Corporate Profile

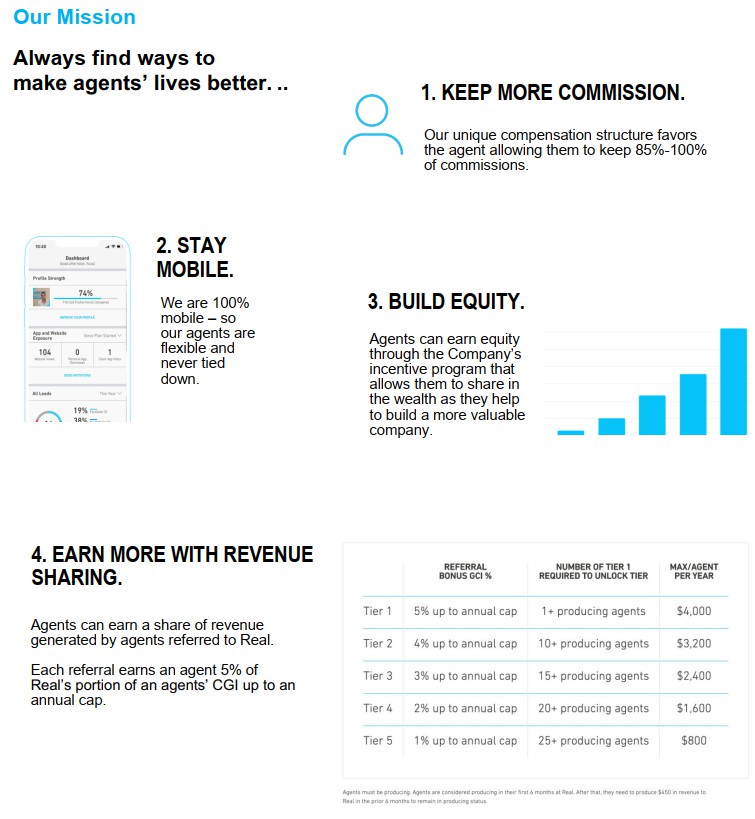

Agents are increasingly tech savvy and mobile. They want more ownership over their careers. The traditional brokerage model is being replaced with a tech-forward model offering agents better service at lower cost and ‘skin in the game’.

Introduction

This Management’s Discussion and Analysis (“MD&A”) is provided to enable a reader to assess the results of operations and financial condition of The Real Brokerage Inc. (formerly ADL Ventures Inc.) (“Real” or the “Company”). for the period ended September 30, 2020 and 2019. This MD&A is dated November 15, 2020 and should be read in conjunction with the unaudited interim condensed financial statements and related notes for the period ended September 30, 2020 and 2019 (“Financial Statements”). Unless the context indicates otherwise, references to “Real”, “the Company”, “we”, “us” and “our” in this MD&A refer to The Real Brokerage Inc. and its operations.

Forward-looking information

Certain information included in this MD&A contains forward-looking information within the meaning of applicable Canadian securities laws. This information includes, but is not limited to, statements made in Business Overview and Strategy, Results from Operations, and other statements concerning Real’s objectives, its strategies to achieve those objectives, as well as statements with respect to management’s beliefs, plans, estimates and intentions, and similar statements concerning anticipated future events, results, circumstances, performance or expectations that are not historical facts. Forward-looking information generally can be identified by the use of forward-looking terminology such as “outlook”, “objective”, “may”, “will”, “would”, “expect”, “intend”, “estimate”, “anticipate”, “believe”, “should”, “plan”, “continue”, or similar expressions suggesting future outcomes or events or the negative thereof. Such forward-looking information reflects management’s current beliefs and is based on information currently available. All forward-looking information in this MD&A is qualified by the following cautionary statements.

Forward looking information necessarily involves known and unknown risks and uncertainties, which may be general or specific and which give rise to the possibility that expectations, forecasts, predictions, projections or conclusions will not prove to be accurate, assumptions may not be correct and objectives, strategic goals and priorities may not be achieved. A variety of factors, many of which are beyond Real’s control, affect the operations, performance and results of the Company and its subsidiaries, and could call actual results to differ materially from current expectations of estimated or anticipated events or results.

Although Real believes that the expectations reflected in such forward-looking information are reasonable and represent the Company’s projections, expectations and beliefs at this time, such information involves known and unknown risks and uncertainties which may cause the Company’s actual performance and results in future periods to differ materially from any estimates or projections of future performance or results expressed or implied by such forward-looking information. See Risks and Uncertainties for further information. The reader is cautioned to consider these factors, uncertainties, and potential events carefully and not to put undue reliance on forward-looking information, as there can be no assurance that actual results will be consistent with such forward-looking information.

The forward-looking information included in this MD&A is made as of the date of this MD&A and should not be relied upon as representing Real’s views as of any date subsequent to the date of this MD&A. Management undertakes no obligation, except as required by applicable law, to publicly update or revise any forward-looking information, whether as a result of new information, future events or otherwise.

Business overview and strategy

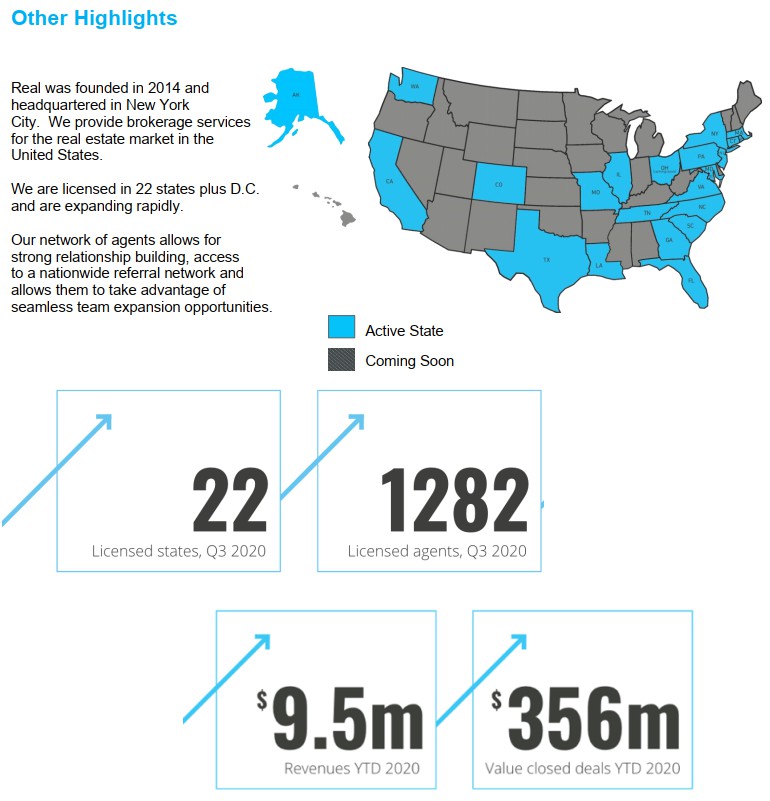

Real is a growing multistate technology-powered real estate brokerage in the United States. We focus our operations on development of technology that helps real estate agents perform better as well as building a scalable, efficient brokerage operation that is not dependent on a cost-heavy brick and mortar presence in the markets that we operate in.

Business overview and strategy (cont’d)

As a licensed real estate brokerage, our revenue is generated, primarily, by processing real estate transactions which entitle us to commissions. We pay a portion of our commission revenue to our agents and brokers.

Our strength is our ability to offer real estate agents a higher value, at a lower cost, compared to other brokerages, while operating efficiently and scaling quickly.

Recent developments

Listing on OTCQX Best Market

On August 11, 2020, Real’s common shares were approved for listing by OTC Markets Group and commenced trading on the OTCQX Best Market under the symbol “REAXF”.

Private Placement

On August 12, 2020, Real closed a non-brokered private placement offering of 1,900,000 common shares of Real at a price of $0.35 per common share for aggregate gross proceeds of $500. Real intends to use the proceeds for sales, marketing and general working capital purposes.

Finance and Operations Leaders

On August 25, Michelle Ressler joined the company's executive team as Vice President of Finance and real estate leaders Sheila Dunagan and Ron Dunagan joined as Vice President of Brokerage Operations and Director of Operations, respectively, with the goal of scaling Real's finance and operations functions.

On October 15, Michelle Ressler was appointed as chief financial officer (“CFO”) effective immediately, replacing Gus Patel. Prior to joining Real, Michelle was the controller at Canaccord Genuity Inc., where she helped scale financial operations following a merger and grew the finance department.

Based in Dallas, Texas, Sheila and Ron Dunagan bring to Real decades of experience in residential real estate and operational excellence in high-growth companies. Most recently, Sheila was the designated broker for the state of Texas at eXp Realty, LLC ("eXp"), and Ron was regional operations manager for the western U.S. at eXp. In their respective roles, the Dunagans helped grow Texas from 2 agents in 2015 to over 4,100 in 2020, with over 32,000 transactions and $6.4 billion in closed sales volume in 2019. Prior to eXp, the Dunagans were agents at Keller Williams, where they were members of the agent leadership counsel. Sheila Dunagan also owned and operated an insurance company that doubled year-over-year revenue three years in a row.

Agent Stock Incentive

On September 21, 2020, the TSX Venture Exchange provided final acceptance of certain amendments to Real's stock option plan (the "Stock Option Plan") and new restricted share unit plan (the "RSU Plan") following the approval of Real shareholders at its annual and special meeting of shareholders held on August 20, 2020. In light of these approvals, Real launched a new agent compensation plan to incentivize real estate agents who contribute to Real's continued growth and success.

Real agents are eligible to receive stock options exercisable for common shares of Real under the Stock Option Plan and restricted share units that vest as common shares of Real under the RSU Plan. Agents can earn these stock-based incentives in recognition of their personal performance and ability to attract agents to Real.

Business overview and strategy (cont’d)

Recent developments (cont’d)

State Expansion

On Oct 6, Real expanded to the state of Alaska with the addition of a top Anchorage real estate team and agents.

Business Strategy

Revenue-share model

As the vast majority of real estate agents are independent contractors, we believe that it is our responsibility to create multiple revenue sources and improve financial opportunities for agents. Our attractive commission split coupled with the equity incentives for agents provide great opportunities. We are now offering agents the opportunity to earn revenue-share, paid out of Real’s portion of commissions, for new agents that they personally refer to Real. The program launched in November 2019 is having a positive impact on our agent count and revenue growth.

Focus on teams

Real estate teams operate as “brokerages inside a brokerage”. A team is typically formed by a high producing agent who attracts other agents to work with them and enjoy the lead flow and mentoring provided by the team leader. To attract teams, we enhanced our team offering to include the full benefits of revenue sharing and the equity program to allow brokers and agents a financial mechanism to build teams across geographical boundaries in any of the markets that we serve without incurring any expense, oversight responsibility, or liability while preserving and enhancing the agents and brokers’ personal brands. These changes are having a positive impact on our agent count that we expect will result in revenue growth.

Path to profitability

We continue to analyze and monitor our spend and operational expenses, developing internal tools and processes for more efficient transaction processing and support, focused our geographic footprint, terminated the affiliation of non-producing agents who had been with us for a long period and closely monitored our return-on-investment in various marketing channels.

Tracking agent satisfaction

Agents’ satisfaction is top-of-mind for Real and we use the Net Promoter Score® (“NPS”) surveys for measurement and tracking. NPS is a measure of customer satisfaction and is measured on a scale between (100) and 100. An NPS above 50 is considered excellent. The question we ask is "On a scale of zero to ten, how likely are you to recommend Real as a potential brokerage firm to other agents?". Our most recent NPS is 67.7, a strong indication to a very high level of satisfaction amongst our agents. We believe that NPS surveys help in ensuring we are delivering on the most important services and value to our agents. A high level of satisfaction contributes to the brand and organic growth of Real.

Objectives

Real seeks to become one of leading real estate brokerages in the United States. Using our proprietary technology, we look to provide agents with all the tools they need in order to manage and market their business and succeed. Real plans to accomplish this through: (i) proprietary integration of technology and tools focused on facilitating and improving tasks performed by agents. (ii) the offering of attractive business terms to agents and creation of multiple potential revenue streams for agents (iii) providing excellent support and service to our agents (iv) the creation of a nationwide collaborative community of agents. Leveraging the engagement of real estate agents and home buyers and sellers, Real will seek to generate revenue through a variety of different channels.

Objectives (cont’d)

Presentation of financial information and non-IFRS measures

Presentation of financial information

Unless otherwise specified herein, financial results, including historical comparatives, contained in this MD&A are based on Real’s Financial Statements, which have been prepared in accordance with International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board (“IASB”) and the interpretations of the IFRS Interpretations Committee (“IFIRC”). Unless otherwise specified, amounts are in Canadian dollars and percentage changes are calculated using whole numbers.

Non-IFRS measures

In addition to the reported IFRS measures, industry practice is to evaluate entities giving consideration to certain non-IFRS performance measures, such as earnings before interest, taxes, depreciation and amortization (“EBITDA”) or adjusted earnings before interest, taxes, depreciation and amortization (“Adjusted EBITDA”).

Management believes that these measures are helpful to investors because they are measures that the Company uses to measure performance relative to other entities. In addition to IFRS results, these measures are also used internally to measure the operating performance of the Company.

These measures are not in accordance with IFRS and have no standardized definitions, and as such, our computations of these non-IFRS measures may not be comparable to measures by other reporting issuers. In addition, Real’s method of calculating non-IFRS measures may differ from other reporting issuers, and accordingly, may not be comparable.

Earnings Before Interest, Taxes, Depreciation and Amortization (“EBITDA”)

EBITDA is used as an alternative to net income because it includes major non-cash items such as interest, taxes and amortization, which management considers non-operating in nature. A reconciliation of EBITDA to IFRS net income is presented under the section Results from Operations of this MD&A.

Adjusted Earnings Before Interest, Taxes, Depreciation and Amortization (“Adjusted EBITDA”)

Adjusted EBITDA is used as an alternative to net income because it excludes major non-cash items such as amortization, interest, stock-based compensation, current and deferred income tax expenses and other items management considers non-operating in nature. A reconciliation of adjusted EBITDA to IFRS net income is presented under section Results from Operations of this MD&A.

Results from operations

Select annual information

| For the period ended September 30, | | | 2020 | | | 2019 | |

| Operating results | | | | | | | |

| Loss before tax | | | (2,275 | ) | | (1,768 | ) |

| Net loss and comprehensive loss | | | (2,275 | ) | | (1,768 | ) |

| Per share basis | | | | | | | |

| Basic and diluted loss per share | | | (0.026 | ) | | (0.042 | ) |

| | | | | | | | |

| | | | September 30, | | | December 31, | |

| As at | Note | | 2020 | | | 2019 | |

| Total assets | | | 2,455 | | | 408 | |

| Total debt | (ii) | | 1,514 | | | 598 | |

| Debt to total assets | (i) (iii) | | 62% | | | 147% | |

| EBITDA | (i) (iv) | | (2,187 | ) | | (1,240 | ) |

| Adjusted EBITDA | (i) (iv) | | (1,392 | ) | | (1,214 | ) |

(i) | Represents a non-IFRS measure. Real's method for calculating non-IFRS measures may differ from other reporting issuers' methods and accordingly may not be comparable. For definitions and basis of presentation of Real's non-IFRS measures, refer to the non-IFRS measures section of this MD&A. |

(ii) | Total debt is defined as accounts payable and other financial liabilities, less preferred equity. |

(iii) | Debt to total assets is a non-IFRS measure and is calculated as total debt divided by total assets. |

(iv) | EBITDA and Adjusted EBITDA is calculated on a trailing twelve month basis. Refer to non-IFRS measures section of this MD&A for further details. |

For the nine months ended September 30, 2020, total revenues amounted to $9,469 compared to $11,780 for the nine months ended September 30, 2019. The decrease in revenues attributable to a one-time commercial lease sale of $2,636 closed in Q1 2019 as well as the impact of COVID-19 on the national real estate market. We are continuing to increase our investment in productive agents on our platform which will continue to translate into a larger transaction volume closed by our agents.

Results from operations (cont’d)

A further breakdown in revenues generated during the year is included below:

| | | Three months ended Sept 30, | | | Nine months ended Sept 30, | |

| | | 2020 | | | 2019 | | | 2020 | | | 2019 | |

| Major service lines | | | | | | | | | | | | |

| Commissions | | 3,915 | | | 3,474 | | | 9,382 | | | 11,632 | |

| Subscriptions | | 15 | | | 14 | | | 38 | | | 48 | |

| Other | | 9 | | | 31 | | | 49 | | | 100 | |

| Total revenue | | 3,939 | | | 3,519 | | | 9,469 | | | 11,780 | |

| Timing of revenue recognition | | | | | | | | | | | | |

| Products transferred at a point in time | | 3,915 | | | 3,474 | | | 9,382 | | | 11,632 | |

| Services transferred over time | | 15 | | | 14 | | | 38 | | | 48 | |

| Revenue from contracts with customers | | 3,930 | | | 3,488 | | | 9,420 | | | 11,680 | |

| Other revenue | | 9 | | | 31 | | | 49 | | | 100 | |

| Total revenue | | 3,939 | | | 3,519 | | | 9,469 | | | 11,780 | |

A further breakdown in expenses during the year is included below:

| | | Three months ended Sep 30, | | | Nine months ended September 30, | |

| | | 2020 | | | 2019 | | | 2020 | | | 2019 | |

| Commissions to agents | | 3,198 | | | 3,094 | | | 8,063 | | | 10,404 | |

| General and administrative | | 188 | | | 329 | | | 528 | | | 653 | |

| Consultancy | | 444 | | | 188 | | | 896 | | | 484 | |

| Advertising | | 88 | | | 140 | | | 449 | | | 391 | |

| Research and development | | 75 | | | 67 | | | 147 | | | 226 | |

| Salaries and benefits | | 152 | | | 3 | | | 331 | | | 246 | |

| Stock Based Compensation | | 139 | | | (218 | ) | | 336 | | | 26 | |

| Depreciation | | 10 | | | 3 | | | 59 | | | 85 | |

| Dues and subscriptions | | 25 | | | 43 | | | 47 | | | 130 | |

| Travel | | 14 | | | - | | | 26 | | | - | |

| Other | | 6 | | | 2 | | | 10 | | | 61 | |

| Occupancy costs | | 10 | | | (62 | ) | | 21 | | | 8 | |

| Total cost of sales, selling expenses, administrative and research and development expenses | | 4,349 | | | 3,589 | | | 10,913 | | | 12,714 | |

We believe that growth can and should be balanced with profits and therefore plan and monitor our spend responsibly to ensure we decrease our loss and work towards being EBITDA positive. Our loss as a percentage of total revenue was 23% for the nine months ended September 30, 2020 and 15% for the nine months ended September 30, 2019. This was primarily due to an increase in administrative expenses as a result of our go-public transaction.

| For the nine month period ended September 30, | | 2020 | | | 2019 | |

| Revenues | | 9,469 | | | 11,780 | |

| Commissions to agents | | 8,063 | | | 10,404 | |

| Commissions to agents as a percentage of revenues | | 85% | | | 88% | |

Results from operations (cont’d)

The commissions paid to agents for the nine months ended September 30, 2020 was $8,063 in comparison to $10,404 for the nine months ended September 30, 2019. The significant decrease is a result of a one-time commercial lease in the prior period. We typically pay our agents 85% of the gross commission earned on every real estate transaction and, as the total revenue increases, the total commission to agents’ expense increases accordingly.

Our general and administrative costs for the nine months ended September 30, 2020 was $528 in comparison to $653 for the nine months ended September 30, 2019. The decrease in general and administrative expenses were generally in line with the prior period.

Our consultancy expenses for the nine months ended September 30, 2020 was $896 in comparison to $484 for the nine months ended September 30, 2019. The increase in consultancy expenses was primarily due to legal and professional fees in connection with the listing on the TSX Venture Exchange and OTCQX Best Market.

Our advertising costs increased for the nine months ended September 30, 2020 was $449 compared to $391 for the nine months ended September 30, 2019 due to our efforts to attract agents. We track the performance of each of these channels and constantly optimize spending. We advertise on multiple online platforms and websites such as Google Adwords, Facebook and Indeed.

At September 30, 2020, Real had 18 full time employees which was a decrease from the employee headcount at September 30, 2019. The decrease was mainly attributed to automation implemented and software that replaced manual work.

We are charging a small portion of our agents a monthly subscription fee of $40 or $100 as a result of a pilot project we conducted in the summer of 2017. The intention was to explore how charging a monthly fee would affect the type of agents joining us and resulted in the conclusion that introducing a mandatory monthly fee negatively affects agent recruiting and revenue in general. In addition, some agents pay us a monthly subscription for using value-added software tools such as customer relationship management software.

Summary of Quarterly Information

The following table provides selected quarterly financial information for the three most recently completed financial quarters ended September 30, 2020. This information is unaudited but reflects all adjustments of a recurring nature that are, in the opinion of management, necessary to present a fair statement of the results of operations for the periods presented. Quarter-to-quarter comparisons of financial results are not necessarily meaningful and should not be relied upon as an indication of future performance.

| | | | | | 2020 | | | | |

| | | Q3 | | | Q2 | | | Q1 | |

| Revenue | | 3,939 | | | 2,594 | | | 2,936 | |

| Bad debt expense | | | | | | | | | |

| Cost of sales | | 3,198 | | | 2,313 | | | 2,552 | |

| Cost of sales | | 3,198 | | | 2,313 | | | 2,552 | |

| Gross profit | | 741 | | | 281 | | | 383 | |

| Administrative expenses | | 988 | | | 482 | | | 784 | |

| Selling expenses | | 88 | | | 209 | | | 152 | |

| Research and development expenses | | 75 | | | 49 | | | 23 | |

| Other income | | - | | | (1 | ) | | - | |

| Operating loss | | (410 | ) | | (458 | ) | | (575 | ) |

| Listing expenses | | - | | | 803 | | | - | |

| Finance costs (income). Net | | 12 | | | 15 | | | 1 | |

| Loss before tax | | (422 | ) | | (1,276 | ) | | (577 | ) |

| Income taxes | | - | | | | | | | |

| Net Loss | | (422 | ) | | (1,276 | ) | | (577 | ) |

| Total loss and comprehensive loss | | (422 | ) | | (1,276 | ) | | (577 | ) |

| Earnings per share | | | | | | | | | |

| Basic and diluted loss per share | | (0.013 | ) | | (0.080 | ) | | (0.006 | ) |

Quarterly trends and risks

Our quarterly results are dependent on the economic conditions within the markets for which we operate. The Company’s revenue and income can experience considerable variations from quarter to quarter and year to year due to factors beyond the Company’s control. The business is affected by the overall conditions of the real estate market, influenced primarily by economic growth, interest rates, unemployment, inventory, and mortgage rate volatility. The Company’s revenue from a real estate transaction is recorded only when a real estate transaction has been closed. Consequently, the timing of revenue recognition can materially affect quarterly results.

Revenue for Q3 2020 increased by 52% over the previous quarter. For the first half of 2020, the COVID-19 pandemic adversely affected the Company’s business and business worldwide. However, the impact to the Company for the nine months ended September 30, 2020 has been less significant than expected. The Company is positioned to continue to grow despite the fluctuations in economic activity resulting from COVID-19.

Liquidity and capital resources

Liquidity and cash management

Our primary sources of liquidity are cash and cash flows from operations as well as cash raised from investors in exchange for issuance of shares. The Company expects to meet all of its obligations and other commitments as they become due. The Company has various financing sources to fund operations and will continue to fund working capital needs through these sources along with cash flows generated from operating activities.

At September 30, 2020, our cash totaled $1,936. Cash is comprised of financial instruments with an original maturity of 90 days or less from the date of purchase, primarily money market funds. We hold no marketable securities.

Financial Instruments

A significant portion of the Company’s assets are comprised of financial instruments. Cash held in deposit accounts is measured at amortized cost. Investments in money market funds are held at fair value through profit or loss. These financial instruments are subject to insignificant risk of changes in value.

Financing activities

We believe that our existing balances of cash and cash flows expected to be generated from our operations will be sufficient to satisfy our operating requirements for at least the next eighteen months.

Our future capital requirements will depend on many factors, including our level of investment in technology, our rate of growth into new markets and our marketing efforts. Our capital requirements may be affected by factors which we cannot control such as the residential real estate market, interest rates, and other monetary and fiscal policy changes to the manner in which we currently operate. To support and achieve our future growth plans, however, we may need or seek advantageously to obtain additional funding through equity or debt financing. If we are unable to raise additional capital when desired, our business and results of operations would likely suffer.

The following table presents liquidity as a percentage of debt:

| | | September 30, | | | December 31, | |

| As at, | | 2020 | | | 2019 | |

| Cash | | 1,936 | | | 53 | |

| Restricted cash | | 44 | | | 43 | |

| Other receivables | | 22 | | | 10 | |

| Liquidity | | 2,002 | | | 106 | |

| Loans and borrowings | | 172 | | | - | |

| Debt | | 172 | | | - | |

| | | | | | | |

| Liquidity expressed as a percentage of debt | | 1164% | | | 0% | |

The Company’s debt obligations can be funded by cash, restricted cash, other receivables and revenues from operations.

Contractual obligations

As at September 30, 2020 the Company had no guarantees, leases, off-balance sheet arrangements other than those noted in our results from operations. We have a lease for our New York office that expires on June 30, 2023. The monthly rent expense per the lease for the period ended September 30, 2020 is $7 per month.

Liquidity and capital resources (cont’d)

Capital management framework

Real defines capital as the aggregate of debt and equity. The Company’s capital management framework is designed to maintain a level of capital that funds the operations and business strategies and builds long-term shareholder value.

The Company’s objective is to manage its capital structure in such a way as to diversify its funding sources, while minimizing its funding costs and risks. For 2020, Real expects to be able to satisfy all of its financing requirements through use of some or all of the following: cash on hand, cash generated by operations and through the public and private offerings of equity securities.

Other metrics

Earnings before interest, taxes, depreciation and amortization (“EBITDA”)

| | | Three months ended September 30, | | | Nine months ended September30, | |

| | | 2020 | | | 2019 | | | 2020 | | | 2019 | |

| Net loss and comprehensive loss | | (422 | ) | | (901 | ) | | (2,275 | ) | | (1,768 | ) |

| Add (deduct): | | | | | | | | | | | | |

| – Taxes | | - | | | - | | | - | | | - | |

| – Interest | | 12 | | | 440 | | | 29 | | | 443 | |

| – Depreciation | | 10 | | | 3 | | | 59 | | | 85 | |

| EBITDA | | (400 | ) | | (458 | ) | | (2,187 | ) | | (1,240 | ) |

Adjusted earnings before interest, taxes, depreciation and amortization (“EBITDA”)

| | | Three months ended September 30, | | | Nine months ended September30, | |

| | | | | | | | | 2020 | | | 2019 | |

| Net loss and comprehensive loss | | (422 | ) | | (901 | ) | | (2,275 | ) | | (1,768 | ) |

| Add (deduct): | | | | | | | | | | | | |

| – Taxes | | - | | | - | | | - | | | - | |

| – Interest | | 12 | | | 440 | | | 29 | | | 443 | |

| – Depreciation | | 10 | | | 3 | | | 59 | | | 85 | |

| – Stock-based compensation | | 139 | | | (218 | ) | | 336 | | | 26 | |

| – Listing expenses | | - | | | - | | | 459 | | | - | |

| Adjusted EBITDA | | (261 | ) | | (676 | ) | | (1,392 | ) | | (1,214 | ) |

Significant accounting policies and other explanatory information

The preparation of the Financial Statements requires management to make estimates and judgments that affect the reported amounts of assets, liabilities, revenues and expenses and the related disclosures as of the date of the Company’s interim condensed consolidated financial statements. Actual results may differ from estimates under different assumptions and conditions.

Significant judgments include the timing of revenue recognition and consolidation adjustments. Our significant judgments have been reviewed and approved by the Audit Committee for completeness of disclosure on what management believes would be relevant and useful to investors in interpreting the amounts and disclosures in our interim condensed consolidated financial statements.

Changes in accounting policies

Amendments to IAS 1, Presentation of Financial Statements (“IAS 1”) and IAS 8, Accounting Policies, Changes in Accounting Estimates and Errors (“IAS 8”) – Definition of Material

In October 2018, the IASB issued amendments to IAS 1 and IAS 8 to align the definition of “material” across the standards and to clarify certain aspects of the definition. The new definition states that, “Information is material if omitting, misstating or obscuring it could reasonably be expected to influence decisions that the primary users of general purpose financial statements make on the basis of those financial statements, which provide financial information about a specific reporting entity.” These amendments are effective January 1, 2020. The amendments to the definition of material and have not had a significant impact on the Company’s Financial Statements.

Future changes in accounting policies

The Company monitors the potential changes proposed by the IASB and analyzes the effect that changes in the standards may have on the Company’s operations. Standards issued but not yet effective up to the date of issuance of the Financial Statements are described below. This description is of the standards and interpretations issued that the Company reasonably expects to be applicable at a future date. The Company intends to adopt these standards when they become effective.

IAS 1, Presentation of Financial Statements (“IAS 1”)

In January 2020, the IASB issued amendments to IAS 1, Presentation of Financial Statements to clarify that the classification of liabilities as current or non-current should be based on rights that are in existence at the end of the reporting period and is unaffected by expectations about whether or not an entity will exercise their right to defer settlement of a liability.

The amendments further clarify that settlement refers to the transfer to the counterparty of cash, equity instruments, other assets, or services. The amendments are effective for annual reporting periods beginning on or after January 1, 2022 and must be applied retrospectively.

The Company is currently evaluating the impact of these amendments on its Financial Statements and will apply the amendments from the effective date.

Disclosure controls and procedures and internal control over financial reporting

Disclosure controls and procedures

The CEO and CFO have designed or caused to design controls to provide reasonable assurance that: (i) material information relating to the Company is made known to management by others, particularly during the period in which the annual and interim filings are being prepared; and (ii) information required to be disclosed by the Company in its annual and interim filings or other reports filed or submitted under securities legislation is recorded, processed, summarized and reported within the time frame specified in the securities legislation.

Based on the evaluations, the CEO and CFO have concluded that the Company’s disclosure controls and procedures were adequate and effective.

Internal control over financial reporting

Real has established internal controls over financial reporting to provide reasonable assurance regarding the reliability of the Company’s financial reporting and the preparation of the Financial Statements for external purposes in accordance with IFRS. Management, including the Company’s CEO and CFO, have determined that as at September 30, 2020 and 2019, the internal controls over financial reporting were effective.

Inherent limitations

It should be noted that in a control system, no matter how well conceived and operated, can provide only reasonable, not absolute, assurance that the objectives of the control system are met. Given the inherent limitations in all control systems, no evaluation of controls can provide absolute assurance that all control issues, including instances of fraud, if any, have been detected. These inherent limitations include, among other items: (i) that management’s assumptions and judgments could ultimately prove to be incorrect under varying conditions and circumstances; (ii) the impact of any undetected errors; and (iii) controls may be circumvented by unauthorized acts of individuals, by collusion of two or more people, or by management override.

Key management compensation

The Company’s key management personnel are comprised of the Board of Directors and current members of the executive team, the Chief Executive Officer, the Chief Financial Officer and the Chief Marketing Officer. Key management personnel compensation for the period consistent of the following:

| | | September 30, | | | September 30, | |

| | | 2020 | | | 2019 | |

| Salaries and benefits | | 488 | | | 327 | |

| Short-term employee benefits | | 6 | | | 4 | |

| Consultancy | | 44 | | | 10 | |

| Share-based payments | | 336 | | | 26 | |

| | | 874 | | | 367 | |

Executive officers participate in the Company’s incentive program. Furthermore, real estate agents of the Company are entitled to participate in the incentive program if they meet certain eligibility criteria.

Market conditions and industry trends

General

Throughout the nine months ended September 30, 2020, home buyers leveraged decreasing interest rates to purchase homes at an increased level. The consensus amongst economists is that interest rates will remain under 4% during 2020, which is likely to support an increasing demand from home buyers.

Our performance during the period was affected by the overall economic situation created by COVID-19 and the social distancing requirements that prevented many of our agents to serve their clients as they have done before. According to the National Association of Realtors (“NAR”), social distancing measures and overall COVID-19 impact is leading to fewer homebuyers, as well as listings being delayed. The economic uncertainty is adding caution to the market.

According to the NAR housing statistics, existing home sales fell 17.8% in April 2020 (compared to March 2020) and continued to decline by 9.7% in May 2020 (26.6% drop compared to May 2019). Conversely, in June 2020 existing home sales increased by a record 20.7%. The NAR reported that pending home sales had a record comeback in May 2020 of 44.3% which continued to increase another 16.6% in June 2020. In September 2020 existing home sales continued to increase by 9.4% from August 2020 and 21% from September 2019.

Market conditions and industry trends (cont’d)

The impressive increase in pending home sales in June and September of 2020 is encouraging as pending home sales are

a forward-looking indicator of future home sales. Inventory

Low mortgage rates fueling increased demand have been causing inventory shortages in many markets, creating a challenging environment for home buyers. According to the NAR, inventory of existing homes for sale in the U.S. was $1,470 (preliminary) as of September 2020 compared to $1,820 at the end of September 2019. Subsequently, NAR indicated the need for new home construction due to the high demand of homes and the record-low inventory levels.

Mortgage rates

According to the NAR, mortgage rates on commitments for 30-year, conventional, fixed-rate mortgages averaged 2.95% for the third quarter of 2020, compared to 3.65% for the third quarter of 2019. Mortgage rates are expected to decrease further. Some lenders have increased their rates to account for the risk and overall financial uncertainty. Low mortgage rates are pushing buyers into the market as well as driving an increase in refinance applications.

Risks and uncertainties

There are a number of risk factors that could cause future results to differ materially from those described herein. The risks and uncertainties described herein are not the only ones the Company faces. Additional risks and uncertainties, including those that the Company does not know about as of the date of this MD&A, or that it currently deems immaterial, may also adversely affect the Company’s business. If any of the following risks actually occur, the Company’s business may be harmed, and its financial condition and the results of operation may suffer significantly.

Risks and uncertainties (cont’d)

Limited operating history

Our limited operating history makes it difficult for potential investors to evaluate our business or prospective operations. As an early stage company, we are subject to all the risks inherent in the initial organization, financing, expenditures, complications and delays inherent in a new business. Investors should evaluate an investment in us in light of the uncertainties encountered by developing companies in a competitive and evolving environment. Our business is dependent upon the implementation of our business plan. We may not be successful in implementing such plan and cannot guarantee that, if implemented, we will ultimately be able to attain profitability.

Rapid Growth

Real may not be able to scale its business quickly enough to meet the growing needs of its affiliated real estate professionals and if Real is not able to grow efficiently, its operating results could be harmed. As Real adds new real estate professionals, Real will need to devote additional financial and human resources to improving its internal systems, integrating with third- party systems, and maintaining infrastructure performance. In addition, Real will need to appropriately scale its internal business systems and our services organization, including support of our affiliated real estate professionals as its demographics expand over time. Any failure of or delay in these efforts could cause impaired system performance and reduced real estate professional satisfaction. These issues could reduce the attractiveness of Real to existing real estate professionals who might leave Real and result in decreased attraction of new real estate professionals and reduced revenue and financial results.

Additional financing

From time to time, Real may need additional financing to operate or grow its business. The ability to continue as a going concern may be dependent upon raising additional capital from time-to-time to fund operations. Real’s ability to obtain additional financing, if and when required, will depend on investor and lender willingness, its operating performance, the condition of the capital markets and other facts, and Real cannot assure anyone that additional financing will be available

to it on favorable terms when required, or at all. If Real raises additional funds through the issuance of equity, equity-linked or debt securities, those securities may have rights, preferences or privileges senior to the rights of its current stock, and its existing stockholders may experience dilution. If Real is unable to obtain adequate financing or financing on terms satisfactory to it when it requires it, its ability to continue to support the operation or growth of its business could be significantly impaired and its operating results may be harmed.

Reliance on United States real estate market

Real’s financial performance is closely tied to the strength of the residential real estate market in the United States, which is cyclical in nature and typically is affected by changes in conditions that are beyond Real’s control. Macroeconomic conditions that could adversely impact the growth of the real estate market and have a material adverse effect on our business include, but are not limited to, economic slowdown or recession, increased unemployment, increased energy costs, reductions in the availability of credit or higher interest rates, increased costs of obtaining mortgages, an increase in foreclosure activity, inflation, disruptions in capital markets, declines in the stock market, adverse tax policies or changes in other regulations, lower consumer confidence, lower wage and salary levels, or the public perception that any of these events may occur. Unfavorable general economic conditions in the United States or other markets Real enters and operates within could negatively affect the affordability of, and consumer demand for, our services which could have a material adverse effect on our business and profitability. In addition, federal and state governments, agencies and government- sponsored entities could take actions that result in unforeseen consequences to the real estate market or that otherwise could negatively impact Real’s business.

Risks and uncertainties (cont’d)

Regulation of United States real estate market

Real operates in the real estate industry which is a heavily regulated industry subject to complex, federal, state, provincial and local laws and regulations and third-party organizations’ regulations, policies and bylaws. Generally, the laws, rules and regulations that apply to Real’s business practices include, without limitation, RESPA, the federal Fair Housing Act, the Dodd-Frank Act, and federal advertising and other laws, as well as comparable state statutes; rules of trade organizations such as NAR, local MLSs, and state and local AORs; licensing requirements and related obligations that could arise from our business practices relating to the provision of services other than real estate brokerage services; privacy regulations relating to our use of personal information collected from the registered users of our websites; laws relating to the use and publication of information through the Internet; and state real estate brokerage licensing requirements, as well as statutory due diligence, disclosure, record keeping and standard-of-care obligations relating to these licenses.

Additionally, the Dodd-Frank Act contains the Mortgage Reform and Anti-Predatory Lending Act (“Mortgage Act”), which imposes a number of additional requirements on lenders and servicers of residential mortgage loans, by amending certain existing provisions and adding new sections to RESPA and other federal laws. It also broadly prohibits unfair, deceptive or abusive acts or practices, and knowingly or recklessly providing substantial assistance to a covered person in violation of that prohibition. The penalties for noncompliance with these laws are also significantly increased by the Mortgage Act, which could lead to an increase in lawsuits against mortgage lenders and servicers.

Maintaining legal compliance is challenging and increases business costs due to resources required to continually monitor business practices for compliance with applicable laws, rules and regulations, and to monitor changes in the applicable laws themselves.

Real may not become aware of all the laws, rules and regulations that govern its business, or be able to comply with all of them, given the rate of regulatory changes, ambiguities in regulations, contradictions in regulations between jurisdictions, and the difficulties in achieving both company-wide and region-specific knowledge and compliance.

If Real fails, or is alleged to have failed, to comply with any existing or future applicable laws, rules and regulations, Real could be subject to lawsuits and administrative complaints and proceedings, as well as criminal proceedings. Non- compliance could result in significant defense costs, settlement costs, damages and penalties.

Real’s business licenses could be suspended or revoked, business practices enjoined, or it could be required to modify its business practices, which could materially impair, or even prevent, Real’s ability to conduct all or any portion of its business. Any such events could also damage Real’s reputation and impair Real’s ability to attract and service home buyers, home sellers and agents, as well its ability to attract brokerages, brokers, teams of agents and agents to Real, without increasing its costs.

Further, if Real loses its ability to obtain and maintain all of the regulatory approvals and licenses necessary to conduct business as we currently operate, Real’s ability to conduct its business may be harmed. Lastly, any lobbying or related activities Real undertakes in response to mitigate liability of current or new regulations could substantially increase Real’s operating expenses.

Risks and uncertainties (cont’d)

Success of the platform

Our business strategy is dependent on our ability to develop platforms and features to attract new businesses and users, while retaining existing ones. Staffing changes, changes in user behavior, changes in agent growth rate or development of competing platforms may cause users to switch to alternative platforms or decrease their use of our platform. There is no guarantee that agents will use these features and we may fail to generate revenue. Additionally, any of the following events may cause decreased use of our platform:

● Emergence of competing platforms and applications with novel technologies;

● Inability to convince potential agents to join our platform;

● Technical issues or delays in releasing, updating or integrating certain platforms or in the cross-compatibility of multiple platforms;

● Security breaches with respect to our data;

● A rise in safety or privacy concerns; and

● An increase in the level of spam or undesired content on the network.

Management team

We are highly dependent on our management team, specifically our Chief Executive Officer. If we lose key employees, our business may suffer. Furthermore, our future success will also depend in part on the continued service of our key management personnel and our ability to identify, hire, and retain additional personnel. We do not carry “key-man” life insurance on the lives of our executive officer, employees or advisors. We experience intense competition for qualified personnel and may be unable to attract and retain the personnel necessary for the development of our business. Because of this competition, our compensation costs may increase significantly.

Monetization of platform

There is no guarantee that our efforts to monetize the Real platform will be successful. Furthermore, our competitors may introduce more advanced technologies that deliver a greater value proposition to realtors in the future. All these factors individually or collectively may preclude us from effectively monetizing our business which would have a material adverse effect on our financial condition and results of operation.

Seasonality of operations

Seasons and weather traditionally impact the real estate industry in the jurisdictions where Real operates. Continuous poor weather or natural disasters negatively impact listings and sales. Spring and summer seasons historically reflect greater sales periods in comparison to fall and winter seasons. Real has historically experienced lower revenues during the fall and winter seasons, as well as during periods of unseasonable weather, which reduces Real’s operating income, net income, operating margins and cash flow.

Real estate listings precede sales and a period of poor listings activity will negatively impact revenue. Past performance in similar seasons or during similar weather events can provide no assurance of future or current performance, and macroeconomic shifts in the markets Real serves can conceal the impact of poor weather or seasonality.

Agent engagement

Our business model involves attracting real estate agents to our platform. There is no guarantee that growth strategies will bring new agents to our network. Changes in relationships with our partners, contractors and businesses we retain to grow our network may result in significant increases in the cost to acquire new agents. In addition, new agents may fail to engage with our network to the same extent current agents are engaging with our network resulting in decreased use of our network.

Risks and uncertainties (cont’d)

Agent engagement (cont’d)

Decreases in the size of our agent base and/or decreased engagement on our network may impair our ability to generate revenue.

Managing growth

Successful implementation of our business strategy requires us to manage our growth. Growth could place an increasing strain on our management and financial resources. To manage growth effectively, we need to continuously: (i) evaluate definitive business strategies, goals and objectives; (ii) maintain a system of management controls; and (iii) attract and retain qualified personnel, as well as, develop, train and manage management-level and other employees. If we fail to manage our growth effectively, our business, financial condition or operating results could be materially harmed.

Competition

We compete with both start-up and established technology companies and brokerages. Our competitors may have substantially greater financial, marketing and other resources than we do and may have been in business longer than we have or have greater name recognition and be better established in the technological or real estate markets than we are. If we are unable to compete successfully with other businesses in our existing market, we may not achieve our projected revenue and/or user targets which may have a material adverse effect on our financial condition.

Volatility

The market price of our common shares could fluctuate significantly in response to various factors and events, including, but not limited to: our ability to execute our business plan; operating results below expectations; announcements regarding regulatory developments with respect to the real estate industry; our issuance of additional securities, including debt or equity or a combination thereof, necessary to fund our operating expenses; announcements of technological innovations or new products by us or our competitors; and period-to-period fluctuations in our financial results. In addition, the securities markets have from time to time experienced significant price and volume fluctuations that are unrelated to the operating performance of particular companies. These market fluctuations may also materially and adversely affect the market price of our common shares.

Loss of investment

An investment in our securities is speculative and involves a high degree of risk. Potential investors should be aware that the value of an investment in the Company may go down as well as up. In addition, there can be no certainty that the market value of an investment in the Company will fully reflect its underlying value. Investors could lose their entire investment. Because we can issue additional common shares, purchasers of our common shares may incur immediate dilution and experience further dilution.

As of the date of this MD&A, we are authorized to issue an unlimited number of common shares, of which 143,290 common shares are issued and outstanding. Our Board of Directors has the authority to cause us to issue additional common shares without consent of any of stockholders. Consequently, our stockholders may experience further dilution in their ownership of our stock in the future, which could have an adverse effect on the trading market for our common shares.

Furthermore, our Articles give our Board the right to create one or more new classes or series of shares. As a result, our Board may, without stockholder approval, issue shares of a new class or series with voting, dividend, conversion, liquidation or other rights that could adversely affect the voting power and equity interests of the holders of our common shares, as well as the price of our common shares.

Risks and uncertainties (cont’d)

Loss of investment (cont’d)

An investment in our securities is speculative and involves a high degree of risk. Potential investors should be aware that the value of an investment in the Company may go down as well as up. In addition, there can be no certainty that the market value of an investment in the Company will fully reflect its underlying value. Investors could lose their entire investment.

Cyber security threats

A cyber incident is an intentional or unintentional event that could threatens the integrity, confidentiality or availability of the Company’s information resources. These events include, but are not limited to, unauthorized access to information systems, a disruption to our information systems, or loss of confidential information. Real’s primary risks that could result directly from the occurrence of a cyber incident include operational interruption, damage to our public image and reputation, and/or potentially impact the relationships with our customers.

We have implemented processes, procedures and controls to mitigate these risks, including, but not limited to, firewalls and antivirus programs and training and awareness programs on the risks of cyber incidents. These procedures and controls do not guarantee that the financial results may not be negatively impacted by such an incident.

Subsequent events

Coronavirus (“COVID-19”)

Since December 31, 2019, the outbreak of the novel strain of coronavirus, specifically identified as “COVID-19”, has resulted in governments worldwide enacting emergency measures to combat the spread of the virus. These measures, which include the implementation of travel bans, self-imposed quarantine periods and social distancing, have caused a material interruption to businesses, resulting in a global economic slowdown.

The global equity markets have experienced significant volatility and weakness, with the government and central bank reacting with significant monetary and fiscal interventions designed to stabilize the economic conditions. The duration and impact of COVID-19 is unknown, as is the efficacy of the government and central bank interventions. It is not possible to reliably estimate the length and severity of those developments and the impact on the financial results and condition of the Company and its operating subsidiaries in future periods.

Outstanding Share Data

As of November 20, 2020, 143,290,651 Common Shares were issued and outstanding.

In addition, as of November 20, 2020, there were 13,837,468 stock options (“Options”) outstanding under the Stock Option Plan with exercises prices ranging from $0.10 to $0.95 per share and expiry dates ranging from January 2026 to August 2030. Each Option is exercisable for one Common Share. A total of 52,146 restricted share units (“RSUs”) were outstanding under the RSU Plan. Once vested, a total of 52,146 Common Shares will be issuable pursuant to the outstanding RSUs.

Additional information

These documents, as well as additional information regarding Real, have been filed electronically on Real’s website at www.joinreal.com.