As submitted confidentially to the Securities and Exchange Commission on February 9, 2021 pursuant to the Jumpstart Our Business Startups Act. This draft registration statement has not been publicly filed with the Securities and Exchange Commission and all information herein remains strictly confidential.

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Instructure Intermediate Holdings I, Inc.*

(Exact name of registrant as specified in its charter)

| | | | |

Delaware

(State or other jurisdiction of

incorporation or organization) | | 7372

(Primary Standard Industrial

Classification Code Number) | | 84-4325548

(I.R.S. Employer

Identification No.) |

6330 South 3000 East, Suite 700

Salt Lake City, UT 84121

(800) 203-6755

(Address, including zip code, and telephone number, including

area code, of registrant’s principal executive offices)

Steve Daly

Chief Executive Officer

6330 South 3000 East, Suite 700

Salt Lake City, UT 84121

(800) 203-6755

(Name, address, including zip code, and telephone number, including area code, of agent for service)

| | | | |

| Copies of all communications, including communications sent to agent for service, should be sent to: |

Bradley C. Reed, P.C. Michael P. Keeley

Kirkland & Ellis LLP

300 North LaSalle

Chicago, IL

(312) 862-2000 | | Matthew A. Kaminer Chief Legal Officer

Instructure, Inc.

6330 South 3000 East, Suite 700

Salt Lake City, UT 84121

(800) 203-6755 | | John T. McKenna Alan D. Hambelton Cooley LLP 3175 Hanover Street Palo Alto, CA 94304 (650) 843-5000 |

Approximate date of commencement of proposed sale to the public:

As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box: ☐

If this Form is filed to registered additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | |

| Large accelerated filer | | ☐ | | Accelerated Filer | | ☐ | | |

| Non-accelerated filer | | ☒ | | Smaller Reporting Company | | ☐ | | |

| | | | Emerging Growth Company | | ☒ | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☒

| | | | |

|

Title of Each Class of Securities to be Registered | | Proposed Maximum Aggregate Offering Price(1)(2) | | Amount of Registration Fee |

Common Stock, par value $0.01 per share | | $ | | $ |

|

|

| (1) | Includes the aggregate offering price of shares of common stock subject to the underwriters’ over-allotment option. |

| (2) | Estimated solely for purposes of computing the amount of the registration fee pursuant to Rule 457(o) under the Securities Act of 1933, as amended. |

The registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until this Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

| * | The registrant will change its name to “Instructure, Inc.” prior to the completion of this offering. The term “Instructure, Inc.” in this prospectus refers to Instructure Intermediate Holdings I, Inc. |

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and neither we nor the selling stockholders are soliciting offers to buy these securities in any jurisdiction where the offer or sale is not permitted.

PROSPECTUS (Subject to Completion)

Issued , 2021

Shares

COMMON STOCK

Instructure, Inc. is offering shares of its common stock. This is our initial public offering and no public market currently exists for our shares. We anticipate that the initial public offering price of our common stock will be between $ and $ per share.

We intend to apply to list our common stock on the under the symbol “ .”

We are an “emerging growth company” as defined under the federal securities laws. Investing in our common stock involves risks. See “Risk Factors” beginning on page 21.

PRICE $ A SHARE

| | | | | | | | | | | | |

| | | Price to

Public | | | Underwriting

Discounts and

Commissions(1) | | | Proceeds to

Instructure | |

Per Share | | | $ | | | | $ | | | | $ | |

Total | | | $ | | | | $ | | | | $ | |

| (1) | See “Underwriting” for a description of the compensation payable to the underwriters. |

We have granted the underwriters the right to purchase up to an additional shares of common stock solely to cover over-allotments, if any.

Immediately after this offering, assuming an offering size as set forth above, funds controlled by our equity sponsor, Thoma Bravo, will own approximately % of our outstanding common stock (or % of our outstanding common stock if the underwriters’ over-allotment option is exercised in full). As a result, we expect to be a “controlled company” within the meaning of the corporate governance standards of the . See “Management—Corporate Governance—Controlled Company Status.”

Neither the Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the shares of common stock against payment in New York, New York on , 2021.

MORGAN STANLEY

, 2021

TABLE OF CONTENTS

We and the underwriters have not authorized anyone to provide any information or to make any representations other than those contained in this prospectus or in any free writing prospectuses we have prepared. We and the underwriters take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may provide you. We are offering to sell, and seeking offers to buy, shares of common stock only in jurisdictions where offers and sales are permitted. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of the common stock.

For investors outside of the United States, neither we nor any of the underwriters have done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. You are required to inform yourselves about, and to observe any restrictions relating to, this offering and the distribution of this prospectus outside of the United States.

Through and including , 2021 (the 25th day after the date of this prospectus), all dealers effecting transactions in these securities, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to a dealer’s obligation to deliver a prospectus when acting as an underwriter and with respect to an unsold allotment or subscription.

i

PROSPECTUS SUMMARY

This summary highlights selected information contained elsewhere in this prospectus. This summary does not contain all of the information that you should consider before investing in our common stock. For a more complete understanding of us and this offering, you should read and carefully consider the entire prospectus, including the more detailed information set forth under “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and the related notes. Some of the statements in this prospectus are forward-looking statements. See “Forward-Looking Statements.”

Unless the context otherwise requires, the terms “Instructure,” the “Company,” “our company,” “we,” “us” and “our” in this prospectus refer to (i) Instructure, Inc., where appropriate, and its consolidated subsidiaries prior to the Take-Private Transaction described herein and (ii) Instructure Intermediate Holdings I, Inc. and its consolidated subsidiaries following the Take-Private Transaction described herein. The term “Thoma Bravo Funds” refers to Thoma Bravo Executive Fund XIII, L.P., Thoma Bravo Fund XIII, L.P., Thoma Bravo Fund XIII-A, L.P., and the term “Thoma Bravo” refers to Thoma Bravo UGP, LLC, the ultimate general partner of the Thoma Bravo Funds, and, unless the context otherwise requires, its affiliated entities, including Thoma Bravo, L.P., the management company of the Thoma Bravo Funds.

INSTRUCTURE, INC.

Instructure’s mission is to elevate student success, amplify the power of teachers everywhere, and inspire everyone to learn together by applying the power of simple, purposeful, and transformative software to the important challenge of educating the world’s population.

From the inception of a teacher’s lesson through a student’s mastery of a concept, Instructure personalizes, simplifies, organizes, and automates the entire learning lifecycle through the power of technology. Our learning platform delivers the elements that leaders, teachers, and learners need – a next-generation Learning Management System (“LMS”), robust assessments for learning, actionable analytics, and engaging, dynamic content. Schools standardize on Instructure’s solutions as their core learning platform because we bring together all of the tools that students, teachers, parents, and administrators need to create an accessible and modern learning environment. Our platform is cloud-native, built on open technologies, and scalable across thousands of institutions and tens of millions of users worldwide. We are the LMS market share leader in both Higher Education and paid K-12, with over 6,000 global customers, representing Higher Education institutions and K-12 districts and schools in more than 90 countries. We are maniacally focused on our customers and enhancing the teaching and learning experience. As such, we continuously innovate to grow the footprint of our platform, including through our acquisitions of Portfolium to add online skills portfolio capabilities for Higher Education students and MasteryConnect and Certica to add K-12 assessment and analytics capabilities. Our platform becomes deeply ingrained into our customers’ instructional workflows – and, since our founding, we have never lost a fully-deployed, four year Canvas Higher Education customer to another LMS provider.

Technology has fundamentally transformed the way education is delivered and consumed – putting the delivery of world-class experiences and the opportunities they engender within everyone’s reach. Despite technology’s potential to massively scale the impact of high quality instruction and elevate student outcomes, a variety of factors have historically led to slower adoption and implementation in academic institutions, including competing budget priorities, institutional resistance to change, low student-to-device ratios, and poor connectivity in school and at home.

The COVID-19 pandemic has created a set of conditions in which students of all ages have been learning remotely for a year, providing an opportunity to demonstrate the efficacy of distance learning at scale and

1

opening up new possibilities for learners who previously could not access quality education. Almost overnight, schools and universities had to rapidly adopt or redeploy online platforms for students and teachers to conduct lessons remotely. As a result of government stimulus and realigned school and university budget priorities, hardware, software, and internet connectivity began to proliferate in regions and markets with historically low levels of access. The COVID-19 pandemic has been a massive tailwind to adoption over the past year, but the need for ongoing technology in education will persist well beyond the pandemic.

The opportunity for platform technologies in education is massive. According to the U.S. Census Bureau and the National Center for Education Statistics, in the U.S. alone, there are over 70 million students enrolled across over 137,000 schools. According to the UNESCO Institute for Statistics, there are an additional 126 million Higher Education students internationally, excluding China and India, and even more in international K-12. According to HolonIQ, global spend on education technology was $163 billion in 2019 and will increase at a compound annual growth rate of 16% between 2019 and 2025. A new minimum threshold for the digital classroom experience has been reached and the LMS is now the de facto technology in any learning environment. Students and teachers have now fully embraced technology in education and the reputational and systemic risk from academic institutions of being unable to provide redundancy and contingency is too great to ignore. Further government stimulus in education is expected to drive technology funding and adoption, particularly in international regions which have seen comparatively less investment than in the U.S. The perfect storm of technology advancements, widespread access to devices, and increased classroom spending has created an extensive and long-lasting transformation of the education market.

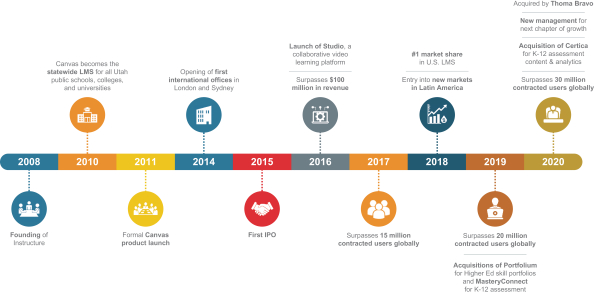

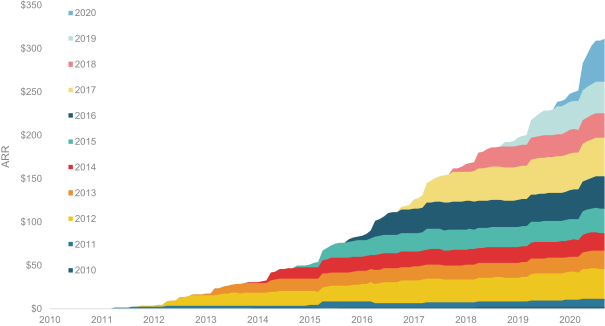

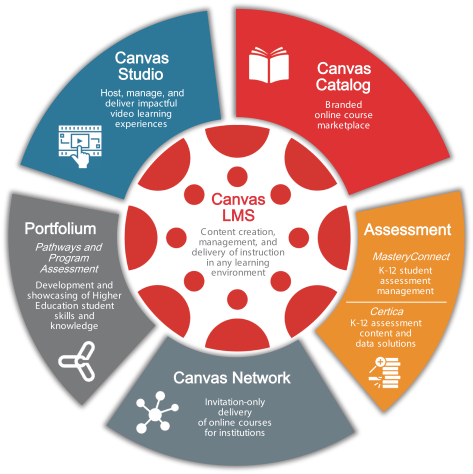

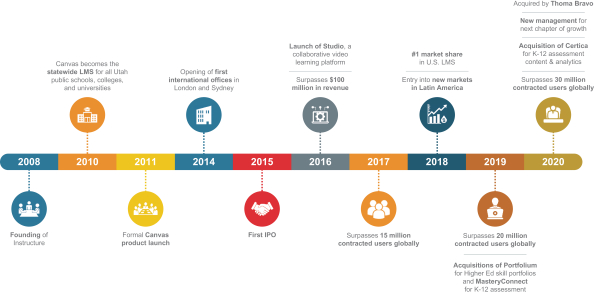

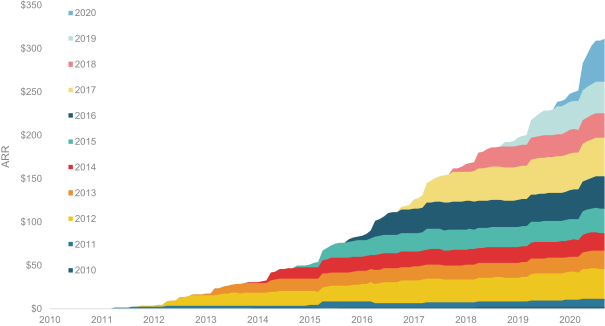

Instructure has been a beneficiary of these tailwinds in education technology. We launched Canvas, our LMS application, in 2011 and quickly saw rapid adoption in the Higher Education market as we displaced legacy systems with our cloud-native and extendable platform and won greenfield opportunities where software solutions did not exist. We have grown our K-12 business over time and have experienced significant acceleration during the COVID-19 pandemic as device proliferation and technology acceptance within districts has advanced. Our extendable learning platform is comprised of the following solutions:

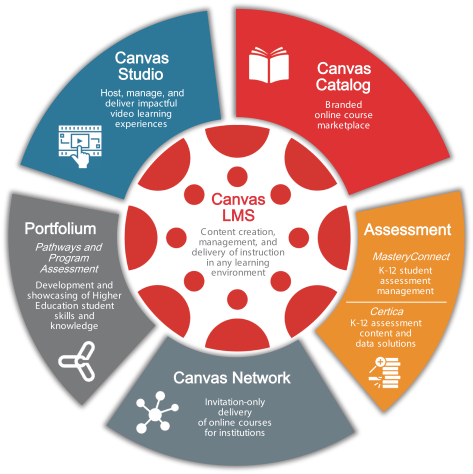

| | • | | Canvas LMS. As the cornerstone of our platform, Canvas LMS is designed to give our Higher Education and K-12 customers an extensive set of flexible tools to support and enhance content creation, management, and delivery of face-to-face and online instruction. |

| | • | | Canvas Studio. An online video platform which enables customers to host, manage, and deliver impactful video learning experiences. |

| | • | | Canvas Catalog. A web-based course catalog and registration system that enables institutions to create and maintain a branded marketplace for their online course offerings. |

| | • | | Assessments. Solutions for K-12 assessment that include MasteryConnect, a robust student assessment management system, and Certica, which provides a variety of assessment content solutions and analytics to inform daily instruction in the classroom and data which measure student learning and preparedness for exams mandated by federal and state regulations. |

| | • | | Portfolium. Solutions for Higher Education that include Pathways and Program Assessment, which guide students along pathways that lead to skills and knowledge showcased in online portfolios. |

| | • | | Canvas Network. An invitation-only offering allowing institutions to offer and deliver courses over the internet to a much broader audience than just their own students. |

Our broad capabilities have expanded our total addressable market, provide significant upsell and cross-sell opportunities, and collectively form the basis of an extendable platform which has become a standard among many U.S. Higher Education and K-12 institutions and a growing number of international institutions.

2

Our global customer base spans from K-12 through Higher Education and Continuing Education, giving us a prominent position to accompany learners throughout their learning lifecycle. We continue to deepen our relationships with Higher Education customers by facilitating their strategic growth – often through powering their emerging Continuing Education initiatives that open their doors to a new universe of non-traditional learners. We are increasingly able to sell to large districts and statewide systems due to the scalability, adaptability, and reliability of our platform. Our customers include State Universities of California, Florida, and Utah, all of the Ivy League universities, the entire Higher Education systems for Sweden and Norway, international K-12 systems such as Queensland, Australia, which administers to over 1,200 schools, and many of our nation’s largest K-12 systems, such as Broward County, Florida and Clark County, Nevada.

Once implemented, Instructure serves as the connected hub for engagement between teachers, students, parents, content providers, and an always growing ecosystem of partners, including the largest commercial providers and the smallest education technology start-ups. As of December 31, 2020, our platform supported over 50 million users and a rich community of over 500 ecosystem partners. This ecosystem contributes to our innovation and product development, and has resulted in students utilizing partner-integrated products over 2.7 billion times in the fourth quarter of 2020, an increase of 361% over the fourth quarter of 2019. Our best-in-class customer support organization supports our customers and ecosystem partners. Our ecosystem has created a network effect of adoption where the embedded nature of our platform drives compounded usage of our applications and those that our partners deliver. The more our platform is used the more valuable it is to customers and users, increasing customer retention and positioning us to more rapidly expand both our customer base and the Instructure products each of those customers will use.

We went public in 2015 and were subsequently taken private by Thoma Bravo in 2020. Thoma Bravo saw the opportunity to combine our market leadership, tremendous customer loyalty, and superior technology with world class operations, to create a mission-driven company that could also be profitable and enduring. Over the past year, we have transformed our business into a more competitive and focused learning platform leader, well-positioned for long-term, durable growth. We have accomplished our strategic transformation through the following initiatives:

| | • | | Aligned focus on core offerings. We have realigned our business to focus solely on education and our learning platform. We stopped spending on unprofitable activities, including legacy analytics initiatives and international products for non-core regions. |

| | • | | Optimized go-to-market strategy. We aligned all sales and marketing functions under a single sales leader. We were able to restructure our sales and marketing organization while improving productivity by eliminating sales coverage in non-core international regions and focusing our efforts solely on education. |

| | • | | Streamlined cost structure. We implemented a strategic expense reduction plan that enabled us to focus on delivering customer value sustained by recurring revenue, durable growth, and improved retention, with fewer resources than we had at the time of the Take-Private Transaction (as defined below). We simplified our organizational design, moved a portion of our development efforts to Budapest, closed and consolidated facilities internationally and within the U.S., and aligned the organization with our sole focus on serving education. |

| | • | | Enhanced management team. We appointed a new Chief Executive Officer, Steve Daly, and a new Chief Financial Officer, Dale Bowen, as well as several other senior executives who bring focus, operational discipline, execution expertise, deep industry knowledge, and innovation to the company. |

3

We have emerged from this transformation a stronger and more resilient company, poised to continue to win in the market. For 2018, 2019, and 2020 our revenues were $209.5 million, $258.5 million, and $ million, respectively, representing year-over-year growth of 23% and %. Our net loss was $43.5 million, $80.8 million, and $ in 2018, 2019, and 2020, respectively. Our adjusted EBITDA was $(11.2) million, $(9.3) million, and $ million in 2018, 2019, and 2020, respectively. We generated operating cash flow of $0.1 million, $18.9 million, and $ million in 2018, 2019, and 2020, respectively. Our free cash flow was $(10.9) million, $8.7 million, and $ million in 2018, 2019, and 2020, respectively.

INDUSTRY BACKGROUND

The Education Industry is one of the Largest and Most Important Sectors of the Global Economy

Success in education is a primary driver of economic well-being, quality of life, geopolitical competitiveness, and societal advancement. As such, the education market is massive and commands high spending from governments and private institutions worldwide. According to the U.S. Census Bureau and the National Center for Education Statistics, in the U.S. alone, there are over 70 million students enrolled across over 137,000 schools. According to the UNESCO Institute for Statistics, there are an additional 126 million Higher Education students internationally, excluding China and India. According to CB Insights, the U.S. spends over $1.6 trillion annually on education, representing one of the highest government spending categories. According to HolonIQ, global spend on education stands at almost $6 trillion. The overwhelming majority of educational spend goes toward traditional instruction – teachers, classrooms and classroom tools, student and teacher support services, and administration. A key component of broader education spend is funding directed to education technology. According to HolonIQ, global spend on education technology was $163 billion in 2019 and will increase at a compound annual growth rate of 16% between 2019 and 2025.

Technology is Disrupting Every Aspect of Education

Technology has fundamentally transformed the way education is delivered and consumed – creating the ability to democratize education and improve the quality of instruction for everyone. From traditional classroom teaching to full online learning, technology has brought disruptive tools to improve teaching efficiency, elevate student performance, enhance peer collaboration, and enable greater personalization. With technology, schools are able to provide equitable access to learning for lifelong development, build communities around education – including students, teachers, parents, and content providers – and scale quality education to bring best-in-class experiences to students at any time or place. Technology also enables blended learning environments, enhancing both face-to-face and online experiences by using data and analytics to inform instruction and enriching learning experiences outside of school hours.

The backbone of education technology is the LMS, a critical software platform that enables teachers to create, deliver, and track the effectiveness of learning programs and students to organize study materials, centralize access to learning content, and increase collaboration. Beyond the LMS, several adjacent technology tools have emerged to improve the experience for teachers and students alike, including student assessments, data and analytics, and interactive content. Collectively, these solutions are integral to achieving significant improvements in education accessibility, scalability, productivity, collaboration, engagement, and skill-building.

Technology Spend has Historically been Underpenetrated Relative to Overall Spend

While on an absolute basis the education technology market is large, spending on education technology in 2019 represented only 2.7% of overall education spending, according to HolonIQ. Despite technology’s disruptive capabilities, a variety of factors have historically led to a slower level of adoption and implementation in academic institutions, including:

| | • | | Competing budget priorities. School administrators and decision-makers have to manage a variety of constituents and budget priorities, leading to historical underfunding of technology. |

4

| | • | | Institutional resistance to change. General institutional resistance and inertia have contributed to underinvestment in technology. |

| | • | | Low student-to-device ratios and poor connectivity in school or at home. According to an analysis conducted by Future Ready Schools of the 2018 U.S. Census American Community Survey, 3.6 million households with children did not have a computer, which put 7.3 million children at an academic disadvantage. Similarly, 8.4 million households with children did not have high-speed home internet service. This imbalance of device access and connectivity has also slowed uniform technology adoption. |

As a result of these historical trends, schools across the world have struggled to provide a robust online learning experience and ensure equitable access to education for all.

Global Distance Learning Mandates Have Accelerated Adoption of Education Technology at All Levels

The COVID-19 pandemic has created a set of conditions in which students of all ages have been learning from home for a year. While the pandemic created unique problems and complexities for everyone, the resulting changes in education have removed historical impediments to implementation of education technology, thereby accelerating adoption at all levels, proving that distance learning can be done at scale and that technology will be a critical element of teaching and learning moving forward.

Almost overnight, schools had to rapidly adopt online platforms for students and teachers to conduct lessons remotely, given mandated distance learning orders. According to the U.S. Census Bureau, since the onset of the COVID-19 pandemic, 93% of U.S. households with school-aged children reported using some form of distance learning and 80% of people living with children in distance learning programs reported children using online tools for schoolwork between May and June 2020. Distance learning mandates resulted in three events:

| | (1) | | Rapid adoption of an LMS and adjacent offerings among schools without existing technology solutions; |

| | (2) | | A transition from free products used for point solutions to paid platform solutions that could scale across districts and states, with the paid LMS penetration rate of K-12 districts increasing from 30% to 41% between 2019 and August 2020; and |

| | (3) | | Government stimulus provided increased grants and subsidies for Higher Education and a proliferation of hardware and software in K-12, which historically had lagged in device availability relative to Higher Education. |

The ultimate result of these events within the education sector has been widespread access to devices, with approximately 86% of students in the U.S. now having access to a device, according to the Center on Reinventing Public Education. In turn, this has allowed schools and institutions to reach more students through online learning platforms while remote learning is required, while also providing a firm basis for these devices to augment and enhance the learning experience for students who have and will return to classrooms. An LMS allows effective use of those computers as key tools within the expanding view of a learning environment, rather than mere portals to the un-curated Internet. As access to computers and connections becomes more widespread, the LMS proliferates, becoming even more useful and allowing for the democratization of education.

COVID-induced Transformation in Education is Permanent

Institutional Transformation: while distance learning mandates required schools to implement learning platforms, the need for such tools will continue to persist in hybrid and in-person learning environments. Students and teachers have now fully embraced technology in education, and the reputational and systemic risk

5

from academic institutions of being unable to provide redundancy and contingency is too great to ignore. Schools and students no longer have to decide between in-person or online – we expect there will be a combination of both options to support various needs and various times. Examples of capabilities that will still be needed in face-to-face and hybrid environments include: content delivery, student assessments, homework submission, grading, student analytics, parent/teacher collaboration, and scheduling. In hybrid learning environments, the need for quality, personalized assessments is in fact even greater, as it is paramount that teachers can understand how students are performing in remote environments and track their progress from a distance. The capabilities of learning platforms along with the institutional scars from the pandemic make technology implementation an investment priority even if budgets tighten in the future.

Financial Transformation: future funding toward education technology is expected. According to the Office of Elementary and Secondary Education, in the U.S., $30.7 billion of the Coronavirus Aid, Relief, and Economic Security Act (the “CARES Act”) stimulus was used to fund education initiatives, including the purchasing of educational technology, planning and coordination of long-term closures, and training and professional development for staff. An additional $82 billion was signed into law in December 2020, and President Biden’s American Rescue Plan has pledged $130 billion to support a reopening plan for K-12 schools and $35 billion to public Higher Education institutions to assist in reopening efforts, such as distance learning programs, the implementation of safety protocols, and emergency financial assistance, according to the National Education Association. International regions have seen education stimulus as well, and we expect to see an increase in spending over the coming years. As a demonstration of the education technology’s funding momentum, it is estimated by HolonIQ that the share of education technology spend as a percentage of global education spend is expected to nearly double from 2.7% in 2019 to 5.2%, or $404 billion, in 2025.

As Adoption Accelerates, Platform Leaders Will Win

As the education technology market continues to grow, platform leaders are best positioned to win. The market is populated with three groups: legacy on-premises providers, point solutions, and platform leaders. Legacy providers are typically siloed, on-premises solutions, or cloud-enabled adaptations of on-premises solutions, designed to address only a limited scope of teaching and learning needs. Point solutions typically provide single features rather than a full suite of products. The weaknesses of these two market archetypes has allowed platforms with broad, best-in-class offerings to emerge and establish significant market leadership. There is now a bifurcation of enduring platform leaders and sub-scale players, with leaders consolidating to add incremental capabilities and expand reach.

Platform leaders have an integrated suite of product offerings, a partner ecosystem connected to the platform, scalable product architecture, and the ability to expand reach into adjacent markets. Platforms in education technology span across K-12, Higher Education, and Continuing Education – the full lifecycle of learning – and have become the centers of gravity for innovation and engagement. Platform leaders benefit from growth in customer base, reduced customer acquisition costs, and high barriers to entry for other competitors. Academic institutions everywhere are now focused on building their student experience and learning protocols around platform leaders with the greatest depth of features and offerings.

Industry Dynamics in U.S. Higher Education

Higher Education institutions were among the first adopters of LMS, and nearly every Higher Education institution in the U.S. has adopted an LMS of some kind to date. A major driver of this adoption has been high rates of access to devices among Higher Education student populations, with approximately 90% of individuals with at least high school degrees having a device, according to the U.S. Census Bureau. Additionally, Higher Education institutions utilize learning platforms to facilitate Continuing Education for alumni or non-matriculating students. However, as LMS adoption has taken place over the past 20 years, many schools are

6

still reliant on legacy systems with limited features and functionality. The impact of the COVID-19 pandemic has driven Higher Education institutions to revisit their technology infrastructures and significantly increase investment in reliable, scalable, and feature-rich learning platforms.

Industry Dynamics in U.S. K-12

In contrast to Higher Education, K-12 adoption of LMS has not been as robust, with the paid LMS penetration rate of K-12 districts standing at approximately 41% as of August 2020. The lower penetration of LMS at the K-12 level represents a large greenfield opportunity for education technology to replace free solutions with paid learning platforms and monetize demand for broader product suites. The impact of the COVID-19 pandemic has driven K-12 schools to invest heavily in learning platforms to build resilience and redundancy and ensure equitable access to education for all students. Additionally, student access to devices now stands at approximately 86% according to the Center on Reinventing Public Education. We expect that the vast majority of K-12 schools will increase their technology investments going forward.

Industry Dynamics for Schools and Universities Internationally

The international market for LMS is highly fragmented and has historically been dependent on free, open source, and on-premises products that lack the functionality, scalability, and reliability of a leading learning platform. Since the onset of the COVID-19 pandemic, international academic institutions have experienced first-hand the scalability and capacity limitations associated with on-premises solutions, and the service and performance issues that can result. LMS penetration and device access vary by region, resulting in a patchwork of heterogeneous technology usage. The opportunity for leading learning platforms to expand internationally is significant, with Western Europe representing the most well-organized and well-funded region. As a result of the COVID-19 pandemic, international academic institutions are evaluating cloud-based platform solutions that can provide increased functionality, redundancy, and resilience in hybrid learning environments.

Requirements for an Effective, Modern Learning Platform

The changing education technology landscape has highlighted the necessity for a modern learning platform capable of meeting the evolving needs of students and teachers in diverse environments. Key elements of an effective, modern learning platform, include:

| | • | | Cloud-first Architecture: schools require learning management solutions that can scale, adapt to changing environments, quickly disseminate information, and leverage data collected across many channels. Learning platforms that are cloud-native provide rapid time to value and are simple to maintain, modify and extend. |

| | • | | Reliability: learning platforms are mission-critical systems for education providers and students, and therefore must be reliable, available, and enterprise-grade. The ability to handle growing data and users, fluctuating demand, and changing workload patterns while maintaining high availability is a critical differentiator. |

| | • | | Open and Extendable: modern infrastructure that supports open standards, transparency, and integrations with other systems including content providers and point solutions. |

| | • | | Multi-functional: ability to span across all areas of instruction, including: teaching and learning, assessments, analytics, and interactive content. |

| | • | | Extendable across the Education Lifecycle: addressing the needs of K-12, Higher Education, and Continuing Education. |

7

| | • | | Management across Schools, Districts, Institutions, and Systems: built with enterprise-grade functionality, configurability, consistency, and management flexibility that can scale to support any size or scope of institution. |

| | • | | Community of Technology Partners and Users: ecosystem of parents, teachers, and students for collaboration; community of content creators and users to share ideas and fuel product roadmaps; and third-party integration partners. |

MARKET OPPORTUNITY

The education technology market that we address is large and rapidly growing. As the need for scalable, reliable, and adaptable solutions that can enable in-person, hybrid, and remote learning environments increases, we believe that investment in education technology will be an imperative for every school and academic institution in the world. According to an August 2019 HolonIQ report, global expenditures on education technology are expected to grow from $163 billion in 2019 to $404 billion in 2025, reflecting a compound annual growth rate of 16%.

We believe that our products can address the needs of all Higher Education and K-12 students in markets where student to device ratios and wireless connectivity are sufficiently high to allow for the effective deployment of education technology. According to the National Student Clearinghouse Research Center, the Higher Education market in the U.S. is comprised of over 17 million students, almost all of whom currently use an LMS. We currently serve approximately 7 million U.S. Higher Education students. According to Agile Education Marketing, the K-12 market in the U.S. is comprised of over 52 million students, and based on an Instructure survey, approximately 26 million used a paid LMS as of August 2020. We currently serve approximately 15 million U.S. K-12 students.

Internationally, the Higher Education market is comprised of an additional 126 million students, excluding China and India. International schools and institutions predominantly use free, on-premises, and open source LMS, resulting in a significant replacement opportunity for cloud-native and scalable learning platforms. The significant number of students worldwide supports our belief that our addressable market is large, and that we have significant greenfield opportunities among addressable customers. Even in markets such as U.S. Higher Education, where LMS adoption is already high, we believe that a significant portion of those institutions are using legacy, on-premises solutions that can be replaced by modernized, cloud-native, scalable learning platforms.

OUR PLATFORM

Our learning platform is an extendable, configurable, and highly integrated set of solutions designed to meet the teaching and learning needs of every K-12 and Higher Education institution and includes the Canvas LMS, Canvas Studio, Canvas Catalog, Assessments, Portfolium, and Canvas Network. With its cloud-native offerings, open application programming interfaces (“APIs”), support of industry standards, and accessibility, our platform streamlines digital tools and content for teachers and students, creating a simpler and more connected learning experience.

BENEFITS OF OUR SOLUTION

Cloud-native Architecture

Our cloud-native architecture enables customers to enjoy all of the benefits of the cloud, including rapid time to value, no maintenance, frequent updates with no downtime, and horizontal scalability across millions of users. The cloud allows users to access our platform at any time, from any device, affording institutions and providers the ability to collaborate on the use of their data, to differentiate and personalize instruction, answer

8

critical questions about the efficacy of content and tools, and put teachers and students in control of their own outcomes.

High Reliability and Uptime

We built our platform with enterprise scalability to span over 5.6 million concurrent users across districts and states. We guarantee 99.9% uptime through service level agreements (“SLAs”), and have generally delivered above this level over the past four years. Our uptime has remained excellent while growing our customer base and usage throughout 2020. Importantly, we are able to scale up and down dynamically when there are abrupt changes in usage, such as immediate moves to distance learning, or changes in school hours, class schedules, and academic calendars.

Open Source and Open Ethos

Our platform is built on open source technologies, providing customers full flexibility in how they use our platform, and giving them access to constant innovation with upgrades to the code base. Importantly, through open APIs, customers get access to massive amounts of their data, providing them the freedom and flexibility to use their own data for assessments, personalization, benchmarking, and engagement.

Extendable Across Partner Ecosystem

We are the connected hub for teaching and learning. A key feature of delivering a platform is building an ecosystem of partners connected to the platform. We enable third-party software providers to integrate with our platform through a library of open APIs, allowing us to provide a more comprehensive offering through product integration, and for third parties to rapidly scale solutions across our customer base. We have over 500 partners, from some of the world’s largest technology companies to niche point solution providers, across content providers, hardware providers, collaboration tools, publishers, and productivity tools. In the fourth quarter of 2020, students utilized partner-integrated products over 2.7 billion times, an increase of 361% from the fourth quarter of 2019.

Multi-Functional Product Suite

Our platform capabilities span multiple areas of instruction, including learning, assessments, analytics, and program management. By addressing multiple areas of instruction, we provide the most relevancy in the classroom to teachers and students. The breadth of our offerings facilitates improved student outcomes, allows us to address a large and growing market, and enables us to cross-sell numerous offerings within our existing customer base, where customers want to buy adjacent solutions.

Solutions Address All Market Segments

We serve all market segments within education, including K-12, Higher Education, and Continuing Education. By serving all segments in the market, we are able to engage with students throughout the education lifecycle and increase retention within our user base. This also provides us with a large market opportunity, with both greenfield and replacement options across U.S. and international markets.

Continuous Innovation to Enable New Applications

Our continuous commitment to innovation leads to stronger retention and customer satisfaction, continued relevancy with our customer base, and the ability to respond quickly to market changes, such as providing

9

increased scalability in response to the COVID-19 pandemic. In 2020, we released a large volume of new features, including 67 new capabilities over a span of three months in response to new demand from our customers as a result of the COVID-19 pandemic. On average, we have approximately 32 releases per year. We also seek to expand our platform by developing into adjacent markets through strategic acquisitions and partnerships.

COMPETITIVE STRENGTHS

Leading Market Share Positions in the North America Higher Education and K-12 Markets

We are the paid LMS market share leader by student enrollment in both North America Higher Education and K-12, demonstrating our differentiated offering, successful execution, and ability to support the entire lifecycle of learning, and positioning us as the de facto learning platform. We believe that our reputation as a market leader creates a network effect in which standardization on our platform is increasingly attractive to ecosystem partners and in turn positions us to more rapidly expand our customer base.

Designed to Scale from Single School to State and Country-wide Deployments

The scalability enabled by our cloud-native architecture, robust set of capabilities, and management features allows us to win any opportunity, from a single school to a large-scale deployment, where point solutions cannot compete. At the institutional level, we provide solutions that can be deployed to manage entire learning environments of any size. At the individual user level, we provide solutions that allow teachers to access new populations of learners across the globe. Our expansive deployment model provides scalability in our go-to-market engine, as we can sell once and then deploy more broadly across systems.

Large and Highly Engaged User Base

We have built a large and growing ecosystem around our platform and company. As of December 31, 2020, we had over 50 million active users globally. In recent months, our website has been one of the top 20 most visited websites in the U.S., demonstrating the high level of engagement we experience from our customers. We have over 1.1 million members in our Canvas Community customer network, where administrators, designers, instructors, parents, and students share, collaborate, and shape the Canvas product through community forums and content repositories. Our vibrant community of users promotes adoption of our solutions by sharing best practices and broadly disseminating the value our solutions deliver.

End-to-end Lifecycle of Customer Success

Our company-wide focus on the customer results in successful implementations, high retention, and happy customers. We invest significantly in customer success, employing more individuals in customer-facing roles than any other group in our organization, and intend to continue investing in and scaling our customer success group moving forward. Our maniacal focus on the customer has led to a best-in-class customer satisfaction score (CSAT) of over 90%. Our platform becomes deeply ingrained into our customers’ instructional workflows – and, since our founding, we have never lost a fully-deployed, four year Canvas Higher Education customer to another LMS provider.

Highly Efficient Go-To-Market Model

We continue to invest in and grow our sales force to go after the massive opportunities ahead of us. We have a highly tenured and effective sales team with quota carrying representatives driving the majority of our business. We utilize a single, outbound sales motion, which has reduced the complexity in sales and allows representatives to focus on replacement and greenfield opportunities from K-12 through Continuing Education. Our average bookings per representative increased over 100% in 2020 and our sales representatives had an average tenure with us of over 3.2 years as of December 31, 2020.

10

GROWTH STRATEGIES

Grow Our Customer Base

Higher Education. We will grow our customer base in Higher Education primarily through replacements of legacy systems in North America, where the LMS market is largely penetrated and our market share has grown from approximately 24% to 37% over the past four years, and through greenfield wins in targeted and strategic international regions. As international penetration of paid LMS and adjacent systems is still relatively low, we will target new opportunities in select regions utilizing our local sales teams, as well as channel partners.

K-12. We will grow our customer base in K-12 by surrounding free solutions currently in place with our scalable platform, monetizing demand for our breadth of capabilities, and focusing customers on the benefits of district or state-wide standardization, in addition to capturing the remaining 50% of the market that is not currently using a paid LMS, based on an Instructure survey.

Cross-sell into our Existing Customer Base

Our broad capabilities spanning learning, assessments, analytics, student success, program management, digital courseware, and global online learning initiatives provide us a significant opportunity to cross-sell offerings into our existing customer base. We generally land with our LMS product and have the ability to cross-sell additional solutions into our LMS customer base.

Continue to Innovate and Expand Our Platform

We will continue to innovate on our platform, expand our features and monetize new offerings. Key to our ability to service our customer base will be the continued strengthening of our core focus areas in learning management, assessment management, student success, and online learning, where we see significant customer demand for broad offerings. We will also continue to innovate our platform and build strengths in adjacent areas of learning analytics, program management, and instructional content, where we see opportunities to expand our customer base.

RISK FACTOR SUMMARY

There are a number of risks related to our business, this offering and our common stock that you should consider before you decide to participate in this offering. Some of the principal risks related to our business include the following:

| | • | | We have benefitted from the U.S. federal government’s stimulus packages focused on educational initiatives approved as a result of the COVID-19 pandemic and there is no guarantee additional funding will be approved. |

| | • | | We have experienced increased customer acquisitions and renewals as a result of the COVID-19 pandemic and such increases in customer acquisitions and renewals may not be sustained or may reverse at any time. |

| | • | | The increased adoption and use of our platform stemming from the COVID-19 pandemic may result in interruptions, delays, or outages, increased customer interactions and waiting times, and increased variable costs, all of which could harm our business, financial condition and results of operations. |

| | • | | We have a history of losses, and we do not expect to be profitable for the foreseeable future. |

| | • | | Our future revenues and operating results will be harmed if we are unable to acquire new customers, if our customers do not renew their contracts with us, or if we are unable to expand sales to our existing customers or develop new products that achieve market acceptance. |

11

| | • | | If the markets for our applications develop more slowly than expected or market conditions reduce IT spending, our growth may slow or stall. |

| | • | | If we fail to manage our growth effectively or our business does not grow as we expect, our operating results may suffer. |

| | • | | Future acquisitions could disrupt our business and may divert management’s attention and, if unsuccessful, harm our business and operating results. |

| | • | | We face significant competition from both established and new companies, and the risk of new entrants, including established entrants, offering learning platforms, which may adversely affect our ability to add new customers, retain existing customers and grow our business. |

| | • | | We rely on our management team and other key employees, and the loss of one or more key employees could harm our business. |

| | • | | If we fail to maintain, enhance or protect our brand, our ability to expand our customer base will be impaired and our business, financial condition and results of operations may suffer. |

| | • | | A breach or compromise of our security measures or those we rely on could result in unauthorized access to customers’ data, which may materially and adversely impact our reputation, business and results of operations. |

| | • | | A substantial portion of the source code for Canvas is available under the terms of an open source license, and accepts contributions of modifications to that source code, each of which could negatively affect our ability to offer our learning platform or subject us to possible litigation. |

| | • | | Failure to protect and enforce our proprietary technology and intellectual property rights could substantially harm our business, operating results and financial condition. |

| | • | | Our customers, domestically and internationally, are highly regulated and subject to a number of challenges and risks. Our failure to comply with laws and regulations applicable to us as a technology provider for Higher Education and K-12 could adversely affect our business and results of operations, increase costs and impose constraints on the way we conduct our business. |

| | • | | We face risk if our estimates of market opportunity and forecasts of market growth prove to be inaccurate or if we need to change our pricing models to compete successfully. |

After this offering, Thoma Bravo will own approximately % of our common stock (or % of our common stock if the underwriters’ over-allotment option is exercised in full) and we will be a “controlled company” within the meaning of the rules of . As a result, we will qualify for, and intend to rely on, exemptions from certain corporate governance requirements and you will not have the same protections as those afforded to stockholders of companies that are subject to such governance requirements.

These and other risks are more fully described in the section entitled “Risk Factors” in this prospectus. If any of these risks actually occurs, our business, financial condition, results of operations, cash flows and prospects could be materially and adversely affected. As a result, you could lose all or part of your investment in our common stock.

OUR SPONSOR

Thoma Bravo is a leading investment firm building on a more than 40-year history of providing capital and strategic support to experienced management teams and growing companies. Thoma Bravo has invested in many fragmented, consolidating industry sectors in the past, but has become known particularly for its history of successful investments in the application, infrastructure and security software and technology-enabled services

12

sectors, which have been its investment focus for more than 15 years. Thoma Bravo manages a series of investment funds representing more than $57.5 billion of capital commitments.

GENERAL CORPORATE INFORMATION

We were incorporated in January 2020 as Instructure Intermediate Holdings I, Inc. to serve as a holding company in connection with Thoma Bravo’s acquisition of Instructure, Inc. on March 24, 2020 (the “Take-Private Transaction”). Our principal executive offices are located at 6330 South 3000 East, Suite 700, Salt Lake City, Utah 84121. Our telephone number is (800) 203-6755. Our website address is www.instructure.com. The information contained on, or that can be accessed through, our website is not incorporated by reference into this prospectus, and you should not consider any information contained on, or that can be accessed through, our website as part of this prospectus or in deciding whether to purchase our common stock. We are a holding company and all of our business operations are conducted through our subsidiaries.

This prospectus includes our trademarks and service marks such as “Instructure,” “Canvas,” the Instructure logo, and the Canvas logo, which are protected under applicable intellectual property laws and are the property of us or our subsidiaries. Solely for convenience, trademarks and trade names referred to in this prospectus may appear without the ® or ™ symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the rights of the applicable licensor to these trademarks and trade names.

IMPLICATIONS OF BEING AN EMERGING GROWTH COMPANY

We qualify as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”). We will remain an emerging growth company until the earliest of (1) the last day of the fiscal year following the fifth anniversary of the completion of this offering, (2) the last day of the fiscal year in which we have total annual gross revenue of at least $1.07 billion, (3) the date on which we are deemed to be a large accelerated filer (this means the market value of common that is held by non-affiliates exceeds $700.0 million as of the end of the second quarter of that fiscal year) or (4) the date on which we have issued more than $1.0 billion in non-convertible debt securities during the prior three-year period.

An emerging growth company may take advantage of reduced reporting requirements that are otherwise applicable to public companies. These provisions include, but are not limited to:

| | • | | not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002, as amended (the “Sarbanes-Oxley Act”); |

| | • | | a requirement to present only two years of audited financial statements, plus unaudited condensed consolidated financial statements for any interim period and related discussion in the section titled “Management’s Discussion and Analysis of Financial Condition and Results of Operations”; |

| | • | | reduced disclosure obligations regarding executive compensation in periodic reports, proxy statements and registration statements; and |

| | • | | exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and stockholder approval of any golden parachute payments not previously approved. |

We have elected to take advantage of certain of the reduced disclosure obligations regarding financial statements (such as not being required to provide audited financial statements for the year ended December 31, 2018 or five years of Selected Consolidated Financial Data) in this prospectus and executive compensation in this prospectus and expect to elect to take advantage of other reduced burdens in future filings. As a result, the information that we provide to our stockholders may be different than you might receive from other public reporting companies in which you hold equity interests.

13

The JOBS Act also permits an emerging growth company like us to take advantage of an extended transition period to comply with new or revised accounting standards applicable to public companies. We have elected to “opt out” of this provision and, as a result, we will comply with new or revised accounting standards on the relevant dates on which adoption of such standards is required for public companies that are not emerging growth companies. The decision to opt out of the extended transition period under the JOBS Act is irrevocable.

14

THE OFFERING

Common stock offered | shares. |

Common stock to be outstanding after this offering |

shares (or shares if the over-allotment option is exercised in full). |

Over-allotment option | shares. |

Use of proceeds | We estimate that our net proceeds from this offering will be approximately $ million, or approximately $ million if the underwriters’ over-allotment option is exercised in full, assuming an initial public offering price of $ per share, which is the midpoint of the estimated price range set forth on the cover page of this prospectus, and after deducting the underwriting discounts and commissions and estimated offering expenses payable by us. |

| | The principal purposes of this offering are to repay indebtedness, increase our capitalization and financial flexibility, create a public market for our common stock and enable access to the public equity markets for us and our stockholders. We expect to use approximately $ of the net proceeds of this offering to repay $ million of outstanding borrowings under our Credit Facilities and the remainder of such net proceeds will be used for general corporate purposes. At this time, other than the repayment of outstanding borrowings under our Credit Facilities, we have not specifically identified a large single use for which we intend to use the net proceeds and, accordingly, we are not able to allocate the net proceeds among any of these potential uses in light of the variety of factors that will impact how such net proceeds are ultimately utilized by us. See “Use of Proceeds” for additional information. |

Controlled company | After this offering, assuming an offering size as set forth in this section, Thoma Bravo will own approximately % of our common stock (or % of our common stock if the underwriters’ over-allotment option is exercised in full). As a result, we expect to be a controlled company within the meaning of the corporate governance standards of the . See “Management—Corporate Governance—Controlled Company Status.” |

Risk factors | Investing in our common stock involves a high degree of risk. See “Risk Factors” elsewhere in this prospectus for a discussion of factors you should carefully consider before deciding to invest in our common stock. |

Proposed trading symbol | “ ” |

The number of shares of common stock to be outstanding following this offering is based on shares of common stock outstanding as of , 2021 and excludes:

| | • | | shares of common stock reserved for future issuance under our 2021 Omnibus Incentive Plan (the “2021 Plan”), which will become effective in connection with this offering; and |

| | • | | shares of our common stock that will become available for future issuance under our 2021 Employee Stock Purchase Plan (the “2021 ESPP”), which will become effective in connection with this offering. |

15

Unless otherwise indicated, all information in this prospectus assumes:

| | • | | an initial public offering price of $ per share, which is the midpoint of the estimated price range set forth on the cover of this prospectus; |

| | • | | no exercise by the underwriters of their over-allotment option to purchase up to additional shares of common stock; and |

| | • | | the filing of our amended and restated certificate of incorporation and the adoption of our amended and restated bylaws, each in connection with the closing of this offering. |

16

SUMMARY CONSOLIDATED FINANCIAL DATA

The following table sets forth our summary historical consolidated financial and other data for the periods and as of the dates indicated. As a result of the Take-Private Transaction on March 24, 2020, our summary historical consolidated financial and other data are presented in two distinct periods to indicate the application of two different bases of accounting between the periods presented and are therefore not comparable. The period prior to and including March 31, 2020 includes all of the accounts of Instructure, Inc. and is identified as “Predecessor” and the period after March 31, 2020 includes all of the accounts of Instructure Intermediate Holdings I, Inc. and is identified as “Successor.” For accounting purposes, management has designated the “Acquisition Date” as March 31, 2020, as the operating results and change in financial position for the intervening period is not material.

To facilitate comparability of the year ended December 31, 2020 to the year ended December 31, 2019, we present combined results for the combination of consolidated results from January 1, 2020 to December 31, 2020, comprising the Predecessor consolidated results from January 1, 2020 to March 31, 2020, the Successor consolidated results for the period from April 1, 2020 to December 31, 2020 and certain pro forma adjustments that give effect to the Take-Private Transaction as if it had occurred on January 1, 2020 (the “Unaudited Pro Forma Combined 2020 Period”).

We derived the summary historical consolidated financial and other data for the year ended December 31, 2018 from the Predecessor’s audited consolidated financial statements not included in this prospectus. We derived the summary historical consolidated financial and other data for the year ended December 31, 2019 from the Predecessor’s audited consolidated financial statements included elsewhere in this prospectus. We derived the summary historical consolidated financial and other data for the periods from January 1, 2020 to March 31, 2020, which relate to the Predecessor, April 1, 2020 to December 31, 2020, which relate to the Successor, and the Combined 2020 Period and as of December 31, 2020 from the Successor’s audited consolidated financial statements included elsewhere in this prospectus.

17

Our historical results are not necessarily indicative of the results that may be expected in the future. You should read the summary historical financial data below in conjunction with the sections titled “Selected Consolidated Financial Data,” “Unaudited Pro Forma Condensed Combined Financial Data,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the financial statements and related notes included elsewhere in this prospectus.

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Predecessor | | | | | | Successor | | | Combined | |

| (in thousands, except per share data) | | Year Ended

December 31,

2018 | | | Year Ended

December 31,

2019 | | | Period from

January 1, 2020

to March 31,

2020 | | | | | | Period from

April 1, 2020 to

December 31,

2020 | | | Pro Forma

Year Ended

December 31,

2020(1) | |

| | | | | | | | | | | | | | | | | | (Unaudited) | |

Consolidated Statement of Operations Data: | | | | | | | | | | | | | | | | | | | | | | | | |

Revenue: | | | | | | | | | | | | | | | | | | | | | | | | |

Subscription and support | | $ | 188,501 | | | $ | 236,241 | | | $ | | | | | | | | $ | | | | $ | | |

Professional services and other | | | 21,043 | | | | 22,232 | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total revenue | | | 209,544 | | | | 258,473 | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Cost of revenue: | | | | | | | | | | | | | | | | | | | | | | | | |

Subscription and support | | | 46,706 | | | | 64,170 | | | | | | | | | | | | | | | | | |

Professional services and other | | | 15,137 | | | | 18,656 | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total cost of revenue | | | 61,843 | | | | 82,826 | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Gross profit | | | 147,701 | | | | 175,647 | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Operating expenses: | | | | | | | | | | | | | | | | | | | | | | | | |

Sales and marketing | | | 97,481 | | | | 121,643 | | | | | | | | | | | | | | | | | |

Research and development | | | 59,391 | | | | 83,526 | | | | | | | | | | | | | | | | | |

General and administrative | | | 35,602 | | | | 56,471 | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total operating expenses | | | 192,474 | | | | 261,640 | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Loss from operations | | | (44,773 | ) | | | (85,993 | ) | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Other income (expense): | | | | | | | | | | | | | | | | | | | | | | | | |

Interest income | | | 2,413 | | | | 1,795 | | | | | | | | | | | | | | | | | |

Interest expense | | | (68 | ) | | | (16 | ) | | | | | | | | | | | | | | | | |

Other income (expense), net | | | (698 | ) | | | (225 | ) | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total other income (expense), net | | | 1,647 | | | | 1,554 | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Loss before income tax benefit | | | (43,126 | ) | | | (84,439 | ) | | | | | | | | | | | | | | | | |

Income tax benefit (expense) | | | (339 | ) | | | 3,620 | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net loss | | $ | (43,465 | ) | | $ | (80,819 | ) | | $ | | | | | | | | $ | | | | $ | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net loss attributable to common stockholders | | $ | (43,465 | ) | | $ | (80,819 | ) | | $ | | | | | | | | $ | | | | $ | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net loss per common share attributable to common stockholders, basic and diluted | | $ | (1.27 | ) | | $ | (2.19 | ) | | $ | | | | | | | | $ | | | | $ | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

18

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Predecessor | | | | | | Successor | | | Combined | |

| (in thousands, except per share data) | | Year Ended

December 31,

2018 | | | Year Ended

December 31,

2019 | | | Period from

January 1, 2020

to March 31,

2020 | | | | | | Period from

April 1, 2020 to

December 31,

2020 | | | Pro Forma

Year Ended

December 31,

2020(1) | |

| | | | | | | | | | | | | | | | | | (Unaudited) | |

Pro forma net loss per common share attributable to common stockholders, basic and diluted(2) | | | | | | | | | | | | | | | | | | | | | | $ | | |

| | | | | | | | | | | | | | | | | | | | |

Pro forma as adjusted net loss per common share attributable to common stockholders, basic and diluted (3) | | | | | | | | | | | | | | | | | | | | | | $ | | |

| | | | | | | | | | | | | | | | | | | | |

Weighted-average common shares used in computing basic and diluted net loss per common share attributable to common stockholders | | | 34,248 | | | | 36,892 | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Pro forma weighted-average common shares used in computing basic and diluted net loss per common share attributable to common stockholders(2) | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

Pro forma as adjusted weighted-average common shares used in computing basic and diluted net loss per common share attributable to common stockholders(3) | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| (1) | For the purpose of performing a comparison to the Predecessor’s year ended December 31, 2019, we prepared Unaudited Pro Forma Combined Supplemental Financial Information for the year ended December 31, 2020, which gives effect to Take-Private Transaction, as if it had occurred on January 1, 2020 (the “Unaudited Pro Forma Combined 2020 Period”). The Unaudited Pro Forma Combined 2020 Period is being discussed herein for informational purposes only and does not reflect any operating efficiencies or potential cost savings that may result from the consolidation of operations. The amounts in the Predecessor and Successor columns do not total to the amounts in the unaudited pro forma combined column due to the adjustments made in preparing the Unaudited Pro Forma Combined 2020 Period, which is described in “Unaudited Pro Forma Condensed Combined Financial Data” and “Management’s Discussion and Analysis of Financial Conditions and Results of Operations.” |

| (2) | Pro forma earnings per share gives effect to the Take-Private Transaction. |

| (3) | Pro forma as adjusted earnings per share gives effect to (i) the Take-Private Transaction and (ii) this offering and the application of the net proceeds therefrom as more fully described in “Use of Proceeds,” including the effect of the repayment of the outstanding borrowings under our Credit Facilities. |

19

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Predecessor | | | | | | Successor | | | Combined | |

| (in thousands) | | Year Ended

December 31,

2018 | | | Year Ended

December 31,

2019 | | | Period from

January 1, 2020 to

March 31, 2020 | | | | | | Period from

April 1, 2020

to December 31,

2020 | | | Pro Forma Year

Ended

December 31,

2020 (1) | |

Non-GAAP Financial Data (unaudited): | | | | | | | | | | | | | | | | | | | | | | | | |

Allocated Combined Receipts (1) | | $ | 209,544 | | | $ | 258,473 | | | | | | | | | | | | | | | | | |

| (1) | “Allocated Combined Receipts” is defined as the combined receipts of our Company and companies that we have acquired allocated to the period of service delivery. We calculate Allocated Combined Receipts as the sum of (i) revenue and (ii) the impact of fair value adjustments to acquired unearned revenue related to services billed by an acquired company prior to its acquisition. For a reconciliation of Allocated Combined Receipts to revenue, the most directly comparable measure calculated and presented in accordance with U.S. generally accepted accounting principles (“GAAP”), see “Management’s Discussion and Analysis of Financial Condition and Results of Operations — Non-GAAP Financial Measures — Allocated Combined Receipts.” |

| | | | | | | | |

| | | Successor | |

| | | | | | As Adjusted(1)(2) | |

| (in thousands) | | As of

December 31,

2020 | | | As of

December 31,

2020 | |

| | | | | | (Unaudited) | |

Consolidated Balance Sheet Data: | | | | | | | | |

Cash and cash equivalents | | $ | | | | $ | | |

Working capital, excluding deferred revenue (unaudited) | | | | | | | | |

Total assets | | | | | | | | |

Deferred revenue | | | | | | | | |

Total debt, including current portion | | | | | | | | |

Total liabilities | | | | | | | | |

Total stockholders’ equity | | | | | | | | |

| (1) | Reflects our sale of shares of common stock in this offering at an assumed initial public offering price of $ per share, which is the midpoint of the estimated price range set forth on the cover page of this prospectus, and after deducting the underwriting discounts and commissions and estimated offering expenses payable by us and the application of the net proceeds from this offering to repay outstanding borrowings under our Credit Facilities as set forth under “Use of Proceeds.” |

| (2) | Each $1.00 increase (decrease) in the assumed initial public offering price of $ per share, the midpoint of the estimated price range set forth on the cover page of this prospectus, would increase (decrease) each of cash and cash equivalents, working capital, excluding deferred revenue, total assets and total stockholders’ equity on an as adjusted basis by $ million, assuming that the number of shares offered by us, as set forth on the cover page of this prospectus remains the same, after deducting underwriting discounts and commissions and estimated offering expenses payable by us. Similarly, each increase (decrease) by 1,000,000 shares in the number of shares offered by us would increase (decrease) each of cash and cash equivalents, working capital, excluding deferred revenue, total assets and total stockholders’ equity on an as adjusted basis by $ million, assuming that the assumed initial public offering price remains the same, after deducting underwriting discounts and commissions. The as adjusted information discussed above is illustrative only and will be adjusted based on the actual initial public offering price and other terms of this offering determined at pricing. |

20

RISK FACTORS

Investing in our common stock involves a high degree of risk. You should carefully consider the risks and uncertainties described below, together with all of the other information contained in this prospectus, including our consolidated financial statements and the related notes thereto, before making a decision to invest in our common stock. The risks and uncertainties described below are not the only ones we face. Additional risks and uncertainties that we are unaware of, or that we currently believe are not material, may also become important factors that affect us. If any of the following risks occur, our business, financial condition, operating results and prospects could be materially and adversely affected. In that event, the price of our common stock could decline, and you could lose all or part of your investment. The ongoing COVID-19 pandemic may also have the effect of heightening many of the risks described in this “Risk Factors” section.

Because of the following factors, as well as other factors affecting our businesses, financial condition, operating results and prospectus, past financial performance should not be considered a reliable indicator of future performance, and investors should not rely on historical trends to anticipate trends or results in the future.

Risks Related to COVID-19

We have benefitted from the U.S. federal government’s stimulus packages focused on educational initiatives approved as a result of the COVID-19 pandemic; however, there is no guarantee that additional funding will be approved, which may adversely affect our business, financial condition and results of operations.