QUESTIONS AND ANSWERS ABOUT THE EXTRAORDINARY GENERAL MEETING

These Questions and Answers are only summaries of the matters they discuss. They do not contain all of the information that may be important to you. You should read carefully the entire document, including any annexes to this proxy statement.

Why am I receiving this proxy statement?

This proxy statement and the enclosed proxy card are being sent to you in connection with the solicitation of proxies by our Board for use at the Extraordinary General Meeting to be held in person or virtually on , 2022, or at any adjournments or postponement thereof. This proxy statement summarizes the information that you need to make an informed decision on the proposals to be considered at the Extraordinary General Meeting.

RMG III is a blank check company incorporated on December 23, 2020 as a Cayman Islands exempted company for the purpose of effecting a merger, share exchange, asset acquisition, share purchase, reorganization or similar business combination with one or more businesses (an “initial business combination”).

In December 2020, the Sponsor paid an aggregate of $25,000 to cover for certain expenses on behalf of the Company in exchange for issuance of 10,062,500 Class B ordinary shares, par value $0.0001 per share, of the Company (the “Class B Ordinary Shares”). On January 30, 2021, the Company effectuated a 5-for-6 share split of the Class B Ordinary Shares, resulting in an aggregate outstanding amount of 12,075,000 Class B Ordinary Shares.

On February 9, 2021, the Company consummated its initial public offering (“IPO”) of 48,300,000 units at $10.00 per unit. Each unit consists of one Class A ordinary share, par value $0.0001 per share, of the Company (“Class A Ordinary Shares” or “public shares”) and one-fifth of one redeemable warrant to purchase one Class A Ordinary Share. Simultaneously with the consummation of the IPO, RMG III completed the private placement of 8,216,330 private placement warrants (the “Private Placement” and collectively the “Private Placement Warrants”) at a purchase price of $1.50 per Private Placement Warrant to the Sponsor, generating gross proceeds to us of approximately $12.3 million. Following the closing of the IPO and the Private Placement, a total of $483.0 million ($10.00 per unit) of the net proceeds from its IPO and the Private Placement were placed in a trust account at Citibank N.A. (the “Trust Account”) with Continental Stock Transfer & Trust Company (“Continental”) acting as trustee. Our charter provides for the return of the IPO proceeds held in the Trust Account to the holders of public shares if we do not complete our initial business combination by February 9, 2023.

While the Company is currently in discussions regarding various business combination opportunities, the Board has determined that there may not be sufficient time before February 9, 2023 to complete an initial business combination. Therefore, the Board has determined that it is in the best interests of the Company’s shareholders to extend the date by which the Company has to complete an initial business combination to August 9, 2023 (the “Extended Date”).

What is being voted on?

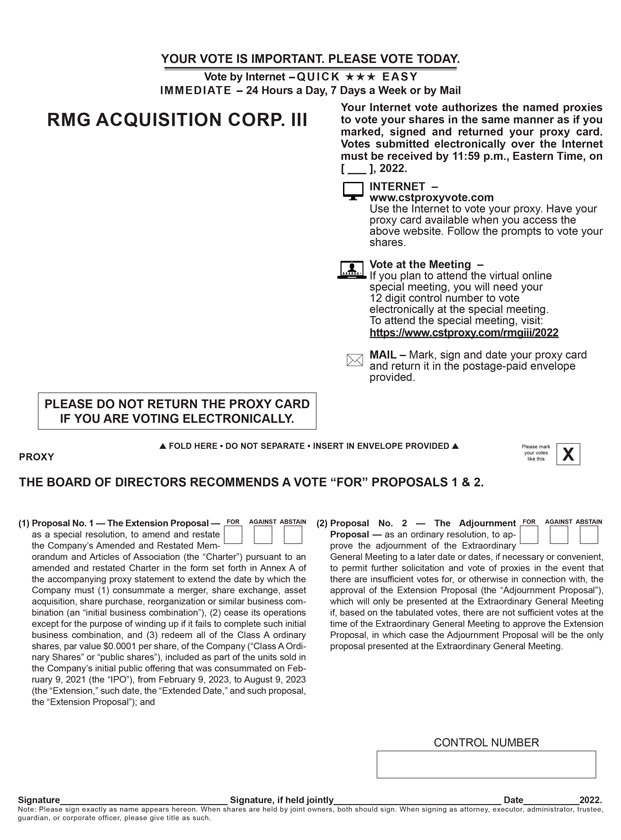

You are being asked to vote on the following proposals:

(1) as a special resolution, to amend and restate the Company’s Amended and Restated Memorandum and Articles of Association (the “Charter”) pursuant to an amended and restated Charter in the form set forth in Annex A of the accompanying proxy statement to extend the date by which the Company must (a) consummate an initial business combination, (b) cease its operations except for the purpose of winding up if it fails to complete such initial business combination, and (c) redeem all of the Class A Ordinary Shares included as part of the units sold in the IPO, from February 9, 2023, to the Extended Date (the “Extension,” and such proposal, the “Extension Proposal”); and

(2) as an ordinary resolution, to approve the adjournment of the Extraordinary General Meeting to a later date or dates, if necessary or convenient, to permit further solicitation and vote of proxies in the event that there are insufficient votes for, or otherwise in connection with, the approval of the Extension Proposal (the “Adjournment Proposal”), which will only be presented at the Extraordinary General Meeting if, based on the tabulated votes, there are not sufficient votes at the time of the Extraordinary General Meeting to approve the Extension Proposal, in which case the Adjournment Proposal will be the only proposal presented at the Extraordinary General Meeting.

2