- SLVM Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

Sylvamo (SLVM) 8-KRegulation FD Disclosure

Filed: 9 Sep 21, 7:33am

Investor Day September 9, 2021 ©2021 International Paper Company. All rights reserved. Exhibit 99.1

Cautionary statement concerning forward-looking statements This presentation contains information that includes or is based upon forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. All statements that do not relate strictly to historical or current facts are forward-looking statements. Forward-looking statements give rise to expectations or forecasts of future events and often can be identified by the use of words such as “anticipate,” “assume,” “could,” “estimate,” “expect,” “project,” “intend,” “plan,” “believe,” “should,” “will,” and other words and terms of similar meaning, or which are statements concerning future periods. Examples of forward-looking statements are those which relate to the formation of Sylvamo, our separation from International Paper, the outlook for Sylvamo and our industry, and our future operating and financial performance. Forward-looking statements are based on currently available business, economic, financial, and other information and reflect our management's current beliefs, expectations, and views with respect to future matters and their potential effects on Sylvamo. They are not guarantees of future performance. Any or all forward-looking statements may turn out to be incorrect, and our actual actions and results could differ materially from what is expressed or implied by these statements. Forward-looking statements can be affected by inaccurate assumptions or by known or unknown risks and uncertainties. Although it is not possible to identify them all, they include, among others: (i) the impact of the COVID-19 pandemic and the measures implemented to contain it, and our inability to accurately predict its future impact on our business and the regulatory environment in which we operate; (ii) our inability to achieve some or all of the benefits that we expect to achieve from the distribution and separation from International Paper and the cost of achieving such benefits possibly being higher than anticipated; (iii) the fulfillment of our obligations as a public company, including with respect to the requirements of, and related to, rules under the Sarbanes-Oxley Act of 2002; (iv) our inability to operate profitably as a stand-alone company or provide benefits and services or receive access to equivalent financial strength and resources as International Paper; (v) the loss of commercial agreements with International Paper; (vi) our historical pro forma financial information may not be indicative of our future results as a separate public company; (vii) our failure to qualify for non-recognition treatment for U.S. federal income tax purposes, in which case, International Paper, Sylvamo and International Paper’s shareholders may be subject to significant U.S. federal income taxes; (viii) our inability to take certain actions after the distribution, given that such actions could jeopardize the tax-free status of the distribution; (ix) significant one-time and ongoing costs associated with the separation that could affect our period-to-period operating results following the completion of the distribution; (x) potential conflicts of interest with certain of our directors or officers following the distribution because of International Paper equity ownership or their former International Paper positions; (xi) the failure of the distribution to be consummated on the terms or timeline currently contemplated, or at all; (xii) the inability to obtain required consents or approvals of third parties in connection with the transfer to us of certain contracts, permits and other assets and rights which may require the consents or approvals of, or provide other rights to, third parties and governmental authorities, such that we would not be entitled to the benefit of such contracts, permits and other assets and rights; (xiii) the satisfaction of indemnification obligations following the distribution; (xiv) substantial indebtedness, in connection with the distribution, which could prevent us from fulfilling our obligations under anticipated agreements governing our indebtedness; (xv) our inability to generate sufficient cash to service our indebtedness, which may force us to take other actions to satisfy our obligations under our indebtedness, which may not be successful, and the potential that we or our subsidiaries default on our or their obligations to pay our and their indebtedness; (xvi) the impact of the limitations and restrictions in the credit agreement governing our indebtedness; (xvii) general business or economic conditions which might affect demand for our products and our business; (xviii) changes in international conditions; (xix) industry-wide decline in demand for paper and related products; (xx) the cyclical nature of the paper industry, which may result in fluctuations in the prices of, and demand for, our paper products; (xxi) competition from other businesses and consolidation within the paper industry; (xxii) changes in the cost or availability of raw materials, energy and transportation; (xxiii) reduced truck, rail and ocean freight availability which could result in higher costs or poor service; (xxiv) climate change and the physical and financial risks associated with fluctuating regional and global weather conditions or patterns; (xxv) material disruptions at one or more of our manufacturing facilities; (xxvi) information technology risks related to potential breaches of security, which may result in the distribution of company, customer, employee and vendor information; (xxvii) extensive U.S. federal and state and non-U.S. environmental laws and regulations, which could result in substantial costs to the company as a result of compliance with, violations of or liabilities under these laws and regulations; (xxviii) numerous laws, regulations and other government requirements that may change in significant ways; (xxix) our inability to achieve the expected benefits from our capital investments and other corporate transactions; (xxx) our reliance on a small number of significant customers; (xxxi) failure to attract and retain senior management and other key employees; (xxxii) adverse results from legal, regulatory and governmental proceedings or other loss contingencies; (xxxiii) a significant write-down of goodwill or other intangible assets; (xxxiv) failure to achieve expected investment returns on pension plan assets, as well as changes in interest rates or plan demographics; (xxxv) a disruption in operations and increased labor costs due to labor disputes; and (xxxvi) our failure to adequately protect our intellectual property and other proprietary rights, or to defend successfully against intellectual property infringement claims by third parties. These and other factors that could cause or contribute to actual results differing materially from such forward-looking statements can be found in Sylvamo’s press releases and U.S. Securities and Exchange Commission filings. In addition, other risks and uncertainties not presently known to Sylvamo or that it currently believes to be immaterial could affect the accuracy of any forward-looking statements. Sylvamo undertakes no obligation to publicly update any forward-looking statements, whether as a result of new information, future events or otherwise.

Statements relating to non-U.S. financial GAAP measures While Sylvamo reports its financial results in accordance with accounting principles generally accepted in the United States ("U.S. GAAP"), during the course of this presentation, certain non-U.S. GAAP financial measures are presented. Management believes that these non-U.S. GAAP financial measures, when used in conjunction with information presented in accordance with U.S. GAAP, can facilitate a better understanding of the impact of various factors and trends on Sylvamo’s financial condition and results of operations. Management also uses these non-U.S. GAAP financial measures in making financial, operating and planning decisions and in evaluating Sylvamo’s performance. The non-U.S. GAAP financial measures in this presentation have limitations as analytical tools and should not be considered in isolation or as a substitute for, or superior to, an analysis of our results presented in accordance with U.S. GAAP. In addition, because not all companies use identical calculations, our presentation of non-U.S. GAAP financial measures in this presentation may not be comparable to similarly titled measures disclosed by other companies, including companies in our industry. See the Appendix in this presentation for a reconciliation of all presented non-U.S. GAAP measures (and their components) to U.S. GAAP financial measures. These slides, including the reconciliation, is also available Sylvamo Corporation’s website at http://www.sylvamo.com.

Today’s discussion leaders Jean-Michel Ribiéras Chairman & Chief Executive Officer 28 years at International Paper John V. Sims Senior Vice President & Chief Financial Officer 27 years at International Paper Rodrigo Davoli Senior Vice President & General Manager, Latin America 28 years at International Paper Oliver Taudien Senior Vice President & General Manager, Europe 26 years at International Paper Greg C. Gibson Senior Vice President & General Manager, North America 39 years at International Paper Thomas A. Cleves Senior Vice President, Corporate Affairs 38 years at International Paper

Agenda Company Overview Jean-Michel Ribiéras Investment Thesis John Sims Regional Overviews Oliver Taudien, Rodrigo Davoli, Greg Gibson Financial Overview John Sims Questions and Answers All Conclusion Jean-Michel Ribiéras 1 2 3 4 5 6

Company Overview

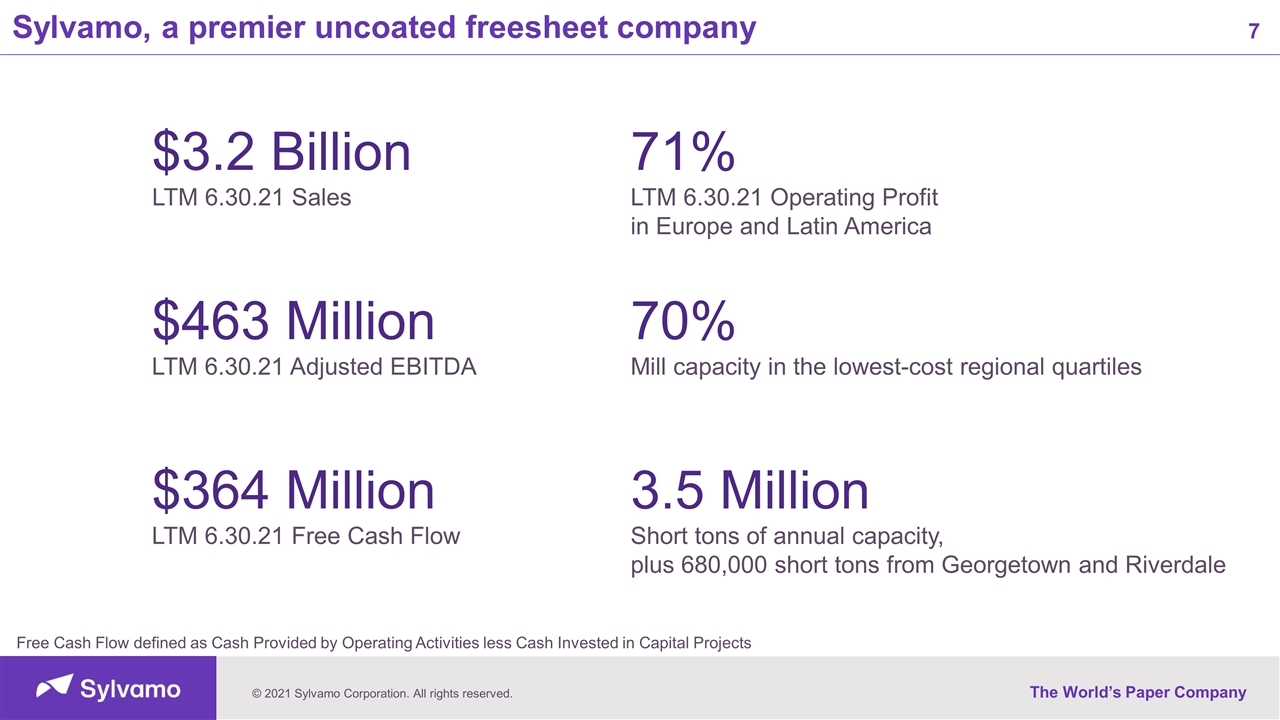

Sylvamo, a premier uncoated freesheet company Free Cash Flow defined as Cash Provided by Operating Activities less Cash Invested in Capital Projects $3.2 Billion LTM 6.30.21 Sales $463 Million LTM 6.30.21 Adjusted EBITDA $364 Million LTM 6.30.21 Free Cash Flow 71% LTM 6.30.21 Operating Profit in Europe and Latin America 70% Mill capacity in the lowest-cost regional quartiles 3.5 Million Short tons of annual capacity, plus 680,000 short tons from Georgetown and Riverdale

Why is Sylvamo compelling? Commercial Advantages Operational Advantages Financial Focus Iconic brands with strongest brand recognition Strategic channel partnerships Best-in-class commercial teams Low-cost mills in attractive regions Brazilian forestlands Best-in-class operating teams Advanced safety and ESG practices Robust, resilient free cash flow Debt reduction Returning cash to shareowners, subject to Board approval and debt covenant restrictions

Our three-pronged strategy Be the supplier of choice by leveraging a deep understanding of end-use applications and customers’ businesses to help them succeed. Operate as a responsible, agile and low-cost company. Be the investment of choice by delivering consistently on our compelling investment thesis. Commercial Excellence Operational Excellence Financial Discipline

Uncoated freesheet is sustainable, affordable and functional Sustainable Affordable Functional Paper is one of the most recycled materials in the world: 74% - Europe, 67% - Latin America and 66% - North America1 Results from 33 studies that tested students’ comprehension showed that students of all ages tend to absorb more when they’re reading on paper than on screens2 1CEPI, Cempre.org.br, AF&PA, 2020; 2The Hechinger Report, Evidence increases for reading on paper instead of screens, by Jill Barshay, August 12, 2019

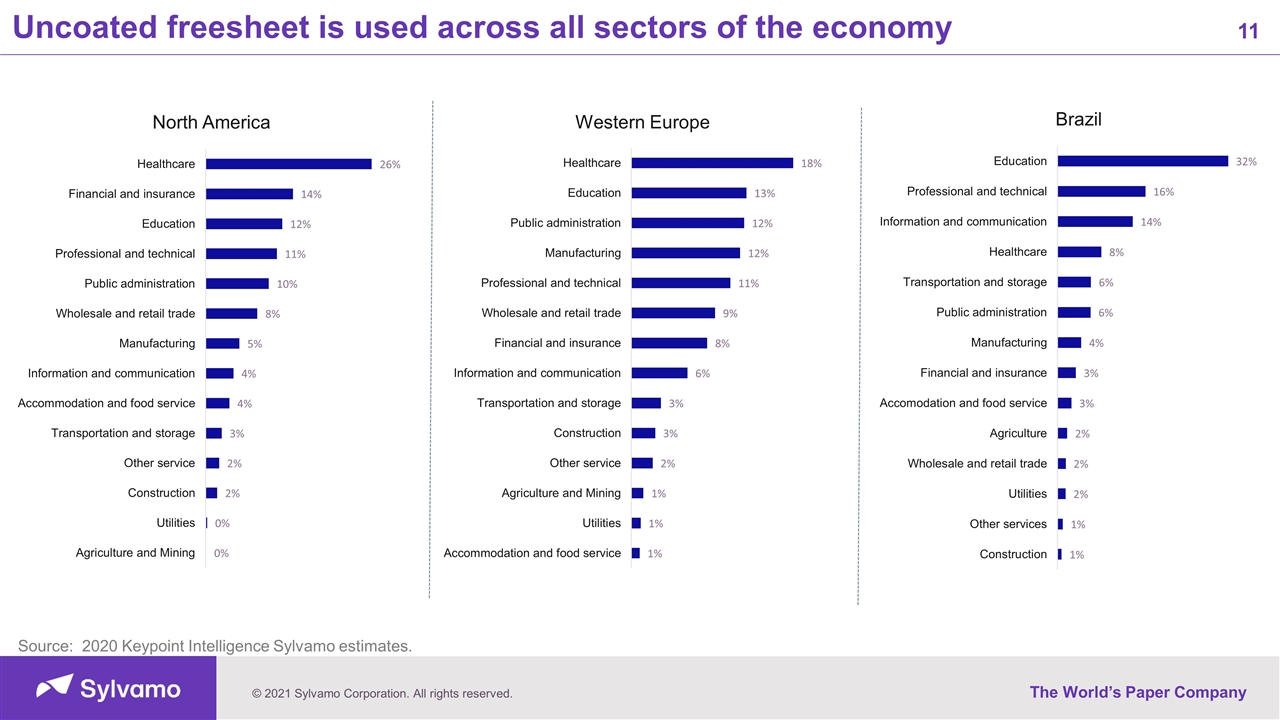

Uncoated freesheet is used across all sectors of the economy Source: 2020 Keypoint Intelligence Sylvamo estimates.

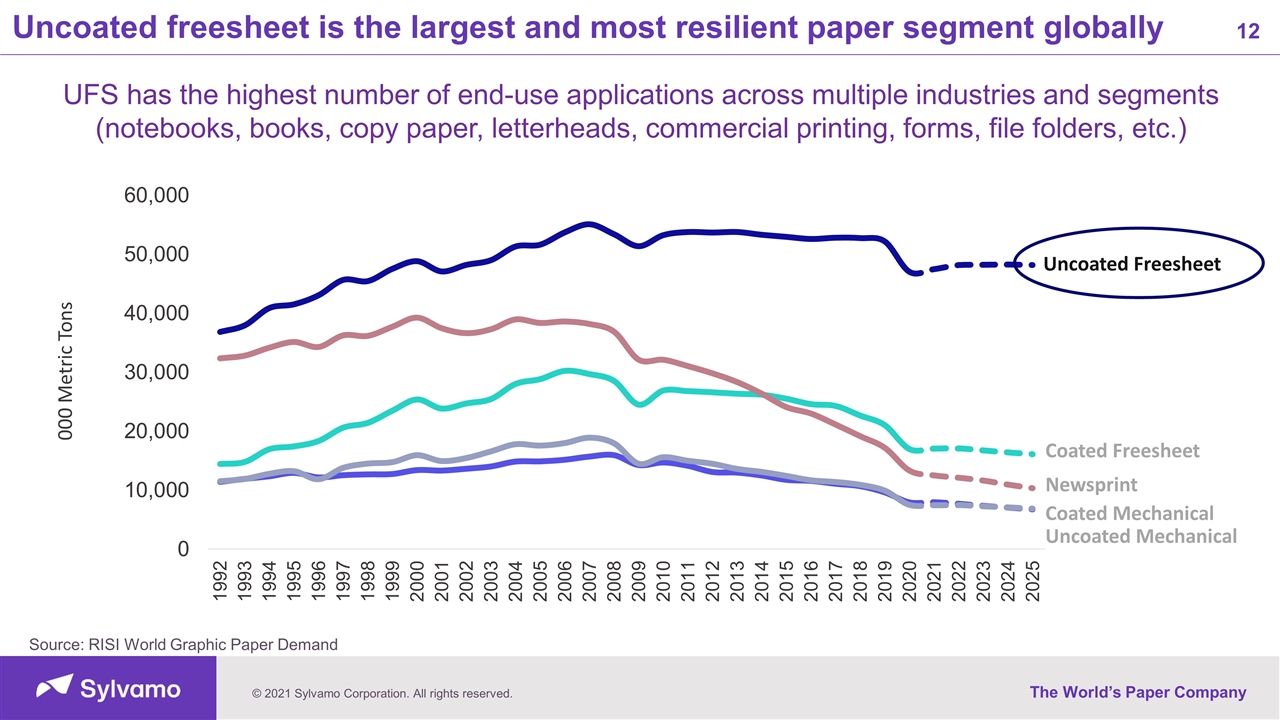

Uncoated freesheet is the largest and most resilient paper segment globally Source: RISI World Graphic Paper Demand Coated Freesheet Newsprint Coated Mechanical Uncoated Freesheet Uncoated Mechanical UFS has the highest number of end-use applications across multiple industries and segments (notebooks, books, copy paper, letterheads, commercial printing, forms, file folders, etc.)

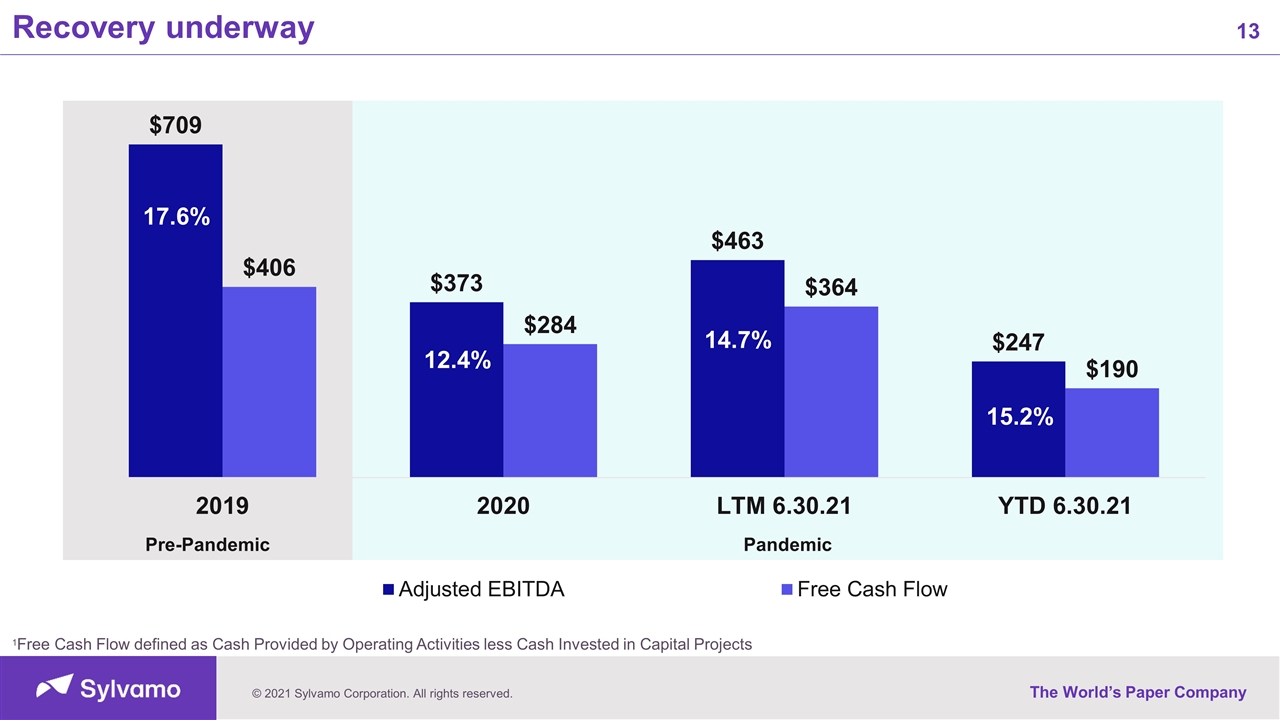

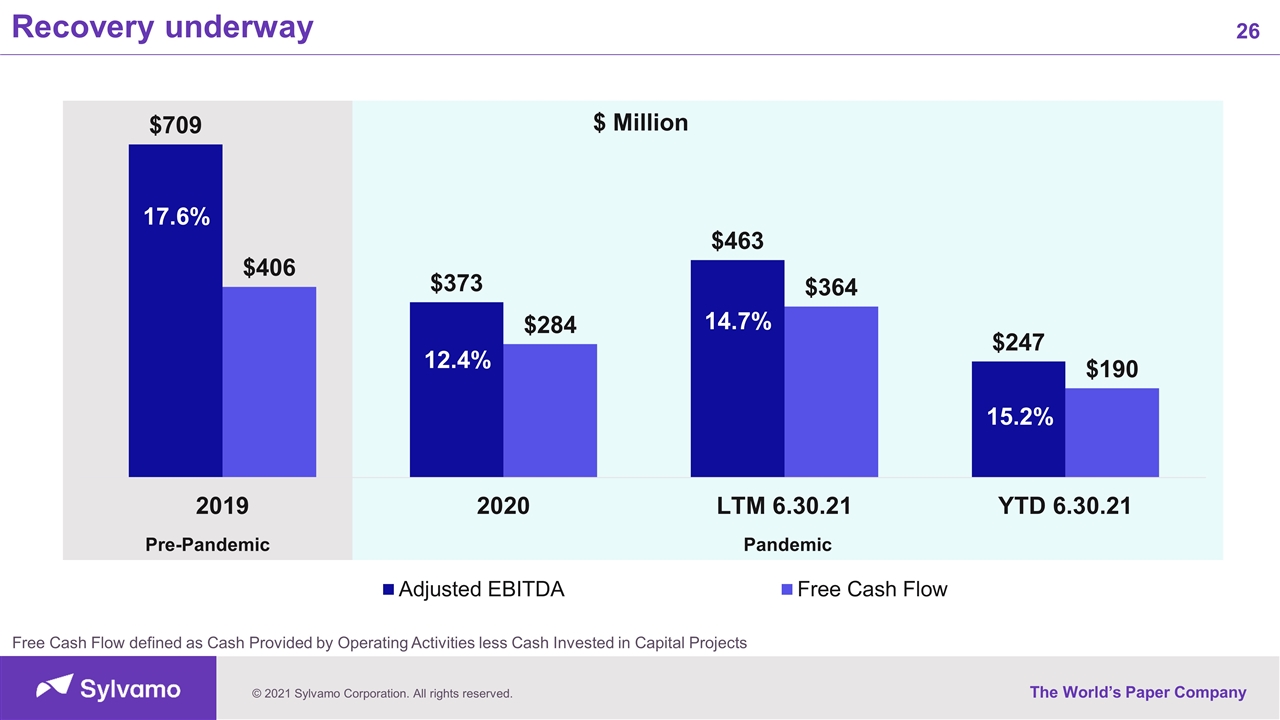

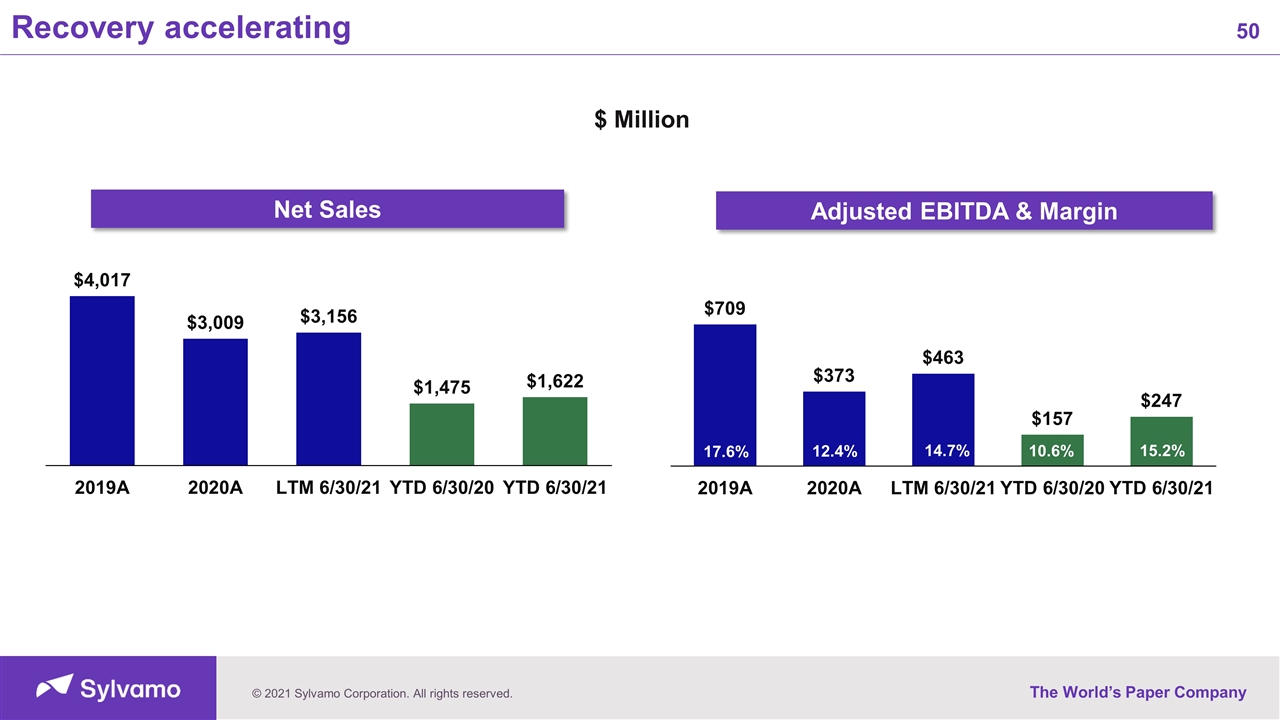

Recovery underway 1Free Cash Flow defined as Cash Provided by Operating Activities less Cash Invested in Capital Projects Pandemic Pre-Pandemic 17.6% 12.4% 15.2% 14.7%

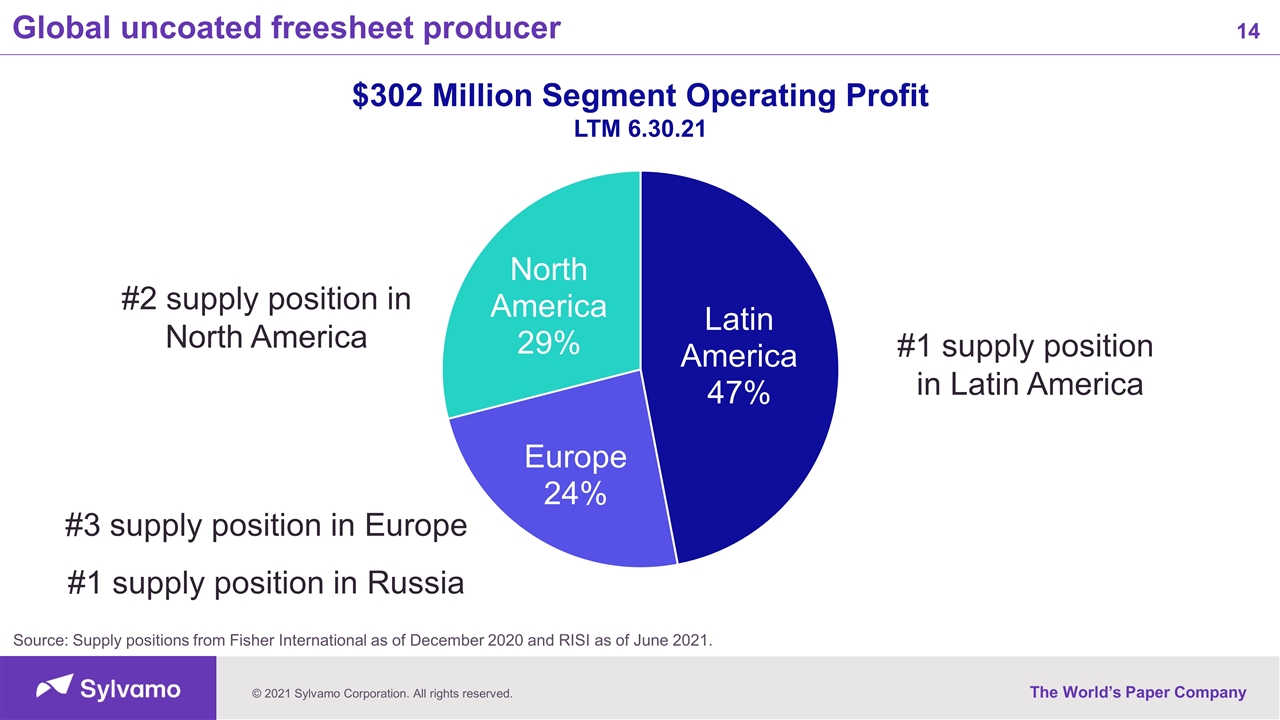

Global uncoated freesheet producer Source: Supply positions from Fisher International as of December 2020 and RISI as of June 2021. $302 Million Segment Operating Profit LTM 6.30.21 #1 supply position in Latin America #2 supply position in North America #3 supply position in Europe #1 supply position in Russia

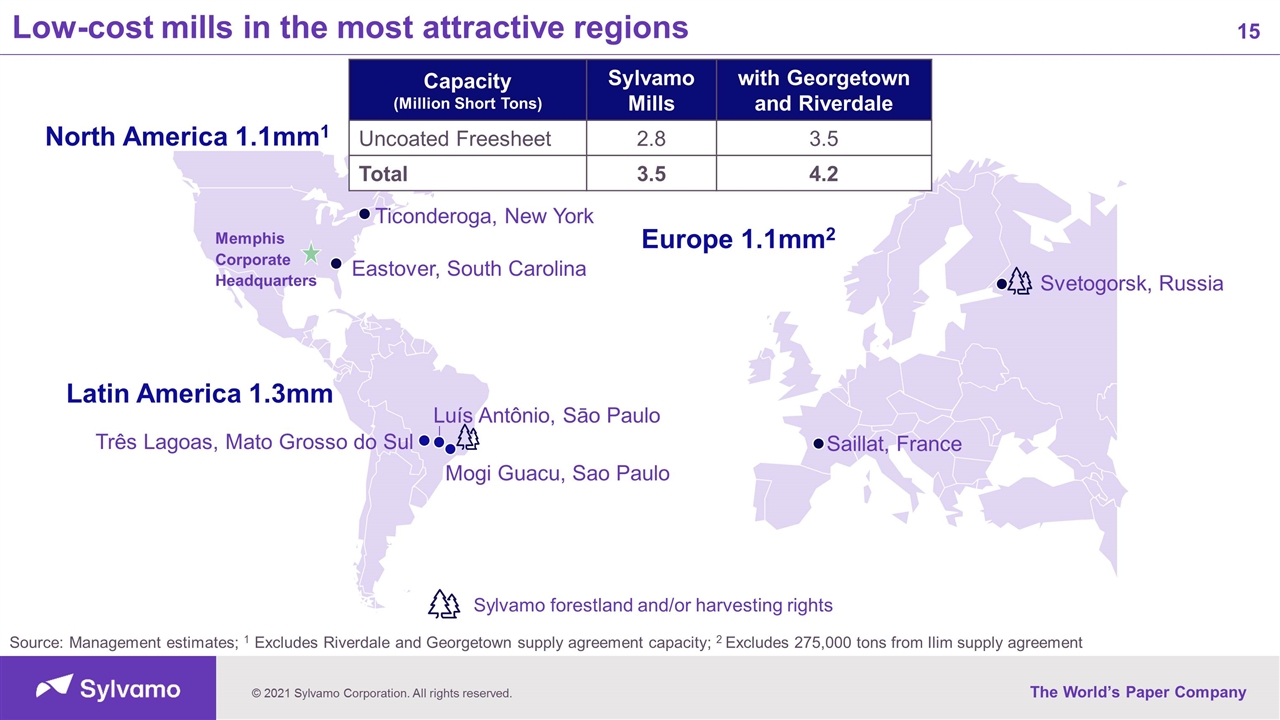

Saillat, France Svetogorsk, Russia Low-cost mills in the most attractive regions Source: Management estimates; 1 Excludes Riverdale and Georgetown supply agreement capacity; 2 Excludes 275,000 tons from Ilim supply agreement Luís Antônio, Sāo Paulo Mogi Guacu, Sao Paulo Três Lagoas, Mato Grosso do Sul North America 1.1mm1 Eastover, South Carolina Ticonderoga, New York Memphis Corporate Headquarters Latin America 1.3mm Europe 1.1mm2 Sylvamo forestland and/or harvesting rights Capacity (Million Short Tons) Sylvamo Mills with Georgetown and Riverdale Uncoated Freesheet 2.8 3.5 Total 3.5 4.2

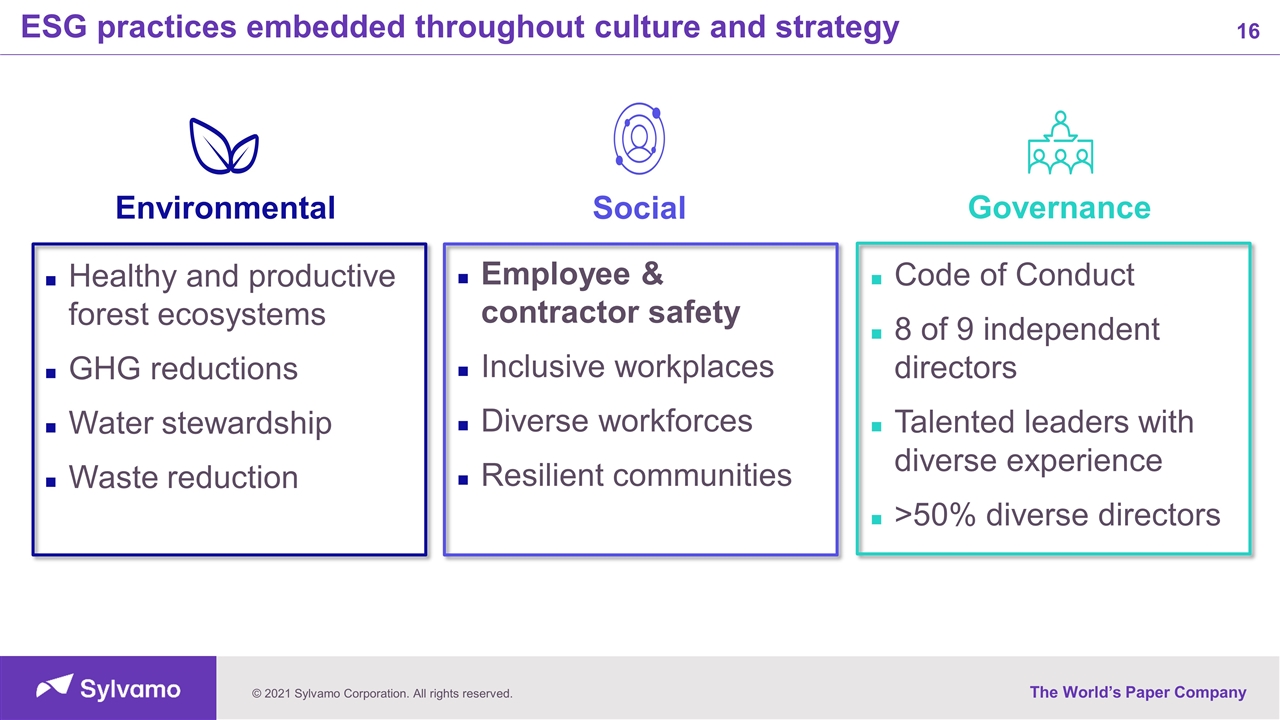

ESG practices embedded throughout culture and strategy Environmental Social Governance Healthy and productive forest ecosystems GHG reductions Water stewardship Waste reduction Employee & contractor safety Inclusive workplaces Diverse workforces Resilient communities Code of Conduct 8 of 9 independent directors Talented leaders with diverse experience >50% diverse directors

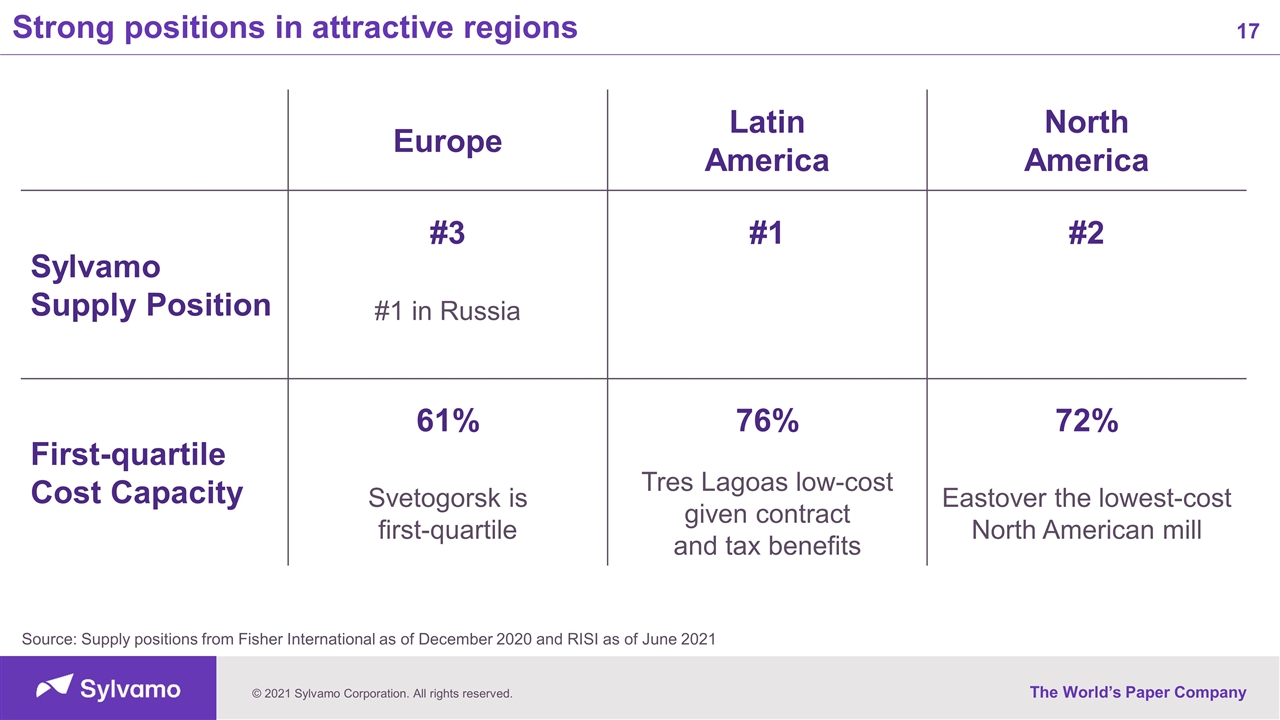

Strong positions in attractive regions Europe Latin America North America Sylvamo Supply Position #3 #1 #2 #1 in Russia First-quartile Cost Capacity 61% 76% 72% Svetogorsk is first-quartile Tres Lagoas low-cost given contract and tax benefits Eastover the lowest-cost North American mill Source: Supply positions from Fisher International as of December 2020 and RISI as of June 2021

Investment Thesis

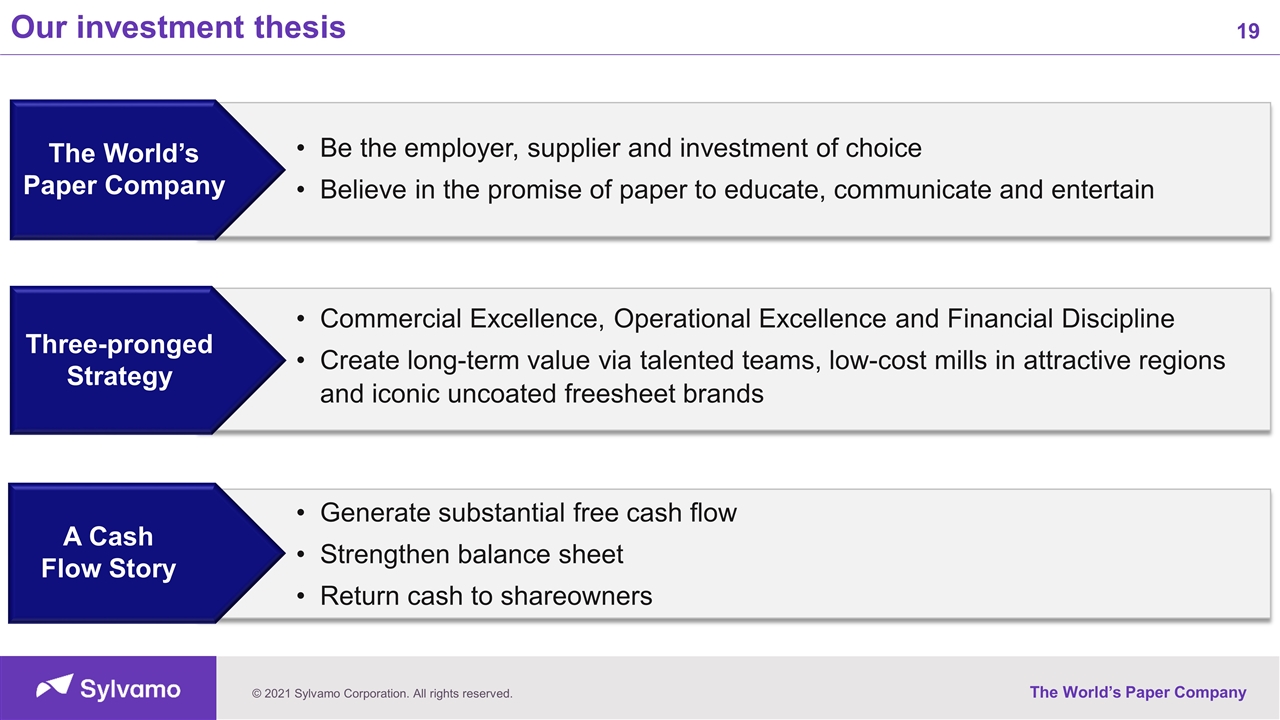

Our investment thesis The World’s Paper Company Three-pronged Strategy A Cash Flow Story Be the employer, supplier and investment of choice Believe in the promise of paper to educate, communicate and entertain Commercial Excellence, Operational Excellence and Financial Discipline Create long-term value via talented teams, low-cost mills in attractive regions and iconic uncoated freesheet brands Generate substantial free cash flow Strengthen balance sheet Return cash to shareowners

Demand expected to continue to grow in Eastern Europe and Latin America Key Short-term Demand Driver Pandemic Restrictions Demand rebounding strongly from 2020 restrictions Re-opening of businesses, offices and schools Impact of work-from-home policies Long-term Demand Drivers Electronic Substitution Use of digital communications Regional Demand Trends Demand growth driven by GDP growth forecasted in Latin America and Eastern Europe

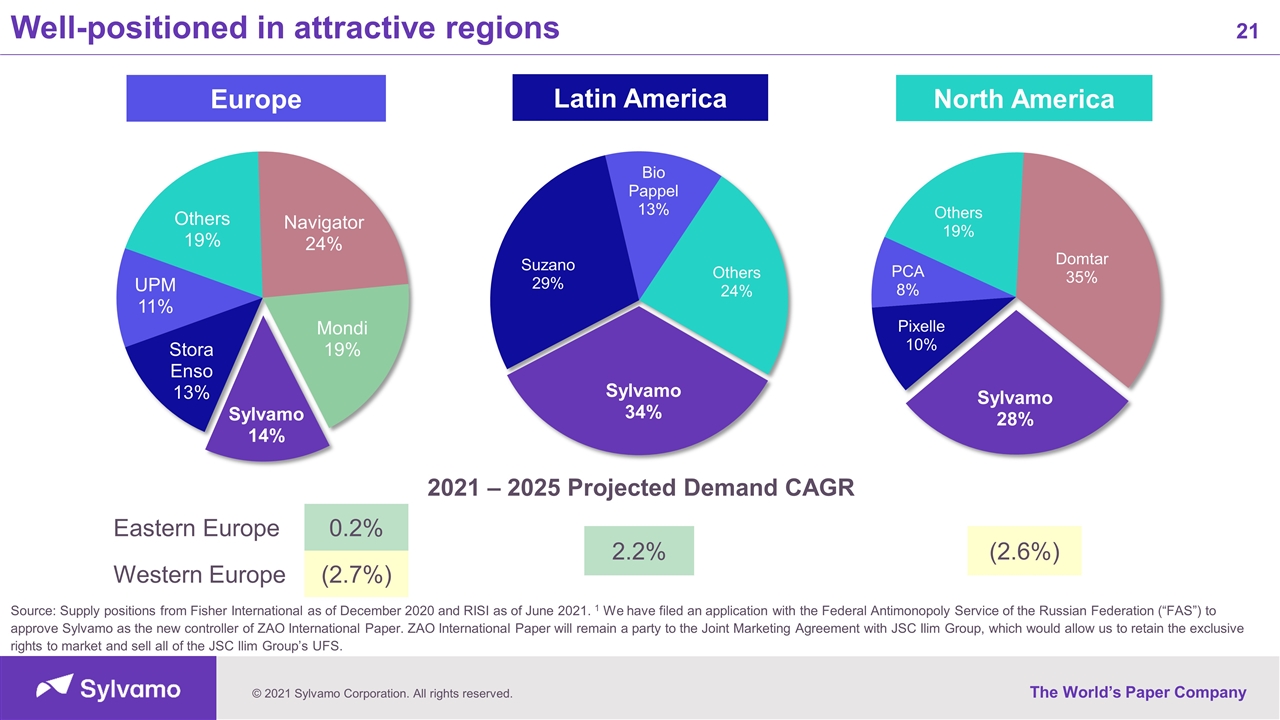

Well-positioned in attractive regions Europe Latin America North America Source: Supply positions from Fisher International as of December 2020 and RISI as of June 2021. 1 We have filed an application with the Federal Antimonopoly Service of the Russian Federation (“FAS”) to approve Sylvamo as the new controller of ZAO International Paper. ZAO International Paper will remain a party to the Joint Marketing Agreement with JSC Ilim Group, which would allow us to retain the exclusive rights to market and sell all of the JSC Ilim Group’s UFS. Eastern Europe 0.2% Western Europe (2.7%) (2.6%) 2021 – 2025 Projected Demand CAGR 2.2%

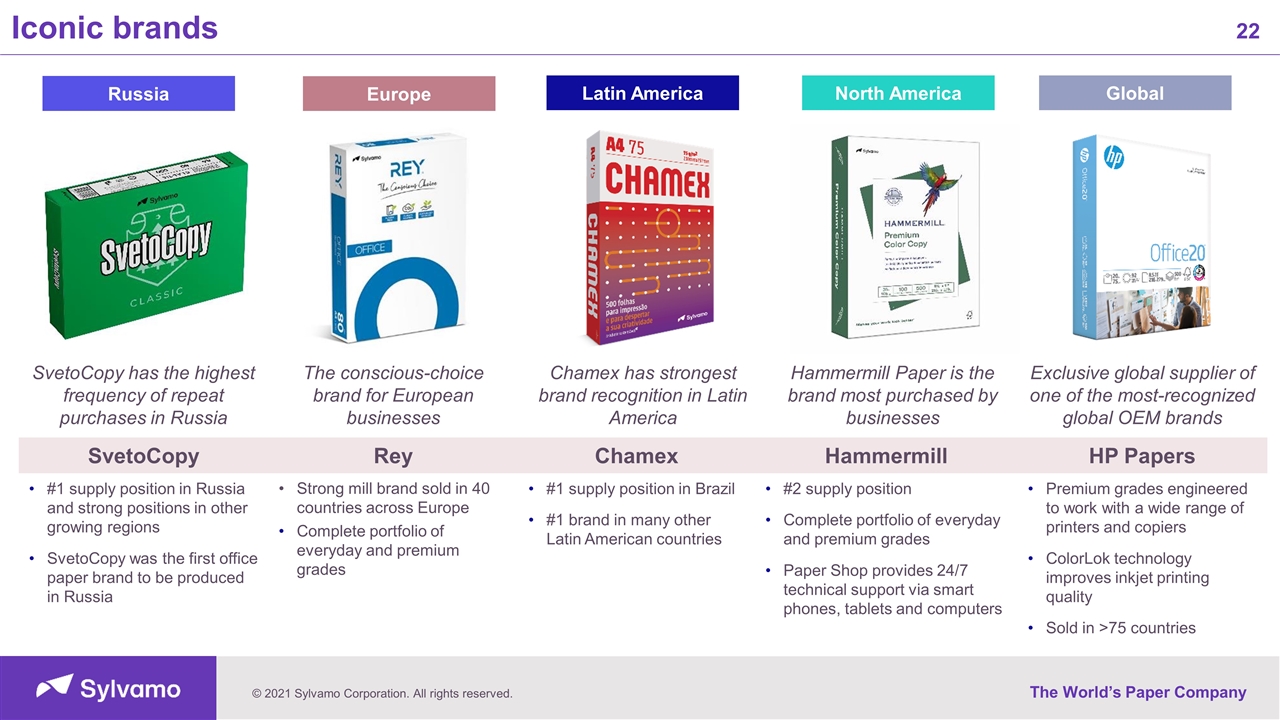

Iconic brands SvetoCopy has the highest frequency of repeat purchases in Russia The conscious-choice brand for European businesses Chamex has strongest brand recognition in Latin America Hammermill Paper is the brand most purchased by businesses Exclusive global supplier of one of the most-recognized global OEM brands Latin America Russia North America Global SvetoCopy Rey Chamex Hammermill HP Papers #1 supply position in Russia and strong positions in other growing regions SvetoCopy was the first office paper brand to be produced in Russia Strong mill brand sold in 40 countries across Europe Complete portfolio of everyday and premium grades #1 supply position in Brazil #1 brand in many other Latin American countries #2 supply position Complete portfolio of everyday and premium grades Paper Shop provides 24/7 technical support via smart phones, tablets and computers Premium grades engineered to work with a wide range of printers and copiers ColorLok technology improves inkjet printing quality Sold in >75 countries Europe

Long-term, committed partnerships Note: Includes predecessor companies; displayed logos are not representative of top ten customers Top 10 customers represent ~1/3 of net sales with average partnership tenure of ~50 years No one customer makes up more than 10% of volume More than 600 customers with strong loyalty and little turnover Customer (Years of partnership) Europe Latin America North America 10+ 20+ 15+ 10+ 20+ 10+ Finsib 10+ 10+ 20+ 25+ 5+ 100+ 20+ 30+ 100+

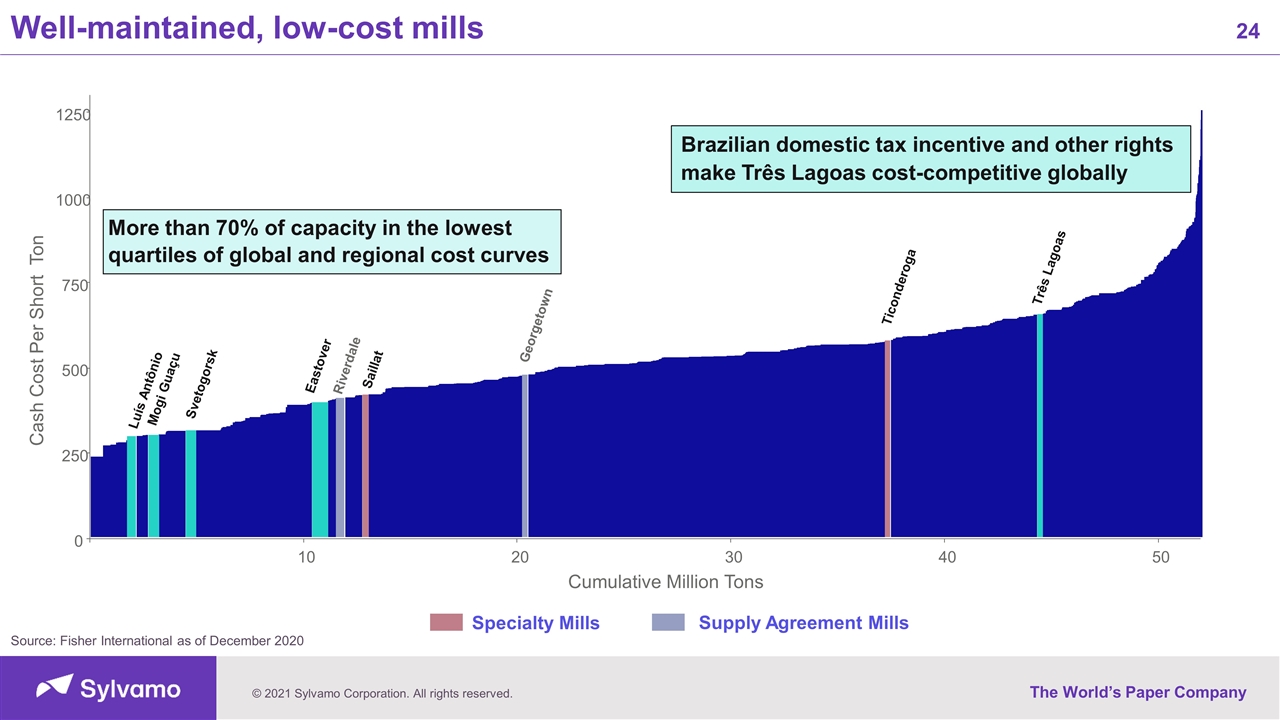

0 250 500 750 1000 1250 10 20 30 40 50 Cash Cost Per Short Ton Cumulative Million Tons Well-maintained, low-cost mills Source: Fisher International as of December 2020 Luís Antônio Mogi Guaçu Svetogorsk Eastover Riverdale Saillat Georgetown Ticonderoga Três Lagoas Specialty Mills Supply Agreement Mills More than 70% of capacity in the lowest quartiles of global and regional cost curves Brazilian domestic tax incentive and other rights make Três Lagoas cost-competitive globally

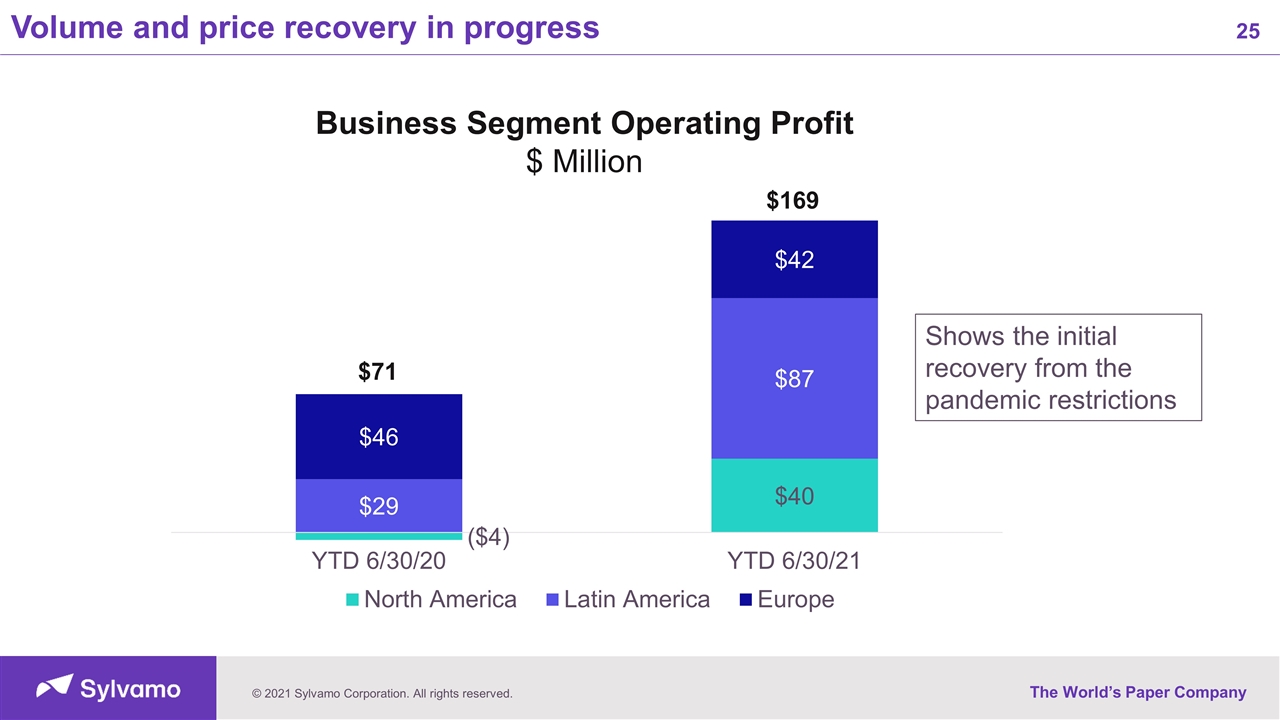

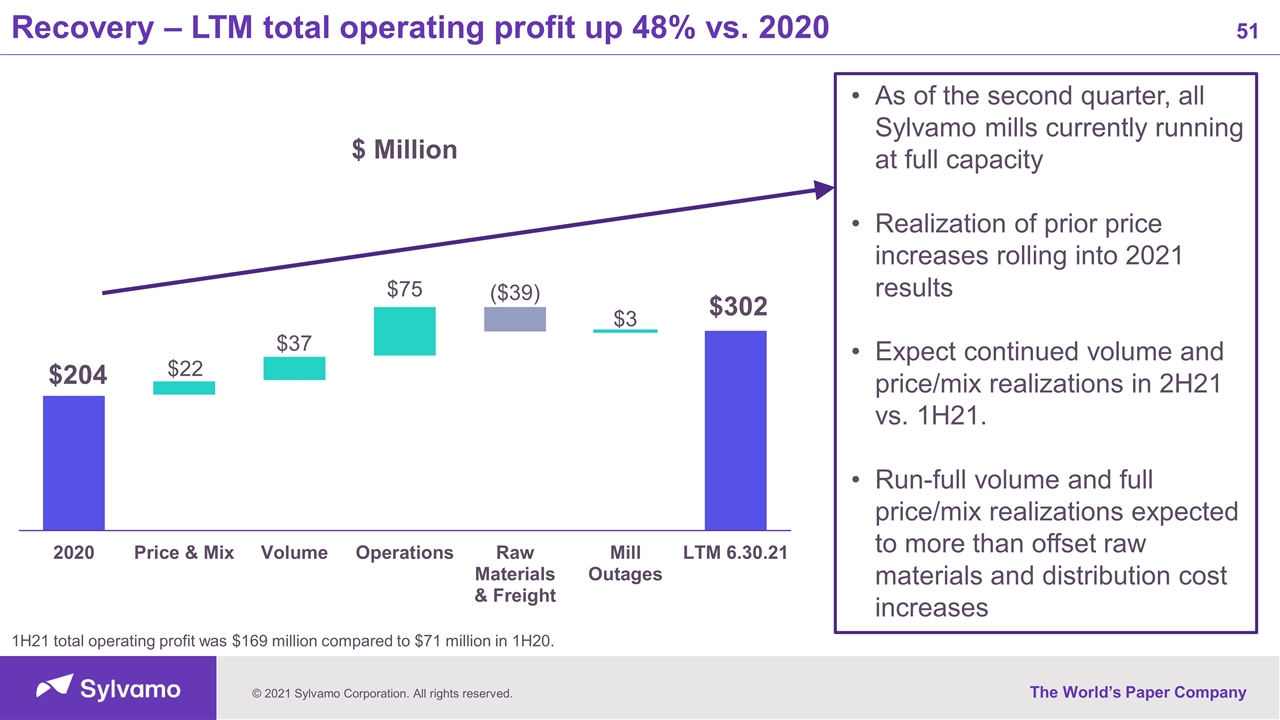

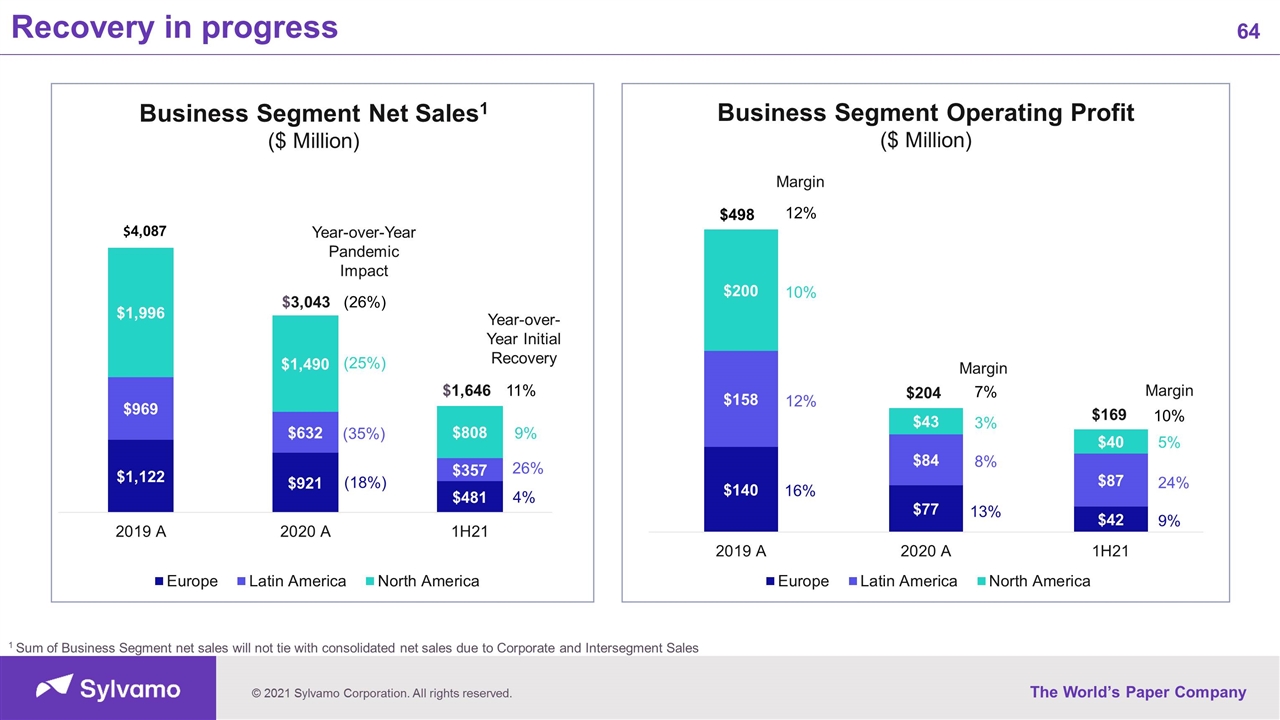

$169 Volume and price recovery in progress Shows the initial recovery from the pandemic restrictions Business Segment Operating Profit $ Million

Recovery underway Free Cash Flow defined as Cash Provided by Operating Activities less Cash Invested in Capital Projects Pandemic Pre-Pandemic 17.6% 12.4% 15.2% 14.7% $ Million

Key competitive advantages ü Attractive regions ü Low-cost mills ü Iconic brands ü Committed channel partnerships ü Talented teams ü Robust, resilient free cash flow

Regional overviews Rodrigo Davoli Senior Vice President & General Manager, Latin America 28 years at International Paper Oliver Taudien Senior Vice President & General Manager, Europe 26 years at International Paper Greg C. Gibson Senior Vice President & General Manager, North America 39 years at International Paper

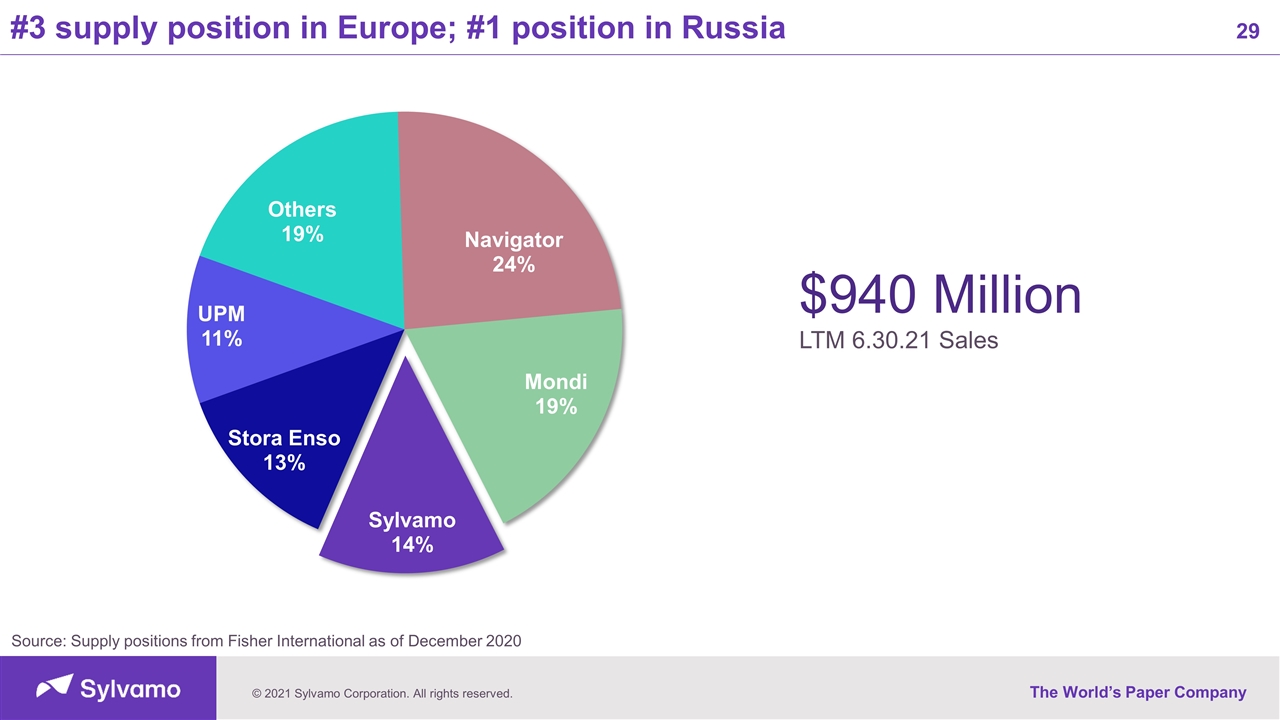

#3 supply position in Europe; #1 position in Russia Source: Supply positions from Fisher International as of December 2020 $940 Million LTM 6.30.21 Sales

Key strategic advantages in Europe SvetoCopy - Strong supply position and brand loyalty First branded office paper produced in Russia Saillat - Only integrated premium UFS mill in Europe Full range of premium grades Svetogorsk - 1st-quartile mill that serves Russia and export markets Margin advantage supports strong, sustainable cash flow 23-year successful track record of operating in Russia Strong and steady cash flow generation over time

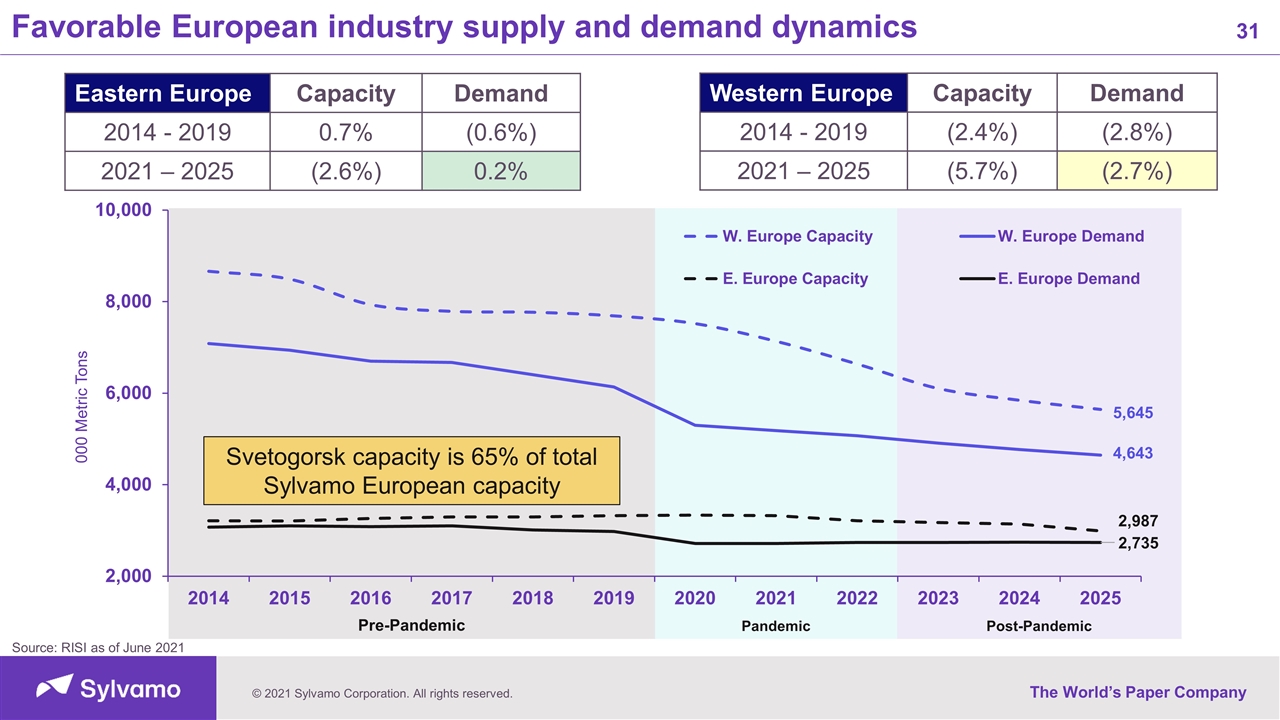

Favorable European industry supply and demand dynamics Source: RISI as of June 2021 Pre-Pandemic Pandemic Post-Pandemic Eastern Europe Capacity Demand 2014 - 2019 0.7% (0.6%) 2021 – 2025 (2.6%) 0.2% Western Europe Capacity Demand 2014 - 2019 (2.4%) (2.8%) 2021 – 2025 (5.7%) (2.7%) Svetogorsk capacity is 65% of total Sylvamo European capacity

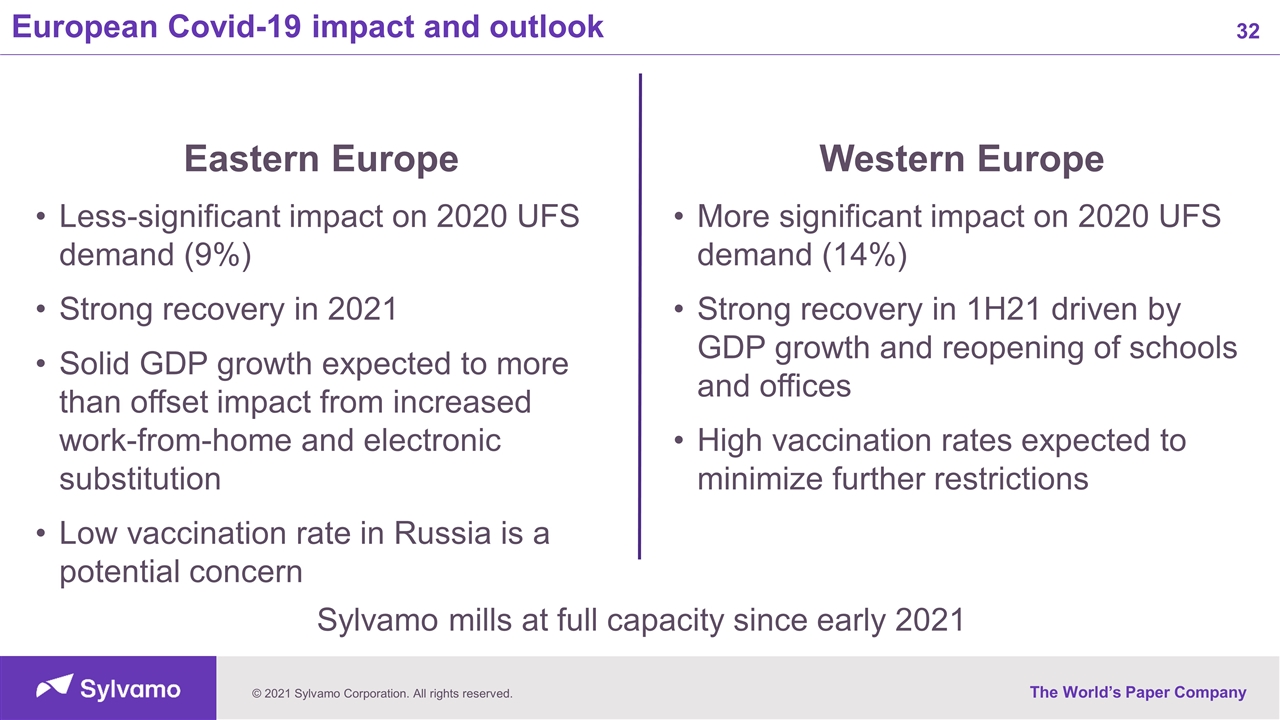

European Covid-19 impact and outlook Western Europe More significant impact on 2020 UFS demand (14%) Strong recovery in 1H21 driven by GDP growth and reopening of schools and offices High vaccination rates expected to minimize further restrictions Eastern Europe Less-significant impact on 2020 UFS demand (9%) Strong recovery in 2021 Solid GDP growth expected to more than offset impact from increased work-from-home and electronic substitution Low vaccination rate in Russia is a potential concern Sylvamo mills at full capacity since early 2021

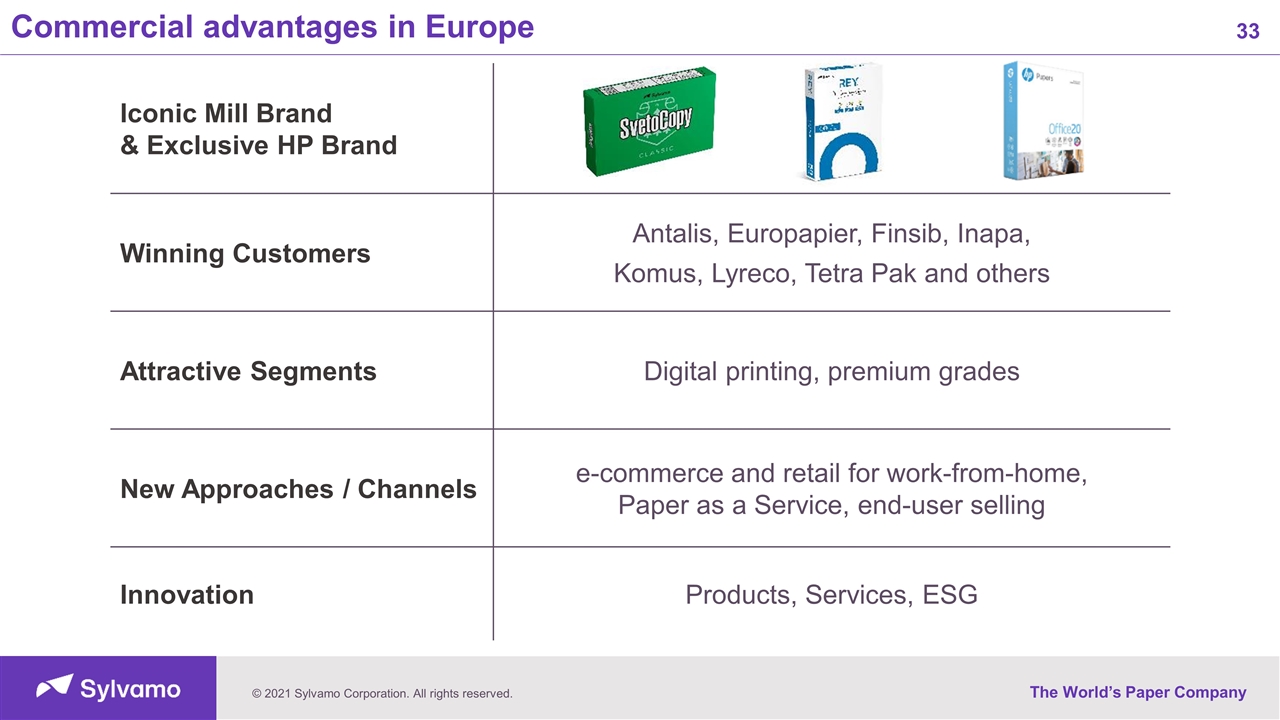

Iconic Mill Brand & Exclusive HP Brand Winning Customers Antalis, Europapier, Finsib, Inapa, Komus, Lyreco, Tetra Pak and others Attractive Segments Digital printing, premium grades New Approaches / Channels e-commerce and retail for work-from-home, Paper as a Service, end-user selling Innovation Products, Services, ESG Commercial advantages in Europe

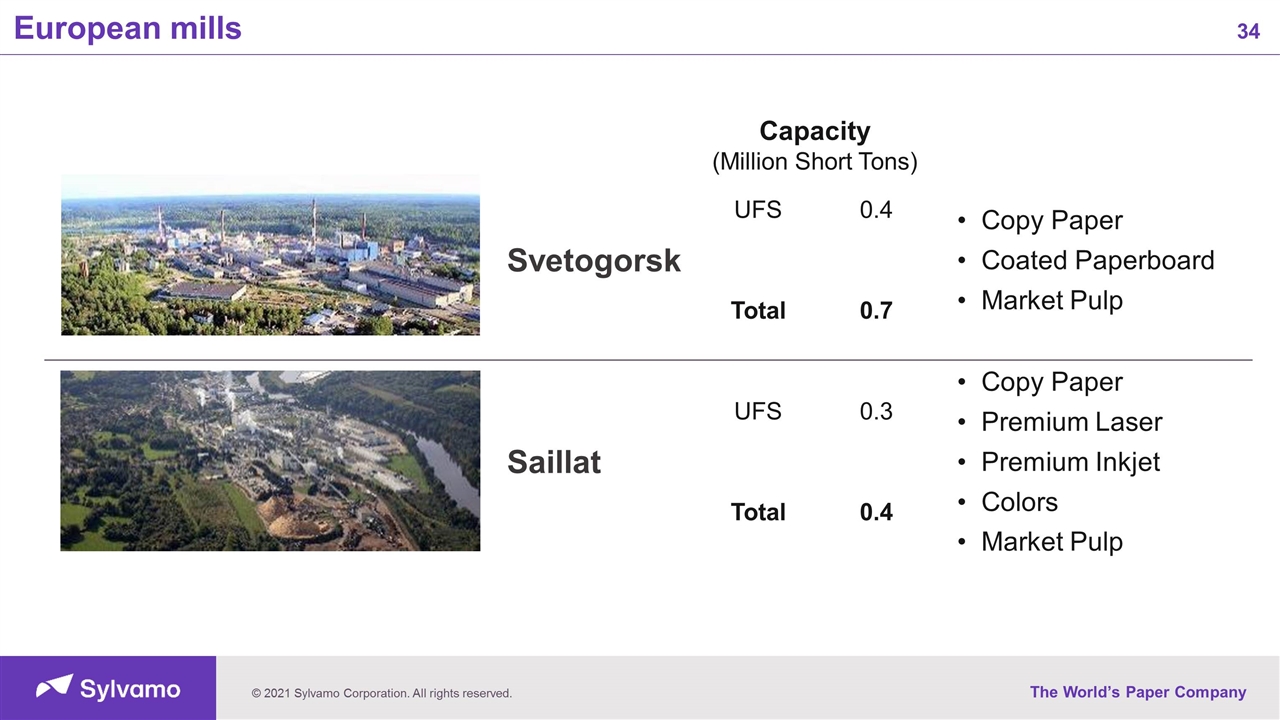

Svetogorsk UFS 0.4 Copy Paper Coated Paperboard Market Pulp Total 0.7 Saillat UFS 0.3 Copy Paper Premium Laser Premium Inkjet Colors Market Pulp Total 0.4 European mills Capacity (Million Short Tons)

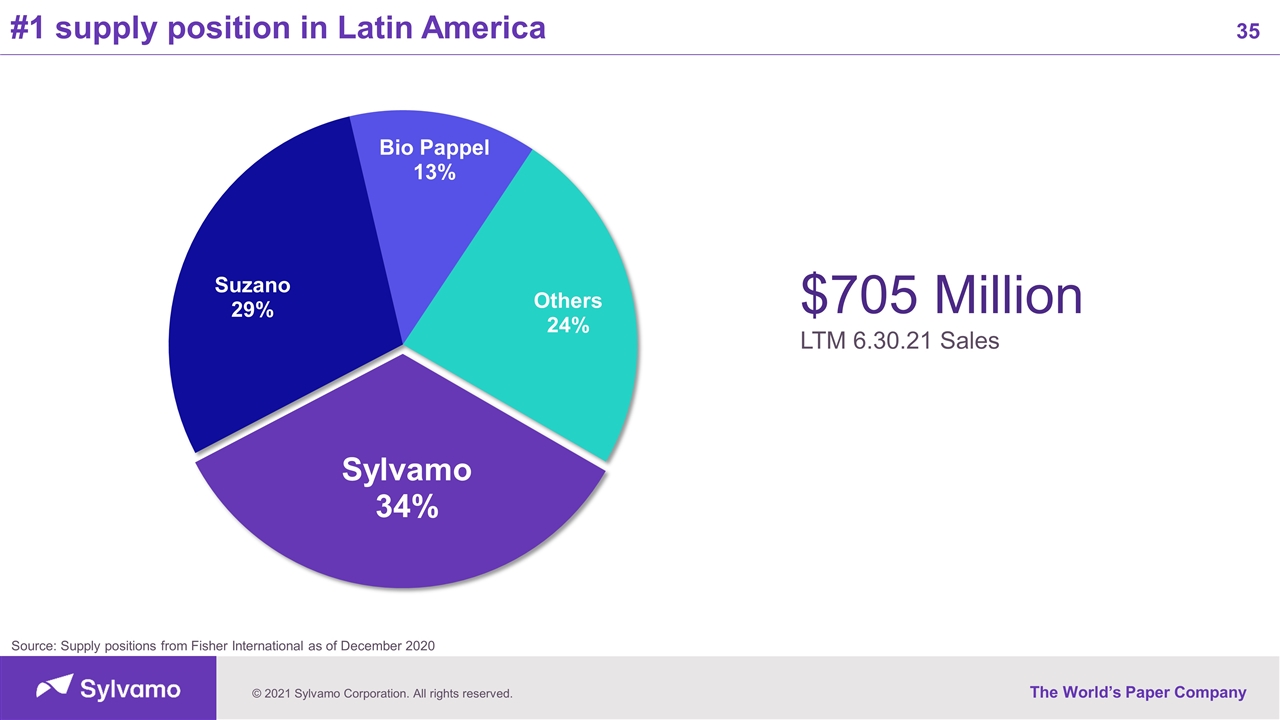

#1 supply position in Latin America Source: Supply positions from Fisher International as of December 2020 $705 Million LTM 6.30.21 Sales

Key strategic advantages in Latin America Low-cost wood sourced from our eucalyptus plantations Fiber source provides significant margin advantage Exports to a majority of Latin American countries U.S. Dollar revenues provide a natural currency hedge Three global low-cost mills with ability to ship globally High margins generate substantial cash throughout the cycle Chamex - Leading brand in Latin America 25% supply position

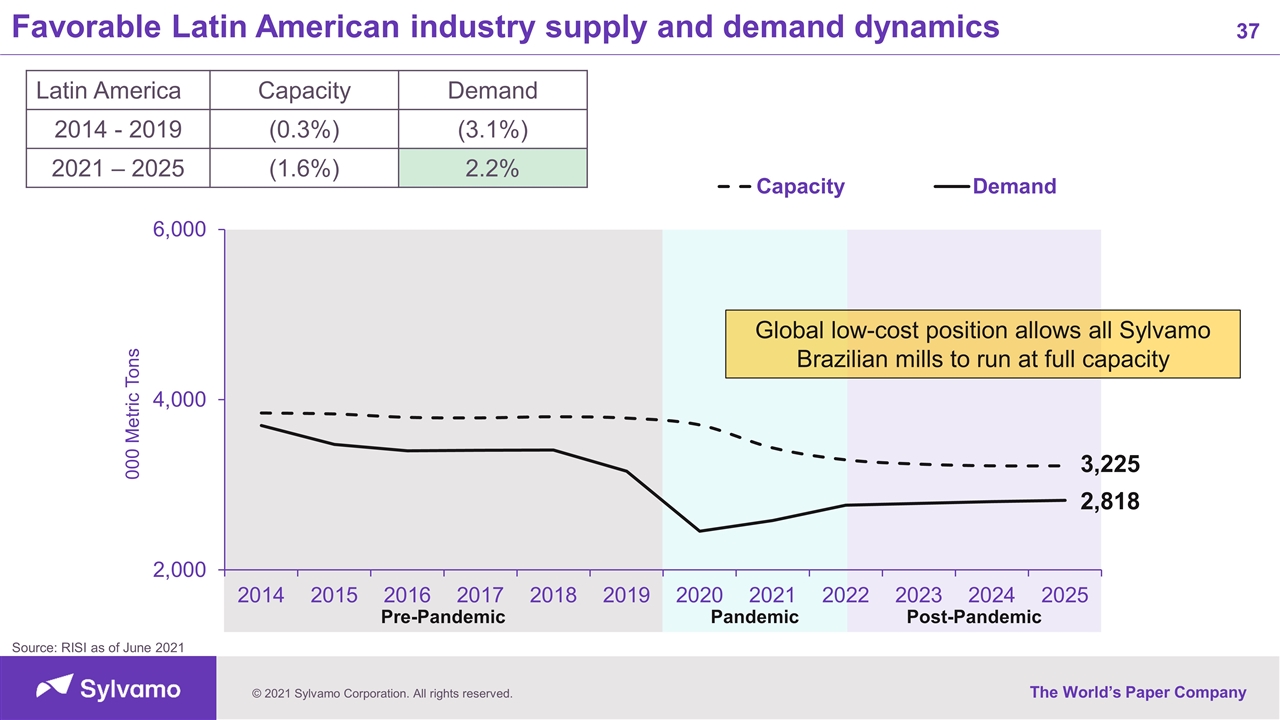

Pre-Pandemic Pandemic Post-Pandemic Favorable Latin American industry supply and demand dynamics Source: RISI as of June 2021 Latin America Capacity Demand 2014 - 2019 (0.3%) (3.1%) 2021 – 2025 (1.6%) 2.2% Global low-cost position allows all Sylvamo Brazilian mills to run at full capacity

Latin American Covid-19 impact and outlook Domtar 770K tons Significant UFS demand decline in 2020 driven by pandemic restrictions Paper for schools and offices the most impacted segments Schools and offices reopening across Latin America as of August 2021 Vaccination rates improving Strong 2021 GDP driving demand recovery All Sylvamo mills running at full capacity in 2021

Iconic Mill Brands & Exclusive HP Brand Winning Customers Acco Brands, CMPC, Kalunga, Nagem, Oji Papers, Perez Trading, and others Attractive Segments Specialized Retail, Digital Printing, Industrial Conversion New Approaches / Channels Innovative Products, e-commerce, General Retail Innovation Portfolio, Products, Services Commercial advantages in Latin America

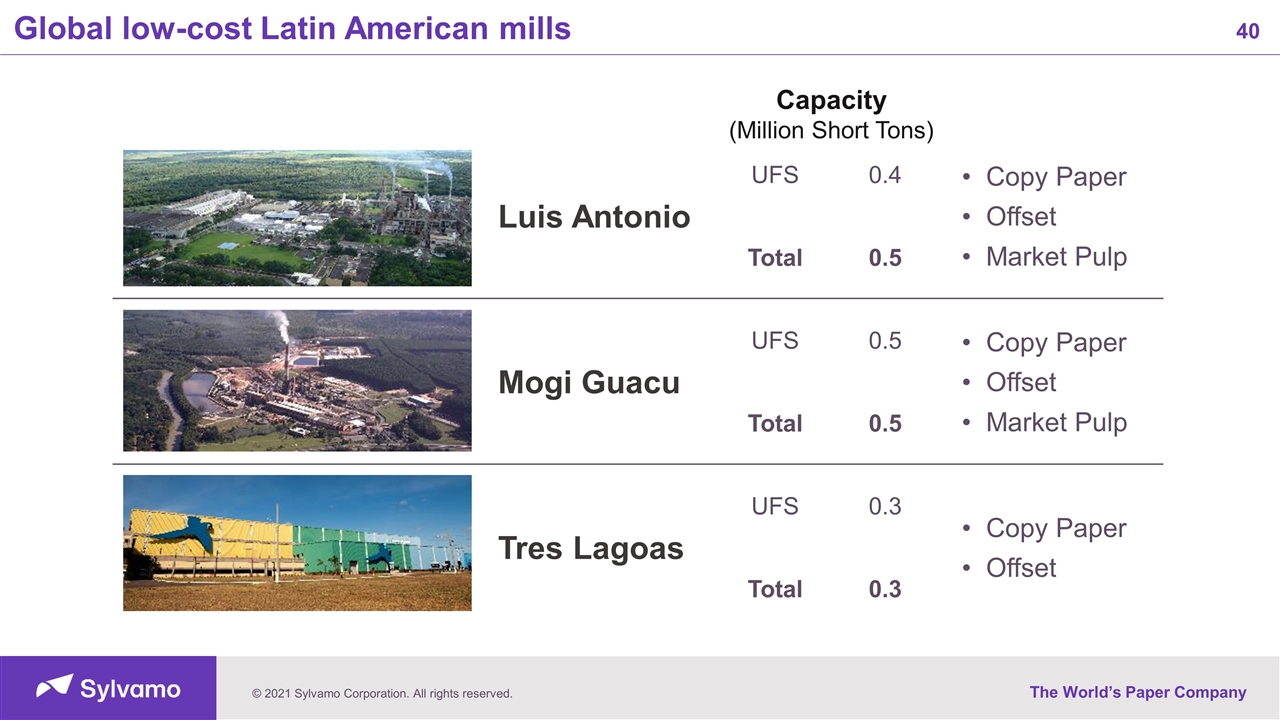

Luis Antonio UFS 0.4 Copy Paper Offset Market Pulp Total 0.5 Mogi Guacu UFS 0.5 Copy Paper Offset Market Pulp Total 0.5 Tres Lagoas UFS 0.3 Copy Paper Offset Total 0.3 Global low-cost Latin American mills Capacity (Million Short Tons)

Our eucalyptus plantations are a key advantage Own 100,000 hectares of forestland 75,000 hectares of eucalyptus trees 25,000 hectares of protected forests Plant 14 million seedlings per year 80% fiber self-sufficient 80 kilometer (50 miles) average haul distance

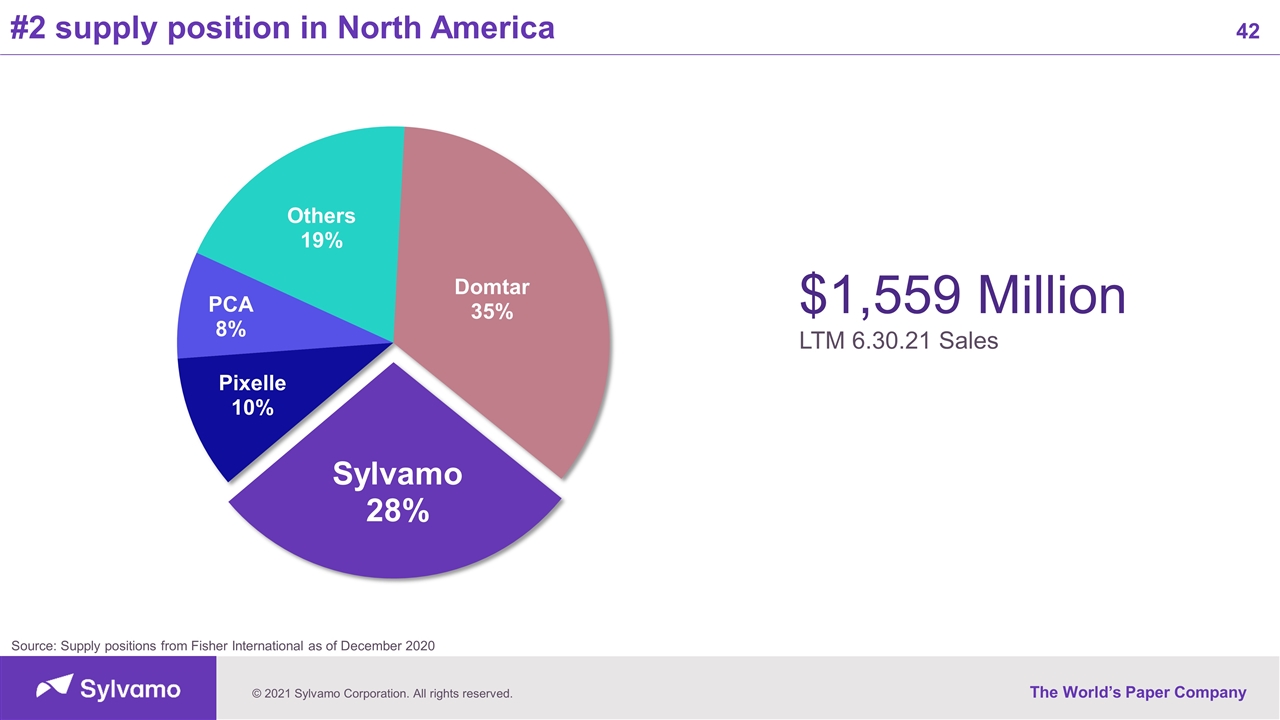

#2 supply position in North America Source: Supply positions from Fisher International as of December 2020 $1,559 Million LTM 6.30.21 Sales

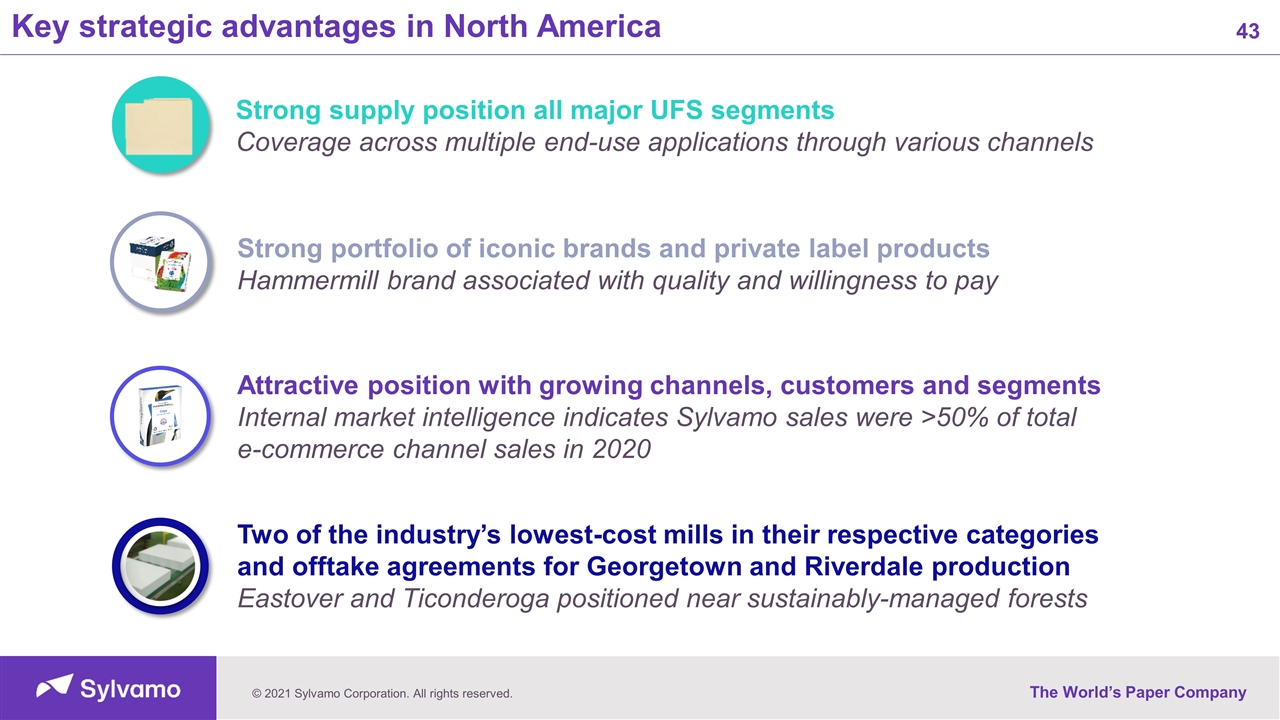

Key strategic advantages in North America Attractive position with growing channels, customers and segments Internal market intelligence indicates Sylvamo sales were >50% of total e-commerce channel sales in 2020 Strong portfolio of iconic brands and private label products Hammermill brand associated with quality and willingness to pay Two of the industry’s lowest-cost mills in their respective categories and offtake agreements for Georgetown and Riverdale production Eastover and Ticonderoga positioned near sustainably-managed forests Strong supply position all major UFS segments Coverage across multiple end-use applications through various channels

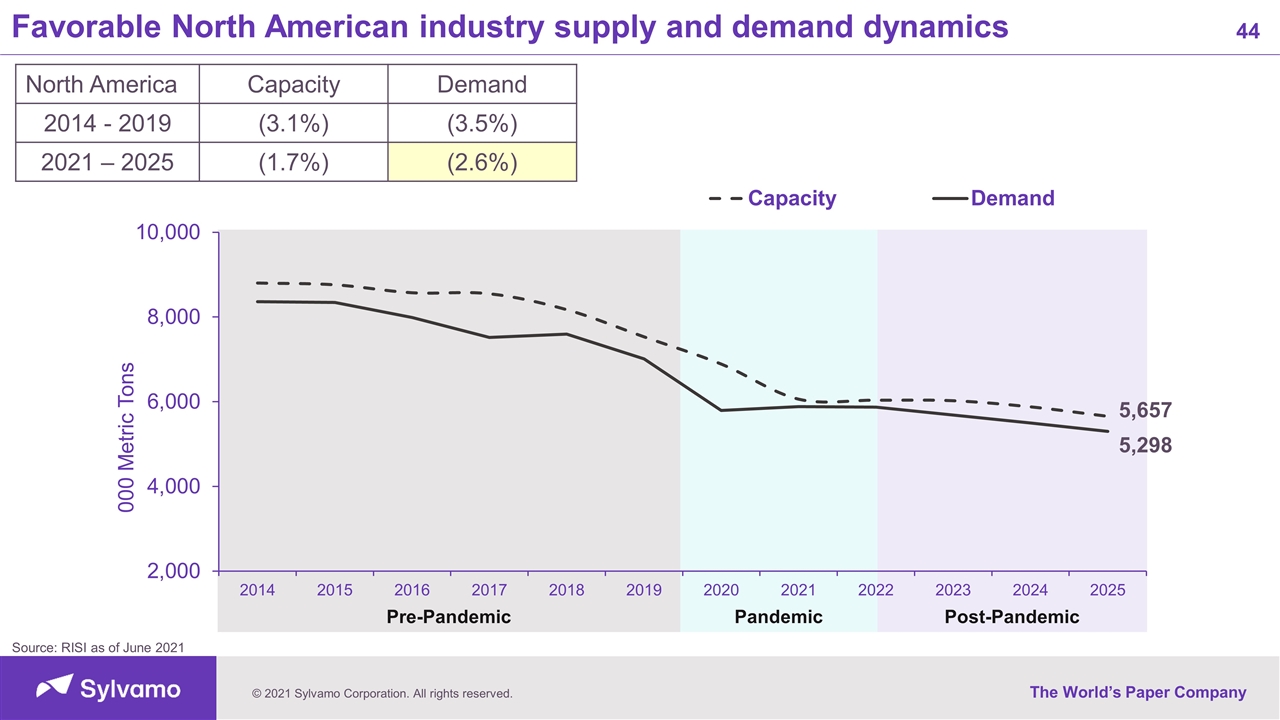

Post-Pandemic Pre-Pandemic Pandemic Favorable North American industry supply and demand dynamics Source: RISI as of June 2021 Domtar 770K tons North America Capacity Demand 2014 - 2019 (3.1%) (3.5%) 2021 – 2025 (1.7%) (2.6%)

North American Covid-19 impact and outlook Domtar 770K tons 18% North American UFS demand decline in 2020 Demand improving and continues to gain momentum Not all UFS segments recovering at the same rate Advertising and direct mail leading the way Copy paper improving, but has not recovered as quickly Anticipate the improving demand trend to continue Vaccinations and continued economic recovery are key All Sylvamo mills running at full capacity since second quarter 2021

Iconic Mill Brand & Exclusive HP Brand Winning Customers Amazon, Central National Gottesman, Staples, and others Attractive Segments Books on Demand, Digital Printing New Approaches / Channels e-commerce, Paper as a Service, End-user Selling Innovation Product, Services, Knowledge Commercial advantages in North America

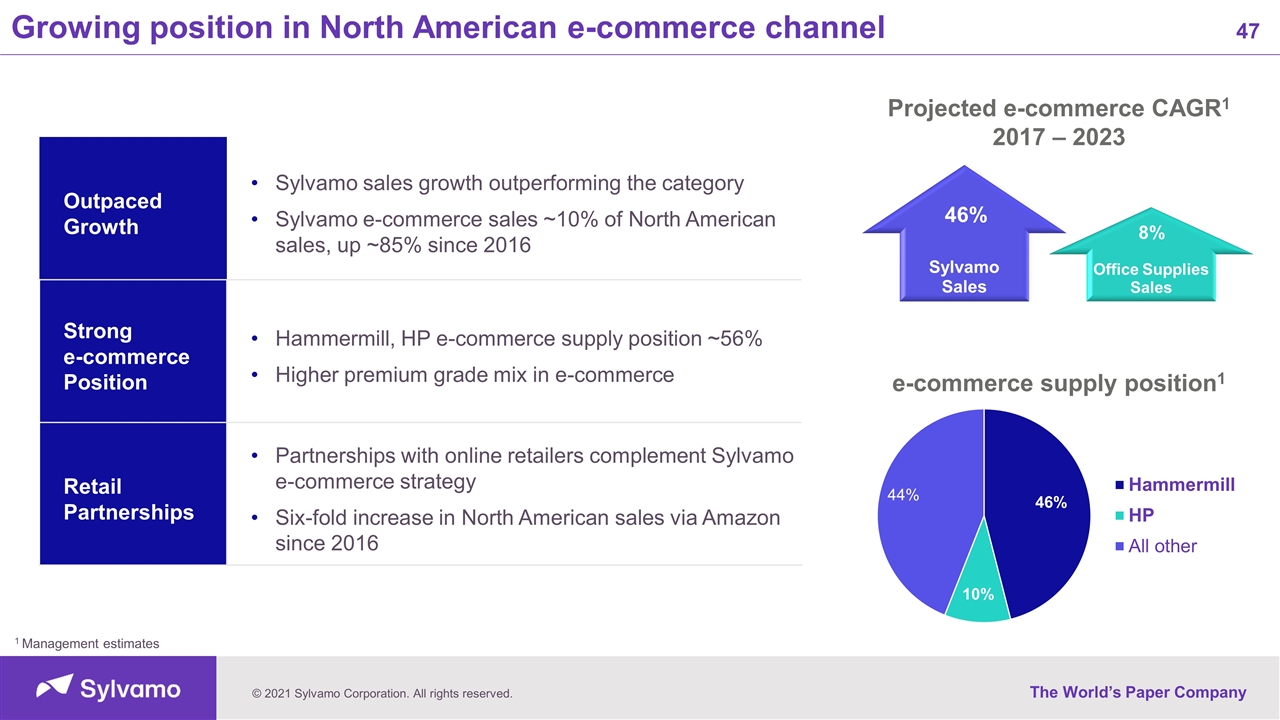

Growing position in North American e-commerce channel Outpaced Growth Sylvamo sales growth outperforming the category Sylvamo e-commerce sales ~10% of North American sales, up ~85% since 2016 Strong e-commerce Position Hammermill, HP e-commerce supply position ~56% Higher premium grade mix in e-commerce Retail Partnerships Partnerships with online retailers complement Sylvamo e-commerce strategy Six-fold increase in North American sales via Amazon since 2016 Sylvamo Sales Office Supplies Sales Projected e-commerce CAGR1 2017 – 2023 46% 8% e-commerce supply position1 1 Management estimates

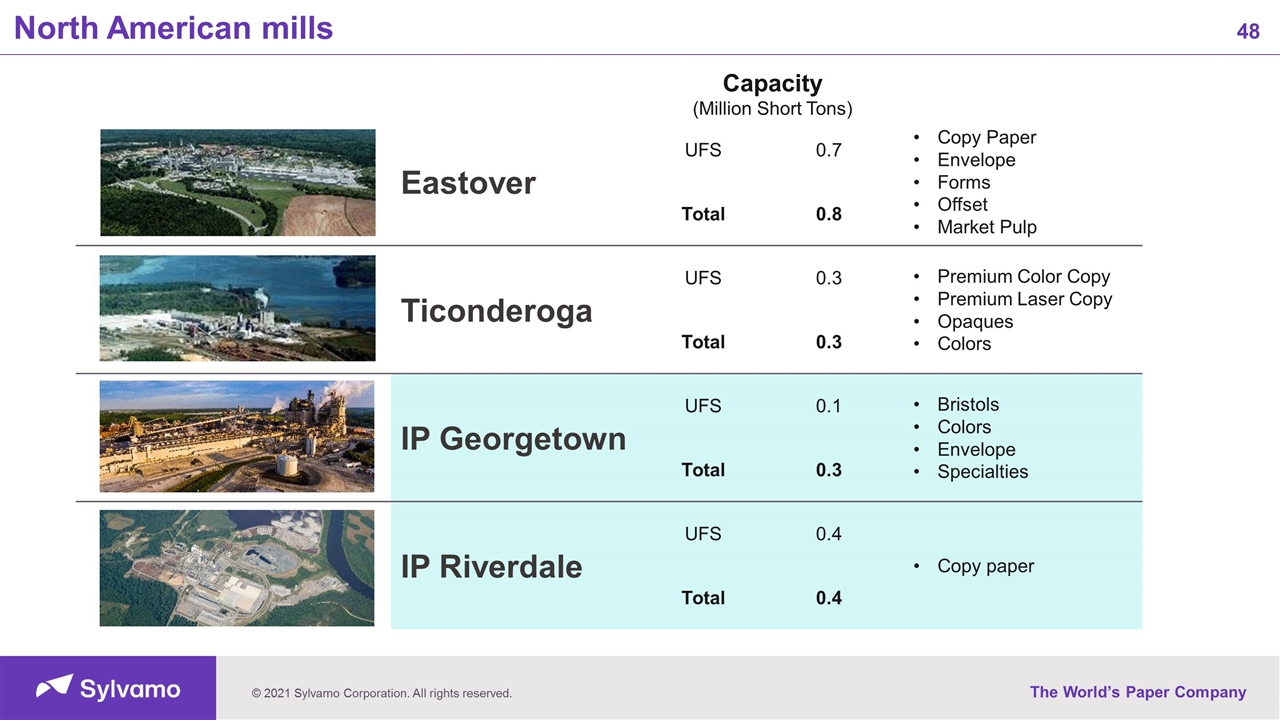

Eastover UFS 0.7 Copy Paper Envelope Forms Offset Market Pulp Total 0.8 Ticonderoga UFS 0.3 Premium Color Copy Premium Laser Copy Opaques Colors Total 0.3 IP Georgetown UFS 0.1 Bristols Colors Envelope Specialties Total 0.3 IP Riverdale UFS 0.4 Copy paper Total 0.4 North American mills Capacity (Million Short Tons)

Financial Highlights

Recovery accelerating Adjusted EBITDA & Margin Net Sales $ Million

Recovery – LTM total operating profit up 48% vs. 2020 As of the second quarter, all Sylvamo mills currently running at full capacity Realization of prior price increases rolling into 2021 results Expect continued volume and price/mix realizations in 2H21 vs. 1H21. Run-full volume and full price/mix realizations expected to more than offset raw materials and distribution cost increases 1H21 total operating profit was $169 million compared to $71 million in 1H20. $ Million

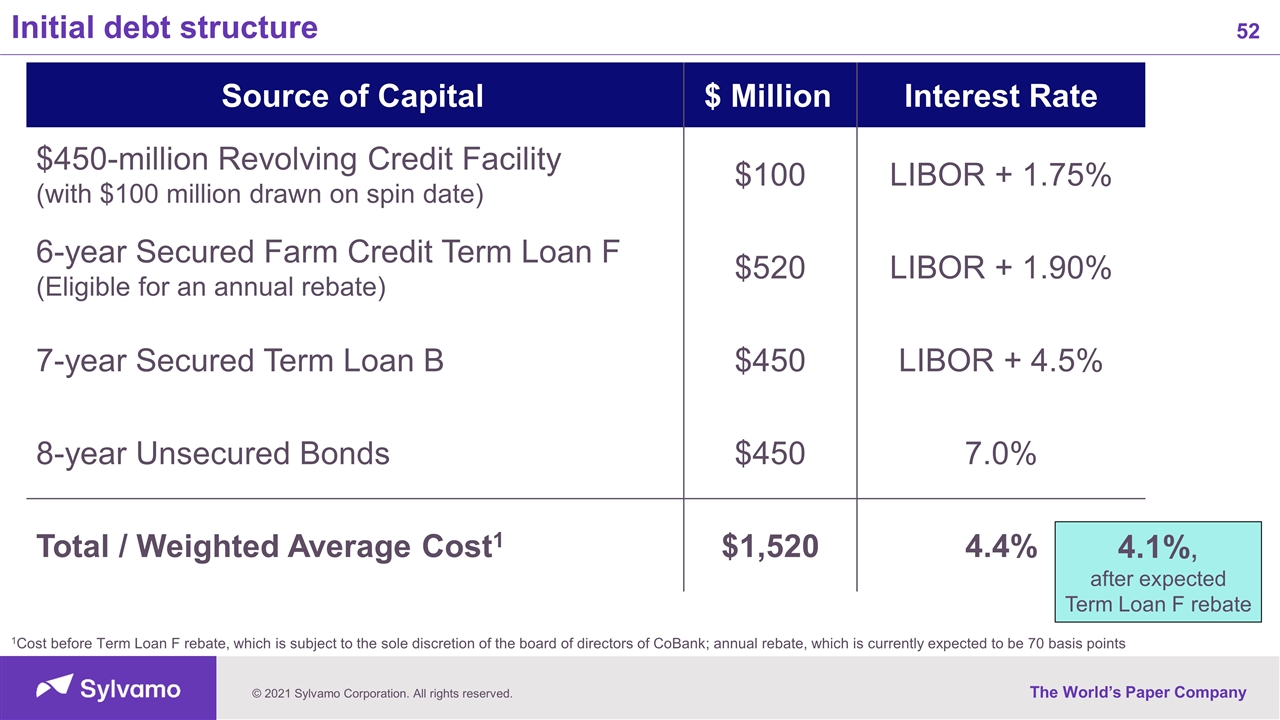

1Cost before Term Loan F rebate, which is subject to the sole discretion of the board of directors of CoBank; annual rebate, which is currently expected to be 70 basis points Initial debt structure Source of Capital $ Million Interest Rate $450-million Revolving Credit Facility (with $100 million drawn on spin date) $100 LIBOR + 1.75% 6-year Secured Farm Credit Term Loan F (Eligible for an annual rebate) $520 LIBOR + 1.90% 7-year Secured Term Loan B $450 LIBOR + 4.5% 8-year Unsecured Bonds $450 7.0% Total / Weighted Average Cost1 $1,520 4.4% 4.1%, after expected Term Loan F rebate

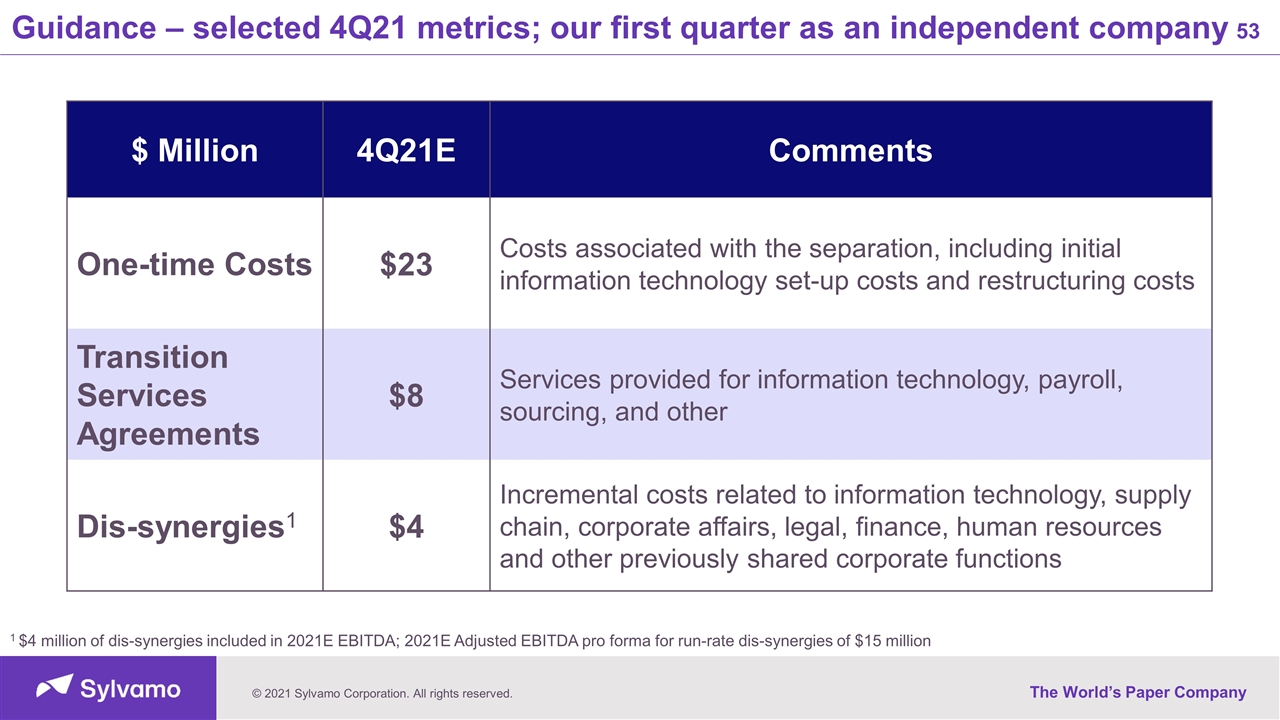

Guidance – selected 4Q21 metrics; our first quarter as an independent company $ Million 4Q21E Comments One-time Costs $23 Costs associated with the separation, including initial information technology set-up costs and restructuring costs Transition Services Agreements $8 Services provided for information technology, payroll, sourcing, and other Dis-synergies1 $4 Incremental costs related to information technology, supply chain, corporate affairs, legal, finance, human resources and other previously shared corporate functions 1 $4 million of dis-synergies included in 2021E EBITDA; 2021E Adjusted EBITDA pro forma for run-rate dis-synergies of $15 million

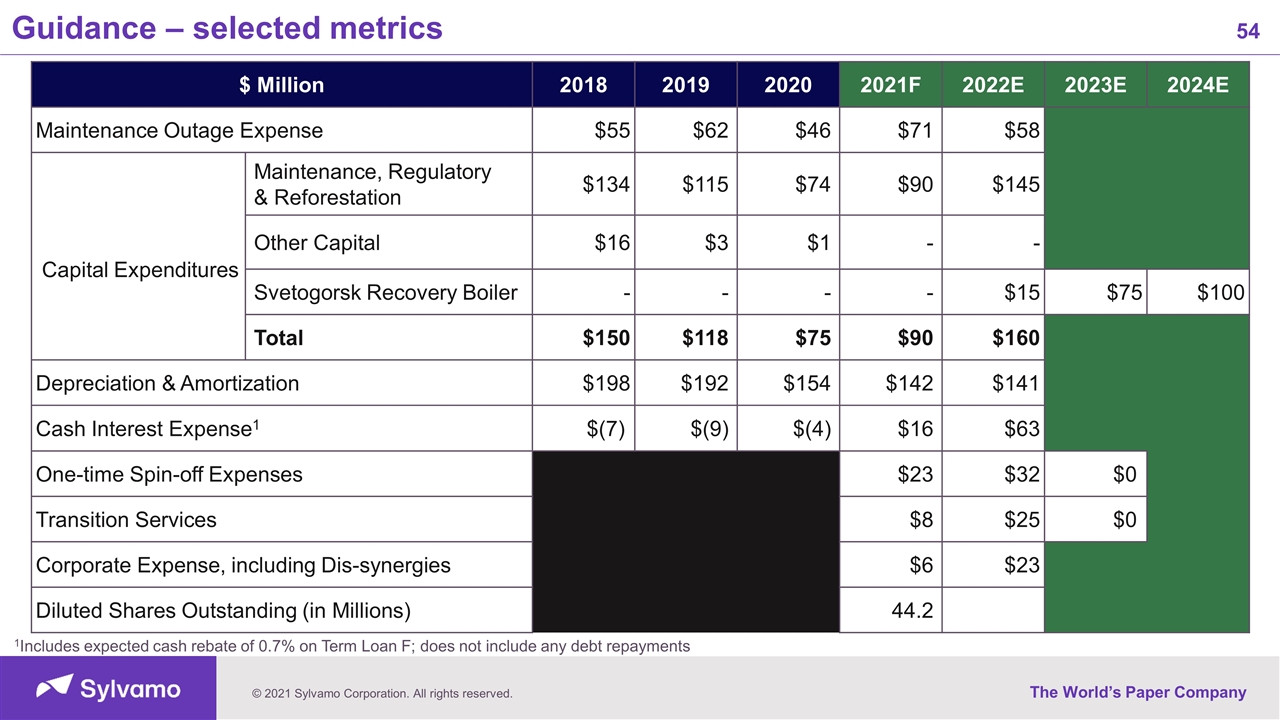

Guidance – selected metrics $ Million 2018 2019 2020 2021F 2022E 2023E 2024E Maintenance Outage Expense $55 $62 $46 $71 $58 Capital Expenditures Maintenance, Regulatory & Reforestation $134 $115 $74 $90 $145 Other Capital $16 $3 $1 - - Svetogorsk Recovery Boiler - - - - $15 $75 $100 Total $150 $118 $75 $90 $160 Depreciation & Amortization $198 $192 $154 $142 $141 Cash Interest Expense1 $(7) $(9) $(4) $16 $63 One-time Spin-off Expenses - - - $23 $32 $0 Transition Services - - - $8 $25 $0 Corporate Expense, including Dis-synergies $5 $5 $10 $6 $23 Diluted Shares Outstanding (in Millions) - - - 44.2 1Includes expected cash rebate of 0.7% on Term Loan F; does not include any debt repayments

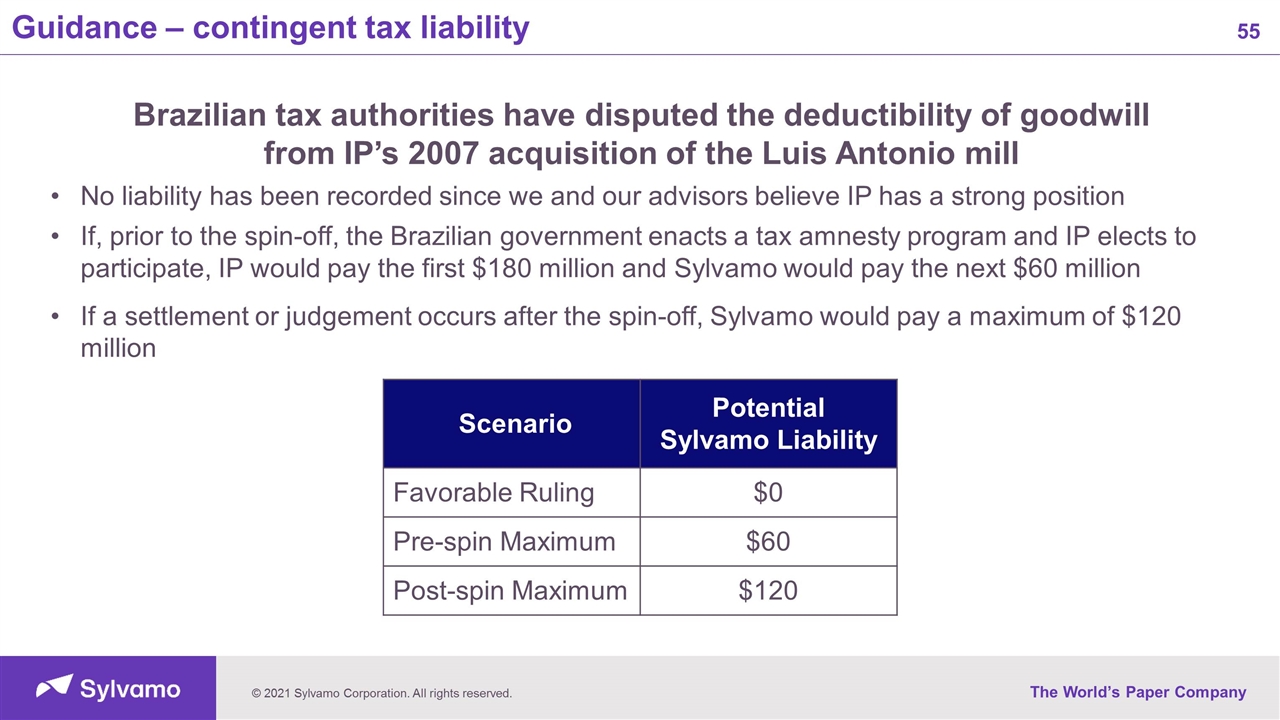

Guidance – contingent tax liability Scenario Potential Sylvamo Liability Favorable Ruling $0 Pre-spin Maximum $60 Post-spin Maximum $120 Brazilian tax authorities have disputed the deductibility of goodwill from IP’s 2007 acquisition of the Luis Antonio mill No liability has been recorded since we and our advisors believe IP has a strong position If, prior to the spin-off, the Brazilian government enacts a tax amnesty program and IP elects to participate, IP would pay the first $180 million and Sylvamo would pay the next $60 million If a settlement or judgement occurs after the spin-off, Sylvamo would pay a maximum of $120 million

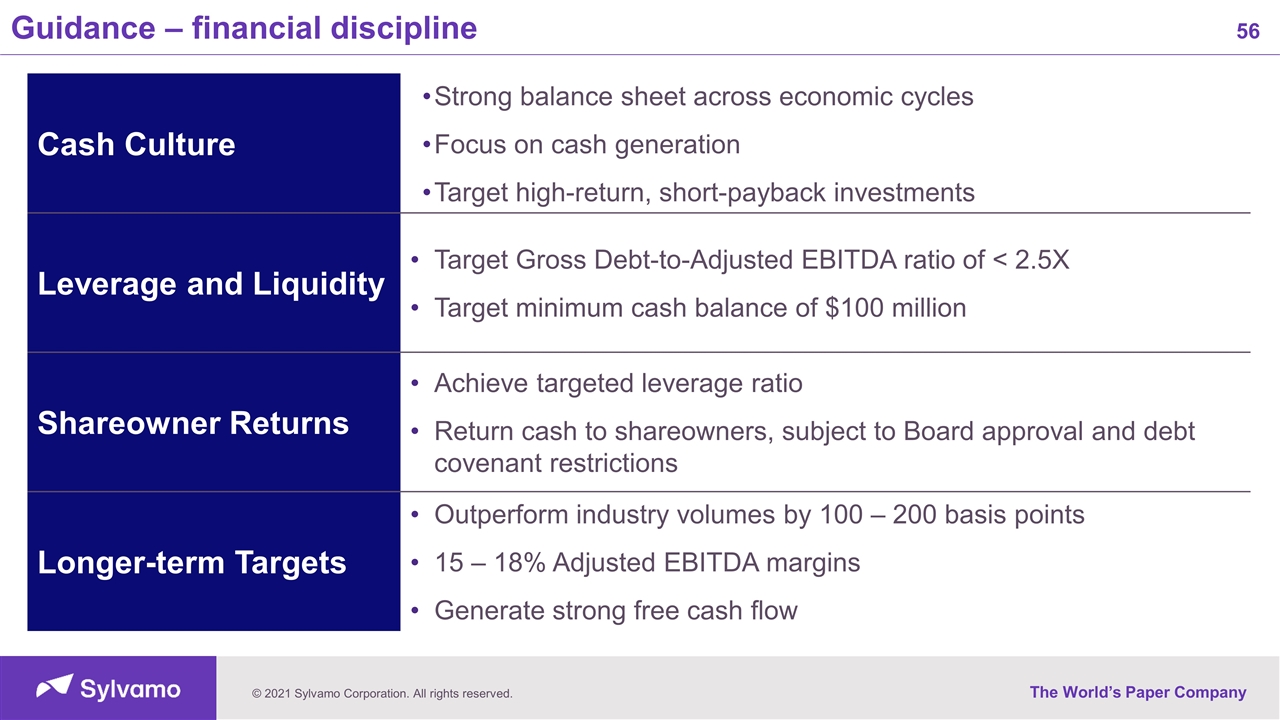

Guidance – financial discipline Cash Culture Strong balance sheet across economic cycles Focus on cash generation Target high-return, short-payback investments Leverage and Liquidity Target Gross Debt-to-Adjusted EBITDA ratio of < 2.5X Target minimum cash balance of $100 million Shareowner Returns Achieve targeted leverage ratio Return cash to shareowners, subject to Board approval and debt covenant restrictions Longer-term Targets Outperform industry volumes by 100 – 200 basis points 15 – 18% Adjusted EBITDA margins Generate strong free cash flow

Questions & Answers

Wrap Up and Thank You

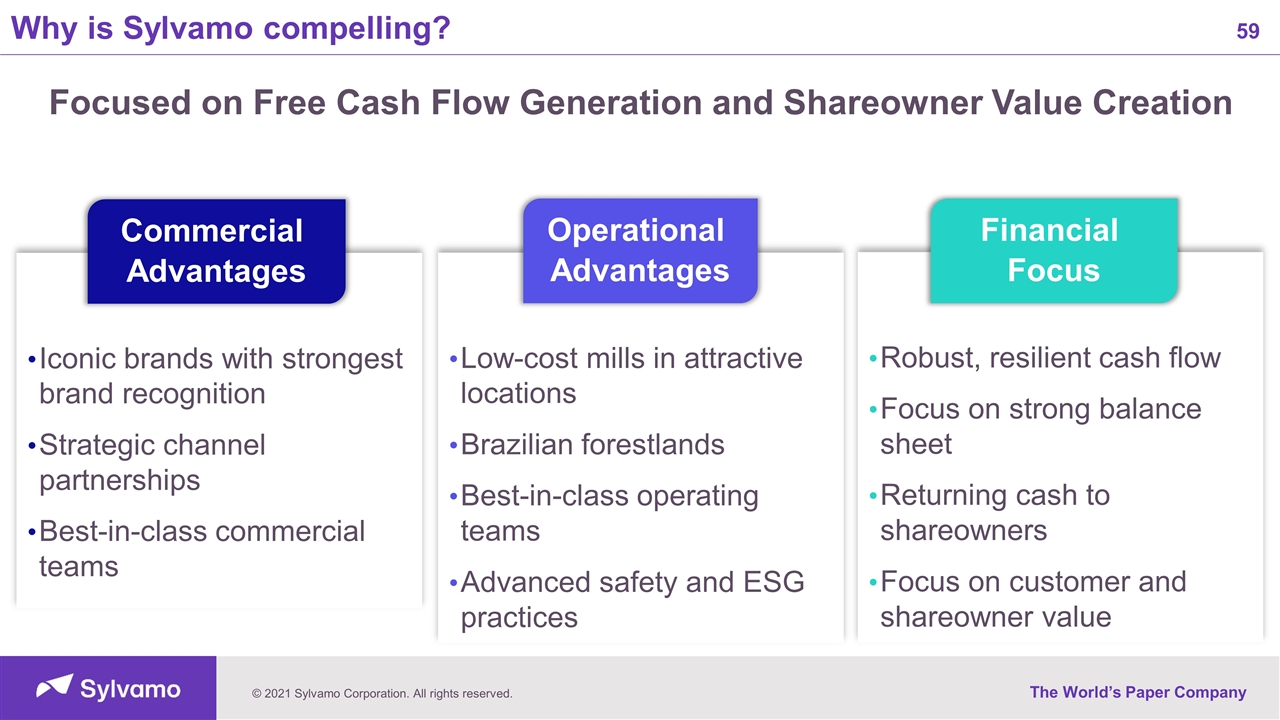

Why is Sylvamo compelling? Iconic brands with strongest brand recognition Strategic channel partnerships Best-in-class commercial teams Low-cost mills in attractive locations Brazilian forestlands Best-in-class operating teams Advanced safety and ESG practices Robust, resilient cash flow Focus on strong balance sheet Returning cash to shareowners Focus on customer and shareowner value Focused on Free Cash Flow Generation and Shareowner Value Creation Commercial Advantages Operational Advantages Financial Focus

Appendix

The Sylvamo Promise We believe in the promise of paper to educate, communicate and entertain. Paper connects us to one another and is an enduring bond to renewable natural resources. Our purpose is to produce the paper you need in the most responsible and sustainable ways. We aim high, innovate, and create value for our customers and investors. The future of paper deserves a company committed to the success of the entire ecosystem. From the forests we love, to the communities where we live, to those who rely on our paper, we know the well-being of each depends on the well-being of all. We are Sylvamo, built to help the world realize the promise of paper.

Vision, Mission and Values Mission Vision Values To be the world’s paper company: the employer, supplier, and investment of choice We transform renewable resources into papers that people depend on for education, communication and entertainment We always do the right things, in the right ways, for the right reasons

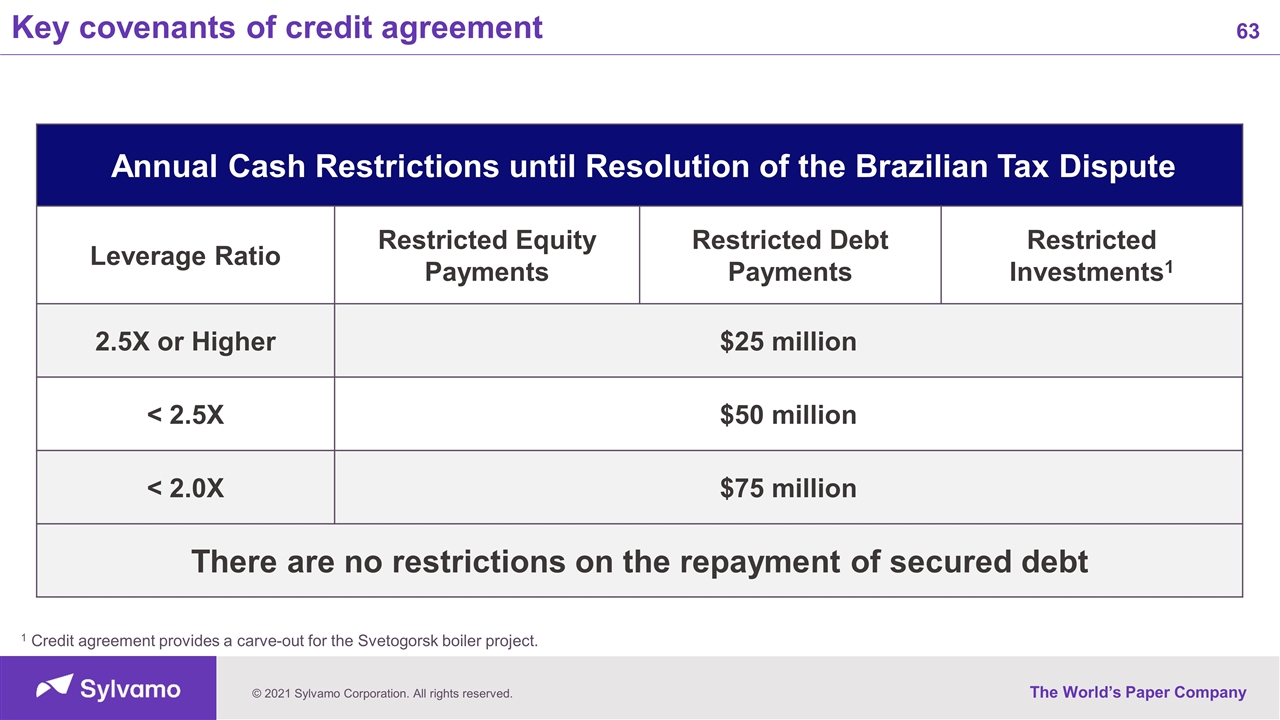

Key covenants of credit agreement Annual Cash Restrictions until Resolution of the Brazilian Tax Dispute Leverage Ratio Restricted Equity Payments Restricted Debt Payments Restricted Investments1 2.5X or Higher $25 million < 2.5X $50 million < 2.0X $75 million There are no restrictions on the repayment of secured debt 1 Credit agreement provides a carve-out for the Svetogorsk boiler project.

Recovery in progress 1 Sum of Business Segment net sales will not tie with consolidated net sales due to Corporate and Intersegment Sales $1,646 $3,043 $169 $204 Margin 12% 10% 12% 16% Margin 3% 8% 13% 7% Margin 5% 24% 9% 10% (25%) (35%) (18%) Year-over-Year Pandemic Impact (26%) 9% 26% 4% Year-over-Year Initial Recovery 11% Business Segment Operating Profit ($ Million) Business Segment Net Sales1 ($ Million)

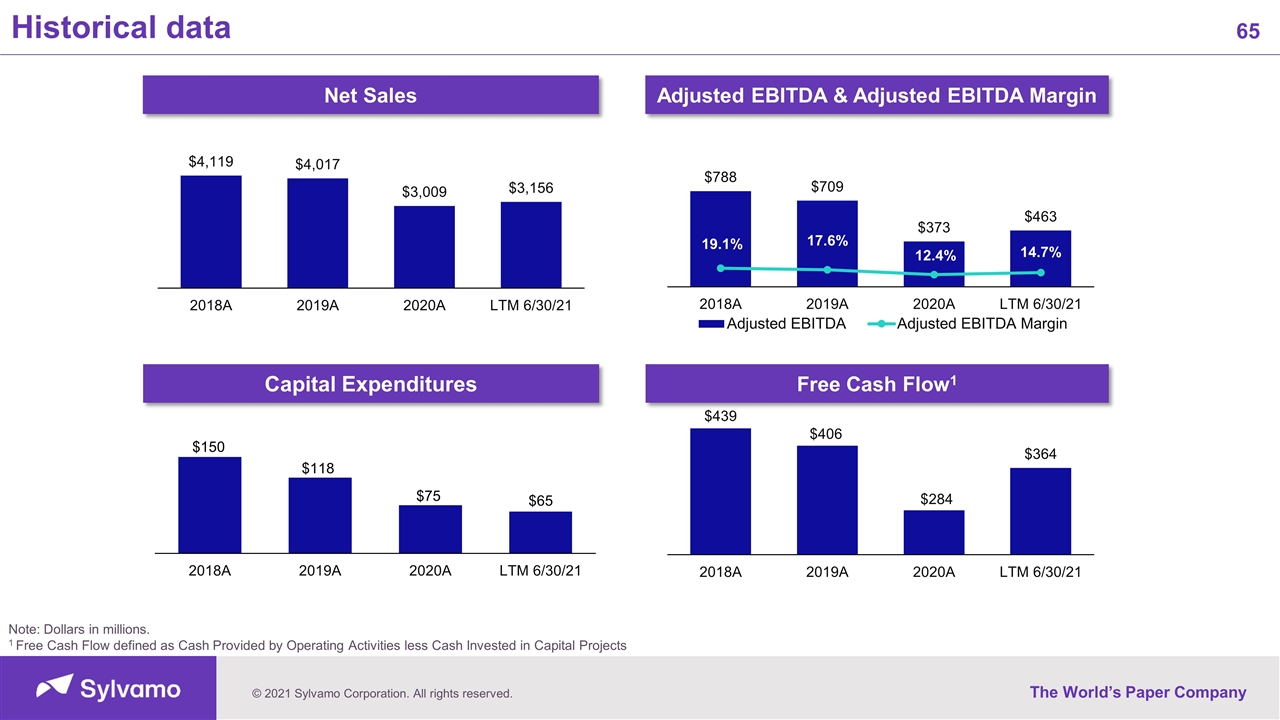

$150 $118 $75 Note: Dollars in millions. Historical data Adjusted EBITDA & Adjusted EBITDA Margin Net Sales Free Cash Flow1 Capital Expenditures 1 Free Cash Flow defined as Cash Provided by Operating Activities less Cash Invested in Capital Projects $65

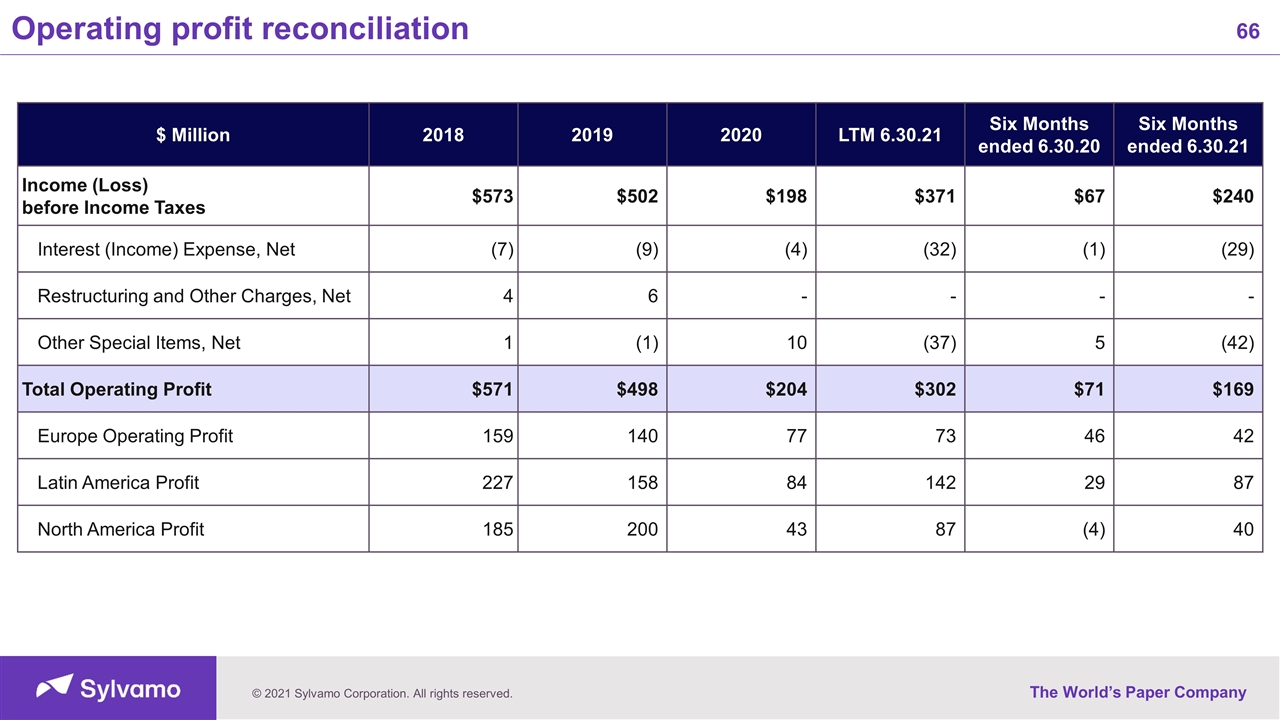

Operating profit reconciliation $ Million 2018 2019 2020 LTM 6.30.21 Six Months ended 6.30.20 Six Months ended 6.30.21 Income (Loss) before Income Taxes $573 $502 $198 $371 $67 $240 Interest (Income) Expense, Net (7) (9) (4) (32) (1) (29) Restructuring and Other Charges, Net 4 6 - - - - Other Special Items, Net 1 (1) 10 (37) 5 (42) Total Operating Profit $571 $498 $204 $302 $71 $169 Europe Operating Profit 159 140 77 73 46 42 Latin America Profit 227 158 84 142 29 87 North America Profit 185 200 43 87 (4) 40

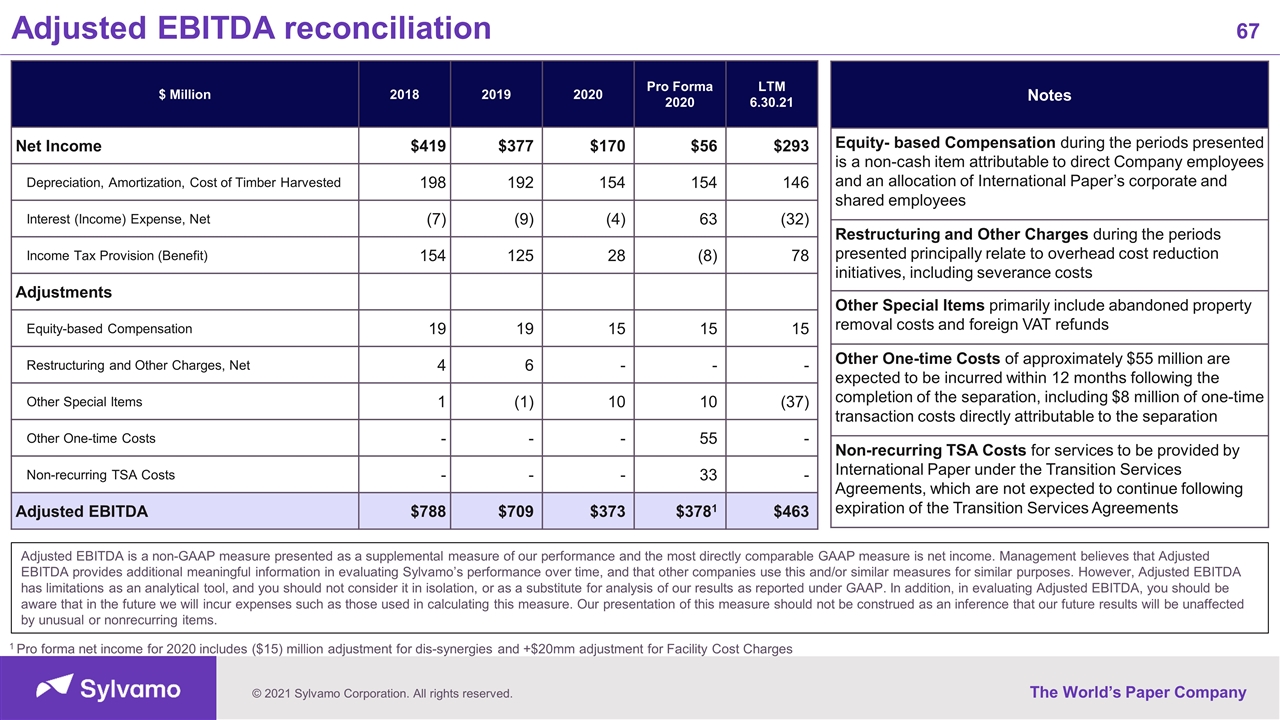

Adjusted EBITDA reconciliation $ Million 2018 2019 2020 Pro Forma 2020 LTM 6.30.21 Net Income $419 $377 $170 $56 $293 Depreciation, Amortization, Cost of Timber Harvested 198 192 154 154 146 Interest (Income) Expense, Net (7) (9) (4) 63 (32) Income Tax Provision (Benefit) 154 125 28 (8) 78 Adjustments Equity-based Compensation 19 19 15 15 15 Restructuring and Other Charges, Net 4 6 - - - Other Special Items 1 (1) 10 10 (37) Other One-time Costs - - - 55 - Non-recurring TSA Costs - - - 33 - Adjusted EBITDA $788 $709 $373 $3781 $463 Notes Equity- based Compensation during the periods presented is a non-cash item attributable to direct Company employees and an allocation of International Paper’s corporate and shared employees Restructuring and Other Charges during the periods presented principally relate to overhead cost reduction initiatives, including severance costs Other Special Items primarily include abandoned property removal costs and foreign VAT refunds Other One-time Costs of approximately $55 million are expected to be incurred within 12 months following the completion of the separation, including $8 million of one-time transaction costs directly attributable to the separation Non-recurring TSA Costs for services to be provided by International Paper under the Transition Services Agreements, which are not expected to continue following expiration of the Transition Services Agreements 1 Pro forma net income for 2020 includes ($15) million adjustment for dis-synergies and +$20mm adjustment for Facility Cost Charges Adjusted EBITDA is a non-GAAP measure presented as a supplemental measure of our performance and the most directly comparable GAAP measure is net income. Management believes that Adjusted EBITDA provides additional meaningful information in evaluating Sylvamo’s performance over time, and that other companies use this and/or similar measures for similar purposes. However, Adjusted EBITDA has limitations as an analytical tool, and you should not consider it in isolation, or as a substitute for analysis of our results as reported under GAAP. In addition, in evaluating Adjusted EBITDA, you should be aware that in the future we will incur expenses such as those used in calculating this measure. Our presentation of this measure should not be construed as an inference that our future results will be unaffected by unusual or nonrecurring items.

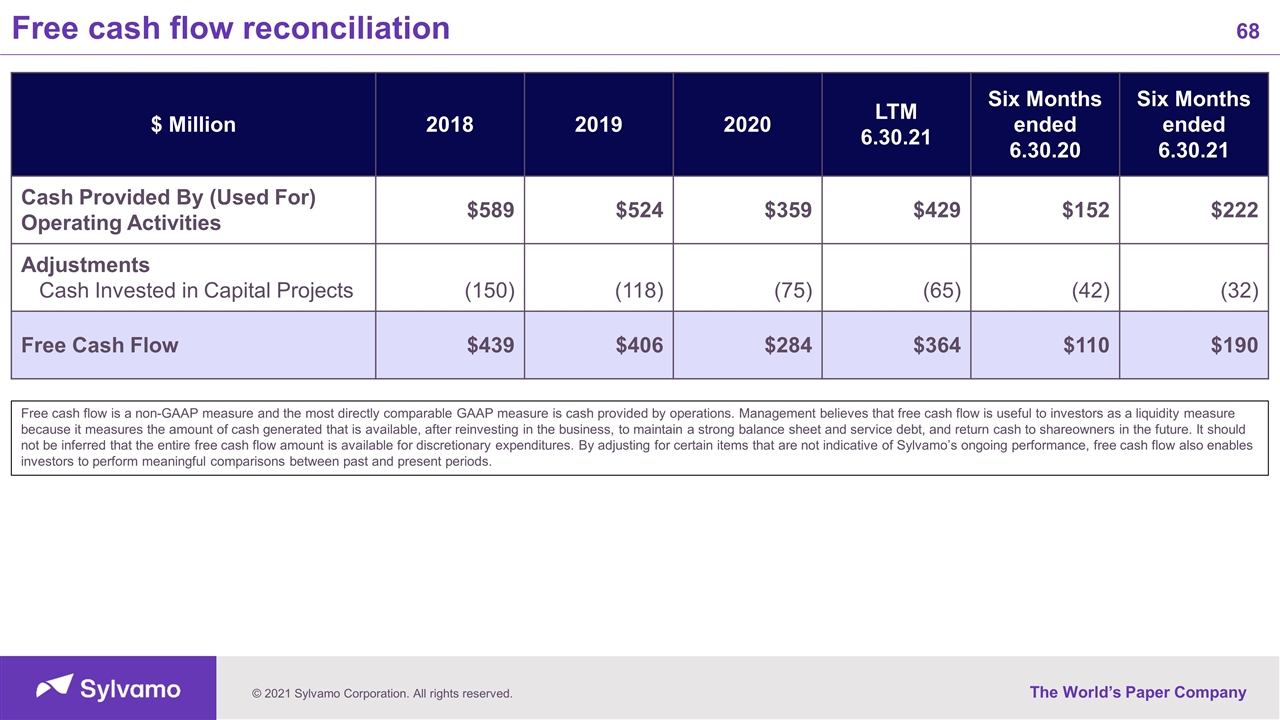

Free cash flow reconciliation Free cash flow is a non-GAAP measure and the most directly comparable GAAP measure is cash provided by operations. Management believes that free cash flow is useful to investors as a liquidity measure because it measures the amount of cash generated that is available, after reinvesting in the business, to maintain a strong balance sheet and service debt, and return cash to shareowners in the future. It should not be inferred that the entire free cash flow amount is available for discretionary expenditures. By adjusting for certain items that are not indicative of Sylvamo’s ongoing performance, free cash flow also enables investors to perform meaningful comparisons between past and present periods. $ Million 2018 2019 2020 LTM 6.30.21 Six Months ended 6.30.20 Six Months ended 6.30.21 Cash Provided By (Used For) Operating Activities $589 $524 $359 $429 $152 $222 Adjustments Cash Invested in Capital Projects (150) (118) (75) (65) (42) (32) Free Cash Flow $439 $406 $284 $364 $110 $190

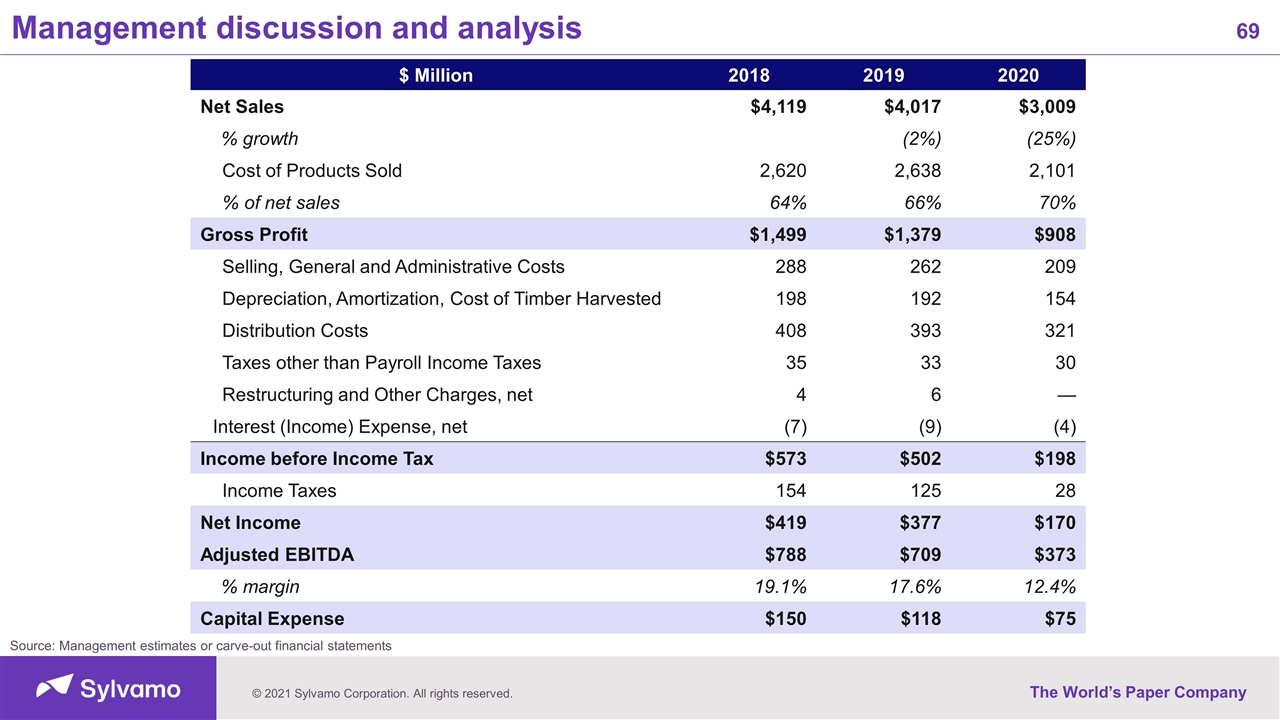

Management discussion and analysis Source: Management estimates or carve-out financial statements $ Million 2018 2019 2020 Net Sales $4,119 $4,017 $3,009 % growth (2%) (25%) Cost of Products Sold 2,620 2,638 2,101 % of net sales 64% 66% 70% Gross Profit $1,499 $1,379 $908 Selling, General and Administrative Costs 288 262 209 Depreciation, Amortization, Cost of Timber Harvested 198 192 154 Distribution Costs 408 393 321 Taxes other than Payroll Income Taxes 35 33 30 Restructuring and Other Charges, net 4 6 — Interest (Income) Expense, net (7) (9) (4) Income before Income Tax $573 $502 $198 Income Taxes 154 125 28 Net Income $419 $377 $170 Adjusted EBITDA $788 $709 $373 % margin 19.1% 17.6% 12.4% Capital Expense $150 $118 $75