36

exclusion from public procurement, other enforcement action or liabilities, including civil liability or liability from third-party claims, and reputational damage.

There are a number of different principles, frameworks, and/or methodologies for integrating sustainability-related incentives, mandates, and/or reporting requirements into financing arrangements. Any principles, frameworks, and/or methodologies which we anticipate referencing and/or utilizing may not align with other asset managers and/or those preferred by prospective investors. In addition, unless otherwise stated in our regulatory disclosures, no assurance is given that any of our financing arrangements will align with particular market frameworks, including the Green Loan, Social Loan, and/or Sustainability-Linked Loan Principles published by the Loan Market Association, Loan Syndications and Trading Association, and the Asia Pacific Loan Market Association, or the Principles. Furthermore, to the extent any of such financing arrangement is considered to be aligned with any relevant Principles at origination by us, there is no guarantee that such financing will maintain alignment with the Principles over the relevant term. Any declassification and/or deviation with the applicable Principles may expose us and/or Oaktree to certain investigations, claims, and/or allegations, which may lead to increased costs and/or result in adverse consequences for certain investors with sustainability-aligned portfolio mandates.

Regulation of derivatives transactions in the United States and other jurisdictions may have a negative impact on the performance of our investments.

Title VII of the Dodd-Frank Act establishes a general framework for systemic regulation that has imposed and will impose mandatory clearing, exchange trading and margin requirements on many derivatives transactions. The Dodd-Frank Act also created new categories of regulated market participants, such as “swap dealers” and “security-based swap dealers” that are subject to significant new capital, registration, recordkeeping, reporting, disclosure, business conduct and other regulatory requirements, a large number of which have been implemented. This regulatory framework has significantly increased the costs of entering into derivatives transactions for

end-users

of derivatives, such as us. In particular, new margin requirements and capital charges, even when not directly applicable to us, are expected to increase the pricing of derivatives we transact in. New exchange trading and trade reporting requirements and position limits may lead to changes in the liquidity of derivative transactions, or higher pricing.

In addition to U.S. laws and regulations relating to derivatives, certain

non-U.S.

regulatory authorities have passed or proposed, or may propose in the future, legislation similar to that imposed by the Dodd-Frank Act. For example, EU legislation imposes position limits on certain commodity transactions, and the European Market Infrastructure Regulation (“EMIR”) requires reporting of derivatives and various risk mitigation techniques to be applied to derivatives entered into by parties that are subject to EMIR. Certain entities may be required to clear certain derivatives and may be subject to initial and variation margin requirements with respect to their

non-cleared

derivatives, under EMIR and its subordinate legislation. These EU regulatory changes have impacted or will impact, directly or indirectly, a broad range of counterparties, both outside and within the EU, and are understood to have increased, and are expected to potentially increase, our costs of transacting derivatives (particularly with banks and other dealers directly subject to such regulations).

In addition, the tax environment for derivative instruments and funds is evolving, and changes in the taxation of derivative instruments or funds may adversely affect the value of certain derivatives contracts we enter into and our ability to pursue our investment strategies. There can be no assurance that new legislation or regulation, including changes to existing laws and regulations, will not have a material negative impact on our investment performance.

37

Compliance with anti-money laundering requirements could require Oaktree and the Adviser to provide to governmental authorities information about the Fund’s shareholders and could require that a shareholder’s funds be frozen or that the shareholder withdraw from the Fund.

The Adviser and Oaktree will be authorized, without the consent of any person, including any shareholder, to take such action as the Adviser or Oaktree determines in its sole discretion to be reasonably necessary or advisable to comply, or to cause the Fund to comply, with any applicable laws and regulations, including any anti-money laundering or counter-terrorist financing laws, rules, regulations, directives or special measures. In addition, the Adviser and Oaktree may disclose, without the consent of any person, including any shareholder, to governmental authorities, SROs and financial institutions information concerning the Fund and one or more of the shareholders that the Adviser or Oaktree determines in its sole discretion is necessary or advisable to comply with applicable laws and regulations, including any anti-money laundering or counter-terrorist financing laws or regulations, and each shareholder will be required to provide the Adviser or Oaktree all information that the Adviser or Oaktree determines in its sole discretion to be advisable or necessary to comply with such laws and regulations. The Adviser may be required by applicable law to freeze a shareholder’s funds or cause such shareholder to withdraw or compulsorily withdraw such shareholder from the Fund.

Economic and trade sanctions and anti-bribery laws could make it more difficult or costly for us to conduct our operations or achieve our business objectives.

Economic and trade sanctions laws in the United States and other jurisdictions may prohibit Oaktree, the Investment Professionals and us from transacting with or in certain countries and with certain individuals, companies and industry sectors. In the United States, the U.S. Department of the Treasury’s Office of Foreign Assets Control (“OFAC”) administers and enforces laws, Executive Orders and regulations establishing U.S. sanctions. Such sanctions prohibit, among other things, transactions with, and the provision of services to, certain foreign countries, territories, entities and individuals. These entities and individuals include specially designated nationals, specially designated narcotics traffickers and other parties subject to OFAC sanctions and embargo programs. In addition, certain sanctions programs prohibit dealing with individuals or entities in certain countries or certain securities and certain industry sectors regardless of whether relevant individuals or entities appear on the lists maintained by OFAC, which may make it more difficult for us to comply with applicable sanctions. These types of sanctions may significantly restrict or limit our investment activities in certain countries (in particular, certain emerging market countries). We, Oaktree and the Investment Professionals may from time to time be subject to trade sanctions laws and regulations of other jurisdictions, which may be inconsistent with or even seek to prohibit compliance with certain sanctions programs administered by OFAC. The legal uncertainties arising from those conflicts may make it more difficult or costly for us to navigate investment activities that are subject to sanctions administered by OFAC or the laws and regulations of other jurisdictions. Some jurisdictions where Oaktree or its portfolio companies do business from time to time have adopted measures prohibiting compliance with certain U.S. sanctions programs, which may make compliance with all applicable sanctions impossible.

At the same time, Oaktree may be obligated to comply with certain anti-boycott laws and regulations that prevent Oaktree and us from engaging in certain discriminatory practices that may be allowed or required in certain jurisdictions. Oaktree’s refusal to discriminate in this manner could make it more difficult for us to pursue certain investments and engage in certain business activities, and any compliance with such practices could subject Oaktree or us to fines, penalties, and adverse legal and reputational consequences.

In some countries, there is a greater acceptance than in the United States and the U.K. of government involvement in commercial activities and of activities constituting corruption in the United States and the U.K. Certain countries, including the United States and the U.K., have laws prohibiting government and private commercial, or commercial, bribery. We and Oaktree are committed to complying with the U.S. Foreign Corrupt Practices Act (“FCPA”), the U.K. Bribery Act 2010 (the “U.K. Bribery Act”) and other anti-corruption laws, anti-bribery laws and regulations, as well as anti-boycott regulations, to which they are subject. As a result, we

38

may be adversely affected because of our unwillingness to participate in transactions that violate such laws or regulations. Such laws and regulations may make it difficult in certain circumstances for us to act successfully on investment opportunities and for portfolio companies to obtain or retain business.

In recent years, the U.S. Department of Justice and the SEC have devoted greater resources to enforcement of the FCPA and have devoted greater scrutiny to investments by private equity sponsors. In addition, the U.K., with enactment of the U.K. Bribery Act, has expanded the reach of its anti-bribery laws significantly. While Oaktree has developed and implemented policies and procedures designed to ensure strict compliance by Oaktree and its personnel with the FCPA and the U.K. Bribery Act and the sanctions regimes that apply to Oaktree, such policies and procedures may not be effective in all instances to prevent violations or offenses. In addition, in spite of Oaktree’s policies and procedures, affiliates of portfolio companies, particularly in cases in which we or an Other Oaktree Fund do not control such portfolio company, may engage in activities that could result in FCPA, U.K.

Bribery Act or other violations of law. Any determination that Oaktree has violated or committed an offense under the FCPA, U.K. Bribery Act or other applicable anti-corruption laws or anti-bribery laws or sanctions requirements could subject Oaktree to, among other things, civil and criminal penalties, reputational damage, material fines, profit disgorgement, injunctions on future conduct, securities litigation, disclosure obligations and a general loss of investor confidence, any one of which could adversely affect Oaktree’s business prospects and/or financial position, as well as our ability to achieve our investment objective and/or conduct our operations.

We may face a breach of our cybersecurity, which could result in adverse consequences to our operations and exposure of confidential information.

Cybersecurity incidents and cyber-attacks have been occurring globally at a more frequent and severe level and are expected to continue to increase in frequency and severity in the future. The information and technology systems of Oaktree, its affiliates, portfolio companies, issuers and service providers may be vulnerable to damage or interruption from cybersecurity breaches, computer viruses or other malicious code, network failures, computer and telecommunication failures, infiltration by unauthorized persons and other security breaches, usage errors or malfeasance by their respective professionals or service providers, power, communications or other service outages, and catastrophic events such as fires, tornadoes, floods, hurricanes, earthquakes or terrorist incidents. If unauthorized parties gain access to such information and technology systems, or if personnel abuse or misuse their access privileges, they may be able to steal, publish, delete or modify private and sensitive information, including

non-public

personal information related to our shareholders (and their beneficial owners) and material

non-public

information. Although Oaktree has implemented, and portfolio companies, issuers and service providers may implement, various measures to manage risks relating to these types of events, such systems could prove to be inadequate and, if compromised, could become inoperable for extended periods of time, cease to function properly or fail to adequately secure private information. Oaktree does not control the cybersecurity plans and systems put in place by third-party service providers, and such third-party service providers may have limited indemnification obligations to Oaktree, its affiliates, us, our shareholders and/or a portfolio company or issuer, each of whom could be negatively impacted as a result. Breaches such as those involving covertly introduced malware, impersonation of authorized users and industrial or other espionage may not be identified in a timely manner or at all, even with sophisticated prevention and detection systems. This could potentially result in further harm and prevent such breaches from being addressed appropriately. The failure of these systems and/or of disaster recovery plans for any reason could cause significant interruptions in Oaktree’s, its affiliates’, our and/or a portfolio company’s or issuer’s operations and result in a failure to maintain the security, confidentiality or privacy of sensitive data, including personal information relating to shareholders (and their beneficial owners), material

non-public

information and the intellectual property and trade secrets and other sensitive information of Oaktree and/or portfolio companies or issuers. We, Oaktree and/or a portfolio company could be required to make a significant investment to remedy the effects of any such failures, harm to our reputations, legal claims that we or our respective affiliates may be subjected to regulatory action or enforcement arising out of applicable privacy and other laws, adverse publicity, and other events that may affect our business and financial performance.

39

We are subject to risks associated with inflation.

High rates of inflation and rapid increases in the rate of inflation generally have a negative impact on financial markets and the broader economy. In an attempt to stabilize inflation, governments may impose wage and price controls or otherwise intervene in a country’s economy. Governmental efforts to curb inflation, including by increasing interest rates or reducing fiscal or monetary stimuli, often have negative effects on the level of economic activity. Certain countries, including the United States, have recently seen increased levels of inflation, and persistently high levels of inflation could have a material and adverse impact on our investments and our aggregated returns. For example, if a portfolio company were unable to increase its revenue while the cost of relevant inputs were increasing, the company’s profitability would likely suffer. Likewise, to the extent a portfolio company has revenue streams that are slow or unable to adjust to changes in inflation, including by contractual arrangements or otherwise, the portfolio company could increase revenue by less than its expenses increase. Conversely, as inflation declines, a portfolio company may see its competitors’ costs stabilize sooner or more rapidly than its own. Moreover, increasing inflation will also impact currencies and can lead to significant currency fluctuations. This has recently resulted in a strengthening of the U.S. dollar

many other currencies but there can be no assurances that such trends will continue and/or that this trend will not reverse such that the U.S. dollar is weakened

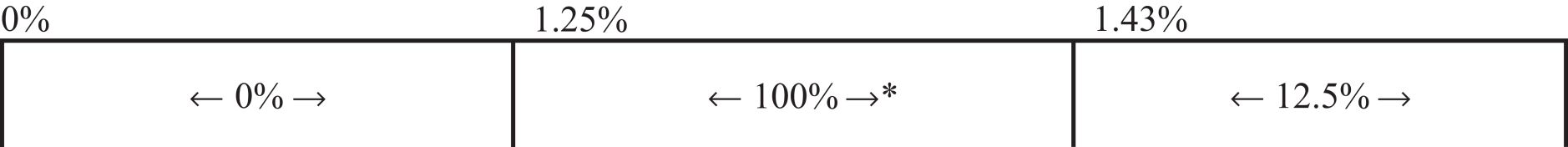

other currencies. Additionally, because the hurdle is not linked to the rate of inflation, as the rate of inflation increases the proportion of real returns (i.e., the nominal rate of return less the rate of inflation), it is easier for the Adviser to meet the quarterly hurdle rate for payment of income incentive fees under the Investment Advisory Agreement, which may result in an increase in the amount of the income-based incentive fee payable to our Adviser. There can be no assurance that high rates of inflation will not have a material adverse effect on our investments.

We may have no or limited insurance against certain catastrophic losses.

Certain losses of a catastrophic nature, such as wars, earthquakes, typhoons, terrorist attacks or other similar events, may be either uninsurable or insurable at such high rates that to maintain such coverage would cause an adverse impact on the related investments. In general, losses related to terrorism are becoming harder and more expensive to insure against. Some insurers are excluding terrorism coverage from their

all-risk

policies. In some cases, the insurers are offering significantly limited coverage against terrorist acts for additional premiums, which can greatly increase the total cost of casualty insurance for a property. As a result, all investments may not be insured against terrorism. If a major uninsured loss occurs, we could lose both invested capital in and anticipated profits from the affected investments.

We may not be able to obtain all required licenses.

Certain federal and local banking and other regulatory bodies or agencies inside or outside the United States may require us and/or the Adviser to obtain licenses or similar authorizations to engage in various types of lending activities, including investment in senior loans. Such licenses or authorizations may take a significant amount of time to obtain, and may require the disclosure of confidential information regarding the Fund, a shareholder or their respective affiliates, including financial information and/or information regarding officers and directors of such investor, and we may or may not be willing or able to comply with these requirements. In addition, there can be no assurance that any such licenses or authorizations would be granted or, if so, would not impose restrictions on us. Alternatively, the Adviser may be able to structure our potential investments in a manner which would not require such licenses and authorizations, but which would be inefficient or otherwise disadvantageous for us and/or the borrower. The inability of the Fund or the Adviser to obtain such licenses or authorizations, or the structuring of an investment in an inefficient or otherwise disadvantageous manner, could adversely affect the Adviser’s ability to implement our strategy and our results.

40

As a public company, we are subject to regulations not applicable to private companies, such as provisions of the Sarbanes-Oxley Act. Efforts to comply with such regulations will involve significant expenditures, and

non-compliance

with such regulations may adversely affect us.

As a public company, we are subject to the Sarbanes-Oxley Act, and the related rules and regulations promulgated by the SEC. Our management is required to report on our internal control over financial reporting pursuant to Section 404 of the Sarbanes-Oxley Act. We are required to review on an annual basis our internal control over financial reporting, and on a quarterly and annual basis to evaluate and disclose changes in our internal control over financial reporting. As a relatively new company, developing and maintaining an effective system of internal controls may require significant expenditures, which may negatively impact our financial performance and our ability to make distributions. This process also will result in a diversion of our management’s time and attention. We cannot be certain of when our evaluation, testing and remediation actions will be completed or the impact of the same on our operations. In addition, we may be unable to ensure that the process is effective or that our internal controls over financial reporting are or will be effective in a timely manner. In the event that we are unable to develop or maintain an effective system of internal controls and maintain or achieve compliance with the Sarbanes-Oxley Act and related rules, we may be adversely affected.

Our independent registered public accounting firm will not be required to formally attest to the effectiveness of our internal control over financial reporting until the date we are no longer an emerging growth company under the JOBS Act.

Compliance with the SEC’s Regulation Best Interest may negatively impact our ability to raise capital in this offering, which would harm our ability to achieve our investment objective.

Broker-dealers must comply with Regulation Best Interest, which, among other requirements, enhances the existing standard of conduct for broker-dealers and natural persons who are associated persons of a broker-dealer when recommending to a retail customer any securities transaction or investment strategy involving securities to a retail customer. The impact of Regulation Best Interest on broker-dealers participating in this offering cannot be determined at this time, but it may negatively impact whether broker-dealers and their associated persons recommend our Common Shares to retail customers. Regulation Best Interest imposes a duty of care for broker-dealers to evaluate reasonable alternatives in the best interests of their clients. Reasonable alternatives to the Fund, such as listed entities, exist and may have lower expenses, less complexity and/or lower investment risk than the Fund. Certain investments in listed entities may involve lower or no commissions at the time of initial purchase. Under Regulation Best Interest, broker-dealers participating in this offering must consider such alternatives in the best interests of their clients. If Regulation Best Interest reduces our ability to raise capital in this offering, it would harm our ability to create a diversified portfolio of investments and achieve our investment objective and would result in our fixed operating costs representing a larger percentage of our gross income.

Risks Related to Our Investments

Investments in privately owned small- and

medium-sized

companies pose a number of significant risks.

We invest primarily in privately owned

medium-sized

companies and may also invest in privately owned small companies. Investments in these types of companies pose a number of significant risks. For example, such companies: (a) have reduced access to the capital markets, resulting in diminished capital resources and ability to withstand financial distress; (b) may have limited financial resources and may be unable to meet their obligations under the debt securities that we hold, which may be accompanied by a deterioration in the value of any collateral and a reduction in the likelihood of the Fund realizing any guarantees it may have obtained in connection with our investment; (c) may have shorter operating histories, narrower product lines and smaller market shares than larger businesses, which tend to render them more vulnerable to competitors’ actions and changing market conditions, as well as general economic downturns; (d) are more likely to depend on the management talents and efforts of a small group of persons; therefore, the death, disability, resignation or termination of one or more of these persons could have a material adverse impact on the portfolio company and,

41

in turn, on us; (e) may have less predictable operating results, may from time to time be parties to litigation, may be engaged in volatile businesses with products subject to a substantial risk of obsolescence and may require substantial additional capital to support their operations, finance expansion or maintain their competitive position; and (f) are not subject to the Exchange Act and other regulations that govern public companies, and, therefore, provide little information to the public. In addition, we, the Adviser, its and our affiliates and trustees, executive management team and members, and the Investment Professionals may, in the ordinary course of business, be named as defendants in litigation arising from our investments in such portfolio companies.

Further, investments in such companies tend to be less liquid. See “—

The illiquid nature of certain of our investments may make it difficult for us to sell these investments when desired”

below.

Finally, little public information generally exists about privately owned companies, and these companies often do not have third-party debt ratings or audited financial statements. Shareholders, therefore, must rely on the ability of the Adviser to obtain adequate information through due diligence to evaluate the creditworthiness and potential returns from investing in these companies. Additionally, these companies and their financial information will not generally be subject to the Sarbanes-Oxley Act and other rules that govern public companies. If the Adviser is unable to uncover all material information about these companies, it may not make a fully informed investment decision, and shareholders may lose money on our investments.

Changes in interest rates may affect our cost of capital and net investment income.

General interest rate fluctuations and changes in credit spreads on floating rate loans may have a substantial negative impact on our investments and investment opportunities and, accordingly, may have a material adverse effect on our rate of return on invested capital, our net investment income and our net asset value. The majority of our debt investments have, and are expected to have, variable interest rates that reset periodically based on benchmarks such as the SOFR, the SONIA, the Euro Interbank Offered Rate, the federal funds rate, prime rate or any other offered rate benchmark or index. Increases in interest rates made it more difficult for our portfolio companies to service their obligations under the debt investments that we will hold and increased defaults even where our investment income increased. Rising interest rates also caused borrowers to shift cash from other productive uses to the payment of interest. Additionally, if interest rates were to increase and the corresponding risk of a default by borrowers increases, the liquidity of higher interest rate loans may decrease as fewer investors may be willing to purchase such loans in the secondary market in light of the increased risk of a default by the borrower and the heightened risk of a loss of an investment in such loans. All of these risks may be exacerbated if interest rates were to again rise rapidly and/or significantly. Decreases in credit spreads on debt that pays a floating rate of return would have an impact on the income generation of our floating rate assets. Trading prices for debt that pays a fixed rate of return tend to fall as interest rates rise. Trading prices tend to fluctuate more for fixed rate securities that have longer maturities.

Conversely, as interest rates decline, borrowers may refinance their loans at lower interest rates, which could shorten the average life of the loans and reduce the associated returns on the investment, as well as require our Adviser and the Investment Professionals to incur management time and expense to

re-deploy

such proceeds, including on terms that may not be as favorable as our existing loans.

In addition, because we borrow to fund our investments, a portion of our net investment income is dependent upon the difference between the interest rate at which we borrow funds and the interest rate at which we invest these funds. Portions of our investment portfolio and our borrowings have floating rate components. As a result, elevated interest rates increased our interest expense as may the incurrence of additional fixed rate borrowings. In future periods of rising interest rates, our cost of funds would again increase, which would tend to reduce our net investment income. We may hedge against interest rate fluctuations by using standard hedging instruments such as interest rate swap agreements, futures, options and forward contracts, subject to applicable legal requirements, including all necessary registrations (or exemptions from registration) with the Commodity Futures Trading Commission. In addition, our interest expense may not decrease at the same rate as overall interest rates because

42

of our fixed rate borrowings, which could lead to greater declines in our net investment income. These activities may limit our ability to participate in the benefits of lower interest rates with respect to the hedged borrowings. Adverse developments resulting from changes in interest rates or hedging transactions could have a material adverse effect on our business, financial condition and results of operations.

Elevated interest rates have the effect of increasing our net investment income, which makes it easier for our Adviser to receive incentive fees.

Elevated interest rates have the effect of increasing the interest rates we receive on many of our debt investments. Accordingly, in an elevated interest rate environment, it is easier for us to meet or exceed the performance threshold in the Investment Advisory Agreement and for the Adviser to earn incentive fees payable to our Adviser with respect to the portion of the incentive fee based on income.

We face risk of loss in connection with transactions with counterparties, settlements and exposure to local intermediaries.

From time to time, certain securities markets have experienced operational clearance and settlement problems that have resulted in failed trades. These problems could cause us to miss attractive investment opportunities or result in our liability to third parties by virtue of an inability to perform our contractual obligation to deliver securities. In addition, delays and inefficiencies of the local postal, transport and banking systems could result in the loss of investment opportunities, the loss of funds (including dividends) and exposure to currency fluctuations.

Because certain purchases, sales, securities lending, derivatives and other transactions in which we engage involve instruments that are not traded on an exchange, but are instead traded between counterparties based on contractual relationships, we are subject to the risk that a counterparty will not perform its obligations under the related contracts, as well as risks of transfer, clearance or settlement default. Such risks may be exacerbated with respect to

non-U.S.

securities or transactions with

non-U.S.

counterparties. There can be no assurance that a counterparty will not default and that we will not sustain a loss on a transaction as a result. Such risks may differ materially from those entailed in exchange-traded transactions that generally are backed by clearing organization guarantees, daily

and settlement of positions and segregation and minimum capital requirements applicable to intermediaries. There can be no assurance that the Adviser’s monitoring activities will be sufficient to adequately control counterparty risk.

In situations where we place assets in the care of a custodian or are required to post margin or other collateral with a counterparty, the custodian or counterparty may fail to segregate such assets or collateral, as applicable, or may commingle the assets or collateral with the relevant custodian’s or counterparty’s own assets or collateral, as applicable. As a result, in the event of the bankruptcy or insolvency of any custodian or counterparty, our excess assets and collateral may be subject to the conflicting claims of the creditors of the relevant custodian or counterparty, and we may be exposed to the risk of a court treating the Fund as a general unsecured creditor of such custodian or counterparty, rather than as the owner of such assets or collateral, as the case may be.

Certain of our transactions may be undertaken through local brokers, banks or other organizations in the countries in which we make investments, and we will be subject to the risk of default, insolvency or fraud of such organizations. The collection, transfer and deposit of bearer securities and cash expose the Fund to a variety of risks, including theft, loss and destruction. Finally, we will be dependent upon the general soundness of the banking systems of countries in which investments will be made.

Recent developments in the banking sector could materially affect the success of our activities and investments.

Recent insolvency, closure, receivership or other financial distress or difficulty and related events experienced by certain U.S. and

non-U.S.

banks (each, a “Distress Event”), have caused uncertainty and fear of instability in the

43

global financial system generally. In addition, eroding market sentiment and speculation of potential future Distress Events have caused other financial institutions—in particular smaller and/or regional banks—to experience volatile stock prices and significant losses in their equity value, and there is concern that depositors at these institutions have withdrawn, or may withdraw in the future, significant sums from their accounts at these institutions, potentially triggering the occurrence of additional Distress Events. Notwithstanding intervention by certain U.S. and

non-U.S.

governmental agencies to protect the uninsured depositors of banks that have recently experienced Distress Events, there is no guarantee that depositors (which depositors could include us and/or our portfolio companies) that have assets in excess of the amount insured by governmental agencies on deposit with a financial institution that experiences a Distress Event will be made whole or, even if made whole, that such deposits will become available for withdrawal or other usage on a timely basis.

There is a risk that other banks, other lenders, or other financial institutions (including such financial institutions in their respective capacities as brokers, hedging counterparties, custodians, loan servicers, administrators, intermediary or other service providers (the foregoing, together with banks, each, a “Financial Institution”)) may be similarly impacted, and it is uncertain what steps (if any) government or other regulators may take in such circumstances. As a consequence, for example, Oaktree, us and/or our portfolio companies may be delayed or prevented from accessing funds or other assets, making any required payments under debt or other contractual obligations, paying distributions or pursuing key strategic initiatives. In addition, such bank or other Financial Institution Distress Events and/or attendant instability could adversely affect, in certain circumstances, the ability of both affiliated and unaffiliated joint venture partners,

co-lenders,

syndicate lenders or other parties to undertake and/or execute transactions with us, which in turn may result in fewer investment opportunities being made available to us or being consummated by us, result in shortfalls or defaults under existing investments, or impact our ability to provide additional

follow-on

support to portfolio companies. Distress Events could also impact the ability of Oaktree, us and/or portfolio companies to access hedging, loan servicing, monitoring, compliance (including compliance with anti-money laundering and related laws and regulations), administration, intermediation or other services, either permanently or for an extended period of time.

In addition, in the event that a Financial Institution that provides credit facilities and/or other financing to us, any of our affiliates, and/or one or more of our portfolio companies closes or experiences any other Distress Event, there can be no assurance that such Financial Institution will honor its obligations to provide such financing or that we or such portfolio company will be able to secure replacement financing or credit accommodations at all or on similar terms, or be able to do so without suffering delays or incurring losses or significant additional expenses. Similarly, if a Distress Event leads to a loss of access to a Financial Institution’s other services (in addition to financing and other credit accommodations), it is also possible that we or our portfolio companies will incur additional expenses or delays in putting in place alternative arrangements or that such alternative arrangements will be less favorable than those formerly in place (with respect to economic terms, service levels, access to capital, or otherwise). We and our portfolio companies are subject to similar risks if a Financial Institution utilized by our investors or by suppliers, vendors, brokers, dealers, custodians, loan and portfolio servicers, hedging and other service providers or other counterparties of us or our portfolio companies becomes subject to a Distress Event, which could have a material adverse effect on us. We, our affiliates, and our portfolio companies are expected to be subject to contractual obligations to maintain all or a portion of their respective assets with a particular Financial Institutions (including, without limitation, in connection with a credit facility or other financing transaction). Accordingly, although each of Oaktree and us seeks to do business with Financial Institutions that it believes are creditworthy and capable of fulfilling their respective obligations, there can be no expectation that any of the foregoing, or any of their respective affiliates or portfolio companies will establish banking relationships or financial arrangements with multiple Financial Institutions or maintain account balances at or below the relevant insured amounts with respect to any Financial Institution.

Uncertainty caused by recent bank failures—and general concern regarding the financial health and outlook for other Financial Institutions—could have an overall negative effect on banking systems and financial markets generally. These recent developments may also have other implications for broader economic and monetary policy, including interest rate policy. For the foregoing reasons, there can be no assurances that conditions in the

44

banking sector and in global financial markets will not worsen and/or adversely affect us, our portfolio companies or our respective financial performance.

The ongoing conflict between Russia and Ukraine could materially affect the success of our activities and investments.

In 2022, the Russian military commenced a full-scale invasion of Russia’s forces into Ukraine. In response, the United States, United Kingdom, the European Union, or EU, and other countries have imposed significant sanctions targeting the Russian financial system, petroleum sector and extractive industries, heavy manufacturing, and other sectors. These and other jurisdictions have also imposed prohibitions on most new investment in Russia, prohibitions on trade in many Russian securities, and prohibitions on the provision of a number of services to certain sectors of the Russian economy. Since the invasion, the sanctions and export controls landscape has been and is likely to continue to be dynamic. Russia’s invasion of Ukraine, the resulting displacement of persons both within Ukraine and to neighboring countries and the increasing international sanctions could have a negative impact on the economy and business activity globally, and therefore could adversely affect the performance of our investments. Furthermore, given the ongoing and evolving nature of the conflict between the two nations and its ongoing escalation (including with respect to the use of nuclear weapons and cyberwarfare against military and civilian targets globally), it is difficult to predict the conflict’s ultimate impact on global economic and market conditions, and, as a result, the situation presents material uncertainty and risk with respect to us and the performance of its investments or operations, and our ability to achieve our investment objectives.

The ongoing conflict between Israel and Hamas could materially affect the success of our activities and investments.

On October 7, 2023, Hamas (an organization which governs Gaza and which has been designated as a terrorist organization by the United States, the United Kingdom, the EU, Australia and other nations) committed a terrorist attack within Israel (the “October 7 Attacks”). As of the date hereof, Israel and Hamas remain in active armed conflict. The ongoing conflict and rapidly evolving measures in response could have a negative impact on the economy and business activity globally, and therefore could adversely affect the performance of our investments. The severity and duration of the conflict and its future impact on global economic and market conditions (including, for example, oil prices and/or the shipping industry) are impossible to predict and, as a result, present material uncertainty and risk with respect to us and the performance of our investments and operations, and our ability to achieve our investment objectives. For example, the armed conflict may expand and may ultimately more actively involve the United States, Lebanon (and/or Hezbollah), Syria, Iran, Yemen and/or other countries or terrorist organizations, any of which may exacerbate the risks described above. Similar risks exist to the extent that any portfolio companies, service providers, vendors or certain other parties have material operations or assets in the Middle East or the immediate surrounding areas. The United States has announced sanctions and other measures against Hamas-related persons and organizations in response to the October 7 Attacks, and the United States (and/or other countries) may announce further sanctions related to the ongoing conflict in the future.

Our investments are subject to environmental risks.

We may face significant environmental liability in connection with our investments. When compared to the United States, the historical lack or inadequacy of environmental regulation in certain

non-U.S.

countries has led to the widespread pollution of air, ground and water resources. The legislative framework for environmental liability in these countries has not been fully established or implemented. The extent of the responsibility, if any, for the costs of abating environmental hazards may be unclear when we are considering an investment. We may engage the services of qualified environmental consultants as necessary to assess the environmental condition of property which may be or is an investment. Nevertheless, we or a company in which we invest may be considered an owner or operator of properties on or in which asbestos or other hazardous or toxic substances

45

exist and, therefore, potentially liable for removal or remediation costs, as well as certain other related costs, including governmental fines and costs of injuries to persons and property. These costs can be substantially in excess of the value of the property. The presence of environmental contamination, pollutants or other hazardous or toxic substances on or emanating from a property (whether known at the time of acquisition or not) could also result in personal injury (and associated liability) to persons on or in the vicinity of the property and persons removing such materials, future or continuing property damage (which may adversely affect property value) or claims by third parties, including as a result of exposure to or damage from such materials through the spread of contaminants.

Environmental laws, regulations and regulatory initiatives play a significant role in the energy and utility industries and can have a substantial impact on investments in this industry. For example, global initiatives to minimize pollution have played a major role in the increase in demand for gas and alternative energy sources, creating numerous new investment opportunities. Conversely, required expenditures for environmental compliance have adversely impacted investment returns in a number of segments of the industry. The energy and utility industries will continue to face considerable oversight from environmental regulatory authorities. We may invest in portfolio companies that are subject to changing and increasingly stringent environmental and health and safety laws, regulations and permit requirements. There can be no guarantee that all costs and risks regarding compliance with environmental laws and regulations can be identified. New and more stringent environmental and health and safety laws, regulations and permit requirements or stricter interpretations of current laws or regulations could impose substantial additional costs on portfolio companies or potential investments. Compliance with such current or future environmental requirements does not ensure that the operations of the portfolio companies will not cause injury to the environment or to people under all circumstances or that the portfolio companies will not be required to incur additional unforeseen environmental expenditures. Moreover, failure to comply with any such requirements could have a material adverse effect on a portfolio company, and there can be no assurance that portfolio companies will at all times comply with all applicable environmental laws, regulations and permit requirements. Past practices or future operations of portfolio companies could also result in material personal injury or property damage claims, which could have an adverse effect on our performance.

We and/or our portfolio companies may be materially and adversely impacted by global climate change.

Global climate change is widely considered to be a significant threat to the global economy. Real estate and similar assets in particular may face risks associated with climate change, including risks related to the impact of climate-related legislation and regulation (both domestically and internationally), risks related to climate-related business trends, and risks stemming from the physical impacts of climate change, such as the increasing frequency or severity of extreme weather events and rising sea levels and temperatures.

The market’s focus on climate change may not have a positive impact on our investments.

Financial resources and public and private investment into business activities seeking to address climate change, reduce emissions and promote adaptation to climate change-related impacts are increasing. While financial and

non-financial

benefits may flow from these types of investments, Oaktree cannot guarantee that such activities will improve the financial or environmental, social and governance-related performance of the investment, reduce emissions or promote adaptation to climate change-related impacts and Oaktree may also not find itself in a position to maximize opportunities presented by such business activities whether in respect of financial or

non-financial

returns.

Additionally, the Paris Agreement and other regulatory and voluntary initiatives launched by international, federal, state, and regional policymakers and regulatory authorities as well as private actors seeking to reduce greenhouse gas (“GHG”) emissions may expose real estate and similar assets to

so-called

“transition risks” in addition to physical risks, such as: (i) political and policy risks (e.g., changing regulatory incentives and legal requirements, including with respect to GHG emissions, that could result in increased costs or changes in

46

business operations), (ii) regulatory and litigation risks (e.g., changing legal requirements that could result in increased permitting, tax and compliance costs, changes in business operations, or the discontinuance of certain operations, and litigation seeking monetary or injunctive relief related to impacts related to climate change), (iii) technology and market risks (e.g., declining market for assets, products and services seen as GHG intensive or less effective than alternatives in reducing GHG emissions) and (iv) reputational risks (e.g., risks tied to changing investor, customer or community perceptions of an asset’s relative contribution to GHG emissions). Oaktree cannot rule out the possibility that climate risks, including changes in weather and climate patterns, could result in unanticipated delays or expenses and, under certain circumstances, could prevent completion of investment activities or the effective management of real estate and similar assets once undertaken, any of which could have a material adverse effect on an investment, or us.

We may invest in derivative instruments from time to time, which present various risks, including market, counterparty, operational and liquidity risks.

Our use of derivatives will largely be limited to hedging certain foreign currency exposures in order to manage risk and return trade-offs, and we may also engage in interest rate hedging or other hedging strategies. While these transactions may reduce certain risks, the transactions themselves entail certain other risks, including counterparty credit risk. Hedging against a decline in the value of a portfolio position does not eliminate fluctuations in the values of portfolio positions or prevent losses if the values of those positions decline, but instead establishes other positions designed to gain from those same developments, thus offsetting the decline in the portfolio positions value. These types of hedging transactions also limit the opportunity for gain if the value of the portfolio position increases. Moreover, it may not be possible to hedge against currency exchange rate, interest rate or public security price fluctuations at a price sufficient to provide protection from the decline in the value of the portfolio position.

While not anticipated to be a meaningful aspect of our investment strategy, we may also invest in

(“OTC”) derivative instruments from time to time. Although we expect to invest in OTC contracts on a bilateral basis with banks or other dealers, we may invest in certain derivatives that are traded on swap execution facilities, security-based swap execution facilities or other similar multi-lateral trading platforms. Certain of such derivatives may be cleared through central counterparties (“CCPs”).

Investing in derivative instruments, particularly OTC derivatives, presents various risks, including market, counterparty, operational and liquidity risks. The prices of derivative instruments, including swaps, forwards and options, may be highly volatile. The value of derivatives also depends upon the price of the underlying security or other asset or index. Typically, investing in a derivative instrument requires the deposit or payment of an initial amount much smaller than the notional or exposure amount from such derivative instrument. Therefore, if the relevant cash market moves against the Fund, we will suffer a larger loss than it would have by directly investing in the underlying security or other asset or index. As discussed below, OTC derivatives are also subject to the default and credit risk of the counterparty if they are not cleared through CCPs, while centrally cleared derivatives are subject to the credit risk of the CCP and the relevant futures commission merchant or other clearing broker. In addition, significant disparities may exist between “bid” and “ask” prices for derivative instruments that are traded

and not on an exchange. While such OTC derivatives are subject to increased regulation under the Dodd-Frank Act, the investor protections and other regulations applicable to such OTC derivatives differ from those applicable to futures and other exchange-traded instruments, as discussed below. In addition, compared with such exchange-traded instruments, the market for OTC derivatives is less liquid. Although OTC derivative instruments are designed to be tailored to meet particular financing and other needs and, therefore, typically provide more flexibility than exchange-traded products, the risk of illiquidity is also greater as these instruments can generally be closed out only by negotiation with the counterparty. In volatile markets, we may not be able to close out a position without incurring a significant amount of loss.

We may also enter into certain other types of swaps, including total return swaps, rate of return swaps, credit default swaps (including index-related credit default swaps), interest rate swaps and credit-linked securities. OTC

47

credit default swaps are bilateral agreements between two parties that transfer a defined credit risk from one party to another.

Swaps transactions, like other financial transactions, involve a variety of significant risks. The specific risks presented by a particular swap transaction necessarily depend upon the terms of the transaction and our circumstances. In general, however, all swaps transactions involve some combination of market risk, credit risk, counterparty credit risk, funding risk, liquidity risk and operational risk. Highly customized swaps transactions in particular may increase liquidity risk. Highly leveraged transactions may experience substantial gains or losses in value as a result of relatively small changes in the value or level of an underlying or related market factor. In evaluating the risks and contractual obligations associated with a particular swap transaction, it is important to consider that a swap transaction may be modified or terminated only by mutual consent of the original parties and subject to agreement on individually negotiated terms. Therefore, it may not be possible for us to modify, terminate or offset our obligations under a swap or our exposure to the risks associated with a swap prior to its scheduled termination date.

Rule

18f-4

under the Investment Company Act addresses the ability of a BDC to use derivatives and other transactions that create future payment or delivery obligations (except reverse repurchase agreements and similar financing transactions). Under the rule, BDCs that use derivatives are subject to a

leverage limit, a derivatives risk management program, testing requirements and requirements related to board reporting. These new requirements will apply unless the BDC qualifies as a “limited derivatives user,” as defined under the rules. We believe we qualify as a limited derivative user under the rule. Under the rule, a BDC may enter into an unfunded commitment agreement that is not a derivatives transaction, such as an agreement to provide financing to a portfolio company, if the BDC has, among other things, a reasonable belief, at the time it enters into such an agreement, that it will have sufficient cash and cash equivalents to meet its obligations with respect to all of its unfunded commitment agreements, in each case as it becomes due. Collectively, these requirements may limit our ability to use derivatives and/or enter into certain other financial contracts.

Investments in options and warrants present risk of loss, including as a result of price movements of underlying securities.

The successful use of options and warrants depends principally on the price movements of the underlying securities. In addition, when we purchase an option or warrant, we run the risk that we will lose our entire investment in a relatively short period of time if the option or warrant turns out to be worthless at the time of its exercise. If the price of the underlying security does not rise (in the case of a call) or fall (in the case of a put) to an extent sufficient to cover the option premium and transaction costs, we will lose part or all of our investment in the option. There is no assurance that we will be able to effect closing transactions at any particular time or at any acceptable price. In the event of the bankruptcy of a broker through which we engage in transactions in options or warrants, we could experience delays or losses in liquidating open positions purchased or sold through the broker.

We will bear certain risks associated with any bridge financing we provide to portfolio companies.

We may provide bridge financing to a portfolio company in order to facilitate an investment we organize. Such bridge financings would typically be convertible into more permanent, long-term positions. We will bear the risk of any changes in capital markets, which may adversely affect the ability to refinance any bridge investments. For reasons not always in our or the Adviser’s control, such refinancings may not occur and such bridge financings may remain outstanding. In such event, the failure to refinance could lead to increased risk and cost to the Fund.

Securities purchased or sold on a when-issued, “when, as and if issued,” delayed delivery or forward commitment basis could increase the volatility of our NAV.

Securities purchased or sold by the Fund on a when-issued, “when, as and if issued,” delayed delivery or forward commitment basis are subject to market fluctuation, and no interest or dividends accrue to the purchaser prior to

48

the settlement date. At the time of delivery of the securities, the value may be more or less than the purchase or sale price. In the case of “when, as and if issued” securities, the Fund could lose an investment opportunity if the securities are not issued. An increase in the percentage of our assets committed to the purchase of securities on a when issued, “when, as and if issued,” delayed delivery or forward commitment basis may increase the volatility of our NAV.

We invest in significant amounts of loans or other debt instruments, including debt-like instruments such as preferred equity, and bank loans and participations, which pose unique risks.

Our investment program includes investments in significant amounts of loans or other debt instruments, including debt-like instruments such as preferred equity, a significant amount of bank loans and participations, as well as other direct lending transactions. These obligations are subject to unique risks, including (a) the possible invalidation of an investment transaction as a fraudulent conveyance under relevant creditors’ rights laws,

(b) so-called

lender-liability claims by the issuer of the obligations, (c) environmental liabilities that may arise with respect to collateral securing the obligations and (d) limitations on our ability to enforce directly our rights with respect to participations. In analyzing each loan or other debt instrument, we compare the relative significance of the risks against the expected benefits of the investment. Successful claims by third parties arising from these and other risks, absent certain conduct by the Adviser, Oaktree, their respective affiliates and certain other individuals, will be borne by the Fund. In addition, the settlement process for the purchase of bank loans can take significantly longer than the timeframes established by the Loan Syndications & Trading Association and comparable

non-U.S.

bodies. The longer a trade is outstanding between the counterparties, the greater the risk of additional operational and settlement issues and the potential for our counterparty to fail to perform. In addition, our investment program may include investments in second lien loans. The nature of second lien loans will entail risks related to priority with respect to collateral, including (a) the subordination of our claims to a senior lien in terms of the coverage and recovery of the collateral and (b) the prohibition of, or limitation on, the right to foreclose on a second lien or exercise other rights as a second lien holder. In certain cases, therefore, no recovery may be available from a defaulted second lien loan.

If we purchase a participation, we will not have established any direct contractual relationship with the borrower. We will be required to rely on the lender or the participant that sold the participation, not only for the enforcement of our rights against the borrower, but also for the receipt and processing of payments due to us under the participation. We will therefore be subject to the credit risk of both the borrower and the selling lender or participant. Because it may be necessary to assert through the selling lender or participant such rights as may exist against the borrower, in the event the borrower fails to pay principal and interest when due, such assertion of rights against the borrower may be subject to delays, expenses and risks that are greater than those that would be involved if we could enforce our rights against the borrower directly.

Loans or other debt instruments we make or acquire may become

non-performing

following their acquisition for a wide variety of reasons. Such

non-performing

loans or debt instruments may require a substantial amount of workout negotiations or restructuring, which may entail, among other things, a substantial reduction in the interest rate and a substantial write-down of principal. It is possible that we may find it necessary or desirable to foreclose on collateral securing one or more loans we have purchased. The foreclosure process varies jurisdiction by jurisdiction and can be lengthy and expensive.

See

“—We invest in bank loans, which have associated risks that are different from those of other debt instruments”

for additional risks associated with investing in bank loans.

Our portfolio companies may incur debt that ranks equally with, or senior to, our investments in such companies.

The characterization of an investment as senior debt or senior secured debt does not mean that such debt will necessarily have repayment priority with respect to all other obligations of an issuer. Issuers may have, and/or

49

may be permitted to incur, other debt and liabilities that rank equally with or senior to the senior loans in which we invest. If other indebtedness is incurred that ranks in parity in right of payment or proceeds of collateral with respect to senior loans in which we invest, we would have to share on an equal basis any distributions with other creditors in the event of a liquidation, reorganization, insolvency, dissolution or bankruptcy of such an issuer. Where we hold a first lien to secure senior indebtedness, the issuers may be permitted to issue other senior loans with liens that rank junior to the first liens granted to us. The intercreditor rights of the holders of such other junior lien debt may, in any liquidation, reorganization, insolvency, dissolution or bankruptcy of such an issuer, affect the recovery that we would have been able to achieve in the absence of such other debt.

Even where the senior loans we hold are secured by a perfected lien over a substantial portion of the assets of an issuer and its subsidiaries, the issuer and its subsidiaries will often be able to incur a substantial amount of additional indebtedness, which may have an exclusive lien over particular assets. For example, debt and other liabilities incurred by

non-guarantor

subsidiaries of issuers will be structurally senior to the debt we hold. Accordingly, any such debt and other liabilities of such subsidiaries would, in the event of liquidation, dissolution, insolvency, reorganization or bankruptcy of such subsidiary, be repaid in full before any distributions to an obligor of the loans we hold. Furthermore, these other assets over which other lenders have a lien may be substantially more liquid or valuable than the assets over which we have a lien. We may also invest in second-lien secured debt, which compounds the risks described in this paragraph.

We may invest in secured or unsecured loans and are subject to risk of loss upon a borrower default.

In the event of a default by a borrower, we might not receive payments to which we are entitled and thereby could experience a decline in the value of our investments in the borrower. If we invest in debt that is not secured by collateral, in the event of such default, we will have only an unsecured claim against the borrower. In the case of second lien loans that are secured by collateral, while the Adviser generally expects the value of the collateral to be greater than the value of such secured second lien loans, the value of the collateral may actually be equal to or less than the value of such second lien loans or may decline below the outstanding amount of such second lien loans subsequent to our investment. Our ability to have access to the collateral may be limited by bankruptcy and other insolvency laws. Under certain circumstances, the collateral may be released with the consent of the lenders or pursuant to the terms of the underlying loan agreement with the borrower. There is no assurance that the liquidation of the collateral securing a loan would occur in a timely fashion or would satisfy the borrower’s obligation in the event of nonpayment of scheduled interest or principal, or that the collateral could be readily liquidated. As a result, we might not receive full payment on a secured loan investment to which we are entitled and thereby may experience a decline in the value of, or a loss on, the investment.

We invest in companies that are highly leveraged, and, in most cases, our investments in such companies will be in below investment grade securities, which are viewed as having predominately speculative characteristics.

We invest in companies that are highly leveraged, and, in most cases, our investments in such companies are not rated by any rating agency. If such investments were rated, the Adviser believes that they would likely receive a rating from a nationally recognized statistical rating organization of below investment grade (i.e., below

BBB-

or Baa), which is often referred to as “high yield” and “junk.” Exposure to below investment grade securities involves certain risks, and those securities are viewed as having predominately speculative characteristics with respect to the issuer’s capacity to pay interest and repay principal. Securities in the lower-rated categories and comparable

non-rated

securities are subject to greater risk of loss of principal and interest than higher-rated and comparable

non-rated

securities and are generally considered to be predominantly speculative with respect to the issuer’s capacity to pay interest and repay principal. Such issuers typically are highly leveraged, with significant burdens on cash flow and, therefore, involve a high degree of financial risk. During an economic downturn or recession, securities of financially troubled or operationally troubled issuers are more likely to go into default than securities of other issuers. Because investors generally perceive that there are greater risks associated with the lower-rated and comparable

non-rated

securities, the yields and prices of such securities may be more volatile than those for higher-rated and comparable

non-rated

securities. The market for lower-rated and comparable

50

non-rated

securities is thinner, often less liquid and less active than that for higher-rated or comparable

non-rated

securities, and the market prices of such securities are subject to erratic and abrupt movements. The spread between bid and asked prices for such securities may be greater than normally expected. Such factors can adversely affect the prices at which these securities can be sold and may even make it difficult to sell such securities.

Investment in the securities of financially troubled issuers and operationally troubled issuers involves a high degree of credit and market risk. These financial difficulties may never be overcome and may cause issuers to become subject to bankruptcy proceedings.

Non-performance

or defaults by our portfolio companies would harm our operating results.

Our investment program is comprised of investments in loans or other debt instruments, focused on direct lending transactions. These obligations are subject to unique risks, including (a) the possible invalidation of investment transactions as fraudulent conveyances or preferential payments under relevant creditors’ rights and bankruptcy laws or the subordination of claims under

so-called

“equitable subordination” common law principles,

(b) so-called

lender-liability claims by the issuer of the obligations and (c) environmental liabilities that may arise with respect to collateral securing the obligations. In analyzing each loan or other debt instrument, we will compare the relative significance of the risks against the expected benefits of the investment. Successful claims by third parties arising from these and other risks, absent certain conduct by the Adviser, its affiliates and certain other individuals, will be borne by us.

Loans or other debt instruments made or otherwise acquired by us may become

non-performing

following their origination or acquisition for a wide variety of reasons. Such

non-performing

loans or debt instruments may require a substantial amount of workout negotiations or restructuring, which may entail, among other things, a substantial reduction in the interest rate and a substantial write-down of principal. It is possible that we may find it necessary or desirable to foreclose on collateral securing one or more loans purchased by us. The foreclosure process varies jurisdiction by jurisdiction and can be lengthy and expensive. Borrowers often resist foreclosure actions by asserting numerous claims, counterclaims and defenses against the holder of a real estate loan, including lender liability claims and defenses, even when such assertions may have no basis in fact, in an effort to prolong the foreclosure action. In some states, foreclosure actions can take up to several years or more to conclude. At any time during the foreclosure proceedings, the borrower may file for bankruptcy, staying the foreclosure action and further delaying the foreclosure process. Foreclosure litigation tends to create a negative public image of the collateral property and may result in disrupting ongoing leasing and management of the property.

A portfolio company’s failure to satisfy financial or operating covenants imposed by us or other lenders could lead to defaults and, potentially, termination of its loans and foreclosure on its secured assets, which could trigger cross-defaults under other agreements and jeopardize a portfolio company’s ability to meet its obligations under the debt or equity securities that we hold. We may incur expenses to the extent necessary to seek recovery upon default or to negotiate new terms, which may include the waiver of certain financial covenants, with a defaulting portfolio company. In addition, we may write-down the value of a portfolio company investment upon the worsening of the financial condition of the portfolio company or in anticipation of a default, which could also have a material adverse effect on our business, financial condition and results of operations.

We may invest in event-driven special situations.

We may invest in companies that become involved in (or the target of) acquisition attempts or tender offers or in companies involved in or undergoing spin-offs or reorganizations, or that become the subject of work-outs, liquidations or bankruptcies or other catalytic changes or similar transactions. In any investment opportunity involving any such type of special situation, there exists the risk that the contemplated transaction either will be unsuccessful, will take considerable time or will result in a distribution of cash or a new security the value of

51

which will be less than the purchase price to the Fund of the security or other financial instrument in respect of which such distribution is received. Similarly, if an anticipated transaction does not in fact occur, we may be required to sell its investment at a loss. Because there is substantial uncertainty concerning the outcome of transactions involving financially troubled companies in which we may be invested, there is a potential risk of loss of our entire investment in such companies.

We invest in lower-rated loans and debt instruments, which are subject to greater risk of loss of principal and interest than higher-rated loans and debt instruments.

Because we invest in loans and other debt instruments that are rated below investment grade by the various credit rating agencies, or trade at a yield similar to

non-investment

grade debt (and in comparable

non-rated

loans), the Adviser must take into account the special nature of such loans and debt instruments and certain special considerations in assessing the risks associated with such investments. Loans and debt instruments rated in the lower rating categories are subject to greater risk of loss of principal and interest than higher-rated loans and debt instruments and are generally considered to be predominantly speculative with respect to the borrower’s capacity to pay interest and repay principal. They are also considered to be subject to greater risk than investment grade rated debt instruments in the case of deterioration of general economic conditions. Because investors perceive that there are greater risks associated with such loans and debt instruments, the yields and prices of such loans and debt instruments may be more volatile than those for higher-rated loans and debt instruments. The market for lower-rated loans and debt instruments is thinner, often less liquid and less active than that for higher-rated loans and debt instruments, which can adversely affect the prices at which such loans and debt instruments can be sold and may even make it impractical to sell such loans or debt instruments. It should be recognized that an economic downturn is likely to have a negative effect on the debt market and on the value of the loans and debt instruments held by the Fund as well as on the ability of the borrowers of such debt, especially highly leveraged borrowers, to service principal and interest payment obligations to meet their projected business goals or to obtain additional financing. If a borrower of a loan owned by the Fund defaults on such loan, we may incur additional expenses to seek recovery, and the possibility of any recovery may be subject to the expense and uncertainty of insolvency proceedings.

We invest in bank loans, which have associated risks that are different from those of other debt instruments.

Our investment program includes investments in significant amounts of bank loans. Bank loans may not be deemed to be “securities” for purposes of the federal securities laws and therefore may not have the protections afforded by the federal securities laws, including anti-fraud protections. In addition, bank loans have a longer settlement period as compared to other debt instruments. When compared to the purchase of high yield bonds, which typically settle within three business days after the initial trade date, the settlement process for the purchase of bank loans can take several days and, in certain instances, several weeks longer than a bond trade. The longer a trade is outstanding between the counterparties may increase the risk of additional operational and settlement issues and the potential for our counterparty to fail to perform.

Borrowers may elect to repay the principal on an obligation earlier than expected.

Our investments will typically permit the borrowers to voluntarily prepay directly originated senior secured loans and other debt investments at any time, either with no or a nominal prepayment premium. Borrowers may elect to repay the principal on an obligation earlier than expected. This may happen, including when there is a decline in interest rates, or when an issuer’s improved credit or operating or financial performance allows the refinancing of certain classes of debt with lower cost debt. Assuming an improvement in a borrower’s or the credit market conditions, early repayments of the debt held by the Fund could increase. Generally, our investments are not expected to include a significant premium payable upon the repayment of such senior debt.

We may engage in short sale transactions.

We may engage in short sale transactions for hedging purposes. Short sales can, in certain circumstances, substantially increase the impact of adverse price movements on our portfolio. A short sale of a security involves

52

the risk of a theoretically unlimited loss from a theoretically unlimited increase in the market price of the security that could result in an inability to cover the short position. In addition, there can be no assurance that securities necessary to cover a short position will be available for purchase.

Our investment portfolios may be subject to high turnover rates, which will increase commission and transaction costs.

The different strategies we use may require frequent trading and a high portfolio turnover. The more frequently we trade, the higher the commission and transaction costs and certain other expenses involved in our operations. We will bear these costs regardless of the profitability of our investment and trading activities. In addition, a high portfolio turnover may increase the recognition of short-term, rather than long-term, capital gains.

Both our portfolio companies and the Fund may be leveraged.

Our investments include companies whose capital structures may have significant leverage. Such investments are inherently more sensitive to declines in revenues and to increases in expenses and interest rates. The leveraged capital structure of such investments will increase the exposure of the portfolio companies to adverse economic factors, such as downturns in the economy or deterioration in the condition of the portfolio company or its industry. Additionally, the securities we acquire may be the most junior in what will typically be a complex capital structure, and, thus, subject to the greatest risk of loss.