Second Quarter 2022 Financial Results Call August 29, 2022 C O N F I D E N T I A L & P R I V A T E

2 Safe Harbor Statement This presentation and the accompanying oral presentation includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, Section 21E of the Securities Exchange Act of 1934, as amended, and the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995, that relate to our current expectations and views of future events. All statements other than statements of historical facts contained in this presentation, including statements regarding when jurisdictions in North America or elsewhere may launch online iGaming or sports betting and/or when affiliate marketing will be permitted in those states, how many M&A transactions we can execute in any given year, if any, our 2022 outlook, and future results of operations and financial position, whether we can sustain our organic growth and make accretive acquisitions, industry dynamics, business strategy and plans and our objectives for future operations, are forward-looking statements. These statements represent our opinions, expectations, beliefs, intentions, estimates or strategies regarding the future, which may not be realized. In some cases, you can identify forward-looking statements by terms such as “believe,” “may,” “estimate,” “continue,” “anticipate,” “intend,” “should,” “plan,” “expect,” “predict,” “potential,” “could,” “will,” “would,” “ongoing,” “future” or the negative of these terms or other similar expressions that are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. Forward-looking statements are based largely on our current expectations and projections about future events and financial trends that we believe may affect our financial condition, results of operations, business strategy, short-term and long-term business operations and objectives and financial needs. These forward-looking statements involve known and unknown risks, uncertainties, contingencies, changes in circumstances that are difficult to predict and other important factors that may cause our actual results, performance or achievements to be materially and/or significantly different from any future results, performance or achievements expressed or implied by the forward-looking statement. Such risks uncertainties, contingencies, and changes in circumstances are discussed under “Item 3. Key Information - Risk Factors” in our annual report filed on Form 20-F for the year ended December 31, 2021 with the US Securities and Exchange Commission (the “SEC”) on March 25, 2022, and our other filings with the SEC as such factors may be updated from time to time. Moreover, we operate in a very competitive and rapidly changing environment. New risks emerge from time to time. It is not possible for our management to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements we may make. In light of these risks, uncertainties and assumptions, the forward-looking events and circumstances discussed in this presentation may not occur and actual results could differ materially and adversely from those anticipated or implied in the forward- looking statements. We caution you therefore against relying on these forward-looking statements, and we qualify all of our forward-looking statements by these cautionary statements. The forward-looking statements included in this presentation are made only as of the date hereof. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee that the future results, levels of activity, performance or events and circumstances reflected in the forward-looking statements will be achieved or occur. Moreover, neither we nor our advisors nor any other person assumes responsibility for the accuracy and completeness of the forward-looking statements. Neither we nor our advisors undertake any obligation to revise, supplement or update any forward-looking statements for any reason after the date of this presentation to conform these statements to actual results or to changes in our expectations, even if new information becomes available in the future, except as may be required by law. You should read this presentation with the understanding that our actual future results, levels of activity, performance and events and circumstances may be materially different from what we expect. Unless otherwise indicated, information contained in this presentation concerning our industry, competitive position and the markets in which we operate is based on information from independent industry and research organizations, other third-party sources and management estimates. Management estimates are derived from publicly available information released by independent industry analysts and other third-party sources, as well as data from our internal research, and are based on assumptions made by us upon reviewing such data, and our experience in, and knowledge of, such industry and markets, which we believe to be reasonable. In addition, projections, assumptions and estimates of the future performance of the industry in which we operate and our future performance are necessarily subject to uncertainty and risk due to a variety of factors, including those described above. These and other factors could cause results to differ materially from those expressed in the estimates made by independent parties and by us. Industry publications, research, surveys and studies generally state that the information they contain has been obtained from sources believed to be reliable, but that the accuracy and completeness of such information is not guaranteed. Forecasts and other forward-looking information obtained from these sources are subject to the same qualifications and uncertainties as the other forward-looking statements in this presentation. The trademarks included herein are the property of the owners thereof and are used for reference purposes only. Non-IFRS Financial Measures - Management uses several financial measures, both IFRS and non-IFRS financial measures, in analyzing and assessing the overall performance of the business and for making operational decisions. Adjusted Operating Expense is a non-IFRS measure defined as operating expense excluding the fair value gain or loss related to contingent consideration. Adjusted Operating Profit is a non-IFRS financial measure defined as operating profit excluding the fair value gain or loss related to the contingent consideration. Adjusted Net Income is a non-IFRS financial measure defined as net income attributable to equity holders excluding the fair value gain or loss related to contingent consideration and unwinding of deferred consideration. Adjusted net income per diluted share is a non-IFRS financial measure defined as adjusted net income attributable to equity holders divided by the diluted weighted average number of common shares outstanding. Adjusted EBITDA is a non-IFRS financial measure defined as earnings excluding net finance costs, income tax charge, depreciation, and amortization, the effect of non-recurring items, significant non-cash items, share-based payment expense and other items that our board of directors believes do not reflect the underlying performance of the business. Adjusted EBITDA Margin is a non-IFRS measure defined as Adjusted EBITDA as a percentage of revenue. We believe Adjusted EBITDA and Adjusted EBITDA Margin are useful to our management as a measure of comparative operating performance from period to period as they remove the effect of items not directly resulting from our core operations including effects that are generated by differences in capital structure, depreciation, tax effects and non-recurring events. While we use Adjusted EBITDA and Adjusted EBITDA Margin as tools to enhance our understanding of certain aspects of our financial performance, we do not believe that Adjusted EBITDA and Adjusted EBITDA Margin are substitutes for, or superior to, the information provided by IFRS results. As such, the presentation of Adjusted EBITDA and Adjusted EBITDA Margin is not intended to be considered in isolation or as a substitute for any measure prepared in accordance with IFRS. The primary limitations associated with the use of Adjusted EBITDA and Adjusted EBITDA Margin as compared to IFRS results are that Adjusted EBITDA and Adjusted EBITDA Margin as we define them may not be comparable to similarly titled measures used by other companies in our industry and that Adjusted EBITDA and Adjusted EBITDA Margin may exclude financial information that some investors may consider important in evaluating our performance. In regard to forward looking non-IFRS guidance, we are not able to reconcile the forward looking non-IFRS Adjusted EBITDA measure to the closest corresponding IFRS measure without unreasonable efforts because we are unable to predict the ultimate outcome of certain significant items including, but not limited to, fair value movements, share-based payments for future awards, acquisition-related expenses and certain financing and tax items. Free Cash Flow is a non-IFRS financial measure defined as cash flow from operating activities less capital expenditures, or CAPEX. We believe Free Cash Flow is useful to our management as a measure of financial performance as it measures our ability to generate additional cash from our operations. While we use Free Cash Flow as a tool to enhance our understanding of certain aspects of our financial performance, we do not believe that Free Cash Flow is a substitute for, or superior to, the information provided by IFRS metrics. As such, the presentation of Free Cash Flow is not intended to be considered in isolation or as a substitute for any measure prepared in accordance with IFRS. The primary limitation associated with the use of Free Cash Flow as compared to IFRS metrics is that Free Cash Flow does not represent residual cash flows available for discretionary expenditures due to the fact that the measure does not deduct the payments required for debt service and other obligations or payments made for business acquisitions. Free Cash Flow as we define it also may not be comparable to similarly titled measures used by other companies in the online gambling affiliate industry. For such non-IFRS information in this presentation, see the tables at the end of this presentation under “Appendix: Financial Tables” for reconciliations to the comparable IFRS numbers.

Second Quarter Highlights 4 - 7 Q2 Financial Results 8 YTD Financial Results 9 2022 Outlook 10 Appendix 11 - 19 AGENDA 3C O N F I D E N T I A L & P R I V A T E

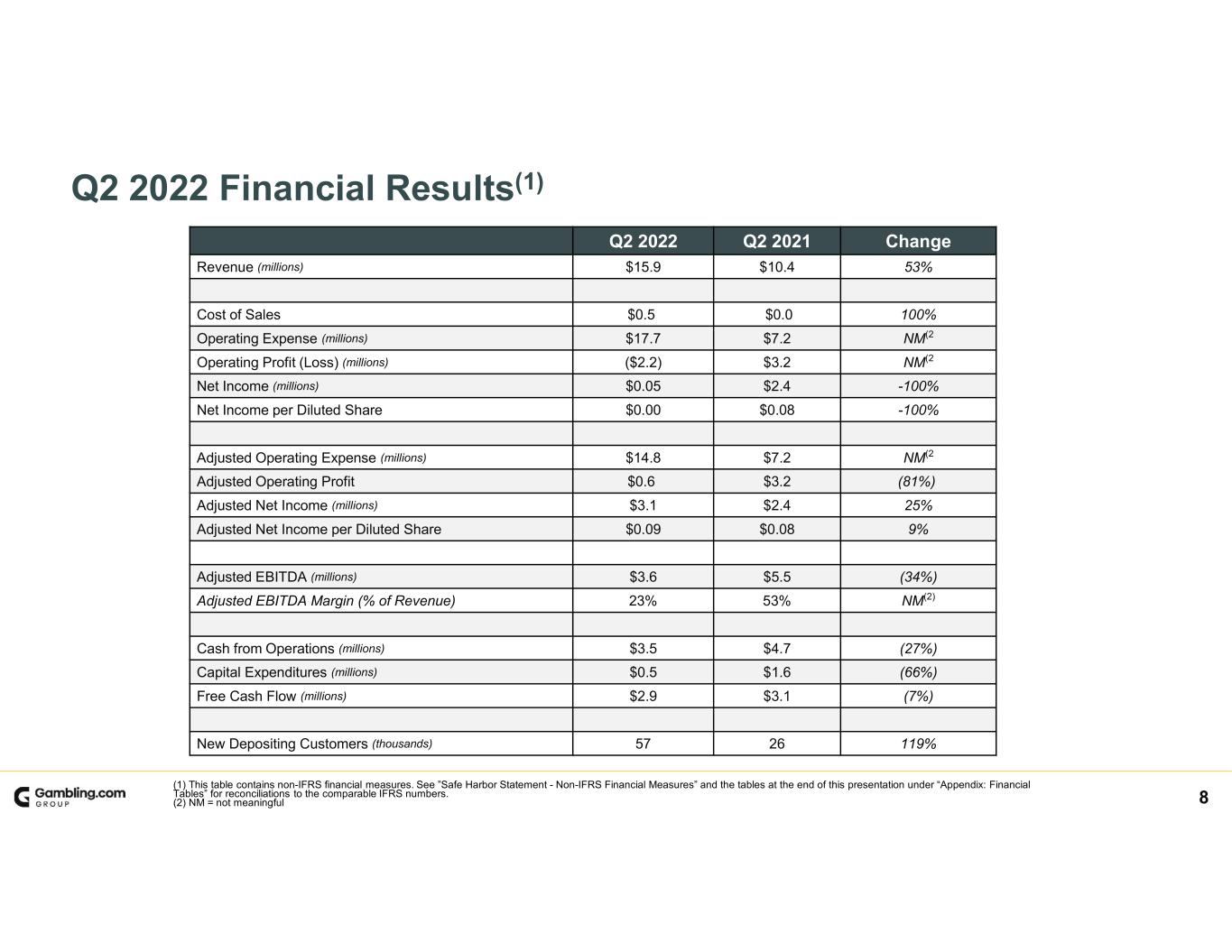

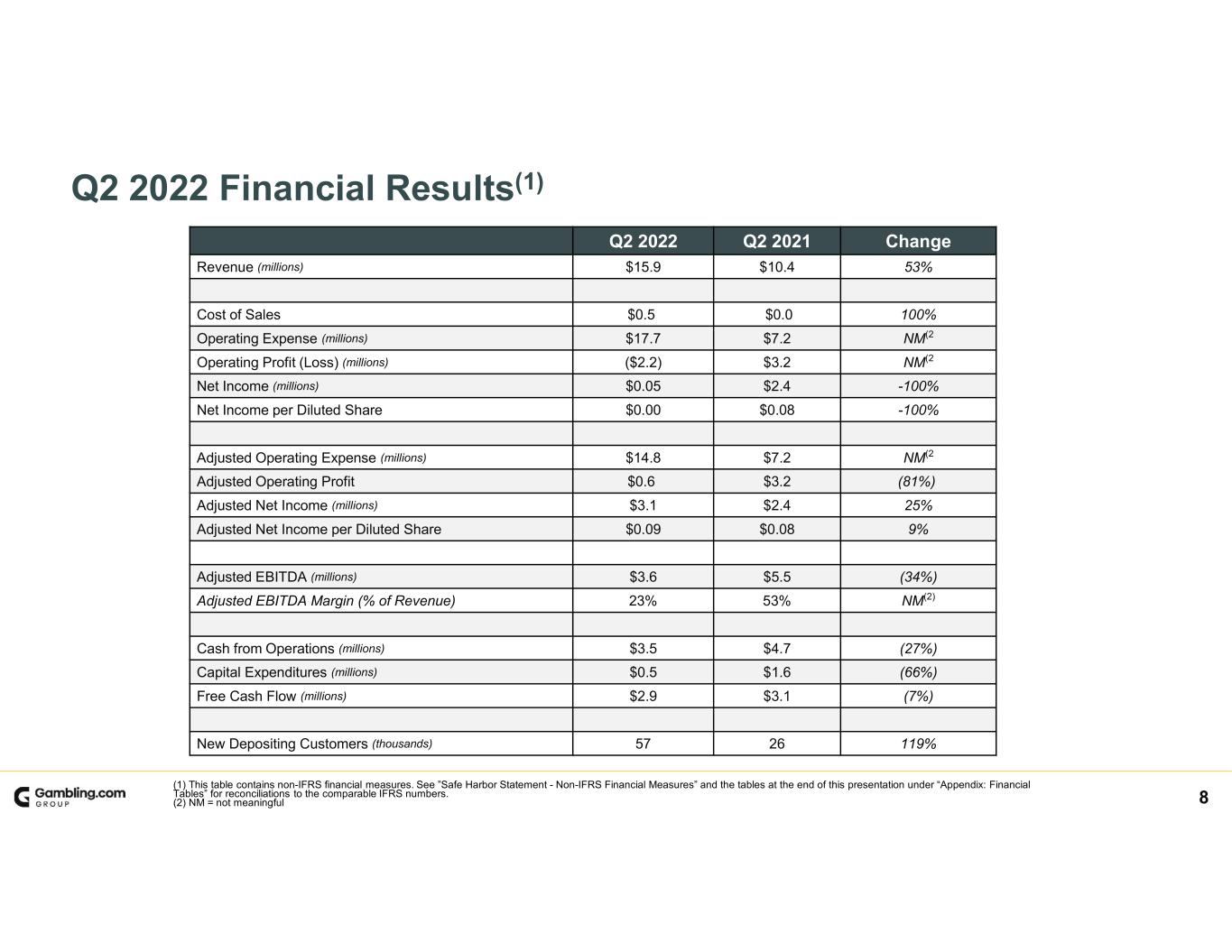

Second Quarter Highlights 4 • Total revenue grew 53% to $15.9 million • Adjusted EBITDA(1) of $3.6 million • Adjusted EBITDA Margin (1) of 23% • Free Cash Flow (1) of $2.9 million • Delivered more than 57,000 new depositing customers in the second quarter, compared to 26,000 in the second quarter 2021 (1) Represents a non-IFRS financial measure. See ”Safe Harbor Statement - Non-IFRS Financial Measures” and the tables at the end of this presentation under “Appendix: Financial Tables” for reconciliations to the comparable IFRS numbers. Named 2022 SBC Sports Affiliate of the Year

5 Second Quarter Highlights • North American revenue grew 342% to $6.2 million • Successful new market launch in Ontario • Continued solid performance in UK and Ireland markets • Work on RotoWire.com is progressing well ahead of the seasonally stronger fall sports season • Added Michael Quartieri, CFO of Dave & Buster’s, to the Board of Directors, effective as of June 30, 2022 • Added to the Russell 3000 Index on June 27, 2022 • Contribution from BonusFinder.com is ahead of plan

6 O T S U.S. State Specific International Brands Strategic U.S. Media Assets and Partnerships National U.S. Sites Diversified Portfolio of Premium Digital Media Assets

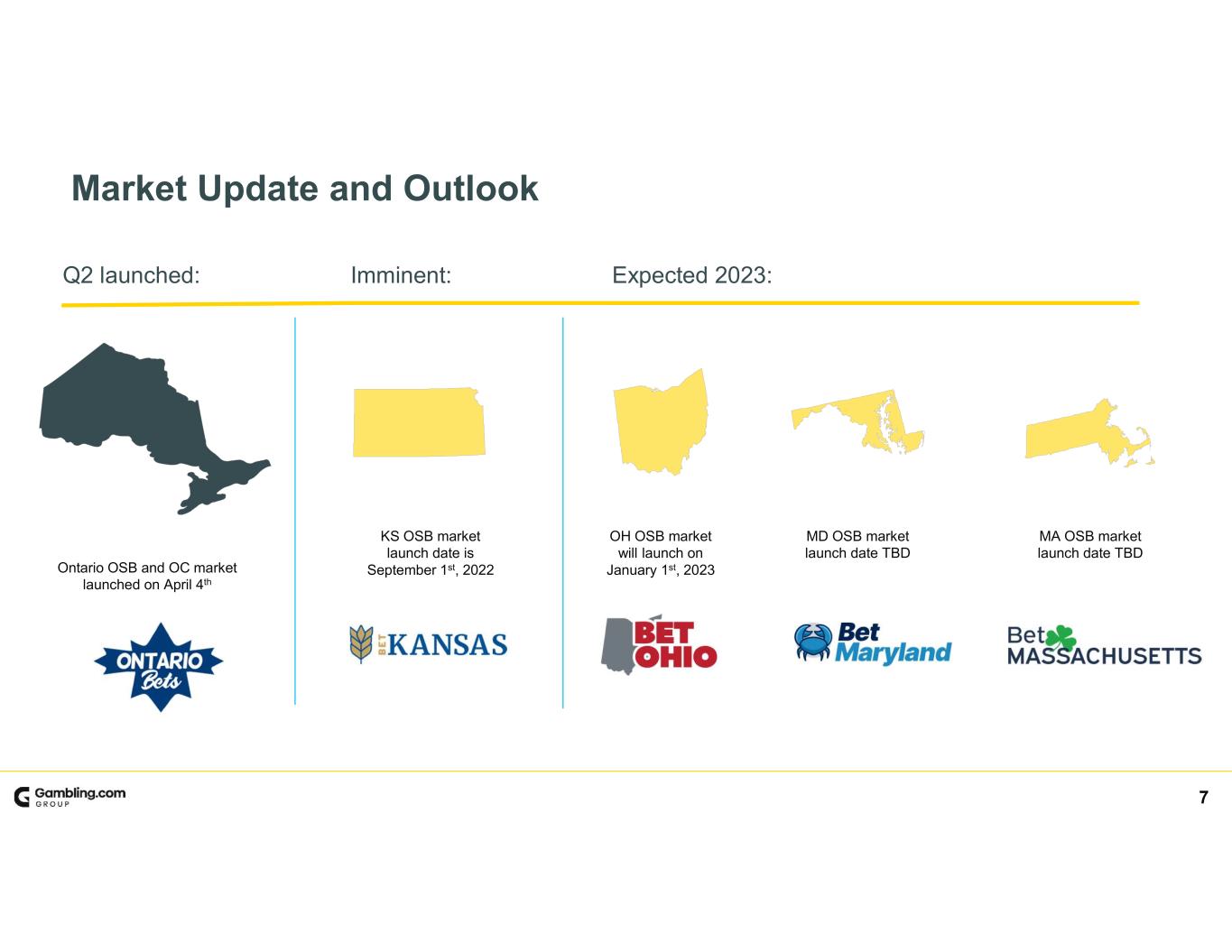

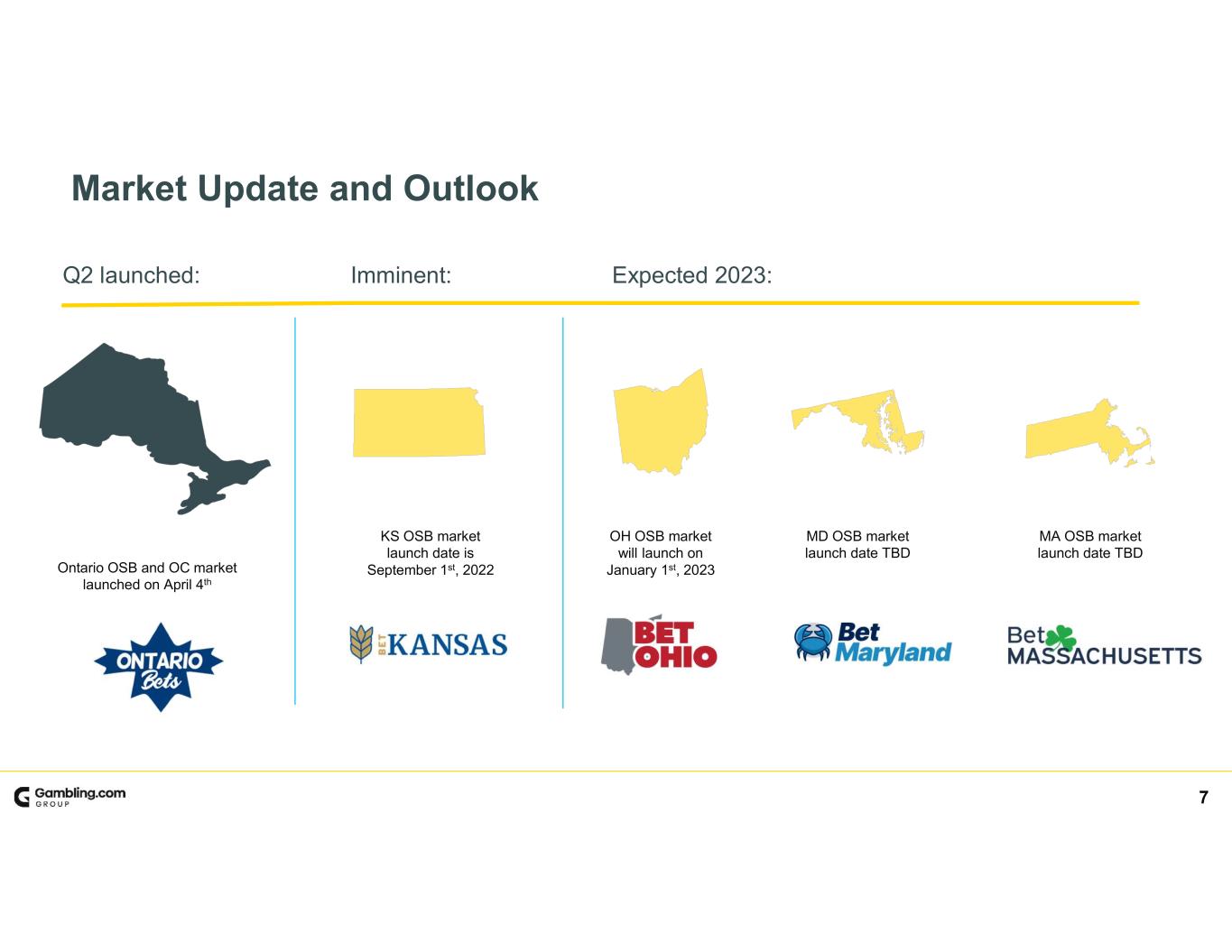

7 Expected 2023: Market Update and Outlook Imminent: Ontario OSB and OC market launched on April 4th OH OSB market will launch on January 1st, 2023 MD OSB market launch date TBD KS OSB market launch date is September 1st, 2022 Q2 launched: MA OSB market launch date TBD

8 Q2 2022 Financial Results(1) (1) This table contains non-IFRS financial measures. See ”Safe Harbor Statement - Non-IFRS Financial Measures” and the tables at the end of this presentation under “Appendix: Financial Tables” for reconciliations to the comparable IFRS numbers. (2) NM = not meaningful Q2 2022 Q2 2021 Change Revenue (millions) $15.9 $10.4 53% Cost of Sales $0.5 $0.0 100% Operating Expense (millions) $17.7 $7.2 NM(2 Operating Profit (Loss) (millions) ($2.2) $3.2 NM(2 Net Income (millions) $0.05 $2.4 -100% Net Income per Diluted Share $0.00 $0.08 -100% Adjusted Operating Expense (millions) $14.8 $7.2 NM(2 Adjusted Operating Profit $0.6 $3.2 (81%) Adjusted Net Income (millions) $3.1 $2.4 25% Adjusted Net Income per Diluted Share $0.09 $0.08 9% Adjusted EBITDA (millions) $3.6 $5.5 (34%) Adjusted EBITDA Margin (% of Revenue) 23% 53% NM(2) Cash from Operations (millions) $3.5 $4.7 (27%) Capital Expenditures (millions) $0.5 $1.6 (66%) Free Cash Flow (millions) $2.9 $3.1 (7%) New Depositing Customers (thousands) 57 26 119%

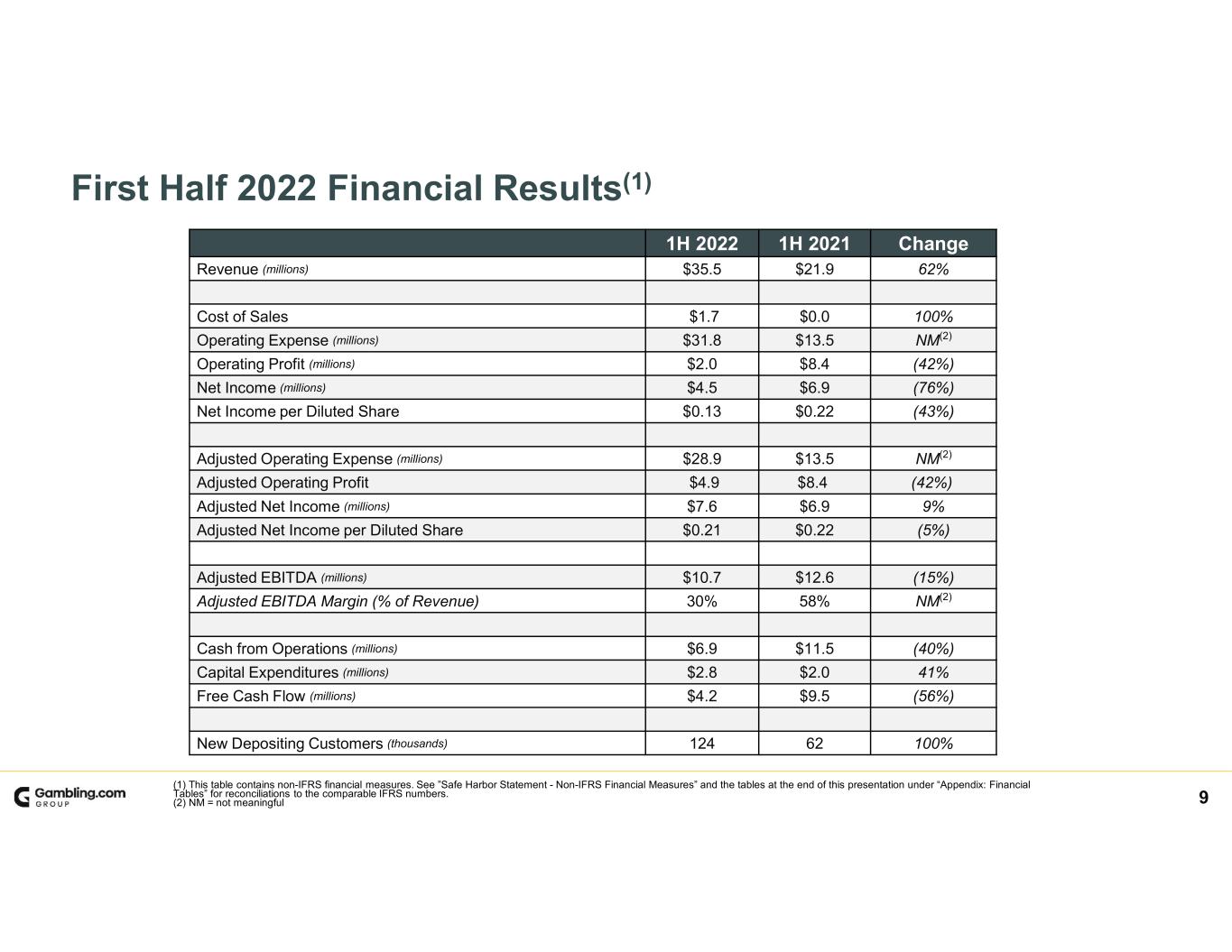

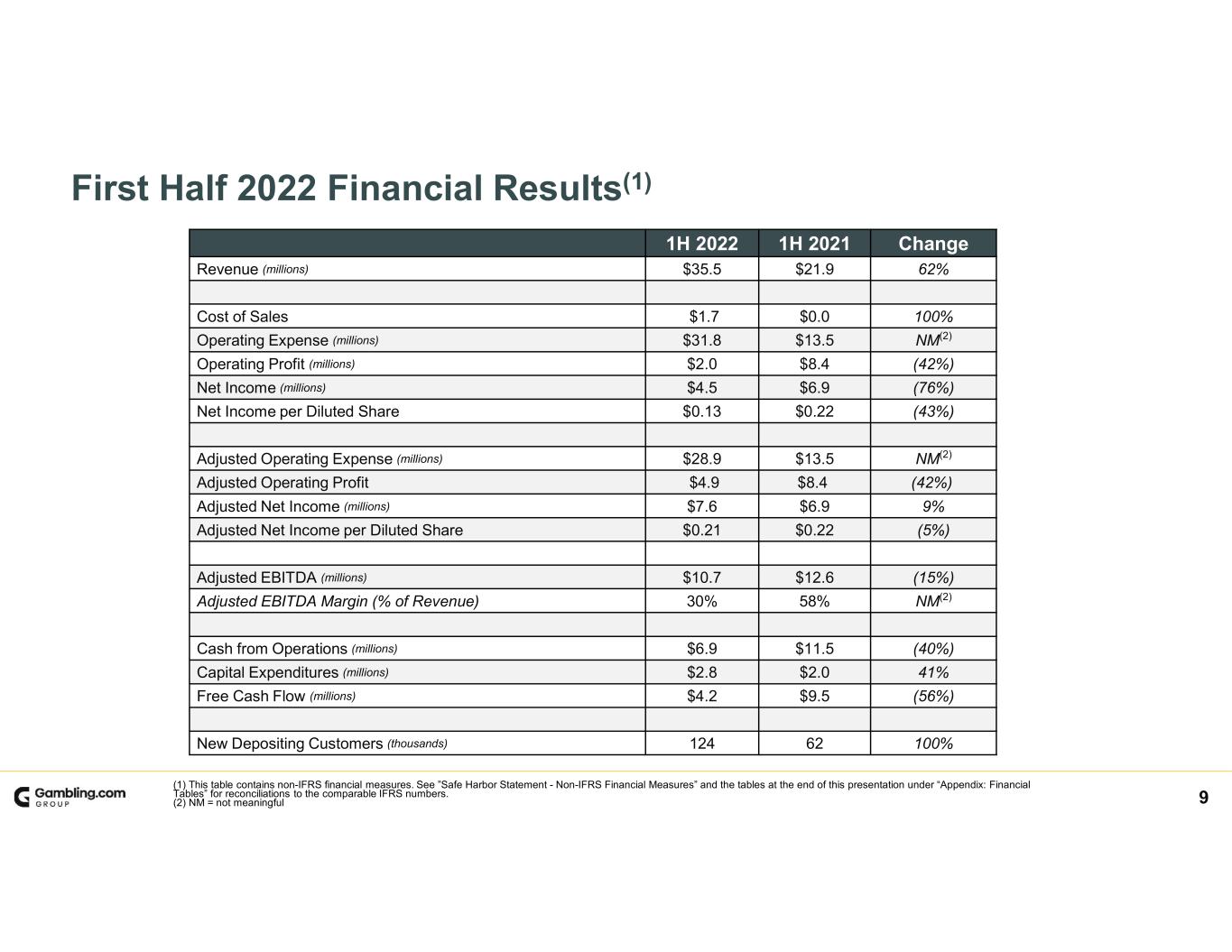

9 First Half 2022 Financial Results(1) (1) This table contains non-IFRS financial measures. See ”Safe Harbor Statement - Non-IFRS Financial Measures” and the tables at the end of this presentation under “Appendix: Financial Tables” for reconciliations to the comparable IFRS numbers. (2) NM = not meaningful 1H 2022 1H 2021 Change Revenue (millions) $35.5 $21.9 62% Cost of Sales $1.7 $0.0 100% Operating Expense (millions) $31.8 $13.5 NM(2) Operating Profit (millions) $2.0 $8.4 (42%) Net Income (millions) $4.5 $6.9 (76%) Net Income per Diluted Share $0.13 $0.22 (43%) Adjusted Operating Expense (millions) $28.9 $13.5 NM(2) Adjusted Operating Profit $4.9 $8.4 (42%) Adjusted Net Income (millions) $7.6 $6.9 9% Adjusted Net Income per Diluted Share $0.21 $0.22 (5%) Adjusted EBITDA (millions) $10.7 $12.6 (15%) Adjusted EBITDA Margin (% of Revenue) 30% 58% NM(2) Cash from Operations (millions) $6.9 $11.5 (40%) Capital Expenditures (millions) $2.8 $2.0 41% Free Cash Flow (millions) $4.2 $9.5 (56%) New Depositing Customers (thousands) 124 62 100%

10 FY 2022 Outlook (1) • For 2022, revenue is expected to be in the range of $71 - $76 million, which implies growth of 68-80%. • For 2022, Adjusted EBITDA is expected to be in the range of $22 - $27 million, which implies growth of 20-47%. Low Midpoint High FY 2021 Revenue (millions) $71.0 $73.5 $76.0 $42.3 Adjusted EBITDA (millions) $22.0 $24.5 $27.0 $18.4 Adjusted EBITDA Margin 31.0% 33.3% 35.5% 43.4% (1) This table contains non-IFRS financial measures. See ”Safe Harbor Statement - Non-IFRS Financial Measures” and the tables at the end of this presentation under “Appendix: Financial Tables” for reconciliations to the comparable IFRS numbers.

11C O N F I D E N T I A L & P R I V A T E Appendix: Financial Tables

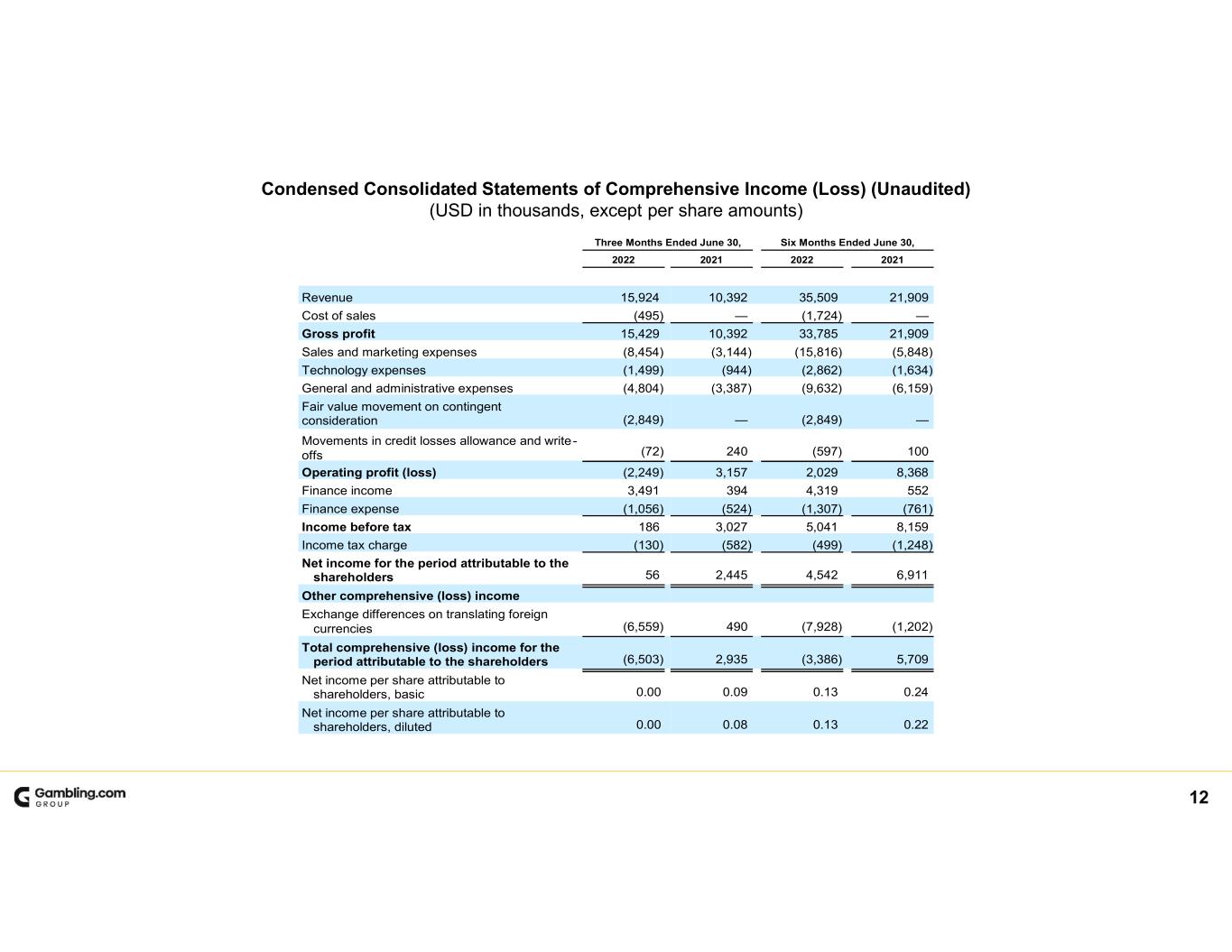

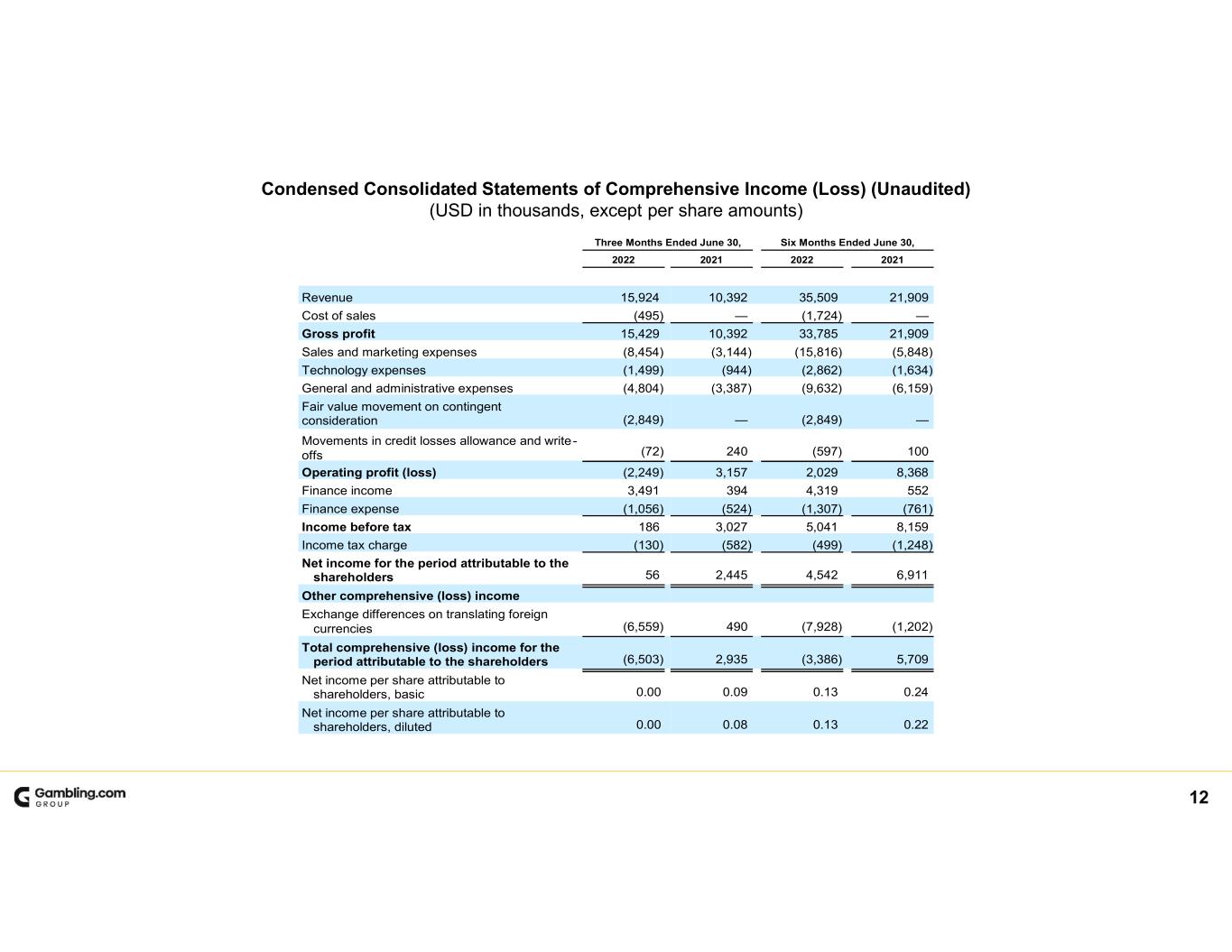

12 Condensed Consolidated Statements of Comprehensive Income (Loss) (Unaudited) (USD in thousands, except per share amounts) Three Months Ended June 30, Six Months Ended June 30, 2022 2021 2022 2021 Revenue 15,924 10,392 35,509 21,909 Cost of sales (495) — (1,724) — Gross profit 15,429 10,392 33,785 21,909 Sales and marketing expenses (8,454) (3,144) (15,816) (5,848) Technology expenses (1,499) (944) (2,862) (1,634) General and administrative expenses (4,804) (3,387) (9,632) (6,159) Fair value movement on contingent consideration (2,849) — (2,849) — Movements in credit losses allowance and write- offs (72) 240 (597) 100 Operating profit (loss) (2,249) 3,157 2,029 8,368 Finance income 3,491 394 4,319 552 Finance expense (1,056) (524) (1,307) (761) Income before tax 186 3,027 5,041 8,159 Income tax charge (130) (582) (499) (1,248) Net income for the period attributable to the shareholders 56 2,445 4,542 6,911 Other comprehensive (loss) income Exchange differences on translating foreign currencies (6,559) 490 (7,928) (1,202) Total comprehensive (loss) income for the period attributable to the shareholders (6,503) 2,935 (3,386) 5,709 Net income per share attributable to shareholders, basic 0.00 0.09 0.13 0.24 Net income per share attributable to shareholders, diluted 0.00 0.08 0.13 0.22

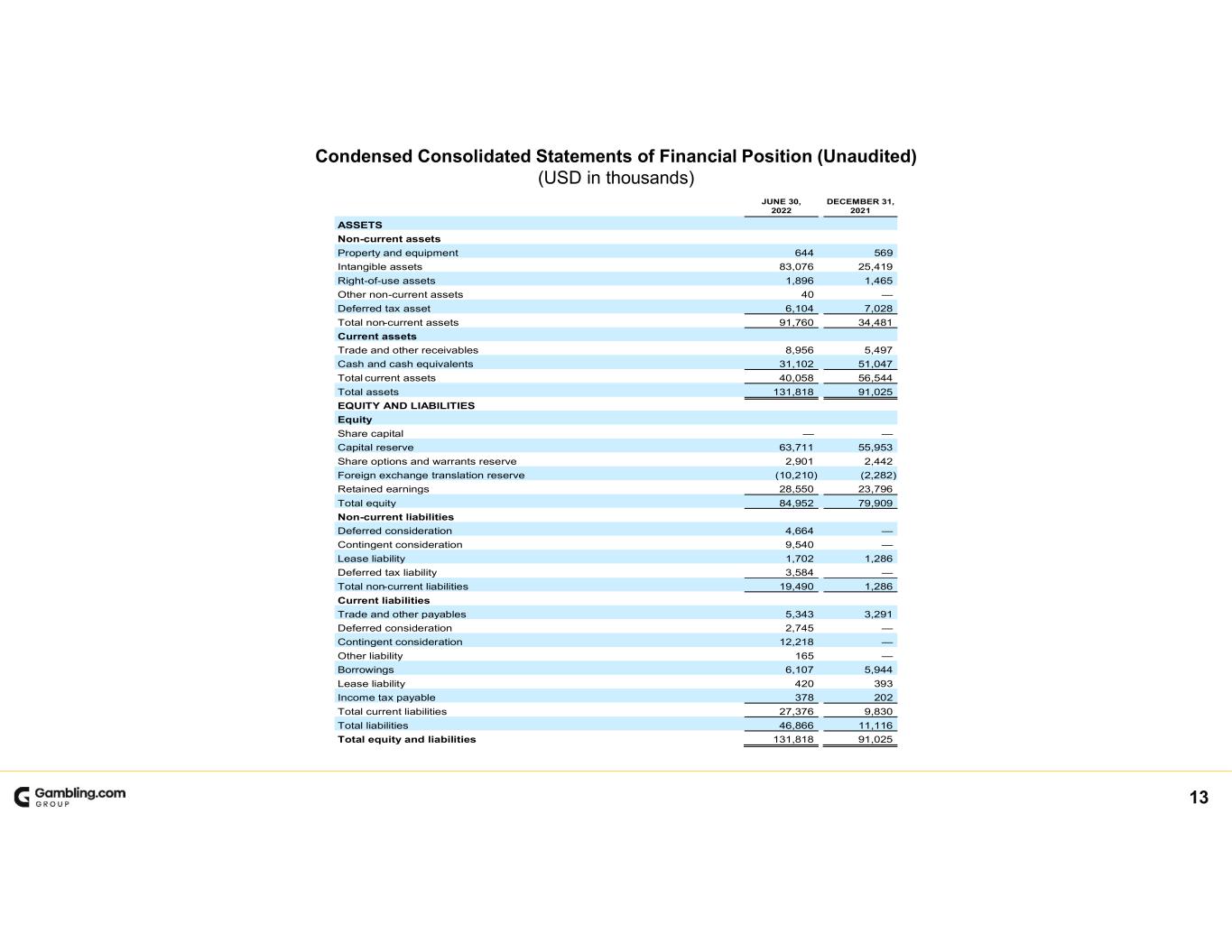

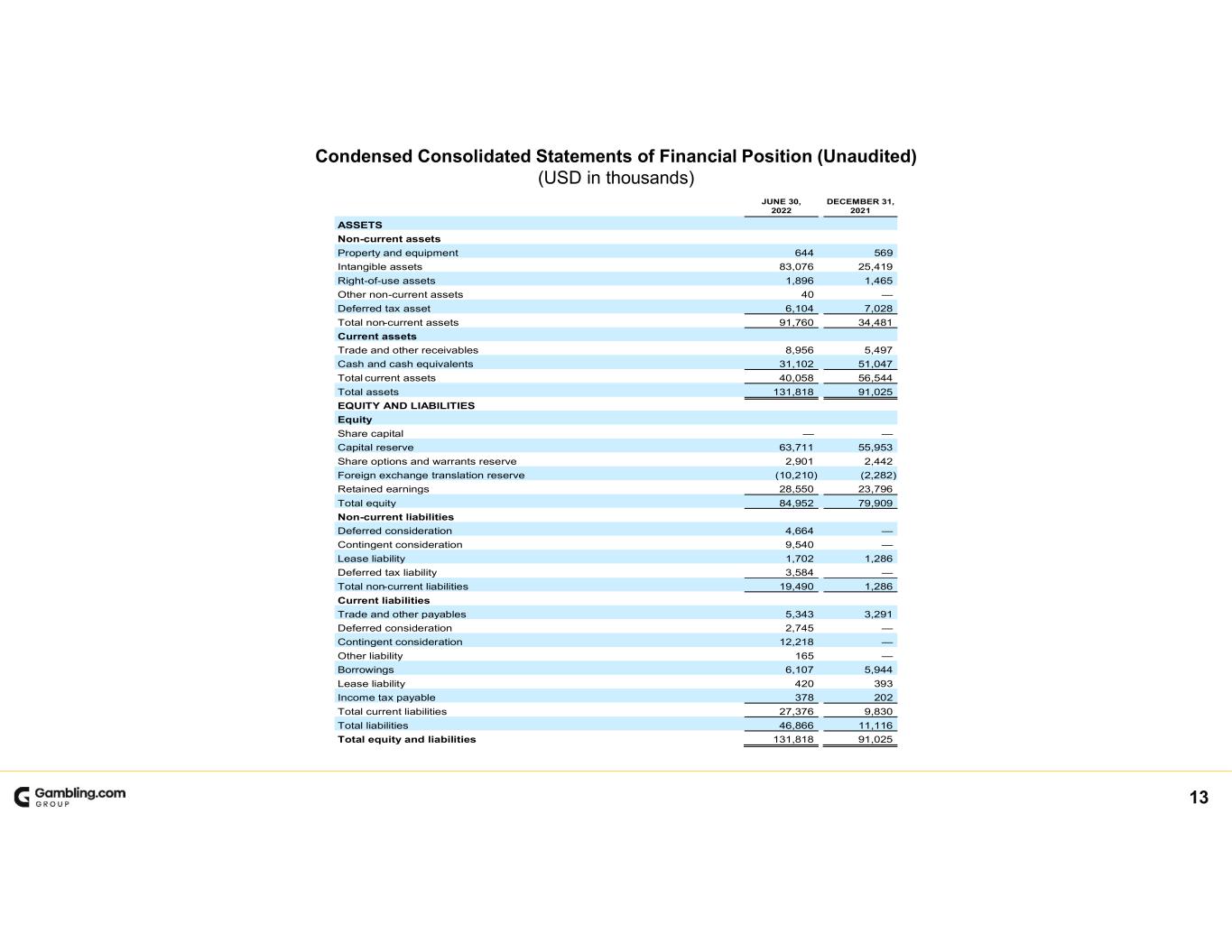

13 Condensed Consolidated Statements of Financial Position (Unaudited) (USD in thousands) JUNE 30, 2022 DECEMBER 31, 2021 ASSETS Non-current assets Property and equipment 644 569 Intangible assets 83,076 25,419 Right-of-use assets 1,896 1,465 Other non-current assets 40 — Deferred tax asset 6,104 7,028 Total non-current assets 91,760 34,481 Current assets Trade and other receivables 8,956 5,497 Cash and cash equivalents 31,102 51,047 Total current assets 40,058 56,544 Total assets 131,818 91,025 EQUITY AND LIABILITIES Equity Share capital — — Capital reserve 63,711 55,953 Share options and warrants reserve 2,901 2,442 Foreign exchange translation reserve (10,210) (2,282) Retained earnings 28,550 23,796 Total equity 84,952 79,909 Non-current liabilities Deferred consideration 4,664 — Contingent consideration 9,540 — Lease liability 1,702 1,286 Deferred tax liability 3,584 — Total non-current liabilities 19,490 1,286 Current liabilities Trade and other payables 5,343 3,291 Deferred consideration 2,745 — Contingent consideration 12,218 — Other liability 165 — Borrowings 6,107 5,944 Lease liability 420 393 Income tax payable 378 202 Total current liabilities 27,376 9,830 Total liabilities 46,866 11,116 Total equity and liabilities 131,818 91,025

14 Condensed Consolidated Statements of Cash Flows (Unaudited) (USD in thousands) Three Months Ended June 30, Six Months Ended June 30, 2022 2021 2022 2021 Cash flow from operating activities Income before tax 186 3,027 5,041 8,159 Finance expenses (income), net (2,435) 130 (3,012) 209 Adjustments for non-cash items: Depreciation and amortization 1,952 634 3,778 1,216 Movements in credit loss allowance and write- offs 71 (240) 597 (100) Fair value movement on contingent consideration 2,849 — 2,849 — Share option charge 885 245 1,609 1,063 Cash flows from operating activities before changes in working capital 3,508 3,796 10,862 10,547 Changes in working capital Trade and other receivables 2,549 14 (2,639) (1,243) Trade and other payables (1,014) 1,464 304 2,710 Warrants repurchased (800) — (800) — Income tax paid (783) (536) (783) (536) Cash flows generated by operating activities 3,460 4,738 6,944 11,478 Cash flows from investing activities Acquisition of property and equipment (99) (188) (242) (218) Acquisition of intangible assets (447) (1,428) (2,516) (1,741) Acquisition of subsidiaries, net of cash acquired (4,114) — (23,409) — Cash flows used in investing activities (4,660) (1,616) (26,167) (1,959) Cash flows from financing activities Interest paid — — (120) (121) Principal paid on lease liability (79) (49) (165) (95) Interest paid on lease liability (45) (47) (95) (96) Cash flows used in financing activities (124) (96) (380) (312) Net movement in cash and cash equivalents (1,324) 3,026 (19,603) 9,207 Cash and cash equivalents at the beginning of the period 33,069 14,035 51,047 8,225 Net foreign exchange differences on cash and cash equivalents (643) 107 (342) (264) Cash and cash equivalents at the end of the period 31,102 17,168 31,102 17,168

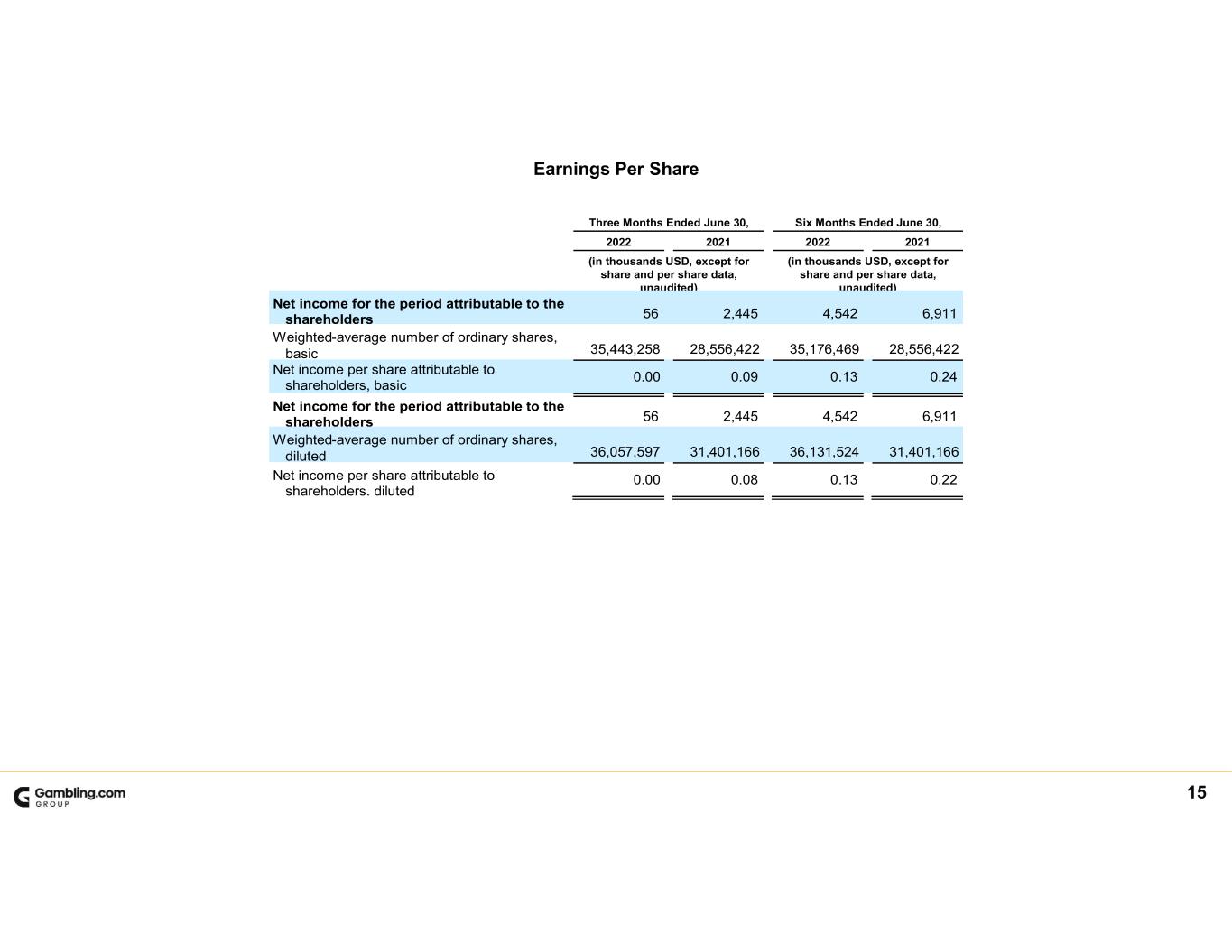

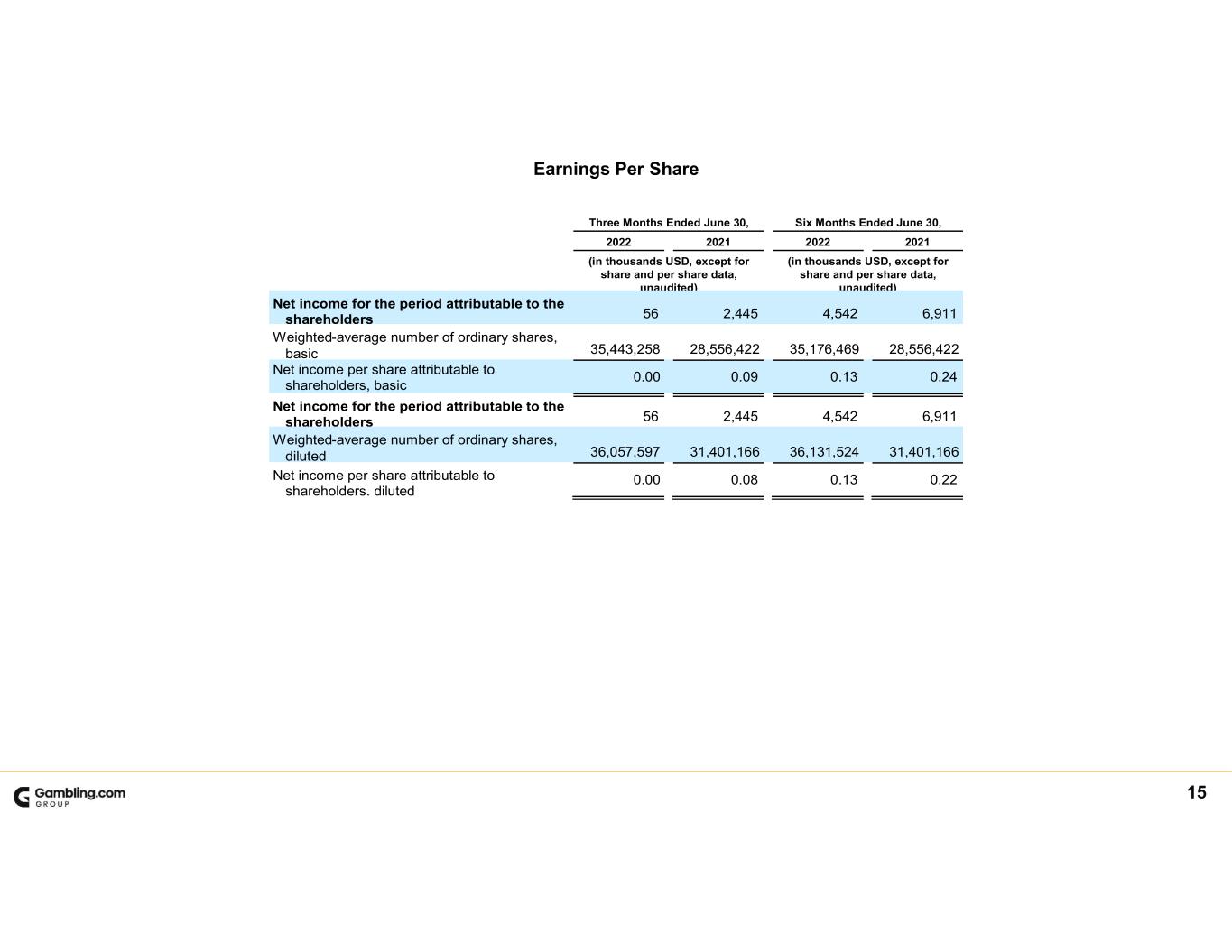

15 Earnings Per Share Three Months Ended June 30, Six Months Ended June 30, 2022 2021 2022 2021 (in thousands USD, except for share and per share data, unaudited) (in thousands USD, except for share and per share data, unaudited) Net income for the period attributable to the shareholders 56 2,445 4,542 6,911 Weighted-average number of ordinary shares, basic 35,443,258 28,556,422 35,176,469 28,556,422 Net income per share attributable to shareholders, basic 0.00 0.09 0.13 0.24 Net income for the period attributable to the shareholders 56 2,445 4,542 6,911 Weighted-average number of ordinary shares, diluted 36,057,597 31,401,166 36,131,524 31,401,166 Net income per share attributable to shareholders, diluted 0.00 0.08 0.13 0.22

16 Adjusted Operating Expense and Adjusted Operating Profit Reconciliation Three Months Ended June 30, Six Months Ended June 30, 2022 2021 2022 2021 (in thousands USD, unaudited) (in thousands USD, unaudited) Operating expenses 17,678 7,235 31,756 13,541 Fair value movement on contingent (2,849) — (2,849) — Adjusted operating expenses 14,829 7,235 28,907 13,541 Three Months Ended June 30, Six Months Ended June 30, 2022 2021 2022 2021 (in thousands USD, unaudited) (in thousands USD, unaudited) Revenue 15,924 10,392 35,509 21,909 Cost of sales (495) — (1,724) — Less Adjusted operating expenses (14,829) (7,235) (28,907) (13,541) Adjusted operating profit 600 3,157 4,878 8,368

17 Adjusted Net Income and Adjusted Net Income Per Share Reconciliation Three Months Ended June 30, Six Months Ended June 30, 2022 2021 2022 2021 (in thousands USD, except for share and per share data, unaudited) (in thousands USD, except for share and per share data, unaudited) Net income for the period attributable to the shareholders 56 2,445 4,542 6,911 Fair value movement on contingent consideration 2,849 — 2,849 — Unwinding of deferred consideration 160 — 160 — Adjusted net income for the period attributable to shareholders 3,065 2,445 7,551 6,911 Weighted-average number of ordinary shares, basic 35,443,258 28,556,422 35,176,469 28,556,422 Net income per share attributable to shareholders, basic 0.00 0.09 0.13 0.24 Adjusted net income per share attributable to shareholders, basic 0.09 0.09 0.21 0.24 Weighted-average number of ordinary shares, diluted 36,057,597 31,401,166 36,131,524 31,401,166 Net income per share attributable to shareholders, diluted 0.00 0.08 0.13 0.22 Adjusted net income per share attributable to shareholders, diluted 0.09 0.08 0.21 0.22

18 Adjusted EBITDA and Adjusted EBITDA Margin Reconciliation n/m = not meaningful 1) Net finance (income) costs is comprised of finance income and finance expense, including unwinding of deferred consideration and foreign exchange gains (losses). 2) The acquisition costs are related to the business combinations of the Group. Three Months Ended June 30, CHANGE Six Months Ended June 30, CHANGE 2022 2021 $ % 2022 2021 $ % (in thousands, USD, unaudited) (in thousands, USD, unaudited) Revenue 15,924 10,392 5,532 53 % 35,509 21,909 13,600 62 % Adjusted EBITDA 3,617 5,518 (1,901) (34) % 10,719 12,635 (1,916) (15) % Adjusted EBITDA Margin 23 % 53 % (30) % 30 % 58 % (27) % Three Months Ended June 30, CHANGE Six Months Ended June 30, CHANGE 2022 2021 $ % 2022 2021 $ % (in thousands USD, unaudited) (in thousands USD, unaudited) Net income for the period attributable to the shareholders 56 2,445 (2,389) (98) % 4,542 6,911 (2,369) (34) % Add Back: Net finance costs (income) (1) (2,435) 130 (2,565) n/m (3,012) 209 (3,221) n/m Income tax charge 130 582 (452) (78) % 499 1,248 (749) (60) % Depreciation expense 44 47 (3) (6) % 87 82 5 6 % Amortization expense 1,908 587 1,321 n/m 3,691 1,134 2,557 n/m Share-based payments 885 245 640 n/m 1,609 1,063 546 51 % Fair value movement on contingent 2,849 — 2,849 n/m 2,849 — 2,849 n/m Accounting and legal fees related to offering — 392 (392) n/m — 898 (898) n/m Bonuses related to the offering — 1,090 (1,090) n/m — 1,090 (1,090) n/m Acquisition related costs (2) 180 — 180 n/m 454 — 454 n/m Adjusted EBITDA 3,617 5,518 (1,901) (34) % 10,719 12,635 (1,916) (15) %

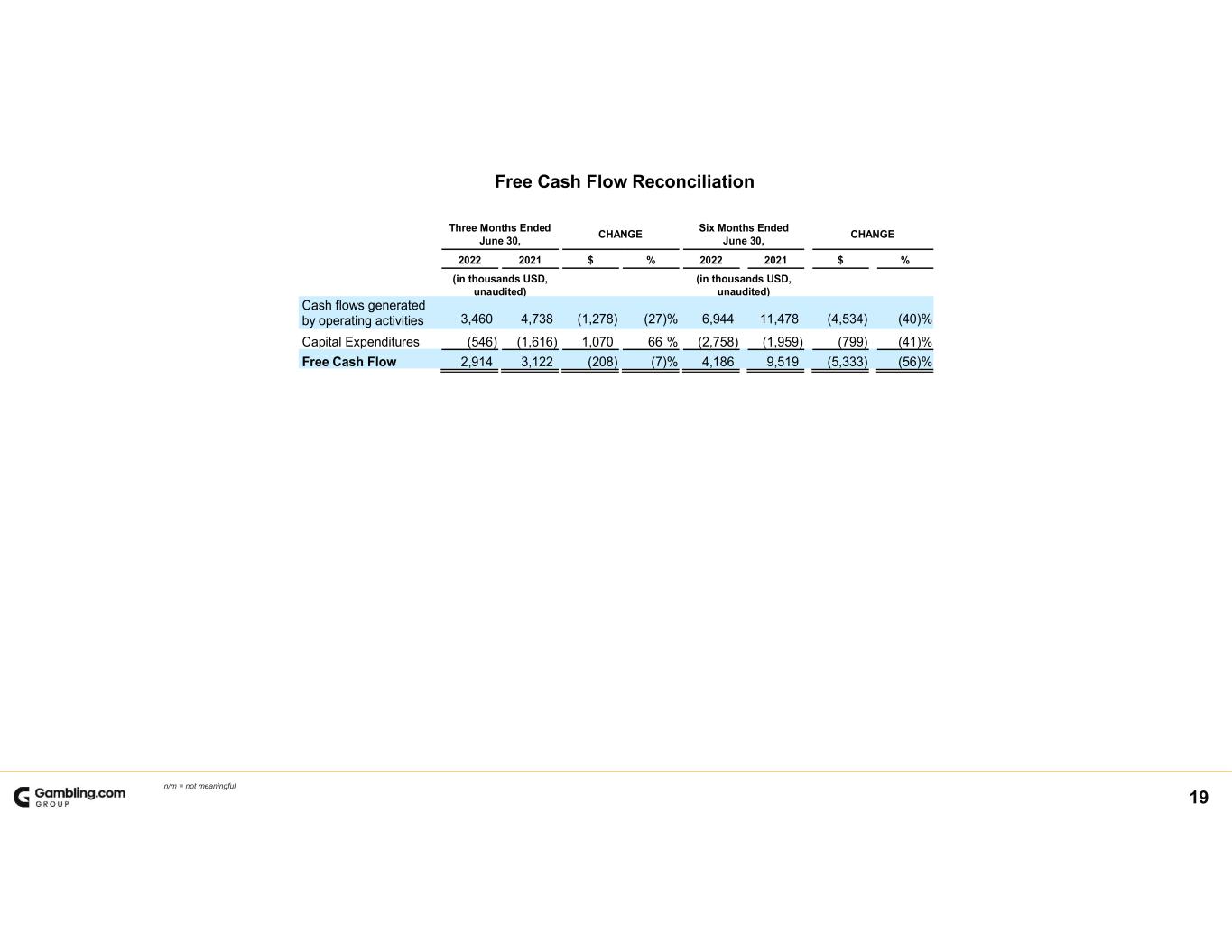

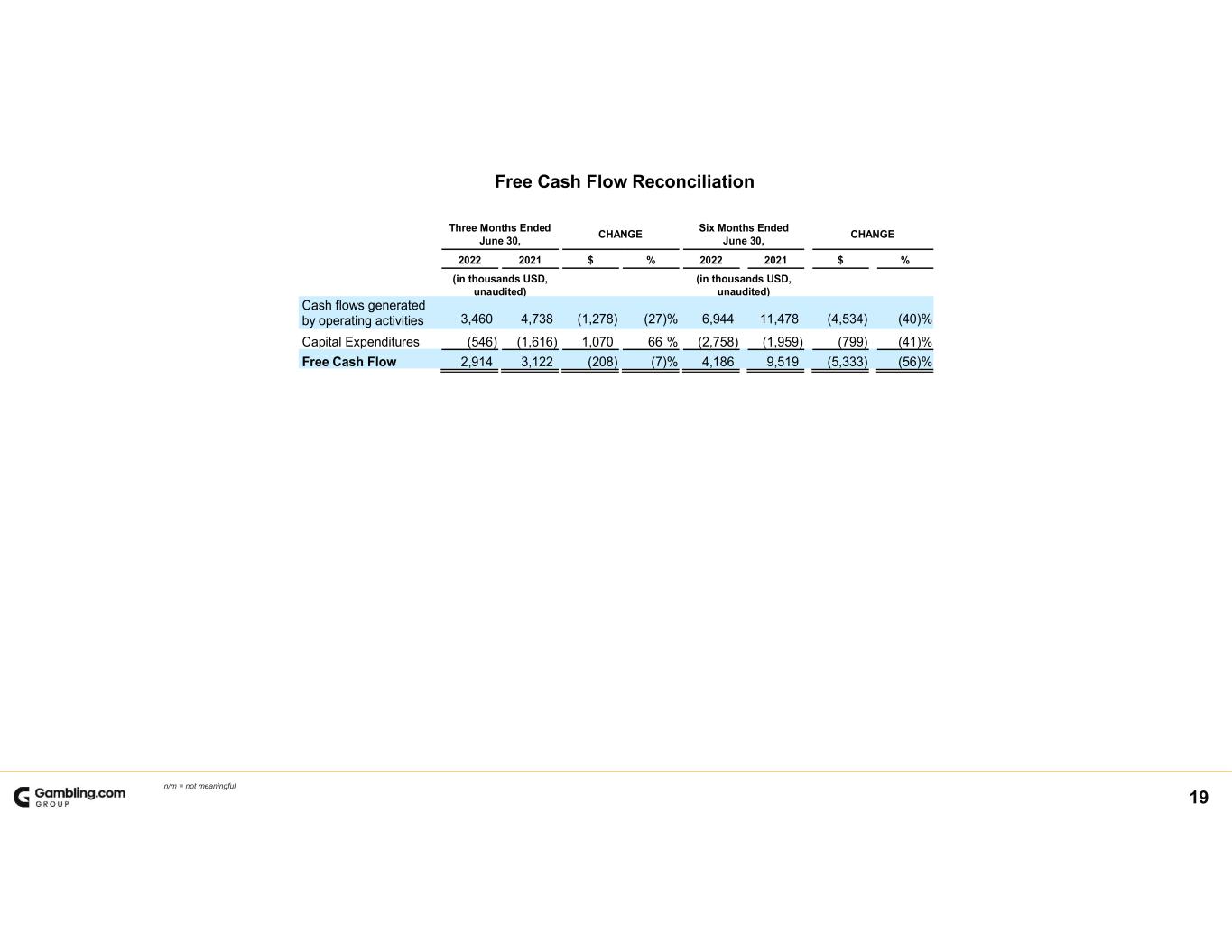

19 Free Cash Flow Reconciliation n/m = not meaningful Three Months Ended June 30, CHANGE Six Months Ended June 30, CHANGE 2022 2021 $ % 2022 2021 $ % (in thousands USD, unaudited) (in thousands USD, unaudited) Cash flows generated by operating activities 3,460 4,738 (1,278) (27) % 6,944 11,478 (4,534) (40) % Capital Expenditures (546) (1,616) 1,070 66 % (2,758) (1,959) (799) (41) % Free Cash Flow 2,914 3,122 (208) (7) % 4,186 9,519 (5,333) (56) %