UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| Investment Company Act file number | 811-23700 |

| |

Cascade Private Capital Fund (formerly, Barings Private Equity Opportunities and Commitments Fund) |

| (Exact name of registrant as specified in charter) |

| |

| c/o UMB Fund Services, Inc., 235 West Galena Street, Milwaukee, WI 53212 |

| (Address of principal executive offices) |

| |

| Ann Maurer |

| c/o UMB Fund Services, Inc., 235 West Galena Street, Milwaukee, WI 53212 |

| (Name and address of agent for service) |

| |

| Registrant's telephone number, including area code: | (888) 442-4420 |

| |

| Date of fiscal year end: | 3/31/2024 |

| | |

| Date of reporting period: | 3/31/2024 |

Item 1. Report to Shareholders.

The following is a copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 (the “1940 Act”):

CASCADE PRIVATE CAPITAL FUND

(formerly known as Barings Private Equity Opportunities and Commitments Fund)

Annual Report

For the Year Ended March 31, 2024

Cascade Private Capital Fund

Table of Contents

For the Year Ended March 31, 2024

| | |

Letter to Shareholders (Unaudited) | 2 |

Portfolio Summary (Unaudited) | 3 |

Fund Performance (Unaudited) | 4 |

Report of Independent Registered Public Accounting Firm | 5 |

Consolidated Portfolio of Investments | 6-8 |

Consolidated Statement of Assets and Liabilities | 9 |

Consolidated Statement of Operations | 10 |

Consolidated Statements of Changes in Net Assets | 11 |

Consolidated Statement of Cash Flows | 12 |

Consolidated Financial Highlights | 13 |

Notes to Consolidated Financial Statements | 14-28 |

Other Information (Unaudited) | 29-30 |

Fund Management (Unaudited) | 31-32 |

Privacy Notice (Unaudited) | 33 |

This report is submitted for the general information of the shareholders of the Fund. It is not authorized for distribution to prospective investors unless preceded or accompanied by an effective prospectus, which includes information regarding the Fund’s risks, objectives, fees and expenses, experience of its management and other information.

www.cliffwaterfunds.com

1

Cascade Private Capital Fund

Letter to Shareholders

March 31, 2024 (Unaudited)

To our valued clients and investors,

First, I would like to thank our initial investors for their early support of the Cascade Private Capital Fund (the “Fund”) and Cliffwater as the new adviser to the Fund, effective February 27, 2024. Cliffwater has assumed responsibility of the Fund from Barings LLC, which built an initial portfolio of single company assets in the middle and lower middle market sponsored by leading buyout and growth equity investment sponsors.

The Fund’s investment objective, since Cliffwater became the new adviser, has been to generate long-term capital appreciation by investing in a portfolio of private equity, private debt, as well as structured equity securities that have both equity and credit qualities, investments in real assets, including real estate, and any newer instruments such as collateralized fund obligations that provide attractive risk-adjusted return potential.

Our management of the fund coincides with the 20th anniversary of Cliffwater’s founding. My partners and I started Cliffwater with the thesis that investors were unlikely to achieve their long-term objectives relying just on public asset classes and that alternative asset classes—in particular, private markets—presented an opportunity to bolster return and reduce risk. We bookmarked our anniversary with an important study demonstrating the strong performance of private equity over more than two decades, one that confirmed our hypothesis that investors can reasonably expect private assets to outperform public assets by three to five percentage points per year.

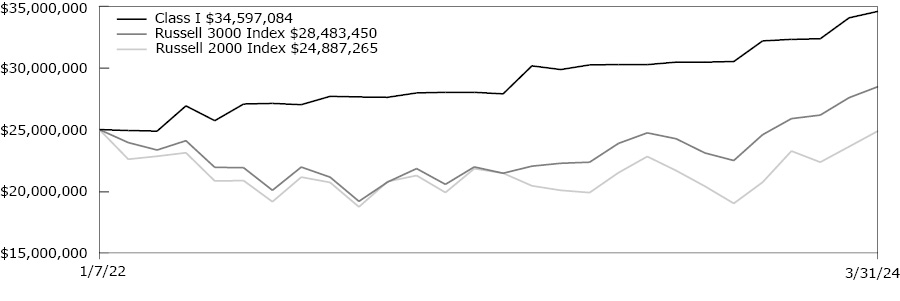

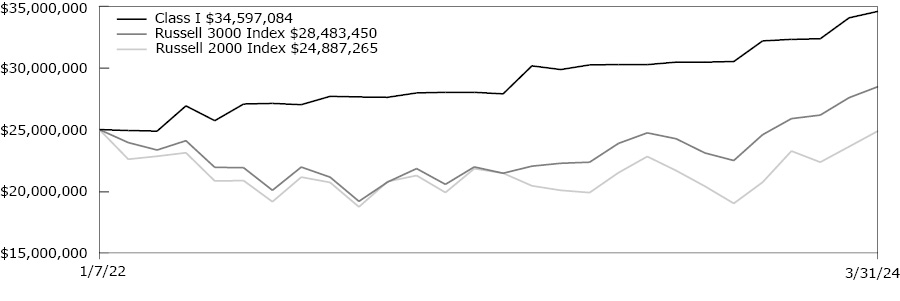

The Fund’s performance has been consistent with these expectations. Since inception of the Fund on January 7, 2022, the Fund has earned a 15.31% annualized total return, compared to 6.02% for the Russell 3000 Index. However, over that period the Fund significantly outperformed in 2022 when stocks fell but underperformed when stocks rose in 2023 and the beginning of 2024. For example, the Fund’s return for the year ended March 31, 2024 was 14.66%, compared to a very strong 29.29% for the Russell 3000 Index.

Thank you for your continued trust in Cliffwater.

Stephen L. Nesbitt

Chief Investment Officer

Cliffwater LLC

Important Disclosures

The Fund’s investment program is speculative and entails substantial risks. There can be no assurance that the Fund’s investment objectives will be achieved or that its investment program will be successful. Investors should consider the Fund as a supplement to an overall investment program and should invest only if they are willing to undertake the risks involved. Investors could lose some or all of their investment.

Shares are an illiquid investment.

We do not intend to list the Fund’s shares (“Shares”) on any securities exchange and we do not expect a secondary market in the Shares to develop.

You should generally not expect to be able to sell your Shares (other than through the limited repurchase process), regardless of how we perform.

Although we are required, beginning May 15, 2024, to implement a Share repurchase program, only a limited number of Shares will be eligible for repurchase by us.

You should consider that you may not have access to the money you invest for an indefinite period of time.

An investment in the Shares is not suitable for you if you have foreseeable need to access the money you invest.

Because you will be unable to sell your Shares or have them repurchased immediately, you will find it difficult to reduce your exposure on a timely basis during a market downturn.

Cybersecurity risks have significantly increased in recent years and the Fund could suffer such losses in the future. One of the fundamental risks associated with the Fund’s investments is the risk that an issuer will be unable to make principal and interest payments on its outstanding debt obligations when due. Other risk factors include interest rate risk (a rise in interest rates causes a decline in the value of debt securities) and prepayment risk (the debtor may pay its obligation early, reducing the amount of interest payments).

2

Cascade Private Capital Fund

Portfolio Summary

March 31, 2024 (Unaudited)

Cascade Private Capital Fund Portfolio Characteristics

(% of Net Assets) |

Equity Co-Investments | | | 13.8 | % |

Secondary Fund Investments | | | 14.4 | % |

Primary Fund Investments | | | 13.4 | % |

Senior Secured Loan | | | 1.0 | % |

Total Long-Term Investments | | | 42.6 | % |

Short-Term Investments and Other Assets and Liabilities | | | 57.4 | % |

Net Assets | | | 100.0 | % |

3

Cascade Private Capital Fund

Fund Performance

March 31, 2024 (Unaudited)

Growth of $25,000,000 Investment Since Inception - Class I

(formerly known as Class 1)

The Fund changed its benchmark index from the small stock Russell 2000 index to the all-stock Russell 3000 index because the latter index is a better representation of public stocks that investors view as an alternative to private equity.

The graph above illustrates a representative class of the Fund’s historical performance since the Fund’s inception in comparison to its benchmark index. The performance of other share classes will be greater than or less than the class depicted above.

Average Annual Total Returns (for the periods ended 03/31/2024) |

| Inception

Date

of Class | 1 Year | Since

Inception |

Class I (formerly named Class 1) | 1/07/2022 | 14.66% | 15.75% |

Russell 2000 Index | | 19.71% | (0.20)% |

Russell 3000 Index | | 29.29% | 6.02% |

Generally accepted accounting principles require adjustments to be made to the net assets of the Fund at period end for financial reporting purposes only, and as such, the total return based on the unadjusted net asset value per share may differ from the total return reported in the financial highlights.

The performance data quoted here represents past performance and past performance is not a guarantee of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information quoted. The most recent quarter end performance may be obtained by calling 1 (888) 442-4420.

Investors should note that the Fund is a professionally managed closed-end fund, while the Russell 2000 index and Russell 3000 Index are unmanaged, does not incur fees, expenses, or taxes, and cannot be purchased directly by investors. Investors should read the Fund’s prospectus with regard to the Fund’s investment objective, risks, and charges and expenses in conjunction with these financial statements. The performance tables and charts do not reflect the deduction of taxes that a shareholder would pay on the Fund distributions or the redemption of the Fund shares.

4

Cascade Private Capital Fund

Report of Independent Registered Public Accounting Firm

March 31, 2024

To the Shareholders and Board of Trustees of

Cascade Private Capital Fund

Opinion on the Financial Statements

We have audited the accompanying consolidated statement of assets and liabilities, including the consolidated portfolio of investments, of Cascade Private Capital Fund (the “Fund”) as of March 31, 2024, and the related consolidated statements of operations, cash flows, and changes in net assets, and the consolidated financial highlights for the year then ended, and the related notes (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund as of March 31, 2024, the results of its operations, its cash flows, the changes in net assets, and the financial highlights for the year then ended, in conformity with accounting principles generally accepted in the United States of America.

The Fund’s consolidated financial statements and financial highlights for the year ended March 31, 2023, and prior, were audited by other auditors whose report dated May 26, 2023, expressed an unqualified opinion on those consolidated financial statements and financial highlights.

Basis for Opinion

These financial statements are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements based on our audit. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement whether due to error or fraud.

Our audit included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of March 31, 2024, by correspondence with the custodian, brokers, agent banks, and underlying fund administrators or managers; when replies were not received from brokers, we performed other auditing procedures. Our audit also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audit provides a reasonable basis for our opinion.

We have served as the auditor of one or more investment companies advised by Cliffwater LLC since 2019.

COHEN & COMPANY, LTD.

Cleveland, Ohio

May 31, 2024

5

Cascade Private Capital Fund

Consolidated Portfolio of Investments

March 31, 2024

Name | | Initial

Acquisition

Date | | | Geographic

Region | | | Unfunded

Commitment | | | Shares/

Units | | | Cost | | | Fair Value | |

Primary Fund Investments — 13.4% |

Bertram Growth Capital IV-A, LP (a) (b) (c) | | | 01/07/2022 | | | | North America | | | $ | 497,008 | | | | — | | | $ | 4,536,524 | | | $ | 6,268,469 | |

Gryphon Partners VI-A, L.P. (a) (b) (c) | | | 01/07/2022 | | | | North America | | | | 1,576,660 | | | | — | | | | 5,893,305 | | | | 6,884,064 | |

ICG Ludgate Hill (Feeder) V-A Charger

SCSp (a) (b) (c) | | | 03/22/2024 | | | | North America | | | | 8,193,109 | | | | — | | | | 6,806,891 | | | | 7,886,049 | |

OceanSound Partners Fund, LP (a) (b) | | | 01/07/2022 | | | | North America | | | | 1,203,552 | | | | — | | | | 6,298,152 | | | | 9,850,733 | |

Pathway Select, LP Series A (a) (b) (c) | | | 03/28/2024 | | | | North America | | | | 2,482,182 | | | | — | | | | 31,217,818 | | | | 33,144,341 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Total | | | | | | | | | | | | | | | | | | $ | 54,752,690 | | | $ | 64,033,656 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Secondary Fund Investments — 14.4% | | | | | | | | | | | | | | | | |

AE Industrial Partners Extended Value Fund,

LP (a) (b) (c) | | | 01/07/2022 | | | | North America | | | $ | 115,699 | | | | — | | | $ | 1,436,765 | | | $ | 1,762,607 | |

BC Partners Galileo (1) LP (a) (b) (c) | | | 01/07/2022 | | | | Europe | | | | — | | | | — | | | | 4,634,265 | | | | 7,599,900 | |

BC Partners Galileo (1) LP Class 2 (a) (b) (c) | | | 01/07/2022 | | | | Europe | | | | 98,608 | | | | — | | | | 226,190 | | | | 419,443 | |

FB HA Holdings LP (a) (b) (c) (d) | | | 01/07/2022 | | | | North America | | | | — | | | | — | | | | 5,073,158 | | | | 5,656,857 | |

Icon Partners V, L.P. (a) (b) (c) | | | 01/07/2022 | | | | North America | | | | 2,515,314 | | | | — | | | | 7,484,556 | | | | 9,729,387 | |

JFL- NG Continuation Fund, L.P. (a) (b) (c) | | | 01/07/2022 | | | | North America | | | | 2,054,657 | | | | — | | | | 7,945,343 | | | | 14,679,262 | |

Montagu + SCSp (a) (b) (c) | | | 01/07/2022 | | | | Europe | | | | 1,645,587 | | | | — | | | | 5,240,899 | | | | 8,082,031 | |

NSH Verisma Holdco, L.P. (a) (b) (c) | | | 01/07/2022 | | | | North America | | | | 552,000 | | | | — | | | | 5,449,834 | | | | 9,589,229 | |

Stork SPV, L.P. (a) (b) | | | 01/07/2022 | | | | North America | | | | 1,023,030 | | | | — | | | | 3,485,552 | | | | 5,664,190 | |

TSCP CV I, L.P. (a) (b) (c) | | | 01/07/2022 | | | | North America | | | | 181,062 | | | | — | | | | 4,443,839 | | | | 5,384,591 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Total | | | | | | | | | | | | | | | | | | $ | 45,420,401 | | | $ | 68,567,497 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Equity Co-Investments — 13.8% | | | | | | | | | | | | | | | | | | | | |

BSP-TS Co-Invest I, LLC (a) (b) (c) | | | 01/07/2022 | | | | North America | | | $ | — | | | | — | | | $ | 5,111,823 | | | $ | 3,450,948 | |

CCOF III Nexus Co-invest Aggregator,

L.P. (a) (b) (c) | | | 03/22/2024 | | | | Europe | | | | 244,874 | | | | — | | | | 5,130,126 | | | | 5,075,481 | |

EPP Holdings, LLC (b) (c) (d) (e) | | | 01/07/2022 | | | | North America | | | | — | | | | 260,000 | | | | 2,605,817 | | | | 5,170,926 | |

Gallant Screening Holdco, Inc. (a) (b) (c) | | | 01/07/2022 | | | | North America | | | | — | | | | — | | | | 4,472,696 | | | | 6,388,531 | |

GoCanvas TopCo, LLC (b) (c) (e) | | | 01/07/2022 | | | | North America | | | | — | | | | 1,844,660 | | | | 1,635,500 | | | | 2,731,131 | |

See accompanying Notes to Consolidated Financial Statements.

6

Cascade Private Capital Fund

Consolidated Portfolio of Investments

March 31, 2024 (Continued)

Name | | Initial

Acquisition

Date | | | Geographic

Region | | | Unfunded

Commitment | | | Shares/

Units | | | Cost | | | Fair Value | |

HH Dayco Parent, LP (a) (b) (c) | | | 09/20/2022 | | | | North America | | | $ | — | | | | — | | | $ | 5,006,861 | | | $ | 12,572,810 | |

Nefco Acquisitions, Inc. Series A1 (b) (c) (e) | | | 08/05/2022 | | | | North America | | | | — | | | | 2,658 | | | | 2,663,520 | | | | 3,326,182 | |

Nefco Acquisitions, Inc. Series B1 (b) (c) (e) | | | 03/31/2023 | | | | North America | | | | — | | | | 80 | | | | 90,065 | | | | 109,339 | |

Nefco Acquisitions, Inc. Series C1 (b) (c) (e) | | | 10/12/2023 | | | | North America | | | | — | | | | 177 | | | | 233,761 | | | | 233,761 | |

North American Essential Services Aggregator, LP (b) (c) (e) | | | 01/07/2022 | | | | North America | | | | 1,050,000 | | | | 2,684 | | | | 4,219,307 | | | | 6,136,687 | |

OceanSound Partners Co-Invest II, LP - Series D (a) (b) (c) | | | 01/07/2022 | | | | North America | | | | — | | | | — | | | | 4,097,670 | | | | 4,929,098 | |

OEP VIII Project Laser Co- Investment Partners, L.P. (a) (b) (c) | | | 03/17/2023 | | | | North America | | | | — | | | | — | | | | 2,556,808 | | | | 2,799,965 | |

Symbiotic Capital EB Fund, L.P. (a) (b) (c) | | | 03/07/2024 | | | | North America | | | | 1,938,014 | | | | — | | | | 5,061,986 | | | | 4,963,000 | |

TSS Co- Invest Holdings, LP (a) (b) | | | 09/09/2022 | | | | North America | | | | — | | | | — | | | | 5,010,222 | | | | 7,765,266 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Total | | | | | | | | | | | | | | | | | | $ | 47,896,162 | | | $ | 65,653,125 | |

| | | Principal

Amount | | | Amortized

Cost | | | Fair Value | |

Senior Secured Loan — 1.0% | | | | |

| | | | | | | | | | | | | |

Health Care — 1.0% | | | | | | | | | | | | |

Nader Upside II Sarl, EUR PIK Term Loan B, 3 mo. EURIBOR + 2.500% 6.400% VRN 3/13/28 EUR (e) (f) | | $ | 4,685,610 | | | $ | 5,000,447 | | | $ | 4,952,964 | |

| | | | | | | | | | | | | |

Total | | | | | | $ | 5,000,447 | | | $ | 4,952,964 | |

| | | | | | | | | | | | | |

TOTAL LONG-TERM INVESTMENTS | | | | | | $ | 153,069,700 | | | $ | 203,207,242 | |

See accompanying Notes to Consolidated Financial Statements.

7

Cascade Private Capital Fund

Consolidated Portfolio of Investments

March 31, 2024 (Continued)

| | | Shares/

Units | | | Cost | | | Fair Value | |

SHORT-TERM INVESTMENTS — 55.9% | | | | |

| | | | | | | | | | | | | |

Money Market — 55.9% | | | | | | | | | | | | |

State Street Institutional US Government Money Market Fund, Premier Class, 5.26% (g) | | | 266,709,775 | | | $ | 266,709,775 | | | $ | 266,709,775 | |

| | | | | | | | | | | | | |

TOTAL SHORT-TERM INVESTMENTS | | | | | | $ | 266,709,775 | | | $ | 266,709,775 | |

| | | | | | | | | | | | | |

TOTAL INVESTMENTS — 98.5% | | | | | | $ | 419,779,475 | | | $ | 469,917,017 | |

| | | | | | | | | | | | | |

Other Assets/(Liabilities) — 1.5% | | | | | | | | | | | 7,384,063 | |

| | | | | | | | | | | | | |

NET ASSETS — 100.0% | | | | | | | | | | $ | 477,301,080 | |

EURIBOR | Euro Inter-Bank Offered Rate |

Notes to Consolidated Portfolio of Investments

Percentages are stated as a percent of net assets.

(a) | Investment valued using net asset value per share as practical expedient. See Note 10 for respective investment categories, unfunded commitments, and redemptive restrictions. |

(b) | Restricted security. At March 31, 2024, the aggregate market value of these securities amounted to $198,254,278 or 41.5% of net assets. |

(c) | Non-income producing security. |

(d) | Held in MassMutual Private Equity Funds Subsidiary LLC. (See Note 1 in the “Notes to Consolidated Fiancal Statements” section for more information on this entity). |

(e) | Fair value estimated by management using significant unobservable inputs. |

(f) | The principal amount of the security is in foreign currency. The market value is in U.S. dollars. |

(g) | The 7 day annualized yield at period end March 31, 2024. |

The Cascade Private Capital Fund invests greater than 25% of its assets in the State Street Institutional US Government Money Market Fund. The Cascade Private Capital Fund may redeem its investment at any time if the Advisor determines if it is in the best interest of the Fund and its shareholders to do so. The performance of the Fund will be directly affected by the performance of this investment. The financial statements of the investment, including the schedule of investments, can be found on the Securities and Exchange Commission’s website www.sec.gov and should be read in conjunction with the Fund’s financial statements. At March 31, 2024, the Cascade Private Capital Fund invested 55.9 % of its net assets in the Cascade Private Capital Fund.

See accompanying Notes to Consolidated Financial Statements.

8

Cascade Private Capital Fund

Consolidated Statement of Assets and Liabilities

March 31, 2024

Assets: | | | | |

Investments, at fair value (Cost $153,069,700) | | $ | 203,207,242 | |

Short-term investments, at fair value (Cost $ 266,709,775) | | | 266,709,775 | |

Total investments, at fair value | | | 469,917,017 | |

Cash | | | 29,009,487 | |

Fund shares sold | | | 6,486,746 | |

Interest and dividends receivable | | | 282,264 | |

Prepaid expenses | | | 197,708 | |

Total assets | | | 505,893,222 | |

Liabilities: | | | | |

Payables for: | | | | |

Payable to counterparty (Note 2) | | | 26,397,754 | |

Deferred tax expense | | | 816,137 | |

Administration fees | | | 490,862 | |

Investment advisory fees | | | 310,415 | |

Legal fees | | | 187,342 | |

Accrued expense and other liabilities | | | 389,632 | |

Total liabilities | | | 28,592,142 | |

Net assets | | $ | 477,301,080 | |

Commitments and Contingencies (see Note 2) | | | | |

Components of Net Assets: | | | | |

Net assets consist of: | | | | |

Paid-in capital | | $ | 428,605,194 | |

Accumulated earnings (loss) | | | 48,695,886 | |

Net assets | | $ | 477,301,080 | |

Class I shares: | | | | |

Net assets | | $ | 477,301,080 | |

Shares outstanding (a) | | | 34,480,208 | |

Net asset value, and redemption price per share | | $ | 13.84 | |

(a) Authorized unlimited number of shares with no par value.

See accompanying Notes to Consolidated Financial Statements.

9

Cascade Private Capital Fund

Consolidated Statement of Operations

For the Year Ended March 31, 2024

Investment income: | | | | |

Distributions from private funds | | $ | 1,231,119 | |

Interest | | | 1,430,224 | |

Total investment income | | | 2,661,343 | |

Expenses: | | | | |

Investment advisory fees | | | 1,985,488 | |

Legal fees | | | 610,136 | |

Administration fees | | | 343,874 | |

Trustees’ fees | | | 171,317 | |

CCO Expense | | | 88,550 | |

Audit and tax fees | | | 94,937 | |

Other Expense | | | 2,913 | |

Total expenses | | | 3,297,215 | |

Expenses waived (Note 4): | | | | |

Reimbursement | | | (262,463 | ) |

Net expenses: | | | 3,034,752 | |

Net investment income (loss) | | | (373,409 | ) |

Realized and unrealized gain (loss): | | | | |

Net realized gain (loss) on: | | | | |

Investment transactions | | | 4,515 | |

Foreign currency transactions | | | 32,323 | |

Net realized gain (loss) | | | 36,838 | |

Net change in unrealized appreciation (depreciation) on: | | | | |

Investment transactions | | | 25,300,340 | |

Deferred tax expense | | | (80,079 | ) |

Net change in unrealized appreciation (depreciation) | | | 25,220,261 | |

Net realized gain (loss) and change in unrealized appreciation (depreciation), net of deferred tax expense | | | 25,257,099 | |

Net increase (decrease) in net assets resulting from operations | | $ | 24,883,690 | |

See accompanying Notes to Consolidated Financial Statements.

10

Cascade Private Capital Fund

Consolidated Statements of Changes in Net Assets

| | | Year Ended

March 31,

2024 | | | Year Ended

March 31,

2023 | |

Increase (Decrease) in Net Assets: | | | | | | | | |

Operations: | | | | | | | | |

Net investment income (loss) | | $ | (373,409 | ) | | $ | (2,146,438 | ) |

Net realized gain (loss) | | | 36,838 | | | | 233 | |

Net change in unrealized appreciation (depreciation) | | | 25,220,261 | | | | 15,581,471 | |

Net increase (decrease) in net assets resulting from operations | | | 24,883,690 | | | | 13,435,266 | |

Net fund share transactions (Note 6): | | | | | | | | |

Proceeds from shares sold of Class I (24,129,400 shares sold) | | | 327,486,256 | | | | — | |

Increase (decrease) in net assets from fund share transactions | | | 327,486,256 | | | | — | |

Total increase (decrease) in net assets | | | 352,369,946 | | | | 13,435,266 | |

Net assets | | | | | | | | |

Beginning of year | | | 124,931,134 | | | | 111,495,868 | |

End of year | | $ | 477,301,080 | | | $ | 124,931,134 | |

See accompanying Notes to Consolidated Financial Statements.

11

Cascade Private Capital Fund

Consolidated Statement of Cash Flows

For the Year Ended March 31, 2024

Cash flows from operating activities: | | | | |

Net increase (decrease) in net assets resulting from operations | | $ | 24,883,690 | |

Adjustments to reconcile net increase in net assets resulting from operations to net cash provided by (used in) operating activities: | | | | |

Investments purchased | | | (62,894,233 | ) |

Net proceeds from investments | | | 4,897,394 | |

Proceeds from return of capital distributions | | | 708,442 | |

Net change in unrealized (appreciation) depreciation on investments | | | (25,300,340 | ) |

Net realized (gain) loss on investments | | | (4,515 | ) |

(Purchase) Sale of short-term investments, net | | | (259,667,086 | ) |

Amortization (accretion) of discount and premium, net | | | (1,124,297 | ) |

(Increase) Decrease in receivable for interest and dividends | | | (282,264 | ) |

(Increase) Decrease in receivable for prepaid expenses | | | (197,708 | ) |

Increase (Decrease) in payable for due to counterparty | | | 26,397,754 | |

Increase (Decrease) in payable for administration fees | | | 528,204 | |

Increase (Decrease) in payable for investment advisory fees | | | (72,388 | ) |

Increase (Decrease) in payable for accrued expenses and other liabilities | | | (135,036 | ) |

Increase (Decrease) in payable for deferred tax expense | | | 80,079 | |

Net cash provided by (used in) operating activities | | | (292,182,304 | ) |

| | | | | |

Cash flows from financing activities: | | | | |

Proceeds from shares sold, net of receivable | | | 320,999,510 | |

Increase (Decrease) in payable for prepaid subscriptions received | | | (20,878,489 | ) |

Net cash provided by (used in) financing activities | | | 300,121,021 | |

| | | | | |

Net increase (decrease) in cash | | | 7,938,717 | |

Cash at beginning of period | | | 21,070,770 | |

Cash at end of period | | $ | 29,009,487 | |

| | | | | |

Non Cash from operating activities: | | | | |

Net change in unrealized (appreciation) depreciation on deferred tax expense | | $ | (80,079 | ) |

See accompanying Notes to Consolidated Financial Statements.

12

Cascade Private Capital Fund

Consolidated Financial Highlights

Class I

| | | | | | | Income (loss) from investment

operations | | | | | | | | | | | | | | | Ratios / Supplemental Data | |

| | | Net

asset

value,

beginning

of the

period | | | Net

investment

income

(loss)c | | | Net

realized

and

unrealized

gain (loss)

on

investments | | | Total

income

(loss) from

investment

operations | | | Net

asset

value,

end of

the

period | | | Total

returne | | | Net

assets,

end of

the

period

(000)’s | | | Ratio of

expenses

to average

daily net

assets

before

expense

waivers | | | Ratio of

expenses

to average

daily net

assets

after

expense

waivers | | | Net

investment

income

(loss) to

average

daily net

assets | |

Class If | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

3/31/24 | | $ | 12.07 | | | $ | (0.03 | ) | | $ | 1.80 | | | $ | 1.77 | | | $ | 13.84 | | | | 14.66 | % | | | 477,301 | | | | 1.86 | % | | | 1.71 | % | | | (0.21 | %) |

3/31/23 | | | 10.77 | | | | (0.21 | ) | | | 1.51 | | | | 1.30 | | | | 12.07 | | | | 12.07 | % | | | 124,931 | | | | 2.32 | % | | | 2.32 | % | | | (1.87 | %) |

3/31/22d | | | 10.00 | | | | (0.05 | ) | | | 0.82 | | | | 0.77 | | | | 10.77 | | | | 7.72 | %b | | | 111,496 | | | | 2.86 | %a | | | 2.54 | %a | | | (2.02 | %)a |

| | Year ended

March 31 | Period

ended

March 31, |

| | 2024 | 2023 | 2022d |

Portfolio turnover rate | 4% | 0% | 0% |

b | Percentage represents the results for the period and is not annualized. |

c | Per share amount calculated on the average shares method. |

d | Fund commenced operations on January 7, 2022. |

e | Total returns would have been lower had expenses not been waived by the Investment Manager. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the repurchase of Fund shares. |

f | Class I was formerly named as Class 1. |

See accompanying Notes to Consolidated Financial Statements.

13

Cascade Private Capital Fund

Notes to Consolidated Financial Statements

March 31, 2024

1. Organization

Cascade Private Capital Fund (formerly known as Barings Private Equity Opportunities and Commitments Fund) (the “Fund”) is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as a non-diversified, closed-end management investment company. The Fund is organized under the laws of the State of Delaware as a Delaware statutory trust pursuant to a Fourth Amended and Restated Certificate of Trust dated as of February 24, 2024, as it may be further amended from time to time. The Fund intends to qualify as a regulated investment company (a “RIC”). The Fund commenced operations on January 7, 2022.

The Fund currently offers one class of shares, Class I shares, on a continuous basis at the net asset value (“NAV”) per share. Class I Shares were formerly named Class 1 Shares. The minimum initial investment in the Fund is $25,000,000 (increased from $1,000,000) for the Class I shares. Investors purchasing Class I shares are not charged a sales load. Class 2 Shares, Class 3 Shares and Class 4 Shares are no longer offered.

The Fund’s investment objective is to generate long-term capital appreciation by investing in a portfolio of private equity, private debt, and other private market investments (together, “Private Capital”); that provide attractive risk-adjusted return potential. Private Capital investments are investments into the equity and/or debt of private companies. The Fund will seek to achieve its objective through exposure to a broad set of managers, strategies and transaction types across multiple sectors, geographies and vintage years. Under normal circumstances, the Fund intends to invest and/or make capital commitments of at least 80% of its net assets (plus the amount of any borrowings for investment purposes) in assets representing investments in Private Capital (“Private Capital Assets”). This test is applied at the time of investment; later percentage changes caused by a change in the value of the Fund’s assets, including as a result of the issuance or repurchase of Shares, will not require the Fund to dispose of an investment.

Basis of Consolidation

On January 7, 2022, Massachusetts Mutual Life Insurance Company (“MassMutual”) performed an in-kind purchase transaction whereby it contributed the assets and liabilities of MassMutual Private Equity Funds LLC (“MMPEF”) and its subsidiary, MassMutual Private Equity Funds Subsidiary LLC (“MMPEF Subsidiary”) to the Fund in exchange for shares of the Fund. The consolidated financial statements of the Fund include MMPEF and MMPEF Subsidiary and the results of which are reported on a consolidated basis with the Fund. Both MMPEF and MMPEF Subsidiary are wholly owned subsidiaries of the Fund; therefore, all intercompany accounts and transactions have been eliminated. MMPEF and MMPEF Subsidiary will hold all of the Fund’s Portfolio Funds and Co-Investments, while short-term investments are held directly by the Fund. As of March 31, 2024, MMPEF and MMPEF Subsidiary hold investments in the amount of $137,149,663 and $10,827,783, respectively.

Fund Changes

In February 2024, the Board of Trustees (the “Prior Board”) of the Fund considered and approved by unanimous written consent the appointment of Paul S. Atkins, Dominic Garcia, Stephen L. Nesbitt and Paul J. Williams (collectively, the “New Board,” each a “New Trustee”) as Trustees of the Fund and each member of the Prior Board resigned from the Board, subject to the approval by the Fund’s shareholder. Shareholder approval of the appointment of the New Board and the resignation of the Prior Board occurred on February 26, 2024.

At a special meeting of the New Board held on February 27, 2024 (the “Meeting”), the New Board considered and approved the appointment of Cliffwater LLC (“Cliffwater” or the “Investment Manager”) as investment adviser of the Fund effective as of February 27, 2024 (the “Effective Date”). At the Meeting, the New Board also approved: (1) the termination of the Fund’s investment advisory agreement with Barings LLC and the implementation of a new investment advisory agreement between the Fund and Cliffwater; (2) the termination of Baring International Investment Limited (“BIIL”) as sub-adviser of the Fund; (3) the adoption of a fundamental policy, effective as of May 15, 2024, to conduct semi-annual repurchase offers for no less than 5% and no more than 25% of the Fund’s shares outstanding pursuant to Rule 23c-3 of the 1940 Act; (4) certain other changes to the Fund’s fundamental policies; and (5) the adoption of the Fourth Amended and Restated Agreement and Declaration of Trust of the Fund. These changes were approved by the Fund’s sole shareholder.

In addition, at the Meeting, the New Board considered and approved, among other things, the following: (1) a change in the name of the Fund to Cascade Private Capital Fund; (2) a change in the address of the Fund to c/o UMB Fund Services, Inc., 235 West Galena Street, Milwaukee, WI 53212; (3) the replacement of State Street Bank and Trust Company (“State Street”) with UMB Fund Services, Inc. as the Fund’s transfer agent; (4) the replacement of Barings LLC with State Street, the Fund’s former sub-administrator, as the Fund’s administrator; (5) the replacement of ALPS Distributors, LLC with Foreside

14

Cascade Private Capital Fund

Notes to Consolidated Financial Statements

March 31, 2024 (Continued)

1. Organization (continued)

Fund Services, LLC as the Fund’s principal underwriter; (6) the replacement of Deloitte & Touche LLP (“Deloitte”) with Cohen & Company, Ltd. (“Cohen”) as the Fund’s independent registered public accounting firm; and (7) a change in the name of the Fund’s Class 1 Shares to Class I Shares.

From September 27, 2022 to February 27, 2024, the investment adviser and administrator for the Fund was Barings, LLC (“Barings”). From December 16, 2022 to February 27, 2024 the name of the Fund was “Barings Private Equity Opportunities and Commitments Fund.” From September 27, 2022 to December 16, 2022, the name of the Fund was “Barings Access Pine Point Fund.” Prior to September 27, 2022, the name of the Fund was “MassMutual AccessSM Pine Point Fund.”

2. Significant Accounting Policies

The following is a summary of significant accounting policies followed consistently by the Fund in the preparation of the financial statements in conformity with accounting principles generally accepted in the United States of America (“generally accepted accounting principles”). The preparation of the financial statements in accordance with generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts and disclosures in the financial statements. Actual results could differ from those estimates.

The Fund is an investment company and accordingly follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board Accounting Standards Codification Topic 946, Financial Services – Investment Companies (“ASC Topic 946”), and applying the specialized accounting and reporting guidance in ASC Topic 946.

Valuation of Investments

Rule 2a-5 under the 1940 Act establishes requirements for determining fair value in good faith for purposes of the 1940 Act. Rule 2a-5 permits fund boards to designate certain parties to perform fair value determinations, subject to board oversight and certain other conditions. Rule 2a-5 also defines when market quotations are “readily available” for purposes of the 1940 Act and the threshold for determining whether a fund must fair value a security. In connection with Rule 2a-5, the SEC also adopted related recordkeeping requirements and rescinded previously issued guidance, including with respect to the role of a board in determining fair value and the accounting and auditing of fund investments. Pursuant to the requirements of Rule 2a-5, the Board of Trustees of the Fund (the “Board”) designated the Investment Manager as its valuation designee (the “Valuation Designee”) to perform fair value determinations and approved new Valuation Procedures for the Fund (the “Valuation Procedures”). Under the Valuation Procedures adopted by the Board, the Board has delegated day-to-day responsibility for fair value determinations and pricing to the Valuation Designee subject to the oversight of the Board.

Securities listed on a securities exchange, market or automated quotation system for which quotations are readily available (except for securities traded on NASDAQ), including securities traded over the counter, are valued at the last quoted sale price on the primary exchange or market (foreign or domestic) on which they are traded on a day the Fund will calculate its net asset value as of the close of business on each day that the New York Stock Exchange is open for business and at such other times as the Board shall determine (each a “Determination Date” or at approximately 4:00 pm U.S. Eastern Time if a security’s primary exchange is normally open at that time), or, if there is no such reported sale on the Determination Date, the mean between the closing bid and asked prices and if no asked price is available, at the bid price. For securities traded on NASDAQ, the NASDAQ Official Closing Price (which is the last trade price at or before 4:00:02 p.m. U.S. Eastern Time adjusted up to NASDAQ’s best offer price if the last trade price is below such bid and down to NASDAQ’s best offer price if the last trade is above such offer price) will be used.

Corporate loans are generally valued using unobservable pricing inputs received from the Fund’s investment partners or other third-party pricing services. The Investment Manager will continuously monitor the valuations of Fund investments provided by investment partners or other third-party pricing services and review any material concerns with the Valuation Committee. The Investment Manager may conclude, however, in certain circumstances, that a fair valuation provided by an investment partner or other third-party pricing service does not represent the fair value of a Fund investment and is not indicative of what actual fair value would be in an active, liquid or established market. In those circumstances, the Fund might value such investment at a discount or a premium to the value it receives from an investment partner or other third-party pricing service, in accordance with the Fund’s valuation procedures. Any such decision would be made in good faith, and subject to the review and supervision of the Valuation Committee. The Investment Manager may choose to value certain immaterial direct corporate loans internally upon approval of the Valuation Committee. The Board will consider, no less frequently than quarterly, all relevant information and the reliability of pricing information provided by the investment partners or other third-party pricing services. Additionally, the values of the Funds’ direct

15

Cascade Private Capital Fund

Notes to Consolidated Financial Statements

March 31, 2024 (Continued)

2. Significant Accounting Policies (continued)

loan investments are adjusted daily based on the estimated total return that the asset will generate during the current quarter. The Investment Manager, other third-party pricing services and the Valuation Committee monitor these estimates regularly and update them as necessary if macro or individual changes warrant any adjustments. At the end of the quarter, each direct loan’s value is adjusted based on the actual income and appreciation or depreciation realized by such loan when its quarterly valuations and income are reported. This information is updated as soon as the information becomes available.

The Fund invests in interests or shares in private investment companies and/or funds (“Private Investment Funds”) where the net asset value may be calculated and reported by respective unaffiliated investment managers on a monthly or quarterly basis. Unless the Valuation Designee is aware of information that a value reported to the Fund by a portfolio, underlying manager, or administrator does not accurately reflect the value of the Fund’s interest in that Private Investment Fund, the Valuation Designee will use the net asset value provided by the Private Investment Funds as a practical expedient to estimate the fair value of such interests.

Repurchase Offers

The Fund intends to operate as an “interval fund” and, as such, has adopted a fundamental policy effective May 15, 2024, to make semi-annual repurchase offers, at per-class NAV, of not less than 5% and not more than 25% of the Fund’s outstanding Shares on the repurchase request deadline. The Fund will offer to purchase only a small portion of its Shares during each repurchase offer, and there is no guarantee that Shareholders will be able to sell all of the Shares that they desire to sell in any particular repurchase offer. If a repurchase offer is oversubscribed, the Fund may repurchase only a pro rata portion of the Shares tendered by each Shareholder. The potential for proration may cause some investors to tender more Shares for repurchase than they wish to have repurchased or result in investors being unable to liquidate all or a given percentage of their investment during the particular repurchase offer. The Fund did not operate as an “interval fund” during the fiscal year ended March 31, 2024.

Accounting for Investment Transactions

Investment transactions are accounted for on the trade date. However, for NAV determination, portfolio securities transactions are reflected no later than in the first calculation on the first business day following trade date. Realized gains and losses on sales of investments are computed by the specific identification cost method. Dividend income and realized capital gain distributions are recorded on the ex-dividend date. Non-cash dividends received in the form of stock are recorded as dividend income at market value. Withholding taxes on foreign interest, dividends, and capital gains have been provided for in accordance with the applicable country’s tax rules and rates. Foreign dividend income is recorded on the ex-dividend date or as soon as practicable after the Fund determines the existence of a dividend declaration after exercising reasonable due diligence. Distributions received on securities that represent a return of capital or capital gains are recorded as a reduction of cost of investments and/or as a realized gain, respectively. Payable to counterparty reflects cash received by the Fund for a contractual sale that was received after March 31, 2024.

Dividends and Distributions to Shareholders

Dividends from net investment income and distributions of any net realized capital gains of the Fund are declared and paid at least annually and at other times as may be required to satisfy tax or regulatory requirements. Distributions to shareholders are recorded on the ex-dividend date. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from generally accepted accounting principles. As a result, net investment income and net realized capital gains on investment transactions for a reporting period may differ significantly from distributions during such period.

Foreign Currency Translation

The books and records of the Fund are maintained in U.S. dollars. The market values of foreign currencies, foreign securities, and other assets and liabilities denominated in foreign currencies are translated into U.S. dollars at the exchange rate on the date of the report. Purchases and sales of foreign securities and income and expense items are translated at the rates of exchange prevailing on the respective dates of such transactions. The Fund does not isolate that portion of the results of operations arising from changes in the exchange rates from that portion arising from changes in the market prices of securities. Net realized foreign currency gains and losses resulting from changes in exchange rates include foreign currency gains and losses between trade date and settlement date on investment securities transactions, foreign currency transactions, and the difference between the amounts of dividends or interest recorded on the books of the Fund and the amount actually received.

16

Cascade Private Capital Fund

Notes to Consolidated Financial Statements

March 31, 2024 (Continued)

2. Significant Accounting Policies (continued)

Participations and Assignments

The Fund may acquire interests in loans either directly (by way of original issuance, sale or assignment) or indirectly (by way of participation). The purchaser of an assignment typically succeeds to all the rights and obligations of the assigning institution and becomes a lender under the credit agreement with respect to the debt obligation; however, its rights can be more restricted than those of the assigning institution. Participation interests in a portion of a debt obligation typically result in a contractual relationship only with the institution participating in the interest, not with the borrower. In purchasing participations, the Fund generally will have no right to enforce compliance by the borrower with the terms of the loan agreement, nor any rights of set-off against the borrower, and the Fund may not directly benefit from the collateral supporting the debt obligation in which it has purchased the participation. As a result, the Fund will assume the credit risk of both the borrower and the institution selling the participation.

Commitments and Contingencies

Corporate Loans purchased by the Fund (whether through participations or as a lender of record) may be structured to include both term loans, which are generally fully funded at the time of investment, and unfunded loan commitments, which are contractual obligations for future funding. Unfunded loan commitments may include revolving credit facilities and delayed draw term loans, which may obligate the Fund to supply additional cash to the borrower on demand, representing a potential financial obligation by the Fund in the future. The Fund may receive a commitment fee based on the undrawn portion of such unfunded loan commitments. The commitment fee is typically set as a percentage of the commitment amount. Commitment fees are processed as income when received and are part of the interest income in the Consolidated Statement of Operations. As of March 31, 2024, the Fund had no unfunded loan commitments.

Federal Income Taxes

The Fund intends to continue to qualify as a “regulated investment company” under Subchapter M of the Internal Revenue Code of 1986, as amended. As so qualified, the Fund will not be subject to federal income tax to the extent it distributes substantially all of its net investment income and capital gains to shareholders. Therefore, no federal income tax provision is required. Management of the Fund is required to determine whether a tax position taken by the Fund is more likely than not to be sustained upon examination by the applicable taxing authority, based on the technical merits of the position. Based on its analysis, there were no tax positions identified by management of the Fund that did not meet the “more likely than not” standard as of March 31, 2024.

The Fund’s policy is to classify interest and penalties associated with underpayment of federal and state income taxes as an income tax expense on the Consolidated Statements of Operations. For the year ended March 31, 2024, the Fund did not have interest or penalties associated with underpayment of income taxes.

3. Principal Risks

General Risks

An investment in the Fund involves a considerable amount of risk. An investor may lose money. Before making an investment decision, a prospective shareholder should (i) consider the suitability of this investment with respect to the shareholder’s investment objectives and personal situation and (ii) consider factors such as the investor’s personal net worth, income, age, risk tolerance and liquidity needs. The Fund is an illiquid investment. Shareholders have no right to require the Fund to redeem their shares of the Fund.

Unlisted Closed-End Structure; Liquidity Limited to Repurchases of Shares

The Fund has been organized as a non-diversified, closed-end management investment company and designed primarily for long-term investors. An investor should not invest in the Fund if the investor needs a liquid investment. Closed-end funds differ from open-end management investment companies (commonly known as mutual funds) in that investors in a closed-end fund do not have the right to redeem their shares on a daily basis. Unlike most closed-end funds, which typically list their shares on a securities exchange, the Fund does not intend to list the shares for trading on any securities exchange, and the Fund does not expect any secondary market to develop for the shares.

17

Cascade Private Capital Fund

Notes to Consolidated Financial Statements

March 31, 2024 (Continued)

3. Principal Risks (continued)

Although the Fund intends to offer a limited degree of liquidity by conducting semi-annual repurchase offers, a shareholder may not be able to tender its shares in the Fund promptly after it has made a decision to do so. There is no assurance that you will be able to tender your shares when or in the amount that you desire or that the Fund will repurchase shares semi-annually. In addition, with very limited exceptions, shares are not transferable, and liquidity will be provided only through semi-annual repurchase offers made by the Fund. The Fund expects any such repurchase offer to apply to no more than 5% of the net assets of the Fund. Shares are considerably less liquid than shares of funds that trade on a stock exchange or shares of open-end registered investment companies, and are therefore suitable only for investors who can bear the risks associated with the limited liquidity of shares, and should be viewed as a long-term investment.

Liquidity and Valuation Risk

Liquidity risk is the risk that securities may be difficult or impossible to sell at the time the Fund would like or at the price it believes the security is currently worth. Liquidity risk may be increased for certain Fund investments, including those investments in funds with gating provisions or other limitations on investor withdrawals and restricted or illiquid securities. The Fund’s current Private Equity Investments do not have provisions which permit the Fund to redeem its investment.

To the extent that the Fund seeks to reduce or sell out of its investment at a time or in an amount that is prohibited, the Fund may not have the liquidity necessary to participate in other investment opportunities or may need to sell other investments that it may not have otherwise sold.

The Fund may also invest in securities that, at the time of investment, are illiquid, as determined by using the SEC’s standard applicable to registered investment companies (i.e., securities that cannot be disposed of by the Fund within seven calendar days in the ordinary course of business at approximately the amount at which the Fund has valued the securities). Illiquid and restricted securities may be difficult to dispose of at a fair price at the times when the Fund believes it is desirable to do so. The market price of illiquid and restricted securities generally is more volatile than that of more liquid securities, which may adversely affect the price that the Fund pays for or recovers upon the sale of such securities. Investment of the Fund’s assets in illiquid and restricted securities may also restrict the Fund’s ability to take advantage of market opportunities. Valuation risk is the risk that one or more of the securities in which the Fund invests are priced differently than the value realized upon such security’s sale. In times of market instability, valuation may be more difficult, in which case the Fund’s judgment may play a greater role in the valuation process.

Valuations of Private Equity Investments; Valuations Subject to Adjustment

A large percentage of the securities in which the Fund invests will not have a readily determinable market price and will use the net asset value provided by the Private Investment Funds as a practical expedient to estimate the fair value of such interests.

Cliffwater has been designated by the Board as the valuation designee for the Fund pursuant to Rule 2a-5 under the 1940 Act. In its capacity as valuation designee, Cliffwater, among other things, is responsible for establishing fair valuation methodologies and determining, in good faith, the fair value of all of the assets of the Fund for which there are no readily available market quotations in accordance with the Fund Valuation Procedures. The determination of fair value is performed by an internal valuation committee that is separated from the investment process.

The valuation methodology set forth in the Fund Valuation Procedures incorporates general private equity valuation principles. Based on the methodology, Cliffwater may adjust a Portfolio Fund manager’s periodic valuation of a Portfolio Fund, or a Co-Investment’s valuation, as appropriate.

While the Fund’s Valuation Procedures are designed to estimate the fair market value of investments as of any measurement date, there is uncertainty in some of the inputs used. For example, valuations are based upon data reported by the Portfolio Funds and Co-investments which may be subject to subsequent revisions. Other adjustments may occur from time to time. Because such adjustments or revisions, whether increasing or decreasing the NAV of the Fund, at the time they occur, relate to information available only at the time of the adjustment or revision, the adjustment or revision may not affect the amount of the repurchase proceeds of the Fund received by investors who had their shares repurchased prior to such adjustments and received their repurchase proceeds, subject to the ability of the Fund to adjust or recoup the repurchase proceeds received by shareholders under certain circumstances. As a result, to the extent that such subsequently adjusted valuations from the Portfolio Funds, Co-Investments, direct private equity investments or the Fund adversely affect the Fund’s NAV, the outstanding shares may be adversely affected by prior repurchases to the benefit of shareholders who had their shares repurchased at

18

Cascade Private Capital Fund

Notes to Consolidated Financial Statements

March 31, 2024 (Continued)

3. Principal Risks (continued)

a NAV higher than the adjusted amount. Conversely, any increases in the NAV resulting from such subsequently adjusted valuations may be entirely for the benefit of the outstanding shares and to the detriment of shareholders who previously had their shares repurchased at a NAV lower than the adjusted amount. The same principles apply to the purchase of shares. New shareholders may be affected in a similar way.

4. Investment Management and Other Agreements

The Fund has entered into an investment management agreement (the “Investment Management Agreement”) with the Investment Manager. Pursuant to the Investment Management Agreement, the Fund pays the Investment Manager a monthly Investment Management Fee equal to 1.40%, accrued daily, on an annualized basis of the Fund’s average net assets. The Fund incurred $262,463 in investment management fees during the period. The Investment Manager waived $262,463 for the fiscal year ending March 31, 2024 and is not permitted to recoup the waived fees under the waiver agreement.

The Investment Manager contractually agreed to waive its entire management fee until June 30, 2025 and agreed to partially waive its management fee to charge 1.00% on an annualized basis of the Fund’s average net assets from July 1, 2025 until June 30, 2026.

Prior to the appointment of Cliffwater as the Fund’s investment adviser, effective on February 27, 2024, Barings served as investment adviser to the Fund. Under the prior investment advisory agreement between Barings and the Fund, Barings was responsible for providing investment management services for the Fund. In return for these services, Barings received an advisory fee at an annual rate of 1.25% of the net assets of the Fund as of the end of each quarter. Pursuant to the agreement, the Fund incurred $1,723,025 in Investment Advisory Fees for the year ended March 31, 2024, which is included in the Consolidated Statement of Operations. As of March 31, 2024, the payable due to Barings was $310,415. Barings had entered into an investment subadvisory agreement with BIIL on behalf of the Fund. This agreement provided that BIIL help manage the investment and reinvestment of assets of the Fund. As compensation under the subadvisory agreement, Barings paid BIIL a quarterly Subadvisory Fee equal to 10% of the advisory fee received by Barings. Barings had also entered into an administrative and shareholding services agreement to provide the Fund certain administration, accounting, and compliance services. The Fund did not incur charges associated with these services. The investment advisory agreement with Barings, the sub-advisory agreement with BIIL and the administrative and shareholder services agreementt with Barings were terminated as of February 27, 2024.

Effective February 27, 2024, Foreside Fund Services, LLC serves as the Fund’s distributor, UMB Fund Services, Inc. (“UMBFS”) serves as the Fund’s transfer agent, and State Street serves as the Fund’s accountant and administrator. Prior to February 27, 2024, ALPS Distributors, LLC served as the Fund’s distributor, and State Street served as the Fund’s transfer agent and sub-administrator. For the year ended March 31, 2024, the Fund’s allocated State Street and UMBFS fees are reported on the Consolidated Statement of Operations. For the year ended March 31, 2024, the Fund’s allocated fees incurred for trustees are reported on the Consolidated Statement of Operations.

Effective February 27, 2024, Vigilant Compliance, LLC provides Chief Compliance Officer (“CCO”) services to the Fund. The Fund’s allocated fees incurred for CCO services for the year ended March 31, 2024, are reported on the Consolidated Statement of Operations.

Officers and Trustees

Certain former officers and/or trustees of the Fund were officers and/or trustees of Barings or its affiliates. The compensation of a trustee who is not an employee of Barings is borne by the Fund. Certain officers and/or trustees of the Fund are officers and/or trustees of Cliffwater or its affiliates. The compensation of a trustee who is not an employee of Cliffwater is borne by the Fund.

Expense Caps and Waivers

Barings had agreed to cap the fees and expenses of the Fund (including organizational and offering expenses, but excluding extraordinary legal and other expenses, Acquired Fund Fees and Expenses, interest expense, expenses related to borrowings, securities lending, leverage, taxes, and brokerage, short sale dividend and loan expense, or other non-recurring or unusual

19

Cascade Private Capital Fund

Notes to Consolidated Financial Statements

March 31, 2024 (Continued)

4. Investment Management and Other Agreements (continued)

expenses such as shareholder meeting expenses, as applicable) until such agreement was terminated effective February 27, 2024, to the extent that Total Annual Fund Operating Expenses after Expense Reimbursement would otherwise exceed the applicable class of shares of the Fund, as follows:

Barings was entitled to recoup in later periods, expenses that Barings had paid or otherwise borne to the extent that the expenses for the Fund after such recoupment did exceed the lower of (i) the annual expense limitation rate in effect at the time of the actual wavier/reimbursement and (ii) the annual expense limitation rate in effect at the time of the recoupment; provided that Barings would not be permitted to recoup any such fees or expenses beyond three years from the end of the month in which such fee was reduced or such expense was reimbursed. Barings did not waive fees during the period and did not recoup previously waived fees. There are no previously waived fees.

5. Fair Value of Investments

The Fund values its investments at fair value. Fair value is defined as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. A three-tier hierarchy is utilized to classify assets based on the use of observable versus unobservable market data inputs of fair value measurements for disclosure purposes. Inputs refer broadly to the assumptions that market participants would use in valuing the asset or liability. Observable inputs are inputs that reflect the assumptions market participants would use in pricing the asset or liability and are developed based on market data obtained from sources independent of the reporting entity. Unobservable inputs may include the adviser’s own assumptions in determining the fair value of investments. The three-tier hierarchy of inputs is summarized in the three broad levels listed below. The inputs or methodology used for valuing investments are not necessarily an indication of the risk associated with investing in those investments and the determination of the significance of a particular input to the fair value measurement in its entirety requires judgment and consideration of factors specific to each security.

Level 1 – quoted prices (unadjusted) in active markets for identical investments that the Fund can access at the measurement date

Level 2 – other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, credit risk, etc.)

Level 3 – significant unobservable inputs, to the extent observable inputs are not available (including the Fund’s own assumptions in determining the fair value of investments)

The availability of observable inputs can vary by security and is affected by a variety of factors, including, for example, the type of security, whether the security is new and not yet established in the marketplace, the liquidity of markets, and other characteristics particular to the security. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. Accordingly, the degree of judgment exercised in determining fair value is greatest for instruments categorized in Level 3.

Changes in valuation techniques may result in transfers in or out of an investment’s assigned level within the hierarchy. In addition, in periods of market dislocation, the observability of prices and inputs may be reduced for many instruments. This condition, as well as changes related to liquidity of investments, could cause a security to be reclassified between levels. In certain cases, the inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls is determined based on the lowest level input that is significant to the overall fair value measurement.

Investments in Private Investment Funds are measured based upon NAV as a practical expedient to determine fair value are not required to be categorized in the fair value hierarchy. These Private Investment Funds are included in the table to reconcile to the Consolidated Statement of Assets and Liabilities.

20

Cascade Private Capital Fund

Notes to Consolidated Financial Statements

March 31, 2024 (Continued)

5. Fair Value of Investments (continued)

The Fund’s assets recorded at fair value have been categorized based on a fair value hierarchy as described in the Fund’s significant accounting policies. The following table presents information about the Fund’s assets and liabilities measured at fair value as of March 31, 2024.

Investment Type | | Level 1 | | | Level 2 | | | Level 3 | | | Investment

Valued at NAV | | | Total | |

Primary Fund Investments | | $ | — | | | $ | — | | | $ | — | | | $ | 64,033,656 | | | $ | 64,033,656 | |

Secondary Fund Investments | | | — | | | | — | | | | — | | | | 68,567,497 | | | | 68,567,497 | |

Equity Co-Investments | | | — | | | | — | | | | 17,708,026 | | | | 47,945,099 | | | | 65,653,125 | |

Senior Secured Loan | | | — | | | | — | | | | 4,952,964 | | | | — | | | | 4,952,964 | |

Short-Term Investments | | | | | | | | | | | | | | | | | | | | |

Money Market Fund | | | 266,709,775 | | | | — | | | | — | | | | — | | | | 266,709,775 | |

Total Investments | | $ | 266,709,775 | | | $ | — | | | $ | 22,660,990 | | | $ | 180,546,252 | | | $ | 469,917,017 | |

The following table presents the changes in assets and transfers in and out for investments that are classified in Level 3 of the fair value hierarchy for the year ended March 31, 2024.

| | Secondary Fund

Investments | | | Co-Investments | | | Senior Secured

Loans | | | Total | |

Balance as of April 1, 2023 | | $ | 5,346,000 | | | $ | 23,489,824 | | | $ | — | | | $ | 28,835,824 | |

Purchases | | | — | | | | 233,627 | | | | 5,000,447 | | | | 5,234,074 | |

Sales | | | — | | | | — | | | | — | | | | — | |

Realized Gain (Loss) | | | — | | | | — | | | | — | | | | — | |

Change in Unrealized Appreciation/ (Depreciation) | | | — | | | | 1,528,280 | | | | (47,483 | ) | | | 1,480,797 | |

Transfer in | | | — | | | | — | | | | — | | | | — | |

Transfer out* | | | (5,346,000 | ) | | | (7,543,705 | ) | | | — | | | | (12,889,705 | ) |

Balance as of March 31, 2024 | | $ | — | | | $ | 17,708,026 | | | $ | 4,952,964 | | | $ | 22,660,990 | |

Net change in Unrealized Appreciation/(Depreciation) attributable to Level 3 Investments held at March 31, 2024 | | $ | — | | | $ | 1,528,280 | | | $ | (47,483 | ) | | $ | 1,480,797 | |

* | Transferred from Level 3 to NAV as Practical Expedient. |

21

Cascade Private Capital Fund

Notes to Consolidated Financial Statements

March 31, 2024 (Continued)

5. Fair Value of Investments (continued)

The following table summarizes the valuation techniques and significant unobservable inputs used for the Fund’s investments that are categorized in Level 3 of the fair value hierarchy as of March 31, 2024.

Investments | | Fair Value | | | Valuation

Technique | | | Unobservable

Inputs | | | Range of

Inputs Low | | | Range of

Inputs High | | | Weight

Average | | | Impact on

Valuation from

Increase in

Input | |

Equity Co-Investments | | $ | 17,708,026 | | | | Income/

Market

Approach | | | | Revenue Multiple | | | | 6.0x | | | | 6.0x | | | | 6.0x | | | | Increase | |

| | | | | | | | | | | | EBITDA Multiple | | | | 9.3x | | | | 13.3x | | | | 11.4x | | | | Increase | |

| | | | | | | | | | | | Discount Rate | | | | 9.10% | | | | 14.00% | | | | 12.17% | | | | Decrease | |

Senior Secured Loans | | | 4,952,964 | | | | Market

Approach | | | | Recent Transaction Price | | | | 105.71 | | | | 105.71 | | | | 105.71 | | | | Increase | |

Total | | $ | 22,660,990 | | | | | | | | | | | | | | | | | | | | | | | | | |

6. Capital Stock

The Fund is authorized as a Delaware statutory trust to issue an unlimited number of Shares in one or more classes, with no par value. The minimum initial investment in Class I Shares by any investor is $25,000,000. Prior to February 27, 2024, Class I Shares were named Class 1 Shares and had a minimum initial investment of $1,000,000. The minimum additional investment in the Fund by any shareholder is $10,000. However, the Fund, in its sole discretion, may accept investments below these minimums. Shares may be purchased by principals and employees of the Investment Manager or its affiliates and their immediate family members without being subject to the minimum investment requirements. Class I Shares are not subject to any initial sales charge. Shares will generally be offered for purchase on each business day, except that Shares may be offered more or less frequently as determined by the Fund in its sole discretion. Prior to Feburary 27, 2024, a 2.00% early repurchase fee was charged by the Fund with respect to any repurchase of shares from a shareholder at any time prior to the day immediately preceding the one-year anniversary of the shareholder’s purchase of shares. Such repurchase fee was retained by the Fund and will benefit the Fund’s remaining shareholders. The Board may also suspend or terminate offerings of Shares at any time.

Shareholders do not have the right to require the Fund to redeem their shares. To provide a limited degree of liquidity to shareholders, the Fund during the reporting period offered to repurchase shares pursuant to written tenders by shareholders. Repurchases, if any, were made at such times, in such amounts and on such terms as may be determined by the Prior Board, in its sole discretion. During the reporting period, the prior Board authorized the Fund to offer to repurchase Class 1 shares from shareholders on four occasions, May 16, 2023, August 16, 2023, November 16, 2023 and Feburary 13, 2024. On May 16, 2023, the Fund offered to repurchase up to 517,540 Class 1 shares (approximately 5% of outstanding Class 1 shares) from shareholders, with a June 30, 2023 valuation date. On August 16, 2023, the Fund offered to repurchase up to 604,030 Class 1 shares (approximately 5% of outstanding Class 1 shares) from shareholders, with a September 30, 2023 valuation date. On November 16, 2023, the Fund offered to repurchase up to 604,030 Class 1 shares (approximately 5% of outstanding Class 1 shares) from shareholders, with a December 31, 2023 valuation date. On February 13, 2024, the Fund offered to repurchase up to 604,030 Class 1 shares (approximately 5% of outstanding Class 1 shares) from shareholders, with a March 31, 2024 valuation date. There were no tender requests received for Class 1 shares in connection with such offers.

7. Federal Income Taxes

At March 31, 2024, gross unrealized appreciation and depreciation on investments, based on cost for federal income tax purposes were as follows:

| | Federal Income

Tax Cost | | | Tax Basis

Unrealized

Appreciation | | | Tax Basis

Unrealized

(Depreciation) | | | Net Unrealized

Appreciation

(Depreciation) | |

| | | $ | 419,204,354 | | | $ | 52,574,652 | | | $ | (1,861,989 | ) | | $ | 50,712,663 | |

22

Cascade Private Capital Fund

Notes to Consolidated Financial Statements

March 31, 2024 (Continued)

7. Federal Income Taxes (continued)

The difference between cost amounts for financial statement and federal income tax purposes is due primarily to timing differences in recognizing certain gains and losses on security transactions.

Net capital loss carryforwards may be applied against any net realized taxable gains in succeeding years, subject to the carryforward period limitations, where applicable. Capital losses may be carried forward indefinitely, and retain the character of the original loss. At September 30, 2023, the Fund had no capital loss carryforwards.

At September 30, 2023, the Fund elected to defer to the fiscal year beginning October 1, 2023, late year ordinary losses in the amount of $1,799,518.

There were no distributions from the Fund for the years ending March 31, 2024 or 2023.

GAAP requires that certain components of net assets be reclassified between financial and tax reporting. These reclassifications have no effect on net assets or net asset value per share. For the year ended March 31, 2024, permanent differences in book and tax accounting have been reclassified to paid-in capital and total distributable earnings as follows, due primarily to the write-off of net operating losses for the tax year ending September 30, 2023:

| | Capital | | | Distributable

Earnings/(Loss) | |

Cascade Private Capital Fund | | $ | (2,288,644 | ) | | $ | 2,288,644 | |

Temporary book and tax accounting differences will reverse in subsequent periods. At September 30, 2023, temporary book and tax accounting differences were primarily attributable to late year ordinary loss deferrals and and partnership activity.

As of September 30, 2023, the components of distributable earnings on a tax basis were as follows:

Capital Loss carryfoward | | $ | — | |

Other temporary differences | | | (1,799,518 | ) |

Unrealized appreciation | | | 27,952,080 | |

Deferred tax liability | | | (852,923 | ) |

Total | | $ | 25,299,639 | |

MMPEF Subsidiary is not taxed as a RIC. Accordingly, prior to the Fund receiving any distributions from MMPEF Subsidiary, all MMPEF Subsidiary’s taxable income and realized gains is subject to taxation at prevailing corporate tax rates.

The MMPEF Subsidiary recorded a provision for income tax expense (benefit) for the year end March 31, 2024. This provision for income tax expense (benefit) is comprised of the following current and deferred income tax expense (benefit):

| | Current | | | Deferred | | | Total | |

Tax expense/(benefit) | | $ | — | | | $ | 80,079 | | | $ | 80,079 | |

Valuation Allowance | | | — | | | | — | | | | — | |

| | | $ | — | | | $ | 80,079 | | | $ | 80,079 | |

Components of the MMPEF Subsidiary’s deferred tax assets and liabilities as of March 31, 2024:

Deferred Tax Assets: | | | | |

Net Operating Loss Carryforward | | $ | 232,840 | |

Less Deferred Tax Liabiities: | | | | |

Unrealized appreciation/depreciation on investments | | | (1,048,977 | ) |

Total net deferred tax asset/(liability) before valuation allowance | | | (816,137 | ) |

Less valuation allowance | | | — | |

Net deferred tax asset (liability) | | $ | (816,137 | ) |

23

Cascade Private Capital Fund

Notes to Consolidated Financial Statements

March 31, 2024 (Continued)

7. Federal Income Taxes (continued)

Net operating loss carry forwards are available to offset future taxable income of the MMPEF subsidiary subject to limitations. For the tax year ended September 30, 2023 the MMPEF Subsidiary has net operating loss and tentative net operating loss carryforward balances as of $897,610. These net operating losses are carried forward indefinitely.

8. Investment Transactions

For the year ended March 31, 2024, purchases and sales of investments, excluding short-term investments, were $62,894,223 and $4,897,384, respectively.

9. Indemnifications

Under the Fund’s organizational documents, current and former Trustees and Officers are provided with specified rights to indemnification against liabilities arising in connection with the performance of their duties to the Fund, and shareholders shall not be subject to any personal liability for obligations of the Fund. In the normal course of business, the Fund may also enter into contracts that provide general indemnifications. The Fund’s maximum exposure under these arrangements is unknown as this would be dependent on future claims that may be made against the Fund. The risk of material loss from such claims is considered remote.

10. Private Investment Vehicles

The following table represents investment strategies, unfunded commitments and redemptive restrictions of investments that are measured at NAV per share (or its equivalent) as a practical expedient as of March 31, 2024:

Security Description | Investment

Category | | Unfunded

Commitments | | | Cost | | | Fair Value | | | Redemption

Frequency | | | Redemption

Lock-up