UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

Certified Shareholder Report of

Registered Management Investment Companies

Investment Company Act File Number: 811-23738

Capital Group Fixed Income ETF Trust

(Exact Name of Registrant as Specified in Charter)

6455 Irvine Center Drive

Irvine, California 92618

(Address of Principal Executive Offices)

Registrant's telephone number, including area code: (949) 975-5000

Date of fiscal year end: December 31

Date of reporting period: December 31, 2023

Troy S. Tanner

Capital Group Fixed Income ETF Trust

6455 Irvine Center Drive

Irvine, California 92618

(Name and Address of Agent for Service)

ITEM 1 – Reports to Stockholders

Capital Group Fixed Income ETF Trust Annual report

for the period ended

December 31, 2023 |  |

Fixed income

for a variety of

investor goals

The Securities and Exchange Commission has adopted new regulations that will change the content and design of annual and semi-annual shareholder reports beginning in July 2024. Certain types of information, including investment portfolio and financial statements, will not be included in the shareholder reports but will be available online, delivered free of charge upon request, and filed on a semi-annual basis on Form N-CSR.

If you would like to receive shareholder reports and other communications from the fund electronically, you may update your mailing preferences with your financial intermediary or enroll in e-delivery at capitalgroup.com (for accounts held directly with the fund).

The funds within Capital Group Fixed Income ETF Trust seek to pursue a variety of objectives for investors and are offered by Capital Group, home of American Funds®. For over 90 years, Capital Group has invested with a long-term focus based on thorough research and attention to risk.

Figures shown are past results and are not predictive of results in future periods. Current and future results may be lower or higher than those shown. Prices and returns will vary, so investors may lose money. Investing for short periods makes losses more likely. For current information and month-end results, refer to capitalgroup.com. Market price returns are determined using the official closing price of the fund’s shares and do not represent the returns you would receive if you traded shares at other times.

Here are the total returns on a $1,000 investment with all distributions reinvested for periods ended December 31, 2023:

| | | Fund

inception date | | 1 year | | Since

inception | | 30-day

SEC yield | | Gross

expense ratio* |

| | | | | | | | | | | | |

| CGCB — Capital Group Core Bond ETF | | 9/26/23 | | | | | | | | | | | 4.48 | % | | | 0.27 | % |

| Net asset value | | | | | — | | | | 6.56 | % | | | | | | | | |

| Market price | | | | | — | | | | 6.84 | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| CGCP — Capital Group Core Plus Income ETF | | 2/22/22 | | | | | | | | | | | 5.48 | | | | 0.34 | |

| Net asset value | | | | | 7.25 | % | | | –1.65 | | | | | | | | | |

| Market price | | | | | 7.19 | | | | –1.56 | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| CGMU — Capital Group Municipal Income ETF | | 10/25/22 | | | | | | | | | | | 3.44 | | | | 0.27 | |

| Net asset value | | | | | 6.78 | | | | 10.07 | | | | | | | | | |

| Market price | | | | | 6.76 | | | | 10.34 | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| CGSD — Capital Group Short Duration Income ETF | | 10/25/22 | | | | | | | | | | | 5.08 | | | | 0.25 | |

| Net asset value | | | | | 5.14 | | | | 5.85 | | | | | | | | | |

| Market price | | | | | 5.01 | | | | 5.98 | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| CGSM — Capital Group Short Duration Municipal Income ETF | 9/26/23 | | | | | | | | | | | 3.23 | | | | 0.25 | |

| Net asset value | | | | | — | | | | 4.00 | | | | | | | | | |

| Market price | | | | | — | | | | 4.24 | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| CGMS — Capital Group U.S. Multi-Sector Income ETF | | 10/25/22 | | | | �� | | | | | | | 6.43 | | | | 0.39 | |

| Net asset value | | | | | 11.39 | | | | 12.90 | | | | | | | | | |

| Market price | | | | | 11.49 | | | | 13.17 | | | | | | | | | |

Capital Group exchange-traded funds (ETFs) are actively managed and do not seek to replicate a specific index. ETF shares are bought and sold through an exchange at the then current market price, not net asset value (NAV), and are not individually redeemed from the fund. Shares may trade at a premium or discount to their NAV when traded on an exchange. Brokerage commissions will reduce returns. There can be no guarantee that an active market for ETFs will develop or be maintained, or that the ETF’s listing will continue or remain unchanged.

ETF market price returns since inception are calculated using NAV for the period until market price became available (generally a few days after inception).

Since inception returns are cumulative for ETFs with less than one year of history and average annual for ETFs with more than one year of history.

As nondiversified funds, Capital Group ETFs have the ability to invest a larger percentage of assets in securities of individual issuers than a diversified fund. As a result, a single issuer could adversely affect a fund’s results more than if the fund invested a smaller percentage of assets in securities of that issuer. Refer to the applicable prospectus for details.

| * | The total annual fund operating expense ratios were as of each fund’s prospectus dated March 1, 2024 (unaudited). The expense ratios for CGCB and CGSM are estimated. |

Investments are not FDIC-insured, nor are they deposits of or guaranteed by a bank or any other entity, so they may lose value.

Contents

Fellow investors:

We are pleased to present this annual report for Capital Group Core Bond ETF (ticker: CGCB), Capital Group Core Plus Income ETF (ticker: CGCP), Capital Group Municipal Income ETF (ticker: CGMU), Capital Group Short Duration Income ETF (ticker: CGSD) and Capital Group Short Duration Municipal Income ETF (ticker: CGSM) and Capital Group U.S. Multi-Sector Income ETF (ticker: CGMS). This report covers the fiscal year ending December 31, 2023. For CGCB and CGSM, the commentary in this report for those funds reflect the funds’ inception date (9/26/23) to fiscal year-end period.

Bond market overview

After experiencing one of the most difficult markets in 40 years in 2022, fixed income markets bounced back modestly in 2023. However, for much of 2023, bond markets were volatile amid continued central bank interest rate hikes as global central banks sought to dampen elevated inflationary pressures. These central banks, particularly the U.S. Federal Reserve (the Fed), were able to use higher interest rate policies to reduce inflationary pressures without seemingly pushing the global economy into recession. By the end of 2023, the Fed had indicated that they had likely reached the end of interest rate hikes and could reduce rates in 2024, which helped propel bond prices higher during the fourth quarter.

In the U.S., the Fed raised benchmark interest rates during the first seven months of 2023, albeit at a more modest pace than in the previous year. At the end of 2023, the target range for the Federal funds rate was 5.25% to 5.50%, or 1% higher than the end of 2022. The 10-year Treasury yield ended 2023 at 3.88%, the same level it ended the previous year after peaking at 4.98% in October 2023, which was the highest yield in more than 15 years. Short-term bond yields from 1-month to 1-year maturities rose during the year, but 2- through 7-year bond yields declined modestly. The yield curve remained inverted during 2023, meaning shorter term bond yields were higher than longer term bond yields. There were periods of more extreme yield curve inversion during the middle of the year, yet as Fed interest rate hikes appeared to be closer to ending, 2- to 7-year yields declined more than longer maturities. This resulted in a modestly steeper portion of the curve for maturities of two or more years. Overall, short-term bond yields remained higher than long-term yields at the end of 2023.

Returns for the Bloomberg U.S. Aggregate Index — the broad-based U.S. bond market benchmark — and the Bloomberg Global Aggregate Index1 were 5.53% and 5.72%, respectively. These gains marked a turnaround from sharp losses in 2022. Looking at short-term investment-grade securities, the Bloomberg U.S. Government/Credit (1-3 Years) Index2 rose 4.61%. As inflation tapered throughout the year, the Bloomberg U.S. Treasury Inflation-Protected Securities Index3 lagged the benchmark with a return of 3.90%. Mortgage bonds bounced back despite tepid housing demand and supply, with the Bloomberg U.S. Mortgage Backed Securities Index4 returning 5.05%.

Within U.S. credit sectors, investment-grade bonds outpaced the broader market and the Bloomberg U.S. Corporate Investment Grade Index5 posted a return of 8.52%.

| 1 | Bloomberg Global Aggregate Index represents the global investment-grade fixed income markets. |

| 2 | Bloomberg 1-3 Year U.S. Government/Credit Index is a market-value weighted index that tracks the total return results of fixed-rate, publicly placed, dollar-denominated obligations issued by the U.S. Treasury, U.S. government agencies, quasi-federal corporations, corporate or foreign debt guaranteed by the U.S. government, and U.S. corporate and foreign debentures and secured notes that meet specified maturity, liquidity and quality requirements, with maturities of one to three years. |

| 3 | Bloomberg U.S. Treasury Inflation-Protected Securities (TIPS) Index consists of investment-grade, fixed-rate, publicly placed, dollar-denominated and non-convertible inflation-protected securities issued by the U.S. Treasury that have at least one year remaining to maturity, and have at least $250 million par amount outstanding. |

| 4 | Bloomberg U.S. Mortgage Backed Securities Index is a market-value-weighted index that covers the mortgage-backed pass-through securities of Ginnie Mae (GNMA), Fannie Mae (FNMA), and Freddie Mac (FHLMC). |

| 5 | Bloomberg U.S. Corporate Investment Grade Index represents the universe of investment-grade, publicly issued U.S. corporate and specified foreign debentures and secured notes that meet the specified maturity, liquidity, and quality requirements. |

Past results are not predictive of results in future periods.

| Capital Group Fixed Income ETF Trust | 1 |

High-yield corporate bonds registered strong returns, with the Bloomberg U.S. Corporate High Yield 2% Issuer Capped Index6 climbing 13.44% for the year.

Turning to the municipal bond market, strong state reserve levels and the U.S. economy seemingly staving off recession helped the Bloomberg Municipal Bond Index7 outpace the taxable fixed income market. The index rose 6.40% in 2023. Shorter maturity municipal bonds lagged with the Bloomberg Municipal Short 1-5 Years Index8 returning 3.58% in 2023.

Inside the funds

Since inception (9/26/23) through the end of the fiscal year (12/31/23), CGCB returned 6.84% on a market price basis and 6.56% on a net asset value (NAV) basis. The fund outpaced its benchmark, the Bloomberg U.S. Aggregate Index, on a market price basis, but lagged on a net asset value basis. CGCB’s yield curve positioning detracted from results relative to the fund’s benchmark, but was counterbalanced by sector/industry selection, largely a result of greater-than-benchmark investment in the securitized credit and investment-grade corporates sectors.

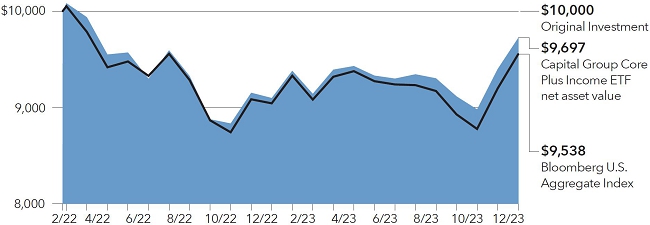

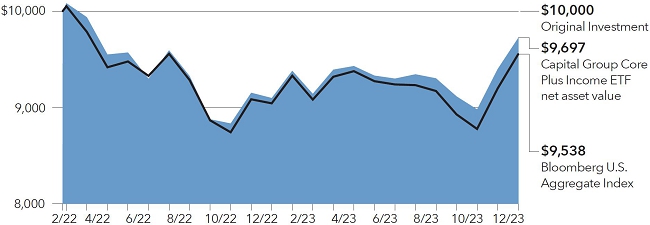

CGCP outpaced its benchmark, the Bloomberg U.S. Aggregate Index, returning 7.19% on a market price basis and 7.25% on a NAV basis in 2023. The fund’s overweight to credit, particularly high yield, and strong security selection across sectors drove much of the contributions to results relative to the benchmark. The fund’s relative underweight duration position for much of the year was further additive to results as yields rose significantly before peaking in October. Meanwhile, CGCP’s positioning for yield curve steepening, intended to help balance procyclical positioning in credit, detracted from relative results as the curve did not steepen as much as the market anticipated in 2023.

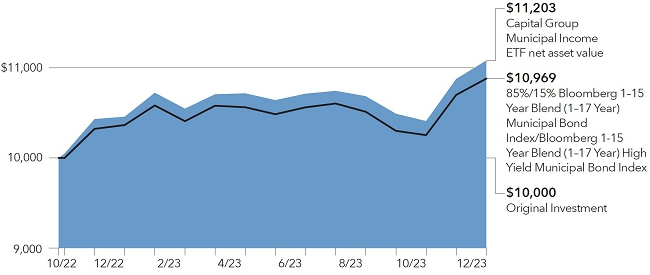

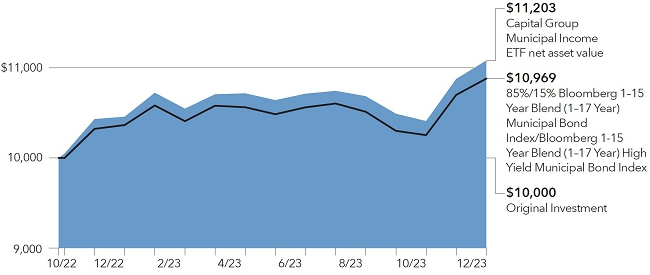

CGMU returned 6.76% on a market price basis and 6.78% on a NAV basis in 2023, outpacing its benchmark, the 85%/15% Bloomberg 1-15 Year Blend (1-17 Year) Municipal Bond Index/Bloomberg 1-15 Year Blend (1-17 Year) High Yield Municipal Bond Index9. Security selection and curve positioning were key drivers of excess returns in 2023. Investment choices and yield curve positioning within the corporates sector were particularly additive. In contrast, duration positioning was a modest detractor from relative results. Housing and utility duration positioning — or the maturity of the investments in these sectors — were drags on returns compared to the benchmark.

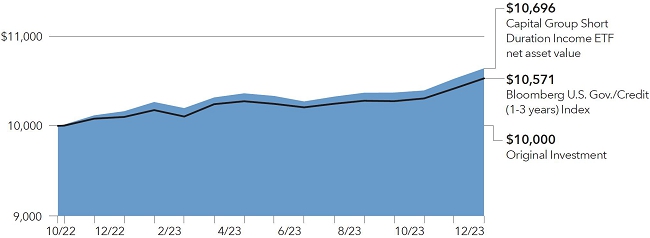

CGSD rose 5.01% and 5.14% on a market price and NAV basis, respectively for the year. Credit sectors and duration positioning contributed to results, while yield curve positioning detracted. All credit sectors contributed to absolute results for the year, and diversification benefitted the fund. Within credit sectors, a diversified mix of asset-backed securities (ABS) contributed the most to absolute results followed by investment-grade industrial corporate bonds. Non-agency CMBS and residential MBS also added strongly to absolute results. Short maturity investment-grade corporate bonds had positive returns and CGSD’s allocation to this sector benefitted the fund. Industrials were the largest driver of results followed by financials. Throughout the year, CGSD managers positioned the portfolio in anticipation of yield curve steepening, which detracted from returns.

Over the fund’s brief lifetime (9/26/23 through 12/31/23), CGSM registered a 4.24% return on a market price basis and 4.00% on a net asset value (NAV) basis, which outpaced its benchmark, the Bloomberg Municipal Short 1-5 Years Index. Security selection and duration positioning were among the contributors to relative returns, while yield curve positioning in the general obligation sector was a notable detractor.

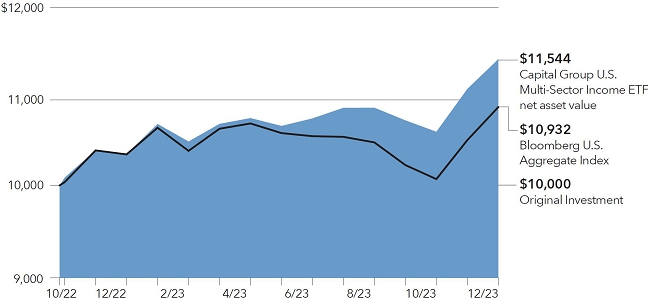

In 2023, CGMS posted an 11.49% return on a market price basis and an 11.39% on a NAV basis. The fund’s results surpassed that of its benchmark index, the Bloomberg U.S. Aggregate Index and its secondary benchmark, the Bloomberg Custom Multi-Sector Composite Index10.

| 6 | Bloomberg U.S. Corporate High Yield Index covers the universe of fixed-rate, non-investment-grade debt. |

| 7 | Bloomberg Municipal Bond Index is a market-value-weighted index designed to represent the long-term investment-grade tax-exempt bond market. This index is unmanaged, and its results include reinvested distributions but do not reflect the effect of sales charges, commissions, account fees, expenses or U.S. federal income taxes. |

| 8 | Bloomberg Municipal Short 1-5 Years Index is a market-value-weighted index that includes investment-grade tax-exempt bonds with maturities of one to five years. |

| 9 | 85%/15% Bloomberg 1-15 Year Blend (1-17) Municipal Bond Index/Bloomberg 1-15 Year Blend (1-17) High Yield Municipal Bond Index blends the Bloomberg 1-15 Year Blend (1-17) Municipal Bond Index with the Bloomberg 1-15 Year Blend (1-17) High Yield Municipal Bond Index by weighting their cumulative total returns at 85% and 15%, respectively. The blend is rebalanced monthly. Bloomberg 1-15 Year Blend (1-17) Municipal Bond Index consists of a broad selection of investment-grade general obligation and revenue bonds of maturities ranging from one year to 17 years. Bloomberg 1-15 Year Blend (1-17) High Yield Municipal Bond Index consists of a broad selection of below-investment-grade general obligation and revenue bonds of maturities ranging from one year to 17 years. |

| 10 | Bloomberg Custom Multi-Sector Composite Index reflect the results of the Custom US CMBS ex AAA/US HY 2% Cap/ US ABS ex AAA/ US Corp Index from 06/01/2022 through 09/30/2023 and the Custom US CMBS Non-Agency ex AAA/US HY 2% Cap/ US ABS ex AAA/US Corp Index, thereafter. Bloomberg U.S. Corporate High Yield 2% Issuer Capped Index covers the universe of fixed-rate, non-investment-grade debt. The index limits the maximum exposure of any one issuer to 2%. Bloomberg U.S. Corporate Investment Grade Index represents the universe of investment-grade publicly issued U.S. corporate and specified foreign debentures and secured notes that meet the specified maturity, liquidity, and quality requirements. Bloomberg CMBS Non-Agency ex AAA Index represents the universe of U.S. commercial mortgage-backed securities, excluding issuers with credit ratings of AAA, the highest credit quality rating. Bloomberg Non-Agency CMBS ex AAA Index represents the universe of U.S. commercial mortgage-backed securities, excluding agency and issuers with credit ratings of AAA, the highest credit quality rating. Bloomberg ABS ex AAA Index represents the universe of U.S. asset-backed securities, excluding issuers with credit ratings of AAA, the highest credit quality rating. |

Past results are not predictive of results in future periods.

| 2 | Capital Group Fixed Income ETF Trust |

Security selection was the primary driver of results compared to the secondary benchmark, especially in investment-grade corporates and securitized credit sectors. Sector/industry positioning detracted from relative returns, driven by CGMS’s lower investment in high-yield corporates and the fund’s allocation to cash & money market instruments in an up-market environment.

Looking ahead

With inflation falling and a cooling economy, bond investors may be feeling some relief: The Fed may finally be done lifting interest rates. Bonds could be one of the more attractive areas of financial markets in 2024 as yields across the bond market are near 20-year highs.

In previous economic cycles, an inverted yield curve, where shorter maturity bond yields are higher than longer maturity bond yields, would have been a harbinger of an imminent recession. Nearly 18 months after this cycle’s initial yield curve inversion, the U.S. economy has yet to enter recession. However, given the significant monetary policy intervention over the past 15 years, a surprisingly resilient U.S. consumer post-COVID and a limited timeframe to determine the impact of higher rates across several industries, it may be too early to tell whether the Fed has pulled off a “soft landing”, meaning slowing economic activity will reaccelerate rather than resulting in recession.

Whether the U.S. economy goes into recession or experiences a soft landing, fixed income portfolio managers believe positioning funds for yield curve normalization or steepening, where long-term Treasury yields are higher than short-term yields, may be appropriate. Managers think there’s a low probability of inflation reaccelerating which would make further Fed rate increases unlikely. Conversely, should economic data show broad deterioration, the Fed could consider lowering rates.

No matter whether the Fed holds rates at current levels in 2024 or even reduces rates, it’s important to note the end of a rate increase cycle has historically been an attractive time to own longer duration securities. Duration, which measures a bond’s sensitivity to interest rates, is a hallmark of bonds with longer maturities. As 2024 progresses, managers will be mindful of opportunities to add duration to portfolios.

Within securitized credit and corporates sectors, portfolio managers believe an active approach may be key to uncovering attractively valued opportunities, especially as some areas within these sectors can see conditions change quickly. Strong balance sheets and low refinancing needs make investment-grade corporate bonds a potential area of opportunity should economic growth remain modest in 2024. Similarly, managers think agency mortgage-backed securities (MBS) could bring an appealing risk-return profile given higher starting yields and their implicit government backing. However, managers feel the attractiveness of agency MBS is valuation sensitive and their active management may help uncover value if the market environment changes quickly.

High-yield bonds (those rated BB/Ba and lower by debt ratings agencies) could offer healthy income potential. Despite the rapid increase in rates during recent years, bond market investors have priced in only modest increases in high-yield corporate debt default rates in 2024. In the high-yield corporate debt sector, most issuers’ existing debt will not reach maturity until 2026 or beyond. Given higher interest rates, many companies with higher debt loads have turned to private credit for their more immediate funding needs. With this backdrop, portfolio managers believe selectivity will be key.

In municipal bonds, fundamentals appear solid despite an uncertain environment. State reserves are ample due to climbing corporate income and sales taxes along with greater household incomes. With the potential for a slower economic growth environment, managers remain cautious in 2024, with some maintaining a more defensive portfolio to potentially safeguard against any macroeconomic headwinds that may arise.

Cordially,

Chitrang Purani

President, Capital Group Core Bond ETF

David A. Hoag

President, Capital Group Core Plus Income ETF

Courtney K. Wolf

President, Capital Group Municipal Income ETF

Vincent J. Gonzales

President, Capital Group Short Duration Income ETF

Vikas Malhotra

President, Capital Group Short Duration Municipal Income ETF

Damien J. McCann

President, Capital Group U.S. Multi-Sector Income ETF

February 14, 2024

For current information about the fund, refer to capitalgroup.com.

Past results are not predictive of results in future periods.

| Capital Group Fixed Income ETF Trust | 3 |

Capital Group Core Bond ETF

Capital Group Core Bond ETF seeks to provide as high a level of current income as is consistent with the preservation of capital.

CGCB returned 6.84% on a market price bases and 6.56% on a net asset value (NAV) basis from inception (September 26, 2023) to the end of the fiscal year (December 31, 2023). The fund’s benchmark, the Bloomberg U.S. Aggregate Index, increased 6.63% over the same period. For the inception to fiscal year-end period, the fund paid a monthly dividend totaling approximately 25 cents a share.

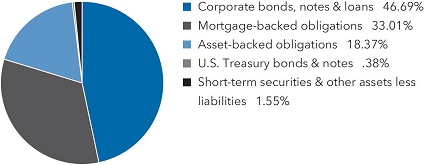

Sector selection contributed positively to returns in excess of the fund’s benchmark, while curve positioning and security selection detracted from relative results. CGCB’s greater-than-benchmark investment in investment-grade corporate debt and securitized assets, particularly agency mortgage-backed securities (MBS), were the largest contributors to returns from a sector selection perspective. Meanwhile, selection within agency MBS resulted in the largest detraction from returns.

CGCB managers continue to seek high quality investments across a variety of bond sectors to pursue the fund’s investment objective. Given the market backdrop, managers are seeking a higher quality and balanced approach. The fund was about neutral duration relative to the benchmark at the end of the fiscal year. Managers believe the Fed may reduce interest rates in 2024, which has historically been a boon to longer-duration bonds and makes interest rate exposure relatively attractive over the medium term. However, managers expect market volatility will create opportunities to profit from shorter term duration positioning and will adjust accordingly. Managers see value in positioning along the yield curve, holding higher-than-benchmark exposure to shorter maturities (from two- to seven-year), which should benefit from expected Fed cuts in 2024. Managers have a lower exposure relative to the benchmark on the long end of the curve, from the 10-year to 30-year portion, which is less likely to benefit from rate cuts and could be negatively affected by elevated U.S. Treasury issuance to fund sustained high government deficits. Managers believe securitized assets, including agency MBS, offer a high-quality profile and minimal credit risk with attractive valuations relative to other sectors. The room for upside given valuations in corporate bonds appears to be limited, but we are leaning into security selection to unearth compelling opportunities.

Results at a glance

For periods ended December 31, 2023, with all distributions reinvested

| | | Cumulative total returns |

| | | Lifetime

(since 9/26/23) |

| | | |

| Capital Group Core Bond ETF | | |

| Net asset value | | | 6.56 | % |

| Market price* | | | 6.84 | |

| Bloomberg U.S. Aggregate Index† | | | 6.63 | |

| * | ETF market price results since inception are calculated using NAV for the period until market price became available (generally a few days after inception). |

| † | Source: Bloomberg Index Services Ltd. Bloomberg U.S. Aggregate Index represents the U.S. investment-grade fixed-rate bond market. The market index is unmanaged and, therefore, has no expenses. Investors cannot invest directly in an index. |

Past results are not predictive of results in future periods.

| 4 | Capital Group Fixed Income ETF Trust |

Capital Group Core Plus Income ETF

Capital Group Core Plus Income ETF seeks to provide current income and maximum total return, consistent with preservation of capital.

The fund registered a total return of 7.19% on a market price basis and 7.25% on a NAV basis in 2023. The fund’s benchmark index, the Bloomberg U.S. Aggregate Index, a market value-weighted index that represents the U.S. investment-grade fixed-rate bond market, posted a 5.53% increase. For the fiscal year, the fund paid a monthly dividend totaling almost $1.13 a share.

CGCP’s investment in credit, particularly sector allocation and security selection, was additive to relative results in 2023. Managers’ security selection in investment-grade corporate, securitized credit (asset-backed securities and commercial mortgage-backed securities) and emerging markets debt benefitted the fund. Additionally, the fund’s active duration positioning contributed to results compared to the index. Meanwhile, CGCP’s managers positioned the portfolio for yield curve steepening in 2023 and, overall, the cost of carrying that position detracted from relative returns. Managers implemented this positioning to potentially provide some ballast in the portfolio should rates normalized or had a recession materialized.

CGCP’s portfolio managers are taking a balanced approach to portfolio construction across credit and interest rates with a goal of generating strong results in an environment of continued economic growth, while having positions in the portfolio that could help protect on the downside should a recession occur in the future. One example of more defensive-positioning is CGCP’s overweight position in agency mortgage-backed securities (MBS). Portfolio managers also see opportunities within securitized credit industries, such as automobile asset-backed securities and commercial mortgage-backed securities (CMBS), due to attractive valuations and favorable fundamentals. With the significant decline in interest rates in the fourth quarter, managers reduced duration to move back to an underweight position compared the benchmark. At the end of the fiscal year, managers maintained positioning for a steeper yield curve which they expect could do well across multiple scenarios. CGCP’s managers believe the yield curve may normalize, or steepen, from its current inverted posture. If the Fed were to cut rates, this positioning could provide ballast in the portfolio in the case of a risk-off (when investors prefer less growth-oriented investments) or recessionary environment or should interest rates rise significantly.

How a hypothetical $10,000 investment has grown

since fund’s inception on February 22, 2022 (with all distributions reinvested)

The results shown are before taxes on fund distributions and sale of fund shares.

| Capital Group Fixed Income ETF Trust | 5 |

Capital Group Core Plus Income ETF (continued)

Results at a glance

For periods ended December 31, 2023, with all distributions reinvested

| | | Cumulative total returns | | Average annual |

| | | 1 Year | | Lifetime

(since 2/22/22) |

| | | | | |

| Capital Group Core Plus Income ETF | | | | |

| Net asset value | | | 7.25 | % | | | –1.65 | % |

| Market price* | | | 7.19 | | | | –1.56 | |

| Bloomberg U.S. Aggregate Index† | | | 5.53 | | | | –2.52 | |

| * | ETF market price results since inception are calculated using NAV for the period until market price became available (generally a few days after inception). |

| † | Source: Bloomberg Index Services Ltd. Bloomberg U.S. Aggregate Index represents the U.S. investment-grade fixed-rate bond market. The market index is unmanaged and, therefore, has no expenses. Investors cannot invest directly in an index. |

Past results are not predictive of results in future periods.

| 6 | Capital Group Fixed Income ETF Trust |

Capital Group Municipal Income ETF

Capital Group Municipal Income ETF seeks to provide a high level of current income exempt from regular federal income tax, consistent with the preservation of capital.

CGMU returned of 6.76% on a market price basis and 6.78% at NAV for fiscal 2023. These returns outpaced the 5.57% total return of the fund’s benchmark index, the 85%/15% Bloomberg 1-15 Year Blend (1-17 Year) Municipal Bond Index/Bloomberg 1-15 Year Blend (1-17 Year) High Yield Municipal Bond Index. For the fiscal year, the fund paid a monthly dividend totaling approximately 84 cents a share.

Security selection and yield curve positioning were the largest contributors to results in 2023 compared to the benchmark. Corporates and general obligation issues were the two areas that managers added the most value from investment choice. The fund’s overweight position compared to the benchmark in long-term bonds in the 20- and 30-year maturities range were particularly additive to comparative results as these maturities experienced the largest decline in yields. Meanwhile, the fund’s duration positioning was a modest drag on relative returns, with duration positioning in housing sector bonds providing a notable headwind.

Despite the rally in bonds at the end of 2023, CGMU portfolio managers believe still-attractive tax-equivalent yields, solid credit fundamentals and investors moving out of cash and cash-like investments could help support strong demand for municipal bonds in 2024. On the heels of the Fed signaling the end of rate hikes in late 2023, managers are constructive on the potential for rate cuts by the Fed in 2024. As a result, CGMU maintained a longer than benchmark duration position. At the sector level, managers feel municipal single-family housing presents compelling valuations. In this area, bonds in the highest AAA-rated and AA-rated tranches offer similar yields to lower quality segments of the market. Managers are also finding what they believe are attractive opportunities in the tax-allocation and tax-assessment segments of the market.

How a hypothetical $10,000 investment has grown

since fund’s inception on October 25, 2022 (with all distributions reinvested)

The results shown are before taxes on fund distributions and sale of fund shares.

| Capital Group Fixed Income ETF Trust | 7 |

Capital Group Municipal Income ETF (continued)

Results at a glance

For periods ended December 31, 2023, with all distributions reinvested

| | | Cumulative total returns | | Average annual |

| | | 1 Year | | Lifetime

(since 10/25/22) |

| | | | | |

| Capital Group Municipal Income ETF | | | | | | | | |

| Net asset value | | | 6.78 | % | | | 10.07 | % |

| Market price* | | | 6.76 | | | | 10.34 | |

| 85%/15% Bloomberg 1-15 Year Blend (1-17 Year) Municipal Bond Index/Bloomberg 1-15 Year Blend (1-17 Year) High Yield Municipal Bond Index† | | | 5.57 | | | | 8.13 | |

| * | ETF market price results since inception are calculated using NAV for the period until market price became available (generally a few days after inception). |

| † | Source: Bloomberg Index Services Ltd. 85%/15% Bloomberg 1-15 Year Blend (1-17) Municipal Bond Index/Bloomberg 1-15 Year Blend (1-17) High Yield Municipal Bond Index blends the Bloomberg 1-15 Year Blend (1-17) Municipal Bond Index with the Bloomberg 1-15 Year Blend (1-17) High Yield Municipal Bond Index by weighting their cumulative total returns at 85% and 15%, respectively. The blend is rebalanced monthly. Bloomberg 1-15 Year Blend (1-17) Municipal Bond Index consists of a broad selection of investment-grade general obligation and revenue bonds of maturities ranging from one year to 17 years. Bloomberg 1-15 Year Blend (1-17) High Yield Municipal Bond Index consists of a broad selection of below-investment-grade general obligation and revenue bonds of maturities ranging from one year to 17 years. The indexes are unmanaged, and results include reinvested distributions but do not reflect the effect of sales charges, commissions, account fees, expenses or U.S. federal income taxes. |

Past results are not predictive of results in future periods.

| 8 | Capital Group Fixed Income ETF Trust |

Capital Group Short Duration Income ETF

Capital Group Short Duration Income ETF seeks to provide current income, consistent with a short duration profile as described in the prospectus and with the preservation of capital.

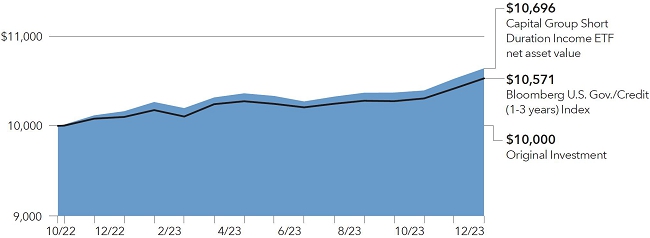

In 2023, the fund recorded a total return of 5.01% on a market price basis and 5.14% on a net asset value (NAV), which surpassed the 4.61% increase of the fund’s benchmark index, the Bloomberg U.S. Government /Credit (1-3 years) Index. For the fiscal year, the fund paid a monthly dividend totaling almost $1.13 a share.

Credit sectors contributed most to absolute results, with asset-backed securities (ABS) and investment-grade industrial corporate bonds in particular driving returns. Auto-backed ABS was a significant contributor along with a mix of other ABS sectors including credit cards, shipping containers and personal and business loans. Short maturity investment-grade bonds had positive returns; industrials, financials and utilities bonds all contributed to 2023 returns. Managers maintained their view that the yield curve may steepen from the deep inversion points seen in mid-February and over the summer. The fund was long the front end of the yield curve (six-month, two-year and five-year maturities) and short the long end of the curve (10-year). Even though the curve was less inverted than the start of the year, curve positioning detracted. Additionally, a small position in Treasuries were a slight drag on relative returns.

At the end of 2023, the portfolio consisted of roughly 50% securitized credit and 50% investment-grade corporates, with a minimal allocation to Treasuries and cash & money market instruments. Portfolio managers continue to seek attractively valued investments in these sectors due to high yields – relative to the past decade – offered by high-quality issuers (those with investment-grade credit ratings of BBB/Baa & above). In investment-grade corporates, there is continued emphasis on idiosyncratic credit opportunities driven by fundamental research with a focus on yield. Managers have recently invested more in large money-center banks’ debt as spreads remained wide relative to other sectors. In securitized credit, the fund is diversified across the various areas of the market such as ABS, commercial mortgage-backed securities (CMBS), non-agency residential MBS and agency MBS. Outside of credit investments, the fund remains positioned to potentially benefit from a steepening of the U.S. Treasury yield curve. Given the current level of inversion, and a more dovish stance from the Federal Reserve (Fed), managers believe the curve will steepen rather than flatten. The curve inversion is one of the longest on record. Interest rate volatility remained elevated as market expectations of higher-for-longer rates quickly shifted to a focus on potential interest rate cuts and more accommodative policy. On the back of the large rally in rates from mid-October through December, managers reduced the fund’s duration from 2.3 years to 1.9 years. Managers will continue to monitor the market and may add to duration if yields move higher in the short term.

How a hypothetical $10,000 investment has grown

since fund’s inception on October 25, 2022 (with all distributions reinvested)

The results shown are before taxes on fund distributions and sale of fund shares.

| Capital Group Fixed Income ETF Trust | 9 |

Capital Group Short Duration Income ETF (continued)

Results at a glance

For periods ended December 31, 2023, with all distributions reinvested

| | | Cumulative total returns | | Average annual |

| | | 1 Year | | Lifetime

(since 10/25/22) |

| | | | | |

| Capital Group Short Duration Income ETF | | | | | | | | |

| Net asset value | | | 5.14 | % | | | 5.85 | % |

| Market price* | | | 5.01 | | | | 5.98 | |

| Bloomberg U.S. Government/Credit (1-3 years) Index† | | | 4.61 | | | | 4.80 | |

| * | ETF market price results since inception are calculated using NAV for the period until market price became available (generally a few days after inception). |

| † | Source: Bloomberg Index Services Ltd. Bloomberg 1-3 Year U.S. Government/Credit Index is a market-value weighted index that tracks the total return results of fixed-rate, publicly placed, dollar-denominated obligations issued by the U.S. Treasury, U.S. government agencies, quasi-federal corporations, corporate or foreign debt guaranteed by the U.S. government, and U.S. corporate and foreign debentures and secured notes that meet specified maturity, liquidity and quality requirements, with maturities of one to three years. This index is unmanaged, and its results include reinvested distributions but do not reflect the effect of sales charges, commissions, account fees, expenses or U.S. federal income taxes. |

Past results are not predictive of results in future periods.

| 10 | Capital Group Fixed Income ETF Trust |

Capital Group Short Duration Municipal Income ETF

Capital Group Short Duration Municipal Income ETF seeks to provide current income exempt from regular federal income tax, consistent with a short duration profile as described in the prospectus and with the preservation of capital.

In the inception (September 26, 2023) to fiscal year-end (December 31, 2023) period, the fund recorded a total return of 4.24% on a market price basis and 4.00% on a net asset value (NAV), which outpaced the 3.31% increase of the fund’s benchmark index, the Bloomberg Municipal Short 1-5 Years Index. For the fiscal year, the fund paid a monthly dividend totaling almost $0.22 a share.

Security selection and duration positioning were the two main drivers of excess returns for the period, with valuation/other factors a very modest relative detractor. Security selection in the education sector helped returns compared to the index as well as duration positioning in housing sector holdings. From an overall sector level, duration positioning and yield curve positioning in the general obligation sector was a notable detractor from relative returns.

CGSM’s managers believe the inverted municipal bond yield curve may offer compelling yield opportunities with less potential interest rate risk than longer duration strategies. Compared to the benchmark, CGSM had a longer relative duration position at the end of the fiscal year, as managers feel the Fed may reduce interest rates in 2024, which would benefit longer duration bonds.

Managers maintained a portfolio that was well-diversified across sectors at the end of the fiscal year. The fund had meaningfully less general obligation and escrowed (bonds issued to pay off an older bond’s payments until it matures) debt compared to the benchmark, while housing and corporates are areas of emphasis relative to the benchmark. Attractive valuations compared to other areas of the municipal market led housing to drive this above-benchmark investment The fund has flexibility to invest in municipal bonds subject to the alternative minimum tax (AMT) and managers are evaluating opportunities in this area in 2024, as some of these bonds look attractively valued compared to non-AMT bonds from the same issuer. Similarly, CGSM managers have employed the fund’s ability to invest in high-yield municipal bonds (bonds rated BB/Ba & below) to pursue the fund’s income objective.

Results at a glance

For periods ended December 31, 2023, with all distributions reinvested

| | | Cumulative total returns |

| | | Lifetime

(since 9/26/23) |

| | | |

| Capital Group Short Duration Municipal Income ETF | | |

| Net asset value | | | 4.00 | % |

| Market price* | | | 4.24 | |

| Bloomberg Municipal Short 1-5 Years Index† | | | 3.31 | |

| * | ETF market price results since inception are calculated using NAV for the period until market price became available (generally a few days after inception). |

| † | Source: Bloomberg Index Services Ltd. Bloomberg Municipal Short 1-5 Years Index is a market-value-weighted index that includes investment-grade tax-exempt bonds with maturities of one to five years. This index is unmanaged, and its results include reinvested distributions but do not reflect the effect of sales charges, commissions, account fees, expenses or U.S. federal income taxes. |

Past results are not predictive of results in future periods.

| Capital Group Fixed Income ETF Trust | 11 |

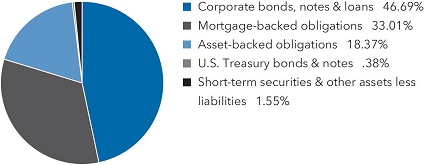

Capital Group U.S. Multi-Sector Income ETF

Capital Group U.S. Multi-Sector Income ETF seeks to provide a high level of current income. Its secondary investment objective is capital appreciation.

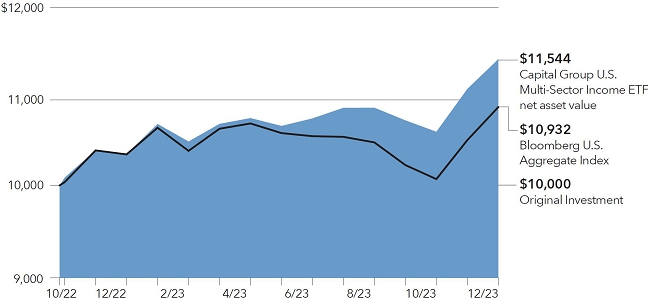

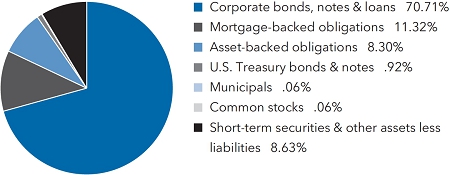

The fund registered a total return of 11.49% on a market price basis and 11.39% on a NAV basis in 2023 surpassing the 5.53% total return of the fund’s benchmark index, the Bloomberg U.S. Aggregate Index, and the 9.98% total return of the Bloomberg Custom Multi-Sector Index, the fund’s secondary benchmark. For the fiscal year, the fund paid a monthly dividend totaling approximately $1.58 a share.

In 2023, security selection drove returns compared to the secondary benchmark, while sector and industry allocation decisions detracted from relative results. Investment selection in the securitized credit sector was the largest driver of excess returns, but this was partially offset by CGMS’s greater than secondary benchmark allocation. Security selection across the fund’s investment grade corporate holdings was also a meaningful contributor to returns relative to the secondary benchmark. The fund’s roughly neutral weighting to the sector relative to its secondary benchmark was also modestly additive to comparative returns. Less investment in high-yield corporate debt than the secondary benchmark was the largest detractor to total returns.

CGMS managers maintain a preference for higher-quality bonds as on a relative basis, investment-grade corporates, asset-backed securities (ABS) and commercial mortgage-backed securities (CMBS) are attractive. The high-yield market continues to trend up in quality as lower-quality issuers migrate to levered-loan and private credit markets. Portfolio managers maintain diversified exposure across numerous deeply researched investments. finding attractive opportunities among select high-yield issuers in the cable, pharmaceutical, automotive, media, aerospace, technology and energy sectors.

How a hypothetical $10,000 investment has grown

since fund’s inception on October 25, 2022 (with all distributions reinvested)

The results shown are before taxes on fund distributions and sale of fund shares.

| 12 | Capital Group Fixed Income ETF Trust |

Capital Group U.S. Multi-Sector Income ETF (continued)

Results at a glance

For periods ended December 31, 2023, with all distributions reinvested

| | | Cumulative total returns | | Average annual |

| | | 1 Year | | Lifetime

(since 10/25/22) |

| | | | | |

| Capital Group U.S. Multi-Sector Income ETF | | | | | | | | |

| Net asset value | | | 11.39 | % | | | 12.90 | % |

| Market price1 | | | 11.49 | | | | 13.17 | |

| Bloomberg U.S. Aggregate Index2 | | | 5.53 | | | | 7.82 | |

| Bloomberg Custom Multi-Sector Index3 | | | 9.98 | | | | 11.21 | |

| 1 | ETF market price results since inception are calculated using NAV for the period until market price became available (generally a few days after inception). |

| 2 | Source: Bloomberg Index Services Ltd. Bloomberg U.S. Aggregate Index represents the U.S. investment-grade fixed-rate bond market. The market index is unmanaged and, therefore, has no expenses. Investors cannot invest directly in an index. |

| 3 | Source: Bloomberg Index Services Ltd. Bloomberg Custom Multi-Sector Composite Index reflect the results of the Custom US CMBS ex AAA/US HY 2% Cap/ US ABS ex AAA/ US Corp Index from 06/01/2022 through 09/30/2023 and the Custom US CMBS Non-Agency ex AAA/US HY 2% Cap/ US ABS ex AAA/US Corp Index, thereafter. Bloomberg U.S. Corporate High Yield 2% Issuer Capped Index covers the universe of fixed-rate, non-investment-grade debt. The index limits the maximum exposure of any one issuer to 2%. Bloomberg U.S. Corporate Investment Grade Index represents the universe of investment-grade publicly issued U.S. corporate and specified foreign debentures and secured notes that meet the specified maturity, liquidity, and quality requirements. Bloomberg CMBS Non-Agency ex AAA Index represents the universe of U.S. commercial mortgage-backed securities, excluding issuers with credit ratings of AAA, the highest credit quality rating. Bloomberg Non-Agency CMBS ex AAA Index represents the universe of U.S. commercial mortgage-backed securities, excluding agency and issuers with credit ratings of AAA, the highest credit quality rating. Bloomberg ABS ex AAA Index represents the universe of U.S. asset-backed securities, excluding issuers with credit ratings of AAA, the highest credit quality rating. |

Past results are not predictive of results in future periods.

| Capital Group Fixed Income ETF Trust | 13 |

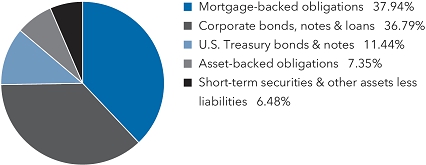

Capital Group Core Bond ETF

Investment portfolio December 31, 2023

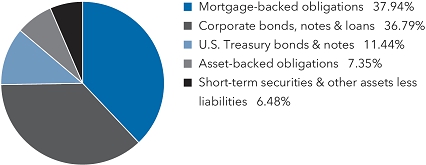

| Portfolio by type of security | Percent of net assets |

| Portfolio quality summary* | | | Percent of

net assets |

| U.S. Treasury and agency† | | | 11.44 | % |

| AAA/Aaa | | | 41.60 | |

| AA/Aa | | | 6.28 | |

| A/A | | | 20.63 | |

| BBB/Baa | | | 13.57 | |

| Short-term securities & other assets less liabilities | | | 6.48 | |

| * | Bond ratings, which typically range from AAA/Aaa (highest) to D (lowest), are assigned by credit rating agencies such as Standard & Poor’s, Moody’s and/or Fitch as an indication of an issuer’s creditworthiness. In assigning a credit rating to a security, the fund looks specifically to the ratings assigned to the issuer of the security by Standard & Poor’s, Moody’s and/or Fitch. If agency ratings differ, the security will be considered to have received the highest of those ratings, consistent with the fund’s investment policies. The ratings are not covered by the Report of Independent Registered Public Accounting Firm. |

| † | These securities are guaranteed by the full faith and credit of the U.S. government. |

| Bonds, notes & other debt instruments 93.52% | | Principal amount

(000) | | | Value

(000) | |

| Mortgage-backed obligations 37.94% | | | | | | | | |

| Federal agency mortgage-backed obligations 34.72% | | | | | | | | |

| Fannie Mae Pool #MA4562 2.00% 3/1/20521 | | USD | 658 | | | $ | 538 | |

| Fannie Mae Pool #MA4623 2.50% 6/1/20521 | | | 1,181 | | | | 1,005 | |

| Fannie Mae Pool #MA4743 2.50% 8/1/20521 | | | 1,806 | | | | 1,537 | |

| Fannie Mae Pool #MA4768 2.50% 9/1/20521 | | | 2,348 | | | | 1,998 | |

| Fannie Mae Pool #MA4731 3.50% 9/1/20521 | | | 284 | | | | 260 | |

| Fannie Mae Pool #MA5071 5.00% 7/1/20531 | | | 1,529 | | | | 1,513 | |

| Fannie Mae Pool #MA5137 5.00% 9/1/20531 | | | 211 | | | | 209 | |

| Fannie Mae Pool #MA5163 4.50% 10/1/20531 | | | 1,026 | | | | 995 | |

| Freddie Mac Pool #SD8204 2.00% 4/1/20521 | | | 3,175 | | | | 2,597 | |

| Freddie Mac Pool #SD8234 2.50% 8/1/20521 | | | 165 | | | | 140 | |

| Freddie Mac Pool #SD8237 4.00% 8/1/20521 | | | 837 | | | | 792 | |

| Freddie Mac Pool #SD8242 3.00% 9/1/20521 | | | 2,696 | | | | 2,387 | |

| Freddie Mac Pool #SD8324 5.50% 5/1/20531 | | | 1,099 | | | | 1,103 | |

| Freddie Mac Pool #SD8388 3.50% 10/1/20531 | | | 1,034 | | | | 949 | |

| Freddie Mac Seasoned Loan Structured Transaction Trust, Series 20-3, Class AC, 2.00% 11/25/20301 | | | 274 | | | | 237 | |

| Freddie Mac Seasoned Loan Structured Transaction Trust, Series 21-1, Class AC, 2.25% 5/26/20311 | | | 274 | | | | 242 | |

| Freddie Mac Seasoned Loan Structured Transaction Trust, Series 21-2, Class AD, 2.00% 7/25/20311 | | | 294 | | | | 255 | |

| Freddie Mac Seasoned Loan Structured Transaction Trust, Series 20-2, Class AC, 2.00% 9/27/20601 | | | 278 | | | | 241 | |

| Uniform Mortgage-Backed Security 2.50% 1/1/20541,2 | | | 2,135 | | | | 1,817 | |

| Uniform Mortgage-Backed Security 3.00% 1/1/20541,2 | | | 2,620 | | | | 2,318 | |

| Uniform Mortgage-Backed Security 3.50% 1/1/20541,2 | | | 3,385 | | | | 3,106 | |

| Uniform Mortgage-Backed Security 4.00% 1/1/20541,2 | | | 2,950 | | | | 2,790 | |

| Uniform Mortgage-Backed Security 4.50% 1/1/20541,2 | | | 1,855 | | | | 1,798 | |

| Uniform Mortgage-Backed Security 5.00% 1/1/20541,2 | | | 220 | | | | 218 | |

| Uniform Mortgage-Backed Security 6.00% 1/1/20541,2 | | | 1,665 | | | | 1,691 | |

| Uniform Mortgage-Backed Security 6.50% 1/1/20541,2 | | | 1,675 | | | | 1,717 | |

| Uniform Mortgage-Backed Security 7.00% 1/1/20541,2 | | | 1,040 | | | | 1,073 | |

| | | | | | | | 33,526 | |

| 14 | Capital Group Fixed Income ETF Trust |

Capital Group Core Bond ETF (continued)

| Bonds, notes & other debt instruments (continued) | | Principal amount

(000) | | | Value

(000) | |

| Mortgage-backed obligations (continued) | | | | | | | | |

| Collateralized mortgage-backed obligations (privately originated) 2.03% | | | | | | | | |

| Connecticut Avenue Securities Trust, Series 2022-R07, Class 1M1, (30-day Average USD-SOFR + 2.95%) 8.287% 6/25/20421,3 | | USD | 115 | | | $ | 118 | |

| Connecticut Avenue Securities Trust, Series 2023-R01, Class 1M1, (30-day Average USD-SOFR + 2.40%) 7.737% 12/25/20421,3 | | | 300 | | | | 306 | |

| Connecticut Avenue Securities Trust, Series 2023-R04, Class 1M1, (30-day Average USD-SOFR + 2.30%) 7.637% 5/25/20431,3 | | | 449 | | | | 459 | |

| JPMorgan Mortgage Trust, Series 2017-1, Class B2, 3.45% 1/25/20471,3 | | | 449 | | | | 403 | |

| Legacy Mortgage Asset Trust, Series 2020-GS4, Class A1, 3.25% 2/25/20601,3 | | | 435 | | | | 435 | |

| Progress Residential Trust, Series 2023-SFR1, Class A, 4.30% 3/17/20401,3 | | | 249 | | | | 239 | |

| | | | | | | | 1,960 | |

| | | | | | | | | |

| Commercial mortgage-backed securities 1.19% | | | | | | | | |

| AMSR Trust, Series 2023-SFR2, Class A, 3.95% 6/17/20401,3 | | | 160 | | | | 151 | |

| Bank Commercial Mortgage Trust, Series 2019-BN19, Class A3, 3.183% 8/15/20611 | | | 35 | | | | 31 | |

| Benchmark Mortgage Trust, Series 2018-B2, Class A5, 3.882% 2/15/20511 | | | 38 | | | | 36 | |

| Benchmark Mortgage Trust, Series 2022-B35, Class A5, 4.444% 5/15/20551 | | | 175 | | | | 162 | |

| Commercial Mortgage Trust, Series 2015-3BP, Class A, 3.178% 2/10/20351,3 | | | 225 | | | | 214 | |

| FS Commercial Trust, Series 2023-4SZN, Class A, 7.066% 11/10/20391,3 | | | 121 | | | | 126 | |

| MSWF Commercial Mortgage Trust, Series 2023-2, Class A5, 6.014% 12/15/20561 | | | 94 | | | | 101 | |

| MSWF Commercial Mortgage Trust, Series 2023-2, Class AS, 6.491% 12/15/20561 | | | 83 | | | | 89 | |

| SFO Commercial Mortgage Trust, Series 2021-555, Class A, (1-month USD CME Term SOFR + 1.264%) 6.63% 5/15/2038 (1-month USD CME Term SOFR + 1.514% on 5/15/2026)1,3,4 | | | 250 | | | | 235 | |

| | | | | | | | 1,145 | |

| | | | | | | | | |

| Total mortgage-backed obligations | | | | | | | 36,631 | |

| | | | | | | | | |

| Corporate bonds, notes & loans 36.79% | | | | | | | | |

| Financials 22.14% | | | | | | | | |

| American Express Co. 6.338% 10/30/2026 (USD-SOFR + 1.33% on 10/30/2025)4 | | | 149 | | | | 152 | |

| American International Group, Inc. 5.125% 3/27/2033 | | | 85 | | | | 86 | |

| Bank of America Corp. 2.551% 2/4/2028 (USD-SOFR + 1.05% on 2/4/2027)4 | | | 1,056 | | | | 979 | |

| Bank of America Corp. 3.974% 2/7/2030 (3-month USD CME Term SOFR + 1.472% on 2/7/2029)4 | | | 722 | | | | 684 | |

| Bank of New York Mellon Corp. 5.834% 10/25/2033 (USD-SOFR + 2.074% on 10/25/2032)4 | | | 256 | | | | 272 | |

| Bank of Nova Scotia (The) 5.25% 6/12/2028 | | | 279 | | | | 283 | |

| Blackstone Holdings Finance Co., LLC 6.20% 4/22/20333 | | | 96 | | | | 103 | |

| BNP Paribas SA 2.591% 1/20/2028 (USD-SOFR + 1.228% on 1/20/2027)3,4 | | | 535 | | | | 495 | |

| BPCE SA 2.045% 10/19/2027 (USD-SOFR + 1.087% on 10/19/2026)3,4 | | | 768 | | | | 698 | |

| CaixaBank, SA 6.208% 1/18/2029 (USD-SOFR + 2.70% on 1/18/2028)3,4 | | | 715 | | | | 730 | |

| Canadian Imperial Bank of Commerce 3.60% 4/7/2032 | | | 120 | | | | 109 | |

| Charles Schwab Corp. (The) 5.643% 5/19/2029 (USD-SOFR + 2.21% on 5/19/2028)4 | | | 195 | | | | 200 | |

| Charles Schwab Corp. (The) 6.196% 11/17/2029 (USD-SOFR + 1.878% on 11/17/2028)4 | | | 71 | | | | 75 | |

| Citigroup, Inc. 4.412% 3/31/2031 (USD-SOFR + 3.914% on 3/31/2030)4 | | | 560 | | | | 536 | |

| Danske Bank AS 4.298% 4/1/2028 (1-year UST Yield Curve Rate T Note Constant Maturity + 1.75% on 4/1/2027)3,4 | | | 520 | | | | 504 | |

| Deutsche Bank AG 2.311% 11/16/2027 (USD-SOFR + 1.219% on 11/16/2026)4 | | | 407 | | | | 372 | |

| Deutsche Bank AG 6.819% 11/20/2029 (USD-SOFR + 2.51% on 11/20/2028)4 | | | 197 | | | | 208 | |

| DNB Bank ASA 1.535% 5/25/2027 (5-year UST Yield Curve Rate T Note Constant Maturity + 0.72% on 5/25/2026)3,4 | | | 826 | | | | 754 | |

| Fifth Third Bancorp 6.339% 7/27/2029 (USD-SOFR + 2.34% on 7/27/2028)4 | | | 252 | | | | 262 | |

| Five Corners Funding Trust III 5.791% 2/15/20333 | | | 186 | | | | 198 | |

| Goldman Sachs Group, Inc. 4.223% 5/1/2029 (3-month USD CME Term SOFR + 1.563% on 5/1/2028)4 | | | 673 | | | | 651 | |

| HSBC Holdings PLC 4.583% 6/19/2029 (3-month USD CME Term SOFR + 1.796% on 6/19/2028)4 | | | 550 | | | | 534 | |

| Intercontinental Exchange, Inc. 4.60% 3/15/2033 | | | 67 | | | | 67 | |

| JPMorgan Chase & Co. 6.07% 10/22/2027 (USD-SOFR + 1.33% on 10/22/2026)4 | | | 164 | | | | 169 | |

| JPMorgan Chase & Co. 4.203% 7/23/2029 (3-month USD CME Term SOFR + 1.522% on 7/23/2028)4 | | | 1,073 | | | | 1,043 | |

| Capital Group Fixed Income ETF Trust | 15 |

Capital Group Core Bond ETF (continued)

| Bonds, notes & other debt instruments (continued) | | Principal amount

(000) | | | Value

(000) | |

| Corporate bonds, notes & loans (continued) | | | | | | | | |

| Financials (continued) | | | | | | | | |

| KBC Groep NV 5.796% 1/19/2029 (1-year UST Yield Curve Rate T Note Constant Maturity + 2.10% on 1/19/2028)3,4 | | USD | 620 | | | $ | 631 | |

| Lloyds Banking Group PLC 5.871% 3/6/2029 (1-year UST Yield Curve Rate T Note Constant Maturity + 1.70% on 3/6/2028)4 | | | 466 | | | | 478 | |

| Metropolitan Life Global Funding I 5.15% 3/28/20333 | | | 338 | | | | 344 | |

| Mitsubishi UFJ Financial Group, Inc. 5.422% 2/22/2029 (1-year UST Yield Curve Rate T Note Constant Maturity + 1.38% on 2/22/2028)4 | | | 896 | | | | 913 | |

| Mizuho Financial Group, Inc. 1.234% 5/22/2027 (1-year UST Yield Curve Rate T Note Constant Maturity + 0.67% on 5/22/2026)4 | | | 676 | | | | 616 | |

| Morgan Stanley 5.123% 2/1/2029 (USD-SOFR + 1.73% on 2/1/2028)4 | | | 1,402 | | | | 1,409 | |

| Nasdaq, Inc. 5.35% 6/28/2028 | | | 287 | | | | 296 | |

| NatWest Group PLC 5.076% 1/27/2030 (3-month USD-LIBOR + 1.905% on 1/27/2029)4 | | | 653 | | | | 644 | |

| New York Life Global Funding 4.55% 1/28/20333 | | | 127 | | | | 125 | |

| Northwestern Mutual Life Insurance Co. (The) 4.90% 6/12/20283 | | | 219 | | | | 220 | |

| PNC Financial Services Group, Inc. 6.615% 10/20/2027 (USD-SOFR + 1.73% on 10/20/2026)4 | | | 108 | | | | 112 | |

| PNC Financial Services Group, Inc. 5.582% 6/12/2029 (USD-SOFR + 1.841% on 6/12/2028)4 | | | 431 | | | | 441 | |

| Royal Bank of Canada 5.20% 8/1/2028 | | | 276 | | | | 282 | |

| State Street Corp. 5.159% 5/18/2034 (USD-SOFR + 1.89% on 5/18/2033)4 | | | 147 | | | | 148 | |

| Sumitomo Mitsui Financial Group, Inc. 1.902% 9/17/2028 | | | 622 | | | | 545 | |

| Svenska Handelsbanken AB 5.50% 6/15/20283 | | | 645 | | | | 657 | |

| Toronto-Dominion Bank (The) 5.523% 7/17/2028 | | | 279 | | | | 287 | |

| U.S. Bancorp 4.653% 2/1/2029 (USD-SOFR + 1.23% on 2/1/2028)4 | | | 514 | | | | 506 | |

| UBS Group AG 9.016% 11/15/2033 (USD-SOFR + 5.02% on 11/15/2032)3,4 | | | 763 | | | | 939 | |

| Wells Fargo & Co. 5.574% 7/25/2029 (USD-SOFR + 1.74% on 7/25/2028)4 | | | 1,434 | | | | 1,465 | |

| Westpac Banking Corp. 4.11% 7/24/2034 (5-year UST Yield Curve Rate T Note Constant Maturity + 2.00% on 7/24/2029)4 | | | 174 | | | | 159 | |

| | | | | | | | 21,381 | |

| | | | | | | | | |

| Health care 3.10% | | | | | | | | |

| Amgen, Inc. 5.25% 3/2/2033 | | | 605 | | | | 621 | |

| Baxter International, Inc. 2.272% 12/1/2028 | | | 782 | | | | 700 | |

| Cencora, Inc. 2.70% 3/15/2031 | | | 123 | | | | 108 | |

| Centene Corp. 2.45% 7/15/2028 | | | 315 | | | | 281 | |

| CVS Health Corp. 4.30% 3/25/2028 | | | 642 | | | | 632 | |

| Elevance Health, Inc. 4.75% 2/15/2033 | | | 75 | | | | 75 | |

| Eli Lilly and Co. 4.70% 2/27/2033 | | | 73 | | | | 75 | |

| GE HealthCare Technologies, Inc. 5.857% 3/15/2030 | | | 303 | | | | 318 | |

| Pfizer Investment Enterprises Pte., Ltd. 4.75% 5/19/2033 | | | 181 | | | | 181 | |

| | | | | | | | 2,991 | |

| | | | | | | | | |

| Communication services 2.54% | | | | | | | | |

| AT&T, Inc. 4.30% 2/15/2030 | | | 727 | | | | 712 | |

| Charter Communications Operating, LLC 6.384% 10/23/2035 | | | 431 | | | | 438 | |

| Netflix, Inc. 4.875% 4/15/2028 | | | 253 | | | | 256 | |

| T-Mobile USA, Inc. 3.875% 4/15/2030 | | | 552 | | | | 524 | |

| Verizon Communications, Inc. 4.329% 9/21/2028 | | | 533 | | | | 528 | |

| | | | | | | | 2,458 | |

| | | | | | | | | |

| Utilities 2.24% | | | | | | | | |

| Edison International 4.125% 3/15/2028 | | | 393 | | | | 380 | |

| FirstEnergy Corp. 2.65% 3/1/2030 | | | 342 | | | | 296 | |

| Georgia Power Co. 4.95% 5/17/2033 | | | 303 | | | | 306 | |

| Pacific Gas and Electric Co. 4.55% 7/1/2030 | | | 924 | | | | 881 | |

| Southern California Edison Co. 2.95% 2/1/2051 | | | 322 | | | | 219 | |

| Xcel Energy, Inc. 5.45% 8/15/2033 | | | 83 | | | | 85 | |

| | | | | | | | 2,167 | |

| 16 | Capital Group Fixed Income ETF Trust |

Capital Group Core Bond ETF (continued)

| Bonds, notes & other debt instruments (continued) | | Principal amount

(000) | | | Value

(000) | |

| Corporate bonds, notes & loans (continued) | | | | | | | | |

| Energy 2.15% | | | | | | | | |

| Columbia Pipelines Operating Co., LLC 5.927% 8/15/20303 | | USD | 155 | | | $ | 160 | |

| Enbridge, Inc. 6.20% 11/15/2030 | | | 506 | | | | 542 | |

| Energy Transfer, LP 6.40% 12/1/2030 | | | 306 | | | | 328 | |

| EQT Corp. 5.70% 4/1/2028 | | | 223 | | | | 226 | |

| Kinder Morgan, Inc. 7.75% 1/15/2032 | | | 136 | | | | 155 | |

| ONEOK, Inc. 5.65% 11/1/2028 | | | 639 | | | | 662 | |

| | | | | | | | 2,073 | |

| | | | | | | | | |

| Consumer staples 1.38% | | | | | | | | |

| BAT Capital Corp. 6.343% 8/2/2030 | | | 636 | | | | 668 | |

| Constellation Brands, Inc. 2.875% 5/1/2030 | | | 126 | | | | 113 | |

| Philip Morris International, Inc. 5.625% 11/17/2029 | | | 530 | | | | 556 | |

| | | | | | | | 1,337 | |

| | | | | | | | | |

| Industrials 0.90% | | | | | | | | |

| Boeing Co. 5.04% 5/1/2027 | | | 702 | | | | 709 | |

| Carrier Global Corp. 2.722% 2/15/2030 | | | 9 | | | | 8 | |

| Carrier Global Corp. 2.70% 2/15/2031 | | | 6 | | | | 5 | |

| Carrier Global Corp. 5.90% 3/15/20343 | | | 139 | | | | 150 | |

| | | | | | | | 872 | |

| | | | | | | | | |

| Consumer discretionary 0.84% | | | | | | | | |

| Daimler Trucks Finance North America, LLC 2.375% 12/14/20283 | | | 211 | | | | 188 | |

| Ford Motor Co. 3.25% 2/12/2032 | | | 235 | | | | 196 | |

| Hyundai Capital America 6.25% 11/3/20253 | | | 417 | | | | 423 | |

| | | | | | | | 807 | |

| | | | | | | | | |

| Real estate 0.82% | | | | | | | | |

| Equinix, Inc. 3.20% 11/18/2029 | | | 232 | | | | 213 | |

| Prologis, LP 4.75% 6/15/2033 | | | 123 | | | | 125 | |

| Public Storage Operating Co. 5.125% 1/15/2029 | | | 220 | | | | 227 | |

| VICI Properties, LP 4.95% 2/15/2030 | | | 231 | | | | 225 | |

| | | | | | | | 790 | |

| | | | | | | | | |

| Information technology 0.68% | | | | | | | | |

| Analog Devices, Inc. 2.10% 10/1/2031 | | | 79 | | | | 68 | |

| Broadcom, Inc. 3.469% 4/15/20343 | | | 371 | | | | 323 | |

| ServiceNow, Inc. 1.40% 9/1/2030 | | | 320 | | | | 263 | |

| | | | | | | | 654 | |

| | | | | | | | | |

| Total corporate bonds, notes & loans | | | | | | | 35,530 | |

| | | | | | | | | |

| U.S. Treasury bonds & notes 11.44% | | | | | | | | |

| U.S. Treasury 11.44% | | | | | | | | |

| U.S. Treasury 4.875% 10/31/2028 | | | 596 | | | | 622 | |

| U.S. Treasury 4.375% 11/30/2030 | | | 865 | | | | 890 | |

| U.S. Treasury 4.50% 11/15/2033 | | | 425 | | | | 447 | |

| U.S. Treasury 4.375% 8/15/2043 | | | 1,290 | | | | 1,319 | |

| U.S. Treasury 4.75% 11/15/2043 | | | 2,046 | | | | 2,199 | |

| U.S. Treasury 4.125% 8/15/20535 | | | 3,350 | | | | 3,395 | |

| U.S. Treasury 4.75% 11/15/2053 | | | 1,935 | | | | 2,176 | |

| | | | | | | | 11,048 | |

| | | | | | | | | |

| Asset-backed obligations 7.35% | | | | | | | | |

| ACHV ABS Trust, Series 2023-3PL, Class B, 7.17% 8/19/20301,3 | | | 300 | | | | 300 | |

| ACHV ABS Trust, Series 2023-4CP, Class A, 6.81% 11/25/20301,3 | | | 84 | | | | 85 | |

| Affirm Asset Securitization Trust, Series 2022-X1, Class A, 1.75% 2/15/20271,3 | | | 122 | | | | 120 | |

| Affirm, Inc., Series 2023-B, Class A, 6.82% 9/15/20281,3 | | | 150 | | | | 152 | |

| Affirm, Inc., Series 2023-X1, Class A, 7.11% 11/15/20281,3 | | | 100 | | | | 100 | |

| Ally Auto Receivables Trust, Series 2023, Class A2, 6.15% 1/17/20341,3 | | | 135 | | | | 135 | |

| Apidos CLO, Ltd., Series 2015-23, Class AR, (3-month USD CME Term SOFR + 1.482%) 6.875% 4/15/20331,3 | | | 275 | | | | 275 | |

| Capital Group Fixed Income ETF Trust | 17 |

Capital Group Core Bond ETF (continued)

| Bonds, notes & other debt instruments (continued) | | Principal amount

(000) | | | Value

(000) | |

| Asset-backed obligations (continued) | | | | | | | | |

| Avis Budget Rental Car Funding (AESOP), LLC, Series 2020-1A, Class A, 2.33% 8/20/20261,3 | | USD | 100 | | | $ | 96 | |

| Avis Budget Rental Car Funding (AESOP), LLC, Series 2023-8, Class A, 6.02% 2/20/20301,3 | | | 150 | | | | 155 | |

| Bain Capital Credit CLO, Ltd., Series 2017-2, Class AR2, (3-month USD CME Term SOFR + 1.442%) 6.82% 7/25/20341,3 | | | 275 | | | | 275 | |

| Bankers Healthcare Group Securitization Trust, Series 2021-A, Class A, 1.42% 11/17/20331,3 | | | 211 | | | | 199 | |

| Bankers Healthcare Group Securitization Trust, Series 2022-A, Class A, 1.71% 2/20/20351,3 | | | 122 | | | | 119 | |

| Bridgecrest Lending Auto Securitization Trust, Series 2023-1, Class A3, 6.51% 11/15/20271 | | | 79 | | | | 80 | |

| Carvana Auto Receivables Trust, Series 2023-N4, Class A, 6.42% 1/10/20281,3 | | | 218 | | | | 219 | |

| CF Hippolyta, LLC, Series 2020-1, Class A1, 1.69% 7/15/20601,3 | | | 90 | | | | 83 | |

| CF Hippolyta, LLC, Series 2021-1, Class A1, 1.53% 3/15/20611,3 | | | 150 | | | | 134 | |

| Citizens Auto Receivables Trust, Series 2023-2, Class A4, 5.74% 10/15/20301,3 | | | 150 | | | | 153 | |

| CLI Funding VI, LLC, Series 2020-3A, Class A, 2.07% 10/18/20451,3 | | | 138 | | | | 124 | |

| CLI Funding VIII, LLC, Series 2022-1, Class A, 2.72% 1/18/20471,3 | | | 201 | | | | 178 | |

| CPS Auto Receivables Trust, Series 2023-C, Class A, 6.13% 9/15/20261,3 | | | 126 | | | | 126 | |

| CPS Auto Receivables Trust, Series 2023-A, Class B, 5.47% 11/16/20261,3 | | | 150 | | | | 149 | |

| CPS Auto Trust, Series 2023-D, Class A, 6.40% 6/15/20271,3 | | | 89 | | | | 90 | |

| Dryden Senior Loan Fund, CLO, Series 2021-93, Class A1A, (3-month USD CME Term SOFR + 1.342%) 6.735% 1/15/20341,3 | | | 275 | | | | 275 | |

| Exeter Automobile Receivables Trust, Series 2023-5, Class A3, 6.32% 3/15/20271 | | | 34 | | | | 34 | |

| Exeter Automobile Receivables Trust, Series 2023-5, Class B, 6.58% 4/17/20281 | | | 101 | | | | 102 | |

| First National Master Note Trust, Series 2023-2, Class A, 5.77% 9/17/20291 | | | 150 | | | | 153 | |

| Ford Credit Auto Owner Trust, Series 2023-B, Class A4, 5.06% 2/15/20291 | | | 100 | | | | 101 | |

| Ford Credit Auto Owner Trust, Series 2023-1, Class A, 4.85% 8/15/20351,3 | | | 150 | | | | 151 | |

| Global SC Finance V SRL, Series 2020-1A, Class A, 2.17% 10/17/20401,3 | | | 159 | | | | 147 | |

| Global SC Finance VII SRL, Series 2020-2A, Class A, 2.26% 11/19/20401,3 | | | 161 | | | | 148 | |

| Global SC Finance VII SRL, Series 2021-1A, Class A, 1.86% 4/17/20411,3 | | | 179 | | | | 160 | |

| GLS Auto Receivables Trust, Series 2023-4, Class A3, 6.42% 6/15/20271,3 | | | 96 | | | | 97 | |

| GM Financial Revolving Receivables Trust, Series 2023-2, Class A, 5.77% 8/11/20361,3 | | | 312 | | | | 326 | |

| Hertz Vehicle Financing III, LLC, Series 2021-2A, Class A, 1.68% 12/27/20271,3 | | | 250 | | | | 227 | |

| Hertz Vehicle Financing III, LLC, Series 2021-2A, Class B, 2.12% 12/27/20271,3 | | | 150 | | | | 136 | |

| Hertz Vehicle Financing III, LLC, Series 2023-4, Class A, 6.15% 3/25/20301,3 | | | 150 | | | | 156 | |

| LAD Auto Receivables Trust, Series 2023-4, Class A3, 6.10% 12/15/20271,3 | | | 33 | | | | 33 | |

| LAD Auto Receivables Trust, Series 2023-2, Class A3, 5.42% 2/15/20281,3 | | | 250 | | | | 250 | |

| Mercedes-Benz Auto Receivables Trust, Series 2023-2, Class A3, 5.95% 11/15/20281 | | | 75 | | | | 77 | |

| PFS Financing Corp., Series 2022-D, Class B, 4.90% 8/16/20271,3 | | | 100 | | | | 98 | |

| PFS Financing Corp., Series 2023-A, Class A, 5.80% 3/15/20281,3 | | | 150 | | | | 152 | |

| TAL Advantage V, LLC, Series 2020-1A, Class A, 2.05% 9/20/20451,3 | | | 329 | | | | 299 | |

| TICP CLO, Ltd., Series 2018-12, Class AR, (3-month USD CME Term SOFR + 1.432%) 6.825% 7/15/20341,3 | | | 275 | | | | 275 | |

| TIF Funding II, LLC, Series 2021-1A, Class A, 1.65% 2/20/20461,3 | | | 335 | | | | 288 | |

| Westlake Automobile Receivables Trust, Series 2023-4, Class A3, 6.24% 7/15/20271,3 | | | 62 | | | | 63 | |

| | | | | | | | 7,095 | |

| | | | | | | | | |

| Total bonds, notes & other debt instruments (cost: $87,343,000) | | | | | | | 90,304 | |

| | | | | | | | | |

| Short-term securities 16.85% | | Shares | | | | | |

| Money market investments 16.85% | | | | | | | | |

| Capital Group Central Cash Fund 5.44%6,7 | | | 162,772 | | | | 16,276 | |

| | | | | | | | | |

| Total short-term securities (cost: $16,278,000) | | | | | | | 16,276 | |

| Total investment securities 110.37% (cost: $103,621,000) | | | | | | | 106,580 | |

| Other assets less liabilities (10.37)% | | | | | | | (10,015 | ) |

| | | | | | | | | |

| Net assets 100.00% | | | | | | $ | 96,565 | |

| 18 | Capital Group Fixed Income ETF Trust |

Capital Group Core Bond ETF (continued)

Futures contracts

| Contracts | | Type | | Number of

contracts | | Expiration

date | | Notional

amount

(000) | | | Value and

unrealized

appreciation

(depreciation)

at 12/31/2023

(000) | |

| 2 Year U.S. Treasury Note Futures | | Long | | 19 | | 3/28/2024 | | | USD | 3,912 | | | | $ | — | 8 |

Swap contracts

Interest rate swaps

Centrally cleared interest rate swaps

| | | | | | | | | | | | | | | | Upfront | | | Unrealized | |

| | | | | | | | | | | | | | | | premium | | | appreciation | |

| Receive | | Pay | | | | Notional | | Value at | | | paid | | | (depreciation) | |

| | | Payment | | | | Payment | | Expiration | | amount | | 12/31/2023 | | | (received) | | | at 12/31/2023 | |

| Rate | | frequency | | Rate | | frequency | | date | | (000) | | (000) | | | (000) | | | | (000) | |

| 5.0135% | | Annual | | SOFR | | Annual | | 9/28/2025 | | USD 5,300 | | | $ | 69 | | | | $ | — | | | | $ | 69 | |

| 4.9295% | | Annual | | SOFR | | Annual | | 10/30/2025 | | 3,750 | | | | 49 | | | | | — | | | | | 49 | |

| 4.9225% | | Annual | | SOFR | | Annual | | 11/1/2025 | | 2,900 | | | | 38 | | | | | — | | | | | 38 | |

| 4.695% | | Annual | | SOFR | | Annual | | 11/24/2025 | | 1,850 | | | | 18 | | | | | — | | | | | 18 | |

| 4.525% | | Annual | | SOFR | | Annual | | 12/13/2025 | | 1,700 | | | | 13 | | | | | — | | | | | 13 | |

| 4.152% | | Annual | | SOFR | | Annual | | 12/18/2025 | | 400 | | | | — | 8 | | | | — | | | | | — | 8 |

| SOFR | | Annual | | 4.2365% | | Annual | | 12/21/2025 | | 2,300 | | | | (6 | ) | | | | — | | | | | (6 | ) |

| 4.129% | | Annual | | SOFR | | Annual | | 12/26/2025 | | 1,600 | | | | 1 | | | | | — | | | | | 1 | |

| 4.8815% | | Annual | | SOFR | | Annual | | 10/23/2026 | | 750 | | | | 21 | | | | | — | | | | | 21 | |

| 4.707% | | Annual | | SOFR | | Annual | | 10/23/2028 | | 370 | | | | 19 | | | | | — | | | | | 19 | |

| 4.5465% | | Annual | | SOFR | | Annual | | 10/19/2030 | | 775 | | | | 50 | | | | | — | | | | | 50 | |

| 4.074% | | Annual | | SOFR | | Annual | | 11/27/2030 | | 1,000 | | | | 36 | | | | | — | | | | | 36 | |

| SOFR | | Annual | | 3.762 | | Annual | | 12/11/2030 | | 640 | | | | (11 | ) | | | | — | | | | | (11 | ) |

| 3.8815% | | Annual | | SOFR | | Annual | | 12/13/2030 | | 700 | | | | 17 | | | | | — | | | | | 17 | |

| SOFR | | Annual | | 3.78 | | Annual | | 12/15/2033 | | 1,725 | | | | (45 | ) | | | | — | | | | | (45 | ) |

| 4.5145% | | Annual | | SOFR | | Annual | | 10/19/2038 | | 580 | | | | 68 | | | | | — | | | | | 68 | |

| 3.482% | | Annual | | SOFR | | Annual | | 1/2/2039 | | 750 | | | | (1 | ) | | | | — | | | | | (1 | ) |

| 4.5535% | | Annual | | SOFR | | Annual | | 10/23/2043 | | 870 | | | | 133 | | | | | — | | | | | 133 | |

| 3.588% | | Annual | | SOFR | | Annual | | 12/11/2053 | | 460 | | | | 24 | | | | | — | | | | | 24 | |

| | | | | | | | | | | | | | $ | 493 | | | | $ | — | | | | $ | 493 | |

Credit default swaps

Centrally cleared credit default swaps on credit indices — sell protection

Financing

rate received | | Payment

frequency | | Reference

index | | Expiration

date | | Notional

amount

(000) | | Value at

12/31/2023

(000) | | Upfront

premium

paid

(received)

(000) | | Unrealized

appreciation

(depreciation)

at 12/31/2023

(000) | |

| 1% | | Quarterly | | CDX.NA.IG.41 | | 12/20/2028 | | USD 575 | | | $11 | | | $4 | | | $7 | |

Investments in affiliates7

| | | Value at

9/26/20239

(000) | | | Additions

(000) | | | Reductions

(000) | | | Net

realized

gain (loss)

(000) | | | Net

unrealized

appreciation

(depreciation)

(000) | | | Value at

12/31/2023

(000) | | | Dividend

or interest

income

(000) | |

| Short-term securities 16.85% | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Money market investments 16.85% | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Capital Group Central Cash Fund 5.44%6 | | $ | — | | | $ | 39,371 | | | $ | 23,093 | | | $ | — | 8 | | $ | (2 | ) | | $ | 16,276 | | | $ | 104 | |

| Capital Group Fixed Income ETF Trust | 19 |

Capital Group Core Bond ETF (continued)

| 1 | Principal payments may be made periodically. Therefore, the effective maturity date may be earlier than the stated maturity date. |

| 2 | Purchased on a TBA basis. |

| 3 | Acquired in a transaction exempt from registration under Rule 144A or, for commercial paper, Section 4(a)(2) of the Securities Act of 1933. May be resold in the U.S. in transactions exempt from registration, normally to qualified institutional buyers. The total value of all such securities was $16,876,000, which represented 17.48% of the net assets of the fund. |

| 4 | Step bond; coupon rate may change at a later date. |

| 5 | All or a portion of this security was pledged as collateral. The total value of pledged collateral was $474,000, which represented .49% of the net assets of the fund. |

| 6 | Rate represents the seven-day yield at December 31, 2023. |

| 7 | Part of the same “group of investment companies” as the fund as defined under the Investment Company Act of 1940, as amended. |

| 8 | Amount less than one thousand. |

| 9 | Commencement of operations. |

Key to abbreviation(s)

CLO = Collateralized Loan Obligations

CME = CME Group

LIBOR = London Interbank Offered Rate

SOFR = Secured Overnight Financing Rate

TBA = To-be-announced

USD = U.S. dollars

Refer to the notes to financial statements.

| 20 | Capital Group Fixed Income ETF Trust |

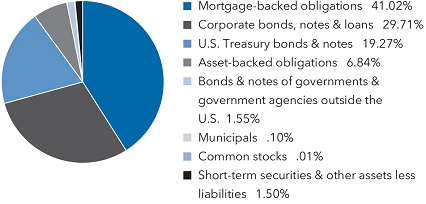

Capital Group Core Plus Income ETF

Investment portfolio December 31, 2023

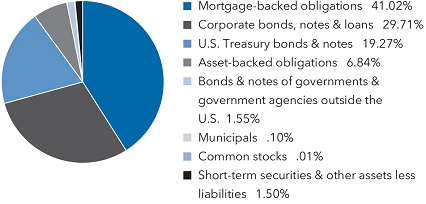

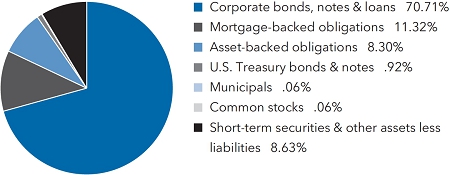

| Portfolio by type of security | Percent of net assets |

| Portfolio quality summary* | | Percent of

net assets |

| U.S. Treasury and agency† | | | 19.27 | % |

| AAA/Aaa | | | 31.46 | |

| AA/Aa | | | 5.43 | |

| A/A | | | 10.41 | |

| BBB/Baa | | | 16.96 | |

| Below investment grade | | | 14.96 | |

| Unrated | | | .01 | |

| Short-term securities & other assets less liabilities | | | 1.50 | |

| * | Bond ratings, which typically range from AAA/Aaa (highest) to D (lowest), are assigned by credit rating agencies such as Standard & Poor’s, Moody’s and/or Fitch as an indication of an issuer’s creditworthiness. In assigning a credit rating to a security, the fund looks specifically to the ratings assigned to the issuer of the security by Standard & Poor’s, Moody’s and/or Fitch. If agency ratings differ, the security will be considered to have received the highest of those ratings, consistent with the fund’s investment policies. Securities in the “unrated” category (above) have not been rated by a rating agency; however, the investment adviser performs its own credit analysis and assigns comparable ratings that are used for compliance with the fund’s investment policies. The ratings are not covered by the Report of Independent Registered Public Accounting Firm. |

| † | These securities are guaranteed by the full faith and credit of the U.S. government. |

| Bonds, notes & other debt instruments 98.49% | | Principal amount

(000) | | | Value

(000) | |

| Mortgage-backed obligations 41.02% | | | | | | |

| Federal agency mortgage-backed obligations 30.47% | | | | | | | | |

| Fannie Mae Pool #FS0647 3.00% 2/1/20521 | | USD | 3,960 | | | $ | 3,574 | |

| Fannie Mae Pool #FS0893 3.00% 2/1/20521 | | | 809 | | | | 716 | |

| Fannie Mae Pool #FS1030 3.00% 3/1/20521 | | | 892 | | | | 790 | |

| Fannie Mae Pool #BV3117 3.00% 3/1/20521 | | | 750 | | | | 664 | |

| Fannie Mae Pool #BV2954 3.00% 3/1/20521 | | | 736 | | | | 652 | |

| Fannie Mae Pool #FS1405 3.00% 4/1/20521 | | | 768 | | | | 680 | |

| Fannie Mae Pool #BU8933 3.00% 4/1/20521 | | | 757 | | | | 670 | |

| Fannie Mae Pool #CB3361 3.00% 4/1/20521 | | | 724 | | | | 646 | |

| Fannie Mae Pool #CB3586 3.00% 5/1/20521 | | | 2,680 | | | | 2,372 | |

| Fannie Mae Pool #MA4919 5.50% 2/1/20531 | | | 1,609 | | | | 1,617 | |

| Fannie Mae Pool #MA5010 5.50% 5/1/20531 | | | 274 | | | | 275 | |

| Fannie Mae Pool #MA5072 5.50% 7/1/20531 | | | 2,055 | | | | 2,065 | |

| Fannie Mae Pool #MA5165 5.50% 10/1/20531 | | | 480 | | | | 482 | |

| Freddie Mac Pool #QC3826 3.00% 7/1/20511 | | | 978 | | | | 866 | |

| Freddie Mac Pool #QD5662 3.00% 1/1/20521 | | | 977 | | | | 865 | |

| Freddie Mac Pool #QD7819 3.00% 2/1/20521 | | | 852 | | | | 754 | |

| Freddie Mac Pool #QD7918 3.00% 3/1/20521 | | | 862 | | | | 763 | |

| Freddie Mac Pool #QD8673 3.00% 3/1/20521 | | | 806 | | | | 713 | |

| Freddie Mac Pool #SD8206 3.00% 4/1/20521 | | | 890 | | | | 788 | |

| Freddie Mac Pool #SD1156 3.00% 4/1/20521 | | | 882 | | | | 780 | |

| Freddie Mac Pool #RA7130 3.00% 4/1/20521 | | | 837 | | | | 741 | |

| Freddie Mac Pool #QE5301 3.50% 5/1/20521 | | | 707 | | | | 648 | |

| Freddie Mac Pool #QE8663 3.50% 5/1/20521 | | | 555 | | | | 509 | |

| Freddie Mac Pool #SD8214 3.50% 5/1/20521 | | | 36 | | | | 33 | |