Defects, errors, or vulnerabilities in our solution, including failures in connection with client market orders, could harm our reputation, result in significant costs to us, impair our ability to sell our solution and subject us to substantial liability.

Our cloud-based investment management solution is inherently complex and may contain errors, failures, defects, bugs, or other performance problems, particularly when first introduced or as new versions are released. Despite extensive testing, from time-to-time we have discovered errors, failures, defects, bugs, or other performance problems in our systems. In addition, due to changes in regulatory requirements relating to our clients, we may discover deficiencies in our software processes related to those requirements. Material performance problems or defects in our systems might arise in the future.

Any such errors, failures, defects, bugs, or other performance problems, or disruptions in service to provide bug fixes or upgrades, whether in connection with day-to-day operations or otherwise, could be costly for us to remedy, damage our clients’ businesses and harm our reputation. In addition, if we have any such errors, failures, defects, bugs, or other performance problems, our clients could seek to terminate their agreements, elect not to renew their subscriptions, delay or withhold payment or make claims against us. Any of these actions could result in lost business, increased insurance costs, difficulty in collecting our accounts receivable, costly litigation and adverse publicity. Such errors, defects, or other problems could also result in reduced sales or a loss of, or delay in, the market acceptance of our solution.

Moreover, software development is time-consuming, expensive, complex and requires regular maintenance. Unforeseen difficulties can arise including failures in connection with client market orders and failures in delivering software development in a timely manner. If we do not complete our periodic maintenance according to schedule or if clients are otherwise dissatisfied with the frequency and/or duration of our maintenance services, clients could elect not to renew, or delay or withhold payment to us or cause us to issue credits, make refunds, or pay penalties. We might also encounter technical obstacles, and it is possible that we discover problems that prevent our solution from operating properly. If our solution does not function reliably or fail to achieve client expectations in terms of performance, clients could seek to cancel their agreements with us and assert liability claims against us, which could damage our reputation, impair our ability to attract or maintain clients and harm our results of operations.

If we fail to effectively anticipate and respond to changes in the industry in which we operate, our ability to attract and retain clients could be impaired and our competitive position could be harmed.

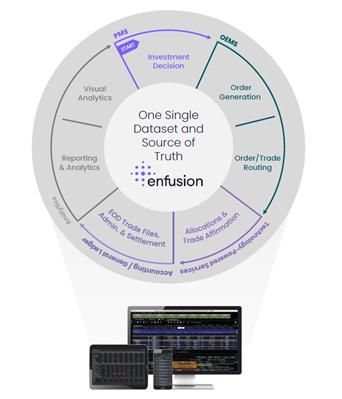

The financial services industry is subject to rapid change and the introduction of new technologies to meet the needs of this industry will continue to have a significant effect on competitive conditions in our market. If we are unable to successfully expand our product offerings beyond our current solution, our clients could migrate to competitors who may offer a broader or more attractive range of products and services. Unexpected delays in releasing new or enhanced versions of our solution, or errors following their release, could result in loss of sales, delay in market acceptance, or client claims against us, any of which could adversely affect our business. The success of any new system depends on several factors, including timely completion, adequate quality testing and market acceptance. We may not be able to enhance aspects of our solution successfully or introduce and gain market acceptance of new applications or improvements in a timely manner, or at all. Additionally, we must continually modify and enhance our solution to keep pace with changes in software applications, database technology, and evolving technical standards and interfaces.

Uncertainties related to our ability to introduce and improve functionality, announcements or introductions of a new or updated solution, or modifications by our competitors could adversely affect our business and results of operations.

Events affecting the investment management industry could materially and adversely affect us and cause our stock price to decline significantly.

Our revenues are diversified across our client base. During the year ended December 31, 2021, no client represented more than 4% of our total revenues, and our top 10 clients represented approximately 14% of our total revenues. However, our clients are concentrated within the investment management sector, and any events that have an adverse impact on that sector could materially and adversely affect us. Furthermore, our clients operate in the volatile global financial markets and are influenced by a number of factors outside of their control, including rising interest rates, inflation, the availability of credit, issues with sovereign and large institutional obligors, changes in laws and regulations,