| II. | Financial Update – Overview |

Financial Condition – Update

Presented in Exhibit X is selected data concerning the Company’s financial position as of June 30, 2021 and December 31, 2019 and December 31, 2020.

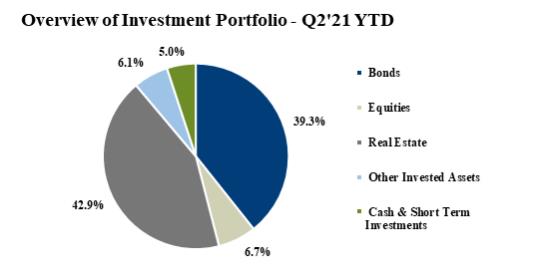

The Company’s total assets were relatively flat at 2Q’21 compared to YE’20, with the asset base primarily comprised of investments and cash, premium and other receivables, reinsurance recoverable, and deferred assets. The composition of the Company’s assets was largely consistent with YE’20, with investments and cash of $72.9 million accounting for the largest portion of the Company’s asset base (82.6% at June 30, 2021), down slightly from 84.4% at December 31, 2020.

The Company’s total liabilities decreased 2.1% to $45.1 million at June 30, 2021 from $46.1 million at December 31, 2020, primarily a function of the Company paying down some of its notes as well as lower loss expenses. The Company’s total equity increased 2.4% to $43.2 million from $42.2 million at December 31, 2020 behind improved earnings as a result of unrealized gains in the Company’s equity portfolio, and lower loss experience due to lower traffic volumes domestically.

Financial Performance – Update

Presented in Exhibit XI is selected data concerning the Company’s financial performance for the last twelve months ended June 30, 2021 and December 31, 2019 and December 31, 2020.

ACIC’s total revenue grew 5.5% to $13.6 million as of LTM June 30, 2021, up from $12.9 million at year end December 31, 2020. Top-line growth was largely attributable to non-core activity, primarily $2.5 million of unrealized gains on equities, up from $814 thousand at YE’20. Consistent with the downward trend in earned premium from 2019 and 2020, the Company’s earned premiums continued to decline, falling 10.1% from YE’20 to $7.3 million as of the LTM June 30, 2021. The Company’s expense base was flat compared to year end December 31, 2020 at $9.2 million and was due to a lower loss experience, slightly offset by higher operating and other expenses.

10