UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| | |

| ☐ | | Preliminary Proxy Statement |

| |

| ☐ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

| ☐ | | Definitive Proxy Statement |

| |

| ☒ | | Definitive Additional Materials |

| |

| ☐ | | Soliciting Material Pursuant to §240.14a-12 |

TAX-FREE FIXED INCOME FUND V FOR PUERTO RICO RESIDENTS, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | | | |

| |

☒ | | No fee required. |

| |

| ☐ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

| | (5) | | Total fee paid: |

| |

| ☐ | | Fee paid previously with preliminary materials. |

| |

| ☐ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| | |

| | (1) | | Amount previously paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

| | (3) | | Filing Party: |

| | (4) | | Date Filed: |

On August 18, 2021, Tax-Free Fixed Income Fund V for Puerto Rico Residents, Inc. (the “Fund”) launched the website UBSPRFunds.com in connection with the Fund’s 2021 annual meeting of shareholders. The website will be regularly updated with relevant information for shareholders. A copy of the materials (other than those previously filed under cover of Schedule 14A) on the website can be found below.

* * * * *

English UBS PUERTO RICO FUNDS TAX-FREE FIXED INCOME FUNDS FOR PUERTO RICO RESIDENTS Under the stewardship of their Boards, Tax-Free Income Funds IV and V for Puerto Rico Residents have reliably generated income for the benefit of Puerto Ricans since their inception. At the Fund’s respective Annual Meetings, slated for August 26, 2021, shareholders have an important decision to make about the future of their investments in the Funds. The Boards of both Funds unanimously recommend that shareholders vote on the WHITE proxy card “FOR” the existing Board’s nominees in order to support the stability and continuity of the Fund. The Funds’ nominess are highly qualified financial professionals with deep roots in Puerto Rico and a long-standing commitment to the Fund. TAX-FREE FIXED INCOME FUND IV FOR PUERTO RICO RESIDENTS, INC MORE INFORMATION TAX-FREE FIXED INCOME FUND V FOR PUERTO RICO RESIDENTS, INC MORE INFORMATION CONTACT US Your name Your email Your message SEND MESSAGE © 2 0 2 1 A l R i g h t s R e s e r v e d . U B S | P r i v a c y P o l i c y | D i s c l a i m e r

English HOW TO VOTE YOUR SHARES IF YOU HAVE ANY QUESTIONS, OR NEED ASSISTANCE VOTING YOUR WHITE PROXY CARD, PLEASE CONTACT: 1212 Avenue of the Americas, 24th Floor New York, NY. 10036 Banks and Brokers: +1 212-297-0720 Shareholders: +1 877-566-1922 (toll-free from U.S., Puerto Rico and Canada) Email: info@okapipartners.com THREE EASY WAYS TO VOTE YOUR PROXY: By Internet – Please visit www.proxyvote.com and enter the 16 digit control number found on the WHITE card you should receive in the mail, on or about August 20th, and follow the simple on-screen instructions. Please note that if you have multiple investments, after submitting initial voting instructions, please scroll down the webpage for other ballots that may be outstanding for this and other meetings which would be listed below. IF YOU DO NOT HAVE YOUR WHITE PROXY CARD, PLEASE CALL YOUR FINANCIAL ADVISOR FOR ASSISTANCE. At the Virtual Meeting – If you plan to attend the meeting, please register at https://viewproxy.com/UBSPuertoRico/broadridgevsm/ no later than 5:00 p.m. Eastern Time on August 25, 2021. You will need to include the Fund’s name in the subject line and provide your name and address in the body of the e-mail. Broadridge will then e-mail you the meeting login information and instructions for attending and voting at the Meeting. By Mail – Sign and date the WHITE proxy card you receive and mail back with the enclosed business reply envelope. If possible, please utilize one of the prior options to ensure your vote is counted in time for the meeting. © 2 0 2 1 A l l R i g h t s R e s e r v e d . U B S | P r i v a c y P o l i c y | D i s c l a i m e r

English UBS PUERTO RICO FUNDS TAX-FREE FIXED INCOME FUND V FOR PUERTO RICO RESIDENTS AN IMPORTANT DECISION AT THIS YEAR’S ANNUAL MEETING At this year’s annual meeting, to be held virtually on August 26, 2021, at 2:00 pm, shareholders have an important decision to make about the future of your investment in the Fund. The Board urges Fund shareholders to vote on the WHITE proxy card “FOR” the four current directors who are up for re-election in order to support the stability and continuity of the Fund. The current Board has a long history overseeing the Fund on behalf of shareholders and is committed to ensuring the Fund’s long-term viability, so that it continues to generate valuable dividend income for Puerto Rican residents like you. VOTE ON THE WHITE PROXY CARD “FOR” THE BOARD’S NOMINEES PERFORMANCE The Fund’s investment objective is to provide its shareholders with current income, as consistent with the preservation of capital. In fact, since inception the Fund has distributed $8.32 per share in cumulative dividends to its shareholders, while delivering positive returns since inception. LEARN MORE NOMINEES As members of the current Board, the Fund’s nominees for re-election at the Annual Meeting are highly qualifed fnancial professionals with deep roots in Puerto Rico and a long-standing commitment to the Fund. They understand Puerto Rico’s fnancial markets and are committed to the Fund’s investment objectives and its shareholders. LEARN MORE RESOURCES More resources for shareholders, including a letter to shareholders and proxy flings. LEARN MORE © 2 0 2 1 A l l R i g h t s R e s e r v e d . U B S | P r i v a c y P o l i c y | D i s c l a i m e r

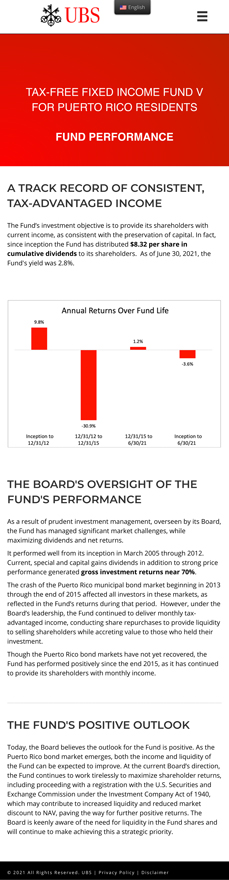

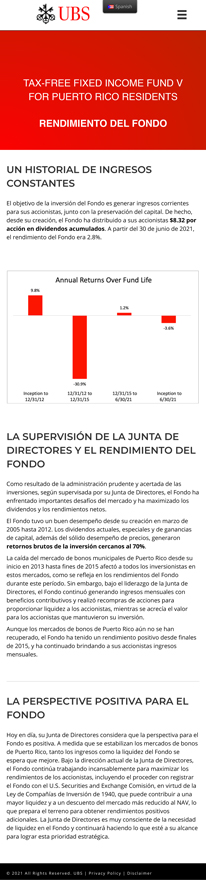

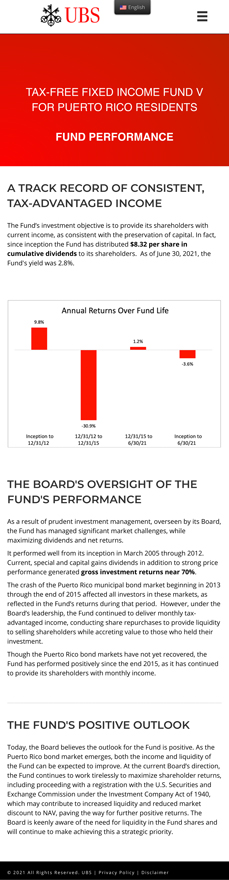

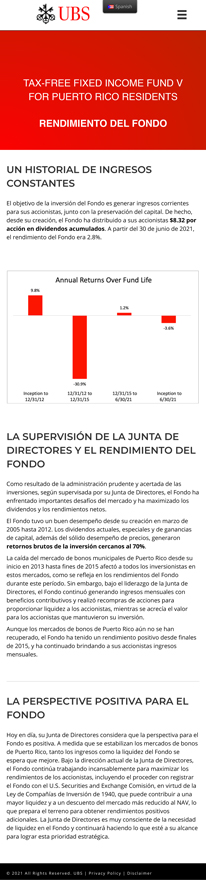

English TAX-FREE FIXED INCOME FUND V FOR PUERTO RICO RESIDENTS FUND PERFORMANCE A TRACK RECORD OF CONSISTENT, TAX-ADVANTAGED INCOME The Fund’s investment objective is to provide its shareholders with current income, as consistent with the preservation of capital. In fact, since inception the Fund has distributed $8.32 per share in cumulative dividends to its shareholders. As of June 30, 2021, the Fund’s yield was 2.8%. THE BOARD’S OVERSIGHT OF THE FUND’S PERFORMANCE As a result of prudent investment management, overseen by its Board, the Fund has managed significant market challenges, while maximizing dividends and net returns. It performed well from its inception in March 2005 through 2012. Current, special and capital gains dividends in addition to strong price performance generated gross investment returns near 70%. The crash of the Puerto Rico municipal bond market beginning in 2013 through the end of 2015 affected all investors in these markets, as reflected in the Fund’s returns during that period. However, under the Board’s leadership, the Fund continued to deliver monthly tax-advantaged income, conducting share repurchases to provide liquidity to selling shareholders while accreting value to those who held their investment. Though the Puerto Rico bond markets have not yet recovered, the Fund has performed positively since the end 2015, as it has continued to provide its shareholders with monthly income. THE FUND’S POSITIVE OUTLOOK Today, the Board believes the outlook for the Fund is positive. As the Puerto Rico bond market emerges, both the income and liquidity of the Fund can be expected to improve. At the current Board’s direction, the Fund continues to work tirelessly to maximize shareholder returns, including proceeding with a registration with the U.S. Securities and Exchange Commission under the Investment Company Act of 1940, which may contribute to increased liquidity and reduced market discount to NAV, paving the way for further positive returns. The Board is keenly aware of the need for liquidity in the Fund shares and will continue to make achieving this a strategic priority. © 2 0 2 1 A l l R i g h t s R e s e r v e d . U B S | P r i v a c y P o l i c y | D i s c l a i m e r

English TAX-FREE FIXED INCOME FUND V FOR PUERTO RICO RESIDENTS FUND NOMINEES As members of the current Board, the Fund’s nominees for re-election at the Annual Meeting are highly qualifed fnancial professionals with deep roots in Puerto Rico and a long-standing commitment to the Fund. They understand Puerto Rico’s fnancial markets and are committed to the Fund’s investment objectives and its shareholders. The Board urges shareholders to support the Fund’s continued positive momentum and plan for long-term stability and viability of Fund as a source of current income for its shareholders by voting “FOR” these three nominees on the WHITE card. Luis M. Pellot has been the President of Pellot-González, Tax Attorneys & Counselors at Law, PSC, since 1989, and is active in the Puerto Rico business community as a member of the Puerto Rico Bar Association. He is a former member of the Puerto Rico Manufacturers Association, Puerto Rico Chamber Commerce, Puerto Rico General Contractors Association, Puerto Rico Hotel & Tourism Association and Hispanic National Bar Association, and President of Tax Committee, Puerto Rico Chamber of Commerce from 1996 to 1997. He has been an Independent Director and member of the Audit Committee of the UBS Puerto Rico Family of Funds since 2002. Carlos Nido has been the President of Green Isle Capital LLC, a Puerto Rico Venture Capital Fund under Law 185 investing primarily in feature flms and healthcare, since 2015. He is also President and Executive Producer of Piñolywood Studios LLC and serves as a member of the Board of B. Fernández & Hnos. Inc., the UBS Puerto Rico Family of Funds, Puerto Rico Ambulatory Surgery Center, and the San Jorge Children’s Foundation; Member of the Advisory Board of Advent Morro Private Equity Funds. Mr. Nido was the Senior Vice President of Sales of El Nuevo Día, President of Del Mar Events, President and founder of Virtual, Inc. and Zona Networks and General Manager of Editorial Primera Hora from 1997 until 1999. Jose J. Villamil is Chairman of the Board and Chief Executive Ofcer of Estudios Técnicos, Inc.; a long-time member of the Board of Governors of United Way of Puerto Rico; Economic Advisor to the Puerto Rico Manufacturer’s Association and the Associated General Contractors of America (Puerto Rico Chapter); as well as Chairman of the Board of BBVA-PR from 2000 to 2012, among his many private, public and non-proft leadership roles in Puerto Rico. Vicente León has developed deep experience in fnance and accounting since 1962, including as a former Member and Audit Committee Chairman of the Board of Directors of Triple S Management Corp. from 2000 to 2012; former Audit Partner at KPMG LLP; and former President of the Puerto Rico Society of CPA.

English TAX-FREE FIXED INCOME FUND V FOR PUERTO RICO RESIDENTS FUND RESOURCES SHAREHOLDER LETTER Letter to Shareholder of Tax-Free Fixed Income Fund V for Puerto Rico Residents, Inc. | August 16, 2021 PROXY FILINGS Fund V Definitive Proxy Statement | June 29, 2021 Proxy Supplement #1| July 19, 2021 Proxy Supplement #2 | July 23, 2021 Proxy Supplement #3 |August 11, 2021 © 2021 All Rights Reserved. UBS | Privacy Policy | Disclaimer

Spanish UBS PUERTO RICO FUNDS TAX-FREE FIXED INCOME FUNDS FOR PUERTO RICO RESIDENTS Bajo la direction de sus Juntas, Tax-Free Income Funds IV y V for Puerto Rico Residents han generado ingresos corrientes de manera confable en benefcio de los puertorriqueños desde sus creaciones. En la reunión anual de accionistas de este año, que se llevará a cabo el 26 de agosto de 2021, los accionistas tendrán una decisión importante que tomar sobre el futuro de su inversión en los Fondos. Las Juntas de Directores de ambos Fondos los exhortan a votar en la tarjeta de poder de votación (Proxy Card) BLANCA “POR” los directores actuales que están postulados para la reelección para asegurar la estabilidad y continuidad de los Fondos. Los directores nominados son profesionales fnancieros altamente califcados, con raíces profundas en Puerto Rico y un compromiso consolidado con el Fondo. TAX-FREE FIXED INCOME FUND IV FOR PUERTO RICO RESIDENTS, INC MÁS INFORMACIÓN TAX-FREE FIXED INCOME FUND V FOR PUERTO RICO RESIDENTS, INC MÁS INFORMACIÓN CONTACT US Su nombre Su correo electronico Su mensaje ENVIAR © 2 0 2 1 A l l R i g h t s R e s e r v e d . U B S | P r i v a c y P o l i c y | D i s c l a i m e r

Spanish CÓMO VOTAR SUS ACCIONES SI TIENE ALGUNA PREGUNTA O NECESITA AYUDA PARA VOTAR CON SU TARJETA DE PODER DE VOTACIÓN BLANCA, COMUNÍQUESE CON: 1212 Avenue of the Americas, 24th Floor New York, NY. 10036 Banks and Brokers: +1 212-297-0720 Shareholders: +1 877-566-1922 (toll-free from U.S., Puerto Rico and Canada) Email: info@okapipartners.com TRES FÁCILES FORMAS DE VOTAR SU PODER DE VOTACIÓN: Por Internet Visite www.proxyvote.com e ingrese el número de control de 16 dígitos que se encuentra en la tarjeta BLANCA que debe recibir por correo el 20 de agosto o alrededor de esa fecha, y siga las sencillas instrucciones en pantalla. Tenga en cuenta que si tiene varias inversiones, después de enviar las instrucciones de votación inicial, desplácese hacia abajo en la página web para ver otras boletas que pueden estar pendientes para esta y otras reuniones que se enumerarían a continuación. SI NO TIENE SU TARJETA DE PROXY BLANCA, LLAME A SU ASESOR FINANCIERO PARA OBTENER ASISTENCIA. En la reunión virtual : Si planea asistir a la reunión, regístrese en https: / /viewproxy.com/UBSPuertoRico/broadridgevsm/ a más tardar a las 5:00 p.m. ET el 25 de agosto de 2021. Deberá incluir el nombre del Fondo en la línea de asunto y proporcionar su nombre y dirección en el cuerpo del correo electrónico. Luego, Broadridge le enviará por correo electrónico la información de inicio de sesión de la reunión y las instrucciones para asistir y votar en la reunión. Por correo: Firme y coloque la fecha en la tarjeta de representación BLANCA que reciba y envíela por correo con el sobre de respuesta comercial adjunto. Si es posible, utilice una de las opciones anteriores para asegurarse de que su voto se cuente a tiempo para la reunión. © 2 0 2 1 A l l R i g h t s R e s e r v e d . U B S | P r i v a c y P o l i c y | D i s c l a i m e r

Spanish UBS PUERTO RICO FUNDS TAX-FREE FIXED INCOME FUND V FOR PUERTO RICO RESIDENTS UNA DECISIÓN IMPORTANTE QUE TOMAR ESTE AÑO En la reunión anual de accionistas de este año, que se llevará a cabo virtualmente el 26 de agosto de 2021 a las 2:00 p.m., los accionistas tendrán una decisión importante que tomar sobre el futuro de su inversión en el Fondo. Su Junta de Directores lo exhorta a votar en la tarjeta de poder de votación (Proxy Card) BLANCA “POR” los cuatro directores actuales que están postulados para la reelección para asegurar la estabilidad y continuidad del Fondo. Su Junta de Directores tiene una larga trayectoria supervisando el Fondo para el benefcio de sus accionistas y está comprometida con asegurar la viabilidad a largo plazo del Fondo, de modo que continúe generando ingresos de dividendos para los residentes puertorriqueños como usted. VOTE “POR” LOS NOMINADOS DE LA JUNTA DE DIRECTORES EN LA TARJETA DE PODER DE VOTACIÓN BLANCA RENDIMIENTO DEL FONDO El objetivo de la inversión del Fondo es generar ingresos corrientes para sus accionistas, junto con la preservación del capital. De hecho, desde su creación, el Fondo ha distribuido a sus accionistas $8.32 por acción en dividendos acumulados. APRENDER MAS LOS NOMINADOS Como miembros de la Junta de Directores actual, los directores nominados para la reelección en la reunión anual de accionistas son profesionales fnancieros altamente califcados, con raíces profundas en Puerto Rico y un compromiso consolidado con el Fondo. Ellos entienden los mercados fnancieros de Puerto Rico y están comprometidos con los objetivos de inversión del Fondo y sus accionistas. APRENDER MAS RECURSOS Más recursos para accionistas, incluso una carta a accionistas y los proxy flings. APRENDER MAS © 2 0 2 1 A l l R i g h t s R e s e r v e d . U B S | P r i v a c y P o l i c y | D i s c l a i m e r

Spanish TAX-FREE FIXED INCOME FUND V FOR PUERTO RICO RESIDENTS RENDIMIENTO DEL FONDO UN HISTORIAL DE INGRESOS CONSTANTES El objetivo de la inversión del Fondo es generar ingresos corrientes para sus accionistas, junto con la preservación del capital. De hecho, desde su creación, el Fondo ha distribuido a sus accionistas $8.32 por acción en dividendos acumulados. A partir del 30 de junio de 2021, el rendimiento del Fondo era 2.8%. LA SUPERVISIÓN DE LA JUNTA DE DIRECTORES Y EL RENDIMIENTO DEL FONDO Como resultado de la administración prudente y acertada de las inversiones, según supervisada por su Junta de Directores, el Fondo ha enfrentado importantes desafíos del mercado y ha maximizado los dividendos y los rendimientos netos. El Fondo tuvo un buen desempeño desde su creación en marzo de 2005 hasta 2012. Los dividendos actuales, especiales y de ganancias de capital, además del sólido desempeño de precios, generaron retornos brutos de la inversión cercanos al 70%. La caída del mercado de bonos municipales de Puerto Rico desde su inicio en 2013 hasta fnes de 2015 afectó a todos los inversionistas en estos mercados, como se refeja en los rendimientos del Fondo durante este período. Sin embargo, bajo el liderazgo de la Junta de Directores, el Fondo continuó generando ingresos mensuales con benefcios contributivos y realizó recompras de acciones para proporcionar liquidez a los accionistas, mientras se acrecía el valor para los accionistas que mantuvieron su inversión. Aunque los mercados de bonos de Puerto Rico aún no se han recuperado, el Fondo ha tenido un rendimiento positivo desde fnales de 2015, y ha continuado brindando a sus accionistas ingresos mensuales. LA PERSPECTIVE POSITIVA PARA EL FONDO Hoy en día, su Junta de Directores considera que la perspectiva para el Fondo es positiva. A medida que se estabilizan los mercados de bonos de Puerto Rico, tanto los ingresos como la liquidez del Fondo se espera que mejore. Bajo la dirección actual de la Junta de Directores, el Fondo continúa trabajando incansablemente para maximizar los rendimientos de los accionistas, incluyendo el proceder con registrar el Fondo con el U.S. Securities and Exchange Comisión, en virtud de la Ley de Compañías de Inversión de 1940, que puede contribuir a una mayor liquidez y a un descuento del mercado más reducido al NAV, lo que prepara el terreno para obtener rendimientos positivos adicionales. La Junta de Directores es muy consciente de la necesidad de liquidez en el Fondo y continuará haciendo lo que esté a su alcance para lograr esta prioridad estratégica. © 2 0 2 1 A l l R i g h t s R e s e r v e d . U B S | P r i v a c y P o l i c y | D i s c l a i m e r

Spanish TAX-FREE FIXED INCOME FUND V FOR PUERTO RICO RESIDENTS LOS NOMINADOS PARA LA JUNTA DE DIRECTORES Como miembros de la Junta de Directores actual, los directores nominados para la reelección en la reunión anual de accionistas son profesionales fnancieros altamente califcados, con raíces profundas en Puerto Rico y un compromiso consolidado con el Fondo. Ellos entienden los mercados fnancieros de Puerto Rico y están comprometidos con los objetivos de inversión del Fondo y sus accionistas. La Junta de Directores insta a los accionistas a apoyar el momentum positivo y continuo del Fondo y asegurar la estabilidad y viabilidad a largo plazo del Fondo como fuente de ingresos corrientes para sus accionistas mediante la votación “POR” estos tres nominados en la tarjeta BLANCA. Luis M. Pellot ha sido presidente de Pellot-González, Tax Attorneys & Counselors at Law, PSC, desde 1989 y está activo en la comunidad empresarial de Puerto Rico como miembro del Colegio de Abogados de Puerto Rico, exmiembro de la Asociación de Industriales de Puerto Rico, Cámara de Comercio de Puerto Rico, Asociación de Contratistas Generales de América (Capítulo de Puerto Rico), Asociación de Hoteles y Turismo de Puerto Rico y Hispanic National Bar Association y presidente del Comité de Impuestos de la Cámara de Comercio de Puerto Rico de 1996 a 1997. Ha sido director independiente y miembro del Comité de Auditoría de la Familia de Fondos de UBS Puerto Rico desde 2002. Carlos Nido ha sido el presidente de Green Isle Capital LLC, un fondo de capital de riesgo de Puerto Rico en virtud de la Ley 185, que invierte principalmente en largometrajes y atención médica, desde 2015. También es presidente y productor ejecutivo de Piñolywood Studios LLC, se desempeña como miembro de la Junta de Directores de B. Fernández & Hnos. Inc., la Familia de Fondos de UBS Puerto Rico, Puerto Rico Ambulatory Surgery Center y San Jorge Children’s Foundation y miembro de la junta de consejo de Advent Morro Private Equity Funds. Anteriormente fue vicepresidente sénior de Ventas de El Nuevo Día, presidente de Del Mar Events, presidente y fundador de Virtual, Inc. y Zona Networks y gerente general de Primera Hora Editorial de 1997 a 1999. José J. Villamil es presidente de la Junta de Directores y director ejecutivo de Estudios Técnicos, Inc., miembro desde hace mucho tiempo de la Junta de Gobernadores de United Way of Puerto Rico, asesor económico a la Asociación de Industriales de Puerto Rico y presidente de la Junta de Directores de BBVA-PR del 2000 al 2012, entre sus muchos roles de liderazgo privados, públicos y sin fnes de lucro en Puerto Rico. Vicente León ha desarrollado una vasta experiencia en fnanzas y contabilidad desde 1962, exmiembro y presidente del Comité de Auditoría de la Junta de Directores de Triple S Management Corp. de 2000 a 2012, exsocio de auditoría de KPMG LLP y expresidente de la Sociedad Puertorriqueña de CPAs. © 2 0 2 1 A l l R i g h t s R e s e r v e d . U B S | P r i v a c y P o l i c y | D i s c l a i m e r

Spanish TAX-FREE FIXED INCOME FUND V FOR PUERTO RICO RESIDENTS RECURSOS CARTA A LOS ACCIONISTAS DEL FONDO Carta a los Accionistas del Tax-Free Fixed Income Fund V for Puerto Rico Residents, Inc.| el 16 de agosto de 2021 PROXY FILINGS Fund V Defnitive Proxy Statement | el 29 de junio de 2021 Proxy Supplement #1| el 19 de julio de 2021 Proxy Supplement #2 | el 23 de julio de 2021 Proxy Supplement #3 | el 11 de agosto de 2021 © 2 0 2 1 A l l R i g h t s R e s e r v e d . U B S | P r i v a c y P o l i c y | D i s c l a i m e r

PRIVACY POLICY This Privacy Policy describes the current policies and practices regarding the collection, use and sharing of personal information relating to your use of the www.ubsprfunds.com website (the “Site”). The Site has been provided for use by Tax-Free Fixed Income Fund IV for Puerto Rico Residents, Inc. and Tax-Free Fixed Income Fund V for Puerto Rico Residents, Inc. (collectively, the “Funds”). This Privacy Policy describes: what information we collect; how information you provide may be used by the Funds and third parties working on our behalf; your choices regarding the collection, use, and sharing of such information; and, the security measures that we have implemented to protect the information. By using this Site, you agree to our practices concerning such information, including the transfer of information pertaining to you from the country where you reside to the United States, as described in this Privacy Policy[, which forms part of our Terms and Conditions of Use. To read our Terms and Conditions of Use, click [https://ubsprfunds.com/terms-and-conditions/]. If you do not agree to our Privacy Policy, please do not use this Site.] Information collection Personal information we collect We will collect personal information about you through the Site that you provide, and information that may be provided by your web browser. We collect information about you when you use the Site or communicate with the Funds online, such as sending us an email message. The types of information that may be submitted to the Site is limited to: Your email address, if you elect to send us an email message Any other personal information that you may provide to us when using the Site We do not use “cookies” on our site, unless otherwise stated. We may provide opportunities to contact us to ask questions or provide comments, ideas, and/or suggestions. When you communicate with us and request a response, we may ask you for additional information such as your name, email address and contact information. If we collect this type of information, we will notify you as to why we are asking for it and how this information will be used. Your provision of such information to us is entirely voluntary. Our Web site uses Google Analytics and its associated tracking technologies. To opt out of Google Analytics Advertising Features, visit https://support.google.com/analytics/answer/181881?hl=en or you may access the Google Analytics Opt-out Browser Add-on, currently located at https://tools.google.com/dlpage/gaoptout. Our Web site may use and provide access to other products, services and content of third parties (collectively, “Third-Party Properties”). Please be aware that we do not control and are not responsible for the information collection and use practices and policies of these third parties and that by accessing or using Third-Party Properties they may collect information regarding your use and access. We encourage you to be aware when you use a Third-Party Property or leave our Web site and review any such third party’s data and information collection and use practices and policies with regard to its Web site, products or services. Uses of personal information The primary purposes for collecting, using, and sharing personal information about you include: to provide you with information related to your request, and to administer and enable your use of the Site. Purposes for using your personal information may also include, but are not limited to: To contact you via email, if you have specifically provided us with this information To respond to your comments and queries To carry out surveys, studies, and evaluations including statistical analysis To comply with applicable laws, regulations or codes of practice In connection with the establishment and defense of legal interests For our internal business purposes For all other purposes to which you have agreed Sharing personal information We may internally transfer the information we collect, including your personal information, to and from the United States and any other country in which we or our agents maintain facilities for the purposes identified above, as well as for storage, processing or other business use as permitted under this Privacy Policy. By accessing or using our Web site or our other products or services, you consent to the transfer of your personal information among these facilities, including those located outside of your country of residence. We use third-party service providers to collect, store, or process your personal information and other information we collect on our Site. We also may disclose information pursuant to a request from law enforcement or pursuant to other legal or regulatory process, or as otherwise required by law, or, in our sole discretion, to protect our rights, property or interests, including to enforce this Privacy Policy or our Terms and Conditions of Use. We may disclose your identity to any third party who claims that any content posted or uploaded by you to this Site constitutes a violation of their intellectual property rights, or of their right to privacy. Information collected from this Site may also be transferred in connection with a merger or other business combination or restructuring, bankruptcy, transfer of assets, or to our successors in interest. How we protect your information While we use security measures to protect sensitive and personal information transmitted online, please be aware that no security measures are perfect or impenetrable. Please use caution when submitting any personal or other sensitive information to us online. Changes to this Privacy Policy We have the discretion to update this Privacy Policy at any time. When we do, we revise the “Last Updated” date at the bottom of this page. We encourage you to frequently check this page for any changes to stay informed about how we are helping to protect the personal information we collect. Your continued use of this Site after the effective date of any modification to the Privacy Policy will be deemed to be your agreement to the changed terms. Children’s information Our Site is not directed to children under the age of 13, and we do not knowingly collect any information from children under 13. Jurisdictional limitation Our Site is directed to residents of the United States. Residents of other countries should not use the Site or submit their information via the Site. All personal information collected through this Site will be processed in the United States consistent with United States law, and if you submit information to us on the Site, you consent to the transfer and processing of your personal information in the United States. Data access and quality We strive to make the data collected via our Site accurate, current, and complete. If you have any questions or concerns about how we manage personal information we collect about you, or if you wish to see what personal information we have about you or want us to delete your data from the program, please contact us using the details below. Contact Us We respect your privacy. If you have any questions about this Privacy Policy, please contact us via mail at: Tax-Free Fixed Income Fund IV for Puerto Rico Residents, Inc. 250 Muñoz Rivera Avenue American International Plaza, Tenth Floor San Juan, Puerto Rico 00918 Tax-Free Fixed Income Fund V for Puerto Rico Residents, Inc. 250 Muñoz Rivera Avenue American International Plaza, Tenth Floor San Juan, Puerto Rico 00918 Last updated: August 17, 2021 © 2021 All Rights Reserved. UBS | Privacy Policy | Disclaimer

DISCLAIMER The views expressed on this website represent the opinions of Tax-Free Fixed Income Fund IV for Puerto Rico Residents, Inc. (“Fund IV”) and Tax-Free Fixed Income Fund V for Puerto Rico Residents, Inc. (“Fund V” and together with Fund IV, the “Funds”). Each Fund reserves the right to change any of its opinions expressed herein at any time as it deems appropriate and disclaims any obligation to update the information or opinions contained on this website. The materials on this website are provided merely as information and are not intended to be, nor should they be construed as, an offer to sell or a solicitation of an offer to buy any security. There is no assurance or guarantee with respect to the prices at which any securities of the Funds will trade, and such securities may not trade at prices that may be implied herein. Although the Funds believe the statements made in this website are substantially accurate in all material respects and do not omit to state material facts necessary to make those statements not misleading, the Funds make no representation or warranty, express or implied, as to the accuracy or completeness of those statements or any other written or oral communication it makes, and the Funds expressly disclaim any liability relating to those statements or communications (or any inaccuracies or omissions therein). Important Additional Information and Where to Find It Each Fund has filed a definitive proxy statement on Schedule 14A (the “Proxy Statement”), an accompanying WHITE proxy card and other relevant documents with the Securities and Exchange Commission (the “SEC”) in connection with such solicitation of proxies for such Fund’s 2021 annual meeting of stockholders (the “Annual Meeting”). STOCKHOLDERS OF THE FUNDS ARE STRONGLY ENCOURAGED TO READ THE PROXY STATEMENT (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO), ACCOMPANYING WHITE PROXY CARD AND ALL OTHER DOCUMENTS FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. Investors and stockholders may obtain a copy of the Proxy Statement, an accompanying WHITE proxy card, any amendments or supplements to the Proxy Statement and other documents that such Fund files with the SEC at no charge at the SEC’s website at www.sec.gov. In addition, a stockholder who wishes to receive a copy of such Fund’s definitive proxy materials, without charge, should submit this request to: UBS Trust Company of Puerto Rico, c/o Claudio Ballester, 250 Muñoz Rivera Avenue, American International Plaza, Tenth Floor, San Juan, Puerto Rico 00918. © 2021 All Rights Reserved. UBS | Privacy Policy | Disclaimer