| | | FREE WRITING PROSPECTUS |

| | | FILED PURSUANT TO RULE 433 |

| | | REGISTRATION FILE NO.: 333-255934-05 |

| Dated May 15, 2023 | BMO 2023-C5 |

Structural and Collateral Term Sheet |

BMO 2023-C5 Mortgage Trust |

$662,700,174 (Approximate Mortgage Pool Balance) |

| |

$[ ] (Approximate Offered Certificates) |

| |

BMO Commercial Mortgage Securities LLC Depositor |

|

Commercial Mortgage Pass-Through Certificates, Series 2023-C5 |

|

| |

Bank of Montreal Citi Real Estate Funding Inc. KeyBank National Association Zions Bancorporation, N.A. BSPRT CMBS Finance, LLC 3650 Real Estate Investment Trust 2 LLC Starwood Mortgage Capital LLC German American Capital Corporation UBS AG Mortgage Loan Sellers |

BMO Capital

Markets | KeyBanc Capital

Markets | Deutsche Bank

Securities | UBS

Securities

LLC | Citigroup |

| Co-Lead Managers and Joint Bookrunners |

Bancroft Capital, LLC

Co-Manager | | Drexel Hamilton

Co-Manager |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | | |

| Dated May 15, 2023 | BMO 2023-C5 |

This material is for your information, and none of BMO Capital Markets Corp., Deutsche Bank Securities Inc., KeyBanc Capital Markets Inc., Citigroup Global Markets Inc., UBS Securities LLC, Bancroft Capital, LLC and Drexel Hamilton, LLC (the “Underwriters”) are soliciting any action based upon it. This material is not to be construed as an offer to sell or the solicitation of any offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal.

The depositor has filed a registration statement (including the prospectus) with the Securities and Exchange Commission (File No. 333-255934) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the Securities and Exchange Commission for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or BMO Capital Markets Corp., any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling 1-866-864-7760. The Offered Certificates referred to in these materials, and the asset pool backing them, are subject to modification or revision (including the possibility that one or more Classes of Certificates may be split, combined or eliminated at any time prior to issuance or availability of a final prospectus) and are offered on a “when, as and if issued” basis. You understand that, when you are considering the purchase of these Certificates, a contract of sale will come into being no sooner than the date on which the relevant Class has been priced and we have verified the allocation of Certificates to be made to you; any “indications of interest” expressed by you, and any “soft circles” generated by us, will not create binding contractual obligations for you or us.

Neither this document nor anything contained in this document shall form the basis for any contract or commitment whatsoever. The information contained in this document is preliminary as of the date of this document, supersedes any previous such information delivered to you and will be superseded by any such information subsequently delivered prior to the time of sale. These materials are subject to change, completion or amendment from time to time. The information should be reviewed only in conjunction with the entire offering document relating to the Commercial Mortgage Pass-Through Certificates, Series 2023-C5 (the “Offering Document”). All of the information contained herein is subject to the same limitations and qualifications contained in the Offering Document. The information contained herein does not contain all relevant information relating to the underlying mortgage loans or mortgaged properties. Such information is described elsewhere in the Offering Document. The information contained herein will be more fully described elsewhere in the Offering Document. The information contained herein should not be viewed as projections, forecasts, predictions or opinions with respect to value. Prior to making any investment decision, prospective investors are strongly urged to read the Offering Document its entirety. Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this free writing prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

This document has been prepared by the Underwriters for information purposes only and does not constitute, in whole or in part, a prospectus for the purposes of Regulation (EU) 2017/1129 (as amended or superseded) and/or Part VI of the Financial Services and Markets Act 2000 (as amended) or other offering document.

The attached information contains certain tables and other statistical analyses (the “Computational Materials”) which have been prepared in reliance upon information furnished by the Mortgage Loan Sellers. Numerous assumptions were used in preparing the Computational Materials, which may or may not be reflected herein. As such, no assurance can be given as to the Computational Materials’ accuracy, appropriateness or completeness in any particular context; or as to whether the Computational Materials and/or the assumptions upon which they are based reflect present market conditions or future market performance. The Computational Materials should not be construed as either projections or predictions or as legal, tax, financial or accounting advice. You should consult your own counsel, accountant and other advisors as to the legal, tax, business, financial and related aspects of a purchase of these Certificates. Any weighted average lives, yields and principal payment periods shown in the Computational Materials are based on prepayment and/or loss assumptions, and changes in such prepayment and/or loss assumptions may dramatically affect such weighted average lives, yields and principal payment periods. In addition, it is possible that prepayments or losses on the underlying assets will occur at rates higher or lower than the rates shown in the attached Computational Materials. The specific characteristics of the Certificates may differ from those shown in the Computational Materials due to differences between the final underlying assets and the preliminary underlying assets used in preparing the Computational Materials. The principal amount and designation of any security described in the Computational Materials are subject to change prior to issuance. None of the Underwriters or any of their respective affiliates make any representation or warranty as to the actual rate or timing of payments or losses on any of the underlying assets or the payments or yield on the Certificates. The information in this presentation is based upon management forecasts and reflects prevailing conditions and management’s views as of this date, all of which are subject to change. In preparing this presentation, we have relied upon and assumed, without independent verification, the accuracy and completeness of all information available from public sources or which was provided to us by or on behalf of the Mortgage Loan Sellers or which was otherwise reviewed by us.

This document contains forward-looking statements. If and when included in this document, the words “expects”, “intends”, “anticipates”, “estimates” and analogous expressions and all statements that are not historical facts, including statements about our beliefs or expectations, are intended to identify forward-looking statements. Any forward-looking statements are made subject to risks and uncertainties which could cause actual results to differ materially from those stated. Those risks and uncertainties include, among other things, declines in general economic and business conditions, increased competition, changes in demographics, changes in political and social conditions, regulatory initiatives and changes in consumer preferences, many of which are beyond our control and the control of any other person or entity related to this offering. The forward-looking statements made in this document are made as of the date hereof. We have no obligation to update or revise any forward-looking statement.

BMO Capital Markets is a trade name used by BMO Financial Group for the wholesale banking businesses of Bank of Montreal, BMO Harris Bank N.A. (member FDIC), Bank of Montreal Europe p.l.c, and Bank of Montreal (China) Co. Ltd, the institutional broker dealer business of BMO Capital Markets Corp. (Member FINRA and SIPC) and the agency broker dealer business of Clearpool Execution Services, LLC (Member FINRA and SIPC) in the U.S., and the institutional broker dealer businesses of BMO Nesbitt Burns Inc. (Member Investment Industry Regulatory Organization of Canada and Member Canadian Investor Protection Fund) in Canada and Asia, Bank of Montreal Europe p.l.c. (authorized and regulated by the Central Bank of Ireland) in Europe and BMO Capital Markets Limited (authorized and regulated by the Financial Conduct Authority) in the UK and Australia.

Securities and investment banking activities in the United States are performed by Deutsche Bank Securities Inc., a member of NYSE, FINRA and SIPC, and its broker-dealer affiliates. Lending and other commercial banking activities in the United States are performed by Deutsche Bank AG and its banking affiliates.

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 2 | |

| Dated May 15, 2023 | BMO 2023-C5 |

IMPORTANT NOTICE RELATING TO AUTOMATICALLY-GENERATED EMAIL DISCLAIMERS

Any legends, disclaimers or other notices that may appear at the bottom of any email communication to which this document is attached relating to (1) these materials not constituting an offer (or a solicitation of an offer), (2) no representation that these materials are accurate or complete and may not be updated or (3) these materials possibly being confidential, are not applicable to these materials and should be disregarded. Such legends, disclaimers or other notices have been automatically generated as a result of these materials having been sent via Bloomberg or another system.

THE CERTIFICATES REFERRED TO IN THESE MATERIALS ARE SUBJECT TO MODIFICATION OR REVISION (INCLUDING THE POSSIBILITY THAT ONE OR MORE CLASSES OF CERTIFICATES MAY BE SPLIT, COMBINED OR ELIMINATED AT ANY TIME PRIOR TO ISSUANCE OR AVAILABILITY OF A FINAL PROSPECTUS) AND ARE OFFERED ON A “WHEN, AS AND IF ISSUED” BASIS.

THE UNDERWRITERS MAY FROM TIME TO TIME PERFORM INVESTMENT BANKING SERVICES FOR, OR SOLICIT INVESTMENT BANKING BUSINESS FROM, ANY COMPANY NAMED IN THESE MATERIALS. THE UNDERWRITERS AND/OR THEIR AFFILIATES OR RESPECTIVE EMPLOYEES MAY FROM TIME TO TIME HAVE A LONG OR SHORT POSITION IN ANY CERTIFICATE OR CONTRACT DISCUSSED IN THESE MATERIALS.

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 3 | |

| Structural and Collateral Term Sheet | | BMO 2023-C5 |

| Collateral Characteristics |

Mortgage Loan Seller | Number of Mortgage Loans | Number of Mortgaged Properties | Aggregate

Cut-off Date Balance | | Roll-up Aggregate Cut-off Date Balance | Roll-up Aggregate % of Cut-off Date Balance |

| BMO | 12 | 25 | $187,243,111 | 28.3% | $212,243,111 | 32.0% |

| CREFI | 4 | 102 | $108,859,465 | 16.4% | $123,859,465 | 18.7% |

| KeyBank | 5 | 50 | $104,573,000 | 15.8% | $104,573,000 | 15.8% |

| ZBNA | 1 | 1 | $64,958,243 | 9.8% | $64,958,243 | 9.8% |

| BSPRT | 3 | 3 | $45,625,000 | 6.9% | $45,625,000 | 6.9% |

| 3650 REIT | 3 | 3 | $36,220,000 | 5.5% | $36,220,000 | 5.5% |

| SMC | 2 | 2 | $29,442,427 | 4.4% | $29,442,427 | 4.4% |

| GACC | - | - | - | - | $27,500,000 | 4.1% |

| UBS AG | 3 | 3 | $18,278,928 | 2.8% | $18,278,928 | 2.8% |

| BMO, GACC | 1 | 1 | $37,500,000 | 5.7% | - | - |

| CREFI, BMO | 1 | 1 | $30,000,000 | 4.5% | - | - |

| Total: | 35 | 191 | $662,700,174 | 100.0% | $662,700,174 | 100.0% |

| Loan Pool | |

| | Initial Pool Balance (“IPB”): | $662,700,174 |

| | Number of Mortgage Loans: | 35 |

| | Number of Mortgaged Properties: | 191 |

| | Average Cut-off Date Balance per Mortgage Loan: | $18,934,291 |

| | Weighted Average Current Mortgage Rate: | 6.63691% |

| | 10 Largest Mortgage Loans as % of IPB: | 56.0% |

| | Weighted Average Remaining Term to Maturity: | 107 months |

| | Weighted Average Seasoning: | 3 months |

| | | |

| Credit Statistics | |

| | Weighted Average UW NCF Debt Service Coverage Ratio (“DSCR”): | 1.73x |

| | Weighted Average UW NOI Debt Yield (“DY”): | 13.0% |

| | Weighted Average Cut-off Date Loan-to-Value Ratio (“LTV”): | 54.0% |

| | Weighted Average Maturity Date/ARD LTV: | 51.5% |

| | | |

| Other Statistics | |

| | % of Mortgage Loans with Additional Debt: | 11.3% |

| | % of Mortgage Loans with Single Tenants: | 21.1% |

| % of Mortgage Loans secured by Multiple Properties: | 30.7% |

| | |

| Amortization | |

| | Weighted Average Original Amortization Term: | 337 months |

| | Weighted Average Remaining Amortization Term: | 335 months |

| | % of Mortgage Loans with Interest-Only: | 65.7% |

| | % of Mortgage Loans with Amortizing Balloon: | 24.3% |

| | % of Mortgage Loans with Partial Interest-Only followed by Amortizing Balloon: | 10.0% |

| | | |

| Lockboxes | |

| | % of Mortgage Loans with Hard Lockboxes: | 68.4% |

| | % of Mortgage Loans with Springing Lockboxes: | 29.3% |

| | % of Mortgage Loans with Soft Springing Lockboxes: | 2.3% |

| | | |

| Reserves | |

| | % of Mortgage Loans Requiring Monthly Tax Reserves: | 71.3% |

| | % of Mortgage Loans Requiring Monthly Insurance Reserves: | 48.1% |

| | % of Mortgage Loans Requiring Monthly CapEx Reserves: | 59.5% |

| | % of Mortgage Loans Requiring Monthly TI/LC Reserves: | 41.3% |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 4 | |

| Structural and Collateral Term Sheet | | BMO 2023-C5 |

| Collateral Characteristics |

| Ten Largest Mortgage Loans |

| No. | Loan Name | City, State | Mortgage Loan Seller | No.

of Prop. | Cut-off Date Balance | % of IPB | Square Feet / Rooms / Units | Property Type | UW

NCF DSCR | UW NOI DY | Cut-off Date LTV | Maturity Date/ARD LTV |

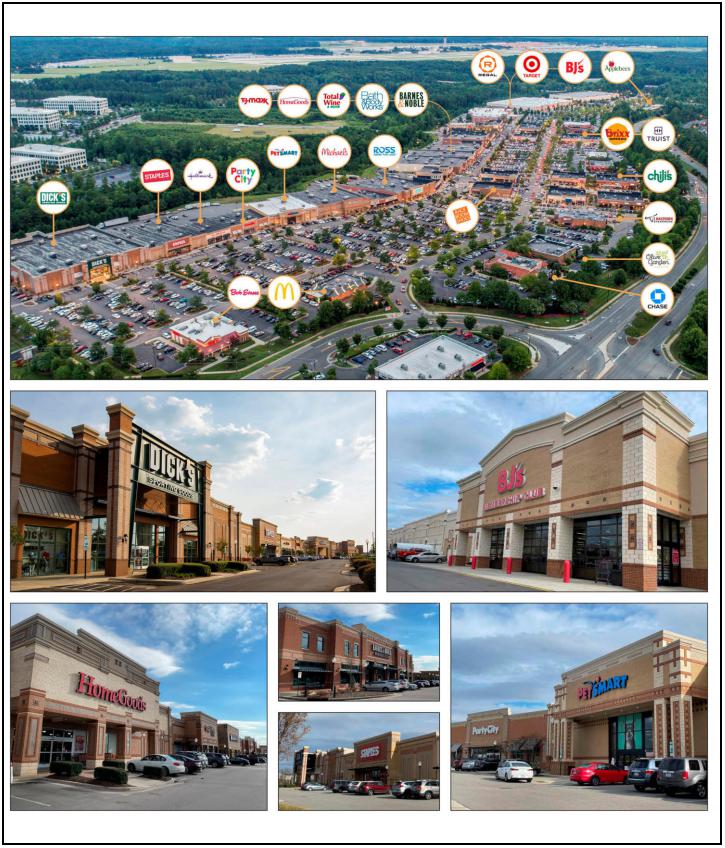

| 1 | Brier Creek Commons | Raleigh, NC | ZBNA | 1 | $64,958,243 | 9.8% | 519,277 | Retail | 1.25x | 10.4% | 62.4% | 54.3% |

| 2 | Central Florida Industrial Portfolio | Various, FL | KeyBank | 4 | $42,240,000 | 6.4% | 419,886 | Industrial | 1.58x | 10.3% | 60.0% | 60.0% |

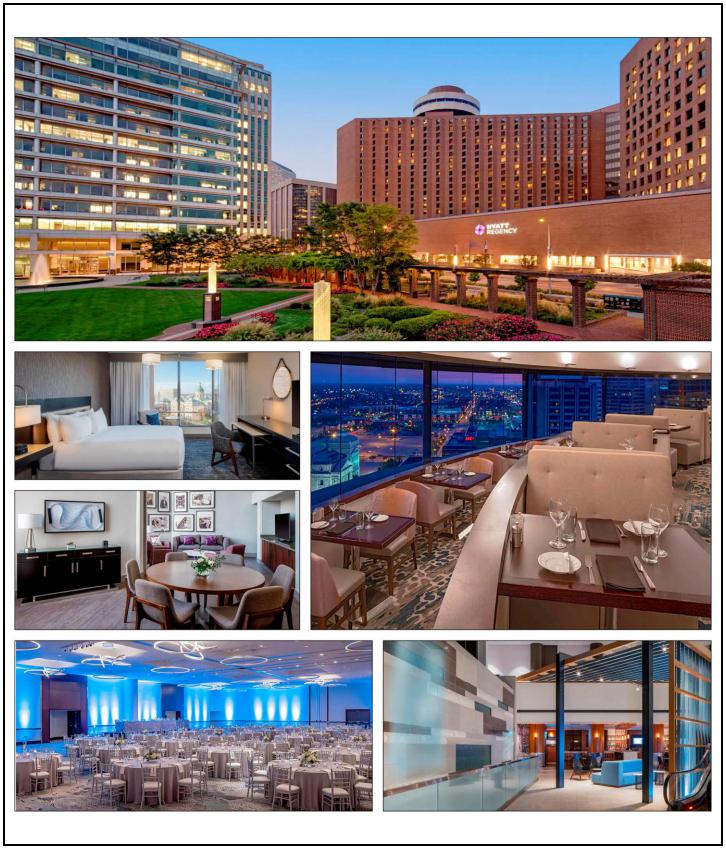

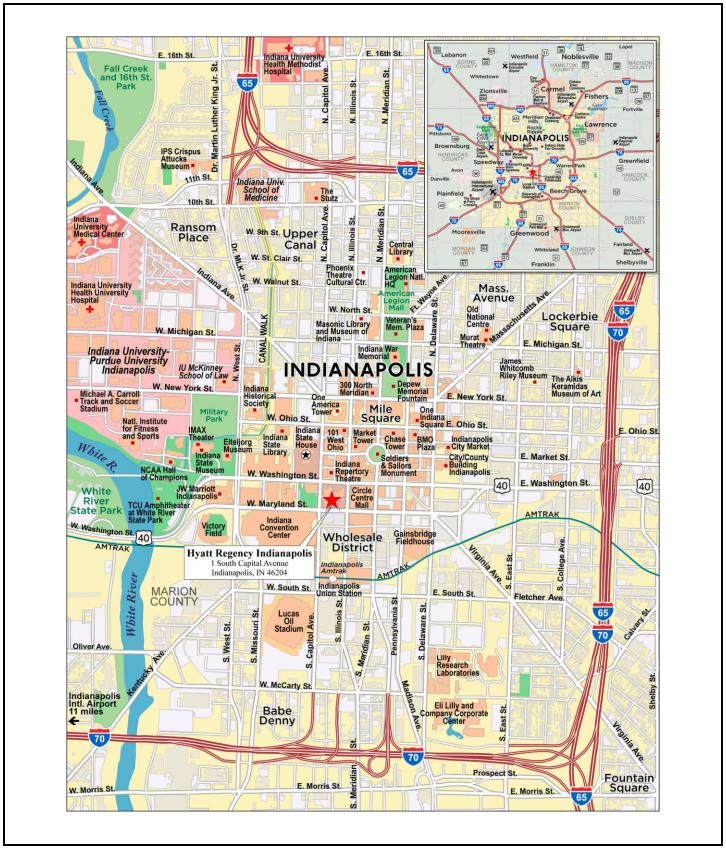

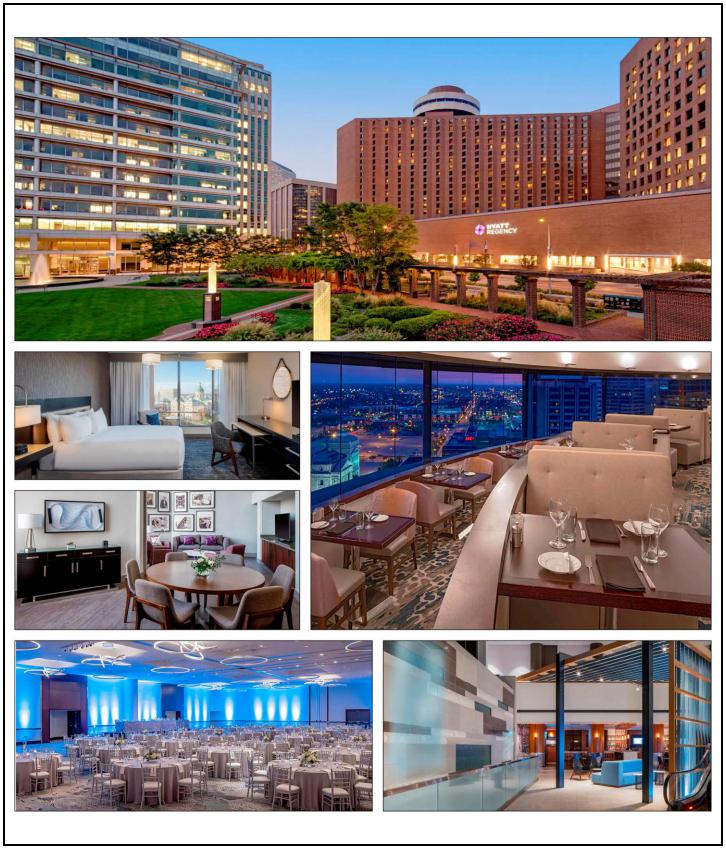

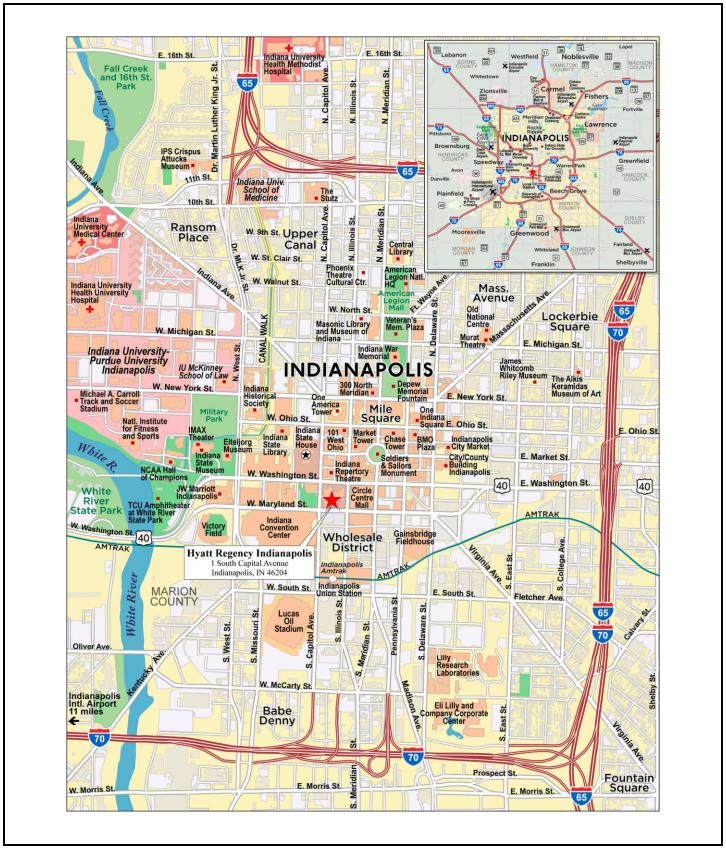

| 3 | Hyatt Regency Indianapolis | Indianapolis, IN | CREFI | 1 | $39,943,123 | 6.0% | 499 | Hospitality | 1.65x | 15.4% | 41.5% | 36.4% |

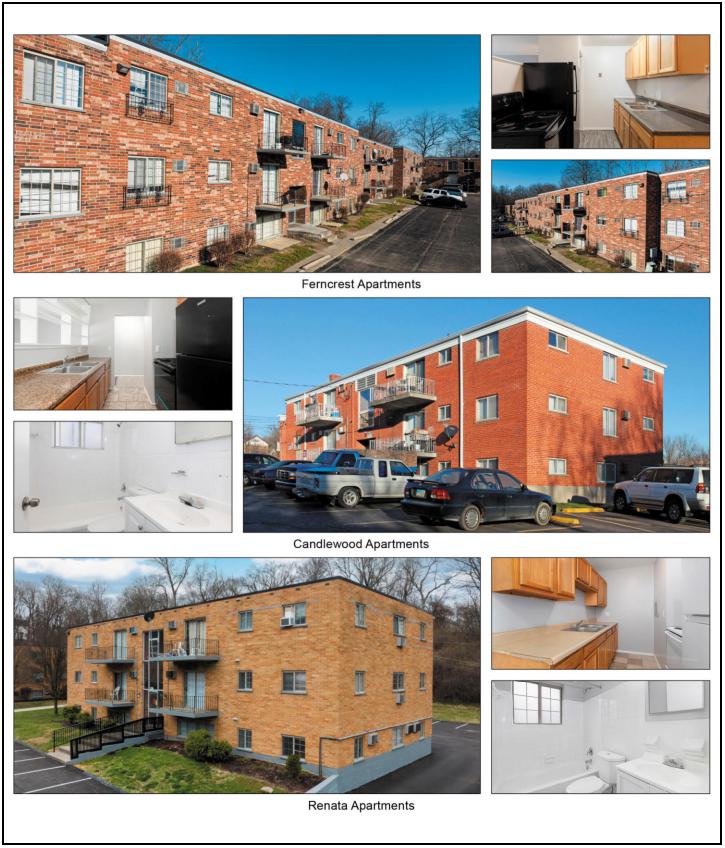

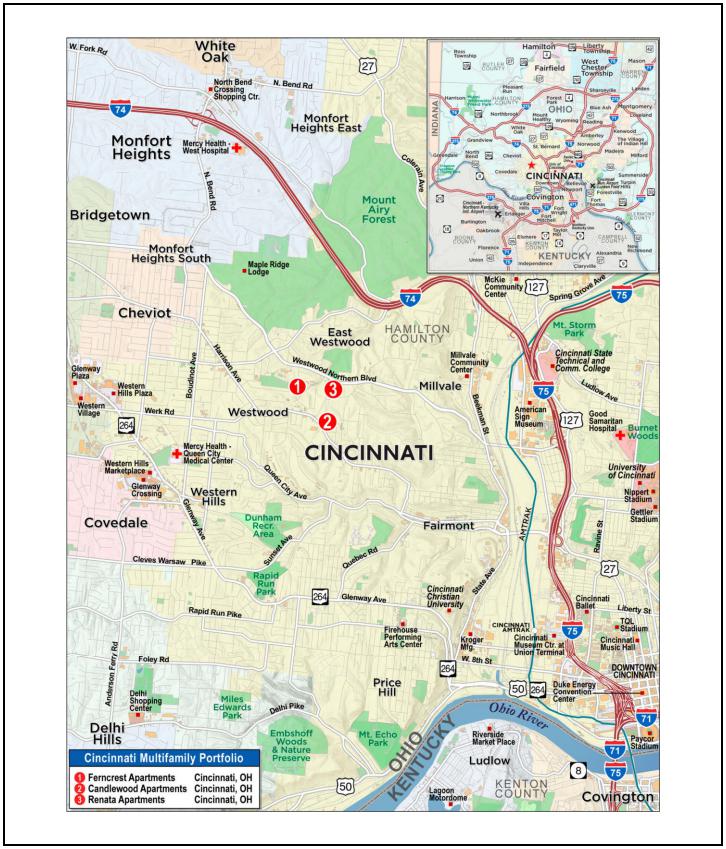

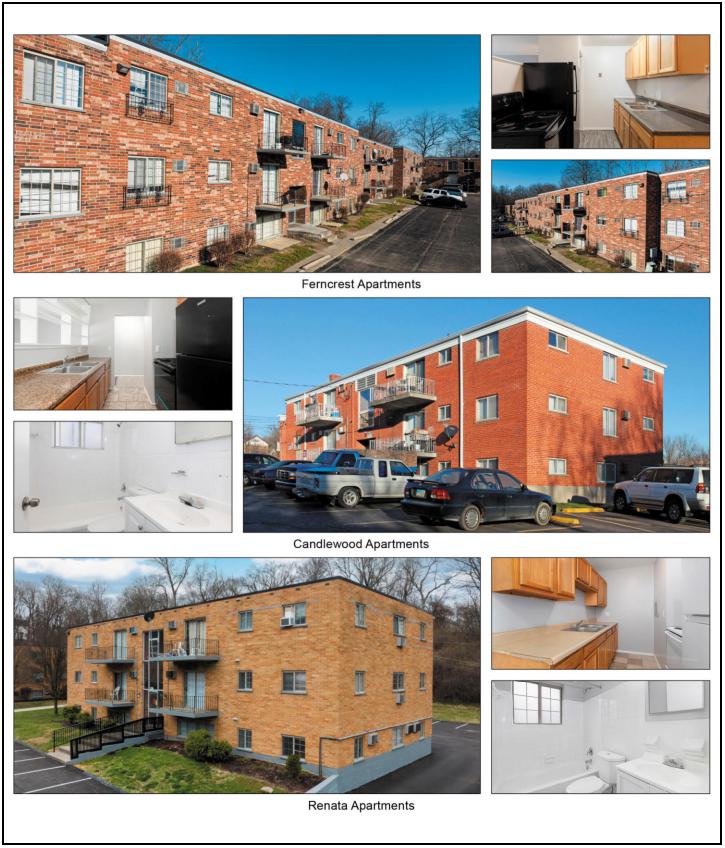

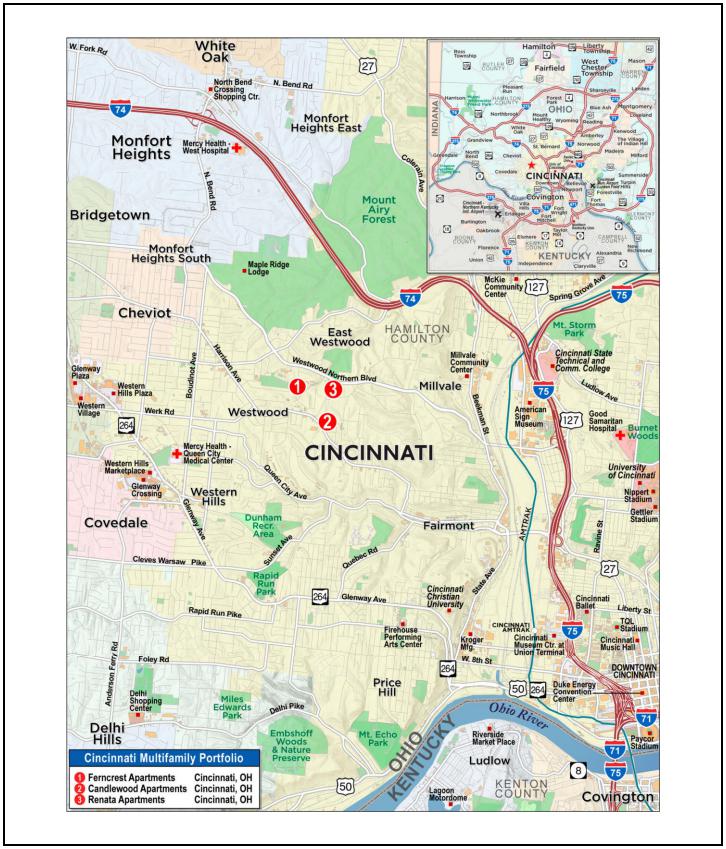

| 4 | Cincinnati Multifamily Portfolio | Cincinnati, OH | BMO | 3 | $39,000,000 | 5.9% | 375 | Multifamily | 1.49x | 10.7% | 64.4% | 64.4% |

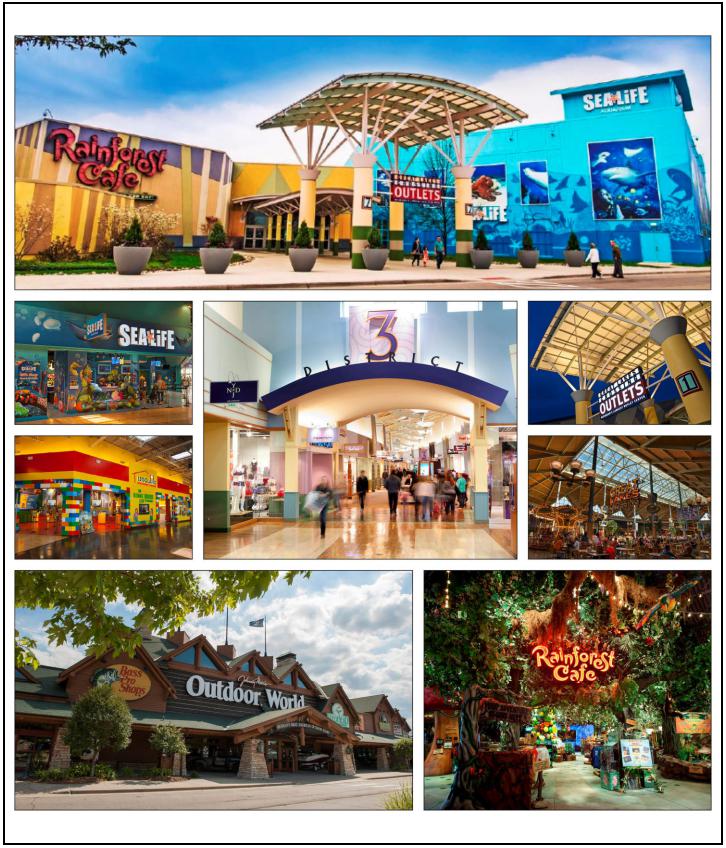

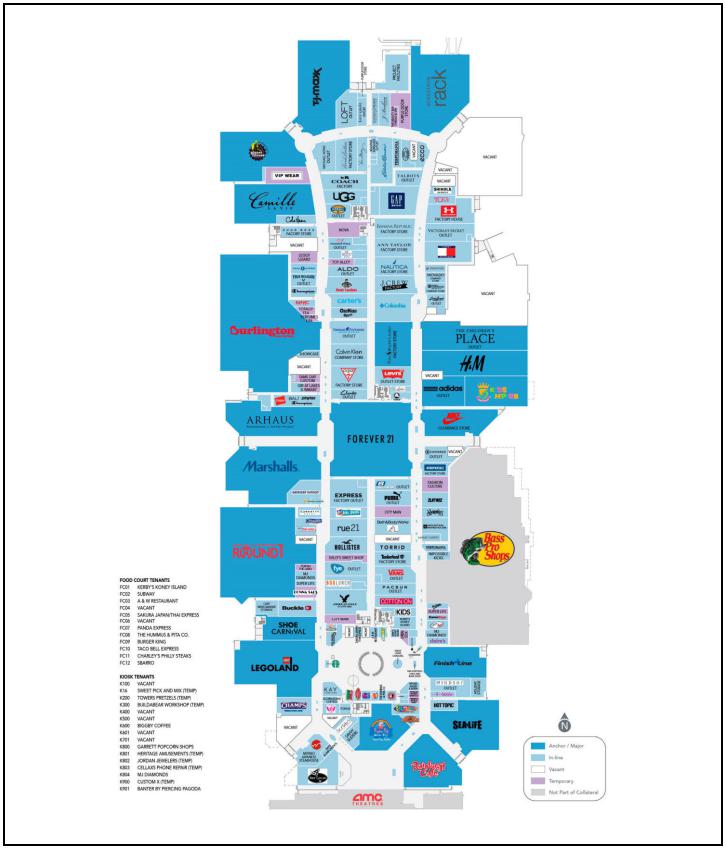

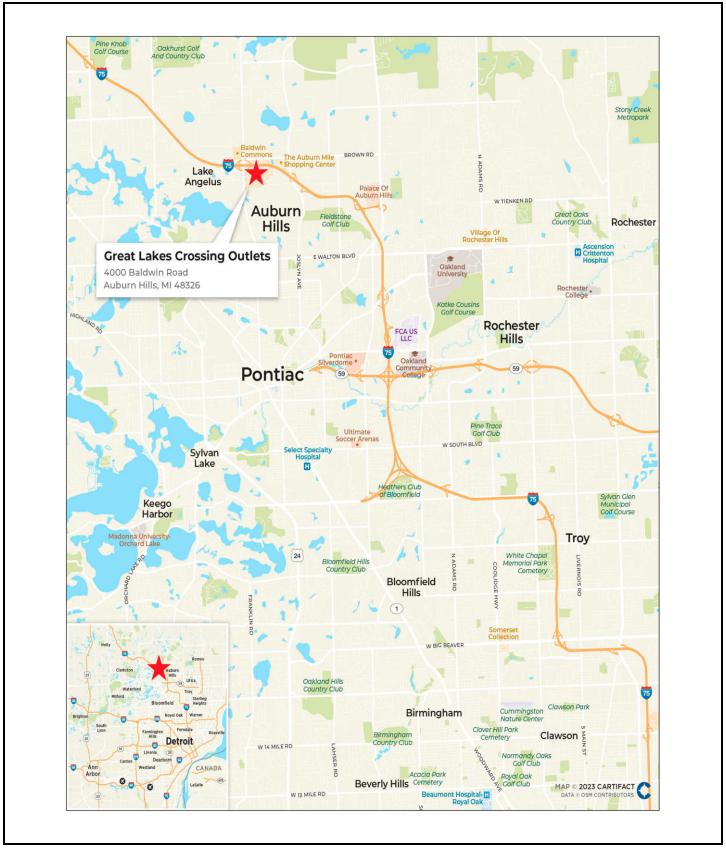

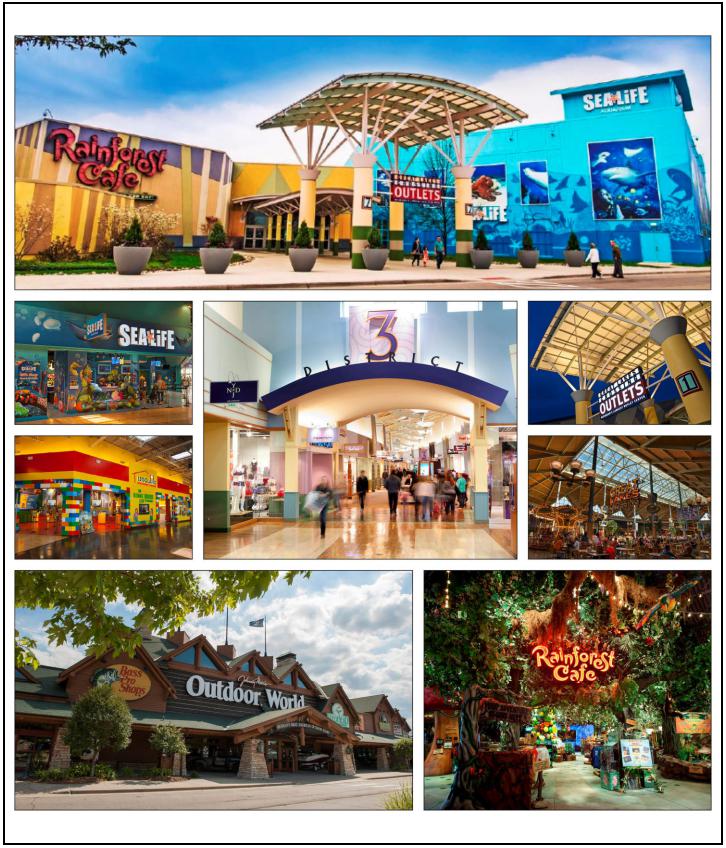

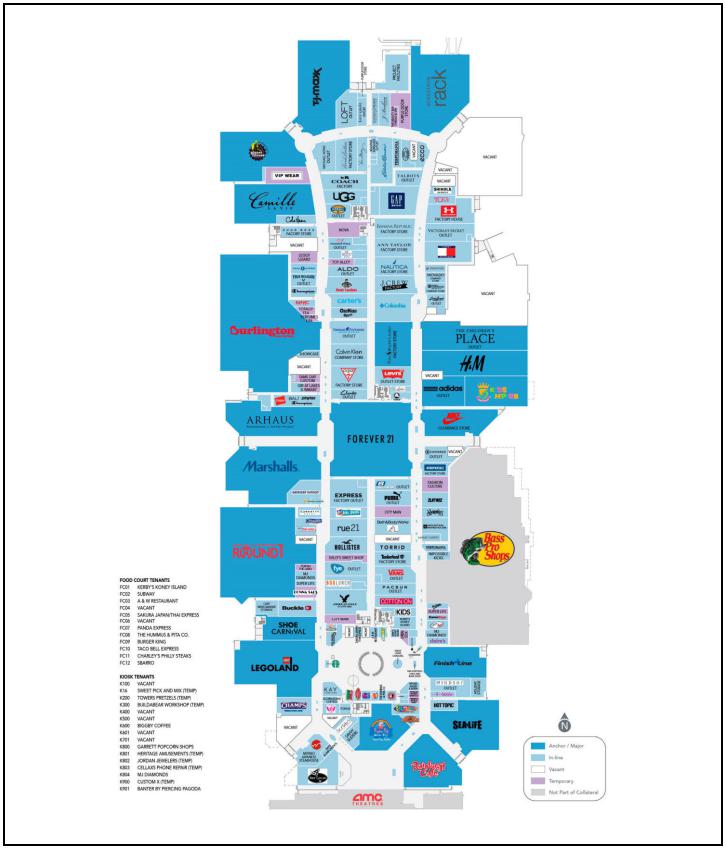

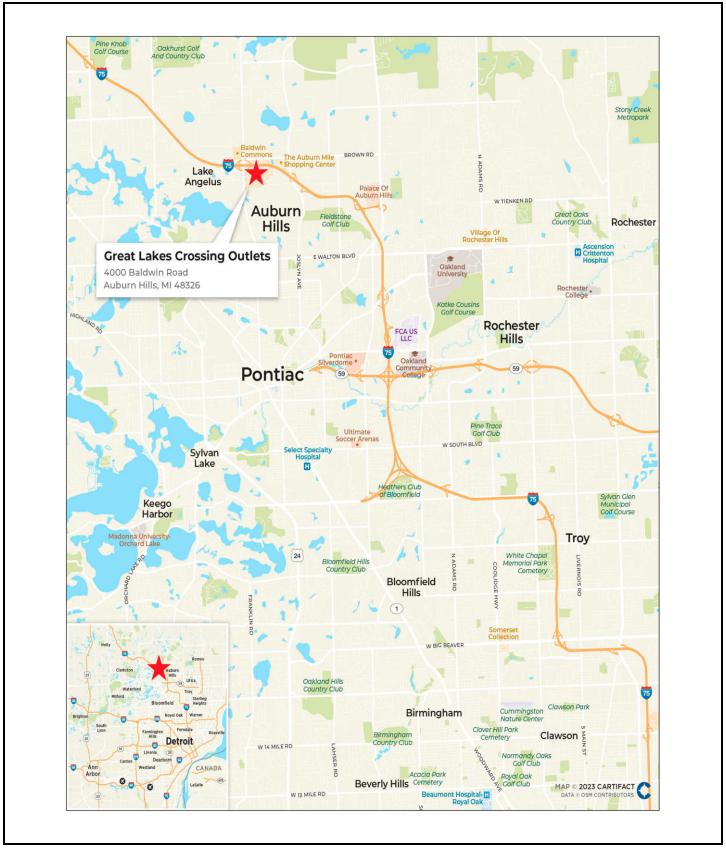

| 5 | Great Lakes Crossing Outlets | Auburn Hills, MI | BMO, GACC | 1 | $37,500,000 | 5.7% | 1,128,332 | Retail | 2.50x | 17.5% | 45.0% | 45.0% |

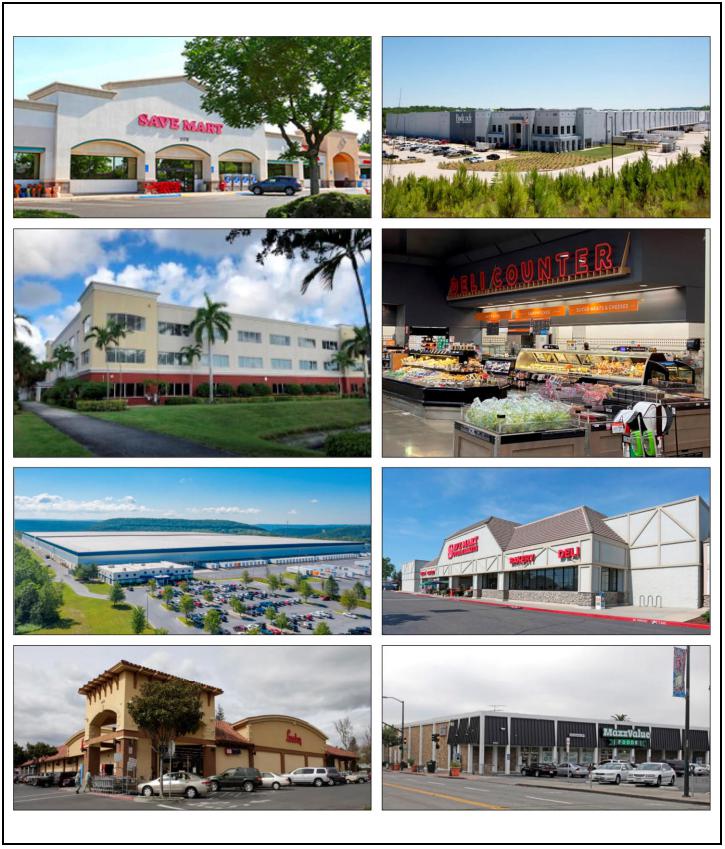

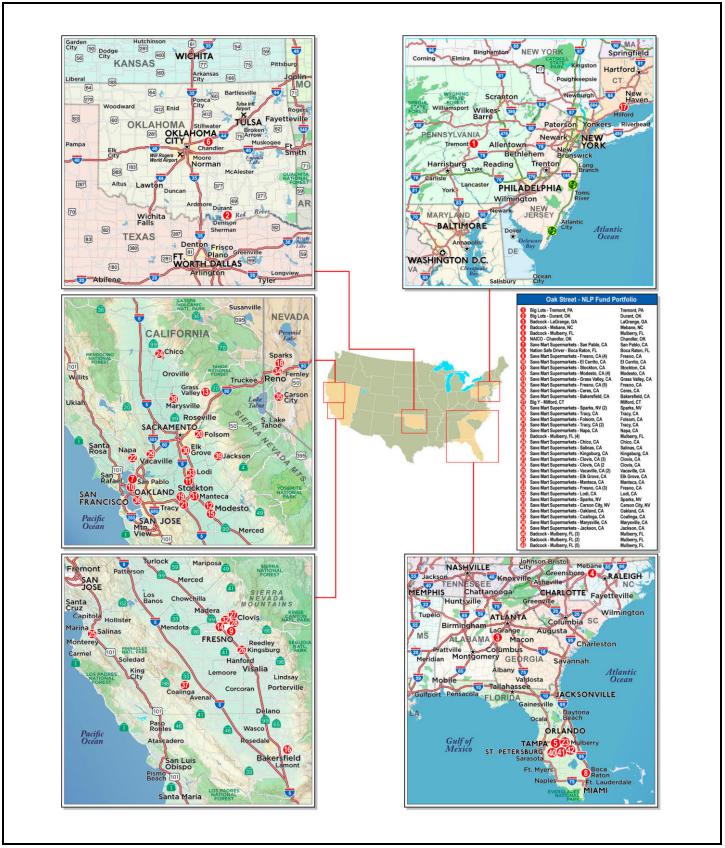

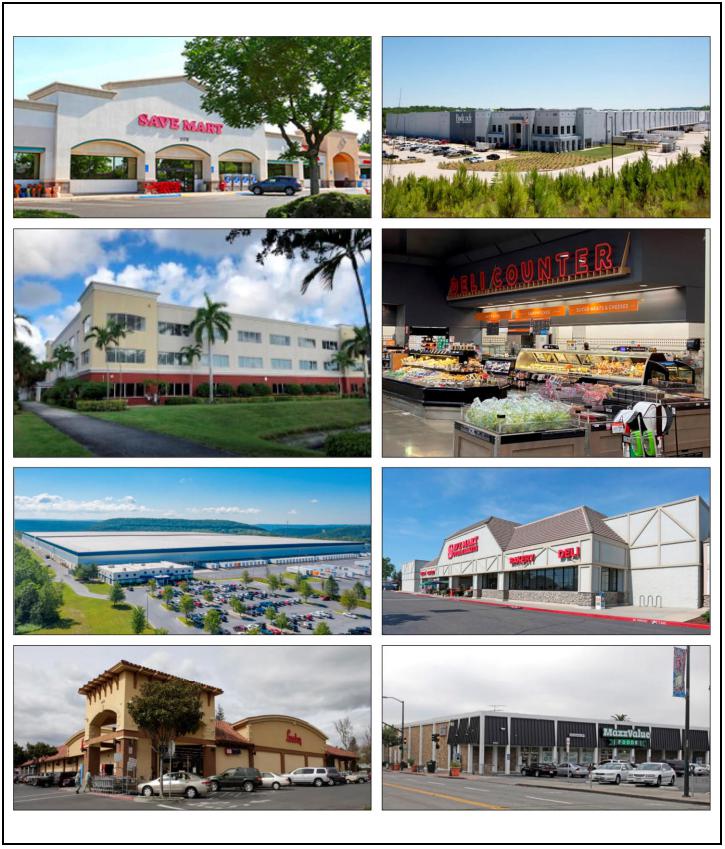

| 6 | Oak Street NLP Fund Portfolio | Various, Various | KeyBank | 42 | $30,000,000 | 4.5% | 6,470,388 | Various | 2.71x | 17.9% | 32.3% | 32.3% |

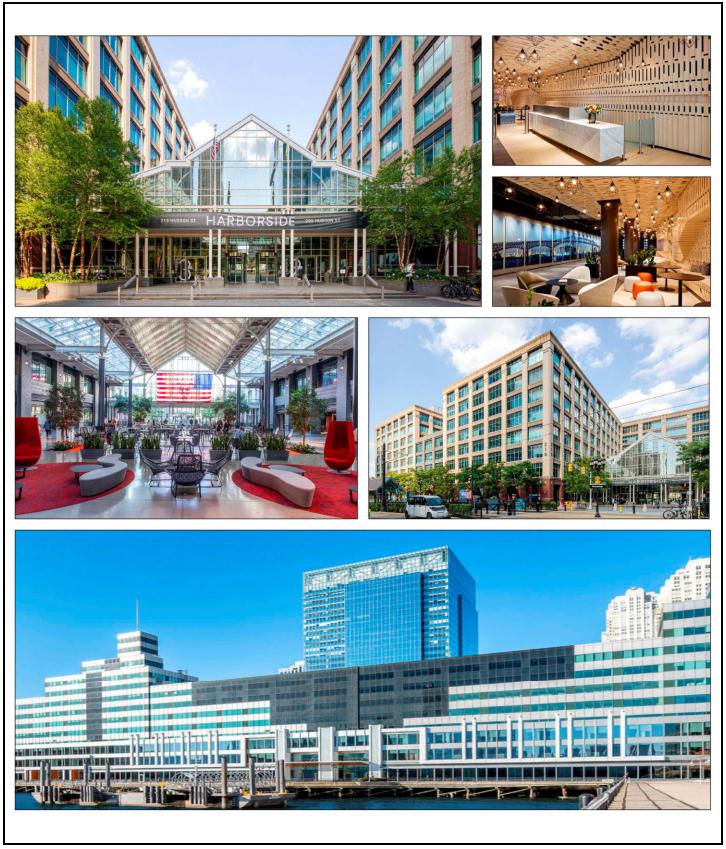

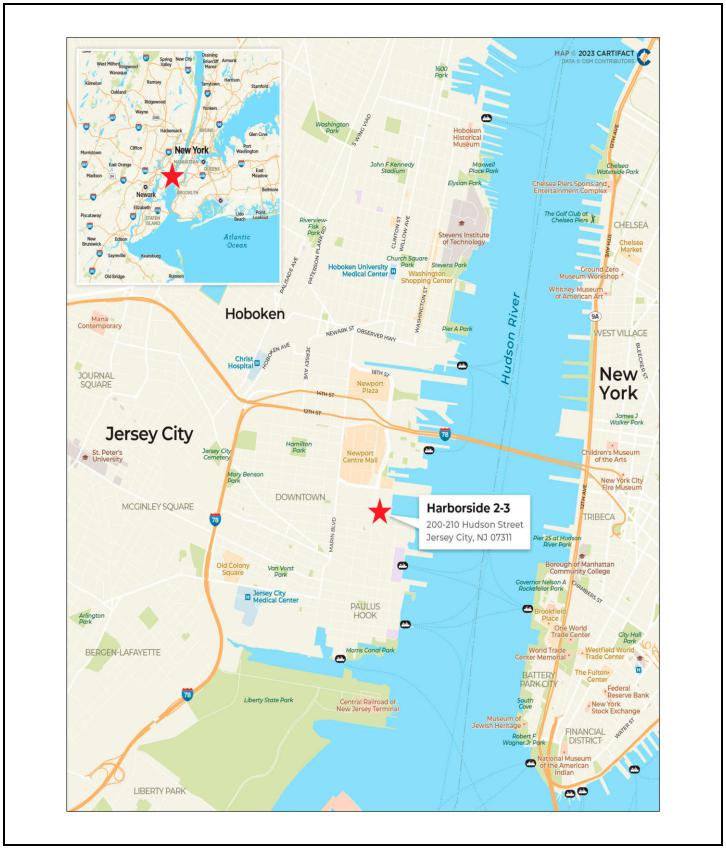

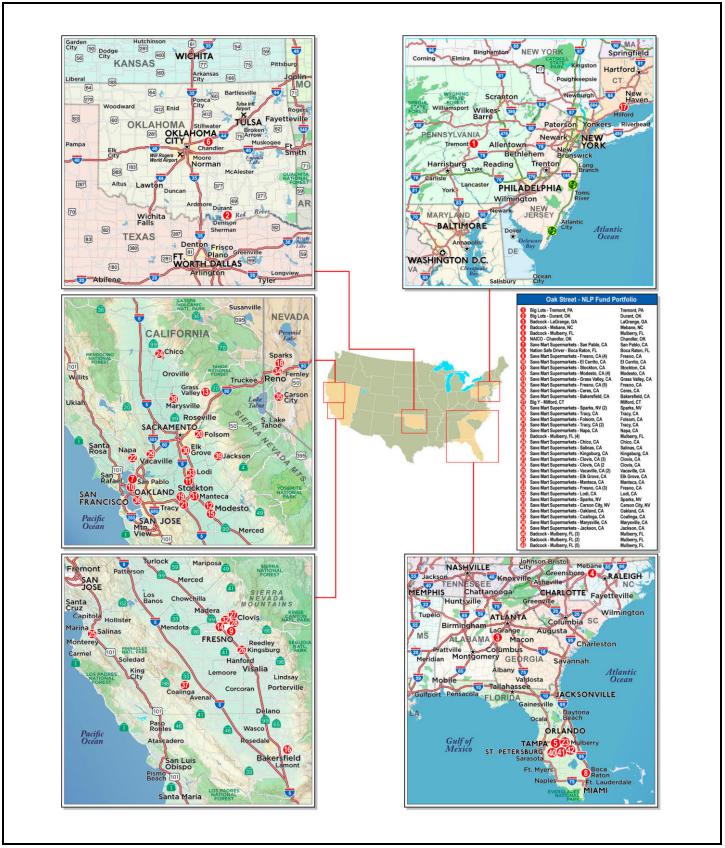

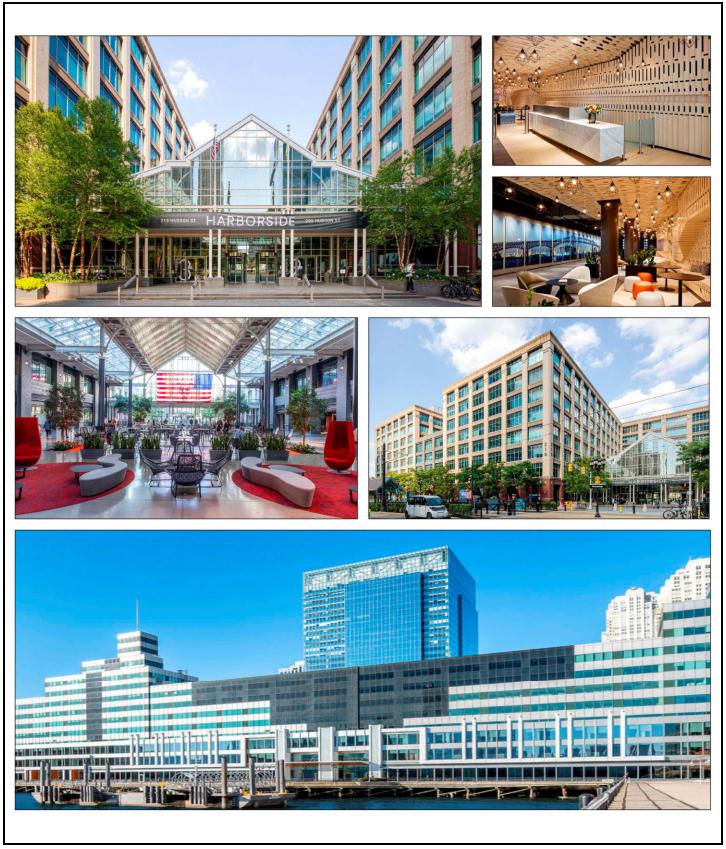

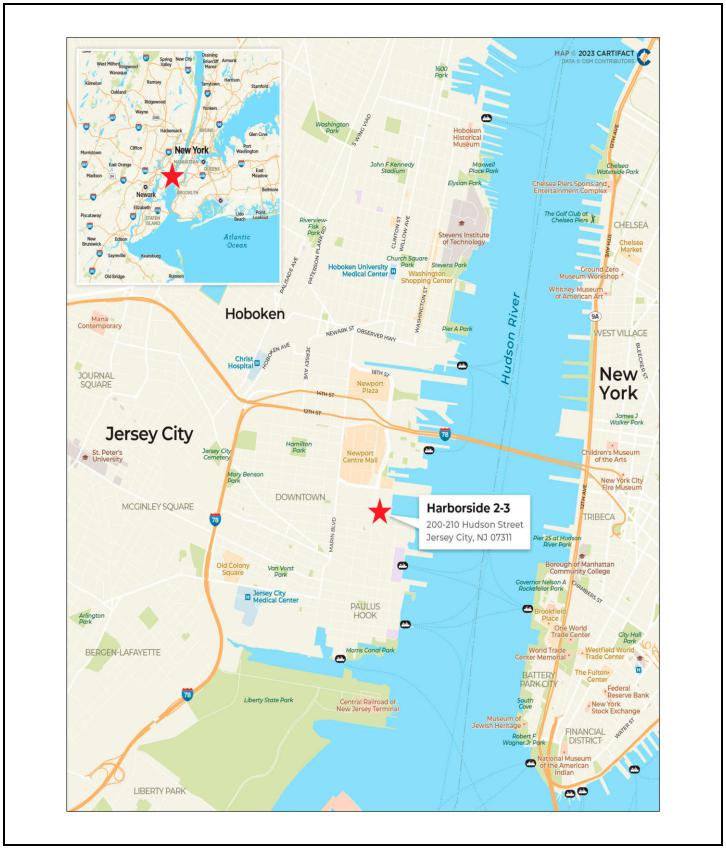

| 7 | Harborside 2-3 | Jersey City, NJ | CREFI, BMO | 1 | $30,000,000 | 4.5% | 1,599,029 | Office | 2.36x | 14.7% | 56.8% | 56.8% |

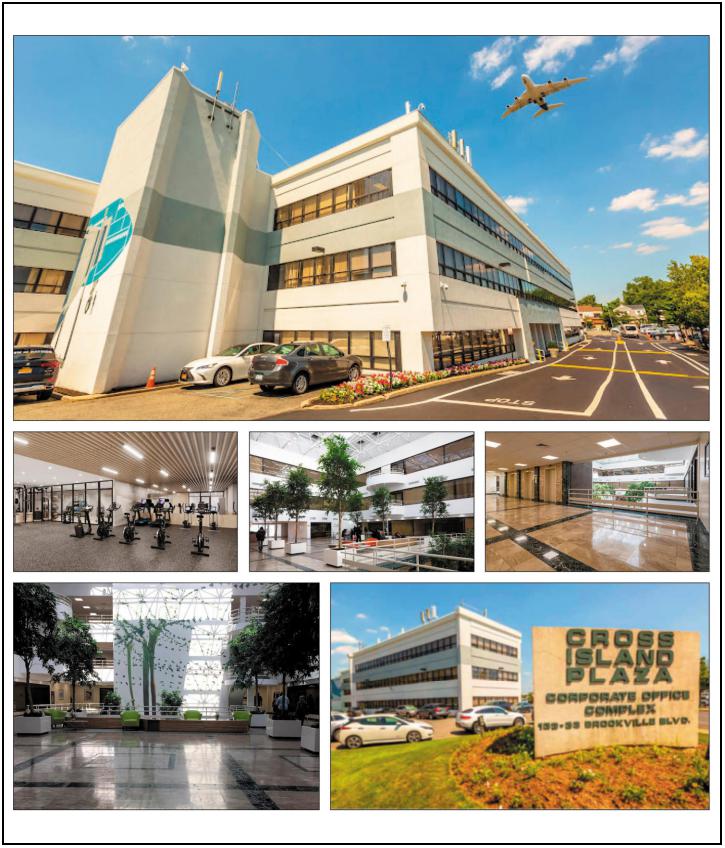

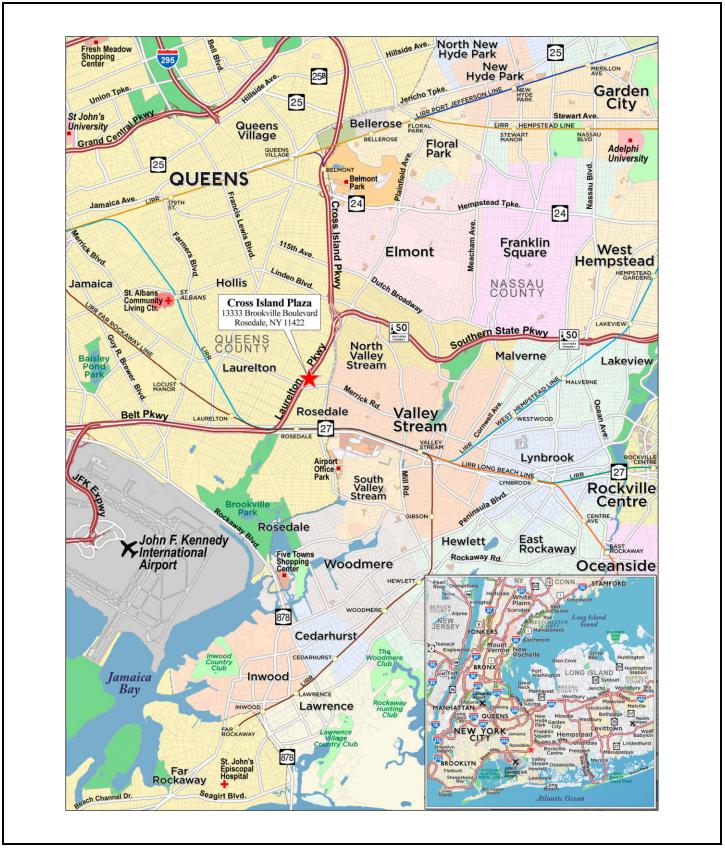

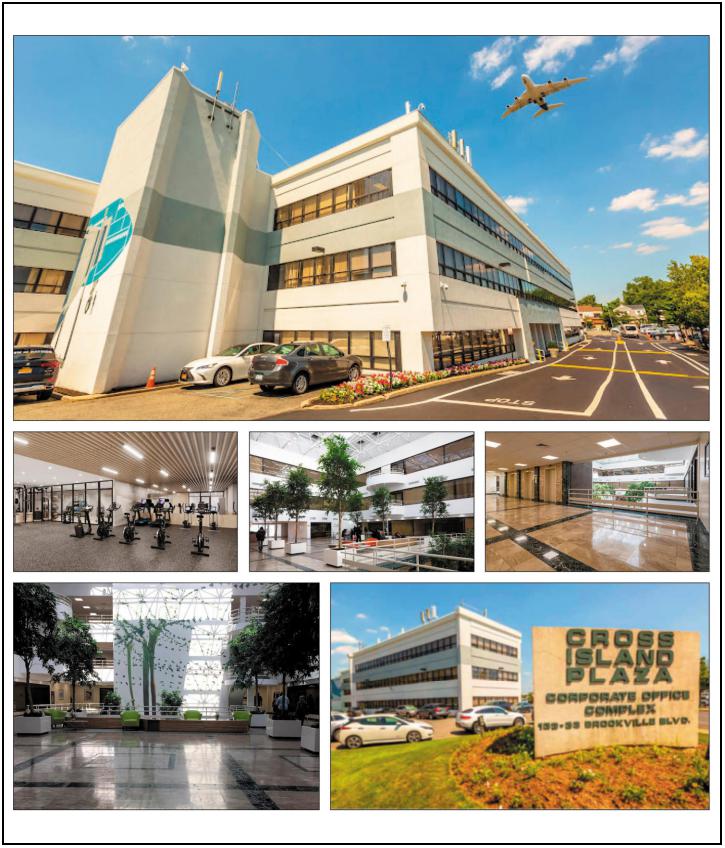

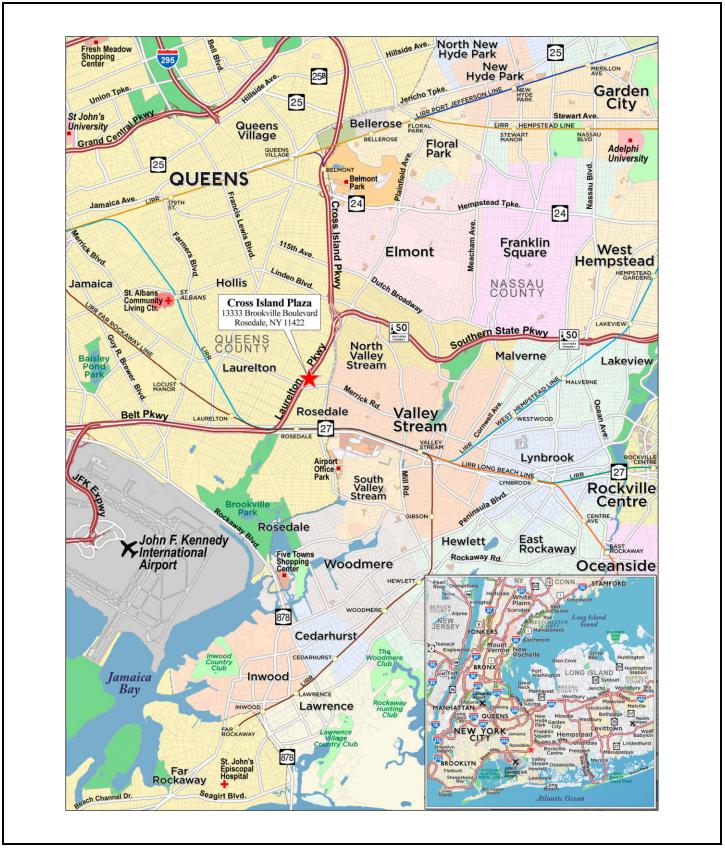

| 8 | Cross Island Plaza | Rosedale, NY | BMO | 1 | $30,000,000 | 4.5% | 256,930 | Office | 1.53x | 10.8% | 56.0% | 56.0% |

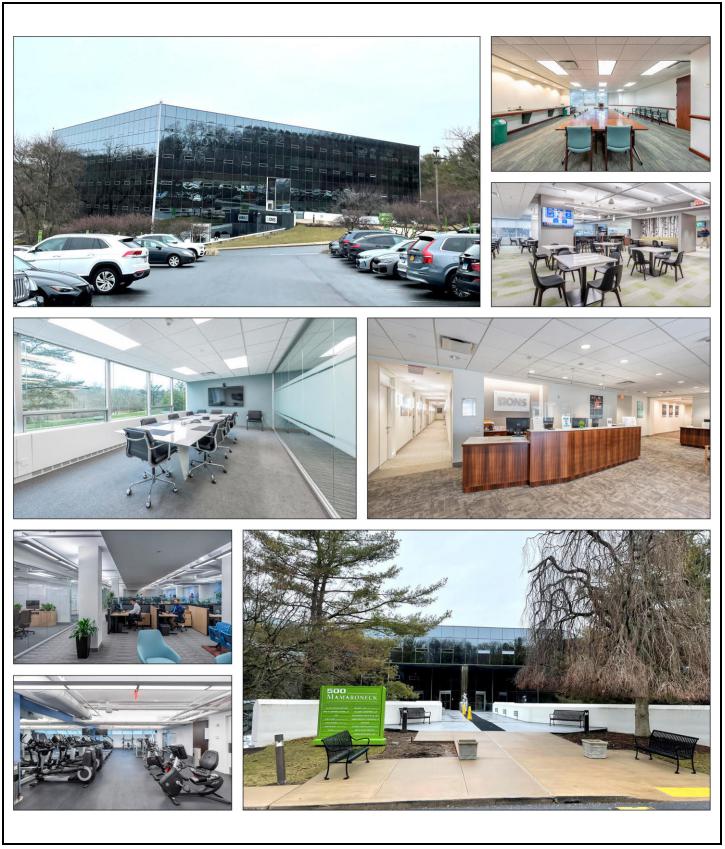

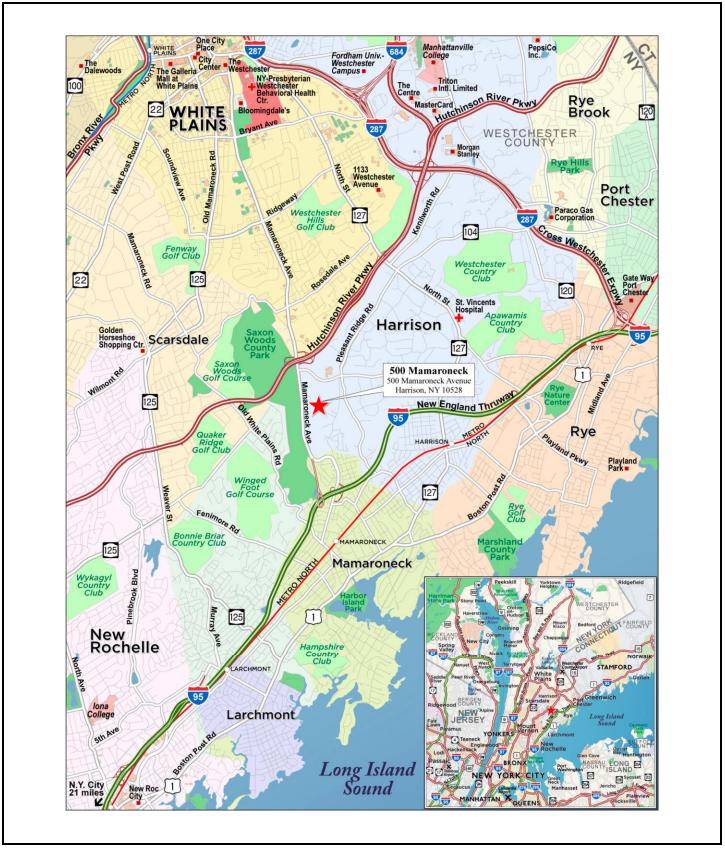

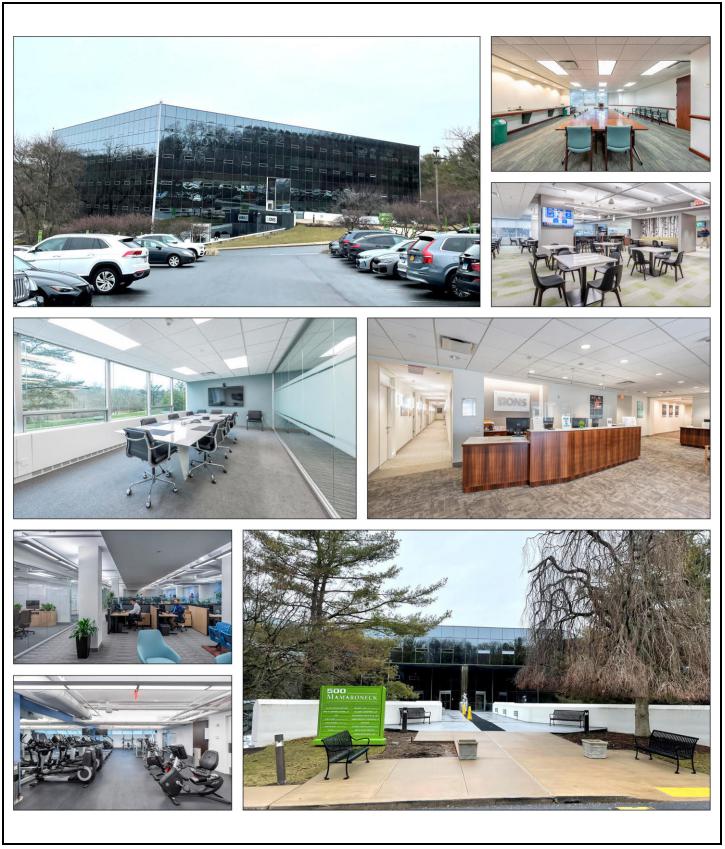

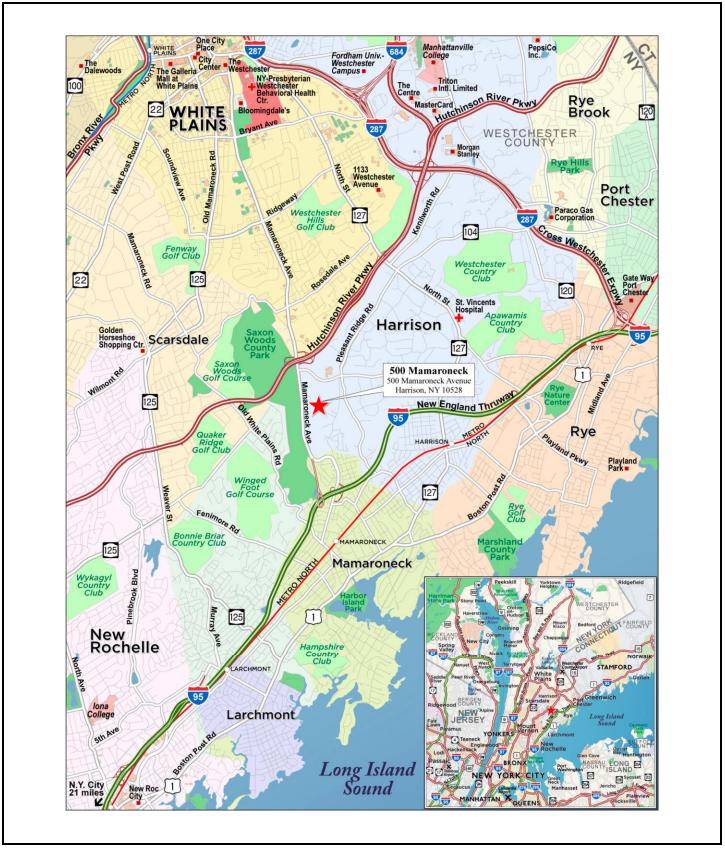

| 9 | 500 Mamaroneck | Harrison, NY | BMO | 1 | $29,500,000 | 4.5% | 1,502,820 | Other | 1.23x | 8.5% | 65.1% | 65.1% |

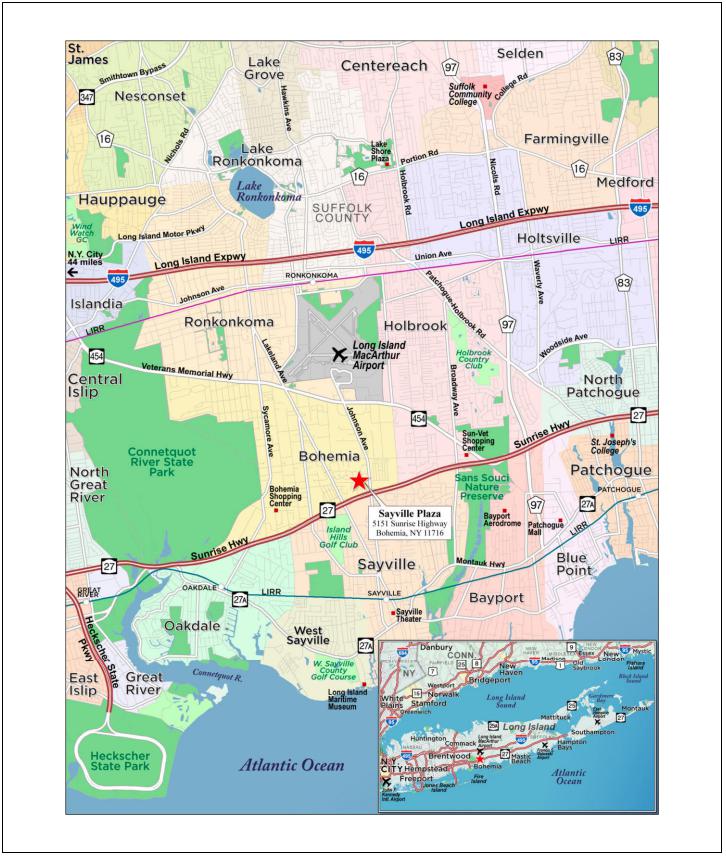

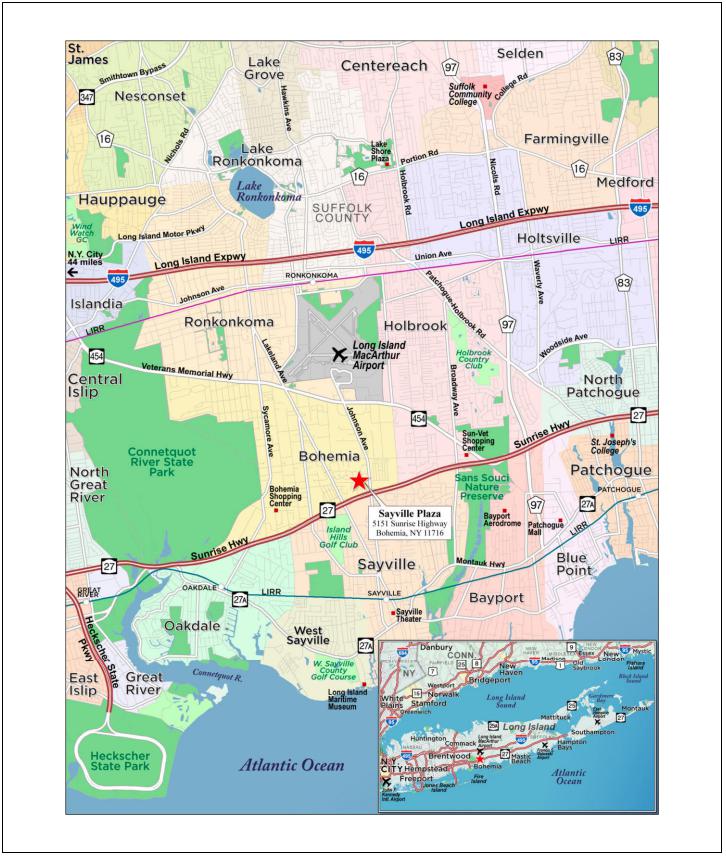

| 10 | Sayville Plaza(1) | Bohemia, NY | CREFI | 1 | $28,000,000 | 4.2% | 237,093 | Retail | 1.21x | 10.9% | 52.6% | 52.6% |

| | | | | | | | | | | | | |

| | Top 3 Total/Weighted Average | | 6 | $147,141,366 | 22.2% | | | 1.45x | 11.7% | 56.0% | 51.1% |

| | Top 5 Total/Weighted Average | | 10 | $223,641,366 | 33.7% | | | 1.64x | 12.5% | 55.6% | 52.4% |

| | Top 10 Total/Weighted Average | | 56 | $371,141,366 | 56.0% | | | 1.71x | 12.5% | 54.4% | 52.4% |

| | Non-Top 10 Total/Weighted Average | | 135 | $291,558,808 | 44.0% | | | 1.77x | 13.6% | 53.5% | 50.2% |

| (1) | The origination of the Sayville Plaza Mortgage Loan is expected to occur on May 15, 2023 and the materials provided herein regarding the Sayville Plaza are premised upon drafts of the Sayville Plaza Mortgage Loan documents, however, there can be no assurance that the Mortgage Loan will be originated as expected or at all.

|

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 5 | |

| Structural and Collateral Term Sheet | | BMO 2023-C5 |

| Collateral Characteristics |

| Pari Passu Companion Loan Summary |

No. | Loan Name | | Trust Cut-off Date Balance | Aggregate Pari Passu Loan Cut-off Date Balance | Controlling Pooling/Trust & Servicing Agreement | Master Servicer | Special Servicer | Related Pari Passu Loan(s) Securitizations | Related Pari Passu Loan(s) Original Balance |

| 1 | Brier Creek Commons | ZBNA | $64,958,243 | $19,987,152 | BMO 2023-C5 | Midland | Rialto | Future Securitization(s) | $20,000,000 |

| 3 | Hyatt Regency Indianapolis | CREFI | $39,943,123 | $18,573,552 | BMO 2023-C5 | Midland | Rialto | Future Securitization(s) | $18,600,000 |

| 5 | Great Lakes Crossing Outlets | BMO, GACC | $37,500,000 | $142,500,000 | BMO 2023-C4 | Midland | LNR | BMO 2023-C4 Future Securitization(s) | $25,750,000 $116,750,000 |

| 6 | Oak Street NLP Fund Portfolio | KeyBank | $30,000,000 | $310,000,000 | OAKST 2023-NLP | KeyBank | Situs | OAKST 2023-NLP BANK52023-5Y1 BBCMS 2023-C19 | $190,000,000 $97,500,000 $22,500,000 |

| 7 | Harborside 2-3 | CREFI, BMO | $30,000,000 | $195,000,000 | BMARK 2023-V2 | Midland | 3650 REIT | BMARK 2023-V2 Future Securitization(s) | $65,000,000 $130,000,000 |

| 8 | Cross Island Plaza | BMO | $30,000,000 | $12,500,000 | BMO 2023-C5 | Midland | Rialto | Future Securitization(s) | $12,500,000 |

| 11 | Jaylor - Burger King Portfolio | CREFI | $27,916,343 | $24,925,306 | BMO 2023-C5(1) | Midland(1) | Rialto(1) | Future Securitization(s) | $25,000,000 |

| 14 | Orizon Aerostructures | BMO | $22,595,000 | $38,500,000 | BMO 2023-C5 | Midland | Rialto | BMO 2023-C4 Future Securitization(s) | $27,000,000 $11,500,000 |

| 17 | Pacific Design Center | BMO | $15,000,000 | $230,000,000 | BMARK 2023-B38 | Midland | Argentic | BMARK 2023-B38 BMARK 2023-C19 Future Securitization(s) | $65,600,000 $65,000,000 $99,400,000 |

| 18 | La Habra Marketplace | 3650 REIT | $15,000,000 | $80,000,000 | BMO 2022-C3(2) | Midland(2) | Midland(2) | BMO 2022-C3 Future Securitization(s) | $20,000,000 $60,000,000 |

| 23 | 800 Cesar Chavez | 3650 REIT | $10,000,000 | $28,000,000 | 3650R 2022-PF2 | Midland | 3650 REIT | 3650R 2022-PF2 BMO 2023-C4 | $13,000,000 $15,000,000 |

| (1) | Until the securitization of the related controlling pari passu companion loan, the related whole loan will be serviced and administered pursuant to the pooling and servicing agreement for the BMO 2023-C5 securitization transaction by the parties thereto. Upon the securitization of the related controlling pari-passu companion loan, servicing of the related whole loan will shift to the servicers under the servicing agreement with respect to such future securitization transaction, which servicing agreement will become the controlling pooling and servicing agreement. |

| | (2) | Until the securitization of the related controlling pari passu companion loan, the related whole loan will be serviced and administered pursuant to the pooling and servicing agreement for the BMO 2022-C3 securitization transaction by the parties thereto. Upon the securitization of the related controlling pari-passu companion loan, servicing of the related whole loan will shift to the servicers under the servicing agreement with respect to such future securitization transaction, which servicing agreement will become the controlling pooling and servicing agreement. |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 6 | |

| Structural and Collateral Term Sheet | | BMO 2023-C5 |

| Collateral Characteristics |

| Mortgaged Properties by Type |

| | | | | | Weighted Average |

| Property Type | Property Subtype | Number of Properties | Cut-off Date Principal Balance | % of IPB | UW

NCF DSCR | UW

NOI DY | Cut-off Date LTV | Maturity Date/ARD LTV |

| Retail | Anchored | 3 | $107,958,243 | 16.3% | 1.39x | 10.3% | 59.8% | 54.9% |

| | Single Tenant | 130 | 42,182,931 | 6.4 | 2.10x | 19.2% | 31.2% | 20.4% |

| | Outlet Center | 1 | 37,500,000 | 5.7 | 2.50x | 17.5% | 45.0% | 45.0% |

| | Subtotal: | 134 | $187,641,174 | 28.3% | 1.77x | 13.7% | 50.4% | 45.2% |

| Industrial | Warehouse / Distribution | 10 | $55,762,286 | 8.4% | 2.11x | 14.6% | 47.5% | 47.5% |

| | Flex | 5 | 54,682,427 | 8.3 | 1.53x | 10.7% | 59.6% | 57.9% |

| | Manufacturing | 4 | 22,595,000 | 3.4 | 1.83x | 12.6% | 48.9% | 48.9% |

| | Warehouse | 2 | 21,220,000 | 3.2 | 1.93x | 11.5% | 60.2% | 60.2% |

| | R&D | 1 | 10,657,949 | 1.6 | 1.94x | 12.9% | 41.2% | 41.2% |

| | Subtotal: | 22 | $164,917,662 | 24.9% | 1.84x | 12.5% | 52.9% | 52.4% |

| Hospitality | Full Service | 2 | $66,193,123 | 10.0% | 1.69x | 15.8% | 49.6% | 44.0% |

| | Limited Service | 5 | 37,380,039 | 5.6 | 1.79x | 16.9% | 55.5% | 51.1% |

| | Subtotal: | 7 | $103,573,161 | 15.6% | 1.73x | 16.2% | 51.7% | 46.6% |

| Multifamily | Garden | 16 | $77,297,000 | 11.7% | 1.39x | 10.4% | 64.1% | 62.9% |

| Office | CBD | 2 | $60,000,000 | 9.1% | 1.95x | 12.8% | 56.4% | 56.4% |

| | Medical | 2 | 13,125,000 | 2.0 | 1.49x | 10.4% | 60.7% | 60.7% |

| | Suburban | 4 | 2,313,176 | 0.3 | 2.71x | 17.9% | 32.3% | 32.3% |

| | Subtotal: | 8 | $75,438,176 | 11.4% | 1.89x | 12.5% | 56.4% | 56.4% |

| Other | Leased Fee | 1 | $29,500,000 | 4.5% | 1.23x | 8.5% | 65.1% | 65.1% |

| Mixed Use | Office/Showroom/Lab | 1 | $15,000,000 | 2.3% | 2.17x | 13.8% | 47.8% | 47.8% |

| | Subtotal: | 1 | $15,000,000 | 2.3% | 2.17x | 13.8% | 47.8% | 47.8% |

| Self Storage | Self Storage | 2 | $9,333,000 | 1.4% | 1.51x | 10.3% | 43.6% | 43.6% |

| Total / Weighted Average: | 191 | $662,700,174 | 100.0% | 1.73x | 13.0% | 54.0% | 51.5% |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 7 | |

| Structural and Collateral Term Sheet | | BMO 2023-C5 |

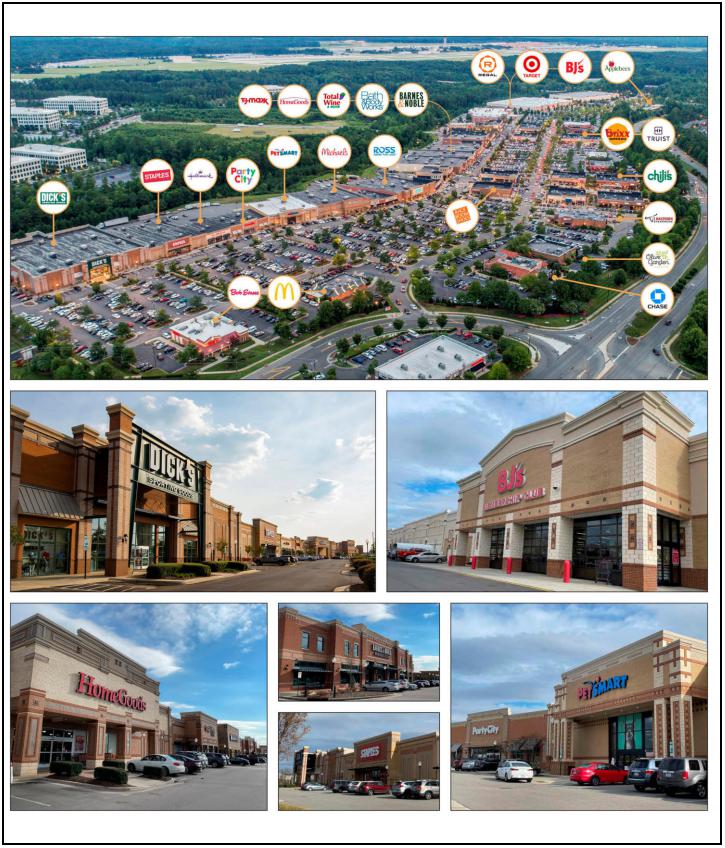

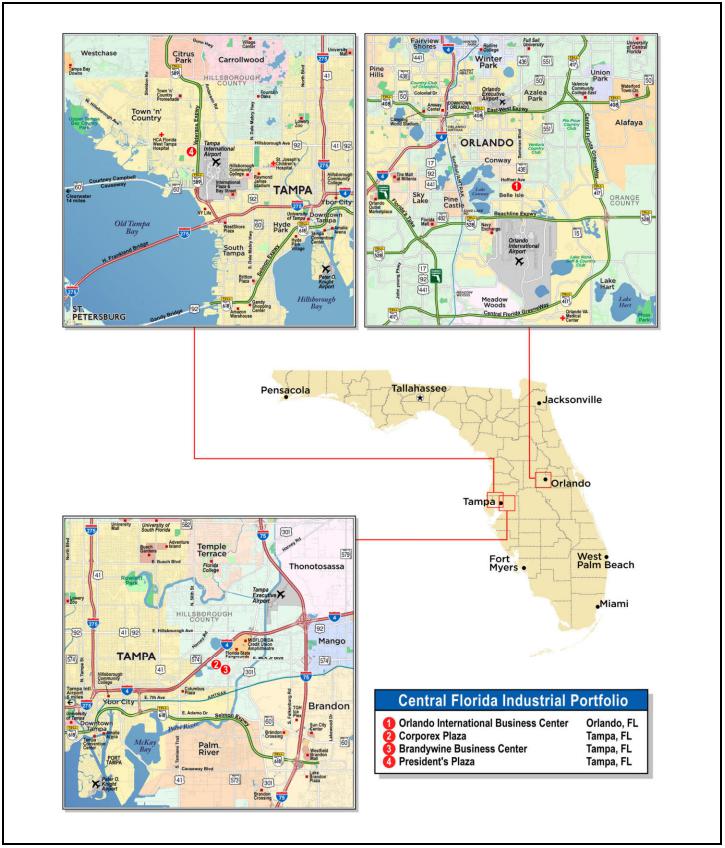

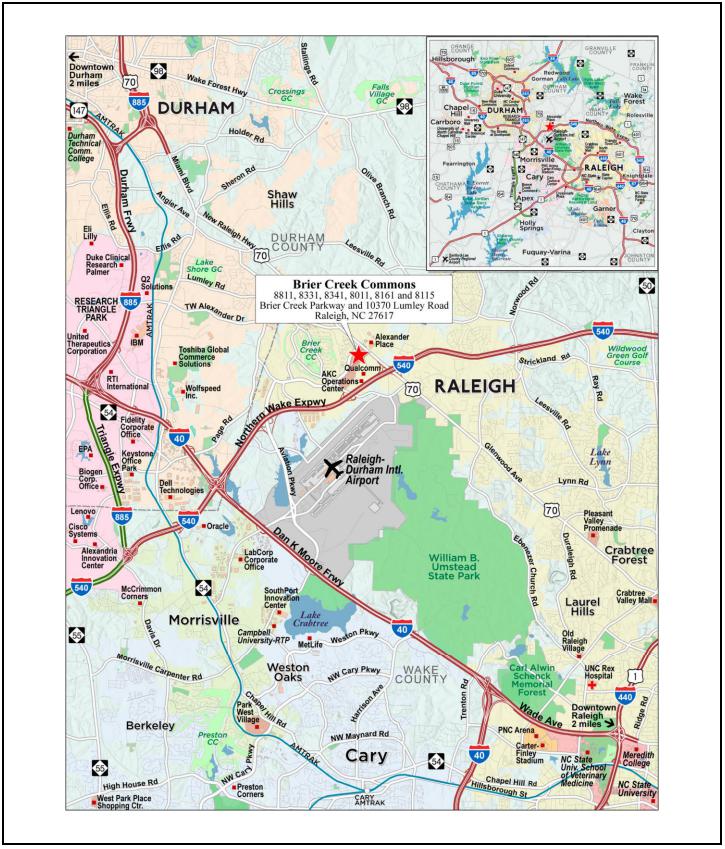

| No. 1 – Brier Creek Commons |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 8 | |

| Structural and Collateral Term Sheet | | BMO 2023-C5 |

| No. 1 – Brier Creek Commons |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 9 | |

| Structural and Collateral Term Sheet | | BMO 2023-C5 |

| No. 1 – Brier Creek Commons |

| Mortgage Loan Information | | Property Information |

| Mortgage Loan Seller: | ZBNA | | Single Asset / Portfolio: | Single Asset |

| Original Principal Balance(1): | $65,000,000 | | Title: | Fee |

| Cut-off Date Principal Balance(1): | $64,958,243 | | Property Type – Subtype: | Retail – Anchored |

| % of IPB: | 9.8% | | Net Rentable Area (SF): | 519,277 |

| Loan Purpose: | Refinance | | Location: | Raleigh, NC |

| Borrower: | BC Retail, LLC | | Year Built / Renovated: | 2001 / NAP |

| Borrower Sponsor: | Maria Beatrice Countess Arco | | Occupancy: | 98.5% |

| Interest Rate: | 6.91000% | | Occupancy Date: | 4/1/2023 |

| Note Date: | 4/20/2023 | | 4th Most Recent NOI (As of): | $8,215,540 (12/31/2020) |

| Maturity Date: | 5/6/2033 | | 3rd Most Recent NOI (As of): | $8,479,332 (12/31/2021) |

| Interest-only Period: | None | | 2nd Most Recent NOI (As of): | $8,569,797 (12/31/2022) |

| Original Term: | 120 months | | Most Recent NOI (As of): | $8,650,973 (TTM 2/28/2023) |

| Original Amortization Term: | 360 months | | UW Economic Occupancy: | 95.0% |

| Amortization Type: | Amortizing Balloon | | UW Revenues: | $12,422,790 |

| Call Protection(2): | L(25),D(91),O(4) | | UW Expenses: | $3,616,139 |

| Lockbox / Cash Management: | Springing / Springing | | UW NOI: | $8,806,651 |

| Additional Debt(1): | Yes | | UW NCF: | $8,430,175 |

| Additional Debt Balance(1): | $19,987,152 | | Appraised Value / Per SF: | $136,200,000 / $262 |

| Additional Debt Type(1): | Pari Passu | | Appraisal Date: | 3/22/2023 |

| | | | | |

| Escrows and Reserves(3) | | Financial Information(1) |

| | Initial | Monthly | Initial Cap | | Cut-off Date Loan / SF: | $164 |

| Taxes: | $752,049 | $83,561 | N/A | | Maturity Date Loan / SF: | $142 |

| Insurance: | $0 | Springing | N/A | | Cut-off Date LTV: | 62.4% |

| Replacement Reserves: | $0 | $6,491 | N/A | | Maturity Date LTV: | 54.3% |

| TI/LC: | $0 | $28,128 | $1,250,000 | | UW NCF DSCR: | 1.25x |

| Rent Concession Reserve: | $58,333 | $0 | N/A | | UW NOI Debt Yield: | 10.4% |

| | | | | | | |

| Sources and Uses |

| Sources | Proceeds | % of Total | | Uses | Proceeds | % of Total | |

| Whole Loan | $85,000,000 | 100.0% | | Loan Payoff | $70,400,945 | 82.8 | % |

| | | | | Partnership Equity Buyout(4) | 10,271,111 | 12.1 | |

| | | | | Return of Equity | 2,060,070 | 2.4 | |

| | | | | Closing Costs | 1,457,492 | 1.7 | |

| | | | | Upfront Reserves | 810,382 | 1.0 | |

| Total Sources | $85,000,000 | 100.0% | | Total Uses | $85,000,000 | 100.0 | % |

| (1) | The Brier Creek Commons Mortgage Loan (as defined below) is part of a whole loan evidenced by three pari passu notes with an aggregate original principal balance of $85,000,000. Financial Information in the chart above reflects the Brier Creek Commons Whole Loan (as defined below). For additional information, see “The Loan” below. |

| (2) | Defeasance is permitted any time after the earlier of (i) April 20, 2026 and (ii) two years from the closing date of the securitization that includes the last pari passu note of the Brier Creek Commons Whole Loan to be securitized. The assumed lockout period of 25 payments is based on the closing date of this transaction in June 2023. The actual lockout period may be longer. |

| (3) | For a full description of Escrows and Reserves, please refer to “Escrows and Reserves” below. |

| (4) | The borrower sponsor used $10,271,111 of the loan proceeds to buy out a corporate equity partner in the non-recourse carveout guarantor, AAC Consolidated Properties, LLC (the “Guarantor”, as further described in “The Borrower Sponsor”). |

The Loan. The largest mortgage loan (the “Brier Creek Commons Mortgage Loan”) is part of a fixed rate whole loan (the “Brier Creek Commons Whole Loan”) evidenced by three pari passu promissory notes in the aggregate original principal amount of $85,000,000, secured by the borrower’s fee interest in an anchored retail power center located in Raleigh, North Carolina (the “Brier Creek Commons Property”). The Brier Creek Commons Mortgage Loan is evidenced by the controlling Note A-1, which has an outstanding principal balance as of the Cut-off Date of $64,958,243. The Brier Creek Commons Mortgage Loan will be included in the BMO 2023-C5 securitization trust and represents approximately 9.8% of the Initial Pool Balance. The Brier Creek Commons Whole Loan was originated on April 20, 2023 by Zions Bancorporation, N.A. (“ZBNA”) and proceeds were used to refinance the existing debt held by MetLife Investment Management on the Brier

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 10 | |

| Structural and Collateral Term Sheet | | BMO 2023-C5 |

| No. 1 – Brier Creek Commons |

Creek Commons Property, fund upfront reserves, pay origination costs, buy out a corporate equity owner’s interests in the Guarantor and return cash equity to the borrower sponsor. The Brier Creek Commons Whole Loan accrues interest at a fixed rate of 6.91000% per annum. The table below summarizes the promissory notes that comprise the Brier Creek Commons Whole Loan. The relationship between the holders of the Brier Creek Commons Whole Loan is governed by a co-lender agreement as described under “Description of the Mortgage Pool—The Whole Loans—The Serviced Pari Passu Whole Loans” in the Preliminary Prospectus. The Brier Creek Commons Whole Loan will be serviced pursuant to the pooling and servicing agreement for the BMO 2023-C5 trust. See “The Pooling and Servicing Agreement” in the Preliminary Prospectus.

| Whole Loan Summary |

| Note | Original Balance | Cut-off Date Balance | | Note Holder | Controlling Piece |

| A-1 | $65,000,000 | $64,958,243 | | BMO 2023-C5 | Yes |

| A-2(1) | $10,000,000 | $9,993,576 | | ZBNA | No |

| A-3(1) | $10,000,000 | $9,993,576 | | ZBNA | No |

| Whole Loan | $85,000,000 | $84,945,395 | | | |

| (1) | Expected to be contributed to one or more future securitization(s). |

The Property.

The Brier Creek Commons Property is a 519,277 square foot, 20-building, Class A anchored retail power center located in Raleigh, North Carolina, approximately 5.8 miles east of the Research Triangle Park (“RTP”). Built in 2001 by the borrower sponsor, the property is situated on a 71.0-acre parcel and is anchored by BJ's Warehouse Club, Dick's Sporting Goods, Ross Dress for Less, TJ Maxx and HomeGoods. Additional notable junior anchor and in-line tenants include Michaels, Staples, PetSmart, Barnes & Noble, Party City, Rack Room Shoes, Total Wine, Talbots, Men’s Wearhouse, Vitamin Shoppe, Crumbl Cookies and Verizon Wireless, plus several dining options including McDonald’s, Chili’s, Olive Garden, Jason’s Deli, Brixx Wood Fired Pizza, Noodles & Co., Caribou Coffee and Bruegger’s Bagels. Four of the anchor tenants, collectively comprising 25.0% of net rentable area and 17.2% of underwritten base rent, are investment-grade rated by Moody’s and S&P (see the “Tenant Summary” table below). Fifteen tenants totaling 57.8% of NRA and 39.7% of underwritten base rent have been in occupancy for at least 20 years, including all five of the anchor tenants. The borrower sponsor completed approximately $3.4 million in capital expenditures from 2017-2022, including a roof replacement, asphalt pavement sealing and striping and exterior painting at the Brier Creek Commons Property.

As of April 1, 2023, the Brier Creek Commons Property was 98.5% occupied by 67 tenants and has averaged 99.1% occupancy from 2013-2022. No single tenant represents more than 11.2% of underwritten base rent and only BJ’s Wholesale Club represents more than 6.7% of underwritten base rent. The Brier Creek Commons Property contains 3,095 surface parking spaces, resulting in a parking ratio of approximately 6.0 spaces per 1,000 square feet of rentable area. There are four tenants totaling 4.9% of underwritten base rent that are ground lease tenants and own their improvements (Olive Garden, Truist Bank, McDonald’s and Chili’s). The Brier Creek Commons Property is shadow anchored by Target and Regal Cinemas; the spaces occupied by Target and Regal Cinemas are not part of the collateral securing the Brier Creek Commons Whole Loan.

The borrower sponsor developed the larger 1,450-acre Brier Creek master planned community, which includes the non-collateral 82,708 square foot Brierdale Commons retail center, the Brier Creek Corporate Center I, II, IV and V totaling 436,022 square feet, a 265-unit multifamily community under construction and future phases planned to include a Westin hotel property, multifamily and additional office buildings totaling approximately 1.5 million square feet.

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 11 | |

| Structural and Collateral Term Sheet | | BMO 2023-C5 |

| No. 1 – Brier Creek Commons |

Anchor Tenants. The three largest tenants based on underwritten base rent are BJ’s Wholesale Club, Dick’s Sporting Goods and Ross Dress for Less, each of which is an anchor tenant.

BJ’s Wholesale Club (108,532 square feet; 20.9% of NRA, 11.2% of underwritten base rent, Moody’s/S&P/Fitch: Ba1/BB+/NR): Founded in 1984 and headquartered in Marlborough, Massachusetts, BJ’s Wholesale Club (“BJ’s”) is a warehouse club operator and retailer with 237 clubs and 165 gas stations, located primarily in the eastern United States. BJ’s is a membership only retailer and has over 6.5 million members as of April 2023. BJ’s annual total revenue was approximately $19.3 billion in its fiscal year ending January 28, 2023. BJ’s has been a tenant at the Brier Creek Commons Property since June 2001, with its current lease expiration date in September 2026 and three remaining 5-year extension options.

Dick’s Sporting Goods (45,000 square feet; 8.7% of NRA, 6.7% of underwritten base rent, Moody’s/S&P/Fitch: Baa3/BBB/NR): Founded by Richard T. Stack in 1948 and headquartered in Pittsburgh, Pennsylvania, Dick’s Sporting Goods (“Dick’s”) is a sporting goods retail chain with 850 stores including Dick’s, Golf Galaxy, Field & Stream, Public Lands, Going Going Gone! and Warehouse Sale stores. Dick’s has been a tenant at the Brier Creek Commons Property since March 2002, with its current lease expiration date in January 2028. Dick’s has one 5-year extension option remaining.

Ross Dress for Less (30,064 square feet; 5.8% of NRA, 4.3% of underwritten base rent, Moody’s/S&P/Fitch: A2/BBB+/NR): Founded in 1982 and headquartered in Dublin, California, Ross Dress for Less (“Ross”) is one of the largest off-price apparel and home fashion chains in the United States, with 1,693 locations in 40 states and an additional 322 dd’s Discounts stores, each as of January 28, 2023. Ross has been a tenant at the Brier Creek Commons Property since January 2003, with its current lease expiration date in January 2028. Ross has one 5-year extension option remaining.

Environmental. The Phase I environmental assessment at the Brier Creek Commons Property dated March 24, 2023 did not identify any recognized environmental conditions. See “Description of the Mortgage Pool—Environmental Considerations” in the Preliminary Prospectus for additional information.

The following table presents certain information relating to the historical occupancy of the Brier Creek Commons Property:

| Historical and Current Occupancy |

| 2018(1) | 2019(1) | 2020(1) | 2021(1) | 2022(1) | Current(2) |

| 99.4% | 99.3% | 95.4% | 99.8% | 98.3% | 98.5% |

| (1) | Historical Occupancies are as of December 31 of each respective year. |

| (2) | Based on the underwritten rent roll dated April 1, 2023. |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 12 | |

| Structural and Collateral Term Sheet | | BMO 2023-C5 |

| No. 1 – Brier Creek Commons |

The following table presents certain information relating to the largest tenants based on net rentable area of the Brier Creek Commons Property:

| Tenant Summary(1) |

| Tenant | Ratings

Moody’s/S&P/Fitch(2) | Net Rentable Area (SF) | % of

Total NRA | UW Base Rent PSF(3) | UW Base Rent(3) | % of Total

UW Base Rent(3) | Sales PSF/Year(4) | UW Occ. Costs(5) | Lease

Exp. Date |

| BJ’s Wholesale Club | Ba1/BB+/NR | 108,532 | 20.9 | % | $10.03 | $1,088,576 | 11.2% | NAV | NAV | 9/16/2026 |

| Dick’s Sporting Goods | Baa3/BBB/NR | 45,000 | 8.7 | | $14.50 | 652,500 | 6.7 | NAV | NAV | 1/31/2028 |

| Ross Dress for Less | A2/BBB+/NR | 30,064 | 5.8 | | $14.00 | 420,896 | 4.3 | NAV | NAV | 1/31/2028 |

| TJ Maxx | A2/A/NR | 30,000 | 5.8 | | $10.78 | 323,333 | 3.3 | $435 | 3.6% | 4/30/2032 |

| HomeGoods | A2/A/NR | 25,000 | 4.8 | | $10.78 | 269,444 | 2.8 | $447 | 3.5% | 4/30/2032 |

| Michaels | B3/B-/NR | 23,928 | 4.6 | | $12.00 | 287,136 | 3.0 | $176 | 9.7% | 10/31/2032 |

| Staples | B3/B/NR | 23,000 | 4.4 | | $11.97 | 275,238 | 2.8 | NAV | NAV | 4/30/2024 |

| Barnes & Noble | NR/NR/NR | 22,975 | 4.4 | | $12.50 | 287,187 | 3.0 | NAV | NAV | 3/31/2025 |

| PetSmart | B1/B+/NR | 18,968 | 3.7 | | $15.00 | 284,520 | 2.9 | NAV | NAV | 1/31/2028 |

| Party City(6) | NR/NR/NR | 12,000 | 2.3 | | $16.50 | 198,000 | 2.0 | NAV | NAV | 7/31/2033 |

| Top 10 Tenants | | 339,467 | 65.4 | % | $12.04 | $4,086,831 | 42.1% | | | |

| Other Tenants(7) | | 172,085 | 33.1 | % | $30.07(7) | $5,617,412 | 57.9% | | | |

| Occupied Collateral Total / Wtd. Avg. | | 511,552 | 98.5 | % | $18.08(7) | $9,704,243 | 100.0% | | | |

| | | | | | | | | | |

| Vacant Space | | 7,725 | 1.5 | % | | | | | | |

| | | | | | | | | | |

| Collateral Total | | 519,277 | 100.0 | % | | | | | | |

| | | | | | | | | | |

| (1) | Based on the underwritten rent roll dated April 1, 2023. |

| (2) | In certain instances, ratings provided are those of the parent company of the entity shown, whether or not the parent company guarantees the lease. |

| (3) | UW Base Rent, % of Total UW Base Rent and UW Base Rent PSF include contractual rent steps through April 2024 for 18 tenants totaling $49,722 and straight-line rent averaging for the investment-grade tenants TJ Maxx and HomeGoods totaling $15,278. |

| (4) | Sales PSF/Year are as of the trailing 12-month period ending January 31, 2022 for TJ Maxx and HomeGoods and as of the trailing 12-month period ending December 31, 2022 for Michaels, as provided by the tenants to the Brier Creek Commons Borrower. |

| (5) | UW Occ. Costs are based on underwritten base rent and reimbursements and most recently reported sales. |

| (6) | Party City Holdco Inc., the parent company of Party City, filed for Chapter 11 bankruptcy protection on January 17, 2023. Party City has not announced a store closure at the Brier Creek Commons Property and is current on its rent payments. |

| (7) | Four tenants totaling 4.9% of underwritten base rent (Olive Garden, Truist Bank, McDonald’s and Chili’s) are ground lease tenants and own their improvements with no associated NRA. An additional 1,073 square feet (0.2% of the NRA) is attributed to a storage space with no corresponding lease or applicable base rent. The weighted average UW Base Rent PSF calculations exclude the underwritten base rent, if any, associated with these ground lease tenants and the storage space. |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 13 | |

| Structural and Collateral Term Sheet | | BMO 2023-C5 |

| No. 1 – Brier Creek Commons |

The following table presents certain information relating to the tenant lease expirations at the Brier Creek Commons Property:

| Lease Rollover Schedule(1)(2) |

| Year | Number of Leases Expiring(3) | Net Rentable Area Expiring(3) | % of NRA Expiring(3) | UW Base Rent Expiring(4) | % of UW Base Rent Expiring(4) | Cumulative Net Rentable Area Expiring(3) | Cumulative % of NRA Expiring(3) | Cumulative UW Base Rent Expiring(4) | Cumulative % of UW Base Rent Expiring(4) |

| Vacant | NAP | 7,725 | 1.5 | % | NAP | NA | P | 7,725 | 1.5% | NAP | NAP | |

| 2023 & MTM | 1 | 4,856 | 0.9 | | $145,680 | 1.5 | % | 12,581 | 2.4% | $145,680 | 1.5% | |

| 2024 | 6 | 44,434 | 8.6 | | 820,045 | 8.5 | | 57,015 | 11.0% | $965,725 | 10.0% | |

| 2025 | 8 | 41,584 | 8.0 | | 1,014,525 | 10.5 | | 98,599 | 19.0% | $1,980,250 | 20.4% | |

| 2026 | 6 | 120,324 | 23.2 | | 1,420,968 | 14.6 | | 218,923 | 42.2% | $3,401,217 | 35.0% | |

| 2027 | 14 | 33,507 | 6.5 | | 1,175,817 | 12.1 | | 252,430 | 48.6% | $4,577,034 | 47.2% | |

| 2028 | 16 | 130,274 | 25.1 | | 2,580,880 | 26.6 | | 382,704 | 73.7% | $7,157,915 | 73.8% | |

| 2029 | 3 | 21,809 | 4.2 | | 478,052 | 4.9 | | 404,513 | 77.9% | $7,635,967 | 78.7% | |

| 2030 | 2 | 2,492 | 0.5 | | 269,891 | 2.8 | | 407,005 | 78.4% | $7,905,858 | 81.5% | |

| 2031 | 1 | 2,596 | 0.5 | | 110,382 | 1.1 | | 409,601 | 78.9% | $8,016,240 | 82.6% | |

| 2032 | 6 | 85,728 | 16.5 | | 1,130,079 | 11.6 | | 495,329 | 95.4% | $9,146,318 | 94.3% | |

| 2033 | 3 | 22,875 | 4.4 | | 557,925 | 5.7 | | 518,204 | 99.8% | $9,704,243 | 100.0% | |

| 2034 & Beyond(5) | 1 | 1,073 | 0.2 | | 0 | 0.0 | | 519,277 | 100.0% | $9,704,243 | 100.0% | |

| Total | 67 | 519,277 | 100.0 | % | $9,704,243 | 100.0 | % | | | | |

| (1) | Based on the underwritten rent roll dated April 1, 2023. |

| (2) | Certain tenants may have lease termination options that are exercisable prior to the originally stated expiration date of the subject lease and that are not considered in the lease rollover schedule. |

| (3) | Four tenants totaling 4.9% of underwritten base rent (Olive Garden, Truist Bank, McDonald’s and Chili’s) are ground lease tenants and own their improvements with no associated NRA. |

| (4) | UW Base Rent Expiring, % of UW Base Rent Expiring, Cumulative UW Base Rent Expiring and Cumulative % of UW Base Rent Expiring include contractual rent steps through April 2024 and straight-line rent averaging for the investment-grade tenants TJ Maxx and HomeGoods. |

| (5) | Represents shopping center storage space with no corresponding lease or applicable base rent. |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 14 | |

| Structural and Collateral Term Sheet | | BMO 2023-C5 |

| No. 1 – Brier Creek Commons |

The following table presents certain information relating to the operating history and underwritten cash flows of the Brier Creek Commons Property:

| Operating History and Underwritten Net Cash Flow |

| | 2020 | 2021 | 2022 | 2/28/2023 TTM(1) | Underwritten(1) | Per Square Foot | %(2) |

| Base Rent | $8,739,023 | $9,190,973 | $9,202,936 | $9,235,283 | $9,704,243 | $18.69 | 74.2 | % |

| Grossed Up Vacant Space | 0 | 0 | 0 | 0 | 278,100 | 0.54 | 2.1 | |

| Gross Potential Rent | $8,739,023 | $9,190,973 | $9,202,936 | $9,235,283 | $9,982,343 | $19.22 | 76.3 | % |

| Other Income(3) | 26,787 | 1,964 | 2,798 | 2,677 | 2,677 | 0.01 | 0.0 | |

| Percentage Rent(4) | 2,615 | 1,790 | 55,389 | 67,052 | 39,917 | 0.08 | 0.3 | |

| Total Reimbursements | 2,651,132 | 2,520,286 | 2,884,346 | 2,808,635 | 3,051,543 | 5.88 | 23.3 | |

| Net Rental Income | $11,419,557 | $11,715,014 | $12,145,468 | $12,113,647 | $13,076,480 | $25.18 | 100.0 | % |

| (Vacancy & Credit Loss)(5) | 0 | 0 | 0 | 0 | (653,690)(5) | (1.26) | (5.0 | ) |

| Effective Gross Income | $11,419,557 | $11,715,014 | $12,145,468 | $12,113,647 | $12,422,790 | $23.92 | 95.0 | % |

| Total Expenses(6) | 3,204,017 | 3,235,682 | 3,575,672 | 3,462,674 | 3,616,139 | 6.96 | 29.1 | |

| Net Operating Income | $8,215,540 | $8,479,332 | $8,569,797 | $8,650,973 | $8,806,651 | $16.96 | 70.9 | % |

| Capital Expenditures | 0 | 0 | 0 | 0 | 77,892 | 0.15 | 0.6 | |

| TI / LC | 0 | 0 | 0 | 0 | 298,584 | 0.58 | 2.4 | |

| Net Cash Flow | $8,215,540 | $8,479,332 | $8,569,797 | $8,650,973 | $8,430,175 | $16.23 | 67.9 | % |

| (1) | TTM reflects the trailing 12-month period ending February 28, 2023. Underwritten rents are higher than TTM Rents due to the inclusion of rent steps underwritten per the tenants' contractual lease terms through April 2024 for 18 tenants totaling $49,722 and straight-line rent averaging for the investment-grade tenants TJ Maxx and HomeGoods totaling $15,278. |

| (2) | % column represents percent of Net Rental Income for all revenue lines and represents percent of Effective Gross Income for the remainder of fields. |

| (3) | Other Income reflects the Brier Creek Commons Borrower’s miscellaneous income. |

| (4) | Includes percentage rent for tenants Crumbl Cookies and Bath and Body Works based on trailing 12-month sales and current sales breakpoints in each respective lease. |

| (5) | The underwritten economic occupancy is 95.0%. The Brier Creek Commons Property was 98.5% physically occupied based on the April 1, 2023 rent roll. |

| (6) | The management fee is underwritten to reflect 3.0% of Effective Gross Income. The fee per the in-place management agreement is 4.0% and is paid to a borrower sponsor affiliate. All management fees above 3.0% have been subordinated to the Brier Creek Commons Whole Loan. |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 15 | |

| Structural and Collateral Term Sheet | | BMO 2023-C5 |

| No. 1 – Brier Creek Commons |

The Market. The Brier Creek Commons Property is located along Interstate 540 between Raleigh and Durham, North Carolina, approximately 13.8 miles northwest of the Raleigh central business district (“CBD”) and 10.6 miles southeast of the Durham CBD. Per the appraisal, combined traffic counts total over 81,000 vehicles per day at the Brier Creek Commons Property. Primary access to the area is provided by Interstates 40 and 540 and Highway 70 (Glenwood Avenue), with approximate driving times to the Raleigh CBD, Durham CBD, RTP and Raleigh-Durham International Airport of 24, 18, 10 and 8 minutes, respectively.

According to the appraisal, the RTP is situated at the Brier Creek Commons Property neighborhood’s western boundary. The RTP is the largest research park in the United States encompassing 7,000 acres, home to over 200 companies and over 50,000 employees. In the Raleigh, NC Metropolitan Statistical Area, approximately 49.4% of individuals over the age of 24 have a college degree, with 31.0% holding a bachelor's degree and 18.4% holding a graduate degree, per the appraisal. Duke University, North Carolina State University and the University of North Carolina at Chapel Hill are each situated approximately 12.4 to 17.4 miles from the Brier Creek Commons Property. This employment base has and continues to generate residential development in the surrounding areas. The immediate area surrounding the Brier Creek Commons Property is a relatively newer area of development, per the appraisal, consisting primarily of residential uses with much of the development being built during the 1990s, 2000s, and 2010s. According to the appraisal, Raleigh and the Research Triangle region continue to be among the fastest-growing metros in the nation. Among markets with populations over 1 million, only Austin grew at a faster rate.

According to the appraisal, within a three- and five-mile radius of the Brier Creek Commons Property, the 2022 average household income was approximately $131,110 and $133,029, respectively; and within the same radii, the 2022 estimated population was 42,109 and 96,661, respectively. The appraisal noted the Raleigh, NC Metropolitan Statistical Area’s 2022 average household income as being $117,896 and the United States Census Bureau noted the 2017-2021 State of North Carolina’s median household income as being $60,516. Since 2010, the population within a three-mile radius has increased by approximately 53.6% and the number of households has increased by approximately 61.7%, with annual growth rates of 3.6% and 4.1%, respectively. According to the appraisal, the top three industries within the area are Prof/Scientific/Tech Services, Health Care/Social Assistance and Retail Trade, which represent a combined total of 37% of the workforce.

According to a third-party market research report, the Brier Creek Commons Property is situated within the RTP/RDU retail submarket of the Raleigh - NC retail market. As of April 10, 2023, the submarket reported total inventory of approximately 2.9 million square feet with a 1.4% vacancy rate and average asking rents of $31.92 per square foot.

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 16 | |

| Structural and Collateral Term Sheet | | BMO 2023-C5 |

| No. 1 – Brier Creek Commons |

The following table presents certain information relating to the seven competitive retail properties to the Brier Creek Commons Property, ranging in size from 103,240 square feet to 388,318 square feet, that reported occupancy rates ranging from 91% to 100% and quoted rents ranging from $14.00 to $40.00 per square foot.

| Competitive Retail Properties(1) |

| Property Name/Location | Year Built/Renovated | Size (SF) | Occupancy | Anchor Tenants | Quoted Rate PSF (NNN) | Distance to Subject (mi.) |

Brier Creek Commons(2) 8811, 8331, 8341, 8011, 8161 and 8115 Brier Creek Parkway and 10370 Lumley Road Raleigh, NC (Subject) | 2001/NAP | 519,277 | 98.5% | BJ’s Warehouse Club, Dick's Sporting Goods, Ross Dress for Less, TJ Maxx, HomeGoods | $10.03 - $42.52 | -- |

Plantation Point 6305 Capital Boulevard Raleigh, NC | 2006/NAV | 388,318 | 93.0% | BJ's, Burlington, Tuesday Morning, Big Lots, Lifetime Fitness | $14.00 - $25.00 | 11.0 |

Stone Creek Village 98 Cornerstone Dr Cary, NC | 2006/NAV | 137,201 | 100.0% | Harris Teeter | $26.00 - $32.00 | 8.8 |

Southpoint Crossing 202 NC Highway 54 Durham, NC | 1999/NAV | 103,240 | 98.0% | Harris Teeter | $19.00 - $25.00 | 8.6 |

Freedom Town Center 612 Congenial Court Fayetteville, NC | 2017/NAV | 350,895 | 100.0% | Dick's Sporting Goods/Field & Stream, Hobby Lobby, Sprouts Farmers Market, HomeGoods, Burke's Outlet, Cost Plus World Market, Buy Buy Baby, DSW, Petco, Five Below | $32.00 - $40.00 | 60.0 |

Holly Springs Towne Center NC 55 and New Hill Road Holly Springs, NC | 2013/2015 | 354,847 | 95.0% | Marshall's, Michaels, Dick's Sporting Goods, Petco, Bed, Bath & Beyond, DSW, Target, AMC Dine-in Theater | $36.00 - $38.00 | 17.0 |

Park West Village – Phase II 2100 Village Market Place Morrisville, NC | 2011/2013 | 190,454 | 91.0% | Stone Theaters, HomeGoods, Michael's | $33.00 - $37.00 | 7.0 |

Wendover Village 4217 Wendover Avenue Greensboro, NC | 2004/NAV | 306,653 | 99.0% | Costco, Five Below, TJ Maxx, Bed Bath and Beyond, Golfsmith, Petco | $25.00 - $38.00 | 63.0 |

| (2) | Based on the underwritten rent roll dated April 1, 2023. |

The following table presents certain information relating to the appraisal’s market rent conclusion for the Brier Creek Commons Property:

| Market Rent Summary(1) |

| | Anchor Space | Jr. Anchor Space | Small Shop Space | Large Shop Space | Restaurant Space | Outparcel (Ground Lease) Space |

| Market Rent (PSF) | $14.00 | $18.00 | $35.00 | $28.00 | $36.00 | $3.07(2) |

| Lease Term (Years) | 10 | 10 | 5 | 5 | 10 | 10 |

| Lease Type (Reimbursements) | NNN | NNN | NNN | NNN | NNN | NNN |

| Tenant Improvements | None | None | None | None | None | None |

| Concessions | 0 months | 0 months | 0 months | 0 months | 0 months | 0 months |

| (2) | The Market Rent (PSF) of the Outparcel (Ground Lease) Space is based on the gross leasable area and not the square footage of the non-collateral leasehold improvements. |

The table below presents certain information relating to comparable sales pertaining to the Brier Creek Commons Property identified by the appraiser:

| Comparable Sales(1) |

| |

| Property Name | Location | Rentable Area (SF) | Sale Date | Sale Price (PSF) |

| Shoppes at Park Place | Pinellas Park, FL | 361,250 | Oct-2022 | $235 |

| The Shoppes at Webb Gin | Snellville, GA | 329,665 | Jun-2022 | $294 |

| Forum on Peachtree Parkway | Peachtree Corners, GA | 503,567 | Mar-2022 | $266 |

| Fontainebleau Park Plaza | Unincorporated Miami-Dade County, FL | 233,350 | Feb-2022 | $300 |

| Freedom Town Center | Fayetteville, NC | 350,834 | Feb-2022 | $219 |

| Promenade at Carolina Reserve | Indian Land, SC | 278,278 | Feb-2022 | $241 |

| The Village at Waterside | Chattanooga, TN | 202,862 | Feb-2022 | $250 |

| Homestead Pavilion | Homestead, FL | 285,833 | Jan-2022 | $290 |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 17 | |

| Structural and Collateral Term Sheet | | BMO 2023-C5 |

| No. 1 – Brier Creek Commons |

The Borrower. The borrower for the Brier Creek Commons Whole Loan is BC Retail, LLC (“Brier Creek Commons Borrower"), a Delaware limited liability company and a bankruptcy remote single purpose entity with two independent directors. Legal counsel to the Brier Creek Commons Borrower delivered a non-consolidation opinion in connection with the origination of the Brier Creek Commons Whole Loan.

The Borrower Sponsor. The non-recourse carveout guarantor is AAC Consolidated Properties, LLC and the borrower sponsor is Maria Beatrice Countess Arco, the President of AAC Consolidated Management, LLC, an affiliate of American Asset Corporation (“AAC”). AAC is a diversified real estate company specializing in development, construction management, leasing and brokerage, and asset and property management. Headquartered in New York with offices in Charlotte and Raleigh, North Carolina, AAC was founded in 1986 and has been involved in over 8.0 million square feet of real estate projects, including development of over 6.0 million square feet. AAC developed and has owned the Brier Creek Commons Property since construction. AAC’s current portfolio comprises nearly 6.0 million square feet of retail, office, and flex space, in addition to 4.5 million square feet of land held for planned development. Approximately 3.0 million square feet of developed retail space is situated in North Carolina and South Carolina, inclusive of the Brier Creek Commons Property. AAC also owns and operates the 582,651 square foot Arboretum Shopping Center in Charlotte, NC.

Property Management. The Brier Creek Commons Property is managed by AAC, an affiliate of the borrower sponsor (see “The Borrower Sponsor” above).

Escrows and Reserves. At the time of origination of the Brier Creek Commons Whole Loan, the Brier Creek Commons Borrower deposited approximately (i) $752,049 into a real estate tax reserve account and (ii) $58,333 into a rent concession reserve representing the amount of future rent credits or abatements under the existing lease with Sephora.

Tax Escrows – The Brier Creek Commons Borrower is required to deposit into a real estate tax reserve, on a monthly basis in an amount equal to one-twelfth of the real estate taxes that the lender estimates will be payable during the next 12 months (initially $83,561 monthly); provided, however, that the Brier Creek Commons Borrower is not required to make the monthly tax reserve deposit attributable to the Chili’s, McDonalds and Olive Garden parcels (each, a “Self-Pay Tax Tenant”) as long as (i) no event of default is continuing; (ii) such Self-Pay Tax Tenant is obligated to pay taxes directly and is actually making such payments; (iii) the Brier Creek Commons Borrower delivers timely evidence to the lender that the applicable taxes have been paid prior to delinquency; and (iv) such Self-Pay Tax Tenant’s lease is in full force and effect with neither the Brier Creek Commons Borrower nor such Self-Pay Tenant being in default of any obligations thereunder beyond any applicable notice and cure periods.

Insurance Escrows – The Brier Creek Commons Whole Loan documents do not require ongoing monthly insurance reserve deposits as long as (i) no event of default is continuing; (ii) the Brier Creek Commons Property is covered under a blanket or umbrella policy acceptable to the lender; (iii) the Brier Creek Commons Borrower provides the lender with evidence of renewal of such policies; and (iv) the Brier Creek Commons Borrower provides the lender with paid receipts for payment of the insurance premiums by no later than five days prior to the policy expiration dates.

Replacement Reserves – The Brier Creek Commons Whole Loan documents require ongoing monthly replacement reserve deposits of $6,491, which the lender may require the Brier Creek Commons Borrower to increase (not more than once per year) upon 30 days’ notice to the Brier Creek Commons Borrower if the lender reasonably determines such increase is necessary to maintain the proper operation of the Brier Creek Commons Property.

Leasing Reserves – The Brier Creek Commons Whole Loan documents require ongoing monthly general tenant improvements and leasing commissions reserves of $28,128. Deposits into the leasing reserve (exclusive of any pending disbursements therefrom) will be capped at $1,250,000 as long as no Cash Trap Event Period (as defined below) is continuing.

Lockbox / Cash Management. The Brier Creek Commons Whole Loan is structured with a springing lockbox and springing cash management. Upon the occurrence of a Cash Trap Event Period, the Brier Creek Commons Borrower is required to (i) execute a deposit account control agreement to establish a deposit account with a clearing bank and (ii) send executed letters directing all tenants to deposit all sums due under their respective leases directly into said deposit account. All funds in the deposit account are required to be swept periodically to a lender-controlled cash management account. If the Brier Creek Commons Borrower or property manager receive any rents or income directly, each is required to deposit such

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 18 | |

| Structural and Collateral Term Sheet | | BMO 2023-C5 |

| No. 1 – Brier Creek Commons |

amounts into the deposit account within five business days of receipt. So long as a Cash Trap Event Period is in effect, all excess funds will be swept to an excess cash flow subaccount controlled by the lender and held for so long as such Cash Trap Event Period is continuing, provided, however, that during a Cash Trap Event Period caused solely by a Major Tenant Event Period (as defined below, and provided that no other Cash Trap Event Period subsequently commences or is continuing) such sweep will be subject to a cap of $1,250,000. For the avoidance of doubt, the Major Tenant Event Period cap is independent and in addition to any cap contemplated for the leasing reserve discussed in “Escrows and Reserves” above.

A “Cash Trap Event Period” will commence upon the earlier of the following:

| (i) | the occurrence of an event of default; |

| (ii) | the net operating income debt service coverage ratio, assuming an amortization period of 30 years (“Amortizing NOI DSCR”) falling below 1.15x (tested quarterly) (a “Low DSCR Event”); or |

| (iii) | a Major Tenant Event Period. |

A Cash Trap Event Period will end upon the occurrence of the following:

| ● | with regard to clause (i), the cure of such event of default; |

| ● | with regard to clause (ii), (x) the Amortizing NOI DSCR being equal to or greater than 1.20x for two consecutive calendar quarters or (y) upon five business days of written notice from the lender, the Brier Creek Commons Borrower having delivered cash and cash equivalents or a letter of credit in an amount equal to six months of excess cash flow (forward looking from the time of such calculation), as determined by the lender in its reasonable discretion, with such deposit being required every subsequent six month period in which a Low DSCR Event is continuing; or |

| ● | with regard to clause (iii), a Major Tenant Event Period Cure (as defined below). |

A “Major Tenant Event Period” will commence upon the earliest to occur of the following with respect to BJ’s, as well as its successors and assigns, and any replacement tenant for all or a portion of such tenant’s space (individually or collectively, as applicable, “Major Tenant”):

| (i) | a Major Tenant, or its parent or guarantor filing, or otherwise becoming involved as debtor in, a bankruptcy or similar insolvency proceeding; |

| (ii) | a Major Tenant “going dark”, vacating or otherwise failing to continually occupy its space (or any material portion thereof), or giving notice of its intent to commence any of the foregoing; |

| (iii) | a Major Tenant surrendering, terminating or canceling its lease (or any material portion thereof), or otherwise failing or ceasing to be in full force and effect, or a Major Tenant giving notice of, or commencing a legal proceeding asserting any of the foregoing; |

| (iv) | a default occurring (beyond any applicable notice and cure period) under a Major Tenant lease; or |

| (v) | a Major Tenant failing to renew or extend the term of its lease on or prior to the date that is the earlier of (x) six months prior to the date of scheduled expiration and (y) the deadline to renew such lease as set forth therein, to the extent that such lease expressly provides for such deadline. |

A “Major Tenant Event Period Cure” will occur upon:

| ● | solely with regards to clause (i) above, (x) a Major Tenant Re-Tenanting Event (as defined below) having occurred or (y) two consecutive calendar quarters after the bankruptcy or insolvency proceeding having terminated in a manner satisfactory to the lender, such Major Tenant’s lease having been affirmed and the terms of such lease, as affirmed, being satisfactory to the lender; |

| ● | solely with regards to clause (ii) above, (x) a Major Tenant Re-Tenanting Event having occurred or (y) the applicable Major Tenant having resumed its normal business operations in its entire space for a period of two consecutive calendar quarters; |

| ● | solely with regards to clause (iii) above, (x) a Major Tenant Re-Tenanting Event having occurred or (y) such Major Tenant having (A) validly and irrevocably waived any notification of any such termination, cancellation, |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 19 | |

| Structural and Collateral Term Sheet | | BMO 2023-C5 |

| No. 1 – Brier Creek Commons |

| | or surrender of such lease and (B) delivered to the lender a tenant estoppel certificate reasonably acceptable to the lender; |

| ● | solely with regards to clause (iv) above, (x) a Major Tenant Re-Tenanting Event having occurred or (y) the subject default having been cured and no other default under the related lease having occurred (beyond any notice and cure period) for a period of two consecutive calendar quarters; or |

| ● | solely with regards to clause (v) above, (x) a Major Tenant Re-Tenanting Event having occurred or (y) the lender having received evidence that the Major Tenant either (A) extended the term of its lease pursuant to the terms thereof (or on terms and conditions otherwise acceptable to the lender) or (B) entered into a new lease for the applicable Major Tenant space (to the extent that no additional renewal options remain under the related lease), in each case, such evidence to include, without limitation, a tenant estoppel certificate from the applicable Major Tenant acceptable to the lender, confirming that all obligations of the Brier Creek Commons Borrower to such Major Tenant with respect to tenant improvements and leasing commissions having been satisfied in full and that such Major Tenant is then paying full, unabated rent pursuant to the terms thereof. |

A “Major Tenant Re-Tenanting Event” will occur upon the lender receiving satisfactory evidence (including, without limitation, a satisfactory estoppel) that (i) space at the Brier Creek Commons Property in an amount equal to all or substantially all of the applicable Major Tenant space (or applicable portion thereof) has been leased to one or more satisfactory replacement tenants pursuant to a satisfactory replacement lease; (ii) each such tenant is in occupancy of its premises, is open for normal business and is paying full, unabated rent pursuant to the terms of its lease (or such abatement having been reserved); and (iii) all tenant improvement costs and leasing commissions provided in each such replacement lease have been paid (or sufficient funds have been deposited into the leasing reserve subaccount for payment of such amounts).

Subordinate Debt. None.

Mezzanine Debt. None.

Partial Release. Not permitted.

Ground Lease. None.

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 20 | |

| Structural and Collateral Term Sheet | | BMO 2023-C5 |

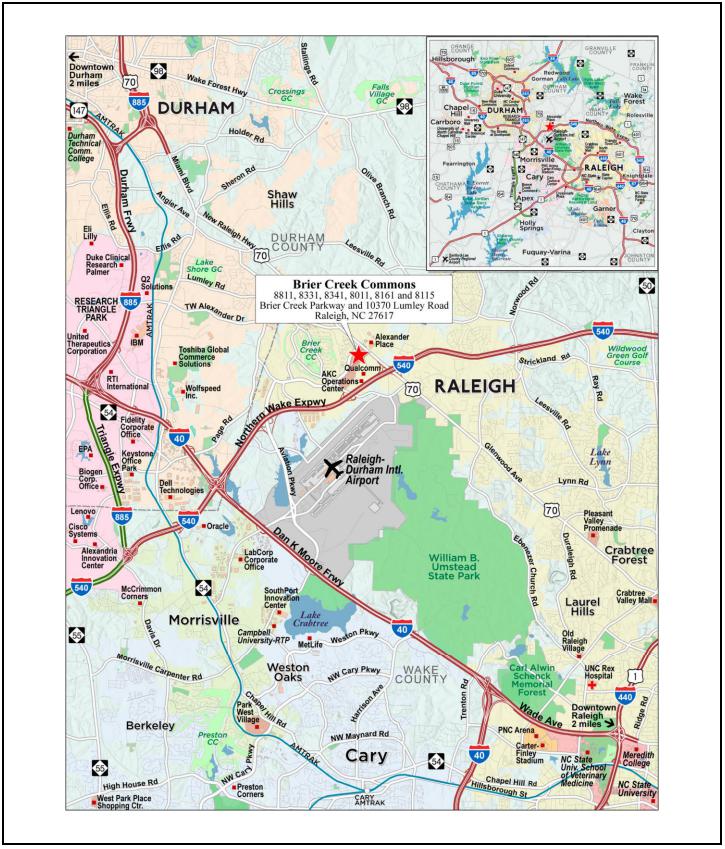

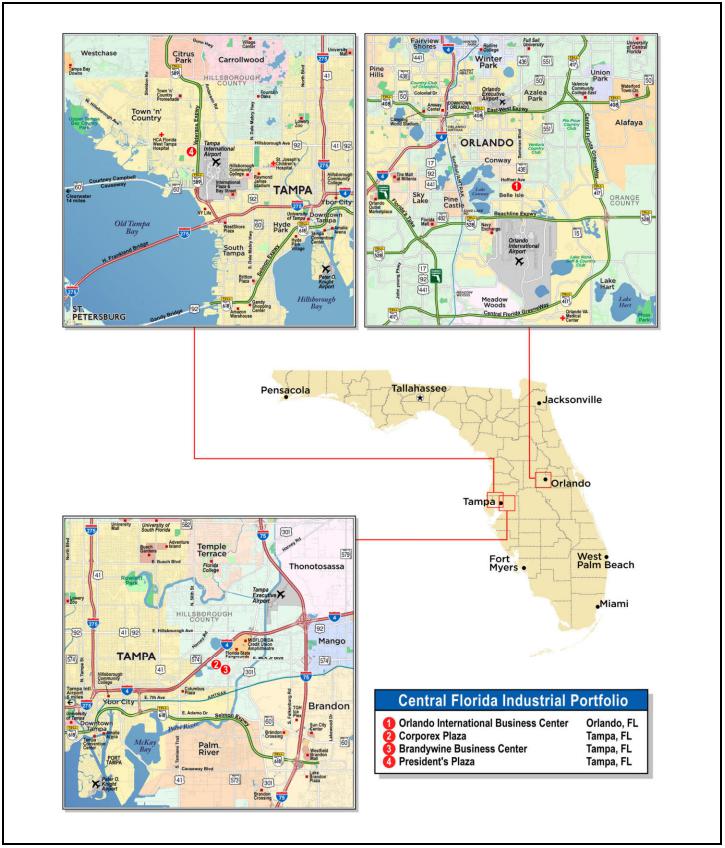

| No. 2 – Central Florida Industrial Portfolio |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 21 | |

| Structural and Collateral Term Sheet | | BMO 2023-C5 |

| No. 2 – Central Florida Industrial Portfolio |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 22 | |

| Structural and Collateral Term Sheet | | BMO 2023-C5 |

| No. 2 – Central Florida Industrial Portfolio |

| Mortgage Loan Information | | Property Information |

| Mortgage Loan Seller: | KeyBank | | Single Asset / Portfolio: | Portfolio |

| Original Principal Balance: | $42,240,000 | | Title: | Fee |

| Cut-off Date Principal Balance: | $42,240,000 | | Property Type – Subtype: | Industrial – Flex |

| % of IPB: | 6.4% | | Net Rentable Area (SF): | 419,886 |

| Loan Purpose(1): | Acquisition/Recapitalization | | Location: | Various, FL |

| Borrowers: | Small Bay I Orlando DST, Small Bay I Corporex DST, Small Bay I Brandywine DST and Small Bay I Presidents DST | | Year Built / Renovated(3): | Various / Various |

| | | Occupancy: | 93.5% |

| | | Occupancy Date: | Various |

| Borrower Sponsor: | NexPoint Real Estate Advisors, L.P. | | 4th Most Recent NOI (As of)(4): | NAV |

| Interest Rate: | 6.21000% | | 3rd Most Recent NOI (As of)(4): | NAV |

| Note Date: | 4/28/2023 | | 2nd Most Recent NOI (As of)(4): | NAV |

| Maturity Date: | 5/1/2033 | | Most Recent NOI (As of)(4): | $3,937,119 (12/31/2021) |

| Interest-only Period: | 120 months | | UW Economic Occupancy: | 91.5% |

| Original Term: | 120 months | | UW Revenues: | $7,554,885 |

| Original Amortization Term: | None | | UW Expenses: | $3,200,036 |

| Amortization Type: | Interest Only | | UW NOI: | $4,354,850 |

| Call Protection: | L(25),D(92),O(3) | | UW NCF: | $4,208,700 |

| Lockbox / Cash Management: | Hard / In Place | | Appraised Value / Per SF: | $70,400,000 / $168 |

| Additional Debt: | No | | Appraisal Date: | 3/20/2023 |

| Additional Debt Balance: | N/A | | | |

| Additional Debt Type: | N/A | | | |

| | | | | |

| Escrows and Reserves(2) | | Financial Information |

| | Initial | Monthly | Initial Cap | | Cut-off Date Loan / SF: | $101 |

| Taxes: | $467,442 | $66,778 | N/A | | Maturity Date Loan / SF: | $101 |

| Insurance: | $348,474 | $62,504 | N/A | | Cut-off Date LTV: | 60.0% |

| Replacement Reserves: | $375,000 | Springing | $375,000 | | Maturity Date LTV: | 60.0% |

| TI / LC Reserve: | $3,500,000 | Springing | $3,500,000 | | UW NCF DSCR: | 1.58x |

| Other: | $378,548 | $0 | N/A | | UW NOI Debt Yield: | 10.3% |

| | | | | | | |

| Sources and Uses |

| Sources | Proceeds | % of Total | | Uses | Proceeds | % of Total |

| Mortgage Loan | $42,240,000 | 64.4 | % | | Purchase Price(5) | $33,000,000 | 50.3 | % |

| Borrower Sponsor Equity | 23,383,521 | 35.6 | | | Loan Payoff(5) | 22,056,296 | 33.6 | |

| | | | | | Closing Costs | 5,497,760 | 8.4 | |

| | | | | | Reserves | 5,069,465 | 7.7 | |

| Total Sources | $65,623,521 | 100.0 | % | | Total Uses | $65,623,521 | 100.0 | % |

| (1) | Three of the Central Florida Industrial Portfolio Properties (as defined below) were acquired at origination of the Central Florida Industrial Portfolio Mortgage Loan (as defined below) and one of the Central Florida Industrial Portfolio Properties had interim financing from an affiliate acquisition before membership interests were transferred to the borrowers at origination of the Central Florida Industrial Portfolio Mortgage Loan. |

| (2) | For a full description of escrows and reserves, please refer to “Escrows and Reserves” below. |

| (3) | See “Portfolio Summary” table herein. |

| (4) | With the exception of the 2021 financials, historical financials were not provided by the sellers of Central Florida Industrial Portfolio Properties. |

| (5) | The Purchase Price of $33,000,000 represents the acquisition of the Tampa Properties (as defined below) and the Loan Payoff of approximately $22,056,296 represents the payoff of previous interim financing from an affiliate acquisition of the Orlando International Business Center Property (as defined below). |

The Loan. The second largest mortgage loan (the “Central Florida Industrial Portfolio Mortgage Loan”) is secured by the borrowers’ fee interest in four industrial properties located in Tampa and Orlando, Florida (the “Central Florida Industrial Portfolio Properties”). The Central Florida Industrial Portfolio Mortgage Loan was originated on April 28, 2023, by KeyBank National Association. The Central Florida Industrial Portfolio Mortgage Loan has a 10-year interest only term and accrues interest at a rate of 6.21000% per annum.

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 23 | |

| Structural and Collateral Term Sheet | | BMO 2023-C5 |

| No. 2 – Central Florida Industrial Portfolio |

The Properties. The Central Florida Industrial Portfolio Properties consist of four industrial flex properties, with an aggregate of 419,886 square feet. The Central Florida Industrial Portfolio Properties are located in Central Florida, with three properties in Tampa (the “Tampa Properties”) and one property in Orlando. The Central Florida Industrial Portfolio Properties are all multi-tenant with an aggregate of 81 tenants and a portfolio occupancy of 93.5%. No tenant represents more than 10.2% of the portfolio net rentable area or 8.7% of the portfolio underwritten base rent. The Tampa Properties were acquired at origination of the Central Florida Industrial Portfolio Mortgage Loan for a combined purchase price of $33,000,000. The Orlando International Business Center Property was acquired in December 2022 by an affiliate of the borrower sponsor and the membership interests in the Orlando International Business Center Property were subsequently transferred to the DST borrowers for a consideration of $54,500,000. The total combined purchase price of $87,500,000 results in a loan-to-purchase price ratio of 48.3%.

The following table presents certain information relating to the Central Florida Industrial Portfolio Properties:

| Portfolio Summary |

| Property Name | Year Built / Renovated | Net Rentable Area (SF) (1) | Occupancy %(1) | Allocated Loan Amount (“ALA”) | % of ALA | Appraised Value | % of Appraised Value | UW NCF | % of UW NCF |

| Orlando International Business Center | 1983, 1985 / 2022 | 196,228 | 91.1 | % | $22,265,000 | 52.7 | % | $36,500,000 | 51.8 | % | $2,221,740 | 52.8 | % |

| Corporex Plaza | 1984-1985 / NAP | 100,265 | 93.4 | | 9,087,000 | 21.5 | | 15,400,000 | 21.9 | | 911,237 | 21.7 | |

| Brandywine Business Center | 1986 / NAP | 79,124 | 100.0 | | 6,793,000 | 16.1 | | 12,000,000 | 17.0 | | 663,908 | 15.8 | |

| President’s Plaza | 1988 / NAP | 44,269 | 92.3 | | 4,095,000 | 9.7 | | 6,500,000 | 9.2 | | 411,816 | 9.8 | |

| Total | | 419,886 | 93.5 | % | $42,240,000 | 100.0 | % | $70,400,000 | 100.0 | % | $4,208,700 | 100.0 | % |

| (1) | Based on underwritten rent rolls dated as of March 15, 2023, for the Orlando International Business Center Property and as of February 27, 2023, for the Corporex Plaza Property, the Brandywine Business Center Property and the President’s Plaza Property. |

Orlando International Business Center. The “Orlando International Business Center Property” is a 196,228 square foot, industrial flex property containing six, single-story buildings located in southeastern Orlando, Florida, at the intersection of South Semoran Boulevard and Hoffner Avenue. The improvements were constructed in two phases in 1983 and 1985. The buildings contain 80.0% office buildout, with the remaining space primarily used as small-bay warehouse. The Orlando International Business Center Property features a total of 28 drive-in doors with 15 foot clear heights and a total of 536 surface parking spaces. As of March 15, 2023, the Orlando International Business Center Property is 91.1% leased to 44 tenants, with suite sizes ranging from 768 to 13,581 square feet. No tenant occupies more than 6.9% of the net rentable area at the Orlando International Business Center Property.