As filed with the Securities and Exchange Commission on February 11, 2022

Registration Statement No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM F-1

REGISTRATION STATEMENT

Under

The Securities Act of 1933

Tritium DCFC Limited

(Exact name of Registrant as specified in its charter)

Not Applicable

(Translation of Registrant name into English)

| Australia | 6770 | Not Applicable | ||

(State or other jurisdiction of incorporation or organization) | (Primary Standard Industrial Classification Code Number) | (IRS Employer Identification Number) |

48 Miller Street

Murarrie, QLD 4172

Australia

+61 (07) 3147 8500

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Cogency Global Inc.

122 East 42nd Street, 18th Floor

New York, NY 10168

(800) 221-0102

(Name, address, including zip code, and telephone number, including area code, of agent for service)

With copies to:

Christopher Lueking

Ryan Maierson

Roderick Branch

Latham & Watkins LLP

330 North Wabash Avenue, Suite 2800

Chicago, IL 60611

(312)-876-7700

Approximate date of commencement of proposed sale to the public: As soon as practicable after this registration statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 (as amended, the “Securities Act”), check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act.

Emerging growth company ☒

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

| † | The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012. |

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act, or until this registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a) may determine.

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the U.S. Securities and Exchange Commission (the “SEC”) is effective. This preliminary prospectus is not an offer to sell nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

PRELIMINARY PROSPECTUS

SUBJECT TO COMPLETION, DATED FEBRUARY 11, 2022

115,368,935 Ordinary Shares

8,366,667 Warrants

21,783,334 Ordinary Shares Issuable Upon Exercise of Warrants

Tritium DCFC Limited

This prospectus relates to the offer and sale by the selling securityholders or their permitted transferees (collectively, the “Selling Securityholders”) of (A) up to 115,368,935 ordinary shares, no par value (“Ordinary Shares”), of Tritium DCFC Limited, a public limited company organized under the laws of Australia (the “Company”), consisting of (i) 95,306,435 Ordinary Shares issued to certain affiliated securityholders of the Company in connection with the Business Combination (as defined below), (ii) 7,500,000 Ordinary Shares the Company anticipates issuing to certain securityholders in connection with the Option Agreements (as defined below), (iii) 2,500,000 Ordinary Shares the Company anticipates issuing to Palantir Technologies Inc. in connection with the A&R Subscription Agreement (as defined below) and (iv) 10,062,500 Ordinary Shares held by Decarbonization Plus Acquisition Sponsor II LLC, a Delaware limited liability company (“DCRN Sponsor”) and certain previous independent directors of Decarbonization Plus Acquisition Corporation II, a Delaware corporation (“DCRN”) that were previously held as Class B common stock of DCRN, which was converted into Class A common stock of DCRN in accordance with DCRN’s amended and restated certificate of incorporation at the effective time of the Merger (as defined below) and subsequently exchanged for Ordinary Shares, and (B) up to 8,366,667 warrants originally issued to DCRN Sponsor and certain previous independent directors of DCRN, in connection with private placements by DCRN to such holders, including 1,000,000 of our Warrants that were issued to DCRN Sponsor at the closing of the business combination in connection with working capital loans made by DCRN Sponsor to DCRN (the “Private Placement Warrants”).

We are registering the offer and sale of the securities held by the Selling Securityholders, in some cases, to satisfy certain registration rights we have granted, and in other cases, to provide for resale by affiliates of the Company under the Securities Act. Subject to existing lockup or other restrictions on transfer, the Selling Securityholders may offer all or part of the securities for resale from time to time through public or private transactions, at either prevailing market prices or at privately negotiated prices. These securities are being registered to permit the Selling Securityholders to sell securities from time to time, in amounts, at prices and on terms determined at the time of offering. The Selling Securityholders may sell these securities through ordinary brokerage transactions, directly to market makers of our shares or through any other means described in the section entitled “Plan of Distribution” herein. In connection with any sales of ordinary shares offered hereunder, the Selling Securityholders, any underwriters, agents, brokers or dealers participating in such sales may be deemed to be “underwriters” within the meaning of the Securities Act of 1933, as amended, or the “Securities Act.”

We are registering these securities for resale by the Selling Securityholders named in this prospectus, or their transferees, pledgees, donees or assignees or other successors-in-interest (that receive any of the shares as a gift, distribution, or other non-sale related transfer).

We will not receive any proceeds from the sale of the securities by the Selling Securityholders, except with respect to amounts received by the Company upon exercise of the Warrants to the extent such Warrants are exercised for cash.

This prospectus also relates to the issuance by us of up to an aggregate of 21,783,334 Ordinary Shares, which consists of (i) up to 8,366,667 Ordinary Shares that are issuable upon the exercise of 8,366,667 Private Placement Warrants and (ii) up to 13,416,667 Ordinary Shares that are issuable upon the exercise of 13,416,667 Warrants, originally issued as warrants of DCRN sold to the public in DCRN’s initial public offering (“Public Warrants” and, together with the Private Placement Warrants, the “Warrants”). This prospectus also relates to the resale by DCRN Sponsor and certain previous independent directors of DCRN of the 8,366,667 Ordinary Shares issuable upon the exercise of the Private Placement Warrants. We will receive the proceeds from any exercise of any warrants for cash.

This prospectus also covers any additional securities that may become issuable by reason of share splits, share dividends or other similar transactions.

Our Ordinary Shares and Warrants are listed on The Nasdaq Stock Market LLC (“Nasdaq”) under the trading symbols “DCFC” and “DCFCW,” respectively. The last reported sale price of our Ordinary Shares on February 10, 2022 was $13.33 per share.

We may amend or supplement this prospectus from time to time by filing amendments or supplements as required. You should read this entire prospectus and any amendments or supplements carefully before you make your investment decision.

We are an “emerging growth company” and a “foreign private issuer” as defined under the Securities and Exchange Commission, or SEC, rules and will be subject to reduced public company reporting requirements for this prospectus and future filings. See “Prospectus Summary—Implications of Being an Emerging Growth Company and a Foreign Private Issuer.”

Investing in our securities involves a high degree of risk. See “Risk Factors” beginning on page 9 of this prospectus and other risk factors contained in the documents incorporated by reference herein for a discussion of information that should be considered in connection with an investment in our securities.

Neither the U.S. Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

PROSPECTUS DATED , 2022

TABLE OF CONTENTS

| Page | ||||

| ii | ||||

| iii | ||||

| iii | ||||

| iii | ||||

| iv | ||||

| v | ||||

| 1 | ||||

| 7 | ||||

| 9 | ||||

| 44 | ||||

| 46 | ||||

| 53 | ||||

| 58 | ||||

| 60 | ||||

| 61 | ||||

UNAUDITED PRO FORMA CONDENSED COMBINED FINANCIAL INFORMATION | 62 | |||

| 76 | ||||

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | 95 | |||

| 121 | ||||

| 129 | ||||

| 142 | ||||

| 154 | ||||

| 161 | ||||

| 163 | ||||

| 165 | ||||

| 168 | ||||

| 171 | ||||

| 172 | ||||

| 172 | ||||

ENFORCEABILITY OF CIVIL LIABILITIES AND AGENT FOR SERVICE OF PROCESS IN THE UNITED STATES | 172 | |||

| 173 | ||||

| F-1 | ||||

You should rely only on the information contained or incorporated by reference in this prospectus or any supplement. Neither we nor the Selling Securityholders have authorized anyone else to provide you with different information. The securities offered by this prospectus are being offered only in jurisdictions where the offer is permitted. You should not assume that the information in this prospectus or any supplement is accurate as of any date other than the date on the front of each document. Our business, financial condition, results of operations and prospects may have changed since that date.

Except as otherwise set forth in this prospectus, neither we nor the Selling Securityholders have taken any action to permit a public offering of these securities outside the United States or to permit the possession or distribution of this prospectus outside the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about and observe any restrictions relating to the offering of these securities and the distribution of this prospectus outside the United States.

i

This prospectus is part of a registration statement on Form F-1 filed with the SEC by Tritium DCFC Limited. The Selling Securityholders named in this prospectus may, from time to time, sell the securities described in this prospectus in one or more offerings. This prospectus includes important information about us, the Ordinary Shares, the Warrants and other information you should know before investing. Any prospectus supplement may also add, update, or change information in this prospectus. If there is any inconsistency between the information contained in this prospectus and any prospectus supplement, you should rely on the information contained in that particular prospectus supplement. This prospectus does not contain all of the information provided in the registration statement that we filed with the SEC. You should read this prospectus together with the additional information about us described in the section below entitled “Where You Can Find More Information.” You should rely only on information contained in this prospectus. We have not, and the Selling Securityholders have not, authorized anyone to provide you with information different from that contained in this prospectus. The information contained in this prospectus is accurate only as of the date on the front cover of the prospectus. You should not assume that the information contained in this prospectus is accurate as of any other date.

The Selling Securityholders may offer and sell the securities through agents or to or through underwriters or dealers. A prospectus supplement, if required, may describe the terms of the plan of distribution and set forth the names of any agents, underwriters or dealers involved in the sale of securities. See “Plan of Distribution.”

Unless otherwise indicated, references to a particular “fiscal year” are to our fiscal year ended June 30 of that year. Our fiscal quarters end on March 31, September 30 and December 31.

References to a year other than a “Fiscal” or “fiscal year” are to the calendar year ended December 31. Unless otherwise specified, all monetary amounts in this prospectus are in U.S. dollars, all references to “$,” “US$,” “USD” and “dollars” mean U.S. dollars and all references to “A$” and “AUD” mean Australian dollars. Any discrepancies in any table between totals and sums of the amounts listed are due to rounding. Certain amounts and percentages have been rounded; consequently, certain figures may add up to be more or less than the total amount and certain percentages may add up to be more or less than 100% due to rounding. In particular and without limitation, amounts expressed in millions contained in this prospectus have been rounded to a single decimal place for the convenience of readers.

Throughout this prospectus, unless otherwise designated, the terms “we,” “us,” “our,” “Tritium,” the “Company” and our “company” refer to Tritium DCFC Limited and its subsidiaries and references to “Tritium Holdings” refer to Tritium Holdings Pty Ltd.

ii

This prospectus contains estimates, projections, and other information concerning our industry and business, as well as data regarding market research, estimates, and forecasts prepared by our management. Information that is based on estimates, forecasts, projections, market research, or similar methodologies is inherently subject to uncertainties, and actual events or circumstances may differ materially from events and circumstances that are assumed in this information. The industry in which we operate is subject to a high degree of uncertainty and risk due to a variety of factors, including those described in the section titled “Risk Factors.” Unless otherwise expressly stated, we obtained industry, business, market, and other data from reports, research surveys, studies, and similar data prepared by market research firms and other third parties, industry and general publications, government data, and similar sources. In some cases, we do not expressly refer to the sources from which this data is derived. In that regard, when we refer to one or more sources of this type of data in any paragraph, you should assume that other data of this type appearing in the same paragraph is derived from sources that we paid for, sponsored, or conducted, unless otherwise expressly stated or the context otherwise requires. While we have compiled, extracted, and reproduced industry data from these sources, we have not independently verified the data. Forecasts and other forward-looking information with respect to industry, business, market, and other data are subject to the same qualifications and additional uncertainties regarding the other forward-looking statements in this prospectus. See “Cautionary Note Regarding Forward-Looking Statements.”

We own or have rights to various trademarks, service marks and trade names that they use in connection with the operation of their respective businesses. This prospectus also contains trademarks, service marks and trade names of third parties, which are the property of their respective owners. The use or display of third parties’ trademarks, service marks, trade names or products in this prospectus is not intended to create, and does not imply, a relationship with us, or an endorsement or sponsorship by or of us. Solely for convenience, the trademarks, service marks and trade names referred to in this prospectus may appear with the ®, TM or SM symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the right of the applicable licensor to these trademarks, service marks and trade names.

PRESENTATION OF FINANCIAL INFORMATION

We were established on May 7, 2021 for the purpose of effectuating the Business Combination described herein. Accordingly, no financial statements of Tritium DCFC Limited have been included in this prospectus. This prospectus contains:

| • | the audited consolidated financial statements of Decarbonization Plus Acquisition Corporation II (“DCRN”) as of December 31, 2020 and for the period from December 4, 2020 (inception) to December 31, 2020 and the unaudited consolidated financial statements of DCRN as of and for the nine months ended September 30, 2021; and |

| • | the audited consolidated financial statements of Tritium Holdings Pty Ltd (“Tritium Holdings”) as of and for the fiscal years ended June 30, 2021 and 2020. |

Unless indicated otherwise, financial data presented in this prospectus has been taken from the audited and unaudited consolidated financial statements of DCRN and Tritium Holdings, as applicable, included in this prospectus. Where information is identified as “unaudited,” it has not been subject to an audit. Unless otherwise indicated, financial information of DCRN and Tritium Holdings has been prepared in accordance with accounting principles generally accepted in the United States (“U.S. GAAP”).

iii

Our reporting currency is the U.S. dollar. The determination of the functional and reporting currency of each group company is based on the primary currency in which the group company operates. For us, the Australian dollar is the functional currency. The functional currency of our subsidiaries is the local currency.

The translation of foreign currencies into U.S. dollars is performed for assets and liabilities at the end of each reporting period based on the then current exchange rates. For revenue and expense accounts, an average monthly foreign currency rate is applied. Adjustments resulting from translating foreign functional currency financial statements into U.S. dollars is recorded as part of a separate component of shareholders’ deficit and reported in our Consolidated Statements of Comprehensive Loss. Foreign currency transaction gains and losses are included in other income (expense), net for the period.

iv

Segment gross (loss), a measure our management uses to assess the operating performance of its segments, is a non-GAAP measure for reporting used by us calculated as total revenue less total cost of goods sold (exclusive of depreciation).

Segment gross margin, a measure our management uses to assess the operating performance of its segments, is Segment gross (loss) expressed as a percentage of total revenue. We offer a range of EV chargers with each charger having a varied contribution to Segment gross (loss).

Segment gross (loss) and Segment gross margin vary from period to period due to the mix of products sold, manufacturing costs and warranty costs.

Financial measures that are not in accordance with U.S. GAAP should not be considered as alternatives to operating income, cash flows from operating activities or any other performance measures derived in accordance with U.S. GAAP. These measures have important limitations as analytical tools, and you should not consider them in isolation or as a substitute for analysis of our results as reported under U.S. GAAP. Because of these limitations, we rely primarily on its U.S. GAAP results and uses Segment gross (loss) and Segment gross margin only as supplements. For the purpose of reconciling non-GAAP financial measures to the most directly comparable GAAP measures, we have calculated gross (loss) and gross margin inclusive of the allocation of relevant depreciation and amortization in accordance with GAAP. Gross (loss) is calculated as total revenue less total cost of goods sold (exclusive of depreciation) and depreciation expense attributable to segments, gross margin is gross (loss) expressed as a percentage of total revenue. It is to be noted that GAAP gross (loss) and gross margin are not presented in the financial statements. See below for reconciliations of Segment gross (loss) to gross (loss) and Segment gross margin to gross margin:

| Group | ||||||||

| Year Ended June 30, 2021 $’000 | Year Ended June 30, 2020 $’000 | |||||||

Total revenue | 56,157 | 46,969 | ||||||

Total cost of goods sold (exclusive of depreciation) | (58,061 | ) | (47,943 | ) | ||||

Segment depreciation expense | (926 | ) | (584 | ) | ||||

|

|

|

| |||||

Gross (loss) | (2,830 | ) | (1,558 | ) | ||||

|

|

|

| |||||

Add back | ||||||||

Segment depreciation expense | (926 | ) | (584 | ) | ||||

|

|

|

| |||||

Segment gross (loss) | (1,904 | ) | (974 | ) | ||||

|

|

|

| |||||

Gross (loss) | (2,830 | ) | (1,558 | ) | ||||

Total revenue | 56,157 | 46,969 | ||||||

|

|

|

| |||||

Gross margin | (5.0 | )% | (3.3 | )% | ||||

|

|

|

| |||||

Segment gross (loss) | (1,904 | ) | (974 | ) | ||||

Total revenue | 56,157 | 46,969 | ||||||

|

|

|

| |||||

Segment gross margin | (3.4 | )% | (2.1 | )% | ||||

v

This summary highlights certain information about us, this offering and selected information contained elsewhere in this prospectus. This summary is not complete and does not contain all of the information that you should consider before deciding whether to invest in the securities covered by this prospectus. You should read the following summary together with the more detailed information in this prospectus, any related prospectus supplement and any related free writing prospectus, including the information set forth in the section titled “Risk Factors” in this prospectus, any related prospectus supplement and any related free writing prospectus in their entirety before making an investment decision.

Overview

We design, sell, manufacture and service proprietary hardware and associated software to create advanced and reliable direct current (“DC”) fast chargers for electric vehicles (“EVs”). Our technology is engineered to be easy to install, own and use. Our compact, robust chargers are designed to look great on Main Street and thrive in harsh conditions. Founded in Brisbane and, as of December 31, 2021, having already sold more than 6,700 DC fast chargers, we have provided more than 3.6 million high-power charging sessions across 41 countries, delivering an aggregate of over 55 gigawatts of energy.

Major auto manufacturers such as BMW, Ford, GM, Honda, and Volkswagen, among others, have committed to producing more EVs and various governments have begun implementing supportive policies. For example, a bipartisan infrastructure bill supports a $7.5 billion investment toward new EV chargers in the United States over the next decade and the Biden Administration has established a target for 50% of all new car sales to be electric by 2030. In the coming years, we believe EVs will cost less than internal combustion engine (“ICE”) vehicles. BNEF has forecasted that this price parity in Europe can be achieved by 2027, and in all countries and vehicle segments by 2029. In addition, BNEF has forecasted that EVs are expected to increase from 4% of global passenger vehicle sales in 2020 to 68% by 2040. Additional factors propelling this shift from ICE vehicles to EVs include proposed fossil fuel bans or restrictions, transit electrification mandates and utility incentive programs. However, the global transition to an EV-based transportation network will depend on, among other things, the availability of sufficient charging infrastructure. Accordingly, a BNEF report projects that the cumulative EV charging infrastructure investment in the United States and Europe will be approximately $60 billion by 2030 and increasing to $192 billion by 2040. We believe we are at the forefront of the charging equipment build-out, focusing exclusively on DC fast charging of EVs.

Recent Developments

Business Combination

On May 25, 2021, we entered into a Business Combination Agreement (the “Business Combination Agreement”) with Decarbonization Plus Acquisition Corporation II, a Delaware corporation (“DCRN”), Tritium Holdings Pty Ltd, an Australian proprietary company limited by shares (including its subsidiaries, “Tritium Holdings”) and Hulk Merger Sub, Inc., a Delaware corporation and wholly owned subsidiary of the Company (“Merger Sub”), pursuant to which, among other things, we acquired all of the issued equity interests in Tritium Holdings and DCRN merged with and into Merger Sub, in each case, on the terms and subject to the conditions set forth therein (the “Business Combination”).

On January 13, 2022 (the “Closing Date”), we consummated the Business Combination through the following transactions:

| • | Pursuant to the share transfer agreement we entered into with DCRN, Tritium Holdings and all then-existing Tritium Holdings shareholders, the holders of ordinary shares in Tritium (“Tritium Shares”) |

1

transferred their Tritium Shares to our company in exchange for an aggregate of 120,000,000 Ordinary Shares and we became the ultimate parent company of Tritium Holdings and any subsidiaries of Tritium Holdings; |

| • | Merger Sub merged with and into DCRN (the “Merger”), with DCRN surviving as our wholly owned subsidiary, as a result of which each share of Class A common stock of DCRN (other than those shares redeemed) (the “DCRN Class A Common Stock”) were exchanged for one Ordinary Share and each DCRN warrant (“DCRN Warrant”) to acquire one share of common stock of DCRN was automatically converted into a Warrant to acquire one Ordinary Share and thereupon were assumed by us pursuant to the (i) Warrant Assignment and Assumption Agreement we entered into with DCRN, Continental Stock Transfer & Trust Company, Computershare Inc. and Computershare Trust Company, N.A. on the Closing Date (the “Warrant Assignment and Assumption Agreement”) and (ii) Amended and Restated Warrant Agreement we entered into with Computershare Inc. and Computershare Trust Company, N.A on the Closing Date, as adjusted in accordance with the terms of the agreement (the “A&R Warrant Agreement”); and |

| • | At the effective time of the Merger, each share of Class B common stock of DCRN (“DCRN Class B Common Stock”) was cancelled and converted into DCRN Class A Common Stock in accordance with DCRN’s amended and restated certificate of incorporation and, accordingly, were exchanged for Ordinary Shares pursuant to the Merger. |

Post-Business Combination Financing

Subscription Agreement

On July 27, 2021, we entered into a subscription agreement (the “Subscription Agreement”) with DCRN and Palantir Technologies Inc. (“Palantir”). We waived the condition to the closing of the Business Combination that, as of the closing, the amount of funds contained in DCRN’s trust account (net of the aggregate amount of cash proceeds required to satisfy any exercise by DCRN’s shareholders of their redemption rights and net of DCRN’s fees and expenses incurred in connection with the Business Combination) plus the amount of cash proceeds to us resulting from any private placements of our Ordinary Shares consummated in connection with the Closing be at least $200,000,000 (the “Minimum Cash Waiver”). As a result of the Minimum Cash Waiver, Palantir exercised its rights under the Subscription Agreement not to consummate its investment in our company.

On January 31, 2022, we and DCRN entered into an amended and restated Subscription Agreement (the “A&R Subscription Agreement”) with Palantir, pursuant to which we granted to Palantir the contingent right to subscribe for and purchase, and Palantir committed to subscribe for and purchase, an aggregate of up to 2,500,000 Ordinary Shares (the “Subscription Shares”), subject to certain conditions, for an exercise price of $6.00 per share and an aggregate purchase price of up to $15.0 million. We intend to provide notice to Palantir that we elect to exercise our right under the A&R Subscription Agreement to issue the 2,500,000 Subscription Shares to Palantir, and we expect to receive gross proceeds of approximately $15.0 million from the issuance and expect settlement to occur on or about, or prior to, March 17, 2022.

Option Agreements

On the Closing Date, we entered into separate option agreements (each, an “Option Agreement”) with each of (i) St Baker Energy Holdings Pty Ltd, (ii) Varley Holdings Pty Ltd, (iii) Ilwella Pty Ltd and (iv) Decarbonization Plus Acquisition Sponsor II LLC (each a “Holder”), pursuant to which we granted to the Holders the contingent right to subscribe for and purchase, and the Holders committed to subscribe for and purchase, an aggregate of up to 7,500,000 Ordinary Shares (the “Option Shares”), for an exercise price of $6.00 per share (the “Option Exercise Price”) and an aggregate purchase price of up to $45.0 million.

2

On January 27, 2022, we provided notice to the Holders that we elected to exercise our rights under the Option Agreements to issue an aggregate of 7,500,000 Ordinary Shares to the Holders in the amounts set forth in the table below. We expect to receive gross proceeds of approximately $45.0 million from the issuance and expect settlement to occur on or about, or prior to, March 17, 2022. The Option Shares that will be issued pursuant to the Option Agreements will not initially be registered under the Securities Act, in reliance upon the exemption provided in Section 4(a)(2) of the Securities Act. See “Certain Relationships and Related Person Transactions” for additional information.

Holder | Option Shares | |||

Decarbonization Plus Acquisition Sponsor II LLC | 3,333,333 | |||

St Baker Energy Holdings Pty Ltd | 2,500,834 | |||

Varley Holdings Pty Ltd | 895,333 | |||

Ilwella Pty Ltd | 770,500 | |||

Total | 7,500,000 | |||

Implications of Being an “Emerging Growth Company” and a Foreign Private Issuer

We are an “emerging growth company,” as defined in Section 2(a) of the Securities Act, as modified by the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”). As such, we are eligible to take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not “emerging growth companies,” including, but not limited to, not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002 (the “Sarbanes-Oxley Act”), reduced disclosure obligations regarding executive compensation in our periodic reports, and exemptions from the requirements of holding a non-binding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved (to the extent applicable to a foreign private issuer). If some investors find our securities less attractive as a result, there may be a less active trading market for our securities and the prices of our securities may be more volatile.

We will remain an emerging growth company under the JOBS Act until the earliest of (a) the last day of our first fiscal year following the fifth anniversary of DCRN’s IPO, (b) the last date of our fiscal year in which we have total annual gross revenue of at least $1.07 billion, (c) the date on which we are deemed to be a “large accelerated filer” under the rules of the SEC with at least $700.0 million of outstanding securities held by non-affiliates or (d) the date on which we have issued more than $1.0 billion in non-convertible debt securities during the previous three years. References herein to “emerging growth company” shall have the meaning associated with it in the JOBS Act.

We report under the Securities Exchange Act of 1934, as amended (the “Exchange Act”) as a non-U.S. company with foreign private issuer status. Even after we no longer qualify as an emerging growth company, as long as we qualify as a foreign private issuer under the Exchange Act we will be exempt from certain provisions of the Exchange Act that are applicable to U.S. domestic public companies, including, but not limited to:

| • | the rules under the Exchange Act requiring domestic filers to issue financial statements prepared under U.S. GAAP; |

| • | the sections of the Exchange Act regulating the solicitation of proxies, consents or authorizations in respect of a security registered under the Exchange Act; |

| • | the sections of the Exchange Act requiring insiders to file public reports of their stock ownership and trading activities and liability for insiders who profit from trades made in a short period of time; and |

| • | the rules under the Exchange Act requiring the filing with the SEC of quarterly reports on Form 10-Q containing unaudited financial and other specific information, or current reports on Form 8-K, upon the occurrence of specified significant events. |

3

We intend to take advantage of these exemptions until such time as we are no longer a foreign private issuer. We would cease to be a foreign private issuer at such time as (i) more than 50% of our outstanding voting securities are held by U.S. residents and (ii) any of the following three circumstances applies: (A) the majority of our executive officers or directors are U.S. citizens or residents, (B) more than 50% of our assets are located in the United States or (C) our business is administered principally in the United States.

Both foreign private issuers and emerging growth companies are also exempt from certain more stringent executive compensation disclosure rules. Thus, even if we no longer qualify as an emerging growth company but remain a foreign private issuer, we will continue to be exempt from the more stringent compensation disclosures required of companies that are not emerging growth companies and will continue to be permitted to follow our home country practice on such matters.

Our Corporation Information

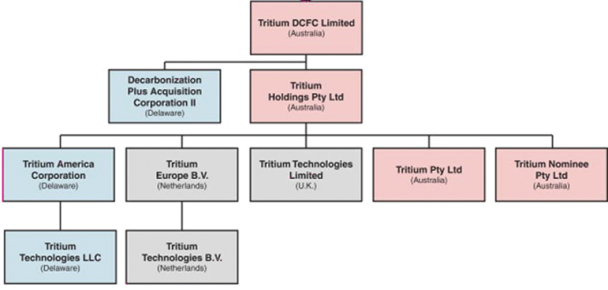

The following chart shows our organization structure as of the date of this prospectus:

Risk Factor Summary

Investing in our securities entails a high degree of risk as more fully described under “Risk Factors.” You should carefully consider such risks before deciding to invest in our securities. These risks include, among others:

| • | We are a growth-stage company with a history of losses, and we expect to incur significant expenses and continuing losses for the near-term. |

| • | We have experienced rapid growth and expect to invest in growth for the foreseeable future. If we fail to manage our growth effectively, our business, operating results and financial condition could be adversely affected. |

| • | We currently face competition from a number of companies and expect to face significant competition in the future as the market for EV charging develops. |

| • | We face risks related to health pandemics, including the recent COVID-19 pandemic, which could have a material adverse effect on our business and results of operations. |

4

| • | We rely on a limited number of suppliers and manufacturers of certain key components for our charging stations. A loss of any of these partners, including as a result of a global supply shortage or major shipping disruption, could negatively affect our business, financial condition and operating results. |

| • | We are dependent on a limited number of significant customers and distributors for a substantial portion of our revenues. The loss of any such customer or distributor, a reduction in sales to any such customer or distributor, or the decline in the financial condition of any such customer or distributor could have a material adverse effect on our business, financial condition, and results of operations if they are not replaced with another large sales order. |

| • | We are expanding our operations internationally, which will expose us to additional tax, compliance, market and other risks. |

| • | If a safety issue occurs with our products, or similar products from another manufacturer, there could be adverse publicity around our products or the safety of charging stations generally, which could adversely affect our business and results of operations. |

| • | If products in our product roadmap, including our software licenses, do not achieve projected sales in the future in their planned channel, revenue forecasts for that product will not be met and our results of operations could be adversely affected. |

| • | Our future growth and success is highly correlated with, and thus dependent upon, the continuing rapid adoption of EVs for passenger and fleet applications. |

| • | The EV charging industry is characterized by rapid technological change, which requires us to continue to develop new products and product innovations. Any delays or failures in such development could adversely affect market adoption of our products and our financial results. |

| • | Our technology could have undetected defects, errors or bugs in hardware or software, which could reduce market adoption, damage our reputation with current or prospective customers and drivers, and/or expose us to product liability and other claims that could materially and adversely affect our business. |

| • | We expect to generate revenue from services and support of our customer installation base. Inadequate services and support could significantly reduce our profitability. |

| • | Future revenue from our software business will depend on customers renewing their services subscriptions and subscribing to newly developed software license offerings. If customers do not agree to pay for the software that they have been previously making use of or stop using the software or any of our other subscription offerings, or if customers fail to add more stations, our business and operating results will be adversely affected. |

| • | We incur significant increased expenses and administrative burdens as a public company, which could have an adverse effect on our business, financial condition and results of operations. |

| • | We have identified material weaknesses in our internal control over financial reporting. If we are unable to remediate these material weaknesses, or if we identify additional material weaknesses in the future or otherwise fail to maintain an effective system of internal control over financial reporting, this may result in material misstatements of our consolidated financial statements or cause us to fail to meet our periodic reporting obligations. |

| • | Our financial condition and results of operations are likely to fluctuate in the future due to, among other things, the cyclical nature of the automotive industry, which could cause our results to fall below expectations, resulting in a decline in the price of our Ordinary Shares. |

| • | We may be adversely affected by foreign currency fluctuations. |

| • | Data protection laws, and similar domestic or foreign regulations, may adversely affect our business. |

5

| • | Failure to comply with anticorruption and anti-money laundering laws, including the FCPA and similar laws associated with activities outside of the United States, could subject us to penalties and other adverse consequences. |

| • | We could be adversely impacted if we fail to comply with U.S. and international import and export laws. |

| • | Failure to comply with laws relating to labor and employment could subject us to penalties and other adverse consequences. |

| • | As a “foreign private issuer” under the rules and regulations of the SEC, we are permitted to, and may, file less or different information with the SEC than a company incorporated in the United States or otherwise not filing as a “foreign private issuer,” and we follow certain home country corporate governance practices in lieu of certain Nasdaq requirements applicable to U.S. issuers. |

6

The summary below describes the principal terms of the offering. The “Description of Securities” section of this prospectus contains a more detailed description of the Company’s Ordinary Shares and Warrants.

Securities being registered for resale by the Selling Stockholders named in the prospectus | (i) 115,368,935 Ordinary Shares and (ii) 8,366,667 Warrants. |

Ordinary Shares being offered by us upon exercise of Warrants | Up to (i) 8,366,667 Ordinary Shares that are issuable upon the exercise of 8,366,667 Private Placement Warrants and (ii) up to 13,416,667 Ordinary Shares that are issuable upon the exercise of 13,416,667 Public Warrants. This prospectus also relates to the resale by DCRN Sponsor and certain previous independent directors of DCRN of the 8,366,667 Ordinary Shares issuable upon the exercise of the Private Placement Warrants. |

Term of Warrants | Each Warrant entitles the registered holder to purchase one Ordinary Share at a price of $6.90 per Ordinary Share. Our Warrants expire on January 13, 2027 at 5:00 p.m., New York City time. |

Offering prices | The securities offered by this prospectus may be offered and sold at prevailing market prices, privately negotiated prices or such other prices as the Selling Securityholders may determine. See “Plan of Distribution.” |

Ordinary Shares issued prior to any exercise of Warrants (as of February 7, 2022) | 135,380,695 Ordinary Shares. |

Warrants issued (as of February 7, 2022) | 21,783,334 Warrants. |

Ordinary Shares outstanding assuming exercise of all Warrants (as of February 7, 2022) | 157,164,029 Ordinary Shares. |

Use of proceeds | We will receive up to an aggregate of approximately $150.3 million from the exercise of the Warrants, assuming the exercise in full of all of the Warrants for cash. If the Warrants are exercised pursuant to a cashless exercise feature, we will not receive any cash from these exercises. We expect to use the net proceeds from the exercise of the Warrants, if any, for general corporate purposes. Our management will have broad discretion over the use of proceeds from the exercise of the Warrants. See “Use of Proceeds.” All of the Ordinary Shares and Warrants (including Ordinary Shares issuable upon the exercise of such Warrants) offered by the Selling Securityholders pursuant to this prospectus will be sold by the Selling Securityholders for their respective accounts. We will not receive any of the proceeds from these sales. |

Dividend policy | We have never declared or paid any cash dividend on our Ordinary Shares. We currently intend to retain any future earnings and do not |

7

expect to pay any dividends in the foreseeable future. Any further determination to pay dividends on our ordinary shares would be at the discretion of our board of directors, subject to applicable laws, and would depend on our financial condition, results of operations, capital requirements, general business conditions, and other factors that our board of directors may deem relevant. |

Market for our Ordinary Shares and Warrants | Our Ordinary Shares and Warrants are listed on Nasdaq under the trading symbols “DCFC” and “DCFCW,” respectively. |

Risk factors | Prospective investors should carefully consider the “Risk Factors” for a discussion of certain factors that should be considered before buying the securities offered hereby. |

8

You should carefully consider the risks described below before making an investment decision. Additional risks not presently known to us or that we currently deem immaterial may also impair our business operations. Our business, financial condition or results of operations could be materially and adversely affected by any of these risks. The trading price and value of our Ordinary Shares and Warrants could decline due to any of these risks, and you may lose all or part of your investment. This prospectus also contains forward-looking statements that involve risks and uncertainties. Our actual results could differ materially from those anticipated in these forward-looking statements as a result of certain factors, including the risks faced by us described below and elsewhere in this prospectus.

Risks Related to Our Business

We are a growth-stage company with a history of losses, and we expect to incur significant expenses and continuing losses for the near-term.

Tritium Holdings incurred total comprehensive losses of $35.0 million and $63.2 million for the year ended June 30, 2020, and the year ended June 30, 2021, respectively. We believe we will continue to incur operating and net losses for the near-term. Even if we achieve profitability, there can be no assurance that we will be able maintain profitability in the future. Our potential profitability is particularly dependent upon the continued adoption of EVs by consumers and fleet operators, the widespread adoption of electric trucks and other vehicles, and other electric transportation modalities, which may not occur. Further, EV charging is a developing technology and our future business performance is dependent upon our ability to build and sell a differentiated technology. If EV charging technology commoditizes and prices decrease more rapidly than we have forecasted, our market share and results of operations may be adversely impacted.

We have experienced rapid growth and expect to invest in growth for the foreseeable future. If we fail to manage growth effectively, our business, operating results and financial condition could be adversely affected.

We have experienced rapid growth in recent periods. For example, the number of full-time employees has grown from 222 in 2018 to 358 as of December 31, 2021. The growth and expansion of our business has placed and continues to place a significant strain on management, operations, financial infrastructure and corporate culture. In the event of further growth, our information technology systems and our internal control over financial reporting and procedures may not be adequate to support our operations and may introduce opportunities for data security incidents that may interrupt business operations and permit bad actors to obtain unauthorized access to business information or misappropriate funds. We may also face risks to the extent such bad actors infiltrate the information technology infrastructure of our contractors.

To manage growth in operations and personnel, we will need to continue to improve our operational, financial and management controls and reporting systems and procedures. Failure to manage growth effectively could result in difficulty or delays in attracting new customers, declines in quality or customer satisfaction, increases in costs, difficulties in introducing new products and services or enhancing existing products and services, loss of customers, loss of key personnel, information security vulnerabilities or other operational difficulties, any of which could adversely affect our business performance and operating results.

We currently face competition from a number of companies and expect to face significant competition in the future as the market for EV charging develops.

The EV charging industry is relatively new, and the competitive landscape is still developing. Successfully penetrating large emerging EV markets, such as North America and Europe, will require early engagement with customers to gain market share, and ongoing efforts to scale channels, installers, teams and processes. Our potential entrance into additional Asia-Pacific markets such as Japan, South Korea and Singapore may require

9

establishing us against existing competitors. In addition, there are multiple competitors in North America and Europe that could begin selling and commissioning chargers of lower quality which, in turn, may cause poor driver experiences, hampering overall EV adoption or trust in EV charging providers.

We believe that we are differentiated from current publicly listed EV charger manufacturers in that we focus exclusively on developing DC fast charging solutions. However, there are other means for charging EVs and the continued or future adoption of such other means could affect the demand for our DC fast charging products and services. For example, Tesla Inc. (“Tesla”), continues to build out its proprietary supercharger network across the United States for Tesla vehicles and has announced that it plans to open this network to other EVs beginning later in 2021, which could reduce overall demand for DC fast charging at other sites. Also, third-party contractors can provide basic electric charging capabilities to potential customers seeking on-premise EV charging capability. In addition, many EV charging manufacturers are offering home charging equipment, which could reduce demand for on-premise charging capabilities if EV owners find charging at home to be sufficient. Further, the continued or future adoption of other home charging technologies could reduce the demand for our planned home charging product offerings.

Further, our current or potential competitors may be acquired by third parties with greater available resources. As a result, competitors may be able to respond more quickly and effectively than us to new or changing opportunities, technologies, standards or customer requirements and may have the ability to initiate or withstand substantial price competition. In addition, competitors may in the future establish cooperative relationships with vendors of complementary products, technologies or services to increase the availability of their solutions in the marketplace. This competition may also materialize in the form of costly intellectual property disputes or litigation.

New competitors or alliances may emerge in the future that have greater market share, more widely adopted technologies, greater marketing expertise and greater financial resources, which could put us at a competitive disadvantage. Future competitors could also be better positioned to serve certain segments of our current or future target markets, which could create price pressure. In light of these factors, even if our offerings are more effective and of higher quality than those of our competitors, current or potential customers may accept competitive solutions. If we fail to adapt to changing market conditions or compete unsuccessfully with current charging providers or new competitors, our growth will be limited, which would adversely affect our business and results of operations.

We face risks related to health pandemics, including the recent COVID-19 pandemic, which could have a material adverse effect on our business and results of operations.

The impact of the COVID-19 pandemic, including changes in consumer and business behavior, pandemic fears and market downturns, and restrictions on business and individual activities, has created significant volatility in the global economy and led to reduced economic activity. The impact of the COVID-19 pandemic has also resulted in a disruption in the manufacturing, delivery and overall supply chain of vehicle manufacturers and suppliers, and has led to a decrease in EV sales in markets around the world. Any sustained downturn in demand for EVs would harm our business.

Throughout the COVID-19 pandemic, government authorities have implemented numerous measures to try to contain the virus, such as travel bans and restrictions, quarantines, stay-at-home or shelter-in-place orders, and business shutdowns. The reimplementation of these measures upon a resurgence of the virus or a rise in variants may adversely impact our employees and operations and the operations of our customers, suppliers, vendors and business partners, and may negatively impact demand for EV charging stations, particularly at workplaces. These measures by government authorities may remain in place for a significant period of time and may adversely affect manufacturing and building plans, sales and marketing activities, business and results of operations.

The COVID-19 pandemic has also prompted a trend towards expanding contractual liability, including penalties for delivery and service delays and force majeure clauses for suppliers, which could have a material

10

adverse effect on our business and results of operations if delivery or servicing of its products is delayed due to COVID-19 restrictions or similar events. There is an increased risk of both litigation and loss of business due to service and delivery delays resulting from COVID-19 pandemic impacts.

The impact of the COVID-19 pandemic on international shipping and air freight, including fewer available shipping providers and routes and air freight capacity and routes and significantly increased costs, has increased our cost of goods sold and may continue to increase cost of goods sold in the future. Additionally, any future shipping or air freight delays and cost increases as a result of the COVID-19 pandemic, or any future pandemic or resurgence, could have a material adverse effect on our business and results of operations.

The extent to which the COVID-19 pandemic impacts our business, prospects and results of operations will depend on future developments, which are highly uncertain and cannot be predicted with certainty, including, but not limited to, the rise and prevalence of future resurgences or variants, duration and spread of the pandemic, its severity, the actions to contain the virus or treat its impact, and when and to what extent normal economic and operating activities can resume. The COVID-19 pandemic could limit the ability of customers, suppliers, vendors and business partners to perform, including third-party suppliers’ ability to provide components and materials used in charging stations or in providing commissioning or maintenance services. Additionally, the COVID-19 pandemic has already led to and may continue to lead to additional cost increases in the component parts used to manufacture and service EV charging stations, impacting our business and results of operations. Even after the COVID-19 pandemic has subsided, we may continue to experience an adverse impact to our business as a result of its global economic impact, including any recession that has occurred or may occur in the future.

The COVID-19 pandemic has also led to less international migration, impacting job markets in the countries that we operate in, specifically increasing labor costs and the cost of attracting talented executives, sales staff and engineers, and also limiting the available pool of talent due to international travel restrictions and quarantine requirements, leading to labor being less mobile for interstate and international moves. These restrictions could have a material adverse effect on our business and results of operations.

Specifically, difficult macroeconomic conditions, such as decreases in per capita income and level of disposable income, increased and prolonged unemployment or a decline in consumer confidence as a result of the COVID-19 pandemic, as well as reduced spending by businesses, could each have a material adverse effect on the demand for our products and services.

We rely on a limited number of suppliers and manufacturers of certain key components for our charging stations. A loss of any of these partners, including as a result of a global supply shortage or major shipping disruption, could negatively affect our business, financial condition and operating results.

We rely on a limited number of suppliers to manufacture components for our charging stations, including in some cases only a single supplier for some products and components. This reliance on a limited number of suppliers increases our risks, since we do not currently have proven reliable alternative or replacement suppliers for certain components beyond these key parties, and in some cases replacing the supplier would require re-certification of the charging station by relevant regulatory authorities. In the event of a disruption, we may not be able to increase capacity from other sources, or develop alternate or secondary sources, without incurring material additional costs and substantial delays. Thus, our business could be adversely affected if one or more of our suppliers is impacted by any raw materials shortages or price increases, or manufacturing, shipping or regulatory disruptions.

If we experience a significant increase in demand for our charging stations, or if we need to replace an existing supplier, we may not be possible to supplement or replace them on acceptable terms or at all, which may undermine our ability to deliver products to customers in a timely manner. For example, we may take a significant amount of time to identify a supplier that has the capability and resources to build charging station components in sufficient volume. Identifying suitable suppliers and sub-assembly manufacturers could be an

11

extensive process that requires us to become satisfied with their component or sub-assembly specifications, quality control, technical capabilities, responsiveness and service, financial stability, regulatory compliance, and labor and other ethical or environmental, social and governance (“ESG”) practices. Accordingly, a loss of any significant suppliers or sub-assembly manufacturers could have an adverse effect on our business, financial condition and operating results.

We are dependent on a limited number of significant customers and distributors for a substantial portion of our revenues. The loss of any such customer or distributor, a reduction in sales to any such customer or distributor, or the decline in the financial condition of any such customer or distributor could have a material adverse effect on our business, financial condition, and results of operations if they are not replaced with another large sales order.

We are, and may continue to be, dependent on a limited number of customers and distributors for a substantial portion of our revenue. We cannot be certain that customers and/or distributors that have accounted for significant revenues in past periods, individually or as a group, will continue to generate similar revenues in any future period. The loss of any of our major customers could negatively affect our results of operations, and any reduction, delay or cancellation of orders from one or more of our significant customers, or a decision by one or more of our significant customers to select products manufactured by a competitor, would significantly and negatively impact our revenue. Additionally, the failure of our significant customers to pay their current or future outstanding balances would increase our operating expenses and reduce our cash flows.

Our contract with our exclusive distributor for the fuel market expired in August 2021, and we do not expect the exclusive distributor contract to be renewed. We expect to continue to work with this distributor to fill fuel customers’ orders that were already secured prior to August 2021.

We previously had a three-year, exclusive distributor agreement with Gilbarco Inc. (“Gilbarco”), an affiliate of one of our shareholders, who had the sole right during the term of the distributor contract to lead sales into fuel customers and to sell our products into the fuel segment (with an exception for charge point operators). That agreement expired on August 29, 2021, which requires us and Gilbarco to negotiate the assignment of existing contracts between Gilbarco’s and our end customers or enter continuity agreements for supply and servicing under such contracts. The expiration of the agreement also means that in order to sell to fuel segment customers, rather than selling through Gilbarco, we must now either (i) directly tender products and services or enter supply arrangements with those customers or (ii) use our other distributors to sell products and services into the fuel segment. Additionally, as a result of the expiration of the agreement, Gilbarco may now sell products that compete with our products to our existing and prospective customers. Failure to retain these fuel customers could adversely affect our business and results of operations. See “Business—Distribution.”

While we have not made material acquisitions to date, should we pursue acquisitions in the future, we would be subject to risks associated with acquisitions.

We may acquire additional assets, products, technologies or businesses that are complementary to our existing business. The process of identifying and consummating acquisitions and the subsequent integration of new assets and businesses into our business would require attention from management and could result in a diversion of resources from our existing business, which in turn could have an adverse effect on our operations. Acquired assets or businesses may not generate the expected financial results. Acquisitions could also result in the use of cash, potentially dilutive issuances of equity securities, goodwill impairment charges, amortization expenses for other intangible assets and exposure to potential unknown liabilities of the acquired business.

If we are unable to attract and retain key employees and hire qualified management, technical, engineering and sales personnel, our ability to compete and successfully grow our business would be harmed.

Our success depends, in part, on our continuing ability to identify, hire, attract, train and develop and retain highly qualified personnel. The inability to do so effectively would adversely affect our business.

12

Competition for employees can be intense, and the ability to attract, hire and retain them depends on our ability to provide competitive compensation, culture and benefits. We may not be able to attract, assimilate, develop or retain qualified personnel in the future, and failure to do so could adversely affect our business, including the execution of our global business strategy.

We are expanding our operations internationally, which will expose us to additional tax, compliance, market and other risks.

Our primary operations are in Australia, the United States and the Netherlands, and we maintain contractual relationships with suppliers and sub-assembly manufacturers throughout the world. We are continuing to invest to increase our presence in these regions and to expand globally. We are also exploring the possibility of establishing a software team and additional corporate offices in California. Managing this expansion requires additional resources and controls, and could subject us to risks associated with international operations, including:

| • | conformity with applicable business customs, including translation into foreign languages and associated expenses; |

| • | lack of availability of government incentives and subsidies; |

| • | potential changes to our established business model; |

| • | cost of alternative power sources, which could vary meaningfully; |

| • | difficulties in staffing and managing foreign operations in an environment of diverse culture, laws, and customers, and the increased travel, infrastructure, and legal and compliance costs associated with international operations; |

| • | installation challenges; |

| • | differing driving habits and transportation modalities in other markets; |

| • | different levels of demand among commercial, fleet and residential customers; |

| • | compliance with multiple, potentially conflicting and changing governmental laws, regulations, certifications, and permitting processes including environmental, banking, employment, tax, information security, privacy, and data protection laws and regulations such as the EU General Data Protection Regulation (the “GDPR”), changing requirements for legally transferring data out of the European Economic Area, Singapore’s Personal Data Protection Act, as amended, and the California Consumer Privacy Act (“CCPA”); |

| • | compliance with U.S. and foreign anti-bribery laws including the FCPA and the UK Bribery Act 2010 (the “UK Bribery Act”); |

| • | conforming products to various international regulatory and safety requirements as well as charging and other electric infrastructures; |

| • | difficulty in establishing, staffing and managing foreign operations; |

| • | difficulties in collecting payments in foreign currencies and associated foreign currency exposure; |

| • | restrictions on repatriation of earnings; |

| • | compliance with potentially conflicting and changing laws of taxing jurisdictions and compliance with applicable U.S. tax laws as they relate to international operations, the complexity and adverse consequences of such tax laws, and potentially adverse tax consequences due to changes in such tax laws; and |

| • | regional economic and political conditions. |

13

As a result of these risks, our current expansion efforts and any potential future international expansion efforts may not be successful.

Our management team has limited experience in operating a public company in the United States.

Our executive officers have limited experience in the management of a publicly traded company in the United States. The management team may not successfully or effectively manage the transition to a public company that will be subject to significant regulatory oversight and reporting obligations under U.S. federal securities laws. Their limited experience in dealing with the increasingly complex laws pertaining to public companies could be a significant disadvantage in that it is likely that a significant amount of their time may be devoted to these activities, which will result in less time being devoted to the management and growth of the company. We may not have adequate personnel with the appropriate level of knowledge, experience and training in the accounting policies, practices or internal control over financial reporting required of public companies. The development and implementation of the standards and controls and the hiring of experienced personnel necessary to achieve the level of accounting standards required of a public company may require costs greater than expected.

Our future revenue growth will depend in significant part on our ability to increase sales of our products and services to fleet operators as that market matures.

Our future revenue growth will depend in significant part on our ability to increase sales of our products and services to fleet operators. The electrification of fleets is an emerging industry, and fleet operators may not adopt EVs on a widespread basis and on the timelines we anticipate. In addition to the factors affecting the growth of the EV market generally, transitioning to an EV fleet can be costly and capital intensive, which could result in slower than anticipated adoption. The sales cycle could also be longer for sales to fleet operators, as they are often larger organizations, with more formal procurement processes than smaller commercial site hosts, for example. Fleet operators may also require significant additional services and support, and if we are unable to provide such services and support, it may adversely affect our ability to attract additional fleet operators as customers. Any failure to attract and retain fleet operators as customers in the future would adversely affect our business and results of operations.

We will need to raise additional funds and these funds may not be available when needed.

We will need to raise additional capital in the future to further scale our business and expand to additional markets. We may raise additional funds through the issuance of equity, equity-related or debt securities, or through obtaining credit from government or financial institutions. We cannot be certain that additional funds will be available on favorable terms when required, or at all. If we cannot raise additional funds when needed, our financial condition, results of operations, business and prospects could be materially and adversely affected. If we raise funds through the issuance of debt securities or through loan arrangements, the terms of such securities or loans could require significant interest payments, contain covenants that restrict our business, or other unfavorable terms. In addition, to the extent we raise funds through the sale of additional equity securities, our shareholders would experience additional dilution.

Any delay in achieving our manufacturing expansion planned for Europe and the United States could impact revenue forecasts associated with these facilities.

Our ability to fund the completion of the establishment of new manufacturing facilities in Europe and the United States depends on, in addition to the funds raised in connection with the Business Combination, cash flow from future operations, which may not materialize or be available at the needed levels, or other sources of funding, which may not be available at acceptable rates or at all. In addition, completion of these projects could be delayed due to factors outside of our control, including equipment delivery delays and other shipping delays or interruptions, delays in customs processing, delays in obtaining regulatory approvals, work stoppages,

14

imposition of new trade tariffs, unusual weather conditions and impacts of the COVID-19 pandemic. Any delays in completion of these projects could impact revenue forecasts associated with the expanded facilities and could adversely affect our business, financial condition and results of operations.

If a safety issue occurs with our products, or similar products from another manufacturer, there could be adverse publicity around our products or the safety of charging stations generally, which could adversely affect our business and results of operations.

Manufacturers of EV charging stations, including us, may be subject to claims that their products have malfunctioned and, as a result, persons were injured and/or property was damaged. For example, under certain circumstances, including improper charging, lithium-ion batteries have been observed to catch fire or vent smoke and flames. In addition, our customers could be subjected to claims as a result of such incidents and may bring legal claims against us to attempt to hold us liable. Any of these events could result in negative publicity and reputational harm, which could adversely affect our business and results of its operations.

If products in our product roadmap, including our software licenses, do not achieve projected sales in the future in their planned channel, revenue forecasts for that product will not be met and our results of operations could be adversely affected.

We cannot assure you that the software and hardware technology on our product roadmap will prove to be commercially viable or meet projected revenue forecasts. Our business is based on new technology and if our software or hardware fails to achieve expected performance and cost metrics, we may be unable to develop demand for products and generate sufficient revenue to meet forecasts for one or more product channels. Further, we and/or our customers may experience operational problems with our products that could delay or defeat the ability of such products to generate revenue or operating profits. If we are unable to achieve our sales targets on time and within our planned budget, our business, results of operations and financial condition could be materially and adversely affected.

An interruption of our production capability at one or more of our manufacturing facilities from pandemics, accident, calamity or other causes, or events affecting the global economy, could adversely affect our business.

We manufacture our products at a limited number of manufacturing facilities, and we generally do not have redundant production capabilities that would enable us to shift production of a particular product rapidly to another facility in the event of a loss of one of, or a portion of one of, our manufacturing facilities. A catastrophic loss of the use of one or more of our manufacturing facilities due to pandemics, including the COVID-19 pandemic, accident, fire, explosion, labor issues, extreme weather events, natural disasters, condemnation, cyberattacks, cancellation or non-renewals of leases, terrorist attacks or other acts of violence or war or otherwise could have a material adverse effect on our production capabilities. In addition, unexpected failures, including as a result of power outages or similar disruptions outside of our control, of our equipment and machinery could result in production delays or the loss of raw materials or products in the equipment or machinery at the time of such failures. Any of these events could result in substantial revenue loss and repair costs. An interruption in our production capabilities could also require us to make substantial capital expenditures to replace damaged or destroyed facilities or equipment. There are a limited number of manufacturers that make some of the equipment we use in our manufacturing facilities, and we could experience significant delay in replacing or repairing manufacturing equipment necessary to resume production. An interruption in our production capability, particularly if it is of significant duration, could result in a permanent loss of customers who decide to seek alternate products and could materially adversely affect our business, financial condition and operating results.

Increases in labor costs, potential labor disputes and work stoppages or an inability to hire skilled manufacturing, sales and other personnel could adversely affect our business.

Our financial performance is affected by the availability of qualified personnel and the cost of labor. An increase in labor costs, work stoppages or disruptions at our facilities or those of our suppliers or transportation

15

service providers, or other labor disruptions, could decrease our sales and increase our expenses. The effects of the COVID-19 pandemic have reduced immigration of skilled labor into Australia and correspondingly reduced the labor pool for certain key roles. The COVID-19 pandemic has also led to reduced interstate migration within Australia. These factors could increase wages for certain roles or cause business operations to suffer. Although our employees are not represented by a union, our labor force may become subject to labor union organizing efforts, which could cause us to incur additional labor costs. Some of our employees are covered by Awards (as defined below) or, in the Netherlands, a Collective Labor Agreement (as defined below). In Australia, Awards are set by the Australian legislature and define the minimum terms of employment within a specific industry or occupation. Awards that apply to our employees in Australia include the Manufacturing and Associated Industries and Occupations Award, the Professional Employees Award and the Clerks Award (collectively, “Awards”). Employees employed by our Dutch subsidiaries (i.e., Tritium Europe B.V. and Tritium Technologies B.V.) are covered by a Collective Labor Agreement (“Collective Labor Agreement”), which sets out the minimum terms of their employment agreements.

The competition for skilled manufacturing, sales and other personnel is intense in the regions in which our manufacturing facilities are located. A significant increase in the salaries and wages paid by competing employers could result in a reduction of our labor force, increases in the salaries and wages that we must pay, or both. Additionally, potential employees may seek remote work options that are unavailable for certain positions. If we are unable to hire and retain skilled manufacturing, sales and other personnel, our ability to execute our business plan, and our results of operations, would suffer.

Risks Related to the EV Market

Changes to fuel economy standards or the success of alternative fuels such as green hydrogen may negatively impact the EV market and depot charging sales opportunities for heavy vehicles and thus the demand for our products and services.