PRELIMINARY PROXY STATEMENT — SUBJECT TO COMPLETION

DATED MARCH 24, 2023

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________

SCHEDULE 14A

___________________

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant | | ☐ |

Filed by a Party other than the Registrant | | ☒ |

Check the appropriate box:

☒ | | Preliminary Proxy Statement |

☐ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☐ | | Definitive Proxy Statement |

☐ | | Definitive Additional Materials |

☐ | | Soliciting Material under §240.14a-12 |

Tax Free Fund For Puerto Rico Residents, Inc. |

(Name of Registrant as Specified in its Charter) |

Ocean Capital LLC

W. Heath Hawk

Roxana Cruz-Rivera

Mojdeh L. Khaghan

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

☒ | | No fee required |

☐ | | Fee paid previously with preliminary materials. |

☐ | | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a- 6(i)(1) and 0-11 |

PRELIMINARY PROXY STATEMENT — SUBJECT TO COMPLETION

DATED MARCH 24, 2023

2023 ANNUAL MEETING OF STOCKHOLDERS OF

Tax Free Fund for Puerto Rico Residents, Inc.

PROXY STATEMENT

OF

OCEAN CAPITAL LLC

Please vote the BLUE Proxy Card (i) “FOR” the election of our slate of highly-qualified nominees, (ii) “FOR” our proposal to repeal any provision of, or amendment to, the Bylaws adopted by the Board without stockholder approval subsequent to March 25, 2022, (iii) “FOR” our proposal to amend Article II, Section 8 of the Bylaws to lower the quorum threshold for stockholder meetings from one-half to one-third of the outstanding shares entitled to vote and to add a supermajority voting standard for all future amendments of that section, (iv) “FOR” our proposal to amend Article II, Section 8 of the Bylaws to clarify that the power to adjourn stockholder meetings belongs exclusively to stockholders and to add a supermajority voting standard for all future amendments of that section and (v) “FOR” our proposal to terminate that certain Amended and Restated Investment Advisory Agreement between the Fund and UBS Asset Managers of Puerto Rico, dated as of May 12, 2021, and all other advisory and management agreements between the Fund and UBS within sixty (60) days.

Please sign, date and mail the enclosed BLUE Proxy Card today!

Ocean Capital LLC, a Puerto Rico limited liability company (“Ocean Capital,” “we,” “us,” or “ours”), and its managing member William Heath Hawk (together with Ocean Capital and the Nominees (as defined below), the “Participants”) are significant stockholders and beneficially own in the aggregate approximately [•]% of the outstanding shares of the Fund’s common stock, par value $0.01 (the “Common Stock”), of Tax Free Fund for Puerto Rico Residents, Inc. (the “Fund”), a Puerto Rico corporation. We are writing to you in connection with (i) our proposal to elect our two (2) nominees to the board of directors of the Fund (the “Board”), (ii) our proposal to repeal any provision of, or amendment to, the Fund’s Amended and Restated By-Laws (the “Bylaws”) that has been or will be adopted by the Board without stockholder approval subsequent to March 25, 2022, (iii) our proposal to amend Article II, Section 8 of the Bylaws to lower the quorum threshold for stockholder meetings from one-half to one-third of the outstanding shares entitled to vote and to add a supermajority voting standard for all future amendments of that section, (iv) our proposal to amend Article II, Section 8 of the Bylaws to clarify that the power to adjourn stockholder meetings belongs exclusively to stockholders and to add a supermajority voting standard for all future amendments of that section and (v) our proposal to terminate that certain Amended and Restated Investment Advisory Agreement between the Fund and UBS Asset Managers of Puerto Rico (“UBS”), a division of UBS Trust Company of Puerto Rico (“UBSTC PR”), dated as of May 12, 2021 (the “Investment Advisory Agreement”), and all other advisory and management agreements between the Fund and UBS within sixty (60) days, each at the 2023 annual meeting of stockholders scheduled to be held virtually at 11:30 a.m., Atlantic Standard Time (11:30 a.m. Eastern Daylight Time), on April 20, 2023, including any adjournments or postponements thereof and any meeting which may be called in lieu thereof (the “2023 Annual Meeting”).

THIS PROXY STATEMENT (including the appendix and exhibits ATTACHED hereto, the “Proxy Statement”) RELATES ONLY TO THE FUND’S 2023 ANNUAL MEETING AND NOT TO THE FUND’S 2022 ANNUAL MEETING OF STOCKHOLDERS (THE “2022 ANNUAL MEETING”). EXCEPT AS DESCRIBED IN THIS PROXY STATEMENT, ANY ACTION REQUESTED TO BE TAKEN BY STOCKHOLDERS PURSUANT TO THIS PROXY STATEMENT WILL ONLY AFFECT MATTERS DECIDED BY STOCKHOLDERS AT THE 2023 ANNUAL MEETING.

1

This Proxy Statement and the enclosed BLUE Proxy Card are first being furnished to stockholders on or about [•], 2023. We are furnishing this Proxy Statement and the enclosed BLUE Proxy Card to seek your support at the 2023 Annual Meeting with respect to the following (each, a “Proposal” and, collectively, the “Proposals”):

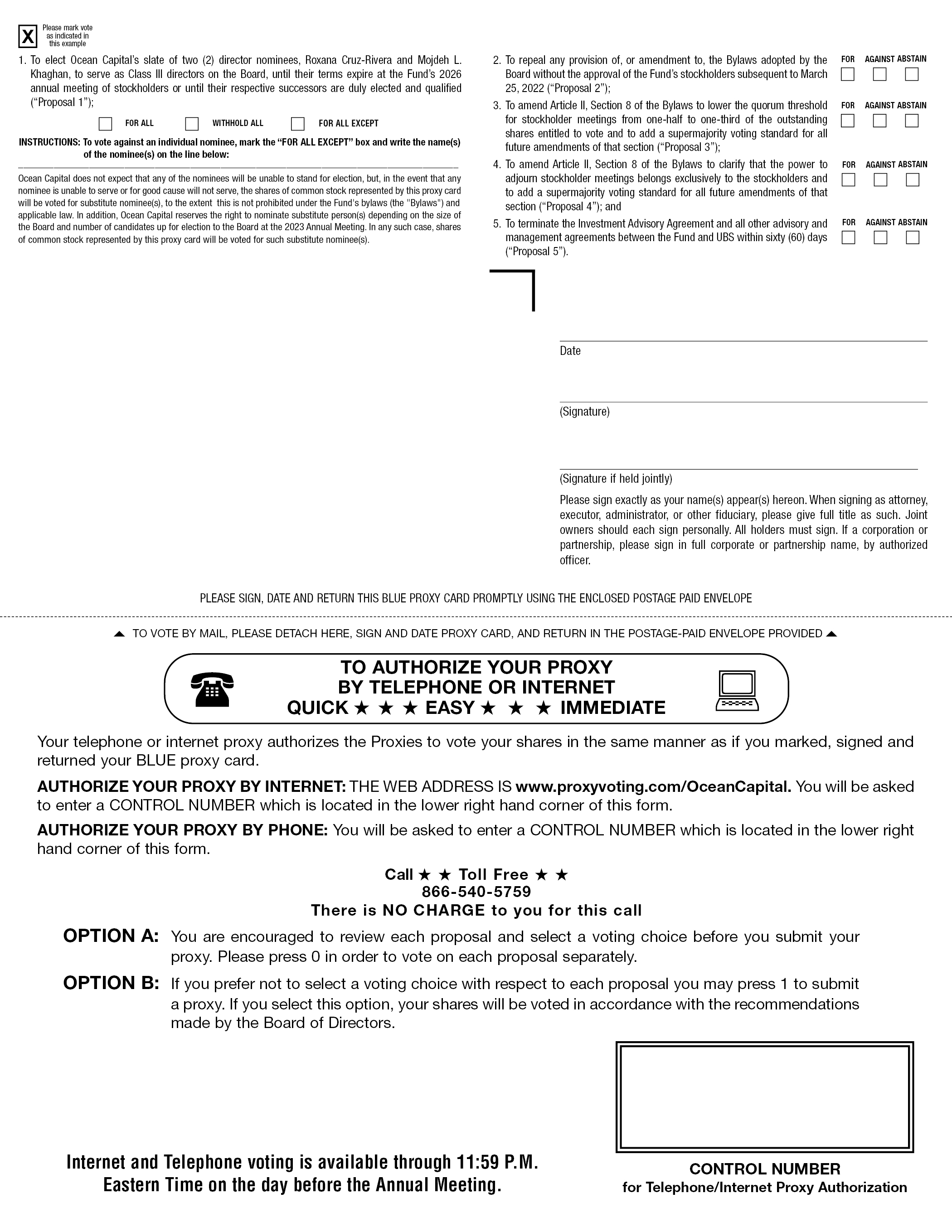

1. To elect Ocean Capital’s slate of two (2) director nominees, Roxana Cruz-Rivera and Mojdeh L. Khaghan (the “Nominees”), to serve as Class III directors on the Board, until their terms expire at the Fund’s 2026 annual meeting of stockholders or until their respective successors are duly elected and qualified (“Proposal 1”);

2. To repeal any provision of, or amendment to, the Bylaws adopted by the Board without the approval of the Fund’s stockholders subsequent to March 25, 2022 (“Proposal 2”);

3. To amend Article II, Section 8 of the Bylaws to lower the quorum threshold for stockholder meetings from one-half to one-third of the outstanding shares entitled to vote and to add a supermajority voting standard for all future amendments of that section (“Proposal 3”);

4. To amend Article II, Section 8 of the Bylaws to clarify that the power to adjourn stockholder meetings belongs exclusively to the stockholders and to add a supermajority voting standard for all future amendments of that section (“Proposal 4”); and

5. To terminate the Investment Advisory Agreement and all other advisory and management agreements between the Fund and UBS within sixty (60) days (“Proposal 5”).

If you have already sent a proxy card furnished by the Fund’s management to the Fund, you have every right to change your vote by signing, dating and returning the enclosed BLUE Proxy Card or by following the instructions for telephone or Internet voting detailed thereon. Only your latest dated proxy card counts!

Please refer to the Section below, Information Concerning the 2023 Annual Meeting (which is incorporated herein by reference), and the Fund’s proxy materials for additional information concerning the 2023 Annual Meeting, including how to register for the meeting, voting and proxy procedures, votes required for approval of the Proposals and the solicitation of proxies. Any stockholder wishing to participate in the 2023 Annual Meeting by means of remote communication can do so, provided such stockholder registers for the 2023 Annual Meeting in advance. If you were a record holder of shares of Common Stock as of the close of business on March 1, 2023, the record date for the 2023 Annual Meeting (the “Record Date”), you must register at https://viewproxy.com/UBSPuertoRico/broadridgevsm/ no later than 5:00 p.m. Atlantic Standard Time (5:00 p.m. Eastern Daylight Time) on April 18, 2023 to attend and vote at the 2023 Annual Meeting. Broadridge Financial Solutions, Inc. (“Broadridge”) will then e-mail you the login information and instructions for attending and voting at the 2023 Annual Meeting. If you were a beneficial owner of shares of Common Stock as of the close of business on the Record Date, i.e., your shares were held for you by a broker, bank or other institution as of the close of business on the Record Date, please consult with your broker, bank or other institution on how to attend and vote at the 2023 Annual Meeting.

If you have any questions or require any assistance with voting your shares, please contact our proxy solicitor, Morrow Sodali LLC (“Morrow Sodali”), toll free at (800) 662-5200 or collect at (203) 658-9400.

This Proxy Statement and all other solicitation materials in connection with this proxy solicitation will be available on the Internet, free of charge, at the SEC’s website https://www.edgar.sec.gov. The Edgar file number for the Fund is 811-23672.

2

IMPORTANT

YOUR VOTE IS IMPORTANT, NO MATTER HOW MANY OR HOW FEW SHARES YOU OWN.

• If your shares are registered in your own name, you may vote such shares by signing, dating and mailing the enclosed BLUE Proxy Card in the enclosed return envelope to Ocean Capital LLC, c/o Morrow Sodali LLC, in the enclosed postage-paid envelope today or by following the instructions for telephone or Internet voting detailed on the enclosed BLUE Proxy Card.

• If your shares were held for you by a brokerage firm, bank, bank nominee or other institution on the Record Date, only they can vote such shares and only upon receipt of your specific instructions. Such brokerage firm, bank, bank nominee or other institution will not have discretionary voting power and, without your specific instructions on how to vote, the underlying shares will not be counted as shares present and entitled to vote at the meeting. Accordingly, please instruct your broker or bank to vote the BLUE Proxy Card on your behalf by following the instructions provided by your broker or bank.

3

REASONS FOR OUR SOLICITATION

With respect to the 2023 Annual Meeting, Ocean Capital, as one of the Fund’s largest stockholders, has notified the Fund of its intent (i) to nominate a slate of two (2) highly-qualified Nominees who would not be “interested persons” (based on Section 2(a)(19) of the Investment Company Act of 1940 (the “1940 Act”)) and are independent (based on Section 301 of the Sarbanes-Oxley Act of 2002); and (ii) to put forth (a) a proposal to repeal any provision of, or amendment to, the Bylaws adopted by the Board without the approval of the Fund’s stockholders subsequent to March 25, 2022; (b) a proposal to amend Article II, Section 8 of the Bylaws to lower the quorum threshold for stockholder meetings from one-half to one-third of all outstanding shares entitled to vote and to add a supermajority voting standard for all future amendments of that section; (c) a proposal to amend Article II, Section 8 of the Bylaws to clarify that the power to adjourn stockholder meetings belongs exclusively to the stockholders and to add a supermajority voting standard for all future amendments of that section, each as further described elsewhere in this Proxy Statement; and (d) a proposal to terminate the Investment Advisory Agreement and all other advisory and management agreements between the Fund and UBS.

As committed investors, we are looking for the Fund to significantly improve both performance and governance in order to generate maximum returns for all stockholders. We believe stockholders cannot expect the Fund to perform significantly better without fundamental change, beginning in the boardroom by adding fresh perspectives. If elected, the Nominees will be committed to putting stockholders’ interests first and evaluating all avenues to maximize value, including, but not limited to, consideration of the reestablishment of a share repurchase program, the liquidation of the Fund to realize its net asset values and other value-unlocking initiatives.

In furtherance of its objectives, Ocean Capital submitted director nominations and a business proposal for the Fund’s 2022 Annual Meeting. The 2022 Annual Meeting was initially scheduled to be held on April 28, 2022 and was adjourned five times for failure to reach a quorum. The 2022 Annual Meeting was reconvened for the last time on March 9, 2023. According to the official contest vote tallies provided by Broadridge, at the 2022 Annual Meeting, a quorum was present and the Fund’s stockholders overwhelmingly voted in favor of Ocean Capital’s three nominees, Ethan A. Danial, Brent D. Rosenthal and José R. Izquierdo II (the “2022 Nominees”) over the Fund’s nominees.1 However, the Fund has so far refused to seat Ocean Capital’s 2022 Nominees and has claimed that Ocean Capital did not properly submit proxies and votes at the 2022 Annual Meeting. In a pending lawsuit between Ocean Capital, the Fund and certain other parties, Ocean Capital has filed a motion seeking leave to amend its answer and counterclaims to add counterclaims against the Fund to enforce the results of the 2022 Annual Meeting (for more information about the pending lawsuit and Ocean Capital’s counterclaims against the Fund, please see “Appendix A — The Federal Action”). Under the Bylaws, each director’s term lasts until his or her successor has been elected and qualified, or until his death, resignation or removal, or until December 31 of the year in which he shall have reached eighty years of age. As a result of the delays due to failure to reach a quorum and the Fund’s refusal to recognize the election results of the 2022 Annual Meeting, the Fund’s three incumbent directors whose terms expired at the 2022 Annual Meeting — Carlos V. Ubiñas, Vicente León and José J. Villamil — have continued to serve on the Board for almost eleven months since the original scheduled date of the 2022 Annual Meeting, which has severely delayed Board refreshment. The adoption of Proposal 3 at the 2023 Annual Meeting will lower the quorum threshold for the Fund’s future stockholder meetings and, if adopted, will reduce the risk of future annual meetings of stockholders being repeatedly delayed due to lack of a quorum.

No matter how many shares of Common Stock you own, we urge you to vote your shares on the enclosed BLUE Proxy Card to support the adoption of Ocean Capital’s Proposals for the 2023 Annual Meeting, which we believe will help unlock value for investors.

4

PROPOSAL NO. 1

ELECTION OF DIRECTORS

According to the Fund’s proxy statement filed with the SEC on [•], 2023 (the “Fund’s proxy statement”), the Board is currently composed of seven (7) directors and two (2) of the Fund’s directors are up for election at the 2023 Annual Meeting. We are seeking your support at the 2023 Annual Meeting to elect each of our two (2) highly qualified Nominees in opposition to the Fund’s Class III director nominees, to serve a three-year term expiring at the Fund’s 2026 annual meeting of stockholders or until their respective successors have been duly elected and qualified. Our Nominees, if elected at the 2023 Annual Meeting, will constitute a minority of the Board. However, if the election results of the 2022 Annual Meeting are formally implemented and Ocean Capital’s Nominees for the 2023 Annual Meeting are also elected, then the 2022 Nominees and the Nominees collectively would constitute a majority of the Board. We do not believe that the election and seating of our Nominees and 2022 Nominees would constitute a change of control under the Fund’s existing contracts that are publicly available.2

OUR NOMINEES

The following information sets forth the name, age, business address, positions held with the Fund, term of office and length of time served in such positions if applicable, principal occupation(s) for the past five (5) years, number of portfolios in fund complexes overseen and other directorships held by each of our Nominees. The nominations were made in a timely manner and in compliance with the applicable provisions of the Fund’s governing instruments. Mojdeh L. Khaghan is the mother of Mr. Danial, one of the 2022 Nominees. Other than that, there is no family relationship between the two Nominees or between either Nominee and any of the 2022 Nominees. The specific experience, qualifications, attributes and skills that led us to conclude that our Nominees should serve as directors of the Fund are set forth below.

Name, Address, and Age | | Position(s)

Held with

the Fund | | Term of

Office and

Length

of Time

Served | | Principal

Occupation(s)

During Past 5 Years | | Number of

Portfolios in

Fund

Complex

Overseen | | Other

Directorships |

Roxana Cruz-Rivera,

155 Arterial Hostos

Golden Court 2,

Apt. 216,

San Juan,

Puerto Rico

00918 (48) | | N/A | | N/A | | Founder and CEO of TLVS LLC dba Tax Law and Venture Services, a law firm, where she has worked since August 2021; Tax Director at RSM Puerto Rico, LLC, a consulting firm, from November 2020 to August 2021; Corporate and Tax Special Counsel at Vidal, Nieves and Bauza, LLC, a law firm, from October 2018 to October 2020; | | N/A | | N/A |

5

Name, Address, and Age | | Position(s)

Held with

the Fund | | Term of

Office and

Length

of Time

Served | | Principal

Occupation(s)

During Past 5 Years | | Number of

Portfolios in

Fund

Complex

Overseen | | Other

Directorships |

| | | | | | | Deputy Secretary of the Treasury at Puerto Rico Treasury Department, from January 2017 to September 2018 | | | | |

Mojdeh L. Khaghan,

5151 Collins Ave.,

Miami Beach, Florida

33140 (55) | | N/A | | N/A | | Principal of the Morgan Reed Group, a diversified real estate and securities investment firm with investments across the United States and Puerto Rico, where she has worked since 1997 | | N/A | | Director of the Greater Miami Jewish Federation since 2020 |

Roxana Cruz-Rivera, age 48, has more than 20 years of legal experience in a broad range of Puerto Rico and federal tax issues affecting large institutions. She is experienced as a former income tax professor, government tax specialist, policy developer and legal business counselor. Ms. Cruz-Rivera is currently the Founder and CEO of TLVS LLC dba Tax Law and Venture Services. From November 2020 to August 2021, Ms. Cruz-Rivera served as Tax Director of the Tax Advisory Services Division of RSM Puerto Rico, LLC, a consulting firm. From 2018 to 2020, she practiced law as corporate and tax special counsel at Vidal, Nieves & Bauza, LLC, a law firm. She served as Deputy Secretary of the Treasury of the Puerto Rico Treasury Department from 2017 to 2018, where she assisted the Secretary of the Treasury in the supervision and direction of the Department. She was an independent law practitioner from 2013 to 2016 and provided legal counsel to multinational business clients specializing in pharma, tourism, manufacturing and energy. She served as Director and Legal Counsel at Puerto Rico Industrial Development Company from 2009 to 2013, partner at Goldman Antonetti & Cordova, a law firm, from 2005 to 2009, and legal advisor in the Puerto Rico Department of Treasury from 2002 to 2005. Ms. Cruz-Rivera also served as an adjunct professor at Universidad del Sagrado Corazon from 2003 to 2006. Ms. Cruz-Rivera received a B.B.A. in accounting, cum laude, from the University of Puerto Rico, a Juris Doctorate, magna cum laude, from the University of Puerto Rico School of Law, and an L.L.M. in taxation from the New York University School of Law. Ocean Capital believes Ms. Cruz-Rivera’s extensive legal and counseling experience at both the public and private sectors makes her qualified to serve as a director of the Fund.

Mojdeh L. Khaghan, age 55, is an attorney admitted to practice in Florida and New York. Since 1997, she has been employed as a principal of the Morgan Reed Group, a diversified real estate and securities investment firm with investments across the United States and Puerto Rico. Ms. Khaghan has specialized in securities litigation, stockholder class and derivative actions and trust and estate litigation. Her portfolio of civic engagement and service includes service with the Jackson Health System Financial Recovery Board and Public Health Trust (governing body of one of the largest public hospitals in the United States, located in Miami) from 2013 to 2019, where she served as Treasurer and Chair of the Audit & Compliance Subcommittee, from 2012 to 2015 and as a member of Jackson Health System Pension Subcommittee (an employee pension plan with assets in excess of $1 billion), from 2018 to present. Ms. Khaghan has also served as the Chair of the City of Miami Beach Budget Advisory Committee since 2020, as the Commissioner of the Housing Authority of the City of Miami Beach since 2017, and on the Personnel Board of the City of Miami Beach from 2011 to 2016. Since 2020, Ms. Khaghan has served as a member of the Florida Bar Grievance Committee, Miami-Dade Subcommittee 11-B. Ms. Khaghan earned her B.A. from Columbia University in 1988 and her J.D. from Columbia Law School in 1991. Ocean Capital believes that Ms. Khaghan’s depth of experience in matters relating to securities law, investment, and corporate governance, serving extensively in various high-level positions in private, non-profit, governmental and quasi-governmental organizations makes her qualified to serve as a director of the Fund.

6

SHARE OWNERSHIP OF NOMINEES

The following table contains a summary of the total number of shares of Common Stock beneficially owned by the Nominees as of the date of this Proxy Statement.

The information in the following table has been furnished to us by the respective Nominees. The percentages used below are based upon the [•] shares of Common Stock outstanding, which represents the outstanding shares of Common Stock as of the Record Date, according to the Fund’s proxy statement:

Name and Address | | Number of

Shares

Beneficially

Owned | | Percentage

of Shares

Beneficially

Owned |

Roxana Cruz-Rivera,

155 Arterial Hostos Golden Court 2,

Apt. 216, San Juan,

Puerto Rico 00918 | | 0 | | N/A |

| | | | | |

Mojdeh L. Khaghan,

5151 Collins Ave.,

Miami Beach, Florida 33410 | | 0 | | N/A |

Ocean Capital believes that none of the Nominees presently is, and if elected as a director of the Fund, none of the Nominees would be, an “interested person” within the meaning of Section 2(a)(19) of the 1940 Act and that each of the Nominees would be independent within the meaning of Section 301 of the Sarbanes-Oxley Act of 2002.

In the event that our Nominees are not elected to the Board at the 2023 Annual Meeting, Ocean Capital intends to consider all available options in the future with respect to the Fund, including, without limitation, nominating director candidates or submitting stockholder proposals at future meetings of stockholders.

For additional information concerning our Nominees, see “Appendix A — Information Concerning the Nominees and Participants” (which is incorporated herein by reference).

Other than as described elsewhere in this Proxy Statement, none of the Participants has any material interest in this Proposal 1, individually or in the aggregate, including any anticipated benefit to any of them.

WE URGE YOU TO VOTE FOR THE ELECTION OF OUR NOMINEES ON THE ENCLOSED BLUE PROXY CARD AND INTEND TO VOTE OUR SHARES FOR THIS PROPOSAL.

7

PROPOSAL NO. 2

PROPOSAL TO REPEAL BYLAW PROVISIONS AND AMENDMENTS

We have submitted the following proposal for stockholder approval at the 2023 Annual Meeting:

Proposal

“RESOLVED, that any provision of, or amendment to, the Amended and Restated By-Laws of Tax Free Fund for Puerto Rico Residents, Inc. adopted by the Board without the approval of the Fund’s stockholders subsequent to March 25, 2022 be and are hereby repealed.”

The reason for conducting this business at the 2023 Annual Meeting is to ensure that the will of the Fund’s stockholders with respect to the Nominees and the other Proposals, as well as the proposal and the 2022 Nominees for election at the 2022 Annual Meeting, results of which have yet to be formally implemented by the Fund, is upheld and not thwarted by any unilateral Bylaw provision or amendment adopted by the Board after we first sent our nomination notice to the Fund for its 2022 Annual Meeting on March 25, 2022. While we are not aware of any such provisions or amendments to the Bylaws, we urge stockholders to adopt this proposal to prevent any possible interference with the stockholder franchise and our right as stockholders of the Fund to present business at the 2023 Annual Meeting for stockholders to consider and vote upon. We believe the approval of this proposal is necessary to safeguard the integrity of the contested 2023 Annual Meeting so that stockholders will not be deprived of considering and voting on our Nominees and the Proposals.

Ocean Capital submitted director nominations and a business proposal identical to this Proposal 2 for the Fund’s 2022 Annual Meeting. The 2022 Annual Meeting was adjourned more than once and then reconvened for the last time on March 9,. 2023, where a quorum was present and stockholders elected Ocean Capital’s nominees and approved its business proposal. However, the election of Ocean Capital’s 2022 Nominees at the 2022 Annual Meeting has yet to be formally implemented by the Fund. The adoption of this Proposal at the 2023 Annual Meeting will ensure that the onboarding of Ocean Capital’s 2022 Nominees will not be further delayed or thwarted by any unilateral Bylaw provision or amendment adopted by the Board since March 25, 2022.

Other than as described here and elsewhere in this Proxy Statement, none of the Participants has any material interest in this Proposal 2, individually or in the aggregate, including any anticipated benefit to any of them.

WE RECOMMEND A VOTE FOR THE PROPOSAL TO REPEAL ANY PROVISION OF, AND AMENDMENT TO, THE BYLAWS ADOPTED WITHOUT STOCKHOLDER APPROVAL SUBSEQUENT TO MARCH 25, 2022 ON THE ENCLOSED BLUE PROXY CARD AND INTEND TO VOTE OUR SHARES FOR THIS PROPOSAL.

8

PROPOSAL NO. 3

PROPOSAL TO AMEND ARTICLE II, SECTION 8 OF THE BYLAWS TO LOWER THE QUORUM THRESHOLD FOR STOCKHOLDER MEETINGS AND TO ADD A SUPERMAJORITY VOTING STANDARD FOR ALL FUTURE AMENDMENTS OF THAT SECTION

We have submitted the following proposal for stockholder approval at the 2023 Annual Meeting:

Proposal

“RESOLVED, that Article II, Section 8 of the Amended and Restated By-Laws of Tax Free Fund for Puerto Rico Residents, Inc. be and is hereby amended as follows:

At any meeting of stockholders more than one-third of the outstanding shares of the Corporation entitled to vote, represented in person or by proxy, shall constitute a quorum. If less than said number of the outstanding shares are represented at a meeting, holders of a majority of the shares so represented may adjourn the meeting from time to time without further notice. At such adjourned meeting at which a quorum shall be present or represented, any business may be transacted which might have been transacted at the meeting as originally notified. The stockholders present at a duly organized meeting may continue to transact business until adjournment, notwithstanding the withdrawal of enough stockholders to leave less than a quorum. Notwithstanding anything to the contrary in these By-Laws and unless otherwise expressly provided under applicable law or the Certificate of Incorporation, this Section 8 of Article II can only be amended by the affirmative vote of holders of 66 2/3% of the outstanding shares of the Corporation’s capital stock entitled to vote thereon.”

A copy of the amended Article II, Section 8 of the Bylaws marked against the current Article II, Section 8 of the Bylaws to show changes pursuant to this Proposal 3 is attached as Exhibit B to this Proxy Statement.

If this Proposal 3 and Proposal 4 are both approved at the 2023 Annual Meeting, their proposed changes to Article II, Section 8 of the Bylaws will be combined. A copy of the amended and restated Article II, Section 8 of the Bylaws marked to show the aggregate changes of this Proposal 3 and Proposal 4 against the current Article II, Section 8 of the Bylaws is attached as Exhibit D to this Proxy Statement.

The reason for conducting this business at the 2023 Annual Meeting is to ensure that the Fund’s meetings of stockholders (including annual elections of directors) are timely held and not subject to repeated delays due to a quorum standard that is unreasonably high, as happened at the 2022 Annual Meeting. Further, the proposal to add a supermajority voting standard for any future amendment of Article II, Section 8 of the Bylaws is to ensure that any future amendment of this Section will not be effected unilaterally by the Board but instead will require adequate consideration and approval by the Fund’s stockholders. Ocean Capital believes that a higher voting standard than a simple majority is appropriate in this context given the fundamental nature of the quorum and adjournment-related provisions in Article II, Section 8 of the Bylaws, which directly affect how stockholders can exercise their voting rights. This supermajority voting standard will apply to all future amendments to Article II, Section 8 of the Bylaws following the consummation of the 2023 Annual Meeting.

Other than as described here and elsewhere in this Proxy Statement, none of the Participants has any material interest in this Proposal 3, individually or in the aggregate, including any anticipated benefit to any of them.

WE RECOMMEND A VOTE FOR THE PROPOSAL TO AMEND THE BYLAWS TO LOWER THE

QUORUM THRESHOLD FROM ONE-HALF TO ONE-THIRD OF THE OUTSTANDING

SHARES AND TO ADD A SUPERMAJORITY VOTING STANDARD FOR ALL FUTURE

AMENDMENTS OF THAT SECTION ON THE ENCLOSED BLUE PROXY CARD AND

INTEND TO VOTE OUR SHARES FOR THIS PROPOSAL.

9

PROPOSAL NO. 4

PROPOSAL TO AMEND ARTICLE II, SECTION 8 OF THE BYLAWS TO CLARIFY THAT THE POWER

TO ADJOURN STOCKHOLDER MEETINGS BELONGS EXCLUSIVELY TO THE STOCKHOLDERS

AND TO ADD A SUPERMAJORITY VOTING STANDARD FOR ALL FUTURE AMENDMENTS

OF THAT SECTION

We have submitted the following proposal for stockholder approval at the 2023 Annual Meeting:

Proposal

“RESOLVED, that Article II, Section 8 of the Amended and Restated By-Laws of Tax Free Fund for Puerto Rico Residents, Inc. be and is hereby amended to add the following language:

Except as otherwise required in the Certificate of Incorporation or applicable law, the power to adjourn any meeting of stockholders belongs exclusively to stockholders and no meeting of stockholders, whether or not a quorum is present, may be adjourned other than as expressly provided in this Section 8 of Article II. Notwithstanding anything to the contrary in these By-Laws and unless otherwise expressly provided under applicable law or the Certificate of Incorporation, this Section 8 of Article II can only be amended by the affirmative vote of holders of 66 2/3% of the outstanding shares of the Corporation’s capital stock entitled to vote thereon.”

A copy of the amended Article II, Section 8 of the Bylaws, marked against the current Article II, Section 8 of the Bylaws to show changes pursuant to this Proposal 4, is attached as Exhibit C to this Proxy Statement.

If Proposal 3 and this Proposal 4 are both approved at the 2023 Annual Meeting, their proposed changes to Article II, Section 8 of the Bylaws will be combined. A copy of the amended and restated Article II, Section 8 of the Bylaws marked to show the aggregate changes of Proposal 3 and this Proposal 4 against the current Article II, Section 8 of the Bylaws is attached as Exhibit D to this Proxy Statement.

The reason for conducting this business at the 2023 Annual Meeting is to ensure that the Fund’s meetings of stockholders are adjourned only in limited circumstances (i.e., in the absence of a quorum and only by the Fund’s stockholders) such that the adjournment power will not be exercised in a manner that jeopardizes stockholder franchise or is otherwise adverse to shareholder democracy. Further, the proposal to add a supermajority voting standard for any future amendment of Article II, Section 8 of the Bylaws is to ensure that any future amendment of this Section will not be effected unilaterally by the Board but instead will require adequate consideration and approval by the Fund’s stockholders. Ocean Capital believes that a higher voting standard than a simple majority is appropriate in this context given the fundamental nature of the quorum and adjournment-related provisions in Article II, Section 8 of the Bylaws, which directly affect how stockholders can exercise their voting rights. This supermajority voting standard will apply to all future amendments to Article II, Section 8 of the Bylaws following the consummation of the 2023 Annual Meeting.

Other than as described here and elsewhere in this Proxy Statement, none of the Participants has any material interest in this Proposal 4, individually or in the aggregate, including any anticipated benefit to any of them.

WE RECOMMEND A VOTE FOR THE PROPOSAL TO AMEND THE BYLAWS TO CLARIFY THE

POWER TO ADJOURN STOCKHOLDER MEETINGS AND TO ADD A SUPERMAJORITY

VOTING STANDARD FOR ALL FUTURE AMENDMENTS OF THAT SECTION

ON THE ENCLOSED BLUE PROXY CARD AND INTEND TO VOTE OUR SHARES

FOR THIS PROPOSAL.

10

PROPOSAL NO. 5

PROPOSAL TO TERMINATE THE INVESTMENT ADVISORY AGREEMENT AND ALL OTHER ADVISORY AND MANAGEMENT AGREEMENTS BETWEEN THE FUND AND UBS

We have submitted the following proposal for stockholder approval at the 2023 Annual Meeting:

Proposal

“RESOLVED, that that certain Amended and Restated Investment Advisory Agreement (the “Investment Advisory Agreement”) between Tax Free Fund for Puerto Rico Residents, Inc. (the “Fund”) and UBS Asset Managers of Puerto Rico (“UBS”), a division of UBS Trust Company of Puerto Rico, dated as of May 12, 2021, and all other advisory and management agreements between the Fund and UBS shall be terminated by the Fund, pursuant to Section 11 of the Investment Advisory Agreement and the right of stockholders as embodied in Section 15(a)(3) of the Investment Company Act of 1940 and as required to be included in such agreements, such termination to be effective no more than sixty (60) days following the date hereof.”

This proposal, if approved at the 2023 Annual Meeting, would allow for the termination of the primary material agreement between the Fund and the Fund’s current investment adviser, UBS, to be terminated. Such a termination would facilitate a new investment adviser to be retained by the Fund. According to the Fund’s Certified Shareholder Report on Form N-CSR filed with the SEC on March 9, 2023, during the fiscal year ended December 31, 2022, the Fund’s total net asset value fell by more than 19% and its stock price fell by more than 48%. Moreover, as of December 31, 2022, the Fund’s stock was trading at a 59.2% discount to its net asset value. Although a change in investment adviser may result in some amount of lost time, a period of uncertainty and incremental expenses related to finding a new investment adviser, we believe that, given the severe underperformance by UBS, a new investment adviser would be able to strengthen the Fund’s performance in future fiscal years, thereby creating more value in the long-run for all stockholders.

The 1940 Act provides a temporary exemption from the approval requirements in the event a prior investment advisory contract is terminated, which exemption allows the Board (including a majority of the independent directors) to approve an interim contract. Such an interim contract is required to be approved by the Board (including a majority of the independent directors) within ten (10) business days after the termination of the prior advisory contract becomes effective, with the compensation to be received under the interim contract no greater than the compensation the adviser would have received under the previous contract. The Board would then have 150 days to obtain stockholder approval for that investment advisory contact. If the Board either does not adopt an interim contract, or fails to obtain all required approvals for an investment advisory contract within the 150-day period, the Fund would be an internally managed fund (i.e., there would be no external investment adviser), and the Board must either manage the Fund itself or hire individuals to manage the Fund. Although the failure to approve an interim or permanent investment advisory agreement could potentially require the Fund to become internally managed (which it might not be prepared to do at that time), we believe beginning the process of replacing UBS as investment adviser of the Fund by terminating the Investment Advisory Agreement can facilitate the selection of a new, suitable alternative investment advisor willing to advise the Fund on attractive terms.

Based on the Fund’s public filings, it is also a party to several other agreements with UBSTC PR, including (i) an Amended and Restated Administration Agreement dated as of May 12, 2021, (ii) an Amended and Restated Transfer Agency, Registrar, and Servicing Agreement dated as of May 13, 2021, and (iii) a Custody Agreement dated as of May 12, 2021. In addition, the Fund is a party to that certain Amended and Restated Underwriting Agreement dated as of May 13, 2021 with UBS Financial Services Incorporated of Puerto Rico (“UBS Financial Services”), which is an affiliate of both UBSTC PR and UBS Asset Managers of Puerto Rico (or UBS). We do not expect the termination of the Investment Advisory Agreement to automatically trigger the termination of the foregoing agreements. However, given that both UBSTC PR and UBS Financial Services are affiliated with UBS, we cannot guarantee that they will not terminate these other agreements following the termination of the Investment Advisory Agreement. The termination of one or more of these other agreements would force the Fund to find replacement entities to serve the applicable functions, which may be critical for the Fund’s operation, and such replacements may not be immediately available.

A copy of the Investment Advisory Agreement, filed as Exhibit g to the Fund’s Registration Statement on Form N-2 dated May 3, 2022, is attached as Exhibit E to this Proxy Statement.

11

Other than as described here and elsewhere in this Proxy Statement, none of the Participants has any material interest in this Proposal 5, individually or in the aggregate, including any anticipated benefit to any of them.

WE RECOMMEND A VOTE FOR THE PROPOSAL TO TERMINATE THE INVESTMENT ADVISORY AGREEMENT AND ALL OTHER ADVISORY AND MANAGEMENT AGREEMENTS BETWEEN THE FUND AND UBS WITHIN SIXTY (60) DAYS ON THE ENCLOSED BLUE PROXY CARD AND INTEND TO VOTE OUR SHARES FOR THIS PROPOSAL.

12

INFORMATION CONCERNING THE 2023 ANNUAL MEETING

VOTING AND PROXY PROCEDURES

The Fund has set the close of business on March 1, 2023 as the Record Date for determining stockholders entitled to notice of and to vote at the 2023 Annual Meeting. Stockholders of record at the close of business on the Record Date will be entitled to vote at the 2023 Annual Meeting. According to the Fund’s proxy statement, there were [•] shares of Common Stock outstanding and entitled to vote at the 2023 Annual Meeting as of the Record Date.

Stockholders, including those who expect to attend the 2023 Annual Meeting, are urged to authorize Ocean Capital to vote their shares on their behalf today by following the instructions for Internet voting detailed on the enclosed BLUE Proxy Card, by calling the toll-free number contained therein, or by signing, dating and mailing the enclosed BLUE Proxy Card in the enclosed return envelope to Ocean Capital LLC, c/o Morrow Sodali LLC, in the enclosed postage-paid envelope.

Authorized proxies will be voted at the 2023 Annual Meeting as marked and, in the absence of specific instructions, will be voted FOR the election of the Nominees, FOR Ocean Capital’s proposal to repeal bylaw provisions and amendments adopted subsequent to March 25, 2022 by the Board without stockholder approval, FOR Ocean Capital’s proposal to amend the Bylaws to lower the quorum threshold for stockholder meetings from one-half to one-third of the outstanding shares entitled to vote, FOR Ocean Capital’s proposal to amend the Bylaws to clarify that the power to adjourn stockholder meetings belongs exclusively to stockholders and, pursuant to Rule 14a-4(c) under the Securities Exchange Act of 1934 (the “Exchange Act”) and FOR Ocean Capital’s proposal to terminate the Investment Advisory Agreement and all other advisory and management agreements between the Fund and UBS within sixty (60) days, in the discretion of the persons named herein as proxies on all other matters as may properly come before the 2023 Annual Meeting.

QUORUM

The presence at the 2023 Annual Meeting, virtually or represented by proxy, of the holders of more than one-half of the outstanding shares of the Fund entitled to vote, shall constitute a quorum. The shares that represent “broker non-votes” (i.e., shares held by brokers or nominees as to which (i) instructions have not been received from the beneficial owners or persons entitled to vote and (ii) the broker or nominee does not have discretionary voting power on a particular matter) will neither be counted as present nor be entitled to vote at the 2023 Annual Meeting for purposes of determining whether a quorum exists. The shares whose proxies reflect an abstention on any item will be counted as shares present and entitled to vote at the 2023 Annual Meeting for purposes of determining whether a quorum exists.

Any stockholder wishing to participate in the 2023 Annual Meeting by means of remote communication can do so, provided such stockholder registers for the 2023 Annual Meeting in advance. If you were a record holder of shares of Common Stock as of the close of business on the Record Date, you must register at https://viewproxy.com/UBSPuertoRico/broadridgevsm/ no later than 5:00 p.m. Atlantic Standard Time (5:00 p.m. Eastern Daylight Time) on April 18, 2023 to attend and vote at the 2023 Annual Meeting. Broadridge will then e-mail you the login information and instructions for attending and voting at the 2023 Annual Meeting. If you were a beneficial owner of shares of Common Stock as of the close of business on the Record Date, i.e., your shares were held for you by a broker, bank or other institution as of the close of business on the Record Date, please consult with your broker, bank or other institution on how to attend and vote at the 2023 Annual Meeting.

VOTES REQUIRED FOR APPROVAL

Election of Directors — The Fund has adopted a plurality vote standard for director elections, meaning the nominees receiving the highest number of affirmative votes will be elected as directors of the Fund at the 2023 Annual Meeting provided that a quorum is present.

Proposal to Repeal Bylaw Provisions and Amendments — Provided that a quorum has been established, Proposal 2 requires the affirmative vote of a majority of the Fund’s shares present virtually or represented by proxy at the 2023 Annual Meeting.

13

Proposal to Lower the Quorum Threshold — Provided that a quorum has been established, Proposal 3 requires the affirmative vote of a majority of the Fund’s shares present virtually or represented by proxy at the 2023 Annual Meeting.

Proposal to Clarify the Adjournment Power — Provided that a quorum has been established, Proposal 4 requires the affirmative vote of a majority of the Fund’s shares present virtually or represented by proxy at the 2023 Annual Meeting.

Proposal to Terminate the Investment Advisory Agreement — Provided that a quorum has been established, Proposal 5 requires the affirmative vote of a majority of the outstanding voting securities of the Fund, meaning the affirmative vote of the lesser of (i) 67% or more of the Fund’s shares present at such meeting, if the holders of more than 50% of the outstanding shares are present or represented by proxy, or (ii) more than 50% of the outstanding shares of the Fund.

None of the applicable Puerto Rico law, the Fund’s Certificate of Incorporation nor the Bylaws provide for appraisal or other similar rights for dissenting stockholders in connection with any of the Proposals set forth in this Proxy Statement. Accordingly, you will have no right to dissent and obtain payment for your shares in connection with such Proposals.

ABSTENTIONS; BROKER NON-VOTES

Abstentions will be treated as votes present at the 2023 Annual Meeting, but will not be treated as votes cast for Proposal 1. Abstentions, therefore, will have no effect on Proposal 1, but will have the effect of “against” votes on Proposals 2, 3, 4 and 5. Broker non-votes will not be treated as votes present at the 2023 Annual Meeting and will not be treated as votes cast for any of Proposals 2, 3 or 4. However, broker non-votes will have the same effect as votes against Proposal 5.

Because of the contested nature of the 2023 Annual Meeting, brokers holding shares of the Fund in “street name” for their customers will not be permitted by New York Stock Exchange (“NYSE”) rules to vote on any of the Proposals on behalf of their customers and beneficial owners in the absence of voting instructions from their customers and beneficial owners.

Additional information regarding when a “broker non-vote” occurs with respect to non-routine matters will be found in the Fund’s proxy statement. We urge you to instruct your broker or other nominee to vote your shares for the BLUE Proxy Card so that your votes may be counted.

Broker-dealers who are not members of the NYSE may be subject to other rules, which may or may not permit them to vote your shares without instruction. We urge you to provide instructions to your broker or nominee to vote your shares for the BLUE Proxy Card so that your votes may be counted.

REVOCATION OF PROXIES

Stockholders of the Fund may, but need not, revoke their proxies at any time prior to exercise by (i) attending the 2023 Annual Meeting and voting his or her shares of Common Stock virtually, (ii) signing, dating and returning a later dated BLUE Proxy Card or the Fund’s proxy card, (iii) submitting a proxy with new voting instructions using the internet or telephone voting system as indicated on the BLUE Proxy Card or the Fund’s proxy card or (iv) by submitting a letter of revocation. The delivery of a later-dated proxy card which is properly completed will constitute a revocation of any earlier proxy. The revocation may be delivered either to Ocean Capital in care of Morrow Sodali at the address set forth on the back cover of the Proxy Statement or to the Fund’s Secretary at American International Plaza, Tenth Floor, 250 Muñoz Rivera Avenue, San Juan, Puerto Rico 00918, or to any other address provided by the Fund. Although a revocation is effective if delivered to the Fund, Ocean Capital requests that either the original or photostatic copies of all revocations be mailed to Ocean Capital LLC, c/o Morrow Sodali LLC, 509 Madison Avenue, Suite 1206, New York, NY 10022, so that Ocean Capital will be aware of all revocations and can more accurately determine if and when proxies have been received from the holders of record on the Record Date of a majority of the outstanding shares. If you hold your shares in street name, please check your voting instruction card or contact your bank, broker or nominee for instructions on how to change or revoke your vote. Additionally, Morrow Sodali may use this information to contact stockholders who have revoked their proxies in order to solicit later-dated proxies for the election of the Nominees and approval of the other Proposals described herein.

14

SOLICITATION OF PROXIES

The solicitation of proxies pursuant to the Proxy Statement is being made by Ocean Capital. Proxies may be solicited by mail, facsimile, telephone, electronic mail, Internet, in person or by advertisements.

Ocean Capital has entered into an agreement with Morrow Sodali for solicitation and advisory services in connection with this solicitation, for which Morrow Sodali will receive a fee of up to $[•], together with reimbursement for its reasonable out-of-pocket expenses, and will be indemnified against certain liabilities and expenses, including certain liabilities under the federal securities laws. Morrow Sodali will solicit proxies from individuals, brokers, banks, bank nominees and other institutional holders. Ocean Capital has requested banks, brokerage houses and other custodians, nominees and fiduciaries to forward all solicitation materials to the beneficial owners of the shares they hold of record. It is anticipated that Morrow Sodali will employ up to 15 persons to solicit the Fund’s stockholders for the 2023 Annual Meeting. The entire expense of soliciting proxies is being borne by Ocean Capital. Ocean Capital does not intend to seek reimbursement from the Fund of all expenses it incurs in connection with this solicitation. Costs of this solicitation of proxies are currently estimated to be approximately $[•]. We estimate that through the date hereof, Ocean Capital’s expenses in connection with this solicitation are approximately $[•].

STOCKHOLDER PROPOSALS

According to the Fund’s proxy statement, to be considered for presentation at any annual or special meeting of stockholders of the Fund, proposals by stockholders and persons nominated for election as directors by stockholders must be delivered to the Fund’s Secretary at its principal office no less than thirty (30) nor more than fifty (50) days prior to the date of the meeting; provided, however, that if the date of the meeting is first publicly announced or disclosed less than forty (40) days prior to the date of the meeting, such notice must be given not more than ten (10) days after such date is first so announced or disclosed. Public notice will be deemed to have been given more than forty (40) days in advance of the annual meeting, if the Fund will have previously disclosed, in the Bylaws or otherwise, that the annual meeting in each year is to be held on a determinable date unless and until the Board determines to hold the meeting on a different date. In order to be included in the Fund’s proxy statement and form of proxy, a stockholder proposal must comply with all applicable legal requirements. Timely submission of a proposal does not guarantee that such proposal will be included.

The incorporation of this information in the Proxy Statement should not be construed as an admission by us that such procedures are legal, valid or binding.

15

OTHER MATTERS AND ADDITIONAL INFORMATION

Ocean Capital is unaware of any other matters to be considered at the 2023 Annual Meeting. However, should other matters, which Ocean Capital is not aware of a reasonable time before this solicitation, be brought before the 2023 Annual Meeting, the persons named as proxies on the enclosed BLUE Proxy Card will vote on such matters in their discretion in accordance with Rule 14a-4(c) under the Exchange Act.

We are asking you to vote FOR the election of our Nominees, FOR our proposal to repeal any provision of, or amendment to, the Bylaws adopted by the Board without stockholder approval subsequent to March 25, 2022, FOR our proposal to amend Article II, Section 8 of the Bylaws to lower the quorum threshold for stockholder meetings from one-half to one-third of the outstanding shares entitled to vote and to add a supermajority voting standard for all future amendments, FOR our proposal to amend Article II, Section 8 of the Bylaws to clarify that the power to adjourn stockholder meetings belongs exclusively to the stockholders and to add a supermajority voting standard for all future amendments and FOR our proposal to terminate the Investment Advisory Agreement and all other advisory and management agreements between the Fund and UBS within sixty (60) days as described in this Proxy Statement.

Ocean Capital has omitted from this Proxy Statement certain disclosure required by applicable law that will be included in the Fund’s definitive proxy statement. This disclosure includes, among other things, biographical information on the Fund’s directors and executive officers, the dollar range of shares owned by the directors of the Fund, information regarding persons who beneficially own more than 5% of the Fund’s Common Stock, information on committees of the Board and other important information. Stockholders should refer to the Fund’s definitive proxy statement, once available, in order to review this disclosure.

According to the Fund’s proxy statement, UBS, a division of UBSTC PR, serves as the Fund’s investment adviser. UBS is located at 250 Muñoz Rivera Avenue, American International Plaza, Tenth Floor, San Juan, Puerto Rico 00918.

According to the Fund’s proxy statement, UBS serves as the Fund’s administrator. UBS is located at 250 Muñoz Rivera Avenue, American International Plaza, Tenth Floor, San Juan, Puerto Rico 00918.

According to the Fund’s proxy statement, UBS Financial Services Puerto Rico serves as the Fund’s principal underwriter. UBS Financial Services Puerto Rico is located at 250 Muñoz Rivera Avenue, American International Plaza, Penthouse Floors, San Juan, Puerto Rico 00918.

Please refer to the Fund’s proxy statement for information about persons that beneficially owned 5% or more of the shares of Common Stock as of the Record Date.

The information concerning the Fund contained in this Proxy Statement and the appendix and exhibits attached hereto has been taken from, or is based upon, publicly available information.

OCEAN CAPITAL LLC

[•], 2023

THIS SOLICITATION IS BEING MADE BY OCEAN CAPITAL AND NOT ON BEHALF OF THE BOARD OF DIRECTORS OF THE FUND. OCEAN CAPITAL IS NOT AWARE OF ANY OTHER MATTERS TO BE BROUGHT BEFORE THE 2023 ANNUAL MEETING. SHOULD OTHER MATTERS WHICH OCEAN CAPITAL IS NOT AWARE OF WITHIN A REASONABLE TIME BEFORE THIS SOLICITATION, BE BROUGHT BEFORE THE 2023 ANNUAL MEETING, THE PERSONS NAMED AS PROXIES IN THE ENCLOSED BLUE PROXY CARD WILL VOTE ON SUCH MATTERS IN THEIR DISCRETION. OCEAN CAPITAL URGES YOU TO VOTE IN FAVOR OF THE ELECTION OF OCEAN CAPITAL’S NOMINEES, EITHER BY TELEPHONE OR BY INTERNET AS DESCRIBED IN THE ENCLOSED BLUE PROXY CARD OR BY SIGNING, DATING AND RETURNING THE ENCLOSED BLUE PROXY CARD TODAY.

16

QUESTIONS AND ANSWERS ABOUT THE PROXY MATERIALS AND THE 2023 ANNUAL MEETING

Who is entitled to vote?

Stockholders of record at the close of business on the Record Date, March 1, 2023, are entitled to be present and to vote at the 2023 Annual Meeting. Each share of Common Stock of record is entitled to one vote.

How do I vote my shares?

Shares held in record name. If your shares are registered in your own name, please vote today by signing, dating and returning the enclosed BLUE Proxy Card in the postage-paid envelope provided. Execution and delivery of a proxy by a record holder of Common Stock will be presumed to be a proxy with respect to all shares held by such record holder unless the proxy specifies otherwise. You may also vote your shares by following the instructions for telephone or Internet voting detailed on the enclosed BLUE Proxy Card.

Shares beneficially owned or held in “street” name. If you hold your shares in “street name” with a broker, bank, trust company or other nominee, only that nominee can exercise the right to vote with respect to the shares of Common Stock that you beneficially own through such nominee and only upon receipt of your specific instructions. Accordingly, it is critical that you promptly give instructions to your broker, bank, dealer, trust company or other nominee to vote in favor of the Proposals and the election of the Nominees. Please follow the instructions to vote provided on the enclosed voting instruction form provided by your broker, bank, trust company or other nominee and have your shares voted promptly.

Any stockholder wishing to participate in the 2023 Annual Meeting by means of remote communication can do so, provided such stockholder registers for the 2023 Annual Meeting in advance. If you were a record holder of shares of Common Stock as of the close of business on the Record Date, you must register at https://viewproxy.com/UBSPuertoRico/broadridgevsm/ no later than 5:00 p.m. Atlantic Standard Time (5:00 p.m. Eastern Daylight Time) on April 18, 2023 to attend and vote at the 2023 Annual Meeting. Broadridge will then e-mail you the login information and instructions for attending and voting at the 2023 Annual Meeting. If you were a beneficial owner of shares of Common Stock as of the close of business on the Record Date, i.e., your shares were held for you by a broker, bank or other institution as of the close of business on the Record Date, please consult with your broker, bank or other institution on how to attend and vote at the 2023 Annual Meeting.

Shares of Common Stock represented by properly executed BLUE Proxy Cards will be voted at the 2023 Annual Meeting as marked and, in the absence of specific instructions, “FOR ALL” of Ocean Capital’s Nominees listed in Proposal 1, “FOR” Proposal 2, “FOR” Proposal 3, “FOR” Proposal 4 and “FOR” Proposal 5.

How should I vote on the Proposals?

We recommend that you vote your shares on the BLUE Proxy Card as follows:

“FOR ALL” of Ocean Capital’s Nominees standing for election to the Board named in this Proxy Statement (Proposal 1);

“FOR” the proposal to repeal any bylaw provisions and amendments adopted by the Board without stockholder approval subsequent to March 25, 2022 (Proposal 2);

“FOR” the proposal to amend Article II, Section 8 of the Bylaws to lower the quorum threshold for stockholder meetings from one-half to one-third of all outstanding shares entitled to vote and to add a supermajority voting standard for all future amendments (Proposal 3);

“FOR” the proposal to amend Article II, Section 8 of the Bylaws to clarify that the power to adjourn stockholder meetings belongs exclusively to the stockholders and to add a supermajority voting standard for all future amendments (Proposal 4); and

“FOR” the proposal to terminate the Investment Advisory Agreement and all other advisory and management agreements between the Fund and UBS within sixty (60) days (Proposal 5).

17

Can I change my vote or revoke my proxy?

If you are the stockholder of record, you may change your proxy instructions or revoke your proxy at any time before your proxy is voted at the 2023 Annual Meeting. Proxies may be revoked by any of the following actions:

• signing, dating and returning the enclosed BLUE Proxy Card (the latest dated proxy is the only one that counts);

• submitting a proxy with new voting instructions using the internet or telephone voting system as indicated on the BLUE Proxy Card or the Fund’s proxy card;

• delivering a written revocation or a later dated proxy for the 2023 Annual Meeting to Ocean Capital LLC, c/o Morrow Sodali LLC, 509 Madison Avenue, Suite 1206, New York, NY 10022, or to the secretary of the Fund; or

• attending the 2023 Annual Meeting and voting virtually (although attendance at the 2023 Annual Meeting will not, by itself, revoke a proxy).

If your shares are held in a brokerage account by a broker, bank or other nominee, you should follow the instructions provided by your broker, bank or other nominee. If you attend the 2023 Annual Meeting and you beneficially own shares but are not the record owner, your mere attendance at the 2023 Annual Meeting WILL NOT be sufficient to revoke your prior given proxy card. You must have written authority from the record owner (e.g., by obtaining a legal proxy) to vote your shares held in its name at the 2023 Annual Meeting. Contact Morrow Sodali toll free at (800) 662-5200 or collect at (203) 658-9400 for assistance or if you have any questions.

IF YOU HAVE ALREADY VOTED USING THE FUND’S PROXY CARD, WE URGE YOU TO REVOKE IT BY FOLLOWING THE INSTRUCTIONS ABOVE. Although a revocation is effective if delivered to the Fund, we request that either the original or a copy of any revocation be mailed to Ocean Capital LLC, c/o Morrow Sodali LLC, 509 Madison Avenue, Suite 1206, New York, NY 10022, so that we will be aware of all revocations.

Who is making this proxy solicitation and who is paying for it?

The solicitation of proxies pursuant to this proxy solicitation is being made by Ocean Capital, Mr. Hawk and the Nominees. Proxies may be solicited by mail, facsimile, telephone, electronic mail, Internet, in person or by advertisements. The Participants will solicit proxies from individuals, brokers, banks, bank nominees and other institutional holders. Ocean Capital has requested banks, brokerage houses and other custodians, nominees and fiduciaries to forward all solicitation materials to the beneficial owners of the shares they hold of record. Ocean Capital will reimburse these record holders for their reasonable out-of-pocket expenses in so doing. It is anticipated that certain regular employees of Ocean Capital will also participate in the solicitation of proxies in support of the Nominees and the Proposals. Such employees will receive no additional compensation if they assist in the solicitation of proxies.

Ocean Capital has entered into an agreement with Morrow Sodali for solicitation and advisory services in connection with this solicitation, for which Morrow Sodali will receive a fee of up to $[•] together with reimbursement for its reasonable out-of-pocket expenses, and will be indemnified against certain liabilities and expenses, including certain liabilities under the federal securities laws. Morrow Sodali will solicit proxies from individuals, brokers, banks, bank nominees and other institutional holders. Ocean Capital has requested banks, brokerage houses and other custodians, nominees and fiduciaries to forward all solicitation materials to the beneficial owners of the shares they hold of record. It is anticipated that Morrow Sodali will employ up to 15 persons to solicit the Fund’s stockholders for the 2023 Annual Meeting. The entire expense of soliciting proxies is being borne by Ocean Capital. Ocean Capital does not intend to seek reimbursement from the Fund of all expenses it incurs in connection with this solicitation. Costs of this solicitation of proxies are currently estimated to be approximately $[•]. We estimate that through the date hereof, Ocean Capital’s expenses in connection with this solicitation are approximately $[•].

18

What is Householding of Proxy Materials?

The SEC has adopted rules that permit companies and intermediaries (such as brokers and banks) to satisfy the delivery requirements for proxy statements and annual reports with respect to two or more stockholders sharing the same address by delivering a single proxy statement addressed to those stockholders. Some banks and brokers with account holders who are stockholders of the Fund may be householding our proxy materials. A single copy of this Proxy Statement (and of the Fund’s proxy statement and annual report) will be delivered to multiple stockholders sharing an address unless contrary instructions have been received from one or more of the affected stockholders. Once you have received notice from your bank or broker that it will be householding communications to your address, householding will continue until you are notified otherwise or until you revoke your consent. If, at any time, you no longer wish to participate in householding and would prefer to receive a separate proxy statement and annual report, please notify your bank or broker and direct your request to the Fund by writing to the Fund’s Secretary at Tax Free Fund for Puerto Rico Residents, Inc., American International Plaza, Tenth Floor, 250 Muñoz Rivera Avenue, San Juan, Puerto Rico 00918. Stockholders who currently receive multiple copies of this Proxy Statement at their address and would like to request householding of their communications should contact their bank or broker.

What is the Coalition of Concerned UBS Closed-End Bond Fund Investors?

On July 22, 2021, Ocean Capital launched a public website for “The Coalition of Concerned UBS Closed-End Bond Fund Investors.” The Coalition of Concerned UBS Closed-End Bond Fund Investors is not intended to describe a discernible group of investors, but instead is used to describe a like-mindedness of various stockholders who might understand and think similarly about the Fund and its affiliated funds with respect to which Ocean Capital has made nominations for director elections. Ocean Capital, its managing member, Mr. Hawk, and its nominees have never entered, and have no intention to enter, into any agreement, whether oral or written, express or implied, to act together with any other person who could be described as a “Concerned UBS Closed-End Bond Fund Investor” for the purpose of acquiring, holding, voting or disposing of securities of any of the funds.

What happened at the 2022 Annual Meeting?

The 2022 Annual Meeting was originally convened on April 28, 2022 and was subsequently adjourned to June 9, 2022, July 28, 2022, September 22, 2022, December 15, 2022 and March 9, 2023. The 2022 Annual Meeting reconvened on March 9, 2023 and a stockholder vote occurred. According to the final contest vote tallies provided by Broadridge, at the 2022 Annual Meeting, the Fund’s stockholders overwhelmingly favored Ocean Capital’s two 2022 Nominees over the Fund’s nominees.3 However, the Fund has so far refused to seat Ocean Capital’s 2022 Nominees and claimed that Ocean Capital did not properly submit proxies and votes at the 2022 Annual Meeting. A lawsuit filed by Ocean Capital to enforce the results of the 2022 Annual Meeting is currently pending (for more information about the pending lawsuit relating to the 2022 Annual Meeting, please see “Appendix A — The Federal Action”).

19

APPENDIX A

INFORMATION CONCERNING THE NOMINEES AND PARTICIPANTS

Ocean Capital has nominated two (2) highly-qualified individuals for election as directors at the 2023 Annual Meeting: Roxana Cruz-Rivera and Mojdeh L. Khaghan.

This proxy solicitation is being made by Ocean Capital, Mr. Hawk and the Nominees. Ocean Capital, Mr. Hawk and the Nominees may each be deemed a “Participant” and, collectively, the “Participants.”

As of the date of this Proxy Statement, the Participants may be deemed to “beneficially own” (within the meaning of Rule 13d-3 or Rule 16a-1 under the Exchange Act for the purposes of this Appendix A), in the aggregate, 1,497,342.25 shares of Common Stock (including 100 shares of Common Stock held in record name by Ocean Capital)4 representing approximately [•]% of the Fund’s outstanding shares of Common Stock. The percentages used herein are based upon [•] shares of Common Stock outstanding, which represents the number of outstanding shares of Common Stock as of the Record Date, according to the Fund’s proxy statement.

As of the date of this Proxy Statement, Ocean Capital beneficially owns 1,479,364.25 shares of Common Stock. As of the date of this Proxy Statement, Mr. Hawk beneficially owns 1,497,342.25 shares of Common Stock, consisting of 17,978 shares of Common Stock owned directly and 1,479,364.25 shares of Common Stock owned by Ocean Capital, which Mr. Hawk, as Managing Member of Ocean Capital, may be deemed to beneficially own, collectively representing approximately [•]% of the Fund’s outstanding shares of Common Stock.

Except as set forth in this Proxy Statement, as of the date of this Proxy Statement, the Nominees do not beneficially own any shares of Common Stock and have not entered into any transactions in securities of the Fund during the past two years. Each Nominee specifically disclaims beneficial ownership of shares of Common Stock except to the extent of her pecuniary interest therein.

Except as set forth in this Proxy Statement, neither the Nominees nor any of their Immediate Family Members owns beneficially or of record any class of securities in (i) the Fund’s investment adviser, principal underwriter or Sponsoring Insurance Company (as defined in Item 22 of Schedule 14A); or (ii) any person (other than a registered investment company) directly or indirectly controlling, controlled by, or under common control with the Fund’s investment adviser, principal underwriter, or Sponsoring Insurance Company. Each of our Nominees specifically disclaims beneficial ownership of the securities that she does not directly own. For information regarding purchases and sales of securities of the Fund during the past two (2) years by the Participants, see Exhibit A — Transactions in the Fund’s Securities During the Past Two Years (which is incorporated herein by reference).

Since the beginning of the Fund’s last two completed fiscal years, no officer of an investment adviser, principal underwriter, or Sponsoring Insurance Company of the Fund, or of a person directly or indirectly controlling, controlled by, or under common control thereby, serves, or has served, on the board of directors of a company of which any of the Nominees is an officer.

None of the Nominees nor any of their Immediate Family Members (as such term is defined in the 1940 Act) has or has had any direct or indirect interest, the value of which exceeded or is to exceed $120,000, during the past five years, in (i) the Fund’s investment adviser, principal underwriter or Sponsoring Insurance Company; or (ii) any person (other than a registered investment company) directly or indirectly controlling, controlled by, or under common control with the Fund’s investment adviser, principal underwriter, or Sponsoring Insurance Company. In addition, none of the Nominees or any of their Immediate Family Members has, or has had since the beginning of the Fund’s last two completed fiscal years, or has currently proposed, any direct or indirect relationship, in which the amount involved exceeds $120,000, with any of the persons specified in paragraphs (b)(8)(i) through (b)(8)(viii) of Item 22 of Schedule 14A.

20

Ocean Capital believes that each Nominee presently is not, and if elected as a director of the Fund, would not be, an “interested person” within the meaning of Section 2(a)(19) of the 1940 Act and that each Nominee would be independent within the meaning of Section 301 of the Sarbanes-Oxley Act of 2002. No Nominee is a member of the Fund’s compensation, nominating and governance, dividend or audit committees that is not independent under any such committee’s applicable independence standards.

The Nominees will not receive any compensation from Ocean Capital for their services as directors of the Fund if elected. If elected, the Nominees will be entitled to such compensation from the Fund as is consistent with the Fund’s practices for services of directors who are not “interested persons” of the Fund.

Except as set forth in this Proxy Statement, neither of our Nominees is a party adverse to the Fund, or any of its subsidiaries, or has a material interest adverse to the Fund, or any of its subsidiaries, in any material pending legal proceeding.

We do not expect that any of our Nominees will be unable to stand for election, but, in the event that any Nominee is unable to serve or, for good cause, will not serve, the shares represented by the enclosed BLUE Proxy Card will be voted for substitute nominee(s), to the extent this is not prohibited under the Fund’s Bylaws and Certificate of Incorporation and applicable law. In addition, we reserve the right to nominate substitute person(s) if the Fund makes or announces any changes to the Bylaws or takes any other action that has, or if consummated would have, the effect of disqualifying any Nominee, to the extent this is not prohibited under the Bylaws and applicable law. In any such case, the shares represented by the enclosed BLUE Proxy Card will be voted for such substitute nominee(s). We reserve the right to nominate additional person(s), to the extent this is not prohibited under the Bylaws and applicable law, if the Fund increases the size of the Board above its existing size or increases the number of directors whose terms expire at the 2023 Annual Meeting. Additional nominations made pursuant to the preceding sentence are without prejudice to the position of Ocean Capital that any attempt to increase the size of the current Board or to change the classifications of the Board would constitute an unlawful manipulation of the Fund’s corporate machinery.

The principal occupation of Ms. Cruz-Rivera is serving as Founder and CEO of TLVS LLC dba Tax Law and Venture Services. The principal occupation of Ms. Khaghan is serving as a Principal of the Reed Morgan Group. The principal occupation of Mr. Hawk is President and Chief Executive Officer of First Southern, LLC, a boutique financial services company that provides a broad spectrum of investment and brokerage services to individuals and institutional clients. The principal business of Ocean Capital is investing in various opportunities in the financial arena and transacting any lawful business in Puerto Rico financial arenas.

The principal business address of Ms. Cruz-Rivera is 155 Arterial Hostos Golden Court 2, Apt. 216, San Juan, Puerto Rico 00918. The principal business address of Ms. Khaghan is 5151 Collins Ave., Miami Beach, Florida 33140. The principal business address of each of Mr. Hawk and Ocean Capital is GAM Tower, 2 Tabonuco St., Suite 200, Guaynabo, Puerto Rico 00968.

Each of the individual Participants is a citizen of the United States of America. Mr. Hawk and Ms. Cruz-Rivera are residents of Puerto Rico.

The relevant information provided above has been furnished to Ocean Capital by the Nominees.

Except as set forth in this Proxy Statement, (i) during the past ten (10) years, no Participant has been convicted in a criminal proceeding (excluding traffic violations or similar misdemeanors); (ii) no Participant has a substantial interest, direct or indirect, by securities holdings or otherwise, in any matter to be acted on at the 2023 Annual Meeting; (iii) no Participant owns any securities of the Fund which are owned of record but not beneficially; (iv) no Participant (other than Ocean Capital and Mr. Hawk, as disclosed elsewhere in this Proxy Statement) directly or indirectly beneficially owns any securities of the Fund; (v) no Participant has purchased or sold any securities of the Fund during the past two (2) years; (vi) no part of the purchase price or market value of the securities of the Fund owned by any Participant is represented by funds borrowed or otherwise obtained for the purpose of acquiring or holding such securities; (vii) no Participant is, or within the past year was, a party to any contract, arrangements or understandings with any person with respect to any securities of the Fund, including, but not limited to, joint ventures, loan or option arrangements, puts or calls, guarantees against loss or guarantees of profit, division of losses or profits, or the giving or withholding of proxies; (viii) no associate of any Participant owns beneficially, directly or indirectly, any securities of the Fund; (ix) no Participant owns beneficially, directly or indirectly, any securities of any parent or subsidiary of the Fund; (x) no Participant or any of his or her associates nor any of his or her immediate family members (as defined in

21

Instruction 1 to Item 404(a) of Regulation S-K) had any direct or indirect interest in any transaction, or series of similar transactions, since the beginning of the Fund’s last fiscal year, or is a party to any currently proposed transaction, or series of similar transactions, to which the Fund or any of its subsidiaries was or is to be a party, in which the amount involved exceeds $120,000; and (xi) no Participant or any of his or her associates has any arrangement or understanding with any person with respect to any future employment by the Fund or its affiliates, nor with respect to any future transactions to which the Fund or any of its affiliates will or may be a party.

On April 4, 2022, Ocean Capital, Mr. Hawk and the 2022 Nominees entered into a Joint Filing and Solicitation Agreement pursuant to which, among other things, the parties agreed (i) to the joint filing of statements on Schedule 13D, and any amendments thereto, with respect to the securities of the Fund, (ii) to solicit proxies in favor of the proposals submitted by Ocean Capital to the Fund’s stockholders for approval at the 2022 Annual Meeting, including the election of Mr. Danial to the Board as a Class I director and Messrs. Rosenthal and Izquierdo to the Board as Class II directors, (iii) to provide Mr. Hawk with notice of any purchase or sale of any securities of the Fund and (iv) that Ocean Capital shall have the right to pre-approve all expenses incurred in connection with the solicitation and agrees to pay all such pre-approved expenses. The 2022 Nominees were nominated by Ocean Capital for election as directors at the 2022 Annual Meeting, which was consummated on March 9, 2023. Ocean Capital, the 2022 Nominees and the Nominees entered into an amended and restated Joint Filing and Solicitation Agreement on March 17, 2023, pursuant to which (i) the Nominees were added as parties, and (ii) Ocean Capital, Mr. Hawk and the Nominees agreed to solicit proxies in favor of the election of the Nominees and the Proposals at the 2023 Annual Meeting. None of the 2022 Nominees is expected to participate in the solicitation of proxies in connection with the 2023 Annual Meeting.

Except as set forth in this Proxy Statement, (i) there are no arrangements or understandings between Ocean Capital or its affiliates and the Nominees or any other person or persons pursuant to which the nominations are to be made by Ocean Capital at the 2023 Annual Meeting, other than the consent by each Nominee to be named in this Proxy Statement and to serve as a director of the Fund, if elected as such at the 2023 Annual Meeting and (ii) no Nominee has purchased or sold any securities of the Fund’s investment adviser or its parents, or subsidiaries of either, since the beginning of the most recently completed fiscal year.