UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 1-U

CURRENT REPORT PURSUANT TO REGULATION A

November 27, 2023

(Date of Report (Date of earliest event reported))

ENERGEA PORTFOLIO 3 AFRICA LLC

(Exact name of registrant as specified in its charter)

Delaware

(State or other jurisdiction of incorporation or organization)

86-2564467

(I.R.S. Employer Identification No.)

62 Clementel Drive, Durham, CT 06422

(Full mailing address of principal executive offices)

860-316-7466

(Issuer's telephone number, including area code)

Class A Investor Shares

(Title of each class of securities issued pursuant to Regulation A)

This IC Memo includes projections and forward-looking information that represent Energea's assumptions and expectations in light of currently available information. Except for statements of historical fact, the information contained herein constitutes forward-looking statements and they are provided to allow potential investors the opportunity to understand management's beliefs and opinions in respect of the future so that they may use such beliefs and opinions as one factor in evaluating an investment. These forward-looking statements are not guarantees of future performance and necessarily involve known and unknown risks and uncertainties, which may cause actual performance and financial results in future periods to differ materially from any projections of future performance.

Executive Summary

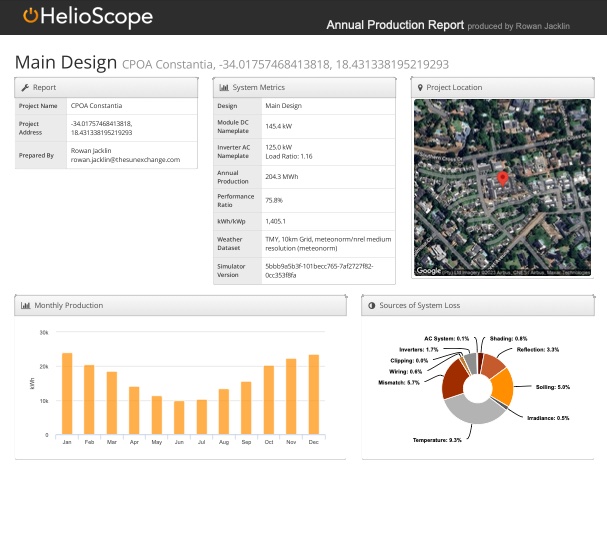

CPOA Constantia Place is a 125 kW (AC) rooftop solar installation to be located at Southern Cross Dr, Constantia, Cape Town, South Africa ("Project"). The Project will be connected "behind the meter" at the CPOA Constantia Place facility.

This solar plant will be leased to Cape Peninsula Organization for the Aged ("CPOA"), the roof owner and offtaker, through a take-or-pay contract for a period of 20 years called a "Solar Lease".

Energea Portfolio 3 Africa LLC ("Energea") will invest, through The Sun Exchange (SA) Bewind Trust ("Sun Exchange Trust"), a total of $115,108.47 with a projected IRR of 12.27% ($USD).

Key Information

General Info

Project Owner | Energea Portfolio 3 Africa LLC |

Project Location | Constantia, Cape Town, South Africa |

Technology | Rooftop Solar |

System Size (AC/DC) | 125 kW AC / 145.4 kW DC |

Estimated Year 1 Production | 204,300 kWh |

Coordinates | -34.01761545 ° S 18.43146708 E |

Roof Status | Verified by a third-party engineer |

Project Status | Under Construction |

Useful Equipment Life (Years) | 25 |

Stakeholders

SPE | The Sun Exchange (SA) Bewind Trust |

Offtaker | Cape Peninsula Organization for the Aged |

EPC Contractor | R.E Design Engineering (PTY) LTD |

O&M Contractor | The Sun Exchange (PTY) LTD ("Sun Exchange") |

Roof Owner | Cape Peninsula Organization for the Aged |

Asset Manager | The Sun Exchange (PTY) LTD ("Sun Exchange") |

Uses of Capital and Project Economics

Project Hard Costs | 1,534,937 ZAR |

Project Soft Costs | 172,986 ZAR |

Developer Fee | 437,699 ZAR |

Total Project Financing | 2,145,622 ZAR |

Debt Funding | N/A |

Equity Funding | 2,145,622 ZAR |

Cell Owner IRR | 12.27% ($USD) |

Project Review

Site

CPOA Constantia Place, the offtaker, owns the propriety on which the project will be installed. The rights to use the roof for a 20-year term has been secured through the Solar Lease.

NWE Consulting Engineers performed their roof inspection of the CPOA Constantia Place rooftops on Wednesday July 5th, 2023. During the inspection of the existing residential semi-detached units/dwellings, they confirmed that the timber trusses and beams system can accommodate the additional loading of the proposed solar panels. After the Project is constructed, NWE will provide the final structural competence certificate in accordance with section 14 subsection (2A) of the NBR and Building Standards Act (1977).

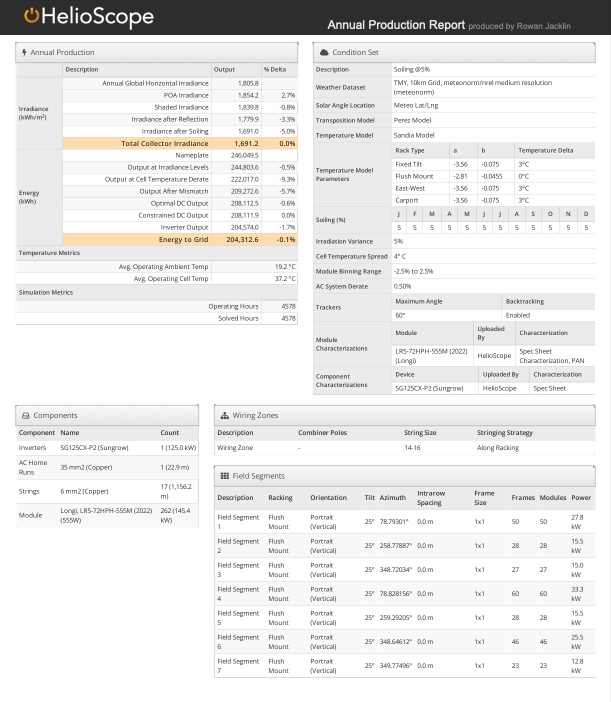

Design

The Project will employ 262 x 555 Wp LR5-72HPH-555M solar modules manufactured by Longi, a Tier 1 module manufacturer based in China. The plant will also use one (1) 125kW SG125CX-P2 Sungrow three phase hybrid inverter. Sungrow is a well-known worldwide inverter manufacturer that is highly recommended for C&I installations. Their technical support systems are worldwide and provide high levels of service in South Africa due to their local distribution facilities. The array will be mounted to a standard, pitched, standing seam roof. The racking/clamp assembly is made by K2 Systems, who has been used on a handful of already constructed and operational assets. The roof itself was inspected by NWE Consulting Engineers who confirmed the proposed array can be installed on the roof. Overall, this is a very standard rooftop solar design utilizing Tier 1 equipment.

The Project is estimated to produce 204.3 MWh/year after taking load shedding and historical irradiance date into consideration.

Interconnection

The Project will be connected to the distribution network owned and operated by the City of Cape Town Network. The Project applied for interconnection with the Energy Management Department and obtained the pre-approval for the installation of 144kW on September 28, 2023. A "revision" will be submitted to reflect the updated change in solar modules being used (LONGI 555W) and the +1.4kW DC capacity increase.

Once the installation of the Project is finished, the Energy Management Department will witness the commissioning process and verify compliance of the system 7-days from the request of the service.

Offtaker

The Sun Exchange Trust and CPOA Constantia Place signed Solar Lease on June 7th, 2023. This revenue agreement stipulates a variable-priced rent to be paid by CPOA Constantia Place based on the number of kWh produced by the Project per month. The tariff is adjusted annually on the anniversary of the COD date. The main terms of the Agreement are show on the Table 1 with additional detail in Legal Review below.

Table 1 - Solar Lease Main Terms

Revenue Contract Term | 20 years |

Asset Rental Rate | 1.63 ZAR per kWh |

Annual Adjustment | CPI + 2% |

Engineering, Procurement and Construction ("EPC")

R.E Design Engineering has been selected as the EPC partner for the Project. RED and Sun Exchange signed an EPC Contract on November 11th, 2023. Sun Exchange has worked with RED before on solar assets in South Africa, including Cape Town. Due diligence was performed on the contractor, and we believe they are capable of installing the Project. Sun Exchange will also have a Project Manager or Engineer onsite during the installation process. Constant oversight, especially during the key install phases will ensure a quality product that meets Energea's standards.

Insurance

During construction, R.E Design will provide and maintain adequate insurance coverage, at its cost, for property and general liability risk until final completion. After COD and during operation, Sun Exchange will provide and maintain an all-risk propriety and general liability insurance for the project. In each case, Energea is named as an additional insured under such policies.

O&M

The O&M services will be provided by RED for the first 2 years of operation. This service includes monitoring, reporting, module cleaning, preventative maintenance, saving calculations and on-site IT and technical support.

Financial Analysis

The resulting nominal IRR, in USD, of CPOA Constantia Place is projected to be 12.27%, with an estimated payback of 9 years, 0 months, and 11 days from the NTP date. The income statement, cash flow statement and balance sheet up until 2032 (shown annually) are presented on Exhibit I.

Energea is acquiring 100.00% ownership of the Project for a total investment of 115,108.47 USD.

The projected revenue model assumes an inflation rate of 5% based on a 5-year trailing average. Data is provided by the South African Department of Statistics, StatsSA, as a basis for defining the Consumer Price Index ("CPI"). This assumption is within the range of the South African Central Bank's targeted inflation of 3.00% to 6.00%.

Revenue

The source of the project's revenue originates from a 20-year Solar Lease with CPOA, for a fixed base price of R1.63 ZAR / kWh. The rate is readjusted annually on the anniversary of COD by the ZAR CPI rate plus a 2% spread. The average customer savings during the period is estimated to be of 31.13%.

Operating Expenses

The only project-level operating expense assumed is the price paid to Sun Exchange under a turnkey Asset Management Agreement which requires Sun Exchange to provide all asset management services the Project needs including operations and maintenance, insurance, accounting, and other project-related fees and expenses. The value of the management fee is calculated as 29.81% of the realized revenue.

Capex

The costs to construct the Project, inclusive of the Value-Added Tax ("VAT") of 15,00%, are described in the table below:

Table 2 - Capital Expenditures Assumptions

Acquisition Costs | N/A | N/A |

| | |

Modules | 605,874 ZAR | 4.20 ZAR/Wdc |

Inverters | 129,624 ZAR | 0.90 ZAR/Wdc |

Mounting Materials | 253,508 ZAR | 1.76 ZAR/Wdc |

Electrical Materials | 207,413 ZAR | 1.44 ZAR/Wdc |

Labor and Accommodations | 281,992 ZAR | 1.96 ZAR/Wdc |

Others | 56,527 ZAR | 0.39 ZAR/Wdc |

Hard Costs | 1,534,937 ZAR | 10.65 ZAR/Wdc |

| | |

Basic Studies and Executive Project | 9,036 ZAR | 0.06 ZAR/Wdc |

Engineering | 163,950 ZAR | 1.14 ZAR/Wdc |

Soft Costs | 172,986 ZAR | 1.20 ZAR/Wdc |

| | |

Developer Fees | 437,699 ZAR | 3.04 ZAR/Wdc |

| | |

Pre-COD OpEx | N/A | N/A |

| | |

Total CapEx (All-In) | 2,145,622 ZAR | 14.89 ZAR/Wdc |

Total CapEx (All-In) | 115,108 USD | 0.80 USD/Wdc |

Legal Review

Relevant Documents

A Legal review was performed in the project's available documentation. The most relevant documents are listed below:

1. Solar Lease

2. EPC Contract

Contracts Summary

Table 3 - Solar Lease Summary

Contract | Asset Lease to Own Agreement |

Date | June 7th, 2023 |

Parties | The Sun Exchange (SA) Bewind Trust - As Lessor Cape Peninsula Organization for the Aged - As Lessee |

Term | 20 years from the Commercial Operation Date |

Object | Lessor will lease to Lessee the asset, a photovoltaic electricity power generator, located at 6 Loret Avenue, Constantia, Cape Town. |

Initial Asset Rental Amount | ZAR1.63/kWh |

Asset Rental Annual Escalation Rate | CPI+2% |

Escalation Frequency and Date | Annually on the anniversary of the COD |

Payment | Monthly, within 14 (fourteen) days of receipt of each monthly invoice |

Late Payment | Interest of 2% (two per cent) per month |

Currency | South African Rand |

Insurance | Lessor shall insure the asset from the COD for an amount equal to the full insurable value of the asset, the premiums and any increases payable in respect of such insurance being for the account of the Lessor. |

Buy-Out Option | Lessee has the option at any time to purchase the asset (and all its component parts) from Lessor at a price defined in an exhibit ("Buy-Out Price"). |

Termination Buy-Out | In case of termination pursuant to the Lessee's breach, Lessor is entitled, in its sole discretion, to exercise the Termination Buy-Out Option, as a consequence of which the Lessee shall be compelled to pay the Lessor the Buy-Out Price. |

Remedy of Lessee | Lessee's remedy against the Lessor for a breach of any obligation is to claim specific performance. Lessee is precluded from cancelling the agreement pursuant to Lessor's breach. |

Dispute Resolution | Arbitration |

Table 4 - EPC Contract

Contract | EPC Contract including Long Term Performance Tests |

Date | November 11th, 2023 |

Parties | Sun Exchange (PTY) LTD - As Customer R.E Design Engineering (PTY) LTD - As Contractor |

Term | 2 years from the Commercial Operation Date |

Object | Technical planning, design, the procurement and delivery of all necessary components, manufacture, assembly and construction services as well as the installation and connection to the Client's electrical reticulation and where grid tied, to the local grid, which is necessary for delivery and transfer from the Contractor to the Customer of a fully operational, turnkey Solar Plant, with a total electrical capacity of 145.4 kWp, which is suitable for safe and continued operation for a period of at least 20 years after it is connected to the electrical reticulation. |

Construction Contract Price | R 1,698,886.98 (exclusive of VAT) |

Rate Fluctuation | Should the ZAR/USD forex rates fluctuate by more than 5% before NTP, the Contractor shall be required to reprice the Construction Contract Price in accordance with the forex rate fluctuation. |

O&M Scope of Works | The Contractor shall provide Operation and Maintenance Services, for 2 years post COD and until the achievement of Final Completion. |

O&M Contract Price | R 50,966.61 (exclusive of VAT), to be paid on a quarterly basis. |

Delay Liquidated Damages | If Contractor fails to complete the works by the due date, the Contractor shall pay the Customer Delay Liquidated Damages. |

Performance Liquidated Damages | If the guaranteed performance ratio or guaranteed availability is not achieved, the Contractor shall pay the Customer Performance Liquidated Damages. |

Warranty Period | 2 years starting from the date of issuance of the COD Notice |

Performance Guarantee | As a condition to achieving the COD, the Contractor shall obtain and deliver (at its cost) to the Customer a Performance Guarantee as security for its proper performance of its obligations, in an amount no less than 5% (five percent) of the Construction Contract Price. |

Governing Law | South Africa |

Disputes Resolution | Arbitration |

Documentation Checklist

Table 5 - Documentation Checklist

Design and Application | Bills | X |

Helioscope Reports | X |

Meter Data | X |

Site and Roof Assessment | X |

Self-Consumption Analysis | X |

Interconnection Application | Interconnection Application | X |

Permission to Install Letter | X |

Offtaker | Offtaker Credit Analysis | X |

Lease Agreement | X |

Incentives | X |

EPC | Construction Set* | X |

Equipment Warranties | X |

Equipment Purchase Order | |

Equipment Datasheet | X |

EPC Contract | X |

EPC Insurance | X |

Asset Management | O&M Agreement | |

Asset Management Agreement | X |

Investment | Project Model | X |

The Investment Committee members have reviewed the Project Memorandum and hereby approve the investment on the CPOA Constantia Place Project.

Signature

Pursuant to the requirements of Regulation A, the issuer has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Energea Global LLC

By MICHAEL SILVESTRINI

Name: Mike Silvestrini

Title: Co-Founder

Date November 27, 2022

Exhibit I

Income Statement, Cash Flow Statement and Balance Sheet

Consolidated Statements of Income

| | | | | December 31, | | | | |

| 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 |

Gross revenue | R 0 | R 237,674 | R 281,206 | R 297,759 | R 315,251 | R 333,734 | R 370,442 | R 398,090 | R 425,956 | R 446,191 |

Taxes on revenue: | | | | | | | | | | |

Total taxes on revenue | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

Net revenue | 0 | 237,674 | 281,206 | 297,759 | 315,251 | 333,734 | 370,442 | 398,090 | 425,956 | 446,191 |

Costs and expenses: | | | | | | | | | | |

Operations and maintenance | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

Land or roof rental | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

Insurance | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

FX Wire Fees | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

Banking Fees | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

Postage and Courier Services | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

Travel | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

Utilities | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

Management Fees | 0 | 64,172 | 75,926 | 80,395 | 85,118 | 90,108 | 100,019 | 107,484 | 115,008 | 120,472 |

Other | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

Total costs and expenses | 0 | 64,172 | 75,926 | 80,395 | 85,118 | 90,108 | 100,019 | 107,484 | 115,008 | 120,472 |

Income from operations | 0 | 173,502 | 205,280 | 217,364 | 230,134 | 243,626 | 270,423 | 290,605 | 310,948 | 325,719 |

Interest and other income (expense), net | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

Depreciation and amortization | 0 | (201,026) | (219,301) | (219,301) | (219,301) | (219,301) | (219,301) | (219,301) | (219,301) | (219,301) |

Income before provision for income taxes | 0 | (27,524) | (14,021) | (1,937) | 10,832 | 24,325 | 51,122 | 71,304 | 91,647 | 106,418 |

Provision for income taxes | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

Net income | R 0 | R (27,524) | R (14,021) | R (1,937) | R 10,832 | R 24,325 | R 51,122 | R 71,304 | R 91,647 | R 106,418 |

Consolidated Statements of Cash Flow

| | | | | December 31, | | | | |

| 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 |

Assets | | | | | | | | | | |

Current assets: | | | | | | | | | | |

Cash and cash equivalents | R 0 | R 19,213 | R 20,345 | R 21,541 | R 22,805 | R 24,141 | R 26,947 | R 28,834 | R 30,852 | R 32,262 |

Accounts receivable | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

Prepaid expenses and other current assets | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

Total current assets | 0 | 19,213 | 20,345 | 21,541 | 22,805 | 24,141 | 26,947 | 28,834 | 30,852 | 32,262 |

Property and equipment | 2,145,622 | 2,145,622 | 2,145,622 | 2,145,622 | 2,145,622 | 2,145,622 | 2,145,622 | 2,145,622 | 2,145,622 | 2,145,622 |

Depreciation | 0 | (201,026) | (420,327) | (639,629) | (858,930) | (1,078,231) | (1,297,532) | (1,516,833) | (1,736,135) | (1,955,436) |

Tax credits | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

Other assets | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

Total assets | R 2,145,622 | R 1,963,809 | R 1,745,639 | R 1,527,535 | R 1,309,498 | R 1,091,532 | R 875,037 | R 657,622 | R 440,339 | R 222,448 |

| | | | | | | | | | |

Liabilities and stockholders' equity | | | | | | | | | | |

Current liabilities: | | | | | | | | | | |

Accounts payable | R 0 | R 0 | R 0 | R 0 | R 0 | R 0 | R 0 | R 0 | R 0 | R 0 |

Short-term debt | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

Accrued expenses and other current liabilities | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

Total current liabilities | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

Tax payable | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

Long-term debt | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

Other liabilities | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

Total liabilities | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| | | | | | | | | | |

Stockholders' equity: | | | | | | | | | | |

Additional paid-in capital | 2,145,622 | 2,145,622 | 2,145,622 | 2,145,622 | 2,145,622 | 2,145,622 | 2,145,622 | 2,145,622 | 2,145,622 | 2,145,622 |

Retained earnings | 0 | (181,813) | (399,982) | (618,087) | (836,124) | (1,054,090) | (1,270,585) | (1,488,000) | (1,705,282) | (1,923,173) |

Total stockholders' equity | 2,145,622 | 1,963,809 | 1,745,639 | 1,527,535 | 1,309,498 | 1,091,532 | 875,037 | 657,622 | 440,339 | 222,448 |

Total liabilities and stockholders' equity | R 2,145,622 | R 1,963,809 | R 1,745,639 | R 1,527,535 | R 1,309,498 | R 1,091,532 | R 875,037 | R 657,622 | R 440,339 | R 222,448 |

Consolidated Balance Sheet

| | | | | December 31, | | | | |

| 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 |

Assets | | | | | | | | | | |

Current assets: | | | | | | | | | | |

Cash and cash equivalents | R 0 | R 19,213 | R 20,345 | R 21,541 | R 22,805 | R 24,141 | R 26,947 | R 28,834 | R 30,852 | R 32,262 |

Accounts receivable | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

Prepaid expenses and other current assets | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

Total current assets | 0 | 19,213 | 20,345 | 21,541 | 22,805 | 24,141 | 26,947 | 28,834 | 30,852 | 32,262 |

Property and equipment | 2,145,622 | 2,145,622 | 2,145,622 | 2,145,622 | 2,145,622 | 2,145,622 | 2,145,622 | 2,145,622 | 2,145,622 | 2,145,622 |

Depreciation | 0 | (201,026) | (420,327) | (639,629) | (858,930) | (1,078,231) | (1,297,532) | (1,516,833) | (1,736,135) | (1,955,436) |

Tax credits | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

Other assets | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

Total assets | R 2,145,622 | R 1,963,809 | R 1,745,639 | R 1,527,535 | R 1,309,498 | R 1,091,532 | R 875,037 | R 657,622 | R 440,339 | R 222,448 |

| | | | | | | | | | |

Liabilities and stockholders' equity | | | | | | | | | | |

Current liabilities: | | | | | | | | | | |

Accounts payable | R 0 | R 0 | R 0 | R 0 | R 0 | R 0 | R 0 | R 0 | R 0 | R 0 |

Short-term debt | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

Accrued expenses and other current liabilities | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

Total current liabilities | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

Tax payable | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

Long-term debt | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

Other liabilities | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

Total liabilities | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| | | | | | | | | | |

Stockholders' equity: | | | | | | | | | | |

Additional paid-in capital | 2,145,622 | 2,145,622 | 2,145,622 | 2,145,622 | 2,145,622 | 2,145,622 | 2,145,622 | 2,145,622 | 2,145,622 | 2,145,622 |

Retained earnings | 0 | (181,813) | (399,982) | (618,087) | (836,124) | (1,054,090) | (1,270,585) | (1,488,000) | (1,705,282) | (1,923,173) |

Total stockholders' equity | 2,145,622 | 1,963,809 | 1,745,639 | 1,527,535 | 1,309,498 | 1,091,532 | 875,037 | 657,622 | 440,339 | 222,448 |

Total liabilities and stockholders' equity | R 2,145,622 | R 1,963,809 | R 1,745,639 | R 1,527,535 | R 1,309,498 | R 1,091,532 | R 875,037 | R 657,622 | R 440,339 | R 222,448 |

Exhibit II

Energy Resource Study