transportation and energy costs, which represent the largest components of our operating costs and can fluctuate based upon factors beyond our control. If the prices or demand for our paper products decline, or if wood fiber, chemicals, transportation or energy costs increase, or both, our business, financial condition and results of operations could be materially adversely affected. See “—Changes in the cost or availability of raw materials, energy and transportation could have a material adverse effect on our business, financial condition and results of operations.”

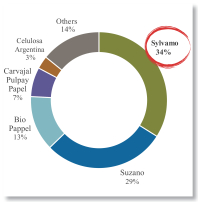

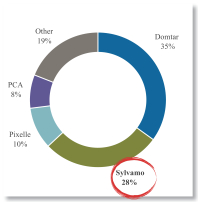

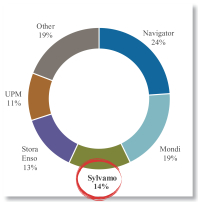

Competition from other businesses and consolidation within the paper industry could have a material adverse effect on our competitive position, financial condition and results of operations.

We operate in a competitive environment, both in the United States and internationally. Product innovations, manufacturing and operating efficiencies, and marketing, distribution and pricing strategies pursued or achieved by competitors could have a material adverse effect on our business, financial condition and results of operations.

In addition, there has been a trend toward consolidation in the paper industry. Consolidation could result in the emergence of competitors with greater resources and scale than ours, which could adversely impact our competitive position, financial conditions and results of operations. In addition, actual or speculated consolidation among competitors, or the acquisition by, or of, our third party service providers and business partners by competitors could increase the competitive pressures faced by us as customers could delay spending decisions or not purchase our products at all.

Changes in the cost or availability of raw materials, energy and transportation could have a material adverse effect on our business, financial condition and results of operations.

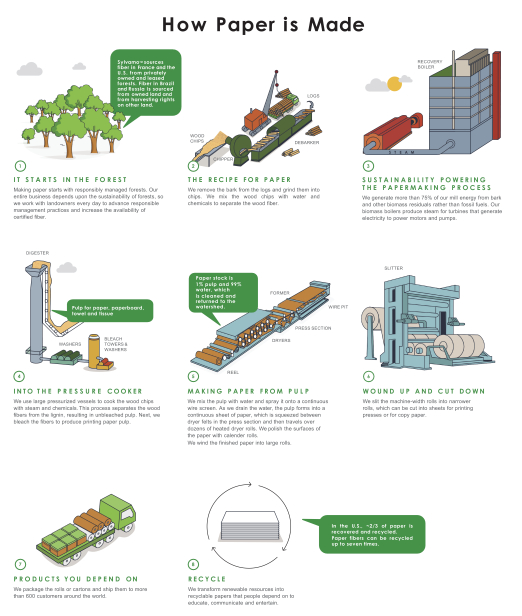

We rely heavily on the use of certain raw materials (principally virgin wood fiber, caustic soda and starch), energy sources (principally biomass, natural gas, electricity and fuel oil) and third-party companies that transport our goods. The market price of virgin wood fiber varies based upon availability, source, and the costs of fuels used in the harvesting and transportation of the fiber. The cost and availability of wood fiber can also be impacted by weather, climate variations, natural disasters, general logging conditions, geography and regulatory activity. The global supply and demand for recycled fiber may be affected by trade policies between countries, legislation and regulations, as well as changes in the global economy. The availability and cost of recycled fiber depends heavily on recycling rates and the domestic and global demand for recycled products. The increase in demand for products manufactured, in whole or in part, from recycled fiber, on a global basis, may cause significant fluctuations in recycled fiber prices. Energy prices, in particular prices for oil and natural gas, have fluctuated dramatically in the past and may continue to fluctuate in the future. The availability of labor and the market price for fuel may affect our costs for third-party transportation. In addition, inflationary cost pressures may make our raw materials more expensive. Our profitability has been, and will continue to be, affected by changes in the cost and availability of the raw materials, energy sources and transportation sources we use.

Due to the commodity nature of our products, the supply and demand for our products determines our ability to increase prices. Consequently, we may be unable to pass on increases in our operating costs to our customers. Any sustained increase in raw material or energy prices without any corresponding increase in product pricing would reduce our operating margins and could have a material adverse effect on our business, financial condition and results of operations.

Reduced truck, rail and ocean freight availability could lead to higher costs or poor service, resulting in lower earnings, and could affect our ability to deliver the products we manufacture in a timely manner.

We rely on third parties for transportation and delivery of raw materials and the products we manufacture. In particular, the goods we manufacture and raw materials we use are transported by railroad, trucks and ships, which are highly regulated. If any of our transportation providers were to fail to deliver the goods that we manufacture in a timely manner, this could result in additional costs in order to remedy the untimely delivery.

38