2022 (2021: loss $4,851) and $72,310 for the year ended October 31, 2022 (2021: loss $18,674). The Company recorded a loss from operations excluding impairment loss of $5,318 compared to a loss from operations excluding impairment loss of $2,118 for the three-month period ended October 31, 2021 in the prior year.

The key factors affecting the results for the year ended October 31, 2022, were:

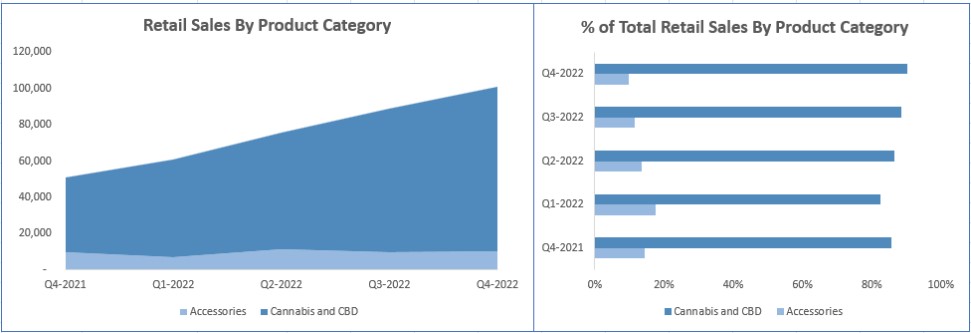

● Merchandise Sales – Merchandise sales increased by 97% for the year ended October 31, 2022, as compared to 2021.

| ● | Gross Profit Margin – Gross Profit Margin decreased by 7% for the year ended October 31, 2022, as compared to 2021. The decrease in gross profit margin was largely driven by the change in retail pricing, from a premium strategy to a discount pricing model. |

● Operating Expenses – Operating expenses increased by 273% in the fourth quarter of 2022, compared to the same period in the prior year, and as a percentage of revenue increased by 36% in the fourth quarter to 77% (2021: 41%). For the year ended October 31, 2022, operating expenses increased by 110% compared to 2021, and as a percentage of revenue increased by 3% in the year ended October 31, 2022 to 49% (2021: 46%). Operating expenses increased over the same period in 2022 due to the impairment loss of $48,592 in the fourth quarter of 2022 (2021: $2,733). Excluding the impairment loss, operating expenses increased by 77% in the fourth quarter of 2022, compared to the same period in the prior year, and as a percentage of revenue decreased 4% in the fourth quarter to 32% (2021: 36%). Excluding the impairment loss, for the year ended October 31, 2022, operating expenses increased by 56% compared to 2021, and as a percentage of revenue decreased by 9% in the year ended October 31, 2022 to 35% (2021: 44%). Company’s continued growth of their Retail Segment through new store openings, the acquisitions of NuLeaf Naturals, Bud Room, 2080791 Alberta Ltd., Crossroads Cannabis, Ontario Lottery Winner, Bud Heaven, Kensington, Halo Kushbar, and Choom as well as full year of results of 2021 acquisitions of Daily High Club, DankStop, and Blessed CBD. The increase in expenses was also related to the full year of expenses associated with up listing of the Company’s stock to Nasdaq in June 2021 including directors and officers’ liability insurance premiums, Nasdaq listing fees and additional human resources to support the integration of newly acquired companies.

Revenue

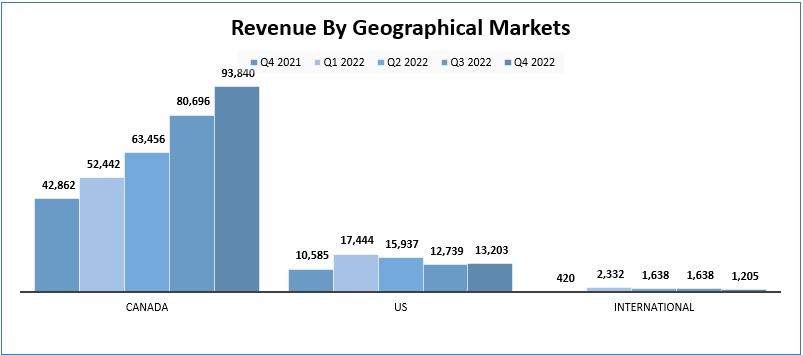

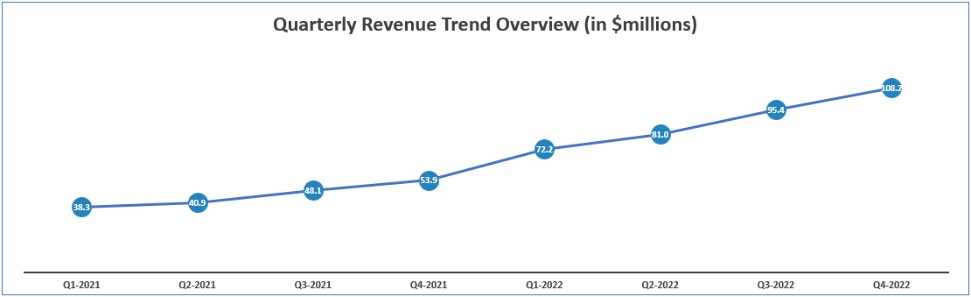

Revenue increased by 101% to $108,249 in the fourth quarter of 2022 (2021: $53,867) and by 97% to $356,852 for the year ended October 31, 2022 (2021: $181,123).

The increase in revenue was driven primarily by the Company’s Retail Segment’s shift in the retail pricing strategy and launch of our discount club model. Additionally, the increase in revenue was due to the acquisitions of NuLeaf Naturals on November 29, 2021, Bud Room on February 9, 2022, 2080791 Alberta Ltd. on April 21, 2022, Crossroads Cannabis on April 26, 2022, Ontario Lottery Winner on May 10, 2022 and August 2, 2022, Bud Heaven on June 1, 2022, Kensington on June 4, 2022, Halo Kushbar on July 15, 2022, and Choom on August 2 and 25, 2022 as well as full year of results of 2021 acquisitions of Smoke Cartel, FAB CBD, Daily High Club, DankStop, and Blessed CBD.

For the three-month period ended October 31, 2022, additions of new stores and the business combinations of DankStop, Blessed CBD, NuLeaf Naturals, Bud Room, 2080791 Alberta Ltd., Crossroads Cannabis, Ontario Lottery Winner, Bud Heaven, Kensington, Halo Kushbar, and Choom into the Company contributed approximately $8,900 of the increase in revenue. For the year ended October 31, 2022, new stores and business combinations contributed approximately $36,000 to the increase in revenue.

Canna Cabana provides a unique customer experience focused on retention and loyalty through its Cabana Club membership platform. Members of Cabana Club receive member-only pricing, text message service and email communications highlighting new and upcoming product arrivals, member-only events, and other special offers. The database communicates with highly relevant consumers who are segmented at the local level by delivering regular content that is specific to their local Canna Cabana and Meta Cannabis Co locations. As of the date of this MD&A, approximately 950,000 members have joined Cabana Club, with over 90% of our