Exhibit 99.7

UNAUDITED PRO FORMA CONDENSED COMBINED FINANCIAL INFORMATION

Introduction

The following unaudited pro forma condensed combined balance sheet as of December 31, 2022 gives effect to the Business Combination as if it was completed on December 31, 2022. The unaudited pro forma combined statement of operations for the year ended December 31, 2022 give pro forma effect to the Business Combination as if it were completed on January 1, 2022. The unaudited pro forma combined balance sheet does not purport to represent, and is not necessarily indicative of, what the actual financial condition of the combined company would have been had the Business Combination taken place on December 31, 2022, nor is it indicative of the financial condition of the combined company as of any future date. The unaudited pro forma combined statement of operations does not purport to represent, and is not necessarily indicative of, what the actual results of operations of the combined company would have been had the Business Combination taken place on January 1, 2022. The unaudited pro forma combined financial information has been prepared, in accordance with Article 11 of Regulation S-X, and is for informational purposes only. It is subject to several uncertainties and assumptions as described in the accompanying notes. The combined financial information presents the pro forma effects of the following:

| | • | | the sale and issuance of 16,936,715 shares of Class A Common Stock at $9.80 per share with a par value of $0.0001 from the Private Placements, inclusive of 100,000 additional shares of Class A Common Stock issued to the Alvarium PIPE Investors pursuant to the Side Letter; |

| | • | | the conversion of the Class D-1 equity interest into an employment contract with the TIG Entities subsequent to the Business Combination; |

| | • | | the settlement of the $7.8 million deferred underwriting commissions incurred in connection with Cartesian’s IPO; |

| | • | | the extinguishment of historical long-term debt and the issuance of new credit facilities in connection with the Business Combination; |

| | • | | the Business Combination described further in Note 1 to the Unaudited Pro Forma Condensed Combined Financial Information (the “Business Combination Adjustments” and collectively with the Non-Business Combination Adjustments, the “Pro Forma Adjustments”). |

In addition, the Target Companies signed a credit agreement with lenders regarding the terms of a new credit facility, the proceeds of which were used to repay existing indebtedness of the Target Companies and to fund future business growth, including acquisitions.

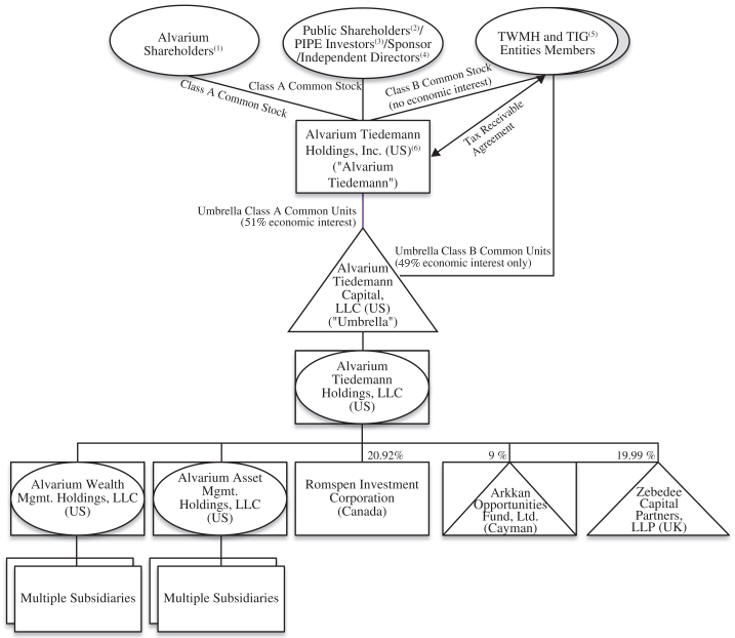

Cartesian was formed on December 18, 2020. As a special purpose acquisition company (“SPAC”), the Company’s purpose entails efforts to acquire one or more businesses through a merger, capital stock exchange, asset acquisition, stock purchase, recapitalization, reorganization or other similar business combination with one or more businesses or entities. Effective September 19, 2021, Cartesian, TWMH, the TIG Entities, and Alvarium entered into an agreement pursuant to which Cartesian intends to use cash and issue shares in exchange for the equity and/or assets of the Target Companies. On December 30, 2022, Cartesian redomiciled and became Alvarium Tiedemann Holdings, Inc. Alvarium Tiedemann Holdings, Inc. is sometimes referred to in this section as “Alvarium Tiedemann”.

1