2023 and (ii) in the event that the Company has not consummated an initial business combination by April 22, 2023, to allow the Company, by resolution of the ESGEN Board and, without any approval of the Company’s shareholders, upon five days’ advance notice prior to each Additional Extension Date, to extend the Termination Date up to six times (with each such extension being upon five days’ advance notice), each by one Additional Extension; provided, that the Sponsor or the Sponsor’s affiliates or permitted designees will deposit into the Trust Account for each Additional Extension Date the lesser of (i) US$140,000 or (ii) $0.04 for each Public Share that is then outstanding, in exchange for one or more non-interest bearing, unsecured promissory notes issued by the Company.

In connection with the vote to approve the Charter Amendment, the holders of 24,703,445 ESGEN Class A ordinary shares properly exercised their right to redeem their shares for cash at a redemption price of approximately $10.35 per share, for an aggregate redemption amount of approximately $255,875,758. The Company’s current Additional Extension Date as of the date hereof is September 22, 2023.

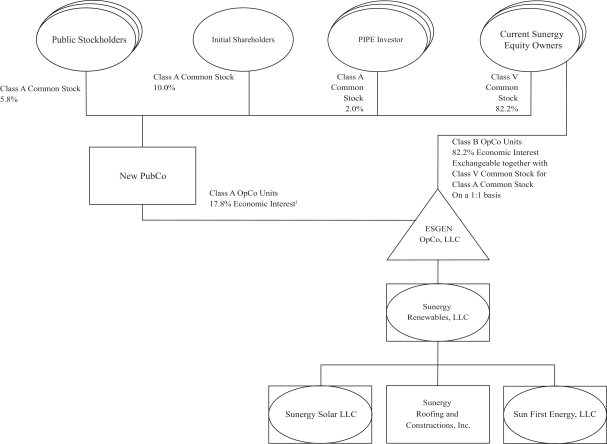

On April 19, 2023, the Company entered into a Business Combination Agreement, by and among the Company, OpCo, Sunergy, the Sellers, the Sponsor, for the limited purposes set forth therein, and Timothy Bridgewater, an individual, in his capacity as the Sellers Representative.

The Business Combination Agreement contains representations and warranties of certain of the parties thereto customary for transactions of this type. The representations and warranties made under the Business Combination Agreement will not survive the Closing.

The Business Combination is expected to close in the fourth quarter of 2023, following the receipt of the required approvals by our shareholders and the fulfillment of other customary closing conditions.

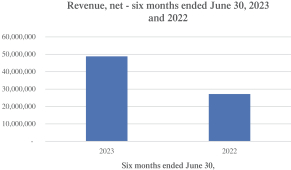

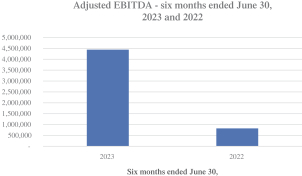

Results of Operations

All of our activity from April 19, 2021 (inception) through June 30, 2023, was in preparation for our IPO, and since our IPO, including the effectuation of the Charter Amendment and the negotiation and entry into the Business Combination Agreement. We will not generate any operating revenues until the closing and completion of a business combination.

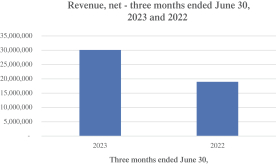

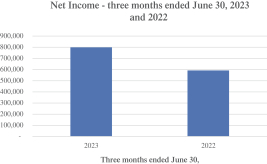

For the three months ended June 30, 2023, we had a net loss of $1,411,072, which consisted of a change in fair value of warrant liabilities of $378,624 and operating costs of $1,822,712, partially offset by interest income from marketable securities held in the Trust Account of $365,224 and recovery of offering costs allocated to warrants of $425,040.

For the three months ended June 30, 2022, we had a net income of $1,494,631, which consisted of a gain on change in fair value of warrant liabilities of $1,527,600, interest income from marketable securities held in Trust Account of $368,774, offset by operating costs of $401,743.

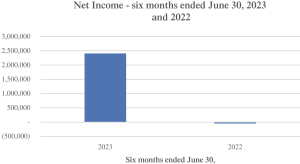

For the six months ended June 30, 2023, we had a net loss of $2,857,183, which consisted of a change in fair value of warrant liabilities of $1,252,800 and operating costs of $3,335,293, partially offset by interest income from marketable securities held in the Trust Account of $1,305,870 and recovery of offering costs allocated to warrants of $425,040.

For the six months ended June 30, 2022, we had a net income of $7,375,172, which consisted of a gain on change in fair value of warrant liabilities of $8,262,960, interest income from marketable securities held in Trust Account of $386,945, offset by formation and operating costs of $1,274,733.

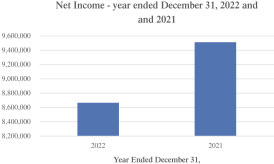

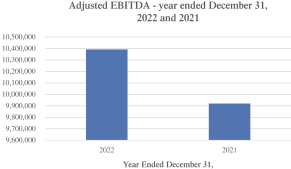

For the year ended December 31, 2022, we had a net income of $14,334,250, which consisted of a change in the fair value of warrant liabilities of $13,179,936, investment income on marketable securities held in the Trust Account of $3,984,431, partially offset by a loss from operations of $2,830,117.

284