Income tax expense, including excise tax

The Company intends to elect to be treated as a RIC under Subchapter M of the Code and operate in a manner so as to qualify for the tax treatment applicable to RICs. To qualify as a RIC, the Company must, among other things, timely distribute to its shareholders generally at least 90% of its investment company taxable income, as defined by the Code, for each year. The Company intends to make the requisite distributions to its shareholders, which will generally relieve the Company from U.S. federal income taxes.

Depending on the level of taxable income earned in a tax year, we may choose to carry forward taxable income in excess of current year dividend distributions from such current year taxable income into the next tax year and pay a 4% excise tax on such income. Any excise tax expense is recorded at year end as such amounts are known. For the period from March 14, 2022 (inception) through December 31, 2022, the Company incurred $11 excise tax.

Net increase in net assets resulting from operations

For the period from March 14, 2022 (inception) through December 31, 2022, the net change in net assets applicable to common shareholders resulting from operations was ($4.4) million.

Liquidity and capital resources

Our liquidity and capital resources are expected to be generated primarily through the initial private placement of shares of the Company’s common stock, borrowings under the Credit Agreement, and cash flows from operations, including investments sales and repayments and income earned from investments and cash equivalents. The primary uses of cash have been investments in debt instruments of portfolio companies, payments to service our debt and other general corporate purposes.

The following table summarizes the total shares issued and proceeds received in connection with the Company’s private placement for the period from March 14, 2022 (inception) through December 31, 2022:

| | | |

| | For the period from March 14, 2022 (inception) through December 31, 2022 |

Shares Issued | | | 10,221,321 |

Average Price Per Share | | $ | 14.81 |

Proceeds | | $ | 151,363,368 |

On April 6, 2022, the Company entered into the Credit Agreement. The Credit Agreement had an initial multicurrency revolving loan commitment of $85 million, with uncommitted capacity to increase the revolving loan commitments up to $500 million in the form of dollar commitments or multicurrency commitments. On May 13, 2022, the Company entered into an Incremental Commitment and Assumption Agreement and First Amendment to Senior Secured Revolving Credit Agreement by and among the Company, the lenders party thereto, the assuming lenders party thereto and the Administrative Agent, pursuant to which, among other things, the Company amended the Credit Agreement to increase its revolving loan commitments thereunder to $145 million, with $100 million in the form of multicurrency commitments and $45 million in the form of dollar commitments. The Credit Agreement permits the Company to use up to $25 million of multicurrency commitments to incur letters of credit.

On August 26, 2022, the Company entered into an Incremental Commitment and Assumption Agreement (the “Incremental Agreement”), which supplements the Senior Secured Revolving Credit Agreement, dated as of April 6, 2022 (as amended, restated, supplemented and otherwise modified to date, including by the Incremental Agreement, the “Credit Agreement”), among the Company, as borrower, ING Capital LLC (“ING”), as administrative agent and the lenders party thereto. Pursuant to the Incremental Agreement, among other changes, the total commitments under the Credit Agreement increased from $145 million to $250 million, consisting of an increase in dollar commitments from $45 million to $140 million and of multicurrency commitments from $100 million to $110 million. In connection with such increase, the Company paid the lenders providing commitments certain fees.

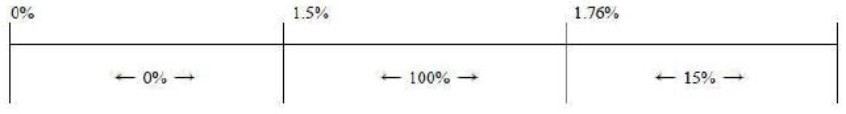

Under Section 61(a) of the 1940 Act, prior to March 23, 2018, a BDC was generally not permitted to issue senior securities unless after giving effect thereto the BDC met a coverage ratio of total assets less liabilities and indebtedness not represented by senior securities to total senior securities, which includes all borrowings of the BDC, of at least 200%. On March 23, 2018, the Small Business Credit Availability Act (“SBCAA”) was signed into law, which among other things, amended Section 61(a) of the 1940 Act to add a new Section 61(a)(2) that reduces the asset coverage requirement applicable to BDCs from 200% to 150% so long as the BDC meets certain disclosure requirements and obtains certain approvals. The reduced asset coverage requirement would permit a BDC to have a ratio of total outstanding indebtedness to net assets of 2:1 as compared to a maximum of 1:1 under the 200% asset coverage requirement. The Company’s sole initial shareholder approved the application of the modified asset coverage requirements set forth in Section 61(a)(2) of the 1940 Act to the Company. As a result, under current law, the Company is permitted as a BDC to issue senior securities in amounts such that the Company’s asset coverage, as defined in the 1940 Act, equals at least 150% of gross