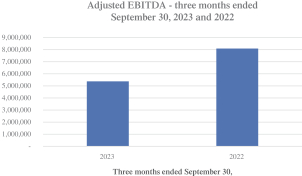

For the three months ended September 30, 2022, we had net income of $4,262,070, which consisted of a gain on change in fair value of warrant liabilities of $3,345,600, dividends earned on marketable securities held in the Trust Account of $1,245,745, partially offset by operating costs of $329,275.

On January 24, 2024, ESGEN issued a new promissory note (“January 2024 Promissory Note”) in the principal amount of up to $750,000 to the Sponsor. The January 2024 Promissory Note may be drawn down by ESGEN from time to time prior to the consummation of ESGEN’s initial Business Combination for specific uses as designated therein. The January 2024 Promissory Note does not bear interest, matures on the date of consummation of the Business Combination and is subject to customary events of default. The principal amount under the January 2024 Promissory Note will be paid at Closing from the funds that ESGEN has available to it outside of its Trust Account.

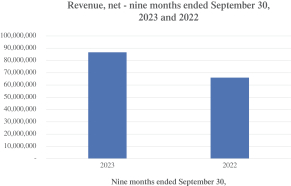

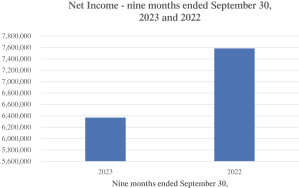

For the nine months ended September 30, 2023, we had a net loss of $2,225,459, which consisted of a change in fair value of warrant liabilities of $206,016 and operating costs of $4,164,293, partially offset by dividends earned on marketable securities held in the Trust Account of $1,719,810 and recovery of offering costs related to the IPO allocated to warrants of $425,040.

For the nine months ended September 30, 2022, we had net income of $11,637,242, which consisted of a gain on change in fair value of warrant liabilities of $11,608,560 and dividends earned on marketable securities held in the Trust Account of $1,632,690, partially offset by operating costs of $1,604,008.

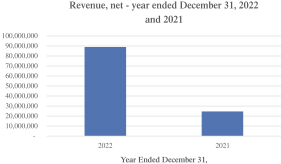

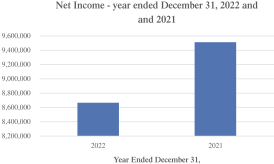

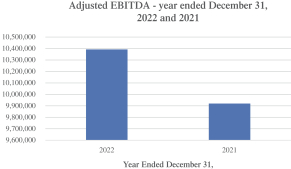

For the year ended December 31, 2022, we had a net income of $14,334,250, which consisted of a change in the fair value of warrant liabilities of $13,179,936, investment income on marketable securities held in the Trust Account of $3,984,431, partially offset by a loss from operations of $2,830,117.

For the period from April 19, 2021 (inception) through December 31, 2021, we had a net income of $9,460,263, which consisted of change in fair value of warrant liabilities of $10,944,240, investment income on marketable securities held in the Trust Account of $2,137, partially offset by a loss from operation including formation and operating costs and operating costs – related party of $776,033 and warrant issuance costs of $710,081.

Liquidity and Capital Resources

As of September 30, 2023, we had cash of $267,058 and owe $5,296,038 in accounts payable and accrued expenses and an additional $1,718,988 payable to related parties. As of September 30, 2022, we had cash of $890,273 and owed $1,089,538 in accrued offering costs and expenses and an additional $285,539 to related parties.

As of December 31, 2022, we had cash of $614,767 and owed $1,866,992 in accrued offering costs and expenses and an additional $315,539 payable to related parties.

Prior to the completion of our IPO, our liquidity needs had been satisfied through a capital contribution from the Sponsor of $25,000 and a loan to us of up to $300,000 by Sponsor under an unsecured promissory note, which had an outstanding balance of $171,346 at September 30, 2023 and December 31, 2022. On April 5, 2023, we issued an unsecured promissory note (the “Note”) in the principal amount of up to $1,500,000 to our Sponsor, which may be drawn down by us from time to time prior to the consummation of an initial business combination. As of September 30, 2023, there was approximately $1,238,449 outstanding under the Note. On October 17, 2023, we amended and restated the Note to increase the maximum principal amount that may be drawn thereunder to $2,500,000. On January 24, 2024, ESGEN issued a new promissory note in the principal amount of up to $750,000 to the Sponsor.

In addition, in order to finance transaction costs in connection with a business combination, the Sponsor, an affiliate of the Sponsor or certain of our officers and directors may, but are not obligated to, provide us Working Capital Loans. As of September 30, 2023 and December 31, 2022, there were no amounts outstanding under any Working Capital Loans.

311