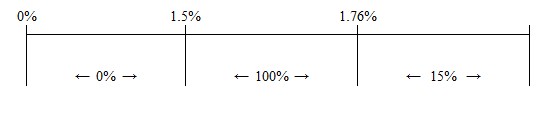

investments bore interest at fixed rates. The percentage of floating rate debt investments in our portfolio that were subject to an interest rate floor was 79.3% and 90.0% at December 31, 2023 and December 31, 2022, respectively. As of both December 31, 2023 and December 31, 2022, zero debt investments in the portfolio were on non-accrual status.

Results of operations

Investment income

Total investment income for the year ended December 31, 2023 and for the period from March 14, 2022 (inception) through December 31, 2022 were $46.9 million and $15.1 million, respectively, mainly comprised of $45.3 million and $14.7 million, respectively, in cash interest income. Interest income was attributable to interest and fees on our debt investments. The increase in investment income for the year ended December 31, 2023 and for the period from March 14, 2022 (inception) through December 31, 2022 reflects the significant increase in portfolio size as the Company continues to ramp up.

Expenses

Total operating expenses for the year ended December 31, 2023 was $19.9 million, comprised of $13.6 million in interest and other debt expenses, $2.8 million in management fees, $2.1 million in incentive fees, $0.6 million in professional fees and $0.8 million in all other expenses, respectively. The Adviser reimbursed expenses of $0.6 million which were in excess of the annualized expense cap.

Total operating expenses for the period from March 14, 2022 (inception) through December 31, 2022 was $6.7 million, comprised of $3.7 million in interest and other debt expenses, $1.1 million in management fees, $0.7 million in organization expenses, $0.5 million in professional fees and $0.7 million in all other expenses, respectively. The Adviser reimbursed expenses of $0.3 million which were in excess of the annualized expense cap and paid all of the $0.7 million of organization expenses.

Net investment income

For the year ended December 31, 2023 and for the period from March 14, 2022 (inception) through December 31, 2022, net investment income were $27.6 million and $9.5 million, respectively.

Net realized and unrealized gain or loss

For the year ended December 31, 2023 and for the period from March 14, 2022 (inception) through December 31, 2022, net realized gain were ($8.4) million and $0.6 million, respectively.

For the year ended December 31, 2023 and for the period from March 14, 2022 (inception) through December 31, 2022, the change in net unrealized depreciation on investments were ($3.0) million and ($14.8) million, respectively.

Incentive compensation

For the year ended December 31, 2023 and for the period from March 14, 2022 (inception) through December 31, 2022, the Company incurred $2.1 million and zero, respectively, in incentive fees.

Income tax expense, including excise tax

The Company intends to elect to be treated as a RIC under Subchapter M of the Code and operate in a manner so as to qualify for the tax treatment applicable to RICs. To qualify as a RIC, the Company must, among other things, timely distribute to its shareholders generally at least 90% of its investment company taxable income, as defined by the Code, for each year. The Company intends to make the requisite distributions to its shareholders, which will generally relieve the Company from U.S. federal income taxes.

Depending on the level of taxable income earned in a tax year, we may choose to carry forward taxable income in excess of current year dividend distributions from such current year taxable income into the next tax year and pay a 4% excise tax on such income. Any excise tax expense is recorded at year end as such amounts are known. For the year ended December 31, 2023 and for the period from March 14, 2022 (inception) through December 31, 2022, the Company incurred $0 and $11 excise tax, respectively.

Net increase in net assets resulting from operations

For the year ended December 31, 2023 and for the period from March 14, 2022 (inception) through December 31, 2022, the net change in net assets applicable to common shareholders resulting from operations were $16.0 million and ($4.4) million, respectively.