As filed with the U.S. Securities and Exchange Commission on July 31, 2024

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM F-1

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

LANNISTER MINING CORP.

(Exact name of Registrant as specified in its charter)

Not Applicable

(Translation of Registrant’s Name into English)

| Vancouver, British Columbia | | 1000 | | Not Applicable |

(State or other jurisdiction of

incorporation or organization) | | (Primary Standard Industrial

Classification Code Number) | | (I.R.S. Employer

Identification No.) |

1055 West Georgia Street, # Suite 1500

Vancouver, British Columbia V6E 4N7

778-788-2745

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

Cogency Global Inc.

122 East 42nd Street, 18th Floor

New York, NY 10168

(800) 221-0102

(Names, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Louis A. Bevilacqua, Esq. Bevilacqua PLLC 1050 Connecticut Avenue, NW, Suite 500 Washington, DC 20036 (202) 869-0888 | Barry I. Grossman Matthew Bernstein Justin Grossman Ellenoff Grossman & Schole LLP

1345 Avenue of the Americas, 11th Fl. New York, NY 10105 (212) 370-1300 |

Approximate date of commencement of proposed sale to public: As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☐

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement the same offering. ☐

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933.

Emerging growth company ☒

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting offers to buy these securities in any state where the offer or sale is not permitted.

| PRELIMINARY PROSPECTUS | | SUBJECT TO COMPLETION | | DATED JULY 31, 2024 |

Common Shares

LANNISTER MINING CORP.

This is the initial public offering of our common shares. We anticipate that the initial public offering price will be between US$ and US$ per share. We are offering common shares, assuming an initial public offering price of US$ per share (which is the midpoint of the estimated range of the initial public offering price).

Currently, no public market exists for our common shares. We plan to apply to list our common shares on the NYSE American under the symbol “DRIL”. We will not close this offering unless the NYSE American has approved our Common Shares for listing.

We are an “emerging growth company,” as that term is used in the Jumpstart Our Business Startups Act of 2012, and as such, have elected to comply with certain reduced public company reporting requirements for this prospectus and future filings. See “Prospectus Summary—Implications of Being an Emerging Growth Company.”

We are a “foreign private issuer” as defined under the U.S. federal securities laws and, as such, may elect to comply with certain reduced public company reporting requirements for this and future filings. See “Prospectus Summary—Implications of Being a Foreign Private Issuer.”

Investing in our common shares involves a high degree of risk. See “Risk Factors” beginning on page 29 of this prospectus for a discussion of information that should be considered in connection with an investment in our common shares.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| | | Per Share | | | Total | |

| Initial public offering price | | US$ | | | | US$ | | |

| Underwriting discounts and commissions(1) | | US$ | | | | US$ | | |

| Proceeds to us, before expenses | | US$ | | | | US$ | | |

| (1) | Underwriting discounts and commissions do not include a non-accountable expense allowance equal to 0.5% of the initial public offering price payable to the underwriters. We refer you to “Underwriting” beginning on page 114 for additional information regarding underwriters’ compensation. |

We have granted a 45 day option to the representative of the underwriters to purchase up to an additional common shares at the public offering price less the underwriting discount and commissions. If the representative of the underwriters exercises the option in full, the total underwriting discounts and commissions will be US$ and the additional proceeds to us, before expenses, from the over-allotment option exercise will be US$ .

The underwriters expect to deliver the common shares to purchasers on or about , 2024.

Kingswood Capital Partners, LLC

The date of this prospectus is , 2024

TABLE OF CONTENTS

You should rely only on the information contained in this prospectus or in any free writing prospectus we may authorize to be delivered or made available to you. Neither we, nor the underwriters have authorized anyone to provide you with different information. The information in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus, or any free writing prospectus, as the case may be, or any sale of common shares.

For investors outside the United States: Neither we, nor the underwriters have done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the common shares and the distribution of this prospectus outside the United States.

This prospectus includes statistical and other industry and market data that we obtained from industry publications and research, surveys and studies conducted by third parties. Industry publications and third-party research, surveys and studies generally indicate that their information has been obtained from sources believed to be reliable, although they do not guarantee the accuracy or completeness of such information. While we believe these industry publications and third-party research, surveys and studies are reliable, you are cautioned not to give undue weight to this information.

QUALIFIED PERSONS STATEMENT

Some technical mining information contained herein with respect to the Basin Gulch Property is derived from the report titled “S-K 1300 Technical Report: The Basin Gulch Property, Granite County, Montana, USA” prepared for us with an effective date of October 1, 2023. We refer to this report herein as our S-K 1300 Report. Each of Michael B. Dufresne, M.Sc., P. Geol., P.Geo. and Dean J. Besserer, B.Sc., P.Geo. have approved and verified the technical mining information related to the Basin Gulch Property contained in the S-K 1300 Report and reproduced in this prospectus.

GLOSSARY OF MINING TERMS

The following is a glossary of certain mining terms that may be used in this prospectus.

| Ag | Silver. |

| | |

| Assay | A metallurgical analysis used to determine the quantity (or grade) of various metals in a sample. |

| | |

| Au | Gold. |

| | |

| Claim | A mining right that grants a holder the exclusive right to search and develop any mineral substance within a given area. |

| | |

| CIM | The Canadian Institute of Mining, Metallurgy and Petroleum. |

| | |

| CIM Standards | The CIM Definition Standards on Mineral Resources and Mineral Reserves adopted by CIM Council from time to time. |

| | |

| Concentrate | A clean product recovered in flotation, which has been upgraded sufficiently for downstream processing or sale. |

| | |

| Core drilling | A specifically designed hollow drill, known as a core drill, is used to remove a cylinder of material from the drill hole, much like a hole saw. The material left inside the drill bit is referred to as the core. In mineral exploration, cores removed from the core drill may be several hundred to several thousand feet in length. |

| | |

| Cu | Copper. |

| | |

| Competent Person | A Competent Person is a minerals industry professional responsible for the preparation and/or signing off reports on exploration results and mineral resources and reserves estimates and who is accountable for the prepared reports. A Competent Person has a minimum of five years’ relevant experience in the style of mineralization or type of deposit under consideration and in the activity which that person is undertaking. A Competent Person must hold acceptable qualification titles as listed in all Reporting Codes and Reporting Standards (NRO Recognized Professional Organizations with enforceable disciplinary processes including the powers to suspend or expel a member) and thus is recognized by governments, stock exchanges, international entities and regulators. |

| | |

| Cut-off grade | When determining economically viable mineral reserves, the lowest grade of mineralized material that can be mined and processed at a profit. |

| | |

| Deposit | An informal term for an accumulation of mineralization or other valuable earth material of any origin. |

| | |

| Dyke | A long and relatively thin body of igneous rock that, while in the molten state, intruded a fissure in older rocks. |

| | |

| Exploration | Prospecting, sampling, mapping, diamond drilling and other work involved in searching for ore. |

| Flotation | A milling process in which valuable mineral particles are induced to become attached to bubbles and float as others sink. |

| | |

| Grade | Term used to indicate the concentration of an economically desirable mineral or element in its host rock as a function of its relative mass. With gold, this term may be expressed as grams per tonne (g/t) or ounces per tonne (opt). |

| | |

| Km | Kilometre(s). Equal to 0.62 miles. |

| | |

| Lithologic | The character of a rock formation, a rock formation having a particular set of characteristics. |

| | |

| M | Metre(s). Equal to 3.28 feet. |

| | |

| Mafic | Igneous rocks composed mostly of dark, iron- and magnesium-rich minerals. |

| | |

| Massive | Said of a mineral deposit, especially of sulfides, characterized by a great concentration of mineralization in one place, as opposed to a disseminated or vein-like deposit. |

| | |

| Metallurgy | The science and art of separating metals and metallic minerals from their ores by mechanical and chemical processes. |

| | |

| Mineral | A naturally occurring homogeneous substance having definite physical properties and chemical composition and, if formed under favorable conditions, a definite crystal form. |

| | |

| Mineral Deposit | A mass of naturally occurring mineral material, e.g. metal ores or nonmetallic minerals, usually of economic value, without regard to mode of origin. |

| | |

| Mineralization | A natural occurrence in rocks or soil of one or more yielding minerals or metals. |

| | |

| Mineral Project | The term “mineral project” means any exploration, development or production activity, including a royalty or similar interest in these activities, in respect of diamonds, natural solid inorganic material, or natural solid fossilized organic material including base, precious and rare metals, coal, and industrial minerals. |

| | |

| Mineral Reserve | The economically mineable part of a Measured and/or Indicated Mineral Resource. |

| | |

| Mineral Resource | A concentration or occurrence of diamonds, natural, solid, inorganic or fossilized organic material including base and precious metals, coal and industrial minerals in or on the Earth’s crust in such form and quantity and of such a grade or quality that it has reasonable prospects for economic extraction. |

| | |

| Mt | Metric tonne. Metric measurement of weight equivalent to 1,000 kilograms or 2,204.6 pounds. |

| | |

| NI 43-101 | National Instrument 43-101 is a national instrument for the Standards of Disclosure for Mineral Projects within Canada. The Instrument is a codified set of rules and guidelines for reporting and displaying information related to mineral properties owned by, or explored by, companies which report these results on stock exchanges within Canada. issuers that are subject to Canadian securities laws. This includes Canadian entities as well as foreign-owned mining entities who have securities that trade on stock exchanges or Over The Counter (OTC) markets overseen by the Canadian Securities Administrators (CSA), even if they only trade on Over The Counter (OTC) derivatives or other instrumented securities. |

| | |

| Ore | Mineralized material that can be extracted and processed at a profit. |

| Ounce | A measure of weight in gold and other precious metals, correctly troy ounces, which weigh 31.2 grams as distinct from an imperial ounce which weigh 28.4 grams. |

| | |

| Qualified Person | An individual who is an engineer or geoscientist with at least five years of experience in mineral exploration, mine development, production activities and project assessment, or any combination thereof, including experience relevant to the subject matter of the project or report and is a member in good standing of a self-regulating organization. |

| | |

| Reclamation | Restoration of mined land to original contour, use, or condition where possible. |

| | |

| Sedimentary | Said of rock formed at the Earth’s surface from solid particles, whether mineral or organic, which have been moved from their position of origin and re-deposited, or chemically precipitated. |

| | |

| Strike | The direction, or bearing from true north, of a vein or rock formation measure on a horizontal surface. |

| | |

| Tonne | A metric ton of 1,000 kilograms (2,205 pounds). |

| | |

| μm | Micrometer. |

| | |

| Zn | Zinc. |

PROSPECTUS SUMMARY

This summary highlights selected information contained elsewhere in this prospectus. This summary is not complete and does not contain all of the information that you should consider before deciding whether to invest in our common shares. You should carefully read the entire prospectus, including the risks associated with an investment in our company discussed in the “Risk Factors” section of this prospectus, before making an investment decision. Some of the statements in this prospectus are forward-looking statements. See the section titled “Special Note Regarding Forward-Looking Statements.”

In this prospectus, “we,” “us,” “our,” “our company,” “Lannister Mining,” “Lannister” and similar references refer to Lannister Mining Corp. and its consolidated subsidiaries.

Our Company

Our Mission

We are a private Montana based gold and silver developer focused on advancing the now consolidated, near surface, primarily oxide Basin Gulch Project (the “Property”, the “Basin Gulch Project” or the “Project”), the majority of which is on patented land.

Overview

We are a mineral exploration company focused on the exploration of the Property in west-central Montana (MT), U.S.A. The Project comprises 11 patented mining claims totaling 216.33 acres (87.55 hectares) and 131 unpatented mining claims totaling approximately 2,642 acres (1,069 hectares). The unpatented claims overlap the patented claims. The Project consists of 131 contiguous mineral claims (claim names: AG1 to AG50; AG13A; AG40A; AG39A; BG1 to BG78) covering 1060 hectares and is located approximately 27 kilometers from the town of Phillipsburg in Montana. We currently have a valid exploration license, a valid stormwater permit, and all the necessary exploration permits to conduct trenching, drilling, and other necessary exploration activities.

Our objective is to is to locate, define and ultimately develop economic mineral deposits. Currently, we are focused on the exploration and development of the Project. If we lose or abandon our interest in the Project, we will endeavor to acquire another mineral property of merit. All of our operations are at the exploration stage, and such activity might not result in commercial production of gold. Our net loss for the years ended September 30, 2023, and 2022 was C$(879,041) (approximately US$(649,458)) and C$(895,937), respectively. We have not generated any principal revenues to date and do not anticipate generating any principal revenue until the fourth quarter of 2026, at the earliest.

The Coming Commodity Supercycle and Growth in Demand

The gold industry encompasses a multifaceted ecosystem, spanning mining and refining, jewelry production, industrial applications, central bank reserves, and investments. Its demand is driven by a blend of emotional, cultural, and financial factors, and influenced by macroeconomic conditions, such as inflation and currency instability.

Gold continues to be a symbol of enduring value, with diverse uses, from jewelry to powering technology and acting as a go to investment in times of uncertainty, all of which make it a resilient and sought-after asset in the global market. The long-term investment appeal is supported by its relative scarcity and long lead time from exploration to production.

From our perspective, gold exhibits an inverse price relationship to the US dollar. Since the beginning of 2021 the US dollar has appreciated as demonstrated by the US dollar index. We believe that this strength will reverse course which, in our opinion, could support a higher price for gold. Additionally, we hold the view that the US dollar is slowly losing its dominant status as the world’s reserve currency standing. We term this ‘global de-dollarization’ and further supports our idea of a weakening the US dollar.

Increasing global tensions such as the ongoing conflict in the Middle East and fears that there could be further escalation of this crisis support the idea that there is a flight to safe assets such as gold given its history as a safe haven asset. In our opinion, this adds further support for a stronger gold price.

Our Corporate Strategy

Our strategy is centered around executing and increasing the value of our company’s asset base by further advancing the Basin Gulch Project. In the long term, we may explore attractive acquisition opportunities to further enhance the company’s value and drive the company’s growth potential through exploration and development.

Our executive team and board of directors possess extensive experience and expertise in the mining sector, spanning exploration, development, operations, and capital markets. We aim to leverage this wealth of expertise as we move forward with the Basin Gulch Project and expand our business. We are committed to adhering to best practices and prioritizing safety, environmental responsibility, and sustainable community development all in a responsible manner.

As part of our approach, we plan to employ a cost-effective business model. This entails maintaining an efficient, highly skilled team while collaborating with external resources when necessary. This approach ensures flexibility in our cost structure allowing scalability while maintaining the ability to explore new opportunities that are both fiscally prudent and value-driven.

Practical Steps

We plan to conduct exploration on the Project that follows recommendations made in the S-K 1300. The S-K 1300, outlines considerable work and includes metallurgy analysis, resource definition, engineering assessment and ore sorting optimization, amongst other studies. Initial work is focused drilling to validate a large database of historical information. The near-term drilling will also focus on areas near surface that have potential to establish maiden mineral resource estimate. Initial success from drilling will lead to a larger resource expansion program that could extend mineralization to depth and test new targets across the land packager.

During 2024 the drill program will establish a maiden gold-silver mineral resource estimate. The program will include metallurgical analysis to establish gold and silver recovery rates. Positive results from 2024 will enable a larger drill expansion program. 2025 will see an updated and larger Mineral Resource Estimate that will enable a Preliminary Economic Assessment (PEA). The PEA will establish the initial engineering and economics towards the path to production.

The Basin Gulch Property

The Property is located in west-central Montana, U.S.A. The Property is located approximately 17 miles (27 km) west of Philipsburg, Montana in Granite County and lies within the Rock Creek Mining District. The Property can be accessed by travelling west from Philipsburg for approximately 15 miles (24 km) on State Highway 438, continuing west along the Lower Rock Creek Road for 2 miles (3.2 Km) to an unimproved mine access road that heads up to Basin Gulch toward the south. Local access to most areas of the Property is via historical drill roads and logging roads (Figure 1).

The Project comprises 11 patented mining claims totaling 216.33 acres (87.55 hectares) and 131 unpatented mining claims totaling approximately 2,642 acres (1,069 hectares). The unpatented claims overlap the patented claims (Figure 2).

On September 15, 2020, 1247666 BC Ltd. (“1247666”) entered into a Property Acquisition Agreement with BG Holdings Group, LLC and Basin Gulch Co. (collectively, the “Vendors”). On September 21, 2021, 1247666 and Lannister Mining Corp. (“Former Lannister”) amalgamated to form a new entity, Lannister Mining Corp. (the “Company” or “Lannister”). Upon Amalgamation, the Company acquired the Property Acquisition Agreement. Pursuant to this Property Acquisition Agreement, Lannister agreed to acquire fifty-three (53) unpatented claims and to assume all rights and obligations under the existing lease agreement for eleven (11) patented mining claims. Concurrently, a Novation Agreement was executed amongst Skanderbeg, Lannister, 1247666 BC Ltd., and BG Holdings Group, LLC. The purpose of this Novation Agreement was to assign all rights and obligations under the original Property Acquisition Agreement to Lannister, and to effectuate a share exchange pursuant to the terms therein. Following the Property Acquisition Agreement, 60431 Montana Ltd. staked an additional seventy-eight (78) unpatented mining claims, totaling 131 unpatented mining claims from acquisition and staking. In accordance with the obligations set forth in the Property Acquisition Agreement, Lannister shall remit payment to the Vendors as follows:

| ● | One hundred fifty thousand United States Dollars ($150,000) upon execution of the Property Acquisition Agreement (this payment has been duly made); |

| ● | Two hundred fifty thousand United States Dollars ($250,000) on the first anniversary of the Property Acquisition Agreement (this payment has been duly made); |

| ● | Three hundred thousand United States Dollars ($300,000) on the second anniversary of the Agreement (this payment has been duly made); and |

| ● | Three hundred fifty thousand United States Dollars ($350,000) on or before the second anniversary of the Agreement (this payment has been duly made). |

In the event that Lannister is listed on a national stock exchange, Lannister shall be obligated to issue Vendors a number of shares constituting an aggregate of five percent (5%) of the total issued and outstanding shares of Lannister immediately subsequent to the completion of its public offering.

The patented claims are held under a lease agreement with Strategic Minerals, Inc. The agreement covers 11 patented claims (as described above) and was signed on April 6, 2006. A Memorandum of Lease was filed, by and between Metesh family and Lannister Mining, Corp., a British Columbia corporation, assignee and successor in interest to Strategic Minerals, Inc., a Nevada corporation, and Basin Gulch Co., a Florida Company, dated March 3rd, 2022, and recorded March 7th, 2022 in the official records of Granite County, MT. The lease is valid for 10 years.

The Metesh family holds an advance production royalty over the patented claims of US$25,000 paid every 6 months (March 10 and September 10) to be paid until production commences. The Metesh family retains a production royalty of 3% of gross gold and silver sales due semi-annually once commercial production has commenced. The total sum of payments, whether advance production royalty or production royalties to be paid to the Metesh family shall not exceed US$8 million dollars.

As per the Property acquisition agreement there is a 2% royalty on claims outside the Metesh Lease. Lannister can purchase half of the 2% royalty for $1 million dollars (USD) until December 31, 2025.

The Company currently holds a valid exploration license (License #00875) to conduct drilling and trenching within the patented mining claims. As part of this license a reclamation bond of $219,181 was submitted to the DEQ on December 16, 2022. While the bond is in place the exploration license can be renewed annually for US$25 which has been completed for 2024.

State mining regulation apply to both private (patented) and public (unpatented) lands in Montana. An Exploration License is required to complete all mineral exploration activities that may involve surface or subsurface disturbance. To acquire an exploration license we must submit a plan of operations including the area to be explored, location and type of planned exploration activities (i.e. drill holes, trenches) and a disturbance reclamation plan. An Exploration License is not a mining permit and cannot be used for mining. There are no defined review times but typically approvals are processed within 30-45 days.

Additionally, a stormwater permit, along with a stormwater pollution prevention plan, a temporary water use permit and a Notice of Intent (NOI) are required. The Company currently has a stormwater permit (Permit#MTR100000) which is valid until 2027 by paying an annual fee of US$750 which has been paid for 2024.

For small scale mining and test mining operations a Small Miner’s Exclusion Statement (SMES) can be obtained. The SMES process is much faster and simpler than the permitting process for an Operating Permit which is required for larger mines in Montana. The SMES allows for ≤ 5 acres of disturbance at up to 2 sites if they are ≥ 1mile apart. A SMES can be obtained within months of filing of an application.

Our Opportunity

The town of Philipsburg, MT is located approximately 17 miles (27 km) by road east of the Basin Gulch Property. It has a population of ~1,000 according to 2008 United States Census data. Philipsburg is a mining and tourist town and is the county seat of Granite County. Services available at Philipsburg include housing, hotels, food and restaurants, hospital and a non-commercial airfield. The nearest major city is Butte, MT located 70 miles (110 km) southeast of the Property and 54 miles (87 km) southeast of Philipsburg. The closest full-service community is Anaconda, Montana, located 47 miles (75 km) southeast of the Property along State Highway 1. The nearest commercial domestic airport is located in Butte, MT. An international airport is located 90 miles (145 km) away in Missoula, Montana. Highway truck transport services are available in Philipsburg. No rail service is available to Philipsburg (Figures 1 and 2).

No public power or phone service or other mining infrastructure is available at the Property. Radio and cell phone communications and a diesel generator have been used during previous field seasons. Sufficient water for exploration is available from Basin Gulch, Rock Creek and other local creeks draining the Property. There is very good access to the property for exploration work. The Project can be accessed year-round. Most exploration activities associated with fieldwork and drilling can likely be conducted year-round, although there may be periods in December to March, where snow conditions at the higher elevations may temporarily impede fieldwork.

Figure 1. Location

Figure 2. Basin Gulch Claims and Patents

The Property is located at the head of Basin Gulch and Quartz Gulch, on the northern slopes of West Fork Buttes, within the Sapphire Range of the Western Montana Rocky Mountains. This area is underlain by a series of metamorphosed Precambrian (1.5 Ga to 800 Ma) marine sedimentary rocks known as the Belt Supergroup which were intruded by Laramide-age silicic volcanics. In this area the late Cretaceous to early Tertiary Laramide orogeny resulted in the formation of the Sapphire Mountain Range. In the area of Basin Gulch, the Tertiary igneous rocks are predominantly biotite-rich rhyolites and trachytes, ash flow tuffs, and associated granites of Eocene age (~50 Ma).

Several diatreme complexes located within the igneous complex have been identified at the head of Basin Gulch. The major diatreme complex on the Property is known as the Basin Gulch or BG diatreme. Several, smaller parasitic diatremes are found throughout the Property and in the surrounding area. The BG diatreme can be described as an Eocene silicic volcanic and intrusive complex that intruded between the plates of two Precambrian thrust sheets. The gold mineralization on the Property is directly related to the diatremes and their associated structures which form the main gold target in the area.

Gold mineralization has been identified throughout the Property at or near surface in rock samples, outcrops and trenches. Drilling has confirmed that the mineralization extends to depths greater than 1,000 feet (300 m) and averages approximately 0.01 to 0.02 ounces per ton (opt). Locally higher grade zones have been identified associated with the margins of the various diatremes and with the post- and pre-diatreme dykes and faults. Interpretation of a CSAMT geophysical survey modelled the diatreme complex to extend to below the geophysical study datum of 1,500 feet (450 m). The majority of historical drilling completed on the Property has been relatively shallow and has not intersected the base of the diatreme.

Basin Gulch is interpreted to be a gold and silver intrusion related, diatreme-type deposit that is associated with, and constrained by, the structures surrounding the local diatremes. The mineralized zones are hosted in breccias associated with fracture zones found at the margins of the diatremes. The mineralization is fairly simple, with the gold varying from fine to very coarse. Test work conducted by Kappes, Cassiday & Associates on behalf of Cable Mountain Mine Inc. (CMM) in the 1990’s indicated that the gold is easily extracted using cyanidation or other gold extraction reagents. A leach recovery rate exceeding 90 percent was reported for some samples. However, due to the prohibition of open pit cyanide leach mining in Montana an alternative processing and extraction method will need to be investigated.

Historical Exploration

The Basin Gulch Project lies within the Rock Creek Mining District. The Rock Creek area is best known for it’s sapphire production. However, gold has historically been placer mined in the Basin/Quartz Gulch area since the early 1900’s. The source of the placer gold was unknown. Gold mining was intermittent with production reported in 1911, 1914 to 1928, 1934 sand 1940. Historical reports indicate that production from Basin Gulch was modest, production being impeded by a lack of water impeded. In 1948, Lynch (1948) suggested that the gold was sourced from the intrusive volcanic rocks exposed near the headwaters of Basin Creek. Sapphires have also been reportedly recovered from the placer operations in Basin Gulch (Frishman, 1992). Historical workings including excavations, mine ponds, remains of log cabins and out buildings, log and dirt dams, and hydraulic diversion structures are still found on the Property.

Modern exploration was conducted over the Property area between 1987 and 1997. In 1987, Cable Mountain Mine Inc. (CMM) discovered a large, mineralized diatreme complex in the upper drainage of the Basin Gulch which was interpreted to be the lode source of the placer gold. The area was extensively explored until 1997 resulting in the completion of 318 reverse circulation (RC) and diamond drill holes totaling over 110,000 feet (33,530 m) (Table 1.), 46 trenches totaling over 15,000 feet (4,570 m), two geophysical surveys, a soil geochemistry survey, topographic surveys, geological mapping and pre-development studies. From 1997 to 2017 the Property changed ownership several times; only desktop studies including data compilation and verification and modelling were completed during this period. The authors have reviewed and accepted the historical results as disclosed herein.

Table 1. Historical Drill hole summary

| | | | | | Total Drill Holes | |

| Company | | | Year | | | | RC | | | | DDH | | | | RC with Core tail | |

| CMM | | | 1987 | | | | 2 | | | | | | | | | |

| Chevron | | | 1989 | | | | 11 | | | | | | | | | |

| Cyprus | | | 1992 | | | | 5 | | | | | | | | | |

| CMM | | | 1993 | | | | 14 | | | | 2 | | | | 2 | |

| CMM | | | 1994 | | | | 68 | | | | 2 | | | | 1 | |

| CMM | | | 1995 | | | | 117 | | | | | | | | | |

| CMM | | | 1996 | | | | 50 | | | | | | | | | |

| CMM | | | 1997 | | | | 52 | | | | 3 | | | | | |

| Total | | | | | | | 319 | | | | 7 | | | | 3 | |

In 1987, Rauno Perttu of CMM recognized the lode potential of the Basin Gulch area and acquired the patented claims. A large block of unpatented claims in the surrounding area was additionally staked. Two shallow holes (BG-1 and BG-2) were drilled near the upper part of the Basin Gulch drainage near the central area of the current Property. The holes targeted a suspected diatreme. Hole BG-1 was too shallow and did not intersect the diatreme. Hole BG-2 was drilled on the southwest margin of the diatreme and intersected significant shallow ore-grade gold and silver mineralization (Perttu, 2009).

The project was subsequently farmed out to Chevron Resources. Chevron’s work was clustered around, and downhill of, the discovery hole BG-2. Chevron’s exploration program included a soil geochemistry survey, 11 shallow RC holes and 13 shallow trenches. The geochemistry survey covered the area over and surrounding the placer mining. Several strong soil anomalies were identified across the soil survey including in the area of hole BG-2. Some of the soil anomalies extended beyond the boundary of the survey. The drill holes were completed in the area of hole BG-2 along what Chevron interpreted to be a mineralized high angle structure. Six of the 11 holes intersected shallow ore-grade mineralization. The remaining 5 holes did not intersect mineralization and were interpreted to be too shallow. From the trench sampling program broad zones of silver and gold mineralization were intersected in several of the trenches. The property was subsequently sold to Cyprus.

Cyprus completed an exploration program in late 1992 that included six (6) trenches and five (5) drill holes. Five (5) of the trenches were excavated in the Basin Gulch area and encountered broad zones of mineralization. However, Cyprus’s program was largely focused on a small area in Cornish Gulch located ~1.3 km (4,500 ft) northeast of the earlier drilling. The longest trench and all 5 drill holes targeted mineralization in the middle and lower hillside of ridge on the west side of Cornish Gulch near the eastern margin of the current unpatented claims. This area contained anomalous mineralization in outcrop within altered shallow rhyolitic igneous rocks. The mineralization appeared to dip gently into the hillside and did not extend to the bottom of the hill. Cyprus interpreted the mineralization to be controlled by a high-angle structure and along with the steep topographical constraints in this area drilled on the lower flank of the hill below the mineralization. Three of the five drill holes intersected anomalous mineralization. Vertical hole 92BG-C2, bottomed out at 350 feet (107 m) in continuous gold mineralization. The trench was located along the road below the hillside and largely contained colluvium. Anomalous gold mineralization was intersected over an interval of 160 feet (50 m).

Cyprus dropped the project due a corporate decision and CMM regained control of the Project in 1993.

CMM conducted exploration programs on the project from 1993 to 1997 including drilling, trench sampling, and ground geophysics. The work completed by CMM identified significant gold and silver mineralization associated with the main BG diatreme complex located at the head of Basin Gulch. Float and outcrops containing anomalous mineralization were also identified across the Property (Figures 3 and 4).

Between 1993 and 1997 CMM drilled 312 holes totaling approximately 105,000 feet (32,000 m) over the entire property, all of these holes lie within the confines of the current Property (Figures 3 and 4). The majority of holes were drilled vertically using RC rigs; 8 diamond drill holes and 4 RC holes with core tails were completed. The majority of holes (87%) were shallow with total depths less than 500 ft. The deepest hole reached a total depth of 1,045 feet (320 m) and ended in mineralization. Additionally, 27 trenches were completed most of which were located over the main mineralized zone (Figures 3 and 4).

The results from the drilling and trench sampling programs indicated that the diatreme complex measured approximately 2,600 feet by 3,300 feet (800 by 1000 m) on the surface, and appeared to be related to other mineralized occurrences in the local area. The diatreme complex was characterized by overall low-grade gold and silver mineralization and local high-grade mineralization. Widely scattered areas of the intrusive contained base levels of gold averaging between 0.01 to 0.02 opt. Numerous holes returned anomalous results with both wide modest grade intercepts and narrower high grade intercepts (Table 2). As demonstrated by holes: BG94-05RC intersected 0.096 opt Au (3.276 g/t) over 240 feet (73 m) including a zone of 125 feet (38 m) which averaged 0.146 opt Au (4.996 g/t). Core hole (BG94-05blD) which was completed at the same location and returned comparable assays over similar intervals: 0.119 opt Au (4.064 g/t) over 197 feet (60 m) including a zone of 77 feet (23 m) at 0.279 opt Au (9.549 g/t). Other wide intercepts included hole 595-073RC with an intersection 180 feet (55 m) with an average grade of 0.029 opt (0.992 g/t) including 110 feet averaging 0.043 opt (1.471 g/t) Au; hole BG95-91RC with an intersection 370 feet (112 m) with and average grade of 0.034 opt (1.181 g/t) Au with a subsequent intersection of 100 feet (30 m) with an average grade of 0.067 opt (2.287 g/t) Au; BG94-01RC with an intersection 240 feet (73 m) averaging 0.096 opt (3.276 g/t) including 125 feet (38 m) averaging 0.0146 opt (4.996 g/t) Au.

Table 2. CMM Historical Assay Highlights from Drilling.

| Hole ID | | From (ft) | | | To (ft) | | | Width (ft) | | | Au (opt) | | | Ag (opt) | | | Au (g/t) | | | Ag (g/t) | |

| BG93-08RC | | | 0 | | | | 110 | | | | 110 | | | | 0.048 | | | | 0.651 | | | | 1.641 | | | | 22.323 | |

| including | | | 0 | | | | 70 | | | | 70 | | | | 0.063 | | | | 0.694 | | | | 2.162 | | | | 23.793 | |

| BG93-14RC | | | 0 | | | | 80 | | | | 80 | | | | 0.026 | | | | 0.661 | | | | 0.891 | | | | 22.675 | |

| BG94-01RC | | | 10 | | | | 250 | | | | 240 | | | | 0.096 | | | | 0.789 | | | | 3.276 | | | | 27.036 | |

| including | | | 100 | | | | 225 | | | | 125 | | | | 0.146 | | | | 0.486 | | | | 4.996 | | | | 16.677 | |

| BG94-05RC | | | 10 | | | | 250 | | | | 240 | | | | 0.096 | | | | 0.789 | | | | 3.276 | | | | 27.036 | |

| including | | | 100 | | | | 225 | | | | 125 | | | | 0.146 | | | | 0.486 | | | | 4.996 | | | | 16.677 | |

| BG94-05blD | | | 25.3 | | | | 221.9 | | | | 197.6 | | | | 0.119 | | | | 0.882 | | | | 4.064 | | | | 30.251 | |

| including | | | 130.5 | | | | 207 | | | | 76.5 | | | | 0.279 | | | | 0.867 | | | | 9.549 | | | | 29.722 | |

| BG94-12RC | | | 60 | | | | 145 | | | | 85 | | | | 0.052 | | | | 2.721 | | | | 1.771 | | | | 93.297 | |

| BG94-15RC | | | 205 | | | | 310 | | | | 105 | | | | 0.053 | | | | 0.359 | | | | 1.809 | | | | 12.31 | |

| including | | | 220 | | | | 290 | | | | 70 | | | | 0.068 | | | | 0.337 | | | | 2.346 | | | | 11.559 | |

| BG94-33RC | | | 40 | | | | 195 | | | | 155 | | | | 0.022 | | | | 0.316 | | | | 0.765 | | | | 10.839 | |

| BG94-36RC | | | 195 | | | | 275 | | | | 80 | | | | 0.02 | | | | 0.313 | | | | 0.677 | | | | 10.714 | |

| BG94-55RC | | | 70 | | | | 235 | | | | 165 | | | | 0.024 | | | | 0.241 | | | | 0.806 | | | | 8.268 | |

| BG94-56RC | | | 30 | | | | 165 | | | | 135 | | | | 0.016 | | | | 0.419 | | | | 0.556 | | | | 14.349 | |

| BG95-003RC | | | 70 | | | | 150 | | | | 80 | | | | 0.028 | | | | 0.161 | | | | 0.96 | | | | 5.529 | |

| BG95-004RC | | | 50 | | | | 215 | | | | 165 | | | | 0.027 | | | | 0.204 | | | | 0.933 | | | | 6.992 | |

| BG95-008RC | | | 65 | | | | 300 | | | | 235 | | | | 0.089 | | | | 0.3 | | | | 3.052 | | | | 10.286 | |

| including | | | 125 | | | | 295 | | | | 170 | | | | 0.114 | | | | 0.319 | | | | 3.923 | | | | 10.951 | |

| BG95-010RC | | | 185 | | | | 270 | | | | 85 | | | | 0.035 | | | | 0.186 | | | | 1.202 | | | | 6.373 | |

| including | | | 205 | | | | 270 | | | | 65 | | | | 0.04 | | | | 0.198 | | | | 1.361 | | | | 6.804 | |

| BG95-034RC | | | 70 | | | | 180 | | | | 110 | | | | 0.039 | | | | 0.416 | | | | 1.322 | | | | 14.275 | |

| BG95-036RC | | | 160 | | | | 240 | | | | 80 | | | | 0.033 | | | | 0.158 | | | | 1.136 | | | | 5.4 | |

| BG95-037RC | | | 215 | | | | 295 | | | | 80 | | | | 0.031 | | | | 0.321 | | | | 1.071 | | | | 11.014 | |

| including | | | 225 | | | | 280 | | | | 55 | | | | 0.037 | | | | 0.395 | | | | 1.284 | | | | 13.527 | |

| BG95-062RC | | | 130 | | | | 320 | | | | 190 | | | | 0.036 | | | | 0.237 | | | | 1.22 | | | | 8.12 | |

| BG95-067RC | | | 140 | | | | 235 | | | | 95 | | | | 0.044 | | | | 0.2 | | | | 1.523 | | | | 6.857 | |

| BG95-073RC | | | 195 | | | | 375 | | | | 180 | | | | 0.029 | | | | 0.323 | | | | 0.992 | | | | 11.086 | |

| and | | | 415 | | | | 525 | | | | 110 | | | | 0.043 | | | | 0.235 | | | | 1.471 | | | | 8.042 | |

| BG95-084RC | | | 50 | | | | 150 | | | | 100 | | | | 0.022 | | | | 0.079 | | | | 0.744 | | | | 2.709 | |

| BG95-086RC | | | 315 | | | | 420 | | | | 105 | | | | 0.029 | | | | 0.143 | | | | 0.98 | | | | 4.898 | |

| BG95-091RC | | | 35 | | | | 405 | | | | 370 | | | | 0.034 | | | | 0.302 | | | | 1.181 | | | | 10.36 | |

| and | | | 425 | | | | 525 | | | | 100 | | | | 0.067 | | | | 0.447 | | | | 2.287 | | | | 15.326 | |

| BG96-001RC | | | 170 | | | | 245 | | | | 75 | | | | 0.021 | | | | 0.197 | | | | 0.731 | | | | 6.766 | |

| BG96-015RC | | | 380 | | | | 460 | | | | 80 | | | | 0.017 | | | | 0.171 | | | | 0.574 | | | | 5.871 | |

| BG97-24RC | | | 0 | | | | 130 | | | | 130 | | | | 0.081 | | | | 0.376 | | | | 2.767 | | | | 12.897 | |

| including | | | 0 | | | | 60 | | | | 60 | | | | 0.108 | | | | 0.455 | | | | 3.709 | | | | 15.6 | |

| FS97-04cRC | | | 110 | | | | 210 | | | | 100 | | | | 0.068 | | | | 0.286 | | | | 2.338 | | | | 9.806 | |

Figure 3. Historical Drilling on the Basin Gulch Property.

Figure 4. Historical Trench Locations on the Basin Gulch Property

Nearby shallow much smaller diatreme zones appear to be adjacent outliers to the main diatreme complex. These outliers are associated with an inferred controlling fault zone that may also be an important control for the main diatreme and for some of the inferred veins. Two of these smaller adjacent diatremes appear to contain near-surface “boiling zones”, and contain high-grade gold and silver mineralization. CMM also reported that anomalous mineralization occurred along structural zones projecting potentially several miles outward from the Basin Gulch mineralized area.

Surface sampling indicated that the mineralization extends across an area of at least 8,000 feet by 14,000 feet (2,400 by 4,300 m) encompassing an area of approximately 2,600 acres (1,052 hectares). Outside of this area of mineralization, geochemical anomalies associated with favorably altered, shattered quartzites and igneous rocks indicated the potential area of mineralization may extend to cover approximately 4,500 acres (1,821 hectares; Perrtu, 1997).

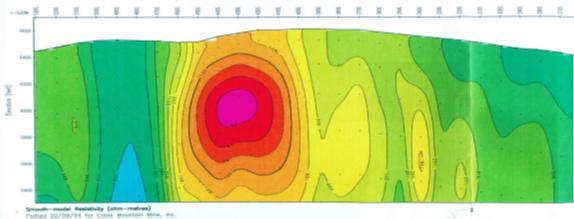

Two geophysical surveys were completed by CMM in 1993 and 1994.

In 1993 a VLF (Very Low Frequency) survey was completed by W.I. Van der Poel of Missoula, MT. This report or data were not available for inspection however, DBA, 2009 and Perttu, 2017 report that the results of the survey were confusing. The general geologic interpretation reported by the geophysicist was somewhat consistent with the local geologic mapping however the lack of detail provided with the interpretation made the survey data un-useable. There is no record of the location of the VLF lines negating the possibility of re-interpretation or correlation with the geology.

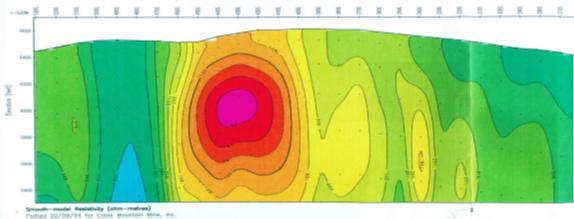

In July 1994, Zonge Engineering and Research of Tucson, AZ was contracted to complete a series of Controlled Source Audiofrequency Magnetotelluric (CSAMT) geophysical survey lines across the top of the mineralized zone. These lines clearly delineate the location of the highly conductive diatreme (Figure 5). The survey was completed along seven (7) lines that were located on or near the Basin Gulch Diatreme. A total of 214 stations were read at frequencies from 8,192 Hz to 2 Hz. The interpretation of the CSAMT data included a correlation to the geology of the area (Zonge, 1994).

The CSAMT data indicated that the highly conductive and altered portions of the diatreme extend to the depth of the survey, approximately 1,500 feet (450 m) below the surface. This was interpreted to indicate that the breccia pipe extends well past 1,500 feet (450 m) depth with a consistent electrical signature.

The CSAMT geophysical survey may have traced the location of the main cross-fault.

The geophysics shows a paired high-conductivity zone, which crosses the diatreme surface expression from northeast to southwest. The high-conductivity zone may be offset by a younger, northwest-trending right-lateral, strike-slip fault, which appears to have post-diatreme movement. This younger fault follows the Basin Gulch drainage, and is suggested by a possible offset of the two parallel high-conductivity zones in the geophysical data, by possible similar sense surface offsets of the diatreme, and by post-diatreme faulting seen in core hole BG94-37C, at the projection of the proposed fault. Morphologic and lithologic changes across the projection of the proposed fault are consistent with this interpretation. The fault appears to post-date diatreme emplacement but pre-date mineralization (Perttu, 1997).

Figure 5. Portion of Line BL-4 showing a representative section through the diatreme as imaged by CSAMT.

Additionally various CSAMT cross-sections indicate the presence of small parasitic diatremes that emanate from the main eruptive center and appear to be connected at depth. These small diatremes are consistent with small features that have been mapped at the surface.

Zonge summarized the results of the survey as follows (Zonge, 1994):”… On all lines, the area outlined as the diatreme on the surface geology map is seen to be conductive on the northern two-thirds of the diatreme, and more resistive on the southern portion. The conductive zone is bounded by a strong narrow resistor.”

The mapped southern boundary of the diatreme on lines BL-1, BL-2, and BL-4 is associated with a weak, locally resistive zone in the CSAMT data. Lines BL-3 and BL-5 do not cross the southern boundary of the diatreme. The northern boundary of the diatreme is less well-defined in the CSAMT data; the change in resistivity to the north is more gradual, and is associated primarily with deep changes in resistivity. These deeper changes, best seen on Plate 8, form a “bench” near the northern limit of the diatreme.

On the lines that crossed it, the contact between the Tertiary intrusive (on the north) and the Missoula Group (on the south) is associated with a locally resistive zone. This contact does not show as much resistivity contrast as the contact described above within the diatreme.

In general, Line BL-4 (Plate 7) shows the best overall picture of the subsurface electrical resistivity structure at this site; a large low resistivity zone, extending from station 0 to station 1700, bounded sharply on the south and more gradually on the north. A large resistive zone extends from station 1700 to the south, and a very steep dip to the north is indicated.

Near the southern end of Line BL-4, a strong low resistivity zone is seen from approximately station 4000 to 4600. This conductive anomaly is bounded on the south by a narrow resistive feature, similar to the resistive-conductive contact within the diatreme itself. This conductive zone apparently does not extend far enough west to be detected on Line BL-2.

It is very important to note that static effects (from very near-surface features) and high contact resistance definitely influenced the data on this project. These effects also provide information, however, and the interpretation has been made on the basis of both raw Cagniard resistivity and static-corrected resistivity. The raw data provide surface and very near-surface information, while the static-corrected data de-emphasize shallow features in order to delineate deeper resistivity structures…”

In 1996, Kinross became interested in acquiring the property from CMM. Kinross completed a review of the project in 1996-1997 which included re-logging of the available core holes and over 200 RC holes, re-assaying 275 sample intervals and metallurgical testing. The re-assay samples were sent to American Assay Labs, Sparks (NV). Results confirmed the original assays reported by CMM. The re-logging confirmed that mineralization was ubiquitous in all rocks with no one rock type having preferential mineralization. Higher grade mineralization was found to be associated with the marginal areas and edges of the intrusive volcanics (Kinross, 1997; Perttu, 1997). The sale of the property was never competed due to the passing of Citizens Initiative Cl-137 in 1998 and a coincidental drop in gold prices. Citizens Initiative Cl-137 banned cyanide leach processing from open pit gold operations in Montana and was effectively seen by most mining companies as a moratorium on large-scale open-pit gold mining in the State. Shortly thereafter, in 1997, CMM ceased its activities and terminated its lease on the Metesh property. Between 1997 and 2006 the Metesh property remained dormant. The authors have reviewed and accepted the historical results as disclosed herein.

Exploration Conducted by Lannister

In 2021 Lannister conducted an exploration program on the Basin Gulch Property. The exploration work included the reconnaissance of historical trenches and drill holes, the collection of 126 rock samples and 1,562 soil samples, along with a ground geophysical survey.

The reconnaissance work and sampling program was completed between May 30 and July 5, 2021. During the reconnaissance program the crew was tasked with trying to locate and identify historical trenches that were ortho-rectified from historical maps. The majority of the historical trenches on the Property have been reclaimed so they were difficult to locate. Only 2 instances of trenches that match historical records were identified in the field. However, 47 additional trenches were identified in the field that were not on the historical maps as well as 41 small sample pits scattered throughout the Property (Figure 4). The majority of the newly identified trenches are located with the main diatreme complex northeast of the previously orthorectified historical workings.

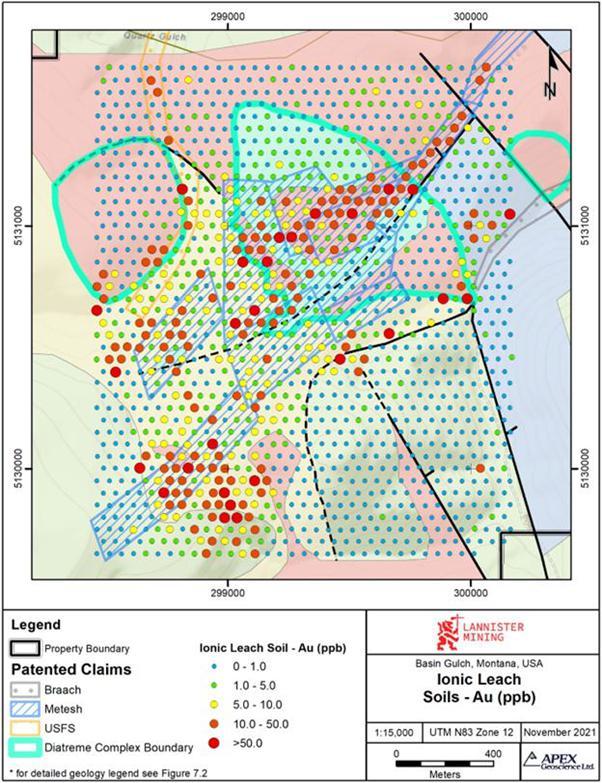

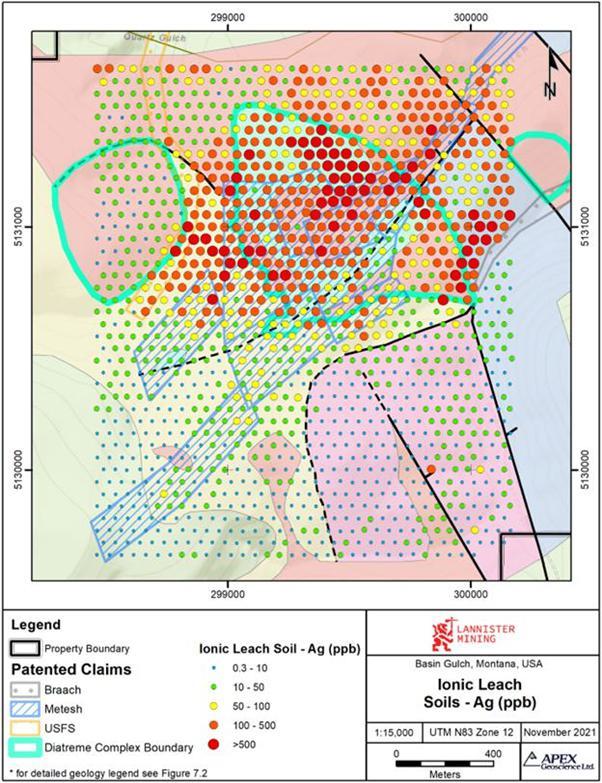

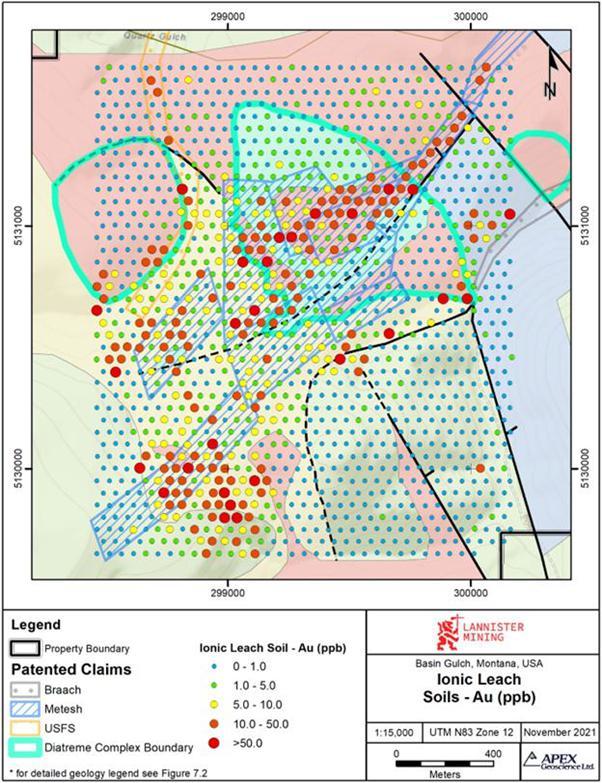

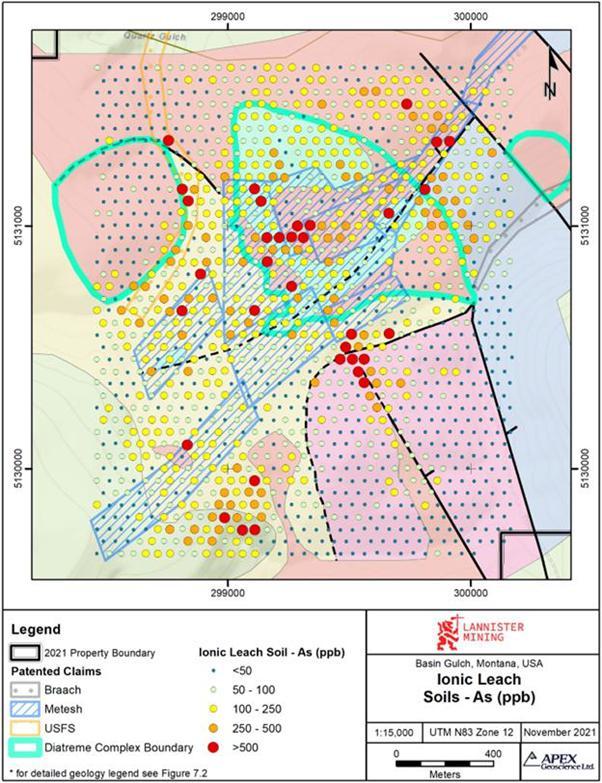

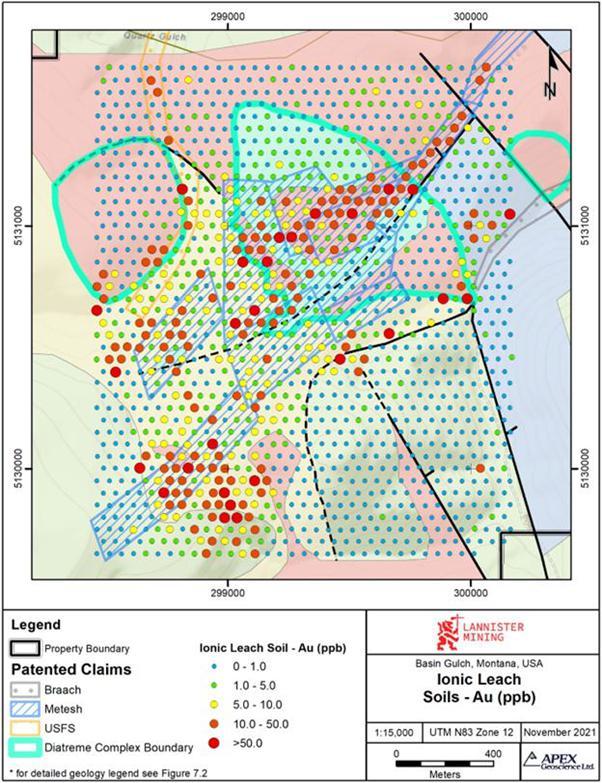

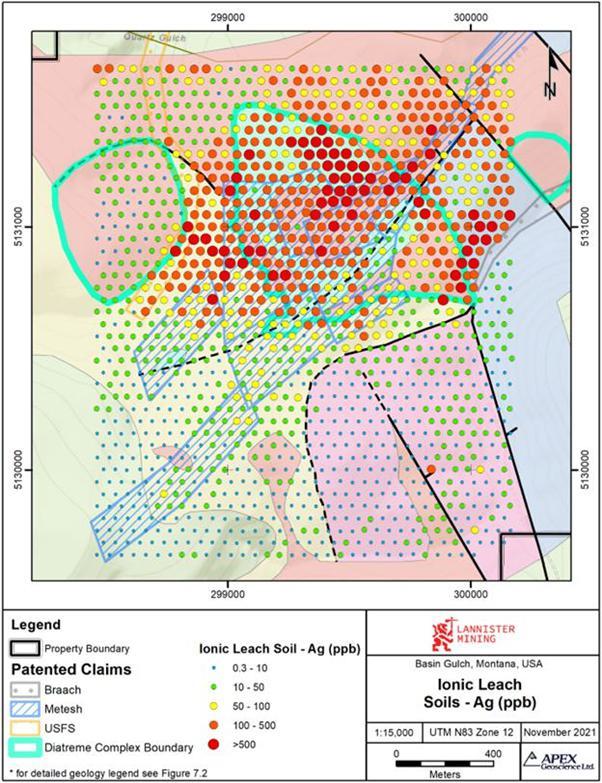

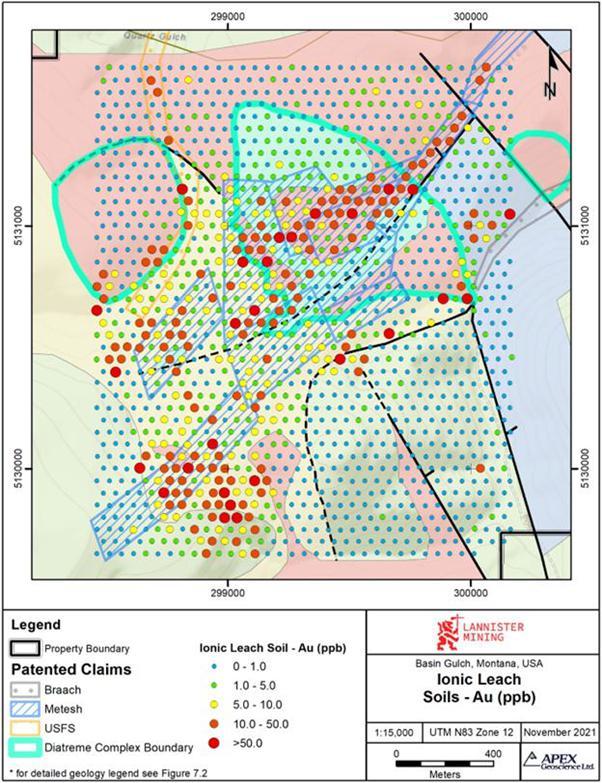

In the summer of 2021, soil samples were collected on a grid centered over the patented claims but extending onto the BLM mineral claims. The soil grid covered an area of 1.7 km by 2.0 km covering the BG diatreme complex and extending southwards. A total of 1,247 soil samples were collected including 65 duplicates. The samples were analysed for 61 elements using the ultra-sensitive Ionic Leach method at ALS Global, Vancouver, BC, Canada (ALS). The ionic leach technique is designed to detect and define subtle, low level anomalies and is very useful where conventional geochemical techniques may be ineffective due to the presence of overburden deposits. Ionic leach sampling identifies geochemical anomalies that are typically weak but the anomalies are in sharp contrast to background values. Additionally anomalies identified by ionic leach sampling tend to be spatially coherent indicating that the anomaly is related to a bedrock signature rather than overburden noise.

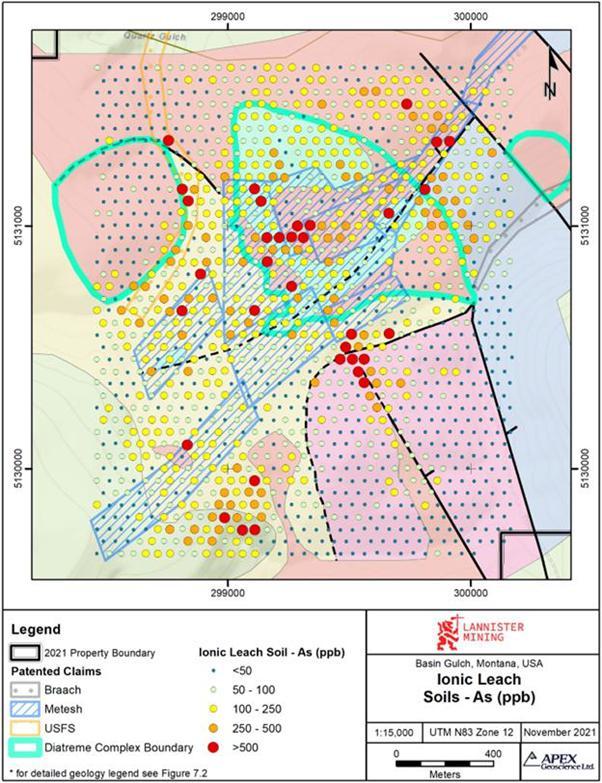

The results of the 2021 soil sampling program show an anomalous response in Au and Ag related to the BG diatreme and edge of the diatreme (Figures 6 and 7). Further work is needed to assess the relationship between the anomalous Au responses and the historical ground disturbance in this area. Preliminary PCR (Principal Component Regression) analysis of the data did not identify any strong positive correlations between Au or Ag and other pathfinder elements. A general association between anomalous Au and low Ca was observed which may indicate a correlation between anomalous gold and decalcified areas. A correlation between anomalous gold and high As and Sb results is evident within the diatreme. Detailed interpretation of the soil sampling results should be completed.

Additional anomalies were also identified by the soil sampling program (Figures 8 and 9). A coherent Au and As anomaly is located approximately 500 m south of the BG diatreme in an area that was the focus of historical drilling and trenching. The anomaly measures approximately 500 m by 500 m. Smaller gold anomalies are also evident to the southwest and southeast of the BG diatreme.

Figure 6. Ionic Leach soil sample results – Au (ppb)

Figure 7. Ionic Leach soil sample results – Ag (ppb)

Figure 8. Ionic Leach soil sample results – As (ppb)

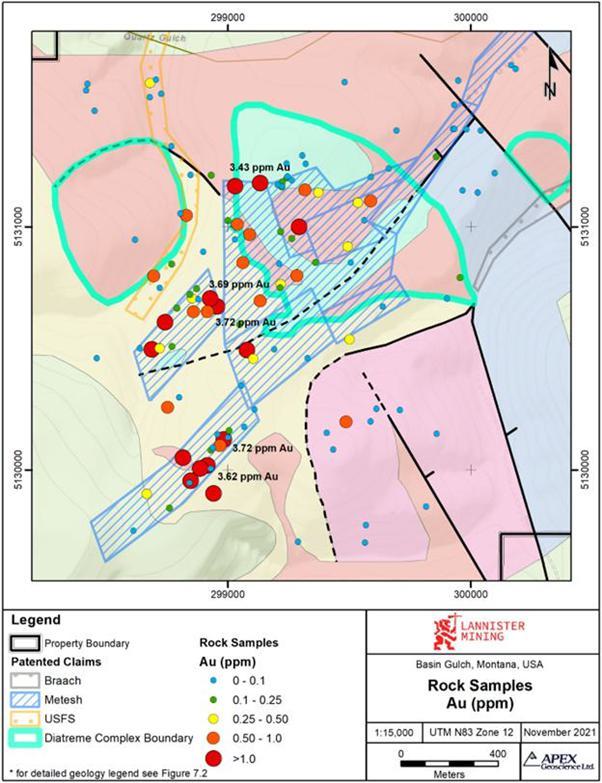

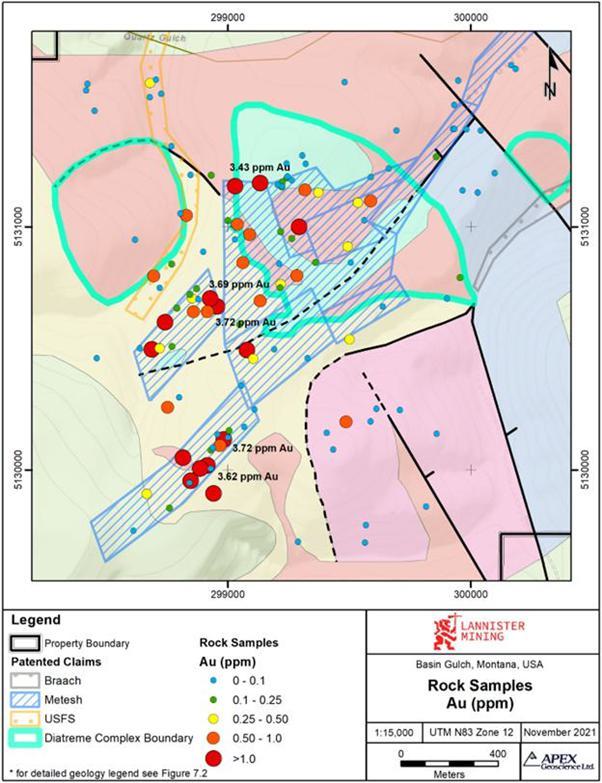

Rock samples were collected during the soil program. Rock samples were collected from float samples, outcrop exposures and historical trenches across the soil grid area. A total of 126 rock samples including 3 duplicates were collected. Anomalous gold assays were recovered across the Property associated with the historical workings in and around the BG diatreme and other historically active areas including the anomalous areas identified by the soil sample survey (Figure 9).

Samples collected within and along the southwest edge of the BG diatreme returned up to 3.43 ppm Au with 10 samples returning >0.5 ppm Au. The samples were mainly collected from float and consisted of silicified volcaniclastic rocks and quartzite that exhibited limonite and hematite.

Samples collected to the southwest of the BG diatreme returned up to 3.72 ppm Au with 6 samples in the area returning >0.5 ppm Au. Sample D239174 which returned 3.72 ppm Au also returned 124 ppm Ag. This sample was collected from, a historical trench and consisted of a silicified pink quartzite breccia. The vein surfaces were limonite rich. A secondary vein containing drusy quartz contained hematite.

Samples collected approximately 500 m south of the BG diatreme in the area associated with the Au-in-soil anomaly and historical workings returned up to 3.72 ppm Au with 6 samples returning >1.0 ppm Au. Samples consisted largely of float samples of vuggy and/or brecciated quartz veins showing hematite, limonite and goethite alteration.

Lannister conducted a ground magnetics survey over the Basin Gulch property between January 31st and February 27th, 2021 (Figure 10). The survey was focused over the BG diatreme, other historical workings and areas identified as highly prospective for gold and silver mineralization. The survey was completed using a high sampling rate paired with closely spaced survey lines to produce a high-resolution magnetics map over the Property.

The ground magnetics survey grid consisted of 120 survey lines: traverse lines were oriented east west and spaced 50 metres (m) apart; with infill lines offset at 25 m from the main grid. Survey lines of variable length between 1,100 m and 1,750 m were used to avoid avalanche prone areas of the Property. The survey totalled 129.76 line-km of magnetic survey data, covering approximately 530 hectares. Several areas of the Property remained inaccessible at the time of surveying due to extensive snow cover and avalanche danger.

Figure 9. Rock sample assay results – Au (ppm)

Figure 10. 2021 Residual Magnetic Intensity (RMI) with Upward Continuation filter of 10 m and Reduced to Pole (RTP)

Smoothing and enhancement filters were applied to the Residual Magnetic Intensity (RMI) to highlight and attenuate high-frequency signals and enhance the signals originating from geological sources. Regional trends on the Property were best highlighted using an upward continuation (UC) filter at 10 m to minimize the high-frequency responses and a Reduce to Pole (RTP) algorithm which places the peak of the response over the anomaly producing it (Figure 10). The processed geophysical data show that the major, northeast trending fault crossing the Property and the BG diatreme are associated with a low amplitude magnetic response. Mineralization within and along the margins of the BG diatreme is also associated with a low amplitude magnetic response.

No drilling has been completed on the Property by Lannister. A trenching and trench sampling program is currently in progress.

Our Competitive Strengths

We believe that the following competitive strengths contribute to our success and differentiate us from our competitors:

| ● | We have an experienced management team comprised of experienced mining executives and operators with a strong history of de-risking and delivering results. |

| ● | We have a large consolidated land package with a significant history of conducted exploration work. Data from this historical work is readily available and in good standing allowing its use in future updated SK-1300 versions. |

| ● | The historical work shows that there’s extensive exploration upside in multiple directions. |

| ● | Our land package primarily sits on coveted ‘patented’ land claims which require minimal permitting. This allows the company to mobilize works crews for exploration and development versus ‘unpatented’ land claims which require additional permitting steps. |

| ● | Our land package is 16 miles by road from Philipsburg, Montana with and experienced work force and 55 miles by road from Butte, Montana a large city center. |

| ● | Our land package is also away from and key waterways that are used for fishing. |

| ● | Existing infrastructure is close by including paved highways and power. |

Our Growth Strategies

Recruiting and retaining qualified personnel is critical to our success. As our business activity grows, we will require additional key financial, administrative, mining, marketing and public relations personnel as well as additional staff on the operations side. The strength and experience of our Board of Directors allows the Company to add top tier personnel to grow the Company as needed.

The Company has developed a strategic plan for further exploration and development of the Basin Gulch property that includes the following milestones:

| ● | Complete mineral resource drilling and validate historical data to enable a maiden Mineral Resource Estimate in accordance with the SEC’s new Mining Modernization Rules. Completion expected during 2nd half of 2024. |

| ● | Continue exploration of additional prospects located on our Lannister property could add additional tonnage through further drilling. We also intend to explore for extensions to the existing mineralization and other potential mineralization within the Lannister™ property. |

| ● | Initiate metallurgical testwork for best and alternative methods for mineral processing and recovery. |

| ● | Following success from exploration and expansion drilling, plan a second stage drill campaign for an updated Mineral Resource Estimate (2025). |

| ● | Initiate environmental baseline studies and technical work to determine mining site infrastructure locations. |

| ● | Complete Preliminary Economic Study (PEA) for 2025. |

| ● | Complete next stage of resource exploration drilling leading to resource upgrade to the Measured from Indicated level. |

Our Risks and Challenges

Our prospects should be considered in light of the risks, uncertainties, expenses and difficulties frequently encountered by similar companies. Our ability to realize our business objectives and execute our strategies is subject to risks and uncertainties, including, among others, the following:

Risks Related to Our Business and Industry

Risks and uncertainties related to our industry include, but are not limited to, the following:

| | ● | All of our business activities are now in the exploration stage and there can be no assurance that our exploration efforts will result in the commercial development of gold and silver or other minerals. Volatile metal prices and external factors may affect our profitability and marketability of minerals. |

| ● | We may invest in exploration without guarantee of profitable mineral discovery. |

| ● | We may face delays if we are unable to secure timely equipment and personnel for exploration. |

| ● | We are exposed to various operational risks and our insurance may not provide adequate coverage. |

| ● | Mining hazards could lead to significant operational disruptions and financial impacts. |

| ● | Our business is subject to operational risks that are generally outside of our control and could adversely affect our business. |

| ● | We have no history of mineral production. |

| | ● | There can be no assurance that we will successfully establish mining operations or profitably produce mineral products. |

| ● | Mineral exploration and development are subject to extraordinary operating risks. We currently do not insure against these risks. In the event of a cave-in or similar occurrence, our liability may exceed our resources, which could have an adverse impact on us. |

| ● | There are numerous risks associated with the development of our mining property. |

| ● | Our business operations are exposed to a high degree of risk associated with the mining industry. |

| ● | Infrastructure required to carry on our business may be affected by unusual or infrequent weather phenomena, sabotage, government or other interference in the maintenance or provision of such infrastructure. |

| ● | Our operations rely on infrastructure, and disruptions could adversely impact our results and financial condition. |

| ● | We face stringent environmental regulations that may increase operational costs and affect profitability. |

| ● | We may not be able to obtain or renew licenses or permits that are necessary to our operations. |

| ● | We cannot guarantee undisputed title to our mineral properties, potentially affecting their validity and size. |

| ● | Our success hinges on our Board and senior management, and their loss could adversely impact our business. |

| ● | We are dependent on the continued services and performance of our senior management and other key officers, the loss of any of whom could adversely affect our business, operating results and financial condition. |

Risks Related to This Offering and Ownership of Our Common Shares

Risks and uncertainties related to this offering and our Common Shares include, but are not limited to, the following:

| ● | There has been no public market for our common shares prior to this offering, and an active market in which investors can resell their shares may not develop. |

| ● | The market price of our common shares may fluctuate, and you could lose all or part of your investment. |

| ● | We have considerable discretion as to the use of the net proceeds from this offering and we may use these proceeds in ways with which you may not agree. |

| ● | You will experience immediate and substantial dilution as a result of this offering. |

| ● | If securities industry analysts do not publish research reports on us, or publish unfavorable reports on us, then the market price and market trading volume of our common shares could be negatively affected. |

| ● | Future issuances of our common shares or securities convertible into, or exercisable or exchangeable for, our common shares, or the expiration of lock-up agreements that restrict the issuance of new common shares or the trading of outstanding common shares, could cause the market price of our common shares to decline and would result in the dilution of your holdings. |

| ● | Future issuances of debt securities, which would rank senior to our common shares upon our bankruptcy or liquidation, and future issuances of preferred shares, which could rank senior to our common shares for the purposes of dividends and liquidating distributions, may adversely affect the level of return you may be able to achieve from an investment in our common shares. |

| ● | Investors may face dilution due to issuance of lower priced securities and outstanding options. |

| ● | We may not be able to satisfy listing requirements of the NYSE American or obtain or maintain a listing of our common shares. |

| ● | We will be subject to ongoing public reporting requirements that are less rigorous than Exchange Act rules for companies that are emerging growth companies and our shareholders could receive less information than they might expect to receive from more mature public companies. |

| ● | As a foreign private issuer, we are permitted to rely on exemptions from certain NYSE American corporate governance standards applicable to domestic U.S. issuers. This may afford less protection to holders of our shares. |

In addition, we face other risks and uncertainties that may materially affect our business prospects, financial condition, and results of operations. You should consider the risks discussed in “Risk Factors” and elsewhere in this prospectus before investing in our common shares.

Our Corporate Structure

We were created as a result of the amalgamation of 1247666 B.C. Ltd. and Lannister Mining Corp. pursuant to the provisions of the Business Corporations Act (British Columbia), which we refer to as the “BCBCA,” on September 21, 2021, which we refer to as the “Amalgamation”. Our registered and records office and head office is located at Suite 1500, 1055 West Georgia Street, Vancouver, British Columbia V6E 4N7.

The Amalgamation was completed pursuant to the terms and conditions of an amalgamation agreement, which we refer to as the “Amalgamation Agreement,” dated June 21, 2021, between 1247666 B.C. Ltd., which we refer to as “BC Co,” and Lannister Mining Corp., which we refer to as “Former Lannister”. In accordance with the Amalgamation Agreement, each holder of common shares in the capital of BC Co, which we refer to as “BC Co Shares,” and Former Lannister, which we refer to as “Former Lannister Shares,” received (i) one Common Share in exchange for each BC Co Share or Former Lannister Share held by such holder, or (ii) cash in exchange for each BC Co Share or Former Lannister Share held by such holder, and the BC Co Shares and Former Lannister Shares were cancelled.

Following the completion of the Amalgamation, BC Co and Former Lannister amalgamated and formed our company and each of BC Co and Former Lannister ceased to exist as entities. Further, the property of each of BC Co and Former Lannister continued as our property and we continued to be liable for the obligations of each of BC Co and Former Lannister.

We have one wholly-owned subsidiary named 60431 Montana Ltd., which we refer to as “Montana Subco”. Montana Subco was incorporated pursuant to the Montana Business Corporation Act on December 28, 2020. Montana Subco’s registered and records office and head office is located at Central Square Building, 201 W. Main Street, Suite 201, Missoula, Montana 59802.

Set forth below is our organizational chart:

We are not currently a reporting issuer in any jurisdiction and our Shares are not listed or posted for trading on any stock exchange.

Corporate Information

Our corporate address is Suite 1500, 1055 West Georgia Street, Vancouver, British Columbia V6E 4N7. Our company email address is info@lannistermining.com.

Our registered office is located at Suite 1500, 1055 West Georgia Street, Vancouver, British Columbia V6E 4N7.

Our agent for service of process in the United States is Cogency Global Inc.,122 East 42nd Street, 18th Floor, New York, NY 10168, (800) 221-0102.

Our website can be found at https://lannistermining.com/. The information contained on our website is not a part of this prospectus, nor is such content incorporated by reference herein, and should not be relied upon in determining whether to make an investment in our common shares.

Implications of Being an Emerging Growth Company

Upon the completion of this offering, we will qualify as an “emerging growth company” under the Jumpstart Our Business Act of 2012, as amended, or the JOBS Act. As a result, we will be permitted to, and intend to, rely on exemptions from certain disclosure requirements. These provisions include exemption from the auditor attestation requirement under Section 404 of the Sarbanes-Oxley Act of 2002 in the assessment of the emerging growth company’s internal control over financial reporting. In addition, Section 107 of the JOBS Act also provides that an emerging growth company can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. In other words, an emerging growth company can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We may choose to take advantage of the benefits of this extended transition period. Our financial statements may therefore not be comparable to those of companies that comply with such new or revised accounting standards.

We will remain an emerging growth company until (for the first five fiscal years after the initial public offering is completed) the earliest of the following occurs: (i) our total annual gross revenues are $1.235 billion or more (ii) we have issued more than $1 billion in non-convertible debt in the past three years or (iii) we become a “large accelerated filer,” as defined in the Securities Exchange Act of 1934, which we refer to as the “Exchange Act,” Rule 12b-2. Once we cease to be an emerging growth company, we will not be entitled to the exemptions provided in the JOBS Act discussed above.

Implications of Being a Foreign Private Issuer

Once the registration statement of which this prospectus is a part is declared effective by the SEC, we will become subject to the information reporting requirements of the Exchange Act that are applicable to “foreign private issuers,” and under those requirements we will file certain reports with the SEC. As a foreign private issuer, we will not be subject to the same requirements that are imposed upon U.S. domestic issuers by the SEC. Under the Exchange Act, we will be subject to reporting obligations that, in certain respects, are less detailed and less frequent than those of U.S. domestic reporting companies. For example, although we report our financial results on a quarterly basis, we will not be required to issue quarterly reports, proxy statements that comply with the requirements applicable to U.S. domestic reporting companies, or individual executive compensation information that is as detailed as that required of U.S. domestic reporting companies. We also will have four months after the end of each fiscal year to file our annual reports with the SEC and we will not be required to file current reports as frequently or promptly as U.S. domestic reporting companies. We also present our financial statements pursuant to International Financial Reporting Standards as issued by International Accounting Standards Board, or IFRS. Furthermore, our officers, directors and principal shareholders will be exempt from the requirements to report transactions in our equity securities and from the short-swing profit liability provisions contained in Section 16 of the Exchange Act. As a foreign private issuer, we will also not be subject to the requirements of Regulation FD (Fair Disclosure) promulgated under the Exchange Act. In addition, as a foreign private issuer, we will be permitted, and intend to follow certain home country corporate governance practices instead of those otherwise required under the listing rules of NYSE American for domestic U.S. issuers. These exemptions and leniencies will reduce the frequency and scope of information and protections available to you in comparison to those applicable to a U.S. domestic reporting companies.

Notes on Prospectus Presentation

Numerical figures included in this prospectus have been subject to rounding adjustments. Accordingly, numerical figures shown as totals in various tables may not be arithmetic aggregations of the figures that precede them. Certain market data and other statistical information contained in this prospectus are based on information from independent industry organizations, publications, surveys and forecasts. Some market data and statistical information contained in this prospectus are also based on management’s estimates and calculations, which are derived from our review and interpretation of the independent sources listed above, our internal research and our knowledge of the mining industry. While we believe such information is reliable, we have not independently verified any third-party information and our internal data has not been verified by any independent source.

Our reporting currency and our functional currency is Canadian dollar. This prospectus contains translations of Canadian dollars into U.S. dollars at specific rates solely for the convenience of the reader. Unless otherwise noted, all translations from Canadian dollars into U.S. dollars in this prospectus were made at a rate of C$1.3540 per US$1.00, the noon buying rate as set forth in the H.10 statistical release of the U.S. Federal Reserve Board in effect as of March 29, 2024, except for section 5 of the audited financial statements. The translations from Canadian dollars into U.S. dollars for amounts relating to the year ended September 30, 2023 were made at a rate of C$1.3535 per $1.00, the noon buying rate as set forth in the H.10 statistical release of the U.S. Federal Reserve Board in effect as of September 29, 2023. The translations from Canadian dollars into U.S. dollars for amounts relating to the six months ending March 31, 2024 were made at a rate of C$1.3540 per $1.00, the noon buying rate as set forth in the H.10 statistical release of the U.S. Federal Reserve Board in effect as of March 29, 2024. On June 21, 2024, the noon buying rate for Canadian dollar was C$1.3698 per US$1.00. We make no representation that the Canadian dollar or U.S. dollar amounts referred to in this prospectus could have been or could be converted into U.S. dollars or Canadian dollar, as the case may be, at any particular rate or at all.

All references in the prospectus to “U.S. dollars,” “dollars,” “US$” and “$” are to the legal currency of the United States and all references to “C$” are to the legal currency of Canada.

Annual General and Special Meeting of Securityholders

On December 8, 2023, we held our Annual General and Special Meeting (the “Meeting”) of Shareholders and holders of Common share purchase warrants at 10:00 a.m. (Pacific time) at 1500-1055 West Georgia Street, Vancouver, British Columbia V6E 4N7. A total of 2,536,041 (post-split) Common shares representing 62.39% of the aggregate shares outstanding and eligible to vote and constituting a quorum were represented in person or by valid proxies at the annual meeting.