UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| | |

| ☐ | | Preliminary Proxy Statement |

| |

| ☐ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

| ☐ | | Definitive Proxy Statement |

| |

| ☒ | | Definitive Additional Materials |

| |

| ☐ | | Soliciting Material Pursuant to §240.14a-12 |

TAX-FREE FIXED INCOME FUND V FOR PUERTO RICO RESIDENTS, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | | | |

| |

| ☒ | | No fee required. |

| |

| ☐ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

| | (5) | | Total fee paid: |

| |

| ☐ | | Fee paid previously with preliminary materials. |

| |

| ☐ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| | |

| | (1) | | Amount previously paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

| | (3) | | Filing Party: |

| | (4) | | Date Filed: |

Today, Tax-Free Fixed Income Fund V for Puerto Rico Residents, Inc. began distributing the below letter, dated as of August 16, 2021, to certain stockholders:

* * * * *

| | |

| | Puerto Rico Family of Funds |

August 16, 2021

To Shareholders of Tax-Free Fixed Income Fund V for Puerto Rico Residents, Inc.:

At this year’s annual meeting, to be held virtually on August 26, 2021, at 2:00 pm, you will have an important decision to make about the future of your investment in the Fund. Your Board urges you to vote on the WHITE proxy card “FOR” the four current directors who are up for re-election in order to support the stability and continuity of the Fund. The current Board has a long history overseeing the Fund on behalf of shareholders and is committed to ensuring the Fund’s long-term viability, so that it continues to generate valuable dividend income for Puerto Rican residents like you.

The Board’s Oversight of Fund V’s Lifetime Performance

The Fund’s investment objective is to provide its shareholders with current income, as consistent with the preservation of capital. In fact, since inception the Fund has distributed $8.32 per share in cumulative dividends to its shareholders.1

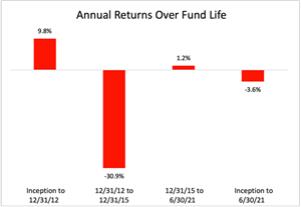

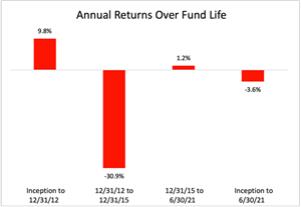

As a result of prudent investment management, overseen by its Board, the Fund has managed significant market challenges, while maximizing dividends and net returns.

It performed well from its inception in March 2005 through 2012. Current, special and capital gains dividends in addition to strong price performance generated gross investment returns near 70%.2

The crash of the Puerto Rico municipal bond market beginning in 2013 through the end of 2015 affected all investors in these markets, as reflected in the Fund’s returns during that period. However, under the Board’s leadership, the Fund continued to deliver monthly tax-advantaged income, conducting share repurchases to provide liquidity to selling shareholders while accreting value to those who held their investment.

Though the Puerto Rico bond markets have not yet recovered, the Fund has performed positively since the end 2015, as it has continued to provide its shareholders with monthly income.

Today, the Board believes the outlook for the Fund is positive. As the Puerto Rico bond market emerges, both the income and liquidity of the Fund can be expected to improve. At the current Board’s direction, the Fund continues to work tirelessly to maximize shareholder returns, including proceeding with a registration with the U.S. Securities and Exchange Commission under the Investment Company Act of 1940, which may contribute to increased liquidity and reduced market discount to NAV, paving the way for further positive returns. The Board is keenly aware of the need for liquidity in the Fund shares and will continue to make achieving this a strategic priority.

Your Fund’s Nominees

As members of the current Board, the Fund’s nominees for re-election at the Annual Meeting are highly qualified financial professionals with deep roots in Puerto Rico and a long-standing commitment to the Fund. They understand Puerto Rico’s financial markets and are committed to the Fund’s investment objectives and its shareholders:

| • | | Luis M. Pellot has been the President of Pellot-González, Tax Attorneys & Counselors at Law, PSC, since 1989, and is active in the Puerto Rico business community as a member of the Puerto Rico Bar Association. He is a former member of the Puerto Rico Manufacturers Association, Puerto Rico Chamber of Commerce, Puerto Rico General Contractors Association, Puerto Rico Hotel & Tourism Association and Hispanic National Bar Association, and President of Tax Committee, Puerto Rico Chamber of Commerce from 1996 to 1997. He has been an Independent Director and member of the Audit Committee of the UBS Puerto Rico Family of Funds since 2002. |

| • | | Carlos Nido has been the President of Green Isle Capital LLC, a Puerto Rico Venture Capital Fund under Law 185 investing primarily in feature films and healthcare, since 2015. He is also President and Executive Producer of Piñolywood Studios LLC and serves as a member of the Board of B. Fernández & Hnos. Inc., the UBS Puerto Rico Family of Funds, Puerto Rico Ambulatory Surgery Center, and the San Jorge Children’s Foundation; Member of the Advisory Board of Advent Morro Private Equity Funds. Mr. Nido was the Senior Vice President of Sales of El Nuevo Día, President of Del Mar Events, President and founder of Virtual, Inc. and Zona Networks and General Manager of Editorial Primera Hora from 1997 until 1999. |

| 1 | From 5/31/07 to 6/30/21. |

| 2 | From 5/31/07 to 12/31/12. |

| | |

| | Puerto Rico Family of Funds |

| • | | Jose J. Villamil is Chairman of the Board and Chief Executive Officer of Estudios Técnicos, Inc.; a long-time member of the Board of Governors of United Way of Puerto Rico; Economic Advisor to the Puerto Rico Manufacturer’s Association and the Associated General Contractors of America (Puerto Rico Chapter); as well as Chairman of the Board of BBVA-PR from 2000 to 2012; among his many private, public and non-profit leadership roles in Puerto Rico. |

| | • | | Vicente León has developed deep experience in finance and accounting since 1962.; including as a former Member and Audit Committee Chairman of the Board of Directors of Triple S Management Corp. from 2000 to 2012; former Audit Partner at KPMG LLP; and former President of the Puerto Rico Society of CPA. |

The Board urges shareholders to support the Fund’s continued positive momentum and plan for long-term stability and viability of the Fund as a source of current income for its shareholders by voting “FOR” these four nominees on the WHITE card.

If You Receive a Blue Proxy from Ocean Capital, Please Discard It

The Fund received a purported notice from Ocean Capital, stating its intention to nominate director candidates and submit a proposal at the Annual Meeting. However, the Fund rejected the purported notice because the Board determined, upon the advice of outside counsel, that Ocean Capital’s notice failed to comply with the Fund’s organizational documents. As a result, we have determined the only director candidates eligible for election at the Annual Meeting are Luis M. Pellot, Carlos Nido, José J. Villamil and Vicente León.

Please note that Ocean Capital is a shell company, formed by Georgia-based hedge fund First Southern and led by First Southern’s founder William Heath Hawk. Ocean Capital apparently targets Puerto Rico bond funds with the goal of liquidating them and extracting short-term profits at the expense of funds’ long-term shareholders’ income and interests. In fact, Mr. Hawk and First Southern have a long history of “distressed bond investing,” facilitating the liquidation of Santander Puerto Rico’s bond funds. As a 20/22 Act company, Ocean Capital is also likely to gain significant tax benefits from their strategy that are not available to ordinary Puerto Rican investors.

PLEASE VOTE “FOR” THE BOARD’S NOMINEES ON THE WHITE PROXY CARD NOW

As your Board, we are honored to serve as your fiduciaries and ask that you continue to place your trust in us by voting FOR the Board’s nominees on the WHITE proxy card. For more information, please visit UBSPRFunds.com.

Very truly yours,

The Board of Directors of Tax-Free Fixed Income Fund V for Puerto Rico Residents, Inc.

If you have any questions, or need assistance voting your

WHITE proxy card, please contact:

1212 Avenue of the Americas, 24th Floor

New York, NY 10036

Telephone for Banks and Brokers: +1 212-297-0720

Shareholders may call toll-free (from the U.S., Puerto Rico, and Canada): +1 877-566-1922

Email: info@okapipartners.com

2

| | |

| | Puerto Rico Family of Funds |

Important Additional Information and Where to Find It

Tax-Free Fixed Income Fund V for Puerto Rico Residents, Inc. (the “Fund”) has filed a definitive proxy statement on Schedule 14A (the “Proxy Statement”), an accompanying WHITE proxy card and other relevant documents with the SEC in connection with such solicitation of proxies from the Fund’s stockholders for its 2021 annual meeting of stockholders. STOCKHOLDERS OF THE FUND ARE STRONGLY ENCOURAGED TO READ THE PROXY STATEMENT (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO), ACCOMPANYING WHITE PROXY CARD AND ALL OTHER DOCUMENTS FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. Investors and stockholders may obtain a copy of the Proxy Statement, an accompanying WHITE proxy card, any amendments or supplements to the Proxy Statement and other documents that the Fund files with the SEC at no charge at the SEC’s website at www.sec.gov. In addition, a stockholder who wishes to receive a copy of the Fund’s definitive proxy materials, without charge, should submit this request to: UBS Trust Company of Puerto Rico, c/o Claudio Ballester, 250 Muñoz Rivera Avenue, American International Plaza, Tenth Floor, San Juan, Puerto Rico 00918.

3

| | | | |

| | Puerto Rico Family of Funds | | UBSPRFunds.com |

16 de agosto de 2021

A los accionistas del Tax-Free Fixed Income Fund V Puerto Rico Residents, Inc. (el “Fondo”):

En la reunión anual de accionistas de este año, que se llevará a cabo virtualmente el 26 de agosto de 2021, a las 2:00 p. m., usted tendrá una decisión importante que tomar sobre el futuro de su inversión en el Fondo. Su Junta de Directores lo exhorta votar en la tarjeta de poder de poder de votación (Proxy Card) BLANCA “POR” los cuatro directores actuales que están postulados para la reelección para asegurar la estabilidad y continuidad del Fondo. Su Junta de Directores actual tiene una larga trayectoria supervisando el Fondo para beneficio de sus accionistas y está comprometida con asegurar la viabilidad a largo plazo del Fondo, de modo que continúe generando ingresos de dividendos para los residentes puertorriqueños como usted.

La supervisión del rendimiento por la Junta de Directores durante toda la vigencia del Fondo V

El objetivo de la inversión del Fondo es generar ingresos corrientes para sus accionistas, junto con la preservación del capital. De hecho, desde su creación, el Fondo ha distribuido a sus accionistas $8.32 por acción en dividendos acumulados.1

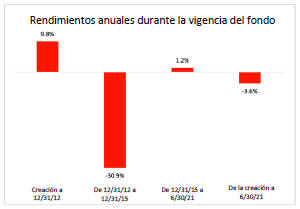

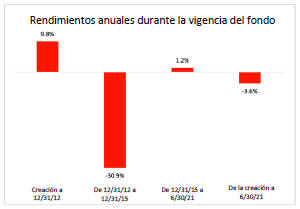

Como resultado de la administración prudente y acertada de las inversiones, según supervisada por su Junta de Directores, el Fondo ha enfrentado importantes desafíos del mercado y ha maximizado los dividendos y los rendimientos netos.

El Fondo tuvo un buen desempeño desde su creación en marzo de 2005 hasta 2012. Los dividendos actuales, especiales y de ganancias de capital, además del sólido desempeño de precios, generaron retornos brutos de la inversión cercanos al 70%.2

La caída del mercado de bonos municipales de Puerto Rico desde su inicio en 2013 hasta fines de 2015 afectó a todos los inversionistas en estos mercados, como se refleja en los rendimientos del Fondo durante este período. Sin embargo, bajo el liderazgo de la Junta de Directores, el Fondo continuó generando ingresos mensuales con beneficios contributivos y realizó recompras de acciones para proporcionar liquidez a los accionistas, mientras se acrecía el valor para los accionistas que mantuvieron su inversión.

Aunque los mercados de bonos de Puerto Rico aún no se han recuperado, el Fondo ha tenido un rendimiento positivo desde finales de 2015, y ha continuado brindando a sus accionistas ingresos mensuales.

Hoy en día, su Junta de Directores considera que la perspectiva para el Fondo es positiva. A medida que se estabilizan los mercados de bonos de Puerto Rico, tanto los ingresos como la liquidez del Fondo se espera que mejore. Bajo la dirección actual de la Junta de Directores, el Fondo continúa trabajando incansablemente para maximizar los rendimientos de los accionistas, incluyendo el proceder con registrar el Fondo con el U.S. Securities and Exchange Commission, en virtud de la Ley de Compañías de Inversión de 1940, que puede contribuir a una mayor liquidez y a un descuento del mercado más reducido al NAV, lo que prepara el terreno para obtener rendimientos positivos adicionales. La Junta de Directores es muy consciente de la necesidad de liquidez en el Fondo y continuará haciendo lo que esté a su alcance para lograr esta prioridad estratégica.

1

| | | | |

| | Puerto Rico Family of Funds | | UBSPRFunds.com |

Los nominados para la Junta de Directores del Fondo

Como miembros de la Junta de Directores actual, los directores nominados para la reelección en la reunión anual de accionistas son profesionales financieros altamente calificados con raíces profundas en Puerto Rico y un compromiso consolidado con el Fondo. Ellos entienden los mercados financieros de Puerto Rico y están comprometidos con los objetivos de inversión del Fondo y sus accionistas:

| • | | Luis M. Pellot ha sido presidente de Pellot-González, Tax Attorneys & Counselors at Law, PSC, desde 1989 y está activo en la comunidad empresarial de Puerto Rico como miembro del Colegio de Abogados de Puerto Rico, exmiembro de la Asociación de Industriales de Puerto Rico, Cámara de Comercio de Puerto Rico, Asociación de Contratistas Generales de América (Capítulo de Puerto Rico), Asociación de Hoteles y Turismo de Puerto Rico y Hispanic National Bar Association y presidente del Comité de Impuestos de la Cámara de Comercio de Puerto Rico de 1996 a 1997. Ha sido director independiente y miembro del Comité de Auditoría de la Familia de Fondos de UBS Puerto Rico desde 2002. |

| • | | Carlos Nido ha sido el presidente de Green Isle Capital LLC, un fondo de capital de riesgo de Puerto Rico en virtud de la Ley 185, que invierte principalmente en largometrajes y atención médica, desde 2015. También es presidente y productor ejecutivo de Piñolywood Studios LLC, se desempeña como miembro de la Junta de Directores de B. Fernández & Hnos. Inc., la Familia de Fondos de UBS Puerto Rico, Puerto Rico Ambulatory Surgery Center y San Jorge Children’s Foundation y miembro de la junta de consejo de Advent Morro Private Equity Funds. Anteriormente fue vicepresidente sénior de Ventas de El Nuevo Día, presidente de Del Mar Events, presidente y fundador de Virtual, Inc. y Zona Networks y gerente general de Primera Hora Editorial de 1997 a 1999. |

| • | | José J. Villamil es presidente de la Junta de Directores y director ejecutivo de Estudios Técnicos, Inc., miembro desde hace mucho tiempo de la Junta de Gobernadores de United Way of Puerto Rico, asesor económico a la Asociación de Industriales de Puerto Rico y presidente de la Junta de Directores de BBVA-PR del 2000 al 2012, entre sus muchos roles de liderazgo privados, públicos y sin fines de lucro en Puerto Rico. |

| • | | Vicente León ha desarrollado una vasta experiencia en finanzas y contabilidad desde 1962, exmiembro y presidente del Comité de Auditoría de la Junta de Directores de Triple S Management Corp. de 2000 a 2012, exsocio de auditoría de KPMG LLP y expresidente de la Sociedad Puertorriqueña de CPAs. |

La Junta de Directores insta a los accionistas a apoyar el momentum positivo y continuo del Fondo y asegurar la estabilidad y viabilidad a largo plazo del Fondo como fuente de ingresos corrientes para sus accionistas mediante la votación “POR” estos cuatro nominados en la tarjeta BLANCA.

Si recibe una tarjeta de poder de votación azul de Ocean Capital, descártela

El Fondo recibió un presunto aviso de Ocean Capital, en el que se indicaba su intención de nominar a candidatos a director y presentar su propuesta en la reunión anual de accionistas. Sin embargo, el Fondo rechazó esta supuesta notificación porque la Junta de Directores determinó, por recomendación de sus abogados externos, que la notificación de Ocean Capital no cumplió con los requisitos estipulados en la documentación organizacional del Fondo, que están diseñadas para proteger a los accionistas, según se establece en los documentos organizacionales del Fondo. Como resultado, determinamos que los únicos candidatos para el cargo de director que cualifican para elección en la reunión anual de accionistas son Luis M. Pellot, Carlos Nido, José J. Villamil y Vicente León.

Hacemos hincapié en que Ocean Capital es una compañía shell, formada por el fondo de cobertura (“hedge fund”) First Southern, con sede en Georgia y dirigida por su fundador William Heath Hawk. Ocean Capital ha puesto en su mirilla a las compañías de inversión puertorriqueñas que invierten en bonos de Puerto Rico, con el objetivo de liquidarlos y extraer ganancias a corto plazo, a expensas de los intereses a largo plazo de sus accionistas y los ingresos corrientes devengados por éstos. De hecho, el Sr. Hawk y First Southern tienen una larga historia de “inversión en bonos en dificultades” y facilitó la liquidación de compañías de inversión puertorriqueñas manejadas por Santander Puerto Rico. Como una empresa que se ha cobijado bajo las Leyes 20/22, es probable que Ocean Capital también se beneficie contributivamente de su estrategia y dichos beneficios no están disponibles para los inversionistas puertorriqueños del patio.

VOTE “POR” LOS NOMINADOS DE LA JUNTA DE DIRECTORES EN LA TARJETA DE PODER DE VOTACIÓN BLANCA AHORA

Como su Junta de Directores, nos sentimos honrados de servir como sus fiduciarios y le pedimos que continúe depositando su confianza en nosotros votando POR los nominados de la Junta de Directores en la tarjeta de poder de votación BLANCA. Para obtener más información, visite UBSPRFunds.com.

Muy atentamente,

La Junta de Directores del Tax-Free Fixed Income Fund V for Puerto Rico Residents, Inc.

2

| | | | |

| | Puerto Rico Family of Funds | | UBSPRFunds.com |

Si tiene alguna pregunta o necesita ayuda para votar su TARJETA DE PODER DE VOTACIÓN

BLANCA, por favor comuníquese con:

1212 Avenue of the Americas, 24th Floor

New York, NY 10036

Telephone for Banks and Brokers: +1 212-297-0720

Shareholders may call toll-free (from the U.S., Puerto Rico, and Canada): +1 877-566-1922

Email: info@okapipartners.com

Important Additional Information and Where to Find It

Tax-Free Fixed Income Fund V for Puerto Rico Residents, Inc. (the “Fund”) has filed a definitive proxy statement on Schedule 14A (the “Proxy Statement”), an accompanying WHITE proxy card and other relevant documents with the SEC in connection with such solicitation of proxies from the Fund’s stockholders for its 2021 annual meeting of stockholders. STOCKHOLDERS OF THE FUND ARE STRONGLY ENCOURAGED TO READ THE PROXY STATEMENT (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO), ACCOMPANYING WHITE PROXY CARD AND ALL OTHER DOCUMENTS FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. Investors and stockholders may obtain a copy of the Proxy Statement, an accompanying WHITE proxy card, any amendments or supplements to the Proxy Statement and other documents that the Fund files with the SEC at no charge at the SEC’s website at www.sec.gov. In addition, a stockholder who wishes to receive a copy of the Fund’s definitive proxy materials, without charge, should submit this request to: UBS Trust Company of Puerto Rico, c/o Claudio Ballester, 250 Muñoz Rivera Avenue, American International Plaza, Tenth Floor, San Juan, Puerto Rico 00918.

3