SIGNA SPORTS UNITED 2 This presentation (“Presentation”) is provided by SIGNA Sports United N.V. (the “Company”, and together with its consolidated subsidiaries, the “Group”) for informational purposes only. The information contained herein does not purport to be all-inclusive and neither the Company nor any of its or their control persons, officers, directors, employees or representatives makes any representation or warranty, express or implied, as to the accuracy, completeness or reliability of the information contained in this Presentation. You should consult your own counsel and tax and financial advisors as to legal and related matters concerning the matters described herein, and, by accepting this Presentation, you confirm that you are not relying upon the information contained herein to make any decision. This Presentation, and other statements that the Group may make, contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act. These forward-looking statements include, but are not limited to, statements regarding: the Group’s intent, belief or current expectations; future events; the estimated or anticipated future results and revenues of the Group; future opportunities for the Group; future planned products and services; business strategy and plans; objectives of management for future operations of the Group; market size and growth opportunities; competitive position, technological and market trends; and other statements that are not historical facts. Forward-looking statements generally are accompanied by words such as “believe,” “may,” “will,” “estimate,” “continue,” “anticipate,” “intend,” “expect,” “should,” “could,” “would,” “plan,” “predict,” “potential,” “seem,” “seek,” “future,” “outlook,” “suggests,” “targets,” “projects,” “forecast” and similar expressions that predict or indicate future events or trends or that are not statements of historical matters. These forward-looking statements are based on the current expectations, beliefs and assumptions of the Group’s management and on information currently available to management and are not predictions of actual performance or further results. Forward-looking statements are subject to risks and uncertainties, and actual results may differ materially from those expressed or implied in the forward-looking statements due to various factors, including, but not limited to, the following, as well as the risk factors discussed in “Item 3. Key Information —D. Risk Factors” in our 20-F filing as of February 7, 2023 and the risk factors discussed in “Operating and Financial Review and Prospects—Risk Factors” of the Unaudited Interim Condensed Consolidated Financial Statements as of and for the six-months period ended March 31, 2023 and Exhibit 99.4 in our 6-K filing as of June 28, 2023: o our liquidity and losses from operations and projected cash flows and related impact on our ability to continue as a going concern; o our future financial condition and operating results; o our ability to remain in compliance with financial covenants under our financing arrangements; o our ability to extend, renew or refinance our existing debt; o our growth, expansion and acquisition prospects and strategies, the success of such strategies, and the benefits we believe can be derived from such strategies; o our ability to effectively manage our inventory and inventory reserves; o impairments of our goodwill or other intangible assets; o changes in consumer spending patterns and overall levels of consumer spending; o our ability to further upgrade our information technology systems and infrastructure, including our accounting processes and functions, and other risks associated with the systems that operate our online retail operations; o our ability to continue to remedy weaknesses in our internal controls; o costs as a result of operating as a public company; o our assumptions regarding interest rates and inflation; o changes affecting currency exchange rates; o continuing business disruptions arising from the on-going war in Ukraine and in the aftermath of the coronavirus pandemic; o our financial condition and ability to obtain financing in the future to implement our business strategy and fund capital expenditures, acquisitions and other general corporate activities; o estimated future capital expenditures needed to preserve our capital base; o changes in general economic conditions in the Federal Republic of Germany (“Germany”), and the European Union and the Unites States of America, including changes in the unemployment rate, the level of energy and consumer prices, wage levels, etc.; o the further development of online sports markets, in particular the levels of acceptance of internet retailing; o our behavior on mobile devices and our ability to attract mobile internet traffic and convert such traffic into purchases of our goods; o our ability to offer our customers an inspirational and attractive online purchasing experience; o demographic changes, in particular with respect to Germany; o changes in our competitive environment and in our competition level; o the occurrence of accidents, terrorist attacks, natural disasters, fires, environmental damage, or systemic delivery failures; o our inability to attract and retain qualified personnel, consultants and collaborators;

SIGNA SPORTS UNITED 3 o political changes; o changes in laws and regulations; o our expectations relating to dividend payments and forecasts of our ability to make such payments. Forward-looking statements speak only as of the date they are made, and the Group assumes no duty to and does not undertake to update forward-looking statements. Actual results could differ materially from those anticipated in forward-looking statements and future results could differ materially from historical performance for many reasons, including the risk factors discussed in “Item 3. Key Information —D. Risk Factors” in our 20-F filing as of February 7, 2023 and the risk factors discussed in “Operating and Financial Review and Prospects—Risk Factors” of the Unaudited Interim Condensed Consolidated Financial Statements as of and for the Six-Months Period ended March 31, 2023 and Exhibit 99.4 in our 6-K filing as of June 28, 2023 and our ability to continue as a going concern. This Presentation is for informational purposes only and does not constitute, or form a part of, an offer to sell or the solicitation of an offer to sell or an offer to buy or the solicitation of an offer to buy any securities, and there shall be no sale of securities, in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended, and otherwise in accordance with applicable law.

SIGNA SPORTS UNITED 4

SIGNA SPORTS UNITED 5 – Strategic realignment and onboarding of highly experienced leadership in Bike and Tennis – Business focus on returning to profitability – Benefits of strategic realignment to drive ~100M EUR of run-rate savings, including o Focus on core markets o Adaptation of commercial and operational models o Deliver on transaction synergies – Exceptional one-time inventory write-off of ~20M EUR to be sold through alternative clearance channels – Major indirect shareholder providing up to 150M EUR of additional liquidity to fund the operational and investment requirements of the business into FY25 – Exploring strategic alternatives related to the sale of Teamsports business – Anticipation of improved operating environment in FY24; renewed focus on profitable long-term growth – Clear pathway to free cash flow generation going into FY25 – Continued challenging operating environment & strategic decisions weighing on financial performance – Most severe impacts of market disruptions incurred in H1 FY23, improvement anticipated for H2 FY23 – Net revenue decline of (2)%; PF YoY growth of (17)% – Gross margin contraction to 26%; Adj. EBITDA margin of (22)%

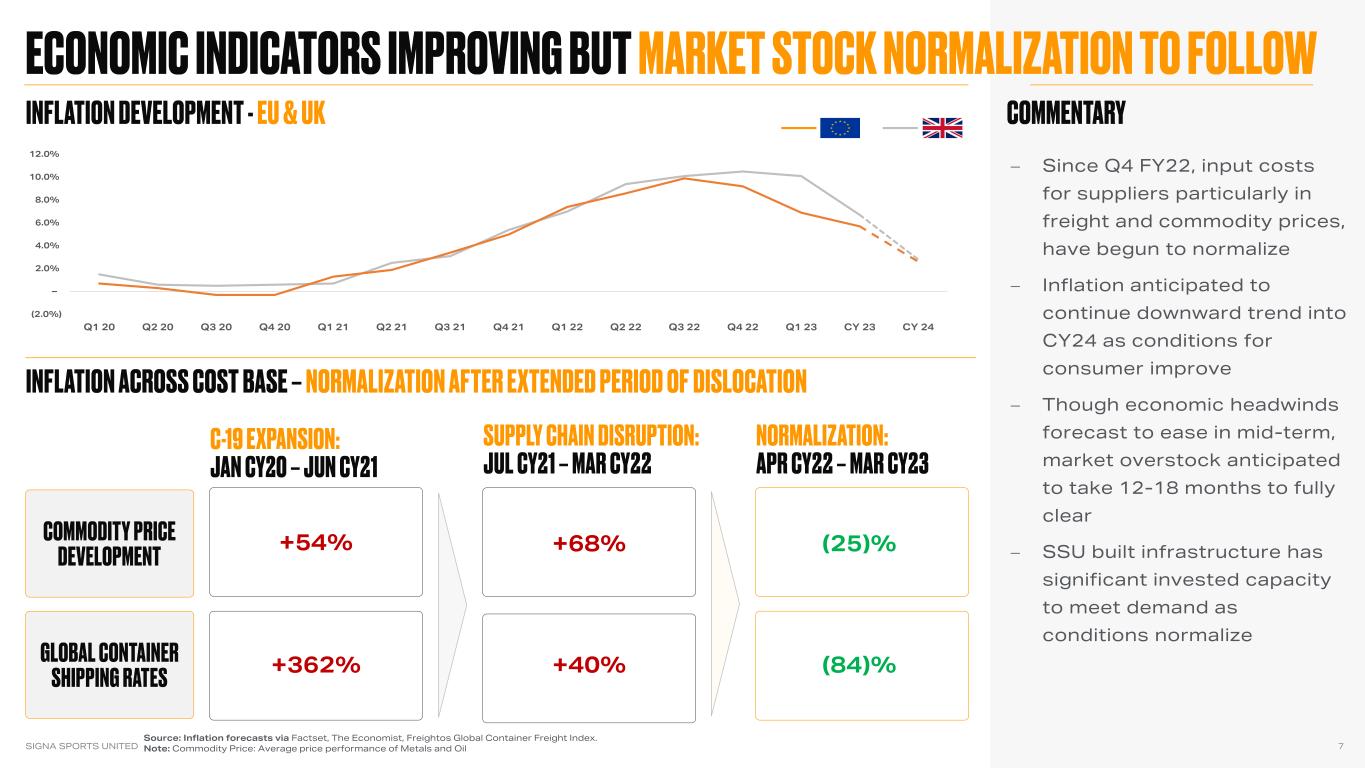

SIGNA SPORTS UNITED 7 (2.0%) – 2.0% 4.0% 6.0% 8.0% 10.0% 12.0% Q1 20 Q2 20 Q3 20 Q4 20 Q1 21 Q2 21 Q3 21 Q4 21 Q1 22 Q2 22 Q3 22 Q4 22 Q1 23 CY 23 CY 24 Source: Inflation forecasts via Factset, The Economist, Freightos Global Container Freight Index. Note: Commodity Price: Average price performance of Metals and Oil +54% (25)% − Since Q4 FY22, input costs for suppliers particularly in freight and commodity prices, have begun to normalize − Inflation anticipated to continue downward trend into CY24 as conditions for consumer improve − Though economic headwinds forecast to ease in mid-term, market overstock anticipated to take 12-18 months to fully clear − SSU built infrastructure has significant invested capacity to meet demand as conditions normalize +68% +362% (84)%+40%

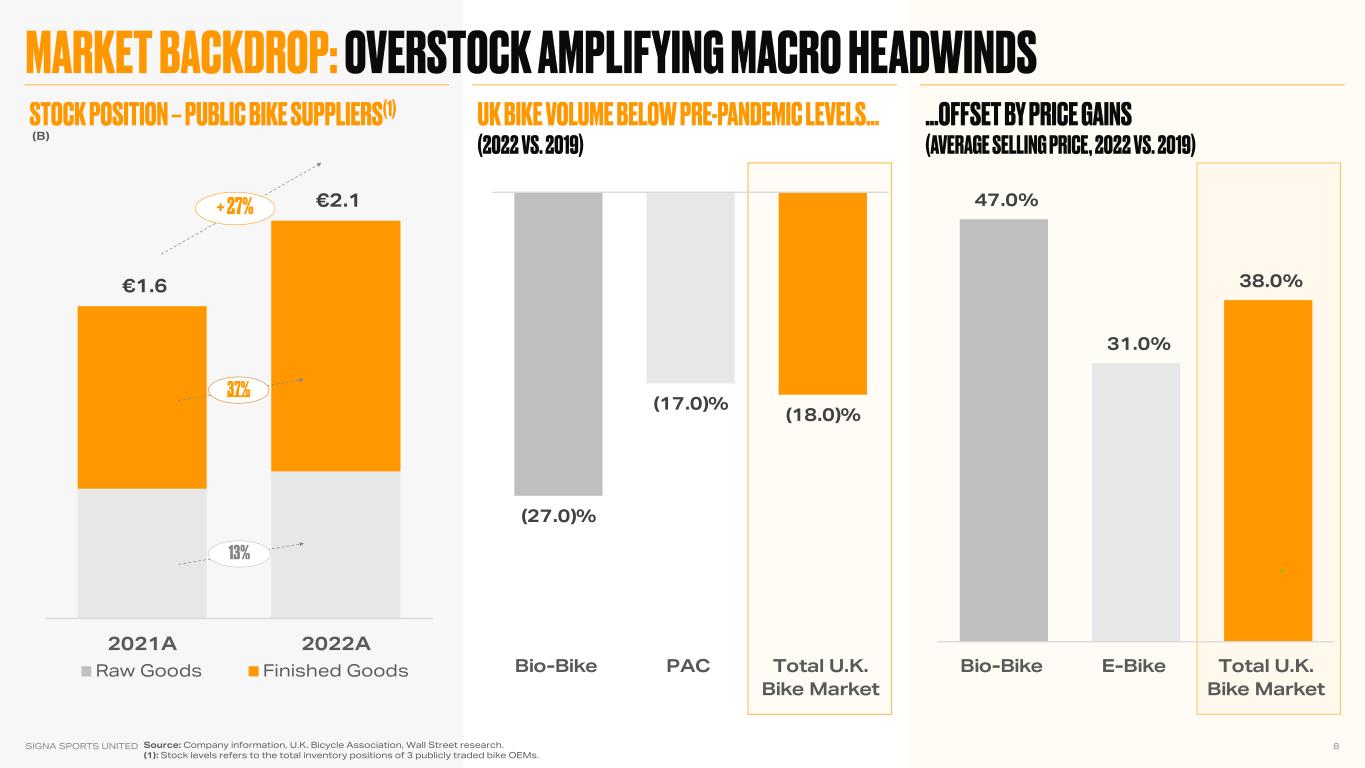

(27.0)% (17.0)% (18.0)% Bio-Bike PAC Total U.K. Bike Market 8SIGNA SPORTS UNITED Source: Company information, U.K. Bicycle Association, Wall Street research. (1): Stock levels refers to the total inventory positions of 3 publicly traded bike OEMs. €1.6 €2.1 2021A 2022A Raw Goods Finished Goods (B) 47.0% 31.0% 38.0% Bio-Bike E-Bike Total U.K. Bike Market

SIGNA SPORTS UNITED 9 Deliver transaction synergies Adapt commercial and operating models Focus on core markets Focused plan to navigate challenging market conditions with clear course towards profitable growth

SIGNA SPORTS UNITED 10 − Deliberate reorientation to prioritize core markets − Commercial proposition in non-core markets optimized for contribution (pricing, delivery fees, returns, marketing) − International partnerships scaled back or not renewed − Localization strategy paused − Consolidation of logistics infrastructure to reduce redundancy and split orders − Continued optimization of fulfilment network to maximize efficiency of owned infrastructure vs. 3PL solutions − Launch of European Bike banners in U.K. to accelerate revenue growth and increase operating leverage − Consolidation of banners in core markets for further operating efficiency €533 €441 PF H1 FY22 H1 FY23 Core Markets Other H1 FY22 vs. H1 FY23 Achievements Actions to Come Renewed focus on markets with established infrastructure critical to attractive unit economics (M) Source: Company information. Note: Core markets defined as DACH, U.K., Southern Europe and U.S.

SIGNA SPORTS UNITED 11 Q3 FY22 vs. H1 FY23 Achievements Actions to Come − Targeted cancellation of inbound orders − Elevated promotional activity to right-size inventory position and clear overstocked inventory − Extraordinary write-off of ~20M EUR of inventory to be sold through alternative channels in H2 − Clean order book for FY24 to allow for more flexible inbound rates − Reduce business complexity by dramatically shrinking SKU and supplier counts − Increased stock management discipline − Negotiations with suppliers to ensure structural improvement in terms Targeted measures to trim stock position and improve flexibility for FY24 (M) €337 €257 Q3 FY22 H1 FY23 Bike Category Tennis + Outdoor Source: Company information. Note: Pro forma for discontinued operations.

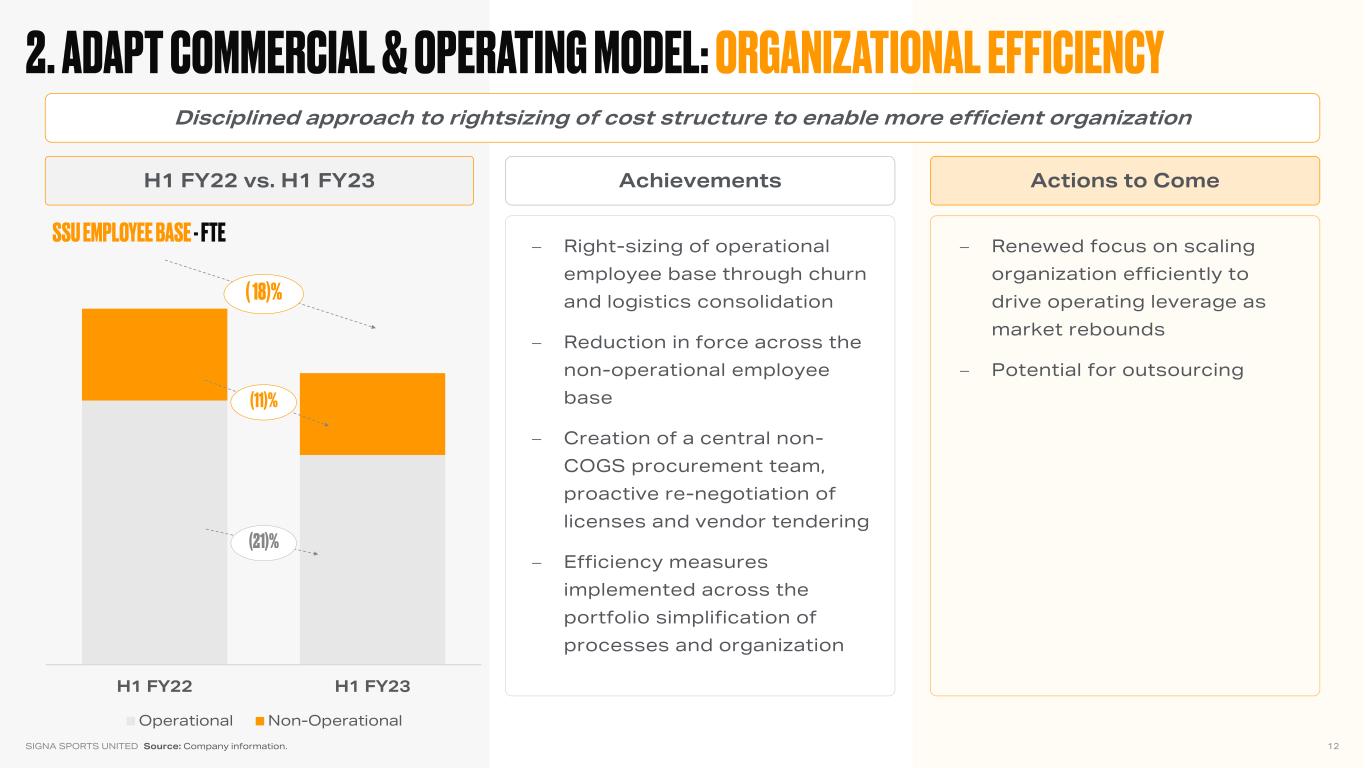

H1 FY22 H1 FY23 Operational Non-Operational SIGNA SPORTS UNITED 12 H1 FY22 vs. H1 FY23 Achievements Actions to Come − Right-sizing of operational employee base through churn and logistics consolidation − Reduction in force across the non-operational employee base − Creation of a central non- COGS procurement team, proactive re-negotiation of licenses and vendor tendering − Efficiency measures implemented across the portfolio simplification of processes and organization − Renewed focus on scaling organization efficiently to drive operating leverage as market rebounds − Potential for outsourcing Disciplined approach to rightsizing of cost structure to enable more efficient organization Source: Company information.

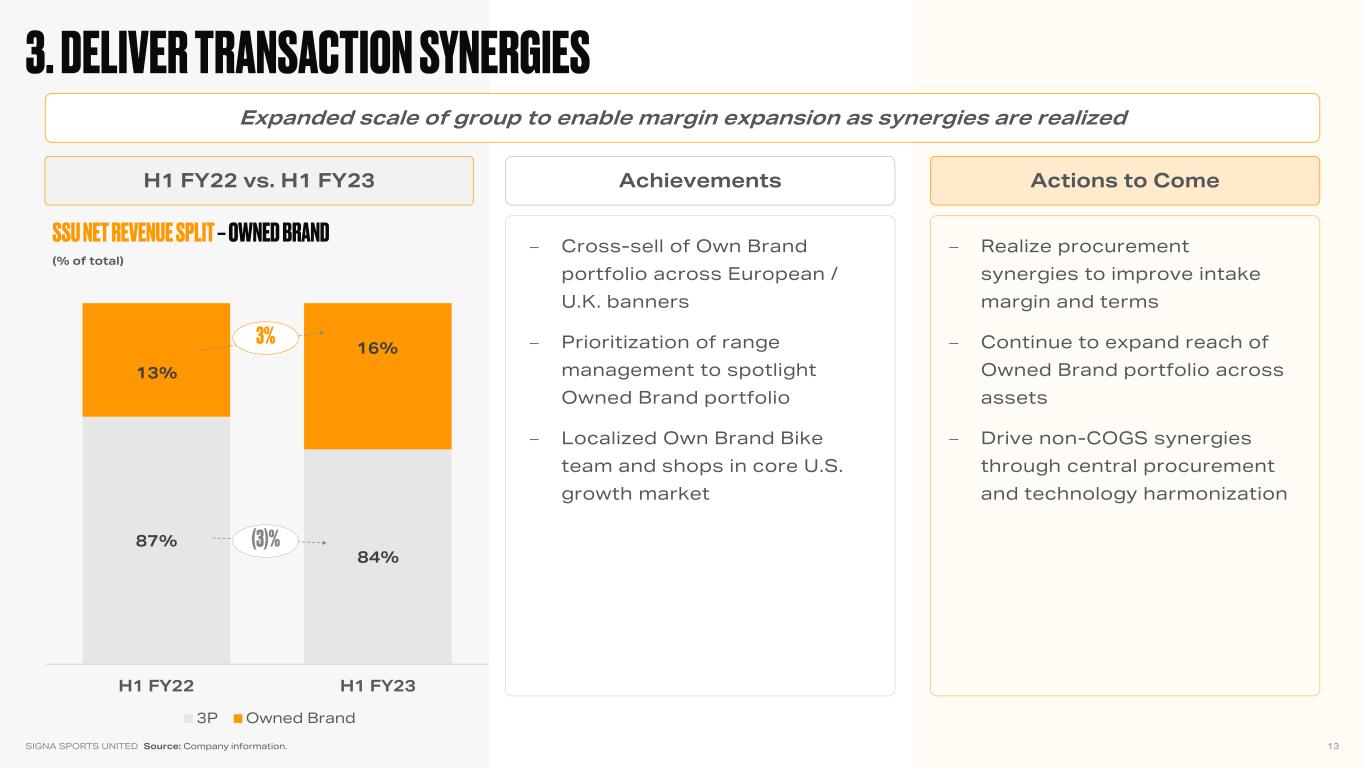

SIGNA SPORTS UNITED 13 H1 FY22 vs. H1 FY23 Achievements Actions to Come − Cross-sell of Own Brand portfolio across European / U.K. banners − Prioritization of range management to spotlight Owned Brand portfolio − Localized Own Brand Bike team and shops in core U.S. growth market − Realize procurement synergies to improve intake margin and terms − Continue to expand reach of Owned Brand portfolio across assets − Drive non-COGS synergies through central procurement and technology harmonization Expanded scale of group to enable margin expansion as synergies are realized (% of total) 87% 84% 13% 16% H1 FY22 H1 FY23 3P Owned Brand Source: Company information.

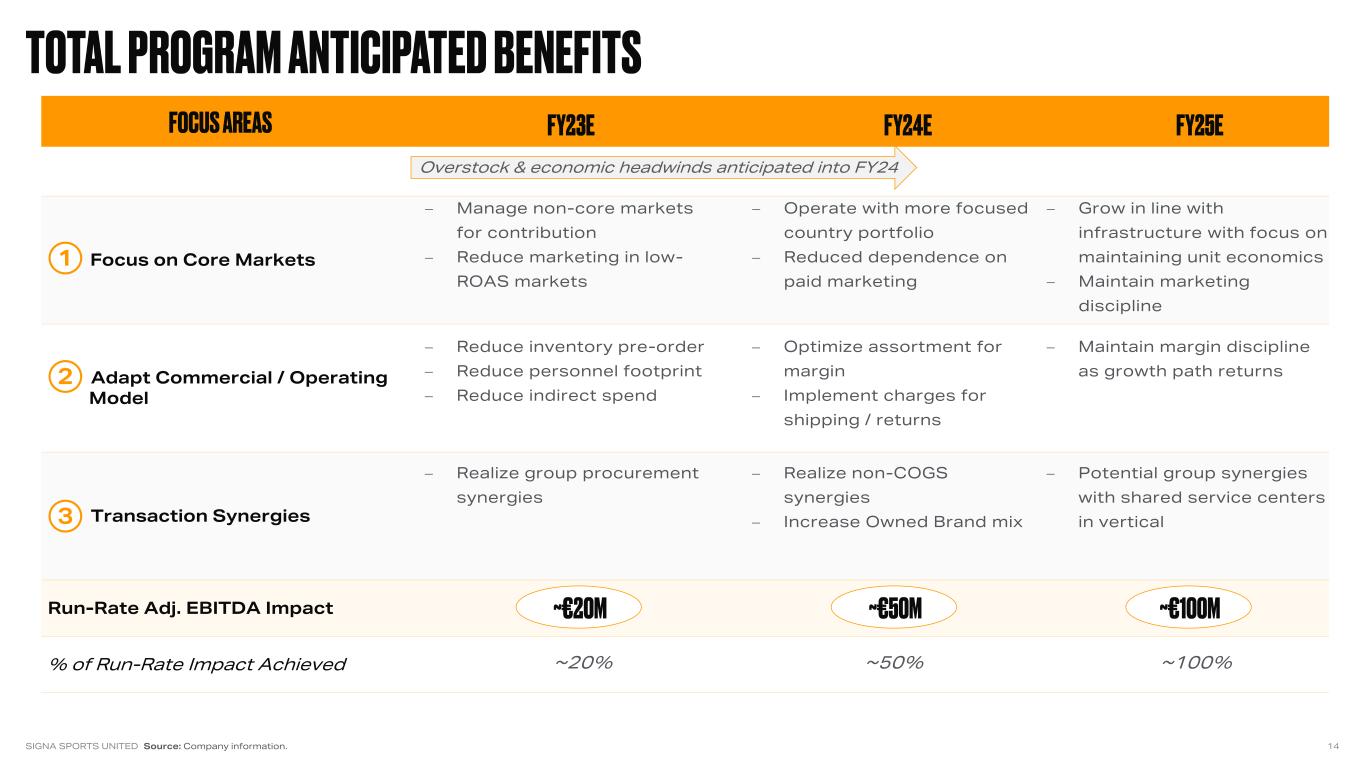

Focus on Core Markets Adapt Commercial / Operating Model Transaction Synergies Run-Rate Adj. EBITDA Impact % of Run-Rate Impact Achieved SIGNA SPORTS UNITED 14 1 2 3 − Manage non-core markets for contribution − Reduce marketing in low- ROAS markets − Reduce inventory pre-order − Reduce personnel footprint − Reduce indirect spend − Realize group procurement synergies − Operate with more focused country portfolio − Reduced dependence on paid marketing − Optimize assortment for margin − Implement charges for shipping / returns − Realize non-COGS synergies − Increase Owned Brand mix − Grow in line with infrastructure with focus on maintaining unit economics − Maintain marketing discipline − Maintain margin discipline as growth path returns − Potential group synergies with shared service centers in vertical ~20% ~50% ~100% Overstock & economic headwinds anticipated into FY24 Source: Company information.

SIGNA SPORTS UNITED 16 Source: Company information. Note: Pro forma metrics include the impact of Midwest Sports, WiggleCRC and Tennis Express acquisitions, assuming ownership for the entire period. For historical comparison of PF metrics, please see Appendix. Metrics are presented for continuing operations only, as a result of the discontinued operations related to Athleisure. Refer to Note 11 - Discontinued Operations of the Company’s 20-F (1) Legacy SSU growth vs. FY19: visits at (10.3%), conversion at +90 bps, net orders at +34%, net AOV at +3%, active customers at +80%. Q2 FY22 Q2 FY23 YoY Total Visits (M) Net Orders (M) Net AOV (€) 76.6 56.5 (26)% 2.1 1.5 (27)% 103.1 105.7 +2% H1 FY22 H1 FY23 YoY PF YoY 131.8 119.4 (9)% (25)% 3.6 3.5 (3)% (20)% 100.1 104.6 +4% +3% Q2 FY22 YoY Growth Q2 FY21 YoY Growth Q2 FY23 CAGR vs. Q2 FY20 • Substantial growth in active customer base from FY20 driven by strategic acquisitions to expand reach in core geographies • Q2 FY23 decline in active customers, visits and net orders on the back of ongoing downturn in consumer sentiment, Q2 typically softest quarter of fiscal year • Increased Q2 FY23 net AOV YoY, driven by improved product mix and relative strength of e-bike category as supply chain pressures have largely eased across core categories • Strong PF growth vs. pre- Covid (FY19) of conversion +84 bps, AOV +7.1% and active customers +18.5%1 Q2 FY23 YoY Growth (M) Q2 FY20 Q2 FY21 Q2 FY22 Q2 FY23

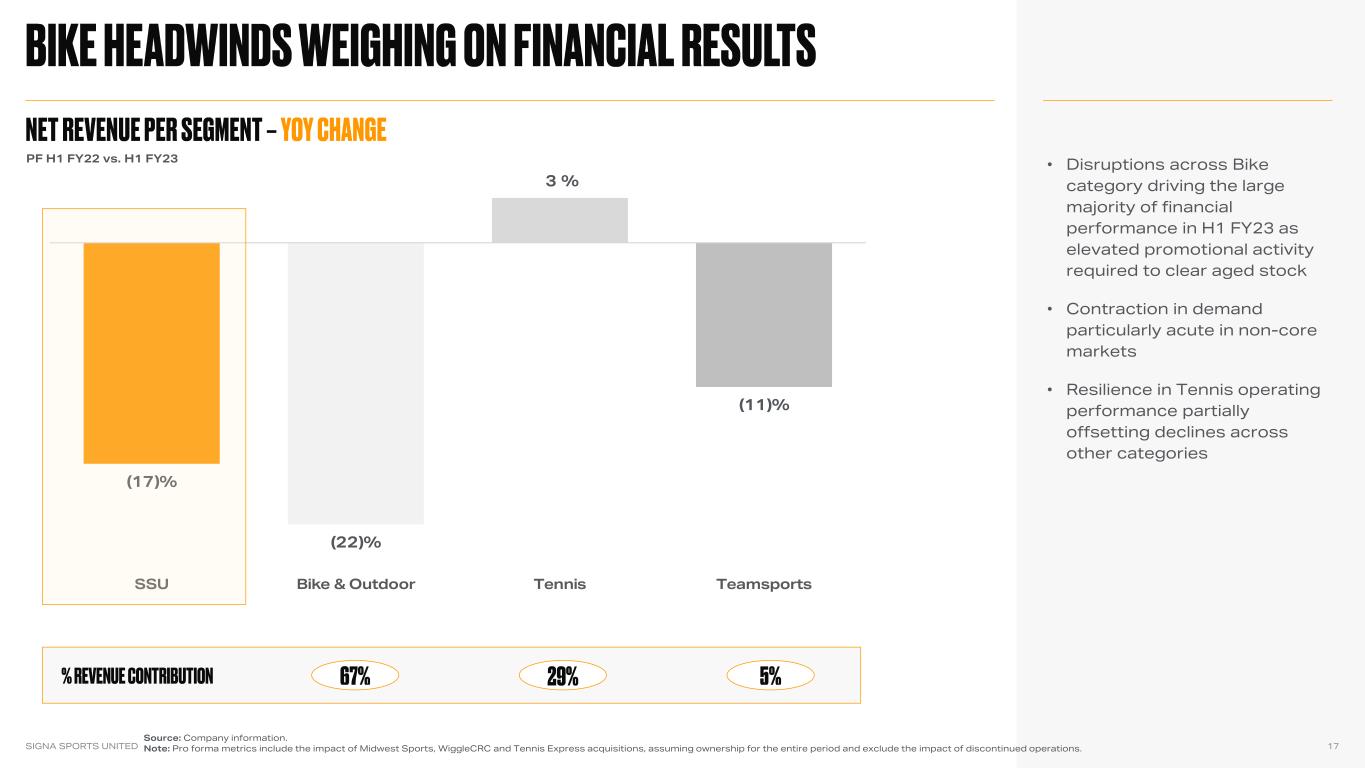

SIGNA SPORTS UNITED 17 • Disruptions across Bike category driving the large majority of financial performance in H1 FY23 as elevated promotional activity required to clear aged stock • Contraction in demand particularly acute in non-core markets • Resilience in Tennis operating performance partially offsetting declines across other categories PF H1 FY22 vs. H1 FY23 (17)% (22)% 3 % (11)% SSU Bike & Outdoor Tennis Teamsports Source: Company information. Note: Pro forma metrics include the impact of Midwest Sports, WiggleCRC and Tennis Express acquisitions, assuming ownership for the entire period and exclude the impact of discontinued operations.

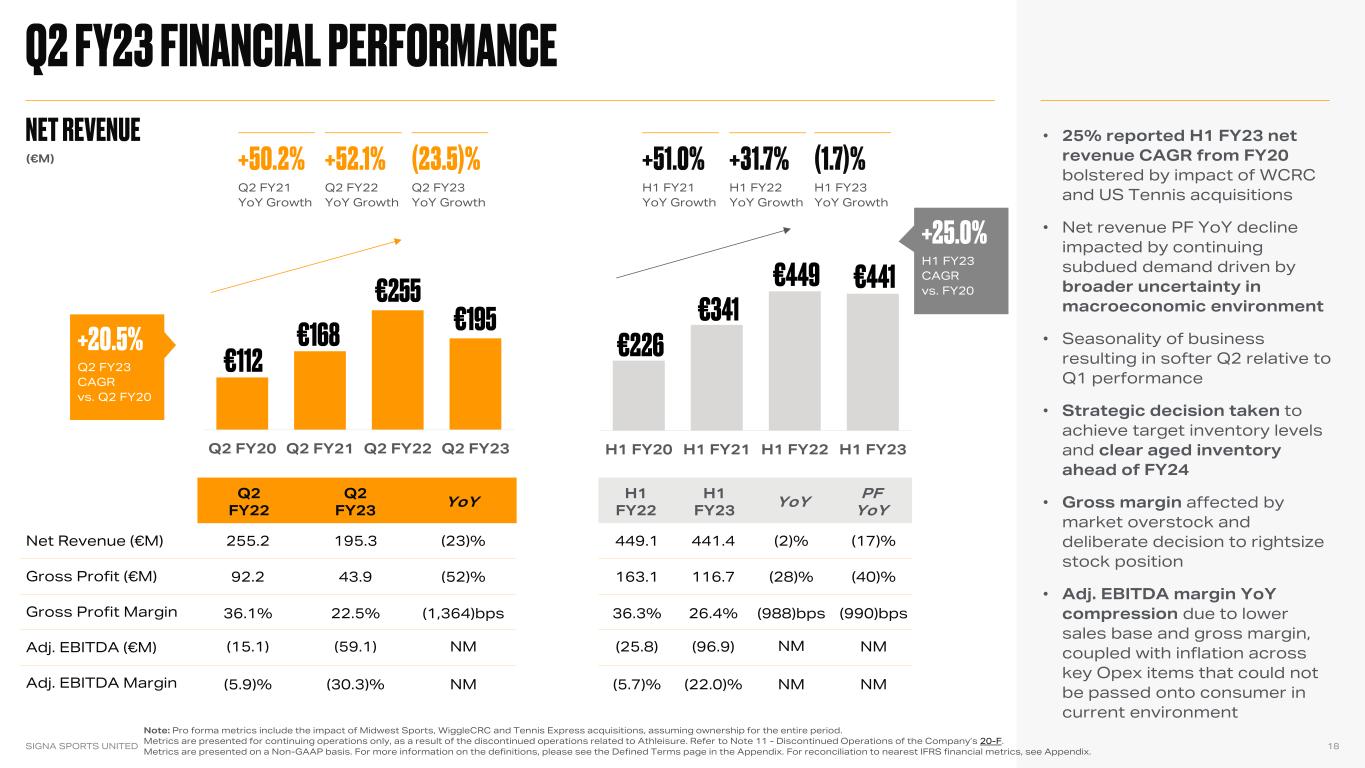

Q2 FY20 Q2 FY21 Q2 FY22 Q2 FY23 H1 FY20 H1 FY21 H1 FY22 H1 FY23 H1 FY22 H1 FY23 YoY PF YoY SIGNA SPORTS UNITED 18 Note: Pro forma metrics include the impact of Midwest Sports, WiggleCRC and Tennis Express acquisitions, assuming ownership for the entire period. Metrics are presented for continuing operations only, as a result of the discontinued operations related to Athleisure. Refer to Note 11 - Discontinued Operations of the Company’s 20-F. Metrics are presented on a Non-GAAP basis. For more information on the definitions, please see the Defined Terms page in the Appendix. For reconciliation to nearest IFRS financial metrics, see Appendix. ` Q2 FY22 Q2 FY23 YoY Net Revenue (€M) Gross Profit (€M) Gross Profit Margin Adj. EBITDA (€M) Adj. EBITDA Margin Q2 FY22 YoY Growth Q2 FY23 YoY Growth 255.2 195.3 (23)% 92.2 43.9 (52)% 36.1% 22.5% (1,364)bps (15.1) (59.1) NM (5.9)% (30.3)% NM 449.1 441.4 (2)% (17)% 163.1 116.7 (28)% (40)% 36.3% 26.4% (988)bps (990)bps (25.8) (96.9) NM NM (5.7)% (22.0)% NM NM H1 FY22 YoY Growth H1 FY23 YoY Growth Q2 FY21 YoY Growth H1 FY21 YoY Growth Q2 FY23 CAGR vs. Q2 FY20 H1 FY23 CAGR vs. FY20 (€M) • 25% reported H1 FY23 net revenue CAGR from FY20 bolstered by impact of WCRC and US Tennis acquisitions • Net revenue PF YoY decline impacted by continuing subdued demand driven by broader uncertainty in macroeconomic environment • Seasonality of business resulting in softer Q2 relative to Q1 performance • Strategic decision taken to achieve target inventory levels and clear aged inventory ahead of FY24 • Gross margin affected by market overstock and deliberate decision to rightsize stock position • Adj. EBITDA margin YoY compression due to lower sales base and gross margin, coupled with inflation across key Opex items that could not be passed onto consumer in current environment

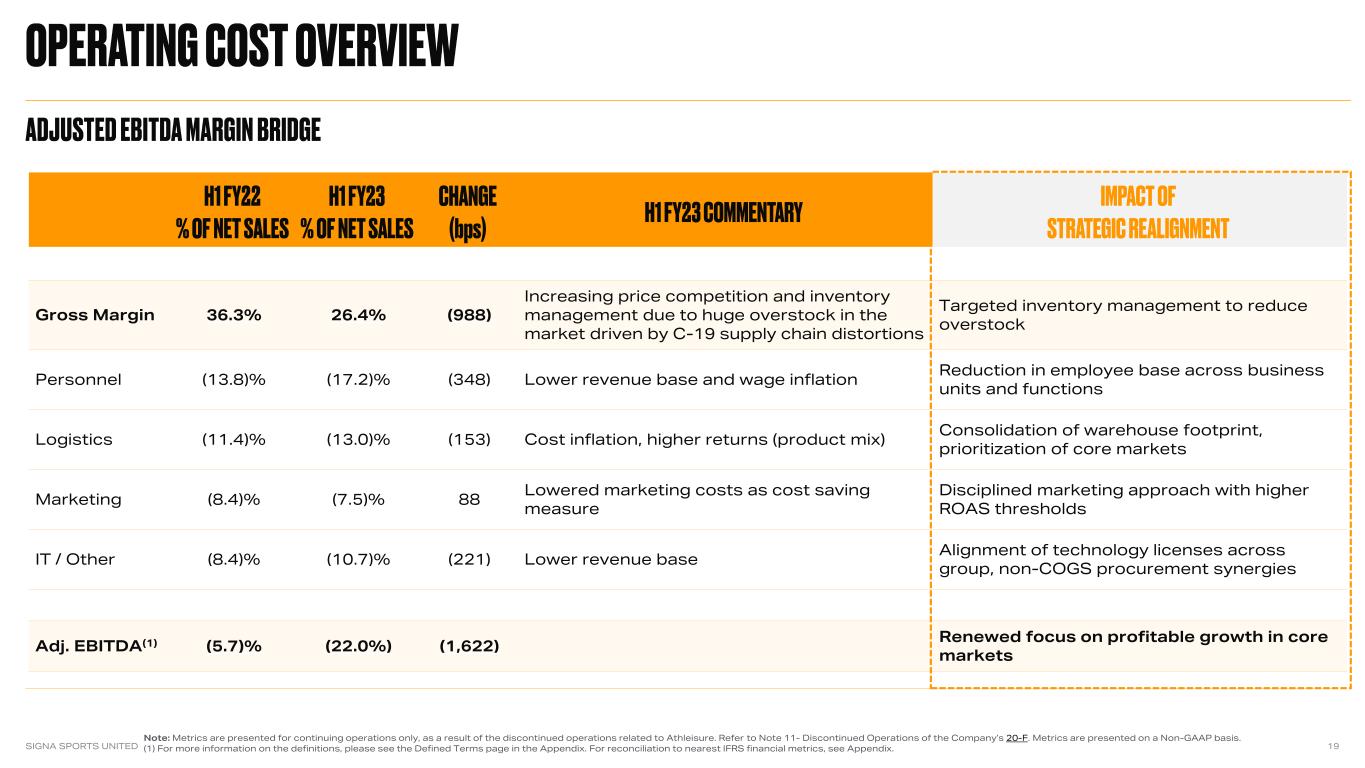

SIGNA SPORTS UNITED 19 Note: Metrics are presented for continuing operations only, as a result of the discontinued operations related to Athleisure. Refer to Note 11- Discontinued Operations of the Company’s 20-F. Metrics are presented on a Non-GAAP basis. (1) For more information on the definitions, please see the Defined Terms page in the Appendix. For reconciliation to nearest IFRS financial metrics, see Appendix. Gross Margin 36.3% 26.4% (988) Increasing price competition and inventory management due to huge overstock in the market driven by C-19 supply chain distortions Targeted inventory management to reduce overstock Personnel (13.8)% (17.2)% (348) Lower revenue base and wage inflation Reduction in employee base across business units and functions Logistics (11.4)% (13.0)% (153) Cost inflation, higher returns (product mix) Consolidation of warehouse footprint, prioritization of core markets Marketing (8.4)% (7.5)% 88 Lowered marketing costs as cost saving measure Disciplined marketing approach with higher ROAS thresholds IT / Other (8.4)% (10.7)% (221) Lower revenue base Alignment of technology licenses across group, non-COGS procurement synergies Adj. EBITDA(1) (5.7)% (22.0%) (1,622) Renewed focus on profitable growth in core markets

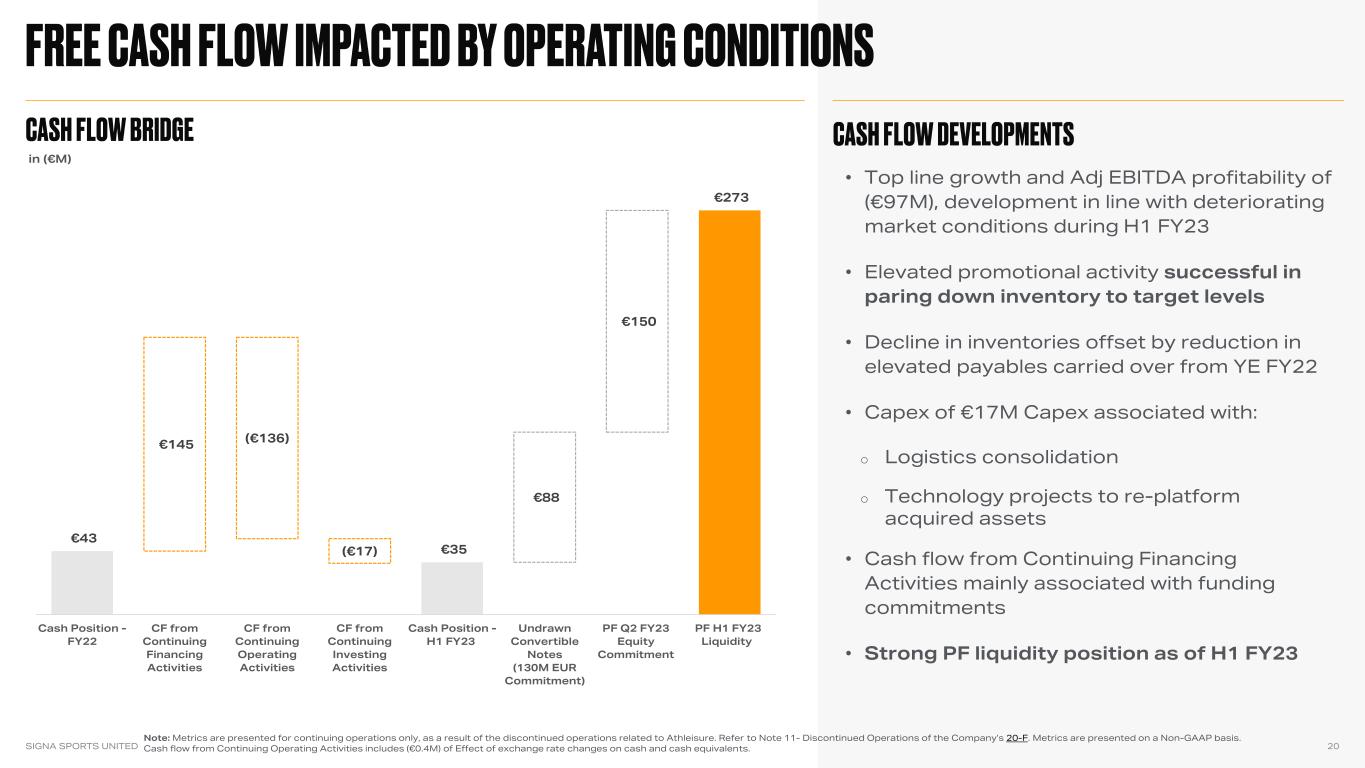

SIGNA SPORTS UNITED 20 Note: Metrics are presented for continuing operations only, as a result of the discontinued operations related to Athleisure. Refer to Note 11- Discontinued Operations of the Company’s 20-F. Metrics are presented on a Non-GAAP basis. Cash flow from Continuing Operating Activities includes (€0.4M) of Effect of exchange rate changes on cash and cash equivalents. • Top line growth and Adj EBITDA profitability of (€97M), development in line with deteriorating market conditions during H1 FY23 • Elevated promotional activity successful in paring down inventory to target levels • Decline in inventories offset by reduction in elevated payables carried over from YE FY22 • Capex of €17M Capex associated with: o Logistics consolidation o Technology projects to re-platform acquired assets • Cash flow from Continuing Financing Activities mainly associated with funding commitments • Strong PF liquidity position as of H1 FY23 €145 (€136) (€17) €88 €150 €43 €35 €273 Cash Position - FY22 CF from Continuing Financing Activities CF from Continuing Operating Activities CF from Continuing Investing Activities Cash Position - H1 FY23 Undrawn Convertible Notes (130M EUR Commitment) PF Q2 FY23 Equity Commitment PF H1 FY23 Liquidity in (€M)

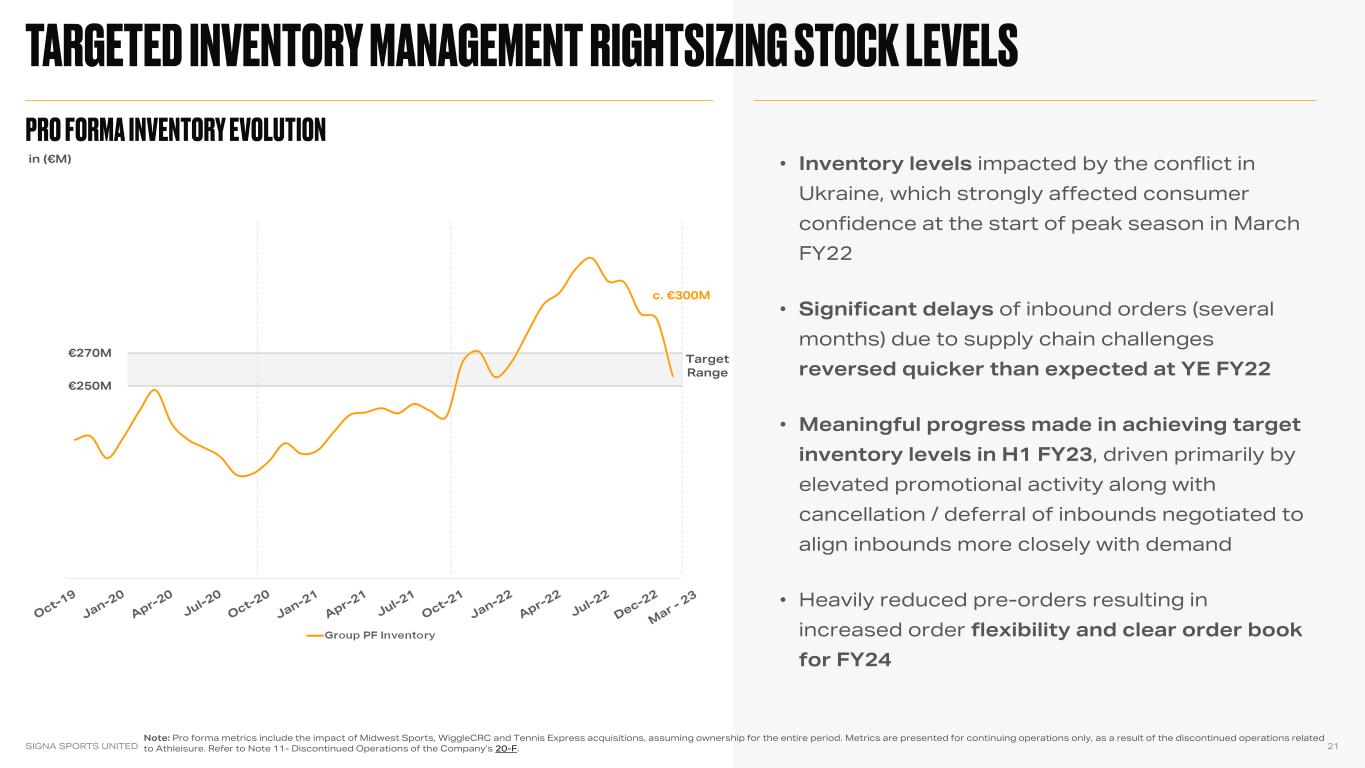

• Inventory levels impacted by the conflict in Ukraine, which strongly affected consumer confidence at the start of peak season in March FY22 • Significant delays of inbound orders (several months) due to supply chain challenges reversed quicker than expected at YE FY22 • Meaningful progress made in achieving target inventory levels in H1 FY23, driven primarily by elevated promotional activity along with cancellation / deferral of inbounds negotiated to align inbounds more closely with demand • Heavily reduced pre-orders resulting in increased order flexibility and clear order book for FY24 SIGNA SPORTS UNITED 21 Note: Pro forma metrics include the impact of Midwest Sports, WiggleCRC and Tennis Express acquisitions, assuming ownership for the entire period. Metrics are presented for continuing operations only, as a result of the discontinued operations related to Athleisure. Refer to Note 11- Discontinued Operations of the Company’s 20-F. (4.1)% in (€M) €270M €250M Target Range c. €300M

Cash on Balance Sheet (Q2 FY23) €35 Debt Summary Bank Revolving Credit Facility(1) €100 Bank Loans 8 SIGNA Holding Credit Facility(2) 100 SIGNA Holding Senior Convertible Notes(3) 142 Total SSU Debt €350 SSU Net Debt €314 PF Q2 FY23 Liquidity Summary SIGNA Holding Convertible Commitment 1(4) €88 SIGNA Holding Convertible Commitment 2 (4) 150 Total Pro Forma Liquidity €273 SIGNA SPORTS UNITED 22 Source: Company information. (1): Refer to Note 7.14 - Non-current Financial Liabilities of the Company’s 20-F. (2): The Company has entered into a €50M revolving credit facility with SIGNA Holding GmbH an affiliate of its largest shareholder SIGNA International Sports Holdings GmbH. Subsequently, the Company and SIGNA Holding GmbH have entered into a second €50M RCF, to be utilized to fund general corporate purposes including working capital and Capex (refer to Note 7.14 - Non-current Financial Liabilities of the Company’s 20-F). (3): €100M senior convertible notes and €42M of drawn funding from €130M Commitment granted in Feb. 2023 (refer to Note 18 - Events after the Reporting Period of the Company’s 20-F) (4): €280M commitment in addition to previously drawn €100M EUR Senior Convertible Notes. Includes incremental 150M EUR commitment in addition to previously disclosed €130M EUR of Senior Convertible Notes. • Proactively negotiated waiver of banking covenants under €100M RCF facility until June 2024 • Commitment from SIGNA Holding GmbH providing the company with the right to put additional convertible bonds to SIGNA Holding GmbH, for an aggregate additional principal amount of up to €130M signed in February 2023, with an amount of ~€88M remaining undrawn as of H1 FY23 • €150M additional hard financing commitment from SIGNA Holding GmbH to fund the operational and investment requirements of the Company into FY25 • Strengthened financial flexibility enabling SSU to pursue adapted strategy in (€M)

SIGNA SPORTS UNITED 24 – Emphasis on driving sales in core markets due to favorable unit economics – Margin improvement anticipated in H2, as industry overstock improves – Cost savings associated with strategic realignment measures to begin to be realized in H2 FY23, full impact to be felt from FY24 – Maintain focus on assortment management to optimize stock position and focus on reducing inventory levels to target – Demand and margin expected to build throughout FY24 – Additional liquidity support from major indirect shareholder funds the operational and investment requirements into FY25

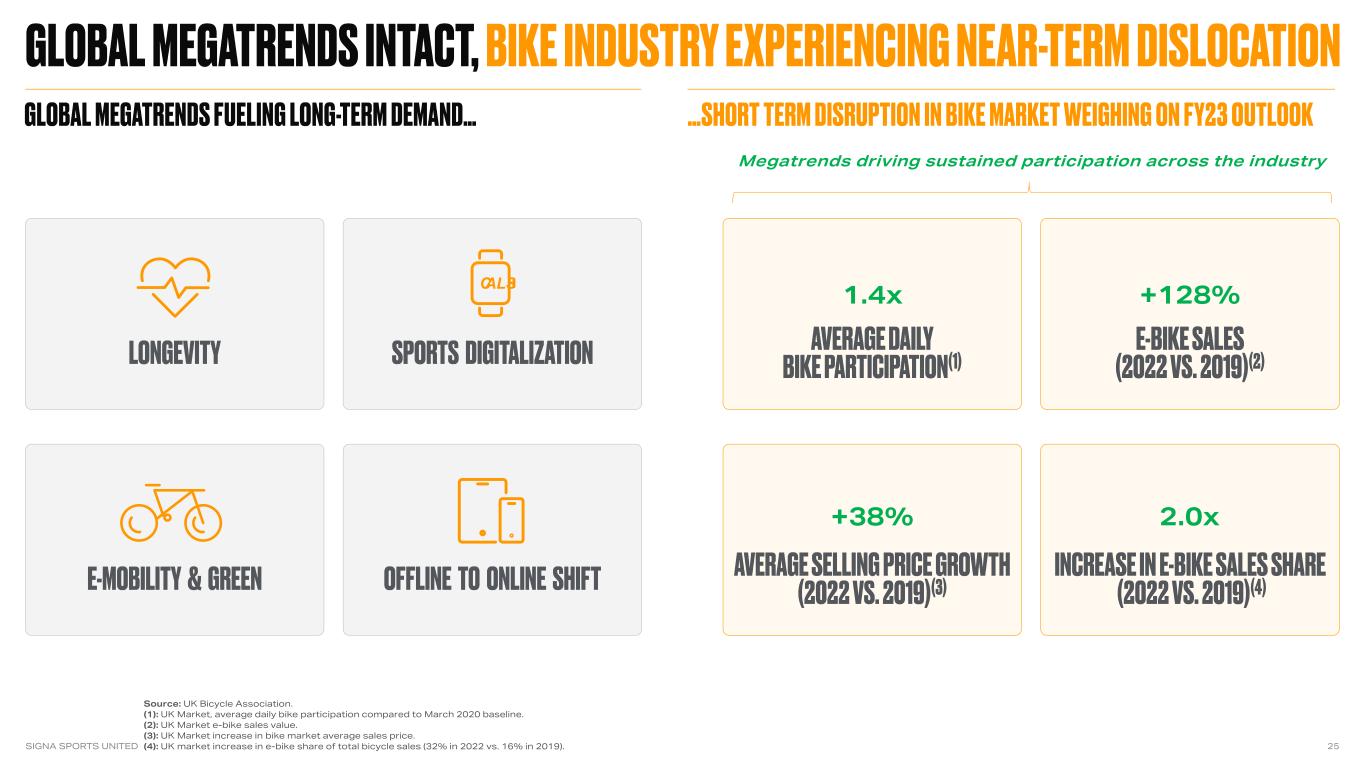

SIGNA SPORTS UNITED 25 Source: UK Bicycle Association. (1): UK Market, average daily bike participation compared to March 2020 baseline. (2): UK Market e-bike sales value. (3): UK Market increase in bike market average sales price. (4): UK market increase in e-bike share of total bicycle sales (32% in 2022 vs. 16% in 2019). Megatrends driving sustained participation across the industry 1.4x +128% +38% 2.0x

SIGNA SPORTS UNITED 26 Overstock to weigh on profitability into H2 FY23 (2)% (22)% €(153)M (9)% - (11)% (16)% - (18)% €(100) - €(120)M €(250) - €(270)M Note: Adj. EBITDA, unlevered free cash flow and free cash flow are presented on a Non GAAP basis. For more information on the definitions, please see the Defined Terms page in the Appendix. For reconciliation to nearest IFRS financial metrics, see Appendix. (1): H1 FY23 reported growth impacted by lack of full contribution of WiggleCRC and Tennis Express in H1 FY22. (11)% - (13)% (9)% - (11)% (1)

SIGNA SPORTS UNITED 27 Business fully funded to navigate near-term disruption, clear pathway to profitability 7% - 10% 10% - 15% 0% - 5% 12% - 15%15% (16)% 5% (6)% − Structural megatrends to resume 10%+ annual growth in online sports retail − Owned Brand portfolio, geographic expansion, expansion of RMS and marketplace business model − Focus on core markets with infrastructure, updated commercial / operating framework − Winning with fewer supplier partners − Transaction synergies / scale benefits to be realized from FY24 − Targeted working capital management as business scales − Minimal maintenance capex requirements post technology re- platforming (€34) (€46) (€240) (€246) Breakeven FY25 Note: Financials reflect pro forma management accounts. Adj. EBITDA, unlevered free cash flow and free cash flow are presented on a Non-GAAP basis. For more information on the definitions, please see the Defined Terms page in the Appendix. For reconciliation to nearest IFRS financial metrics, see Appendix. Cash Generating (9)% - (11)% (16)% - (18)% €(250) - €(270)M €(230) - €(250)M

SIGNA SPORTS UNITED 28 ✓ Intact structural megatrends behind online specialist sports retail ✓ Market dislocation is accelerating industry consolidation ✓ Strategic realignment to increase SSU’s competitiveness for sustainable and profitable growth; most severe impact of market dislocations already felt in H1 FY23 ✓ Capitalized to weather market dislocation and fortify strong position in market as competitors grapple with industry wide disruptions ✓ Despite headwinds, continue to make targeted investments across logistics and IT to enable long-term cost structure ✓ Pursue focused M&A activities to take advantage of once-in-a-cycle buying opportunities

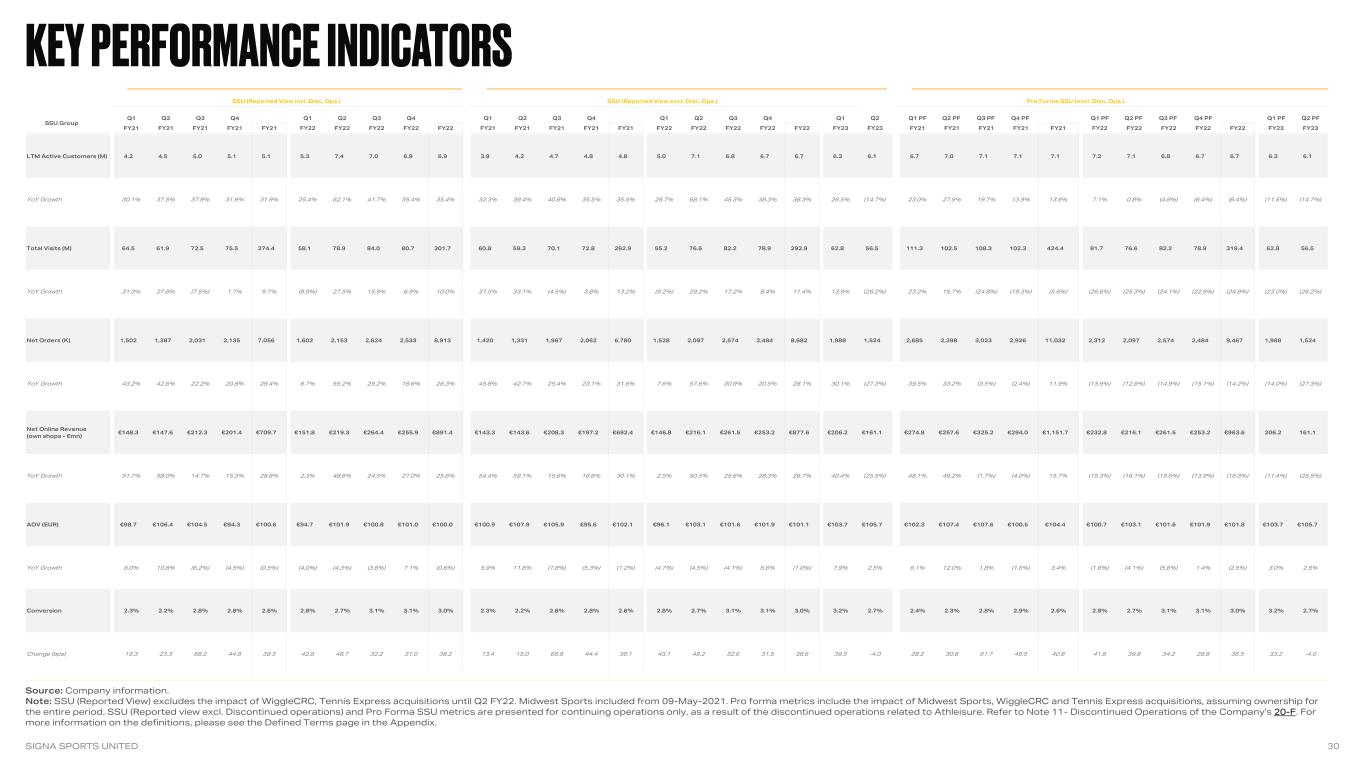

SIGNA SPORTS UNITED 30 Source: Company information. Note: SSU (Reported View) excludes the impact of WiggleCRC, Tennis Express acquisitions until Q2 FY22. Midwest Sports included from 09-May-2021. Pro forma metrics include the impact of Midwest Sports, WiggleCRC and Tennis Express acquisitions, assuming ownership for the entire period. SSU (Reported view excl. Discontinued operations) and Pro Forma SSU metrics are presented for continuing operations only, as a result of the discontinued operations related to Athleisure. Refer to Note 11- Discontinued Operations of the Company’s 20-F. For more information on the definitions, please see the Defined Terms page in the Appendix. Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q1 PF Q2 PF Q3 PF Q4 PF Q1 PF Q2 PF Q3 PF Q4 PF Q1 PF Q2 PF FY21 FY21 FY21 FY21 FY21 FY22 FY22 FY22 FY22 FY22 FY21 FY21 FY21 FY21 FY21 FY22 FY22 FY22 FY22 FY22 FY23 FY23 FY21 FY21 FY21 FY21 FY21 FY22 FY22 FY22 FY22 FY22 FY23 FY23 LTM Active Customers (M) 4.2 4.5 5.0 5.1 5.1 5.3 7.4 7.0 6.9 6.9 3.9 4.2 4.7 4.8 4.8 5.0 7.1 6.8 6.7 6.7 6.3 6.1 6.7 7.0 7.1 7.1 7.1 7.2 7.1 6.8 6.7 6.7 6.3 6.1 YoY Growth 30.1% 37.5% 37.9% 31.9% 31.9% 25.4% 62.1% 41.7% 35.4% 35.4% 32.3% 39.4% 40.8% 35.5% 35.5% 28.7% 68.1% 45.3% 38.3% 38.3% 26.5% (14.7%) 23.0% 27.9% 19.7% 13.9% 13.9% 7.1% 0.8% (4.8%) (6.4%) (6.4%) (11.5%) (14.7%) Total Visits (M) 64.5 61.9 72.5 75.5 274.4 58.1 78.9 84.0 80.7 301.7 60.8 59.3 70.1 72.8 262.9 55.2 76.6 82.2 78.9 292.9 62.8 56.5 111.3 102.5 108.3 102.3 424.4 81.7 76.6 82.2 78.9 319.4 62.8 56.5 YoY Growth 31.3% 27.8% (7.5%) 1.7% 9.7% (9.9%) 27.5% 15.9% 6.9% 10.0% 37.5% 33.1% (4.5%) 3.8% 13.2% (9.2%) 29.2% 17.2% 8.4% 11.4% 13.9% (26.2%) 23.2% 15.7% (24.8%) (19.3%) (5.6%) (26.6%) (25.3%) (24.1%) (22.9%) (24.8%) (23.0%) (26.2%) Net Orders (K) 1,502 1,387 2,031 2,135 7,056 1,602 2,153 2,624 2,533 8,913 1,420 1,331 1,967 2,062 6,780 1,528 2,097 2,574 2,484 8,682 1,988 1,524 2,685 2,398 3,023 2,926 11,032 2,312 2,097 2,574 2,484 9,467 1,988 1,524 YoY Growth 43.2% 42.6% 22.2% 20.8% 29.4% 6.7% 55.2% 29.2% 18.6% 26.3% 45.8% 42.7% 25.4% 23.1% 31.6% 7.6% 57.6% 30.9% 20.5% 28.1% 30.1% (27.3%) 39.5% 33.2% (3.5%) (2.4%) 11.9% (13.9%) (12.6%) (14.9%) (15.1%) (14.2%) (14.0%) (27.3%) Net Online Revenue (own shops - €mn) €148.3 €147.6 €212.3 €201.4 €709.7 €151.8 €219.3 €264.4 €255.9 €891.4 €143.3 €143.6 €208.3 €197.2 €692.4 €146.8 €216.1 €261.5 €253.2 €877.6 €206.2 €161.1 €274.8 €257.6 €325.2 €294.0 €1,151.7 €232.8 €216.1 €261.5 €253.2 €963.6 206.2 161.1 YoY Growth 51.7% 58.0% 14.7% 15.3% 28.8% 2.3% 48.6% 24.5% 27.0% 25.6% 54.4% 59.1% 15.6% 16.6% 30.1% 2.5% 50.5% 25.6% 28.3% 26.7% 40.4% (25.5%) 48.1% 49.2% (1.7%) (4.0%) 15.7% (15.3%) (16.1%) (19.6%) (13.9%) (16.3%) (11.4%) (25.5%) AOV (EUR) €98.7 €106.4 €104.5 €94.3 €100.6 €94.7 €101.9 €100.8 €101.0 €100.0 €100.9 €107.9 €105.9 €95.6 €102.1 €96.1 €103.1 €101.6 €101.9 €101.1 €103.7 €105.7 €102.3 €107.4 €107.6 €100.5 €104.4 €100.7 €103.1 €101.6 €101.9 €101.8 €103.7 €105.7 YoY Growth 6.0% 10.8% (6.2%) (4.5%) (0.5%) (4.0%) (4.3%) (3.6%) 7.1% (0.6%) 5.9% 11.6% (7.8%) (5.3%) (1.2%) (4.7%) (4.5%) (4.1%) 6.6% (1.0%) 7.9% 2.5% 6.1% 12.0% 1.8% (1.6%) 3.4% (1.6%) (4.1%) (5.6%) 1.4% (2.5%) 3.0% 2.5% Conversion 2.3% 2.2% 2.8% 2.8% 2.6% 2.8% 2.7% 3.1% 3.1% 3.0% 2.3% 2.2% 2.8% 2.8% 2.6% 2.8% 2.7% 3.1% 3.1% 3.0% 3.2% 2.7% 2.4% 2.3% 2.8% 2.9% 2.6% 2.8% 2.7% 3.1% 3.1% 3.0% 3.2% 2.7% Change (bps) 19.3 23.3 68.2 44.8 39.3 42.8 48.7 32.2 31.0 38.2 13.4 15.0 66.8 44.4 36.1 43.1 49.2 32.6 31.5 38.6 39.5 -4.0 28.2 30.8 61.7 49.5 40.8 41.8 39.8 34.2 28.8 36.5 33.2 -4.0 SSU Group SSU (Reported View incl. Disc. Ops.) SSU (Reported View excl. Disc. Ops.) Pro Forma SSU (excl. Disc. Ops.)

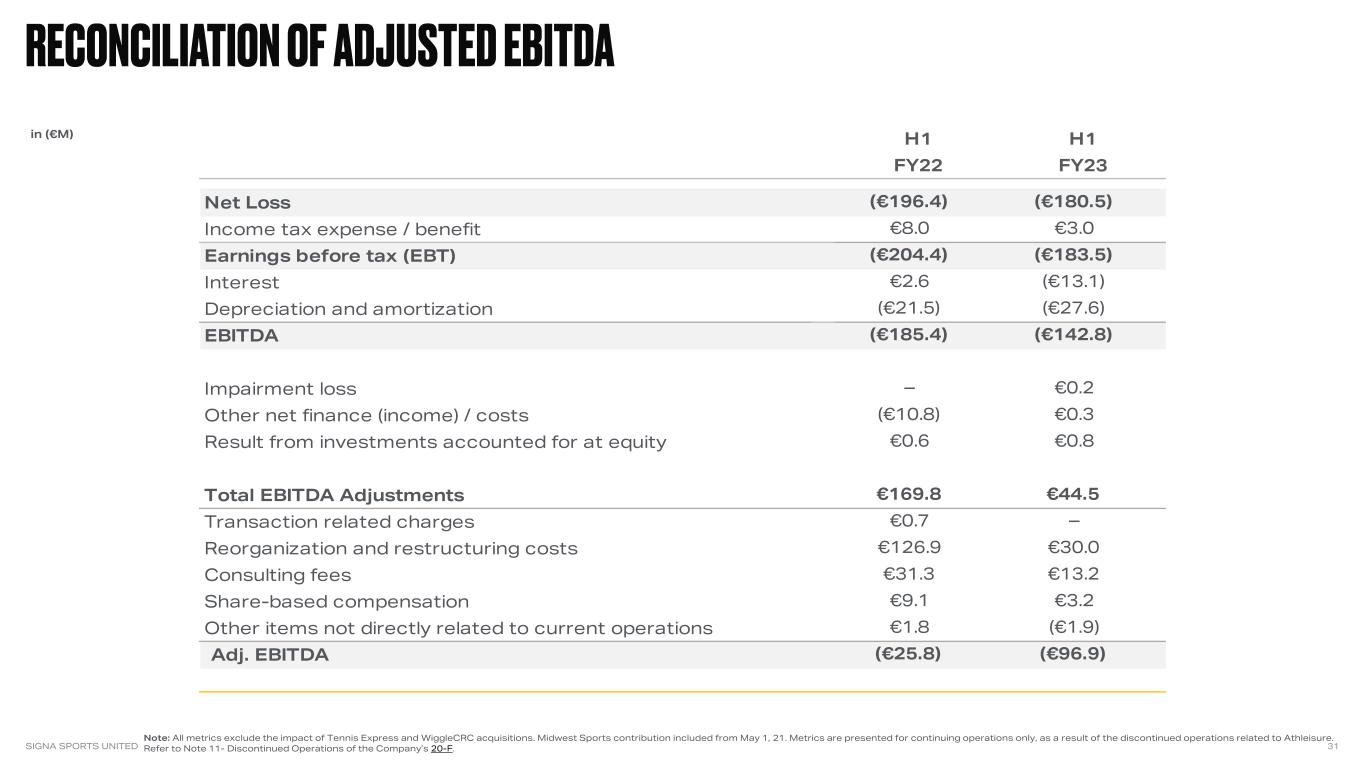

H1 H1 FY22 FY23 Net Loss (€196.4) (€180.5) Income tax expense / benefit €8.0 €3.0 Earnings before tax (EBT) (€204.4) (€183.5) Interest €2.6 (€13.1) Depreciation and amortization (€21.5) (€27.6) EBITDA (€185.4) (€142.8) Impairment loss – €0.2 Other net finance (income) / costs (€10.8) €0.3 Result from investments accounted for at equity €0.6 €0.8 Total EBITDA Adjustments €169.8 €44.5 Transaction related charges €0.7 – Reorganization and restructuring costs €126.9 €30.0 Consulting fees €31.3 €13.2 Share-based compensation €9.1 €3.2 Other items not directly related to current operations €1.8 (€1.9) Adj. EBITDA (€25.8) (€96.9) SIGNA SPORTS UNITED 31 Note: All metrics exclude the impact of Tennis Express and WiggleCRC acquisitions. Midwest Sports contribution included from May 1, 21. Metrics are presented for continuing operations only, as a result of the discontinued operations related to Athleisure. Refer to Note 11- Discontinued Operations of the Company’s 20-F. in (€M)

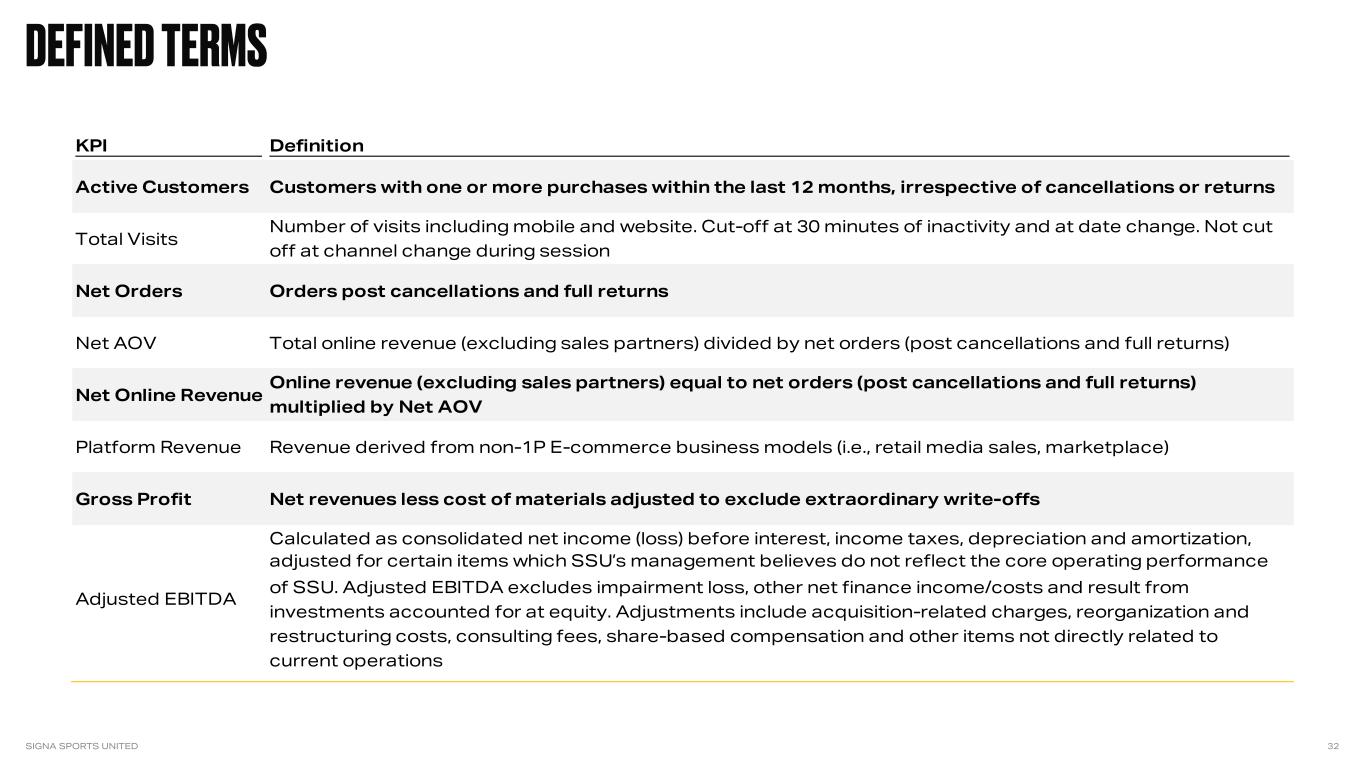

KPI Definition Active Customers Customers with one or more purchases within the last 12 months, irrespective of cancellations or returns Total Visits Number of visits including mobile and website. Cut-off at 30 minutes of inactivity and at date change. Not cut off at channel change during session Net Orders Orders post cancellations and full returns Net AOV Total online revenue (excluding sales partners) divided by net orders (post cancellations and full returns) Net Online Revenue Online revenue (excluding sales partners) equal to net orders (post cancellations and full returns) multiplied by Net AOV Platform Revenue Revenue derived from non-1P E-commerce business models (i.e., retail media sales, marketplace) Gross Profit Net revenues less cost of materials adjusted to exclude extraordinary write-offs Adjusted EBITDA Calculated as consolidated net income (loss) before interest, income taxes, depreciation and amortization, adjusted for certain items which SSU’s management believes do not reflect the core operating performance of SSU. Adjusted EBITDA excludes impairment loss, other net finance income/costs and result from investments accounted for at equity. Adjustments include acquisition-related charges, reorganization and restructuring costs, consulting fees, share-based compensation and other items not directly related to current operations SIGNA SPORTS UNITED 32

SIGNA SPORTS UNITED 33 SSU Investor Relations https://investor.signa-sportsunited.com SSU Investors Contact Alima Levy a.levy@signa-sportsunited.com +49 174 7304938