| | | FREE WRITING PROSPECTUS |

| | | FILED PURSUANT TO RULE 433 |

| | | REGISTRATION FILE NO.: 333-226486-18 |

| | | |

Free Writing Prospectus

Structural and Collateral Term Sheet

$905,186,404

(Approximate Initial Pool Balance)

BANK 2021-BNK31

as Issuing Entity

Wells Fargo Commercial Mortgage Securities, Inc.

as Depositor

Wells Fargo Bank, National Association

Morgan Stanley Mortgage Capital Holdings LLC

Bank of America, National Association

National Cooperative Bank, N.A.

as Sponsors and Mortgage Loan Sellers

Commercial Mortgage Pass-Through Certificates

Series 2021-BNK31

January 21, 2021

| WELLS FARGO SECURITIES | BofA SECURITIES | MORGAN STANLEY |

Co-Lead Manager and Joint Bookrunner | Co-Lead Manager and Joint Bookrunner | Co-Lead Manager and Joint Bookrunner |

Academy Securities, Inc. Co-Manager | | Drexel Hamilton Co-Manager |

STATEMENT REGARDING THIS FREE WRITING PROSPECTUS

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (‘‘SEC’’) (SEC File No. 333-226486) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the depositor, any underwriter, or any dealer participating in the offering will arrange to send you the prospectus after filing if you request it by calling toll free 1-800-745-2063 (8 a.m. – 5 p.m. EST) or by emailing wfs.cmbs@wellsfargo.com.

Nothing in this document constitutes an offer of securities for sale in any jurisdiction where the offer or sale is not permitted. The information contained herein is preliminary as of the date hereof, supersedes any such information previously delivered to you and will be superseded by any such information subsequently delivered and ultimately by the final prospectus relating to the securities. These materials are subject to change, completion, supplement or amendment from time to time.

This free writing prospectus has been prepared by the underwriters for information purposes only and does not constitute, in whole or in part, a prospectus for the purposes of Regulation (EU) 2017/1129 (as amended) and/or Part VI of the Financial Services and Markets Act 2000, as amended, or other offering document.

STATEMENT REGARDING ASSUMPTIONS AS TO SECURITIES, PRICING ESTIMATES AND OTHER INFORMATION

The attached information contains certain tables and other statistical analyses (the “Computational Materials”) which have been prepared in reliance upon information furnished by the Mortgage Loan Sellers. Numerous assumptions were used in preparing the Computational Materials, which may or may not be reflected herein. As such, no assurance can be given as to the Computational Materials’ accuracy, appropriateness or completeness in any particular context; or as to whether the Computational Materials and/or the assumptions upon which they are based reflect present market conditions or future market performance. The Computational Materials should not be construed as either projections or predictions or as legal, tax, financial or accounting advice. You should consult your own counsel, accountant and other advisors as to the legal, tax, business, financial and related aspects of a purchase of these securities. Any weighted average lives, yields and principal payment periods shown in the Computational Materials are based on prepayment and/or loss assumptions, and changes in such prepayment and/or loss assumptions may dramatically affect such weighted average lives, yields and principal payment periods. In addition, it is possible that prepayments or losses on the underlying assets will occur at rates higher or lower than the rates shown in the attached Computational Materials. The specific characteristics of the securities may differ from those shown in the Computational Materials due to differences between the final underlying assets and the preliminary underlying assets used in preparing the Computational Materials. The principal amount and designation of any security described in the Computational Materials are subject to change prior to issuance. None of Wells Fargo Securities, LLC, BofA Securities, Inc., Morgan Stanley & Co. LLC, Academy Securities, Inc., Drexel Hamilton, LLC or any of their respective affiliates, make any representation or warranty as to the actual rate or timing of payments or losses on any of the underlying assets or the payments or yield on the securities. The information in this presentation is based upon management forecasts and reflects prevailing conditions and management’s views as of this date, all of which are subject to change. In preparing this presentation, we have relied upon and assumed, without independent verification, the accuracy and completeness of all information available from public sources or which was provided to us by or on behalf of the Mortgage Loan Sellers or which was otherwise reviewed by us.

This free writing prospectus contains certain forward-looking statements. If and when included in this free writing prospectus, the words “expects”, “intends”, “anticipates”, “estimates” and analogous expressions and all statements that are not historical facts, including statements about our beliefs or expectations, are intended to identify forward-looking statements. Any forward-looking statements are made subject to risks and uncertainties which could cause actual results to differ materially from those stated. Those risks and uncertainties include, among other things, declines in general economic and business conditions, increased competition, changes in demographics, changes in political and social conditions, regulatory initiatives and changes in customer preferences, many of which are beyond our control and the control of any other person or entity related to this offering. The forward-looking statements made in this free writing prospectus are made as of the date stated on the cover. We have no obligation to update or revise any forward-looking statement.

Wells Fargo Securities is the trade name for the capital markets and investment banking services of Wells Fargo & Company and its subsidiaries, including but not limited to Wells Fargo Securities, LLC, a member of NYSE, FINRA, NFA and SIPC, Wells Fargo Prime Services, LLC, a member of FINRA, NFA and SIPC, and Wells Fargo Bank, N.A. Wells Fargo Securities, LLC and Wells Fargo Prime Services, LLC are distinct entities from affiliated banks and thrifts.

IMPORTANT NOTICE REGARDING THE OFFERED CERTIFICATES

The information herein is preliminary and may be supplemented or amended prior to the time of sale. In addition, the Offered Certificates referred to in these materials and the asset pool backing them are subject to modification or revision (including the possibility that one or more classes of certificates may be split, combined or eliminated at any time prior to issuance or availability of a final prospectus) and are offered on a “when, as and if issued” basis.

The underwriters described in these materials may from time to time perform investment banking services for, or solicit investment banking business from, any company named in these materials. The underwriters and/or their affiliates or respective employees may from time to time have a long or short position in any security or contract discussed in these materials.

The information contained herein supersedes any previous such information delivered to any prospective investor and will be superseded by information delivered to such prospective investor prior to the time of sale.

IMPORTANT NOTICE RELATING TO AUTOMATICALLY-GENERATED EMAIL DISCLAIMERS

Any legends, disclaimers or other notices that may appear at the bottom of any email communication to which this free writing prospectus is attached relating to (1) these materials not constituting an offer (or a solicitation of an offer), (2) any representation that these materials are accurate or complete and may not be updated or (3) these materials possibly being confidential, are not applicable to these materials and should be disregarded. Such legends, disclaimers or other notices have been automatically generated as a result of these materials having been sent via Bloomberg or another system.

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

T-2

| BANK 2021-BNK31 | Transaction Highlights |

I. Transaction Highlights

Mortgage Loan Sellers:

Mortgage Loan Seller | | Number of

Mortgage Loans | | Number of

Mortgaged

Properties | | Aggregate Cut-off Date Balance | | Approx. % of Initial Pool

Balance |

| Wells Fargo Bank, National Association | | 16 | | | 36 | | | $311,413,202 | | | 34.4 | % |

| Morgan Stanley Mortgage Capital Holdings LLC | | 17 | | | 38 | | | 274,568,000 | | | 30.3 | |

| Bank of America, National Association | | 11 | | | 35 | | | 259,652,948 | | | 28.7 | |

| National Cooperative Bank, N.A. | | 17 | | | 17 | | | 59,552,254 | | | 6.6 | |

Total | | 61 | | | 126 | | | $905,186,404 | | | 100.0 | % |

Loan Pool:

| Initial Pool Balance: | $905,186,404 |

| Number of Mortgage Loans: | 61 |

| Average Cut-off Date Balance per Mortgage Loan: | $14,839,121 |

| Number of Mortgaged Properties: | 126 |

| Average Cut-off Date Balance per Mortgaged Property(1): | $7,184,019 |

| Weighted Average Mortgage Interest Rate: | 3.211% |

| Ten Largest Mortgage Loans as % of Initial Pool Balance: | 55.4% |

| Weighted Average Original Term to Maturity or ARD (months): | 120 |

| Weighted Average Remaining Term to Maturity or ARD (months): | 118 |

| Weighted Average Original Amortization Term (months)(2): | 333 |

| Weighted Average Remaining Amortization Term (months)(2): | 332 |

| Weighted Average Seasoning (months): | 2 |

| (1) | Information regarding mortgage loans secured by multiple properties is based on an allocation according to relative appraised values or the allocated loan amounts or property-specific release prices set forth in the related loan documents or such other allocation as the related mortgage loan seller deemed appropriate. |

| (2) | Excludes any mortgage loan that does not amortize. |

Credit Statistics:

| Weighted Average U/W Net Cash Flow DSCR(1): | 3.25x |

| Weighted Average U/W Net Operating Income Debt Yield(1): | 12.1% |

| Weighted Average Cut-off Date Loan-to-Value Ratio(1): | 52.1% |

| Weighted Average Balloon or ARD Loan-to-Value Ratio(1): | 49.1% |

| % of Mortgage Loans with Additional Subordinate Debt(2): | 21.5% |

| % of Mortgage Loans with Single Tenants(3): | 14.1% |

| (1) | With respect to any mortgage loan that is part of a whole loan, loan-to-value ratio, debt service coverage ratio and debt yield calculations include the related pari passu companion loan(s) but exclude any related subordinate companion loan(s) (unless otherwise stated). For mortgaged properties securing residential cooperative mortgage loans, the debt service coverage ratio and debt yield for each such mortgaged property are calculated using U/W Net Operating Income or U/W Net Cash Flow, as applicable, for the related residential cooperative property which is the projected net operating income or net cash flow, as applicable, reflected in the most recent appraisal obtained by or otherwise in the possession of the related mortgage loan seller as of the cut-off date, and the loan-to-value ratio is calculated based upon the appraised value of the residential cooperative property determined as if such residential cooperative property is operated as a residential cooperative, inclusive of the amount of the underlying debt encumbering such residential cooperative property. The debt service coverage ratio, debt yield and loan-to-value ratio information do not take into account any subordinate debt (whether or not secured by the related mortgaged property), that currently exists or is allowed under the terms of any mortgage loan. See “Description of the Mortgage Pool—Mortgage Pool Characteristics” in the Preliminary Prospectus and Annex A-1 to the Preliminary Prospectus. |

| (2) | Fifteen (15) of the mortgage loans, each of which is secured by a residential cooperative property sold to the depositor by National Cooperative Bank, N.A. currently have in place subordinate secured lines of credit to the related mortgage borrowers that permit future advances (such loans, collectively, the “Subordinate Coop LOCs”). The percentage figure expressed as “% of Mortgage Loans with Additional Subordinate Debt” is determined as a percentage of the initial pool balance and does not take into account any future subordinate debt (whether or not secured by the mortgaged property), if any, that may be permitted under the terms of any mortgage loan or the pooling and servicing agreement. See “Description of the Mortgage Pool—Additional Indebtedness—Other Unsecured Indebtedness” and “Description of the Mortgage Pool—Additional Indebtedness—Other Secured Indebtedness—Additional Debt Financing for Mortgage Loans Secured by Residential Cooperatives Sold to the Depositor by National Cooperative Bank, N.A.” in the Preliminary Prospectus. |

| (3) | Excludes mortgage loans that are secured by multiple single tenant properties. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

T-3

| BANK 2021-BNK31 | Transaction Highlights |

III. COVID-19 Considerations

The following table contains information regarding the status of the Mortgage Loans and Mortgaged Properties provided by the respective borrowers as of the date set forth in the “Information As Of Date” column. The information from the borrowers has not been independently verified by the Mortgage Loan Sellers, the Underwriters or any other party, and there can be no assurances that the status of the Mortgage Loans and of the related Mortgaged Properties has not changed since the date in the “Information As Of Date” column. The cumulative effects of the COVID-19 emergency on the global economy may cause tenants to be unable to pay their rent and borrowers to be unable to pay debt service under the Mortgage Loans. As a result, we cannot assure you that the information in the following table is indicative of future performance or that tenants or borrowers will not seek rent or debt service relief (including forbearance arrangements) or other lease or loan modifications in the future. Such actions may lead to shortfalls and losses on the certificates.

Loan Number | Mortgage Loan Seller | Information As Of Date | Origination Date | Mortgage Loan Name | Mortgaged Property Type | November Debt Service Payment Received (Y/N) | December Debt Service Payment Received (Y/N) | January Debt Service Payment Received (Y/N) | Forbearance or Other Debt Service Relief Requested (Y/N) | Other Loan Modification Requested (Y/N) | Lease Modification or Rent Relief Requested (Y/N) | Total SF or Unit Count Making Full December Rent Payment (%)(1) | UW December Base Rent Paid (%) | Total SF or Unit Count Making Full January Rent Payment (%)(1) | UW January Base Rent Paid (%) |

| 1 | WFB | 1/15/2021 | 11/13/2020 | McClellan Park | Industrial | NAP(2) | NAP(2) | Y | N | N | Y(3) | 98.0% | 99.0% | 95.0% | 93.0% |

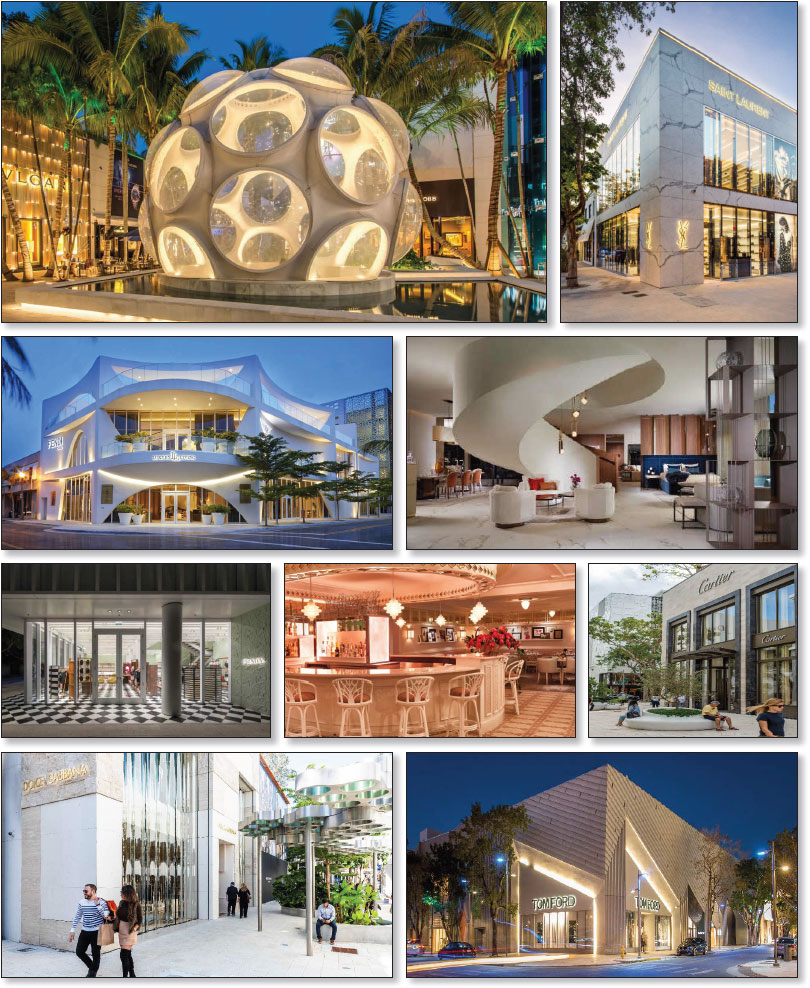

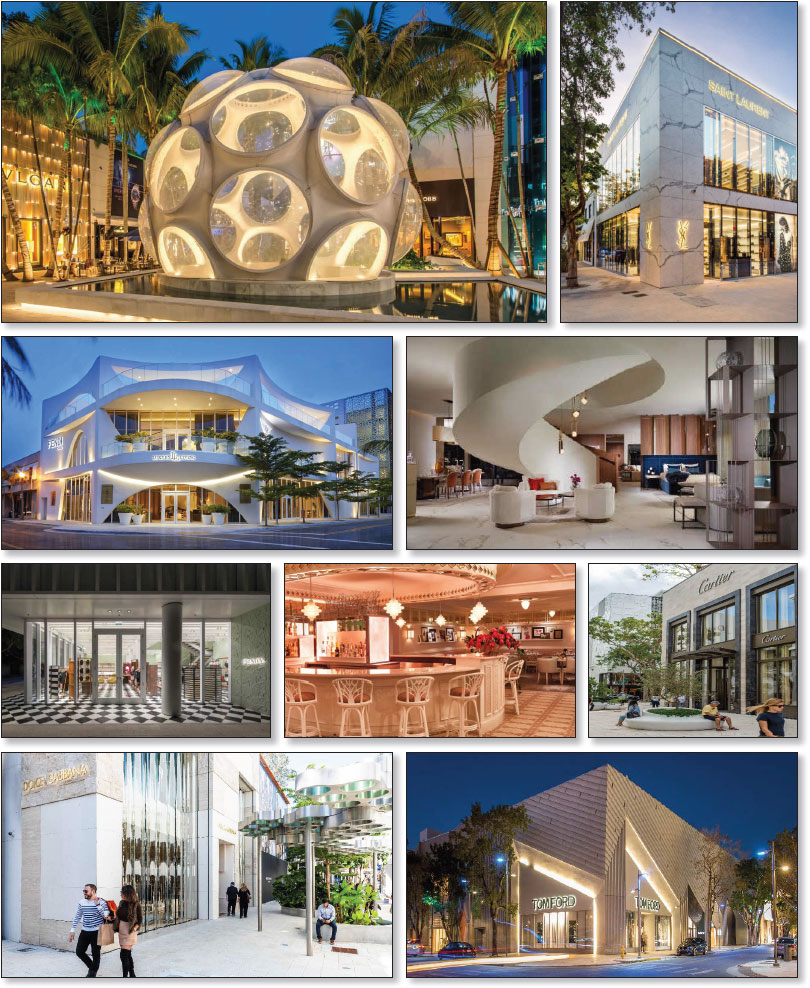

| 2 | BANA | 1/14/2021 | 2/28/2020 | Miami Design District | Retail | Y | Y | Y | Y(4) | Y(4) | Y(5) | 91.3% | 95.6% | 98.9% | 99.0% |

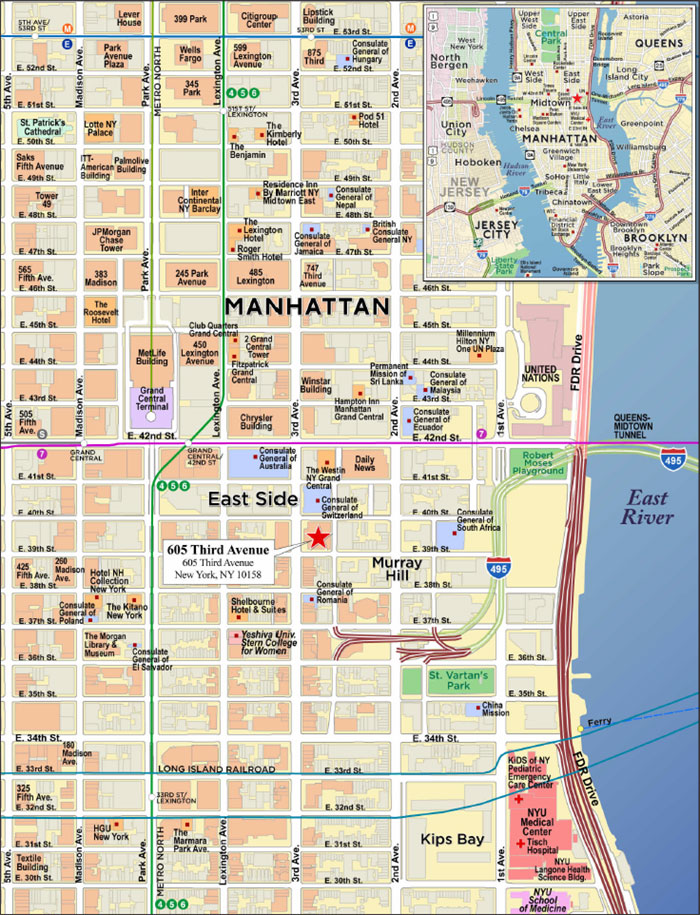

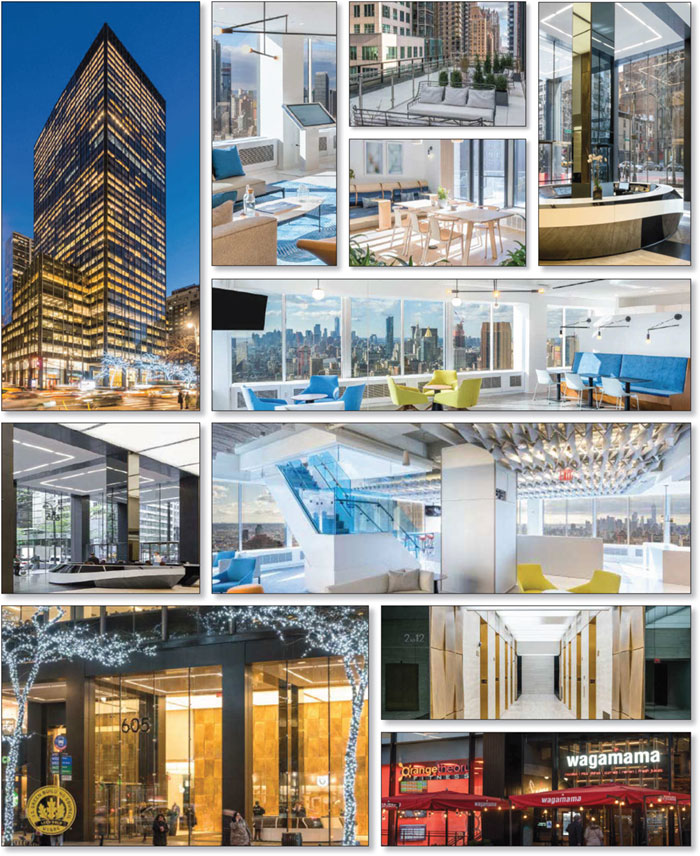

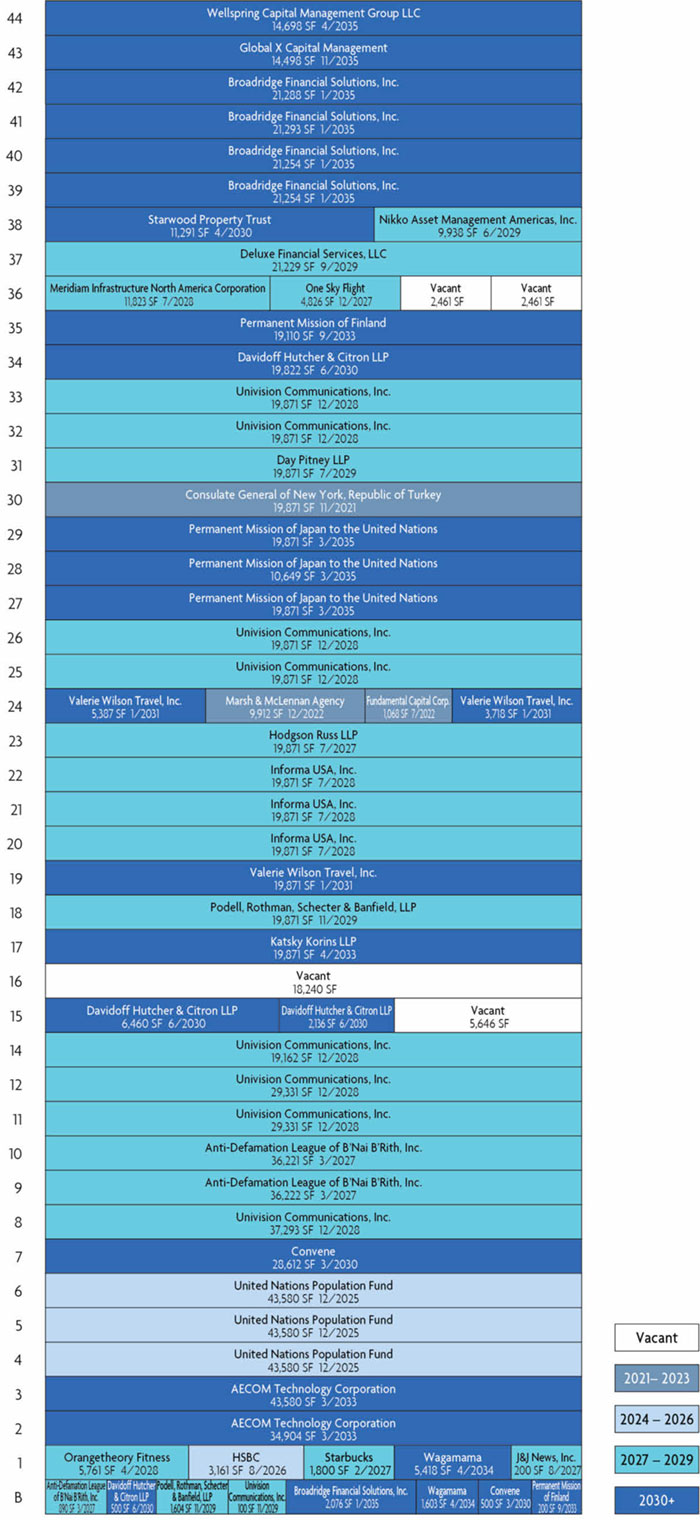

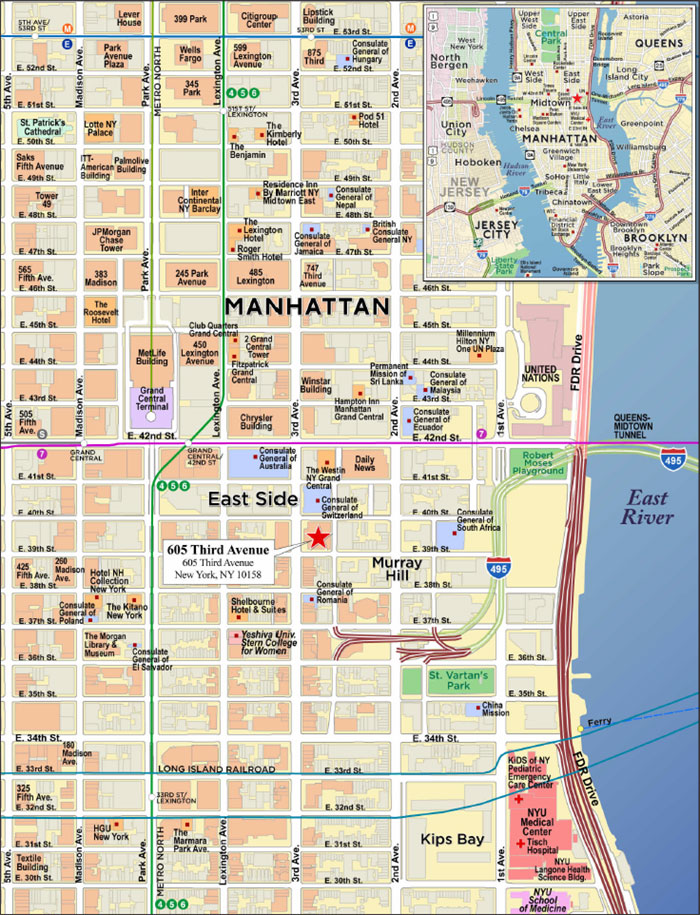

| 3 | MSMCH | 1/5/2021 | 11/20/2020 | 605 Third Avenue | Office | NAP(2) | NAP(2) | Y | N | N | Y(6) | (7) | (7) | (7) | (7) |

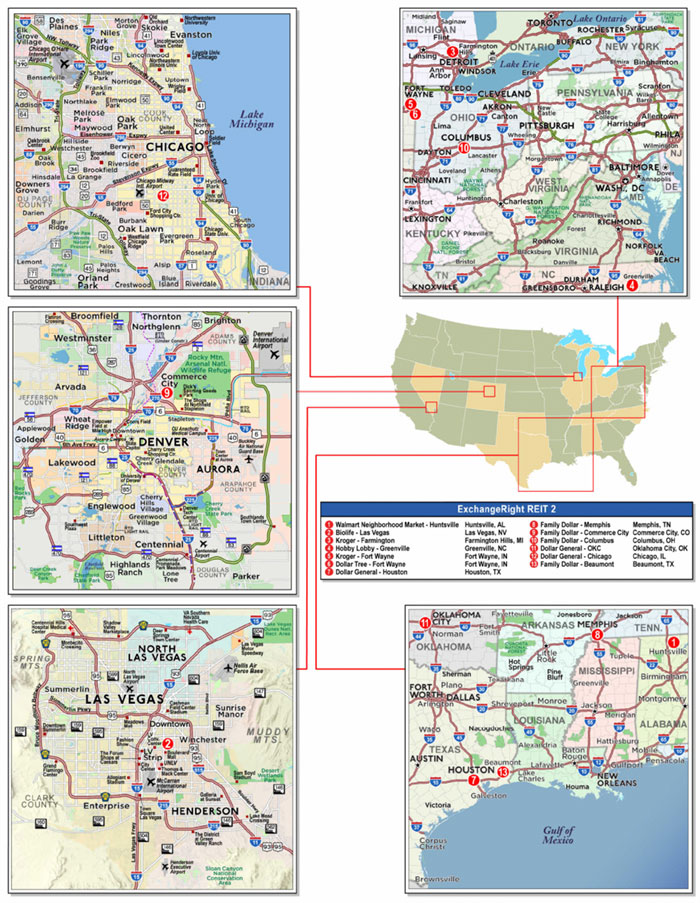

| 4 | BANA | 1/19/2021 | 12/22/2020 | ExchangeRight Net Leased Portfolio #42 | Various | NAP(8) | NAP(8) | NAP(8) | N | N | N | 100.0% | 100.0% | 100.0% | 100.0% |

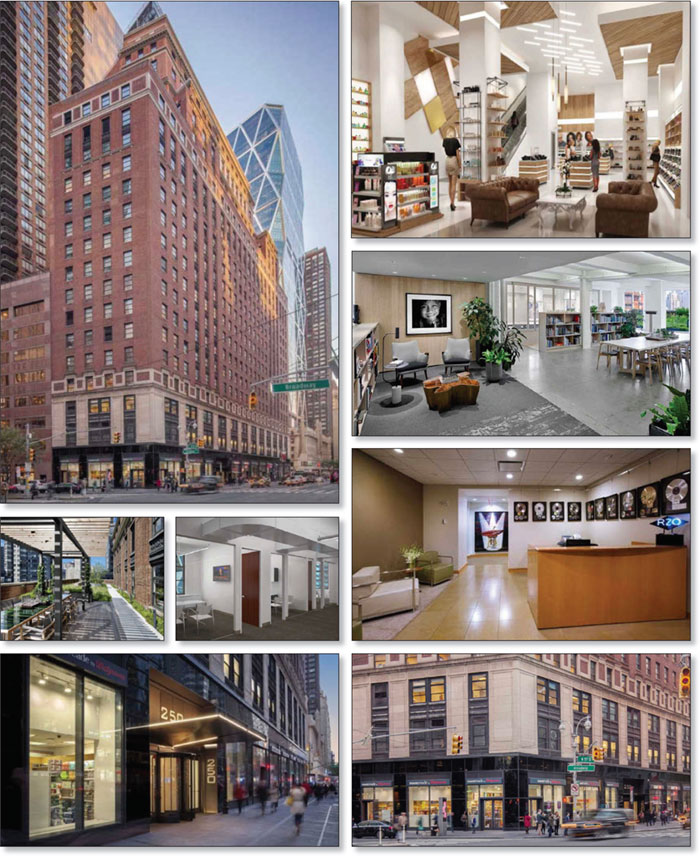

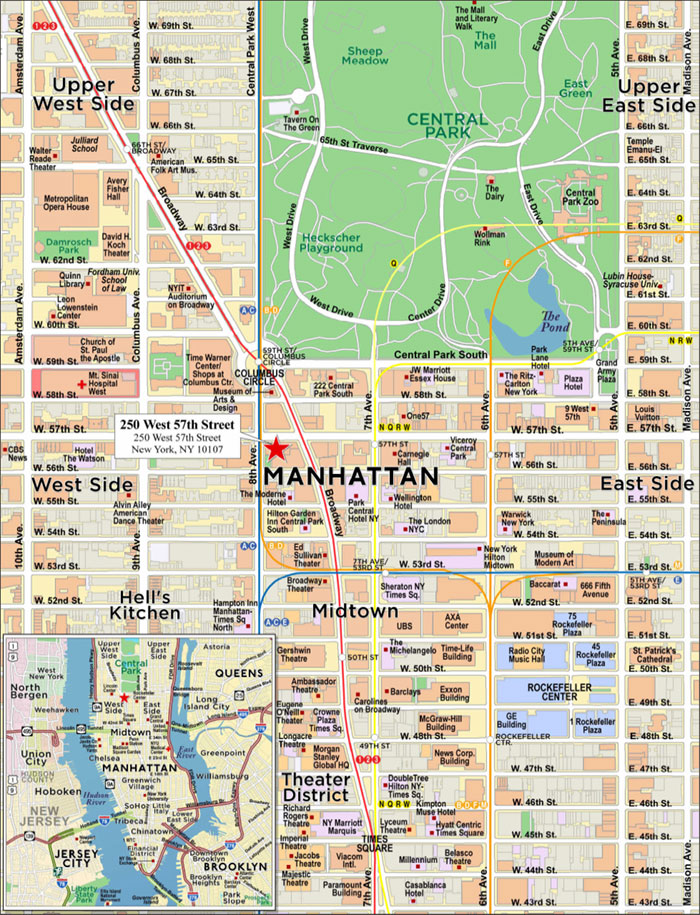

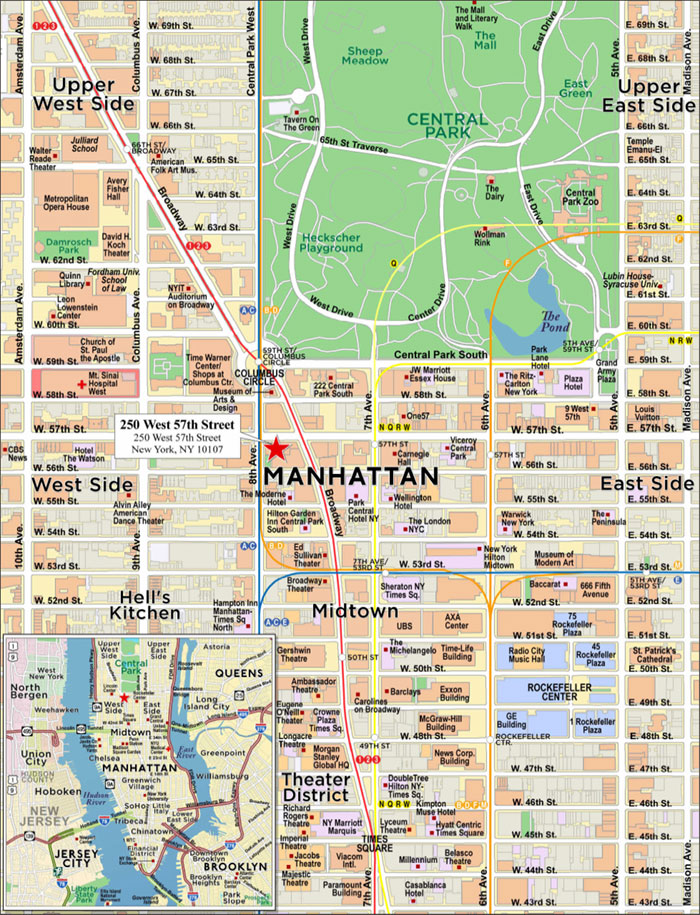

| 5 | MSMCH | 1/20/2021 | 11/12/2020 | 250 West 57th Street | Office | NAP(2) | NAP(2) | Y | N | N | Y(9) | 93.8% | 94.5% | 90.7% | 92.3% |

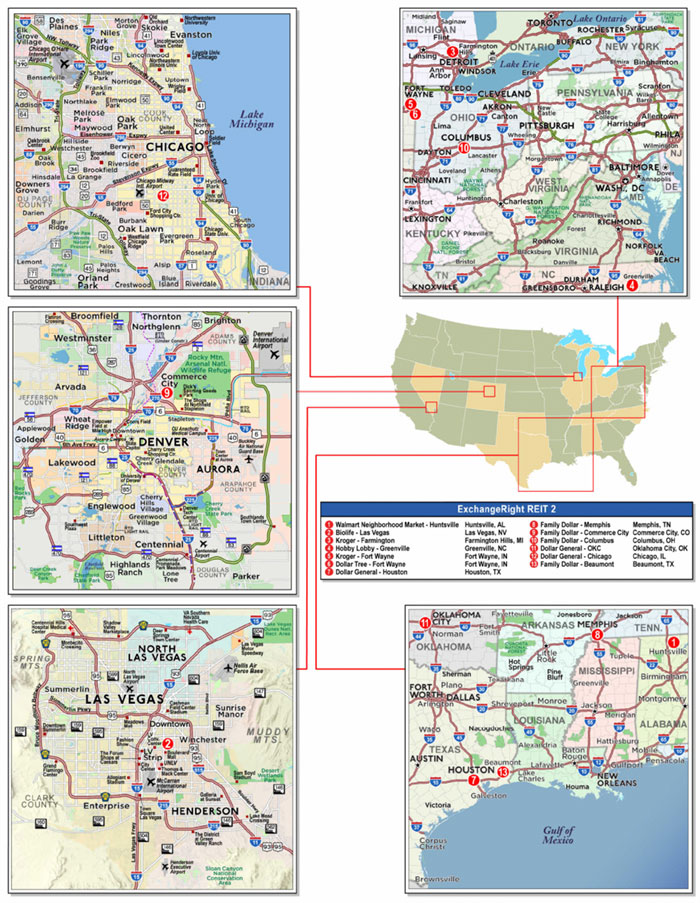

| 6 | WFB | 1/7/2021 | 12/24/2020 | ExchangeRight REIT 2 | Various | NAP(8) | NAP(8) | NAP(8) | N | N | N | 100.0% | 100.0% | 100.0% | 100.0% |

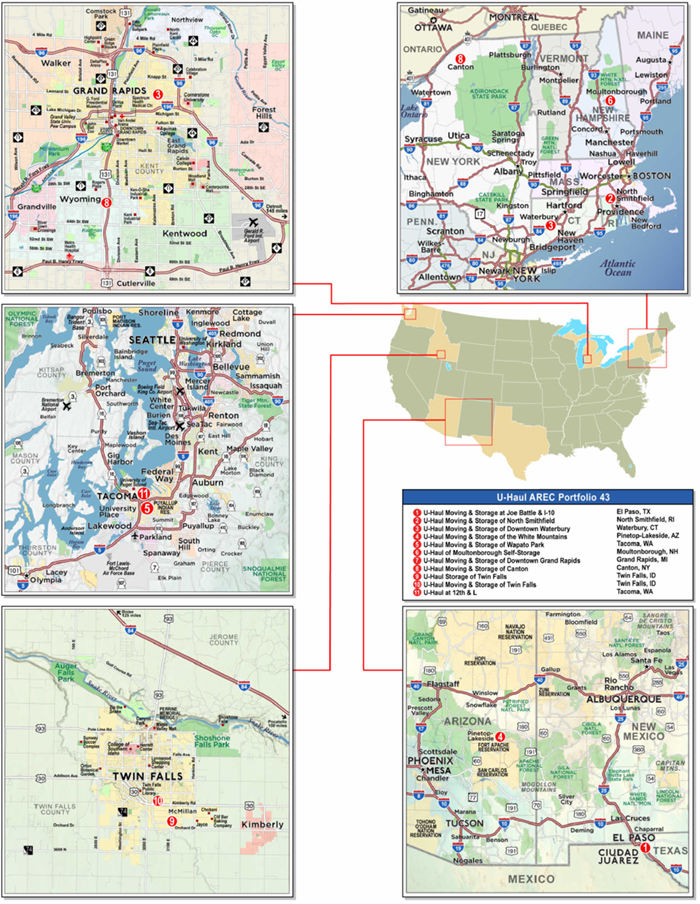

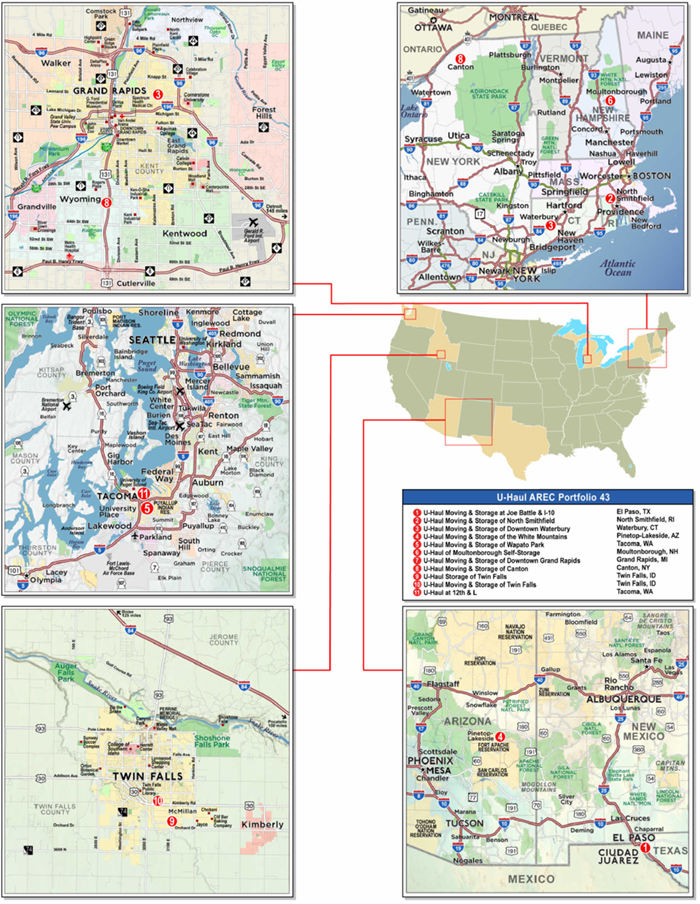

| 7 | BANA | 12/23/2020 | 12/23/2020 | U-Haul AREC Portfolio 43 | Self Storage | NAP(8) | NAP(8) | NAP(8) | N | N | N | (10) | (10) | (10) | (10) |

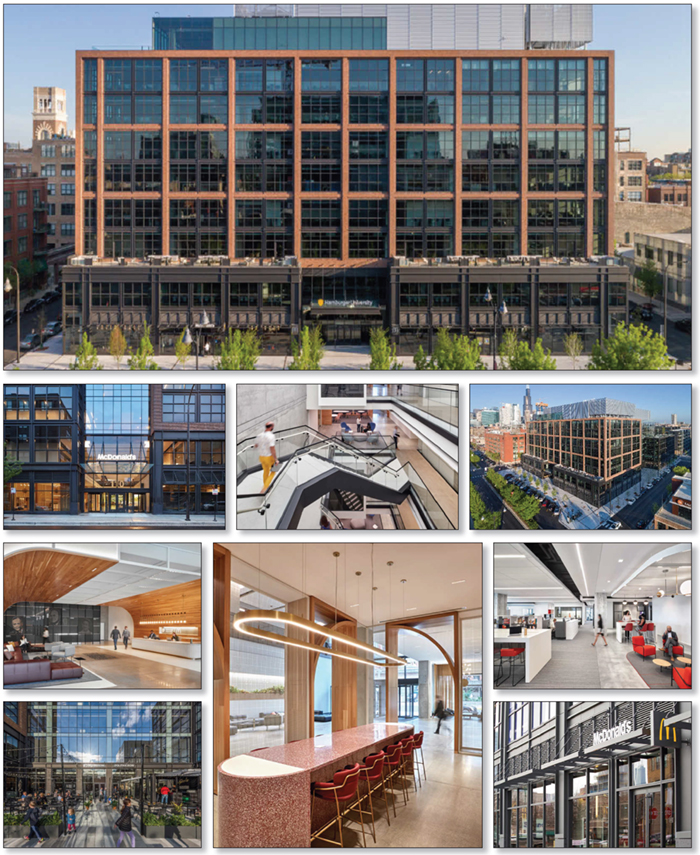

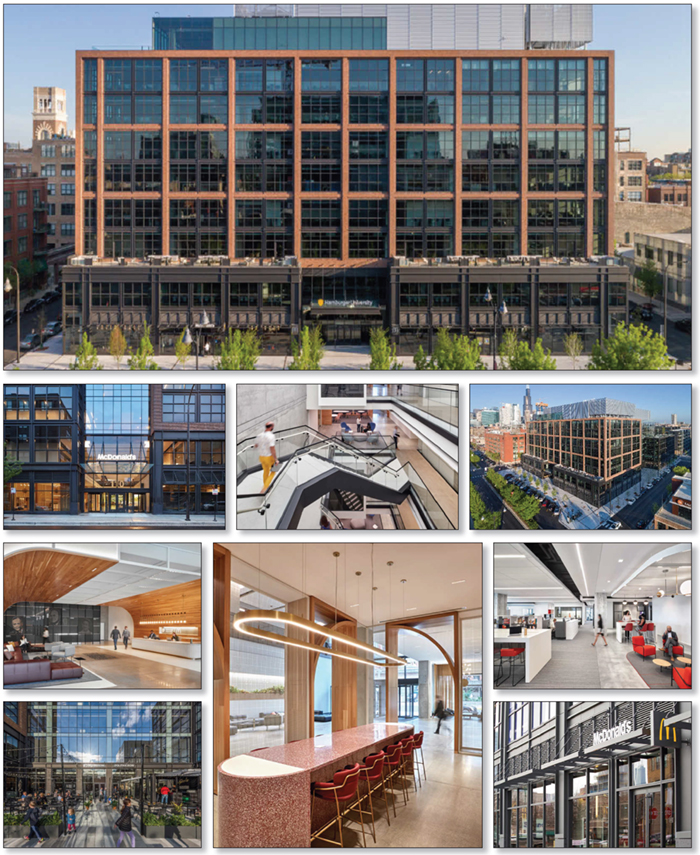

| 8 | BANA | 1/14/2021 | 10/29/2020 | McDonald’s Global HQ | Office | NAP(11) | Y | Y | N | N | Y(12) | 100.0% | 100.0% | 100.0% | 100.0% |

| 9 | WFB | 1/15/2021 | 12/15/2020 | Inland SE Self Storage Portfolio | Self Storage | NAP(8) | NAP(8) | NAP(8) | N | N | N | NAV(13) | 95.0% | NAV(13) | 90.9% |

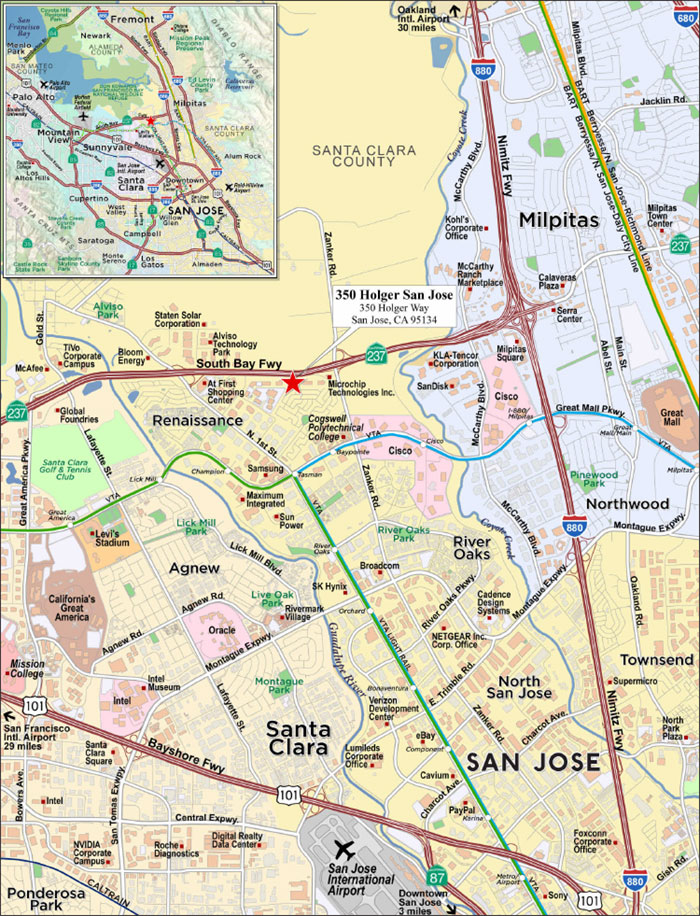

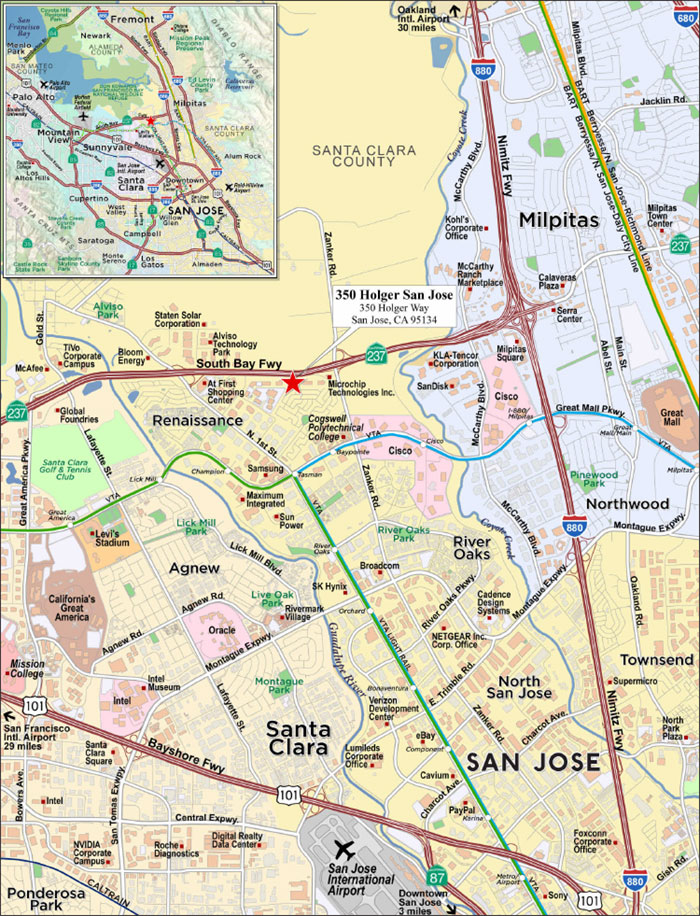

| 10 | WFB | 1/6/2021 | 12/23/2020 | 350 Holger San Jose | Office | NAP(8) | NAP(8) | NAP(8) | N | N | N | 100.0% | 100.0% | 100.0% | 100.0% |

| 11 | MSMCH | 1/4/2021 | 11/24/2020 | ExchangeRight Net Leased Portfolio #41 | Various | NAP(2) | NAP(2) | Y | N | N | N | 100.0% | 100.0% | 100.0% | 100.0% |

| 12 | WFB | 1/11/2021 | 10/30/2020 | Coleman Highline | Office | NAP(11) | Y | Y | N | N | N | 100.0% | 100.0% | 100.0% | 100.0% |

| 13 | MSMCH | 1/14/2021 | 10/27/2020 | Fresh Pond Cambridge | Retail | NAP(11) | Y | Y | N | N | Y(14) | 99.5% | 99.5% | 97.2% | 97.4% |

| 14 | NCB | 1/13/2021 | 12/29/2020 | Holliswood Owners Corp. | Multifamily | NAP(8) | NAP(8) | NAP(8) | N | N | N | 91.6%(15) | NAP(16) | 88.5%(15) | NAP(16) |

| 15 | MSMCH | 1/4/2021 | 11/13/2020 | Harvard West (Roseburg DHS Office) | Office | NAP(2) | NAP(2) | Y | N | N | N | 100.0% | 100.0% | (17) | (17) |

| 16 | MSMCH | 1/11/2021 | 12/23/2020 | 23000 Millcreek Boulevard | Office | NAP(8) | NAP(8) | NAP(8) | N | N | N | 100.0% | 100.0% | 100.0% | 100.0% |

| 17 | BANA | 12/31/2020 | 12/22/2020 | Laguna Hills Self Storage | Self Storage | NAP(8) | NAP(8) | NAP(8) | N | N | N | 99.5% | 97.0% | (17) | (17) |

| 18 | BANA | 1/14/2020 | 1/15/2021 | Newport Court | Industrial | NAP(8) | NAP(8) | NAP(8) | N | N | N | 100.0% | 100.0% | 100.0% | 100.0% |

| 19 | WFB | 1/14/2021 | 12/22/2020 | EZ Storage Southfield Portfolio | Self Storage | NAP(8) | NAP(8) | NAP(8) | N | N | N | 90.1% | 94.9% | (17) | (17) |

| 20 | MSMCH | 1/19/2021 | 1/7/2021 | Naiman Industrial Portfolio | Industrial | NAP(8) | NAP(8) | NAP(8) | N | N | N | 100.0% | 100.0% | 100.0% | 100.0% |

| 21 | WFB | 1/18/2021 | 9/30/2020 | Mission Ridge - CA | Retail | Y | Y | Y | N | N | Y(18) | 94.7%(19) | 98.2% | 90.8%(19) | 92.1% |

| 22 | WFB | 1/15/2021 | 12/23/2020 | All Aboard - 4 Property Portfolio | Various | NAP(8) | NAP(8) | NAP(8) | N | N | N | 95.4%(20) | 94.1%(20) | 95.4%(20) | 94.2%(20) |

| 23 | WFB | 1/20/2021 | 1/20/2021 | C.C. Filson World Headquarters | Office | NAP(8) | NAP(8) | NAP(8) | N | N | N | 100.0% | 100.0% | 100.0% | 100.0% |

| 24 | WFB | 1/13/2021 | 12/17/2020 | 100 & 200 Westlake - CA | Office | NAP(8) | NAP(8) | NAP(8) | N | N | N | 88.0%(21) | 90.0% | 88.0%(21) | 89.0% |

| 25 | BANA | 12/16/2020 | 12/16/2020 | Guardian Storage Bridgeville | Self Storage | NAP(8) | NAP(8) | NAP(8) | N | N | N | 99.7% | 99.5% | (17) | (17) |

| 26 | WFB | 1/14/2021 | 12/18/2020 | East Manchester Village | Retail | NAP(8) | NAP(8) | NAP(8) | N | N | Y(22) | 80.9%(23) | 89.0%(23) | 80.9%(23) | 89.5%(23) |

| 27 | MSMCH | 1/11/2021 | 12/23/2020 | 3900 Kinross | Office | NAP(8) | NAP(8) | NAP(8) | N | N | N | 100.0% | 100.0% | (17) | (17) |

| 28 | BANA | 12/16/2020 | 12/16/2020 | Guardian Storage Fox Chapel | Self Storage | NAP(8) | NAP(8) | NAP(8) | N | N | N | 100.0% | 100.0% | (17) | (17) |

| 29 | MSMCH | 1/6/2021 | 12/23/2020 | Apple Cupertino | Office | NAP(8) | NAP(8) | NAP(8) | N | N | N | 100.0% | 100.0% | 100.0% | 100.0% |

| 30 | BANA | 1/19/2021 | 1/15/2021 | Amazon - Hazleton, PA | Industrial | NAP(8) | NAP(8) | NAP(8) | N | N | N | 100.0% | 100.0% | 100.0% | 100.0% |

| 31 | MSMCH | 1/7/2021 | 12/2/2020 | Walgreens Anchorage AK | Retail | NAP(8) | NAP(8) | NAP(8) | N | N | N | 100.0% | 100.0% | 100.0% | 100.0% |

| 32 | MSMCH | 1/7/2021 | 12/21/2020 | Sunset Hills | Office | NAP(8) | NAP(8) | NAP(8) | N | N | Y(24) | 100.0% | 100.0% | 100.0% | 100.0% |

| 33 | NCB | 12/31/2020 | 1/12/2021 | 440 East 62nd St. Owners Corp. | Multifamily | NAP(8) | NAP(8) | NAP(8) | N | N | N | 94.0%(15) | NAP(16) | NAP(15) | NAP(16) |

| 34 | MSMCH | 12/23/2020 | 12/23/2020 | Quinnipiac Gardens | Multifamily | NAP(8) | NAP(8) | NAP(8) | N | N | Y(25) | (10) | (10) | (10) | (10) |

| 35 | WFB | 1/13/2021 | 12/31/2020 | Walgreens - Fresno | Retail | NAP(8) | NAP(8) | NAP(8) | N | N | N | NAP(26) | NAP(26) | 100.0% | 100.0% |

| 36 | WFB | 1/14/2021 | 12/21/2020 | Walgreens - Glenview | Retail | NAP(8) | NAP(8) | NAP(8) | N | N | N | 100.0% | 100.0% | 100.0% | 100.0% |

| 37 | MSMCH | 1/8/2021 | 12/15/2020 | A1 Access Self Storage | Self Storage | NAP(8) | NAP(8) | NAP(8) | N | N | N | 94.1% | 92.7% | (17) | (17) |

| 38 | MSMCH | 1/15/2021 | 12/31/2020 | 1049 5th Avenue | Office | NAP(8) | NAP(8) | NAP(8) | N | N | N | 100.0% | 100.0% | 100.0% | 100.0% |

| 39 | WFB | 1/18/2021 | 12/1/2020 | Hemet Self Storage | Self Storage | NAP(2) | NAP(2) | Y | N | N | N | (27) | (27) | (27) | (27) |

| 40 | MSMCH | 1/15/2021 | 12/10/2020 | Katy Station Business Park and West Belt | Various | NAP(8) | NAP(8) | NAP(8) | N | N | Y(28) | 100.0% | 100.0% | 100.0% | 100.0% |

| 41 | BANA | 1/8/2021 | 12/10/2020 | 45-26 44th Street | Multifamily | NAP(8) | NAP(8) | NAP(8) | N | N | N | 100.0% | 100.0% | (17) | (17) |

| 42 | NCB | 1/11/2021 | 1/13/2021 | 25 West 13th Corp. | Multifamily | NAP(8) | NAP(8) | NAP(8) | N | N | N | 98.9%(15) | NAP(16) | 95.0%(15) | NAP(16) |

| 43 | NCB | 1/13/2021 | 12/29/2020 | Jackson 34 Realty Corp. | Multifamily | NAP(8) | NAP(8) | NAP(8) | N | N | N | 97.9%(15) | NAP(16) | 100.0%(15) | NAP(16) |

| 44 | WFB | 1/6/2021 | 12/11/2020 | 980 Fifth Avenue | Office | NAP(2) | NAP(2) | Y | N | N | N | 100.0% | 100.0% | 100.0% | 100.0% |

| 45 | MSMCH | 12/11/2020 | 12/11/2020 | Rent A Space Dunbar | Self Storage | NAP(8) | NAP(8) | NAP(8) | N | N | N | (10) | (10) | (10) | (10) |

| 46 | NCB | 1/13/2021 | 12/23/2020 | 365 Bronx River Road Owners, Inc. | Multifamily | NAP(8) | NAP(8) | NAP(8) | N | N | N | 95.4%(15) | NAP(16) | 95.4%(15) | NAP(16) |

| 47 | BANA | 1/11/2021 | 12/22/2020 | Ottawa Kansas MHC Portfolio | MHC | NAP(8) | NAP(8) | NAP(8) | N | N | N | 94.0%(29) | 94.0%(29) | 100.0%(29) | 100.0%(29) |

| 48 | MSMCH | 1/7/2021 | 12/30/2020 | Hawthorn Self Storage | Self Storage | NAP(8) | NAP(8) | NAP(8) | N | N | N | 99.0% | 99.0% | (17) | (17) |

| 49 | NCB | 1/13/2021 | 12/4/2020 | 3111 Tenant’s Corp. a/k/a 3111 Tenants Corp. | Multifamily | NAP(8) | NAP(8) | NAP(8) | N | N | N | 94.1%(15) | NAP(16) | 94.1%(15) | NAP(16) |

| 50 | NCB | 1/13/2021 | 12/29/2020 | Michelle Tenants Corp. | Multifamily | NAP(8) | NAP(8) | NAP(8) | N | N | N | 95.8%(15) | NAP(16) | 94.4%(15) | NAP(16) |

| 51 | NCB | 1/13/2021 | 12/30/2020 | Plaza East Owners Corp. | Multifamily | NAP(8) | NAP(8) | NAP(8) | N | N | N | 94.1%(15) | NAP(16) | 94.1%(15) | NAP(16) |

| 52 | NCB | 1/13/2021 | 1/8/2021 | Rugby Road Owners Corp. | Multifamily | NAP(8) | NAP(8) | NAP(8) | N | N | N | 95.9%(15) | NAP(16) | 91.8%(15) | NAP(16) |

| 53 | NCB | 12/31/2020 | 12/30/2020 | 575 Riverhouse Corp. | Multifamily | NAP(8) | NAP(8) | NAP(8) | N | N | N | 95.3%(15) | NAP(16) | NAP(15) | NAP(16) |

| 54 | NCB | 1/13/2021 | 12/30/2020 | 424 East 57th Street Tenants Corp. | Multifamily | NAP(8) | NAP(8) | NAP(8) | N | N | N | 100.0%(15) | NAP(16) | 100.0%(15) | NAP(16) |

| 55 | WFB | 1/20/2021 | 12/10/2020 | Walgreens – Laurel | Other | NAP(2) | NAP(2) | Y | N | N | N | 100.0% | 100.0% | 100.0% | 100.0% |

| 56 | NCB | 1/14/2021 | 12/29/2020 | 599 Wea Owners Corp. | Multifamily | NAP(8) | NAP(8) | NAP(8) | N | N | N | 100.0%(15) | NAP(16) | 96.3%(15) | NAP(16) |

| 57 | NCB | 12/31/2020 | 1/13/2021 | 30-40 Fleetwood Avenue Apartment Corp. | Multifamily | NAP(8) | NAP(8) | NAP(8) | N | N | N | 95.4%(15) | NAP(16) | NAP%(15) | NAP(16) |

| 58 | NCB | 1/13/2021 | 12/23/2020 | 57 Thompson Corp. | Multifamily | NAP(8) | NAP(8) | NAP(8) | N | N | N | 87.5%(15) | NAP(16) | 96.9%(15) | NAP(16) |

| 59 | NCB | 1/13/2021 | 12/29/2020 | 2 W. 90th St. Housing Corp. | Multifamily | NAP(8) | NAP(8) | NAP(8) | N | N | N | 100.0%(15) | NAP(16) | 100.0%(15) | NAP(16) |

| 60 | NCB | 1/13/2021 | 12/29/2020 | Grand Liberte Cooperative, Inc. | Multifamily | NAP(8) | NAP(8) | NAP(8) | N | N | N | 90.0%(15) | NAP(16) | 70.0%(15) | NAP(16) |

| 61 | NCB | 1/13/2021 | 12/15/2020 | 362 West Broadway Cooperative Corp. | Multifamily | NAP(8) | NAP(8) | NAP(8) | N | N | N | 87.5%(15) | NAP(16) | 87.5%(15) | NAP(16) |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

T-4

| BANK 2021-BNK31 | Transaction Highlights |

| (1) | Except as otherwise stated, Total SF or Unit Count Making Full December Rent Payment (%) and Total SF or Unit Count Making Full January Rent Payment (%) are presented as percentages of the total net rentable area. With respect to the McClellan Park mortgage loan and with respect to the mortgage loans secured by residential cooperative properties, Total SF or Unit Count Making Full Rent Payment and UW Base Rent Paid percentages are based on occupied rather than total SF. |

| (2) | The related mortgage loan has its first due date in January 2021. |

| (3) | With respect to the McClellan Park mortgaged property, six tenants, representing 5.7% of the NRA have requested rent relief. |

| (4) | With respect to the Miami Design District mortgaged property, as of April 29, 2020, the borrower entered into a loan modification to defer debt service payments for May, June and July 2020, which are payable on the earlier of the maturity date or when the loan is paid in full. On December 1, 2020, the borrower deposited $10,474,740 as a debt service reserve which, provided that no event of default is continuing, will be applied to supplement any debt service payments beginning as early as January 1, 2021. |

| (5) | With respect to the Miami Design District mortgaged property, five tenants (3.5% of NRA and 4.5% of UW rent) fully or partially abated their rent for December 2020. Three tenants (1.0% of NRA and 1.2% of UW rent) fully or partially abated their rent for January 2021. Two tenants (4.2% of NRA and 3.1% of UW rent) partially deferred their rent for December 2020. |

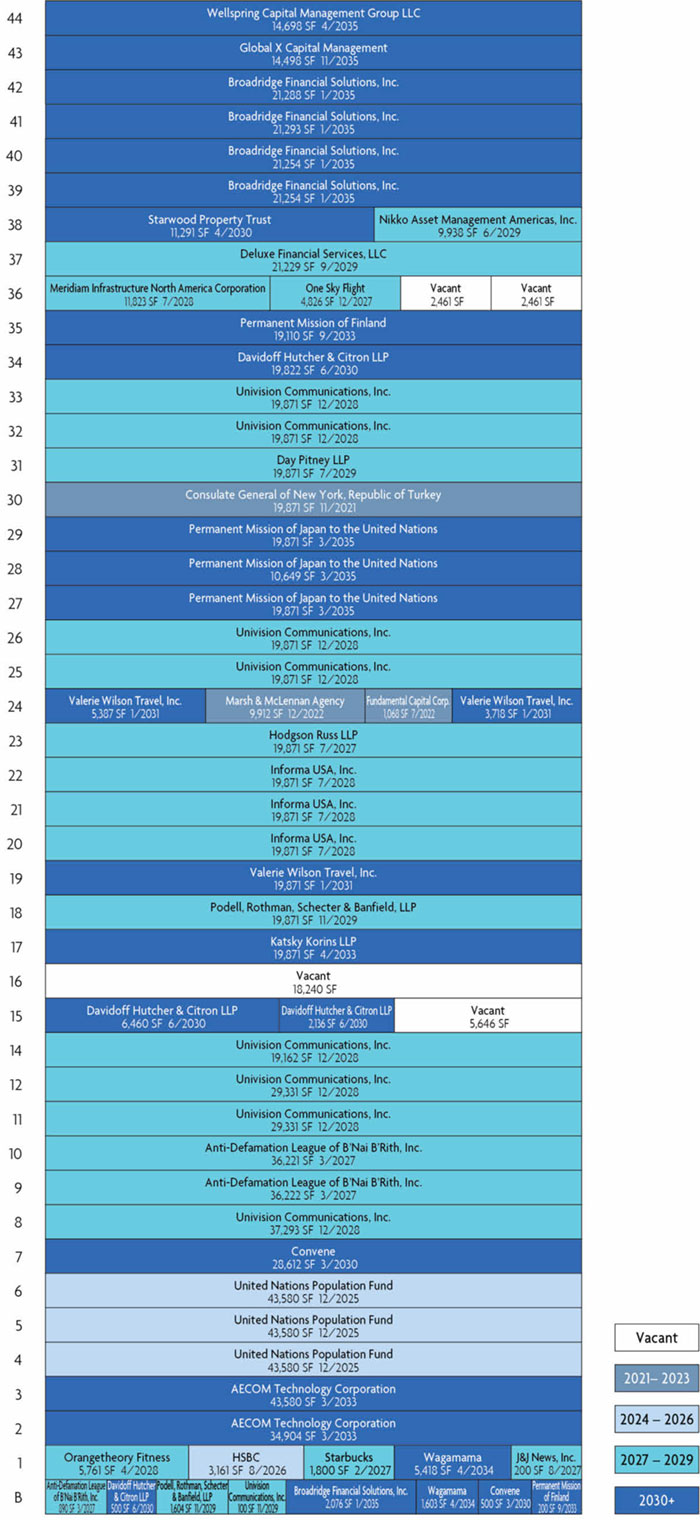

| (6) | With respect to the 605 Third Avenue mortgage loan, the borrower has reported that five tenants (14.0% of NRA and 12.6% of underwritten base rent) at the 605 Third Avenue Property have been granted deferrals of rent by the 605 Third Avenue Borrower. Four of the five tenants (13.3% of NRA and 11.5% of underwritten base rent) were granted between 3 and 5 months of deferred rent with repayment over fixed periods commencing on various dates in 2020 and 2021. One of the five tenants (0.7% of NRA and 1.1% of underwritten base rent) was granted deferred rent from August through December 2020, of which 50% was forgiven and the remaining deferred amount ($196,829) is required to be repaid across 24 monthly installments beginning January 1, 2021. |

| (7) | With respect to the 605 Third Avenue mortgage loan, the borrower sponsor was not able to provide updated December and January collections. According to the borrower sponsor, 96.4% of tenants by occupied NRA and 97.0% of tenants by underwritten base rent have paid their full November 2020 rent payments. |

| (8) | The related mortgage loan has its first due date in February or March 2021. |

| (9) | With respect to the 250 West 57th Street mortgaged property, ten tenants (16.2% of NRA and 16.8% of underwritten base rent) requested rent relief and five of such tenants (9.4% of NRA and 10.6% of underwritten base rent) were granted rent relief. Three of such five tenants (6.1% of NRA and 6.6% of underwritten base rent) were granted between 1 and 3 months of deferred rent with repayment over fixed periods. One of such five tenants (3.2% of NRA and 3.9% of underwritten base rent) is in discussions with the borrower regarding a rent deferral plan. One of such five tenants (0.1% of NRA and 0.1% of underwritten base rent) is paying 25% of their monthly gross sales from April to December 2020 and is required to resume paying fixed rent in January 2021. |

| (10) | Given the timing of collection and reporting, an accurate estimate of the percentage of tenants paying rent in December and January is not available. |

| (11) | The related mortgage loan has its first due date in December 2020. |

| (12) | With respect to the McDonald’s Global HQ mortgaged property, the second largest tenant, Politan Row (1.8% of NRA and 2.1% of UW rent), closed from April to July, in compliance with local COVID-19 regulations. The tenant re-opened for outdoor dining in August, and recently announced that it was closing temporarily for the winter, with plans to re-open in the spring of 2021. The tenant is under a rent abatement period till June 2021, such free rent was fully reserved at closing. |

(13) With respect to the Inland SE Self Storage Portfolio mortgaged properties, information based on the NRA or unit count was not available.

| (14) | With respect to the Fresh Pond Cambridge mortgage loan, the borrower has reported that three tenants were granted some form of rent relief. TJ Maxx/Homegoods (15.6% of NRA and 21.5% of underwritten rent) was granted deferred rent from June to August 2020 with repayment expected in six equal installments starting in January 2021. The tenant made its first repayment of deferred rent as agreed. Mattress Firm (2.0% of NRA and 3.0% of underwritten rent) was granted deferred rent from March to May 2020, of which 50% was forgiven and the remaining deferred amount is required to be repaid across six equal installments starting in January 2021. The tenant made its first repayment of deferred rent as agreed. All Dental (1.1% of NRA and 1.9% of underwritten rent) was granted rent relief from April to May 2020 and repayment was received in October 2020. |

| (15) | For residential cooperative properties, the percentages reported were determined based on available cooperative maintenance receivables reports provided from the borrowers (although the borrowers were not required, pursuant to the loan documents, to furnish those reports). Generally, this information is not tracked for residential cooperative properties and the borrowers are not required, pursuant to the loan documents, to report this data on a monthly basis. |

| (16) | This information is not presented for residential cooperative properties. The base rent represented in the cash flow for residential cooperative properties is the hypothetical income derived from the appraisal. Residential cooperative properties are structured to allow for an increase in unit owner maintenance charges or the assessment of additional charges to cover operating deficits, including deficits resulting from unpaid or delinquent rents or maintenance charges. |

| (17) | Given the timing of collection and reporting, an accurate estimate of the percentage of tenants paying rent in January is not available. |

| (18) | With respect to the Mission Ridge – CA mortgaged property, nine tenants accounting for 30.7% of underwritten base rent and 26.3% of the NRA (including one tenant, representing 1.6% of NRA, that was underwritten as vacant) received rent abatements ranging from one to three months, all of which ended by July 2020. The abated rents were forgiven. |

| (19) | With respect to the Mission Ridge – CA mortgaged property, one tenant underwritten as vacant (1.6% of the NRA) made full December and January rent payments. Including this tenant in total rent collections, full tenant rent collections for December and January based on NRA and UW Base Rent represent 96.3% of NRA, 101.2% of UW Base Rent and 92.4% of NRA, 95.2% of UW Base Rent, respectively. |

| (20) | Represents payment information related to the self storage properties in the All Aboard – 4 Property Portfolio (Big Tree Depot Property, Daytona Depot Property, and Hand & Younge Property). The office property (Clark Office Building) reported that 100% of NRA and 100% of base rent made their full December and January rent payments. |

| (21) | With respect to the 100 & 200 Westlake – CA mortgaged property, 9.6% of the NRA is vacant. One tenant, representing 2.4% of NRA and 2.7% of UW Base Rent, has not paid rent in December or January but is in discussions with the borrower to create a payment plan. |

| (22) | With respect to the East Manchester Village, five tenants, representing 6.8% of the NRA and 12.9% of UW Base Rent, were granted rent deferrals for two or three months between April and June 2020. One tenant, representing 15.5% of NRA and 11.0% of UW Base Rent was not granted its requested rent relief and has been operating under a settlement agreement since October 2020. |

| (23) | With respect to the East Manchester Village, one tenant, representing 15.5% of NRA and 11.0% of UW Base Rent, has not paid its rent in December or January. |

| (24) | With respect to the Sunset Hills mortgaged property, Progress Residential (7.5% of NRA and 7.4% of underwritten base rent) was granted rent relief from April through June 2020, which is now being repaid at an additional $1,989 per month through July 2021 and After-School All Stars (3.9% of NRA and 3.6% of underwritten base rent) were granted rent relief April 2020, which rent was deferred to the end of their lease term with the lease extended one month. |

| (25) | With respect to the Quinnipiac Gardens mortgaged property, according to the borrower sponsor, five out of the 71 units were granted rent relief. |

| (26) | With respect to the Walgreens Fresno mortgaged property, the lease commenced on December 30, 2020; therefore, no December rent was paid. |

| (27) | With respect to the Hemet Self Storage mortgaged property, due to the recent acquisition and transition to a new property manager, accurate accounts receivable information is not available. |

| (28) | With respect to the Katy Station Business Park and West Belt mortgaged property, S&D Threads (4.2% of NRA and 3.8% of underwritten rent) was granted 100% rent forgiveness for April and May 2020 and was granted rent relief from June to August 2020, of which 40% was forgiven and the remaining deferred amount was repaid. The tenant is back to making regular rent payment and is not in arrears. 9Rounds Fitness (2.3% of NRA and 3.8% of underwritten rent) was granted rent relief for May and June 2020 due to mandatory closure during the COVID-19 pandemic. The tenant has started repayment and owe a remaining amount of $1,000. Otherwise, the tenant is current on rent. |

| (29) | Collections for Ottawa Kansas MHC Portfolio mortgaged property are not formally reported. The numbers shown are estimates by the sponsor. |

See “Risk Factors—Risks Related to Market Conditions and Other External Factors—The Coronavirus Pandemic Has Adversely Affected the Global Economy and Will Likely Adversely Affect the Performance of the Mortgage Loans”.

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

T-5

| BANK 2021-BNK31 | Characteristics of the Mortgage Pool |

III. Summary of the Whole Loans

| No. | Property Name | Mortgage Loan Seller in BANK 2021-BNK31 | Trust Cut-off Date Balance | Aggregate Pari-Passu Companion Loan Cut-off Date Balance(1) | Controlling Pooling / Trust & Servicing Agreement | Master Servicer | Special Servicer Agreement | Related Pari Passu Companion Loan(s) Securitizations | Related Pari Passu Companion Loan(s) Original Balance |

| 1 | McClellan Park | WFB | $90,000,000 | $268,000,000 | BANK 2020-BNK30 | Wells Fargo Bank, National Association | Greystone Servicing Company LLC | BANK 2020-BNK30 | $75,000,000 |

| | | | | | | | | | WFCM 2020-C58 | $69,000,000 |

| | | | | | | | | | Benchmark 2020-B21 | $75,000,000 |

| | | | | | | | | | Benchmark 2020-B22 | $32,400,000 |

| | | | | | | | | | Future Securitizations(s) | $16,600,000 |

| 2 | 605 Third Avenue | MSMCH | $80,000,000 | $151,000,000 | BANK 2020-BNK30 | Wells Fargo Bank, National Association | Greystone Servicing Company LLC | BANK 2020-BNK30 | $80,000,000 |

| | | | | | | | | Future Securitization(s) | $71,000,000 |

| 3 | Miami Design District | BANA | $80,000,000 | $320,000,000 | BANK 2020-BNK30(2) | Wells Fargo Bank, National Association(2) | Greystone Servicing Company LLC(2) | BANK 2020-BNK30 | $75,000,000 |

| | | | | | | | | Future Securitization(s) | $245,000,000 |

| 5 | 250 West 57th Street | MSMCH | $38,000,000 | $142,000,000 | BANK 2020-BNK29 | Wells Fargo Bank, National Association | Rialto Capital Advisors, LLC | BANK 2020-BNK29 | $87,000,000 |

| | | | | | | | | BANK 2020-BNK30 | $55,000,000 |

| 8 | McDonald’s Global HQ | BANA | $34,555,371 | $133,285,001 | BANK 2020-BNK30 | Wells Fargo Bank, National Association | Greystone Servicing Company LLC | BANK 2020-BNK29 | $50,000,000 |

| | | | | | | BANK 2020-BNK30 | $70,000,000 |

| | | | | | | Future Securitization(s) | $15,000,000 |

| 11 | ExchangeRight Net Leased Portfolio #41 | MSMCH | $26,338,000 | $40,000,000 | BANK 2020-BNK30 | Wells Fargo Bank, National Association | Greystone Servicing Company LLC | BANK 2020-BNK30 | $40,000,000 |

| | |

| 12 | Coleman Highline | WFB | $22,000,000 | $145,700,000 | BANK 2020-BNK29 | Wells Fargo Bank, National Association | Rialto Capital Advisors, LLC | BANK 2020-BNK29 | $85,000,000 |

| | | | | | | | | BANK 2020-BNK30 | $60,700,000 |

| 13 | Fresh Pond Cambridge | MSMCH | $20,000,000 | $30,000,000 | BANK 2020-BNK30 | Wells Fargo Bank, National Association | Greystone Servicing Company LLC | BANK 2020-BNK30 | $30,000,000 |

| (1) | The Aggregate Pari Passu Companion Loan Cut-off Date Balance excludes the related Subordinate Companion Loans. |

| (2) | The related whole loan is expected to initially be serviced under the BANK 2020-BNK30 securitization pooling and servicing agreement until the securitization of the related “lead” pari passu note, after which the related whole loan will be serviced under the pooling and servicing agreement governing such securitization of the related “lead” pari passu note. The master servicer and special servicer for such securitization will be identified in a notice, report or statement to holders of the BANK 2021-BNK31 certificates after the closing of such securitization. Control rights with respect to the related whole loan will be exercised by the holder of the “lead” pari passu note. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

T-6

| BANK 2021-BNK31 | Characteristics of the Mortgage Pool |

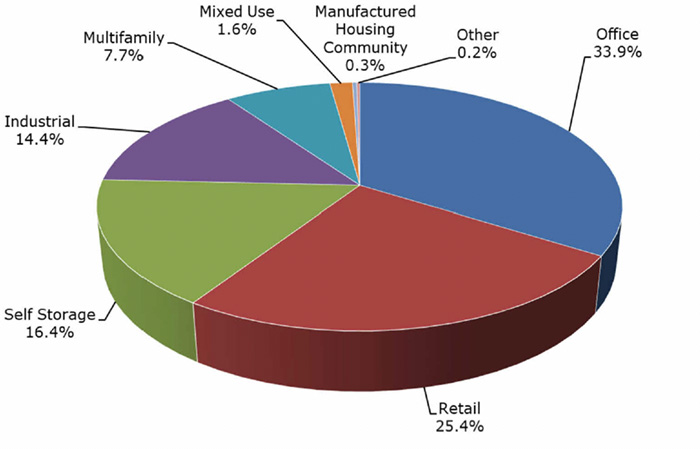

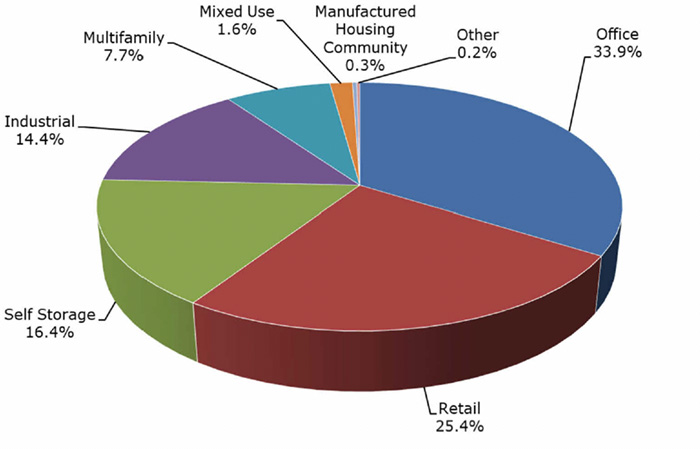

IV. Property Type Distribution(1)

| Property Type | Number of Mortgaged Properties | Aggregate Cut-off Date Balance ($) | % of Cut-off

Date Balance (%) | Weighted

Average Cut-

off Date LTV

Ratio (%) | Weighted Average Balloon or ARD LTV Ratio (%) | Weighted Average U/W NCF DSCR (x) | Weighted Average U/W NOI Debt Yield (%) | Weighted Average U/W NCF Debt Yield (%) | Weighted Average Mortgage Rate (%) |

| Office | 20 | $306,991,814 | 33.9% | 50.8% | 47.6% | 3.83x | 11.7% | 11.0% | 2.829% |

| CBD | 3 | 152,555,371 | 16.9 | 40.5 | 35.1 | 4.66 | 12.7 | 12.0 | 2.386 |

| Suburban | 10 | 131,866,964 | 14.6 | 61.4 | 60.3 | 3.08 | 10.9 | 10.1 | 3.224 |

| Medical | 7 | 22,569,480 | 2.5 | 57.8 | 57.8 | 2.54 | 9.3 | 8.9 | 3.520 |

| Retail | 46 | 229,877,520 | 25.4 | 55.3 | 54.3 | 2.43 | 9.6 | 9.3 | 3.651 |

| Single Tenant | 42 | 105,477,520 | 11.7 | 61.1 | 61.1 | 2.61 | 9.2 | 9.0 | 3.410 |

| Luxury Retail | 1 | 80,000,000 | 8.8 | 46.7 | 46.7 | 2.14 | 9.3 | 9.0 | 4.133 |

| Anchored | 3 | 44,400,000 | 4.9 | 57.1 | 51.8 | 2.54 | 11.1 | 10.4 | 3.355 |

| Self Storage | 28 | 148,619,816 | 16.4 | 58.3 | 50.4 | 2.17 | 9.9 | 9.7 | 3.113 |

| Self Storage | 28 | 148,619,816 | 16.4 | 58.3 | 50.4 | 2.17 | 9.9 | 9.7 | 3.113 |

| Industrial | 8 | 130,644,000 | 14.4 | 56.2 | 55.7 | 2.86 | 10.7 | 9.8 | 3.369 |

| Warehouse | 2 | 92,649,000 | 10.2 | 60.3 | 60.3 | 2.89 | 10.5 | 9.7 | 3.323 |

| Manufacturing | 1 | 15,000,000 | 1.7 | 25.9 | 25.9 | 3.65 | 11.8 | 11.0 | 2.970 |

| Flex | 4 | 14,245,000 | 1.6 | 63.6 | 63.6 | 2.59 | 11.8 | 10.0 | 3.788 |

| Warehouse Distribution | 1 | 8,750,000 | 1.0 | 53.0 | 45.7 | 1.59 | 9.4 | 9.0 | 3.860 |

| Multifamily | 19 | 69,402,254 | 7.7 | 24.3 | 20.3 | 6.65 | 30.6 | 30.0 | 3.214 |

| Cooperative | 17 | 59,552,254 | 6.6 | 18.3 | 14.6 | 7.37 | 34.1 | 33.4 | 3.174 |

| Garden | 1 | 6,000,000 | 0.7 | 72.3 | 62.2 | 1.53 | 8.9 | 8.6 | 3.810 |

| Mid Rise | 1 | 3,850,000 | 0.4 | 42.3 | 42.3 | 3.38 | 10.3 | 10.0 | 2.910 |

| Mixed Use | 2 | 14,801,000 | 1.6 | 60.0 | 60.0 | 2.58 | 10.2 | 9.5 | 3.632 |

| Office/Industrial/Retail | 1 | 13,100,000 | 1.4 | 59.5 | 59.5 | 2.59 | 10.2 | 9.5 | 3.626 |

| Industrial/Retail | 1 | 1,701,000 | 0.2 | 64.0 | 64.0 | 2.52 | 10.1 | 9.4 | 3.680 |

| Manufactured Housing Community | 2 | 2,850,000 | 0.3 | 67.2 | 55.1 | 1.68 | 9.8 | 9.6 | 4.040 |

| Manufactured Housing Community | 2 | 2,850,000 | 0.3 | 67.2 | 55.1 | 1.68 | 9.8 | 9.6 | 4.040 |

| Other | 1 | 2,000,000 | 0.2 | 60.6 | 60.6 | 2.09 | 8.1 | 8.1 | 3.817 |

| Leased Fee | 1 | 2,000,000 | 0.2 | 60.6 | 60.6 | 2.09 | 8.1 | 8.1 | 3.817 |

| Total | 126 | $905,186,404 | 100.0% | 52.1% | 49.1% | 3.25x | 12.1% | 11.6% | 3.211% |

| (1) | Because this table presents information relating to the mortgaged properties and not the mortgage loans, the information for mortgage loans secured by more than one mortgaged property is based on allocated loan amounts (allocating the principal balance of the mortgage loan to each of those properties according to the relative appraised values of the mortgaged properties or the allocated loan amounts or property-specific release prices set forth in the related mortgage loan documents or such other allocation as the related mortgage loan seller deemed appropriate). For mortgaged properties securing residential cooperative mortgage loans, the debt service coverage ratio and debt yield for each such mortgaged property is calculated using U/W Net Operating Income or U/W Net Cash Flow, as applicable, for the related residential cooperative property which is the projected net operating income or net cash flow, as applicable, reflected in the most recent appraisal obtained by or otherwise in the possession of the related mortgage loan seller as of the cut-off date and the loan-to-value ratio, is calculated based upon the appraised value of the residential cooperative property determined as if such residential cooperative property is operated as a residential cooperative, inclusive of the amount of the underlying debt encumbering such residential cooperative property. With respect to any mortgage loan that is part of a whole loan, the loan-to-value ratio, debt service coverage ratio and debt yield calculations include the related pari passu companion loan(s) but exclude any related subordinate companion loan(s) (unless otherwise stated). With respect to each mortgage loan, debt service coverage ratio, debt yield and loan-to-value ratio information do not take into account any subordinate debt (whether or not secured by the related mortgaged property) that currently exists or is allowed under the terms of such mortgage loan. See Annex A-1 to the Preliminary Prospectus. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

T-7

| Industrial – Warehouse | Loan #1 | Cut-off Date Balance: | | $90,000,000 |

Various McClellan, CA 95652 | McClellan Park | Cut-off Date LTV: U/W NCF DSCR: U/W NOI Debt Yield: | | 60.2% 2.90x 10.5% |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

T-8

| Industrial – Warehouse | Loan #1 | Cut-off Date Balance: | | $90,000,000 |

Various McClellan, CA 95652 | McClellan Park | Cut-off Date LTV: U/W NCF DSCR: U/W NOI Debt Yield: | | 60.2% 2.90x 10.5% |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

T-9

| No. 1 – McClellan Park |

| | | | | |

| Mortgage Loan Information | | Mortgaged Property Information |

| Mortgage Loan Seller: | Wells Fargo Bank, National Association | | Single Asset/Portfolio: | Single Asset |

Credit Assessment

(Fitch/KBRA/S&P): | NR/NR/NR | | Property Type – Subtype: | Industrial - Warehouse |

| Original Principal Balance(1): | $90,000,000 | | Location: | McClellan, CA |

| Cut-off Date Balance(1): | $90,000,000 | | Size: | 6,925,484 SF |

| % of Initial Pool Balance: | 9.9% | | Cut-off Date Balance Per SF(1): | $51.69 |

| Loan Purpose: | Refinance | | Maturity Date Balance Per SF(1): | $51.69 |

| Borrower Sponsor: | McClellan Business Park, LLC | | Year Built/Renovated: | 1938/2019 |

| Guarantor: | McClellan Business Park, LLC | | Title Vesting: | Fee |

| Mortgage Rate: | 3.3090% | | Property Manager: | Self-managed |

| Note Date: | November 13, 2020 | | Current Occupancy (As of): | 86.8% (9/15/2020) |

| Seasoning: | 2 months | | YE 2019 Occupancy(4): | 88.4% |

| Maturity Date: | December 11, 2030 | | YE 2018 Occupancy(4): | 83.4% |

| IO Period: | 120 months | | YE 2017 Occupancy(4): | 80.3% |

| Loan Term (Original): | 120 months | | YE 2016 Occupancy(4): | NAV |

| Amortization Term (Original): | NAP | | As-Is Appraised Value: | $595,000,000 |

| Loan Amortization Type: | Interest-only, Balloon | | As-Is Appraised Value Per SF: | $85.91 |

| Call Protection(2): | YM(26),YM or D(87),O(7) | | As-Is Appraisal Valuation Date: | September 15, 2020 |

| Lockbox Type: | Hard/Springing Cash Management | | |

| Additional Debt(1): | Yes | | Underwriting and Financial Information(5) |

| Additional Debt Type (Balance)(1): | Pari Passu ($266,400,000) | | TTM NOI (9/30/2020): | $29,593,816 |

| | | | YE 2019 NOI(6): | $27,579,910 |

| | | | YE 2018 NOI(6): | $24,924,493 |

| | | | | | YE 2017 NOI(6): | $21,645,209 |

| Escrows and Reserves(3) | | U/W Revenues: | $52,666,380 |

| | Initial | Monthly | Cap | | U/W Expenses: | $15,037,967 |

| Taxes | $0 | Springing | NAP | | U/W NOI(6): | $37,628,413 |

| Insurance | $0 | Springing | NAP | | U/W NCF: | $34,858,219 |

| Replacement Reserve | $0 | Springing | $2,077,645 | | U/W DSCR based on NOI/NCF(1): | 3.13x / 2.90x |

| TI/LC Reserve | $0 | Springing | $6,925,484 | | U/W Debt Yield based on NOI/NCF(1): | 10.5% / 9.7% |

| Tenant Specific TI/LC | $5,482,591 | $0 | NAP | | U/W Debt Yield at Maturity based on NOI/NCF(1): | 10.5% / 9.7% |

| Rent Concession | $18,717 | $0 | NAP | | Cut-off Date LTV Ratio(1): | 60.2% |

| Development Agency Reserve | $689,614 | $0 | NAP | | LTV Ratio at Maturity(1): | 60.2% |

| | | | | | | | |

| Sources and Uses |

| Sources | | | | | Uses | | | |

| Original whole loan amount(1) | $358,000,000 | | 100.0% | | Loan payoff | $334,182,430 | | 93.3% |

| | | | | | Upfront reserves | 6,190,922 | | 1.7 |

| | | | | | Closing costs | 5,652,858 | | 1.6 |

| | | | | | Return of equity | 11,973,790 | | 3.3 |

| Total Sources | $358,000,000 | | 100.0% | | Total Uses | $358,000,000 | | 100.0% |

| (1) | The McClellan Park Mortgage Loan (as defined below) is part of the McClellan Park Whole Loan (as defined below) with an original aggregate principal balance of $358,000,000. The Cut-off Date Balance Per SF, Maturity Date Balance Per SF, U/W Debt Yield based on NOI/NCF, U/W Debt Yield at Maturity based on NOI/NCF, U/W DSCR based on NOI/NCF, Cut-off Date LTV Ratio and LTV Ratio at Maturity numbers presented above are based on the McClellan Park Whole Loan. |

| (2) | At any time after the earlier of (i) January 11, 2024 and (ii) two years from the closing date of the securitization that includes the last pari passu note of the McClellan Park Whole Loan to be securitized, the McClellan Park Borrower (as defined below) has the right to defease the McClellan Park Whole Loan in whole, but not in part. Additionally, the McClellan Park Borrower may prepay the McClellan Park Whole Loan at any time during the term with a 30-day prior notice and, if such prepayment occurs on or before May 11, 2030, payment of the yield maintenance premium. |

| (3) | See “Escrows” section below. |

| (4) | See “Historical Occupancy” section below. |

| (5) | While the McClellan Park Whole Loan was originated after the emergence of the novel coronavirus pandemic and the economic disruption resulting from measures to combat the pandemic, the pandemic is an evolving situation and could impact the McClellan Park Whole Loan more severely than assumed in the underwriting of the McClellan Park Whole Loan and could adversely affect the NOI, NCF and occupancy information, as well as the appraised value and the DSCR, LTV and Debt Yield metrics presented above. See “Risk Factors—Risks Related to Market Conditions and Other External Factors—Coronavirus Pandemic Has Adversely Affected the Global Economy and Will Likely Adversely Affect the Performance of the Mortgage Loans” in the Preliminary Prospectus. |

| (6) | See “Operating History and Underwritten Cash Flow” section below for information regarding year-over-year increases in NOI and increase to U/W NOI from YE 2019 NOI. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

T-10

| Industrial – Warehouse | Loan #1 | Cut-off Date Balance: | | $90,000,000 |

Various McClellan, CA 95652 | McClellan Park | Cut-off Date LTV: U/W NCF DSCR: U/W NOI Debt Yield: | | 60.2% 2.90x 10.5% |

The Mortgage Loan. The mortgage loan (the “McClellan Park Mortgage Loan”) is part of a whole loan (the “McClellan Park Whole Loan”) that is evidenced by eight pari passu promissory notes in the aggregate original principal amount of $358,000,000. The McClellan Park Whole Loan is secured by a first priority fee mortgage encumbering McClellan Park, a 6,925,484 square foot primarily industrial and office portfolio located in McClellan, California (the “McClellan Park Property”). The McClellan Park Whole Loan was co-originated on November 13, 2020 by Wells Fargo Bank, National Association and Goldman Sachs Bank USA.

The McClellan Park Mortgage Loan is evidenced by the non-controlling promissory Notes A-3 and A-4 in the original principal amount of $90,000,000. As noted in the Note Summary chart below, The McClellan Park Whole Loan is also evidenced by the controlling A-1 promissory Note and the non-controlling promissory Notes A-2, A-5, A-6, A-7 and A-8 (the “McClellan Park Non-Serviced Pari Passu Companion Loans”). Note A-2 was included in the WFCM 2020-C58 securitization, Note A-6 was included in the BMARK 2020-B21 securitization and Notes A-7 and A-8 were included in the BMARK 2020-B22 securitization. The McClellan Park Whole Loan will be serviced under the pooling and servicing agreement for the BANK 2020-BNK30 securitization trust. See “Description of the Mortgage Pool—The Whole Loans—The Non-Serviced Pari Passu Whole Loans” and “Pooling and Servicing Agreement” in the Preliminary Prospectus.

Note Summary

| Notes | Original Balance | Cut-off Date Balance | Note Holder | Controlling Piece |

| McClellan Park Whole Loan |

| A-1 | $75,000,000 | $75,000,000 | BANK 2020-BNK30 | Yes |

| A-2 | $69,000,000 | $69,000,000 | WFCM 2020–C58 | No |

| A-3 | $54,000,000 | $54,000,000 | BANK 2020-BNK31 | No |

| A-4 | $36,000,000 | $36,000,000 | BANK 2020-BNK31 | No |

| A-5 | $16,600,000 | $16,600,000 | Wells Fargo Bank, National Association | No |

| A-6 | $75,000,000 | $75,000,000 | BMARK 2020–B21 | No |

| A-7 | $16,400,000 | $16,400,000 | BMARK 2020-B22 | No |

| A-8 | $16,000,000 | $16,000,000 | BMARK 2020-B22 | No |

| Total | $358,000,000 | $358,000,000 | | |

The Borrower and Borrower Sponsor. The borrower is McClellan Realty, LLC (the “McClellan Park Borrower”), a Delaware limited liability company and single purpose entity with two independent directors. In connection with the origination of the loan, counsel to the McClellan Park Borrower delivered a non-consolidation opinion.

The borrower sponsor and carveout guarantor is McClellan Business Park, LLC (the “Guarantor”). McClellan Business Park, LLC is a privately held company that was selected to acquire and redevelop McClellan Air Force Base in 1999. Today the project consists of 3,000 acres with approximately 8.5 million square feet of rentable space and 500 acres of developable land. The company is comprised of three entities, MBP Ventures, LLC, LDK Capital, LLC and Industrial Realty Group. MBP Ventures, LLC has acquired and developed real estate totaling over 20 million square feet and more than five thousand acres of land. LDK Capital, LLC has developed numerous master planned communities and business parks. Industrial Realty Group specializes in industrial properties and has holdings in excess of 100 million square feet.

The Property. The McClellan Park Property is a portion of McClellan Park, a large office and industrial park encompassing 3,000-acres and approximately 8.5 million square feet of leasable space, located west of Watt Avenue in an unincorporated area of Sacramento County, California. The McClellan Park Property represents the majority of McClellan Park with 6,925,484 square feet and comprises 139 buildings spanning approximately 785.1 acres. The McClellan Park Property surrounds the 10,600-foot McClellan Airfield runway, which, according to the appraisal, is one of the west coast’s most active airstrips for private aircraft. The McClellan Park Property benefits from approximately seven miles of on-site rail with multiple rails spurs, trans load yard, and rail served warehouses, which are serviced by both Burlington Northern Railroad and Union Pacific Railroad. Onsite amenities include a 112-room hotel, dining options, a gym, a credit union and a park.

Until July 2001, the McClellan Park Property served as McClellan Air Force Base, one of five major depots in the United States that provided repair and maintenance services to military aircraft. The McClellan Park Borrower was selected to acquire the base and implement an extensive redevelopment program. Since the acquisition in 2001, the borrower sponsor has invested more than $580 million in critical infrastructure, building improvements, and land development, which has driven the lease-up or sale of more than seven million square feet of office and industrial space.

As of September 15, 2020, the McClellan Park Property was 86.8% leased by approximately 176 tenants with no tenant accounting for more than 6.0% of the net rentable area or 7.0% of underwritten base rent. The McClellan Park Property has averaged 84.7% occupancy over the past five years. Since 2018 there has been over 3.4 million square feet of leasing activity. Approximately 21.7% of the net rentable area and 37.5% of underwritten base rent is attributable to investment grade tenants.

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

T-11

| Industrial – Warehouse | Loan #1 | Cut-off Date Balance: | | $90,000,000 |

Various McClellan, CA 95652 | McClellan Park | Cut-off Date LTV: U/W NCF DSCR: U/W NOI Debt Yield: | | 60.2% 2.90x 10.5% |

The following table represents the different use types for the McClellan Park Property:

| Use Type | NRSF | % of

NRSF | In Place Cut-Off Date Occupancy |

| Warehouse | 2,532,812 | 36.6% | 96.6% |

| Manufacturing | 1,660,684 | 24.0% | 91.6% |

| Research | 604,753 | 8.7% | 70.2% |

| Airfield | 843,221 | 12.2% | 78.6% |

| | | | |

| Total Industrial | 5,641,470 | 81.5% | 89.6% |

| | | | |

| Office | 1,020,349 | 14.7% | 72.5% |

| Residential | 157,254 | 2.3% | 71.8% |

| Commercial | 103,291 | 1.5% | 93.8% |

| Yard | 3,120 | 0.0% | 100.0% |

| | | | |

| Collateral Total | 6,925,484 | 100.0% | 86.8% |

| | | | |

Industrial (81.5% of net rentable area; 60.8% of underwritten gross rent) The industrial component of the McClellan Park Property includes over 5.6 million square feet, representing 81.5% of net rentable area and 60.8% of underwritten gross rent (including rent attributed to grossed up vacant space), and encompasses warehouse, manufacturing, research, and airfield/hanger buildings. The cluster of manufacturing, warehouse, research, residential, and office space provides the opportunity for industrial tenants to lease complementary use products all within one park.

Office (14.7% of net rentable area; 31.8% of underwritten gross rent) The office component of the McClellan Park Property includes buildings designated as office and recreational (37 primary buildings totaling 1,020,349 square feet). These buildings range in size from 800 to 331,670 square feet, with most buildings below 15,000 square feet in size. The median size within this set of buildings is 7,606 square feet. Originally constructed from 1938 to 1992, many of the buildings have been renovated to various levels. Existing office tenants include a variety of larger and small public and private operations such as the USDA Forest Services, Gateway Charters, and Faneuil, Inc.

Residential (2.3% of net rentable area; 5.0% of underwritten gross rent) The residential component at the McClellan Park Property includes seven primary buildings which include renovated and non-renovated dorm buildings. These buildings are consistent in size, ranging from 19,038 to 25,380 square feet with a median of 24,000 square feet. The subject residential space is currently 71.8% occupied by two tenants, the USDA Forest Service and AmeriCorps.

Commercial (1.5% of net rentable area; 2.5% of underwritten gross rent) Currently 93.8% leased, the retail portion of the McClellan Park Property consists of 11 buildings totaling 103,291 square feet of improved retail space. The retail operations provide tenants amenities such as a credit union, a gas station, restaurants, and a gym.

COVID-19 Update. As of January 15, 2021, most tenants at the McClellan Park Property are open and operating. Approximately 98% of the tenants by square footage and 99% of the tenants by underwritten base rent made their full December rent payments. Approximately 95% of the tenants by square footage and 93% of the tenants by underwritten base rent made their full January rent payments. Four tenants, representing approximately 4.2% of underwritten base rent, received rent deferrals ranging from 3-5 months. Three of the four tenants concurrently extended their leases. Two tenants representing 0.2% of underwritten base rent have pending rent relief requests. As January 15, 2021, the McClellan Park Whole Loan is current and is not subject to any modification or forbearance request.

Major Tenants.

Largest Tenant: Amazon (417,637 square feet, 6.0% of net rentable area; 6.5% of underwritten base rent; June 30, 2030 lease expiration) Amazon fully occupies a warehouse building at the McClellan Park Property that was constructed in 2019. According to a third party news source, Amazon’s building at the McClellan Park Property features 36-foot clear height ceilings, a 135-foot truck courtyard, as well as 40 trailer parking stalls. Amazon created an open warehouse of approximately 158,000 square feet, a drive-thru warehouse of approximately 240,000 square feet and office and support area of approximately 18,200 square feet. Additional work included creating chilled and frozen warehouse space along with will call and flex pickup areas. Amazon has leased over 1 million square feet of distribution space in Sacramento in recent years. Amazon has two 5-year renewal options, each with 270 days’ notice, at the fair market rental rate.

2nd Largest Tenant: Hydra Distribution (388,784 square feet, 5.6% of net rentable area; 3.0% of underwritten base rent; April 16, 2025 lease expiration) Hydra Distribution provides contract warehouse, transportation, crossdocking and shipping services within its central California distribution network (based at the McClellan Park Property). Hydra Distribution features access to over 2.4 million square feet of rail-served facilities and over seven miles of rail track. Hydra Distribution’s facility at the McClellan Park Property

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

T-12

| Industrial – Warehouse | Loan #1 | Cut-off Date Balance: | | $90,000,000 |

Various McClellan, CA 95652 | McClellan Park | Cut-off Date LTV: U/W NCF DSCR: U/W NOI Debt Yield: | | 60.2% 2.90x 10.5% |

features 24-foot clear height ceilings and raised floor tilt-ups. Hydra Distribution has one 5-year renewal option to extend, each with six months’ notice, at the 95% of fair market rental rate.

3rd Largest Tenant: Dome Printing (320,000 square feet, 4.6% of net rentable area; 2.6% of underwritten base rent; November 17, 2033 lease expiration) Dome Printing was founded in 1914 as an engraving company serving local printers and newspapers. In 1969, Dome Printing transformed into an offset printing facility, becoming one of the largest privately held commercial printing companies in northern California. Dome Printing offers direct printing on canvas, plastics, paperboard, synthetics and metalized substrates for both its retail and packaging clients. Dome Printing has two 5-year renewal options, each with nine months’ notice, at the fair market rental rate.

The following table presents certain information relating to the tenancy at the McClellan Park Property:

Major Tenants

| Tenant Name | Credit Rating (Fitch/ Moody’s/

S&P)(1) | Tenant NRSF | % of

NRSF | Annual U/W Base Rent PSF(2) | Annual

U/W Base Rent(2) | % of Total Annual U/W Base Rent | Lease

Expiration Date | Extension Options | Termination Option (Y/N) |

| Major Tenants | | | | | | | | |

| Amazon | A+/A2/AA- | 417,637 | 6.0% | $6.15 | $2,568,468 | 6.5% | 6/30/2030 | 2, 5- year | N |

| Hydra Distribution | NR/NR/NR | 388,784 | 5.6% | $3.05 | $1,184,293 | 3.0% | 4/16/2025 | 1, 5-year | N |

| Dome Printing | NR/NR/NR | 320,000 | 4.6% | $3.23 | $1,033,815 | 2.6% | 11/17/2033 | 2, 5-year | N |

| McClellan Jet Services | NR/NR/NR | 280,839 | 4.1% | $3.67 | $1,031,119 | 2.6% | 9/12/2022 | None | Y(3) |

| Northrop Grumman Systems | BBB/Baa1/BBB | 267,618 | 3.9% | $10.47 | $2,801,193 | 7.0% | Multiple(4) | Various(5) | Y(6) |

| Total Major Tenants | 1,674,878 | 24.2% | $5.15 | $8,618,888 | 21.7% | | | |

| | | | | | | | | |

| Non-Major Tenants(7) | 4,333,579 | 62.6% | $7.19 | $31,137,427 | 78.3% | | | |

| | | | | | | | | |

| Occupied Collateral Total | 6,008,457 | 86.8% | $6.62 | $39,756,315 | 100.0% | | | |

| | | | | | | | | |

| Vacant Space | 917,027 | 13.2% | | | | | | |

| | | | | | | | | |

| Collateral Total | 6,925,484 | 100.0% | | | | | | |

| | | | | | | | | | |

| (1) | Certain ratings are those of the parent company, whether or not the parent company guarantees the lease. |

| (2) | The Annual U/W Base Rent PSF and Annual U/W Base Rent shown above include rent steps through October 2021 totaling $1,210,817. The lender’s underwriting gives separate credit for straight-line rent averaging for investment grade tenants totaling $585,214 (see “Operating History and Underwritten Net Cash Flow” below). The Annual U/W Base Rent PSF and Annual U/W Base Rent shown in the table above do not include credit given for such investment grade tenants. |

| (3) | McClellan Jet Services has the right to terminate 1,373 square feet of its space after November 30, 2023 with 30 days’ notice. |

| (4) | Northrup Grumman Systems lease for its 161,589 square foot space and its 92,922 square foot space expire on December 31, 2021 (collectively, the “NG Space A”), its 4,857 square foot space expires on July 31, 2022 (“NG Space B”) and its 8,250 square foot space expires on November 30, 2022 (“NG Space C��). |

| (5) | NG Space A lease has two 5-year options to renew with nine months’ notice, NG Space B lease has two, 1-year options to renew with six months’ notice and NG Space C has no renewal options. |

| (6) | Northrup Grumman may terminate NG Space B on December 1st of each year of its term with 180 days’ notice and payment of the unamortized portion of the funded tenant improvement allowance, plus unamortized leasing commissions and three months of the base rent payable for the month immediately preceding the termination date. |

| (7) | Includes two tenants, Siemens Industry, Inc. (65,785 SF) and Veterans Affairs (10,000 SF), that have leases starting in January 2021 and February 2021, respectively. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

T-13

| Industrial – Warehouse | Loan #1 | Cut-off Date Balance: | | $90,000,000 |

Various McClellan, CA 95652 | McClellan Park | Cut-off Date LTV: U/W NCF DSCR: U/W NOI Debt Yield: | | 60.2% 2.90x 10.5% |

The following table presents certain information relating to the lease rollover schedule at the McClellan Park Property:

Lease Expiration Schedule(1)(2)

Year Ending

December 31, | No. of Leases Expiring | Expiring NRSF | % of Total NRSF | Cumulative Expiring NRSF | Cumulative % of Total NRSF | Annual

U/W

Base Rent | % of Total Annual U/W Base Rent | Annual

U/W

Base Rent

PSF(3) |

| MTM | 15 | 75,533 | 1.1% | 75,533 | 1.1% | $484,397 | 1.2% | $6.41 |

| 2020 | 17 | 150,128 | 2.2% | 225,661 | 3.3% | $1,399,982 | 3.5% | $9.33 |

| 2021 | 94 | 896,269 | 12.9% | 1,121,930 | 16.2% | $7,521,327 | 18.9% | $8.39 |

| 2022 | 63 | 1,044,895 | 15.1% | 2,166,825 | 31.3% | $8,252,111 | 20.8% | $7.90 |

| 2023 | 35 | 783,580 | 11.3% | 2,950,405 | 42.6% | $3,945,606 | 9.9% | $5.04 |

| 2024 | 21 | 463,243 | 6.7% | 3,413,648 | 49.3% | $2,279,219 | 5.7% | $4.92 |

| 2025 | 26 | 791,251 | 11.4% | 4,204,899 | 60.7% | $4,257,919 | 10.7% | $5.38 |

| 2026 | 5 | 152,898 | 2.2% | 4,357,797 | 62.9% | $1,010,198 | 2.5% | $6.61 |

| 2027 | 21 | 601,568 | 8.7% | 4,959,365 | 71.6% | $3,048,594 | 7.7% | $5.07 |

| 2028 | 21 | 233,106 | 3.4% | 5,192,471 | 75.0% | $2,702,656 | 6.8% | $11.59 |

| 2029 | 3 | 64,800 | 0.9% | 5,257,271 | 75.9% | $1,184,601 | 3.0% | $18.28 |

| 2030 | 5 | 420,757 | 6.1% | 5,678,028 | 82.0% | $2,568,468 | 6.5% | $6.10 |

| Thereafter | 13 | 330,429 | 4.8% | 6,008,457 | 86.8% | $1,101,237 | 2.8% | $3.33 |

| Vacant | 0 | 917,027 | 13.2% | 6,925,484 | 100.0% | $0 | 0.0% | $0.00 |

| Total/Wtd. Avg. | 339 | 6,925,484 | 100.0% | | | $39,756,315 | 100.0% | $6.62 |

| (1) | Information obtained from the underwritten rent roll. |

| (2) | Certain tenants may have lease termination options that are exercisable prior to the originally stated expiration date of the subject lease and that are not considered in the Lease Expiration Schedule. |

| (3) | Total/Wtd. Avg. Annual U/W Base Rent excludes vacant space. |

The following table presents historical occupancy percentages at the McClellan Park Property:

Historical Occupancy

12/31/2016 | 12/31/2017(1) | 12/31/2018(1) | 12/31/2019(1) | 9/15/2020(2)(3) |

| NAV(4) | 80.3% | 83.4% | 88.4% | 86.8% |

| (1) | Information obtained from the borrower sponsor. |

| (2) | Information obtained from the underwritten rent roll. |

| (3) | Includes two tenants, Siemens Industry, Inc. (65,785 SF) and Veterans Affairs (10,000 SF), that have leases starting in January 2021 and February 2021, respectively. |

| (4) | Information on 2016 Occupancy was not provided by the McClellan Park Borrower. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

T-14

| Industrial – Warehouse | Loan #1 | Cut-off Date Balance: | | $90,000,000 |

Various McClellan, CA 95652 | McClellan Park | Cut-off Date LTV: U/W NCF DSCR: U/W NOI Debt Yield: | | 60.2% 2.90x 10.5% |

Operating History and Underwritten Net Cash Flow. The following table presents certain information relating to the historical operating performance and underwritten net cash flow at the McClellan Park Property:

Cash Flow Analysis

| | 2017 | 2018 | 2019 | TTM 9/30/2020 | U/W | %(1) | U/W $ per SF |

| Base Rent | $30,020,185 | $34,154,288 | $36,215,976 | $38,587,412 | $38,545,498 | 61.5% | $5.57 |

| Rent Steps | 0 | 0 | 0 | 0 | 1,210,817(2) | 1.9 | 0.17 |

| Rent Average Benefit | 0 | 0 | 0 | 0 | 585,214 | 0.9 | 0.08 |

| TI Amortization(3) | 0 | 0 | 0 | 0 | 535,080 | 0.9 | 0.08 |

| Yard Rent(3)(4) | 0 | 0 | 0 | 0 | 4,145,429 | 6.6 | 0.60 |

| Grossed Up Vacant Space | 0 | 0 | 0 | 0 | 10,013,909(5) | 16.0 | 1.45 |

| Gross Potential Rent | $30,020,185 | $34,154,288 | $36,215,976 | $38,587,412 | $55,035,947 | 87.8% | $7.95 |

| Other Income(6) | 252,056 | 47,853 | 300,496 | 793,948 | 793,948 | 1.3 | 0.11 |

| Expense Reimbursements | 4,748,711 | 5,452,877 | 6,256,187 | 6,754,163 | 6,850,394 | 10.9 | 0.99 |

| Net Rental Income | $35,020,952 | $39,655,018 | $42,772,659 | $46,135,523 | $62,680,289 | 100.0% | $9.05 |

| (Vacancy & Credit Loss) | 0 | 0 | 0 | 0 | (10,013,909) | (18.2) | (1.45) |

| Effective Gross Income | $35,020,952 | $39,655,018 | $42,772,659 | $46,135,523 | $52,666,380 | 84.0% | $7.60 |

| | | | | | | | |

| Real Estate Taxes | 3,963,293 | 4,255,008 | 4,257,566 | 4,625,532 | 4,454,422 | 8.5 | 0.64 |

| Insurance | 642,426 | 674,916 | 712,904 | 844,519 | 844,519 | 1.6 | 0.12 |

| Management Fee | 1,824,797 | 2,055,920 | 2,208,082 | 2,332,630 | 1,000,000 | 1.9 | 0.14 |

| Other Operating Expenses | 6,945,227 | 7,744,681 | 8,014,197 | 8,739,026 | 8,739,026 | 16.6 | 1.26 |

| Total Operating Expenses | $13,375,743 | $14,730,525 | $15,192,749 | $16,541,707 | $15,037,967 | 28.6% | $2.17 |

| | | | | | | | |

| Net Operating Income(7) | $21,645,209 | $24,924,493 | $27,579,910 | $29,593,816 | $37,628,413 | 71.4% | $5.43 |

| Replacement Reserves | 0 | 0 | 0 | 0 | 1,038,823 | 2.0 | 0.15 |

| TI/LC | 0 | 0 | 0 | 0 | 1,731,371 | 3.3 | 0.25 |

| Net Cash Flow | $21,645,209 | $24,924,493 | $27,579,910 | $29,593,816 | $34,858,219 | 66.2% | $5.03 |

| | | | | | | | |

| NOI DSCR(8) | 1.80x | 2.08x | 2.30x | 2.46x | 3.13x | | |

| NCF DSCR(8) | 1.80x | 2.08x | 2.30x | 2.46x | 2.90x | | |

| NOI Debt Yield(8) | 6.0% | 7.0% | 7.7% | 8.3% | 10.5% | | |

| NCF Debt Yield(8) | 6.0% | 7.0% | 7.7% | 8.3% | 9.7% | | |

| (1) | Represents (i) percent of Net Rental Income for all revenue fields, (ii) percent of Gross Potential Rent for Vacancy & Credit Loss and (iii) percent of Effective Gross Income for all other fields. |

| (2) | Represents rent steps through October 2021. |

| (3) | Yard Rent and TI Amortization has historically been captured under base rent. |

| (4) | Yard Rent represents land that is leased to tenants for additional parking needs. It is typically co-terminus with the contractual obligations in the lease. |

| (5) | Grossed Up Vacant Space is grossed up at appraisal concluded market rents. |

| (6) | Other Income represents late fees, termination fees, excess rail usage and ancillary income. |

| (7) | The increase from YE 2017 to YE 2018 NOI was primarily due to an increase in occupancy from 80.3% to 83.4% and annual increases in existing tenant rental rates. The increase in YE 2018 NOI to YE 2019 NOI was primarily due to an increase in occupancy from 83.4% to 88.4% and annual increases in existing tenant rental rates. The increase in U/W NOI from the TTM 9/30/2020 is partially driven by $1,210,817 in rent steps and $585,214 in straight line rent average for investment grade tenants. The other main driver is Amazon’s lease for 417,637 SF, under which it began paying rent in July of 2020. Its lease represents approximately $2.6 million of U/W base rent and an additional $1.2 million of Yard Rent. Additionally, the U/W base rent includes approximately $526,152 of U/W rent from two tenants, Siemens Industry, Inc. (65,785 SF) and Veterans Affairs (10,000 SF) which have leases starting in January 2021 and February 2021, respectively. Lastly, the management fee is capped at $1.0 million. |

| (8) | The NOI DSCR, NCF DSCR, NOI Debt Yield and NCF Debt Yield are based on the McClellan Park Whole Loan. |

Appraisal. The appraiser concluded to an “as-is market value” of $595,000,000 as of September 15, 2020 and a “hypothetical land value – bulk property” appraised value of $70,000,000 as of September 15, 2020.

Environmental Matters. According to the Phase I environmental reports dated between November 2, 2020 and November 6, 2020, the McClellan Business Park Property is a part of the former McClellan Air Force Base, which is on the National Priorities List (NPL) as a Superfund site due to impacts related to the long-term military operation of the McClellan Business Park Property. According to the related environmental reports, environmental impacts include, among other things, groundwater contamination from volatile organic compounds, 1,4-dioxane, metals, and perchlorate. The environmental reports identified such impacts, including the potential for vapor encroachment, as a site-wide recognized environmental condition. In addition, the Phase I ESAs identified two lot-specific recognized environmental conditions related to (i) perfluorooctane sulfonate concentrations exceeding U.S. Environmental Protection Agency screening criteria for drinking water at one parcel and (ii) impacts from the prior operations of a wastewater treatment plant, sludge

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

T-15

| Industrial – Warehouse | Loan #1 | Cut-off Date Balance: | | $90,000,000 |

Various McClellan, CA 95652 | McClellan Park | Cut-off Date LTV: U/W NCF DSCR: U/W NOI Debt Yield: | | 60.2% 2.90x 10.5% |

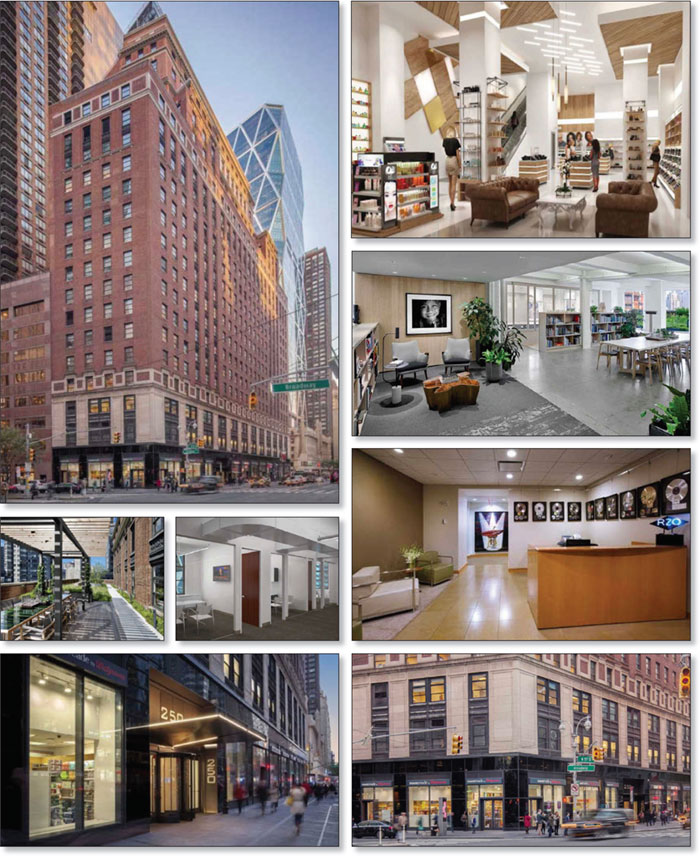

drying beds, an underground oil-water separator, a 10,000-gallon oil storage tank and a pesticide/herbicide storage area on another parcel. The McClellan Business Park Property is subject to multiple local, state and federal restrictions and institutional controls, including, among other things, groundwater use restrictions, use restrictions, digging restrictions, interference restrictions and access restrictions. According to the environmental reports, the United States Air Force is the responsible party of record and retains responsibility for subsequent discoveries of previously unknown environmental conditions. See “Description of the Mortgage Pool—Environmental Considerations” in the Preliminary Prospectus.