Exhibit 99.3

VOTE FOR THE PROPOSED PLAN OF ARRANGEMENT TO CREATE CANADA’S LARGEST CANNABIS COMPANY1

ü Significantly greater market liquidity ü Continued participation in Canada’s leading vertically integrated cannabis company | ü Creation of a top 10 market share company in overall cannabis and cannabis 2.0 ü 21% premium on the 60-day VWAP prior to signing the definitive agreement, or a 48% premium on the 10-day VWAP prior to signing the non-binding expression of interest |

October 24, 2022

Dear fellow Valens Shareholders,

| We are pleased to present you with an exciting opportunity to approve a transaction that we believe will place Valens Shareholders in a solid position to benefit from the next phase of the cannabis industry’s maturation. The Valens Company (“Valens”) is asking you to approve the proposed plan of arrangement (the “Arrangement” or the “Transaction”) with SNDL Inc. (“SNDL”). | Meeting Date & Time:

November 29, 2022, at

10:00 a.m. (Toronto time)

Location:

Offices of Stikeman Elliott LLP

5300 Commerce Court West,

199 Bay Street, Toronto,

Ontario M5L 1B9 |

The Consideration

| ü | Under the terms of the Arrangement, Valens Shareholders will receive 0.3334 SNDL Shares for each Valens Share held (the “Consideration”). |

| ü | The Consideration represents an implied value of $1.26 per Valens Share, representing a premium of 21%, based on the 60-day volume-weighted average price (“VWAP”) of the Valens Shares on the Toronto Stock Exchange (the “TSX”) for the period ending August 19, 2022, or a 48% premium based on the 10-day VWAP of the Valens Shares on the TSX for the period ending June 27, 2022, being the last trading day prior to entering into the non-binding expression of interest for the Transaction. |

Benefits of Transaction

| ü | This transaction will create a leading vertically integrated cannabis platform with what we believe will have enormous potential. |

1 Based on revenue in the last fiscal quarter.

| ü | The resulting pro forma entity will be the largest cannabis company in Canada, with approximately $314 million in net cash and no debt, providing an excellent opportunity for Valens Shareholders to benefit at this critical stage in the cannabis industry. |

| ü | The combination of the two complementary platforms enhances branded product offerings with low-cost in-house manufacturing capabilities. |

| ü | Increases optionality on biomass by pairing premium indoor small batch cultivation with low-cost procurement. |

| ü | Creates synergies through cost rationalization and operational efficiencies including public company costs. |

| ü | Valens shareholders will own approximately 9.5% of the pro forma entity and will continue to participate in the potential upside. |

Strategic Rationale

Since legalization, the Canadian cannabis sector has found its footing and emerged as a thriving new source of economic growth, creating and supporting tens of thousands of jobs in communities countrywide. Despite this economic growth the industry has been afflicted with inflationary cost pressures which have been amplified by an ongoing drastic industry recalibration. Furthermore, as the cannabis sector in Canada grows to maturity, so too grows the requirement for operational excellence, product quality, and safety for long-term sustainable growth. Over the last three years, Valens has developed one of the most comprehensive low-cost manufacturing platforms in Canada with best-in-class automation equipment and a leading IP portfolio, allowing us to develop and produce products that better capture consumers preferences than our Canadian peers.

This transaction provides Valens shareholders with the opportunity to participate in a leading, vertically integrated entity with the highest revenue among cannabis companies in Canada (based on revenue in the last fiscal quarter). Moreover, by combining Valens highly scalable CPG-style manufacturing capabilities with SNDL’s leading portfolio of 1852 cannabis retail stores and premium indoor cultivation, this powerful combination allows the pro forma entity to better navigate the current industry and macro economic headwinds providing what we believe will be a sustainable competitive advantage for long-term growth at a time when unfunded business plans and bankruptcies are on the rise across the industry.

Source: Hifyre, based on the month ending July 2022 in AB, BC, ON, SK

2 Includes Nova Cannabis Inc. corporate stores and franchise stores.

Furthermore, with a comprehensive brand portfolio across all product categories and price points, the pro forma entity is expected to be a top LP with approximately 4.5% market share (see figure above). In addition, the pro forma entity will have the potential for significant growth through cross-penetration of Valens-branded products into Canada’s cannabis retail stores, including through ColdHaus’ robust distribution sales network.

Most importantly, the pro forma entity will have a strong balance sheet, with a net cash position of $314 million and no debt, compared to Valens current net debt position of $28 million. With a strong cash balance and an integrated cannabis infrastructure, this combination will allow us to continue to pursue our branded commercial strategy and will also allow us to better tailor our products to meet evolving consumer tastes through robust retail analytics, a well funded innovation pipeline and best-in-class low-cost manufacturing.

Finally, this combination will allow Valens to avoid a dilutive financing or adding additional debt and instead provide the opportunity for us to solidify a premier position within a compelling growth industry. We believe the pro forma company provides investors with attractive exposure not only to the highest revenue generating cannabis company in Canada (based on annualized in the last fiscal quarter) currently trading well under its tangible book value but also a platform with the potential to become a global leader in cannabis.

Source: Company filings

Note: As at August 19, 2022, using exchange rate of 1.300; Share count calculated on a fully diluted basis

Vote FOR the Proposed Transaction Today

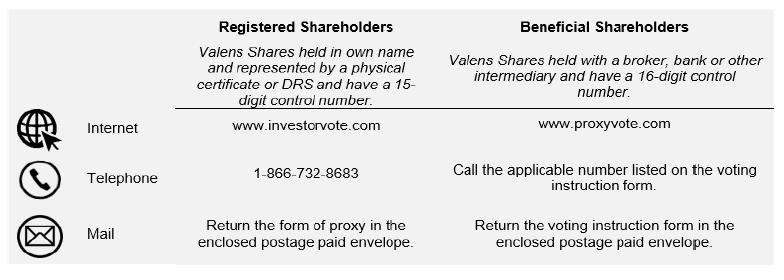

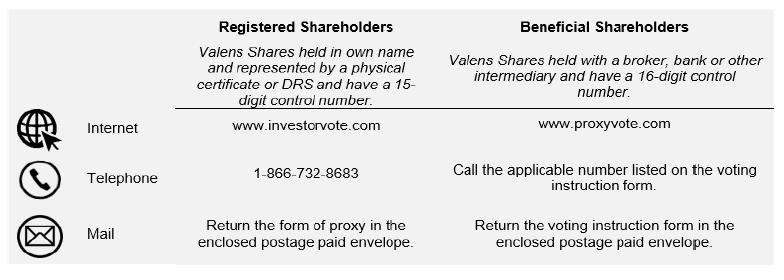

All Valens directors and executive officers, including myself, have committed to vote in favour of the Arrangement, and we encourage all Valens shareholders to do the same as soon as possible. If you have any questions or require assistance with voting your shares, please contact our strategic shareholder advisor and proxy solicitation agent, Laurel Hill Advisory Group, by telephone at 1-877-452- 7184 (+1 416-304-0211 for calls outside North America) or by email at assistance@laurelhill.com. Shareholders are also encouraged to read the accompanying documents for more details on the Transaction and to vote your Valens Shares in support.

The preceding reasons are why our board feels so strongly that the Transaction is in the best interests of Valens and its shareholders; simply, Valens and SNDL are better together.

| Yours Truly, | |

| | |

| /s/ Tyler Robson | |

| | |

| Tyler Robson | |

| CEO and Director | |

Vote FOR the Proposed Transaction well in Advance of the Proxy Voting Deadline on November 25, 2022

Questions or Require Voting Assistance?

Contact Valens’ proxy solicitation agent, Laurel Hill Advisory Group at:

Toll Free: 1-877-452-7184 (+1 416-304-0211 outside North America)

Email: assistance@laurelhill.com