PRELIMINARY PROXY STATEMENT — SUBJECT TO COMPLETION

DATED MARCH 21, 2024

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________

SCHEDULE 14A

___________________

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant | | ☐ |

Filed by a Party other than the Registrant | | ☒ |

Check the appropriate box:

☒ | | Preliminary Proxy Statement |

☐ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☐ | | Definitive Proxy Statement |

☐ | | Definitive Additional Materials |

☐ | | Soliciting Material under §240.14a-12 |

Tax Free Fund For Puerto Rico Residents, Inc. |

(Name of Registrant as Specified in its Charter) |

Ocean Capital LLC

W. Heath Hawk

ETHAN A. DANIAL

IAN MCCARTHY

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

☒ | | No fee required |

☐ | | Fee paid previously with preliminary materials. |

☐ | | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

PRELIMINARY PROXY STATEMENT — SUBJECT TO COMPLETION

DATED MARCH 21, 2024

2024 ANNUAL MEETING OF STOCKHOLDERS OF

Tax Free Fund for Puerto Rico Residents, Inc.

PROXY STATEMENT

OF

OCEAN CAPITAL LLC

Please vote the BLUE Proxy Card (i) “FOR” the election of our highly qualified nominees and (ii) “FOR” each of Ocean Capital’s proposals!

Please sign, date and mail the enclosed BLUE Proxy Card today!

Ocean Capital LLC, a Puerto Rico limited liability company (“Ocean Capital,” “we,” “us,” or “ours”), and its managing member William Heath Hawk (together with Ocean Capital and the Nominees (as defined below), the “Participants”) are significant stockholders and beneficially own in the aggregate approximately [•]% of the outstanding shares of the common stock, par value $0.01 (the “Common Stock”), of Tax Free Fund for Puerto Rico Residents, Inc. (the “Fund”), a Puerto Rico corporation. We are writing to you in connection with our (i) nomination of two highly qualified individuals, Ethan A. Danial and Ian McCarthy, to the board of directors of the Fund (the “Board”), (ii) submission of ten business proposals for stockholder consideration and (iii) stockholder proposal submitted pursuant to Rule 14a-8 under the Securities Exchange Act of 1934 (as amended, the “Exchange Act”), each at the 2024 annual meeting of stockholders scheduled to be held virtually at 11:30 a.m., Atlantic Standard Time (11:30 a.m. Eastern Daylight Time), on April 18, 2024 (collectively, with any meeting held in lieu thereof and any adjournments, postponements, reschedulings or continuations thereof, the “2024 Annual Meeting”). This Proxy Statement and the enclosed BLUE Proxy Card are first being furnished to stockholders on or about [•], 2024.

We are furnishing this Proxy Statement and the enclosed BLUE Proxy Card to seek your support at the 2024 Annual Meeting with respect to the following business proposals (each, a “Proposal” and, collectively, the “Proposals”) to:

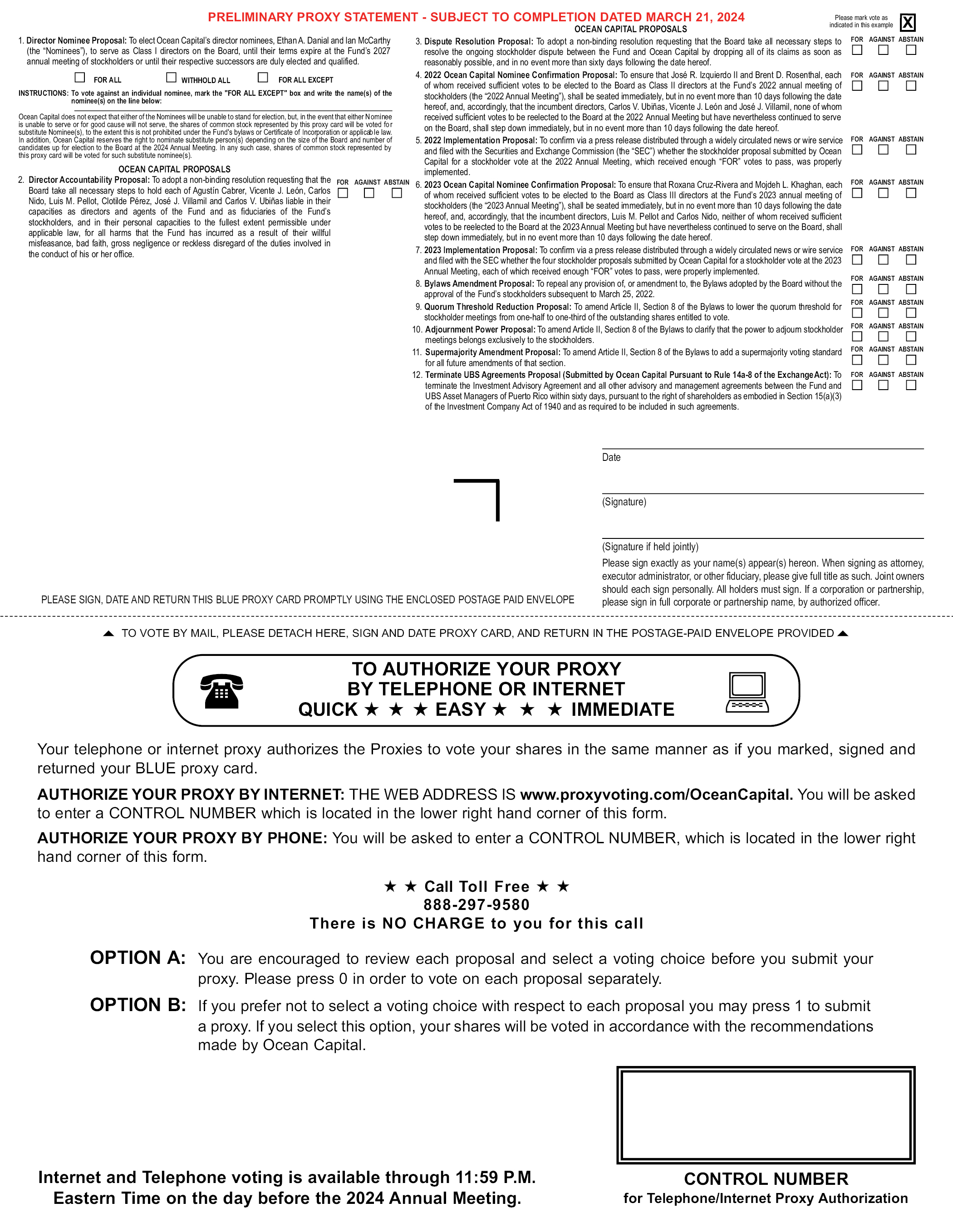

1. Elect Ocean Capital’s slate of two director nominees, Ethan A. Danial and Ian McCarthy (the “Nominees”), to serve as Class I directors on the Board, until their terms expire at the Fund’s 2027 annual meeting of stockholders or until their respective successors are duly elected and qualified;

2. Adopt a non-binding resolution urging that the Board take all necessary steps to hold each of Agustín Cabrer, Vicente J. León, Carlos Nido, Luis M. Pellot, Clotilde Pérez, José J. Villamil and Carlos V. Ubiñas liable in their capacities as directors and agents of the Fund and as fiduciaries of the Fund’s stockholders for harms that he or she has caused the Fund to incur as a result of his or her willful misfeasance, bad faith, gross negligence or reckless disregard of the duties involved in the conduct of his or her office (the “Director Accountability Proposal”);

3. Adopt a non-binding resolution urging that the Board take all necessary steps to resolve the stockholder dispute between the Fund and Ocean Capital by dropping all of its claims as soon as reasonably possible, and in no event more than sixty days following the date hereof (the “Dispute Resolution Proposal”);

4. Ensure that José R. Izquierdo II and Brent D. Rosenthal (collectively, with Mr. Danial, the “2022 Ocean Capital Nominees”), each of whom received sufficient votes to be elected to the Board as Class II directors at the Fund’s 2022 annual meeting of stockholders (the “2022 Annual Meeting”), shall be seated immediately, but in no event more than 10 days following the date hereof, and, accordingly, that the incumbent directors, Carlos V. Ubiñas, Vicente J. Léon and José J. Villamil, none of whom received sufficient votes to be reelected to the Board at the 2022 Annual Meeting but have nevertheless continued to serve on the Board, shall step down immediately, but in no event more than 10 days following the date hereof (the “2022 Ocean Capital Nominee Confirmation Proposal”);

1

5. Confirm via a press release distributed through a widely circulated news or wire service and filed with the Securities and Exchange Commission (the “SEC”) whether the stockholder proposal submitted by Ocean Capital for stockholder vote at the 2022 Annual Meeting, which received enough “FOR” votes to pass, was properly implemented (the “2022 Implementation Proposal”);

6. Ensure that Roxana Cruz-Rivera and Mojdeh L. Khaghan (together, the “2023 Ocean Capital Nominees”), each of whom received sufficient votes to be elected to the Board as Class III directors at the Fund’s 2023 annual meeting of stockholders (the “2023 Annual Meeting”), shall be seated immediately, but in no event more than 10 days following the date hereof, and, accordingly, that the incumbent directors, Luis M. Pellot and Carlos Nido, neither of whom received sufficient votes to be reelected to the Board at the 2023 Annual Meeting but have nevertheless continued to serve on the Board, shall step down immediately, but in no event more than 10 days following the date hereof (the “2023 Ocean Capital Nominee Confirmation Proposal”);

7. Confirm via a press release distributed through a widely circulated news or wire service and filed with the SEC whether the four stockholder proposals submitted by Ocean Capital for stockholder vote at the 2023 Annual Meeting, each of which received enough “FOR” votes to pass, were properly implemented (“the 2023 Implementation Proposal”);

8. Repeal any provision of, or amendment to, the Amended and Restated By-Laws of Tax Free Fund for Puerto Rico Residents (the “Bylaws”) adopted by the Board without the approval of the Fund’s stockholders subsequent to March 25, 2022 (the “Bylaws Amendment Proposal”);

9. Amend Article II, Section 8 of the Bylaws to lower the quorum threshold for stockholder meetings from one-half to one-third of the outstanding shares entitled to vote (the “Quorum Threshold Reduction Proposal”);

10. Amend Article II, Section 8 of the Bylaws to clarify that the power to adjourn stockholder meetings belongs exclusively to the stockholders (the “Adjournment Power Proposal”);

11. Amend Article II, Section 8 of the Bylaws to add a supermajority voting standard (66⅔% of outstanding shares entitled to vote thereon) for all future amendments of that section (the “Supermajority Amendment Proposal”); and

12. Terminate the Amended and Restated Investment Advisory Agreement between the Fund and UBS Asset Managers of Puerto Rico (“UBS”), a division of UBS Trust Company of Puerto Rico (“UBSTC PR”), dated May 12, 2021 (the “Investment Advisory Agreement”), and all other advisory and management agreements between the Fund and UBS (collectively with the Investment Advisory Agreement, the “UBS Agreements”) within sixty days, pursuant to Section 11 of the Investment Advisory Agreement and the right of stockholders as embodied in Section 15(a)(3) of the Investment Company Act of 1940 (the “1940 Act”) and as required to be included in such agreements (the “Terminate UBS Agreements Proposal”).

If you have already sent a proxy card furnished by the Fund’s management to the Fund, you have every right to change your vote by signing, dating and returning the enclosed BLUE Proxy Card or by following the instructions for telephone or Internet voting detailed thereon. Only your latest dated proxy card counts!

Please refer to the Section below, Information Concerning the 2024 Annual Meeting (which is incorporated herein by reference), and the Fund’s proxy materials for additional information concerning the 2024 Annual Meeting, including how to register for the meeting, voting and proxy procedures, votes required for approval of the Proposals and the solicitation of proxies. Any stockholder wishing to participate in the 2024 Annual Meeting by means of remote communication can do so, provided such stockholder registers for the 2024 Annual Meeting in advance. If you were a record holder of shares of Common Stock as of the close of business on March 7, 2024, the record date for the 2024 Annual Meeting (the “Record Date”), you must register at https://viewproxy.com/UBSPuertoRico/broadridgevsm/ no later than 5:00 p.m. Atlantic Standard Time (5:00 p.m. Eastern Daylight Time) on April 16, 2024 to attend and vote at the 2024 Annual Meeting. Broadridge Financial Solutions, Inc. (“Broadridge”) will then e-mail you the login information and instructions for attending and voting at the 2024 Annual Meeting. If you were a beneficial owner of

2

shares of Common Stock as of the close of business on the Record Date, i.e., your shares were held for you by a broker, bank or other institution as of the close of business on the Record Date, please consult with your broker, bank or other institution on how to attend and vote at the 2024 Annual Meeting.

If you have any questions or require any assistance with voting your shares, please contact our proxy solicitor, Morrow Sodali LLC (“Morrow Sodali”), toll free at (800) 662-5200 or collect at (203) 658-9400.

This Proxy Statement and all other solicitation materials in connection with this proxy solicitation will be available on the Internet, free of charge, at the SEC’s website https://www.edgar.sec.gov.

The Edgar file number for the Fund is 811-23672.

3

IMPORTANT:

YOUR VOTE IS IMPORTANT, NO MATTER HOW MANY OR HOW FEW SHARES YOU OWN.

• If your shares are registered in your own name, you may vote such shares by signing, dating and mailing the enclosed BLUE Proxy Card to Ocean Capital LLC, c/o Morrow Sodali LLC, in the enclosed postage-paid return envelope today or by following the instructions for telephone or Internet voting detailed on the enclosed BLUE Proxy Card.

• If your shares were held for you by a brokerage firm, bank, bank nominee or other institution on the Record Date, only they can vote such shares and only upon receipt of your specific instructions. Such brokerage firm, bank, bank nominee or other institution will not have discretionary voting power and, without your specific instructions on how to vote, the underlying shares will not be counted as shares present and entitled to vote at the meeting. Accordingly, please instruct your broker, bank or other institution to vote the BLUE Proxy Card on your behalf by following the instructions provided by your broker or bank.

4

REASONS FOR OUR SOLICITATION

Ocean Capital, as one of the Fund’s largest stockholders, has notified the Fund of its intent to nominate a slate of two highly qualified Nominees who would not be “interested persons” (based on Section 2(a)(19) of the 1940 Act) and are independent (based on Section 301 of the Sarbanes-Oxley Act of 2002) and to put forth ten business proposals for submission to a stockholder vote at the 2024 Annual Meeting, each as further described elsewhere in this Proxy Statement. Additionally, Ocean Capital submitted a stockholder proposal pursuant to Rule 14a-8 under the Exchange Act, as further described elsewhere in this Proxy Statement.

As committed investors, we are looking for the Fund to significantly improve both performance and governance in order to generate maximum returns for all stockholders, consistent with the Fund’s investment objectives and strategies. We believe stockholders cannot expect the Fund to perform significantly better without fundamental change, beginning in the boardroom by adding fresh perspectives. If elected, the Nominees will be committed to putting stockholders’ interests first and evaluating all avenues to maximize value, including, but not limited to, consideration of the reestablishment of a share repurchase program, the liquidation of the Fund to realize its net asset values and other value-unlocking initiatives. Although there can be no assurances that any such avenues will in fact increase stockholder value, the Participants to the solicitation believe that the Nominees’ presence on the Board will benefit all stockholders. Ocean Capital further believes that its business proposals will, among other things, ensure that the principles of shareholder democracy and good corporate governance are respected and upheld.

In furtherance of its objectives, Ocean Capital previously submitted director nominations and a business proposal for the Fund’s 2022 Annual Meeting. The 2022 Annual Meeting was initially scheduled to be held on April 28, 2022 and was adjourned five times for failure to reach a quorum. The 2022 Annual Meeting was reconvened for the last time on March 9, 2023. According to the Fund’s Semi-Annual Certified Shareholder Report on Form N-CSRS filed with the SEC on September 6, 2023 (the “September 2023 Shareholder Report”), at the 2022 Annual Meeting, a quorum was present and the Fund’s stockholders overwhelmingly favored the 2022 Ocean Capital Nominees over the Fund’s nominees.1 Since then, the Fund has so far refused to seat the 2022 Ocean Capital Nominees, claiming that Ocean Capital did not properly submit proxies and votes at the 2022 Annual Meeting. Ocean Capital has moved for a statutory injunction seeking to enforce the results of the 2022 Annual Meeting, which is currently pending (for more information about the pending lawsuit and Ocean Capital’s counterclaims against the Fund, please see “Appendix A — The Federal Action”).

Additionally, Ocean Capital previously submitted director nominations and three business proposals for the 2023 Annual Meeting. The 2023 Annual Meeting was initially scheduled to be held on April 20, 2023 and was adjourned three times for failure to reach a quorum. The 2023 Annual Meeting was reconvened for the last time on November 2, 2023. According to the Certified Shareholder Report on Form N-CSR filed with the SEC on March 7, 2024 (the “March 2024 Shareholder Report”) at the 2023 Annual Meeting, the Fund’s stockholders overwhelmingly favored the 2023 Ocean Capital Nominees, over the Fund’s nominees, Messrs. Carlos Nido and Luis M. Pellot.2 As with the 2022 Ocean Capital Nominees, the Fund has refused to seat the 2023 Ocean Capital Nominees, claiming that whether a quorum was present at the 2023 Annual Meeting and the validity of the vote at the 2023 Annual Meeting remain subject to legal challenge.

Under the Bylaws, each director’s term lasts until his or her successor has been elected and qualified, or until his death, resignation or removal, or until December 31 of the year in which he shall have reached eighty-five years of age. As a result of the delays due to failure to reach a quorum and the Fund’s refusal to recognize the election results of the 2022 Annual Meeting and the 2023 Annual Meeting, the Fund’s three incumbent directors whose terms expired at the 2022 Annual Meeting — Carlos V. Ubiñas, Vicente León and José J. Villamil — have continued to serve on the Board for nearly two years since the original scheduled date of the 2022 Annual Meeting and for nearly a year since the 2022 Annual Meeting was finally held, and the Fund’s two incumbent directors whose terms expired at the 2023 Annual Meeting — Luis M. Pellot and Carlos Nido — have continued to serve on the Board for nearly a year since the original scheduled date of the 2023 Annual Meeting and for over four months since the date of the 2023 Annual Meeting was finally held. Ocean Capital believes that its business proposals will ensure that the will of the shareholders, as expressed at the 2022 Annual Meeting, the 2023 Annual Meeting and future meetings, is honored. For more information on the reasons that Ocean Capital supports its business proposals see the descriptions of the respective proposals below.

5

Please see “Appendix A — Information Concerning the Nominees and Participants — The Federal Action” for a description of ongoing litigation between Ocean Capital, on the one hand, and the Fund and certain related funds, on the other, relating to the 2022 Annual Meeting and the 2023 Annual Meeting.

The 14a-8 Proposal

On December 6, 2023, Ocean Capital submitted a stockholder proposal and corresponding supporting statement to the Fund to be included in the Fund’s proxy materials pursuant to Rule 14a-8 under the Exchange Act, which was subsequently supplemented on December 8, 2023 (as supplemented, the “14a-8 Proposal”). The purpose of the 14a-8 Proposal is to allow stockholders the opportunity to vote on a proposal to terminate the Investment Advisory Agreement and all other advisory and managements agreements between the Fund and UBS, pursuant to the right of stockholders as embodied in Section 15(a)(3) of the 1940 Act and as required to be included in such agreements. Pursuant to Section 11 of the Investment Advisory Agreement, the approval of the Terminate UBS Agreements Proposal (the 14a-8 Proposal) requires the affirmative vote of a majority of the outstanding voting securities of the Fund. For that purpose, and in accordance with the 1940 Act, the vote of “a majority of the outstanding voting securities of the Fund” at the 2024 Annual Meeting means the affirmative vote of the lesser of (i) 67% or more of Fund’s shares present at such meeting, if the holders of more than 50% of the outstanding shares are present or represented by proxy, or (ii) more than 50% of the outstanding Fund shares.

On January 31, 2024, the Fund notified Ocean Capital of its intent to include a statement of opposition to Ocean Capital’s proposal to terminate the Fund’s investment advisory agreement with UBS Asset Managers of Puerto Rico (the “Opposition Statement”). On February 20, 2024, Ocean Capital submitted a response letter (the “14a-8 Response Letter”) to the SEC pursuant to Rule 14a-8(m)(2) of the Exchange Act to inform the Staff of its belief that the Opposition Statement contains certain materially false or misleading statements in violation of Rule 14a-9 of the Exchange Act. The Fund has included the 14a-8 Proposal in its solicitation materials, along with the Opposition Statement, which Ocean Capital believes contains materially false or misleading statements in violation of Rule 14a-9. The 14a-8 Proposal is presented herein and has been labeled as the Terminate UBS Agreements Proposal. The 14a-8 Proposal is reproduced in the Section below, “Proposal No. 12 — Terminate UBS Agreements Proposal.”

The Federal Action

On February 28, 2022, a number of closed-end bond funds affiliated with the Fund (the “Sibling Funds”) first brought suit against Ocean Capital, Mr. Hawk and certain other named defendants, alleging certain of Ocean Capital’s proxy disclosures and other conduct of Ocean Capital and the defendants in connection with campaigns against the funds violated Sections 13(d), 14(a), and 20(a) of the Exchange Act. The Fund joined the Federal Action along with the Sibling Funds by an amended complaint filed January 5, 2023. With respect to the Fund, both the 2022 Ocean Capital Nominees and 2023 Ocean Capital Nominees received sufficient votes to be elected by the Fund’s stockholders at the 2022 Annual Meeting and 2023 Annual Meeting, respectively. Nevertheless, the Fund’s candidates at the 2022 Annual Meeting — Messrs. Ubiñas, León and Villamil — have continued to serve on the Board for almost two years since the original scheduled date of the 2022 Annual Meeting and nearly a year since the 2022 Annual Meeting was consummated, and the Fund’s candidates at the 2023 Annual Meeting — Messrs. Nido and Pellot — have continued to serve on the Board for almost a year since the original scheduled date of the 2023 Annual Meeting and almost four months since the 2023 Annual Meeting was consummated. The Fund claimed that the pendency of the aforementioned claims against Ocean Capital precluded the seating of Ocean Capital’s director candidates who received enough votes to be elected to their respective boards at the annual meetings at which a quorum was present. However, on September 13, 2023, the Court (as defined below) entered a partial judgment confirming its dismissal with prejudice of the funds’ claims. The Fund has not provided any other justification for its failure to seat Ocean Capital’s director candidates who received enough votes to be elected, which has now continued for months past the dismissal of its claims against Ocean Capital and the other defendants. In addition to counterclaims against the Fund, Puerto Rico Residents Tax-Free Fund, Inc. (“PRRTFF I”), and Puerto Rico Residents Tax-Free Fund VI, Inc. (“PRRTFF VI”), Ocean Capital brought a motion for statutory injunction pursuant to Section 3655 (as defined below) to have its nominees who received sufficient votes to be elected. Ocean Capital’s counterclaims and its motion remain pending. Please refer to the Section below, “Appendix A — Information Concerning the Nominees and Participants, The Federal Action”, for more information regarding the related litigation.

No matter how many shares of Common Stock you own, we urge you to vote your shares on the enclosed BLUE Proxy Card to support the adoption of Ocean Capital’s Proposals for the 2024 Annual Meeting, which we believe will help unlock value for investors.

6

PROPOSAL NO. 1

ELECTION OF DIRECTORS

According to the Fund’s preliminary proxy statement filed with the SEC on February 23, 2024 (the “Fund’s proxy statement”), the Board is currently composed of seven directors and three of the Fund’s directors are up for election at the 2024 Annual Meeting. We are seeking your support at the 2024 Annual Meeting to elect each of our two highly qualified Nominees in opposition to the Fund’s Class I director nominees, to serve a three-year term expiring at the Fund’s 2027 annual meeting of stockholders or until their respective successors have been duly elected and qualified. Our Nominees, if elected at the 2024 Annual Meeting, will constitute a minority of the Board. However, if the election results of the 2022 Annual Meeting and 2023 Annual Meeting are formally implemented and Ocean Capital’s Nominees for the 2024 Annual Meeting are also elected, then the 2022 Ocean Capital Nominees, the 2023 Ocean Capital Nominees and the Nominees collectively would constitute a majority of the Board. We do not believe that the election and seating of our Nominees, the 2022 Ocean Capital Nominees and the 2023 Ocean Capital Nominees would constitute a change of control under the Fund’s existing contracts that are publicly available.3

OUR NOMINEES

The following information sets forth the name, age, business address, positions held with the Fund, term of office and length of time served in such positions if applicable, principal occupation(s) for the past five years, number of portfolios in fund complexes overseen and other directorships held by each of our Nominees. The nominations were made in a timely manner and in compliance with the applicable provisions of the Fund’s governing instruments. Mr. Danial is the son of Ms. Khaghan, one of the 2023 Ocean Capital Nominees. Other than that, there is no family

7

relationship between the two Nominees or between either Nominee and any of the 2022 Ocean Capital Nominees or 2023 Ocean Capital Nominees. The specific experience, qualifications, attributes and skills that led us to conclude that our Nominees should serve as directors of the Fund are set forth below.

Name, Address, and Age | | Position(s)

Held with

the Fund | | Term of

Office and

Length

of Time

Served | | Principal

Occupation(s)

During Past 5 Years | | Number of

Portfolios in

Fund

Complex

Overseen | | Other

Directorships |

Ethan A. Danial,

954 Avenida Ponce De Leon, San Juan, Puerto Rico 00907,

(27) | | Director4 | | N/A | | Member, Authorized Officer and Manager at RAD Investments, LLC, an investment firm in Puerto Rico where he has worked since January 2019 Vice President of Caribbean Capital and Consultancy Corp., an investment firm in Puerto Rico from August 2017 through October 2022 | | N/A | | Director of Campo Caribe LLC, an agricultural business in Puerto Rico, from September 2019 to September 2022 Director of First Puerto Rico Tax-Exempt Target Maturity Fund VII, a Puerto Rico-based investment fund, from November 2020 to June 2021 Director of Puerto Rico Residents Tax-Free Fund, Inc. since 20225 Director of Puerto Rico Residents Tax-Free Fund VI, Inc. since 20225 Director of Tax Free Fund For Puerto Rico Residents, Inc. since 20224 |

Ian McCarthy, 1959 Loiza Street, Suite 401, San Juan, Puerto Rico 00911,

(32) | | N/A | | N/A | | Managing Director at Fairview Asset Management, LLC, an investment management services firm, where he has worked since June 2020 Director, Originations & Fundraising, at Stabilis Capital Management, LP, an investment firm, where he worked from January 2018 to May 2020 | | N/A | | Director of Puerto Rico Residents Tax-Free Fund VI, Inc. since 20236 |

8

Ethan A. Danial, age 27, is a Puerto Rico-based investment professional with experience in research and trading of defaulted and restructured Puerto Rico municipal bonds. Mr. Danial has been employed as a member, authorized officer and manager at RAD Investments, LLC, an investment firm in Puerto Rico, since January 2019. Additionally, from August 2017 through October 2022, Mr. Danial was the Vice President of Caribbean Capital and Consultancy Corp., an investment firm in Puerto Rico. Mr. Danial served as a director for Campo Caribe LLC, an agricultural business in Puerto Rico, from September 2019 to September 2022. Further, Mr. Danial served as a director at First Puerto Rico Tax-Exempt Target Maturity Fund VII, a Puerto Rico-based investment fund, from November 2020 until June 2021. Prior to Mr. Danial’s employment at Caribbean Capital and Consultancy Corp., he earned his B.A. in Mathematics-Statistics from Columbia University in 2017. Since August 2023, Mr. Danial is studying for his J.D. at Harvard Law School. Ocean Capital believes Mr. Danial’s investment and research experience with municipal bond funds makes him qualified to serve as a director of the Fund.

Ian McCarthy, age 32, is a Puerto Rico-based investment professional with experience in unconventional debt restructurings and loan workouts in the commercial real estate finance space. Mr. McCarthy currently serves as a Managing Director at Fairview Asset Management, LLC, an investment management services firm based in Puerto Rico, a position he has held since June 2020. Prior to that, Mr. McCarthy served as Director, Originations & Fundraising at Stabilis Capital Management, LP, a New York-based investment firm, from January 2018 until May 2020. He previously worked at Ten-X, a real estate trading software platform, from June 2014 to December 2017 and as an analyst at Rockwood Real Estate Advisors, a California real estate advisory firm. The Nominee earned his B.A. in Economics from Kenyon College in 2013. Ocean Capital believes Mr. McCarthy’s extensive investment and finance experience makes him qualified to serve as a director of the Fund.

9

SHARE OWNERSHIP OF NOMINEES

The following table contains a summary of the total number of shares of Common Stock beneficially owned by the Nominees as of the date of this Proxy Statement.

The information in the following table has been furnished to us by the respective Nominees:

Name and Address | | Number of

Shares

Beneficially

Owned | | Percentage of

Shares

Beneficially

Owned |

Ethan A. Danial,

954 Avenida Ponce De Leon,

San Juan,

Puerto Rico 00907 | | 0 | | N/A |

| | | | | |

Ian McCarthy,

1959 Loiza Street,

Suite 401, San Juan,

Puerto Rico 00911 | | 0 | | N/A |

Ocean Capital believes that none of the Nominees presently is, and if elected as a director of the Fund, none of the Nominees would be, an “interested person” within the meaning of Section 2(a)(19) of the 1940 Act and that each of the Nominees would be independent within the meaning of Section 301 of the Sarbanes-Oxley Act of 2002.

In the event that our Nominees are not elected to the Board at the 2024 Annual Meeting, Ocean Capital intends to consider all available options in the future with respect to the Fund, including, without limitation, nominating director candidates or submitting stockholder proposals at future meetings of stockholders.

For additional information concerning our Nominees, see “Appendix A — Information Concerning the Nominees and Participants” (which is incorporated herein by reference).

Other than as described elsewhere in this Proxy Statement, none of the Participants has any material interest in this Proposal No. 1, individually or in the aggregate, including any anticipated benefit to any of them.

WE URGE YOU TO VOTE FOR THE ELECTION OF OUR NOMINEES ON THE ENCLOSED BLUE PROXY CARD AND INTEND TO VOTE OUR SHARES FOR THIS PROPOSAL.

10

PROPOSAL NO. 2

DIRECTOR ACCOUNTABILITY PROPOSAL

We have submitted the following non-binding proposal for stockholder approval at the 2024 Annual Meeting:

Proposal:

“RESOLVED, that the stockholders of Tax Free Fund for Puerto Rico Residents, Inc. (the “Fund”) urge the Fund to take all necessary steps to hold Agustín Cabrer, Vicente J. León, Carlos Nido, Luis M. Pellot, Clotilde Pérez, José J. Villamil and Carlos V. Ubiñas liable in their capacities as directors and agents of the Fund and as fiduciaries of the Fund’s stockholders, and in their personal capacities to the fullest extent permissible under applicable law, for all harms that the Fund has incurred as a result of their willful misfeasance, bad faith, gross negligence or reckless disregard of the duties involved in the conduct of his or her office, as provided for in Article VI of the Amended and Restated By-Laws of the Fund and to the extent permitted under the Certificate of Incorporation of the Fund and state and federal law.”

The reason for conducting this business at the 2024 Annual Meeting is because Ocean Capital believes that Agustín Cabrer, Vicente J. León, Carlos Nido, Luis M. Pellot, Clotilde Pérez, José J. Villamil and Carlos V. Ubiñas (collectively, the “Incumbent Directors”) have employed self-serving entrenchment tactics for years at the expense of stockholders and in violation of their fiduciary duties. The Director Accountability Proposal is intended to give voice to the frustrations of any and all stockholders who share the belief that the Incumbent Directors’ actions are in breach of their fiduciary duties and, as a direct result, have led to financial and reputational harms for the Fund and its stockholders. These actions include, but are not limited to, repeatedly refusing to acknowledge or implement stockholder proposals that receive enough votes to pass, repeatedly refusing to seat new directors who have received enough votes to be elected, engaging in baseless litigation against Ocean Capital and certain of its nominees, continuing to pay directors whose terms have expired and who have been unseated by newly elected directors, employing an investment advisor that has consistently provided below market returns, failing to certify the results of meetings of stockholders at which a quorum was present, and failing to resolve an ongoing dispute with its stockholders (including Ocean Capital).

Other than as described here and elsewhere in this Proxy Statement and other than any such benefit that will accrue to all stockholders should the Director Accountability Proposal be approved and adopted, none of the Participants has any material interest in the Director Accountability Proposal, individually or in the aggregate.

WE RECOMMEND A VOTE FOR THE DIRECTOR ACCOUNTABILITY PROPOSAL

ON THE ENCLOSED BLUE PROXY CARD AND INTEND TO VOTE OUR SHARES FOR THIS PROPOSAL.

11

PROPOSAL NO. 3

DISPUTE RESOLUTION PROPOSAL

We have submitted the following non-binding proposal for stockholder approval at the 2024 Annual Meeting:

Proposal:

“RESOLVED, that the stockholders of Tax Free Fund for Puerto Rico Residents, Inc. (the “Fund”) urge the Fund to take all necessary steps to resolve the ongoing stockholder dispute between the Fund and Ocean Capital LLC by dropping all of its claims as soon as reasonably possible, and in no event more than sixty days following the date hereof.”

The reason for conducting this business at the 2024 Annual Meeting is because Ocean Capital believes that the Fund has willfully refused to resolve the Federal Action despite the ruling of the Court (as defined below) rejecting the Fund’s claims; the ongoing litigation has cost the Fund and its stockholders significant money and wrongfully deprived stockholders of their preferred nominees to serve as Fund directors. Ocean Capital believes the Fund’s refusal to accept the outcome of stockholder vote(s) reflects a calculated and intentional disregard for basic principles of corporate governance and the clearly and emphatically expressed desires of the Fund’s stockholders. By dropping all of its claims, the Fund will ensure a swift resolution to the Federal Action, which will in turn put an end to the substantial costs with this prolonged litigation and result in elected directors being properly seated.

Ocean Capital, as a party to the Federal Action, has a material interest in the implementation of the Dispute Resolution Proposal. Other than as described here and elsewhere in this Proxy Statement and other than any such benefit that will accrue to all stockholders should the Dispute Resolution Proposal be approved and adopted, none of the Participants has any material interest in the Dispute Resolution Proposal, individually or in the aggregate.

WE RECOMMEND A VOTE FOR THE DISPUTE RESOLUTION PROPOSAL

ON THE ENCLOSED BLUE PROXY CARD AND INTEND TO VOTE OUR SHARES FOR THIS PROPOSAL.

12

PROPOSAL NO. 4

2022 OCEAN CAPITAL NOMINEE CONFIRMATION PROPOSAL

We have submitted the following proposal for stockholder approval at the 2024 Annual Meeting:

Proposal:

“RESOLVED, that Messrs. José R. Izquierdo II and Brent D. Rosenthal, each of whom received sufficient votes to be elected to the Board of Tax Free Fund for Puerto Rico Residents, Inc. (the “Fund”) as Class II directors at the Fund’s 2022 annual meeting of stockholders (the “2022 Annual Meeting”), shall be seated immediately, but in no event more than 10 days following the date hereof, and, accordingly, that the incumbent directors, Messrs. Carlos V. Ubiñas, Vicente J. Léon and José J. Villamil, none of whom received sufficient votes to be reelected to the Board at the 2022 Annual Meeting but have nevertheless continued to serve on the Board, shall step down immediately, but in no event more than 10 days following the date hereof.”

The reason for conducting this business at the 2024 Annual Meeting is to ensure that the will of the Fund’s stockholders as expressed at the 2022 Annual Meeting is upheld. Ocean Capital believes that the approval of the 2022 Ocean Capital Nominee Confirmation Proposal is necessary to uphold the stockholder franchise as provided for and in accordance with the Bylaws and applicable law. Messrs. Danial, Izquierdo and Rosenthal each received sufficient votes to be elected by the Fund’s stockholders by wide margins as a Class I and as Class II directors, respectively (with terms expiring in 2024 and 2025, respectively), at the 2022 Annual Meeting. Because the Fund has not seated any of the 2022 Ocean Capital Nominees as directors, continuing to cite ongoing litigation and the assertion that the presence of a quorum “remains subject to legal challenge,” Messrs. Izquierdo’s and Rosenthal’s terms are already halfway to completion, and Mr. Danial’s term will likely expire without him serving a single day. Allowing Messrs. Ubiñas, Léon and Villamil to continue to serve well past the expiration of their terms and against the expressed will of the Fund’s stockholders contravenes and undermines the legal right of stockholders to elect directors and improperly nullifies the results of the 2022 Annual Meeting, at which the 2022 Ocean Capital Nominees received sufficient votes to be elected.

Ocean Capital submitted director nominations and a business proposal for consideration at the 2022 Annual Meeting, which was originally scheduled for April 28, 2022. After several adjournments, the 2022 Annual Meeting was reconvened on March 9, 2023 and a stockholder vote occurred. According to the final contest vote tallies, as provided in the September 2023 Shareholder Report, the 2022 Ocean Capital Nominees each received at least 4,754,292 votes, while none of the Fund’s nominees for the 2022 Annual Meeting received more than 130,514 votes. Nevertheless, the results of the 2022 Annual Meeting have yet to be implemented under the pretense that “the legal validity of the vote at the 2022 Annual Meeting remains subject to legal challenge,” even though all of the Fund’s claims have been dismissed in the Federal Action. As such, Ocean Capital has a material interest in seeing the 2022 Ocean Capital Nominees be seated and the will of the stockholders be honored. Other than as described here and elsewhere in this Proxy Statement and other than any such benefit that will accrue to all stockholders should the 2022 Ocean Capital Nominee Confirmation Proposal be approved and adopted, none of the Participants has any material interest in the 2022 Ocean Capital Nominee Confirmation Proposal, individually or in the aggregate.

WE RECOMMEND A VOTE FOR THE 2022 OCEAN CAPITAL NOMINEE CONFIRMATION PROPOSAL ON THE ENCLOSED BLUE PROXY CARD AND INTEND TO VOTE OUR SHARES FOR THIS PROPOSAL.

13

PROPOSAL NO. 5

2022 IMPLEMENTATION PROPOSAL

We have submitted the following proposal for stockholder approval at the 2024 Annual Meeting:

Proposal:

“RESOLVED, that Tax Free Fund for Puerto Rico Residents, Inc. (the “Fund”) shall provide confirmation, in a press release distributed through a widely circulated news or wire service and filed with the Securities and Exchange Commission, of whether or not the stockholder proposal submitted by Ocean Capital LLC for stockholder vote at the Fund’s 2022 annual meeting of stockholders, which received enough “FOR” votes to pass, was properly implemented by the Fund, with such press release to be released and filed as soon as practicable, but in no event more than 10 days following the date hereof.”

The reason for conducting this business at the 2024 Annual Meeting is because it believes that it is important to receive confirmation that the stockholder franchise was not disregarded at the 2022 Annual Meeting. Specifically, Ocean Capital submitted a business proposal for consideration at the 2022 Annual Meeting to repeal any provision of, or amendment, to the Bylaws adopted by the Board without stockholder approval subsequent to March 25, 2022 (the “2022 Ocean Capital Business Proposal”). According to the voting results provided in the September 2023 Shareholder Report, the 2022 Ocean Capital Business Proposal received 5,263,479 “FOR” votes — enough to pass by a wide margin — yet the Fund has not confirmed whether the result of the vote has been recognized and implemented. If the Fund has disregarded the vote of its stockholders by refusing to implement the 2022 Ocean Capital Business Proposal, then that would constitute a subversion of shareholder democracy.

As the stockholder proponent of the 2022 Ocean Capital Business Proposal, Ocean Capital has a material interest in the approval and adoption of this 2022 Implementation Proposal. Other than as described here and elsewhere in this Proxy Statement and other than any such benefit that will accrue to all stockholders should the 2022 Implementation Proposal be approved and adopted, none of the Participants has any material interest in the 2022 Implementation Proposal, individually or in the aggregate.

WE RECOMMEND A VOTE FOR THE 2022 IMPLEMENTATION PROPOSAL

ON THE ENCLOSED BLUE PROXY CARD AND INTEND TO VOTE OUR SHARES FOR THIS PROPOSAL.

14

PROPOSAL NO. 6

2023 OCEAN CAPITAL NOMINEE CONFIRMATION PROPOSAL

We have submitted the following proposal for stockholder approval at the 2024 Annual Meeting:

Proposal:

“RESOLVED, that Mses. Roxana Cruz-Rivera and Mojdeh L. Khaghan, each of whom received sufficient votes to be elected to the Board of Tax Free Fund for Puerto Rico Residents, Inc. (the “Fund”) as Class III directors at the Fund’s 2023 annual meeting of stockholders (the “2023 Annual Meeting”), shall be seated immediately, but in no event more than 10 days following the date hereof, and, accordingly, that the incumbent directors, Messrs. Luis M. Pellot and Carlos Nido, neither of whom received sufficient votes to be reelected to the Board at the 2023 Annual Meeting but have nevertheless continued to serve on the Board, shall step down immediately, but in no event more than 10 days following the date hereof.”

The reason for conducting this business at the 2024 Annual Meeting is to ensure that the will of the Fund’s stockholders as expressed at the 2023 Annual Meeting is upheld. Ocean Capital believes that the approval of the 2023 Ocean Capital Nominee Confirmation Proposal is necessary to uphold the stockholder franchise as provided for and in accordance with the Bylaws and applicable law. Mses. Roxana Cruz-Rivera and Mojdeh L. Khaghan each received sufficient votes to be elected by the Fund’s stockholders by a wide margin as Class III Directors (with terms expiring in 2026) at the 2023 Annual Meeting. Because the Fund has not seated any of the 2023 Ocean Capital Nominees as duly elected directors, continuing to cite ongoing litigation and the assertion that the presence of a quorum “remains subject to legal challenge,” the 2023 Ocean Capital Nominees’ terms are already substantially underway even though they have yet to be seated. Allowing Messrs. Pellot and Nido to continue to serve well past the expiration of their terms and against the expressed will of the Fund’s stockholders contravenes and undermines the legal right of stockholders to elect directors and improperly nullifies the results of the 2023 Annual Meeting.

Ocean Capital submitted director nominations and four business proposals for consideration at the 2023 Annual Meeting, which was originally scheduled for April 20, 2023. After several adjournments, the 2023 Annual Meeting was reconvened on November 2, 2023 and a stockholder vote occurred. According to the final contest vote tallies, as provided in the March 2024 Shareholder Report, the 2023 Ocean Capital Nominees each received at least 5,685,086 votes, while none of the Fund’s nominees for the 2023 Annual Meeting received more than 137,801 votes. Nevertheless, the results of the 2023 Annual Meeting have yet to be implemented under the pretense that the presence of a quorum at the 2023 Annual Meeting “remains subject to legal challenge,” even though all of the Fund’s claims have been dismissed in the Federal Action. As such, Ocean Capital has a material interest in seeing the 2023 Ocean Capital Nominees be seated and the will of the stockholders being honored. Other than as described here and elsewhere in this Proxy Statement and other than any such benefit that will accrue to all stockholders should the 2023 Ocean Capital Nominee Confirmation Proposal be approved and adopted, none of the Participants has any material interest in the 2023 Ocean Capital Nominee Confirmation Proposal, individually or in the aggregate.

WE RECOMMEND A VOTE FOR THE 2023 OCEAN CAPITAL NOMINEE CONFIRMATION PROPOSAL ON THE ENCLOSED BLUE PROXY CARD AND INTEND TO VOTE OUR SHARES FOR THIS PROPOSAL.

15

PROPOSAL NO. 7

2023 IMPLEMENTATION PROPOSAL

We have submitted the following proposal for stockholder approval at the 2024 Annual Meeting:

Proposal:

“RESOLVED, that Tax Free Fund for Puerto Rico Residents, Inc. (the “Fund”) shall provide confirmation in a press release distributed through a widely circulated news or wire service and filed with the Securities and Exchange Commission of whether the four stockholder proposals submitted by Ocean Capital LLC for stockholder vote at the Fund’s 2023 annual meeting of stockholders, each of which received enough “FOR” votes to pass, were properly implemented, with such press release to be released and filed as soon as practicable, but in no event more than 10 days following the date hereof.”

The reason for conducting this business at the 2024 Annual Meeting is because Ocean Capital believes that it is important to receive confirmation that the stockholder franchise was not disregarded at the 2023 Annual Meeting. Specifically, Ocean Capital submitted four business proposals for consideration at the 2023 Annual Meeting: (i) a proposal to repeal any provision of, or amendment to, the Bylaws adopted by the Board without stockholder approval subsequent to March 25, 2022 (the “2023 Bylaws Amendment Proposal”), (ii) a proposal to amend Article II, Section 8 of the Bylaws to lower the quorum threshold for stockholder meetings from one-half to one-third of the outstanding shares entitled to vote and to add a supermajority voting standard for all future amendments to that section (the “2023 Quorum Threshold Reduction Proposal”), (iii) a proposal to amend Article II, Section 8 of the Bylaws to clarify that the power to adjourn stockholder meetings belongs exclusively to stockholders and to add a supermajority voting standard for all future amendments of that section (the “2023 Adjournment Power Proposal”) and (iv) a proposal to terminate the Investment Advisory Agreement and all other advisory and management agreements between the Fund and UBS within 60 days (the “2023 Investment Advisory Agreement Proposal” and, collectively, with the 2023 Bylaws Amendment Proposal, the 2023 Quorum Threshold Reduction Proposal and the 2023 Adjournment Power Proposal, the “2023 Ocean Capital Business Proposals”). According to the voting results provided in the March 2024 Shareholder Report, the 2023 Bylaws Amendment Proposal, the 2023 Quorum Threshold Reduction Proposal and the 2023 Adjournment Power Proposal all received enough “FOR” votes to pass, yet the Fund has not confirmed whether the results of the vote have been recognized and implemented.7 If the Fund has disregarded the vote of its stockholders by refusing to implement the 2023 Ocean Capital Business Proposals, then that would constitute a subversion of shareholder democracy.

As the stockholder proponent of the 2023 Ocean Capital Business Proposals, Ocean Capital has a material interest in the approval and adoption of this 2023 Implementation Proposal. Other than as described here and elsewhere in this Proxy Statement and other than any such benefit that will accrue to all stockholders should the 2023 Implementation Proposal be approved and adopted, none of the Participants has any material interest in the 2023 Implementation Proposal, individually or in the aggregate.

WE RECOMMEND A VOTE FOR THE 2023 IMPLEMENTATION PROPOSAL

ON THE ENCLOSED BLUE PROXY CARD AND INTEND TO VOTE OUR SHARES FOR THIS PROPOSAL.

16

PROPOSAL NO. 8

BYLAWS AMENDMENT PROPOSAL

We have submitted the following proposal for stockholder approval at the 2024 Annual Meeting:

Proposal

“RESOLVED, that any provision of, or amendment to, the Amended and Restated By-Laws of Tax Free Fund for Puerto Rico Residents, Inc. adopted by the Board without the approval of the Fund’s stockholders subsequent to March 25, 2022 be and are hereby repealed.”

The reason for conducting this business at the 2024 Annual Meeting is to ensure that the will of the Fund’s stockholders with respect to the Proposals and the Nominees at the 2024 Annual Meeting, as well as (i) the 2022 Ocean Capital Business Proposal and the 2022 Ocean Capital Nominees for election at the 2022 Annual Meeting, which was consummated on March 9, 2023, and (ii) the 2023 Ocean Capital Business Proposals and the 2023 Ocean Capital Nominees for election at the 2023 Annual Meeting, which was consummated on November 2, 2023, is upheld and not thwarted by any unilateral bylaw provision or amendment adopted by the Board after Ocean Capital first sent its nomination notice to the Fund for its 2022 Annual Meeting. While we are not aware of any such provisions or amendments to the Bylaws, we urge stockholders to adopt this proposal to prevent any possible interference with the stockholder franchise and our right as stockholders of the Fund to present business at the 2024 Annual Meeting for stockholders to consider and vote upon. We believe the approval of this proposal is necessary to safeguard the integrity of the contested 2024 Annual Meeting so that stockholders will not be deprived of considering and voting on our Nominees and the Proposals.

Ocean Capital submitted director nominations and the 2022 Ocean Capital Business Proposal (substantially identical to this Bylaws Amendment Proposal) at the Fund’s 2022 Annual Meeting, where a quorum was present and a plurality of stockholders voted to elect the 2022 Ocean Capital Nominees and the 2022 Ocean Capital Business Proposal received a majority of the votes cast. However, the election of the 2022 Ocean Capital Nominees has yet to be implemented by the Fund. Nor has the Fund implemented the stockholders’ approval of the 2022 Ocean Capital Business Proposal at the 2022 Annual Meeting. Ocean Capital also submitted director nominations and the 2023 Ocean Capital Business Proposals (one of which — the 2023 Bylaws Amendment Proposal — being substantially identical to this Bylaws Amendment Proposal) for the 2023 Annual Meeting, which was adjourned more than once and then reconvened for the last time on November 2, 2023, where a quorum was present and shareholders elected the 2023 Ocean Capital Nominees by a plurality vote and the 2023 Ocean Capital Business Proposals received a majority of the votes cast. Similarly, the election of the 2023 Ocean Capital Nominees has yet to be implemented by the Fund and neither has the Fund implemented the stockholders’ approval of any of the 2023 Ocean Capital Business Proposals, including the 2023 Bylaws Amendment Proposal. Other than as described here and elsewhere in this Proxy Statement and other than any such benefit that will accrue to all stockholders should this Bylaws Amendment Proposal be approved and adopted, none of the Participants has any material interest in this Bylaws Amendment Proposal, individually or in the aggregate.

WE RECOMMEND A VOTE FOR THE BYLAWS AMENDMENT PROPOSAL

ON THE ENCLOSED BLUE PROXY CARD AND INTEND TO VOTE OUR SHARES FOR THIS PROPOSAL.

17

PROPOSAL NO. 9

QUORUM THRESHOLD REDUCTION PROPOSAL

We have submitted the following proposal for stockholder approval at the 2024 Annual Meeting:

Proposal

“RESOLVED, that Article II, Section 8 of the Amended and Restated By-Laws of Tax Free Fund for Puerto Rico Residents, Inc. be and is hereby amended as follows:

At any meeting of stockholders, more than one-third of the outstanding shares of the Corporation entitled to vote, represented in person or by proxy, shall constitute a quorum. If less than said number of the outstanding shares are represented at a meeting, holders of a majority of the shares so represented may adjourn the meeting from time to time without further notice. At such adjourned meeting at which a quorum shall be present or represented, any business may be transacted which might have been transacted at the meeting as originally notified. The stockholders present at a duly organized meeting may continue to transact business until adjournment, notwithstanding the withdrawal of enough stockholders to leave less than a quorum.”

A copy of the amended Article II, Section 8 of the Bylaws, marked against the current Article II, Section 8 of the Bylaws to show changes pursuant to this Proposal, is attached as Exhibit B to this Proxy Statement. The effect of the Quorum Threshold Reduction Proposal would be to reduce the quorum for meetings of shareholders from 50% to 33⅓% of the outstanding shares of the Fund entitled to vote.

If this Proposal, the Adjournment Power Proposal and the Supermajority Amendment Proposal are all approved at the 2024 Annual Meeting, their proposed changes to Article II, Section 8 of the Bylaws will be combined. A copy of the amended and restated Article II, Section 8 of the Bylaws marked to show the aggregate changes of this Proposal, the Adjournment Power Proposal and the Supermajority Amendment Proposal against the current Article II, Section 8 of the Bylaws is attached as Exhibit E to this Proxy Statement.

The reason for conducting this business at the 2024 Annual Meeting is to ensure that the Fund’s meetings of stockholders (including annual elections of directors) are timely held and not subject to potentially repeated delays due to a quorum standard that is unreasonably high, given the amount of times previous annual meetings have had to be adjourned in order to reach the current quorum threshold.

A lower quorum threshold means that fewer shares need to be represented in order to hold a valid stockholder meeting. This could result in decisions being made or actions taken with the approval of fewer stockholders than currently required. Hence, a lower quorum threshold could make it easier for a minority of stockholders to impose their views on the Fund, whether or not those views are in the best interests of the Fund and its stockholders.

Ocean Capital submitted director nominations and business proposals (one of which — the 2023 Quorum Threshold Reduction Proposal — being similar to this Quorum Threshold Reduction Proposal) for the Fund’s 2023 Annual Meeting, which was adjourned more than once and then reconvened for the last time on November 2, 2023, where a quorum was present and the 2023 Ocean Capital Business Proposals received a majority of the votes cast. As of the date of this Proxy Statement, the Fund has not yet confirmed implementation of the 2023 Quorum Threshold Reduction Proposal. Other than as described here and elsewhere in this Proxy Statement and other than any such benefit that will accrue to all stockholders should the Quorum Threshold Reduction Proposal be approved and adopted, none of the Participants has any material interest in the Quorum Threshold Reduction Proposal, individually or in the aggregate, including any anticipated benefit to any of them.

WE RECOMMEND A VOTE FOR THE QUORUM THRESHOLD REDUCTION PROPOSAL

ON THE ENCLOSED BLUE PROXY CARD AND INTEND TO VOTE OUR SHARES FOR THIS PROPOSAL.

18

PROPOSAL NO. 10

ADJOURNMENT POWER PROPOSAL

We have submitted the following proposal for stockholder approval at the 2024 Annual Meeting:

Proposal

“RESOLVED, that Article II, Section 8 of the Amended and Restated By-Laws of Tax Free Fund for Puerto Rico Residents, Inc. be and is hereby amended to add the following language:

Except as otherwise required in the Certificate of Incorporation or applicable law, the power to adjourn any meeting of stockholders belongs exclusively to stockholders and no meeting of stockholders, whether or not a quorum is present, may be adjourned other than as expressly provided in this Section 8 of Article II.”

A copy of the amended Article II, Section 8 of the Bylaws, marked against the current Article II, Section 8 of the Bylaws to show changes pursuant to this Proposal, is attached as Exhibit C to this Proxy Statement.

If this Proposal, the Quorum Threshold Reduction Proposal and the Supermajority Amendment Proposal are all approved at the 2024 Annual Meeting, their proposed changes to Article II, Section 8 of the Bylaws will be combined. A copy of the amended and restated Article II, Section 8 of the Bylaws marked to show the aggregate changes of this Proposal, the Quorum Threshold Reduction Proposal and the Supermajority Amendment Proposal against the current Article II, Section 8 of the Bylaws is attached as Exhibit E to this Proxy Statement.

The reason for conducting this business at the 2024 Annual Meeting is to ensure that the Fund’s meetings of stockholders (including annual elections of directors) are adjourned only in limited circumstances (i.e., in the absence of a quorum and only by the Fund’s stockholders) such that the adjournment power will not be exercised in a manner that jeopardizes stockholder franchise or is otherwise adverse to stockholder democracy.

Ocean Capital submitted director nominations and business proposals (one of which — the 2023 Adjournment Power Proposal — being similar to this Adjournment Power Proposal) for the Fund’s 2023 Annual Meeting, which was adjourned more than once and then reconvened for the last time on November 2, 2023, where a quorum was present and the 2023 Ocean Capital Business Proposals received a majority of the votes cast. As of the date of this Proxy Statement, the Fund has not yet confirmed implementation of the 2023 Adjournment Power Proposal. Ocean Capital intends to submit business proposals and director nominations at the Fund’s future annual meetings of stockholders. Accordingly, Ocean Capital has an interest in ensuring that such future meetings are not unilaterally adjourned against the will of the Fund’s stockholders. Other than as described here and elsewhere in this Proxy Statement and other than any such benefit that will accrue to all stockholders should the Adjournment Power Proposal be approved and adopted, none of the Participants has any material interest in the Adjournment Power Proposal, individually or in the aggregate.

WE RECOMMEND A VOTE FOR THE ADJOURNMENT POWER PROPOSAL

ON THE ENCLOSED BLUE PROXY CARD AND INTEND TO VOTE OUR SHARES FOR THIS PROPOSAL.

19

PROPOSAL NO. 11

SUPERMAJORITY AMENDMENT PROPOSAL

We have submitted the following proposal for stockholder approval at the 2024 Annual Meeting:

Proposal

“RESOLVED, that Article II, Section 8 of the Amended and Restated By-Laws of Tax Free Fund for Puerto Rico Residents, Inc. be and is hereby amended to add the following language:

Notwithstanding anything to the contrary in these Amended and Restated By-Laws and unless otherwise expressly provided under applicable law or the Certificate of Incorporation, this Section 8 of Article II can only be amended by the affirmative vote of holders of 66⅔% of the outstanding shares of the Corporation’s capital stock entitled to vote thereon.”

A copy of the amended Article II, Section 8 of the Bylaws, marked against the current Article II, Section 8 of the Bylaws to show changes pursuant to this Proposal, is attached as Exhibit D to this Proxy Statement.

If this Proposal, the Quorum Threshold Reduction Proposal and the Adjournment Power Proposal are all approved at the 2024 Annual Meeting, their proposed changes to Article II, Section 8 of the Bylaws will be combined. A copy of the amended and restated Article II, Section 8 of the Bylaws marked to show the aggregate changes of this Proposal, the Quorum Threshold Reduction Proposal and the Adjournment Power Proposal against the current Article II, Section 8 of the Bylaws is attached as Exhibit E to this Proxy Statement.

The reason for conducting this business at the 2024 Annual Meeting is to ensure that any future amendment to Article II, Section 8 of the Bylaws will not be effected unilaterally by the Board but instead will require adequate consideration and approval by the Fund’s stockholders. Ocean Capital believes that a higher voting standard than a simple majority is appropriate in this context given the fundamental nature of the quorum and adjournment-related provisions in Article II, Section 8 of the Bylaws, which directly affect how stockholders can exercise their voting rights. This supermajority voting standard will apply to all future amendments to Article II, Section 8 of the Bylaws following the consummation of the 2024 Annual Meeting.

A supermajority requires a broad consensus among the stockholder voting base for decisions to be made at stockholder meetings and can therefore be a helpful mechanism to ensure that a large majority of stockholders agree with a proposed amendment. However, supermajority votes can be difficult to achieve, which could delay the decision-making process. Additionally, such a requirement could make it easier for a minority of stockholders to prevent a decision from being made or action from being taken at a stockholder meeting even if that decision or action is supported by holders of a majority of the Fund’s shares and even though such a decision or action may be in the best interests of the Fund and its stockholders.

Ocean Capital submitted director nominations and business proposals (two of which contain similar language to this Supermajority Amendment Proposal) for the Fund’s 2023 Annual Meeting, which was adjourned more than once and then reconvened for the last time on November 2, 2023, where a quorum was present and Ocean Capital’s business proposals received a majority of the votes cast. As of the date of this Proxy Statement, the Fund has not yet confirmed implementation of any of the 2023 Ocean Capital Business Proposals. Other than as described here and elsewhere in this Proxy Statement and other than any such benefit that will accrue to all stockholders should the Supermajority Amendment Proposal be approved and adopted, none of the Participants has any material interest in the Supermajority Amendment Proposal, individually or in the aggregate, including any anticipated benefit to any of them.

WE RECOMMEND A VOTE FOR THE SUPERMAJORITY AMENDMENT PROPOSAL

ON THE ENCLOSED BLUE PROXY CARD AND INTEND TO VOTE OUR SHARES FOR THIS PROPOSAL.

20

PROPOSAL NO. 12

STOCKHOLDER PROPOSAL SUBMITTED BY OCEAN CAPITAL PURSUANT TO RULE 14a-8

TO TERMINATE ADVISORY AGREEMENTS

Ocean Capital submitted the 14a-8 Proposal to be included in the Fund’s proxy statement for stockholder approval at the 2024 Annual Meeting pursuant to Rule 14a-8 of the Exchange Act. The 14a-8 Proposal is reproduced below as submitted to the Fund on December 8, 2023. The data presented in the supporting statement contained in the 14a-8 Proposal is accurate as of the date of the 14a-8 Proposal and no changes have been made to the 14a-8 Proposal since its submission to the Fund on December 8, 2023.

Proposal [1]: Terminate UBS Agreements

RESOLVED, that the Amended and Restated Investment Advisory Agreement (the “Agreement”) between Tax Free Fund for Puerto Rico Residents, Inc. (the “Fund”) and UBS Asset Managers of Puerto Rico (“UBS”), a division of UBS Trust Company of Puerto Rico, dated May 12, 2021, and all other advisory and management agreements between the Fund and UBS (collectively with the Agreement, the “UBS Agreements”), shall be terminated by the Fund, pursuant to Section 11 of the Agreement and the right of shareholders as embodied in Section 15(a)(3) of the Investment Company Act of 1940 and as required to be included in such agreements, with such termination to be effective no more than sixty days following the date hereof.

The Fund has consistently incurred significant losses and failed to maximize shareholder value. As reported in the Fund’s public filings, during the year ended December 31, 2022, the Fund’s total net asset value (“NAV”) and stock price declined over 19% and over 48%, respectively.8 As of June 30, 2023, the Fund’s stock traded at a 60.4% discount to its NAV,9 almost doubling from 34.4% as of June 30, 2021.10 This underperformance is to the detriment of shareholders and is particularly troubling when compared to the broader municipal bond market, for which total returns are up 10.6% and 31.9% over the past 5 and 10 years, respectively.11

We believe that, given the Fund’s inability to maximize shareholder value, termination of the Agreement would allow the Fund to initiate a competitive, open process to secure a new, more suitable investment advisory agreement, with an advisor that can strengthen the Fund’s performance through lower fees, new perspectives and revamped investment strategy. Further, shareholder support of this proposal could encourage the Fund to take other actions, including reevaluating its operations, that may lead to a significant increase in the value of the Fund’s shares, directly benefiting its shareholders.

We believe our interests are aligned with shareholders, as our intent with this proposal is to maximize value for shareholders, not to cause a liquidation of the Fund. While termination of the UBS Agreements could result in some near-term disruptions and costs associated with securing a new investment advisor relationship, we believe that over the longer term, ending this underperforming arrangement will serve all shareholders. If a new permanent advisory agreement is not entered into, the Fund could become internally managed on an interim or permanent basis.12 Despite disruption risks, we believe beginning the process of replacing the current UBS Agreements will facilitate the selection of an investment advisor that is able to bring a fresh perspective and advise the Fund on terms more favorable to the Fund.

Please vote “FOR” Proposal [1]: Terminate UBS Agreements.

WE RECOMMEND A VOTE FOR THE TERMINATE UBS AGREEMENTS PROPOSAL

ON THE ENCLOSED BLUE PROXY CARD AND INTEND TO VOTE OUR SHARES FOR THIS PROPOSAL.

21

INFORMATION CONCERNING THE 2024 ANNUAL MEETING

VOTING AND PROXY PROCEDURES

The Fund has set the close of business on March 7, 2024 as the Record Date for determining stockholders entitled to notice of and to vote at the 2024 Annual Meeting. Stockholders of record at the close of business on the Record Date will be entitled to vote at the 2024 Annual Meeting. According to the Fund’s proxy statement, there were [•] shares of Common Stock outstanding and entitled to vote at the 2024 Annual Meeting as of the Record Date.

Stockholders, including those who expect to attend the 2024 Annual Meeting, are urged to authorize Ocean Capital to vote their shares on their behalf today by following the instructions for Internet voting detailed on the enclosed BLUE Proxy Card, by calling the toll-free number contained therein, or by signing, dating and mailing the enclosed BLUE Proxy Card in the enclosed return envelope to Ocean Capital LLC, c/o Morrow Sodali LLC, in the enclosed postage-paid envelope.

Authorized proxies will be voted at the 2024 Annual Meeting as marked and, in the absence of specific instructions, will be voted FOR the election of the Nominees, FOR the Director Accountability Proposal, FOR the 2022 Ocean Capital Nominee Confirmation Proposal, FOR the 2022 Implementation Proposal, FOR the 2023 Ocean Capital Nominee Confirmation Proposal, FOR the Bylaws Amendment Proposal, FOR the Quorum Threshold Reduction Proposal, FOR the Adjournment Power Proposal, FOR the Supermajority Amendment Proposal and FOR the Terminate UBS Agreements Proposal (the 14a-8 Proposal).

QUORUM

The presence at the 2024 Annual Meeting, virtually or represented by proxy, of the holders of more than one-half of the outstanding shares of the Fund entitled to vote, shall constitute a quorum. The shares that represent “broker non-votes” (i.e., shares held by brokers or nominees as to which (i) instructions have not been received from the beneficial owners or persons entitled to vote and (ii) the broker or nominee does not have discretionary voting power on a particular matter) will neither be counted as present for purposes of determining whether a quorum exists nor be entitled to vote at the 2024 Annual Meeting. The shares whose proxies reflect an abstention on any item will be counted as shares present and entitled to vote at the 2024 Annual Meeting for purposes of determining whether a quorum exists.

Any stockholder wishing to participate in the 2024 Annual Meeting by means of remote communication can do so, provided such stockholder registers for the 2024 Annual Meeting in advance. If you were a record holder of shares of Common Stock as of the close of business on the Record Date, you must register at https://viewproxy.com/UBSPuertoRico/broadridgevsm/ no later than 5:00 p.m. Atlantic Standard Time (5:00 p.m. Eastern Daylight Time) on April 16, 2024 to attend and vote at the 2024 Annual Meeting. Broadridge will then e-mail you the login information and instructions for attending and voting at the 2024 Annual Meeting. If you were a beneficial owner of shares of Common Stock as of the close of business on the Record Date, i.e., your shares were held for you by a broker, bank or other institution as of the close of business on the Record Date, please consult with your broker, bank or other institution on how to attend and vote at the 2024 Annual Meeting.

VOTES REQUIRED FOR APPROVAL

Election of Directors — The Fund has adopted a plurality vote standard for director elections, meaning the nominees receiving the highest number of affirmative votes will be elected as directors of the Fund at the 2024 Annual Meeting provided that a quorum is present (Proposal No. 1).

Director Accountability Proposal — Provided that a quorum has been established, this Proposal requires the affirmative vote of a majority of the Fund’s shares present virtually or represented by proxy at the 2024 Annual Meeting (Proposal No. 2).

Dispute Resolution Proposal — Provided that a quorum has been established, this Proposal requires the affirmative vote of a majority of the Fund’s shares present virtually or represented by proxy at the 2024 Annual Meeting (Proposal No. 3).

22

2022 Ocean Capital Nominee Confirmation Proposal — Provided that a quorum has been established, this Proposal requires the affirmative vote of a majority of the Fund’s shares present virtually or represented by proxy at the 2024 Annual Meeting (Proposal No. 4).

2022 Implementation Proposal — Provided that a quorum has been established, this Proposal requires the affirmative vote of a majority of the Fund’s shares present virtually or represented by proxy at the 2024 Annual Meeting (Proposal No. 5).

2023 Ocean Capital Nominee Confirmation Proposal — Provided that a quorum has been established, this Proposal requires the affirmative vote of a majority of the Fund’s shares present virtually or represented by proxy at the 2024 Annual Meeting (Proposal No. 6).

2023 Implementation Proposal — Provided that a quorum has been established, this Proposal requires the affirmative vote of a majority of the Fund’s shares present virtually or represented by proxy at the 2024 Annual Meeting (Proposal No. 7).

Bylaws Amendment Proposal — Provided that a quorum has been established, this Proposal requires the affirmative vote of a majority of the Fund’s shares present virtually or represented by proxy at the 2024 Annual Meeting (Proposal No. 8).

Quorum Threshold Reduction Proposal — Provided that a quorum has been established, this Proposal requires the affirmative vote of a majority of the Fund’s shares present virtually or represented by proxy at the 2024 Annual Meeting (Proposal No. 9).

Adjournment Power Proposal — Provided that a quorum has been established, this Proposal requires the affirmative vote of a majority of the Fund’s shares present virtually or represented by proxy at the 2024 Annual Meeting (Proposal No. 10).

Supermajority Amendment Proposal — Provided that a quorum has been established, this Proposal requires the affirmative vote of a majority of the Fund’s shares present virtually or represented by proxy at the 2024 Annual Meeting (Proposal No. 11).

Terminate UBS Agreements Proposal (the 14a-8 Proposal) — Provided that a quorum has been established at the 2024 Annual Meeting, this Proposal requires the affirmative vote of a majority of the outstanding voting securities of the Fund, meaning the affirmative vote of the lesser of (i) 67% or more of the Fund’s shares present at such meeting, if the holders of more than 50% of the outstanding shares are present or represented by proxy, or (ii) more than 50% of the outstanding shares of the Fund (Proposal No. 12).

None of the applicable Puerto Rico law, the Fund’s Certificate of Incorporation nor the Bylaws provide for appraisal or other similar rights for dissenting stockholders in connection with any of the Proposals set forth in this Proxy Statement. Accordingly, you will have no right to dissent and obtain payment for your shares in connection with such Proposals.

ABSTENTIONS; BROKER NON-VOTES

Abstentions will be treated as votes present at the 2024 Annual Meeting, but will not be treated as votes cast for Proposal No. 1. Abstentions, therefore, will have no effect on Proposal No. 1, but will have the effect of “against” votes on the remaining proposals. Broker non-votes will not be treated as votes present at the 2024 Annual Meeting and will not be treated as votes cast for any of Proposals Nos. 1 through 11. However, broker non-votes will have the same effect as votes against Proposal No. 12.

Because of the contested nature of the 2024 Annual Meeting, brokers holding shares of the Fund in “street name” for their customers will not be permitted by New York Stock Exchange (“NYSE”) rules to vote on any of the Proposals on behalf of their customers and beneficial owners in the absence of voting instructions from their customers and beneficial owners.

23

Additional information regarding when a “broker non-vote” occurs with respect to non-routine matters will be found in the Fund’s proxy statement. We urge you to instruct your broker or other nominee to vote your shares for the BLUE Proxy Card so that your votes may be counted.

Broker-dealers who are not members of the NYSE may be subject to other rules, which may or may not permit them to vote your shares without instruction. We urge you to provide instructions to your broker or nominee to vote your shares for the BLUE Proxy Card so that your votes may be counted.

REVOCATION OF PROXIES

Stockholders of the Fund may, but need not, revoke their proxies at any time prior to exercise by (i) attending the 2024 Annual Meeting and voting his or her shares of Common Stock virtually, (ii) signing, dating and returning a later dated BLUE Proxy Card or the Fund’s proxy card, (iii) submitting a proxy with new voting instructions using the internet or telephone voting system as indicated on the BLUE Proxy Card or the Fund’s proxy card or (iv) by submitting a letter of revocation. The delivery of a later-dated proxy card which is properly completed will constitute a revocation of any earlier proxy. The revocation may be delivered either to Ocean Capital in care of Morrow Sodali at the address set forth on the back cover of the Proxy Statement or to the Fund’s Secretary at American International Plaza, Tenth Floor, 250 Muñoz Rivera Avenue, San Juan, Puerto Rico 00918, or to any other address provided by the Fund. Although a revocation is effective if delivered to the Fund, Ocean Capital requests that either the original or photostatic copies of all revocations be mailed to Ocean Capital LLC, c/o Morrow Sodali LLC, 509 Madison Avenue, Suite 1206, New York, NY 10022, so that Ocean Capital will be aware of all revocations and can more accurately determine if and when proxies have been received from the holders of record on the Record Date of a majority of the outstanding shares. If you hold your shares in street name, please check your voting instruction card or contact your bank, broker or nominee for instructions on how to change or revoke your vote. Additionally, Morrow Sodali may use this information to contact stockholders who have revoked their proxies in order to solicit later-dated proxies for the election of the Nominees and approval of the other Proposals described herein.

SOLICITATION OF PROXIES

The solicitation of proxies pursuant to the Proxy Statement is being made by Ocean Capital. Proxies may be solicited by mail, facsimile, telephone, electronic mail, Internet, in person or by advertisements. The Participants will solicit proxies from individuals, brokers, banks, bank nominees and other institutional holders. Ocean Capital has requested banks, brokerage houses and other custodians, nominees and fiduciaries to forward all solicitation materials to the beneficial owners of the shares they hold of record. Ocean Capital will reimburse these record holders for their reasonable out-of-pocket expenses in so doing. It is anticipated that certain regular employees of Ocean Capital will also participate in the solicitation of proxies in support of the Nominee. Such employees will receive no additional compensation if they assist in the solicitation of proxies.