Exhibit 99.5

IF YOU ARE A REGISTERED SHAREHOLDER OF The valens company inc., THIS LETTER OF TRANSMITTAL MUST BE COMPLETED AND RETURNED AS INSTRUCTED HEREIN IN ORDER TO PARTICPATE IN THE ARRANGEMENT.

IT IS IMPORTANT THAT YOU VALIDLY COMPLETE, EXECUTE AND RETURN THIS LETTER OF TRANSMITTAL ON A TIMELY BASIS IN ACCORDANCE WITH THE INSTRUCTIONS CONTAINED HEREIN. THE DEPOSITARY, Laurel Hill Advisory Group OR YOUR FINANCIAL ADVISOR CAN ASSIST YOU IN COMPLETING THIS LETTER OF TRANSMITTAL.

HOLDERS OF VALENS OPTIONS DO NOT NEED TO COMPLETE AND SUBMIT THIS LETTER OF TRANSMITTAL AS option agreements for THEIR REPLACEMeNT SNDL OPTIONS WILL BE AUTOMATICALLY ISSUED AND SENT TO THEM ON THE COMPLETION OF THE ARRANGEMENT.

Please read the accompanying Circular (as defined below) carefully before completing this Letter of Transmittal. The instructions accompanying this Letter of Transmittal should also be read carefully before this Letter of Transmittal is completed or submitted to the Depositary (as defined below). If you have any questions or require more information with regard to the procedures for completing this Letter of Transmittal, please contact the Depositary at (587) 885-0960. You can email the Depositary at corp.actions@odysseytrust.com. You may also contact Laurel Hill Advisory Group by telephone at 1-877-452-7184 (+1 416-304-0211 for collect calls outside North America) or by email at assistance@laurelhill.com.

LETTER OF TRANSMITTAL FOR REGISTERED HOLDERS OF

COMMON SHARES OF THE VALENS COMPANY INC.

For use only in connection with the proposed arrangement involving

SNDL Inc., The Valens Company Inc. and its securityholders

This letter of transmittal (this “Letter of Transmittal”) is for use by registered holders of common shares (“Valens Shares”) of The Valens Company Inc. (“Valens”) in connection with a proposed arrangement (the “Arrangement”) involving SNDL Inc. (“SNDL”), Valens and its securityholders, as described in the management information circular of Valens dated October 24, 2022, as amended (the “Circular”), which is to be considered at a special meeting of holders of Valens Shares (“Shareholders”) scheduled to be held on November 29, 2022 (the “Meeting”) and/or any adjournment(s) or postponement(s) thereof. Shareholders are referred to the Circular, including the appendices attached thereto, that accompanies this Letter of Transmittal. Capitalized terms used but not otherwise defined herein have the respective meanings ascribed thereto in the Circular.

This Letter of Transmittal is for use only by registered Shareholders. Shareholders whose Valens Shares are registered in the name of a broker, investment dealer, bank, trust company or other nominee (each, an “Intermediary”), or in the name of a clearing agency (such as CDS Clearing and Depository Services Inc.) of which the Intermediary is a participant, should contact the Intermediary for assistance in depositing their Valens Shares.

| TO: | The Valens Company Inc. |

| AND TO: | Odyssey Trust Company of Canada (the “Depositary”) |

| The undersigned Shareholder hereby irrevocably deposits the Valens Shares held by the undersigned (the “Deposited Shares”). Each Shareholder will receive, for each Valens Share held, 0.3334 of a common share of SNDL (each whole common share of SNDL, a “SNDL Share”) pursuant to the Arrangement. |

The undersigned, by the execution of this Letter of Transmittal, hereby represents and warrants in favour of Valens and SNDL that: (i) the undersigned acknowledges receipt of the Circular; (ii) the undersigned is the registered and legal owner of the Deposited Shares, has good right and title to the rights represented by the certificates and/or Direct Registration System (“DRS”) statements representing the Deposited Shares, as applicable; (iii) such Deposited Shares are owned by the undersigned free and clear of all mortgages, liens, charges, encumbrances, security interests and adverse claims; (iv) the undersigned has full power and authority to execute and deliver this Letter of Transmittal and to deposit, sell, assign, transfer and deliver the Deposited Shares and that, when the SNDL Shares to which the undersigned is entitled are delivered, none of Valens, SNDL or any affiliate thereof or successor thereto will be subject to any adverse claim in respect of such Deposited Shares; (v) the Deposited Shares have not been sold, assigned or transferred, nor has any agreement been entered into to sell, assign or transfer any such Deposited Shares, to any other person; (vi) the transfer of the Deposited Shares complies with all applicable laws; (vii) all information inserted by the undersigned into this Letter of Transmittal is complete, true and accurate; (viii) none of SNDL or Valens nor any of their respective directors, officers, advisors or representatives are responsible for the proper completion of this Letter of Transmittal; and (ix) the delivery of the applicable number of SNDL Shares will discharge any and all obligations of Valens, SNDL and the Depositary with respect to the matters contemplated by this Letter of Transmittal and the Arrangement. These representations and warranties shall survive the completion of the Arrangement.

In connection with the Arrangement and for value received, at the Effective Time all of the right, title and interest of the undersigned in and to the Deposited Shares and in and to any and all dividends, distributions, payments, securities, rights, warrants, assets or other interests (collectively, “distributions”) which may be declared, paid, accrued, issued, distributed, made or transferred on or in respect of the Deposited Shares or any of them as and from the Effective Date of the Arrangement, as well as the right of the undersigned to receive any and all distributions shall have been assigned to SNDL. If, notwithstanding such assignment, any distributions are received by or made payable to or to the order of the undersigned, then the undersigned shall promptly pay or deliver the whole of any such distribution to the Depositary for the account of SNDL, together with appropriate documentation of transfer.

The undersigned irrevocably constitutes and appoints the Depositary, any one officer or director of Valens, or its affiliate, or any other person designated by Valens in writing, the true and lawful agent, attorney and attorney-in-fact of the undersigned with respect to the Deposited Shares purchased in connection with the Arrangement with full power of substitution (such power of attorney, being coupled with an interest, being irrevocable) to, in the name of and on behalf of the undersigned, (a) register or record the transfer of such Deposited Shares consisting of securities on the registers of Valens and (b) execute and negotiate any cheques or other instruments representing any such distribution referred to above payable to or to the order of the undersigned.

Except for any proxy deposited with respect to the vote on the Arrangement Resolution in connection with the Meeting or as granted by this Letter of Transmittal, the undersigned revokes any and all authority, whether as agent, attorney-in-fact, proxy or otherwise, previously conferred or agreed to be conferred by the undersigned at any time with respect to the Deposited Shares and no subsequent authority, whether as agent, attorney-in-fact, proxy or otherwise, will be granted with respect to the Deposited Shares or any distributions by or on behalf of the undersigned, unless the Arrangement is not completed.

The undersigned acknowledges, covenants and agrees to execute all such documents, transfers and other assurances as may be necessary or desirable to convey the Deposited Shares and distributions effectively to SNDL. The undersigned acknowledges, covenants and agrees that the undersigned will not transfer or permit to be transferred any of the Deposited Shares. The undersigned agrees that all questions as to validity, form, eligibility (including timely receipt) and acceptance of the Deposited Shares transferred in connection with the Arrangement shall be determined by SNDL, in its sole discretion and that such determination shall be final and binding and acknowledges that there is no duty or obligation upon Valens, SNDL, the Depositary or any other person to give notice of any defect or irregularity in any such surrender of the Deposited Shares and no liability will be incurred by any of them for failure to give any such notice.

The undersigned acknowledges that the delivery of the Deposited Shares shall be effected and the risk of loss to such Deposited Shares shall pass only upon proper receipt thereof by the Depositary.

The undersigned acknowledges that all authority conferred, or agreed to be conferred, by the undersigned herein may be exercised during any subsequent legal incapacity of the undersigned and shall survive the death, incapacity, bankruptcy or insolvency of the undersigned and all obligations of the undersigned herein shall be binding upon the heirs, personal or legal representatives, successors and assigns of the undersigned.

Subject to the requisite approvals of the Arrangement by the Valens Shareholders and certain other conditions described in the Circular, the Arrangement is anticipated to become effective in the first calendar quarter of 2023. If all necessary approvals are obtained and all other conditions to closing the Arrangement are satisfied, SNDL will, acquire all of the issued and outstanding Valens Shares. The undersigned acknowledges that all deposits made under this Letter of Transmittal are irrevocable and may not be withdrawn by a Shareholder except that all Letter of Transmittal will be automatically revoked if the Depositary is notified in writing by Valens and SNDL that the Arrangement Agreement has been terminated. If the Arrangement is not completed or proceeded with, the enclosed certificate(s), if any, representing the Deposited Shares, and all other ancillary documents will be returned as soon as possible to the undersigned as per the instructions in Box A or Box B, as applicable. The undersigned acknowledges that none of Valens, SNDL or the Depositary has any obligation or authority pursuant to the instructions given below to transfer any Deposited Shares from the name of the undersigned if the Arrangement is not completed.

The undersigned acknowledges that it will not receive the SNDL Shares to which the undersigned is entitled to receive in respect of the Deposited Shares until, if the undersigned holds their Valens Shares in the form of a physical share certificate(s), such certificate(s) representing the Deposited Shares, are received by the Depositary at the address set forth on the back of this Letter of Transmittal or at any of the other addresses set forth in Instruction 10 below, together, in the case of all registered Shareholders, with a duly completed Letter of Transmittal and such additional documents as the Depositary may require, and the same are processed by the Depositary. It is understood that under no circumstances will interest accrue or be paid in respect of the Deposited Shares in connection with the Arrangement.

The undersigned acknowledges that in no event will the undersigned be entitled to a fractional SNDL Share. If the aggregate number of SNDL Shares to be issued to the undersigned in connection with the Arrangement would result in a fraction of a SNDL Share being issuable, the number of SNDL Shares to be received by the undersigned will be rounded down to the nearest whole SNDL Share (without any payment or compensation in lieu of such fractional SNDL Share). For the avoidance of doubt, in calculating such fractional interests, all SNDL Shares registered in the name of a Shareholder or its nominee shall be aggregated.

The undersigned acknowledges that in accordance with the terms of the Arrangement, Valens, SNDL and/or the Depositary, as applicable, are entitled to deduct and withhold from any amount payable to the undersigned pursuant to the Arrangement, such amounts as they may determine, acting reasonably, that they are required or permitted to be deducted and withheld with respect to such payment under the Income Tax Act (Canada), the U.S. Internal Revenue Code of 1986, as amended, or any provision of any other Law. To the extent that amounts are so withheld, such withheld amounts shall be treated for all purposes hereof as having been paid to the undersigned in respect of which such withholding was made, provided that such amounts are actually remitted to the appropriate taxing authority.

Each of Valens, SNDL and/or the Depositary, as applicable and any person acting on their behalf is authorized to sell or otherwise dispose of such portion of the SNDL Shares which the undersigned is entitled to receive in respect of the Deposited Shares as is necessary to provide sufficient funds to Valens, SNDL and/or the Depositary, as the case may be, to enable it to implement such deduction or withholding, and Valens, SNDL and/or the Depositary will notify the holder thereof and remit to the holder any unapplied balance of the net proceeds of such sale.

The SNDL Shares to be received by the undersigned pursuant to the Arrangement have not been and will not be registered under the United States Securities Act of 1933, as amended (the “Securities Act”), or any state securities laws and are being issued in reliance on the exemption from the registration requirements provided by Section 3(a)(10) of the Securities Act on the basis of, among other things, a court approval of the Arrangement and compliance with or exemption from the registration or qualification requirements of state or “blue sky” securities laws. Section 3(a)(10) of the Securities Act exempts securities issued in exchange for one or more outstanding securities from the registration requirements of the Securities Act where, among other things, the terms and conditions of the issuance and exchange of the securities have been approved by a court or governmental authority of competent jurisdiction, after a hearing upon the substantive and procedural fairness of the terms and conditions of the issuance and exchange at which all persons to whom the securities will be issued have the right to appear and to whom timely and adequate notice of the hearing has been given.

Upon issuance, the SNDL Shares may be resold without restriction in the United States, except in respect of resales by persons who are “affiliates” (within the meaning of Rule 144 under the Securities Act) of SNDL at the time of such resale or who have been affiliates of SNDL within 90 days before the Effective Date of the Arrangement. Persons who may be deemed to be “affiliates” of an issuer include individuals or entities that control, are controlled by, or are under common control with, the issuer, whether through the ownership of voting securities, by contract, or otherwise, and generally include executive officers and directors of the issuer as well as shareholders holding more than 10% of the issuer’s outstanding shares of capital stock. Any resale of such SNDL Shares by an affiliate of SNDL (or person who was an affiliate of SNDL within 90 days before the Effective Date of the Arrangement) may be subject to the registration requirements of the Securities Act, absent an exemption therefrom, as more fully described in the Circular.

The undersigned represents and warrants that the undersigned has such knowledge and experience in financial and business matters that the undersigned is capable of evaluating the merits and risks of an investment in the SNDL Shares.

Whether or not the undersigned delivers the required documentation to the Depositary, as of the Effective Time, the undersigned will cease to be a holder of Valens Shares and, subject to the ultimate expiry deadline identified below, will only be entitled to receive the consideration to which the undersigned is entitled under the Arrangement. REGISTERED SHAREHOLDERS WHO DO NOT DELIVER A VALIDLY COMPLETED AND DULY EXECUTED LETTER OF TRANSMITTAL, THE CERTIFICATES REPRESENTING THEIR VALENS SHARES (IF APPLICABLE) AND ALL OTHER REQUIRED DOCUMENTS TO THE DEPOSITARY ON OR BEFORE THE SIXTH ANNIVERSARY OF THE EFFECTIVE DATE WILL LOSE THEIR RIGHT TO RECEIVE ANY CONSIDERATION FOR THEIR VALENS SHARES AND ANY CLAIM OR INTEREST OF ANY KIND OR NATURE AGAINST VALENS, SNDL OR THE DEPOSITARY. ON SUCH DATE, (I) ALL SNDL SHARES TO WHICH SUCH FORMER SHAREHOLDER WAS ULTIMATELY ENTITLED SHALL ALSO BE DEEMED TO HAVE BEEN SURRENDERED FOR NO CONSIDERATION TO SNDL BY THE DEPOSITARY AND SUCH SNDL SHARES SHALL BE DEEMED TO BE CANCELLED, AND (II) SUBJECT TO ANY APPLICABLE LAWS RELATING TO UNCLAIMED PERSONAL PROPERTY, ANY CERTIFICATE, LETTER OR OTHER INSTRUMENT, AS APPLICABLE, FORMERLY REPRESENTING OUTSTANDING VALENS SHARES THAT IS NOT DULY SURRENDERED ON OR BEFORE SUCH DATE SHALL CEASE TO REPRESENT A CLAIM BY OR INTEREST OF ANY FORMER VALENS SHAREHOLDER OF ANY KIND OR NATURE AGAINST OR IN SNDL OR VALENS. Therefore, all registered Shareholders should properly complete and execute this Letter of Transmittal and return it, together with the certificate(s) representing their Valens Shares, as applicable, and all other required documentation, to the Depositary.

The undersigned acknowledges that a registered Shareholder who does not properly complete and execute this Letter of Transmittal and deposit it, together with the certificate(s) representing his, her or its Deposited Shares and all other required documentation, with the Depositary will not be recorded on the register of holders of SNDL Shares, nor will they be entitled to vote with respect to any SNDL Shares or receive any dividend or other distribution declared or made after the Effective Time with respect to SNDL Shares with a record date after the Effective Time unless and until he, she or it does so.

Please read the Circular and the instructions set out below carefully before completing this Letter of Transmittal. Delivery of this Letter of Transmittal to an address other than as set forth herein will not constitute a valid delivery. If Valens Shares are registered in different names, a separate Letter of Transmittal must be submitted for each different registered Shareholder.

In connection with the Arrangement, the undersigned encloses herewith the certificate(s), if any, for the following Valens Shares registered in the name of the undersigned or duly endorsed for transfer to the undersigned:

DESCRIPTION OF Valens SHARES DEPOSITED

(please print)

DRS Holder Account

Number(s) and/or Certificate Number(s) (as

applicable) | Name(s) and Address(es) of

Registered Shareholder(s) | Number of Valens Shares

Deposited |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | TOTAL: |

(Please print or type. If space is insufficient, please attach a list to this Letter of Transmittal in the above form.)

The undersigned authorizes and directs the Depositary to issue the SNDL Shares to which the undersigned is entitled under the Arrangement as indicated below and to mail or e-mail evidence of such issuance (whether evidence of the book entry issuance or a representative share certificate) to the address or e-mail address indicated below or hold for pickup, in accordance with the instructions given below, or if no instructions are given, mail such evidence of issuance in the name and to the address, if any, of the undersigned as appears on the share register maintained by Odyssey Trust Company on behalf of Valens.

BOX A REGISTRATION AND DELIVERY INSTRUCTIONS DRS statement representing SNDL Shares to be registered as follows: (Name) (Street Address and Number) (City and Province or State) (Postal (Zip) Code and Country) (Telephone – Business Hours) (Email Delivery Address for DRS Statement) 1 ¨ Please issue physical share certificate instead of DRS Statement | | BOX B SPECIAL DELIVERY INSTRUCTIONS To be completed ONLY if the SNDL Shares to which the undersigned are entitled to under the Arrangement are to be sent to someone other than the person shown in Box A or to an address other than the address shown in Box A. (Name) (Street Address and Number) (City and Province or State) (Postal (Zip) Code and Country) (Telephone – Business Hours) |

BOX C – SPECIAL PICK-UP INSTRUCTIONS Hold for pick-up at the office of the Depositary: ¨ TORONTO ¨ VANCOUVER ¨ CALGARY |

1 By providing their email address, the undersigned consents to electronic delivery by the Depositary.

BOX C

RESIDENCY DECLARATION

ALL VALENS SHAREHOLDERS ARE REQUIRED TO COMPLETE A RESIDENCY DECLARATION. FAILURE TO COMPLETE A RESIDENCY DECLARATION MAY RESULT IN A DELAY IN YOUR PAYMENT.

The undersigned represents that the beneficial owner of the Valens Shares deposited herewith (check all boxes that apply – at least one box must be checked and completed, as applicable):

| �� | is a resident of Canada. |

| ¨ | is a resident of ______________. |

A “U.S. Shareholder” is any Shareholder who is either (i) located or providing an address pursuant to Box A or Box B that is located within the United States or any territory or possession thereof, or (ii) a “U.S. Person” for United States federal income tax purposes as defined in Instruction 9 below (or acting on behalf of a U.S. Person). If you are a U.S Person (as defined in (ii) above) or acting on behalf of a U.S. Person, then you must provide a completed IRS Form W-9 (enclosed) below, as discussed in Instruction 9 below. If you are a U.S. Shareholder that is not a U.S. Person (as defined in (ii) above), , you must complete an appropriate IRS Form W-8 (W-8BEN, W-8BEN-E, W-8EXP or other form of W-8) which may be obtained from the Depositary.

SHAREHOLDER SIGNATURE(S)

Signature guaranteed by

(if required under Instruction 3) | | Signature of Shareholder

(as required under Instruction 2) |

| | | |

| | | Dated:_______________________________, 202__ |

| Authorized Signature | | |

| | | |

| | | |

| Name of Guarantor (please print or type) | | Signature of Shareholder or authorized representative (see Instructions 2 and 4) |

| | | |

| | | |

| Address of Guarantor (please print or type) | | Address |

| | | |

| | | |

| | | Name of Shareholder (please print or type) |

| | | |

| | | |

| | | Telephone No |

| | | |

| | | |

| | | Name of authorized representative, if applicable (please print or type)* *If the signature is by a trustee, executor, administrator, guardian, attorney-in-fact, agent, officer of a corporation or any other person acting in a fiduciary or representative capacity, proof of signing authority dated within 6 months is required. See instructions 4 for more details. |

INSTRUCTIONS

| 1. | Use and Delivery of the Letter of Transmittal |

Registered Shareholders should read the accompanying Circular prior to completing this Letter of Transmittal. Capitalized terms used but not otherwise defined herein have the respective meanings ascribed thereto in the Circular. To receive the SNDL Shares to which they are entitled upon completion of the Arrangement, registered Shareholders must deposit with the Depositary (at any of the offices specified below), on or before the sixth anniversary of the Effective Date, a duly completed Letter of Transmittal together with the certificate(s) representing their Valens Shares, if applicable, and any other documents the Depositary reasonably requires.

Pursuant to the terms of the Arrangement, any certificates formerly representing Valens Shares that are not deposited with the Depositary together with a duly completed Letter of Transmittal and any other documents the Depositary reasonably requires, on or before the sixth anniversary of the Effective Date, shall cease to represent a right or claim of any kind or nature and the right of the holder of certificates representing Valens Shares to receive the SNDL Shares for such Valens Shares shall be deemed to be surrendered together with all dividends or distributions thereon held for such holder (less any withholding tax that was required by applicable law to have been remitted to a taxing authority in respect of any such dividends or distributions held for such holder). On such date, all SNDL Shares to which such former Shareholder was ultimately entitled under the Arrangement shall also be deemed to have been surrendered for no consideration to SNDL by the Depositary and such SNDL Shares shall be deemed to be cancelled.

All deposits made under this Letter of Transmittal are irrevocable except that all Letter of Transmittal will be automatically revoked if the Depositary is notified in writing by Valens and SNDL that the Arrangement Agreement has been terminated.

The method used to deliver this Letter of Transmittal and any accompanying certificates representing the Valens Shares is at the option and risk of the Shareholder, and delivery will be deemed effective only when such documents are actually received by the Depositary. Valens and SNDL recommend that the necessary documentation be hand delivered to the Depositary, at any of the offices specified below, and a receipt obtained; otherwise the use of registered mail with return receipt requested, properly insured, is recommended. Shareholders whose Valens Shares are registered in the name of an Intermediary should contact that Intermediary for assistance in depositing those Valens Shares.

This Letter of Transmittal must be filled in, dated and signed by the registered holder of the Valens Shares described above or by such Shareholder’s duly authorized representative (in accordance with Instruction 4).

| (a) | If this Letter of Transmittal is signed by the registered Shareholder(s) of the Deposited Shares, as evidenced by the register of Valens Shares maintained by or on behalf of Valens, such signature(s) on this Letter of Transmittal must correspond with the name(s) as registered or as written on the face of such certificate(s) or the applicable DRS statement(s) without any change whatsoever, and the certificate(s) need not be endorsed. If the Deposited Share(s) is/are held of record by two or more joint Shareholders, all such Shareholders must sign this Letter of Transmittal. |

| (b) | If this Letter of Transmittal is signed by a person other than the registered holder(s) of the Deposited Share(s), or if the SNDL Share Certificate is to be issued to a person other than the registered Shareholder(s): |

| (i) | any deposited certificate(s) representing the Deposited Share(s) must be endorsed or be accompanied by appropriate share transfer power(s) of attorney duly and properly completed by the registered Shareholder(s); and |

| (ii) | the signature(s) on such endorsement or share transfer power(s) of attorney must correspond exactly to the name(s) of the registered Shareholder(s) as registered or as appearing on the certificate(s) and must be guaranteed as noted in Instruction 3 below. |

| (c) | If any of the Deposited Shares are registered in different names on several certificates and/or DRS statements, it will be necessary to complete, sign and submit as many separate Letters of Transmittal as there are different registrations of such Deposited Shares. |

| 3. | Guarantee of Signatures |

| (a) | No signature guarantee is required on this Letter of Transmittal if it is signed by the registered holder(s) of the Valens Shares deposited therewith, unless this Letter of Transmittal is signed by a person other than the registered owner(s) of the DRS statement(s) or accompanying certificate(s) representing Valens Shares, or if a DRS statement or certificate(s) representing SNDL Shares are to be issued to a person other than the registered owner(s); and |

| (b) | If this Letter of Transmittal is signed by a person other than the registered owner(s) of the Valens Shares, or if the Arrangement is not completed and the accompanying certificate(s), if any, are to be returned to a person other than such registered owner(s), or sent to an address other than the address of the registered owner(s) as shown on the registers of Valens, or if the SNDL Shares are to be issued in a name other than the registered owner(s), such signature must be guaranteed by an Eligible Institution (see below), or in some other manner satisfactory to the Depositary (except that no guarantee is required if the signature is that of an Eligible Institution). |

An “Eligible Institution” means a member of the Securities Transfer Agents Medallion Program (STAMP), a member of the Stock Exchanges Medallion Program (SEMP) or a member of the New York Stock Exchange Inc. Medallion Signature Program (MSP). Members of these programs are usually members of a recognized stock exchange in Canada and/or the United States, members of the Investment Industry Regulatory Organization of Canada, members of the Financial Industry Regulatory Authority or banks and trust companies in the United States. A signature guarantee will also be accepted from a Canadian Schedule 1 chartered bank that is not participating in a Medallion Signature Guarantee Program and makes available its list of authorized signing officers to the Transfer Agent. Currently signature guarantees are accepted from Bank of Nova Scotia, Royal Bank of Canada and TD Bank.

| 4. | Fiduciaries, Representatives and Authorizations |

Where this Letter of Transmittal is executed by a person in a representative capacity, such as (a) an executor, administrator, trustee or guardian, (b) on behalf of a corporation, partnership or association, or (c) is executed by any other person acting in a representative or fiduciary capacity, then in each case such signature must be guaranteed by an Eligible Institution, or in some other manner satisfactory to the Depositary (except that no guarantee is required if the signature is that of an Eligible Institution). Additionally, this Letter of Transmittal must be accompanied by satisfactory evidence of their proof of appointment and authority to act. SNDL and the Depositary may, at their discretion, require additional evidence of appointment or authority or additional documentation.

If neither Box A nor Box B is completed, any SNDL DRS statement to be issued for the Deposited Shares will be issued in the name of the registered holder of the Deposited Shares and will be mailed to the address of the registered holder of the Deposited Shares as it appears on the register of Valens Shares maintained by or on behalf of Valens.

Shareholders whose certificate(s) representing Valens Shares has been lost, stolen or destroyed, should complete this Letter of Transmittal as fully as possible and forwarded together with a letter describing the loss to the Depositary. The Depositary will respond with the replacement requirements. Upon the receipt by Depositary of an affidavit by the holder claiming such certificate(s) to be lost, stolen or destroyed and a Letter of Transmittal and any other documents the Depositary requires, the Depositary will deliver the SNDL Shares that such holder is entitled to receive in accordance with the Arrangement. When authorizing such delivery, the holder to whom the SNDL Shares are to be delivered shall, as a condition precedent to such delivery, give a bond satisfactory to SNDL and the Depositary in such amount as SNDL and the Depositary may direct, or otherwise indemnify SNDL and the Depositary in a manner satisfactory to SNDL and the Depositary, against any claim that may be made against SNDL and the Depositary with respect to the certificate(s) alleged to have been lost, stolen or destroyed and shall otherwise take such actions as may be required by the constating documents of Valens.

| (a) | If the space on this Letter of Transmittal is insufficient to list all share certificates for Valens Shares, as applicable, additional certificate numbers and the associated numbers of Valens Shares may be included on a separate signed list affixed to this Letter of Transmittal. |

| (b) | If Valens Shares are registered in different forms (e.g., “John Doe” or “J. Doe”) a separate Letter of Transmittal should be signed for each different registration. |

| (c) | No alternative, conditional or contingent deposits of Valens Shares will be accepted and no fractional SNDL Shares will be issued. |

| (d) | Additional copies of the Circular and this Letter of Transmittal may be obtained from the Depositary at any of its offices at the addresses listed below. |

| (e) | All questions as to the validity, form, eligibility (including timely receipt) and acceptance of Valens Shares deposited pursuant to the Arrangement will be determined by SNDL in its sole discretion and that such determination shall be final and binding. SNDL reserves the right, if it so elects, in its absolute discretion, to instruct the Depositary to waive any defect or irregularity contained in any Letter of Transmittal received by the Depositary. There shall be no duty or obligation of SNDL to give notice of any defects or irregularities of any deposit and no liability shall be incurred by any of them for failure to give any such notice. |

| (f) | This Letter of Transmittal will be governed by and construed in accordance with the laws of the Province of Ontario and the federal laws of Canada applicable therein. |

| (g) | By reason of the use by the undersigned of an English language form of Letter of Transmittal, the undersigned shall be deemed to have required that any contract evidenced by the Arrangement as accepted through this Letter of Transmittal, as well as all documents related thereto, be drawn exclusively in the English language. En raison de l’usage d’une lettre d’envoi en langue anglaise par le soussigné, le soussigné et les destinataires sont présumés d’avoir requis que tout contrat attesté par l’arrangement et son acceptation par cette lettre d’envoi, de même que tous les documents qui s’y rapportent, soient rédigés exclusivement en langue anglaise. |

At Odyssey Trust Company, we take your privacy seriously. When providing services to you, we receive non-public, personal information about you. We receive this information through transactions we perform for you or an issuer in which you hold securities, from enrolment forms and through other communications with you. We may also receive information about you by virtue of your transactions with affiliates of Odyssey Trust Company or other parties. This information may include your name, social insurance number, securities ownership information and other financial information. With respect to both current and former customers, Odyssey Trust Company does not share non-public personal information with any non-affiliated third party except as necessary to process a transaction, service your account or as permitted by law. Our affiliates and outside service providers with whom we share information are legally bound not to disclose the information in any manner, unless permitted by law or other governmental process. We strive to restrict access to your personal information to those employees who need to know the information to provide our services to you, and we maintain physical, electronic and procedural safeguards to protect your personal information. Odyssey Trust Company realizes that you entrust us with confidential personal and financial information, and we take that trust very seriously. By providing your personal information to us and signing this form, we will assume, unless we hear from you to the contrary, that you have consented and are consenting to this use and disclosure. A complete copy of our Privacy Code, may be accessed at www.odysseytrust.com, or you may request a copy in writing Attn: Chief Privacy Officer, Odyssey Trust Company at 350 – 409 Granville St, Vancouver, BC, V6C 1T2.

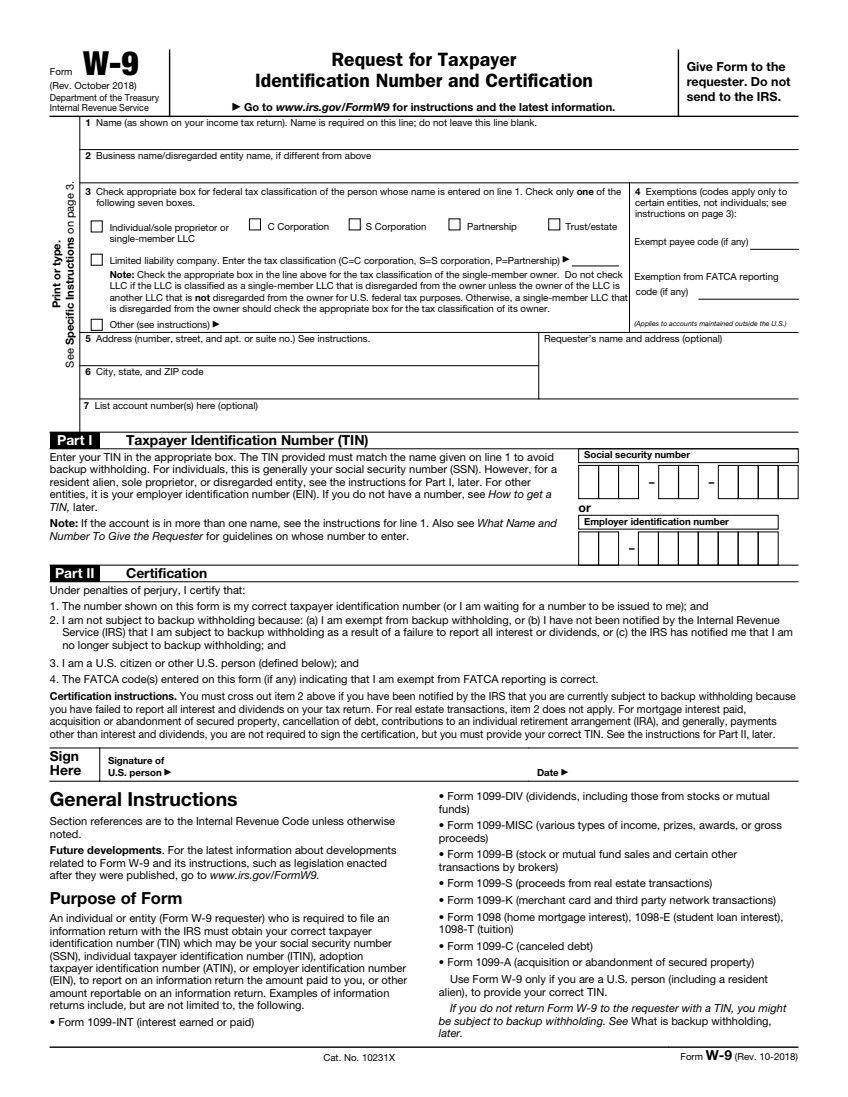

| 9. | U.S. Internal Revenue Service Forms W-9 and W-8 |

For purposes of this Letter of Transmittal, a “U.S. Person” is a beneficial owner of Valens Shares that, for U.S. federal income tax purposes, is (a) an individual who is a citizen or resident of the United States, (b) a corporation, partnership, or other entity classified as a corporation or partnership for U.S. federal income tax purposes, that is created or organized in or under the laws of the United States, or any political subdivision thereof or therein, (c) an estate if the income of such estate is subject to U.S. federal income taxation regardless of the source of such income, or (d) a trust if (i) such trust has validly elected to be treated as a U.S. person for U.S. federal income tax purposes, or (ii) a U.S. court is able to exercise primary supervision over the administration of such trust and one or more U.S. persons have the authority to control all substantial decisions of such trust. A U.S. Shareholder (as defined in Box C above) who is a U.S. Person is referred to in this Instruction 9 as a “U.S. Holder”. A U.S. Shareholder (as defined in Box C above) who is not a U.S. Person is referred to in this Instruction 9 as a “Non-U.S. Holder”.

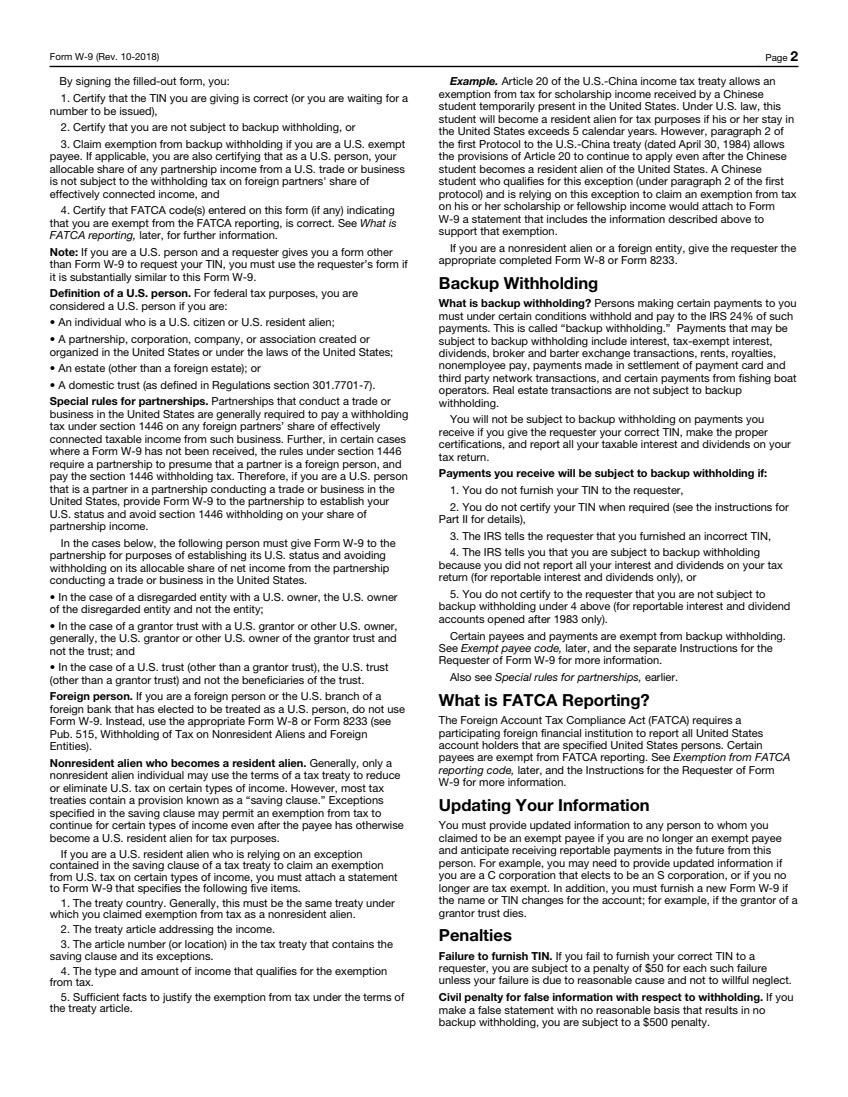

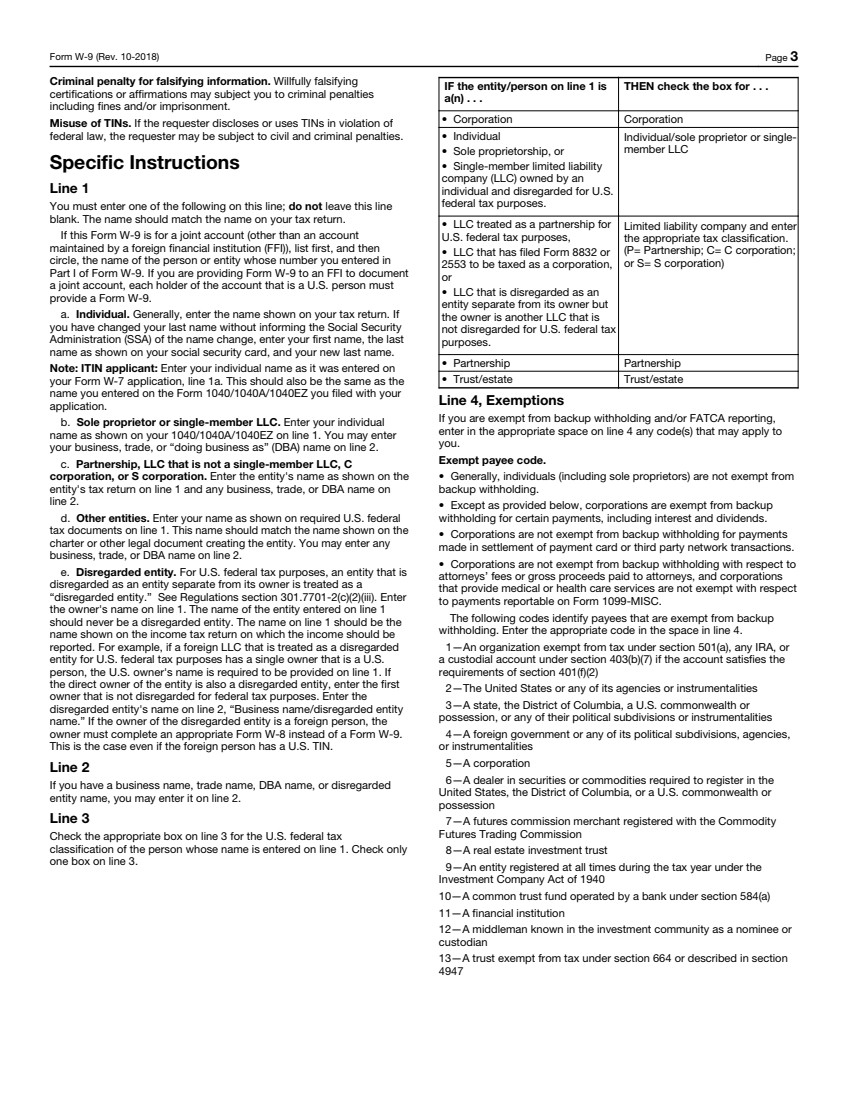

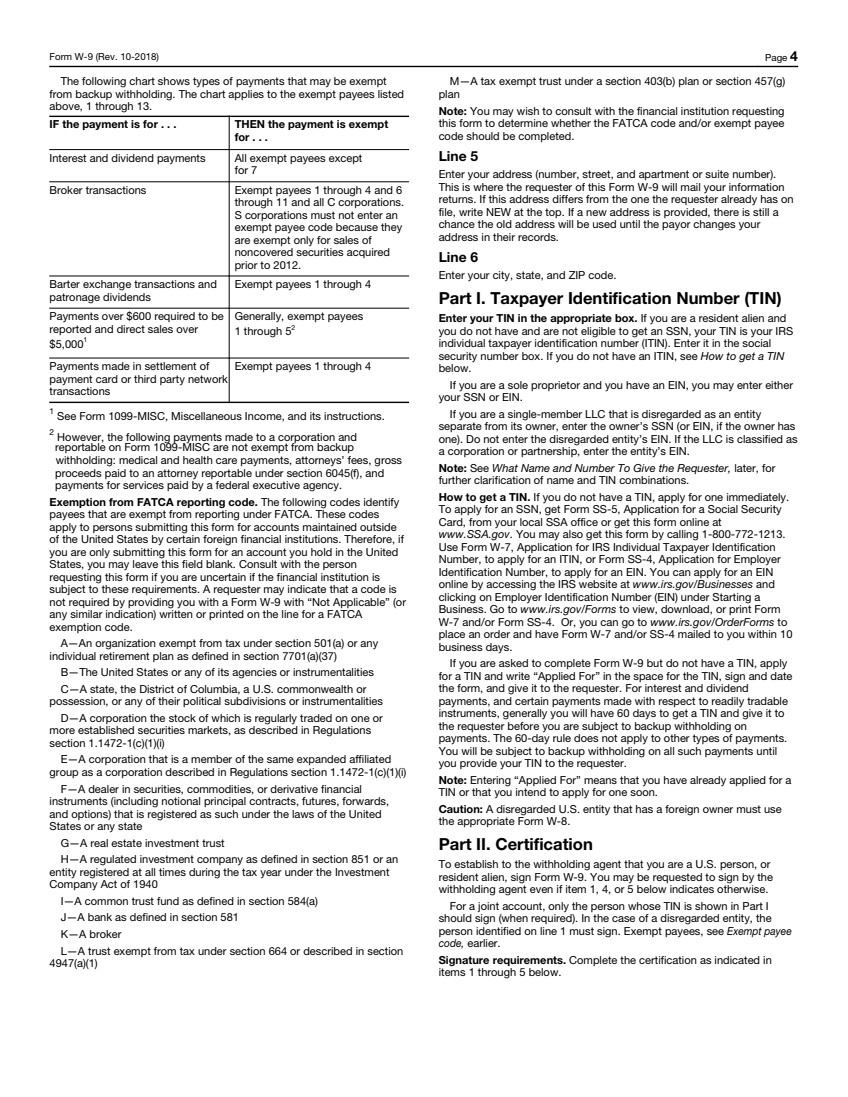

A U.S. Holder must generally provide his, her or its correct U.S. taxpayer identification number (“TIN”) on the U.S. Internal Revenue Service (“IRS”) Form W-9 attached hereto and certify, under penalties of perjury, that (i) such number is correct, (ii) such U.S. Holder is not subject to U.S. federal backup withholding, (iii) such U.S. Holder is a U.S. person (including a U.S. resident alien), and (iv) any FATCA codes provided on the form are correct. If the correct TIN is not provided or if other information is not correctly provided, cash payments made with respect to the such U.S. Holder’s Valens Shares may be subject to U.S. federal backup withholding (currently at a 24% rate).

The TIN for an individual U.S. citizen or resident is the individual’s U.S. social security number. The TIN for a U.S. entity, trust or estate generally is that person’s U.S. employer identification number.

U.S. federal backup withholding is not an additional tax. Rather, the U.S. federal income tax liability of persons subject to U.S. federal backup withholding will be reduced by the amount of U.S. federal income tax withheld. If U.S. federal backup withholding results in an overpayment of U.S. federal income taxes, a refund may be obtained provided that the required information is timely furnished to the IRS.

Certain persons (including, among others, corporations, certain “not-for-profit” organizations, and certain non-U.S. persons) are not subject to U.S. federal backup withholding. A U.S. Holder should consult his, her or its own tax advisor as to the U.S. Holder’s qualification for an exemption from U.S. federal backup withholding and the procedures for obtaining such exemption.

Inserting the words “Awaiting TIN” on Part II of the IRS Form W-9 may be indicated if a U.S. Holder has not been issued a TIN and has applied for a TIN or intends to apply for a TIN in the near future. If the “Awaiting TIN” box is indicated the U.S. Holder must also complete the Certificate of Awaiting Taxpayer Identification Number found in Box D below. If a U.S. Holder completes the Certificate of Awaiting Taxpayer Identification Number but does not provide a TIN within 60 days, such U.S. Holder will be subject to U.S. federal backup withholding on cash payments until a TIN is provided.

Failure to furnish TIN — A U.S. Holder that fails to furnish his, her or its correct TIN may be subject to a penalty of U.S.$50 for each such failure unless the failure is due to reasonable cause and not to willful neglect.

In general, Non-U.S. Holders are not subject to U.S. federal backup withholding. In order, however, for such persons to qualify as exempt recipients for U.S. federal backup withholding purposes, Non-U.S. Holders should return the appropriate duly completed IRS Form W-8, copies of which are available from the Depositary upon request.

U.S. Shareholders should consult with and rely upon their own tax advisors for advice in respect of which IRS form is appropriate and/or how to fill out such form.

| 10. | Odyssey Trust Company Office Locations |

Below are the applicable Odyssey Trust Company office locations. All necessary documentation and accompanying certificates representing the Valens Shares, as applicable, may be delivered to any of the Odyssey Trust Company office locations below. Entitlements may be picked up at any of the Odyssey Trust Company office locations below with counter services. Pickup instructions must be selected in Box A.

| Toronto | Calgary | Vancouver |

Odyssey Transfer Inc. Trader’s Bank Building 702, 67 Yonge Street, Toronto ON M5E 1J8 | Stock Exchange Tower 1230 – 300 5th Avenue SW Calgary AB T2P 3C4 | United Kingdom Building 350 – 409 Granville Street Vancouver BC V6C 1T2 |

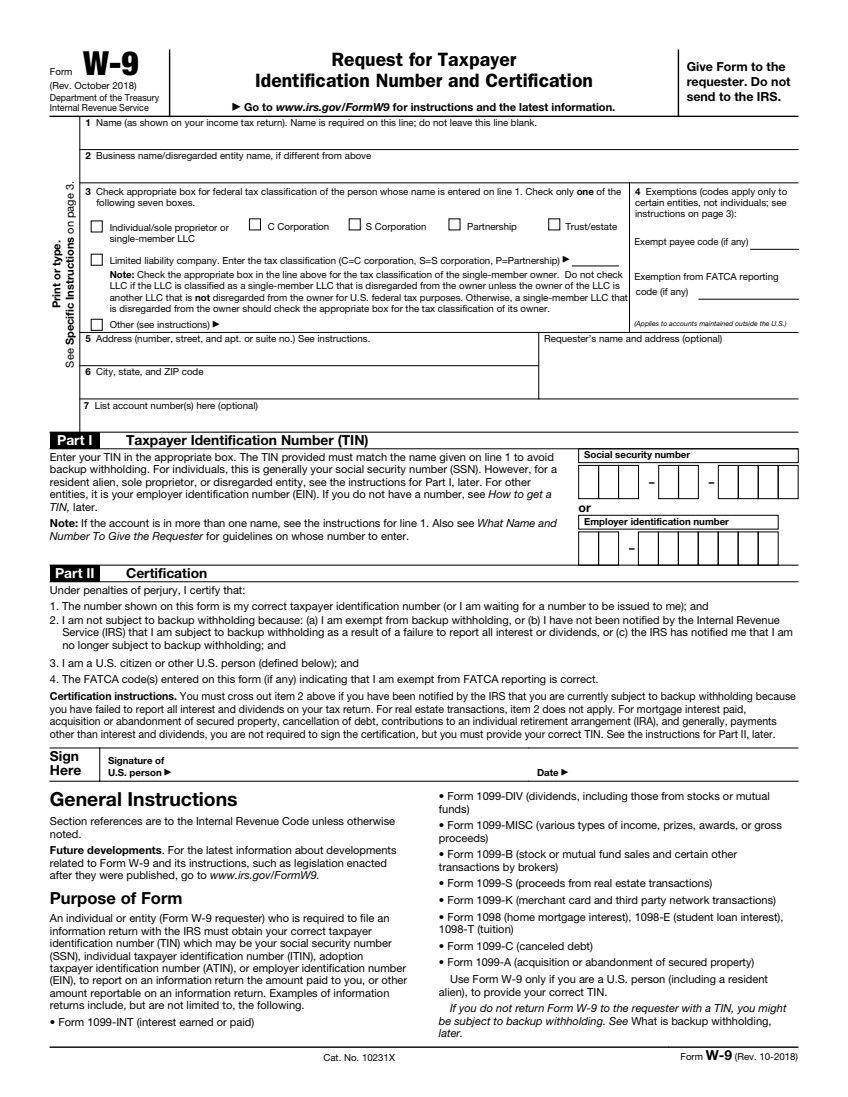

| Form W-9(Rev. October 2018) Department of the Treasury Internal Revenue Service Request for Taxpayer Identification Number and Certification▶ Go to www.irs.gov/FormW9 for instructions and the latest information. Give Form to the requester. Do not send to the IRS. Print or type. See Specific Instructions on page 3. 1 Name (as shown on your income tax return). Name is required on this line; do not leave this line blank. 2 Business name/disregarded entity name, if different from above3 Check appropriate box for federal tax classification of the person whose name is entered on line 1. Check only one of the following seven boxes. Individual/sole proprietor or single-member LLC C Corporation S Corporation Partnership Trust/estate Limited liability company. Enter the tax classification (C=C corporation, S=S corporation, P=Partnership) ▶ Note: Check the appropriate box in the line above for the tax classification of the single-member owner. Do not check LLC if the LLC is classified as a single-member LLC that is disregarded from the owner unless the owner of the LLC is another LLC that is not disregarded from the owner for U.S. federal tax purposes. Otherwise, a single-member LLC that is disregarded from the owner should check the appropriate box for the tax classification of its owner. Other (see instructions) ▶ 4 Exemptions (codes apply only to certain entities, not individuals; see instructions on page 3): Exempt payee code (if any)Exemption from FATCA reporting code (if any)(Applies to accounts maintained outside the U.S.) 5 Address (number, street, and apt. or suite no.) See instructions. 6 City, state, and ZIP code Requesters name and address (optional) 7 List account number(s) here (optional) Part I Taxpayer Identification Number (TIN)Enter your TIN in the appropriate box. The TIN provided must match the name given on line 1 to avoid backup withholding. For individuals, this is generally your social security number (SSN). However, for a resident alien, sole proprietor, or disregarded entity, see the instructions for Part I, later. For other entities, it is your employer identification number (EIN). If you do not have a number, see How to get a TIN, later.Note: If the account is in more than one name, see the instructions for line 1. Also see What Name and Number To Give the Requester for guidelines on whose number to enter. Social security number or Employer identification number Part II CertificationUnder penalties of perjury, I certify that:1. The number shown on this form is my correct taxpayer identification number (or I am waiting for a number to be issued to me); and2. I am not subject to backup withholding because: (a) I am exempt from backup withholding, or (b) I have not been notified by the Internal Revenue Service (IRS) that I am subject to backup withholding as a result of a failure to report all interest or dividends, or (c) the IRS has notified me that I am no longer subject to backup withholding; and3. I am a U.S. citizen or other U.S. person (defined below); and4. The FATCA code(s) entered on this form (if any) indicating that I am exempt from FATCA reporting is correct.Certification instructions. You must cross out item 2 above if you have been notified by the IRS that you are currently subject to backup withholding because you have failed to report all interest and dividends on your tax return. For real estate transactions, item 2 does not apply. For mortgage interest paid, acquisition or abandonment of secured property, cancellation of debt, contributions to an individual retirement arrangement (IRA), and generally, payments other than interest and dividends, you are not required to sign the certification, but you must provide your correct TIN. See the instructions for Part II, later. Sign Here Signature of U.S. person ▶ Date ▶General InstructionsSection references are to the Internal Revenue Code unless otherwise noted.Future developments. For the latest information about developments related to Form W-9 and its instructions, such as legislation enacted after they were published, go to www.irs.gov/FormW9.Purpose of FormAn individual or entity (Form W-9 requester) who is required to file an information return with the IRS must obtain your correct taxpayer identification number (TIN) which may be your social security number (SSN), individual taxpayer identification number (ITIN), adoption taxpayer identification number (ATIN), or employer identification number (EIN), to report on an information return the amount paid to you, or other amount reportable on an information return. Examples of information returns include, but are not limited to, the following. Form 1099-INT (interest earned or paid) Form 1099-DIV (dividends, including those from stocks or mutual funds) Form 1099-MISC (various types of income, prizes, awards, or gross proceeds) Form 1099-B (stock or mutual fund sales and certain other transactions by brokers) Form 1099-S (proceeds from real estate transactions) Form 1099-K (merchant card and third party network transactions) Form 1098 (home mortgage interest), 1098-E (student loan interest), 1098-T (tuition) Form 1099-C (canceled debt) Form 1099-A (acquisition or abandonment of secured property)Use Form W-9 only if you are a U.S. person (including a resident alien), to provide your correct TIN. If you do not return Form W-9 to the requester with a TIN, you might be subject to backup withholding. See What is backup withholding, later. Cat. No. 10231X Form W-9 (Rev. 10-2018) |

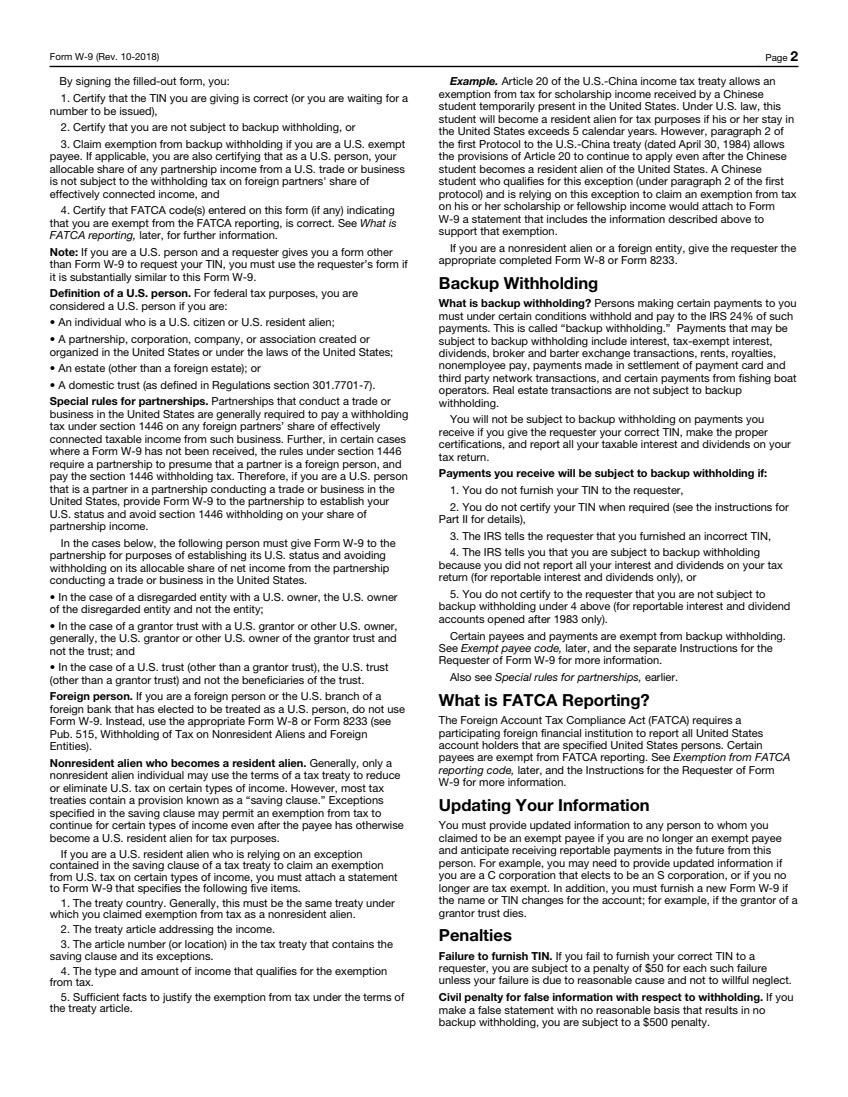

| Form W-9 (Rev. 10-2018) Page 2 By signing the filled-out form, you: 1. Certify that the TIN you are giving is correct (or you are waiting for a number to be issued),2. Certify that you are not subject to backup withholding, or3. Claim exemption from backup withholding if you are a U.S. exempt payee. If applicable, you are also certifying that as a U.S. person, your allocable share of any partnership income from a U.S. trade or business is not subject to the withholding tax on foreign partners' share of effectively connected income, and 4. Certify that FATCA code(s) entered on this form (if any) indicating that you are exempt from the FATCA reporting, is correct. See What is FATCA reporting, later, for further information.Note: If you are a U.S. person and a requester gives you a form other than Form W-9 to request your TIN, you must use the requesters form if it is substantially similar to this Form W-9.Definition of a U.S. person. For federal tax purposes, you are considered a U.S. person if you are: An individual who is a U.S. citizen or U.S. resident alien; A partnership, corporation, company, or association created or organized in the United States or under the laws of the United States; An estate (other than a foreign estate); or A domestic trust (as defined in Regulations section 301.7701-7). Special rules for partnerships. Partnerships that conduct a trade or business in the United States are generally required to pay a withholding tax under section 1446 on any foreign partners share of effectively connected taxable income from such business. Further, in certain cases where a Form W-9 has not been received, the rules under section 1446 require a partnership to presume that a partner is a foreign person, and pay the section 1446 withholding tax. Therefore, if you are a U.S. person that is a partner in a partnership conducting a trade or business in the United States, provide Form W-9 to the partnership to establish your U.S. status and avoid section 1446 withholding on your share of partnership income.In the cases below, the following person must give Form W-9 to the partnership for purposes of establishing its U.S. status and avoiding withholding on its allocable share of net income from the partnership conducting a trade or business in the United States. In the case of a disregarded entity with a U.S. owner, the U.S. owner of the disregarded entity and not the entity; In the case of a grantor trust with a U.S. grantor or other U.S. owner, generally, the U.S. grantor or other U.S. owner of the grantor trust and not the trust; and In the case of a U.S. trust (other than a grantor trust), the U.S. trust (other than a grantor trust) and not the beneficiaries of the trust.Foreign person. If you are a foreign person or the U.S. branch of a foreign bank that has elected to be treated as a U.S. person, do not use Form W-9. Instead, use the appropriate Form W-8 or Form 8233 (see Pub. 515, Withholding of Tax on Nonresident Aliens and Foreign Entities).Nonresident alien who becomes a resident alien. Generally, only a nonresident alien individual may use the terms of a tax treaty to reduce or eliminate U.S. tax on certain types of income. However, most tax treaties contain a provision known as a saving clause. Exceptions specified in the saving clause may permit an exemption from tax to continue for certain types of income even after the payee has otherwise become a U.S. resident alien for tax purposes.If you are a U.S. resident alien who is relying on an exception contained in the saving clause of a tax treaty to claim an exemption from U.S. tax on certain types of income, you must attach a statement to Form W-9 that specifies the following five items.1. The treaty country. Generally, this must be the same treaty under which you claimed exemption from tax as a nonresident alien.2. The treaty article addressing the income.3. The article number (or location) in the tax treaty that contains the saving clause and its exceptions.4. The type and amount of income that qualifies for the exemption from tax.5. Sufficient facts to justify the exemption from tax under the terms of the treaty article.Example. Article 20 of the U.S.-China income tax treaty allows an exemption from tax for scholarship income received by a Chinese student temporarily present in the United States. Under U.S. law, this student will become a resident alien for tax purposes if his or her stay in the United States exceeds 5 calendar years. However, paragraph 2 of the first Protocol to the U.S.-China treaty (dated April 30, 1984) allows the provisions of Article 20 to continue to apply even after the Chinese student becomes a resident alien of the United States. A Chinese student who qualifies for this exception (under paragraph 2 of the first protocol) and is relying on this exception to claim an exemption from tax on his or her scholarship or fellowship income would attach to Form W-9 a statement that includes the information described above to support that exemption.If you are a nonresident alien or a foreign entity, give the requester the appropriate completed Form W-8 or Form 8233.Backup WithholdingWhat is backup withholding? Persons making certain payments to you must under certain conditions withhold and pay to the IRS 24% of such payments. This is called backup withholding. Payments that may be subject to backup withholding include interest, tax-exempt interest, dividends, broker and barter exchange transactions, rents, royalties, nonemployee pay, payments made in settlement of payment card and third party network transactions, and certain payments from fishing boat operators. Real estate transactions are not subject to backup withholding.You will not be subject to backup withholding on payments you receive if you give the requester your correct TIN, make the proper certifications, and report all your taxable interest and dividends on your tax return.Payments you receive will be subject to backup withholding if: 1. You do not furnish your TIN to the requester, 2. You do not certify your TIN when required (see the instructions for Part II for details),3. The IRS tells the requester that you furnished an incorrect TIN, 4. The IRS tells you that you are subject to backup withholding because you did not report all your interest and dividends on your tax return (for reportable interest and dividends only), or5. You do not certify to the requester that you are not subject to backup withholding under 4 above (for reportable interest and dividend accounts opened after 1983 only).Certain payees and payments are exempt from backup withholding. See Exempt payee code, later, and the separate Instructions for the Requester of Form W-9 for more information.Also see Special rules for partnerships, earlier.What is FATCA Reporting?The Foreign Account Tax Compliance Act (FATCA) requires a participating foreign financial institution to report all United States account holders that are specified United States persons. Certain payees are exempt from FATCA reporting. See Exemption from FATCA reporting code, later, and the Instructions for the Requester of Form W-9 for more information.Updating Your InformationYou must provide updated information to any person to whom you claimed to be an exempt payee if you are no longer an exempt payee and anticipate receiving reportable payments in the future from this person. For example, you may need to provide updated information if you are a C corporation that elects to be an S corporation, or if you no longer are tax exempt. In addition, you must furnish a new Form W-9 if the name or TIN changes for the account; for example, if the grantor of a grantor trust dies.PenaltiesFailure to furnish TIN. If you fail to furnish your correct TIN to a requester, you are subject to a penalty of $50 for each such failure unless your failure is due to reasonable cause and not to willful neglect.Civil penalty for false information with respect to withholding. If you make a false statement with no reasonable basis that results in no backup withholding, you are subject to a $500 penalty. |

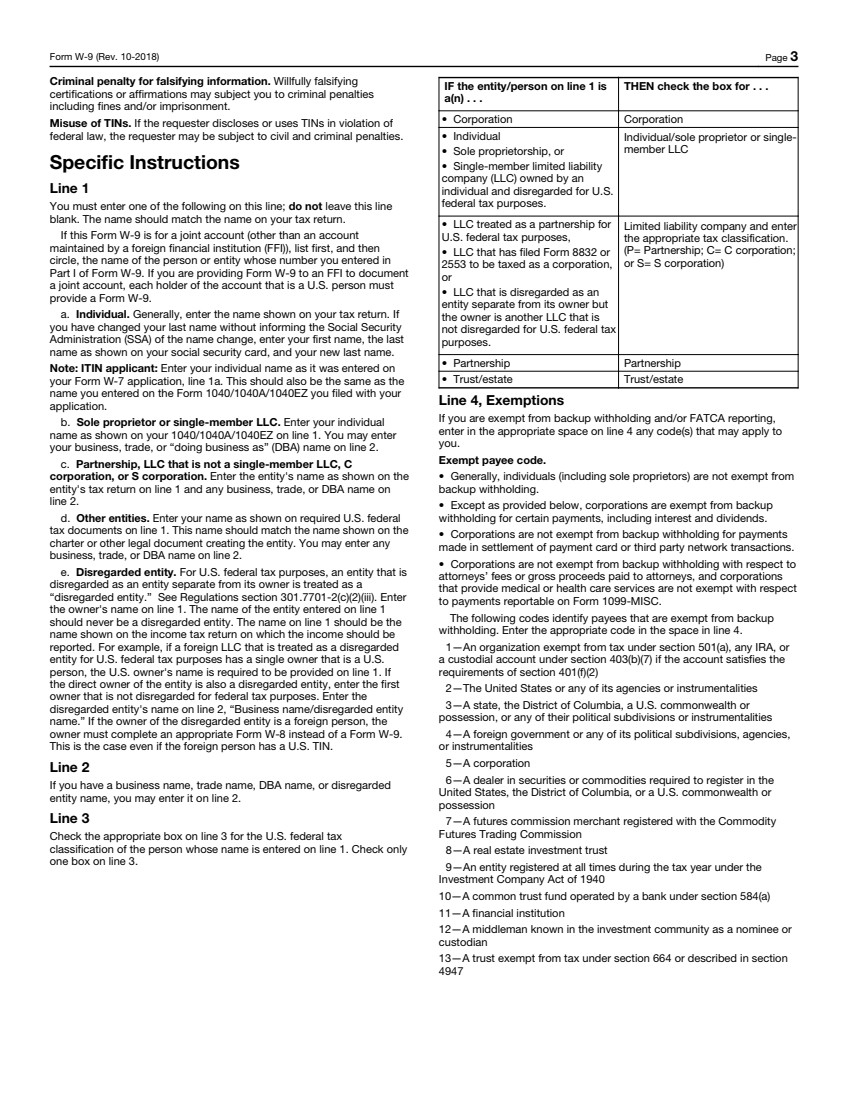

| Form W-9 (Rev. 10-2018) Page 3 Criminal penalty for falsifying information. Willfully falsifying certifications or affirmations may subject you to criminal penalties including fines and/or imprisonment.Misuse of TINs. If the requester discloses or uses TINs in violation of federal law, the requester may be subject to civil and criminal penalties.Specific InstructionsLine 1You must enter one of the following on this line; do not leave this line blank. The name should match the name on your tax return.If this Form W-9 is for a joint account (other than an account maintained by a foreign financial institution (FFI)), list first, and then circle, the name of the person or entity whose number you entered in Part I of Form W-9. If you are providing Form W-9 to an FFI to document a joint account, each holder of the account that is a U.S. person must provide a Form W-9.a. Individual. Generally, enter the name shown on your tax return. If you have changed your last name without informing the Social Security Administration (SSA) of the name change, enter your first name, the last name as shown on your social security card, and your new last name. Note: ITIN applicant: Enter your individual name as it was entered on your Form W-7 application, line 1a. This should also be the same as the name you entered on the Form 1040/1040A/1040EZ you filed with your application.b. Sole proprietor or single-member LLC. Enter your individual name as shown on your 1040/1040A/1040EZ on line 1. You may enter your business, trade, or doing business as (DBA) name on line 2.c. Partnership, LLC that is not a single-member LLC, C corporation, or S corporation. Enter the entity's name as shown on the entity's tax return on line 1 and any business, trade, or DBA name on line 2.d. Other entities. Enter your name as shown on required U.S. federal tax documents on line 1. This name should match the name shown on the charter or other legal document creating the entity. You may enter any business, trade, or DBA name on line 2.e. Disregarded entity. For U.S. federal tax purposes, an entity that is disregarded as an entity separate from its owner is treated as a disregarded entity. See Regulations section 301.7701-2(c)(2)(iii). Enter the owner's name on line 1. The name of the entity entered on line 1 should never be a disregarded entity. The name on line 1 should be the name shown on the income tax return on which the income should be reported. For example, if a foreign LLC that is treated as a disregarded entity for U.S. federal tax purposes has a single owner that is a U.S. person, the U.S. owner's name is required to be provided on line 1. If the direct owner of the entity is also a disregarded entity, enter the first owner that is not disregarded for federal tax purposes. Enter the disregarded entity's name on line 2, Business name/disregarded entity name. If the owner of the disregarded entity is a foreign person, the owner must complete an appropriate Form W-8 instead of a Form W-9. This is the case even if the foreign person has a U.S. TIN. Line 2If you have a business name, trade name, DBA name, or disregarded entity name, you may enter it on line 2.Line 3Check the appropriate box on line 3 for the U.S. federal tax classification of the person whose name is entered on line 1. Check only one box on line 3. IF the entity/person on line 1 is a(n) . . . THEN check the box for . . . Corporation Corporation Individual Sole proprietorship, or Single-member limited liability company (LLC) owned by an individual and disregarded for U.S. federal tax purposes. Individual/sole proprietor or single- member LLC LLC treated as a partnership for U.S. federal tax purposes, LLC that has filed Form 8832 or 2553 to be taxed as a corporation, or LLC that is disregarded as an entity separate from its owner but the owner is another LLC that is not disregarded for U.S. federal tax purposes. Limited liability company and enter the appropriate tax classification. (P= Partnership; C= C corporation; or S= S corporation) Partnership Partnership Trust/estate Trust/estateLine 4, ExemptionsIf you are exempt from backup withholding and/or FATCA reporting, enter in the appropriate space on line 4 any code(s) that may apply to you.Exempt payee code. Generally, individuals (including sole proprietors) are not exempt from backup withholding. Except as provided below, corporations are exempt from backup withholding for certain payments, including interest and dividends. Corporations are not exempt from backup withholding for payments made in settlement of payment card or third party network transactions. Corporations are not exempt from backup withholding with respect to attorneys fees or gross proceeds paid to attorneys, and corporations that provide medical or health care services are not exempt with respect to payments reportable on Form 1099-MISC.The following codes identify payees that are exempt from backup withholding. Enter the appropriate code in the space in line 4.1An organization exempt from tax under section 501(a), any IRA, or a custodial account under section 403(b)(7) if the account satisfies the requirements of section 401(f)(2)2The United States or any of its agencies or instrumentalities3A state, the District of Columbia, a U.S. commonwealth or possession, or any of their political subdivisions or instrumentalities4A foreign government or any of its political subdivisions, agencies, or instrumentalities 5A corporation 6A dealer in securities or commodities required to register in the United States, the District of Columbia, or a U.S. commonwealth or possession 7A futures commission merchant registered with the Commodity Futures Trading Commission8A real estate investment trust9An entity registered at all times during the tax year under the Investment Company Act of 1940 10A common trust fund operated by a bank under section 584(a) 11A financial institution 12A middleman known in the investment community as a nominee or custodian13A trust exempt from tax under section 664 or described in section 4947 |

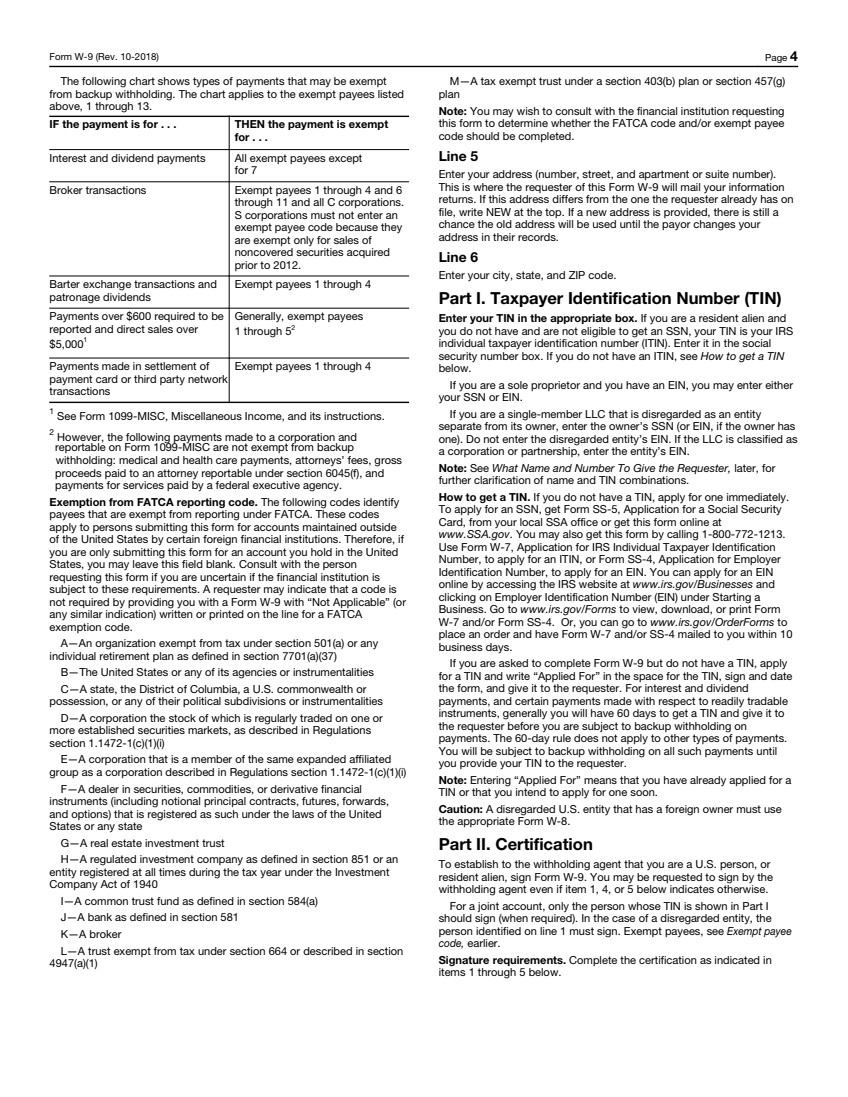

| Form W-9 (Rev. 10-2018) Page 4 The following chart shows types of payments that may be exempt from backup withholding. The chart applies to the exempt payees listed above, 1 through 13. IF the payment is for . . . THEN the payment is exempt for . . . Interest and dividend payments All exempt payees except for 7 Broker transactions Exempt payees 1 through 4 and 6 through 11 and all C corporations. S corporations must not enter an exempt payee code because they are exempt only for sales of noncovered securities acquired prior to 2012. Barter exchange transactions and patronage dividends Exempt payees 1 through 4 Payments over $600 required to be reported and direct sales over $5,0001 Generally, exempt payees 1 through 52 Payments made in settlement of payment card or third party network transactions Exempt payees 1 through 41 See Form 1099-MISC, Miscellaneous Income, and its instructions.2 However, the following payments made to a corporation and reportable on Form 1099-MISC are not exempt from backup withholding: medical and health care payments, attorneys fees, gross proceeds paid to an attorney reportable under section 6045(f), and payments for services paid by a federal executive agency.Exemption from FATCA reporting code. The following codes identify payees that are exempt from reporting under FATCA. These codes apply to persons submitting this form for accounts maintained outside of the United States by certain foreign financial institutions. Therefore, if you are only submitting this form for an account you hold in the United States, you may leave this field blank. Consult with the person requesting this form if you are uncertain if the financial institution is subject to these requirements. A requester may indicate that a code is not required by providing you with a Form W-9 with Not Applicable (or any similar indication) written or printed on the line for a FATCA exemption code.AAn organization exempt from tax under section 501(a) or any individual retirement plan as defined in section 7701(a)(37)BThe United States or any of its agencies or instrumentalitiesCA state, the District of Columbia, a U.S. commonwealth or possession, or any of their political subdivisions or instrumentalitiesDA corporation the stock of which is regularly traded on one or more established securities markets, as described in Regulations section 1.1472-1(c)(1)(i)EA corporation that is a member of the same expanded affiliated group as a corporation described in Regulations section 1.1472-1(c)(1)(i)FA dealer in securities, commodities, or derivative financial instruments (including notional principal contracts, futures, forwards, and options) that is registered as such under the laws of the United States or any stateGA real estate investment trustHA regulated investment company as defined in section 851 or an entity registered at all times during the tax year under the Investment Company Act of 1940IA common trust fund as defined in section 584(a)JA bank as defined in section 581 KA broker LA trust exempt from tax under section 664 or described in section 4947(a)(1)MA tax exempt trust under a section 403(b) plan or section 457(g) plan Note: You may wish to consult with the financial institution requesting this form to determine whether the FATCA code and/or exempt payee code should be completed.Line 5Enter your address (number, street, and apartment or suite number). This is where the requester of this Form W-9 will mail your information returns. If this address differs from the one the requester already has on file, write NEW at the top. If a new address is provided, there is still a chance the old address will be used until the payor changes your address in their records.Line 6Enter your city, state, and ZIP code.Part I. Taxpayer Identification Number (TIN)Enter your TIN in the appropriate box. If you are a resident alien and you do not have and are not eligible to get an SSN, your TIN is your IRS individual taxpayer identification number (ITIN). Enter it in the social security number box. If you do not have an ITIN, see How to get a TIN below.If you are a sole proprietor and you have an EIN, you may enter either your SSN or EIN. If you are a single-member LLC that is disregarded as an entity separate from its owner, enter the owners SSN (or EIN, if the owner has one). Do not enter the disregarded entitys EIN. If the LLC is classified as a corporation or partnership, enter the entitys EIN.Note: See What Name and Number To Give the Requester, later, for further clarification of name and TIN combinations.How to get a TIN. If you do not have a TIN, apply for one immediately. To apply for an SSN, get Form SS-5, Application for a Social Security Card, from your local SSA office or get this form online at www.SSA.gov. You may also get this form by calling 1-800-772-1213. Use Form W-7, Application for IRS Individual Taxpayer Identification Number, to apply for an ITIN, or Form SS-4, Application for Employer Identification Number, to apply for an EIN. You can apply for an EIN online by accessing the IRS website at www.irs.gov/Businesses and clicking on Employer Identification Number (EIN) under Starting a Business. Go to www.irs.gov/Forms to view, download, or print Form W-7 and/or Form SS-4. Or, you can go to www.irs.gov/OrderForms to place an order and have Form W-7 and/or SS-4 mailed to you within 10 business days.If you are asked to complete Form W-9 but do not have a TIN, apply for a TIN and write Applied For in the space for the TIN, sign and date the form, and give it to the requester. For interest and dividend payments, and certain payments made with respect to readily tradable instruments, generally you will have 60 days to get a TIN and give it to the requester before you are subject to backup withholding on payments. The 60-day rule does not apply to other types of payments. You will be subject to backup withholding on all such payments until you provide your TIN to the requester.Note: Entering Applied For means that you have already applied for a TIN or that you intend to apply for one soon.Caution: A disregarded U.S. entity that has a foreign owner must use the appropriate Form W-8.Part II. CertificationTo establish to the withholding agent that you are a U.S. person, or resident alien, sign Form W-9. You may be requested to sign by the withholding agent even if item 1, 4, or 5 below indicates otherwise.For a joint account, only the person whose TIN is shown in Part I should sign (when required). In the case of a disregarded entity, the person identified on line 1 must sign. Exempt payees, see Exempt payee code, earlier.Signature requirements. Complete the certification as indicated in items 1 through 5 below. |

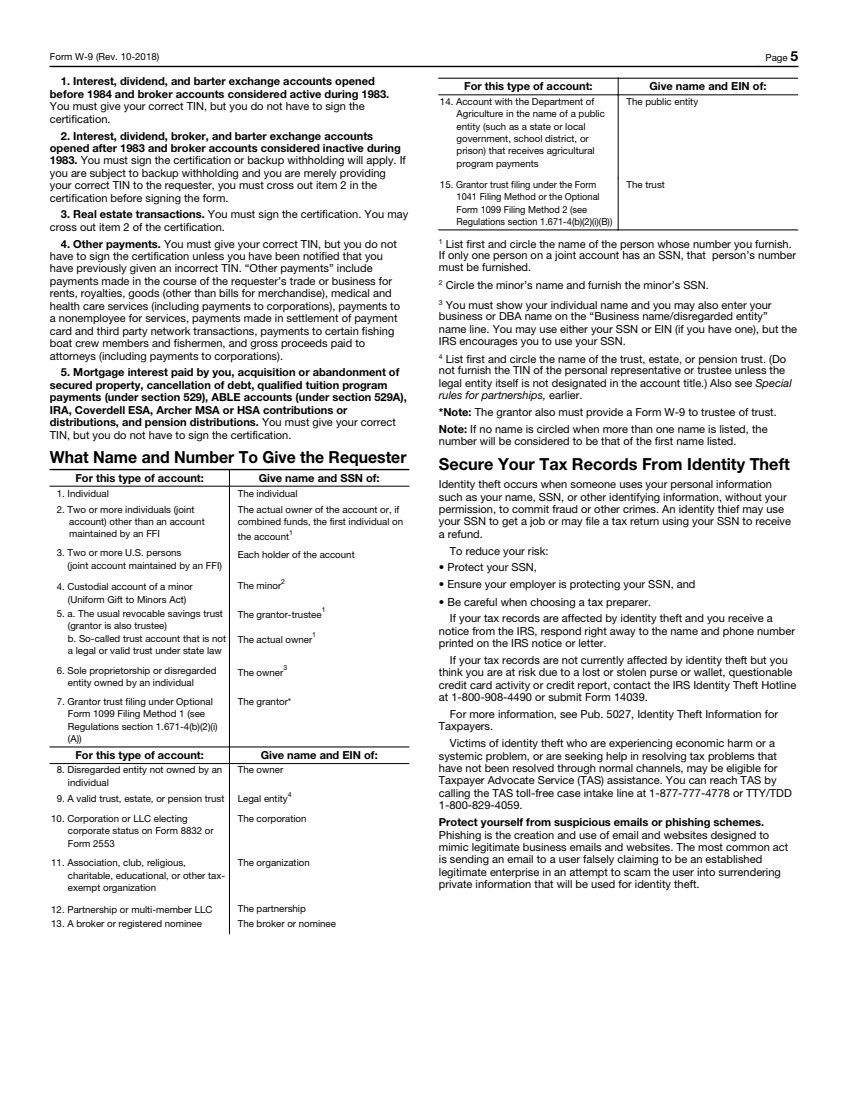

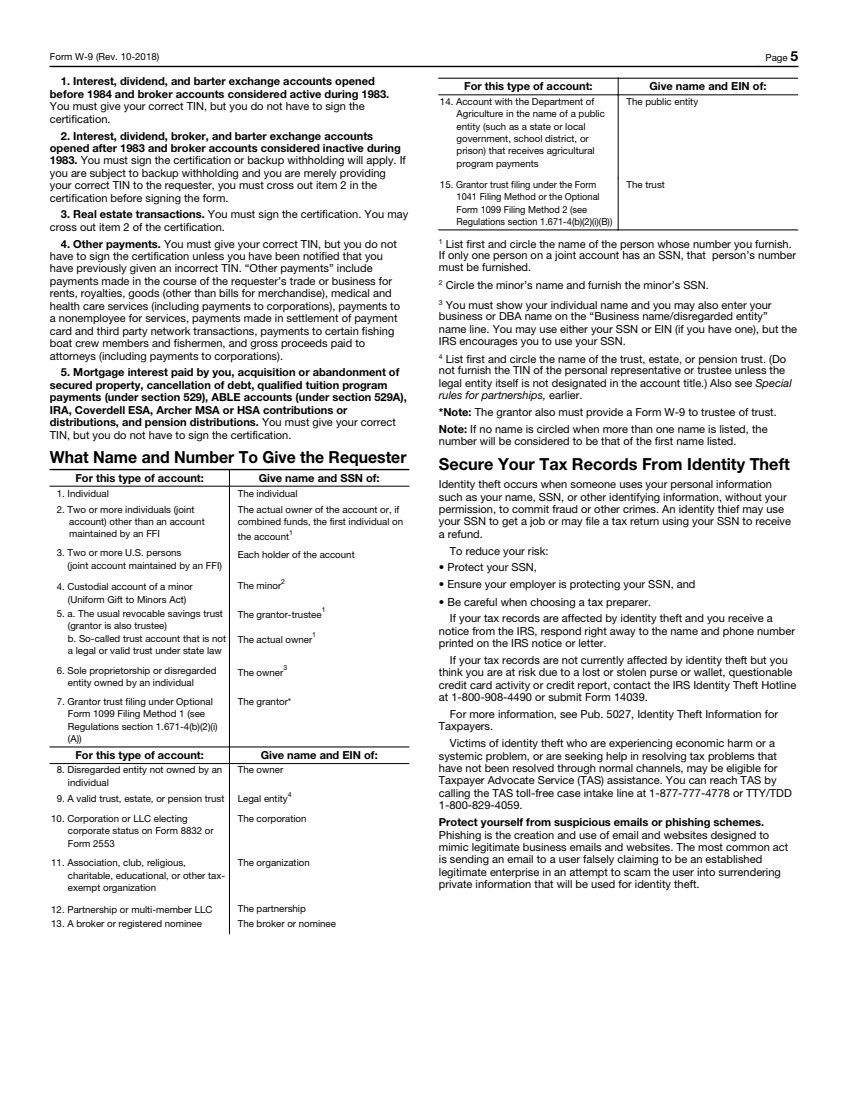

| Form W-9 (Rev. 10-2018) Page 5 1. Interest, dividend, and barter exchange accounts opened before 1984 and broker accounts considered active during 1983. You must give your correct TIN, but you do not have to sign the certification.2. Interest, dividend, broker, and barter exchange accounts opened after 1983 and broker accounts considered inactive during 1983. You must sign the certification or backup withholding will apply. If you are subject to backup withholding and you are merely providing your correct TIN to the requester, you must cross out item 2 in the certification before signing the form.3. Real estate transactions. You must sign the certification. You may cross out item 2 of the certification.4. Other payments. You must give your correct TIN, but you do not have to sign the certification unless you have been notified that you have previously given an incorrect TIN. Other payments include payments made in the course of the requesters trade or business for rents, royalties, goods (other than bills for merchandise), medical and health care services (including payments to corporations), payments to a nonemployee for services, payments made in settlement of payment card and third party network transactions, payments to certain fishing boat crew members and fishermen, and gross proceeds paid to attorneys (including payments to corporations). 5. Mortgage interest paid by you, acquisition or abandonment of secured property, cancellation of debt, qualified tuition program payments (under section 529), ABLE accounts (under section 529A), IRA, Coverdell ESA, Archer MSA or HSA contributions or distributions, and pension distributions. You must give your correct TIN, but you do not have to sign the certification. What Name and Number To Give the Requester For this type of account: Give name and SSN of:1. Individual The individual2. Two or more individuals (joint account) other than an account maintained by an FFI The actual owner of the account or, if combined funds, the first individual on the account13. Two or more U.S. persons (joint account maintained by an FFI) Each holder of the account 4. Custodial account of a minor (Uniform Gift to Minors Act) The minor2 5. a. The usual revocable savings trust (grantor is also trustee) b. So-called trust account that is not a legal or valid trust under state law The grantor-trustee1 The actual owner16. Sole proprietorship or disregarded entity owned by an individual The owner37. Grantor trust filing under Optional Form 1099 Filing Method 1 (see Regulations section 1.671-4(b)(2)(i)(A)) The grantor* For this type of account: Give name and EIN of:8. Disregarded entity not owned by an individual The owner9. A valid trust, estate, or pension trust Legal entity410. Corporation or LLC electing corporate status on Form 8832 or Form 2553 The corporation11. Association, club, religious, charitable, educational, or other tax- exempt organization The organization12. Partnership or multi-member LLC The partnership13. A broker or registered nominee The broker or nominee For this type of account: Give name and EIN of:14. Account with the Department of Agriculture in the name of a public entity (such as a state or local government, school district, or prison) that receives agricultural program payments The public entity 15. Grantor trust filing under the Form 1041 Filing Method or the Optional Form 1099 Filing Method 2 (see Regulations section 1.671-4(b)(2)(i)(B)) The trust1 List first and circle the name of the person whose number you furnish. If only one person on a joint account has an SSN, that persons number must be furnished.2 Circle the minors name and furnish the minors SSN.3 You must show your individual name and you may also enter your business or DBA name on the Business name/disregarded entity name line. You may use either your SSN or EIN (if you have one), but the IRS encourages you to use your SSN.4 List first and circle the name of the trust, estate, or pension trust. (Do not furnish the TIN of the personal representative or trustee unless the legal entity itself is not designated in the account title.) Also see Special rules for partnerships, earlier.*Note: The grantor also must provide a Form W-9 to trustee of trust. Note: If no name is circled when more than one name is listed, the number will be considered to be that of the first name listed.Secure Your Tax Records From Identity TheftIdentity theft occurs when someone uses your personal information such as your name, SSN, or other identifying information, without your permission, to commit fraud or other crimes. An identity thief may use your SSN to get a job or may file a tax return using your SSN to receive a refund.To reduce your risk: Protect your SSN, Ensure your employer is protecting your SSN, and Be careful when choosing a tax preparer.If your tax records are affected by identity theft and you receive a notice from the IRS, respond right away to the name and phone number printed on the IRS notice or letter.If your tax records are not currently affected by identity theft but you think you are at risk due to a lost or stolen purse or wallet, questionable credit card activity or credit report, contact the IRS Identity Theft Hotline at 1-800-908-4490 or submit Form 14039.For more information, see Pub. 5027, Identity Theft Information for Taxpayers.Victims of identity theft who are experiencing economic harm or a systemic problem, or are seeking help in resolving tax problems that have not been resolved through normal channels, may be eligible for Taxpayer Advocate Service (TAS) assistance. You can reach TAS by calling the TAS toll-free case intake line at 1-877-777-4778 or TTY/TDD 1-800-829-4059.Protect yourself from suspicious emails or phishing schemes. Phishing is the creation and use of email and websites designed to mimic legitimate business emails and websites. The most common act is sending an email to a user falsely claiming to be an established legitimate enterprise in an attempt to scam the user into surrendering private information that will be used for identity theft. |

| Form W-9 (Rev. 10-2018) Page 6 The IRS does not initiate contacts with taxpayers via emails. Also, the IRS does not request personal detailed information through email or ask taxpayers for the PIN numbers, passwords, or similar secret access information for their credit card, bank, or other financial accounts.If you receive an unsolicited email claiming to be from the IRS, forward this message to phishing@irs.gov. You may also report misuse of the IRS name, logo, or other IRS property to the Treasury Inspector General for Tax Administration (TIGTA) at 1-800-366-4484. You can forward suspicious emails to the Federal Trade Commission at spam@uce.gov or report them at www.ftc.gov/complaint. You can contact the FTC at www.ftc.gov/idtheft or 877-IDTHEFT (877-438-4338). If you have been the victim of identity theft, see www.IdentityTheft.gov and Pub. 5027.Visit www.irs.gov/IdentityTheft to learn more about identity theft and how to reduce your risk.Privacy Act NoticeSection 6109 of the Internal Revenue Code requires you to provide your correct TIN to persons (including federal agencies) who are required to file information returns with the IRS to report interest, dividends, or certain other income paid to you; mortgage interest you paid; the acquisition or abandonment of secured property; the cancellation of debt; or contributions you made to an IRA, Archer MSA, or HSA. The person collecting this form uses the information on the form to file information returns with the IRS, reporting the above information. Routine uses of this information include giving it to the Department of Justice for civil and criminal litigation and to cities, states, the District of Columbia, and U.S. commonwealths and possessions for use in administering their laws. The information also may be disclosed to other countries under a treaty, to federal and state agencies to enforce civil and criminal laws, or to federal law enforcement and intelligence agencies to combat terrorism. You must provide your TIN whether or not you are required to file a tax return. Under section 3406, payers must generally withhold a percentage of taxable interest, dividend, and certain other payments to a payee who does not give a TIN to the payer. Certain penalties may also apply for providing false or fraudulent information. |

BOX D

CERTIFICATE OF AWAITING TAXPAYER IDENTIFICATION NUMBER

YOU MUST COMPLETE THE FOLLOWING CERTIFICATE IF YOU CHECKED THE “AWAITING TIN” BOX ON THE IRS FORM W-9.

I certify under penalties of perjury that (i) a TIN has not been issued to me, (ii) either (a) I have mailed an application to receive a TIN to the appropriate Internal Revenue Service Center or Social Security Administration Office or (b) I intend to mail or deliver an application in the near future, and (iii) I understand that if I do not provide a TIN within 60 days, I will be subject to U.S. federal backup withholding at a rate of 24% of all reportable payments made to me.

| | |

| (Signature of U.S. Shareholder) | | (Date) |

OFFICES OF THE DEPOSITARY,

ODYSSEY TRUST COMPANY

By Registered Mail, Mail, Hand or Courier:

Trader’s Bank Building

702 – 67 Yonge Street

Toronto ON M5E 1J8

Attention: Corporate Actions

Telephone:

(587) 885-0960

E-Mail:

corp.actions@odysseytrust.com

Any questions and requests for assistance may be directed by Shareholders to the Depositary at the telephone number or email address set out above. Shareholders may also contact Laurel Hill Advisory Group, strategic shareholder advisor and proxy solicitation agent to Valens, by telephone at 1-877-452-7184 (+1 416-304-0211 for collect calls outside North America) or by email at assistance@laurelhill.com.