FOURTH QUARTER AND FULL YEAR 2024 EARNINGS PRESENTATION February 26, 2025 1 JanusIntl.com

2 FORWARD-LOOKING STATEMENTS Certain statements in this communication, including the estimated guidance provided under “2025 Financial Guidance” and under “Reaffirmed Long Term Strategic Outlook” herein, may be considered “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements other than statements of historical fact included in this communication are forward-looking statements, including, but not limited to statements regarding Janus’s belief regarding the demand outlook for Janus’s products and the strength of the industrials markets. When used in this communication, words such as “plan,” “believe,” “expect,” “anticipate,” “intend,” “outlook,” “estimate,” “forecast,” “project,” “continue,” “could,” “may,” “might,” “possible,” “potential,” “predict,” “should,” “would” and other similar words and expressions or the negative of such terms or other similar expressions, as they relate to the management team, identify forward-looking statements. The forward-looking statements contained in this communication are based on our current expectations and beliefs concerning future developments and their potential effects on us. We cannot assure you that future developments affecting us will be those that we have anticipated. These forward-looking statements involve a number of risks, uncertainties (some of which are beyond our control) or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements. Should one or more of these risks or uncertainties materialize, or should any of our assumptions prove incorrect, actual results may vary in material respects from those projected in these forward-looking statements. Some factors that could cause actual results to differ include, but are not limited to: (i) risks of the self-storage industry; (ii) the highly competitive nature of the self-storage industry and Janus’s ability to compete therein; (iii) litigation, complaints, and/or adverse publicity; (iv) cyber incidents or directed attacks that could result in information theft, data corruption, operational disruption and/or financial loss; and (v) the risk that the demand outlook for Janus’s products may not be as strong as anticipated. There can be no assurance that the events, results, trends or guidance regarding financial outlook identified in these forward-looking statements will occur or be achieved. Forward-looking statements speak only as of the date they are made, and Janus is not under any obligation and expressly disclaims any obligation, to update, alter or otherwise revise any forward-looking statement, whether as a result of new information, future events or otherwise, except as required by law. This communication is not intended to be all-inclusive or to contain all the information that a person may desire in considering an investment in Janus and is not intended to form the basis of an investment decision in Janus. All subsequent written and oral forward-looking statements concerning Janus or other matters and attributable to Janus or any person acting on its behalf are expressly qualified in their entirety by the cautionary statements above and under the heading “Risk Factors” in Janus’s most recently filed Annual Report on Form 10-K and any subsequent Quarterly Report on Form 10-Q, as updated from time to time in amendments and its subsequent filings with the SEC. NON-GAAP FINANCIAL MEASURES Janus uses measures of performance that are not required by or presented in accordance with GAAP in the United States. Non-GAAP financial performance measures are used to supplement the financial information presented on a GAAP basis. These non-GAAP financial measures should not be considered in isolation or as a substitute for the relevant GAAP measures and should be read in conjunction with information presented on a GAAP basis. Please see Appendix, which includes definitions of non-GAAP measures and metrics used in this presentation and reconciliations of non-GAAP measures to the most directly comparable GAAP measure. Adjusted EBITDA and Adjusted Net Income are non-GAAP financial measures used by Janus to evaluate its operating performance, generate future operating plans, and make strategic decisions, including those relating to operating expenses and the allocation of internal resources. Accordingly, Janus believes Adjusted EBITDA and Adjusted Net Income provide useful information to investors and others in understanding and evaluating Janus’s operating results in the same manner as its management and board of directors and in comparison with Janus’s peer group companies. In addition, Adjusted EBITDA and Adjusted Net Income provide useful measures for period-to-period comparisons of Janus’s business, as they remove the effect of certain non-recurring events and other non-recurring charges, such as acquisitions, and certain variable or non-recurring charges. Adjusted EBITDA is defined as net income excluding interest expense, income taxes, depreciation expense, amortization, and other non-operational, non-recurring items. Adjusted Net Income is defined as net income plus the corresponding tax-adjusted add-backs shown in the Adjusted EBITDA reconciliation. Please note that the Company has not provided the most directly comparable GAAP financial measure, or a quantitative reconciliation thereto, for the Adjusted EBITDA forward-looking guidance for 2025 included in this communication in reliance on the "unreasonable efforts" exception provided under Item 10(e)(1)(i)(B) of Regulation S-K. Providing the most directly comparable GAAP financial measure, or a quantitative reconciliation thereto, cannot be done without unreasonable effort due to the inherent uncertainty and difficulty in predicting certain non-cash, material and/or non-recurring expenses or benefits, legal settlements or other matters, and certain tax positions. Because these adjustments are inherently variable and uncertain and depend on various factors that are beyond the Company's control, the Company is also unable to predict their probable significance. The variability of these items could have an unpredictable, and potentially significant, impact on our future GAAP financial results. Adjusted EBITDA and Adjusted Net Income should not be considered in isolation of, or as an alternative to, measures prepared in accordance with GAAP. There are a number of limitations related to the use of Adjusted EBITDA and Adjusted Net Income rather than net income (loss), which is the nearest GAAP equivalent of Adjusted EBITDA and Adjusted Net Income. These limitations include that the non-GAAP financial measures: exclude depreciation and amortization, and although these are non-cash expenses, the assets being depreciated may be replaced in the future; do not reflect interest expense, or the cash requirements necessary to service interest on debt, which reduces cash available; do not reflect the provision for or benefit from income tax that may result in payments that reduce cash available; exclude non-recurring items (i.e., the extinguishment of debt); and may not be comparable to similar non-GAAP financial measures used by other companies, because the expenses and other items that Janus excludes in the calculation of these non-GAAP financial measures may differ from the expenses and other items, if any, that other companies may exclude from these non-GAAP financial measures when they report their operating results. Because of these limitations, these non-GAAP financial measures should be considered along with other operating and financial performance measures presented in accordance with GAAP.

3 AGENDA Ramey Jackson Chief Executive Officer Business Overview & Market Update Anselm Wong Chief Financial Officer 2024 Financial Overview & 2025 Financial Guidance

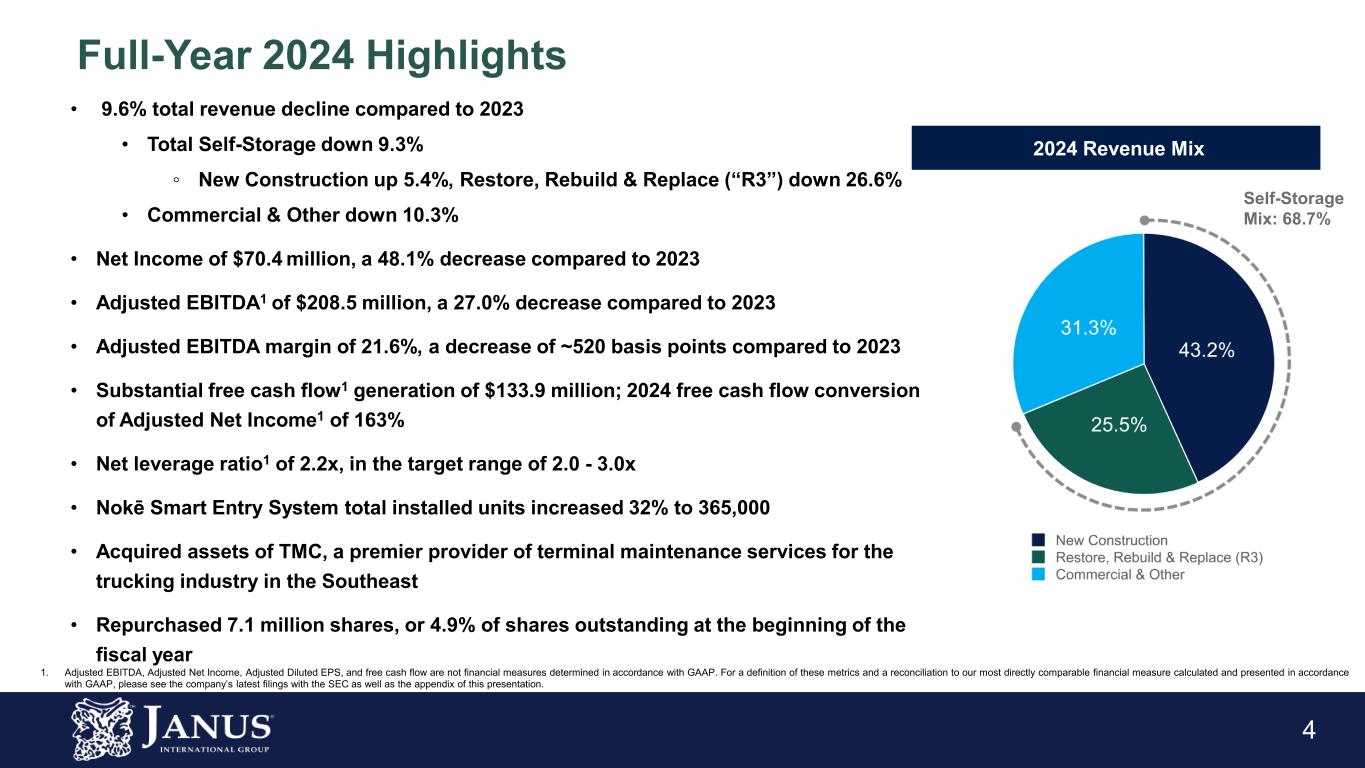

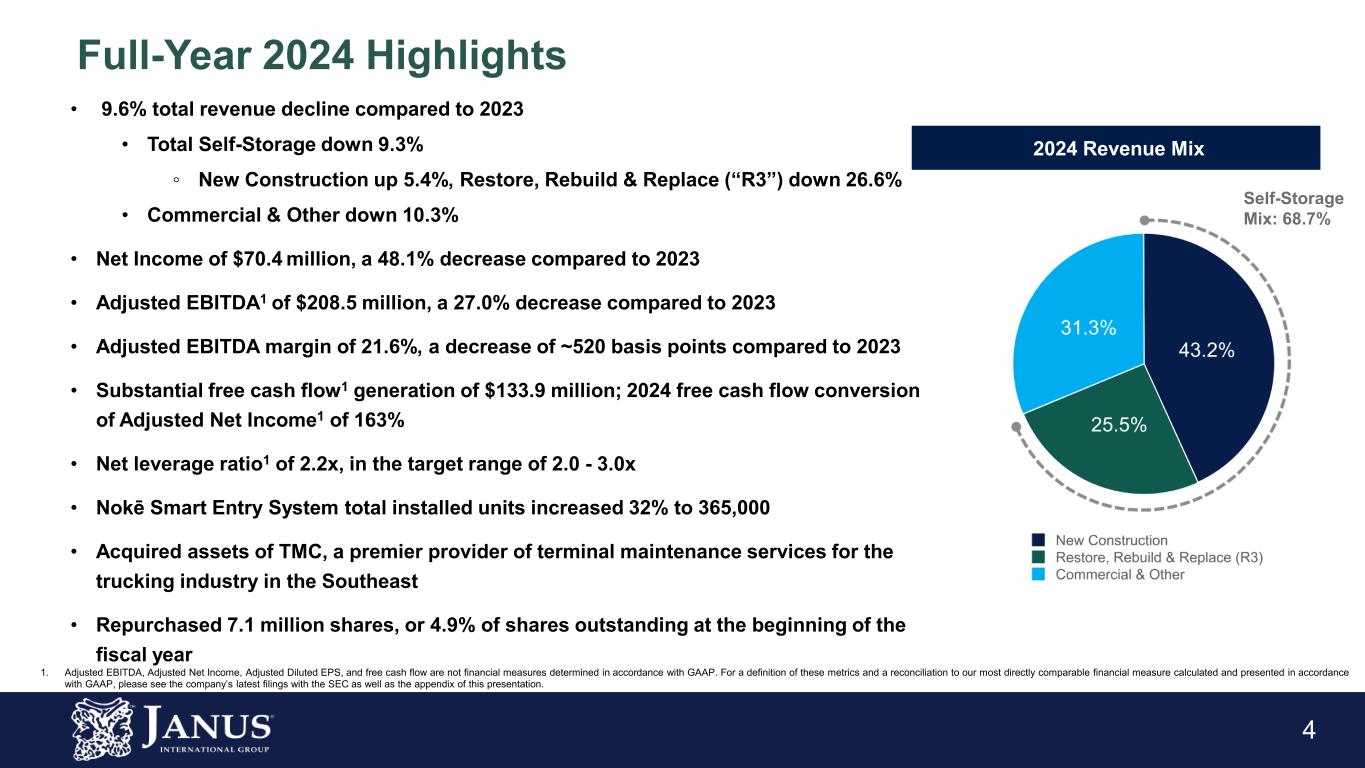

4 • 9.6% total revenue decline compared to 2023 • Total Self-Storage down 9.3% ◦ New Construction up 5.4%, Restore, Rebuild & Replace (“R3”) down 26.6% • Commercial & Other down 10.3% • Net Income of $70.4 million, a 48.1% decrease compared to 2023 • Adjusted EBITDA1 of $208.5 million, a 27.0% decrease compared to 2023 • Adjusted EBITDA margin of 21.6%, a decrease of ~520 basis points compared to 2023 • Substantial free cash flow1 generation of $133.9 million; 2024 free cash flow conversion of Adjusted Net Income1 of 163% • Net leverage ratio1 of 2.2x, in the target range of 2.0 - 3.0x • Nokē Smart Entry System total installed units increased 32% to 365,000 • Acquired assets of TMC, a premier provider of terminal maintenance services for the trucking industry in the Southeast • Repurchased 7.1 million shares, or 4.9% of shares outstanding at the beginning of the fiscal year 2024 Revenue Mix Full-Year 2024 Highlights Self-Storage Mix: 68.7% 1. Adjusted EBITDA, Adjusted Net Income, Adjusted Diluted EPS, and free cash flow are not financial measures determined in accordance with GAAP. For a definition of these metrics and a reconciliation to our most directly comparable financial measure calculated and presented in accordance with GAAP, please see the company’s latest filings with the SEC as well as the appendix of this presentation.

5 Adj. EBITDA1 $208.5M 27.0% decrease 21.6% margin Revenue $963.8M 9.6% decrease Adj. Diluted EPS1 $0.57 Adj. Net Income1 of $82.1M Operating Cash Flow $154.0M FCF1 of $133.9M Full-Year 2024 Results Overview 1. Adjusted EBITDA, Adjusted Net Income, Adjusted Diluted EPS, and free cash flow are not financial measures determined in accordance with GAAP. For a definition of these metrics and a reconciliation to our most directly comparable financial measure calculated and presented in accordance with GAAP, please see the company’s latest filings with the SEC as well as the appendix of this presentation. Strong Cash Flow Generation Amid A Challenging Macroeconomic Environment

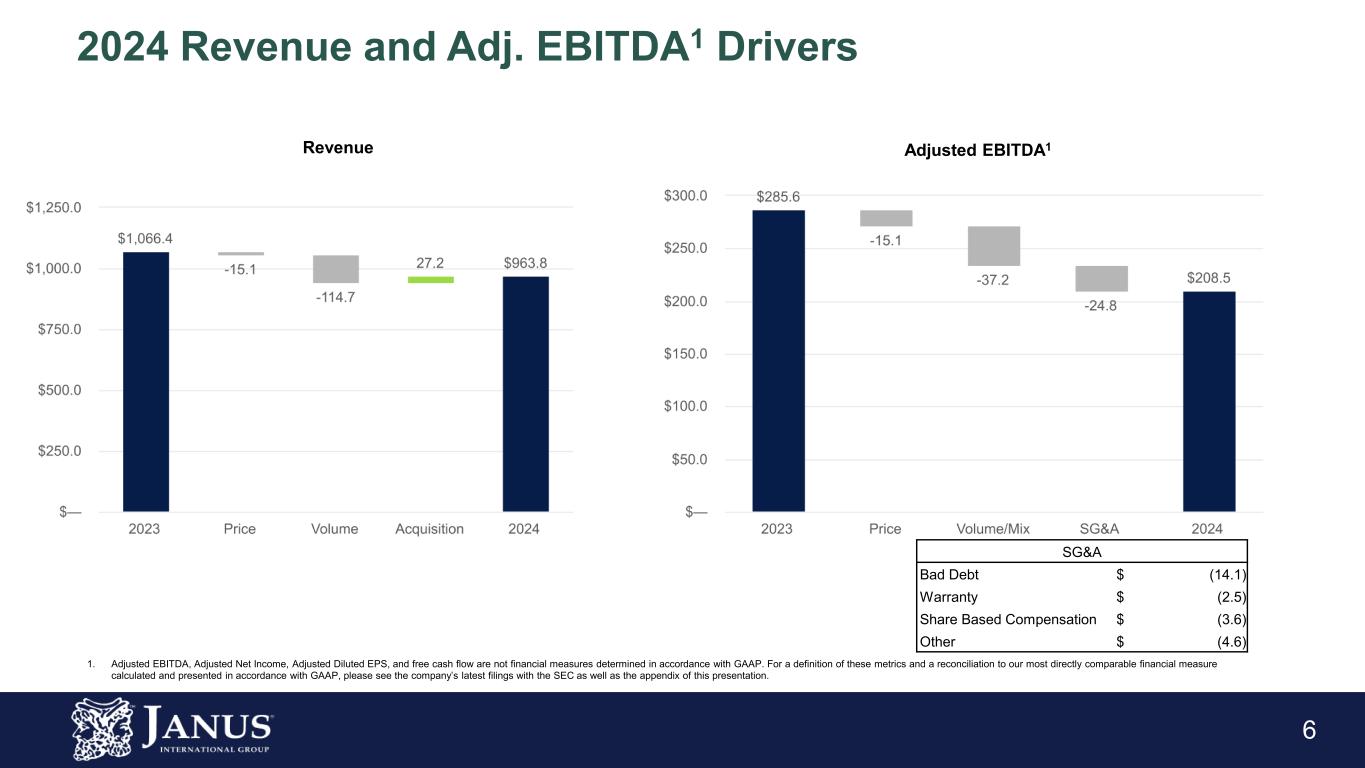

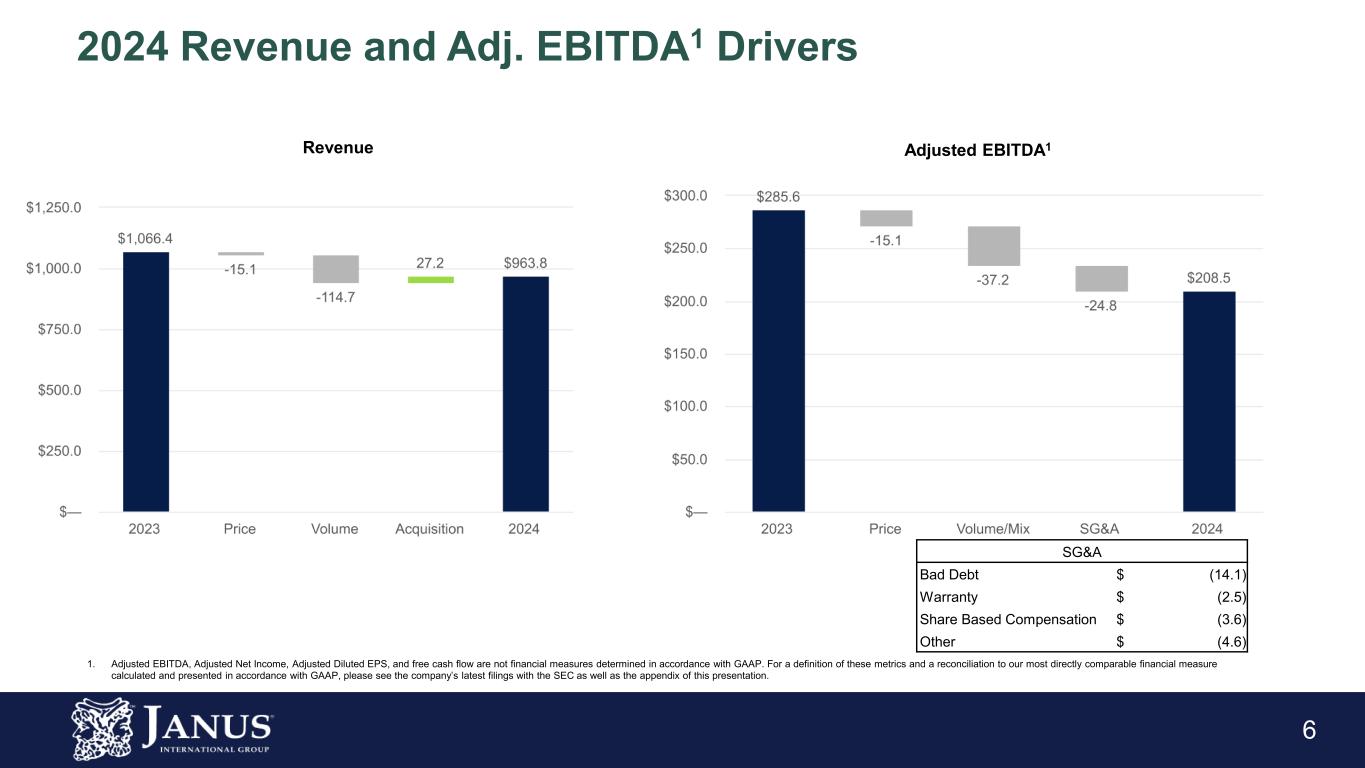

6 2024 Revenue and Adj. EBITDA1 Drivers 1. Adjusted EBITDA, Adjusted Net Income, Adjusted Diluted EPS, and free cash flow are not financial measures determined in accordance with GAAP. For a definition of these metrics and a reconciliation to our most directly comparable financial measure calculated and presented in accordance with GAAP, please see the company’s latest filings with the SEC as well as the appendix of this presentation. Revenue Adjusted EBITDA1 SG&A Bad Debt $ (14.1) Warranty $ (2.5) Share Based Compensation $ (3.6) Other $ (4.6)

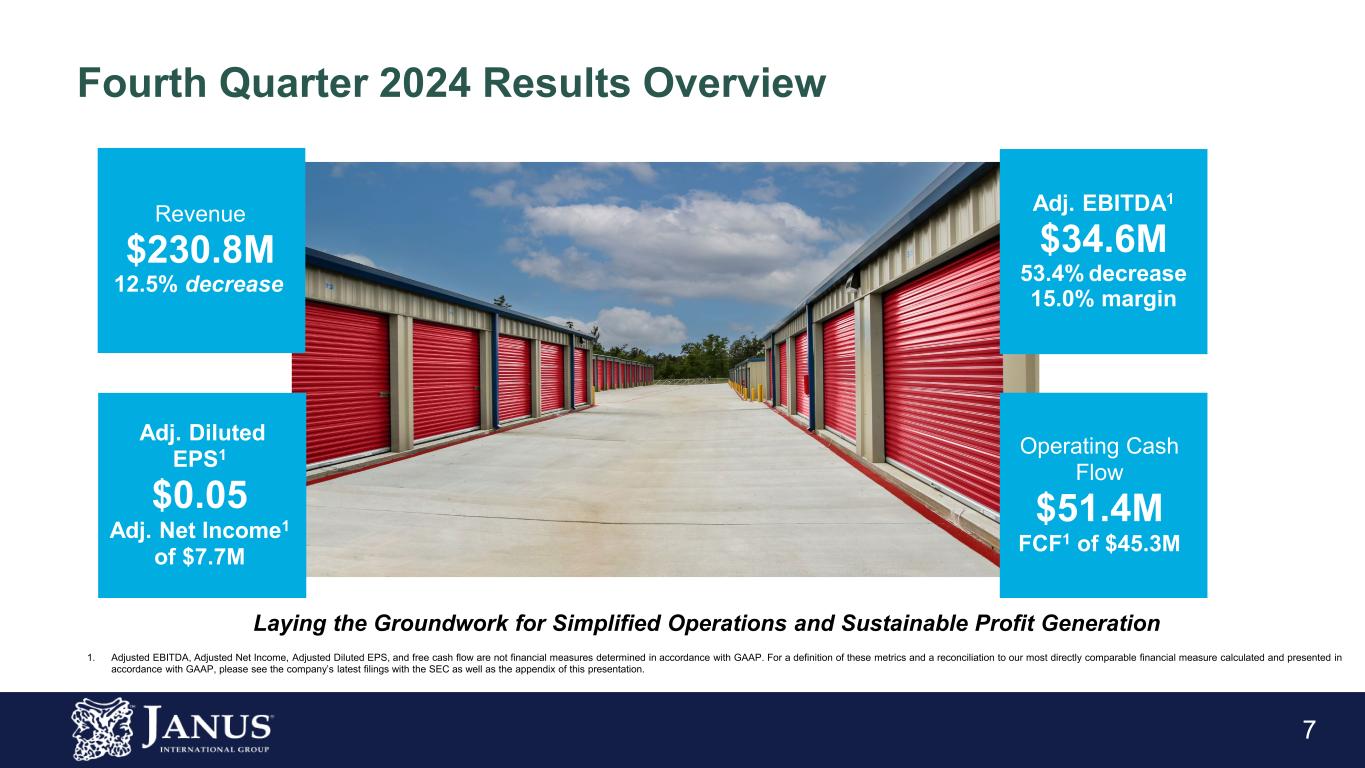

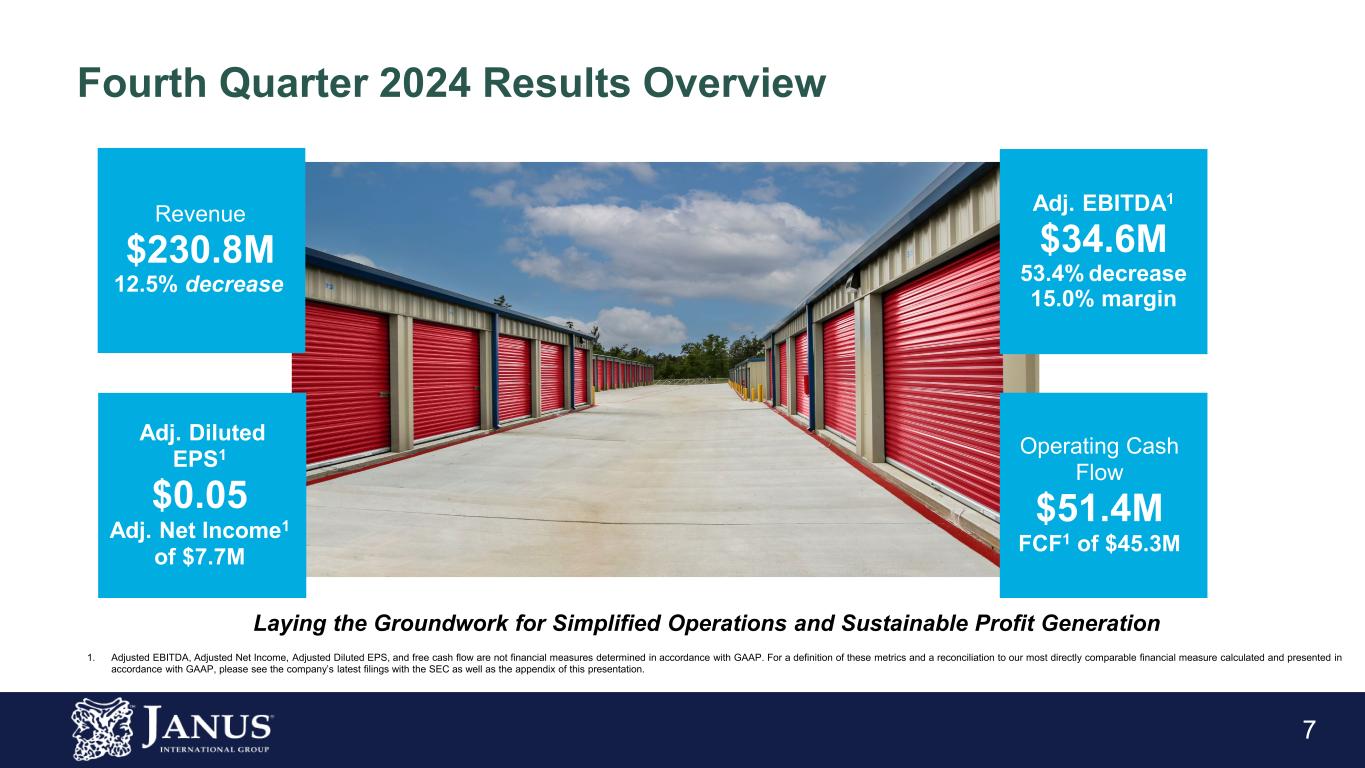

7 Adj. EBITDA1 $34.6M 53.4% decrease 15.0% margin Revenue $230.8M 12.5% decrease Adj. Diluted EPS1 $0.05 Adj. Net Income1 of $7.7M Operating Cash Flow $51.4M FCF1 of $45.3M Fourth Quarter 2024 Results Overview 1. Adjusted EBITDA, Adjusted Net Income, Adjusted Diluted EPS, and free cash flow are not financial measures determined in accordance with GAAP. For a definition of these metrics and a reconciliation to our most directly comparable financial measure calculated and presented in accordance with GAAP, please see the company’s latest filings with the SEC as well as the appendix of this presentation. Laying the Groundwork for Simplified Operations and Sustainable Profit Generation

8 Fourth Quarter 2024 Revenue and Adj. EBITDA1 Drivers 1. Adjusted EBITDA, Adjusted Net Income, Adjusted Diluted EPS, and free cash flow are not financial measures determined in accordance with GAAP. For a definition of these metrics and a reconciliation to our most directly comparable financial measure calculated and presented in accordance with GAAP, please see the company’s latest filings with the SEC as well as the appendix of this presentation. Revenue Adjusted EBITDA1 SG&A Bad Debt $ (7.1) Warranty $ (2.1) Other $ (3.3)

9 Building on Record of High Return Capital Allocation Strong cash flow profile, financial flexibility, disciplined capital deployment Free Cash Flow Conversion of Adj. Net Income1 163% for Full Year 2024 Solid Balance Sheet 2.0x-3.0x Net Leverage Target1 Net Debt/Adj. EBITDA of 2.2x at YE 2024 Liquidity2 of $231.3M at YE 2024 Invest in Growth Acquisitions Focus on core business and strategic adjacencies Aim to maintain discipline across all capital allocation opportunities Financial Flexibility Share Repurchases And other actions to optimize capital structure and returns Repurchased 7.1M shares for $79.6M (including commissions and excise taxes) 1. Free Cash Flow Conversion of Adjusted Net Income and Net Leverage Ratio are not financial measure determined in accordance with GAAP. For a definition of these metrics and reconciliation to our most directly comparable financial measure calculated and presented in accordance with GAAP, please see the company’s latest filings with the SEC as well as the appendix of this presentation. 2. Liquidity is defined as cash and cash equivalents + available balance on line of credit

10 Structural Cost Reduction Plan Action Plan Streamline labor force Rationalize real estate holdings Reduce selling, general and administrative costs Goals Improve margins Simplify organizational structure Enhance flexibility and efficiencies Estimated Annual Pre-Tax Cost Savings $10 Million - $12 Million 1. Excluding $5M gain on sale of manufacturing facility recognized in 4Q 2024

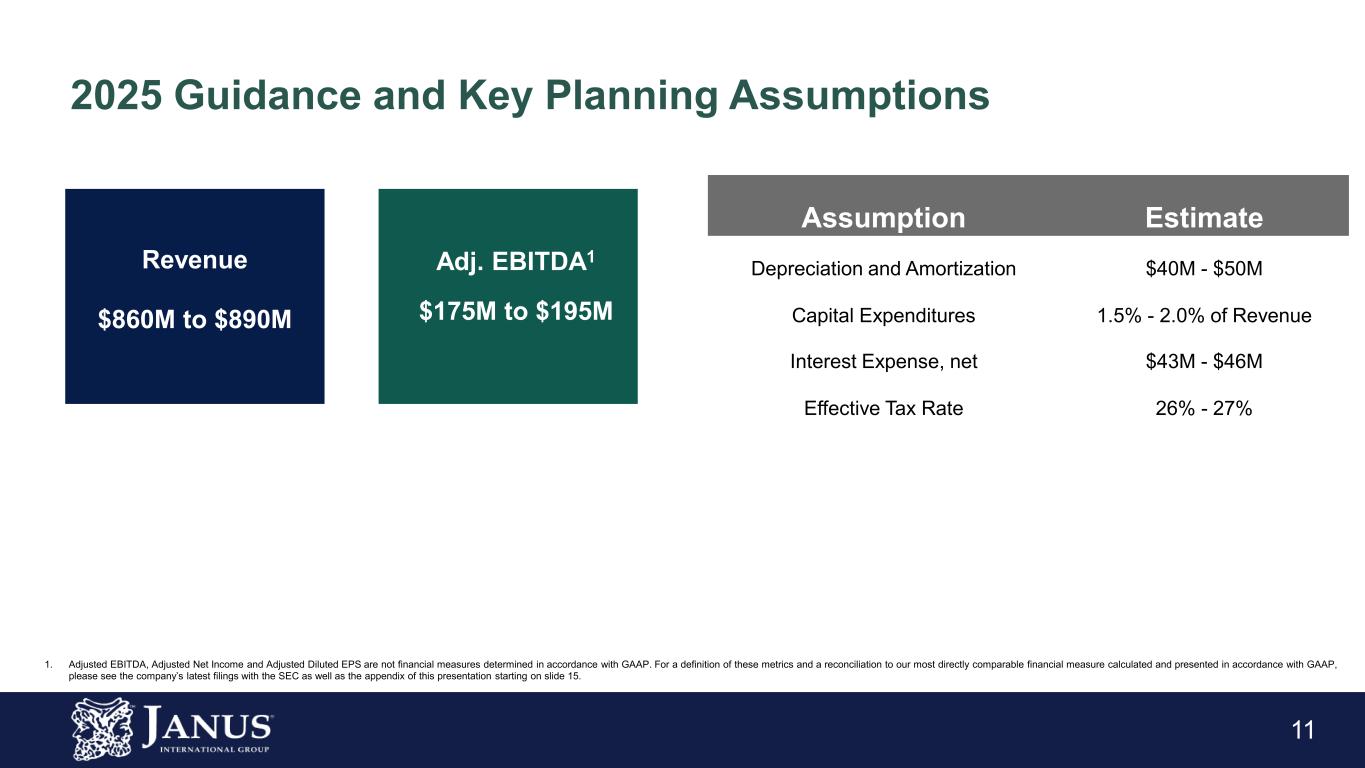

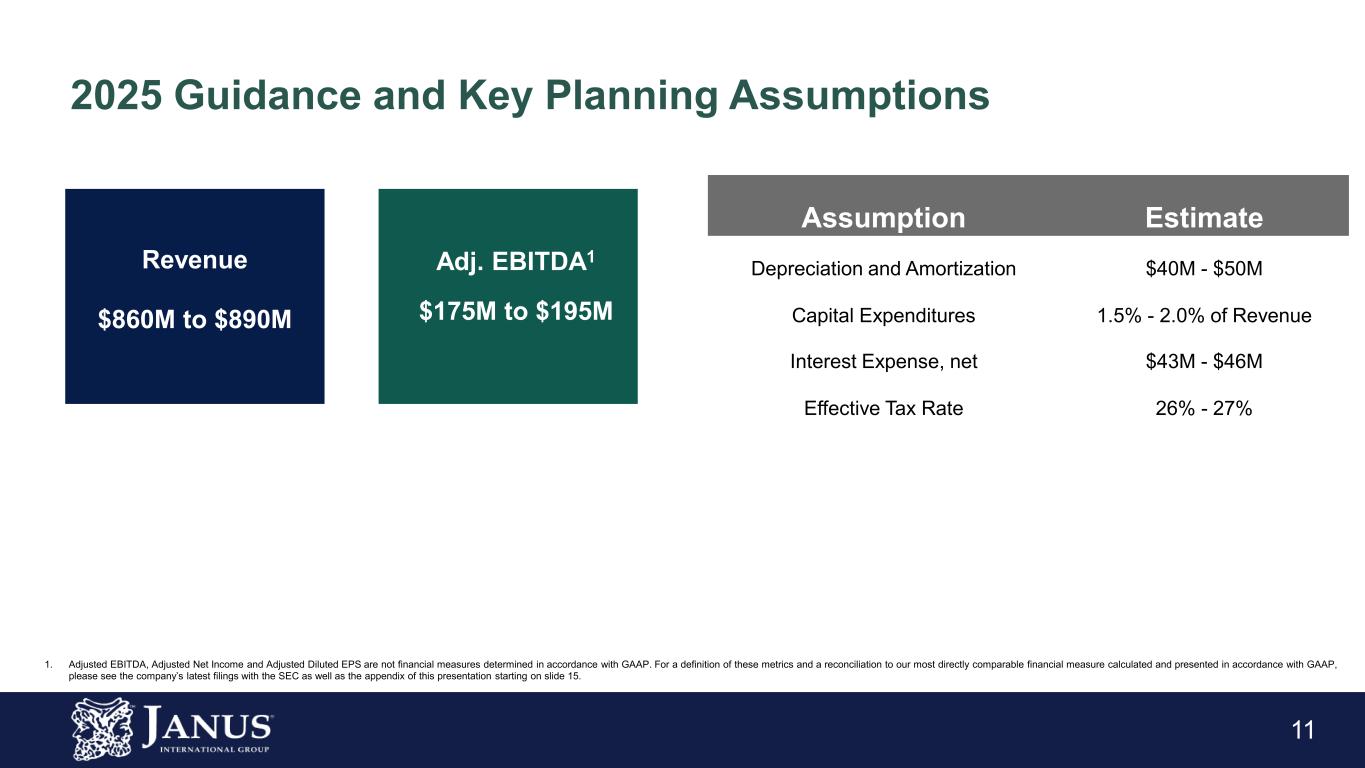

11 2025 Guidance and Key Planning Assumptions Assumption Estimate Depreciation and Amortization $40M - $50M Capital Expenditures 1.5% - 2.0% of Revenue Interest Expense, net $43M - $46M Effective Tax Rate 26% - 27% Revenue $860M to $890M Adj. EBITDA1 $175M to $195M 1. Adjusted EBITDA, Adjusted Net Income and Adjusted Diluted EPS are not financial measures determined in accordance with GAAP. For a definition of these metrics and a reconciliation to our most directly comparable financial measure calculated and presented in accordance with GAAP, please see the company’s latest filings with the SEC as well as the appendix of this presentation starting on slide 15.

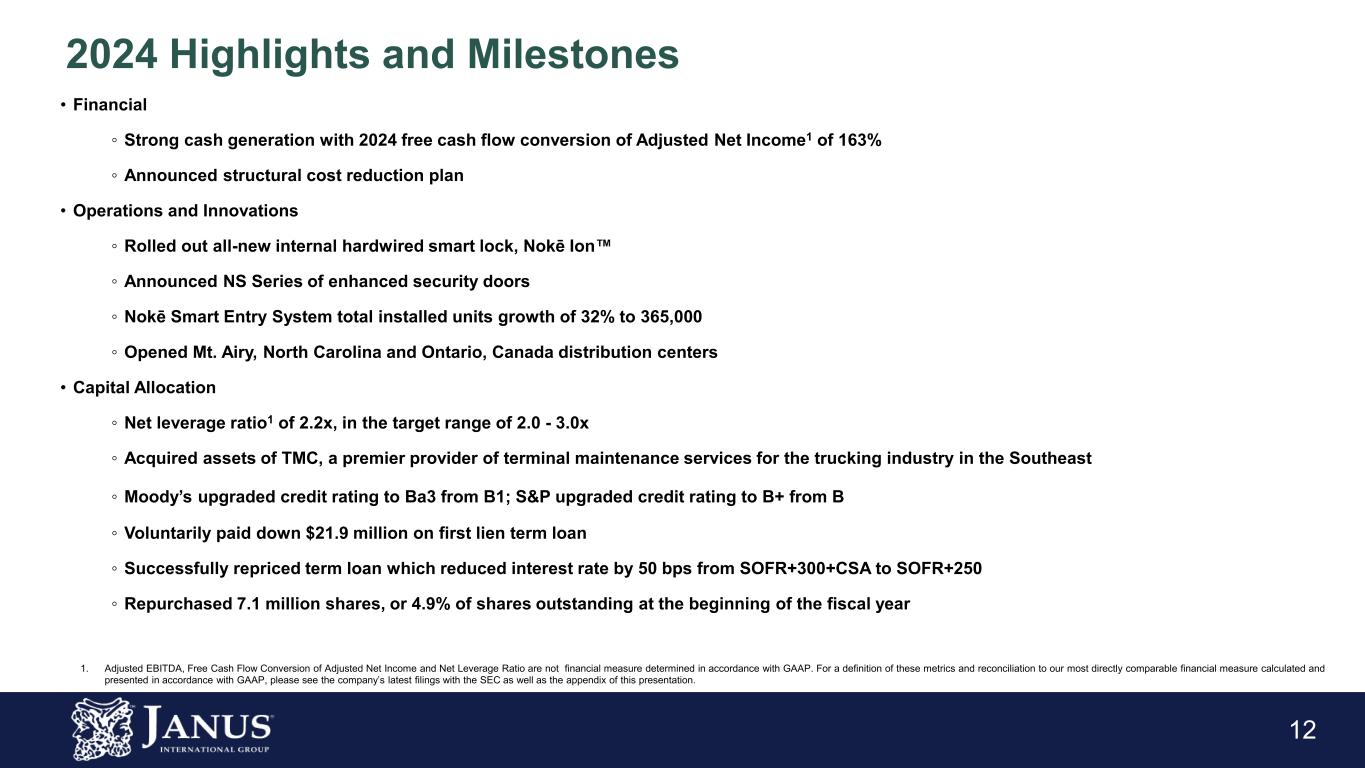

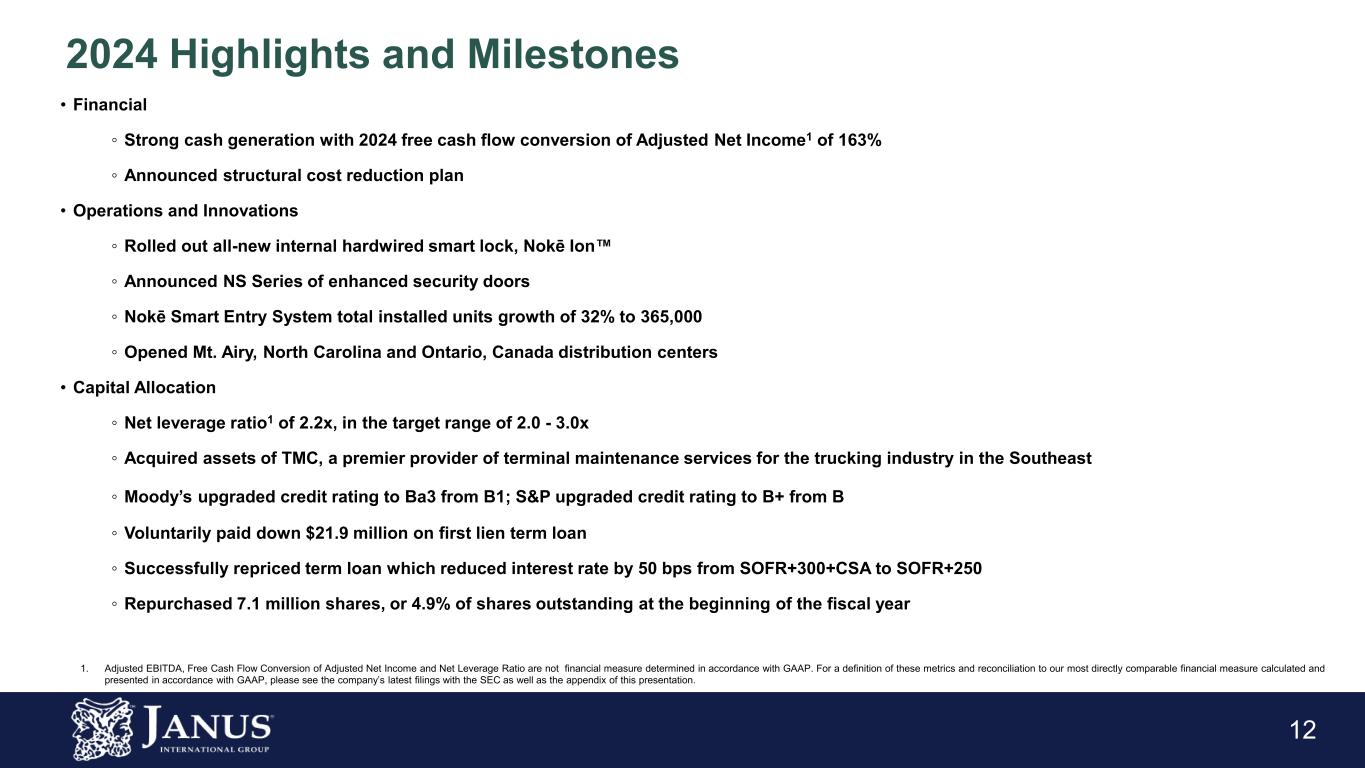

12 • Financial ◦ Strong cash generation with 2024 free cash flow conversion of Adjusted Net Income1 of 163% ◦ Announced structural cost reduction plan • Operations and Innovations ◦ Rolled out all-new internal hardwired smart lock, Nokē Ion ◦ Announced NS Series of enhanced security doors ◦ Nokē Smart Entry System total installed units growth of 32% to 365,000 ◦ Opened Mt. Airy, North Carolina and Ontario, Canada distribution centers • Capital Allocation ◦ Net leverage ratio1 of 2.2x, in the target range of 2.0 - 3.0x ◦ Acquired assets of TMC, a premier provider of terminal maintenance services for the trucking industry in the Southeast ◦ Moody’s upgraded credit rating to Ba3 from B1; S&P upgraded credit rating to B+ from B ◦ Voluntarily paid down $21.9 million on first lien term loan ◦ Successfully repriced term loan which reduced interest rate by 50 bps from SOFR+300+CSA to SOFR+250 ◦ Repurchased 7.1 million shares, or 4.9% of shares outstanding at the beginning of the fiscal year 2024 Highlights and Milestones 1. Adjusted EBITDA, Free Cash Flow Conversion of Adjusted Net Income and Net Leverage Ratio are not financial measure determined in accordance with GAAP. For a definition of these metrics and reconciliation to our most directly comparable financial measure calculated and presented in accordance with GAAP, please see the company’s latest filings with the SEC as well as the appendix of this presentation.

1313 Industry Leader in Well- Structured Market Sustainable Demand Drivers Self-Storage facility demand driven by recurring life events • Dislocation, disaster, divorce, death decluttering, distribution • Elevated occupancy rates drive new capacity additions • Average age of facilities >20 years drives R3 activity Commercial & Other • Rising growth of eCommerce at the expense of in-person retail Self-Storage (New Construction and R3): • Provider of end-to-end solutions, from early design throughout facility life • On-time delivery, efficient installation, best-in- class service and high quality products differentiate Janus from competitors • Nokē Smart Entry Systems enhance physical security, and automate operational processes Commercial & Other: • Opportunity to increase share in growing market for commercial doors • eCommerce driving conversion of existing brick and mortar to warehousing and distribution Long-Term Fundamentals and Investment Overview Multi-Faceted Strategy Driving Long-Term Growth Further Penetration of Self-Storage • Leverage differentiated R3 capabilities to target highly fragmented self-storage market Adoption of Access Control Technology • Introduction of Nokē Ion to drive further penetration into self-storage Increase Share in Commercial Market • Leverage scale and footprint to take share in fragmented market Pursue Strategic, Accretive Acquisitions • Continue to execute on strategic M&A to expand product and solutions offering Source: Janus Management and Industry Reports

14 Appendix

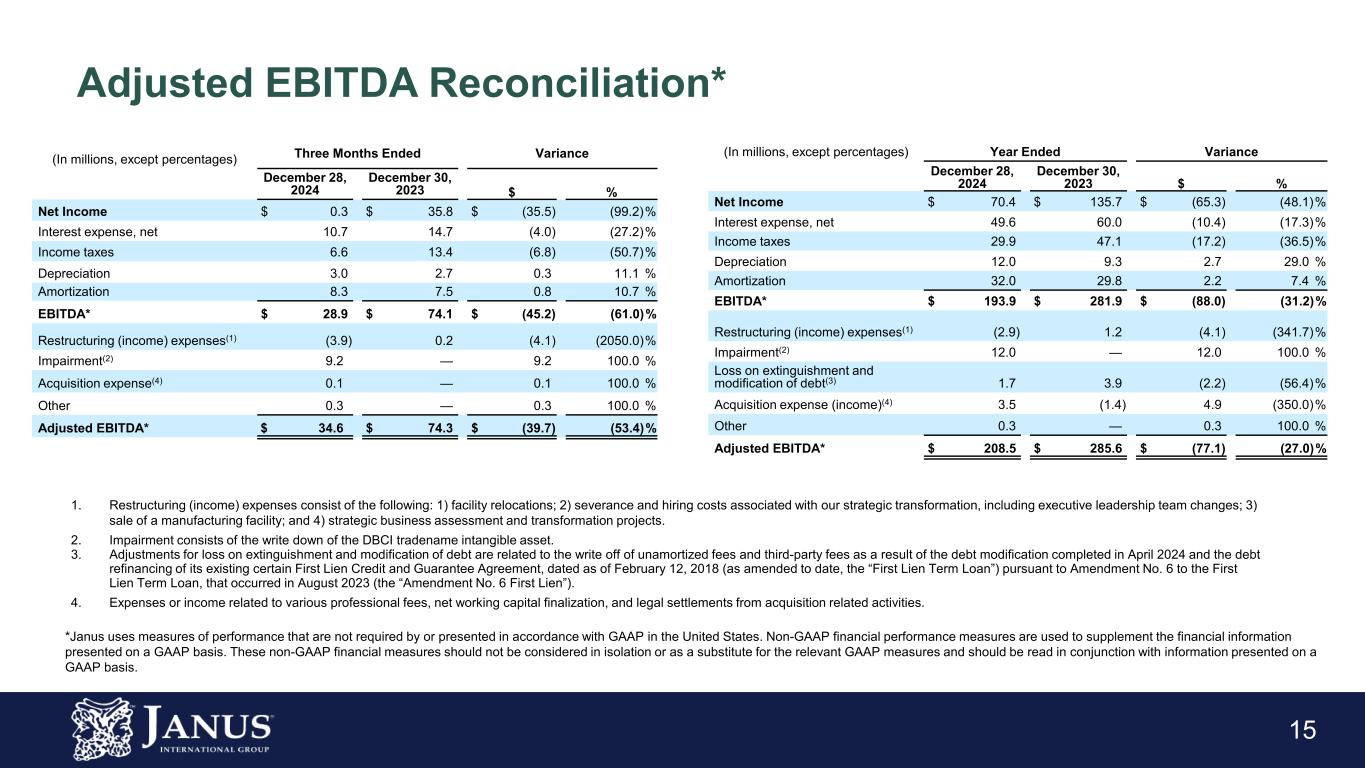

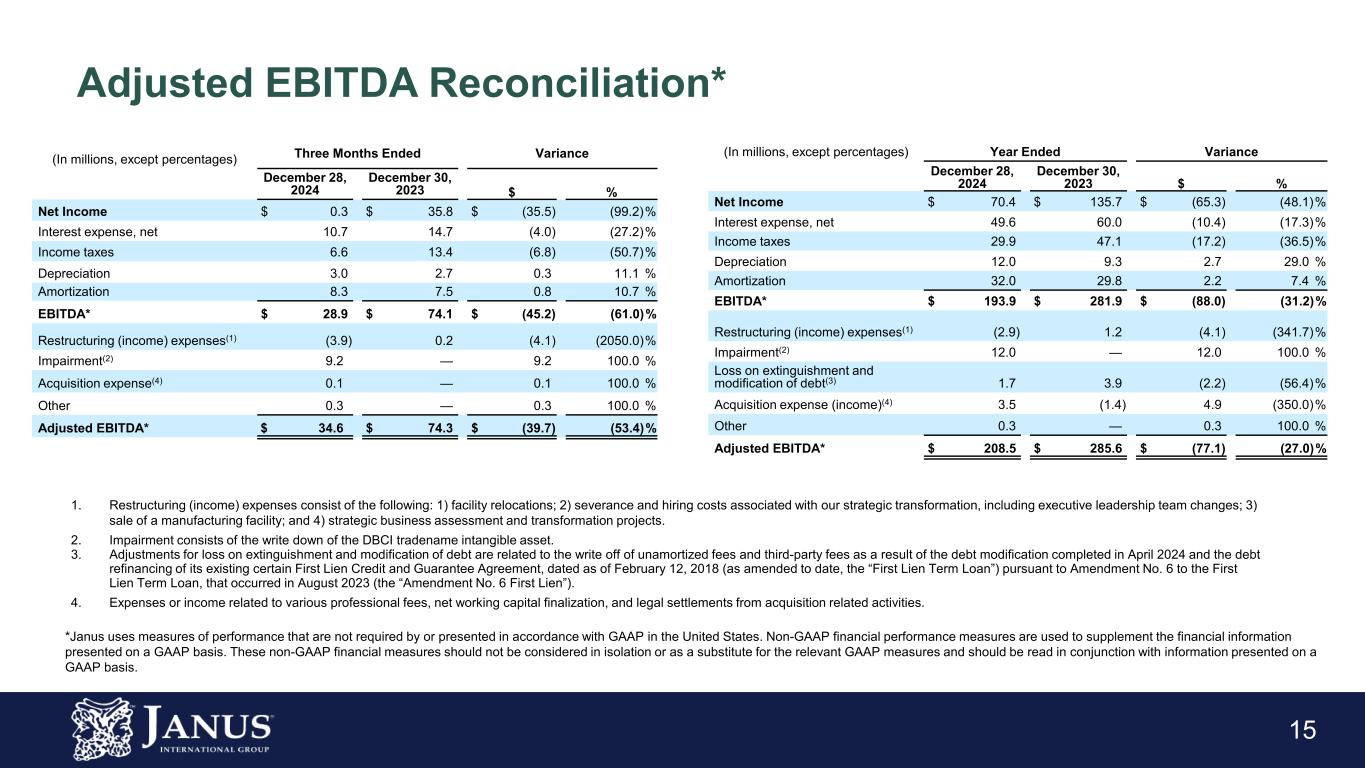

15 Adjusted EBITDA Reconciliation* (In millions, except percentages) Three Months Ended Variance December 28, 2024 December 30, 2023 $ % Net Income $ 0.3 $ 35.8 $ (35.5) (99.2)% Interest expense, net 10.7 14.7 (4.0) (27.2)% Income taxes 6.6 13.4 (6.8) (50.7)% Depreciation 3.0 2.7 0.3 11.1 % Amortization 8.3 7.5 0.8 10.7 % EBITDA* $ 28.9 $ 74.1 $ (45.2) (61.0)% Restructuring (income) expenses(1) (3.9) 0.2 (4.1) (2050.0)% Impairment(2) 9.2 — 9.2 100.0 % Acquisition expense(4) 0.1 — 0.1 100.0 % Other 0.3 — 0.3 100.0 % Adjusted EBITDA* $ 34.6 $ 74.3 $ (39.7) (53.4)% (In millions, except percentages) Year Ended Variance December 28, 2024 December 30, 2023 $ % Net Income $ 70.4 $ 135.7 $ (65.3) (48.1)% Interest expense, net 49.6 60.0 (10.4) (17.3)% Income taxes 29.9 47.1 (17.2) (36.5)% Depreciation 12.0 9.3 2.7 29.0 % Amortization 32.0 29.8 2.2 7.4 % EBITDA* $ 193.9 $ 281.9 $ (88.0) (31.2)% Restructuring (income) expenses(1) (2.9) 1.2 (4.1) (341.7)% Impairment(2) 12.0 — 12.0 100.0 % Loss on extinguishment and modification of debt(3) 1.7 3.9 (2.2) (56.4)% Acquisition expense (income)(4) 3.5 (1.4) 4.9 (350.0)% Other 0.3 — 0.3 100.0 % Adjusted EBITDA* $ 208.5 $ 285.6 $ (77.1) (27.0)% *Janus uses measures of performance that are not required by or presented in accordance with GAAP in the United States. Non-GAAP financial performance measures are used to supplement the financial information presented on a GAAP basis. These non-GAAP financial measures should not be considered in isolation or as a substitute for the relevant GAAP measures and should be read in conjunction with information presented on a GAAP basis. 1. Restructuring (income) expenses consist of the following: 1) facility relocations; 2) severance and hiring costs associated with our strategic transformation, including executive leadership team changes; 3) sale of a manufacturing facility; and 4) strategic business assessment and transformation projects. 2. Impairment consists of the write down of the DBCI tradename intangible asset. 3. Adjustments for loss on extinguishment and modification of debt are related to the write off of unamortized fees and third-party fees as a result of the debt modification completed in April 2024 and the debt refinancing of its existing certain First Lien Credit and Guarantee Agreement, dated as of February 12, 2018 (as amended to date, the “First Lien Term Loan”) pursuant to Amendment No. 6 to the First Lien Term Loan, that occurred in August 2023 (the “Amendment No. 6 First Lien”). 4. Expenses or income related to various professional fees, net working capital finalization, and legal settlements from acquisition related activities.

16 Non-GAAP Adjusted Net Income Reconciliation* 1. Refer to the Adjusted EBITDA table above for detailed breakout of adjustment items. 2. Tax effected for the net income adjustments. Effective tax rates of 29.8% and 25.8% were used for the periods ended December 28, 2024 and December 30, 2023, respectively. 3. Prior year adjustments for the three months ended December 28, 2024 includes a tax correction of $3.4. For the twelve months ended December 28, 2024 prior year adjustments includes a tax correction of $3.4 partially offset by a reduction in service cost of revenues of $1.9, net of tax. (In millions) Three Months Ended Year Ended December 28, 2024 December 30, 2023 December 28, 2024 December 30, 2023 Net Income $ 0.3 $ 35.8 $ 70.4 $ 135.7 Net Income Adjustments1 5.7 0.2 14.6 3.7 Tax Effect on Net Income Adjustments2 (1.7) (0.1) (4.4) (1.0) Prior Year Adjustments3 3.4 — 1.5 — Non-GAAP Adjusted Net Income* $ 7.7 $ 35.9 $ 82.1 $ 138.4 *Janus uses measures of performance that are not required by or presented in accordance with GAAP in the United States. Non-GAAP financial performance measures are used to supplement the financial information presented on a GAAP basis. These non-GAAP financial measures should not be considered in isolation or as a substitute for the relevant GAAP measures and should be read in conjunction with information presented on a GAAP basis.

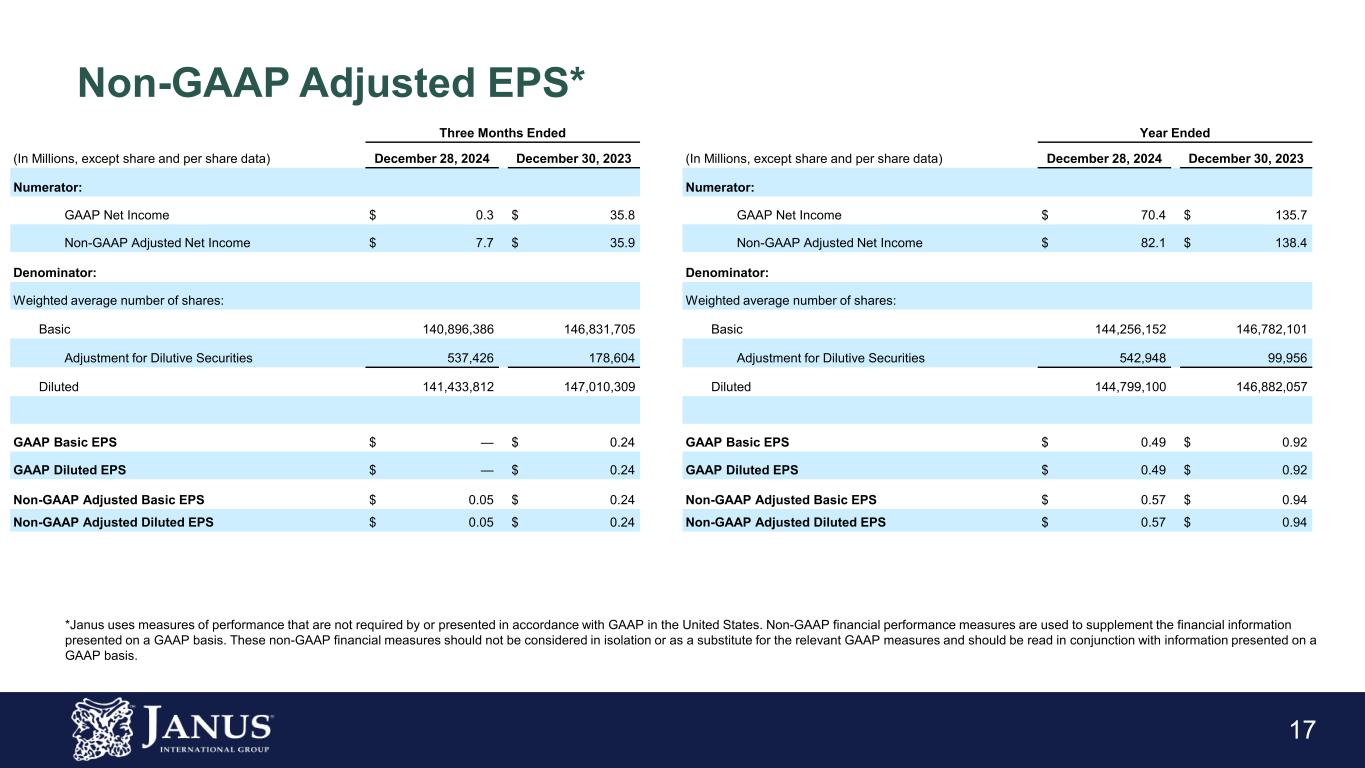

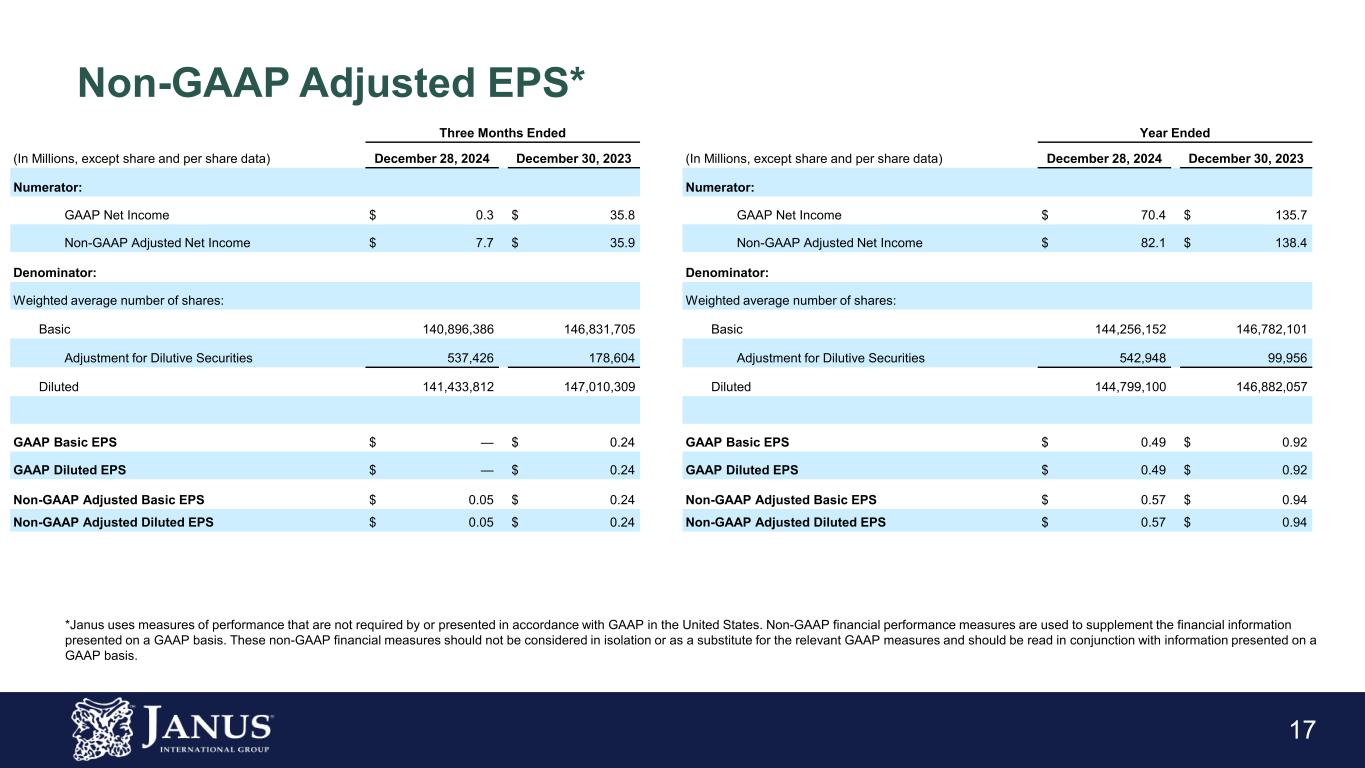

17 Non-GAAP Adjusted EPS* Three Months Ended (In Millions, except share and per share data) December 28, 2024 December 30, 2023 Numerator: GAAP Net Income $ 0.3 $ 35.8 Non-GAAP Adjusted Net Income $ 7.7 $ 35.9 Denominator: Weighted average number of shares: Basic 140,896,386 146,831,705 Adjustment for Dilutive Securities 537,426 178,604 Diluted 141,433,812 147,010,309 GAAP Basic EPS $ — $ 0.24 GAAP Diluted EPS $ — $ 0.24 Non-GAAP Adjusted Basic EPS $ 0.05 $ 0.24 Non-GAAP Adjusted Diluted EPS $ 0.05 $ 0.24 Year Ended (In Millions, except share and per share data) December 28, 2024 December 30, 2023 Numerator: GAAP Net Income $ 70.4 $ 135.7 Non-GAAP Adjusted Net Income $ 82.1 $ 138.4 Denominator: Weighted average number of shares: Basic 144,256,152 146,782,101 Adjustment for Dilutive Securities 542,948 99,956 Diluted 144,799,100 146,882,057 GAAP Basic EPS $ 0.49 $ 0.92 GAAP Diluted EPS $ 0.49 $ 0.92 Non-GAAP Adjusted Basic EPS $ 0.57 $ 0.94 Non-GAAP Adjusted Diluted EPS $ 0.57 $ 0.94 *Janus uses measures of performance that are not required by or presented in accordance with GAAP in the United States. Non-GAAP financial performance measures are used to supplement the financial information presented on a GAAP basis. These non-GAAP financial measures should not be considered in isolation or as a substitute for the relevant GAAP measures and should be read in conjunction with information presented on a GAAP basis.

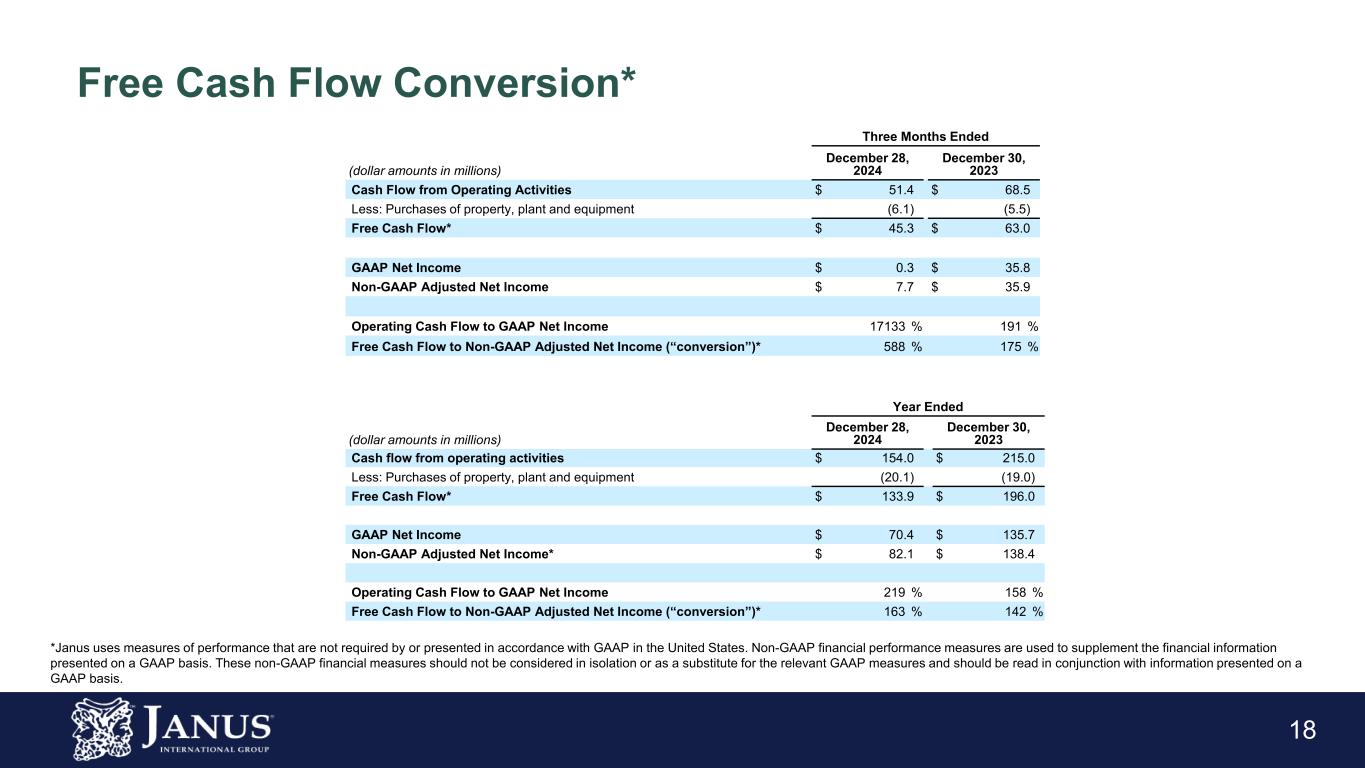

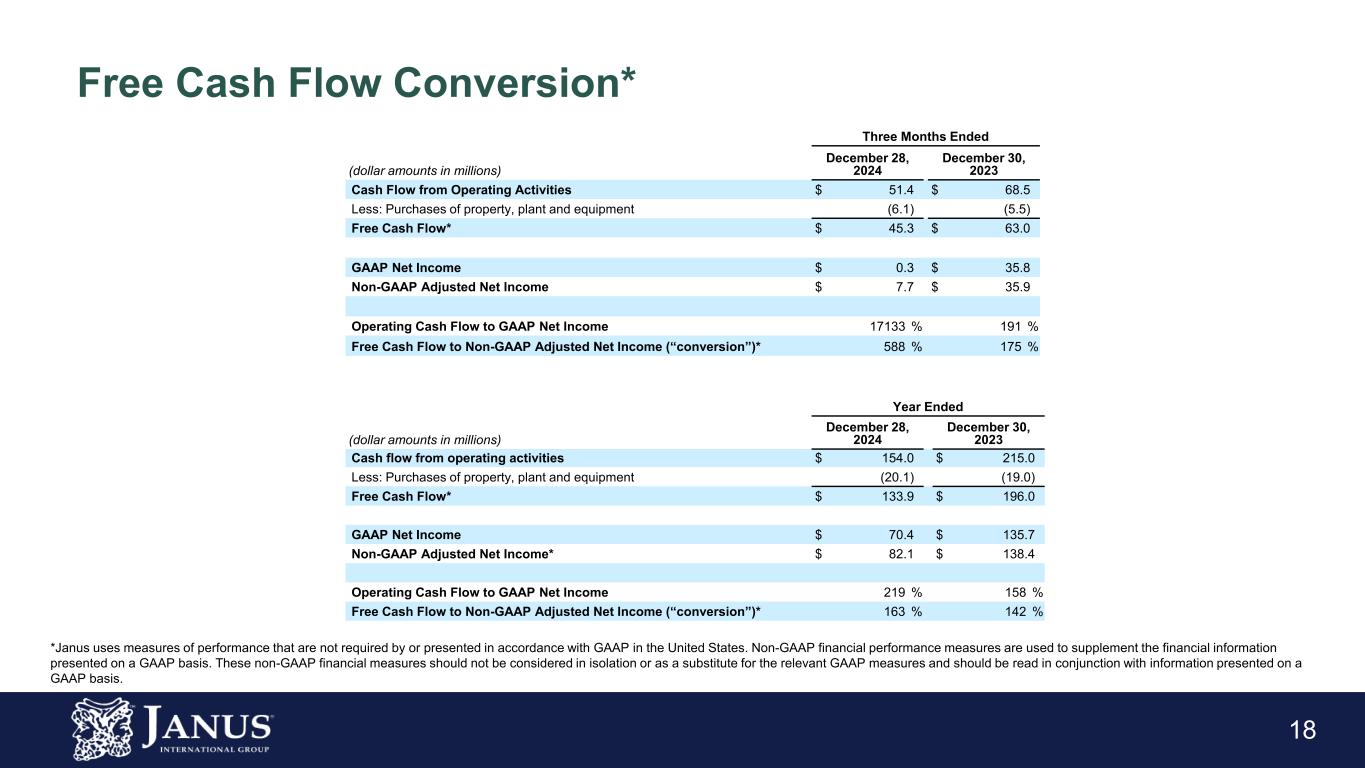

18 Free Cash Flow Conversion* Year Ended (dollar amounts in millions) December 28, 2024 December 30, 2023 Cash flow from operating activities $ 154.0 $ 215.0 Less: Purchases of property, plant and equipment (20.1) (19.0) Free Cash Flow* $ 133.9 $ 196.0 GAAP Net Income $ 70.4 $ 135.7 Non-GAAP Adjusted Net Income* $ 82.1 $ 138.4 Operating Cash Flow to GAAP Net Income 219 % 158 % Free Cash Flow to Non-GAAP Adjusted Net Income (“conversion”)* 163 % 142 % Three Months Ended (dollar amounts in millions) December 28, 2024 December 30, 2023 Cash Flow from Operating Activities $ 51.4 $ 68.5 Less: Purchases of property, plant and equipment (6.1) (5.5) Free Cash Flow* $ 45.3 $ 63.0 GAAP Net Income $ 0.3 $ 35.8 Non-GAAP Adjusted Net Income $ 7.7 $ 35.9 Operating Cash Flow to GAAP Net Income 17133 % 191 % Free Cash Flow to Non-GAAP Adjusted Net Income (“conversion”)* 588 % 175 % *Janus uses measures of performance that are not required by or presented in accordance with GAAP in the United States. Non-GAAP financial performance measures are used to supplement the financial information presented on a GAAP basis. These non-GAAP financial measures should not be considered in isolation or as a substitute for the relevant GAAP measures and should be read in conjunction with information presented on a GAAP basis.

19 Net Leverage Ratio* *Janus uses measures of performance that are not required by or presented in accordance with GAAP in the United States. Non-GAAP financial performance measures are used to supplement the financial information presented on a GAAP basis. These non-GAAP financial measures should not be considered in isolation or as a substitute for the relevant GAAP measures and should be read in conjunction with information presented on a GAAP basis. Year Ended December 28, 2024 December 30, 2023 Note payable - First Lien $ 598.5 $ 623.4 Less: Cash 149.3 171.7 Net Debt* $ 449.2 $ 451.7 Net Income $ 70.4 $ 135.7 Adjusted EBITDA $ 208.5 $ 285.6 Long-Term Debt to Net Income 8.5 4.6 Non-GAAP Net Leverage Ratio* 2.2 1.6 (In millions)