An offering statement pursuant to Regulation A relating to these securities has been filed with the Securities and Exchange Commission. Information contained in this Preliminary Offering Circular is subject to completion or amendment. These securities may not be sold nor may offers to buy be accepted before the offering statement filed with the Commission is qualified. This Preliminary Offering Circular shall not constitute an offer to sell or the solicitation of an offer to buy nor may there be any sales of these securities in any state in which such offer, solicitation, or sale would be unlawful before registration or qualification under the laws of any such state. We may elect to satisfy our obligation to deliver a Final Offering Circular by sending you a notice within two business days after the completion of our sale to you that contains the URL where the Final Offering Circular or the offering statement in which such Final Offering Circular was filed may be obtained.

Preliminary Offering Circular Subject to Completion, dated January [ ], 2022

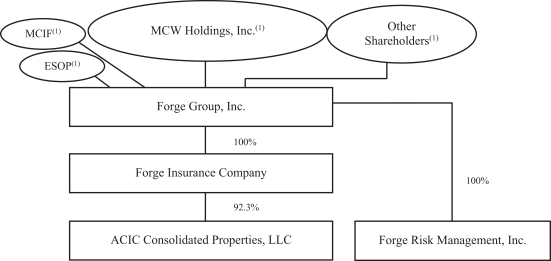

Forge Group, Inc.

We are offering up to 2,300,000 shares of our common stock for sale at a price of $10.00 per share in connection with the conversion of Amalgamated Casualty Insurance Company, or ACIC, from the mutual to stock form of organization. Immediately following the conversion, we will acquire all of the newly issued shares of ACIC common stock. This is our initial public offering. For a description of our common stock, see “Description of Our Capital Stock.”

We are offering shares of our common stock in a subscription offering and a public offering. The subscription offering will be made in the following order of priority: (1) first, to eligible members of ACIC, who were the policyholders of ACIC as of February 3, 2021, which we refer to herein as “eligible members”; (2) second, to our employee stock ownership plan, which we refer to as our ESOP; and (3) third, to the trustees, officers, and employees of ACIC. The minimum number of shares that a person may subscribe to purchase is 50 shares. For information regarding limitations on the number of shares that may be purchased, see “The Conversion and Offering — Limitations on Purchases of Common Stock.”

Each eligible member will receive the right to purchase shares of our common stock. In addition to the right to purchase shares of our common stock, if the offering and the conversion are completed, ACIC will distribute $4,594 to each eligible member. See “The Conversion and Offering — Cash Distribution to Eligible Members.”

The subscription offering will end at noon, Eastern Time, on [ ], 2022. Concurrently with the subscription offering and subject to the prior right of subscribers in the subscription offering, shares will be offered in a public offering to the general public. This phase of the stock offering is referred to as the public offering. We refer to the subscription offering and the public offering as the offering.

Our ability to complete this offering is subject to two conditions. First, a minimum of 1,700,000 shares of common stock must be sold to complete this offering. Second, ACIC’s plan of conversion must be approved by the affirmative vote of at least a majority of the votes cast at the special meeting of members to be held on March 7, 2022. Until such time as these conditions are satisfied, all funds submitted to purchase shares will be held in escrow with Computershare Trust Company, N.A. If the offering is terminated, purchasers will have their funds promptly returned without interest.

Shares purchased by the ESOP and by trustees, employees and officers of ACIC will be counted toward satisfaction of the minimum amount needed to complete this offering. If more orders are received than shares offered, shares will be allocated in the manner and priority described in this offering circular.

Generally, no sale may be made to you in this offering if the aggregate purchase price you pay is more than 10% of the greater of your annual income or net worth. Different rules apply to accredited investors and non-natural persons. Before making any representation that your investment does not exceed applicable thresholds, we encourage you to review Rule 251(d)(2)(C) of Regulation A. For general information on investing, we encourage you to refer to www.investor.gov.

Griffin Financial Group LLC will act as our placement agent and will use its best efforts to assist us in selling our common stock in this offering, but Griffin Financial is not obligated to purchase any shares of common stock that are being offered for sale. Any commissions paid in connection with the purchase of shares of common stock in this offering will be paid by us from the gross proceeds of the offering.

There is currently no public market for our common stock. We do not intend to apply for the listing of our common stock on any stock exchange. This will materially and adversely affect the liquidity of our stock. We intend to apply to have “buy” and “sell” quotes for shares of our common stock reported on the “OTC Pink” market by broker-dealers that agree to make a market in our common stock. See “Risk Factors — Risks Relating to Ownership of Our Common Stock — Our shares will not be listed on any stock exchange, and there will not be an active, liquid market for our common stock.”

Our principal executive offices are located at 8401 Connecticut Avenue, Suite 300, Chevy Chase, Maryland 20815, our phone number is (202) 547-8700 and our website address is asginsurance.com. This is a Regulation A+ Tier 2 offering. This offering circular is intended to provide the information required by the Offering Circular format of Part II of Form 1-A.

Investing in our common stock involves risks. For a discussion of the material risks that you should consider, see “Risk Factors” beginning on page 13 of this offering circular.

OFFERING SUMMARY

Price: $10.00 per share

| | | | | | | | | | | | |

| | | Minimum | | | Midpoint | | | Maximum | |

Number of shares | | | 1,700,000 | | | | 2,000,000 | | | | 2,300,000 | |

Gross offering proceeds | | $ | 17,000,000 | | | $ | 20,000,000 | | | $ | 23,000,000 | |

Less: Proceeds from ESOP shares(1) | | $ | 1,683,000 | | | $ | 1,980,000 | | | $ | 2,277,000 | |

Estimated offering expenses | | $ | 3,270,269 | | | $ | 3,270,269 | | | $ | 3,270,269 | |

Commissions(2)(3) | | $ | 728,886 | | | $ | 891,141 | | | $ | 1,053,396 | |

Cash distribution to eligible members | | $ | 7,300,000 | | | $ | 7,300,000 | | | $ | 7,300,000 | |

Net proceeds(4) | | $ | 4,017,845 | | | $ | 6,558,900 | | | $ | 9,099,335 | |

Net proceeds per share | | $ | 2.36 | | | $ | 3.28 | | | $ | 3.96 | |

| (1) | The calculation of net proceeds from this offering does not include the shares being purchased by our ESOP because ACIC will loan a portion of the proceeds to the ESOP to fund the purchase of such shares. The ESOP is purchasing such number of shares as will equal 9.9% of the total number of shares sold in the offering. |

| (2) | Represents the amount to be paid to Griffin Financial, based on (i) 2.0% of the proceeds from shares sold in the offering to policyholders, trustees, officers, and employees of ACIC and the ESOP, and (ii) 6.25% of the proceeds from all other shares sold in the offering. See “The Conversion and Offering — Marketing Arrangements” for a description of the placement agent compensation. |

| (3) | Assumes that at the offering minimum, the offering midpoint, and at the offering maximum 916,525, 1,157,125, and 1,397,725 shares, respectively, are sold in the offering to persons other than the policyholders, trustees, officers and employees and the ESOP. |

| (4) | Does not include the $7,300,000 cash distribution that will be paid to eligible members shortly after completion of the conversion and offering. |

The District of Columbia Department of Insurance, Securities and Banking has not approved or disapproved of these securities or determined if this offering circular is accurate or complete.

The United States Securities and Exchange Commission does not pass upon the merits of or give its approval to any securities offered or the terms of the offering, nor does it pass upon the accuracy or completeness of any offering circular or other solicitation materials. These securities are offered pursuant to an exemption from registration with the Commission; however, the Commission has not made an independent determination that the securities offered are exempt from registration.

For assistance, please call the Stock Information Center at (610) 205-6005.

Griffin Financial Group LLC

The date of this Offering Circular is January[ ], 2022