INVESTMENT AGREEMENT

This INVESTMENT AGREEMENT (this “Agreement”), dated as of January 31st, 2024, is entered into by and among Zenvia Inc., a Cayman Islands exempted company with limited liability (together with any successor or assign pursuant to Section 6.05, the “Company”), and Bobsin Corp., a company formed under the laws of the British Virgin Islands (together with its respective successor and assign under Section 6.05, the “Purchaser”). Capitalized terms not otherwise defined where used shall have the meanings ascribed thereto in Article 1.

WHEREAS, the Purchaser desires to purchase from the Company, and the Company desires to issue and sell to the Purchaser, the Securities (as defined below) on the Closing Date (as defined below) upon payment of the Purchase Price (as defined below), pursuant to the terms and conditions of this Agreement;

WHEREAS, the Company intends to use the proceeds from the issuance of the Securities (as defined below) for general corporate purposes; and

WHEREAS, the Company and the Purchaser desire to set forth certain agreements herein.

NOW, THEREFORE, in consideration of the premises and the representations, warranties and agreements herein contained and intending to be legally bound hereby, the parties hereby agree as follows:

“Affiliate” shall mean, with respect to any specified Person, any other Person who, at the time of determination, directly or indirectly, controls, is controlled by, or is under common control with, such Person. As used herein, the term “control” means the possession, direct or indirect, of the power to direct or cause the direction of the management and policies of a Person, whether through ownership of voting securities, by contract or otherwise. For the avoidance of doubt, for purposes of this Agreement, (i) the Company and its subsidiaries, on the one hand, and the Purchaser, on the other, shall not be considered Affiliates of each other and (ii) any fund or account managed, directly or indirectly, by the Purchaser or its Affiliates, shall be considered an Affiliate of the Purchaser.

“Agreement” shall have the meaning set forth in the preamble hereto.

“Applicable Law” shall mean, with respect to any Person, any transnational, domestic or foreign federal, national, state, provincial, local or municipal law (statutory, common or otherwise), constitution, treaty, convention, ordinance, code, rule, regulation, executive order, injunction, judgment, decree, ruling or other similar requirement enacted, adopted, promulgated or applied by, or governmental approval, concession, grant, franchise, license, agreement, directive, or other governmental restriction or any similar form of decision of, or determination by, or any formally issued written interpretation or administration of any of the foregoing by, a Governmental Entity that is binding upon or applicable to such Person or any of such Person’s assets, rights or properties.

“Board of Directors” shall mean the board of directors of the Company or a committee of such board duly authorized to act on behalf of such board.

“Business Day” shall mean any day, other than a Saturday, Sunday or a day on which banking institutions in the Cayman Islands, The City of New York, New York or the City of São Paulo, State of São Paulo, Brazil are authorized or obligated by law or executive order to remain closed.

“Change of Control” shall mean any Person or group of Persons, in a single transaction or in a related series of transactions, by way of merger, consolidation, other business combination transaction, contract or otherwise, acquiring beneficial ownership representing more than fifty point one percent (50.1%) of the voting power of the Company or the right to appoint a majority of the Company’s Board of Directors.

“Class A Common Shares” shall mean the Class A common shares, par value $0.00005 per share, of the Company.

“Class B Common Shares” shall mean the Class B common shares, par value $0.00005 per share, of the Company.

“Closing” shall have the meaning set forth in Section 2.02(a).

“Closing Date” shall mean a date occurring on or after the date on which the conditions precedent set forth in Section 2.02(c) and (d) are satisfied or waived, as the case may be, as specified by the Company to the Purchaser in writing not less than two (2) Business Days prior to such date or in any other date otherwise agreed by the parties.

“Code” shall mean the U.S. Internal Revenue Code of 1986, as amended.

“Company” shall have the meaning set forth in the preamble hereto.

“Corporate Transaction Event” shall mean (a) the sale, transfer or other disposition of assets constituting all or substantially all of the Company’s assets, (b) the merger or consolidation of the Company into another entity (except a merger or consolidation in which the holders of Shares of the Company immediately prior to such merger or consolidation continue to hold at least fifty point one percent (50.1%) of the voting power of the Company or the surviving or acquiring entity), or (c) the transfer (whether by merger, consolidation or otherwise), in one or a series of related transactions, that results in a Change of Control.

“Corporate Transaction Event Payment” shall have the meaning set forth in Section 3.01(b).

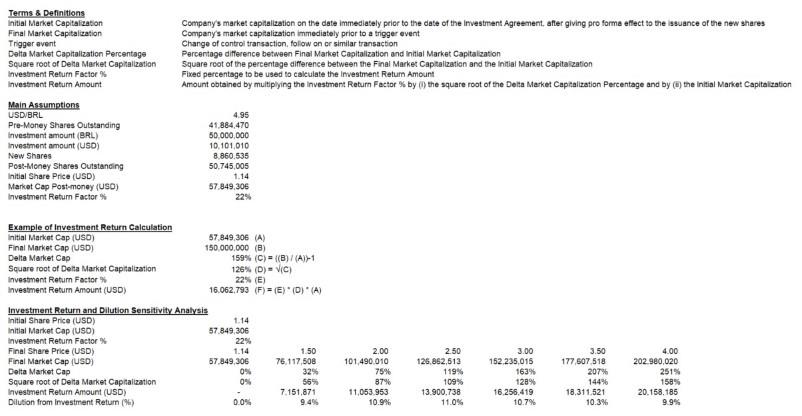

“Delta Market Capitalization” means the amount resulting from the difference between the Final Market Capitalization and the Initial Market Capitalization.

“Delta Market Capitalization Percentage” means the percentage resulting from the division between the Delta Market Capitalization by the Initial Market Capitalization.

“Enforceability Exceptions” shall have the meaning set forth in Section 4.01(d).

“Exchange Act” shall mean the U.S. Securities Exchange Act of 1934, as amended.

“Final Market Capitalization” means the Market Capitalization of the Company immediately prior to the consummation of a Trigger Event.

“Governmental Entity” shall mean any court, administrative agency or commission or other governmental authority or instrumentality, whether federal, state, local or foreign, and any applicable industry self-regulatory organization.

“Initial Market Capitalization” means the Market Capitalization of the Company on the date immediately prior to the date hereof, after giving pro forma effect to the issuance of the Securities.

“Investment Return Amount” means the amount resulting from the Investment Return Formula.

“Investment Return Formula” means the formula below that shall be used to calculate the amount of Investment Return with respect to the occurrence of a Trigger Event:

For illustrative purposes, Schedule I hereto sets forth a simulation of scenarios of the Investment Return Formula in use as a result of a change in the Market Capitalization of the Company.

“Investment Return Payment” shall have the meaning set forth in Section 3.01(b).

“Joinder” shall mean, with respect to any Person permitted to sign such document in accordance with the terms hereof, a joinder executed and delivered by such Person, providing such Person to have all the rights and obligations of the Purchaser under this Agreement, in the form and substance substantially as attached hereto as Exhibit A or such other form as may be agreed to by the Company and the Purchaser.

“Law” means, with respect to any Person, any federal, state or local law (statutory, common or otherwise), constitution, treaty, convention, ordinance, code, rule, regulation, order, injunction, judgment, decree, ruling or other similar requirement enacted, adopted, promulgated or applied by a Governmental Entity that is binding upon or applicable to such Person, as amended unless expressly specified otherwise.

“Liquidity Event” means any offering of the Shares in the context of a capital raise process by the Company in exchange for cash (being understood that, for the avoidance of doubt, (i) any offering of the Shares that is comprised exclusively by a secondary offering and (ii) any Share issuance in the context of a long-term incentive plan of the Company or any other similar transaction shall not be deemed a Liquidity Event).

“Liquidity Event Payment” shall have the meaning set forth in Section 3.01(a).

“Lock-Up Period” shall have the meaning set forth in Section 5.02.

“Material Adverse Effect” shall mean any event, occurrence, fact, circumstance, condition, change or development, individually or together with other events, occurrences, facts, circumstances, conditions, changes or developments, that has had, has, or would reasonably be expected to have a material adverse effect on (a) the condition (financial or otherwise), business, properties or results of operations or prospects of the Company and its subsidiaries, taken as a whole, or (b) the ability of the Company to consummate the Transactions contemplated by this Agreement and to timely perform its material obligations hereunder and thereunder.

“Market Capitalization” means, at any given date, the sum of the number of outstanding Class A Common Shares and outstanding Class B Common Shares multiplied by the Nasdaq official closing price of the Shares (as reflected on Nasdaq.com) on such date.

“Nasdaq” shall mean the Nasdaq Capital Market.

“Permitted Transfers” shall have the meaning set forth in Section 5.02.

“Person” shall mean an individual, exempted company, corporation, limited liability or unlimited liability company, association, partnership, trust, estate, joint venture, business trust or unincorporated organization, or a government or any agency or political subdivision thereof, or other entity of any kind or nature.

“Purchaser” shall have the meaning set forth in the preamble hereto.

“Purchase Price” shall have the meaning set forth in Section 2.01(a).

“Sanctions” means any sanctions administered or enforced by the U.S. Government, including, without limitation, the Office of Foreign Assets Control of the U.S. Department of the Treasury, the Bureau of Industry and Security, or the U.S. Department of State (including, without limitation, the designation as a “specially designated national” or “blocked person”), the European Union, His Majesty’s Treasury, the United Nations Security Council, or other relevant sanctions authority.

“SEC” shall mean the U.S. Securities and Exchange Commission.

“Securities” shall have the meaning set forth in Section 2.01(a).

“Securities Act” shall mean the U.S. Securities Act of 1933, as amended.

“Shares” means Class A Common Shares.

“Subsidiaries” shall have the meaning set forth in Section 4.01(a).

“Third Party” shall mean with respect to the Purchaser, a Person other than the Purchaser or any Affiliate of the Purchaser.

“Transactions” shall have the meaning set forth in Section 4.01(d).

“Transfer” shall have the meaning set forth in Section 5.02.

“Trigger Event” means a Liquidity Event or a Corporate Transaction Event, as the case may be.

Section 1.02. General Interpretive Principles. Whenever used in this Agreement, except as otherwise expressly provided or unless the context otherwise requires, any noun or pronoun shall be deemed to include the plural as well as the singular and to cover all genders. The name assigned to this Agreement and the section captions used herein are for convenience of reference only and shall not be construed to affect the meaning, construction or effect hereof. Whenever the words “include,” “includes,” or “including” are used in this Agreement, they shall be deemed to be followed by the words “without limitation.” Unless otherwise specified, the terms “hereto,” “hereof,” “herein” and similar terms refer to this Agreement as a whole (including the exhibits, schedules and disclosure statements hereto), and references herein to Articles or Sections refer to Articles or Sections of this Agreement. References to “law,” “laws” or to a particular statute or law shall be deemed also to include any and all Applicable Law. (a) Subject to the terms and conditions of this Agreement, the Company and the Purchaser agree with each other that at the Closing the Company shall issue and sell to the Purchaser, and the Purchaser shall purchase and acquire from the Company, 8,860,535 Shares (the “Securities”) for a total purchase price equal to US$ 10,101,010.00 (ten million, one hundred and one thousand and ten U.S. dollars) (the “Purchase Price”). The price per Security is US$ 1.14 (one U.S. dollar and fourteen cents) per Security, which represents the Nasdaq official closing price (as reflected on Nasdaq.com) on the trading day immediately preceding the date hereof.

(b) For the avoidance of doubt, the agreement of the Company to issue Securities to the Purchaser and the Purchaser to purchase such Securities pursuant to this Article 2 is an agreement solely between the Company and the Purchaser, and, notwithstanding anything else to the contrary herein or in any other agreement entered into in connection with this Agreement, this Agreement is not intended to and shall not confer upon any person, other than the Company and the Purchaser, any rights or remedies with respect to the agreement of the Company to issue Securities to the Purchaser and of the Purchaser to purchase Securities pursuant to this Article 2.

(a) Subject to the satisfaction or waiver of the conditions precedent set forth in Section 2.02(c) and (d), the closing (the “Closing”) of the purchase and sale of the Securities hereunder shall take place on the date of Closing (the “Closing Date”).

(b) To effect the purchase and sale of Securities, upon the terms and subject to the conditions set forth in this Agreement, at the Closing:

(i) The Company shall issue to the Purchaser the Securities registered in the name of the Purchaser in the register of members of the Company maintained by the transfer agent in book-entry form, against payment in full by or on behalf of the Purchaser of the Purchase Price for the Securities agreed to be purchased by the Purchaser.

(ii) The Purchaser shall cause a wire transfer to be made in same day funds to an account of the Company (or any of its subsidiaries) designated in writing by the Company to the Purchaser in an amount equal to the Purchase Price for the Securities.

(c) The obligations of the Purchaser to purchase the Securities to be purchased by it hereunder are subject to the satisfaction or waiver by the Purchaser of the following conditions to Closing:

(i) the purchase and sale of the Securities pursuant to this Article 2 shall not be prohibited or enjoined by any court of competent jurisdiction;

(ii) the representations and warranties of the Company set forth in Section 3.01 shall be true and correct in all material respects on and as of the Closing Date (except in the case of representations and warranties that are made as of a specified date, which shall be true and correct in all material respects as of such specified date);

(iii) the Company shall have performed and complied in all material respects with all agreements and obligations required by this Agreement to be performed or complied with by it on or prior to the Closing Date; and

(iv) the Purchaser shall have received a certificate, dated the Closing Date, duly executed by an executive officer of the Company on behalf of the Company, certifying that the conditions specified in Section 2.02(c)(ii) and (iii) have been satisfied.

(d) The obligations of the Company to sell the Securities to the Purchaser are subject to the satisfaction or waiver of the following conditions to Closing:

(i) the purchase and sale of the Securities pursuant to this Article 2 shall not be prohibited or enjoined by any court of competent jurisdiction;

(ii) the representations and warranties of the Purchaser set forth in Section 3.02 shall be true and correct in all material respects on and as of the Closing Date;

(iii) the Purchaser shall have performed and complied in all material respects with all agreements and obligations required by this Agreement to be performed or complied with by it on or prior to the Closing Date; and

(iv) the Company shall have received a certificate, dated the Closing Date, duly executed by the sole member of the Purchaser on behalf of the Purchaser, certifying that the conditions specified in Section 2.02(d)(ii) and (iii) have been satisfied.

Section 3.01. Investment Return. In case any Trigger Event is consummated within the first thirty six (36) months from the Closing Date, then the Purchaser shall receive the applicable Investment Return Amount, as follows:

(a) In case of a Liquidity Event, then the Investment Return Amount shall be calculated in accordance with the Investment Return Formula and, within two (2) Business Days from the date of consummation of such Liquidity Event, the Company shall make a payment to the Purchaser, in cash or the equivalent amount in Shares, at the Purchaser’s discretion, so that the Purchaser has received as of such date, in the aggregate, the applicable Investment Return Amount (the “Liquidity Event Payment”).

(b) In case a Corporate Transaction Event, then the Investment Return Amount shall be calculated in accordance with the Investment Return Formula and the Company or the surviving entity following the consummation of such Corporate Transaction Event shall, prior and in preference to any payment or distribution in connection with such Corporate Transaction, make a payment to the Purchaser, in cash, or the equivalent amount in Shares or in shares of the entity resulting from such Corporate Transaction Event, at the Purchaser’s discretion, so that the Purchaser has received, in the aggregate, applicable Investment Return Amount (the “Corporate Transaction Event Payment” and, with the Liquidity Event Payment, each an “Investment Return Payment”).

(c) For the avoidance of doubt, the Investment Return Payment shall not be payable on more than one (1) occasion.

(a) Capital Stock. The authorized share capital of the Company consists of 500,000,000 Class A Common Shares, 250,000,000 Class B Common Shares and 250,000,000 which are as yet undesignated and may be issued as common shares or shares with preferred rights. As of the date hereof, there were 18,219,545 Class A Common Shares and 23,664,925 Class B Common Shares issued and outstanding. All outstanding Class A Common Shares and Class B Common Shares are duly authorized, validly issued, fully paid and nonassessable.

(b) Authorization and Power. The execution, delivery and performance of this Agreement and the consummation of the transactions contemplated herein and therein (collectively, the “Transactions”), have been duly and validly authorized by the Board of Directors and all other necessary corporate action on the part of the Company have been taken. Assuming this Agreement constitutes the valid and binding obligation of the Purchaser, this Agreement is a valid and binding obligation of the Company, enforceable against the Company in accordance with its terms, subject to the limitation of such enforcement by (A) the effect of bankruptcy, insolvency, reorganization, receivership, conservatorship, arrangement, moratorium or other laws affecting or relating to creditors’ rights generally or (B) the rules governing the availability of specific performance, injunctive relief or other equitable remedies and general principles of equity, regardless of whether considered in a proceeding in equity or at law (the “Enforceability Exceptions”).

(c) The Shares. The Shares to be issued and sold by the Company to the Purchaser at Closing, have been duly and validly authorized, and when issued in accordance with the terms of this Agreement, will be validly issued, fully paid and non-assessable, and the issuance of such Shares will not be subject to any preemptive or similar rights and will be free of restrictions on transfer and any other liens, restrictions or encumbrances, other than restrictions on transfer under applicable state and federal securities laws or as contemplated hereby.

(d) No Conflicts. No Consent. The execution, delivery and performance of this Agreement, the issuance of the Shares and the consummation by the Company of the Transactions, will not conflict with or result in a breach or violation of any of the terms or provisions of, or constitute a default under, (i) any indenture, mortgage, deed of trust, loan agreement or other agreement or instrument to which the Company or any of its Subsidiaries is a party or by which the Company or any of its Subsidiaries is bound or to which any of the property or assets of the Company or any of its Subsidiaries is subject, except for such conflicts, breaches, violations or defaults that would not, individually or in the aggregate, have a Material Adverse Effect, (ii) the articles of association or by-laws (or other applicable organizational document) of the Company or any of its Subsidiaries, or (iii) any statute or any order, rule or regulation of any court or governmental agency or body having jurisdiction over the Company or any of its Subsidiaries or any of their properties, except for such conflicts, breaches, violations or defaults that would not, individually or in the aggregate, have a Material Adverse Effect; and no consent, approval, authorization, order, registration or qualification of or with any such court or governmental agency or body is required in connection with the execution, delivery and performance by the Company of this Agreement and the consummation by the Company of the Transactions, except for (A) requirements or regulations in connection with the issuance of Shares, (B) any required filings pursuant to the Exchange Act or the rules of the SEC or Nasdaq or (C) as have been obtained prior to the date of this Agreement.

(e) No Securities Act Registration.

(i) Neither the Company nor any other Person or entity authorized by the Company to act on its behalf has engaged in any general solicitation or general advertising (within the meaning of Rule 502(c) of Regulation D of the Securities Act) of investors with respect to offers or sales of the Securities. The Company has not, directly or indirectly, sold, offered for sale, solicited offers to buy or otherwise negotiated in respect of, any security (as defined in the Securities Act) which, to its knowledge, is or will be integrated with the Securities sold pursuant to this Agreement.

(ii) Assuming the accuracy of the Purchaser’s representations and warranties under Section 4.02(d), it is not necessary in connection with the issuance and sale to the Purchaser to register the Securities under the Securities Act or to qualify or register the Securities under applicable U.S. state securities laws.

(f) No Additional Representations.

(i) Except for the representations and warranties contained in this Section 4.01 and any schedules or certificates delivered in connection herewith, the Company makes no other representation or warranty, express or implied, written or oral, and hereby, to the maximum extent permitted by applicable Law, disclaims any such representation or warranty, whether by the Company or any other Person, with respect to the Company or with respect to (A) any matters relating to the Company and its Subsidiaries, their respective businesses, financial condition, results of operations, prospects or otherwise, (B) any projections, estimates or budgets delivered or made available to the Purchaser (or any of its Affiliates, officers, directors, employees or other representatives) of future revenues, results of operations (or any component thereof), cash flows or financial condition (or any component thereof) of the Company and its Subsidiaries or (C) the future business and operations of the Company and its Subsidiaries.

(ii) The Company acknowledges that the Purchaser makes no representation or warranty as to any matter whatsoever except as expressly set forth in Section 4.02 and in any certificate delivered by the Purchaser pursuant to this Agreement, and the Company has not relied on or been induced by such information or any other representations or warranties (whether express or implied or made orally or in writing) not expressly set forth in Section 4.02 and in any certificate delivered by the Purchaser pursuant to this Agreement.

(iii) The Company acknowledges and agrees that, except for the representations and warranties expressly set forth in Section 4.02 and in any certificate delivered by the Purchaser pursuant to this Agreement, (A) no person has been authorized by the Purchaser to make any representation or warranty relating to the Purchaser or otherwise in connection with the transactions contemplated hereby, and if made, such representation or warranty must not be relied upon by the Company as having been authorized by the Purchaser, and (B) any materials or information provided or addressed to the Company or any of its Affiliates or representatives are not and shall not be deemed to be or include representations or warranties of the Purchaser unless any such materials or information are the subject of any express representation or warranty set forth in Section 4.02 of this Agreement and in any certificate delivered by the Purchaser pursuant to this Agreement.