| FREE WRITING PROSPECTUS | ||

| FILED PURSUANT TO RULE 433 | ||

| REGISTRATION FILE NO.: 333-228597-08 | ||

The information in this free writing prospectus is preliminary and may be supplemented or changed. This free writing prospectus is not an offering to sell these securities and is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

THIS FREE WRITING PROSPECTUS, DATED JANUARY 21, 2021

MAY BE AMENDED OR SUPPLEMENTED PRIOR TO TIME OF SALE

BENCHMARK 2021-B23

The depositor has filed a registration statement (including a prospectus) with the SEC (SEC File No. 333-228597) for the offering to which this free writing prospectus relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor, Citigroup Global Markets Inc., J.P. Morgan Securities LLC, Goldman Sachs & Co. LLC, Deutsche Bank Securities Inc., Academy Securities, Inc., Drexel Hamilton, LLC, or any other underwriter or dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-800-831-9146.

The securities to which these collateral materials (“Materials”) relate will be described in greater detail in the prospectus expected to be dated in January 2021 (the “Preliminary Prospectus”) that will be included as part of our registration statement. The Preliminary Prospectus will contain material information that is not contained in these Materials (including, without limitation, a summary of risks associated with an investment in the offered securities under the heading “Summary of Risk Factors” and a detailed discussion of such risks under the heading “Risk Factors”).

These Materials are preliminary and subject to change. The information in these Materials supersedes all prior such information delivered to you and will be superseded by any subsequent information delivered prior to the time of sale.

Neither these materials nor anything contained in these materials shall form the basis for any contract or commitment whatsoever. These Materials are not to be construed as an offer to sell or the solicitation of any offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal.

The information contained in these Materials may not pertain to any securities that will actually be sold. The information contained in these Materials may be based on assumptions regarding market conditions and other matters as reflected in these Materials. We make no representations regarding the reasonableness of such assumptions or the likelihood that any of such assumptions will coincide with actual market conditions or events, and these Materials should not be relied upon for such purposes. We and our affiliates, officers, directors, partners and employees, including persons involved in the preparation or issuance of these Materials may, from time to time, have long or short positions in, and buy or sell, the securities mentioned in these Materials or derivatives thereof (including options). Information contained in these Materials is current as of the date appearing on these Materials only.

IMPORTANT NOTICE RELATING TO AUTOMATICALLY GENERATED EMAIL DISCLAIMERS

Any legends, disclaimers or other notices that may appear at the bottom of the email communication to which this free writing prospectus is attached relating to (1) these Materials not constituting an offer (or a solicitation of an offer), (2) no representation being made that these Materials are accurate or complete and that these Materials may not be updated or (3) these Materials possibly being confidential, are, in each case, not applicable to these Materials and should be disregarded. Such legends, disclaimers or other notices have been automatically generated as a result of these Materials having been sent via Bloomberg or another system.

2

LOAN #1: 860 WASHINGTON

3

LOAN #1: 860 WASHINGTON

4

LOAN #1: 860 WASHINGTON

5

LOAN #1: 860 WASHINGTON

| Mortgaged Property Information | Mortgage Loan Information | ||||

| Number of Mortgaged Properties | 1 | Loan Seller | JPMCB/GACC | ||

| Location (City/State) | New York, New York | Cut-off Date Balance | $116,000,000 | ||

| Property Type | Mixed Use | Cut-off Date Balance per SF | $989.51 | ||

| Size (SF) | 117,230 | Percentage of Initial Pool Balance | [ ]% | ||

| Total Occupancy as of 11/1/2020 | 96.6% | Number of Related Mortgage Loans | None | ||

| Owned Occupancy as of 11/1/2020 | 96.6% | Type of Security | Leasehold | ||

| Year Built / Latest Renovation | 2016 / NAP | Mortgage Rate | 2.40000% | ||

| Appraised Value(1) | $240,000,000 | Original Term to Maturity (Months) | 120 | ||

| Appraisal Date | 12/1/2020 | Original Amortization Term (Months) | NAP | ||

| Borrower Sponsor(2) | Meadow Partners; | Original Interest Only Period (Months) | 120 | ||

| California Public Employees’ Retirement System | First Payment Date | 2/6/2021 | |||

| Property Management | 860 Washington GORP Manager LLC; | Maturity Date | 1/6/2031 | ||

| Property Group Partners LLC | |||||

| Underwritten Revenues | $21,866,809 | ||||

| Underwritten Expenses | $7,925,179 | Escrows(3) | |||

| Underwritten Net Operating Income (NOI) | $13,941,629 | Upfront | Monthly | ||

| Underwritten Net Cash Flow (NCF) | $12,937,269 | Taxes | $0 | $237,646 | |

| Cut-off Date LTV Ratio | 48.3% | Insurance | $0 | $0 | |

| Maturity Date LTV Ratio | 48.3% | Replacement Reserve | $0 | $0 | |

| DSCR Based on Underwritten NOI / NCF | 4.94x / 4.58x | TI/LC | $0 | $0 | |

| Debt Yield Based on Underwritten NOI / NCF | 12.0% / 11.2% | Other(4) | $196,050 | $166,667 | |

| Sources and Uses | |||||

| Sources | $ | % | Uses | $ | % |

| Loan Amount | $116,000,000 | 48.8% | Purchase Price | $232,000,000 | 96.9% |

| Borrower Sponsor Equity | 123,318,778 | 51.5 | Closing Costs | 7,122,728 | 3.0 |

| Upfront Reserves | 196,050 | 0.1 | |||

| Total Sources | $239,318,778 | 100.0% | Total Uses | $239,318,778 | 100.0% |

| (1) | The appraised value represents the “as-is” appraised value, as of 12/1/2020. |

| (2) | The nonrecourse carveout guarantor is Gotham Office Realty Partnership LLC, a joint venture between Meadow Partners and the California Public Employees’ Retirement System. |

| (3) | See “—Escrows” below. |

| (4) | Other Upfront Escrows represents reserves for unfunded obligations. Other Monthly Escrows represents reserves for the ground lease. |

| ■ | The Mortgage Loan. The mortgage loan (the “860 Washington Loan”) is secured by a first mortgage encumbering the borrower’s leasehold interest in a Class A mixed use building located in New York, New York (the “860 Washington Property”) The 860 Washington Loan, which accrues interest at an interest rate of 2.40000% per annum, has an original principal balance and an outstanding principal balance as of the Cut-off Date of $116,000,000. The 860 Washington Loan has an original term of 120 months and a remaining term of 119 months, and is interest only for the full term. The scheduled maturity date of the 860 Washington Loan is the due date in January 2031. Voluntary prepayment of the 860 Washington Loan is permitted on or after September 6, 2030 without a payment of any prepayment premium. Provided no event of default under the 860 Washington Loan documents is continuing, defeasance of the 860 Washington Loan is permitted at any time after the earlier of (a) the second anniversary of the Benchmark 2021-B23 securitization closing date and (b) February 6, 2024. |

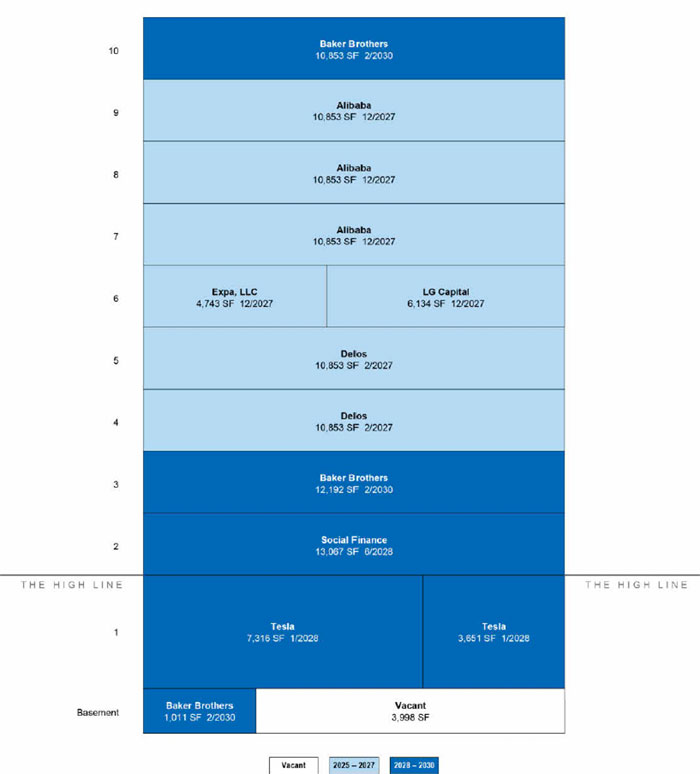

| ■ | The Mortgaged Property. The 860 Washington Property is a recently built 117,230 SF Class A mixed use complex in New York, New York. Built in 2016, the 860 Washington Property features a glass curtain wall façade, while office and retail spaces have slab-to-slab heights of 11’3” and 24’8”, respectively. The property consists of office space located on the 2nd through 10th floors, with a terrace on the fourth floor that is exclusive to the single tenant on that floor, Delos, and ground floor retail space leased to Tesla Motors New York, LLC (“Tesla”). The office space features primarily single floor tenants, with one multi-tenant layout on the 6th floor. The column free spacing throughout the office component and protection of views based on the location adjacent to the High Line provides an abundance of light and air into the building. |

The largest tenant by underwritten base rent, Tesla (10,967 SF; 9.4% of NRA; 26.7% of UW Base Rent), was founded in 2003 and designs, develops, manufactures, leases, and sells electric vehicles, and energy generation and storage systems. Tesla’s space at the 860 Washington Property represents Tesla’s only Manhattan store. Tesla operates in two segments: automotive and energy generation/storage. In the third quarter of 2020, Tesla posted a total gross profit of $2.063 billion, representing a 73% increase over the third quarter of 2019. Tesla has steadily grown its automotive presence over the past few years, increasing its 2020 vehicle production to 139,593 deliveries made in the third quarter of 2020, approximately 44% higher than the third quarter of 2019 and the highest it had ever recorded in a single quarter. The tenant signed a lease for its expansion premises in 2017; however, it is unclear due to COVID-19 if and when Tesla will move forward with the expansion. The expansion space was previously available for sublease. Tesla leases the ground floor retail space at the 860 Washington Property through January 31, 2028 with two, five-year extension options.

6

LOAN #1: 860 WASHINGTON

The second largest tenant by underwritten base rent, Alibaba Group (U.S.) Inc. (“Alibaba”) (32,559 SF; 27.8% of NRA; 21.6% of UW Base Rent), is the largest online commerce company in the world based on gross merchandise value. Founded in 1999, Alibaba operates through four segments: core commerce, cloud computing, digital media and entertainment, and innovation initiatives and others, primarily providing online and mobile commerce to businesses internationally. Alibaba continues to expand, with revenues of approximately $45.5 billion in the first half of 2020, a 32% increase from the first half of 2019. Alibaba leases the entire 7th, 8th, and 9th floors of the 860 Washington Property, however it is currently only occupying the 7th and 8th floors. According to the borrower sponsor, Alibaba leased three floors with the intention of expanding into the 9th floor over time, however they are currently offering the space available for sublease. Alibaba continues to pay rent for the 9th floor space. Its lease is set to expire on December 31, 2027, and it has one, five-year extension option.

The third largest tenant by underwritten base rent, Baker Brothers Advisors, LP (“Baker Brothers”) (24,056 SF; 20.5% of NRA; 18.2% of UW Base Rent), is a privately-owned hedge fund sponsor that provides services to university endowments, foundations, and families. Founded in 2001, the firm primarily invests in life sciences companies. As of December 31, 2019, Baker Brothers had approximately $23.6 billion assets under management. It leases the entire 3rd and 10th floors at the 860 Washington Property. Baker Brothers’ lease is set to expire on February 28, 2030, and they have one, five-year extension option.

COVID-19 Update. As of January 18, 2021, the 860 Washington Property is open and operational, however the majority of the building’s tenants are working remotely. As of November 2020, the 860 Washington Property was 96.6% leased. Since March 2020, tenants at the 860 Washington Property have paid 100% of contractual rent. Reportedly, Tesla asked for rent deferrals across many of its showrooms including the 860 Washington Property, but that request was denied by the borrower sponsor. No other tenant has requested rent relief.

The following table presents certain information relating to the tenants at the 860 Washington Property:

Tenant Summary(1)

Tenant Name | Credit Rating | Tenant | % of | UW Base | % of Total UW | UW Base | Lease | Renewal / |

| Tesla | NR/B3/BB | 10,967 | 9.4% | $5,701,490 | 26.7% | $519.88 | 1/31/2028 | 2, 5-year options |

| Alibaba | A+/A1/A+ | 32,559 | 27.8 | 4,595,160 | 21.6 | 141.13 | 12/31/2027 | 1, 5-year option |

| Baker Brothers | NR/NR/NR | 24,056 | 20.5 | 3,890,147 | 18.2 | 161.71 | 2/28/2030 | 1, 5-year option |

| Delos | NR/NR/NR | 21,706 | 18.5 | 3,524,295 | 16.5 | 162.37 | 2/28/2027 | 1, 5-year option |

| Social Finance | NR/NR/NR | 13,067 | 11.1 | 2,133,580 | 10.0 | 163.28 | 6/30/2028 | 1, 5-year option |

| LG Capital | NR/NR/NR | 6,134 | 5.2 | 785,152 | 3.7 | 128.00 | 12/31/2027 | None |

| Expa, LLC | NR/NR/NR | 4,743 | 4.0 | 687,735 | 3.2 | 145.00 | 12/31/2027 | None |

| Total / Wtd. Avg. | 113,232 | 96.6% | $21,317,558 | 100.0% | $188.26 | |||

| Vacant | 3,998 | 3.4 | 0 | |||||

| Total / Wtd. Avg. All Owned Tenants | 117,230 | 100.0% | $21,317,558 |

| (1) | Based on the rent roll dated November 1, 2020. |

| (2) | In some instances, ratings provided are those of the parent company of the entity shown, whether or not the parent company guarantees the lease. |

The following table presents certain information relating to the lease rollover schedule at the 860 Washington Property, based on initial lease expiration dates:

Lease Expiration Schedule(1)

Year Ending | Expiring Owned | % of Owned | Cumulative % of | UW Base Rent | % of Total UW | UW Base Rent $ | # of Expiring |

| MTM | 0 | 0.0% | 0.0% | $0 | 0.0% | $0.00 | 0 |

| 2021 | 0 | 0.0% | 0.0% | $0 | 0.0% | $0.00 | 0 |

| 2022 | 0 | 0.0% | 0.0% | $0 | 0.0% | $0.00 | 0 |

| 2023 | 0 | 0.0% | 0.0% | $0 | 0.0% | $0.00 | 0 |

| 2024 | 0 | 0.0% | 0.0% | $0 | 0.0% | $0.00 | 0 |

| 2025 | 0 | 0.0% | 0.0% | $0 | 0.0% | $0.00 | 0 |

| 2026 | 0 | 0.0% | 0.0% | $0 | 0.0% | $0.00 | 0 |

| 2027 | 65,142 | 55.6% | 55.6% | $9,592,342 | 45.0% | $147.25 | 4 |

| 2028 | 24,034 | 20.5% | 76.1% | $7,835,070 | 36.8% | $326.00 | 2 |

| 2029 | 0 | 0.0% | 76.1% | $0 | 0.0% | $0.00 | 0 |

| 2030 | 24,056 | 20.5% | 96.6% | $3,890,147 | 18.2% | $161.71 | 1 |

| 2031 | 0 | 0.0% | 96.6% | $0 | 0.0% | $0.00 | 0 |

| 2032 & Thereafter | 0 | 0.0% | 96.6% | $0 | 0.0% | $0.00 | 0 |

| Vacant | 3,998 | 3.4% | 100.0% | NAP | NAP | NAP | NAP |

| Total / Wtd. Avg. | 117,230 | 100.0% | $21,317,558 | 100.0% | $188.26 | 7 |

| (1) | Based on the underwritten rent roll dated November 1, 2020. |

7

LOAN #1: 860 WASHINGTON

The following table presents certain information relating to historical leasing at the 860 Washington Property:

Historical Leased %

2017 | 2018 | 2019 | As of 11/1/2020(1) | |

| Owned Space | 91.7% | 91.7% | 92.5% | 96.6% |

| (1) | Based on the underwritten rent roll dated November 1, 2020. |

| ■ | Operating History and Underwritten Net Cash Flow. The following table presents certain information relating to the historical operating performance and Underwritten Net Cash Flow at the 860 Washington Property: |

Cash Flow Analysis(1)

2018 | 2019 | Underwritten | Underwritten $ per SF | |

| Base Rent(2) | $18,987,726 | $19,503,308 | $21,317,558 | $181.84 |

| Vacant Income | 0 | 0 | 219,890 | 1.88 |

| Reimbursements | 779,262 | 1,383,478 | 1,480,245 | 12.63 |

| Vacancy & Credit Loss(3) | 0 | 0 | (1,150,885) | (9.82) |

| Concessions | (3,380,488) | (83,466) | 0 | 0.00 |

| Parking Income | 7,190 | 325 | 0 | 0.00 |

| Other Income | 63,613 | 197,619 | 0 | 0.00 |

| Effective Gross Income | $16,457,303 | $21,001,264 | $21,866,809 | $186.53 |

| Real Estate Taxes | 2,421,467 | 2,481,733 | 2,851,747 | 24.33 |

| Insurance | 133,936 | 134,030 | 138,807 | 1.18 |

| Management Fee | 456,139 | 583,788 | 656,004 | 5.60 |

| Other Operating Expenses | 2,146,970 | 2,240,773 | 4,278,621 | 36.50 |

| Total Operating Expenses | 5,158,512 | 5,440,324 | $7,925,179 | $67.60 |

| Net Operating Income | $11,298,791 | $15,560,940 | $13,941,629 | $118.93 |

| TI/LC | 0 | 0 | 980,914 | 8.37 |

| Capital Expenditures | 0 | 0 | 23,446 | 0.20 |

| Net Cash Flow | $11,298,791 | $15,560,940 | $12,937,269 | $110.36 |

| Occupancy | 91.7% | 92.5% | 96.6% | |

| NOI Debt Yield | 9.7% | 13.4% | 12.0% | |

| NCF DSCR(4) | 4.00x | 5.51x | 4.58x |

| (1) | Certain items such as interest expense, interest income, lease cancellation income, depreciation, amortization, debt service payments and any other non-recurring were excluded from the historical presentation and are not considered for the underwritten cash flow. |

| (2) | Based on in-place rent roll dated November 1, 2020. |

| (3) | Represents an underwritten economic vacancy of 5.0%. |

| (4) | Based on the interest only debt service payments of the 860 Washington Loan. |

| ■ | Appraisal. According to the appraisal, the 860 Washington Property has an “as-is” appraised value of $240,000,000 as of December 1, 2020. |

Appraisal Approach | “As-Is” Value | Discount Rate | Capitalization Rate |

| Direct Capitalization Approach | $230,000,000 | N/A | 4.75% |

| Discounted Cash Flow Approach | $240,000,000 | 5.75% | 5.00%(1) |

| (1) | Represents the terminal capitalization rate. |

| ■ | Environmental Matters. The Phase I environmental report dated December 18, 2020 identified a controlled recognized environmental condition at the 860 Washington Property. See “Description of the Mortgage Pool—Environmental Considerations” in the Preliminary Prospectus for more information. See “—The Borrower” below. |

8

LOAN #1: 860 WASHINGTON

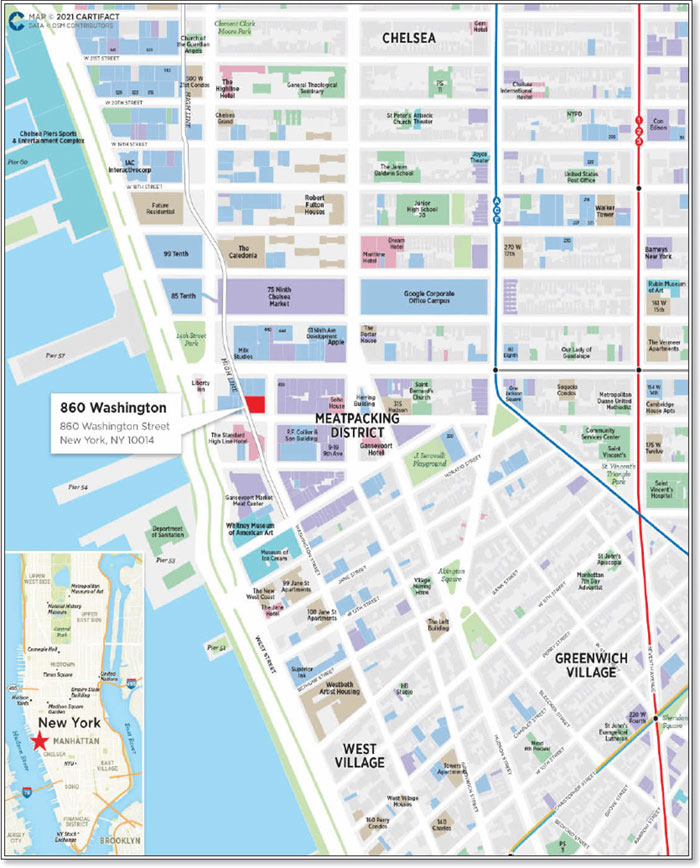

| ■ | Market Overview and Competition. The 860 Washington Property location features major crosstown thoroughfares as well as public attractions. The area benefits from one of New York’s most well-known food halls, Chelsea Market, and is served by the constant foot traffic exiting from the High Line Elevated Park, which is adjacent to the 860 Washington Property. The 860 Washington Property is located within a five-minute walk of the A, C, E, and L trains at the 14th Street station and is within a couple of blocks from the Westside Highway. |

The 860 Washington Property is located within the Hudson Square/Meatpacking submarket in the greater Manhattan office market. The Hudson Square/Meatpacking office submarket contains 11.4 million SF of office space and is defined as Canal Street to 14th Street, and Hudson River to Sixth Avenue. The Hudson Square/Meatpacking office submarket vacancy as of the third quarter of 2020 has increased by 50 basis points year-over-year to 3.5%. Class A vacancy in the third quarter of 2020 was 2.4%, the third lowest it has been since the first quarter of 2014. According to the appraisal, the competitive supply in the Hudson Square/Meatpacking submarket currently totals 3,020,397 SF with average asking rents of $140.94 per SF. According to the appraisal, the estimated average household income in 2020 within a 0.25-, 0.5-, and 1-mile radius of the 860 Washington Property was $115,266, $172,577, and $172,909, respectively. The appraisal also identified 15 office lease comparables for the 860 Washington Property. Base rents for the 15 office lease comparables ranged from $105.00 to $160.00 per SF with an average of $135.68 per SF. The appraisal’s concluded market rents ranged from $145.00 to $165.00 per SF, varying by the floor of the 860 Washington Property. These concluded office market rents are in line with the 860 Washington Property’s weighted average in-place office rent of $151.40 per SF.

Summary of Appraisal’s Concluded Office Market Rent(1)

Floor(s) | Appraisal’s Concluded Office |

| 2-3 | $145.00 |

| 4 | $165.00 |

| 5-10 | $150.00 |

| (1) | Source: Appraisal. |

The following table presents certain information relating to the primary office competition for the 860 Washington Property:

Competitive Set - Comparable Office Leases(1)

Property Name | Tenant Name | Tenant Leased | Lease Sign Date | Lease Term | Base Rent Per SF |

860 Washington Hudson Square/Meatpacking, Midtown South | Various | 101,254 | Various | Various | $151.40 |

60-74 Gansevoort Street Hudson Square/Meatpacking, Midtown South | Match.com | 40,569 | May-20 | 11.3 | $118.00 |

40 Tenth Avenue Hudson Square/Meatpacking, Midtown South | RTW Investments | 14,082 | Mar-20 | 10.0 | $145.00 |

40 Tenth Avenue Hudson Square/Meatpacking, Midtown South | Aquarian | 13,766 | Feb-20 | 10.5 | $147.00 |

90 Fifth Avenue Chelsea, Midtown South | App Academy | 12,602 | Feb-20 | 5.2 | $105.00 |

512 West 22nd Street Chelsea, Midtown South | Next Jump Media | 41,300 | Dec-19 | 10.8 | $150.00 |

415 West 13th Street Hudson Square/Meatpacking, Midtown South | Affirmation Arts Limited | 7,205 | Nov-19 | 10.8 | $110.00 |

412 West 15th Street Chelsea, Midtown South | Hunter Creek Advisors | 6,092 | Sep-19 | 10.5 | $155.00 |

550 Washington Street Hudson Square/Meatpacking, Midtown South | 1,257,529 | Sep-19 | 17.0 | $125.82 | |

412 West 15th Street Chelsea, Midtown South | Untitled Investments, LP | 6,930 | Jul-19 | 8.9 | $134.00 |

809 Broadway Noho/Soho, Midtown South | WestCap Management | 3,345 | Jul-19 | 5.3 | $130.00 |

300 Lafayette Street Noho/Soho, Midtown South | Microsoft Corporation | 63,346 | Apr-19 | 16.5 | $160.00 |

875 Washington Street Hudson Square/Meatpacking, Midtown South | Soho Works | 52,932 | Apr-19 | 15.7 | $133.09 |

412 West 15th Street Chelsea, Midtown South | XN Strategic, LLC | 6,092 | Mar-19 | 10.9 | $135.00 |

40 Tenth Avenue Hudson Square/Meatpacking, Midtown South | Starwood | 14,258 | Mar-19 | 11.0 | $150.00 |

61 Ninth Avenue Hudson Square/Meatpacking, Midtown South | Aetna | 142,342 | Jul-18 | 12.3 | $137.27 |

| (1) | Source: Appraisal. |

9

LOAN #1: 860 WASHINGTON

The appraisal identified 14 comparable retail leases for the 860 Washington Property. Base rents for the 14 retail leases ranged from $310.75 to $718.75 per SF, with an average of $456.54 per SF. The appraisal concluded a market rent of $450.00 per SF for the retail space at the 860 Washington Property.

The following table presents certain information relating to the primary retail competition for the 860 Washington Property:

Competitive Set - Comparable Retail Leases(1)

Property Name | Tenant Name | Tenant Leased | Lease Sign Date | Lease Term | Base Rent Per SF |

| 860 Washington, Meatpacking District, Manhattan, NY | Tesla | 10,967 | Q3 2016 / Q2 2017 | Various | $504.74 |

2 Ninth Avenue, Meatpacking District, Manhattan, NY | Lucid Motors | 3,200 | Q2 2020 | 10.0 | $718.75 |

33 Ninth Avenue, Meatpacking District, Manhattan, NY | Tourneau (Rolex) | 3,941 | Q1 2020 | 10.0 | $545.55 |

64 Gansevoort Street, Meatpacking District, Manhattan, NY | Frame Denim | 2,074 | Q3 2019 | 10.0 | $336.75 |

50 Gansevoort Street, Meatpacking District, Manhattan, NY | Brunello Cucinelli | 2,053 | Q3 2019 | 10.0 | $345.10 |

62 Gansevoort Street, Meatpacking District, Manhattan, NY | Belstaff | 2,089 | Q2 2019 | 12.0 | $346.78 |

875 Washington Street, Meatpacking District, Manhattan, NY | Vans | 2,000 | Q3 2018 | 5.0 | $397.50 |

33 Ninth Avenue, Meatpacking District, Manhattan, NY | MadMen | 3,995 | Q3 2018 | 10.0 | $500.00 |

3 Ninth Avenue, Meatpacking District, Manhattan, NY | Loro Piana | 1,700 | Q2 2018 | 10.0 | $380.88 |

48-54 Ninth Avenue, Meatpacking District, Manhattan, NY | Verizon | 757 | Q2 2018 | 10.0 | $431.14 |

412 West 14th Street, Meatpacking District, Manhattan, NY | Lexus | 4,754 | Q2 2018 | 10.0 | $576.30 |

40 Tenth Avenue, Meatpacking District, Manhattan, NY | Genesis by Hyundai | 9,500 | Q4 2017 | 10.0 | $628.00 |

61 Ninth Avenue, Meatpacking District, Manhattan, NY | Starbucks Reserve Roastery | 10,000 | Q3 2017 | 20.0 | $524.00 |

807 Washington Street, Meatpacking District, Manhattan, NY | Reign | 1,562 | Q3 2017 | 10.0 | $310.75 |

823 Washington Street, Meatpacking District, Manhattan, NY | Caudalie | 800 | Q1 2017 | 10.0 | $350.00 |

| (1) | Source: Appraisal. |

| ■ | The Borrower. The borrower is 860 Washington GORP Property LLC, a single purpose Delaware limited liability company structured to be bankruptcy remote with two independent directors in the organizational structure. Legal counsel to the borrower delivered a non-consolidation opinion in connection with the origination of the 860 Washington Loan. |

The non-recourse carveout guarantor is Gotham Office Realty Partnership LLC, a joint venture between the borrower sponsors, which are Meadow Partners and the California Public Employees’ Retirement System (“CalPERS”). Founded in 2009 by Jeff Kaplan, Tim Yantz, and Andrew McDaniel, Meadow Partners is a private real estate investment firm based in New York City and London that manages a series of closed-end funds and separate accounts on behalf of institutional investors. The firm specializes in middle-market transactions in all sectors and across the risk spectrum. Since inception, Meadow Partners has invested over $1.5 billion of equity and has acquired more than $5 billion of real estate assets in its target markets of New York City, Washington, D.C., London, and Paris. CalPERS is the nation’s largest public pension fund, serving more than 2 million members in the retirement system and 1.5 million members and their families in their health program. As of June 30, 2020, CalPERS held approximately $37.4 billion of their $389.0 billion assets in real estate.

| ■ | Escrows. At loan origination of the 860 Washington Loan, the borrower funded a reserve of $196,050 for unfunded obligations related to two tenant leases. |

Tax Reserve – On each due date, the borrower is required to deposit into the tax and insurance escrow fund 1/12 of the taxes that will be payable during the ensuing twelve months.

Insurance Reserve – On each due date, if the liability or casualty policy maintained by the borrower covering the 860 Washington Property does not constitute an approved blanket or umbrella policy, the borrower is required to deposit into the tax and insurance escrow fund 1/12 of the estimated insurance premiums estimated to be payable for the renewal of coverage.

10

LOAN #1: 860 WASHINGTON

Ground Lease Reserve – On each due date, the borrower is required to deposit into the ground lease reserve fund 1/12 of the rents that will be payable during the ensuing 12 months.

Replacement Reserve – On each due date occurring during the continuance of a Cash Sweep Period (as defined below), the borrower is required to deposit $1,954 into the replacement reserve fund for replacements and repairs required to be made to the 860 Washington Property during the calendar year.

TI/LC Reserve – On each due date occurring during the continuance of a Cash Sweep Period, the borrower is required to deposit $48,846 into the rollover reserve account for tenant improvement and leasing commission obligations incurred following the loan origination date.

Specified Tenant Reserve – On each due date during a Specified Tenant Collection Period (as defined below), the borrower shall deposit with the lender an amount equal to the lesser of (a) the total rentable square feet of the applicable specified tenant space multiplied by $100.00, and (b) the available cash flow for the applicable month after payment of the monthly debt service payment amount, monthly reserve payments, and actual operating expenses at the 860 Washington Property.

| ■ | Lockbox and Cash Management. The 860 Washington Loan is structured with a hard lockbox and in-place cash management. The borrower was required at loan origination to send tenant direction letters instructing the tenants to deposit rents directly into a lender-approved lockbox account (the “Clearing Account”). In addition, all funds on deposit in the Clearing Account are required to be transferred to the cash management account once every business day, and applied and disbursed in accordance with the 860 Washington Loan documents. If no Cash Sweep Period is ongoing, amounts on deposit in the cash management account are required to be applied each month to make required monthly disbursements into the tax reserve, the ground lease reserve, and the insurance reserve with any remainder being disbursed to the borrower. |

A “Cash Sweep Period” means each period commencing on the occurrence of a Cash Sweep Event and continuing until the earlier of (a) the occurrence of a Cash Sweep Event Cure (as defined below) with respect to the applicable Cash Sweep Event, or (b) the payment in full of all principal and interest on the 860 Washington Loan and all other amounts payable under the 860 Washington Loan documents or defeasance of the 860 Washington Loan in accordance with the terms and provisions of the 860 Washington Loan documents.

A “Cash Sweep Event” means the occurrence of (a) an event of default, (b) any bankruptcy action of the borrower, (c) the commencement of a Debt Yield Trigger Period (as defined below), or (d) the commencement of a Lease Sweep Period (as defined below).

A “Cash Sweep Event Cure” means (i) with respect to clause (a) above, the acceptance by the lender of a cure of such event of default (which cure the lender is not obligated to accept and may reject or accept in its sole and absolute discretion), (ii) with respect to clause (c) above, a Debt Yield Cure (as defined below), or (c) with respect to clause (d) above, a Lease Sweep Event Cure; provided that such Cash Sweep Event Cure will be subject to the following conditions, (1) no event of default has occurred and is continuing under the 860 Washington Loan documents, (2) the borrower has paid all of the lender’s reasonable expenses incurred in connection with such Cash Sweep Event Cure, including reasonable attorney’s fees and expenses, and (3) in no event will the borrower be entitled to cure a Cash Sweep Period caused by a bankruptcy action of the borrower.

A “Debt Yield Trigger Period” means a period (a) commencing on the occurrence of a debt yield (to be tested quarterly) being less than 8.0% on any date of determination for the calendar quarter immediately preceding the date of such determination, based upon the trailing 12-month period immediately preceding such date of determination (other than with respect to the rental income component of the debt yield calculation, which component shall be based on in-place rents annualized as of the applicable date of calculation), as determined by the lender; provided, however, upon certain events described in the 860 Washington Loan documents, including, among other events, such tenant having delivered a notice of termination or, in certain circumstances as described the 860 Washington Loan documents, such tenant having gone dark, the net operating income as of the most recent calculation date may be immediately adjusted downward by the lender and, to the extent such adjustment results in a debt yield that is below 8.0%, a Debt Yield Trigger Period will immediately commence; and continuing until (b) (i) no event of default is continuing and (ii) either: (x) the achievement of a debt yield of 8.0% for one calendar quarter immediately preceding the date of determination based upon the trailing 12-month period immediately preceding such date of determination (other than with respect to the rental income component of the debt yield calculation, which component shall be based on in-place rents annualized as of the applicable date of calculation), as determined by the lender or (y) the borrower delivers cash or a letter of credit in an amount that would be sufficient if the same were to be deducted from the principal balance of the 860

11

LOAN #1: 860 WASHINGTON

Washington Loan to cause the debt yield to equal 8.0% (each of the events described in the foregoing clause (b), a “Debt Yield Cure”).

A “Lease Sweep Period” means each period (a) commencing on the occurrence of either (or both) of Tesla failing to exercise the renewal option set forth in its lease on or before the date that is 15 months prior to the earliest stated expiration of the lease (a “Tesla Event”) and/or Alibaba failing to exercise the renewal option set forth in its lease on or before the date that is 12 months prior to the earliest stated expiration of the lease (an “Alibaba Event”), and Delos fails to exercise the renewal option set forth in its lease on or before the date that is 18 months prior the earliest stated expiration of the its lease (each of the events described in the foregoing clause (a), a “Lease Sweep Event”); and continuing until (b) the earlier to occur of (i) (x) all Specified Tenant Collection Periods have been cured in accordance with the terms hereof and (y) a portion of the space (each, a “Specified Tenant Space”) demised under the lease of Tesla, Alibaba and/or Delos (each, a “Specified Tenant Lease”) (i.e. the Specified Tenant Space demised pursuant to the Specified Tenant Leases with respect to which a Specified Tenant Collection Period has occurred) has been re-tenanted pursuant to one or more qualified leases (each, a “Qualified Lease”) which satisfy certain occupancy conditions, including, without limitation, the entire applicable Specified Tenant Space is tenanted under one or more Qualified Leases, and (taking into account such Qualified Leases), the debt yield equals or exceeds 8.0% (each of the events described in the foregoing clause (b), a “Lease Sweep Event Cure”).

A “Specified Tenant Collection Period” means a period (a) commencing on the first due date following the occurrence of (i) a Tesla Event, (ii) an Alibaba Event, or (iii) a Lease Sweep Event; and (b) ending upon the first to occur of the following (i) the entirety of the square footage of space occupied by the tenant for which a Specified Tenant Collection Period is ongoing (excluding the square footage of space occupied pursuant to the Delos lease if no lease sweep period is ongoing) is leased pursuant to one or more Qualified Leases and sufficient funds have been deposited in the specified tenant reserve account required under the 860 Washington Loan documents (the “Specified Tenant Reserve Account”) to satisfy any free rent periods, leasing expenses, and/or rent abatements, (ii) the tenant for which a Specified Tenant Collection Period is ongoing (excluding the square footage of space occupied pursuant to the Delos lease if no lease sweep period is ongoing) exercises its renewal or extension option with respect to all of its space (excluding the square footage of space occupied pursuant to the Delos lease if no Lease Sweep period is ongoing) and sufficient funds have been deposited in the Specified Tenant Reserve Account to satisfy any free rent periods, leasing expenses, and/or rent abatements, or (iii) the date on which the amount in the Specified Tenant Reserve Account collected is equal to $100 per square foot of space occupied by the tenant for which the Specified Tenant Collection Period is ongoing (excluding the square footage of space occupied pursuant to the Delos lease if no Lease Sweep period is ongoing).

| ■ | Property Management. The 860 Washington Property is managed by 860 Washington GORP Manager LLC, an affiliate of the borrower, and Property Group Partners LLC. |

| ■ | Current Mezzanine or Subordinate Indebtedness. None. |

| ■ | Permitted Future Mezzanine or Subordinate Indebtedness. Not permitted. |

| ■ | Release of Collateral. Not permitted. |

| ■ | Terrorism Insurance. The borrower is required to maintain terrorism insurance in an amount equal to the full replacement cost of the 860 Washington Property, as well as 18 months of rental loss and/or business interruption coverage, together with a 12-month extended period of indemnity following casualty. See “Risk Factors—Risks Relating to the Mortgage Loans—Terrorism Insurance May Not Be Available for All Mortgaged Properties” in the Preliminary Prospectus. |

| ■ | Ground Lease. The 860 Washington Property is subject to a ground lease (the “Ground Lease”) between Eight60 LLC, as the lessor, and the borrower, as the ground lessee, with a term of 99 years from the date of the Ground Lease, December 11, 2020. The annual ground lease payment, payable in equal monthly installments, will be $2,000,000 for years 1-5, $2,128,164 for years 6-10, and $2,292,637 for years 11-15. The Ground Lease provides a customary set of mortgage protections. |

12

LOAN #2: MILLENNIUM CORPORATE PARK

13

LOAN #2: MILLENNIUM CORPORATE PARK

14

LOAN #2: MILLENNIUM CORPORATE PARK

| Mortgaged Property Information | Mortgage Loan Information | ||||

| Number of Mortgaged Properties | 1 | Loan Seller | GSMC | ||

| Location (City/State) | Redmond, Washington | Cut-off Date Balance(2) | $105,000,000 | ||

| Property Type | Office | Cut-off Date Balance per SF(1) | $245.79 | ||

| Size (SF) | 537,046 | Percentage of Initial Pool Balance | 6.9% | ||

| Total Occupancy as of 10/1/2020 | 100.0% | Number of Related Mortgage Loans | None | ||

| Owned Occupancy as of 10/1/2020 | 100.0% | Type of Security | Fee Simple | ||

| Year Built / Latest Renovation | 1999-2000, 2014 / NAP | Mortgage Rate | 3.03200% | ||

| Appraised Value | $216,700,000 | Original Term to Maturity (Months) | 60 | ||

| Appraisal Date | 11/18/2020 | Original Amortization Term (Months) | NAP | ||

| Borrower Sponsor | Vanbarton Group LLC | Original Interest Only Period (Months) | 60 | ||

| Property Management | CBRE, Inc. | First Payment Date | 2/6/2021 | ||

| Maturity Date | 1/6/2026 | ||||

| Underwritten Revenues | $16,787,509 | ||||

| Underwritten Expenses | $3,539,016 | Escrows(3) | |||

| Underwritten Net Operating Income (NOI) | $13,248,492 | Upfront | Monthly | ||

| Underwritten Net Cash Flow (NCF) | $12,720,483 | Taxes | $0 | $0 | |

| Cut-off Date LTV Ratio(1) | 60.9% | Insurance | $0 | $0 | |

| Maturity Date LTV Ratio(1) | 60.9% | Replacement Reserve | $0 | $0 | |

| DSCR Based on Underwritten NOI / NCF(1) | 3.26x / 3.13x | TI/LC | $0 | $0 | |

| Debt Yield Based on Underwritten NOI / NCF(1) | 10.0% / 9.6% | Other(4) | $9,568,123 | $0 | |

| Sources and Uses | |||||

| Sources | $ | % | Uses | $ | % |

| Loan Combination Amount | $132,000,000 | 58.1% | Purchase Price | $217,000,000 | 95.5% |

| Principal’s New Cash Contribution | 95,168,385 | 41.9 | Upfront Reserves | 9,568,123 | 4.2 |

| Origination Costs | 600,262 | 0.3 | |||

| Total Sources | $227,168,385 | 100.0% | Total Uses | $227,168,385 | 100.0% |

| (1) | Calculated based on the aggregate outstanding principal balance as of the Cut-off Date of the Millennium Corporate Park Loan Combination (as defined below). |

| (2) | The Cut-off Date Balance of $105,000,000 represents the controlling Note A-1 of the $132,000,000 Millennium Corporate Park Loan Combination, which is evidenced by two pari passu notes. See “—The Mortgage Loan” below. |

| (3) | See “—Escrows” below. |

| (4) | Other upfront reserve represents unfunded obligations to third parties, such as unpaid tenant allowances, leasing commissions, free rent and gap rent. |

| ■ | The Mortgage Loan. The mortgage loan (the “Millennium Corporate Park Loan”) is part of a loan combination (the “Millennium Corporate Park Loan Combination”) consisting of two pari passu notes with an outstanding aggregate principal balance of $132,000,000 and is secured by a first deed of trust encumbering the borrower’s fee simple interest in an office property located in Redmond, Washington (the “Millennium Corporate Park Property”). The Millennium Corporate Park Loan, evidenced by the controlling Note A-1, has an outstanding principal balance as of the Cut-off Date of $105,000,000 and represents approximately 6.9% of the Initial Pool Balance. The Millennium Corporate Park Loan Combination was originated by Goldman Sachs Bank USA on December 17, 2020. The Millennium Corporate Park Loan Combination has an interest rate of 3.03200% per annum. The borrower utilized the proceeds of the Millennium Corporate Park Loan Combination to acquire the Millennium Corporate Park Property, fund upfront reserves and pay origination costs. |

The Millennium Corporate Park Loan Combination had an initial term of 60 months and has a remaining term of 59 months as of the Cut-off Date. The Millennium Corporate Park Loan Combination requires payments of interest only for the entire term of the Millennium Corporate Park Loan Combination. The stated maturity date is the due date in January 2026. Voluntary prepayment of the Millennium Corporate Park Loan Combination is permitted on or after September 6, 2025. The borrower has the option to defease the entire $132,000,000 principal balance of the Millennium Corporate Park Loan Combination in whole (but not in part) on or after the first due date following the earlier to occur of (i) two years after the closing date of the securitization that includes the last note to be securitized and (ii) December 17, 2023.

15

LOAN #2: MILLENNIUM CORPORATE PARK

The table below summarizes the promissory notes that comprise the Millennium Corporate Park Loan Combination. The relationship between the holders of the Millennium Corporate Park Loan Combination is governed by a co-lender agreement as described under “Description of the Mortgage Pool—The Loan Combinations—The Serviced Pari Passu Loan Combinations” in the Preliminary Prospectus.

| Loan Combination Summary | ||||

| Note | Original Balance | Cut-off Date Balance | Note Holder | Controlling Piece |

| A-1 | $105,000,000 | $105,000,000 | BMARK 2021-B23 | Yes |

| A-2 | 27,000,000 | 27,000,000 | GSBI(1) | No |

| Total | $132,000,000 | $132,000,000 | ||

| (1) | Expected to be contributed to one or more future securitizations. |

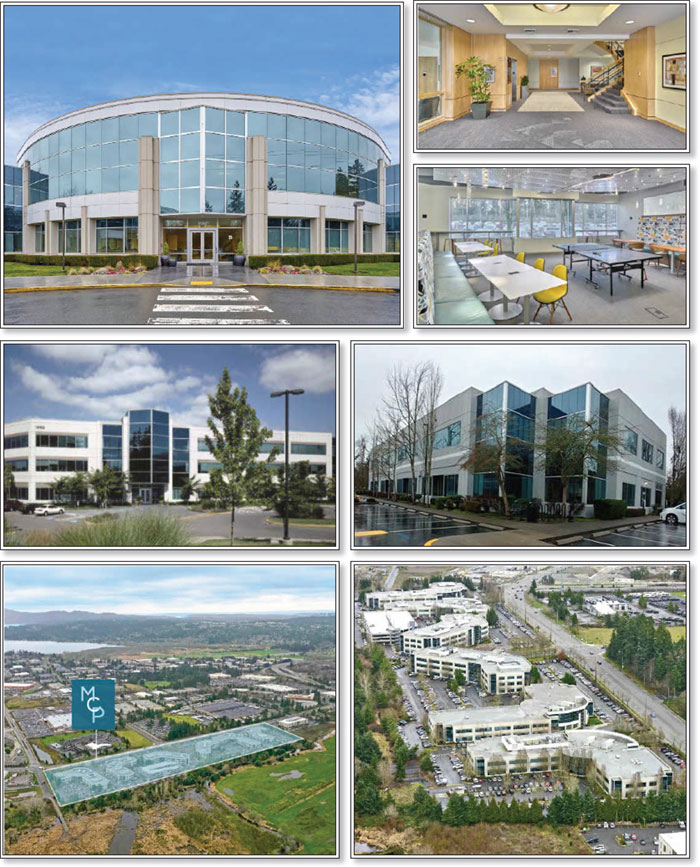

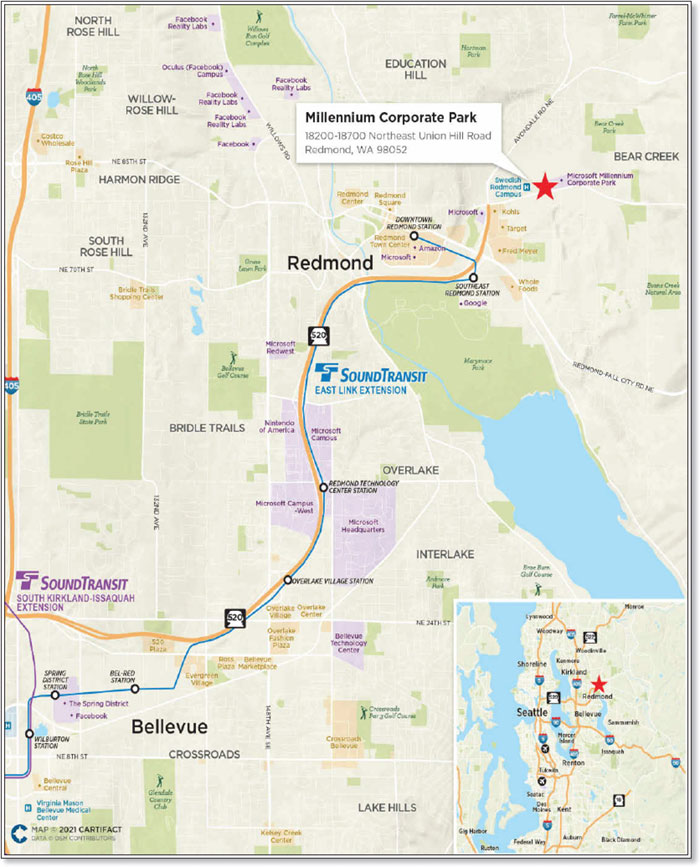

| ■ | The Mortgaged Property. The Millennium Corporate Park Property consists of six, 2-3 story office buildings totaling 537,046 SF located in Redmond, Washington. The Millennium Corporate Park Property was built in 1999-2000 and 2014 on a 29.75-acre site, located in Seattle’s office submarket. Based on the rent roll dated October 1, 2020, the Millennium Corporate Park Property is currently 100% leased. |

Microsoft Corp. (“Microsoft”) (479,193 SF; 89.2% of NRA; 88.5% of Base Rent) is the largest tenant based on NRA at the Millennium Corporate Park Property. Microsoft occupies space in all six buildings, with leases beginning between 1999-2014 and expiring between 2022-2028. Each of Microsoft’s six leases has two, 3-year or 5-year renewal options. Founded in 1975, Microsoft is the world’s largest software company with over $130 billion in LTM revenues. Microsoft offers a wide range of software products and services including the Windows operating system.

Golder Associates, Inc. (“Golder”) (36,965 SF; 6.9% of NRA; 7.0% of Base Rent) is the second largest tenant based on NRA at the Millennium Corporate Park Property and has been in occupancy since June 1999. Golder’s lease expires in March 2024 and has one, 5-year renewal option. Golder is an employee-owned global company providing energy consulting, design, and construction services. Golder operates in over 155 offices in Africa, Asia, Australia, Europe, North America, and South America.

Quantrarium, LLC (11,798 SF; 2.2% of NRA; 2.6% of Base Rent) is the third largest tenant based on NRA at the Millennium Corporate Park Property. Quantrarium, LLC is a technology company specializing in artificial intelligence driven valuations, data, analytics, and innovation.

COVID-19 Update. As of January 14, 2021 the Millennium Corporate Park Property is open with tenants working remotely. 100% of tenants by SF and UW Base Rent paid their November and December 2020 rent payments. As of January 14, 2020, the Millennium Corporate Park Loan is not subject to any modification or forbearance requests.

16

LOAN #2: MILLENNIUM CORPORATE PARK

The following table presents certain information relating to the tenants at the Millennium Corporate Park Property:

Largest Tenants Based on Underwritten Base Rent(1)

Tenant Name | Credit Rating | Tenant | % of GLA | UW Base Rent | % of Total | UW Base | Lease | Renewal / |

| Microsoft Corp. | AA+ / Aaa / AAA | 479,193 | 89.2% | $11,584,008 | 88.5% | $24.17 | Various(3) | Various(4) |

| Golder Associates, Inc. | NR / NR / NR | 36,965 | 6.9 | 921,168 | 7.0 | $24.92 | 3/31/2024 | 1, 5-year option |

| Quantrarium, LLC | NR / NR / NR | 11,798 | 2.2 | 339,192 | 2.6 | $28.75 | 7/31/2024 | 1, 5-year option |

| People Tech Group | NR / NR / NR | 7,992 | 1.5 | 239,760 | 1.8 | $30.00 | 8/31/2024 | NAP |

| CBRE Management Office | NR / NR / NR | 1,098 | 0.2 | 0 | 0.0 | $0.00 | 12/31/2039 | NAP |

| Largest Tenants | 537,046 | 100.0% | $13,084,128 | 100.0% | $24.36 | |||

| Vacant Space | 0 | 0.0 | 0 | 0.0 | $0.00 | |||

| Total / Wtd. Avg. All Owned Tenants | 537,046 | 100.0% | $13,084,128 | 100.0% | $24.36 |

| (1) | Based on the underwritten rent roll dated October 1, 2020. |

| (2) | Credit Ratings are those of the parent company whether or not the parent guarantees the lease. |

| (3) | Microsoft Corp. occupies 130,805 SF expiring on May 31, 2022, 148,545 SF expiring on May 31, 2024 and 199,843 SF expiring on April 30, 2028. |

| (4) | Microsoft Corp. leases have two, 3-year or 5-year renewal options. |

The following table presents certain information relating to the lease rollover schedule at the Millennium Corporate Park Property, based on the initial lease expiration date:

Lease Expiration Schedule(1)(2)

Year Ending December 31 | Expiring Owned GLA | % of Owned GLA | Cumulative % of | UW Base Rent | % of Total UW | UW Base Rent $ | # of Expiring | |||||||

| MTM | 0 | 0.0% | 0.0% | $0 | 0.0% | $0.00 | 0 | |||||||

| 2021 | 0 | 0.0 | 0.0% | 0 | 0.0 | $0.00 | 0 | |||||||

| 2022 | 130,805 | 24.4 | 24.4% | 2,944,421 | 22.5 | $22.51 | 1 | |||||||

| 2023 | 0 | 0.0 | 24.4% | 0 | 0.0 | $0.00 | 0 | |||||||

| 2024 | 205,300 | 38.2 | 62.6% | 4,843,868 | 37.0 | $23.59 | 4 | |||||||

| 2025 | 0 | 0.0 | 62.6% | 0 | 0.0 | $0.00 | 0 | |||||||

| 2026 | 0 | 0.0 | 62.6% | 0 | 0.0 | $0.00 | 0 | |||||||

| 2027 | 0 | 0.0 | 62.6% | 0 | 0.0 | $0.00 | 0 | |||||||

| 2028 | 199,843 | 37.2 | 99.8% | 5,295,840 | 40.5 | $26.50 | 1 | |||||||

| 2029 | 0 | 0.0 | 99.8% | 0 | 0.0 | $0.00 | 0 | |||||||

| 2030 | 0 | 0.0 | 99.8% | 0 | 0.0 | $0.00 | 0 | |||||||

| 2031 | 0 | 0.0 | 99.8% | 0 | 0.0 | $0.00 | 0 | |||||||

| 2032 & Thereafter | 1,098 | 0.2 | 100.0% | 0 | 0.0 | $0.00 | 1 | |||||||

| Vacant | 0 | 0.0 | 100.0% | NAP | NAP | NAP | NAP | |||||||

| Total / Wtd. Avg. | 537,046 | 100.0% | $13,084,128 | 100.0% | $24.36 | 7 |

| (1) | Certain tenants may have termination or contraction options that may become exercisable prior to the originally stated expiration date of the tenant lease that are not considered in this rollover schedule. |

| (2) | Based on the underwritten rent roll dated October 1, 2020. |

The following table presents certain information relating to historical leasing at the Millennium Corporate Park Property:

Historical Leased %(1)

2017 | 2018 | 2019 | As of 10/1/2020(2) |

| 85.5% | 85.5% | 95.2% | 100.0% |

| (1) | As provided by the borrower and reflects year-end occupancy for the indicated year ended December 31 unless specified otherwise. |

| (2) | Based on the underwritten rent roll dated October 1, 2020. |

17

LOAN #2: MILLENNIUM CORPORATE PARK

| ■ | Underwritten Net Cash Flow. The following table presents certain information relating to the Underwritten Net Cash Flow at the Millennium Corporate Park Property: |

Cash Flow Analysis(1)

2017 | 2018 | 2019 | TTM 10/31/2020 | Underwritten(2) | Underwritten $ per SF | |||||||

| Base Rent | $10,118,050 | $10,179,744 | $11,029,280 | $11,356,569 | $13,084,128 | $24.36 | ||||||

| Vacant Income | 0 | 0 | 0 | 0 | 0 | 0.00 | ||||||

| Contractual Rent Steps | 0 | 0 | 0 | 0 | 930,347 | 1.73 | ||||||

| Reimbursements | 2,373,187 | 2,990,712 | 3,133,322 | 3,233,506 | 3,477,404 | 6.48 | ||||||

| Vacancy & Credit Loss | 0 | 0 | 0 | 0 | (705,271) | (1.31) | ||||||

| Other Income | 900 | 900 | 900 | 408 | 900 | 0.00 | ||||||

| Effective Gross Revenue | $12,492,137 | $13,171,355 | $14,163,501 | $14,590,482 | $16,787,509 | $31.26 | ||||||

| Total Operating Expenses | 2,779,147 | 3,120,392 | 3,148,266 | 3,260,799 | 3,539,016 | 6.59 | ||||||

| Net Operating Income | $9,712,990 | $10,050,963 | $11,015,235 | $11,329,683 | $13,248,492 | $24.67 | ||||||

| TI/LC | 0 | 0 | 0 | 0 | 420,600 | 0.78 | ||||||

| Capital Expenditures | 0 | 0 | 0 | 0 | 107,409 | 0.20 | ||||||

| Net Cash Flow | $9,712,990 | $10,050,963 | $11,015,235 | $11,329,683 | $12,720,483 | $23.69 | ||||||

| Occupancy | 85.5% | 85.5% | 95.2% | 95.9% | 100.0% | |||||||

| NOI Debt Yield | 7.4% | 7.6% | 8.3% | 8.6% | 10.0% | |||||||

| NCF DSCR | 2.39x | 2.48x | 2.71x | 2.79x | 3.13x |

| (1) | Certain items such as interest expense, interest income, lease cancellation income, depreciation, amortization, debt service payments and any other non-recurring or non-operating items were excluded from the historical presentation and are not considered for the underwritten cash flow. |

| (2) | Underwritten cash flow is based on annualized in-place rents as of October 1, 2020, with contractual rent steps through March 31, 2022. |

| ■ | Appraisal. According to the appraisal, the Millennium Corporate Park Property had an “as-is” appraised value of $216,700,000 as of November 18, 2020. The appraisal also concluded to an “as dark” value of $176,100,000 as of November 18, 2020. |

| ■ | Environmental Matters. According to the Phase I environmental report dated as of October 21, 2020, there are no recognized environmental conditions or recommendations for further action at the Millennium Corporate Park Property. |

| ■ | Market Overview and Competition. The Millennium Corporate Park Property is located in Redmond, Washington. According to the appraisal, the Millennium Corporate Park Property is located within Washington’s Redmond submarket, a hub for technology and entrepreneurial start-ups. The Millennium Corporate Park Property is considered a Class B office park in the Redmond submarket. |

The Millennium Corporate Park Property is located in the Redmond submarket, which contains 7,646,728 SF of office inventory. During the third quarter of 2020, asking rents in the Redmond submarket declined by 0.5% to an average of $35.42. Since the third quarter of 2019, asking rents have increased by 11.5%, up from $31.78. According to the appraisal, occupancy rates in the Redmond office submarket have remained relatively stable over the past year. In the third quarter of 2020, 96% of all office space was occupied compared to 95.8% occupancy in the third quarter of 2019.

The following table presents certain information relating to the primary office competition for the Millennium Corporate Park Property:

Competitive Set(1)

Property Name | City / State | Building SF | NOI/SF | Year Built / Renovated | Occupancy |

| Millennium Corporate Park | Redmond, WA | 537,032 | $23.89 | 1999, 2000, 2014 / NAP | 100.0% |

| Sunset North | Bellevue, WA | 464,061 | $29.35 | 1999 / 2018 | 99.0% |

| 90 North Campus | Bellevue, WA | 262,953 | $27.59 | 1991 / 2019 | 100.0% |

| The Offices at Riverpark | Redmond, WA | 106,281 | $28.92 | 2008 / NAP | 100.0% |

| Redmond Technology | Redmond, WA | 101,252 | $21.75 | 2008 / NAP | 100.0% |

| Newport Corporate Center | Bellevue, WA | 998,284 | $28.10 | 1988 / 2019 | 99.0% |

| (1) | Source: Appraisal. |

18

LOAN #2: MILLENNIUM CORPORATE PARK

| ■ | The Borrower. The borrower is Millennium Strategic Venture LLC, a Delaware limited liability company. The borrower is structured to be a single purpose bankruptcy-remote entity, having two independent directors in its organizational structure. Legal counsel to the borrower delivered a non-consolidation opinion in connection with the origination of the Millennium Corporate Park Loan Combination. There is no nonrecourse carve-out guarantor or separate environmental indemnitor with respect to the Millennium Corporate Park Loan Combination. |

The borrower sponsor is Vanbarton Group LLC (“Vanbarton”). Vanbarton is a privately owned, vertically integrated real estate investment and advisory firm founded in 1992 with corporate offices in New York City, San Francisco and Seattle. Vanbarton’s investments include core plus, value-add and opportunistic equity investments, preferred equity, junior participations, bridge loans, secondary market debt acquisitions and securitized credit. With $2.56 billion in assets under management, Vanbarton has a track record of investing in office, retail and multifamily within major United States markets on behalf of its institutional client base.

| ■ | Escrows. At loan origination, the borrower deposited approximately $9,568,122.99 into a reserve for certain unfunded obligations, such as unpaid tenant allowances, leasing commissions, free rent and gap rent. |

Tax Reserve. The borrower is required to deposit into a real estate tax reserve, on a monthly basis during the continuance of a Millennium Corporate Park Trigger Period (as defined below), 1/12 of the reasonably estimated annual real estate taxes.

Insurance Reserve. The borrower is required to deposit into an insurance reserve, on a monthly basis during the continuance of a Millennium Corporate Park Trigger Period, 1/12 of reasonably estimated insurance premiums, unless the borrower is maintaining a blanket policy in accordance with the loan documents.

TI/LC Reserve. The borrower is required to deposit into a tenant improvement and leasing commission reserve, on a monthly basis during the continuance of a Millennium Corporate Park Trigger Period, an amount equal to approximately $67,129.

Capital Expenditure Reserve. The borrower is required to deposit into a capital expenditure reserve, on a monthly basis during the continuance of a Millennium Corporate Park Trigger Period, an amount equal to approximately $8,951.

Microsoft Rollover Reserve. Within 10 days following the commencement of a Microsoft 2022 Reserve Period, the borrower will be required to deliver to the lender (i) an amount equal to $2,000,000 for deposit in a rollover reserve account or (ii) a notice electing to deliver on each due date an amount equal to $222,000 (subject to a cap of $2,000,000). Any amount (or portion thereof) required to be deposited into the Microsoft rollover reserve account may, at the borrower’s election, be provided in the form of one or more letters of credit.

A “Millennium Corporate Park Trigger Period” means each period (i) commencing when the debt yield (as calculated under the related loan documents), as reasonably determined by the lender as of the first day of any fiscal quarter, is less than 6.8%, and concluding when the debt yield, determined as of the first day of any fiscal quarter thereafter, is equal to or greater than 6.8%, and (ii) commencing upon the borrower’s failure to deliver annual, quarterly or monthly financial reports as and when required under the related loan documents and concluding when such reports are delivered and indicate that no other Millennium Corporate Park Trigger Period is continuing.

“Microsoft 2022 Reserve Period” means the period that (x) commences on August 31, 2021, unless prior to such date (i) Microsoft has either exercised its applicable renewal options under its leases on the structures at the Millennium Corporate Park Property known as “Building B” and “Building F” or (ii) the borrower delivers to the lender evidence reasonably satisfactory to the lender that Microsoft has otherwise extended the term of each of its lease on each of Building B and Building F on terms no less favorable to the borrower than would have been applicable had Microsoft exercised its renewal options under the foregoing clause (i), in each case to an expiration date at least three years beyond the scheduled expiration date set forth in each applicable lease, and (y) will terminate upon the earlier to occur of (A) the occurrence after August 31, 2021 of the event described in clause (x)(ii) of this definition and (B) satisfaction by the borrower of the Microsoft 2022 Rollover Reserve End Date Conditions.

“Microsoft 2022 Rollover Reserve End Date Conditions” means the delivery to the lender of evidence reasonably satisfactory to the lender establishing that: (i) the borrower has entered into lease demising at least 75% of the space in Building B and Building F to Microsoft or to tenant(s) under Qualifying 2022 Replacement Leases (provided that, if such leases are for part and not all of Building B and Building F, following the entry into such leases, the debt yield as of such date of determination is equal to or greater than the lesser of (A) the debt yield as of the origination date and (B) 9.75%); (ii) all tenant improvement costs and leasing commissions associated with such reletting have been paid in full (or reserved with the lender) and (iii) either (x) all free rent periods in excess of three months have expired or (y) the

19

LOAN #2: MILLENNIUM CORPORATE PARK

amount of any free rent for any free rent periods under such leases in excess of three months has been reserved with the lender).

“Qualifying 2022 Replacement Lease” means a lease (other than with Microsoft) with respect to Building B and/or Building F to a tenant that has been reasonably approved by the lender and for which (i) the term of such lease is at least five years past the expiration of the term of the Microsoft lease with respect to Building B or Building F as of the origination date, with no early termination rights other than for casualty or condemnation or as a customary remedy for certain events of default by the landlord thereunder, (ii) the triple-net rent owed thereunder is at least $25 per rentable square foot per annum, and (iii) the lender has reserved, as of such date of determination, an amount equal to (x) the aggregate amount of all unpaid costs of tenant inducements, tenant improvements and leasing commissions and all unexpired free rent, minus (y) the aggregate amount in the Microsoft rollover reserve account, excess cash flow account and the tenant improvement and leasing commission account.

| ■ | Lockbox and Cash Management. The Millennium Corporate Park Loan Combination is structured with a hard lockbox and springing cash management. The borrower was required to direct each tenant to remit rents directly to a lender-controlled lockbox account. In addition, the borrower is required to cause all cash revenues relating to the Millennium Corporate Park Property and all other money received by the borrower or the property manager with respect to the Millennium Corporate Park Property (other than tenant security deposits) to be deposited into the lockbox account or a lender-controlled cash management account within one business day of receipt. On each business day during the continuance of a Millennium Corporate Park Trigger Period, Microsoft 2024 Reserve Period or event of default under the Millennium Corporate Park Loan Combination, all amounts in the lockbox account are required to be remitted to the cash management account. On each business day that no Millennium Corporate Park Trigger Period, Microsoft 2024 Reserve Period or event of default under the Millennium Corporate Park Loan Combination is continuing, all amounts in the lockbox account are required to be remitted to a borrower-controlled operating account. |

On each due date during the continuance of a Millennium Corporate Park Trigger Period or Microsoft 2024 Reserve Period (or, at the lender’s discretion, during an event of default under the Millennium Corporate Park Loan Combination), all funds on deposit in the cash management account after payment of debt service, required reserves and budgeted operating expenses are required to be reserved (i) during the continuance of a Microsoft 2024 Reserve Period, in the Microsoft rollover reserve account or (ii) if no Microsoft 2024 Reserve Period is continuing, as additional collateral for the Millennium Corporate Park Loan Combination.

A “Microsoft 2024 Reserve Period” means the period that (i) commences on August 31, 2023, unless prior to such date, (a) Microsoft has either exercised its applicable renewal options under its leases on the structures at the Millennium Corporate Park Property known as “Building A” and “Building E” or (b) the borrower delivers to the lender evidence reasonably satisfactory to the lender that Microsoft has otherwise extended the term of its lease on each of Building A and Building E on terms no less favorable to the borrower than would have been applicable had Microsoft exercised its renewal options under the foregoing clause (a), in each case to an expiration date at least three years beyond the scheduled expiration date set forth in each applicable lease, and (ii) will terminate upon the earlier to occur of (A) the occurrence after August 31, 2023 of the event described in clause (i)(b) above and (A) satisfaction by the borrower of the Microsoft 2024 Rollover Reserve End Date Conditions.

“Microsoft 2024 Rollover Reserve End Date Conditions” means the delivery to the lender of evidence reasonably satisfactory to the lender establishing that: (i) the borrower has entered Qualifying 2024 Replacement Leases demising space at all or part of Building A and/or Building E such that following the entry into such leases, the debt yield as of such date of determination is equal to or greater than the lesser of (A) the debt yield as of the origination date and (B) 9.75%, (ii) all tenant improvement costs and leasing commissions associated with such reletting have been paid in full (or reserved with the lender) and (iii) either (x) all free rent periods in excess of three months have expired or (y) the amount of any free rent for any free rent period under such leases in excess of three months has been reserved with the lender).

A “Qualifying 2024 Replacement Lease” means a lease (other than with Microsoft) with respect to Building A and/or Building E to a tenant that has been reasonably approved by the lender for which (i) the term of such lease is at least five years past the expiration of the term of the Microsoft lease with respect to Building A or Building E as of the origination date, with no early termination rights other than for casualty or condemnation or as a customary remedy for certain events of default by the landlord thereunder, (ii) the triple-net rent owed thereunder is at least $25 per rentable square foot per annum, and (iii) the lender has reserved, as of such date of determination, an amount equal to (x) the aggregate amount of all unpaid costs of tenant inducements, tenant improvements and leasing commissions and all unexpired free rent, minus (y) the aggregate amount in the Microsoft rollover reserve account, excess cash flow account and the tenant improvement and leasing commission reserve account.

20

LOAN #2: MILLENNIUM CORPORATE PARK

| ■ | Property Management. The Millennium Corporate Park Property is managed on behalf of the borrower by CBRE, Inc. |

| ■ | Current Mezzanine or Secured Subordinate Indebtedness. None. |

| ■ | Permitted Future Mezzanine or Subordinate Indebtedness. Not permitted. |

| ■ | Terrorism Insurance. The borrower is required to maintain terrorism insurance in an amount equal to the full replacement cost of the Millennium Corporate Park Property, as well as 18 months of rental loss and/or business interruption coverage, together with a 12-month extended period of indemnity following restoration. If TRIPRA is no longer in effect, then the borrower’s requirement will be capped at insurance premiums equal to two times the amount of insurance premiums payable in respect of the property and business interruption/rental loss insurance required under the related Millennium Corporate Park Loan Combination documents. See “Risk Factors—Risks Relating to the Mortgage Loans—Terrorism Insurance May Not Be Available for All Mortgaged Properties” in the Preliminary Prospectus. |

21

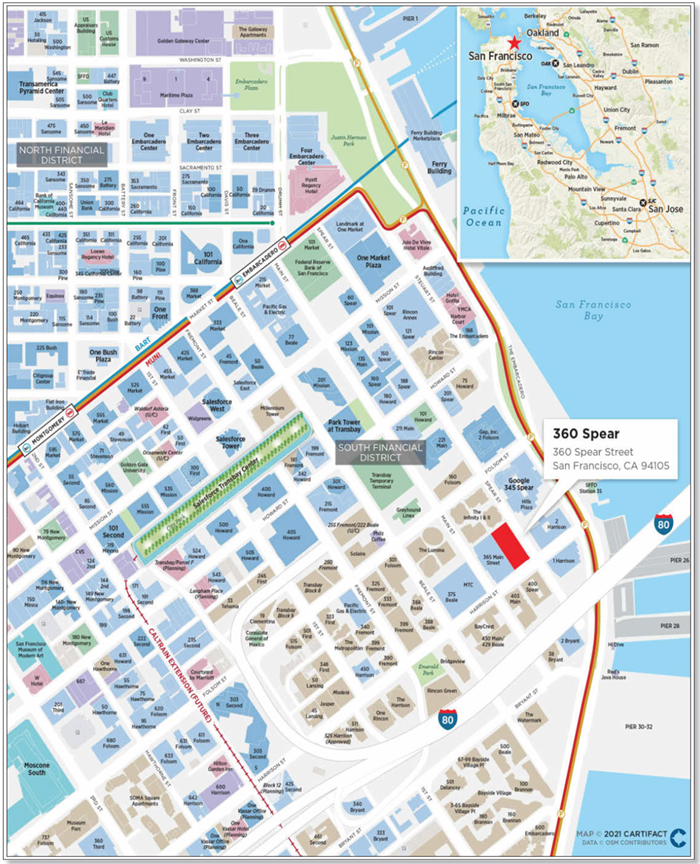

LOAN #3: 360 SPEAR

22

LOAN #3: 360 SPEAR

23

LOAN #3: 360 SPEAR

24

LOAN #3: 360 SPEAR

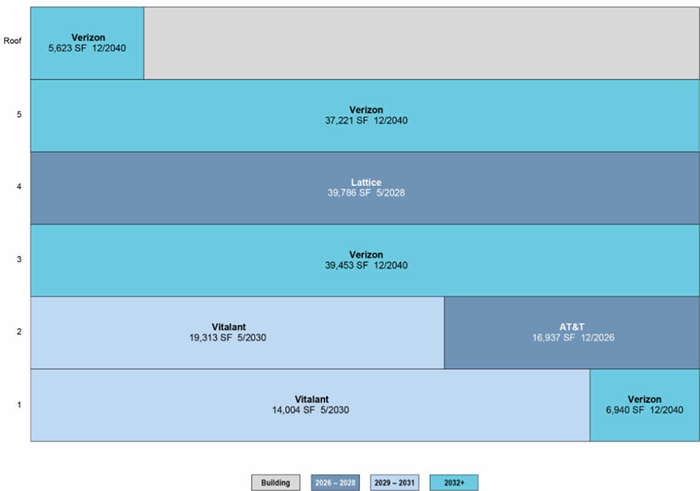

| Mortgaged Property Information | Mortgage Loan Information | ||||||||||

| Number of Mortgaged Properties | 1 | Loan Seller | GACC | ||||||||

| Location (City/State) | San Francisco, California | Cut-off Date Principal Balance(4) | $[104,726,660] | ||||||||

| Property Type | Office/Data Center | Cut-off Date Principal Balance per SF(3) | $[584.16] | ||||||||

| Size (SF) | 179,277 | Percentage of Initial Pool Balance | 6.8% | ||||||||

| Total Occupancy as of 12/30/2020(1) | 100.0% | Number of Related Mortgage Loans | One | ||||||||

| Owned Occupancy as of 12/30/2020(1) | 100.0% | Type of Security | Fee Simple | ||||||||

| Year Built / Latest Renovation | 1924 / 2000 | Mortgage Rate | 2.7680625% | ||||||||

| Appraised Value(2) | $260,000,000 | Original Term to Maturity (Months)(5) | 120 | ||||||||

| Appraisal Date | 5/1/2022 | Original Amortization Term (Months) | 360 | ||||||||

| Borrower Sponsor | John R. Winther | Original Interest Only Period (Months)(5) | 60 | ||||||||

| Property Management | Harvest Properties Inc. | First Payment Date | 2/6/2021 | ||||||||

| Maturity Date | 1/6/2031 | ||||||||||

| Underwritten Revenues | $18,490,906 | ||||||||||

| Underwritten Expenses | $4,757,608 | Escrows(6) | |||||||||

| Underwritten Net Operating Income (NOI) | $13,733,298 | Upfront | Monthly | ||||||||

| Underwritten Net Cash Flow (NCF) | $13,464,382 | Taxes | $382,011 | $95,503 | |||||||

| Cut-off Date LTV Ratio(2)(3) | [40.3]% | Insurance | $0 | $0 | |||||||

| Maturity Date LTV Ratio(2)(3) | [33.4]% | Replacement Reserves | $0 | $3,735 | |||||||

| DSCR Based on Underwritten NOI / NCF(3) | [2.18]x / [2.13]x | TI/LC(2) | $0 | $18,675 | |||||||

| Debt Yield Based on Underwritten NOI / NCF(3) | [13.1]% / [12.9]% | Other(7) | $23,354,784 | $0 | |||||||

| Sources and Uses | |||||||||||

| Sources | $ | % | Uses | $ | % | ||||||

| Senior Loan Amount | $105,000,000 | 54.8% | Purchase Price | $165,468,922(8) | 86.4% | ||||||

| Subordinate Loan Amount | 55,000,000 | 28.7 | Reserves | 23,736,795 | 12.4 | ||||||

| Mezzanine Loan Amount | 25,000,000 | 13.1 | Origination Costs | 2,241,582 | 1.2 | ||||||

| Sponsor Equity | $6,447,299 | 3.4 | |||||||||

| Total Sources | $191,447,299 | 100.0% | Total Uses | $191,447,299 | 100.0% | ||||||

| (1) | Total and Owned Occupancy includes Vitalant (18.6% of NRA), which has a fully executed lease; however, such lease does not commence until completion of the landlord’s work for Vitalant’s space, which has not yet been completed. The borrower has advised the landlord work is expected to be completed in May 2021. There can be no assurance the Vitalant lease will commence as expected or at all. |

| (2) | Based on the “As Stabilized” value of $260.0 million as of May 1, 2022. The “As Stabilized” value assumes all contractual tenant improvement and leasing commission (“TI/LC”) obligations have been fulfilled and all tenants are paying unabated rent. At loan origination, the borrower reserved with the lender a gap and free rent reserve of approximately $6,703,964, an unfunded obligations reserve of approximately $8,608,319 and a holdback reserve for Vitalant of $8,042,501. The appraisal also concluded an “As Is” appraised value of $236.0 million, which results in a Cut-off Date LTV ratio of [44.4]% for the 360 Spear Loan, [67.7]% for the 360 Spear Loan Combination (as defined below) and [78.3]% for the aggregate of the 360 Spear Loan Combination and the 360 Spear Mezzanine Loan (as defined below) (together, the “360 Spear Total Debt”) and a Maturity Date LTV Ratio of [36.8]% for the 360 Spear Loan, [60.2]% of the 360 Spear Loan Combination and [70.7]% for the 360 Spear Total Debt. Each appraised value is based on certain extraordinary assumptions, including the assumption that the Verizon Tenant (as defined below) would modify its existing lease to provide an extension expiring at the end of December 2040 for all of its existing premises and a co-terminous expansion for expansion premises commencing January 2022, in each case, on terms provided to the appraisal firm. A modification on such terms did become effective simultaneously with the purchase of the 360 Spear Property (as defined below) by the borrower. The purchase price does not reflect such lease extension and expansion. |

| (3) | Calculated based on the aggregate outstanding principal balance of the 360 Spear Senior Loans and excludes the 360 Spear Trust Subordinate Companion Loan (as defined below) unless otherwise specified. See “—The Mortgage Loan” below. |

| (4) | The 360 Spear Loan (as defined below) is part of the 360 Spear Loan Combination evidenced by three senior pari passu notes and one subordinate note, with an aggregate outstanding principal balance as of the Cut-off Date of approximately $159.7 million. |

| (5) | The 360 Spear Loan Combination has a 10-year term and will amortize based on a 30-year schedule for the first 60 months, followed by an interest-only period of 60 months. |

| (6) | See “—Escrows” below. |

| (7) | Other upfront reserves represent a gap and free rent reserve of approximately $6,703,964, an unfunded obligations reserve of approximately $8,608,319 and a holdback reserve for Vitalant of $8,042,501. |

| (8) | Represents the net purchase price and includes approximately $9.5 million in seller credits for outstanding TI/LC and Vitalant landlord work. The gross purchase price is equal to $175.0 million. |

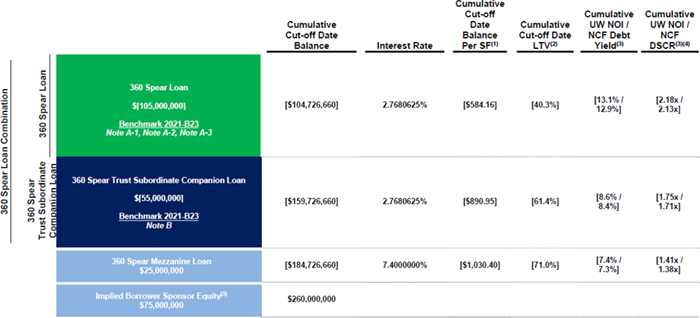

| ■ | The Mortgage Loan. The mortgage loan (the “360 Spear Loan”) is part of a loan combination (the “360 Spear Loan Combination”) with an aggregate outstanding principal balance as of the Cut-off Date of approximately $159.7 million, which is secured by the borrower’s fee simple interest in a Class B flex creative office, telecom and laboratory building located in San Francisco, California (the “360 Spear Property”). The 360 Spear Loan will be evidenced by the non-controlling notes A-1, A-2 and A-3 with an aggregate original principal balance as of the Cut-off Date of [$104.7] million. The 360 Spear Loan Combination is comprised of (i) the 360 Spear Loan which is a senior loan comprised of three senior pari passu notes with an aggregate principal balance as of the Cut-off Date of approximately $[104.7] million, and (ii) one subordinate note with an outstanding principal balance as of the Cut-off Date of $[55.0] million (the “360 Spear Trust Subordinate Companion Loan”) as detailed in the “Loan Combination Summary” table below. The 360 Spear Loan Combination was originated by DBR Investments Co. Limited (“DBRI”). Only the 360 Spear Loan is expected to be included in the mortgage pool for the Benchmark 2021-B23 mortgage trust. The 360 Spear Trust Subordinate Companion Loan is expected to be contributed to the Benchmark 2021-B23 mortgage trust but will not be included in the mortgage pool. Payments allocated to the 360 Spear Trust Subordinate Companion Loan will be paid only to the holders of the 360 Spear loan-specific certificates as described in “Description of the Mortgage Pool—The Loan Combinations—The 360 Spear Pari Passu-AB Loan Combination” in the Preliminary Prospectus. |

The 360 Spear Loan Combination has a 10-year term and will pay principal and interest monthly based on a 30-year amortization schedule for the first 60 months, followed by an interest-only period of 60 months. On February 6, 2021 and each monthly payment date thereafter through and including the monthly payment date immediately preceding the monthly payment date occurring in February 2026, the borrower is required to make a payment of principal and interest equal to the monthly debt service payment amount, which will be applied (i) first, to accrued and unpaid interest under the notes included in the 360 Spear Loan, on pari passu basis, (ii) second, to accrued and unpaid interest under the 360 Spear Trust Subordinate Companion Loan, (iii) third, to the reduction of the outstanding principal balance of the

25

LOAN #3: 360 SPEAR

notes included in the 360 Spear Loan, on a pari passu basis, until the entire 360 Spear Loan principal balance has been reduced to zero, and (iv) fourth, to the reduction of the outstanding principal balance of the 360 Spear Trust Subordinate Companion Loan until reduced to zero. On and after the monthly payment date occurring in February 2026, accrued interest will be applied on a senior sequential basis.

The 360 Spear Loan represents approximately 6.8% of the Initial Pool Balance. The 360 Spear Loan Combination had an initial term of 120 months and has a remaining term of 119 months as of the Cut-off Date. The scheduled maturity date of the 360 Spear Loan Combination is January 6, 2031. On and after the monthly payment date in February 2022, the 360 Spear Loan Combination may be voluntarily prepaid with a prepayment fee equal to the greater of a yield maintenance premium amount or 1% of the unpaid principal balance as of the prepayment date.

The 360 Spear Loan Combination proceeds along with a $25.0 million mezzanine loan (the “360 Spear Mezzanine Loan”) and sponsor equity were used to purchase the 360 Spear Property, fund upfront reserves and pay origination costs.

The table below summarizes the promissory notes that comprise the 360 Spear Loan Combination. The relationship between the holders of the 360 Spear Loan Combination is governed by a co-lender agreement as described under “Description of the Mortgage Pool—The Loan Combinations—The 360 Spear Pari Passu-AB Loan Combination” in the Preliminary Prospectus.

Loan Combination Summary | ||||

| Note | Original Balance | Cut-off Date Balance | Note Holder(s) | Controlling Piece |

| A-1 | $75,000,000 | $74,804,757 | Benchmark 2021-B23 | No(1) |

| A-2 | $25,000,000 | $24,934,919 | Benchmark 2021-B23 | No |

| A-3 | $5,000,000 | $4,986,984 | Benchmark 2021-B23 | No |

| Total Senior Notes | ||||

| B | $55,000,000 | $45,000,000 | Benchmark 2021-B23 Loan Specific Certificates | Yes(1) |

| Total | $160,000,000 | $159,725,832 | ||

| (1) | The initial controlling note is Note B, so long as no 360 Spear control appraisal period has occurred and is continuing. If and for so long as a 360 Spear control appraisal period has occurred and is continuing, then the controlling note will be Note A-1. See “Description of the Mortgage Pool—The Loan Combinations—The 360 Spear Pari Passu – AB Loan Combination”. The 360 Spear Loan Combination is expected to be serviced pursuant to the Benchmark 2021-B23 trust pooling and servicing agreement. For so long as no 360 Spear control appraisal period has occurred and is continuing, the control rights of the 360 Spear Trust Subordinate Companion Loan are expected to be exercisable by the 360 Spear controlling class representative under the Benchmark 2021-B23 pooling and servicing agreement. |

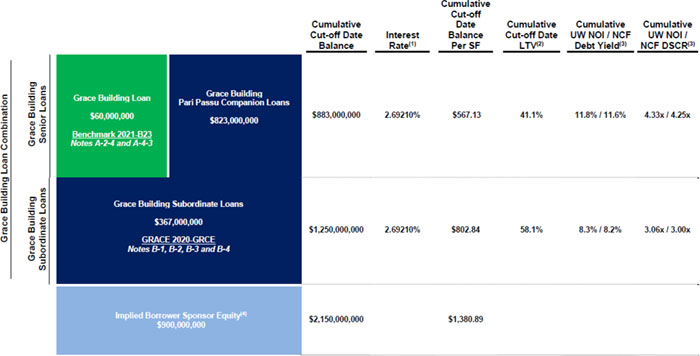

The capital structure for the 360 Spear Total Debt is shown below:

360 Spear Total Debt Capital Structure

| (1) | Based on the net rentable area of 179,277 SF. |

| (2) | Based upon the “As Stabilized” value of $260.0 million as determined by the appraisal as of May 1, 2022. The appraisal also concluded an “As Is” appraised value of $236.0 million, which results in a Cut-off Date LTV ratio of [44.4]% for the 360 Spear Loan, [67.7]% for the 360 Spear Loan Combination and [78.3]% for the 360 Spear Total Debt. |

| (3) | Cumulative UW NOI/NCF Debt Yield and Cumulative UW NOI/NCF DSCR are calculated based on an UW NOI and UW NCF of $13,733,298 and $13,464,382, respectively. See “—Operating History and Underwritten Net Cash Flow” below. |

| (4) | The Cumulative UW NOI / NCF DSCR is based on amortizing payments. |

| (5) | Based on the “As Stabilized” value of $260.0 million, the Implied Borrower Sponsor Equity is $75.0 million. |

26

LOAN #3: 360 SPEAR

| ■ | The Mortgaged Property. The 360 Spear Property is a 179,277 SF creative office, telecom and laboratory building located at 360 Spear Street in San Francisco, California. The 360 Spear Property was originally constructed as the Navy and Marine Headquarters in 1924, and was converted to its current use in 2000. Over the last couple of years, additional capital improvements repositioned the 360 Spear Property as a high-end creative office and data center building. The capital repositioning included a lobby expansion and renovation, new tenant amenities, and converting ground floor space and the garage into data center space with private entrances. The repositioning also included upgrades to the vertical transportation, MEP (mechanical, electrical and plumbing), HVAC, façade, and windows. The total capital expenses for the project were approximately $11.0 million. The 360 Spear Property sits on an approximately 0.79 acre site adjacent to the San Francisco Bay waterfront and south of the Financial District. The 360 Spear Property is one of only 19 buildings in the Financial District with floorplates larger than 30,000 square feet, featuring a typical floorplate of 31,470 SF. |