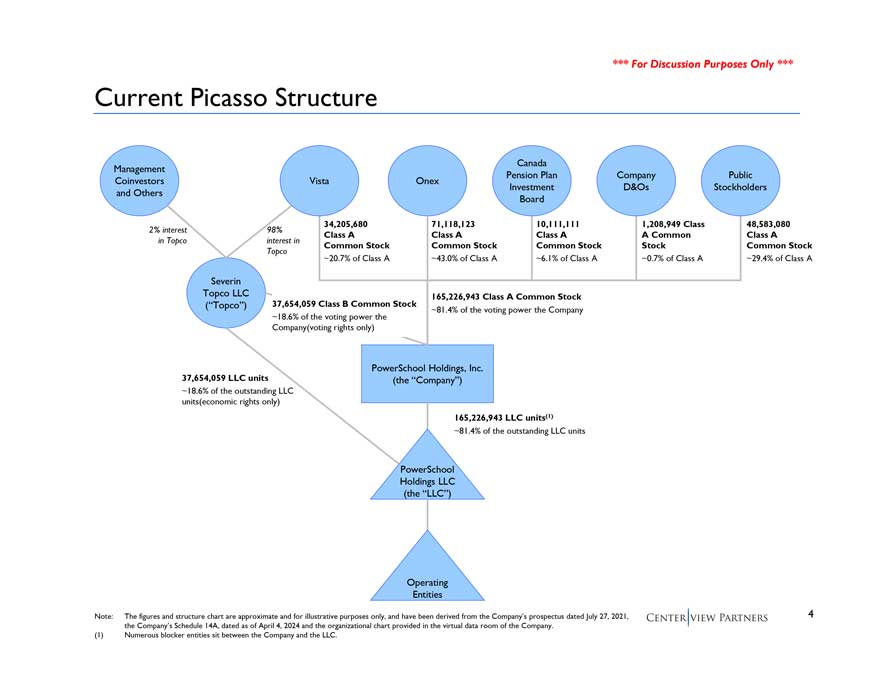

*** For Discussion Purposes Only *** Current Picasso Structure Canada Management Pension Plan Company Public Coinvestors Vista Onex Investment D&Os Stockholders and Others Board 34,205,680 71,118,123 10,111,111 1,208,949 Class 48,583,080 2% interest 98% Class A Class A Class A A Common Class A in Topco interest in Common Stock Common Stock Common Stock Stock Common Stock Topco ~20.7% of Class A ~43.0% of Class A ~6.1% of Class A ~0.7% of Class A ~29.4% of Class A Severin Topco LLC 165,226,943 Class A Common Stock (“Topco”) 37,654,059 Class B Common Stock ~81.4% of the voting power the Company ~18.6% of the voting power the Company(voting rights only) PowerSchool Holdings, Inc. 37,654,059 LLC units (the “Company”) ~18.6% of the outstanding LLC units(economic rights only) 165,226,943 LLC units(1) ~81.4% of the outstanding LLC units PowerSchool Holdings LLC (the “LLC”) Operating Entities Note: The figures and structure chart are approximate and for illustrative purposes only, and have been derived from the Company’s prospectus dated July 27, 2021, 4 the Company’s Schedule 14A, dated as of April 4, 2024 and the organizational chart provided in the virtual data room of the Company. (1) Numerous blocker entities sit between the Company and the LLC.

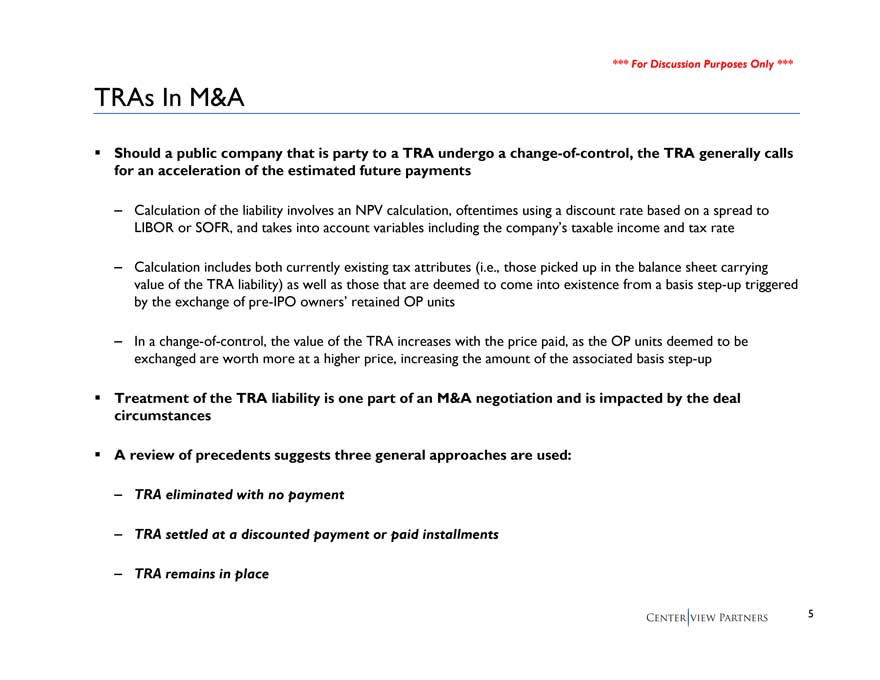

*** For Discussion Purpose s Only *** TRAs In M&A ◾ Should a public company that is party to a TRA undergo a change-of-control, the TRA generally calls for an acceleration of the estimated future payments – Calculation of the liability involves an NPV calculation, oftentimes using a discount rate based on a spread to LIBOR or SOFR, and takes into account variables including the company’s taxable income and tax rate – Calculation includes both currently existing tax attributes (i.e., those picked up in the balance sheet carrying value of the TRA liability) as well as those that are deemed to come into existence from a basis step-up triggered by the exchange of pre-IPO owners’ retained OP units – In a change-of-control, the value of the TRA increases with the price paid, as the OP units deemed to be exchanged are worth more at a higher price, increasing the amount of the associated basis step-up ◾ Treatment of the TRA liability is one part of an M&A negotiation and is impacted by the deal circumstances ◾ A review of precedents suggests three general approaches are used: – TRA eliminated with no payment – TRA settled at a discounted payment or paid installments – TRA remains in place *

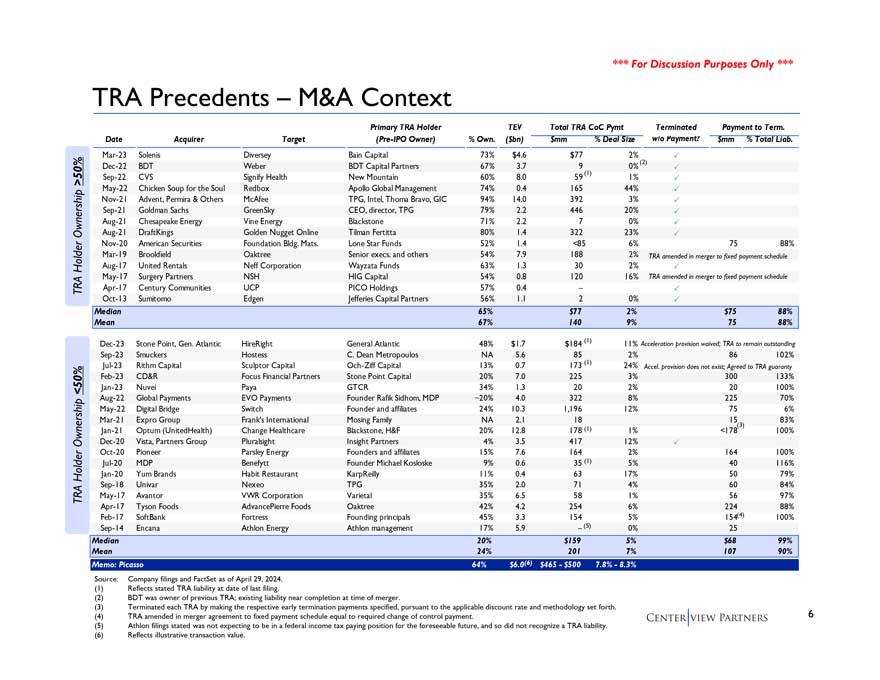

** For Discussion Purposes Only *** TRA Precedents – M&A Context Primary TRA Holder TEV Total TRA CoC Pymt Terminated Payment to Term. Date Acquirer Target (Pre-IPO Owner) % Own. ($bn) $mm % Deal Size w/o Payment? $mm % Total Liab. Mar-23 Solenis Diversey Bain Capital 73% $4.6 $77 2% (2)ï Dec-22 BDT Weber BDT Capital Partners 67% 3.7 9 (1) 0%ï >50% Sep-22 CVS Signify Health New Mountain 60% 8.0 59 1%ï May-22 Chicken Soup for the Soul Redbox Apollo Global Management 74% 0.4 165 44%ï Nov-21 Advent, Permira & Others McAfee TPG, Intel, Thoma Bravo, GIC 94% 14.0 392 3%ï Sep-21 Goldman Sachs GreenSky CEO, director, TPG 79% 2.2 446 20%ï Aug-21 Chesapeake Energy Vine Energy Blackstone 71% 2.2 7 0%ï Ownership Aug-21 DraftKings Golden Nugget Online Tilman Fertitta 80% 1.4 322 23%ï Nov-20 American Securities Foundation Bldg. Mats. Lone Star Funds 52% 1.4 <85 6% 75 88% Mar-19 Brookfield Oaktree Senior execs. and others 54% 7.9 188 2% TRA amended in merger to fixed payment schedule Holder Aug-17 United Rentals Neff Corporation Wayzata Funds 63% 1.3 30 2%ï May-17 Surgery Partners NSH HIG Capital 54% 0.8 120 16% TRA amended in merger to fixed payment schedule TRA Apr-17 Century Communities UCP PICO Holdings 57% 0.4 –ï Oct-13 Sumitomo Edgen Jefferies Capital Partners 56% 1.1 2 0%ï Dec-23 Stone Point, Gen. Atlantic HireRight General Atlantic 48% $1.7 $184 (1) 11% Acceleration provision waived; TRA to remain outstanding Sep-23 Smuckers Hostess C. Dean Metropoulos NA 5.6 85 2% 86 102% Jul-23 Rithm Capital Sculptor Capital Och-Ziff Capital 13% 0.7 173 (1) 24% Accel. provisio n does not exist; Agreed to TRA guaranty Feb-23 CD&R Focus Financial Partners Stone Point Capital 20% 7.0 225 3% 300 133% <50% Jan-23 Nuvei Paya GTCR 34% 1.3 20 2% 20 100% Aug-22 Global Payments EVO Payments Founder Rafik Sidhom, MDP ~20% 4.0 322 8% 225 70% May-22 Digital Bridge Switch Founder and affiliates 24% 10.3 1,196 12% 75 6% Mar-21 Expro Group Frank’s International Mosing Family NA 2.1 18 15 83% Jan-21 Optum (UnitedHealth) Change Healthcare Blackstone, H&F 20% 12.8 178 (1) 1% <178 100% Ownership Dec-20 Vista, Partners Group Pluralsight Insight Partners 4% 3.5 417 12%ï Oct-20 Pioneer Parsley Energy Founders and affiliates 15% 7.6 164 2% 164 100% Jul-20 MDP Benefytt Founder Michael Kosloske 9% 0.6 35 (1) 5% 40 116% Holder Jan-20 Yum Brands Habit Restaurant KarpReilly 11% 0.4 63 17% 50 79% Sep-18 Univar Nexeo TPG 35% 2.0 71 4% 60 84% TRA May-17 Avantor VWR Corporation Varietal 35% 6.5 58 1% 56 97% Apr-17 Tyson Foods AdvancePierre Foods Oaktree 42% 4.2 254 6% 224 88% Feb-17 SoftBank Fortress Founding principals 45% 3.3 154 5% 154(4) 100% Sep-14 Encana Athlon Energy Athlon management 17% 5.9 – (5) 0% 25 Median 20% $159 5% $68 99% Mean 24% 201 7% 107 90% Memo: Picasso 64% $6.0(6) $465 - $500 7.8% - 8.3% Source: Company filings and FactSet as of April 29, 2024. (1) Reflects stated TRA liability at date of last filing. (2) BDT was owner of previous TRA; existing liability near completion at time of merger. (3) Terminated each TRA by making the respective early termination payments specified, pursuant to the applicable discount rate and methodology set forth. (4) TRA amended in merger agreement to fixed payment schedule equal to required change of control payment. 6 (5) Athlon filings stated was not expecting to be in a federal income tax paying position for the foreseeable future, and so did not recognize a TRA liability. (6) Reflects illustrative transaction value.

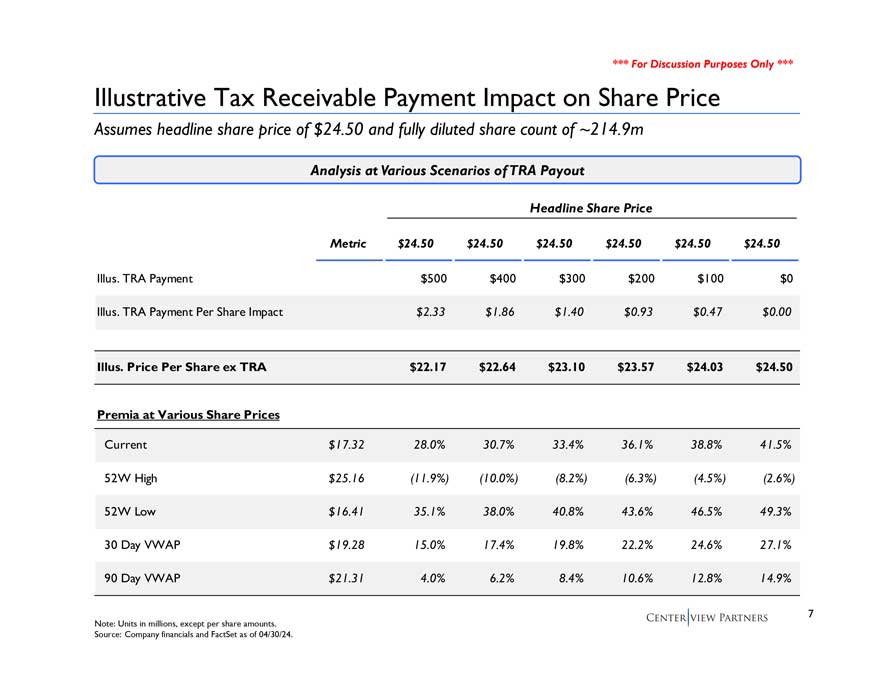

*** For Discussion Purposes Only *** Assumes headline share price of $24.50 and fully diluted share count of ~214.9m Analysis at Various Scenarios of TRA Payout Headline Share Price Metric $24.50 $24.50 $24.50 $24.50 $24.50 $24.50 Illus. TRA Payment $500 $400 $300 $200 $100 $0 Illus. TRA Payment Per Share Impact $2.33 $1.86 $1.40 $0.93 $0.47 $0.00 Illus. Price Per Share ex TRA $22.17 $22.64 $23.10 $23.57 $24.03 $24.50 Premia at Various Share Prices Current $17.32 28.0% 30.7% 33.4% 36.1% 38.8% 41.5% 52W High $25.16 (11.9%) (10.0%) (8.2%) (6.3%) (4.5%) (2.6%) 52W Low $16.41 35.1% 38.0% 40.8% 43.6% 46.5% 49.3% 30 Day VWAP $19.28 15.0% 17.4% 19.8% 22.2% 24.6% 27.1% 90 Day VWAP $21.31 4.0% 6.2% 8.4% 10.6% 12.8% 14.9% Note: Units in millions, except per share amounts. Source: Company financials and FactSet as of 04/30/24.

Appendix *** For Discussion Purposes Only ***

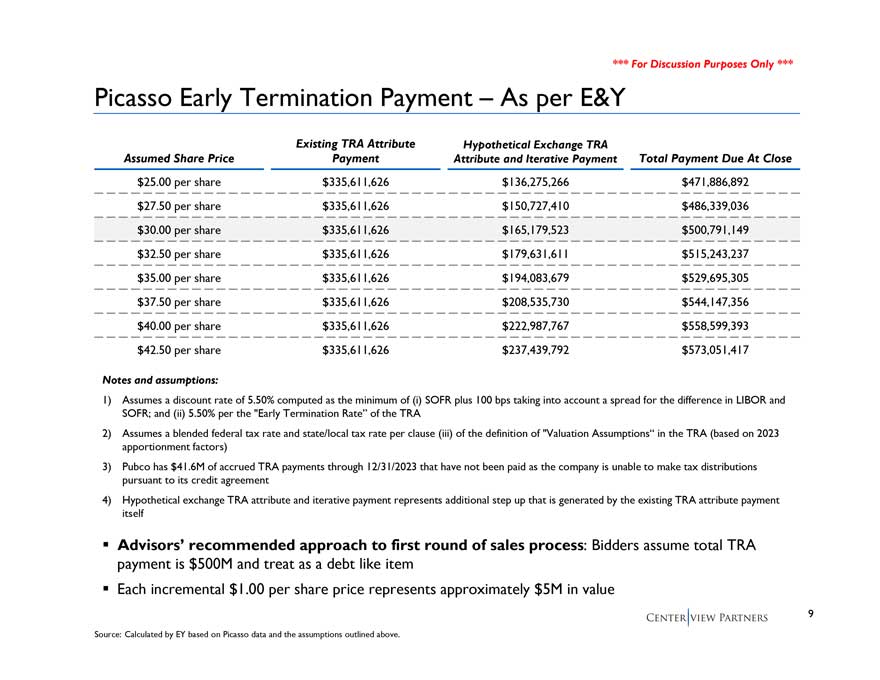

Picasso Early Termination Payment – As per E&Y Existing TRA Attribute Hypothetical Exchange TRA Assumed Share Price Payment Attribute and Iterative Payment Total Payment Due At Close $25.00 per share $335,611,626 $136,275,266 $471,886,892 $27.50 per share $335,611,626 $150,727,410 $486,339,036 $30.00 per share $335,611,626 $165,179,523 $500,791,149 $32.50 per share $335,611,626 $179,631,611 $515,243,237 $35.00 per share $335,611,626 $194,083,679 $529,695,305 $37.50 per share $335,611,626 $208,535,730 $544,147,356 $40.00 per share $335,611,626 $222,987,767 $558,599,393 $42.50 per share $335,611,626 $237,439,792 $573,051,417 Notes and assumptions: 1) Assumes a discount rate of 5.50% computed as the minimum of (i) SOFR plus 100 bps taking into account a spread for the difference in LIBOR and SOFR; and (ii) 5.50% per the “Early Termination Rate” of the TRA 2) Assumes a blended federal tax rate and state/local tax rate per clause (iii) of the definition of “Valuation Assumptions“ in the TRA (based on 2023 apportionment factors) 3) Pubco has $41.6M of accrued TRA payments through 12/31/2023 that have not been paid as the company is unable to make tax distributions pursuant to its credit agreement ◾ Advisors’ recommended approach to first round of sales process: Bidders assume total TRA payment is $500M and treat as a debt like item◾ Each incremental $1.00 per share price represents approximately $5M in value 9 Source: Calculated by EY based on Picasso data and the assumptions outlined above.

*** For Discussion Purposes Only ** * Disclaimer This presentation has been prepared by Centerview Partners LLC (“Centerview”) for use solely by the Special Committee of the Board of Directors of Picasso in connection with its evaluation of a proposed sale of Picasso and for no other purpose. The information contained herein is based upon information supplied by or on behalf of Picasso and publicly available information, and portions of the information contained herein may be based upon statements, estimates and forecasts provided by Picasso. Centerview has relied upon the accuracy and completeness of the foregoing information, and has not assumed any responsibility for any independent verification of such information or for any independent evaluation or appraisal of any of the assets or liabilities (contingent or otherwise) of Picasso or any other entity, or concerning the solvency or fair value of Picasso or any other entity. With respect to financial forecasts, Centerview has assumed that such forecasts have been reasonably prepared on bases reflecting the best currently available estimates and judgments of the management of Picasso as to the future financial performance of Picasso, and at your direction Centerview has relied upon such forecasts, as provided by Picasso’s management, with respect to Picasso. Centerview assumes no responsibility for and expresses no view as to such forecasts or the assumptions on which they are based. The information set forth herein is based upon economic, monetary, market and other conditions as in effect on, and the information made available to us as of, the date hereof, unless indicated otherwise and Centerview assumes no obligation to update or otherwise revise these materials. The financial analysis in this presentation is complex and is not necessarily susceptible to a partial analysis or summary description. In performingthis financial analysis, Centerview has considered the results of its analysis as a whole and did not necessarily attribute a particular weight to any particular portion of the analysis considered. Furthermore, selecting any portion of Centerview’s analysis, without considering the analysis as a whole, would create an incomplete view of the process underlying its financial analysis. Centerview may have deemed various assumptions more or less probable than other assumptions, so the reference ranges resulting from any particular portion of the analysis described above should not be taken to be Centerview’s view of the actual value of Picasso. These materials and the information contained herein are confidential, were not prepared with a view toward public disclosure, and may not be disclosed publicly or made available to third parties without the prior written consent of Centerview. These materials and any other advice, written or oral, rendered by Centerview are intended solely for the benefit and use of the Special Committee of the Board of Directors of Picasso (in its capacity as such) in its consideration of the proposed transaction, and are not for the benefit of, and do not convey any rights or remedies for any holder of securities of Picasso or any other person. Centerview will not be responsible for and has not provided any tax, accounting, actuarial, legal or other specialist advice. These materials are not intended to provide the sole basis for evaluating the proposed transaction, and this presentation does not represent a fairness opinion, recommendation, valuation or opinion of any kind, and is necessarily incomplete and should be viewed solely in conjunction with the oral presentation provided by Centerview. 10