| | |

| UNITED STATES

SECURITIES AND EXCHANGE COMMISSION |

| | |

| CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

|

| | |

| Investment Company Act file number: | (811-23643) |

| | |

| Exact name of registrant as specified in charter: | Putnam ETF Trust |

| | |

| Address of principal executive offices: | 100 Federal Street, Boston, Massachusetts 02110 |

| | |

| Name and address of agent for service: | Stephen Tate, Vice President

100 Federal Street

Boston, Massachusetts 02110 |

| | |

| Copy to: | Bryan Chegwidden, Esq.

Ropes & Gray LLP

1211 Avenue of the Americas

New York, New York 10036 |

| | |

| | James E. Thomas, Esq.

Ropes & Gray LLP

800 Boylston Street

Boston, Massachusetts 02199 |

| | |

| Registrant’s telephone number, including area code: | (617) 292-1000 |

| | |

| Date of fiscal year end: | April 30, 2024 |

| | |

| Date of reporting period: | May 1, 2023 – April 30, 2024 |

| | |

|

Item 1. Report to Stockholders: | |

| | |

| The following is a copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Investment Company Act of 1940: | |

Putnam PanAgora

ESG International

Equity ETF

Annual report

4 | 30 | 24

Message from the Trustees

June 13, 2024

Dear Shareholder:

We are pleased to report that on January 1, 2024, Franklin Resources, Inc., a leading global asset management firm operating as Franklin Templeton, acquired Putnam Investments. With complementary capabilities and an established infrastructure serving over 150 countries, Franklin Templeton enhances Putnam’s investment, risk management, operations, and technology platforms. Together, our firms are committed to delivering strong fund performance and more choices for our investors.

We are also pleased to welcome Jane E. Trust and Gregory G. McGreevey to your Board of Trustees. Ms. Trust is an interested trustee who has served as Senior Vice President, Fund Board Management, at Franklin Templeton since 2020. Mr. McGreevey joins the Board as an independent trustee, most recently serving as Senior Managing Director, Investments, at Invesco Ltd., until 2023.

As we enter this new chapter, you can rest assured that your fund continues to be actively managed by the same experienced investment professionals. Your investment team is exploring new and attractive opportunities for your fund while monitoring changing market conditions.

Thank you for investing with Putnam.

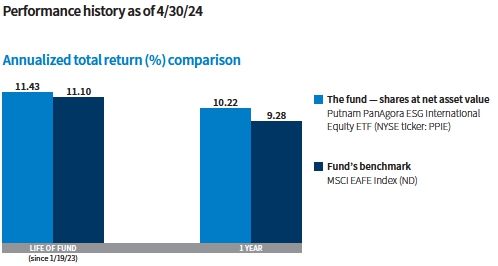

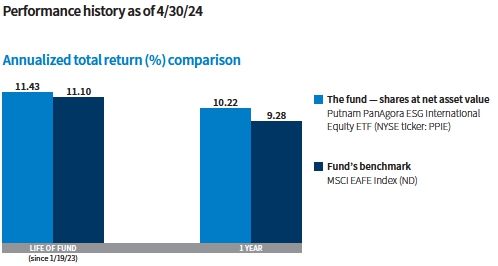

Data are historical. Past performance does not guarantee future results. More recent returns may be less or more than those shown. Share price, principal value, and return will fluctuate, and you may have a gain or a loss when you sell your shares. Performance of fund shares assumes reinvestment of distributions and does not account for taxes. Fund returns in the bar chart are at net asset value (NAV). See below and pages 7–8 for additional performance information, including fund returns at market price. For a portion of the periods, the fund had expense limitations, without which returns would have been lower. Index results should be compared with fund performance at NAV. To obtain the most recent month-end performance, please visit putnam.com or franklintempleton.com or call 1-833-228-5577 (toll free).

All MSCI indices are provided by MSCI.

This comparison shows your fund’s performance in the context of broad market indexes for the 12 months ended 4/30/24. See above and pages 7–8 for additional fund performance information. Index descriptions can be found on page 11.

All Bloomberg indices are provided by Bloomberg Index Services Limited.

All MSCI indices are provided by MSCI.

|

| 2 PanAgora ESG International Equity ETF |

Please describe investing conditions during the reporting period.

During the period, investors closely monitored inflation data, economic growth, and Federal Reserve policy. A big concern was whether the Fed could raise interest rates enough to lower inflation without causing a recession. The Fed made two interest-rate increases during the period. At its meeting in July 2023, the Fed raised rates to a 22-year high of 5.25%–5.50% and held rates steady thereafter.

The U.S. economy showed resilience against the Fed’s restrictive monetary policy. The annual rate of U.S. inflation declined from 4.9% in April 2023 to 3.5% in March 2024, according to data from the Consumer Price Index. Despite higher borrowing costs, the U.S. unemployment rate remained relatively low at 3.8% as of April 2024. Appetite for risk assets was generally strong over the period.

Along with central bank policy, economic and geopolitical tensions contributed to market volatility. In March 2023, the failure of three U.S. regional banks, followed by government intervention, weighed on investor sentiment in the months that followed. Geopolitical turmoil, including the ongoing Russia-Ukraine War and a Hamas-led attack on Israel in October 2023,

|

| PanAgora ESG International Equity ETF 3 |

Allocations are shown as a percentage of the fund’s net assets as of 4/30/24. Cash and net other assets, if any, represent the market value weights of cash, derivatives, short-term securities, and other unclassified assets in the portfolio. Summary information may differ from the information in the portfolio schedule notes included in the financial statements due to the inclusion of derivative securities, any interest accruals, the exclusion of as-of trades, if any, and rounding. Holdings and allocations may vary over time. Due to rounding, percentages may not equal 100%.

This table shows the fund’s top 10 individual holdings and the percentage of the fund’s net assets that each represented as of 4/30/24. Short-term investments, to-be-announced (TBA) commitments, and derivatives, if any, are excluded. Holdings may vary over time.

|

| 4 PanAgora ESG International Equity ETF |

also caused concern. Despite these risks, stocks rallied at the end of calendar 2023 when the Fed signaled it would begin cutting interest rates in early calendar 2024. However, an uptick in inflation in February 2024 prompted the Fed to hold interest rates higher for longer than anticipated.

A handful of mega-cap technology companies with interests in artificial intelligence caused a surge in the U.S. stock market, as measured by the S&P 500 Index, in the first quarter of 2024. In the months that followed, U.S. stocks posted gains more broadly across sectors, and the S&P 500 Index returned 22.66% for the 12-month reporting period.

A generationally weak Japanese yen and positive earnings results provided a tailwind for Japanese stocks, and the MSCI Japan Index [ND] returned 19.23% for the reporting period. Emerging market stocks, as measured by the MSCI Emerging Markets Index [ND], returned 9.88%. China’s worsening economic outlook and the influence of a growing group of retail traders weakened performance of Chinese and emerging market stocks over the period.

How did the fund perform in this environment?

For the 12-month period ended April 30, 2024, the fund returned 10.22%, outperforming its benchmark, the MSCI EAFE Index [ND], which returned 9.28%.

Can you discuss some of the fund’s top contributors and detractors from performance relative to the benchmark for the reporting period?

Our alpha model performed well over the period, driven by strong performance from companies ranked in our top alpha deciles. Our underlying factor composites provided mixed results over the period. Our ESG [environment, social, and governance] factor composite performed well, aided by the strength of our Governance factor. The Management & Governance factor composite was mixed, with strong performance from our proprietary Growth factor and weaker performance from our Quality factor. Within our Market Intelligence factor composite, our Momentum and Value factors performed best.

On a country basis, Japan was the fund’s top contributor for the period. Within Japan, an overweight position in Mitsubishi Heavy Industries Ltd. was a top performer. Shares of this Tokyo-based multinational engineering company appreciated in the first quarter of calendar 2024. The company reported robust quarterly earnings fueled by a 51% year-over-year increase in order inflows. The fund’s overweight position in Mitsubishi Heavy Industries was due to its favorable rankings in our Momentum and Quality factors.

By country, Australia was the fund’s top detractor for the period. Within Australia, the fund’s overweight position in mining company IGO Ltd. hindered fund returns. IGO shares declined over the period due to a significant drop in nickel prices. This caused the company to adjust the valuation of its mines and halt progress on current projects. Shares of IGO faced sell-offs at the end of February 2024. We exited our position in the stock during the reporting period.

By sector, health care was the top contributor, while energy was the top detractor. Within health care, an overweight position in Novo Nordisk was a top performer. Shares of the Danish pharmaceutical company rose sharply in August 2023 after announcing its popular weight management drug Wegovy was shown to ease heart failure in obese people. The fund’s overweight position in Novo was due to its favorable ESG-related metrics. Within energy, the fund’s overweight position in Neste Oyj, a Finland-based oil refining company, was a top detractor. Shares of Neste declined sharply in

|

| PanAgora ESG International Equity ETF 5 |

February 2024 after the company reported a lower-than-expected operating profit and a downbeat outlook. Neste is held overweight in the portfolio due to its favorable rankings in our proprietary Social factor.

What is your outlook and portfolio strategy for the coming months?

The fund seeks to generate an above-benchmark alpha return and an above-benchmark sustainability profile. Management deploys a systematic investment process that seeks to generate excess returns relative to the benchmark. The investment team uses a bottom-up, quantitative-oriented approach to stock selection. This process seeks to quantify fundamental metrics that are predictive of a company’s business strengths and weaknesses, in our view.

Our research has shown that by incorporating a company’s attributes along certain sustainability dimensions, we can complement other fundamental metrics and enhance the portfolio’s alpha model. In addition to using quantitative ESG and sustainability factors to generate alpha, we utilize a proprietary portfolio construction methodology that seeks to optimize both the return and ESG objectives. We believe that ESG investment opportunities offered by the fund continue to be strong.

Thank you both for your time and insights today.

Past performance is not a guarantee of future results.

The opinions expressed in this article represent the current, good faith views of the author(s) at the time of publication, are provided for limited purposes, are not definitive investment advice, and should not be relied on as such. The information presented in this article has been developed internally and/or obtained from sources believed to be reliable; however, PanAgora does not guarantee the accuracy, adequacy, or completeness of such information. Predictions, opinions, and other information contained in this article are subject to change continually and without notice of any kind and may no longer be true after the date indicated. As with any investment there is a potential for profit as well as the possibility of loss.

Any forward-looking statements speak only as of the date they are made, and PanAgora assumes no duty to and does not undertake to update forward-looking statements. Forward-looking statements are subject to numerous assumptions, risks and uncertainties, which change over time. Actual results could differ materially from those anticipated in forward-looking statements. This material is directed exclusively at investment professionals. Any investments to which this material relates are available only to or will be engaged in only with investment professionals.

|

| 6 PanAgora ESG International Equity ETF |

Your fund’s performance

This section shows your fund’s performance, price, and distribution information for periods ended April 30, 2024, the end of its most recent fiscal year. We also include performance information as of the most recent calendar quarter-end. Performance should always be considered in light of a fund’s investment strategy. Data represent past performance. Past performance does not guarantee future results. More recent returns may be less or more than those shown. Investment return, net asset value, and market price will fluctuate, and you may have a gain or a loss when you sell your shares. For the most recent month-end performance, please visit putnam.com or call 1-833-228-5577 (toll free).

Annualized fund performance Total return for periods ended 4/30/24

| | |

| | Life of fund | |

| | (since 1/19/23) | 1 year |

| Net asset value | 11.43% | 10.22% |

| Market price | 11.74 | 10.26 |

Current performance may be lower or higher than the quoted past performance, which cannot guarantee future results. Performance assumes reinvestment of distributions and does not account for taxes.

Performance includes the deduction of management fees.

For a portion of the periods, the fund had expense limitations, without which returns would have been lower.

Comparative annualized index returns For periods ended 4/30/24

| | |

| | Life of fund | |

| | (since 1/19/23) | 1 year |

| MSCI EAFE Index (ND) | 11.10% | 9.28% |

Index results should be compared with fund performance at net asset value.

All MSCI indices are provided by MSCI.

|

| PanAgora ESG International Equity ETF 7 |

Past performance does not indicate future results.

All MSCI indices are provided by MSCI.

Fund price and distribution information For the 12-month period ended 4/30/24

| | |

| Distributions | | |

| Number | 1 |

| Income | $0.710 |

| Capital gains | — |

| Total | $0.710 |

| Share value | Net asset value | Market price |

| 4/30/23 | $20.84 | $20.91 |

| 4/30/24 | 22.23 | 22.31 |

The classification of distributions, if any, is an estimate. Final distribution information will appear on your year-end tax forms.

Annualized fund performance as of most recent calendar quarter

Total return for periods ended 3/31/24

| | |

| | Life of fund | |

| | (since 1/19/23) | 1 year |

| Net asset value | 14.60% | 15.91% |

| Market price | 14.95 | 16.54 |

See the discussion following the fund performance table on page 7 for information about the calculation of fund performance.

|

| 8 PanAgora ESG International Equity ETF |

Your fund’s expenses

As an investor, you pay ongoing expenses, such as management fees, and other expenses (with certain exceptions). In the most recent six-month period, your fund’s expenses were limited; had expenses not been limited, they would have been higher. Using the following information, you can estimate how these expenses affect your investment and compare them with the expenses of other funds. You may also pay brokerage commissions in connection with your purchase or sale of shares of the fund, which are not shown in this section and would have resulted in higher total expenses. The expenses shown in the example also do not reflect transaction costs, which would have resulted in higher total expenses. For more information, see your fund’s prospectus or talk to your financial representative.

Expense ratios

| |

| | |

| Estimated total annual operating expenses for the fiscal year ended 4/30/24* | 0.49% |

| Annualized expense ratio for the six-month period ended 4/30/24† | 0.49% |

Estimated fiscal year expense information in this table is taken from the most recent prospectus, is subject to change, and may differ from that shown for the annualized expense ratio and in the financial highlights of this report.

Expenses are shown as a percentage of average net assets.

* Expenses are based on estimated amounts for the current fiscal year.

† Expense ratio is for the fund’s most recent fiscal half year. As a result of this, the ratio may differ from the expense ratio based on one-year data in the financial highlights.

Expenses per $1,000

The following table shows the expenses you would have paid on a $1,000 investment in the fund from 11/1/23 to 4/30/24. It also shows how much a $1,000 investment would be worth at the close of the period, assuming actual returns and expenses.

| |

| | |

| Expenses paid per $1,000*† | $2.65 |

| Ending value (after expenses) | $1,179.20 |

* Expenses are calculated using the fund’s annualized expense ratio, which represents the ongoing expenses as a percentage of average net assets for the six months ended 4/30/24.

† Expenses are calculated by multiplying the expense ratio by the average account value for the period; then multiplying the result by the number of days in the period (182); and then dividing that result by the number of days in the year (366).

|

| PanAgora ESG International Equity ETF 9 |

Estimate the expenses you paid

To estimate the ongoing expenses you paid for the six months ended 4/30/24, use the following calculation method. To find the value of your investment on 11/1/23, call 1-833-228-5577.

Compare expenses using the SEC’s method

The Securities and Exchange Commission (SEC) has established guidelines to help investors assess fund expenses. Per these guidelines, the following table shows your fund’s expenses based on a $1,000 investment, assuming a hypothetical 5% annualized return. You can use this information to compare the ongoing expenses (but not transaction expenses or total costs) of investing in the fund with those of other funds. All shareholder reports will provide this information to help you make this comparison. Please note that you cannot use this information to estimate your actual ending account balance and expenses paid during the period.

| |

| | |

| Expenses paid per $1,000*† | $2.46 |

| Ending value (after expenses) | $1,022.43 |

* Expenses are calculated using the fund’s annualized expense ratio, which represents the ongoing expenses as a percentage of average net assets for the six months ended 4/30/24.

† Expenses are calculated by multiplying the expense ratio by the average account value for the six-month period; then multiplying the result by the number of days in the six-month period (182); and then dividing that result by the number of days in the year (366).

|

| 10 PanAgora ESG International Equity ETF |

Comparative index definitions

Bloomberg U.S. Aggregate Bond Index is an unmanaged index of U.S. investment-grade fixed income securities.

ICE BofA (Intercontinental Exchange Bank of America) U.S. 3-Month Treasury Bill Index is an unmanaged index that seeks to measure the performance of U.S. Treasury bills available in the marketplace.

MSCI EAFE Index (ND) is an unmanaged index of equity securities from developed countries in Western Europe, the Far East, and Australasia. Calculated with net dividends (ND), this total return index reflects the reinvestment of dividends after the deduction of withholding taxes, using a tax rate applicable to non-resident institutional investors who do not benefit from double taxation treaties.

MSCI Emerging Markets Index (ND) is an unmanaged index that seeks to measure equity market performance in the global emerging markets. Calculated with net dividends (ND), this total return index reflects the reinvestment of dividends after the deduction of withholding taxes, using a tax rate applicable to non-resident institutional investors who do not benefit from double taxation treaties.

MSCI Japan Index (ND) is an unmanaged index that seeks to measure the performance of the large and mid-cap segments of the Japanese market. Calculated with net dividends (ND), this total return index reflects the reinvestment of dividends after the deduction of withholding taxes, using a tax rate applicable to non-resident institutional investors who do not benefit from double taxation treaties.

S&P 500® Index is an unmanaged index of common stock performance.

Indexes assume reinvestment of all distributions and do not account for fees. Securities and performance of a fund and an index will differ. You cannot invest directly in an index.

BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Neither Bloomberg nor Bloomberg’s licensors approve or endorse this material, or guarantee the accuracy or completeness of any information herein, or make any warranty, express or implied, as to the results to be obtained therefrom, and to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

ICE Data Indices, LLC (“ICE BofA”), used with permission. ICE BofA permits use of the ICE BofA indices and related data on an “as is” basis; makes no warranties regarding same; does not guarantee the suitability, quality, accuracy, timeliness, and/or completeness of the ICE BofA indices or any data included in, related to, or derived therefrom; assumes no liability in connection with the use of the foregoing; and does not sponsor, endorse, or recommend Putnam Investments or Franklin Templeton, or any of its products or services.

MSCI makes no warranties and shall have no liability with respect to any MSCI data reproduced herein. No further redistribution or use is permitted. This report is not prepared or endorsed by MSCI. Important data provider notices and terms available at www.franklintempletondatasources.com.

|

| PanAgora ESG International Equity ETF 11 |

Other information for shareholders

Important notice regarding delivery of shareholder documents

In accordance with Securities and Exchange Commission (SEC) regulations, your fund’s manager sends a single notice of internet availability, or a single printed copy, of annual and semiannual shareholder reports, prospectuses, and proxy statements to shareholders who share the same address, unless a shareholder requests otherwise. If you prefer to receive your own copy of these documents, please call 1-800-225-1581 or, for exchange-traded funds only, 1-833-228-5577. We will begin sending individual copies within 30 days.

Proxy voting

The Putnam Funds’ proxy voting guidelines and procedures, as well as information regarding how your fund voted proxies relating to portfolio securities during the period from January 19, 2023 (commencement of operations) to June 30, 2023, are available in the Individual Investors section of putnam.com and on the SEC’s website, www.sec.gov. If you have questions about finding forms on the SEC’s website, you may call the SEC at 1-800-SEC-0330. You may also obtain The Putnam Funds’ proxy voting guidelines and procedures at no charge by calling Shareholder Services at 1-800-225-1581 or, for exchange-traded funds only, 1-833-228-5577.

Fund portfolio holdings

The fund will file a complete schedule of its portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-PORT within 60 days of the end of such fiscal quarter. Shareholders may obtain the fund’s Form N-PORT on the SEC’s website at www.sec.gov.

Liquidity risk management program

Putnam Investment Management, LLC (“Putnam Management”), as the administrator of the fund’s liquidity risk management program (appointed by the Board of Trustees), presented the most recent annual report on the program to the Trustees in April 2024. The report covered the structure of the program, including the program documents and related policies and procedures adopted to comply with Rule 22e-4 under the Investment Company Act of 1940, and reviewed the operation of the program from January 2023 through December 2023. The report included a description of the annual liquidity assessment of the fund that Putnam Management performed in November 2023. The report noted that there were no material compliance exceptions identified under Rule 22e-4 during the period. The report included a review of the governance of the program and the methodology for classification of the fund’s investments. Putnam Management concluded that the program has been operating effectively and adequately to ensure compliance with Rule 22e-4.

|

| 12 PanAgora ESG International Equity ETF |

Important notice regarding Putnam’s privacy policy

In order to conduct business with our shareholders, we must obtain certain personal information such as account holders’ names, addresses, Social Security numbers, and dates of birth. Using this information, we are able to maintain accurate records of accounts and transactions.

It is our policy to protect the confidentiality of our shareholder information, whether or not a shareholder currently owns shares of our funds. In particular, it is our policy not to sell information about you or your accounts to outside marketing firms. We have safeguards in place designed to prevent unauthorized access to our computer systems and procedures to protect personal information from unauthorized use.

Under certain circumstances, we must share account information with outside vendors who provide services to us, such as mailings and proxy solicitations. In these cases, the service providers enter into confidentiality agreements with us, and we provide only the information necessary to process transactions and perform other services related to your account. Finally, it is our policy to share account information with your financial representative, if you’ve listed one on your Putnam account.

|

| PanAgora ESG International Equity ETF 13 |

Audited financial statements

These sections of the report, as well as the accompanying Notes, preceded by the Report of Independent Registered Public Accounting Firm, constitute the fund’s audited financial statements.

The fund’s portfolio lists all the fund’s investments and their values as of the last day of the reporting period. Holdings are organized by asset type and industry sector, country, or state to show areas of concentration and diversification.

Statement of assets and liabilities shows how the fund’s net assets and share price are determined. All investment and non-investment assets are added together. Any unpaid expenses and other liabilities are subtracted from this total. The result is divided by the number of shares to determine the net asset value per share, which is calculated separately for each class of shares. (For funds with preferred shares, the amount subtracted from total assets includes the liquidation preference of preferred shares.)

Statement of operations shows the fund’s net investment gain or loss. This is done by first adding up all the fund’s earnings — from dividends and interest income — and subtracting its operating expenses to determine net investment income (or loss). Then, any net gain or loss the fund realized on the sales of its holdings — as well as any unrealized gains or losses over the period — is added to or subtracted from the net investment result to determine the fund’s net gain or loss for the fiscal period.

Statement of changes in net assets shows how the fund’s net assets were affected by the fund’s net investment gain or loss, by distributions to shareholders, and by changes in the number of the fund’s shares. It lists distributions and their sources (net investment income or realized capital gains) over the current reporting period and the most recent fiscal year-end. The distributions listed here may not match the sources listed in the Statement of operations because the distributions are determined on a tax basis and may be paid in a different period from the one in which they were earned.

Financial highlights provide an overview of the fund’s investment results, per-share distributions, expense ratios, net investment income ratios, and portfolio turnover (not required for money market funds) in one summary table, reflecting the five most recent reporting periods. In a semiannual report, the highlights table also includes the current reporting period.

|

| 14 PanAgora ESG International Equity ETF |

Report of Independent Registered Public Accounting Firm

To the Board of Trustees of Putnam ETF Trust and Shareholders of

Putnam PanAgora ESG International Equity ETF:

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities, including the fund’s portfolio, of Putnam PanAgora ESG International Equity ETF (one of the funds constituting Putnam ETF Trust, referred to hereafter as the “Fund”) as of April 30, 2024, the related statement of operations for the year ended April 30, 2024 and the statement of changes in net assets and the financial highlights for the year ended April 30, 2024 and for the period January 19, 2023 (commencement of operations) through April 30, 2023, including the related notes (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund as of April 30, 2024, the results of its operations for the year ended April 30, 2024, and the changes in its net assets and the financial highlights for the year ended April 30, 2024 and for the period January 19, 2023 (commencement of operations) through April 30, 2023 in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits of these financial statements in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. Our procedures included confirmation of securities owned as of April 30, 2024 by correspondence with the custodian and transfer agent. We believe that our audits provide a reasonable basis for our opinion.

PricewaterhouseCoopers LLP

Boston, Massachusetts

June 13, 2024

We have served as the auditor of one or more investment companies in the Putnam Funds family of funds since at least 1957. We have not been able to determine the specific year we began serving as auditor.

|

| PanAgora ESG International Equity ETF 15 |

| | |

| The fund’s portfolio 4/30/24 | | |

|

| | |

| COMMON STOCKS (99.2%)* | Shares | Value |

| Air freight and logistics (1.8%) | | |

| DHL Group (Germany) | 69,305 | $2,902,727 |

| | 2,902,727 |

| Automobile components (2.7%) | | |

| Bridgestone Corp. (Japan) | 53,800 | 2,374,577 |

| CIE Generale Des Etablissements Michelin SCA (France) | 42,699 | 1,640,654 |

| FORVIA SE (France) † | 19,280 | 303,548 |

| | 4,318,779 |

| Automobiles (0.4%) | | |

| Isuzu Motors, Ltd. (Japan) | 52,900 | 670,578 |

| | 670,578 |

| Banks (9.9%) | | |

| BAWAG Group AG (Austria) | 11,463 | 685,335 |

| Commonwealth Bank of Australia (Australia) | 16,665 | 1,229,642 |

| Erste Group Bank AG (Czech Republic) | 47,157 | 2,196,545 |

| Intesa Sanpaolo SpA (Italy) | 1,090,262 | 4,090,928 |

| Japan Post Bank Co., Ltd. (Japan) | 59,400 | 601,181 |

| NatWest Group PLC (United Kingdom) | 809,531 | 3,048,961 |

| Sumitomo Mitsui Financial Group, Inc. (Japan) | 74,700 | 4,240,477 |

| | 16,093,069 |

| Beverages (2.3%) | | |

| Asahi Group Holdings, Ltd. (Japan) | 51,002 | 1,742,879 |

| Diageo PLC ADR (United Kingdom) | 11,136 | 1,538,550 |

| Kirin Holdings Co., Ltd. (Japan) | 35,500 | 517,238 |

| | 3,798,667 |

| Biotechnology (1.6%) | | |

| CSL, Ltd. (Australia) | 7,045 | 1,259,327 |

| Genmab A/S (Denmark) † | 3,169 | 878,135 |

| Swedish Orphan Biovitrum AB (Sweden) † | 17,801 | 460,427 |

| | 2,597,889 |

| Broadline retail (0.3%) | | |

| Wesfarmers, Ltd. (Australia) | 12,789 | 551,624 |

| | 551,624 |

| Capital markets (3.1%) | | |

| 3i Group PLC (United Kingdom) | 114,529 | 4,082,065 |

| Julius Baer Group, Ltd. (Switzerland) | 16,950 | 912,766 |

| | 4,994,831 |

| Chemicals (2.2%) | | |

| Akzo Nobel NV (Netherlands) | 19,538 | 1,291,936 |

| Mitsubishi Chemical Group Corp. (Japan) | 217,100 | 1,264,040 |

| Nutrien, Ltd. (Canada) | 8,734 | 460,539 |

| Yara International ASA (Norway) | 18,031 | 515,224 |

| | 3,531,739 |

| Commercial services and supplies (0.9%) | | |

| Brambles, Ltd. (Australia) | 157,170 | 1,476,132 |

| | 1,476,132 |

| Communications equipment (0.7%) | | |

| Nokia Oyj ADR (Finland) | 299,564 | 1,093,409 |

| | 1,093,409 |

| |

16 PanAgora ESG International Equity ETF |

| | |

| COMMON STOCKS (99.2%)* cont. | Shares | Value |

| Construction and engineering (2.7%) | | |

| Vinci SA (France) | 37,661 | $4,407,829 |

| | 4,407,829 |

| Construction materials (1.7%) | | |

| CRH PLC (Ireland) | 35,392 | 2,736,214 |

| | 2,736,214 |

| Consumer staples distribution and retail (3.2%) | | |

| Kesko Oyj Class B (Finland) | 50,317 | 857,251 |

| Koninklijke Ahold Delhaize NV (Netherlands) | 34,596 | 1,049,552 |

| Tesco PLC (United Kingdom) | 878,608 | 3,241,854 |

| | 5,148,657 |

| Diversified telecommunication services (1.2%) | | |

| Koninklijke KPN NV (Netherlands) | 305,173 | 1,109,668 |

| Telstra Group, Ltd. (Australia) | 390,602 | 927,790 |

| | 2,037,458 |

| Electric utilities (0.6%) | | |

| Energias de Portugal (EDP) SA (Portugal) | 250,495 | 942,795 |

| | 942,795 |

| Electrical equipment (2.4%) | | |

| Legrand SA (France) | 11,002 | 1,130,887 |

| Schneider Electric SE (France) | 12,243 | 2,788,268 |

| | 3,919,155 |

| Electronic equipment, instruments, and components (0.6%) | | |

| Halma PLC (United Kingdom) | 33,712 | 922,782 |

| | 922,782 |

| Energy equipment and services (0.2%) | | |

| Technip Energies NV (France) | 12,114 | 287,018 |

| | 287,018 |

| Food products (1.8%) | | |

| Danone SA (France) | 31,959 | 1,998,536 |

| Glanbia PLC (Ireland) | 27,371 | 521,918 |

| Orkla ASA (Norway) † | 63,888 | 434,150 |

| | 2,954,604 |

| Health care equipment and supplies (1.4%) | | |

| ConvaTec Group PLC (United Kingdom) | 100,646 | 314,221 |

| Hoya Corp. (Japan) | 17,300 | 2,010,050 |

| | 2,324,271 |

| Health care providers and services (0.9%) | | |

| Fresenius SE & Co. KGaA (Germany) | 47,768 | 1,425,073 |

| | 1,425,073 |

| Hotels, restaurants, and leisure (1.4%) | | |

| Amadeus IT Holding SA (Spain) | 25,280 | 1,603,995 |

| Sodexo SA (France) | 7,565 | 659,429 |

| | 2,263,424 |

| Household durables (4.3%) | | |

| Berkeley Group Holdings PLC (The) (United Kingdom) | 3,173 | 185,514 |

| Sekisui Chemical Co., Ltd. (Japan) | 49,400 | 718,651 |

| Sekisui House, Ltd. (Japan) | 28,600 | 655,444 |

| Sony Group Corp. (Japan) | 54,500 | 4,501,821 |

| Taylor Wimpey PLC (United Kingdom) | 566,896 | 925,150 |

| | 6,986,580 |

| |

PanAgora ESG International Equity ETF 17 |

| | |

| COMMON STOCKS (99.2%)* cont. | Shares | Value |

| Household products (0.6%) | | |

| Henkel AG & Co. KGaA Vorzug (Germany) | 14,743 | $1,055,998 |

| | 1,055,998 |

| Independent power and renewable electricity producers (0.2%) | | |

| Meridian Energy, Ltd. (New Zealand) | 114,283 | 403,722 |

| | 403,722 |

| Industrial conglomerates (1.2%) | | |

| Hitachi, Ltd. (Japan) | 15,365 | 1,414,833 |

| Keppel, Ltd. (Singapore) | 93,100 | 466,500 |

| | 1,881,333 |

| Industrial REITs (0.4%) | | |

| CapitaLand Ascendas REIT (Singapore) R | 338,400 | 642,383 |

| | 642,383 |

| Insurance (6.7%) | | |

| Aegon, Ltd. (Netherlands) | 149,441 | 930,185 |

| Aviva PLC (United Kingdom) | 153,356 | 888,786 |

| Muenchener Rueckversicherungs-Gesellschaft AG in Muenchen (Germany) | 8,313 | 3,653,295 |

| QBE Insurance Group, Ltd. (Australia) | 143,080 | 1,640,992 |

| Swiss Re AG (Switzerland) | 34,604 | 3,736,262 |

| | 10,849,520 |

| Interactive media and services (0.4%) | | |

| Auto Trader Group PLC (United Kingdom) | 80,630 | 698,233 |

| | 698,233 |

| IT Services (3.1%) | | |

| Capgemini SE (France) | 6,534 | 1,372,767 |

| NEC Corp. (Japan) | 42,200 | 3,060,312 |

| Sopra Steria Group SACA (France) | 2,483 | 543,458 |

| | 4,976,537 |

| Machinery (2.7%) | | |

| FANUC Corp. (Japan) | 58,500 | 1,712,106 |

| GEA Group AG (Germany) | 12,882 | 520,982 |

| Mitsubishi Heavy Industries, Ltd. (Japan) | 186,790 | 1,667,921 |

| Wartsila Oyj Abp (Finland) | 22,918 | 421,579 |

| | 4,322,588 |

| Media (0.6%) | | |

| Publicis Groupe SA (France) | 8,968 | 991,164 |

| | 991,164 |

| Metals and mining (2.7%) | | |

| BlueScope Steel, Ltd. (Australia) | 53,557 | 790,060 |

| Boliden AB (Sweden) | 51,482 | 1,704,242 |

| Northern Star Resources, Inc. (Australia) | 204,504 | 1,952,717 |

| | 4,447,019 |

| Multi-utilities (1.8%) | | |

| Centrica PLC (United Kingdom) | 289,893 | 461,468 |

| E.ON SE (Germany) | 187,775 | 2,479,908 |

| | 2,941,376 |

| |

18 PanAgora ESG International Equity ETF |

| | |

| COMMON STOCKS (99.2%)* cont. | Shares | Value |

| Oil, gas, and consumable fuels (3.7%) | | |

| Equinor ASA ADR (Norway) | 57,635 | $1,532,515 |

| Neste Oyj (Finland) | 39,000 | 888,014 |

| Shell PLC (United Kingdom) | 101,783 | 3,627,200 |

| | 6,047,729 |

| Pharmaceuticals (9.7%) | | |

| Hikma Pharmaceuticals PLC (United Kingdom) | 21,244 | 510,263 |

| Novartis AG (Switzerland) | 47,495 | 4,587,587 |

| Novo Nordisk A/S Class B (Denmark) | 50,689 | 6,514,321 |

| Shionogi & Co., Ltd. (Japan) | 22,631 | 1,057,756 |

| UCB SA (Belgium) | 22,811 | 3,023,050 |

| | 15,692,977 |

| Professional services (1.1%) | | |

| RELX PLC (United Kingdom) | 42,680 | 1,754,211 |

| | 1,754,211 |

| Retail REITs (1.0%) | | |

| CapitaLand Integrated Commercial Trust (CITC) (Singapore) R | 499,100 | 713,973 |

| Klepierre SA (France) R | 18,305 | 492,809 |

| Link REIT (The) (Hong Kong) R | 107,700 | 464,193 |

| | 1,670,975 |

| Semiconductors and semiconductor equipment (5.4%) | | |

| Advantest Corp. (Japan) | 43,500 | 1,337,144 |

| ASML Holding NV (NY Reg Shares) (Netherlands) | 3,614 | 3,153,107 |

| Infineon Technologies AG (Germany) | 67,948 | 2,371,367 |

| Renesas Electronics Corp. (Japan) | 113,700 | 1,873,442 |

| | 8,735,060 |

| Technology hardware, storage, and peripherals (0.2%) | | |

| Logitech International SA (Switzerland) | 3,161 | 245,720 |

| | 245,720 |

| Textiles, apparel, and luxury goods (3.2%) | | |

| Hermes International (France) | 1,640 | 3,942,738 |

| Pandora A/S (Denmark) | 7,846 | 1,194,231 |

| | 5,136,969 |

| Trading companies and distributors (4.6%) | | |

| AerCap Holdings NV (Ireland) † | 19,956 | 1,686,082 |

| Ferguson PLC (United Kingdom) | 2,260 | 476,722 |

| ITOCHU Corp. (Japan) | 35,100 | 1,569,529 |

| Mitsui & Co., Ltd. (Japan) | 76,735 | 3,698,056 |

| | 7,430,389 |

| Transportation infrastructure (0.4%) | | |

| Getlink SE (France) | 39,502 | 671,843 |

| | 671,843 |

| Wireless telecommunication services (1.2%) | | |

| KDDI Corp. (Japan) | 42,325 | 1,177,563 |

| SoftBank Corp. (Japan) | 67,100 | 812,857 |

| | 1,990,420 |

| Total common stocks (cost $148,049,597) | $160,971,470 |

|

| |

PanAgora ESG International Equity ETF 19 |

| | | |

| SHORT-TERM INVESTMENTS (—%)* | Shares | Value |

| Putnam Government Money Market Fund Class P 5.04% L | | 47,901 | $47,901 |

| Total short-term investments (cost $47,901) | $47,901 |

|

| |

| TOTAL INVESTMENTS |

| Total investments (cost $148,097,498) | $161,019,371 |

|

| |

| Key to holding’s abbreviations |

| ADR | American Depository Receipts: Represents ownership of foreign securities on deposit with a custodian bank. |

|

| | | |

| Notes to the fund’s portfolio |

| Unless noted otherwise, the notes to the fund’s portfolio are for the close of the fund’s reporting period, which ran from May 1, 2023 through April 30, 2024 (the reporting period). Within the following notes to the portfolio, references to “Putnam Management” represent Putnam Investment Management, LLC, the fund’s manager, an indirect wholly-owned subsidiary of Franklin Resources, Inc., and references to “ASC 820” represent Accounting Standards Codification 820 Fair Value Measurements and Disclosures. |

| * | Percentages indicated are based on net assets of $162,287,267. |

| † | This security is non-income-producing. |

| L | Affiliated company (Note 6). The rate quoted in the security description is the annualized 7-day yield of the fund at the close of the reporting period. |

| R | Real Estate Investment Trust. |

|

| | | | |

| DIVERSIFICATION BY COUNTRY | | | | |

| Distribution of investments by country of risk at the close of the reporting period, excluding collateral received, if any (as a percentage of Portfolio Value): |

| Japan | 24.0% | | Finland | 2.0% |

| United Kingdom | 14.1 | | Belgium | 1.9 |

| France | 13.2 | | Norway | 1.5 |

| Germany | 8.9 | | Czech Republic | 1.4 |

| Australia | 6.1 | | Sweden | 1.3 |

| Switzerland | 5.9 | | Singapore | 1.1 |

| Denmark | 5.3 | | Spain | 1.0 |

| Netherlands | 4.7 | | Portugal | 0.6 |

| Ireland | 3.1 | | Other | 1.4 |

| Italy | 2.5 | | Total | 100.0% |

|

|

| |

20 PanAgora ESG International Equity ETF |

ASC 820 establishes a three-level hierarchy for disclosure of fair value measurements. The valuation hierarchy is based upon the transparency of inputs to the valuation of the fund’s investments. The three levels are defined as follows:

Level 1: Valuations based on quoted prices for identical securities in active markets.

Level 2: Valuations based on quoted prices in markets that are not active or for which all significant inputs are observable, either directly or indirectly.

Level 3: Valuations based on inputs that are unobservable and significant to the fair value measurement.

The following is a summary of the inputs used to value the fund’s net assets as of the close of the reporting period:

| | | |

| | Valuation inputs |

| Investments in securities: | Level 1 | Level 2 | Level 3 |

| Common stocks*: | | | |

| Communication services | $— | $5,717,275 | $— |

| Consumer discretionary | — | 19,927,954 | — |

| Consumer staples | 1,538,550 | 11,419,376 | — |

| Energy | 1,532,515 | 4,802,232 | — |

| Financials | — | 31,937,420 | — |

| Health care | — | 22,040,210 | — |

| Industrials | 1,686,082 | 27,080,125 | — |

| Information technology | 4,246,516 | 11,726,992 | — |

| Materials | 460,539 | 10,254,433 | — |

| Real estate | — | 2,313,358 | — |

| Utilities | — | 4,287,893 | — |

| Total common stocks | 9,464,202 | 151,507,268 | — |

| Short-term investments | 47,901 | — | — |

| Totals by level | $9,512,103 | $151,507,268 | $— |

* Common stock classifications are presented at the sector level, which may differ from the fund’s portfolio presentation.

The accompanying notes are an integral part of these financial statements.

| |

PanAgora ESG International Equity ETF 21 |

Statement of assets and liabilities 4/30/24

| |

| ASSETS | |

| Investment in securities, at value (Note 1): | |

| Unaffiliated issuers (identified cost $148,049,597) | $160,971,470 |

| Affiliated issuers (identified cost $47,901) (Note 6) | 47,901 |

| Foreign currency (cost $574,975) (Note 1) | 571,891 |

| Dividends, interest and other receivables | 441,318 |

| Foreign tax reclaim | 383,563 |

| Total assets | 162,416,143 |

| |

| LIABILITIES | |

| Payable for compensation of Manager (Note 2) | 128,876 |

| Total liabilities | 128,876 |

| | |

| Net assets | $162,287,267 |

| |

| REPRESENTED BY | |

| Paid-in capital (Unlimited shares authorized) (Notes 1, 4 and 5) | $148,331,630 |

| Total distributable earnings (Note 1) | 13,955,637 |

| Total — Representing net assets applicable to capital shares outstanding | $162,287,267 |

| |

| COMPUTATION OF NET ASSET VALUE | |

| Net asset value per share | |

| ($162,287,267 divided by 7,300,000 shares) | $22.23 |

The accompanying notes are an integral part of these financial statements.

|

| 22 PanAgora ESG International Equity ETF |

Statement of operations Year ended 4/30/24

| |

| INVESTMENT INCOME | |

| Dividends (net of foreign tax of $429,329) | $4,005,701 |

| Interest (including interest income of $23,431 from investments in affiliated issuers) (Note 6) | 23,643 |

| Total investment income | 4,029,344 |

| |

| EXPENSES | |

| Compensation of Manager (Note 2) | 673,668 |

| Fees waived and reimbursed by Manager (Note 2) | (1,453) |

| Total expenses | 672,215 |

| | |

| Net investment income | 3,357,129 |

| |

| REALIZED AND UNREALIZED GAIN (LOSS) | |

| Net realized gain (loss) on: | |

| Securities from unaffiliated issuers (Notes 1 and 3) | 856,869 |

| Foreign currency transactions (Note 1) | (34,332) |

| Securities from in-kind transactions (Notes 1 and 3) | 195 |

| Total net realized gain | 822,732 |

| Change in net unrealized appreciation (depreciation) on: | |

| Securities from unaffiliated issuers | 9,862,078 |

| Assets and liabilities in foreign currencies | (24,513) |

| Total change in net unrealized appreciation | 9,837,565 |

| | |

| Net gain on investments | 10,660,297 |

| |

| Net increase in net assets resulting from operations | $14,017,426 |

The accompanying notes are an integral part of these financial statements.

|

| PanAgora ESG International Equity ETF 23 |

Statement of changes in net assets

| | |

| | | For the period |

| | | 1/19/23 |

| | | (commencement |

| | | of operations) |

| INCREASE IN NET ASSETS | Year ended 4/30/24 | to 4/30/23 |

| Operations | | |

| Net investment income | $3,357,129 | $1,664,214 |

| Net realized gain (loss) on investments | | |

| and foreign currency transactions | 822,732 | (171,631) |

| Change in net unrealized appreciation of investments | | |

| and assets and liabilities in foreign currencies | 9,837,565 | 3,059,161 |

| Net increase in net assets resulting from operations | 14,017,426 | 4,551,744 |

| Distributions to shareholders (Note 1): | | |

| From ordinary income | | |

| Net investment income | (4,613,700) | — |

| Proceeds from shares sold (Note 4) | 24,183,564 | 127,598,690 |

| Decrease from shares redeemed (Note 4) | — | (5,542,610) |

| Other capital (Note 4) | 12,268 | 79,885 |

| Total increase in net assets | 33,599,558 | 126,687,709 |

| |

| NET ASSETS | | |

| Beginning of period (Note 5) | 128,687,709 | 2,000,000 |

| End of period | $162,287,267 | $128,687,709 |

| |

| NUMBER OF FUND SHARES | | |

| Shares outstanding at beginning of period (Note 5) | 6,175,000 | 100,000 |

| Shares sold (Note 4) | 1,125,000 | 6,350,000 |

| Shares redeemed (Note 4) | — | (275,000) |

| Shares outstanding at end of period | 7,300,000 | 6,175,000 |

The accompanying notes are an integral part of these financial statements.

|

| 24 PanAgora ESG International Equity ETF |

Financial highlights

(For a common share outstanding throughout the period)

| | |

| PER-SHARE OPERATING PERFORMANCE | | |

| | | For the period |

| | | 1/19/23 |

| | | (commencement |

| | Year ended | of operations) |

| | 4/30/24 | to 4/30/23 |

| Net asset value, beginning of period | $20.84 | $20.00 |

| Investment operations: | | |

| Net investment income (loss)a | .52 | .35 |

| Net realized and unrealized gain (loss) on investments | 1.58 | .47 |

| Total from investment operations | 2.10 | .82 |

| Less distributions: | | |

| From net investment income | (.71) | — |

| Total distributions | (.71) | — |

| Other capital | —f | .02 |

| Net asset value, end of period | $22.23 | $20.84 |

| Total return at net asset value (%)b | 10.22 | 4.20* |

| |

| RATIOS AND SUPPLEMENTAL DATA | | |

| Net assets, end of period (in thousands) | $162,287 | $128,688 |

| Ratio of expenses to average net assets (%)c,d | .49 | .14* |

| Ratio of net investment income (loss) to average net assets (%)d | 2.44 | 1.73* |

| Portfolio turnover (%)e | 111 | 42* |

* Not annualized.

a Per share net investment income (loss) has been determined on the basis of the weighted average number of shares outstanding during the period.

b Total return assumes dividend reinvestment.

c Excludes acquired fund fees and expenses, if any.

d Reflects waivers of certain fund expenses in connection with investments in Putnam Government Money Market Fund during the period. As a result of such waivers, the expenses of the fund reflect a reduction of the following amounts (Notes 2 and 6):

| |

| | Percentage of average net assets |

| April 30, 2024 | <0.01% |

| April 30, 2023 | <0.01 |

e Portfolio turnover excludes securities received or delivered in-kind, if any.

f Amount represents less than $0.01 per share.

The accompanying notes are an integral part of these financial statements.

|

| PanAgora ESG International Equity ETF 25 |

Notes to financial statements 4/30/24

Unless otherwise noted, the “reporting period” represents the period from May 1, 2023 through April 30, 2024. The following table defines commonly used references within the Notes to financial statements:

| |

| References to | Represent |

| ESG | Environmental, social and/or corporate governance |

| ETF | Exchange-traded fund |

| Franklin Templeton | Franklin Resources, Inc. |

| JPMorgan | JPMorgan Chase Bank, N.A. |

| OTC | Over-the-counter |

| PanAgora | PanAgora Asset Management, Inc., an affiliate of Putnam Management |

| Putnam Management | Putnam Investment Management, LLC, the fund’s manager, an indirect wholly-owned |

| | subsidiary of Franklin Templeton |

| SEC | Securities and Exchange Commission |

| State Street | State Street Bank and Trust Company |

Putnam PanAgora ESG International Equity ETF (the fund) is a diversified, open-end series of Putnam ETF Trust (the Trust), a Delaware statutory trust organized under the Investment Company Act of 1940, as amended. The fund is an actively managed ETF. The fund’s investment objective is to seek long term capital appreciation. The fund invests mainly in common stocks (growth or value stocks or both) of companies of any size outside the United States with a focus on companies that the fund’s subadviser, PanAgora, believes offer attractive benchmark-relative returns and exhibit positive ESG metrics. In evaluating and selecting investments for the fund, PanAgora employs a proprietary framework using quantitative models that identify companies that offer above-market return potential based on their ESG metrics, together with other proprietary factors measuring a company’s financial and operational health, and then construct a portfolio that integrates return potential and ESG metrics.

PanAgora uses advanced statistical and machine learning techniques, together with third-party and proprietary data sources, in evaluating companies’ ESG metrics and return potential. Metrics designed to evaluate companies’ environmental practices may include third-party or proprietary data sources, including those regarding a company’s environmental footprint or its environmental efficiencies. Metrics designed to evaluate companies’ social practices may include third-party or proprietary data sources, including those regarding board diversity levels at a company. Metrics designed to evaluate companies’ governance practices may include third-party or proprietary data sources, including those regarding a company’s shareholder structure. Additionally, PanAgora’s quantitative model may also use third-party and/or proprietary data sources to identify companies exhibiting improved ESG profiles or those investing in ESG initiatives. The ESG metrics and information used in the portfolio construction process may change over time and may not be relevant to all companies that are eligible for investment by the fund.

In addition, the fund will not invest in securities of companies that PanAgora, based on third-party data, determines at the time of investment to have a severe ESG risk rating (which measures a company’s exposure to industry-specific material ESG risks and how well a company is managing those risks), to have a category 5 controversy rating (an assessment of a company’s involvement in incidents with negative ESG implications), to be classified as non-compliant under the United Nations Global Compact principles, or to be substantially engaged in Arctic drilling or in the thermal coal, palm oil, controversial weapons or tobacco industries (each, a “Restricted Company”). In addition, at the time of any periodic rebalancing of the fund’s portfolio, the fund will dispose of its position in any security that, at that time, PanAgora determines to be a Restricted Company.

Under normal circumstances, the fund invests at least 80% of its net assets in equity securities of companies that meet PanAgora’s ESG criteria, as described above. PanAgora will assign each company an ESG rating using proprietary ESG scores. In order to meet PanAgora’s ESG criteria, a company must have an ESG score above 0, reflecting more positive characteristics, and, on or after June 12, 2023, must also not be a Restricted Company. A negative ESG score indicates a lower (or worse) rating. PanAgora assigns companies an ESG score that ranges from –2 to +2, although the range of scores may change over time. This policy is non-fundamental and may be changed only after 60 days’ notice to shareholders. PanAgora may not apply ESG criteria to investments that are not subject to the fund’s 80% policy, and such investments may not meet PanAgora’s ESG criteria.

|

| 26 PanAgora ESG International Equity ETF |

The fund’s equity investments may include common stocks, preferred stocks, convertible securities, warrants, American Depository Receipts (“ADRs”) and Global Depository Receipts (“GDRs”). The fund invests mainly in developed countries but may also invest in emerging markets.

PanAgora may consider, among other factors, a company’s valuation, financial strength, growth potential, competitive position in its industry, projected future earnings, cash flows and dividends when deciding whether to buy or sell investments. While PanAgora may consider independent third-party data as a part of its analytical process (and currently uses third-party data in applying certain of the fund’s investment policies), the portfolio management team performs its own independent analysis of issuers, through its quantitative model and proprietary scoring system, and does not rely solely on third-party screens.

From time to time, the fund may invest a significant portion of its assets in companies in one or more related industries or sectors. The fund may also invest a significant portion of its assets in one or more related geographic regions, such as European and Asian countries.

In the normal course of business, the fund enters into contracts that may include agreements to indemnify another party under given circumstances. The fund’s maximum exposure under these arrangements is unknown as this would involve future claims that may be, but have not yet been, made against the fund. However, the fund’s management team expects the risk of material loss to be remote.

The fund has entered into contractual arrangements with an investment adviser, administrator, distributor, transfer agent and custodian, who each provide services to the fund. Unless expressly stated otherwise, shareholders are not parties to, or intended beneficiaries of these contractual arrangements, and these contractual arrangements are not intended to create any shareholder right to enforce them against the service providers or to seek any remedy under them against the service providers, either directly or on behalf of the fund.

Under the Trust’s Agreement and Declaration of Trust, any claims asserted by a shareholder against or on behalf of the Trust (or its series), including claims against Trustees and Officers, must be brought in courts of the State of Delaware.

Note 1: Significant accounting policies

The fund follows the accounting and reporting guidance in Financial Accounting Standards Board (FASB) Accounting Standards Codification Topic 946, Financial Services – Investment Companies (ASC 946) and applies the specialized accounting and reporting guidance in U.S. Generally Accepted Accounting Principles (U.S. GAAP), including, but not limited to, ASC 946. The following is a summary of significant accounting policies consistently followed by the fund in the preparation of its financial statements. The preparation of financial statements is in conformity with accounting principles generally accepted in the United States of America and requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities in the financial statements and the reported amounts of increases and decreases in net assets from operations. Actual results could differ from those estimates. Subsequent events after the Statement of assets and liabilities date through the date that the financial statements were issued have been evaluated in the preparation of the financial statements.

Security valuation Portfolio securities and other investments are valued using policies and procedures adopted by the Board of Trustees. The Trustees have formed a Pricing Committee to oversee the implementation of these procedures and have delegated responsibility for valuing the fund’s assets in accordance with these procedures to Putnam Management. Putnam Management has established an internal Valuation Committee that is responsible for making fair value determinations, evaluating the effectiveness of the pricing policies of the fund and reporting to the Pricing Committee.

Investments for which market quotations are readily available are valued at the last reported sales price on their principal exchange, or official closing price for certain markets, and are classified as Level 1 securities under Accounting Standards Codification 820 Fair Value Measurements and Disclosures (ASC 820). If no sales are reported, as in the case of some securities that are traded OTC, a security is valued at its last reported bid price and is generally categorized as a Level 2 security.

Investments in open-end investment companies (excluding exchange-traded funds), if any, which can be classified as Level 1 or Level 2 securities, are valued based on their net asset value. The net asset value of such investment companies equals the total value of their assets less their liabilities and divided by the number of their outstanding shares.

Many securities markets and exchanges outside the U.S. close prior to the scheduled close of the New York Stock Exchange and therefore the closing prices for securities in such markets or on such exchanges may not fully

|

| PanAgora ESG International Equity ETF 27 |

reflect events that occur after such close but before the scheduled close of the New York Stock Exchange. Accordingly, on certain days, the fund will fair value certain foreign equity securities taking into account multiple factors including movements in the U.S. securities markets, currency valuations and comparisons to the valuation of American Depository Receipts, exchange-traded funds and futures contracts. The foreign equity securities, which would generally be classified as Level 1 securities, will be transferred to Level 2 of the fair value hierarchy when they are valued at fair value. The number of days on which fair value prices will be used will depend on market activity and it is possible that fair value prices will be used by the fund to a significant extent. At the close of the reporting period, fair value pricing was used for certain foreign securities in the portfolio. Securities quoted in foreign currencies, if any, are translated into U.S. dollars at the current exchange rate. Short-term securities with remaining maturities of 60 days or less are valued using an independent pricing service approved by the Trustees, and are classified as Level 2 securities.

To the extent a pricing service or dealer is unable to value a security or provides a valuation that Putnam Management does not believe accurately reflects the security’s fair value, the security will be valued at fair value by Putnam Management, which has been designated as valuation designee pursuant to Rule 2a–5 under the Investment Company Act of 1940, in accordance with policies and procedures approved by the Trustees. Certain investments, including certain restricted and illiquid securities and derivatives, are also valued at fair value following procedures approved by the Trustees. These valuations consider such factors as significant market or specific security events such as interest rate or credit quality changes, various relationships with other securities, discount rates, U.S. Treasury, U.S. swap and credit yields, index levels, convexity exposures, recovery rates, sales and other multiples and resale restrictions. These securities are classified as Level 2 or as Level 3 depending on the priority of the significant inputs.

To assess the continuing appropriateness of fair valuations, the Valuation Committee reviews and affirms the reasonableness of such valuations on a regular basis after considering all relevant information that is reasonably available. Such valuations and procedures are reviewed periodically by the Trustees. The fair value of securities is generally determined as the amount that the fund could reasonably expect to realize from an orderly disposition of such securities over a reasonable period of time. By its nature, a fair value price is a good faith estimate of the value of a security in a current sale and does not reflect an actual market price, which may be different by a material amount.

Security transactions and related investment income Security transactions are recorded on the trade date (the date the order to buy or sell is executed). Gains or losses on securities sold are determined on the identified cost basis.

Interest income, net of any applicable withholding taxes, if any, is recorded on the accrual basis. Amortization and accretion of premiums and discounts on debt securities, if any, is recorded on the accrual basis.

Dividend income, net of any applicable withholding taxes, is recognized on the ex-dividend date except that certain dividends from foreign securities, if any, are recognized as soon as the fund is informed of the ex-dividend date. Non-cash dividends, if any, are recorded at the fair value of the securities received. Dividends representing a return of capital or capital gains, if any, are reflected as a reduction of cost and/or as a realized gain.

Foreign currency translation The accounting records of the fund are maintained in U.S. dollars. The fair value of foreign securities, currency holdings, and other assets and liabilities is recorded in the books and records of the fund after translation to U.S. dollars based on the exchange rates on that day. The cost of each security is determined using historical exchange rates. Income and withholding taxes are translated at prevailing exchange rates when earned or incurred. The fund does not isolate that portion of realized or unrealized gains or losses resulting from changes in the foreign exchange rate on investments from fluctuations arising from changes in the market prices of the securities. Such gains and losses are included with the net realized and unrealized gain or loss on investments. Net realized gains and losses on foreign currency transactions represent net realized exchange gains or losses on disposition of foreign currencies, currency gains and losses realized between the trade and settlement dates on securities transactions and the difference between the amount of investment income and foreign withholding taxes recorded on the fund’s books and the U.S. dollar equivalent amounts actually received or paid. Net unrealized appreciation and depreciation of assets and liabilities in foreign currencies arise from changes in the value of assets and liabilities other than investments at the period end, resulting from changes in the exchange rate.

Lines of credit The fund participates, along with other Putnam funds, in a $320 million syndicated unsecured committed line of credit, provided by State Street ($160 million) and JPMorgan ($160 million), and a $235.5 million unsecured uncommitted line of credit, provided by State Street. Borrowings may be made for temporary or emergency purposes, including the funding of shareholder redemption requests and trade settlements. Interest

|

| 28 PanAgora ESG International Equity ETF |

is charged to the fund based on the fund’s borrowing at a rate equal to 1.25% plus the higher of (1) the Federal Funds rate and (2) the Overnight Bank Funding Rate for the committed line of credit and 1.30% plus the higher of (1) the Federal Funds rate and (2) the Overnight Bank Funding Rate for the uncommitted line of credit. A closing fee equal to 0.04% of the committed line of credit and 0.04% of the uncommitted line of credit has been paid by the participating funds and a $75,000 fee has been paid by the participating funds to State Street as agent of the syndicated committed line of credit. In addition, a commitment fee of 0.21% per annum on any unutilized portion of the committed line of credit is allocated to the participating funds based on their relative net assets and paid quarterly. During the reporting period, the fund had no borrowings against these arrangements.

Federal taxes It is the policy of the fund to distribute all of its taxable income within the prescribed time period and otherwise comply with the provisions of the Internal Revenue Code of 1986, as amended (the Code), applicable to regulated investment companies. It is also the intention of the fund to distribute an amount sufficient to avoid imposition of any excise tax under Section 4982 of the Code.

The fund is subject to the provisions of Accounting Standards Codification 740 Income Taxes (ASC 740). ASC 740 sets forth a minimum threshold for financial statement recognition of the benefit of a tax position taken or expected to be taken in a tax return. The fund did not have a liability to record for any unrecognized tax benefits in the accompanying financial statements. No provision has been made for federal taxes on income, capital gains or unrealized appreciation on securities held nor for excise tax on income and capital gains. The fund’s federal tax return for the prior period remains subject to examination by the Internal Revenue Service.

The fund may also be subject to taxes imposed by governments of countries in which it invests. Such taxes are generally based on either income or gains earned or repatriated. The fund accrues and applies such taxes to net investment income, net realized gains and net unrealized gains as income and/or capital gains are earned. In some cases, the fund may be entitled to reclaim all or a portion of such taxes, and such reclaim amounts, if any, are reflected as an asset on the fund’s books. In many cases, however, the fund may not receive such amounts for an extended period of time, depending on the country of investment.

Distributions to shareholders Distributions to shareholders from net investment income, if any, are recorded by the fund on the ex-dividend date. Distributions from capital gains, if any, are recorded on the ex-dividend date and paid at least annually. The amount and character of income and gains to be distributed are determined in accordance with income tax regulations, which may differ from generally accepted accounting principles. These differences include temporary and/or permanent differences from losses on wash sale transactions, from a basis adjustment due to corporate actions and from realized and unrealized gains and losses on passive foreign investment companies. Reclassifications are made to the fund’s capital accounts to reflect income and gains available for distribution (or available capital loss carryovers) under income tax regulations. At the close of the reporting period, the fund reclassified $2,432,494 to increase undistributed net investment income, $167 to decrease paid-in capital and $2,432,327 to decrease accumulated net realized gain.

Tax cost of investments includes adjustments to net unrealized appreciation (depreciation) which may not necessarily be final tax cost basis adjustments, but closely approximate the tax basis unrealized gains and losses that may be realized and distributed to shareholders. The tax basis components of distributable earnings and the federal tax cost as of the close of the reporting period were as follows:

| |

| Unrealized appreciation | $15,550,217 |

| Unrealized depreciation | (4,965,884) |

| Net unrealized appreciation | 10,584,333 |

| Undistributed ordinary income | 3,062,224 |

| Undistributed long-term gains | 334,227 |

| Undistributed short-term gains | — |

| Cost for federal income tax purposes | $150,435,038 |

Expenses of the Trust Expenses directly charged or attributable to any fund will be paid from the assets of that fund. Generally, expenses of the Trust will be allocated among and charged to the assets of each fund on a basis that the Trustees deem fair and equitable, which may be based on the relative assets of each fund or the nature of the services performed and relative applicability to each fund.

|

| PanAgora ESG International Equity ETF 29 |

Note 2: Management fee, administrative services and other transactions

The fund pays the Manager an annual all-inclusive management fee of 0.49% based on the fund’s average daily net assets computed and paid monthly. The management fee covers investment management services and all of the fund’s organizational and other operating expenses with certain exceptions, including but not limited to: payments under distribution plans, interest expenses, taxes, brokerage commissions and other transaction costs, fund proxy expenses, litigation expenses, extraordinary expenses and acquired fund fees and expenses.

The fund invests in Putnam Government Money Market Fund, an open-end management investment company managed by Putnam Management. Management fees paid by the fund are reduced by an amount equal to the management fees paid by Putnam Government Money Market Fund with respect to assets invested by the fund in Putnam Government Money Market Fund. During the reporting period, management fees paid were reduced by $1,453 relating to the fund’s investment in Putnam Government Money Market Fund.

PanAgora is authorized by the Trustees to make investment decisions for the assets of the fund as determined by Putnam Management. Putnam Management (and not the fund) pays a quarterly sub-advisory fee to PanAgora for its services at an annual rate of 0.17% of the average net assets of the fund.

On January 1, 2024, a subsidiary of Franklin Templeton acquired Putnam U.S. Holdings I, LLC (“Putnam Holdings”), the parent company of Putnam Management, in a stock and cash transaction (the “Transaction”). As a result of the Transaction, Putnam Management became an indirect, wholly-owned subsidiary of Franklin Templeton. PanAgora, the fund’s subadviser, was not acquired in the Transaction and remains an indirect, wholly-owned subsidiary of Great-West Lifeco Inc., which, prior to the Transaction, was the parent company of Putnam Holdings. The Transaction also resulted in the automatic termination of the investment management contract between the fund and Putnam Management and the sub-advisory contract for the fund between Putnam Management and PanAgora that were in place before the Transaction (together, the “Previous Advisory Contracts”). However, Putnam Management and PanAgora continue to provide uninterrupted services with respect to the fund pursuant to new investment management and sub-advisory contracts that were approved by fund shareholders at a shareholder meeting held in connection with the Transaction and that took effect on January 1, 2024 (together, the “New Advisory Contracts”). The terms of the New Advisory Contracts are substantially similar to those of the Previous Advisory Contracts, and the fee rates payable under the New Advisory Contracts are the same as the fee rates under the Previous Advisory Contracts.

Effective June 1, 2024, under an agreement with Putnam Management, Franklin Templeton Services, LLC, a wholly-owned subsidiary of Franklin Templeton and an affiliate of Putnam Management, will provide certain administrative services to the fund. The fee for those services will be paid by Putnam Management based on the costs incurred by Franklin Templeton Services, LLC, and is not an additional expense of the fund.

The fund has adopted a distribution and service plan pursuant to Rule 12b–1 under the 1940 Act that authorizes the fund to pay distribution fees in connection with the sale and distribution of its shares and service fees in connection with the provision of ongoing shareholder support services. No Rule 12b–1 fees are currently paid by the fund.

Note 3: Purchases and sales of securities

During the reporting period, the cost of purchases and the proceeds from sales, excluding short-term investments and in-kind transactions, were as follows:

| | |

| | Cost of purchases | Proceeds from sales |

| Investments in securities (Long-term) | $172,203,776 | $152,442,281 |

| U.S. government securities (Long-term) | — | — |

| Total | $172,203,776 | $152,442,281 |

Portfolio securities received or delivered through in-kind transactions were $3,736,865 and $2,315, respectively.

The fund may purchase or sell investments from or to other Putnam funds in the ordinary course of business, which can reduce the fund’s transaction costs, at prices determined in accordance with SEC requirements and policies approved by the Trustees. During the reporting period, purchases or sales of long-term securities from or to other Putnam funds, if any, did not represent more than 5% of the fund’s total cost of purchases and/or total proceeds from sales.

|

| 30 PanAgora ESG International Equity ETF |

Note 4: Capital shares