UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-23715

OAKTREE DIVERSIFIED INCOME FUND INC.

(Exact name of registrant as specified in charter)

BROOKFIELD PLACE

250 VESEY STREET, 15th Floor

NEW YORK, NEW YORK 10281-1023

(Address of principal executive offices) (Zip code)

BRIAN F. HURLEY, PRESIDENT

OAKTREE DIVERSIFIED INCOME FUND INC.

BROOKFIELD PLACE

250 VESEY STREET, 15th Floor

NEW YORK, NEW YORK 10281-1023

(Name and address of agent for service)

Registrant’s telephone number, including area code: (855) 777-8001

Date of fiscal year end: December 31

Date of reporting period: December 31, 2022

Item 1. Reports to Stockholders.

ANNUAL REPORT

DECEMBER 31, 2022

Oaktree Diversified Income Fund Inc.

* Please see inside front cover of the report for important information regarding delivery of shareholder reports.

IN PROFILE

Oaktree Fund Advisors, LLC (the "Adviser" or "Oaktree") is an investment adviser registered with the SEC and is also an affiliate and related adviser of Oaktree Capital Management, L.P., an investment adviser registered with the SEC. Oaktree serves as the investment adviser to the Fund. Oaktree was founded in April 1995 and is a leader among global investment managers specializing in alternative investments. Oaktree manages assets across a wide range of investment strategies within four asset classes: Credit, Private Equity, Real Assets, and Listed Equities. As of December 31, 2022, Oaktree had $170 billion in assets under management. Brookfield Public Securities Group LLC ("PSG") serves as the Administrator to the Fund. PSG is an indirect wholly-owned subsidiary of Brookfield Asset Management ULC with approximately $800 billion of assets under management as of December 31, 2022, an unlimited liability company formed under the laws of British Columbia, Canada ("BAM ULC"). Brookfield Corporation, a publicly traded company (NYSE: BN; TSX: BN), holds a 75% interest in BAM ULC, while Brookfield Asset Management Ltd., a publicly traded company (NYSE: BAM; TSX: BAMA) ("Brookfield Asset Management"), holds a 25% interest in BAM ULC. In 2019, Brookfield acquired a majority interest in Oaktree.

Oaktree Diversified Income Fund Inc. (the "Fund") is managed by Oaktree Fund Advisors, LLC. The Fund uses its website as a channel of distribution of material company information. Financial and other material information regarding the Fund is routinely posted on and accessible at https://publicsecurities.brookfield.com/products/us-interval-funds/oaktree-diversified-income-fund?id=192692

As permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Fund's annual and semi-annual shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports. Instead, the reports will be made available on the Fund's website (https://publicsecurities.brookfield.com/en), and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Fund electronically anytime by contacting your financial intermediary (such as a broker, investment adviser, bank or trust company) or, if you are a direct investor, by calling the Fund (toll-free) at 1-855-777-8001 or by sending an e-mail request to the Fund at publicsecurities.enquiries@brookfield.com.

You may elect to receive all future reports in paper free of charge. If you invest through a financial intermediary, you may contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. If you invest directly with the Fund, you may call 1-855-777-8001 or send an email request to publicsecurities.enquiries@brookfield.com to let the Fund know you wish to continue receiving paper copies of your shareholder reports. Your election to receive reports in paper will apply to all funds held in your account if you invest through your financial intermediary or all funds held within the fund complex if you invest directly with the Fund.

TABLE OF CONTENTS

Letter to Shareholders | | | 1 | | |

| Management Discussion of Fund Performance | | | 3 | | |

| Portfolio Characteristics | | | 7 | | |

| Consolidated Schedule of Investments | | | 8 | | |

| Consolidated Statement of Assets and Liabilities | | | 36 | | |

| Consolidated Statement of Operations | | | 37 | | |

| Consolidated Statements of Changes in Net Assets | | | 38 | | |

| Consolidated Statement of Cash Flows | | | 39 | | |

| Consolidated Financial Highlights | | | 40 | | |

| Notes to Consolidated Financial Statements | | | 41 | | |

| Report of Independent Registered Public Accounting Firm | | | 55 | | |

| Tax Information | | | 56 | | |

| Additional Information Regarding the Fund | | | 57 | | |

| Information Concerning Trustees and Officers | | | 67 | | |

| Dividend Reinvestment Plan | | | 70 | | |

| Joint Notice of Privacy Policy | | | 71 | | |

This report is for shareholder information. This is not a prospectus intended for use in the purchase or sale of Fund shares.

NOT FDIC INSURED | | MAY LOSE VALUE | | NOT BANK GUARANTEED | |

[THIS PAGE IS INTENTIONALLY LEFT BLANK]

LETTER TO SHAREHOLDERS

Dear Shareholders,

We are pleased to provide the Annual Report for the Oaktree Diversified Income Fund (the "Fund") for the year ended December 31, 2022.

Global financial markets experienced a historically challenging year in 2022. A war in eastern Europe, soaring inflation and interest rate hikes to reign in costs resulted in steep losses across equities and fixed income. One of the few silver linings occurred at the very end of the year, when China announced faster-than-expected relaxing of COVID-19 restrictions.

While rising interest rates negatively impacted most credit asset classes in the first half of the year, tighter monetary policy helped floating-rate assets outperform their fixed-rate counterparts as well as equities. During this period, senior loans returned -4.7%, while high yield bonds, investment grade bonds, and U.S. large cap equities were down by 10.1%, 6.4%, and 16.1%, respectively. Despite continued market volatility throughout the second half of 2022, risk assets delivered broad-based gains at the end of the year: Global equities, high yield bonds and senior loans returned 9.9%, 4.3% and 2.6%, respectively. The fourth quarter got off to a rocky start with the failed UK budget proposal that roiled UK gilt markets and higher-than-expected September Consumer Price Index ("CPI") in the U.S. The S&P 500 touched its year-to-date low, while the yields of U.S. high yield bonds soared to their year-to-date high, all in the first half of October. Risk asset prices then reversed course amid better-than-expected third-quarter earnings, perceived more dovish global central bank policy, and a cooling of U.S. inflation in both October and November. A rally lasted for most of the quarter, though markets came under renewed pressure in late December. The result of this was full-year returns of -1.06% for senior loans, -11.19% for high yield bonds, -16.72% for investment grade bonds and -19.44% for equities.

Interest rates were also volatile throughout the year. By mid-year the yields on the 2- and 10-year U.S. Treasury notes increased by 62 bps and 68 bps, respectively. At the end of the third quarter, the the Federal Reserve System's (the "Fed" or the "Federal Reserve") hawkish rhetoric weighed heavily on risk asset prices and pushed interest rates even higher with the yields on the 5- and 10-year U.S. Treasury notes rising by 105 bps and 81 bps, respectively. While the Federal Reserve hiked rates in the U.S. an additional 125 bps during the fourth quarter, ultimately yields on the 5- and 10-year U.S. Treasury notes were roughly unchanged.

Against this backdrop, the Fund's diversified asset mix of both public and private debt provided steady income and performance better than that of high yield bonds, investment grade or equities. Private credit performed well throughout the year, led by strength in non-cyclical sectors, such as health care. After being under significant pressure for much of 2022, the EM asset class rallied in the final two months of the year as negative sentiment began to alleviate amid China's easing of its zero-COVID policy and comprehensive support package for the property sector. The portfolio's high yield bond and senior loan investments across the U.S. and Europe also gained, with loans leading in the final month of the year given their shorter duration and higher current yields, as interest rates rose. Structured credit investments were also additive, given price appreciation for CLO debt tranches (particularly those in Europe) and real estate debt.

At the end of 2022, we increased the portfolio's allocation to private credit, high yield bonds and convertible bonds, with an emphasis on European opportunities trading at dislocated prices. As we look ahead to 2023, we are excited about the opportunity set across credit with yields at multi-year highs. Oaktree's co-founder Howard Marks has described a sea change currently under way in markets, with these higher yields setting the stage for credit to potentially deliver equity-like performance that may help investors accomplish their goals.

In addition to performance information and additional discussion of factors impacting the Fund, this report provides the Fund's audited financial statements and schedules of investments as of December 31, 2022.

We welcome your questions and comments and encourage you to contact our Investor Relations team at 1-855-777-8001 or visit us at https://publicsecurities.brookfield.com/en for more information.

2022 Annual Report

1

LETTER TO SHAREHOLDERS (continued)

Thank you for your support.

Sincerely,

| |

| |

Brian F. Hurley | | David W. Levi, CFA | |

President | | Chief Executive Officer | |

Oaktree Diversified Income Fund Inc. | | Brookfield Public Securities Group LLC | |

These views represent the opinions of Oaktree Fund Advisors, LLC and are not intended to predict or depict the performance of any investment. These views are primarily as of the close of business on December 31, 2022, and subject to change based on subsequent developments.

Investing involves risk. Principal loss is possible. Real assets includes real estate securities, infrastructure securities and natural resources securities. Property values may fall due to increasing vacancies or declining rents resulting from unanticipated economic, legal, cultural or technological developments. Infrastructure companies may be subject to a variety of factors that may adversely affect their business, including high interest costs, high leverage, regulation costs, economic slowdown, surplus capacity, increased competition, lack of fuel availability and energy conservation policies. Natural resources securities may be affected by numerous factors, including events occurring in nature, inflationary pressures and international politics.

Quasar Distributors, LLC is the distributor of Oaktree Diversified Income Fund Inc.

OAKTREE DIVERSIFIED INCOME FUND INC.

MANAGEMENT DISCUSSION OF FUND PERFORMANCE

The Oaktree Diversified Income Fund (the "Fund") Class D shares returned 7.03% for the year ended December 31, 2022, and 2.67% (net of fees) for the final month of the year. The Fund's positive performance in the final month of the year was fueled by a second consecutive month of gains in global emerging markets debt and corporate structured credit. Within emerging markets, Chinese property sector bonds continued benefiting from government support (announced last month,) and corporate bonds in Argentina were also a standout performer. Credit spreads tightened for BBB- and BB-rated CLO debt tranches (particularly in Europe), pushing prices higher at the end of the year, while real estate-backed structured credit posted modest declines. Senior loans contributed positively to performance: their shorter duration and higher current yields helped them outperform high yield bonds, which declined across ratings and regions. Private credit contributed positively, too, led by strength in healthcare private loans.

The Fund's largest sector allocations at the end of 2022 were software (8.5%), hotels, restaurants & leisure (7.9%), healthcare technology (6.7%) and commercial services & supplies (6.3%). At the end of 2022, the Fund's investments had an average yield of 11.46%,1 a price of 89.5 and an effective duration of 1.27 years. We believe this profile reflects upside potential for both yield and return, balanced against the risk that interest rates could continue rising.

GLOBAL CREDIT MARKET OVERVIEW

Global financial markets experienced a historically challenging year in 2022. A war in eastern Europe, soaring inflation and interest rate hikes to rein in costs resulted in steep losses across equities and fixed income. One of the few silver linings occurred at the very end of the year, when China announced faster-than-expected relaxing of COVID-19 restrictions. While rising interest rates negatively impacted most credit asset classes in the first half of the year, tighter monetary policy helped floating-rate assets outperform their fixed-rate counterparts as well as equities. During this period, senior loans returned -4.7%, while high yield bonds, investment grade bonds, and U.S. large cap equities were down by 10.1%, 6.4%, and 16.1%, respectively. Despite continued market volatility throughout the second half of 2022, risk assets delivered broad-based gains at the end of the year: global equities, high yield bonds and senior loans returned 9.9%, 4.3% and 2.6%, respectively. The fourth quarter got off to a rocky start with the failed UK budget proposal that roiled UK gilt markets and higher-than-expected September CPI in the U.S. The S&P 500 touched its year-to-date low, while the yields of U.S. high yield bonds soared to their year-to-date high, all in the first half of October. Risk asset prices then reversed course amid better-than-expected third-quarter earnings, perceived more dovish global central bank policy, and a cooling of U.S. inflation in both October and November. A rally lasted for most of the quarter, though markets came under renewed pressure in late December. The result of this was full-year returns of -1.06% for senior loans, -11.19% for high yield bonds, -16.2% for investment grade bonds and -19.44% for equities.

Interest rates were also volatile throughout the year. By mid-year the yields on the 2- and 10-year U.S. Treasury notes increased by 62 bps and 68 bps, respectively. At the end of the third quarter, the Fed's hawkish rhetoric weighed heavily on risk asset prices and pushed interest rates even higher with the yields on the 5- and 10-year U.S. Treasury notes rising by 105 bps and 81 bps, respectively. While the Federal Reserve hiked rates in the U.S. an additional 125 bps during the fourth quarter, ultimately yields on the 5- and 10-year U.S. Treasury notes were roughly unchanged.

OUTLOOK

Looking ahead to 2023, we increased the portfolio's allocation to private credit, high yield bonds and convertible bonds, with an emphasis on European opportunities trading at dislocated prices. At the end of the year, Oaktree's co-founder Howard Marks wrote of a sea change under way in markets. Given their meaningfully higher yields, we believe credit instruments of all kinds are potentially poised to deliver performance that can help investors accomplish their goals. We also believe that the high current yield and low U.S. dollar price could help protect against the volatility that could be seen in early 2023.

Past performance is no guarantee of future results.

2022 Annual Report

3

OAKTREE DIVERSIFIED INCOME FUND INC. (continued)

Areas of the portfolio such as structured and private credit continue to offer some of the most attractive risk-adjusted return potential in the portfolio, but we see upside potential over the next 12 months across all our strategies. We continue employing a conservative yet opportunistic approach, focused on credit fundamentals and having dry powder on hand to deploy into attractive opportunities in high-quality assets at dislocated prices, particularly as market activity picks up following the year-end period.

1 Source: Oaktree. Yield reflects yield to worst. Yield to worst is a measure of the lowest possible yield that can be received on a bond that fully operates within the terms of its contract without defaulting.

OAKTREE DIVERSIFIED INCOME FUND INC.

Fund Performance (Unaudited)

AVERAGE ANNUAL TOTAL RETURNS

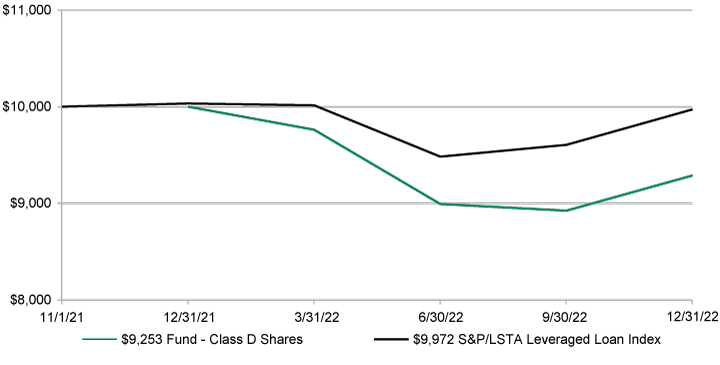

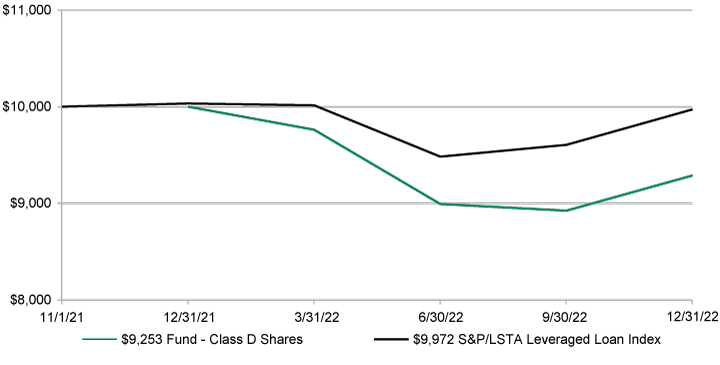

As of December 31, 2022 | | 1 Year | | Since Inception* | |

Class D Shares | | | 7.03 | % | | | -6.45 | % | |

S&P/LSTA Leveraged Loan Index | | | -0.60 | % | | | -0.24 | % | |

* Class D Shares commenced operations on November 1, 2021.

The graph below illustrates a hypothetical investment of $10,000 in the Fund from the commencement of investment operations on November 1, 2021 to December 31, 2022 compared to the S&P/LSTA Leverage Loan Index.

The table and graphs do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

Disclosure

All returns shown in USD.

S&P/LSTA (Loans Syndications and Trading Association) Leveraged Loan Index tracks the largest leveraged-loan-to-market facilities, considering market weightings, spreads and interest payments.

An index does not reflect any fees, expenses or sales charges. It is not possible to invest directly in an index. Index performance is shown for illustrative purposes only and does not predict or depict the performance of the Fund.

The Fund's portfolio holdings are subject to change without notice. The mention of specific securities is not a recommendation or solicitation for any person to buy, sell or hold any particular security. There is no assurance that the Fund currently holds these securities. Please refer to the Schedule of Investments contained in this report for a full listing of fund holdings.

Performance data quoted represents past performance and is no guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Performance includes the reinvestment of income, dividends and capital gain distributions. To obtain performance

2022 Annual Report

5

OAKTREE DIVERSIFIED INCOME FUND INC.

Fund Performance (Unaudited)

information current to the most recent month-end, please call 1-855-862-5873. Performance reflects management fees and other fund expenses.

An investor should consider the Fund's investment objectives, risks, charges and expenses carefully before investing.

The Fund is subject to investment risks, including the possible loss of principal invested. Investing involves risk, and principal loss is possible. The Adviser employs an active approach to allocation across multiple credit sectors, but there is no guarantee that such allocation techniques will produce the desired results. General interest rate fluctuations may have a substantial negative impact on the Fund's investments and investment opportunities, and, accordingly, may have a material adverse effect on the Fund's rate of return. The Fund may invest in foreign securities, including, but not limited to, risk related to exchange rate changes, political and economic upheaval, and relatively low market liquidity, all of which are magnified in emerging markets. The Fund intends to invest in illiquid investments which can face significant difficulties and delays associated with such transactions, and the Fund may be unable to sell other illiquid investments when it desires to do so, resulting in the Fund obtaining a lower price or being required to retain the investment. Investments in derivatives involve special risks including correlation, counterparty, liquidity, operational, accounting and tax risks. These risks, in certain cases, may be greater than the risks presented by more traditional investments.

High-yield debt securities rated below investment grade are commonly referred to as "junk bonds" and are considered speculative. Investment by the Fund in lower-rated and non-rated securities presents a greater risk of loss to principal and interest than higher-rated securities. Bank loans (including senior loans) are usually rated below investment grade, and the market for bank loans may be subject to irregular trading activity, wide bid/ask spreads, restrictions on resale, and extended trade settlement periods. The Fund's investments in senior loans may be subject to greater levels of credit risk, call risk, settlement risk and liquidity risk than funds that do not invest in such securities. The Fund may invest in distressed securities of corporate issuers that are the subject of bankruptcy proceedings or otherwise in default as to the repayment of principal and/or interest or in significant risk of being in such default which is speculative and involves significant risk. Distressed Securities frequently do not produce income while they are outstanding and may require the Fund to bear certain extraordinary expenses in order to protect and recover its investment. The Fund may invest in loans that may be "covenant-lite," generally loans that do not have financial maintenance covenants, which can cause the Fund to have fewer rights against a borrower and may have a greater risk of loss on such investments.

The Fund may invest in a variety of mortgage related and other asset-backed securities, which are subject to greater price volatility in relation to interest rate movements. Residential mortgage backed securities (RMBS) may be subject to prepayment risk, meaning that securities may be paid off more quickly than originally anticipated and the Fund will have to invest the proceeds in securities with lower yields. Commercial mortgage backed securities (CMBS) may be subject to extension risk, meaning that the value of CMBS may be adversely affected in rising interest rate environments when payments on underlying mortgages do not occur as anticipated, resulting in the extension of the security's effective maturity and the related increase in interest rate sensitivity of a longer-term instrument. Investments in collateralized loan obligations (CLOs) carry additional risks including, but not limited to: 1) the possibility that distributions from collateral securities will not be adequate to make interest or other payments; 2) the quality of the collateral may decline in value or default; 3) the possibility that the Fund may invest in CLOs that are subordinate to other classes; and 4) the complex structure of the security may produce disputes with the issuer or unexpected investment results.

Short term performance in particular is not a good indication of the Fund's future performance and an investment should not be made based solely on returns.

These views represent the opinions of Oaktree Fund Advisors, LLC and are not intended to predict or depict the performance of any investment. These views are as of the close of business on December 31, 2022 and subject to change based on subsequent developments.

6

OAKTREE DIVERSIFIED INCOME FUND INC.

Portfolio Characteristics (Unaudited)

December 31, 2022

ASSETS BY SECTOR1 | |

Corporate Credit | | | |

| — Senior Loans (Syndicated) | | | 23.6 | % | |

| — High Yield | | | 18.6 | % | |

| — Emerging Markets | | | 5.5 | % | |

| — Corporate Bonds | | | 2.1 | % | |

| — Convertible Bonds | | | 0.4 | % | |

| — Investment Grade | | | 0.1 | % | |

Total Corporate Credit | | | 50.3 | % | |

Securitized Credit | | | |

| — Collateralized Loan Obligations | | | 14.5 | % | |

| — Commercial Mortgage-Backed Securities | | | 7.1 | % | |

| — Residential Mortgage-Backed Securities | | | 1.9 | % | |

| — Other | | | 0.8 | % | |

Total Securitized Credit | | | 24.3 | % | |

Private Credit | | | |

| — Senior Loans | | | 21.7 | % | |

| — Preferred Stock | | | 1.0 | % | |

| — Common Stock | | | 0.1 | % | |

| — Warrants | | | 0.2 | % | |

Total Private Credit | | | 23.0 | % | |

Money Market Fund | | | 2.4 | % | |

Total | | | 100.0 | % | |

ASSETS BY GEOGRAPHY1 | |

North America | | | 80.1 | % | |

Europe Ex UK | | | 8.9 | % | |

UK | | | 4.9 | % | |

Asia Ex Japan | | | 3.1 | % | |

South America | | | 2.9 | % | |

Africa | | | 0.1 | % | |

Total | | | 100.0 | % | |

1 Percentages are based on total market value of investments.

2022 Annual Report

7

OAKTREE DIVERSIFIED INCOME FUND INC.

Consolidated Schedule of Investments

December 31, 2022

Description | | Country | | Principal

Amount | | Value | |

CORPORATE CREDIT – 56.3% | |

Senior Loans (Syndicated) – 25.6% (a) | |

Aerospace & Defense – 1.0% | |

AI Convoy Luxembourg Sarl,

First Lien Tranche B Term Loan

3.50% (3 Month EURIBOR + 3.50%), 01/20/2027 (b) | | Luxembourg | | € | 240,000 | | | $ | 245,882 | | |

Cobham Ultra US Company Borrower LLC,

First Lien Tranche B Term Loan

4.25% (6 Month LIBOR USD + 3.75%), 08/04/2029 (b) | | United States | | $ | 1,000,000 | | | | 974,165 | | |

WP CPP Holdings LLC,

First Lien Tranche B Term Loan

7.51% (3 Month LIBOR USD + 3.75%), 04/30/2025 (b) | | United States | | | 495,075 | | | | 432,926 | | |

Total Aerospace & Defense | | | | | | | | | 1,652,973 | | |

Airlines – 0.4% | |

Mileage Plus Holdings LLC,

First Lien Tranche B Term Loan

10.00% (1 Month LIBOR USD + 5.25%), 06/20/2027 (b) | | United States | | | 181,800 | | | | 187,322 | | |

United Airlines, Inc.,

First Lien Tranche B Term Loan

6.53% (3 Month LIBOR USD + 3.75%), 04/21/2028 (b) | | United States | | | 496,222 | | | | 491,364 | | |

Total Airlines | | | | | | | | | 678,686 | | |

Beverages – 0.8% | |

Pegasus Bidco BV

4.57% (3 Month EURIBOR + 4.25%), 07/12/2029 (b) | | Netherlands | | € | 250,000 | | | | 259,067 | | |

Pegasus Bidco BV,

First Lien Tranche B Term Loan

8.52% (3 Month SOFR + 4.25%), 07/12/2029 (b) | | Netherlands | | $ | 500,000 | | | | 485,000 | | |

Triton Water Holdings, Inc.,

First Lien Tranche B Term Loan

7.17% (3 Month US LIBOR + 3.50%), 03/31/2028 (b) | | United States | | | 742,482 | | | | 693,013 | | |

Total Beverages | | | | | | | | | 1,437,080 | | |

Biotechnology – 0.2% | |

Curium Bidco Sarl,

First Lien Tranche B Term Loan

6.50% (1 Month LIBOR USD + 4.25%), 12/09/2027 (b) | | Luxembourg | | | 248,750 | | | | 243,153 | | |

Building Products – 0.2% | |

Timber Servicios Empresariales SA,

First Lien Tranche B Term Loan

4.75% (1 Month EURIBOR + 4.75%), 02/19/2029 (b) | | Spain | | € | 300,000 | | | | 245,067 | | |

Chemicals – 0.6% | |

Axalta Coating Systems US Holdings, Inc.

7.12% (1 Month SOFR + 3.00%), 12/20/2029 (b) | | United States | | $ | 250,000 | | | | 250,563 | | |

INEOS Enterprises Holdings II Ltd.,

First Lien Tranche B Term Loan

3.25% (3 Month EURIBOR + 3.25%), 09/03/2026 (b) | | United Kingdom | | € | 250,000 | | | | 258,102 | | |

INEOS Finance PLC,

First Lien Tranche B Term Loan

5.49% (3 Month EURIBOR + 2.00%), 11/03/2027 (b) | | United Kingdom | | | 247,403 | | | | 258,409 | | |

INEOS Quattro,

First Lien Tranche B Term Loan

4.24% (1 Month EURIBOR + 2.75%), 01/29/2026 (b) | | United Kingdom | | | 250,000 | | | | 251,778 | | |

Total Chemicals | | | | | | | | | 1,018,852 | | |

See Notes to Consolidated Financial Statements.

8

OAKTREE DIVERSIFIED INCOME FUND INC.

Consolidated Schedule of Investments (continued)

December 31, 2022

Description | | Country | | Principal

Amount | | Value | |

CORPORATE CREDIT (continued) | |

Commercial Services & Supplies – 2.9% | |

Access CIG LLC,

First Lien Term Loan

7.82% (3 Month LIBOR USD + 3.75%), 02/27/2025 (b) | | United States | | $ | 989,356 | | | $ | 971,320 | | |

Allied Universal

5.24% (3 Month EURIBOR + 3.75%), 05/14/2028 (b) | | Luxembourg | | € | 250,000 | | | | 250,468 | | |

Allied Universal Holdco LLC,

First Lien Tranche B Term Loan

7.82% (1 Month LIBOR USD + 3.75%), 05/14/2028 (b) | | United States | | $ | 990,000 | | | | 942,485 | | |

Broom Holdings Bidco Ltd.,

First Lien Tranche B Term Loan

4.94% (3 Month EURIBOR + 3.75%), 08/23/2028 (b) | | Ireland | | € | 250,000 | | | | 254,231 | | |

Freshworld Holding III GMBH

4.65%, 10/02/2026 (c) | | Germany | | | 250,000 | | | | 251,287 | | |

Garda World Security Corp.,

First Lien Tranche B Term Loan

8.93% (1 Month LIBOR USD + 4.25%), 10/30/2026 (b) | | Canada | | $ | 1,000,000 | | | | 975,499 | | |

PECF USS Intermediate Holding III Corp.,

First Lien Tranche B Term Loan

8.32% (1 Month LIBOR USD + 4.25%), 12/15/2028 (b) | | United States | | | 865,714 | | | | 725,096 | | |

Trugreen LP,

First Lien Tranche B Term Loan

8.07% (1 Month LIBOR USD + 4.00%), 11/02/2027 (b) | | United States | | | 112,000 | | | | 99,751 | | |

Total Commercial Services & Supplies | | | | | | | | | 4,470,137 | | |

Communications Equipment – 0.3% | |

Sorenson Communications LLC,

First Lien Tranche B Term Loan

9.17% (1 Month LIBOR USD + 5.50%), 03/17/2026 (b) | | United States | | | 472,222 | | | | 452,301 | | |

Construction & Engineering – 1.2% | |

ADB Companies LLC,

First Lien Term Loan

9.80% (1 Month LIBOR USD + 6.25%), 12/18/2025 (b) (d) | | United States | | | 1,290,844 | | | | 1,268,513 | | |

Tiger Acquisition LLC,

First Lien Tranche B Term Loan

7.32% (1 Month LIBOR USD + 3.25%), 06/01/2028 (b) | | United States | | | 744,347 | | | | 708,573 | | |

Total Construction & Engineering | | | | | | | | | 1,977,086 | | |

Construction Materials – 0.2% | |

Hunter Douglas, Inc.,

First Lien Tranche B Term Loan

7.86% (3 Month SOFR + 3.50%), 02/25/2029 (b) | | Netherlands | | | 304,850 | | | | 269,765 | | |

Consumer Finance – 0.2% | |

American Auto Auction Group LLC,

Second Lien Term Loan

12.30% (3 Month SOFR + 8.75%), 12/30/2028 (b) | | United States | | | 483,000 | | | | 374,325 | | |

Containers & Packaging – 0.9% | |

Clydesdale Acquisition Holdings, Inc.,

First Lien Term Loan

8.36% (1 Month SOFR + 4.18%), 04/13/2029 (b) | | United States | | | 479,798 | | | | 458,147 | | |

Proampac PG Borrower LLC,

First Lien Tranche B Term Loan

7.96% (1 Month LIBOR USD + 3.75%), 11/03/2025 (b) | | United States | | | 990,000 | | | | 950,603 | | |

Total Containers & Packaging | | | | | | | | | 1,408,750 | | |

See Notes to Consolidated Financial Statements.

2022 Annual Report

9

OAKTREE DIVERSIFIED INCOME FUND INC.

Consolidated Schedule of Investments (continued)

December 31, 2022

Description | | Country | | Principal

Amount | | Value | |

CORPORATE CREDIT (continued) | |

Distributors – 0.1% | |

Dealer Tire Financial LLC,

First Lien Tranche B Term Loan

8.73% (1 Month SOFR + 4.50%), 12/14/2027 (b) | | United States | | $ | 161,212 | | | $ | 159,842 | | |

Diversified Consumer Services – 1.3% | |

AI Aqua Merger Sub, Inc.,

First Lien Tranche B Term Loan

4.50% (1 Month SOFR + 4.00%), 07/30/2028 (b) | | United States | | | 425,926 | | | | 402,145 | | |

AI Aqua Merger Sub, Inc.,

First Lien Delay Draw Term Loan

4.50% (1 Month SOFR + 4.00%), 07/30/2028 (b) (e) | | United States | | | 74,074 | | | | 32,901 | | |

Houghton Mifflin Harcourt Co.,

First Lien Tranche B Term Loan

9.44% (1 Month SOFR + 5.25%), 04/07/2029 (b) | | United States | | | 498,750 | | | | 475,837 | | |

Obol France 3 SAS,

First Lien Tranche B Term Loan

6.36% (3 Month EURIBOR + 4.75%), 12/09/2025 (b) | | France | | € | 250,000 | | | | 236,056 | | |

PetVet Care Centers LLC,

Second Lien Term Loan

10.32% (3 Month LIBOR USD + 6.25%), 02/15/2026 (b) | | United States | | $ | 500,000 | | | | 461,875 | | |

Springer Nature Deutschland GmbH,

First Lien Tranche B Term Loan

3.25% (3 Month EURIBOR + 3.25%), 08/14/2026 (b) | | Germany | | € | 250,000 | | | | 256,668 | | |

Verisure Holding AB,

First Lien Tranche B Term Loan

3.47% (3 Month EURIBOR + 3.50%), 03/25/2028 (b) | | Sweden | | | 250,000 | | | | 249,640 | | |

Total Diversified Consumer Services | | | | | | | | | 2,115,122 | | |

Diversified Financial Services – 0.4% | |

Apex Group Treasury Ltd.,

First Lien Tranche B Term Loan

4.26% (3 Month EURIBOR + 4.00%), 07/27/2028 (b) | | Bermuda | | | 250,000 | | | | 254,995 | | |

Nexus Buyer LLC,

Second Lien Term Loan

10.32% (1 Month LIBOR USD + 6.25%), 11/01/2029 (b) | | United States | | $ | 376,000 | | | | 349,368 | | |

Total Diversified Financial Services | | | | | | | | | 604,363 | | |

Diversified Telecommunication Services – 0.7% | |

Altice France SA,

First Lien Tranche B Term Loan

4.38% (3 Month EURIBOR + 3.00%), 01/31/2026 (b) | | France | | € | 237,194 | | | | 241,526 | | |

5.00% (3 Month EURIBOR + 3.00%), 10/28/2027 (b) | | France | | | 230,000 | | | | 242,098 | | |

Intelsat Jackson Holdings SA,

First Lien Tranche EXIT Term Loan

7.44% (6 Month SOFR + 4.25%), 02/01/2029 (b) | | Luxembourg | | $ | 439,466 | | | | 425,183 | | |

Total Diversified Telecommunication Services | | | | | | | | | 908,807 | | |

Electronic Equipment, Instruments & Components – 0.6% | |

LTI Holdings, Inc.,

First Lien Tranche B Term Loan

7.57% (3 Month LIBOR USD + 3.50%), 09/06/2025 (b) | | United States | | | 989,691 | | | | 949,791 | | |

See Notes to Consolidated Financial Statements.

10

OAKTREE DIVERSIFIED INCOME FUND INC.

Consolidated Schedule of Investments (continued)

December 31, 2022

Description | | Country | | Principal

Amount | | Value | |

CORPORATE CREDIT (continued) | |

Energy Equipment & Services – 0.4% | |

Artera Services LLC,

First Lien Term Loan

7.17% (1 Month LIBOR USD + 3.50%), 03/06/2025 (b) | | United States | | $ | 742,481 | | | $ | 610,695 | | |

Food & Staples Retailing – 0.2% | |

Bellis Acquisition Company PLC,

First Lien Tranche B Term Loan

2.75% (3 Month EURIBOR + 2.75%), 02/16/2026 (b) | | United Kingdom | | € | 250,000 | | | | 253,413 | | |

Food Products – 0.4% | |

Shearer's Foods LLC,

First Lien Tranche B Term Loan

7.57% (1 Month LIBOR USD + 3.50%), 09/23/2027 (b) | | United States | | $ | 698,924 | | | | 668,347 | | |

Health Care Providers & Services – 1.2% | |

Baart Programs, Inc.,

First Lien Delay Draw Term Loan

8.75% (1 Month LIBOR USD + 5.00%), 06/11/2027 (b) (d) (e) | | United States | | | 719,614 | | | | 402,794 | | |

Baart Programs, Inc.,

Second Lien Delay Draw Term Loan

12.57% (1 Month LIBOR USD + 8.50%), 06/11/2028 (b) (d) (e) | | United States | | | 1,246,000 | | | | 545,529 | | |

Corgi BidCo,

First Lien Term Loan

8.78% (3 Month SOFR + 5.00%), 10/13/2029 (b) | | United States | | | 362,000 | | | | 340,099 | | |

HomeVi SASU,

First Lien Tranche B Term Loan

4.24% (3 Month EURIBOR + 4.00%), 10/31/2026 (b) | | France | | € | 250,000 | | | | 240,415 | | |

Nidda Healthcare Holding Gmb,

First Lien Tranche F Term Loan

3.50% (3 Month EURIBOR + 3.50%), 08/21/2026 (b) | | Germany | | | 250,000 | | | | 246,314 | | |

Total Health Care Providers & Services | | | | | | | | | 1,775,151 | | |

Health Care Technology – 1.3% | |

MedAssets Software Intermediate Holdings, Inc,

Second Lien Term Loan

10.82% (1 Month LIBOR USD + 6.75%), 12/17/2029 (b) | | United States | | $ | 2,082,000 | | | | 1,601,183 | | |

Polaris Newco LL,

First Lien Tranche B Term Loan

8.38% (3 Month LIBOR USD + 4.00%), 06/04/2028 (b) | | United States | | | 209,667 | | | | 191,845 | | |

Solera LL,

First Lien Tranche B Term Loan

4.00% (3 Month EURIBOR + 4.00%), 06/04/2028 (b) | | United States | | € | 247,500 | | | | 247,882 | | |

Total Health Care Technology | | | | | | | | | 2,040,910 | | |

Hotels, Restaurants & Leisure – 2.1% | |

Alterra Mountain Co.,

First Lien Tranche B Term Loan

7.57% (1 Month LIBOR USD + 3.50%), 08/17/2028 (b) | | United States | | $ | 932,436 | | | | 923,405 | | |

Carnival Corp.

5.88% (6 Month LIBOR USD + 3.00%), 06/30/2025 (b) | | United States | | | 748,087 | | | | 719,364 | | |

Entain Holdings Gibraltar Ltd.,

First Lien Tranche B Term Loan

7.51% (1 Month SOFR + 3.50%), 10/31/2029 (b) | | Gibraltar | | | 266,000 | | | | 265,169 | | |

See Notes to Consolidated Financial Statements.

2022 Annual Report

11

OAKTREE DIVERSIFIED INCOME FUND INC.

Consolidated Schedule of Investments (continued)

December 31, 2022

Description | | Country | | Principal

Amount | | Value | |

CORPORATE CREDIT (continued) | |

Flutter Financing BV,

First Lien Tranche B Term Loan

7.01% (1 Month SOFR + 3.25%), 07/04/2028 (b) | | Ireland | | $ | 258,000 | | | $ | 257,248 | | |

Flynn Restaurant Group LP,

First Lien Tranche B Term Loan

8.32% (1 Month LIBOR USD + 4.25%), 12/03/2028 (b) | | United States | | | 992,500 | | | | 933,362 | | |

Hurtigruten Group AS,

First Lien Tranche B Term Loan

4.00% (3 Month EURIBOR + 4.00%), 02/22/2025 (b) | | Norway | | € | 200,000 | | | | 169,231 | | |

Whatabrands LLC,

First Lien Tranche B Term Loan

7.32% (1 Month LIBOR USD + 3.25%), 08/03/2028 (b) | | United States | | $ | 87,000 | | | | 84,281 | | |

Total Hotels, Restaurants & Leisure | | | | | | | | | 3,352,060 | | |

Independent Power and Renewable Electricity Producers – 0.5% | |

Parkway Generation LLC,

First Lien Tranche B Term Loan

8.95% (1 Month SOFR + 4.75%), 02/18/2029 (b) | | United States | | | 685,181 | | | | 675,417 | | |

Parkway Generation LLC,

First Lien Tranche C Term Loan

8.95% (1 Month LIBOR USD + 4.75%), 02/18/2029 (b) | | United States | | | 89,876 | | | | 88,939 | | |

Insurance – 0.2% | |

Asurion, LLC,

First Lien Tranche B10 Term Loan

7.65% (3 Month SOFR + 4.00%), 08/19/2028 (b) | | United States | | | 299,250 | | | | 267,754 | | |

Leisure Products – 0.3% | |

Gibson Brands, Inc.,

First Lien Term Loan

9.13% (1 Month LIBOR USD + 5.00%), 08/13/2028 (b) | | United States | | | 396,000 | | | | 293,040 | | |

Peloton Interactive,

First Lien Term Loan

11.26% (1 Month SOFR + 6.50%), 05/17/2027 (b) | | United States | | | 148,628 | | | | 146,584 | | |

Total Leisure Products | | | | | | | | | 439,624 | | |

Machinery – 0.4% | |

Delachaux Group SA,

First Lien Tranche B Term Loan

3.99% (3 Month EURIBOR + 3.75%), 04/16/2026 (b) | | France | | € | 239,144 | | | | 241,377 | | |

Restaurant Technologies, Inc.,

First Lien Tranche B Term Loan

7.80% (3 Month SOFR + 4.25%), 04/01/2029 (b) | | United States | | $ | 508,250 | | | | 500,245 | | |

Total Machinery | | | | | | | | | 741,622 | | |

Media – 0.7% | |

Directv Financing LLC,

First Lien Term Loan

9.07% (1 Month LIBOR USD + 5.00%), 08/02/2027 (b) | | United States | | | 910,000 | | | | 887,913 | | |

Learfield Communications LLC,

First Lien Term Loan

7.33% (1 Month US LIBOR + 3.25%), 12/01/2023 (b) | | United States | | | 233,675 | | | | 175,798 | | |

Virgin Media SFA Finance Ltd.,

First Lien Term Loan

5.47% (Secured Overnight Financing Rate + 3.25%), 01/15/2027 (b) | | United Kingdom | | £ | 200,000 | | | | 224,715 | | |

Total Media | | | | | | | | | 1,288,426 | | |

See Notes to Consolidated Financial Statements.

12

OAKTREE DIVERSIFIED INCOME FUND INC.

Consolidated Schedule of Investments (continued)

December 31, 2022

Description | | Country | | Principal

Amount | | Value | |

CORPORATE CREDIT (continued) | |

Metals & Mining – 1.2% | |

American Rock Salt Company LLC,

First Lien Tranche B Term Loan

8.07% (1 Month LIBOR USD + 4.00%), 06/11/2028 (b) | | United States | | $ | 500,000 | | | $ | 471,875 | | |

PMHC II, Inc.,

First Lien Term Loan

8.49% (3 Month SOFR + 4.25%), 04/21/2029 (b) | | United States | | | 476,000 | | | | 404,724 | | |

SCIH Salt Holdings, Inc.,

First Lien Tranche B Term Loan

8.41% (1 Month LIBOR USD + 4.00%), 03/16/2027 (b) | | United States | | | 915,280 | | | | 892,068 | | |

Total Metals & Mining | | | | | | | | | 1,768,667 | | |

Multiline Retail – 0.2% | |

Amer Sports Holding Oy,

First Lien Tranche B Term Loan

4.25% (6 Month EURLIBOR + 4.50%), 03/30/2026 (b) | | Finland | | € | 250,000 | | | | 249,269 | | |

Personal Products – 0.2% | |

Olaplex, Inc.,

First Lien Tranche B Term Loan

7.92% (3 Month SOFR + 3.75%), 02/07/2028 (b) | | United States | | $ | 248,750 | | | | 233,203 | | |

Pharmaceuticals – 0.3% | |

Antigua Bidco Ltd.,

First Lien Tranche B Term Loan

4.58% (3 Month EURIBOR + 4.00%), 08/07/2026 (b) | | United Kingdom | | € | 250,000 | | | | 258,814 | | |

Zentiva,

First Lien Tranche B Term Loan

4.74% (3 Month EURIBOR + 3.75%), 09/30/2025 (b) | | Czech Republic | | | 250,000 | | | | 258,245 | | |

Total Pharmaceuticals | | | | | | | | | 517,059 | | |

Professional Services – 0.6% | |

DTI Holdco, Inc.,

First Lien Tranche B Term Loan

7.33% (3 Month SOFR + 4.75%), 04/26/2029 (b) | | United States | | $ | 500,000 | | | | 461,875 | | |

Element Materials Technology Group US Holdings, Inc.,

First Lien Delay Draw Term Loan

7.90% (1 Month SOFR + 4.25%), 06/24/2029 (b) | | United States | | | 342,105 | | | | 335,122 | | |

7.90% (3 Month SOFR + 4.25%), 06/24/2029 (b) | | United States | | | 157,895 | | | | 154,671 | | |

Total Professional Services | | | | | | | | | 951,668 | | |

Software – 2.5% | |

BYJU's Alpha, Inc.,

First Lien Tranche B Term Loan

10.70% (3 Month LIBOR USD + 6.00%), 11/24/2026 (b) | | India | | | 445,500 | | | | 359,262 | | |

ION Corporate Solutions Finance Sarl,

First Lien Tranche B Term Loan

4.94% (3 Month EURIBOR + 3.75%), 03/11/2028 (b) | | Luxembourg | | € | 250,000 | | | | 257,576 | | |

McAfee Corp.,

First Lien Tranche B Term Loan

4.20% (1 Month EURIBOR + 4.00%), 02/02/2029 (b) | | United States | | | 249,375 | | | | 254,072 | | |

Mitchell International, Inc.,

First Lien Tranche B Term Loan

8.41% (3 Month LIBOR USD + 3.75%), 10/15/2028 (b) | | United States | | $ | 707,911 | | | | 654,453 | | |

See Notes to Consolidated Financial Statements.

2022 Annual Report

13

OAKTREE DIVERSIFIED INCOME FUND INC.

Consolidated Schedule of Investments (continued)

December 31, 2022

Description | | Country | | Principal

Amount | | Value | |

CORPORATE CREDIT (continued) | |

Planview Parent, Inc.,

First Lien Term Loan

7.67% (3 Month LIBOR USD + 4.00%), 12/17/2027 (b) | | United States | | $ | 160,809 | | | $ | 150,184 | | |

Sitel Group SA,

First Lien Tranche B Term Loan

5.25% (1 Month EURIBOR + 3.75%), 08/28/2028 (b) | | United States | | € | 270,000 | | | | 281,745 | | |

Skopima Consilio Parent LLC,

First Lien Term Loan

8.07% (1 Month LIBOR USD + 4.00%), 05/17/2028 (b) | | United States | | $ | 929,307 | | | | 881,512 | | |

TIBCO Software, Inc.,

First Lien Tranche B Term Loan

8.05% (3 Month SOFR + 4.50%), 09/30/2028 (b) | | United States | | | 193,000 | | | | 172,011 | | |

8.15% (3 Month SOFR + 4.50%), 03/30/2029 (b) | | United States | | | 329,000 | | | | 294,631 | | |

UKG, Inc.,,

Second Lien Term Loan

9.00% (3 Month LIBOR USD + 5.25%), 05/03/2027 (b) | | United States | | | 500,000 | | | | 461,375 | | |

Total Software | | | | | | | 3,766,821 | | |

Specialty Retail – 0.4% | |

CD&R Firefly Bidco Ltd.,

First Lien Tranche B1 Term Loan

5.80% (1 Month SONIA + 4.75%), 06/21/2025 (b) | | United Kingdom | | £ | 250,000 | | | | 278,395 | | |

Great Outdoors Group LLC,

First Lien Tranche B Term Loan

7.82% (1 Month LIBOR USD + 3.75%), 03/05/2028 (b) | | United States | | $ | 500,000 | | | | 481,563 | | |

Total Specialty Retail | | | | | | | 759,958 | | |

Technology Hardware, Storage & Peripherals – 0.5% | |

Castle US Holding Corp.,

First Lien Tranche B Term Loan

5.24% (3 Month EURIBOR + 3.75%), 01/29/2027 (b) | | United States | | € | 247,462 | | | | 178,804 | | |

8.07% (1 Month LIBOR USD + 4.00%), 01/29/2027 (b) | | United States | | $ | 991,614 | | | | 617,280 | | |

Total Senior Loans (Syndicated) | | | | | | | | | 40,211,187 | | |

High Yield – 21.8% | |

Aerospace & Defense – 0.7% | |

Bombardier, Inc.

7.13%, 06/15/2026 (f) | | Canada | | | 240,000 | | | | 233,288 | | |

Spirit AeroSystems, Inc.

7.50%, 04/15/2025 (f) | | United States | | | 275,000 | | | | 272,335 | | |

TransDigm, Inc.

6.25%, Perpetual (f) | | United States | | | 95,000 | | | | 93,897 | | |

5.50%, 11/15/2027 | | United States | | | 360,000 | | | | 338,789 | | |

Total Aerospace & Defense | | | | | | | 938,309 | | |

Airlines – 0.1% | |

Hawaiian Brand Intellectual Property Ltd.

5.75%, 01/20/2026 (f) | | United States | | | 150,000 | | | | 136,035 | | |

Auto Components – 0.2% | |

Dana Financing Luxembourg Sarl

3.00%, 07/15/2029 | | United States | | € | 200,000 | | | | 164,709 | | |

Renk AG

5.75%, 07/15/2025 | | Germany | | | 100,000 | | | | 100,753 | | |

Total Auto Components | | | | | | | | | 265,462 | | |

See Notes to Consolidated Financial Statements.

14

OAKTREE DIVERSIFIED INCOME FUND INC.

Consolidated Schedule of Investments (continued)

December 31, 2022

Description | | Country | | Principal

Amount | | Value | |

CORPORATE CREDIT (continued) | |

Beverages – 0.1% | |

Primo Water Holdings, Inc.

3.88%, 10/31/2028 | | Canada | | € | 100,000 | | | $ | 95,405 | | |

Building Products – 0.1% | |

Standard Industries, Inc.

2.25%, 11/21/2026 | | United States | | | 200,000 | | | | 183,978 | | |

Chemicals – 0.7% | |

Diamond BC BV

4.63%, 10/01/2029 (f) | | United States | | $ | 245,000 | | | | 196,931 | | |

EverArc Escrow Sarl

5.00%, 10/30/2029 (f) | | United States | | | 225,000 | | | | 184,793 | | |

Nufarm Australia Ltd.

5.00%, 01/27/2030 (f) | | Australia | | | 445,000 | | | | 386,189 | | |

Olympus Water US Holding Corp.

4.25%, 10/01/2028 (f) | | United States | | | 280,000 | | | | 227,683 | | |

6.25%, 10/01/2029 (f) | | United States | | | 60,000 | | | | 45,630 | | |

Total Chemicals | | | | | | | 1,041,226 | | |

Commercial Services & Supplies – 1.8% | |

Allied Universal Holdco LLC

4.63%, 06/01/2028 (f) | | United States | | | 405,000 | | | | 335,259 | | |

GFL Environmental, Inc.

4.75%, 06/15/2029 (f) | | Canada | | | 265,000 | | | | 232,279 | | |

Hurricane Finance PLC

8.00%, 10/15/2025 | | United Kingdom | | £ | 100,000 | | | | 108,202 | | |

Iron Mountain, Inc.

5.00%, 07/15/2028 (f) | | United States | | $ | 435,000 | | | | 391,478 | | |

LABL, Inc.

5.88%, 11/01/2028 (f) | | United States | | | 445,000 | | | | 388,549 | | |

Prime Security Services Borrower LLC

6.25%, 01/15/2028 (f) | | United States | | | 485,000 | | | | 442,427 | | |

TMS International Corp.

6.25%, 04/15/2029 (f) | | United States | | | 330,000 | | | | 236,843 | | |

WASH Multifamily Acquisition, Inc.

5.75%, 04/15/2026 (f) | | United States | | | 430,000 | | | | 405,772 | | |

Total Commercial Services & Supplies | | | | | | | 2,540,809 | | |

Communications Equipment – 0.3% | |

CommScope Technologies LLC

6.00%, 06/15/2025 (f) | | United States | | | 260,000 | | | | 237,136 | | |

CommScope, Inc.

6.00%, 03/01/2026 (f) | | United States | | | 95,000 | | | | 87,870 | | |

4.75%, 09/01/2029 (f) | | United States | | | 75,000 | | | | 60,606 | | |

Total Communications Equipment | | | | | | | 385,612 | | |

Construction & Engineering – 0.5% | |

Great Lakes Dredge & Dock Corp.

5.25%, 06/01/2029 (f) | | United States | | | 340,000 | | | | 264,758 | | |

Pike Corp.

5.50%, 09/01/2028 (f) | | United States | | | 440,000 | | | | 385,383 | | |

Total Construction & Engineering | | | | | | | | | 650,141 | | |

See Notes to Consolidated Financial Statements.

2022 Annual Report

15

OAKTREE DIVERSIFIED INCOME FUND INC.

Consolidated Schedule of Investments (continued)

December 31, 2022

Description | | Country | | Principal

Amount | | Value | |

CORPORATE CREDIT (continued) | |

Consumer Finance – 0.1% | |

FirstCash, Inc.

5.63%, 01/01/2030 (f) | | United States | | $ | 220,000 | | | $ | 196,100 | | |

Containers & Packaging – 0.6% | |

Ardagh Packaging Finance PLC

5.25%, 08/15/2027 (f) | | United States | | | 260,000 | | | | 194,824 | | |

Graham Packaging Company, Inc.

7.13%, 08/15/2028 (f) | | United States | | | 285,000 | | | | 238,252 | | |

Intelligent Packaging Limited Finco, Inc.

6.00%, Perpetual (f) | | Canada | | | 435,000 | | | | 351,685 | | |

Trivium Packaging Finance BV

3.75%, 08/15/2026 | | Netherlands | | € | 100,000 | | | | 98,207 | | |

Total Containers & Packaging | | | | | | | | | 882,968 | | |

Diversified Consumer Services – 0.2% | |

AA Bond Company Ltd.

6.50%, 01/31/2026 | | United Kingdom | | £ | 100,000 | | | | 97,045 | | |

Verisure Midholding AB

5.25%, 02/15/2029 | | Sweden | | € | 100,000 | | | | 85,903 | | |

Total Diversified Consumer Services | | | | | | | | | 182,948 | | |

Diversified Telecommunication Services – 1.3% | |

Altice Financing SA

3.00%, 01/15/2028 | | Luxembourg | | | 200,000 | | | | 169,720 | | |

Altice France SA

4.13%, 01/15/2029 | | France | | | 100,000 | | | | 82,027 | | |

Cogent Communications Group, Inc.

7.00%, 06/15/2027 (f) | | United States | | $ | 210,000 | | | | 206,047 | | |

eircom Finance DAC

3.50%, 05/15/2026 | | Ireland | | € | 200,000 | | | | 193,844 | | |

Frontier Communications Holdings LLC

6.75%, 05/01/2029 (f) | | United States | | $ | 155,000 | | | | 128,438 | | |

8.75%, 05/15/2030 (f) | | United States | | | 255,000 | | | | 259,767 | | |

Iliad Holding SASU

5.63%, 10/15/2028 | | France | | € | 200,000 | | | | 194,871 | | |

Level 3 Financing, Inc.

4.25%, 07/01/2028 (f) | | United States | | $ | 330,000 | | | | 260,693 | | |

Lorca Telecom Bondco SA

4.00%, 09/18/2027 | | Spain | | € | 200,000 | | | | 192,413 | | |

Telecom Italia SpA

4.00%, 04/11/2024 | | Italy | | | 200,000 | | | | 209,245 | | |

Ziggo Bond Company BV

3.38%, 02/28/2030 | | Netherlands | | | 100,000 | | | | 77,752 | | |

Total Diversified Telecommunication Services | | | | | | | | | 1,974,817 | | |

Electrical Equipment – 0.2% | |

APX Group, Inc.

6.75%, 02/15/2027 (f) | | United States | | $ | 290,000 | | | | 279,589 | | |

Electronic Equipment, Instruments & Components – 0.1% | |

Centurion Bidco SpA

5.88%, 09/30/2026 | | Italy | | € | 100,000 | | | | 92,874 | | |

See Notes to Consolidated Financial Statements.

16

OAKTREE DIVERSIFIED INCOME FUND INC.

Consolidated Schedule of Investments (continued)

December 31, 2022

Description | | Country | | Principal

Amount | | Value | |

CORPORATE CREDIT (continued) | |

Energy Equipment & Services – 0.2% | |

Precision Drilling Corp.

7.13%, 01/15/2026 (f) | | Canada | | $ | 245,000 | | | $ | 237,425 | | |

Entertainment – 0.2% | |

Banijay Entertainment SASU

3.50%, 03/01/2025 | | France | | € | 200,000 | | | | 202,224 | | |

Pinewood Finance Co Ltd.

3.63%, 11/15/2027 | | United Kingdom | | £ | 100,000 | | | | 106,800 | | |

Total Entertainment | | | | | | | | | 309,024 | | |

Equity Real Estate Investment Trusts (REITs) – 0.2% | |

American Finance Trust, Inc.

4.50%, 09/30/2028 (f) | | United States | | $ | 395,000 | | | | 290,906 | | |

Food & Staples Retailing – 0.2% | |

Performance Food Group, Inc.

5.50%, 10/15/2027 (f) | | United States | | | 335,000 | | | | 316,673 | | |

Food Products – 0.3% | |

Post Holdings, Inc.

5.63%, 01/15/2028 (f) | | United States | | | 430,000 | | | | 405,406 | | |

Gas Utilities – 0.1% | |

CQP Holdco LP

5.50%, 06/15/2031 (f) | | United States | | | 165,000 | | | | 144,438 | | |

Health Care Equipment & Supplies – 0.2% | |

Mozart Debt Merger Sub, Inc.

5.25%, 10/01/2029 (f) | | United States | | | 395,000 | | | | 314,441 | | |

Health Care Providers & Services – 1.1% | |

Acadia Healthcare Company, Inc.

5.50%, 07/01/2028 (f) | | United States | | | 215,000 | | | | 204,272 | | |

Avantor Funding, Inc.

3.88%, 07/15/2028 | | United States | | € | 100,000 | | | | 99,204 | | |

CAB Selas

3.38%, 02/01/2028 | | France | | | 200,000 | | | | 172,723 | | |

CHS/Community Health Systems, Inc.

5.63%, 03/15/2027 (f) | | United States | | $ | 335,000 | | | | 287,859 | | |

MEDNAX, Inc.

5.38%, 02/15/2030 (f) | | United States | | | 295,000 | | | | 256,772 | | |

ModivCare Escrow Issuer, Inc.

5.00%, 10/01/2029 (f) | | United States | | | 345,000 | | | | 291,387 | | |

Radiology Partners, Inc.

9.25%, 02/01/2028 (f) | | United States | | | 800,000 | | | | 450,346 | | |

Total Health Care Providers & Services | | | | | | | | | 1,762,563 | | |

Health Care Technology – 0.1% | |

MPH Acquisition Holdings LLC

5.50%, 09/01/2028 (f) | | United States | | | 160,000 | | | | 125,142 | | |

Health Facilities – 0.2% | |

Tenet Healthcare Corp.

6.13%, 10/01/2028 (f) | | United States | | | 285,000 | | | | 255,768 | | |

See Notes to Consolidated Financial Statements.

2022 Annual Report

17

OAKTREE DIVERSIFIED INCOME FUND INC.

Consolidated Schedule of Investments (continued)

December 31, 2022

Description | | Country | | Principal

Amount | | Value | |

CORPORATE CREDIT (continued) | |

Hotels, Restaurants & Leisure – 1.5% | |

Bloomin' Brands, Inc.

5.13%, 04/15/2029 (f) | | United States | | $ | 220,000 | | | $ | 185,328 | | |

Carnival Corp.

5.75%, 03/01/2027 (f) | | United States | | | 490,000 | | | | 350,727 | | |

10.50%, 06/01/2030 (f) | | United States | | | 80,000 | | | | 65,180 | | |

Cirsa Finance International Sarl

4.50%, 03/15/2027 | | Spain | | € | 100,000 | | | | 92,772 | | |

Everi Holdings, Inc.

5.00%, 07/15/2029 (f) | | United States | | $ | 345,000 | | | | 296,792 | | |

Fertitta Entertainment LLC

6.75%, 01/15/2030 (f) | | United States | | | 160,000 | | | | 129,356 | | |

Gamma Bidco SpA

5.13%, 07/15/2025 | | Italy | | € | 100,000 | | | | 101,778 | | |

Hilton Grand Vacations Borrower Escrow LLC

5.00%, 06/01/2029 (f) | | United States | | $ | 215,000 | | | | 185,174 | | |

Legends Hospitality Holding Company LLC

5.00%, Perpetual (f) | | United States | | | 440,000 | | | | 392,150 | | |

SeaWorld Parks & Entertainment, Inc.

5.25%, 08/15/2029 (f) | | United States | | | 265,000 | | | | 231,080 | | |

TUI Cruises GmbH

6.50%, 05/15/2026 | | Germany | | € | 100,000 | | | | 89,784 | | |

Total Hotels, Restaurants & Leisure | | | | | | | | | 2,120,121 | | |

Household Durables – 0.1% | |

Weekley Homes LLC

4.88%, 09/15/2028 (f) | | United States | | $ | 185,000 | | | | 155,778 | | |

Household Products – 0.1% | |

Energizer Gamma Acquisition BV

3.50%, 06/30/2029 | | United States | | € | 100,000 | | | | 86,018 | | |

Insurance – 0.2% | |

AssuredPartners, Inc.

5.63%, 01/15/2029 (f) | | United States | | $ | 250,000 | | | | 206,085 | | |

HUB International Ltd.

7.00%, 05/01/2026 (f) | | United States | | | 190,000 | | | | 186,394 | | |

Total Insurance | | | | | | | | | 392,479 | | |

IT Services – 0.7% | |

Ahead DB Holdings LLC

6.63%, 05/01/2028 (f) | | United States | | | 340,000 | | | | 273,714 | | |

Sabre GLBL, Inc.

7.38%, 09/01/2025 (f) | | United States | | | 150,000 | | | | 144,404 | | |

VM Consolidated, Inc.

5.50%, 04/15/2029 (f) | | United States | | | 655,000 | | | | 577,749 | | |

Total IT Services | | | | | | | | | 995,867 | | |

Leisure Products – 0.0% | |

Vista Outdoor, Inc.

4.50%, 03/15/2029 (f) | | United States | | | 65,000 | | | | 47,810 | | |

Machinery – 0.3% | |

Redwood Star Merger Sub, Inc.

8.75%, 04/01/2030 (f) | | United States | | | 500,000 | | | | 394,980 | | |

See Notes to Consolidated Financial Statements.

18

OAKTREE DIVERSIFIED INCOME FUND INC.

Consolidated Schedule of Investments (continued)

December 31, 2022

Description | | Country | | Principal

Amount | | Value | |

CORPORATE CREDIT (continued) | |

Media – 1.3% | |

CCO Holdings LLC

6.38%, 09/01/2029 (f) | | United States | | $ | 140,000 | | | $ | 131,833 | | |

CSC Holdings LLC

4.13%, 12/01/2030 (f) | | United States | | | 435,000 | | | | 307,995 | | |

Directv Financing LLC

5.88%, 08/15/2027 (f) | | United States | | | 435,000 | | | | 390,003 | | |

DISH DBS Corp.

5.25%, 12/01/2026 (f) | | United States | | | 195,000 | | | | 164,621 | | |

5.75%, 12/01/2028 (f) | | United States | | | 25,000 | | | | 20,000 | | |

Gray Television, Inc.

4.75%, 10/15/2030 (f) | | United States | | | 160,000 | | | | 116,000 | | |

iHeartCommunications, Inc.

6.38%, 05/01/2026 | | United States | | | 95,000 | | | | 87,550 | | |

5.25%, 08/15/2027 (f) | | United States | | | 360,000 | | | | 305,519 | | |

Scripps Escrow II, Inc.

5.38%, 01/15/2031 (f) | | United States | | | 130,000 | | | | 104,365 | | |

Univision Communications, Inc.

6.63%, 06/01/2027 (f) | | United States | | | 145,000 | | | | 140,206 | | |

Virgin Media Vendor Financing Notes III DAC

4.88%, 07/15/2028 | | United Kingdom | | £ | 100,000 | | | | 98,042 | | |

Total Media | | | | | | | | | 1,866,134 | | |

Metals & Mining – 0.7% | |

Arconic Corp.

6.13%, 02/15/2028 (f) | | United States | | $ | 425,000 | | | | 399,494 | | |

Constellium SE

5.63%, 06/15/2028 (f) | | United States | | | 260,000 | | | | 240,713 | | |

Mineral Resources Ltd.

8.13%, 05/01/2027 (f) | | Australia | | | 60,000 | | | | 60,519 | | |

8.50%, 05/01/2030 (f) | | Australia | | | 300,000 | | | | 304,499 | | |

Total Metals & Mining | | | | | | | | | 1,005,225 | | |

Oil Gas Transportation & Distribution – 0.1% | |

Suburban Propane Partners LP

5.00%, 06/01/2031 (f) | | United States | | | 220,000 | | | | 187,277 | | |

Oil, Gas & Consumable Fuels – 0.6% | |

CITGO Petroleum Corp.

7.00%, 06/15/2025 (f) | | United States | | | 360,000 | | | | 351,965 | | |

CVR Energy, Inc.

5.25%, 02/15/2025 (f) | | United States | | | 305,000 | | | | 281,053 | | |

Hess Midstream Operations LP

5.63%, 02/15/2026 (f) | | United States | | | 140,000 | | | | 136,600 | | |

5.13%, 06/15/2028 (f) | | United States | | | 235,000 | | | | 217,720 | | |

Total Oil, Gas & Consumable Fuels | | | | | | | 987,338 | | |

Paper & Forest Products – 0.3% | |

Mercer International, Inc.

5.50%, 01/15/2026 | | Germany | | | 440,000 | | | | 417,520 | | |

Personal Products – 0.6% | |

BellRing Brands, Inc.

7.00%, 03/15/2030 (f) | | United States | | | 365,000 | | | | 351,687 | | |

See Notes to Consolidated Financial Statements.

2022 Annual Report

19

OAKTREE DIVERSIFIED INCOME FUND INC.

Consolidated Schedule of Investments (continued)

December 31, 2022

Description | | Country | | Principal

Amount | | Value | |

CORPORATE CREDIT (continued) | |

Coty, Inc.

5.00%, 04/15/2026 (f) | | United States | | $ | 215,000 | | | $ | 204,177 | | |

Edgewell Personal Care Co.

5.50%, 06/01/2028 (f) | | United States | | | 355,000 | | | | 332,635 | | |

Total Personal Products | | | | | | | | | 888,499 | | |

Pharmaceuticals – 0.3% | |

Bausch Health Companies, Inc.

6.13%, 02/01/2027 (f) | | United States | | | 190,000 | | | | 131,267 | | |

4.88%, 06/01/2028 (f) | | United States | | | 240,000 | | | | 153,099 | | |

Cheplapharm Arzneimittel GmbH

4.38%, 01/15/2028 | | Germany | | € | 100,000 | | | | 94,391 | | |

Total Pharmaceuticals | | | | | | | | | 378,757 | | |

Professional Services – 0.1% | |

Summer BC Holdco B SARL

5.75%, 10/31/2026 | | Luxembourg | | | 100,000 | | | | 91,657 | | |

Real Estate Management & Development – 1.8% | |

Cushman & Wakefield US Borrower LLC

6.75%, 05/15/2028 (f) | | United States | | $ | 53,000 | | | | 50,675 | | |

Hunt Companies, Inc.

5.25%, 04/15/2029 (f) | | United States | | | 360,000 | | | | 303,052 | | |

OWS Cre Funding I LLC

9.02%, 2021-MARG (1 Month LIBOR USD + 4.90%),

09/01/2023 (b) (f) | | United States | | | 2,500,000 | | | | 2,394,137 | | |

Samhallsbyggnadsbolaget i Norden AB

2.88% (5 Year Swap Rate EUR + 3.22%), Perpetual (b) | | Sweden | | € | 100,000 | | | | 42,637 | | |

Total Real Estate Management & Development | | | | | | | 2,790,501 | | |

Road & Rail – 0.1% | |

The Hertz Corp.

4.63%, 12/01/2026 (f) | | United States | | $ | 200,000 | | | | 167,750 | | |

Software – 0.9% | |

Acuris Finance US, Inc.

5.00%, 05/01/2028 (f) | | United States | | | 395,000 | | | | 317,159 | | |

Brunello Bidco SpA

3.50%, 02/15/2028 | | Italy | | € | 100,000 | | | | 89,893 | | |

Castor SpA

7.30% (3 Month EURIBOR + 5.25%), 02/15/2029 (b) (g) (h) | | Italy | | | 200,000 | | | | 208,299 | | |

Cedacri Mergeco SPA

6.39% (3 Month EURIBOR + 4.63%), 05/15/2028 (b) | | Italy | | | 100,000 | | | | 99,795 | | |

Condor Merger Sub, Inc.

7.38%, 02/15/2030 (f) | | United States | | $ | 100,000 | | | | 80,582 | | |

NCR Corp.

5.13%, 04/15/2029 (f) | | United States | | | 15,000 | | | | 12,572 | | |

6.13%, 09/01/2029 (f) | | United States | | | 405,000 | | | | 379,347 | | |

Total Software | | | | | | | | | 1,187,647 | | |

Specialty Retail – 0.4% | |

Academy Ltd.

6.00%, 11/15/2027 (f) | | United States | | | 420,000 | | | | 402,698 | | |

See Notes to Consolidated Financial Statements.

20

OAKTREE DIVERSIFIED INCOME FUND INC.

Consolidated Schedule of Investments (continued)

December 31, 2022

Description | | Country | | Principal

Amount | | Value | |

CORPORATE CREDIT (continued) | |

eG Global Finance PLC

6.25%, 10/30/2025 | | United Kingdom | | € | 100,000 | | | $ | 94,349 | | |

Total Specialty Retail | | | | | | | | | 497,047 | | |

Technology Hardware, Storage & Peripherals – 0.1% | |

Xerox Holdings Corp.

5.50%, 08/15/2028 (f) | | United States | | $ | 180,000 | | | | 144,342 | | |

Telecommunication Services – 0.6% | |

Cablevision Lightpath LLC

5.63%, 09/15/2028 (f) | | United States | | | 415,000 | | | | 309,062 | | |

Consolidated Communications, Inc.

6.50%, 10/01/2028 (f) | | United States | | | 380,000 | | | | 296,233 | | |

Frontier Communications Holdings LLC

5.00%, 05/01/2028 (f) | | United States | | | 290,000 | | | | 253,463 | | |

Total Telecommunication Services | | | | | | | 858,758 | | |

Textiles, Apparel & Luxury Goods – 0.2% | |

Afflelou SAS

4.25%, 05/19/2026 | | France | | € | 100,000 | | | | 95,762 | | |

Crocs, Inc.

4.25%, 03/15/2029 (f) | | United States | | $ | 220,000 | | | | 186,643 | | |

Total Textiles, Apparel & Luxury Goods | | | | | | | 282,405 | | |

Thrifts & Mortgage Finance – 0.1% | |

Nationstar Mortgage Holdings, Inc.

6.00%, 01/15/2027 (f) | | United States | | | 140,000 | | | | 125,521 | | |

5.75%, 11/15/2031 (f) | | United States | | | 120,000 | | | | 93,456 | | |

Trading Companies & Distributors – 0.5% | |

Fortress Transportation and Infrastructure Investors LLC

6.50%, 10/01/2025 (f) | | United States | | | 16,000 | | | | 15,071 | | |

5.50%, 05/01/2028 (f) | | United States | | | 350,000 | | | | 299,051 | | |

Loxam SAS

3.75%, 07/15/2026 | | France | | € | 100,000 | | | | 96,945 | | |

Unifrax Escrow Issuer Corp.

5.25%, 09/30/2028 (f) | | United States | | $ | 450,000 | | | | 362,696 | | |

Total Trading Companies & Distributors | | | | | | | | | 773,763 | | |

Utility – 0.2% | �� |

Calpine Corp.

5.13%, 03/15/2028 (f) | | United States | | | 350,000 | | | | 313,015 | | |

Wireless Telecommunication Services – 0.2% | |

Matterhorn Telecom SA

4.00%, 11/15/2027 | | Luxembourg | | € | 200,000 | | | | 196,234 | | |

Vodafone Group PLC

3.00% (5 Year Swap Rate EUR + 3.48%), 08/27/2080 (b) | | United Kingdom | | | 200,000 | | | | 171,404 | | |

Total Wireless Telecommunication Services | | | | | | | | | 367,638 | | |

Total High Yield | | | | | | | | | 31,625,362 | | |

See Notes to Consolidated Financial Statements.

2022 Annual Report

21

OAKTREE DIVERSIFIED INCOME FUND INC.

Consolidated Schedule of Investments (continued)

December 31, 2022

Description | | Country | | Principal

Amount | | Value | |

CORPORATE CREDIT (continued) | |

Emerging Markets – 6.2% | |

Airlines – 0.5% | |

Azul Investments LLP

7.25%, 06/15/2026 | | Brazil | | $ | 1,130,000 | | | $ | 692,620 | | |

Chemicals – 0.4% | |

Braskem Idesa SAPI

6.99%, 02/20/2032 | | Mexico | | | 1,000,000 | | | | 715,713 | | |

Construction Materials – 0.1% | |

Cemex SAB de CV

5.13% (5 Year CMT Rate + 4.53%), Perpetual (b) | | Mexico | | | 200,000 | | | | 185,057 | | |

Diversified Telecommunication Services – 0.6% | |

Telecom Argentina SA

8.00%, 07/18/2026 | | Argentina | | | 1,000,000 | | | | 947,558 | | |

Electric Utilities – 0.1% | |

Pampa Energia SA

9.13%, 04/15/2029 | | Argentina | | | 150,000 | | | | 137,969 | | |

Hotels, Restaurants & Leisure – 0.0% | |

Grupo Posadas SAB de CV

4.00%, .00, 12/30/2027 (i) | | Mexico | | | 20,000 | | | | 15,713 | | |

Independent Power and Renewable Electricity Producers – 0.6% | |

Genneia SA

8.75%, 09/02/2027 (f) | | Argentina | | | 40,000 | | | | 39,150 | | |

8.75%, 09/02/2027 | | Argentina | | | 919,000 | | | | 899,471 | | |

Metals & Mining – 0.9% | |

Vedanta Resources Finance II PLC

13.88%, 01/21/2024 | | India | | | 1,600,000 | | | | 1,395,427 | | |

Oil, Gas & Consumable Fuels – 1.0% | |

CITGO Holding, Inc.

9.25%, 08/01/2024 | | United States | | | 690,000 | | | | 689,814 | | |

Kosmos Energy Ltd.

7.13%, 04/04/2026 | | United States | | | 200,000 | | | | 170,816 | | |

YPF SA

2.50%, 06/30/2029 (j) | | Argentina | | | 758,000 | | | | 607,035 | | |

1.50%, 09/30/2033 (j) | | Argentina | | | 55,000 | | | | 36,564 | | |

Total Oil, Gas & Consumable Fuels | | | | | | | | | 1,504,229 | | |

Real Estate Management & Development – 2.0% | |

CIFI Holdings Group Company Ltd.

11.58% (5 Year CMT Rate + 8.57%), Perpetual (b) | | China | | | 450,000 | | | | 81,225 | | |

6.45%, 11/07/2024 | | China | | | 200,000 | | | | 53,544 | | |

6.00%, 07/16/2025 | | China | | | 400,000 | | | | 105,116 | | |

Country Garden Holdings Company Ltd.

7.25%, 04/08/2026 | | China | | | 600,000 | | | | 383,016 | | |

4.80%, 08/06/2030 | | China | | | 200,000 | | | | 106,878 | | |

RKPF Overseas Ltd.

5.90%, 03/05/2025 | | China | | | 500,000 | | | | 418,750 | | |

6.00%, 09/04/2025 | | China | | | 500,000 | | | | 405,000 | | |

Shimao Group Holdings Ltd.

6.13%, 02/21/2024 | | China | | | 370,000 | | | | 69,888 | | |

See Notes to Consolidated Financial Statements.

22

OAKTREE DIVERSIFIED INCOME FUND INC.

Consolidated Schedule of Investments (continued)

December 31, 2022

Description | | Country | | Principal

Amount | | Value | |

CORPORATE CREDIT (continued) | |

5.60%, 07/15/2026 (n) | | China | | $ | 400,000 | | | $ | 75,993 | | |

5.20%, 01/16/2027 | | China | | | 1,210,000 | | | | 229,900 | | |

4.60%, 07/13/2030 | | China | | | 200,000 | | | | 36,593 | | |

3.45%, 01/11/2031 | | China | | | 400,000 | | | | 74,805 | | |

Shui On Development Holding Ltd.

5.50%, 06/29/2026 | | China | | | 200,000 | | | | 161,680 | | |

Sino-Ocean Land Treasure IV Ltd.

3.25%, 05/05/2026 | | China | | | 200,000 | | | | 105,367 | | |

4.75%, 08/05/2029 | | China | | | 410,000 | | | | 214,430 | | |

4.75%, 01/14/2030 | | China | | | 400,000 | | | | 205,872 | | |

Total Real Estate Management & Development | | | | | | | | | 2,728,057 | | |

Total Emerging Markets | | | | | | | | | 9,260,964 | | |

Corporate Bonds – 2.6% | |

Aerospace & Defense – 0.2% | |

Spirit AeroSystems, Inc.

9.38%, 11/30/2029 (f) | | United States | | | 235,000 | | | | 247,678 | | |

Auto Components – 0.1% | |

IHO Verwaltungs GmbH

3.63%, 4.38, 05/15/2025 (i) | | Germany | | € | 160,000 | | | | 156,709 | | |

Biotechnology – 0.1% | |

Grifols SA

3.20%, 05/01/2025 | | Spain | | | 160,000 | | | | 158,633 | | |

Containers & Packaging – 0.3% | |

Ardagh Packaging Finance PLC

2.13%, 08/15/2026 | | United States | | | 180,000 | | | | 161,663 | | |

Fiber Bidco SpA

7.95% (3 Month EURIBOR + 6.00%), 10/25/2027 (b) (f) | | Italy | | | 100,000 | | | | 107,148 | | |

Silgan Holdings, Inc.

3.25%, 03/15/2025 | | United States | | | 150,000 | | | | 156,135 | | |

Total Containers & Packaging | | | | | | | 424,946 | | |

Diversified Consumer Services – 0.1% | |

Verisure Holding AB

3.88%, 07/15/2026 | | Sweden | | | 100,000 | | | | 97,278 | | |

Diversified Telecommunication Services – 0.2% | |

Altice France SA

3.38%, 01/15/2028 | | France | | | 100,000 | | | | 81,027 | | |

Telefonica Europe BV

4.38% (EUSA6 + 4.11%), Perpetual (b) | | Spain | | | 200,000 | | | | 204,763 | | |

Total Diversified Telecommunication Services | | | | | | | 285,790 | | |

Health Care Equipment & Supplies – 0.2% | |

Limacorporate SpA

5.51% (3 Month EURIBOR + 3.75%), 08/15/2023 (b) | | Italy | | | 250,000 | | | | 261,101 | | |

Health Care Providers & Services – 0.1% | |

Nidda Healthcare Holding GmbH

7.50%, 08/21/2026 | | Germany | | | 100,000 | | | | 102,557 | | |

See Notes to Consolidated Financial Statements.

2022 Annual Report

23

OAKTREE DIVERSIFIED INCOME FUND INC.

Consolidated Schedule of Investments (continued)

December 31, 2022

Description | | Country | | Principal

Amount | | Value | |

CORPORATE CREDIT (continued) | |

Hotels, Restaurants & Leisure – 0.2% | |

Aramark International Finance Sarl

3.13%, 04/01/2025 | | United States | | € | 100,000 | | | $ | 103,030 | | |

Playtech PLC

4.25%, 03/07/2026 | | United Kingdom | | | 100,000 | | | | 101,423 | | |

Total Hotels, Restaurants & Leisure | | | | | | | | | 204,453 | | |

Household Durables – 0.2% | |

Shea Homes LP

4.75%, 02/15/2028 | | United States | | $ | 345,000 | | | | 301,767 | | |

IT Services – 0.2% | |

Mooney Group SpA

5.94% (3 Month EURIBOR + 3.88%), 12/17/2026 (b) | | Italy | | € | 250,000 | | | | 254,398 | | |

Life Sciences Tools & Services – 0.1% | |

IQVIA, Inc.

2.88%, 06/15/2028 | | United States | | | 165,000 | | | | 158,078 | | |

Media – 0.2% | |

Telenet Finance Luxembourg Notes Sarl

3.50%, 03/01/2028 | | Belgium | | | 100,000 | | | | 96,974 | | |

Virgin Media Secured Finance PLC

5.25%, 05/15/2029 | | United Kingdom | | £ | 100,000 | | | | 104,142 | | |

Total Media | | | | | | | | | 201,116 | | |

Mortgage Real Estate Investment Trusts (REITs) – 0.2% | |

HAT Holdings I LLC

3.38%, 06/15/2026 (f) | | United States | | $ | 415,000 | | | | 361,129 | | |

Software – 0.1% | |

Cloud Software Group Holdings, Inc.

6.50%, 03/31/2029 (f) | | United States | | | 210,000 | | | | 177,254 | | |

Textiles, Apparel & Luxury Goods – 0.1% | |

Hanesbrands Finance Luxembourg S.C.A

3.50%, 06/15/2024 | | United States | | € | 150,000 | | | | 156,031 | | |

Total Corporate Bonds | | | | | | | | | 3,548,918 | | |

Convertible Bonds – 0.0% | |

Airlines – 0.0% | |

JetBlue Airways Corp.

0.50%, 04/01/2026 | | United States | | $ | 21,000 | | | | 15,416 | | |

Biotechnology – 0.0% | |

Ionis Pharmaceuticals, Inc.

0.13%, 12/15/2024 | | United States | | | 21,000 | | | | 19,175 | | |

Entertainment – 0.0% | |

Sea Ltd.

0.25%, 09/15/2026 | | Singapore | | | 34,000 | | | | 25,075 | | |

Spotify USA, Inc.

0.00%, 03/15/2026 | | United States | | | 35,000 | | | | 28,350 | | |

Total Entertainment | | | | | | | | | 53,425 | | |

Health Care Equipment & Supplies – 0.0% | |

NuVasive, Inc.

0.38%, 03/15/2025 | | United States | | | 24,000 | | | | 21,084 | | |

See Notes to Consolidated Financial Statements.

24

OAKTREE DIVERSIFIED INCOME FUND INC.

Consolidated Schedule of Investments (continued)

December 31, 2022

Description | | Country | | Principal

Amount | | Value | |

CORPORATE CREDIT (continued) | |

Hotels, Restaurants & Leisure – 0.0% | |

Accor SA

0.70%, 12/07/2027 | | France | | € | 35,000 | | | $ | 15,479 | | |

Airbnb, Inc.

0.00%, 03/15/2026 | | United States | | $ | 31,000 | | | | 25,591 | | |

Shake Shack, Inc.

0.00%, 03/01/2028 | | United States | | | 29,000 | | | | 19,376 | | |

Total Hotels, Restaurants & Leisure | | | | | | | | | 60,446 | | |

Interactive Media & Services – 0.0% | |

Snap, Inc.

0.13%, 03/01/2028 (f) | | United States | | | 36,000 | | | | 24,210 | | |

IT Services – 0.0% | |

Block, Inc.

0.00%, 05/01/2026 | | United States | | | 20,000 | | | | 16,290 | | |

Cloudflare, Inc.

0.00%, 08/15/2026 | | United States | | | 13,000 | | | | 10,660 | | |

DigitalOcean Holdings, Inc.

0.00%, 12/01/2026 | | United States | | | 27,000 | | | | 20,318 | | |

Okta, Inc.

0.38%, 06/15/2026 | | United States | | | 20,000 | | | | 16,900 | | |

Perficient, Inc.

0.13%, 11/15/2026 | | United States | | | 19,000 | | | | 14,773 | | |

Shift4 Payments, Inc.

0.50%, 08/01/2027 | | United States | | | 20,000 | | | | 16,930 | | |

Shopify, Inc.

0.13%, 11/01/2025 | | Canada | | | 30,000 | | | | 25,763 | | |

Wix.com Ltd.

0.00%, 08/15/2025 | | United States | | | 19,000 | | | | 16,093 | | |

Worldline SA

0.00%, 07/30/2025 | | France | | € | 19,100 | | | | 21,914 | | |

Total IT Services | | | | | | | | | 159,641 | | |

Media – 0.0% | |

Cable One, Inc.

0.00%, 03/15/2026 | | United States | | $ | 33,000 | | | | 26,087 | | |

Liberty Broadband Corp.

2.75%, 09/30/2050 (f) | | United States | | | 27,000 | | | | 26,364 | | |

Total Media | | | | | | | | | 52,451 | | |

Personal Products – 0.0% | |

The Beauty Health Co.

1.25%, 10/01/2026 (f) | | United States | | | 23,000 | | | | 17,503 | | |

Professional Services – 0.0% | |

Ceridian HCM Holding, Inc.

0.25%, 03/15/2026 | | United States | | | 21,000 | | | | 18,512 | | |

Software – 0.0% | |

Alarm.com Holdings, Inc.

0.00%, 01/15/2026 | | United States | | | 21,000 | | | | 17,155 | | |

Bentley Systems, Inc.

0.38%, 07/01/2027 | | United States | | | 28,000 | | | | 22,932 | | |

See Notes to Consolidated Financial Statements.

2022 Annual Report

25

OAKTREE DIVERSIFIED INCOME FUND INC.

Consolidated Schedule of Investments (continued)

December 31, 2022

Description | | Country | | Principal

Amount | | Value | |

CORPORATE CREDIT (continued) | |

Blackline, Inc.

0.00%, 03/15/2026 | | United States | | $ | 17,000 | | | $ | 14,567 | | |

Coupa Software, Inc.

0.38%, 06/15/2026 | | United States | | | 21,000 | | | | 20,297 | | |

DocuSign, Inc.

0.00%, 01/15/2024 | | United States | | | 34,000 | | | | 32,130 | | |

Dropbox, Inc.

0.00%, 03/01/2026 | | United States | | | 17,000 | | | | 15,436 | | |

Envestnet, Inc.

0.75%, 08/15/2025 | | United States | | | 35,000 | | | | 31,763 | | |

Nutanix, Inc.