UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

Form 10-K

| [ X ] | | Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

for the Fiscal Year Ended December 31, 2011

December 31, 2011

or

| [ ] | | Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

for the Transition Period from to

Commission file number:001-05519

CDI Corp.

(Exact name of registrant as specified in its charter)

| | |

Pennsylvania (State of incorporation) 1717 Arch Street, 35th Floor, Philadelphia, PA 19103-2768 (Address of principal executive offices) 23-2394430 (I.R.S. Employer Identification Number) (215) 569-2200 (Registrant’s telephone number, including area code) | | Securities registered pursuant to Section 12(b) of the Act: Common stock, $0.10 par value (Title of each class) New York Stock Exchange (Name of exchange on which registered) Securities registered pursuant to Section 12(g) of the Act: None |

Indicate by a check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. [ ] YES [X] NO

Indicate by a check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. [ ] YES [X] NO

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. [X] YES [ ] NO

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (section 232.405 of this chapter) during the preceding 12 months (or for shorter period that the registrant was required to submit and post such files). [X] YES [ ] NO

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (section 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [X]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| | | | | | |

Large accelerated filer [ ] | | | | Accelerated filer [X] |

Non-accelerated filer [ ] (Do not check if a smaller reporting company) | | Smaller reporting company [ ] |

| | | | | | | |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act.) [ ] YES [X] NO

The aggregate market value of the registrant’s voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold on June 30, 2011, the last business day of the registrant’s most recently completed second fiscal quarter, as reported on the New York Stock Exchange, was $176,527,708.

The number of shares outstanding of each of the registrant’s classes of common stock as of February 24, 2012 was as follows:

| | | | | | |

| | | Common stock, $0.10 par value | | 19,181,657 Shares | | |

| | | Class B common stock, $0.10 par value | | None | | |

Documents Incorporated By Reference

Portions of the registrant’s definitive proxy statement for its 2012 annual meeting of shareholders (to be filed with the Securities and Exchange Commission within 120 days after the registrant’s fiscal year end of December 31, 2011) are incorporated by reference into Part III of this Form 10-K.

Caution Concerning Forward-Looking Statements

This report (including Management’s Discussion and Analysis of Financial Condition and Results of Operations) contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. All statements that address expectations or projections about the future, including, but not limited to, statements about our strategies for growth and future financial results (such as revenue, operating profit, cash flow, and tax rate), are forward-looking statements. Some of the forward-looking statements can be identified by words like “anticipates,” “believes,” “expects,” “may,” “will,” “could,” “should,” “intends,” “plans,” “estimates” and similar references to future periods. These statements are not guarantees of future performance and involve a number of risks, uncertainties and assumptions that are difficult to predict. Because these forward-looking statements are based on estimates and assumptions that are subject to significant business, economic and competitive uncertainties, many of which are beyond our control or are subject to change, actual outcomes and results may differ materially from what is expressed or forecasted in these forward-looking statements. Important factors that could cause actual results to differ materially from these forward-looking statements include, but are not limited to: weakness in general economic conditions and levels of capital spending by clients in the industries we serve; weakness or volatility in the financial and capital markets, which may result in the postponement or cancellation of our clients’ capital projects or the inability of our clients to pay our fees; the inability to successfully implement our new strategic plan; the termination of a major client contract or project; our ability to maintain or expand our existing bank credit facility on satisfactory terms; credit risks associated with our clients; competitive market pressures; the availability and cost of qualified labor; our level of success in attracting, training, and retaining qualified management personnel and other staff employees; changes in tax laws and other government regulations; the possibility of incurring liability for our business activities, including, but not limited to, the activities of our temporary employees; our performance on client contracts; negative outcome of pending and future claims and litigation; and government policies, legislation or judicial decisions adverse to our businesses. More detailed information about some of these and other risks and uncertainties may be found in our filings with the SEC, particularly in the “Risk Factors” section in Part I, Item 1A of this Form 10-K Report. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. We assume no obligation to update such statements, whether as a result of new information, future events or otherwise, except as required by law.

Unless the context otherwise requires, all references herein to “CDI,” the “Registrant,” the “Company,” “we,” “us” or “our” are to CDI Corp. and its consolidated subsidiaries.

General

CDI Corp. (NYSE:CDI) is an integrated engineering and technology services organization providing differentiated, client-focused solutions in select global industries.

On December 8, 2011, the Company announced business model and organizational changes aligned with a new strategic plan to make CDI an engineering and technology solutions company with global capabilities in select markets. The objectives of these changes are to grow the Company’s solutions business, optimize the Company’s professional staffing operations and prioritize the geographic markets and industries to which the Company will deliver engineering and technology solutions. See “Business Strategy” in this Item 1 for a further description of the Company’s new strategic plan.

Services

Effective January 2012, CDI’s restructured business model provides a range of integrated engineering and technology solutions and professional staffing services through an organizational platform focused on services offered to clients, geographic markets that reflect its clients’ growth plans and select industries that are aligned with the Company’s core capabilities. Effective January 2012, the Company’s reportable segments are as follows:

| | Ÿ | | Global Engineering and Technology Solutions (“GETS”)—The Company provides engineering and information technology solutions for its clients that involve the production of deliverable work products or services performed at a CDI facility or at a client’s facility under the supervision of CDI personnel. These solutions typically include analysis of a client’s engineering or information technology needs and the development of a solution that generally range in duration from several months to multiple years. Depending on the industry, engineering services can include such functions as feasibility studies, technology assessment, conceptual design, cost estimating, preliminary design, execution planning, procurement optimization detailed design, testing and validation of regulatory compliance, technology integration and operating and maintenance support. Information technology services can include assessments, execution of business application services, web development, quality assurance and testing and program management. GETS provides these solutions for the Company’s geographic regions through a delivery model consisting of: centers of excellence, with concentrated skill sets required for larger, more complex projects; regional centers to service local needs of clients; client-centered offices to deliver site-specific services; and off-shore and near-shore centers to leverage low-cost design resources. |

2

| | Ÿ | | Professional Services Staffing (“PSS”)—The Company provides skilled technical and professional personnel to its clients for discrete periods of time to augment the client’s workforce in times of project, seasonal, peak period or business cycle needs. These engagements can range from several months to multiple years in duration. The Company also provides permanent placement services. The Company provides professional staffing services to targeted industries that include managed services and managed staffing programs, functional staffing outsourcing and business advisory services. The Company delivers these services through its PSS delivery organization which provides centralized global staffing delivery focused on select engineering and technology skill sets and competencies. |

| | Ÿ | | Management Recruiters International, Inc. (“MRI”)—MRI is a global franchisor that does business as MRINetwork® and provides the use of its trademarks, business systems and training and support services to its franchisees who engage in the search and recruitment of executive, technical, professional and managerial personnel for employment by their clients. The MRI franchisees provide permanent placement services primarily under the brand names Management Recruiters®, Sales Consultants®, CompuSearch® and OfficeMates 5®. MRI also provides training and support, implementation services and back-office services to enable franchisees to pursue contract staffing opportunities. |

CDI’s restructured business is focused on offering services through three geographic regions: the Americas; Europe, the Middle East and Africa (“EMEA”); and Asia Pacific (“APAC”). These geographic regions have separate organizations that include client-facing management and teams deployed in a strategic client engagement model to provide focused client development, to sell offerings across the Company’s service lines and to manage successful long-term client relationships. The majority of the Company’s operations are currently in the Americas.

2011 Reporting Segments and Services

The financial information presented in this Form 10-K Report does not give effect to the change in the composition of the Company’s operating segments as a result of the restructuring effective January 2012. During 2011, the Company managed its business under the following four reporting segments:

CDI Engineering Solutions (“ES”)—ES provided engineering, architecture, procurement, construction management and technical staffing services. Approximately 19% of ES’s total revenue in 2011 was from clients domiciled outside the U.S.

CDI Information Technology Solutions (“ITS”)—ITS provided IT-related services to its clients, which were primarily large and mid-sized clients with significant IT requirements and/or the need to supplement their own staff on a flexible basis. Services included staffing augmentation, permanent placement, outsourcing (both on-site, under the client’s supervision, and off-site) and consulting.

MRI—See the description of the MRI business under Services above.

CDI AndersElite (“Anders”)—Anders provided contract and permanent placement candidates to national, regional and local UK and Australia-based clients that operated within the public and private sectors in the industrial, commercial, government and defense, housing, rail, IT, mining, and oil & gas industries. The Company maintained offices in the UK and Australia. In addition, Anders provided staffing, managed services and recruitment outsourcing services to the aerospace, mining, oil & gas, power and energy, and IT industries.

During 2011, the Company categorized the services it provided into project outsourcing, staffing and professional services. Project outsourcing services primarily related to managing clients’ outsourcing of projects or functions. Staffing services primarily related to providing temporary workforce augmentation. Professional services primarily related to providing permanent placement staffing except for MRI, which was primarily related to royalties and franchise fees.

Business Strategy

On December 8, 2011 the Company announced a new business model and organizational changes aligned with a new strategic growth plan effective January 2012. The new strategic plan will focus on high-potential growth opportunities in a discrete number of priority industries, selectively expand the Company’s geographic footprint to meet the global needs of the Company’s core clients, provide a clear vision and improved organizational structure to become recognized as a market-leading global engineering and technology solutions provider.

Key elements of the organizational changes and strategic growth plan are as follows:

| | Ÿ | | Create an organization that includes a client engagement model in three geographic regions—the Americas, EMEA and APAC. These geographic regions are designed to build deeper and more strategic client relationships in targeted industries across the portfolio of CDI services. |

| | Ÿ | | Reorganize CDI’s project solutions business previously within the ES and ITS segments into the GETS reporting segment. GETS’ primary focus is to more effectively deliver value-added engineering and IT solutions services to the Company’s clients. |

| | Ÿ | | Reorganize CDI’s staffing services previously within the ES, ITS and the Anders segments into the PSS reporting segment. PSS will provide global talent sourcing and delivery. |

3

| | Ÿ | | Maintain the Company’s MRI business as a separate reporting segment. |

| | Ÿ | | Centralize support functions and processes into a global model to optimize execution and more effectively manage costs. |

| | Ÿ | | Prioritize investments in the following strategic industry verticals: Oil, Gas and Chemicals; Aerospace and Industrial Equipment; and Hi-Tech. |

Financial Information about Segments and Geographic Areas

Results for 2011 and prior periods in this Form 10-K Report are reported on the basis under which the Company managed its business in 2011 and do not reflect the new reporting segments effective January 2012. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in Part II, Item 7 and Note 14—Reporting Segments, in the notes to the consolidated financial statements included in Part II, Item 8 of this Form 10-K Report for financial information by reporting segment and about geographic areas in which the Company operates.

Other Information

The Company was incorporated in Pennsylvania on July 30, 1985. It is the successor registrant to CDI Corporation, which was incorporated in Pennsylvania on September 16, 1950.

Clients/Markets

The Company’s clients consist primarily of: multi-national, national and regional companies; and US Federal, state, local and foreign governments. The Company seeks to expand its service offerings of engineering and technology solutions as well as professional staffing within the Oil & Gas, Chemicals, Aerospace, Industrial Products and Hi-Tech industries. The Company also does significant business in other industries, including the U.S. defense, financial services, rail and mining industries. Revenue from one client, International Business Machines Corporation (“IBM”), accounted for 21% of total CDI consolidated revenue in 2011.

MRI provides trademarks and business systems, as well as service, training, support and ancillary services to its franchisees, to enable them to be successful in their businesses. MRI seeks to sell new franchises and renew existing franchises. New franchisees have historically been brought into the MRI network primarily on a referral basis. MRI’s business is not dependent on any single franchisee.

Seasonality

The Company’s operating results are impacted by the seasonality of its clients’ or franchisees’ businesses. This seasonality is generally due to the clients vacation and holiday schedules which tend to impact the fourth quarter and beginning of the first quarter of each year as well as result in a modest downturn during heavy vacation periods in the third quarter of each year. In addition, this seasonality is impacted by weather, and daylight limitations. MRI franchisee clients’ hiring rates tend to be lower in the fourth quarter, leading to lower royalty revenues in the first quarter of the following year. Demand for MRI’s staffing services is typically subject to seasonal slowdown at the end of the fourth quarter and beginning of the first quarter of each year.

Pricing

The Company generally determines its pricing based on mark-ups of its employees’ hourly rates of pay and bill rates for GETS and PSS services. Permanent placement revenues are generally contingent upon filling an assigned position. If the client hires the candidate, the Company receives a fee based on an agreed-upon rate, which generally is a percentage of the candidate’s first-year compensation. Clients typically invite several companies to bid for contracts, which the Company believes are awarded primarily on the basis of prior performance, reputation, value-added services, technological capability and price. Clients frequently award multi-vendor contracts.

MRI’s revenue consists of ongoing royalties, initial franchise fees and support service fees. MRI receives ongoing royalty fees based on a percentage of the franchisee’s permanent placement fees and any other revenue collected. New franchise agreements generally have a term of 10 to 15 years. Individual franchises may be acquired by qualified candidates both in the U.S. and internationally. The domestic pricing structure includes an initial fee, a support fee payable over the first 24 months of operation, and a royalty rate schedule.

Competition

The Company competes in global, national, and regional markets with numerous engineering and information technology outsourcing companies and with temporary staffing and permanent placement firms. All segments of the Company’s operations face competition in attracting both clients and high-quality specialized employment candidates.

The engineering and information technology outsourcing business is highly fragmented. Certain of the Company’s competitors have greater financial resources and offer a broader range of services and others are smaller and tend to be more specialized. The extent of the competition varies according to the particular markets and geographic area. The degree and type of competition is also influenced by the type and scope of a particular project.

The temporary and permanent placement businesses are very competitive and highly fragmented, with limited barriers to entry into the market. In many areas, the local companies are the strongest competitors. Price competition among companies and pricing pressures from clients are significant in the staffing services industry in which we compete.

4

The trend of clients who consolidate their purchases of engineering, information technology and staffing services with a single provider or with a small number of providers continues. This trend to consolidate purchases may make it more difficult for the Company to obtain or retain clients when competing with larger competitors. The Company believes it derives a competitive advantage from its lengthy experience with and long-standing commitment to the industries it serves, long-term relationships with its clients, technical capabilities, and national and international presence.

In 2011, CDI’s primary competitors by business segment included:

| | Ÿ | | ES—AECOM Technology Corporation; Aerotek, Inc.; Belcan Corporation; Day & Zimmermann, Inc.; Gibbs and Cox, Inc.; Jacobs Engineering Group Inc.; and Shaw Group Inc. |

| | Ÿ | | ITS—Aerotek, Inc.; CIBER, Inc.; Computer Task Group, Inc.; MPS Group, Inc. (a subsidiary of Adecco S.A.); and Volt Information Sciences, Inc. |

| | Ÿ | | MRI—Heidrick & Struggles International, Inc.; Korn/Ferry International; and Robert Half International Inc. |

| | Ÿ | | Anders—Hays plc; Hill McGlynn (a subsidiary of Randstad Holding nv); Matchtech Group plc; and Morson plc. |

Safeguards—Business, Disaster and Contingency Planning

CDI has a number of safeguards that seek to protect the Company from various system-related risks. Given the significant amount of data generated in the Company’s key processes, including client-related projects, recruiting, payroll, and client invoicing, CDI has implemented fault tolerant processing capability within the Company’s primary data center. This mitigates the risks related to hardware failure. Additionally, CDI has contracted with a third-party provider to restore its primary data center operations in the event of a disruption. Finally, the Company maintains site disaster plans for a majority of its operating offices as well as maintaining data back-up requirements throughout the Company.

Employees

As of December 31, 2011, CDI had approximately 1,000 staff employees. In addition, CDI had approximately 9,400 employees and other workers engaged as billable personnel. The number of billable employees and other workers varies in relation to the number of projects and assignments in progress at any particular time.

Access to Company Information

CDI maintains a website atwww.cdicorp.com and makes available free of charge on that website (under the “Investor Relations” tab) the Company’s annual reports on Form 10-K, quarterly reports on Form 10-Q,current reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended, as soon as reasonably practicable after CDI electronically files these materials with, or furnishes them to, the Securities and Exchange Commission. Also available on CDI’s website are the Company’s Corporate Governance Principles, Code of Conduct and the charters for the Audit Committee, Compensation Committee, Finance Committee, Executive Committee and Governance and Nominating Committee. The information contained on CDI’s website, or on other websites linked to CDI’s website, is not part of, or incorporated in, this report.

CDI’s business involves a number of risks, many of which are beyond our control. The risks and uncertainties described below could individually or collectively have a material adverse effect on our business, assets, profitability or prospects. While these are not the only risks and uncertainties we face, management believes that the more significant risks and uncertainties are as follows:

CDI’s business is heavily dependent on capital spending by clients in the industries we serve, and cuts in capital spending and economic downturns may result in the loss of revenue and profitability.

The demand for CDI’s services is highly dependent upon the level of capital spending by our clients, especially in our engineering project outsourcing business and in certain portions of our staffing business. The pace of client capital spending programs, new product launches and similar activities have a direct impact on our clients’ needs for project outsourcing and both temporary and permanent employees. There have been and, despite recent signs of a turnaround, may continue to be delays and cancellations of projects due to credit constraints and weak economic conditions experienced by some of our clients. These delays and cancellations can adversely affect CDI’s revenue and profitability

Unfavorable economic conditions could negatively affect CDI’s business.

Financial markets in the U.S., Europe and Asia experienced extreme disruption in recent years, causing severely tightened credit availability, increases in unemployment and general declines in the U.S. economy and economies around the world. While conditions are improving in many countries, the economic recovery appears to be somewhat slower and weaker than following previous economic downturns. Many companies are limiting, and may continue to limit, their spending on the services which CDI provides, which in turn could have a material adverse effect on our financial and operating performance.

Our staffing businesses earn revenue when qualified candidates accept open positions with potential employers. These

5

employers may postpone or cut back on hiring in efforts to cut costs, particularly during economic downturns. In addition, during periods of high unemployment, candidates may be less likely to take the risk of seeking new employment, creating a lack of qualified candidates. Both of these could have a material adverse effect on our financial and operating performance.

In addition, our MRI segment derives royalty revenue from franchisees. If persons hoping to start MRI franchises are unable to obtain credit, they could be prevented from purchasing franchises, which could impede our growth in that sector. If current franchisees are unable to obtain credit, it could cause downsizing in their organizations, in turn negatively affecting MRI’s royalty revenue, potentially having a material adverse effect on CDI’s financial and operating performance.

While CDI manages its cost structure in response to reduced demand for our services, these efforts may not be successful in having us remain profitable or, if profitable, maintain our current profit margins.

Our revenues are subject to uncertainties and cyclicality. Our results of operations depend on, among other factors, new contract awards and contract renewals, and the selection process and timing for performing these contracts are subject to contingencies beyond our control. In addition, our client contracts and arrangements may be adjusted, cancelled or suspended by our clients, in most cases on short notice. Fluctuations in commodity prices could also have a material adverse impact on our operating results.

A significant portion of our revenues is directly or indirectly derived from awards of long-term contracts. It is difficult to predict whether and when we will receive such awards due to the typically lengthy and complex bidding and selection process, which is affected by a number of factors, such as market conditions, clients’ financing arrangements and governmental approvals. Because a meaningful portion of our revenues is generated from these contracts, CDI’s results of operations and cash flows can fluctuate from quarter to quarter depending on the timing of contract awards and contract renewals.

Many of the industries CDI serves (such as the oil & gas industry) historically have been, and will likely continue to be, cyclical in nature and vulnerable to general downturns in the domestic and international economies, such as what was experienced in recent years. Consequently, CDI’s results of operations have fluctuated and may continue to fluctuate depending on the demand for services from these cyclical industries. For example, fluctuations in commodity prices (such as chemicals or oil & gas) can have a significant impact on our engineering outsourcing and staffing businesses, since those prices have a direct effect on our clients’ decisions to invest in capital projects. Rising commodity prices can negatively impact the financial returns on those projects, which may result in projects being delayed or cancelled, which in turn could have a material adverse impact on our operating results.

Furthermore, substantially all of CDI’s contracts are subject to cancellation or termination at the discretion of the client, typically on short notice. Many of our contracts, particularly in the staffing business, contain no minimum purchase obligations on the part of the client. Project contracts are generally subject to changes in the scope of services to be provided. Accordingly, we do not have a guaranteed backlog of business.

If we are not able to successfully execute on our new growth strategy, our business and results of operations would be adversely affected.

On December 8, 2011, CDI announced a new strategic plan designed to enhance the company’s long-term growth. The strategic plan, which was described earlier in this Form 10-K Report, also included a restructuring of CDI’s operations and a reduction in staff. Implementation of this plan presents various managerial, administrative, operational and other challenges. Implementing our new strategic growth plan will require, among other things, expending capital, developing and adopting new technologies, recruiting, developing, motivating and retaining talented employees, and changing our corporate culture. If we are unable to successfully execute any or all of the initiatives contained in our plan, our revenues, operating results and profitability may be adversely affected. Even if we successfully implement our new strategic plan, we cannot guarantee that our revenues, operating results and profitability will improve.

The loss of one or more major clients could have a material adverse effect on our financial results.

The loss of one or more major clients or projects, or a significant decrease in the volume of business that we receive from such major clients or projects could have a material adverse effect on CDI’s financial condition and results of operations. Revenue from one client, IBM, accounted for 21% of total CDI consolidated revenue in 2011. Our current contract with IBM was extended at the end of 2011, with a new three-year term, but which is subject to termination by IBM with or without cause at any time.

CDI derives a substantial portion of its revenue and profits from government agencies. If adequate government funding is delayed or is not available, then our revenue and profits could decline.

CDI is a party to many prime contracts and subcontracts involving U.S. federal, state and local governments and their agencies and authorities, as well as foreign governments and their agencies. Such contracts are subject to various uncertainties, restrictions and regulations. All levels of government are facing budget pressures, and government contracts are exposed to risks associated with appropriations. Contracts with the U.S. federal government, for example, are subject to the uncertainties of Congressional funding. Legislatures may appropriate funds for a given project on a year-by-year basis, even

6

though the project may take more than one year to perform. In addition, public-supported financing, such as state and local municipal bonds, may be only partially raised to support existing infrastructure projects. As a result, a project we are currently working on may only be partially funded and thus additional public funding may be required in order to complete our contract. Governments are typically under no obligation to maintain funding at any specific level, and funds for government programs may even be eliminated. As a result, CDI’s government clients may terminate our contracts for convenience or decide not to renew the contracts with little or no prior notice. Government contracts may also contain terms (such as broad indemnification obligations) that expose CDI to higher levels of risk and potential liability than non-government contracts.

We are subject to many different laws and regulations. The failure to comply with those laws and regulations could result in significant fines and penalties being imposed on CDI, harm to our reputation, loss of business and other adverse consequences. Changes in laws and regulations could also result in loss of business and increased costs.

Many U.S., state, local and foreign laws and regulations govern and impact the business, operations and employees of CDI. These laws and regulations are often complex. CDI’s policies mandate compliance with all applicable laws and regulations, and we maintain a compliance program and provide employees with training, guidelines and information about laws and regulations. CDI has controls and procedures in place that are designed to detect and prevent legal violations and errors and misconduct by employees. However, these policies, programs, controls and procedures cannot provide assurance that employees or agents of CDI will not violate any laws or regulations. Government regulatory agencies can investigate CDI’s compliance with laws and regulations and, if they believe there have been violations, can seek to impose significant fines and penalties (both civil and criminal) on us. Recent laws, such as the Dodd-Frank Act, increase the rewards for whistleblowing and could result in more claims of violations and in more government investigations. Compliance with laws and regulations, and responding to government investigations, even when no violations have occurred, can entail significant costs and expenses. If violations are alleged or found, CDI’s reputation could be materially damaged for a considerable period of time, which in turn could directly or indirectly result in a loss of business for CDI. Clients and potential clients could decide to discontinue doing business with us, to decrease the amount of business they do with us or to not award new business to us. In some cases, we could be suspended or debarred from government contract work. Our senior management may be required to devote a significant amount of time to repairing the relationship with any client that decides to discontinue or decrease its business with CDI, thereby decreasing the amount of time senior management is able to devote to other facets of our business; additionally, potential clients may not award business to CDI.

Government contracts are subject to specific procurement regulations, profit and cost controls, and a variety of other legal requirements. For example, for contracts with the U.S. federal government, we must comply with the Federal Acquisition Regulation, the Truth in Negotiations Act, the Cost Accounting Standards, the Service Contract Act and Department of Defense security regulations. We are also subject to government audits, investigations and proceedings and so-called “qui tam” actions brought by individuals or the government under the U.S. False Claims Act or under similar state and local laws. Government agencies routinely review and audit government contractors to determine whether allowable costs are in accordance with applicable regulations.

If we violate a law or regulation, fail to comply with a contractual or other requirement or do not satisfy an audit, a variety of penalties can be imposed including monetary damages and criminal and civil penalties. In addition, our government contracts could be terminated, CDI could be suspended or debarred from government contract work, or payment of our costs could be disallowed. Any of these actions could harm CDI’s reputation and could have a material adverse impact on our business, financial condition and results of operations.

CDI’s business is also subject to licensing in many states and in certain foreign countries. There can be no assurance we will continue to obtain all necessary government licenses or that the cost of compliance with the licensing rules will not prove to be material in the future. Any failure to comply with licensing requirements, or increase in the cost of compliance, could materially and adversely impact us.

New laws or regulations also could disrupt or reduce existing business done by CDI. Changes in laws or regulations could result in the imposition of new or additional employee benefits, licensing or tax requirements, thereby increasing our costs of doing business. There can be no assurance that we will be able to increase the fees charged to our clients in a timely manner or in a sufficient amount to cover increased costs as a result of any of the foregoing. CDI’s staffing services entail employing a large number of individuals on a temporary basis and placing such individuals in clients’ workplaces. Therefore, increased government regulation of the workplace or of the employer-employee relationship could materially and adversely impact CDI.

CDI’s existing credit facility includes restrictive and financial covenants. CDI’s ability to access additional credit also could be limited.

CDI has entered into a credit agreement with JPMorgan Chase Bank, N.A. under which we have access to a $50.0 million revolving line of credit facility (the “Credit Facility”) that terminates on November 30, 2012. CDI had no borrowings under the Credit Facility as of December 31, 2011. Our obligations under the Credit Facility are secured by substantially all of the assets of CDI Corp. and its major U.S. subsidiaries. The terms of the Credit Facility include, among other provisions,

7

specific limitations on creating liens on its assets, subsidiary indebtedness, acquisitions and investments, mergers and consolidations, dividends, stock repurchases, disposition of assets other than in the ordinary course of business, and changing its line of business. Additionally, the Credit Facility requires CDI to maintain certain financial covenants, including a maximum consolidated leverage ratio, a minimum consolidated fixed charge coverage ratio, and a minimum level of consolidated liquidity. The failure to comply with any of these debt covenants would cause a default under the Credit Facility. A default, if not waived or cured, could cause CDI’s debt under the Credit Facility to become immediately due and payable. In such a situation, we may not be able to repay the debt or borrow sufficient funds to refinance the debt, and even if new financing is available, it may not be on terms acceptable to us. Additionally, if we need to obtain a waiver under the Credit Facility or if we seek other financing, if available, our cost of borrowing could significantly increase and we could face more restrictive covenants. This could materially and adversely affect CDI’s results of operations and financial condition.

Although CDI is currently in compliance with the financial covenants of the Credit Facility, a deterioration of economic conditions could negatively impact our business, resulting in a failure to comply with these covenants in the future, which could in turn limit our ability to borrow funds under the Credit Facility. In such circumstances, we may not be able to secure alternative financing or may only be able to do so at significantly higher costs.

Although CDI generally finances much of its operations using cash provided by operations, at times we depend on the availability of credit to support our working capital needs, grow our business and to help fund business acquisitions. The state of the global credit markets could make it more difficult for us to access funds, refinance our existing indebtedness, enter into agreements for new indebtedness, or obtain funding through the issuance of our debt securities. There is no guarantee that CDI will be able to renew the Credit Facility on terms as favorable as those in the existing facility, and if we are unable to do so, CDI’s costs of borrowing and our business may be materially adversely affected.

We rely on information systems in our operations. Failure to protect these systems against security breaches could materially and adversely affect our business and results of operations. Additionally, if these systems fail or become unavailable for any significant period of time, our business could be harmed.

The efficient operation of CDI’s business is dependent on computer hardware and software systems. Information systems are inherently vulnerable to security breaches by computer hackers and cyber terrorists. Cybersecurity attacks are evolving and include malicious software, attempts to gain unauthorized access to data, and other electronic security breaches that could lead to disruptions in systems, unauthorized release of confidential or otherwise protected information and corruption of data. We rely on industry-accepted security measures and technology to securely maintain confidential and proprietary information maintained on our information systems. However, these measures and technology may not always be adequate to properly prevent security breaches. In addition, the unavailability of the information systems or the failure of these systems to perform as anticipated for any reason could disrupt our business and could result in decreased performance and increased overhead costs, causing our business and results of operations to suffer. Any significant interruption or failure of our information systems or any significant breach of security could materially and adversely affect our business and results of operations. We maintain insurance to cover certain of these cybersecurity risks, but that insurance is subject to limits and self-insured retentions.

The failure of clients to pay amounts owed to CDI could cause us to experience significant losses.

We typically bill our clients for our services in arrears and so are subject to the risk that our clients will delay or fail to pay our invoices. Accounts receivable represent the largest asset on CDI’s balance sheet. While we take steps to evaluate and manage the credit risks relating to our clients, economic downturns such as the one experienced in recent years can adversely affect various industries and, within those industries, particular clients’ ability to pay, which could reduce our ability to collect all amounts due from clients. There may also be delays in payments from clients, which would increase the working capital which CDI needs to maintain and could impact our liquidity. In addition, in the staffing business, there are sometimes intermediaries between us and the client, and therefore financial problems involving the intermediary company could pose credit risks to CDI.

CDI is engaged in highly competitive businesses. Pricing pressures and increasing consolidation of purchasing by our clients could reduce our market share and profits.

The engineering and IT project outsourcing business and the professional staffing business are highly competitive and fragmented, and particularly in the case of staffing services, have limited barriers to entry. CDI competes in global, national, regional and local markets with numerous engineering and IT outsourcing companies and with temporary staffing and permanent placement firms, some of which have greater financial and other resources than we have. Price competition among companies in our industry and pricing pressures from clients are significant. The number of clients that consolidate their purchases of engineering and IT outsourcing and staffing services with a single provider or with a small number of providers has continued to rise. This long-term trend to consolidate purchases may make it more difficult for CDI to obtain or retain clients in the future.

8

We could also face the risk that certain clients may decide to provide internally services similar to those we offer. Additionally, pricing pressures have intensified as clients have continued to competitively bid new contracts and seek price reductions on existing contracts. This trend is expected to continue for the foreseeable future, which could limit our ability to maintain or increase our market share or profitability.

CDI’s continued success is dependent on our ability to hire and retain qualified employees, both management and billable personnel. The loss of key personnel could have a material adverse effect on our business. In addition, our business may be harmed if CDI or its employees are unable to obtain the security clearances or other qualifications needed to perform services for our clients.

CDI depends upon its ability to attract qualified personnel who possess the skills and experience required by its clients and to successfully bid for new client projects. CDI must continually evaluate its base of available qualified personnel to keep pace with changing client needs and emerging technologies. Competition for individuals with proven professional or technical skills always exists, and the demand for such individuals (particularly in certain engineering disciplines and geographic areas) is expected to remain strong in the foreseeable future. There can be no assurance that qualified personnel will continue to be available to CDI in sufficient numbers and on terms of employment acceptable to CDI.

Our operations also depend on the continued efforts of our executives and senior management. The loss of key members of CDI’s management team may cause a significant disruption to our business. CDI also depends on the performance and productivity of its local managers and sales and recruiting personnel. The loss of key managers and field personnel may also jeopardize existing client relationships, which could cause revenues to decline.

A number of government programs require contractors to have security clearances. Depending on the level of required clearance, security clearances can be difficult and time-consuming to obtain. If CDI or its employees are unable to obtain or retain necessary security clearances, we may not be able to win certain new business, and our existing clients could terminate their contracts with us or decide not to renew them. To the extent we cannot obtain or maintain the required security clearances for our employees working on a particular contract, we may not derive the anticipated revenue or profit from such contract.

CDI faces competition from lower-cost, offshore outsourcing companies, which may result in a loss of market share and reduced profitability.

There is increasing pressure from clients on their suppliers to outsource certain areas of their businesses to lower-cost offshore locations. Many engineering and IT outsourcing and staffing companies already have or are seeking offshore solutions to support their technology and business process functions, and as a result, a significant amount of domestic technology and engineering project work may utilize offshore capabilities as alternatives to domestic resources. CDI has established lower-cost outsourcing centers and has partnered with offshore companies to provide additional lower cost options to its clients. In connection with our new growth strategy, we expect to expand our service delivery capabilities outside the U.S. Conducting business through offshore arrangements entails additional compliance and regulatory issues and may result in additional costs to CDI. CDI’s partnering arrangements are subject to our ability to maintain good working relationships with our foreign partners and on our partners’ ability to fulfill their obligations under our agreements with them. Changes in the supply and demand for offshore personnel with the training to perform the engineering and IT services sought by CDI’s clients, as well as other factors affecting offshore labor costs, could raise CDI’s costs, which would put pressure on its margins. Also, other offshore solution providers could develop direct relationships with CDI’s clients resulting in a significant loss of CDI’s market share and revenue.

Foreign currency fluctuations, weak foreign economies and unfavorable political developments in connection with CDI’s international operations could harm our financial condition.

CDI’s international operations are important to our business, and we expect that they will account for an increasing portion of our total revenues as we implement our new growth strategy. CDI’s reported financial condition and results of operations are exposed to the effects (both positive and negative) of fluctuating exchange rates. CDI’s exposure to foreign currency fluctuations currently relates primarily to operations denominated in British pounds sterling and Canadian dollars. Exchange rate fluctuations impact the U.S. dollar value of reported earnings derived from these foreign operations as well as our investment in the net assets related to these operations. CDI has at times in the past engaged, and may in the future engage, in hedging activities with respect to certain of its foreign operations.

Our international operations are subject to a variety of other risks, including, but not limited to, the following:

| | Ÿ | | Recessions in foreign economies and the impact on costs of doing business in those countries; |

| | Ÿ | | Difficulties in staffing and managing foreign operations; |

| | Ÿ | | Changes in foreign government policies and regulatory requirements; |

| | Ÿ | | The adoption of new, and the expansion of existing, trade restrictions and the failure to comply with U.S. export control laws; |

| | Ÿ | | The lack of well-developed legal systems and less established or traditional business practices in some countries, which could make it difficult for CDI to enforce its contractual rights; |

9

| | Ÿ | | Social, political and economic instability, including risks of loss due to civil strife, acts of war, insurrection and terrorism; |

| | Ÿ | | Limitations on the movement of cash; and |

| | Ÿ | | Logistical and communications challenges. |

If our growth strategy is successful, we will earn an increasing portion of our income, and accumulate a greater portion of our cash flow, in foreign jurisdictions. Any repatriation of funds currently held in foreign jurisdictions may result in higher effective tax rates and incremental cash tax payments. In addition, changes in legislation with respect to the tax treatment of foreign earnings may have a material impact on our U.S. tax expense and cash flows.

CDI operates in many different jurisdictions and could be materially and adversely affected by violations of the U.S. Foreign Corrupt Practices Act, the UK Bribery Act and similar worldwide anti-corruption laws.

The U.S. Foreign Corrupt Practices Act, the UK Bribery Act and similar worldwide anti-corruption laws generally prohibit companies and their intermediaries from making improper payments to government officials and others for the purpose of obtaining or retaining business. CDI’s internal policies mandate compliance with these anti-corruption laws. We operate in parts of the world that have experienced governmental corruption to some degree, and in certain circumstances, strict compliance with anti-corruption laws may conflict with local customs and practices. Despite our training and compliance programs, there can be no assurance that our internal control policies and procedures will protect us from reckless or criminal acts committed by those of our employees or agents who violate our policies. Our continued expansion outside the U.S. (including in developing countries) in connection with our growth strategy could increase the risk of such violations in the future. Violations of these laws, or allegations of such violations, could disrupt our business and result in a material adverse effect on our results of operations or financial condition.

CDI’s project outsourcing services expose the company to potential professional liability, product liability, warranty and other claims. Our project outsourcing business may encounter difficulties that result in additional costs, reductions in revenues, claims, disputes and the payment of damages.

In connection with certain of our project outsourcing services, the Company engineers and performs services in various types of facilities, including major industrial facilities, where accidents or system failures can be disastrous. CDI also provides engineering and related services in connection with major products such as aircraft engines and naval ships. Any catastrophic occurrences in excess of insurance limits relating to locations or products which are engineered by CDI or locations where our services are performed could result in significant professional liability, product liability, warranty and other claims against us. Furthermore, the project outsourcing services CDI provides expose us to additional risks including equipment failures, personal injuries, property damage and unforeseen engineering, architectural and environmental problems, each of which could significantly impact our performance and materially impact our financial statements.

CDI’s project outsourcing services often involve complex design and engineering, significant procurement of equipment and supplies, and broad construction management. We may encounter difficulties in the design or engineering, equipment and supply delivery, schedule changes and other factors, some of which are beyond our control, that impact our ability to complete the project in accordance with the original delivery schedule. In addition, we often rely on third-party equipment manufacturers as well as other third-party subcontractors to assist with the completion of our contracts. Any delay by these equipment manufacturers or subcontractors to complete their respective portions of a project, or any failure by subcontractors to satisfactorily complete their respective portions of a project, as well as other factors beyond our control, may result in delays in the overall progress of such project, cause us to incur additional costs or both. These delays and additional costs may be substantial, and we may be required to compensate the client for these delays. While we may recover these additional costs from the responsible vendor, subcontractor or other third party, we may not be able to recover all of these costs in all circumstances.

In addition, some contracts may require our clients to provide us with design or engineering information or with equipment or materials to be used on the project. In some cases, the client may provide us with deficient design or engineering information or equipment, or may provide the information or equipment to us later than required by the project schedule. The client may also determine, after commencement of the project, to change various elements of the project. We are subject to the risk that we might be unable to obtain, through negotiation, arbitration, litigation or otherwise, adequate amounts to compensate us for the additional work or expenses incurred due to client requested change orders or failure by the client to timely provide required items. A failure to obtain adequate compensation for these matters could require CDI to record an adjustment to amounts of revenues and gross profit that were recognized in prior periods. Any such adjustments could have a material adverse effect on our results of operations and financial condition.

The outcome of pending and future claims and litigation could have a material adverse effect on our business.

From time to time, various types of legal claims arise in connection with the ordinary course of our business. Employees of CDI may make a variety of claims including workplace injury claims and employment-related claims such as discrimination,

10

harassment, and wage and hour claims. Since CDI’s staffing business involves employing a large number of individuals on a temporary basis and placing them in client workplaces where we have limited ability to control the workplace environment, these types of claims may arise more frequently in those business operations. CDI’s clients may make claims based on our alleged failure to perform in accordance with contract requirements. Since our project business often involves responsibility to produce specified deliverables, these types of claims may arise more frequently in those business operations. Clients in the staffing business may allege claims based on the conduct of staffing employees assigned to the client’s worksite. Clients and subcontractors may make claims alleging CDI’s failure to abide by certain contract provisions. In addition, CDI is subject to possible government claims or fines for violations of various laws. See Note 10—Commitment and Contingencies, in the notes to the consolidated financial statements included in Part II, Item 8 of this Form 10-K Report, for more information regarding legal proceedings and claims.

CDI has significant payroll-related costs, such as workers’ compensation, unemployment taxes and health benefits, which are subject to increases caused by government regulation and other factors, and such increases could reduce our profits.

In conducting its business, CDI pays a number of payroll-related costs and expenses, including unemployment taxes, workers’ compensation and medical coverage for its personnel. Unemployment insurance premiums paid by employers typically increase during periods of increased levels of unemployment and have increased substantially in the past couple years. Workers’ compensation costs may increase in the future if states raise benefit levels and liberalize allowable claims. CDI maintains insurance relating to its exposure for losses associated with workers’ compensation and medical coverage for its personnel, but this insurance coverage is subject to deductibles. We have established reserves for workers’ compensation and medical coverage claims based on historical loss statistics and periodic independent actuarial valuations. While we believe that our assumptions and estimates are appropriate, significant differences in actual experience or significant changes in assumptions may materially and adversely affect our future financial results. Our future earnings could also be materially and adversely affected if we are not able to increase the fees charged to clients to absorb the increased costs related to unemployment insurance, workers’ compensation and medical benefits. In addition, our future earnings could also be materially and adversely affected by future cost increases.

Disasters could interfere with CDI’s ability to operate its business. Certain of our clients operate in areas that may be impacted by severe weather conditions.

Various types of natural or man-made disasters could interfere with CDI’s continued ability to operate its business normally. For example, our ability to protect our data centers and information systems against damage from fire, power loss, telecommunications failure and other disasters is critical. In order to provide many of our services, we must be able to store, retrieve, process and manage large databases and periodically expand and upgrade our capabilities. Any damage to our data centers or any failure of our telecommunication links that interrupts our operations or results in an inadvertent loss of data could materially and adversely affect our ability to meet our clients’ needs and their confidence in utilizing CDI for future services. While we have developed various backup plans and disaster recovery plans, there can be no assurance that we would be able to continue to operate our business smoothly in the face of certain natural or man-made disasters. Such business interruptions could materially and adversely affect our financial results and future prospects.

CDI services the oil & gas and chemical industries, each of which has a significant concentration of activities in the Gulf Coast of the U.S. CDI also has two major engineering centers in this area. The U.S. Gulf Coast has been impacted by several hurricanes in the past, and could be further impacted by severe weather in the future. Some scientists believe that increased hurricane activity is associated with climate change. Hurricanes in the U.S. Gulf Coast could negatively impact CDI’s clients and our ability to serve them.

Regulation regarding climate change may negatively impact our clients and our projects.

Increasing concerns about climate change may result in additional regulation affecting our clients and our projects, particularly those who are involved in the exploration, production or refining of fossil fuels. Those new regulations could increase the cost of projects for our clients and, in some cases, prevent a project from moving forward, thereby potentially reducing the need for our services, which could in turn have a material adverse impact on our results of operation.

Past and future acquisitions may not be successful.

CDI has pursued and continues to pursue acquisitions as an element of its growth strategy, but we cannot provide assurances that we will be able to locate suitable acquisitions or that we will be able to consummate any such transactions on terms and conditions acceptable to us, or that such transactions will be successful. Adverse changes in the credit markets may make it more difficult and costly to finance acquisitions. Acquisitions involve a number of risks, including the diversion of management’s attention from its existing operations, the failure to retain key personnel or clients of an acquired business, the failure to realize anticipated benefits, such as cost savings and revenue enhancements, the potentially substantial transaction costs associated with acquisitions, the assumption of unknown liabilities of the acquired business, and the inability to successfully integrate the business within CDI. Potential impairment could result if we overpay for an acquisition. There can be no

11

assurance that any past or future acquired businesses will generate anticipated revenues or earnings.

We perform certain projects through joint ventures. Participation in joint ventures exposes CDI to additional risks and uncertainties.

As is common in the project engineering industry, CDI executes certain projects jointly with other contractors through joint ventures or other teaming arrangements. These arrangements expose CDI to a number of risks, including the risk that our partners may not be able to fulfill their performance obligations under the joint venture agreements and related client contracts. There is also a risk that our joint venture partners may be incapable of providing the required financial support to the joint ventures. Another risk is that improper, illegal or unethical actions by our joint venture partners would have a negative impact on the reputation of the joint venture and CDI. Disputes can arise not only between CDI and its joint venture partners, but also between the joint ventures and the clients.

Improper disclosure of employee and client data could result in liabilities and harm CDI’s reputation.

CDI’s business involves the use, storage and transmission of information about its employees, candidates, clients and franchisees. The protection of such information, as well as CDI data, is critical to us. The regulatory environment surrounding information security and privacy is increasingly demanding, with the frequent imposition of new and constantly changing requirements. We have established policies and procedures to help protect the security and privacy of this information. We also, from time to time, export sensitive client data and technical information to recipients outside the U.S. CDI has a policy in place that requires an analysis prior to the export of any products, software, data, technology or other information from our systems to determine if any restrictions apply to the export. It is possible that CDI’s security controls over personal and client data and other practices that we follow may not prevent the improper access to or disclosure of personally identifiable and client information. Such disclosure could harm CDI’s reputation, cause us to lose clients or candidates, and subject us to liability under our contracts and laws that protect personal and client data, resulting in increased costs or loss of revenue.

CDI relies on outside suppliers to perform certain administrative services, and we may suffer damage to our business if those suppliers fail to adequately perform those services.

CDI outsources certain payroll, employee benefits administration and other back-office functions to companies that specialize in performing those services. The failure of such outside service providers to adequately perform such services could have a material adverse effect on our business and operations. Such third parties may have risks relating to cybersecurity and possible breaches of data privacy laws which are similar to those risks described above for CDI. We seek to reduce those risks by requiring audits of the relevant third parties’ information technology processes or by performing other due diligence inquiries regarding such processes, but there can be no assurance that such parties will not experience cybersecurity or data privacy breaches which could adversely affect our employees, clients and business.

We bear the risk of cost overruns in fixed-price contracts.

CDI sometimes enters into fixed-price contracts with clients, primarily for engineering project services. Revenue recognized under fixed-price contracts accounts for less than 5% of 2011 consolidated revenue. Under these fixed-price contracts, prices are established based on cost and scheduling estimates, which in turn are based in part on assumptions about the prices and availability of skilled personnel, equipment and materials. If our price estimates for a particular project prove to be inaccurate, if there are errors or ambiguities as to contract specifications, or if there are unanticipated technical problems, then cost overruns may occur, and we could experience reduced profits or a loss for that project. Cost overruns may also be caused by changes in the scope of the project after the contract has been entered into or by a failure of the parties to adequately define and agree upon the entire scope of the project at inception. In those cases, there may be disputes between the parties over who should pay for the cost overruns. We will attempt to negotiate change orders to recover the additional costs, but there can be no assurance that we will be successful in our negotiations with our clients. In general, fixed-price contracts can offer greater profit potential but also entail more inherent risk—both in terms of possible financial losses and the potential for significant disputes with clients—than contracts containing pricing on a time-and-materials basis.

A charge for impairment of goodwill or other intangible assets could have a material adverse effect on our reported results of operations.

We are required to test the goodwill and other indefinite-lived intangible assets carried on our consolidated balance sheets for possible impairment on an annual basis based upon a fair value approach. As of December 31, 2011, CDI had $80.0 million of goodwill and other intangible assets, representing 20% of our total assets of $390.7 million.

12

CDI has chosen to perform its annual goodwill and other indefinite-lived intangible assets impairment testing by reporting unit as of July 1 of each fiscal year. We are also required to test for impairment between annual tests if events occur or circumstances change that would indicate that it is more likely than not that the fair value of a reporting unit was below its carrying value. Examples of events or circumstances include, but are not limited to: adverse changes in legal factors, business climate or regulatory environment; unanticipated competition; loss of key personnel; and a more-likely-than-not expectation that a reporting unit or a significant portion of a reporting unit will be sold or otherwise disposed of. Other factors that could impact an impairment include, but are not limited to, significant underperformance relative to projected future operating results, significant changes in the manner of use of acquired assets or the strategy for our overall business, significant negative industry or economic trends, a significant decline in our stock price for a sustained period and decreases in our market capitalization below the recorded amount of our net assets for a sustained period. If the fair value of CDI’s reporting units were to be less than their book value, we could be required to record a non-cash impairment charge. The amount of any impairment could be significant and could have a material adverse effect on our financial results for the period in which the charge is taken.

Estimates of our income tax liabilities are subject to various uncertainties and actual results could vary significantly from these estimates.

When we prepare our financial statements, we estimate our income tax liabilities with respect to the various jurisdictions in which we do business. Significant judgment is required in determining the provision for income tax liabilities in our financial statements and in forecasting our effective income tax rate in a given period. The provision for income taxes and tax liability in the future could be materially and adversely affected by numerous factors, including changes in tax laws, regulations or accounting principles, changes in the valuation of deferred tax assets and liabilities and audits by taxing authorities.

If CDI fails to maintain an effective system of internal controls over financial reporting, it may not be able to accurately report its financial results or prevent fraud. As a result, investors could lose confidence in our financial reporting, which could harm our business and the trading price of our stock.

Effective internal controls are necessary for CDI to provide reliable financial reports and prevent fraud. If we cannot provide reliable financial reports or prevent fraud, our operating results could be harmed. We devote significant attention to establishing and maintaining effective internal controls. Any failure to implement required new or improved controls or difficulties encountered in their implementation could affect our operating results or cause us to fail to meet reporting obligations in future periods. Ineffective internal controls could also cause investors to lose confidence in our reported financial information, which could have a negative effect on the market price of CDI stock.

CDI may not be able to obtain the insurance coverages necessary to manage its risks.

CDI relies on insurance to help manage its risks and to limit our exposure to significant claims. The future availability and cost of such insurance is subject to market forces and our claims experience. There can be no assurance that CDI can always obtain and maintain appropriate insurance coverage, including errors and omissions insurance, in order to effectively manage the risks of its business.

In addition, CDI has elected to retain a portion of losses that may occur through the use of various deductibles, limits and retentions under these programs. As a result, we may be subject to future liability for which CDI is only partially insured, or completely uninsured. Our insurers are subject to business risk. One or more of our insurers may be unable to fulfill their insurance obligations due to insolvency or otherwise. To the extent we are not insured against a loss or any of our insurers fails to provide coverage, CDI’s financial condition and results of operations could be materially and adversely affected.

A significant portion of CDI’s common stock is owned by related parties, and they could vote their shares in a way that is adverse to the interests of other shareholders.

Certain of CDI’s directors and trusts, for which some of our directors serve as trustee, own a substantial portion of CDI’s outstanding common stock. By virtue of this stock ownership, such shareholders have the power to significantly influence our affairs and are able to influence the outcome of matters required to be submitted to shareholders for approval, including the election of directors and the amendment of our Articles of Incorporation or Bylaws. Such shareholders could exercise influence over CDI in a manner adverse to the interests of our other shareholders.

| | |

| Item 1B. | | Unresolved Staff Comments |

None.

13

The Company maintains major facilities in the following locations, all of which are leased:

| | | | |

| Segment | | Address | | Description |

Corporate/MRI | | Philadelphia, Pennsylvania | | Executive offices/MRI offices |

Corporate/ES | | Philadelphia, Pennsylvania | | Corporate offices/Engineering center |

ES | | Ebensburg, Pennsylvania | | Engineering center |

ES | | Baton Rouge, Louisiana | | Engineering center |

ES | | Cincinnati, Ohio | | Engineering center |

ES | | Houston, Texas | | Engineering center |

Corporate/ITS | | Cross Lanes, West Virginia | | Shared services center/ITS service

desk operations |

Additionally, each reporting segment has numerous other active facilities and locations under operating lease agreements. Most of the leased space is devoted to sales, marketing, engineering design, and administrative and back-office functions. Most of these facilities are leased for terms ranging from three to ten years. The Company believes that its facilities are adequate to meet its current and near-term needs.

A few of the Company’s offices accommodate more than one operating segment. In such cases, square-foot usage is allocated among the segments, primarily based on utilization.

| | |

| Item 3. | | Legal Proceedings |

The Company is subject to various legal proceedings and claims that have arisen in the ordinary course of business. Although management cannot predict the timing or outcome of these matters with certainty, management does not believe that the final resolution of these matters, individually or in the aggregate, would have a material adverse effect on the Company’s consolidated financial condition, results of operations or cash flows.

| | |

| Item 4. | | Mine Safety Disclosures |

Not Applicable.

14

| | |

| Item 5. | | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities |

Market Information

Shares of CDI’s common stock are traded on the New York Stock Exchange under the trading symbol “CDI”. The high and low sales price per share of the Company’s common stock for each quarter during the last two years are shown in the table below, together with dividend information for each period.

| | | | | | | | | | | | |

| | | High | | | Low | | | Dividends | |

2011 | | | | | | | | | | | | |

First quarter | | $ | 20.34 | | | $ | 13.71 | | | $ | 0.13 | |

Second quarter | | | 15.40 | | | | 12.70 | | | | 0.13 | |

Third quarter | | | 13.71 | | | | 9.84 | | | | 0.13 | |

Fourth quarter | | | 14.24 | | | | 10.05 | | | | 0.13 | |

| | | |

2010 | | | | | | | | | | | | |

First quarter | | $ | 16.07 | | | $ | 12.25 | | | $ | 0.13 | |

Second quarter | | | 18.65 | | | | 14.04 | | | | 0.13 | |

Third quarter | | | 18.26 | | | | 10.86 | | | | 0.13 | |

Fourth quarter | | | 19.90 | | | | 12.09 | | | | 0.13 | |

Dividends

Dividends have been paid quarterly during the past two years. The declaration and payment of future dividends will be at the discretion of the Company’s Board of Directors and will depend upon many factors, including the Company’s earnings, financial condition and capital requirements. The Company maintains a Credit Agreement with JPMorgan Chase Bank, N.A. that requires a minimum liquidity balance (unrestricted cash and cash equivalents plus the unused amount available for borrowing under the credit facility) of greater than $25.0 million to be maintained by CDI Corp. before the Company can pay a dividend.

Shareholders

As of February 24, 2012, there were 367 shareholders of record of the Company’s common stock. A single record shareholder account may however represent multiple beneficial owners, including holders of shares in street name accounts. Including those multiple beneficial owners, the Company estimates that the total number of shareholders of the Company’s common stock on February 24, 2012 was approximately 4,200. See Part III, Item 12 and Note 7—Stock-Based Compensation, in the notes to the consolidated financial statements included in Item 8 of this Form 10-K Report, for information relating to securities authorized for issuance under the Company’s equity compensation plans.

Comparative Stock Performance

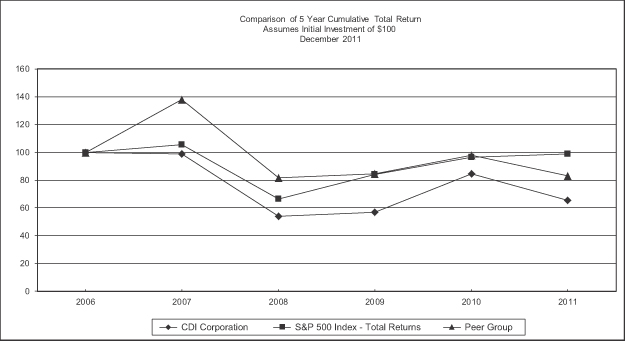

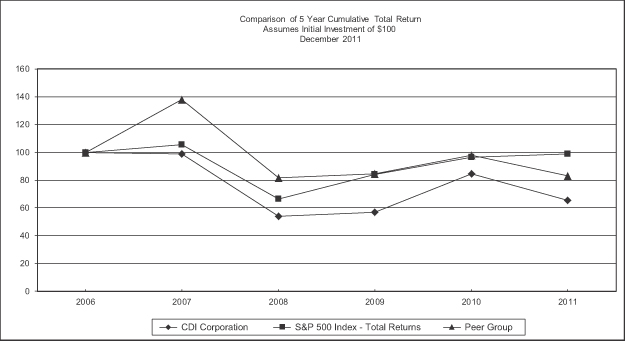

The following graph sets forth the cumulative total shareholder return (assuming an investment of $100 on December 31, 2006 and the reinvestment of any dividends) for the last five fiscal years on: CDI stock, the Standard & Poor’s (“S&P”) 500 Index, and peer group.

CDI’s peer group (“Peer Group”) consists of the following companies: AECOM Technology Corp., CIBER, Inc., Computer Task Group Inc., Heidrick & Struggles International Inc., Jacobs Engineering Group, Inc., Korn/Ferry International, Robert Half International Inc., Shaw Group Inc. and Volt Information Sciences Inc.

15

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Years ended December 31, | |

| | | 2006 | | | 2007 | | | 2008 | | | 2009 | | | 2010 | | | 2011 | |

CDI Corp. | | $ | 100.00 | | | $ | 98.97 | | | $ | 54.26 | | | $ | 56.75 | | | $ | 84.48 | | | $ | 65.27 | |

S&P 500 Index—Total Return | | | 100.00 | | | | 105.50 | | | | 66.47 | | | | 84.05 | | | | 96.71 | | | | 98.75 | |

Peer Group | | | 100.00 | | | | 138.09 | | | | 81.48 | | | | 84.47 | | | | 98.08 | | | | 83.26 | |

Recent Sales of Unregistered Securities and Use of Proceeds from Registered Securities

None.