UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSRS

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number 811-23718

Catholic Responsible Investments Funds

(Exact name of registrant as specified in charter)

One Freedom Valley Drive

Oaks, Pennsylvania 19456

(Address of principal executive offices) (Zip code)

Michael Beattie

c/o SEI Investments

One Freedom Valley Drive

Oaks, Pennsylvania 19456 (Name and address of agent for service)

Registrant’s telephone number, including area code: 1-866-348-6466

Date of fiscal year end: October 31, 2023

Date of reporting period: April 30, 2023

| Item 1. | Reports to Stockholders. |

The registrant’s schedules as of the close of the reporting period, pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (the “Act”) (17 CFR § 270.30e-1), are attached hereto.

Catholic Responsible Investments

Semi-Annual Report April 30, 2023

| | | | | | |

| | | CRI Ultra Short Bond Fund Institutional Shares: CRHSX CRI Short Duration Bond Fund Institutional Shares: CRDSX CRI Bond Fund Investor Shares: CRBVX Institutional Shares: CRBSX CRI Opportunistic Bond Fund Investor Shares: CROVX Institutional Shares: CROSX CRI Equity Index Fund Institutional Shares: CRQSX CRI Small-Cap Fund Institutional Shares: CRSSX CRI Multi-Style US Equity Fund Investor Shares: CRTVX Institutional Shares: CRTSX | | CRI International Equity Fund Investor Shares: CRLVX Institutional Shares: CRLSX CRI International Small-Cap Fund Institutional Shares: CRNSX CRI Magnus 45/55 Fund Investor Shares: CMNVX Institutional Shares: CMNSX CRI Magnus 60/40 Alpha Plus Fund Investor Shares: CMPVX Institutional Shares: CMPSX CRI Magnus 60/40 Beta Plus Fund Investor Shares: CMMVX Institutional Shares: CMMSX CRI Magnus 75/25 Fund Investor Shares: CMUVX Institutional Shares: CMUSX | | |

Investment Adviser:

Christian Brothers Investment Services

CATHOLIC RESPONSIBLE INVESTMENTS

APRIL 30, 2023 (Unaudited)

TABLE OF CONTENTS

The Funds file their complete schedules of investments with the Securities and Exchange Commission (“SEC”) for the first and third quarters of each fiscal year as an exhibit to its reports on Form N-PORT. The Funds’ Form N-PORT reports are available on the SEC’s website at http://www.sec.gov, and may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

A description of the policies and procedures that the Funds use to determine how to vote proxies relating to fund securities, as well as information relating to how the Fund voted proxies relating to fund securities during the most recent 12-month period ended June 30, is available (i) without charge, upon request, by calling 1- 866-392-2626; and (ii) on the SEC’s website at http://www.sec.gov.

1

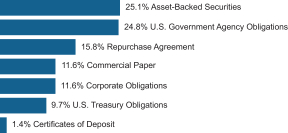

CATHOLIC RESPONSIBLE INVESTMENTS ULTRA SHORT BOND FUND

APRIL 30, 2023 (Unaudited)

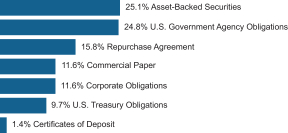

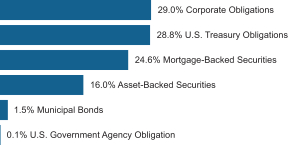

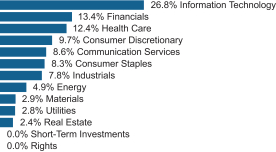

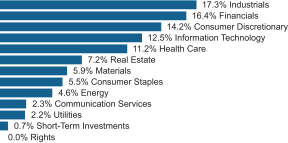

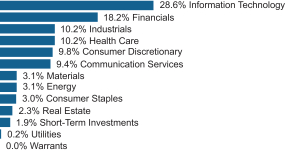

† Percentages are based on total investments. Total investments do not include derivatives such as options, futures contracts, forward contracts, and swap contracts, if applicable.

| | | | | | | | |

SCHEDULE OF INVESTMENTS | |

ASSET-BACKED SECURITIES — 24.6% | |

| | |

| | | Face

Amount | | | Value | |

| | |

Automotive — 21.6% | | | | | | | | |

Ally Auto Receivables Trust, Ser 2022-3, Cl A2 | | | | | | | | |

5.290%, 06/16/25 | | $ | 95,000 | | | $ | 94,846 | |

American Credit Acceptance Receivables Trust, Ser 2022-2, Cl A | | | | | | | | |

2.660%, 02/13/26 (A) | | | 36,718 | | | | 36,625 | |

American Credit Acceptance Receivables Trust, Ser 2022-3, Cl A | | | | | | | | |

4.120%, 02/13/26 (A) | | | 17,125 | | | | 17,040 | |

American Credit Acceptance Receivables Trust, Ser 2023-1, Cl A | | | | | | | | |

5.450%, 09/14/26 (A) | | | 206,123 | | | | 205,684 | |

American Credit Acceptance Receivables Trust, Ser 2023-2, Cl A | | | | | | | | |

5.890%, 10/13/26 (A) | | | 105,000 | | | | 105,006 | |

AmeriCredit Automobile Receivables Trust, Ser 2019-2, Cl C | | | | | | | | |

2.740%, 04/18/25 | | | 158,332 | | | | 157,303 | |

AmeriCredit Automobile Receivables Trust, Ser 2020-3, Cl A3 | | | | | | | | |

0.530%, 06/18/25 | | | 44,234 | | | | 43,810 | |

AmeriCredit Automobile Receivables Trust, Ser 2021-1, Cl A3 | | | | | | | | |

0.370%, 08/18/25 | | | 94,481 | | | | 93,139 | |

AmeriCredit Automobile Receivables Trust, Ser 2021-3, Cl A2 | | | | | | | | |

0.410%, 02/18/25 | | | 8,888 | | | | 8,867 | |

| | | | | | | | |

| ASSET-BACKED SECURITIES — continued | |

| | |

| | | Face

Amount | | | Value | |

AmeriCredit Automobile Receivables Trust, Ser 2022-1, Cl A2 | | | | | | | | |

2.050%, 01/20/26 | | $ | 235,160 | | | $ | 232,980 | |

AmeriCredit Automobile Receivables Trust, Ser 2022-2, Cl A2A | | | | | | | | |

4.200%, 12/18/25 | | | 60,837 | | | | 60,335 | |

Americredit Automobile Receivables Trust,

Ser 2023-1, Cl A1 | | | | | | | | |

5.154%, 03/18/24 | | | 400,000 | | | | 399,959 | |

ARI Fleet Lease Trust, Ser 2020-A, Cl A3 | | | | | | | | |

1.800%, 08/15/28 (A) | | | 320,365 | | | | 318,251 | |

ARI Fleet Lease Trust, Ser 2021-A, Cl A2 | | | | | | | | |

0.370%, 03/15/30 (A) | | | 295,552 | | | | 292,592 | |

ARI Fleet Lease Trust,

Ser 2023-A, Cl A1 | | | | | | | | |

5.426%, 04/15/24 (A) | | | 375,000 | | | | 374,916 | |

BMW Vehicle Lease Trust, Ser 2021-1, Cl A4 | | | | | | | | |

0.370%, 07/25/24 | | | 325,000 | | | | 321,178 | |

BMW Vehicle Lease Trust, Ser 2021-2, Cl A4 | | | | | | | | |

0.430%, 01/27/25 | | | 400,000 | | | | 385,527 | |

BMW Vehicle Lease Trust, Ser 2023-1, Cl A1 | | | | | | | | |

4.831%, 02/26/24 | | | 193,050 | | | | 193,019 | |

BMW Vehicle Owner Trust, Ser 2019-A, Cl A4 | | | | | | | | |

1.950%, 01/26/26 | | | 309,719 | | | | 308,330 | |

BMW Vehicle Owner Trust, Ser 2022-A, Cl A2B | | | | | | | | |

5.335%, SOFR30A + 0.520%, 12/26/24 (B) | | | 35,489 | | | | 35,501 | |

CarMax Auto Owner Trust, Ser 2022-2, Cl A2B | | | | | | | | |

5.350%, SOFR30A + 0.600%, 05/15/25 (B) | | | 28,297 | | | | 28,293 | |

CarMax Auto Owner Trust, Ser 2023-1, Cl A1 | | | | | | | | |

4.964%, 02/15/24 | | | 85,917 | | | | 85,937 | |

CarMax Auto Owner Trust, Ser 2023-2, Cl A1 | | | | | | | | |

5.508%, 05/15/24 | | | 162,000 | | | | 162,081 | |

Carvana Auto Receivables Trust, Ser 2021-N2, Cl A1 | | | | | | | | |

0.320%, 03/10/28 | | | 4,211 | | | | 4,176 | |

Chesapeake Funding II,

Ser 2020-1A, Cl A1 | | | | | | | | |

0.870%, 08/15/32 (A) | | | 456,410 | | | | 453,155 | |

The accompanying notes are an integral part of the financial statements.

2

CATHOLIC RESPONSIBLE INVESTMENTS ULTRA SHORT BOND FUND

APRIL 30, 2023 (Unaudited)

| | | | | | | | |

| ASSET-BACKED SECURITIES — continued | |

| | |

| | | Face

Amount | | | Value | |

CPS Auto Receivables Trust, Ser 2019-D, Cl D | | | | | | | | |

2.720%, 09/15/25 (A) | | $ | 116,620 | | | $ | 115,904 | |

CPS Auto Receivables Trust, Ser 2022-C, Cl A | | | | | | | | |

4.180%, 04/15/30 (A) | | | 58,160 | | | | 57,683 | |

CPS Auto Receivables Trust, Ser 2023-A, Cl A | | | | | | | | |

5.540%, 03/16/26 (A) | | | 189,988 | | | | 189,560 | |

Credit Acceptance Auto Loan Trust, Ser 2021-3A, Cl A | | | | | | | | |

1.000%, 05/15/30 (A) | | | 375,000 | | | | 363,508 | |

Donlen Fleet Lease Funding 2, Ser 2021-2, Cl A1 | | | | | | | | |

5.220%, ICE LIBOR USD 1 Month + 0.330%, 12/11/34 (A)(B) | | | 95,794 | | | | 95,494 | |

Drive Auto Receivables Trust, Ser 2020-2, Cl C | | | | | | | | |

2.280%, 08/17/26 | | | 44,407 | | | | 44,174 | |

Drive Auto Receivables Trust, Ser 2021-1, Cl C | | | | | | | | |

1.020%, 06/15/27 | | | 116,529 | | | | 114,401 | |

DT Auto Owner Trust, Ser 2021-1A, Cl B | | | | | | | | |

0.620%, 09/15/25 (A) | | | 27,718 | | | | 27,665 | |

DT Auto Owner Trust, Ser 2021-3A, Cl A | | | | | | | | |

0.330%, 04/15/25 (A) | | | 16,156 | | | | 16,122 | |

Enterprise Fleet Financing, Ser 2019-3, Cl A3 | | | | | | | | |

2.190%, 05/20/25 (A) | | | 270,729 | | | | 270,092 | |

Enterprise Fleet Financing, Ser 2020-1, Cl A3 | | | | | | | | |

1.860%, 12/22/25 (A) | | | 450,000 | | | | 446,547 | |

Enterprise Fleet Financing, Ser 2021-2, Cl A2 | | | | | | | | |

0.480%, 05/20/27 (A) | | | 365,211 | | | | 350,676 | |

Enterprise Fleet Financing, Ser 2023-1, Cl A1 | | | | | | | | |

5.330%, 03/20/24 (A) | | | 152,269 | | | | 152,183 | |

Exeter Automobile Receivables Trust, Ser 2020-2A, Cl C | | | | | | | | |

3.280%, 05/15/25 (A) | | | 78,368 | | | | 78,291 | |

Exeter Automobile Receivables Trust, Ser 2021-3A, Cl B | | | | | | | | |

0.690%, 01/15/26 | | | 47,220 | | | | 46,752 | |

Exeter Automobile Receivables Trust, Ser 2022-1A, Cl A3 | | | | | | | | |

1.540%, 07/15/25 | | | 81,320 | | | | 81,103 | |

Exeter Automobile Receivables Trust, Ser 2022-3A, Cl A2 | | | | | | | | |

3.450%, 08/15/24 | | | 6,434 | | | | 6,429 | |

| | | | | | | | |

| ASSET-BACKED SECURITIES — continued | |

| | |

| | | Face

Amount | | | Value | |

Exeter Automobile Receivables Trust, Ser 2022-4A, Cl A2 | | | | | | | | |

3.990%, 08/15/24 | | $ | 13,626 | | | $ | 13,617 | |

Exeter Automobile Receivables Trust, Ser 2022-4A, Cl A3 | | | | | | | | |

4.330%, 02/17/26 | | | 250,000 | | | | 248,678 | |

Exeter Automobile Receivables Trust, Ser 2022-5A, Cl A2 | | | | | | | | |

5.290%, 01/15/25 | | | 299,522 | | | | 299,487 | |

Exeter Automobile Receivables Trust, Ser 2023-1A, Cl A2 | | | | | | | | |

5.610%, 06/16/25 | | | 70,000 | | | | 69,939 | |

First Investors Auto Owner Trust, Ser 2021-1A, Cl A | | | | | | | | |

0.450%, 03/16/26 (A) | | | 31,744 | | | | 31,581 | |

Flagship Credit Auto Trust, Ser 2020-3, Cl B | | | | | | | | |

1.410%, 09/15/26 (A) | | | 127,547 | | | | 126,508 | |

Flagship Credit Auto Trust, Ser 2021-2, Cl A | | | | | | | | |

0.370%, 12/15/26 (A) | | | 89,534 | | | | 88,438 | |

Flagship Credit Auto Trust, Ser 2022-1, Cl A | | | | | | | | |

1.790%, 10/15/26 (A) | | | 197,284 | | | | 191,852 | |

Flagship Credit Auto Trust, Ser 2023-1, Cl A1 | | | | | | | | |

4.922%, 02/15/24 (A) | | | 160,462 | | | | 160,478 | |

Flagship Credit Auto Trust, Ser 2023-2, Cl A1 | | | | | | | | |

5.420%, 05/15/24 (A) | | | 250,000 | | | | 250,043 | |

Ford Credit Auto Lease Trust, Ser 2021-A, Cl B | | | | | | | | |

0.470%, 05/15/24 | | | 175,592 | | | | 175,185 | |

Ford Credit Auto Lease Trust, Ser 2021-B, Cl A3 | | | | | | | | |

0.370%, 10/15/24 | | | 371,840 | | | | 367,390 | |

Ford Credit Auto Lease Trust, Ser 2022-A, Cl A2B | | | | | | | | |

5.350%, SOFR30A + 0.600%, 10/15/24 (B) | | | 20,751 | | | | 20,754 | |

Ford Credit Auto Lease Trust, Ser 2023-A, Cl A1 | | | | | | | | |

4.959%, 02/15/24 | | | 76,410 | | | | 76,391 | |

Ford Credit Auto Owner Trust, Ser 2022-D, Cl A1 | | | | | | | | |

4.594%, 12/15/23 | | | 37,115 | | | | 37,117 | |

Ford Credit Auto Owner Trust, Ser 2023-A, Cl A1 | | | | | | | | |

5.028%, 04/15/24 | | | 126,965 | | | | 126,990 | |

Foursight Capital Automobile Receivables Trust, Ser 2023-1, Cl A1 | | | | | | | | |

4.974%, 02/15/24 (A) | | | 136,752 | | | | 136,714 | |

The accompanying notes are an integral part of the financial statements.

3

CATHOLIC RESPONSIBLE INVESTMENTS ULTRA SHORT BOND FUND

APRIL 30, 2023 (Unaudited)

| | | | | | | | |

| ASSET-BACKED SECURITIES — continued | |

| | |

| | | Face

Amount | | | Value | |

GLS Auto Receivables Issuer Trust, Ser 2021-2A, Cl B | | | | | | | | |

0.770%, 09/15/25 (A) | | $ | 77,623 | | | $ | 77,015 | |

GM Financial Automobile Leasing Trust, Ser 2021-2, Cl A4 | | | | | | | | |

0.410%, 05/20/25 | | | 200,000 | | | | 195,819 | |

GM Financial Automobile Leasing Trust, Ser 2021-3, Cl A3 | | | | | | | | |

0.390%, 10/21/24 | | | 447,541 | | | | 438,878 | |

GM Financial Automobile Leasing Trust, Ser 2022-2, Cl A2 | | | | | | | | |

2.930%, 10/21/24 | | | 92,577 | | | | 91,653 | |

GM Financial Automobile Leasing Trust, Ser 2023-1, Cl A1 | | | | | | | | |

4.948%, 02/20/24 | | | 118,434 | | | | 118,445 | |

GM Financial Consumer Automobile Receivables Trust, Ser 2023-1, Cl A1 | | | | | | | | |

4.890%, 01/16/24 | | | 214,016 | | | | 214,045 | |

GM Financial Consumer Automobile Receivables Trust, Ser 2023-2, Cl A1 | | | | | | | | |

5.186%, 04/16/24 | | | 330,000 | | | | 330,061 | |

Honda Auto Receivables Owner Trust, Ser 2020-1, Cl A3 | | | | | | | | |

1.610%, 04/22/24 | | | 33,128 | | | | 33,021 | |

Honda Auto Receivables Owner Trust, Ser 2020-1, Cl A4 | | | | | | | | |

1.630%, 10/21/26 | | | 300,000 | | | | 298,463 | |

Honda Auto Receivables Owner Trust, Ser 2021-1, Cl A3 | | | | | | | | |

0.270%, 04/21/25 | | | 348,366 | | | | 339,147 | |

Hyundai Auto Lease Securitization Trust, Ser 2021-B, Cl A3 | | | | | | | | |

0.330%, 06/17/24 (A) | | | 149,357 | | | | 147,839 | |

Hyundai Auto Lease Securitization Trust, Ser 2022-B, Cl A2B | | | | | | | | |

5.370%, SOFR30A + 0.620%, 10/15/24 (A)(B) | | | 63,588 | | | | 63,582 | |

Hyundai Auto Lease Securitization Trust, Ser 2023-A, Cl A2A | | | | | | | | |

5.200%, 04/15/25 (A) | | | 100,000 | | | | 99,825 | |

Hyundai Auto Receivables Trust, Ser 2019-B, Cl B | | | | | | | | |

2.210%, 04/15/25 | | | 100,000 | | | | 98,441 | |

Hyundai Auto Receivables Trust, Ser 2023-A, Cl A1 | | | | | | | | |

5.167%, 04/15/24 | | | 360,000 | | | | 360,144 | |

Mercedes-Benz Auto Lease Trust, Ser 2021-B, Cl A3 | | | | | | | | |

0.400%, 11/15/24 | | | 217,661 | | | | 213,375 | |

Nissan Auto Receivables Owner Trust, Ser 2020-A, Cl A3 | | | | | | | | |

1.380%, 12/16/24 | | | 152,260 | | | | 150,852 | |

| | | | | | | | |

| ASSET-BACKED SECURITIES — continued | |

| | |

| | | Face

Amount | | | Value | |

Nissan Auto Receivables Owner Trust, Ser 2023-A, Cl A1 | | | | | | | | |

5.424%, 05/15/24 | | $ | 130,000 | | | $ | 130,051 | |

Santander Drive Auto Receivables Trust, Ser 2021-1, Cl C | | | | | | | | |

0.750%, 02/17/26 | | | 123,490 | | | | 122,128 | |

Santander Drive Auto Receivables Trust, Ser 2022-2, Cl A3 | | | | | | | | |

2.980%, 10/15/26 | | | 315,915 | | | | 312,052 | |

Santander Drive Auto Receivables Trust, Ser 2022-4, Cl A2 | | | | | | | | |

4.050%, 07/15/25 | | | 59,295 | | | | 59,146 | |

Santander Drive Auto Receivables Trust, Ser 2022-5, Cl A2 | | | | | | | | |

3.980%, 01/15/25 | | | 293,060 | | | | 292,317 | |

Santander Drive Auto Receivables Trust, Ser 2022-5, Cl A3 | | | | | | | | |

4.110%, 08/17/26 | | | 225,000 | | | | 222,355 | |

Santander Drive Auto Receivables Trust, Ser 2022-6, Cl A2 | | | | | | | | |

4.370%, 05/15/25 | | | 53,718 | | | | 53,580 | |

Santander Drive Auto Receivables Trust, Ser 2023-1, Cl A2 | | | | | | | | |

5.360%, 05/15/26 | | | 355,000 | | | | 354,286 | |

Toyota Lease Owner Trust, Ser 2021-B, Cl A3 | | | | | | | | |

0.420%, 10/21/24 (A) | | | 256,784 | | | | 252,433 | |

Toyota Lease Owner Trust, Ser 2023-A, Cl A1 | | | | | | | | |

5.388%, 04/22/24 (A) | | | 204,000 | | | | 203,990 | |

United Auto Credit Securitization Trust, Ser 2022-2, Cl A | | | | | | | | |

4.390%, 04/10/25 (A) | | | 62,460 | | | | 62,229 | |

United Auto Credit Securitization Trust, Ser 2023-1, Cl A | | | | | | | | |

5.570%, 07/10/25 (A) | | | 128,488 | | | | 128,274 | |

Westlake Automobile Receivables Trust, Ser 2019-3A, Cl D | | | | | | | | |

2.720%, 11/15/24 (A) | | | 82,641 | | | | 82,429 | |

Westlake Automobile Receivables Trust, Ser 2021-1A, Cl B | | | | | | | | |

0.640%, 03/16/26 (A) | | | 155,942 | | | | 155,002 | |

Westlake Automobile Receivables Trust, Ser 2021-2A, Cl A2A | | | | | | | | |

0.320%, 04/15/25 (A) | | | 54,284 | | | | 54,045 | |

Westlake Automobile Receivables Trust, Ser 2021-3A, Cl A2 | | | | | | | | |

0.570%, 09/16/24 (A) | | | 16,632 | | | | 16,599 | |

Westlake Automobile Receivables Trust, Ser 2022-3A, Cl A1 | | | | | | | | |

4.005%, 10/16/23 (A) | | | 45,977 | | | | 45,941 | |

Westlake Automobile Receivables Trust, Ser 2023-1A, Cl A1 | | | | | | | | |

5.046%, 01/16/24 (A) | | | 210,245 | | | | 210,262 | |

The accompanying notes are an integral part of the financial statements.

4

CATHOLIC RESPONSIBLE INVESTMENTS ULTRA SHORT BOND FUND

APRIL 30, 2023 (Unaudited)

| | | | | | | | |

| ASSET-BACKED SECURITIES — continued | |

| | |

| | | Face

Amount | | | Value | |

Westlake Automobile Receivables Trust, Ser 2023-2A, Cl A1 | | | | | | | | |

5.266%, 03/15/24 (A) | | $ | 205,939 | | | $ | 205,909 | |

World Omni Auto Receivables Trust, Ser 2022-B, Cl A2B | | | | | | | | |

5.320%, SOFR30A + 0.570%, 10/15/25 (B) | | | 42,132 | | | | 42,118 | |

World Omni Auto Receivables Trust, Ser 2023-A, Cl A1 | | | | | | | | |

4.867%, 02/15/24 | | | 284,234 | | | | 284,251 | |

World Omni Automobile Lease Securitization Trust,

Ser 2020-B, Cl A4 | | | | | | | | |

0.520%, 02/17/26 | | | 67,410 | | | | 67,284 | |

World Omni Select Auto Trust, Ser 2020-A, Cl A3 | | | | | | | | |

0.550%, 07/15/25 | | | 51,708 | | | | 51,589 | |

| | | | | | | | |

| | | | | | | 15,975,171 | |

| | | | | | | | |

|

Other Asset-Backed Securities — 3.0% | |

BHG Securitization Trust, Ser 2022-C, Cl A | | | | | | | | |

5.320%, 10/17/35 (A) | | | 75,660 | | | | 74,981 | |

CCG Receivables Trust, Ser 2023-1, Cl A1 | | | | | | | | |

5.395%, 03/14/24 (A) | | | 187,677 | | | | 187,588 | |

CNH Equipment Trust, Ser 2023-A, Cl A1 | | | | | | | | |

5.425%, 05/15/24 | | | 160,000 | | | | 160,102 | |

Dell Equipment Finance Trust, Ser 2021-2, Cl A3 | | | | | | | | |

0.530%, 12/22/26 (A) | | | 375,000 | | | | 363,417 | |

Dell Equipment Finance Trust, Ser 2023-1, Cl A1 | | | | | | | | |

5.456%, 03/22/24 (A) | | | 250,000 | | | | 249,966 | |

DLLAD, Ser 2021-1A, Cl A2 | | | | | | | | |

0.350%, 09/20/24 (A) | | | 40,530 | | | | 40,254 | |

DLLAD, Ser 2023-1A, Cl A1 | | | | | | | | |

5.014%, 02/20/24 (A) | | | 130,744 | | | | 130,521 | |

GreatAmerica Leasing Receivables Funding Series, Ser 2022-1, Cl A1 | | | | | | | | |

4.335%, 10/16/23 (A) | | | 42,930 | | | | 42,841 | |

Hpefs Equipment Trust, Ser 2022-3A, Cl A1 | | | | | | | | |

4.331%, 10/20/23 (A) | | | 35,967 | | | | 35,958 | |

Hpefs Equipment Trust, Ser 2023-1A, Cl A1 | | | | | | | | |

5.450%, 03/20/24 (A) | | | 250,000 | | | | 249,780 | |

Kubota Credit Owner Trust, Ser 2023-1A, Cl A1 | | | | | | | | |

5.292%, 03/15/24 (A) | | | 60,140 | | | | 60,085 | |

MMAF Equipment Finance, Ser 2022-B, Cl A1 | | | | | | | | |

4.924%, 12/01/23 (A) | | | 80,807 | | | | 80,736 | |

| | | | | | | | |

| ASSET-BACKED SECURITIES — continued | |

| | |

| | | Face

Amount | | | Value | |

Verizon Owner Trust,

Ser 2020-A, Cl B | | | | | | | | |

1.980%, 07/22/24 | | $ | 172,282 | | | $ | 171,951 | |

Verizon Owner Trust,

Ser 2020-B, Cl B | | | | | | | | |

0.680%, 02/20/25 | | | 375,000 | | | | 366,392 | |

| | | | | | | | |

| | | | | | | 2,214,572 | |

| | | | | | | | |

Total Asset-Backed Securities | | | | | | | | |

(Cost $18,162,946) | | | | | | | 18,189,743 | |

| | | | | | | | |

U.S. GOVERNMENT AGENCY OBLIGATIONS — 24.3% | |

| | |

| | | Face

Amount | | | Value | |

FFCB | | | | | | | | |

4.845%, U.S. SOFR + 0.035%, 07/12/23(B) | | $ | 600,000 | | | $ | 600,009 | |

FHLB DN | | | | | | | | |

5.041%, 10/20/23(C) | | | 1,575,000 | | | | 1,539,341 | |

FHLB DN | | | | | | | | |

5.023%, 06/09/23(C) | | | 1,500,000 | | | | 1,492,308 | |

FHLB DN | | | | | | | | |

4.955%, 08/16/23(C) | | | 762,000 | | | | 751,200 | |

FHLB DN | | | | | | | | |

4.936%, 10/11/23(C) | | | 1,525,000 | | | | 1,492,260 | |

FHLB DN | | | | | | | | |

4.919%, 09/29/23(C) | | | 1,136,000 | | | | 1,113,233 | |

FHLB DN | | | | | | | | |

4.919%, 10/13/23(C) | | | 375,000 | | | | 366,851 | |

FHLB DN | | | | | | | | |

4.859%, 07/05/23(C) | | | 2,300,000 | | | | 2,280,063 | |

FHLB DN | | | | | | | | |

4.858%, 06/02/23(C) | | | 1,500,000 | | | | 1,493,686 | |

FHLB DN | | | | | | | | |

4.855%, 07/07/23(C) | | | 2,500,000 | | | | 2,477,665 | |

FHLB DN | | | | | | | | |

4.829%, 08/04/23(C) | | | 750,000 | | | | 740,555 | |

FHLB DN | | | | | | | | |

4.825%, 07/21/23(C) | | | 2,250,000 | | | | 2,225,721 | |

FHLB DN | | | | | | | | |

4.719%, 06/06/23(C) | | | 1,400,000 | | | | 1,393,372 | |

| | | | | | | | |

Total U.S. Government Agency Obligations | | | | | | | | |

(Cost $17,964,241) | | | | | | | 17,966,264 | |

| | | | | | | | |

REPURCHASE AGREEMENT — 15.5% | |

| | |

| | | Face

Amount | | | Value | |

Socgen Triparty Tsy | | | | | | | | |

4.760%, dated 04/28/23, to be repurchased on 05/01/23, repurchase price $11,504,562, collateralized by a U.S. Government obligation, par value $11,730,000, 5.000%, 12/20/2052, with a total market value of $11,685,863 | | $ | 11,500,000 | | | $ | 11,500,000 | |

| | | | | | | | |

Total Repurchase Agreements | | | | | | | | |

(Cost $11,500,000) | | | | | | | 11,500,000 | |

| | | | | | | | |

The accompanying notes are an integral part of the financial statements.

5

CATHOLIC RESPONSIBLE INVESTMENTS ULTRA SHORT BOND FUND

APRIL 30, 2023 (Unaudited)

| | | | | | | | |

CORPORATE OBLIGATIONS — 11.4% | |

| | |

| | | Face

Amount | | | Value | |

|

COMMUNICATION SERVICES — 0.3% | |

Warnermedia Holdings | | | | | | | | |

6.592%, SOFRINDX + 1.780%, 03/15/24(A)(B) | | $ | 215,000 | | | $ | 216,214 | |

| | | | | | | | |

|

CONSUMER DISCRETIONARY — 0.2% | |

Starbucks | | | | | | | | |

5.140%, SOFRINDX + 0.420%, 02/14/24(B) | | | 175,000 | | | | 174,897 | |

| | | | | | | | |

|

CONSUMER STAPLES — 0.3% | |

Daimler Truck Finance North America | | | | | | | | |

5.837%, U.S. SOFR + 1.000%, 04/05/24(A)(B) | | | 175,000 | | | | 174,778 | |

| | | | | | | | |

|

ENERGY — 0.4% | |

Enbridge | | | | | | | | |

5.357%, SOFRINDX + 0.630%, 02/16/24(B) | | | 250,000 | | | | 249,315 | |

| | | | | | | | |

|

FINANCIALS — 8.3% | |

American Express | | | | | | | | |

5.559%, SOFRINDX + 0.720%, 05/03/24(B) | | | 150,000 | | | | 150,045 | |

Bank of Montreal MTN | | | | | | | | |

5.502%, SOFRINDX + 0.710%, 03/08/24(B) | | | 300,000 | | | | 299,287 | |

Barclays MTN | | | | | | | | |

4.338%, ICE LIBOR USD 3 Month + 1.356%, 05/16/24(B) | | | 450,000 | | | | 449,549 | |

Canadian Imperial Bank of Commerce | | | | | | | | |

0.450%, 06/22/23 | | | 525,000 | | | | 521,323 | |

Cooperatieve Rabobank UA | | | | | | | | |

5.340%, U.S. SOFR + 0.530%, 06/28/23(B) | | | 300,000 | | | | 300,186 | |

Credit Suisse NY | | | | | | | | |

5.086%, SOFRINDX + 0.380%, 08/09/23(B) | | | 300,000 | | | | 296,378 | |

Deutsche Bank NY | | | | | | | | |

5.339%, U.S. SOFR + 0.500%, 11/08/23(B) | | | 225,000 | | | | 222,966 | |

0.962%, 11/08/23 | | | 250,000 | | | | 242,068 | |

Goldman Sachs Group | | | | | | | | |

1.217%, 12/06/23 | | | 275,000 | | | | 268,534 | |

Morgan Stanley MTN | | | | | | | | |

5.185%, U.S. SOFR + 0.466%, 11/10/23(B) | | | 117,000 | | | | 116,860 | |

New York Life Global Funding MTN | | | | | | | | |

5.211%, SOFRINDX + 0.430%, 06/06/24(A)(B) | | | 300,000 | | | | 299,135 | |

Nordea Bank Abp | | | | | | | | |

1.000%, 06/09/23(A) | | | 350,000 | | | | 348,327 | |

| | | | | | | | |

| CORPORATE OBLIGATIONS — continued | |

| | |

| | | Face

Amount | | | Value | |

|

FINANCIALS — continued | |

Pacific Life Global Funding II | | | | | | | | |

5.581%, SOFRINDX + 0.800%, 12/06/24(A)(B) | | $ | 300,000 | | | $ | 298,373 | |

Svenska Handelsbanken | | | | | | | | |

0.625%, 06/30/23(A) | | | 350,000 | | | | 347,193 | |

Swedbank | | | | | | | | |

1.300%, 06/02/23(A) | | | 350,000 | | | | 348,555 | |

Toronto-Dominion Bank MTN | | | | | | | | |

2.350%, 03/08/24 | | | 475,000 | | | | 462,613 | |

0.750%, 06/12/23 | | | 225,000 | | | | 223,815 | |

Truist Bank | | | | | | | | |

5.037%, U.S. SOFR + 0.200%, 01/17/24(B) | | | 650,000 | | | | 642,333 | |

UBS | | | | | | | | |

5.092%, U.S. SOFR + 0.320%, 06/01/23(A)(B) | | | 375,000 | | | | 374,996 | |

| | | | | | | | |

| | | | | | | 6,212,536 | |

| | | | | | | | |

|

INDUSTRIALS — 0.7% | |

Caterpillar Financial Services MTN | | | | | | | | |

5.169%, U.S. SOFR + 0.450%, 11/13/23(B) | | | 200,000 | | | | 200,072 | |

5.007%, U.S. SOFR + 0.170%, 01/10/24(B) | | | 175,000 | | | | 174,614 | |

Protective Life Global Funding | | | | | | | | |

5.850%, U.S. SOFR + 1.050%, 12/11/24(A)(B) | | | 150,000 | | | | 150,116 | |

| | | | | | | | |

| | | | | | | 524,802 | |

| | | | | | | | |

UTILITIES — 1.2% | |

Florida Power & Light | | | | | | | | |

4.963%, SOFRINDX + 0.250%, 05/10/23(B) | | | 200,000 | | | | 199,961 | |

National Rural Utilities Cooperative Finance MTN | | | | | | | | |

5.239%, U.S. SOFR + 0.400%, 08/07/23(B) | | | 225,000 | | | | 224,959 | |

ONE Gas | | | | | | | | |

3.610%, 02/01/24 | | | 160,000 | | | | 157,953 | |

Southern | | | | | | | | |

5.083%, SOFRINDX + 0.370%, 05/10/23(B) | | | 300,000 | | | | 299,966 | |

| | | | | | | | |

| | | | | | | 882,839 | |

| | | | | | | | |

Total Corporate Obligations | | | | | | | | |

(Cost $8,454,083) | | | | | | | 8,435,381 | |

| | | | | | | | |

COMMERCIAL PAPER — 11.4% | |

| | |

| | | Face

Amount | | | Value | |

AT&T Inc | | | | | | | | |

6.035%, 03/19/24(C) | | $ | 550,000 | | | $ | 522,049 | |

Banco Santander | | | | | | | | |

5.388%, 09/01/23(C) | | | 200,000 | | | | 196,294 | |

5.386%, 05/25/23(C) | | | 200,000 | | | | 199,252 | |

The accompanying notes are an integral part of the financial statements.

6

CATHOLIC RESPONSIBLE INVESTMENTS ULTRA SHORT BOND FUND

APRIL 30, 2023 (Unaudited)

| | | | | | | | |

| COMMERCIAL PAPER — continued | |

| | |

| | | Face

Amount | | | Value | |

Bank of Montreal | | | | | | | | |

2.811%, 05/24/23(C) | | $ | 250,000 | | | $ | 249,104 | |

BNP Paribas | | | | | | | | |

5.354%, 12/05/23(C) | | | 400,000 | | | | 387,172 | |

BofA Securities | | | | | | | | |

5.375%, 10/13/23(C) | | | 250,000 | | | | 243,875 | |

5.203%, 05/19/23(C) | | | 300,000 | | | | 299,130 | |

BPC Disc | | | | | | | | |

5.516%, 03/06/24(C) | | | 400,000 | | | | 382,096 | |

CDP Financial | | | | | | | | |

4.957%, 05/31/23(C) | | | 250,000 | | | | 248,841 | |

Cooperatieve Rabobank UA | | | | | | | | |

5.215%, 09/15/23(C) | | | 375,000 | | | | 367,300 | |

Credit Agricole | | | | | | | | |

5.354%, 05/31/23(C) | | | 250,000 | | | | 248,848 | |

HSBC USA Inc | | | | | | | | |

5.734%, 01/05/24(C) | | | 300,000 | | | | 288,807 | |

Macquarie Bank Ltd | | | | | | | | |

5.523%, 01/17/12(C) | | | 250,000 | | | | 240,443 | |

5.374%, 11/15/23(C) | | | 250,000 | | | | 242,637 | |

Mercedes-Benz Financial | | | | | | | | |

5.433%, 05/02/23(C) | | | 375,000 | | | | 374,801 | |

Mitsubushi | | | | | | | | |

5.392%, 05/15/23(C) | | | 250,000 | | | | 249,420 | |

MUFG BLK Ltd | | | | | | | | |

5.419%, 10/16/23(C) | | | 250,000 | | | | 243,730 | |

National Bank | | | | | | | | |

5.136%, 07/06/23(C) | | | 327,000 | | | | 323,846 | |

5.116%, 06/07/23(C) | | | 375,000 | | | | 372,925 | |

Natixis | | | | | | | | |

5.401%, 10/06/23(C) | | | 300,000 | | | | 292,936 | |

Old Line Funding LLC | | | | | | | | |

5.151%, 06/26/23(C) | | | 375,000 | | | | 371,825 | |

Royal Bank | | | | | | | | |

5.330%, 09/26/23(C) | | | 345,000 | | | | 337,545 | |

5.266%, 08/14/23(C) | | | 250,000 | | | | 246,190 | |

Skandinaviska Enskilda Banken | | | | | | | | |

5.462%, 08/01/23(C) | | | 400,000 | | | | 394,653 | |

Societe Generale | | | | | | | | |

5.322%, 09/15/23(C) | | | 250,000 | | | | 244,860 | |

Thunder Bay Funding LLC | | | | | | | | |

5.022%, 05/17/23(C) | | | 250,000 | | | | 249,353 | |

Transcanada Pipelines Ltd | | | | | | | | |

5.507%, 05/08/23(C) | | | 250,000 | | | | 249,648 | |

Westpac Banking | | | | | | | | |

5.147%, 06/29/23(C) | | | 348,000 | | | | 345,014 | |

| | | | | | | | |

| | | | | | | | |

Total Commercial Paper | | | | | | | | |

(Cost $8,415,647) | | | | | | | 8,412,594 | |

| | | | | | | | |

| | | | | | | | |

U.S. TREASURY OBLIGATIONS — 9.5% | |

| | |

| | | Face

Amount | | | Value | |

U.S. Treasury Bills | | | | | | | | |

4.962%, 10/26/23(C) | | $ | 2,300,000 | | | $ | 2,244,985 | |

4.914%, 10/12/23(C) | | | 1,500,000 | | | | 1,466,935 | |

4.817%, 10/05/23(C) | | | 747,600 | | | | 731,884 | |

U.S. Treasury Note | | | | | | | | |

5.222%, US Treasury 3 Month Bill Money Market Yield + 0.035%, 10/31/23(B) | | | 2,625,000 | | | | 2,624,981 | |

| | | | | | | | |

Total U.S. Treasury Obligations | | | | | | | | |

(Cost $7,069,188) | | | | | | | 7,068,785 | |

| | | | | | | | |

CERTIFICATES OF DEPOSIT — 1.3% | |

| | |

| | | Face

Amount | | | Value | |

BofA Securities | | | | | | | | |

1.320%, 06/16/23 | | $ | 250,000 | | | $ | 250,103 | |

Natixis | | | | | | | | |

5.150%, 11/02/23 | | | 250,000 | | | | 249,589 | |

Toronto-Dominion Bank | | | | | | | | |

0.000%, 05/01/23 | | | 500,000 | | | | 500,022 | |

| | | | | | | | |

Total Certificates of Deposit | | | | | | | | |

(Cost $999,809) | | | | | | | 999,714 | |

| | | | | | | | |

Total Investments in Securities — 98.0% | | | | | |

(Cost $72,565,914) | | | | | | $ | 72,572,481 | |

| | | | | | | | |

Percentages are based on Net Assets of $74,026,566.

| (A) | Securities sold within the terms of a private placement memorandum, exempt from registration under section 144A of the Securities Act of 1933, as amended, and maybe sold only to dealers in the program or other “accredited investors”. The total value of these securities at April 30, 2023 was $12,610,228 and represented 17.0% of Net Assets. |

| (B) | Variable or floating rate security. The rate shown is the effective interest rate as of period end. The rates for certain securities are not based on published reference rates and spreads and are either determined by the issuer or agent based on current market conditions; by using a formula based on the rates of underlying loans; or by adjusting periodically based on prevailing interest rates. |

| (C) | Interest rate represents the security’s effective yield at the time of purchase. |

Cl — Class

DN — Discount Note

FFCB — Federal Farm Credit Bank

The accompanying notes are an integral part of the financial statements.

7

CATHOLIC RESPONSIBLE INVESTMENTS ULTRA SHORT BOND FUND

APRIL 30, 2023 (Unaudited)

FHLB — Federal Home Loan Bank

LIBOR — London Interbank Offered Rate

MTN — Medium Term Note

Ser — Series

SOFR — Secured Overnight Financing Rate

SOFR30A — Secured Overnight Financing Rate 30-day Average

SOFRINDX — Secured Overnight Financing Rate

USD — U.S. Dollar

As of April 30, 2023, all of the Fund’s investments in securities were considered level 2, in accordance with the authoritative guidance of fair value measurements and disclosure under U.S. generally accepted accounting principles.

For more information on valuation inputs, see Note 2 — Significant Accounting Policies in the Notes to Financial Statements.

The accompanying notes are an integral part of the financial statements.

8

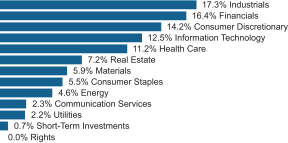

CATHOLIC RESPONSIBLE INVESTMENTS SHORT DURATION BOND FUND

APRIL 30, 2023 (Unaudited)

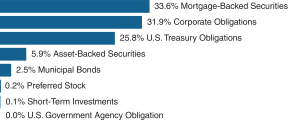

† Percentages are based on total investments. Total investments do not include derivatives such as options, futures contracts, forward contracts, and swap contracts, if applicable.

| | | | | | | | |

SCHEDULE OF INVESTMENTS | |

| CORPORATE OBLIGATIONS — 40.6% | |

| | | Face

Amount | | | Value | |

COMMUNICATION SERVICES — 1.0% | |

Sprint Spectrum | | | | | | | | |

4.738%, 03/20/25(A) | | $ | 1,280,000 | | | $ | 1,270,884 | |

Take-Two Interactive Software | | | | | | | | |

5.000%, 03/28/26 | | | 725,000 | | | | 729,689 | |

Warnermedia Holdings | | | | | | | | |

3.428%, 03/15/24(A) | | | 2,625,000 | | | | 2,568,576 | |

| | | | | | | | |

| | | | | | | 4,569,149 | |

| | | | | | | | |

CONSUMER DISCRETIONARY — 2.3% | |

DR Horton | | | | | | | | |

2.600%, 10/15/25 | | | 2,575,000 | | | | 2,428,830 | |

Ford Motor Credit | | | | | | | | |

2.300%, 02/10/25 | | | 2,500,000 | | | | 2,327,469 | |

General Motors Financial | | | | | | | | |

4.150%, 06/19/23 | | | 1,000,000 | | | | 997,844 | |

Haleon UK Capital | | | | | | | | |

3.125%, 03/24/25 | | | 625,000 | | | | 603,300 | |

Haleon US Capital | | | | | | | | |

3.024%, 03/24/24 | | | 525,000 | | | | 513,657 | |

Lennar | | | | | | | | |

4.875%, 12/15/23 | | | 2,000,000 | | | | 1,995,856 | |

4.750%, 05/30/25 | | | 1,825,000 | | | | 1,811,768 | |

ZF North America Capital | | | | | | | | |

6.875%, 04/14/28(A) | | | 150,000 | | | | 154,503 | |

| | | | | | | | |

| | | | | | | 10,833,227 | |

| | | | | | | | |

CONSUMER STAPLES — 1.2% | |

Bunge Finance | | | | | | | | |

1.630%, 08/17/25 | | | 2,200,000 | | | | 2,032,472 | |

Cargill | | | | | | | | |

4.500%, 06/24/26(A) | | | 535,000 | | | | 537,465 | |

CVS Pass-Through Trust | | | | | | | | |

6.036%, 12/10/28 | | | 2,355,905 | | | | 2,374,080 | |

General Mills | | | | | | | | |

5.241%, 11/18/25 | | | 800,000 | | | | 800,395 | |

| | | | | | | | |

| | | | | | | 5,744,412 | |

| | | | | | | | |

| | | | | | | | |

| CORPORATE OBLIGATIONS — continued | |

| | | Face

Amount | | | Value | |

ENERGY — 2.3% | |

Continental Resources | | | | | | | | |

3.800%, 06/01/24 | | $ | 1,695,000 | | | $ | 1,661,848 | |

Hydro-Quebec | | | | | | | | |

8.050%, 07/07/24 | | | 2,000,000 | | | | 2,069,720 | |

MidAmerican Energy | | | | | | | | |

3.100%, 05/01/27 | | | 2,000,000 | | | | 1,909,910 | |

Petroleos Mexicanos | | | | | | | | |

2.830%, 02/15/24 | | | 184,500 | | | | 182,079 | |

Pioneer Natural Resources | | | | | | | | |

5.100%, 03/29/26 | | | 130,000 | | | | 131,142 | |

Plains All American Pipeline | | | | | | | | |

4.650%, 10/15/25 | | | 2,250,000 | | | | 2,225,275 | |

Terraform Power Operating | | | | | | | | |

7.430%, 05/21/29 | | | 2,493,719 | | | | 2,487,484 | |

Williams | | | | | | | | |

5.400%, 03/02/26 | | | 300,000 | | | | 305,685 | |

| | | | | | | | |

| | | | | | | 10,973,143 | |

| | | | | | | | |

FINANCIALS — 27.1% | |

ABN AMRO Bank | | | | | | | | |

7.750%, 05/15/23(A) | | | 1,700,000 | | | | 1,700,958 | |

Aflac | | | | | | | | |

1.125%, 03/15/26 | | | 900,000 | | | | 821,994 | |

AIB Group | | | | | | | | |

7.583%, U.S. SOFR + 3.456%, 10/14/26(A)(B) | | | 750,000 | | | | 773,313 | |

American Express | | | | | | | | |

4.990%, U.S. SOFR + 0.999%, 05/01/26(B) | | | 1,250,000 | | | | 1,248,800 | |

Asian Development Bank MTN | | | | | | | | |

1.750%, 08/14/26 | | | 2,387,000 | | | | 2,236,319 | |

Athene Global Funding | | | | | | | | |

2.800%, 05/26/23(A) | | | 1,000,000 | | | | 997,420 | |

2.514%, 03/08/24(A) | | | 1,570,000 | | | | 1,516,452 | |

Bank of America MTN | | | | | | | | |

5.080%, U.S. SOFR + 1.290%, 01/20/27(B) | | | 1,000,000 | | | | 997,988 | |

2.456%, ICE LIBOR USD 3 Month + 0.870%, 10/22/25(B) | | | 1,464,000 | | | | 1,398,293 | |

1.530%, U.S. SOFR + 0.650%, 12/06/25(B) | | | 1,000,000 | | | | 937,598 | |

0.810%, U.S. SOFR + 0.730%, 10/24/24(B) | | | 2,000,000 | | | | 1,953,180 | |

Bank of Ireland Group | | | | | | | | |

6.253%, H15T1Y + 2.650%, 09/16/26(A)(B) | | | 815,000 | | | | 819,782 | |

Bank of New York Mellon | | | | | | | | |

4.947%, U.S. SOFR + 1.026%, 04/26/27(B) | | | 470,000 | | | | 472,847 | |

Bank of Nova Scotia | | | | | | | | |

4.750%, 02/02/26 | | | 750,000 | | | | 747,539 | |

Bank One Michigan | | | | | | | | |

8.250%, 11/01/24 | | | 1,925,000 | | | | 1,996,407 | |

The accompanying notes are an integral part of the financial statements.

9

CATHOLIC RESPONSIBLE INVESTMENTS SHORT DURATION BOND FUND

APRIL 30, 2023 (Unaudited)

| | | | | | | | |

| CORPORATE OBLIGATIONS — continued | |

| | | Face

Amount | | | Value | |

| FINANCIALS — continued | |

Banque Federative du Credit Mutuel | | | | | | | | |

4.935%, 01/26/26(A) | | $ | 750,000 | | | $ | 747,022 | |

4.524%, 07/13/25(A) | | | 1,225,000 | | | | 1,202,975 | |

Barclays | | | | | | | | |

5.304%, H15T1Y + 2.300%, 08/09/26(B) | | | 1,450,000 | | | | 1,436,365 | |

BB Blue Financing DAC | | | | | | | | |

4.395%, 09/20/29 | | | 2,500,000 | | | | 2,506,470 | |

Brighthouse Financial Global Funding MTN | | | | | | | | |

1.200%, 12/15/23(A) | | | 1,720,000 | | | | 1,668,362 | |

1.000%, 04/12/24(A) | | | 594,000 | | | | 567,868 | |

Caisse d’Amortissement de la Dette Sociale | | | | | | | | |

3.000%, 05/17/25(A) | | | 428,000 | | | | 416,803 | |

0.375%, 05/27/24(A) | | | 1,000,000 | | | | 956,097 | |

Canadian Imperial Bank of Commerce | | | | | | | | |

3.945%, 08/04/25 | | | 1,000,000 | | | | 976,819 | |

Capital One Financial | | | | | | | | |

4.985%, U.S. SOFR + 2.160%, 07/24/26(B) | | | 825,000 | | | | 804,649 | |

4.166%, U.S. SOFR + 1.370%, 05/09/25(B) | | | 1,185,000 | | | | 1,154,036 | |

CDP Financial MTN | | | | | | | | |

1.000%, 05/26/26(A) | | | 1,000,000 | | | | 909,422 | |

Central American Bank for Economic Integration | | | | | | | | |

5.000%, 02/09/26(A) | | | 500,000 | | | | 503,902 | |

Citigroup | | | | | | | | |

5.610%, U.S. SOFR + 1.546%, 09/29/26(B) | | | 1,250,000 | | | | 1,262,736 | |

5.532%, U.S. SOFR + 0.694%, 01/25/26(B) | | | 2,117,000 | | | | 2,085,631 | |

2.014%, U.S. SOFR + 0.694%, 01/25/26(B) | | | 1,000,000 | | | | 943,459 | |

0.776%, U.S. SOFR + 0.686%, 10/30/24(B) | | | 1,000,000 | | | | 975,261 | |

Council of Europe Development Bank | | | | | | | | |

3.000%, 06/16/25 | | | 1,000,000 | | | | 975,527 | |

Credit Agricole MTN | | | | | | | | |

1.907%, U.S. SOFR + 1.676%, 06/16/26(A)(B) | | | 2,525,000 | | | | 2,335,601 | |

Credit Suisse Group | | | | | | | | |

2.593%, U.S. SOFR + 1.560%, 09/11/25(A)(B) | | | 3,050,000 | | | | 2,837,089 | |

Credit Suisse NY | | | | | | | | |

4.750%, 08/09/24 | | | 625,000 | | | | 603,906 | |

Daimler Truck Finance North America | | | | | | | | |

5.150%, 01/16/26(A) | | | 710,000 | | | | 715,111 | |

| | | | | | | | |

| CORPORATE OBLIGATIONS — continued | |

| | | Face

Amount | | | Value | |

| FINANCIALS — continued | |

Danske Bank | | | | | | | | |

6.466%, H15T1Y + 2.100%, 01/09/26(A)(B) | | $ | 875,000 | | | $ | 880,729 | |

Deutsche Bank NY | | | | | | | | |

2.222%, U.S. SOFR + 2.159%, 09/18/24(B) | | | 2,605,000 | | | | 2,551,400 | |

1.686%, 03/19/26 | | | 1,000,000 | | | | 894,003 | |

European Investment Bank | | | | | | | | |

2.875%, 06/13/25(A) | | | 2,000,000 | | | | 1,950,815 | |

2.125%, 04/13/26 | | | 447,000 | | | | 425,574 | |

0.625%, 10/21/27 | | | 2,000,000 | | | | 1,750,832 | |

Federation des Caisses Desjardins du Quebec | | | | | | | | |

0.700%, 05/21/24(A) | | | 1,500,000 | | | | 1,428,948 | |

Fifth Third Bank | | | | | | | | |

5.852%, U.S. SOFR + 1.230%, 10/27/25(B) | | | 1,130,000 | | | | 1,122,291 | |

GATX Financial 2005-1 Pass Through Trust | | | | | | | | |

5.697%, 01/02/25(A) | | | 156,537 | | | | 156,593 | |

Global Payments | | | | | | | | |

4.000%, 06/01/23 | | | 2,000,000 | | | | 1,997,063 | |

Goldman Sachs Group | | | | | | | | |

5.700%, 11/01/24 | | | 750,000 | | | | 756,260 | |

4.387%, U.S. SOFR + 1.510%, 06/15/27(B) | | | 1,000,000 | | | | 981,408 | |

0.855%, U.S. SOFR + 0.609%, 02/12/26(B) | | | 579,000 | | | | 531,048 | |

HSBC Holdings | | | | | | | | |

7.336%, U.S. SOFR + 3.030%, 11/03/26(B) | | | 1,000,000 | | | | 1,047,727 | |

ING Bank | | | | | | | | |

5.800%, 09/25/23(A) | | | 2,500,000 | | | | 2,500,083 | |

ING Groep | | | | | | | | |

1.400%, H15T1Y + 1.100%, 07/01/26(A)(B) | | | 1,000,000 | | | | 915,168 | |

Inter-American Development Bank | | | | | | | | |

0.500%, 05/24/23 | | | 2,443,000 | | | | 2,436,282 | |

Inter-American Investment | | | | | | | | |

4.125%, 02/15/28 | | | 500,000 | | | | 504,044 | |

International Bank for Reconstruction & Development MTN | | | | | | | | |

1.875%, 06/19/23 | | | 2,000,000 | | | | 1,991,580 | |

0.250%, 11/24/23 | | | 1,341,000 | | | | 1,304,753 | |

0.000%, 03/31/28(C) | | | 1,000,000 | | | | 1,007,595 | |

0.000%, 03/31/27(C) | | | 2,500,000 | | | | 2,298,800 | |

International Finance MTN | | | | | | | | |

4.930%, U.S. SOFR + 0.090%, 04/03/24(B) | | | 2,000,000 | | | | 1,999,714 | |

JPMorgan Chase | | | | | | | | |

1.045%, U.S. SOFR + 0.800%, 11/19/26(B) | | | 1,500,000 | | | | 1,351,032 | |

The accompanying notes are an integral part of the financial statements.

10

CATHOLIC RESPONSIBLE INVESTMENTS SHORT DURATION BOND FUND

APRIL 30, 2023 (Unaudited)

| | | | | | | | |

| CORPORATE OBLIGATIONS — continued | |

| | | Face

Amount | | | Value | |

| FINANCIALS — continued | |

0.768%, U.S. SOFR + 0.490%, 08/09/25(B) | | $ | 1,000,000 | | | $ | 939,795 | |

0.653%, TSFR3M + 0.600%, 09/16/24(B) | | | 2,500,000 | | | | 2,453,194 | |

Kansas City Southern | | | | | | | | |

3.850%, 11/15/23 | | | 1,975,000 | | | | 1,954,841 | |

KBC Group | | | | | | | | |

5.796%, H15T1Y + 2.100%, 01/19/29(A)(B) | | | 295,000 | | | | 298,777 | |

Macquarie Group | | | | | | | | |

5.108%, U.S. SOFR + 2.208%, 08/09/26(A)(B) | | | 1,450,000 | | | | 1,446,773 | |

Manufacturers & Traders Trust | | | | | | | | |

5.400%, 11/21/25 | | | 1,000,000 | | | | 976,001 | |

4.650%, 01/27/26 | | | 1,650,000 | | | | 1,597,114 | |

Massachusetts Mutual Life Insurance | | | | | | | | |

7.625%, 11/15/23(A) | | | 1,250,000 | | | | 1,258,035 | |

Metropolitan Tower Life Insurance | | | | | | | | |

7.625%, 01/15/24(A) | | | 2,000,000 | | | | 2,019,073 | |

Mitsubishi UFJ Financial Group | | | | | | | | |

5.063%, H15T1Y + 1.550%, 09/12/25(B) | | | 1,000,000 | | | | 994,400 | |

4.788%, H15T1Y + 1.700%, 07/18/25(B) | | | 1,000,000 | | | | 990,566 | |

2.527%, 09/13/23 | | | 1,000,000 | | | | 989,690 | |

Morgan Stanley MTN | | | | | | | | |

5.000%, 11/24/25 | | | 3,425,000 | | | | 3,428,010 | |

0.864%, U.S. SOFR + 0.745%, 10/21/25(B) | | | 1,000,000 | | | | 929,786 | |

National Australia Bank | | | | | | | | |

4.966%, 01/12/26 | | | 700,000 | | | | 707,813 | |

National Bank of Canada MTN | | | | | | | | |

0.550%, H15T1Y + 0.400%, 11/15/24(B) | | | 2,000,000 | | | | 1,946,771 | |

NatWest Group | | | | | | | | |

5.847%, H15T1Y + 1.350%, 03/02/27(B) | | | 435,000 | | | | 439,575 | |

2.359%, H15T1Y + 2.150%, 05/22/24(B) | | | 1,000,000 | | | | 997,740 | |

NatWest Markets | | | | | | | | |

3.479%, 03/22/25(A) | | | 1,585,000 | | | | 1,527,173 | |

OPEC Fund for International Development | | | | | | | | |

4.500%, 01/26/26(A) | | | 450,000 | | | | 450,043 | |

Royal Bank of Canada MTN | | | | | | | | |

4.950%, 04/25/25 | | | 750,000 | | | | 749,955 | |

Santander Holdings USA | | | | | | | | |

5.807%, U.S. SOFR + 2.328%, 09/09/26(B) | | | 1,000,000 | | | | 990,724 | |

Societe Generale MTN | | | | | | | | |

6.447%, H15T1Y + 2.300%, 01/12/27(A)(B) | | | 875,000 | | | | 883,811 | |

| | | | | | | | |

| CORPORATE OBLIGATIONS — continued | |

| | | Face

Amount | | | Value | |

| FINANCIALS — continued | |

Standard Chartered | | | | | | | | |

7.776%, H15T1Y + 3.100%, 11/16/25(A)(B) | | $ | 1,000,000 | | | $ | 1,028,301 | |

6.170%, H15T1Y + 2.050%, 01/09/27(A)(B) | | | 700,000 | | | | 709,268 | |

Toronto-Dominion Bank MTN | | | | | | | | |

5.291%, U.S. SOFR + 0.450%, 09/28/23(B) | | | 3,587,000 | | | | 3,585,772 | |

Truist Financial MTN | | | | | | | | |

4.260%, U.S. SOFR + 1.456%, 07/28/26(B) | | | 1,025,000 | | | | 991,685 | |

TTX MTN | | | | | | | | |

3.600%, 01/15/25(A) | | | 2,500,000 | | | | 2,434,991 | |

UBS Group | | | | | | | | |

1.008%, H15T1Y + 0.830%, 07/30/24(A)(B) | | | 2,500,000 | | | | 2,464,878 | |

USAA Capital | | | | | | | | |

1.500%, 05/01/23(A) | | | 1,000,000 | | | | 1,000,000 | |

0.500%, 05/01/24(A) | | | 2,500,000 | | | | 2,383,319 | |

Wells Fargo MTN | | | | | | | | |

2.406%, ICE LIBOR USD 3 Month + 0.825%, 10/30/25(B) | | | 2,500,000 | | | | 2,390,651 | |

0.805%, U.S. SOFR + 0.510%, 05/19/25(B) | | | 1,000,000 | | | | 951,185 | |

WLB Asset II D Pte | | | | | | | | |

6.500%, 12/21/26(A) | | | 1,000,000 | | | | 1,006,372 | |

| | | | | | | | |

| | | | | | | 125,903,825 | |

| | | | | | | | |

HEALTH CARE — 1.2% | |

Adventist Health System | | | | | | | | |

2.433%, 09/01/24 | | | 1,415,000 | | | | 1,365,186 | |

CommonSpirit Health | | | | | | | | |

1.547%, 10/01/25 | | | 1,000,000 | | | | 921,250 | |

CVS Health | | | | | | | | |

5.000%, 02/20/26 | | | 1,000,000 | | | | 1,010,665 | |

Elevance Health | | | | | | | | |

5.350%, 10/15/25 | | | 330,000 | | | | 334,190 | |

GE HealthCare Technologies | | | | | | | | |

5.600%, 11/15/25(A) | | | 950,000 | | | | 961,366 | |

Quest Diagnostics | | | | | | | | |

3.450%, 06/01/26 | | | 910,000 | | | | 878,708 | |

| | | | | | | | |

| | | | | | | 5,471,365 | |

| | | | | | | | |

INDUSTRIALS — 1.2% | |

AerCap Ireland Capital DAC | | | | | | | | |

4.875%, 01/16/24 | | | 1,000,000 | | | | 991,870 | |

Burlington Northern and Santa Fe Railway Pass Through Trust, Ser 2006-1 | | | | | | | | |

5.720%, 01/15/24 | | | 180,734 | | | | 183,972 | |

CNH Industrial | | | | | | | | |

4.500%, 08/15/23 | | | 2,375,000 | | | | 2,369,211 | |

The accompanying notes are an integral part of the financial statements.

11

CATHOLIC RESPONSIBLE INVESTMENTS SHORT DURATION BOND FUND

APRIL 30, 2023 (Unaudited)

| | | | | | | | |

| CORPORATE OBLIGATIONS — continued | |

| | | Face

Amount | | | Value | |

INDUSTRIALS — continued | |

Mileage Plus Holdings | | | | | | | | |

6.500%, 06/20/27(A) | | $ | 1,147,488 | | | $ | 1,145,697 | |

Nature Conservancy | | | | | | | | |

0.467%, 07/01/23 | | | 425,000 | | | | 421,213 | |

Regal Rexnord | | | | | | | | |

6.050%, 02/15/26(A) | | | 715,000 | | | | 724,802 | |

| | | | | | | | |

| | | | | | | 5,836,765 | |

| | | | | | | | |

INFORMATION TECHNOLOGY — 0.5% | |

Flex | | | | | | | | |

6.000%, 01/15/28 | | | 550,000 | | | | 560,717 | |

Intel | | | | | | | | |

4.875%, 02/10/26 | | | 1,105,000 | | | | 1,118,073 | |

Open Text | | | | | | | | |

6.900%, 12/01/27(A) | | | 570,000 | | | | 588,731 | |

Oracle | | | | | | | | |

5.800%, 11/10/25 | | | 200,000 | | | | 204,736 | |

| | | | | | | | |

| | | | | | | 2,472,257 | |

| | | | | | | | |

MATERIALS — 1.5% | |

Berry Global | | | | | | | | |

4.875%, 07/15/26(A) | | | 1,250,000 | | | | 1,222,156 | |

BHP Billiton Finance USA | | | | | | | | |

4.875%, 02/27/26 | | | 500,000 | | | | 505,624 | |

Celanese US Holdings | | | | | | | | |

6.050%, 03/15/25 | | | 1,025,000 | | | | 1,028,214 | |

Graphic Packaging International | | | | | | | | |

0.821%, 04/15/24(A) | | | 1,025,000 | | | | 973,750 | |

LG Chemical | | | | | | | | |

4.375%, 07/14/25(A) | | | 570,000 | | | | 560,405 | |

Nutrien | | | | | | | | |

5.950%, 11/07/25 | | | 370,000 | | | | 380,785 | |

1.900%, 05/13/23 | | | 1,175,000 | | | | 1,173,446 | |

Steel Dynamics | | | | | | | | |

5.000%, 12/15/26 | | | 1,550,000 | | | | 1,554,657 | |

| | | | | | | | |

| | | | | | | 7,399,037 | |

| | | | | | | | |

REAL ESTATE — 0.2% | |

Realty Income | | | | | | | | |

5.050%, 01/13/26 | | | 910,000 | | | | 909,849 | |

| | | | | | | | |

UTILITIES — 2.1% | |

Avangrid | | | | | | | | |

3.200%, 04/15/25 | | | 2,500,000 | | | | 2,398,463 | |

3.150%, 12/01/24 | | | 1,000,000 | | | | 966,062 | |

Edison International | | | | | | | | |

4.700%, 08/15/25 | | | 1,450,000 | | | | 1,430,399 | |

Electricite de France | | | | | | | | |

3.625%, 10/13/25(A) | | | 500,000 | | | | 489,224 | |

NextEra Energy Capital Holdings | | | | | | | | |

6.051%, 03/01/25 | | | 515,000 | | | | 523,236 | |

Pacific Gas and Electric | | | | | | | | |

5.450%, 06/15/27 | | | 725,000 | | | | 718,897 | |

Pennsylvania Electric | | | | | | | | |

5.150%, 03/30/26(A) | | | 500,000 | | | | 501,845 | |

| | | | | | | | |

| CORPORATE OBLIGATIONS — continued | |

| | | Face

Amount | | | Value | |

UTILITIES — continued | |

Southern | | | | | | | | |

5.150%, 10/06/25 | | $ | 750,000 | | | $ | 756,998 | |

Southern Power | | | | | | | | |

4.150%, 12/01/25 | | | 1,000,000 | | | | 980,761 | |

0.900%, 01/15/26 | | | 1,000,000 | | | | 907,851 | |

| | | | | | | | |

| | | | | | | 9,673,736 | |

| | | | | | | | |

Total Corporate Obligations | | | | | | | | |

(Cost $193,676,214) | | | | | | | 189,786,765 | |

| | | | | | | | |

U.S. TREASURY OBLIGATIONS — 28.8% | |

| | |

| | | Face

Amount | | | Value | |

U.S. Treasury Notes | | | | | | | | |

4.250%, 10/15/25 | | $ | 7,000,000 | | | $ | 7,050,859 | |

4.000%, 12/15/25 | | | 5,000,000 | | | | 5,017,383 | |

4.000%, 02/15/26 | | | 19,800,000 | | | | 19,891,266 | |

3.000%, 10/31/25 | | | 2,450,000 | | | | 2,396,885 | |

2.875%, 06/15/25 | | | 28,000,000 | | | | 27,337,187 | |

2.750%, 02/28/25 | | | 7,640,000 | | | | 7,449,000 | |

2.625%, 03/31/25 | | | 3,640,000 | | | | 3,540,042 | |

2.500%, 05/31/24 | | | 705,000 | | | | 688,036 | |

2.250%, 11/15/24 | | �� | 3,600,000 | | | | 3,485,672 | |

2.250%, 12/31/24 | | | 2,580,000 | | | | 2,495,747 | |

1.875%, 06/30/26 | | | 33,900,000 | | | | 32,026,230 | |

1.750%, 12/31/24 | | | 14,145,000 | | | | 13,571,464 | |

1.125%, 02/28/25 | | | 1,280,000 | | | | 1,211,550 | |

0.250%, 06/30/25 | | | 9,150,000 | | | | 8,449,811 | |

| | | | | | | | |

Total U.S. Treasury Obligations | | | | | | | | |

(Cost $137,216,313) | | | | | | | 134,611,132 | |

| | | | | | | | |

ASSET-BACKED SECURITIES — 18.0% | |

| | |

| | | Face

Amount | | | Value | |

Automotive — 9.2% | | | | | | | | |

American Credit Acceptance Receivables Trust, Ser 2022-3, Cl A | | | | | | | | |

4.120%, 02/13/26 (A) | | $ | 112,263 | | | $ | 111,703 | |

American Credit Acceptance Receivables Trust, Ser 2023-2, Cl A | | | | | | | | |

5.890%, 10/13/26 (A) | | | 520,000 | | | | 520,002 | |

Americredit Automobile Receivables Trust, Ser 2022-1, Cl A3 | | | | | | | | |

2.450%, 11/18/26 | | | 950,000 | | | | 918,508 | |

Americredit Automobile Receivables Trust, Ser 2023-1, Cl A3 | | | | | | | | |

5.620%, 11/18/27 | | | 1,000,000 | | | | 1,009,176 | |

ARI Fleet Lease Trust, Ser 2022-A, Cl A2 | | | | | | | | |

3.120%, 01/15/31 (A) | | | 749,615 | | | | 737,097 | |

The accompanying notes are an integral part of the financial statements.

12

CATHOLIC RESPONSIBLE INVESTMENTS SHORT DURATION BOND FUND

APRIL 30, 2023 (Unaudited)

| | | | | | | | |

| ASSET-BACKED SECURITIES — continued | |

| | |

| | | Face

Amount | | | Value | |

BMW Vehicle Lease Trust, Ser 2023-1, Cl A3 | | | | | | | | |

5.160%, 11/25/25 | | $ | 265,000 | | | $ | 265,312 | |

BMW Vehicle Lease Trust, Ser 2023-1, Cl A4 | | | | | | | | |

5.070%, 06/25/26 | | | 480,000 | | | | 481,318 | |

CarMax Auto Owner Trust, Ser 2023-1, Cl A2A | | | | | | | | |

5.230%, 01/15/26 | | | 540,000 | | | | 538,852 | |

CarMax Auto Owner Trust, Ser 2023-1, Cl A3 | | | | | | | | |

4.750%, 10/15/27 | | | 500,000 | | | | 500,775 | |

Carvana Auto Receivables Trust, Ser 2021-N3, Cl B | | | | | | | | |

0.660%, 06/12/28 | | | 198,292 | | | | 181,683 | |

Carvana Auto Receivables Trust, Ser 2022-P3, Cl A2 | | | | | | | | |

4.420%, 12/10/25 | | | 631,325 | | | | 627,675 | |

Chesapeake Funding II, Ser 2023-1A, Cl A1 | | | | | | | | |

5.650%, 05/15/35 (A) | | | 1,100,000 | | | | 1,104,533 | |

CPS Auto Receivables Trust, Ser 2022-C, Cl A | | | | | | | | |

4.180%, 04/15/30 (A) | | | 401,305 | | | | 397,996 | |

Drive Auto Receivables Trust, Ser 2021-2, Cl C | | | | | | | | |

0.870%, 10/15/27 | | | 1,250,000 | | | | 1,211,642 | |

Enterprise Fleet Financing, Ser 2022-3, Cl A2 | | | | | | | | |

4.380%, 07/20/29 (A) | | | 285,000 | | | | 280,660 | |

Enterprise Fleet Financing, Ser 2023-1, Cl A2 | | | | | | | | |

5.510%, 01/22/29 (A) | | | 545,000 | | | | 546,751 | |

Exeter Automobile Receivables Trust, Ser 2022-4A, Cl A2 | | | | | | | | |

3.990%, 08/15/24 | | | 101,059 | | | | 100,993 | |

Flagship Credit Auto Trust, Ser 2022-2, Cl A2 | | | | | | | | |

3.280%, 08/15/25 (A) | | | 1,082,659 | | | | 1,074,919 | |

Flagship Credit Auto Trust, Ser 2022-3, Cl A2 | | | | | | | | |

4.060%, 10/15/25 (A) | | | 640,632 | | | | 635,724 | |

Flagship Credit Auto Trust, Ser 2023-2, Cl A2 | | | | | | | | |

5.760%, 04/15/27 (A) | | | 700,000 | | | | 700,008 | |

Flagship Credit Auto Trust, Ser 2023-2, Cl A3 | | | | | | | | |

5.220%, 12/15/27 (A) | | | 599,000 | | | | 599,232 | |

Ford Credit Auto Lease Trust, Ser 2021-B, Cl B | | | | | | | | |

0.660%, 01/15/25 | | | 1,250,000 | | | | 1,209,737 | |

Ford Credit Auto Lease Trust, Ser 2023-A, Cl A3 | | | | | | | | |

4.940%, 03/15/26 | | | 1,495,000 | | | | 1,492,779 | |

| | | | | | | | |

| ASSET-BACKED SECURITIES — continued | |

| | |

| | | Face

Amount | | | Value | |

Foursight Capital Automobile Receivables Trust, Ser 2022-2, Cl A2 | | | | | | | | |

4.490%, 03/16/26 (A) | | $ | 1,438,434 | | | $ | 1,427,045 | |

Foursight Capital Automobile Receivables Trust, Ser 2023-1, Cl A2 | | | | | | | | |

5.430%, 10/15/26 (A) | | | 515,000 | | | | 512,144 | |

Foursight Capital Automobile Receivables Trust, Ser 2023-1, Cl A3 | | | | | | | | |

5.390%, 12/15/27 (A) | | | 900,000 | | | | 895,070 | |

GM Financial Automobile Leasing Trust, Ser 2023-1, Cl A4 | | | | | | | | |

5.160%, 01/20/27 | | | 1,000,000 | | | | 1,003,403 | |

GM Financial Consumer Automobile Receivables Trust, Ser 2023-2, Cl A2A | | | | | | | | |

5.100%, 05/18/26 | | | 695,000 | | | | 693,308 | |

GM Financial Consumer Automobile Receivables Trust, Ser 2023-2, Cl A3 | | | | | | | | |

4.470%, 02/16/28 | | | 475,000 | | | | 472,732 | |

Hertz Vehicle Financing, Ser 2021-1A, Cl A | | | | | | | | |

1.210%, 12/26/25 (A) | | | 2,575,000 | | | | 2,413,443 | |

Hyundai Auto Lease Securitization Trust, Ser 2022-B, Cl A3 | | | | | | | | |

3.350%, 06/16/25 (A) | | | 1,435,000 | | | | 1,408,057 | |

Hyundai Auto Lease Securitization Trust, Ser 2023-A, Cl A3 | | | | | | | | |

5.050%, 01/15/26 (A) | | | 990,000 | | | | 990,123 | |

Hyundai Auto Lease Securitization Trust, Ser 2023-A, Cl A4 | | | | | | | | |

4.940%, 11/16/26 (A) | | | 900,000 | | | | 902,350 | |

Hyundai Auto Receivables Trust, Ser 2023-A, Cl A2A | | | | | | | | |

5.190%, 12/15/25 | | | 810,000 | | | | 808,293 | |

Hyundai Auto Receivables Trust, Ser 2023-A, Cl A3 | | | | | | | | |

4.580%, 04/15/27 | | | 355,000 | | | | 353,645 | |

Nissan Auto Lease Trust, Ser 2023-A, Cl A4 | | | | | | | | |

4.800%, 07/15/27 | | | 895,000 | | | | 894,650 | |

Santander Drive Auto Receivables Trust, Ser 2022-4, Cl A2 | | | | | | | | |

4.050%, 07/15/25 | | | 429,887 | | | | 428,832 | |

Santander Drive Auto Receivables Trust, Ser 2022-5, Cl A2 | | | | | | | | |

3.980%, 01/15/25 | | | 307,836 | | | | 307,072 | |

Tesla Auto Lease Trust, Ser 2021-A, Cl B | | | | | | | | |

1.020%, 03/20/25 (A) | | | 1,000,000 | | | | 972,586 | |

The accompanying notes are an integral part of the financial statements.

13

CATHOLIC RESPONSIBLE INVESTMENTS SHORT DURATION BOND FUND

APRIL 30, 2023 (Unaudited)

| | | | | | | | |

| ASSET-BACKED SECURITIES — continued | |

| | |

| | | Face

Amount | | | Value | |

Tesla Auto Lease Trust, Ser 2021-B, Cl A3 | | | | | | | | |

0.600%, 09/22/25 (A) | | $ | 1,540,000 | | | $ | 1,476,409 | |

Tesla Auto Lease Trust, Ser 2021-B, Cl D | | | | | | | | |

1.320%, 09/22/25 (A) | | | 1,000,000 | | | | 934,061 | |

Toyota Auto Receivables Owner Trust, Ser 2022-B, Cl A3 | | | | | | | | |

2.930%, 09/15/26 | | | 935,000 | | | | 907,857 | |

Toyota Lease Owner Trust, Ser 2023-A, Cl A3 | | | | | | | | |

4.930%, 04/20/26 (A) | | | 555,000 | | | | 556,783 | |

Tricolor Auto Securitization Trust, Ser 2023-1A, Cl A | | | | | | | | |

6.480%, 08/17/26 (A) | | | 494,106 | | | | 493,233 | |

United Auto Credit Securitization Trust, Ser 2022-2, Cl A | | | | | | | | |

4.390%, 04/10/25 (A) | | | 640,310 | | | | 637,935 | |

United Auto Credit Securitization Trust, Ser 2023-1, Cl A | | | | | | | | |

5.570%, 07/10/25 (A) | | | 606,666 | | | | 605,639 | |

Westlake Automobile Receivables Trust, Ser 2021-3A, Cl A3 | | | | | | | | |

0.950%, 06/16/25 (A) | | | 1,908,000 | | | | 1,877,870 | |

Westlake Automobile Receivables Trust, Ser 2022-3A, Cl A2 | | | | | | | | |

5.240%, 07/15/25 (A) | | | 1,250,000 | | | | 1,246,708 | |

Westlake Automobile Receivables Trust, Ser 2023-1A, Cl A2A | | | | | | | | |

5.510%, 06/15/26 (A) | | | 940,000 | | | | 938,944 | |

World Omni Auto Receivables Trust, Ser 2020-C, Cl A3 | | | | | | | | |

0.480%, 11/17/25 | | | 689,368 | | | | 671,586 | |

World Omni Select Auto Trust, Ser 2020-A, Cl B | | | | | | | | |

0.840%, 06/15/26 | | | 2,500,000 | | | | 2,438,862 | |

World Omni Select Auto Trust, Ser 2023-A, Cl A3 | | | | | | | | |

5.650%, 07/17/28 | | | 700,000 | | | | 709,160 | |

| | | | | | | | |

| | | | | | | 43,224,875 | |

| | | | | | | | |

Other Asset-Backed Securities — 8.8% | |

Affirm Asset Securitization Trust, Ser 2023-A, Cl 1A | | | | | | | | |

6.610%, 01/18/28 (A) | | | 755,000 | | | | 754,798 | |

Amur Equipment Finance Receivables XI, Ser 2022-2A, Cl A2 | | | | | | | | |

5.300%, 06/21/28 (A) | | | 441,604 | | | | 438,954 | |

Apidos CLO XXII, Ser 2020-22A, Cl A1R | | | | | | | | |

6.310%, ICE LIBOR USD 3 Month + 1.060%, 04/20/31 (A)(B) | | | 925,000 | | | | 916,643 | |

| | | | | | | | |

| ASSET-BACKED SECURITIES — continued | |

| | |

| | | Face

Amount | | | Value | |

Bain Capital Credit CLO, Ser 2018-1A, Cl A1 | | | | | | | | |

6.233%, ICE LIBOR USD 3 Month +

0.960%, 04/23/31 (A)(B) | | $ | 1,675,000 | | | $ | 1,660,027 | |

BHG Securitization Trust, Ser 2022-C, Cl A | | | | | | | | |

5.320%, 10/17/35 (A) | | | 279,943 | | | | 277,418 | |

CCG Receivables Trust, Ser 2023-1, Cl A2 | | | | | | | | |

5.820%, 09/16/30 (A) | | | 1,000,000 | | | | 1,007,645 | |

CIFC Funding, Ser 2017-5A, Cl A1 | | | | | | | | |

6.440%, ICE LIBOR USD 3 Month + 1.180%, 11/16/30 (A)(B) | | | 1,201,894 | | | | 1,193,897 | |

CNH Equipment Trust, Ser 2022-B, Cl A2 | | | | | | | | |

3.940%, 12/15/25 | | | 473,010 | | | | 469,777 | |

CNH Equipment Trust, Ser 2023-A, Cl A3 | | | | | | | | |

4.810%, 08/15/28 | | | 1,000,000 | | | | 1,004,257 | |

Dell Equipment Finance Trust, Ser 2022-2, Cl A2 | | | | | | | | |

4.030%, 07/22/27 (A) | | | 794,814 | | | | 788,552 | |

DLLAD, Ser 2023-1A, Cl A2 | | | | | | | | |

5.190%, 04/20/26 (A) | | | 605,000 | | | | 602,352 | |

DLLAD, Ser 2023-1A, Cl A3 | | | | | | | | |

4.790%, 01/20/28 (A) | | | 685,000 | | | | 680,952 | |

DLLST, Ser 2022-1A, Cl A2 | | | | | | | | |

2.790%, 01/22/24 (A) | | | 417,662 | | | | 415,427 | |

Evergreen Credit Card Trust Series, Ser 2022-CRT1, Cl B | | | | | | | | |

5.610%, 07/15/26 (A) | | | 2,000,000 | | | | 1,985,355 | |

FCI Funding, Ser 2021-1A, Cl A | | | | | | | | |

1.130%, 04/15/33 (A) | | | 270,960 | | | | 258,595 | |

Flatiron CLO 17, Ser 2021-1A, Cl AR | | | | | | | | |

5.844%, ICE LIBOR USD 3 Month + 0.980%, 05/15/30 (A)(B) | | | 1,325,014 | | | | 1,314,172 | |

FREED ABS Trust, Ser 2022-2CP, Cl A | | | | | | | | |

3.030%, 05/18/29 (A) | | | 313,380 | | | | 312,585 | |

Golub Capital Partners CLO, Ser 2017-24A, Cl AR | | | | | | | | |

6.406%, ICE LIBOR USD 3 Month + 1.600%, 11/05/29 (A)(B) | | | 2,378,108 | | | | 2,348,241 | |

GoodLeap Sustainable Home Solutions Trust, Ser 2022-3CS, Cl B | | | | | | | | |

5.500%, 07/20/49 (A) | | | 500,000 | | | | 440,733 | |

GreatAmerica Leasing Receivables Funding Series, Ser 2022-1, Cl A2 | | | | | | | | |

4.920%, 05/15/25 (A) | | | 605,000 | | | | 601,656 | |

The accompanying notes are an integral part of the financial statements.

14

CATHOLIC RESPONSIBLE INVESTMENTS SHORT DURATION BOND FUND

APRIL 30, 2023 (Unaudited)

| | | | | | | | |

| ASSET-BACKED SECURITIES — continued | |

| | |

| | | Face

Amount | | | Value | |

John Deere Owner Trust, Ser 2023-A, Cl A3 | | | | | | | | |

5.010%, 11/15/27 | | $ | 850,000 | | | $ | 860,122 | |

Kubota Credit Owner Trust, Ser 2023-1A, Cl A2 | | | | | | | | |

5.400%, 02/17/26 (A) | | | 500,000 | | | | 499,422 | |

Mariner Finance Issuance Trust, Ser 2020-AA, Cl A | | | | | | | | |

2.190%, 08/21/34 (A) | | | 3,250,000 | | | | 3,128,167 | |

Marlette Funding Trust, Ser 2022-2A, Cl A | | | | | | | | |

4.250%, 08/15/32 (A) | | | 171,391 | | | | 169,616 | |

Marlette Funding Trust, Ser 2022-3A, Cl A | | | | | | | | |

5.180%, 11/15/32 (A) | | | 348,830 | | | | 345,979 | |

MMAF Equipment Finance, Ser 2021-A, Cl A5 | | | | | | | | |

1.190%, 11/13/43 (A) | | | 620,000 | | | | 558,014 | |

Mosaic Solar Loan Trust, Ser 2020-1A, Cl B | | | | | | | | |

3.100%, 04/20/46 (A) | | | 170,600 | | | | 144,844 | |

OBX Trust, Ser 2023-NQM2, Cl A1 | | | | | | | | |

6.319%, 01/25/62 (A) | | | 881,883 | | | | 890,920 | |

Octagon Investment Partners 35, Ser 2018-1A, Cl A1A | | | | | | | | |

6.310%, ICE LIBOR USD 3 Month + 1.060%, 01/20/31 (A)(B) | | | 1,496,734 | | | | 1,485,501 | |

Octagon Investment Partners 36, Ser 2018-1A, Cl A1 | | | | | | | | |

6.230%, ICE LIBOR USD 3 Month + 0.970%, 04/15/31 (A)(B) | | | 540,000 | | | | 534,777 | |

Octane Receivables Trust, Ser 2021-1A, Cl A | | | | | | | | |

0.930%, 03/22/27 (A) | | | 564,957 | | | | 547,775 | |

OnDeck Asset Securitization Trust III, Ser 2021-1A, Cl A | | | | | | | | |

1.590%, 05/17/27 (A) | | | 1,910,000 | | | | 1,778,027 | |

PFS Financing, Ser 2020-A, Cl A | | | | | | | | |

1.270%, 06/15/25 (A) | | | 4,000,000 | | | | 3,979,727 | |

RR 24, Ser 2022-24A, Cl A1 | | | | | | | | |

7.386%, TSFR3M + 2.400%, 01/15/32 (A)(B) | | | 1,698,562 | | | | 1,701,310 | |

SCF Equipment Leasing, Ser 2019-2A, Cl B | | | | | | | | |

2.760%, 08/20/26 (A) | | | 870,000 | | | | 843,700 | |

SCF Equipment Leasing, Ser 2020-1A, Cl A3 | | | | | | | | |

1.190%, 10/20/27 (A) | | | 452,191 | | | | 445,546 | |

SCF Equipment Leasing, Ser 2022-2A, Cl A2 | | | | | | | | |

6.240%, 07/20/28 (A) | | | 635,157 | | | | 637,019 | |

| | | | | | | | |

| ASSET-BACKED SECURITIES — continued | |

| | |

| | | Face

Amount | | | Value | |

SoFi Consumer Loan Program Trust, Ser 2023-1S, Cl A | | | | | | | | |

5.810%, 05/15/31 (A) | | $ | 307,831 | | | $ | 307,776 | |

TCI-Flatiron CLO, Ser 2021-1A, Cl AR | | | | | | | | |

5.837%, ICE LIBOR USD 3 Month + 0.960%, 11/18/30 (A)(B) | | | 749,252 | | | | 741,054 | |

Transportation Finance Equipment Trust, Ser 2019-1, Cl A4 | | | | | | | | |

1.880%, 03/25/24 (A) | | | 718,830 | | | | 717,331 | |

Verizon Master Trust, Ser 2023-2, Cl A | | | | | | | | |

4.890%, 04/13/28 | | | 1,575,000 | | | | 1,578,515 | |

Vivint Solar Financing V, Ser 2018-1A, Cl A | | | | | | | | |

4.730%, 04/30/48 (A) | | | 457,572 | | | | 415,395 | |

Vivint Solar Financing V, Ser 2018-1A, Cl B | | | | | | | | |

7.370%, 04/30/48 (A) | | | 316,522 | | | | 291,990 | |

Vivint Solar Financing VII, Ser 2020-1A, Cl B | | | | | | | | |

3.220%, 07/31/51 (A) | | | 915,428 | | | | 700,429 | |

| | | | | | | | |

| | | | | | | 40,774,992 | |

| | | | | | | | |

Total Asset-Backed Securities | | | | | | | | |

(Cost $84,745,272) | | | | | | | 83,999,867 | |

| | | | | | | | |

MORTGAGE-BACKED SECURITIES — 6.4% | |

| | |

| | | Face

Amount | | | Value | |

Agency Mortgage-Backed Obligation — 1.4% | |

FHLMC | | | | | | | | |

5.000%, 07/01/35 | | $ | 122,394 | | | $ | 124,574 | |

FNMA | | | | | | | | |

5.000%, 03/01/34 | | | 97,626 | | | | 99,256 | |

3.500%, 11/01/34 | | | 1,563,841 | | | | 1,531,385 | |

3.000%, 02/01/35 | | | 1,966,451 | | | | 1,889,772 | |

FNMA, Ser 2009-62, Cl WA | | | | | | | | |

5.579%, 08/25/39 (B) | | | 28,342 | | | | 28,645 | |

FNMA, Ser 2013-9, Cl AE | | | | | | | | |

1.750%, 03/25/39 | | | 43,426 | | | | 42,983 | |

FNMA, Ser 2019-18, Cl A | | | | | | | | |

3.500%, 05/25/49 | | | 593,402 | | | | 567,040 | |

FNMA, Ser 2022-29, Cl MG | | | | | | | | |

4.500%, 11/25/42 | | | 1,757,317 | | | | 1,726,516 | |

GNMA, Ser 2011-57, Cl BA | | | | | | | | |

3.000%, 05/20/40 | | | 25,694 | | | | 25,008 | |

GNMA, Ser 2016-131, Cl A | | | | | | | | |

2.200%, 04/16/57 | | | 76,600 | | | | 75,619 | |

GNMA, Ser 2017-99, Cl WA | | | | | | | | |

4.876%, 12/20/32 (B) | | | 248,940 | | | | 248,461 | |

GNMA, Ser 2022-177, Cl LA | | | | | | | | |

3.500%, 01/20/52 | | | 288,837 | | | | 281,739 | |

| | | | | | | | |

| | | | | | | 6,640,998 | |

| | | | | | | | |

The accompanying notes are an integral part of the financial statements.

15

CATHOLIC RESPONSIBLE INVESTMENTS SHORT DURATION BOND FUND

APRIL 30, 2023 (Unaudited)

| | | | | | | | |

| MORTGAGE-BACKED SECURITIES — continued | |

| | |

| | | Face

Amount | | | Value | |

Non-Agency Mortgage-Backed Obligation — 5.0% | |

BANK, Ser 2018-BN10, Cl ASB | | | | | | | | |

3.641%, 02/15/61 | | $ | 395,309 | | | $ | 381,702 | |

BX Commercial Mortgage Trust, Ser 2022-AHP, Cl A | | | | | | | | |

5.880%, TSFR1M + 0.990%, 01/17/39 (A)(B) | | | 492,000 | | | | 478,054 | |

BX Commercial Mortgage Trust, Ser 2022-AHP, Cl AS | | | | | | | | |

6.380%, TSFR1M + 1.490%, 01/17/39 (A)(B) | | | 2,500,000 | | | | 2,433,409 | |

BX Trust, Ser 2022-CLS, Cl B | | | | | | | | |

6.300%, 10/13/27 (A) | | | 2,200,000 | | | | 2,156,706 | |

CHL Mortgage Pass-Through Trust, Ser 2004-29, Cl 1A1 | | | | | | | | |

5.401%, ICE LIBOR USD 1 Month + 0.540%, 02/25/35 (B) | | | 9,728 | | | | 8,536 | |

COMM Mortgage Trust, Ser 2013-CR11, Cl A4 | | | | | | | | |

4.258%, 08/10/50 | | | 1,500,000 | | | | 1,487,732 | |

COMM Mortgage Trust, Ser 2014-UBS5, Cl ASB | | | | | | | | |

3.548%, 09/10/47 | | | 379,165 | | | | 373,321 | |

COMM Mortgage Trust, Ser 2015-LC19, Cl A4 | | | | | | | | |

3.183%, 02/10/48 | | | 1,275,000 | | | | 1,220,609 | |

CSAIL Commercial Mortgage Trust, Ser 2015-C1, Cl ASB | | | | | | | | |

3.351%, 04/15/50 | | | 762,840 | | | | 745,569 | |

CSAIL Commercial Mortgage Trust, Ser 2018-CX11, Cl A3 | | | | | | | | |

4.095%, 04/15/51 | | | 982,335 | | | | 970,670 | |

DBUBS Mortgage Trust, Ser 2017-BRBK, Cl E | | | | | | | | |

3.648%, 10/10/34 (A)(B) | | | 521,000 | | | | 442,143 | |

Extended Stay America Trust, Ser 2021-ESH, Cl B | | | | | | | | |

6.328%, ICE LIBOR USD 1 Month + 1.380%, 07/15/38 (A)(B) | | | 1,073,811 | | | | 1,041,539 | |

GS Mortgage Securities II, Ser 2018-GS10, Cl WLSC | | | | | | | | |

5.067%, 03/10/33 (A)(B) | | | 400,000 | | | | 338,190 | |

GS Mortgage Securities Trust, Ser 2022-SHIP, Cl A | | | | | | | | |

5.621%, TSFR1M + 0.731%, 08/15/36 (A)(B) | | | 115,000 | | | | 114,220 | |

GSR Mortgage Loan Trust, Ser 2004-9, Cl 3A1 | | | | | | | | |

3.502%, 08/25/34 (B) | | | 16,282 | | | | 15,061 | |

Hudson Yards Mortgage Trust, Ser 2016-10HY, Cl A | | | | | | | | |

2.835%, 08/10/38 (A) | | | 1,000,000 | | | | 897,771 | |

| | | | | | | | |

| MORTGAGE-BACKED SECURITIES — continued | |

| | |

| | | Face

Amount | | | Value | |

JP Morgan Mortgage Trust, Ser 2006-A2, Cl 4A1 | | | | | | | | |

4.061%, 08/25/34 (B) | | $ | 14,027 | | | $ | 13,822 | |

Life Mortgage Trust, Ser 2021-BMR, Cl A | | | | | | | | |

5.705%, TSFR1M + 0.814%, 03/15/38 (A)(B) | | | 1,867,643 | | | | 1,817,824 | |

Manhattan West 2020-1MW Mortgage Trust, Ser 1MW, Cl C | | | | | | | | |

2.413%, 09/10/39 (A)(B) | | | 214,000 | | | | 175,211 | |

MHC Commercial Mortgage Trust, Ser 2021-MHC, Cl A | | | | | | | | |

5.805%, TSFR1M + 0.915%, 04/15/38 (A)(B) | | | 4,650,000 | | | | 4,539,510 | |

Morgan Stanley Bank of America Merrill Lynch Trust, Ser 2015-C20, Cl ASB | | | | | | | | |

3.069%, 02/15/48 | | | 592,449 | | | | 578,025 | |

One Market Plaza Trust, Ser 2017-1MKT, Cl B | | | | | | | | |

3.845%, 02/10/32 (A) | | | 2,000,000 | | | | 1,819,707 | |

One Market Plaza Trust, Ser 2017-1MKT, Cl C | | | | | | | | |

4.016%, 02/10/32 (A) | | | 965,000 | | | | 868,883 | |

Sequoia Mortgage Trust, Ser 2013-2, Cl A | | | | | | | | |

1.874%, 02/25/43 (B) | | | 89,304 | | | | 75,299 | |

STWD Mortgage Trust, Ser 2021-LIH, Cl D | | | | | | | | |

7.253%, ICE LIBOR USD 1 Month + 2.305%, 11/15/36 (A)(B) | | | 450,000 | | | | 418,043 | |

| | | | | | | | |

| | | | | | | 23,411,556 | |

| | | | | | | | |

Total Mortgage-Backed Securities | | | | | | | | |

(Cost $30,846,750) | | | | | | | 30,052,554 | |

| | | | | | | | |

MUNICIPAL BONDS — 2.8% | |

| | |

| | | Face

Amount | | | Value | |

California — 0.6% | |

California Community Choice Financing Authority, RB | | | | | | | | |

5.950%, 08/01/29 | | $ | 825,000 | | | $ | 843,840 | |

City of Union City California, RB | | | | | | | | |

5.920%, 07/01/24 | | | 1,730,000 | | | | 1,739,895 | |

| | | | | | | | |

| | | | | | | 2,583,735 | |

| | | | | | | | |

Florida — 0.4% | |

Florida Development Finance | | | | | | | | |

7.500%, 07/01/57 (A)(B) | | | 1,000,000 | | | | 982,740 | |

7.250%, 07/01/57 (A)(B) | | | 1,000,000 | | | | 1,012,652 | |

| | | | | | | | |

| | | | | | | 1,995,392 | |

| | | | | | | | |

The accompanying notes are an integral part of the financial statements.

16

CATHOLIC RESPONSIBLE INVESTMENTS SHORT DURATION BOND FUND

APRIL 30, 2023 (Unaudited)

| | | | | | | | |

| MUNICIPAL BONDS — continued | |

| | |

| | | Face

Amount | | | Value | |

Hawaii — 0.2% | |

State of Hawaii Department of Business Economic Development & Tourism, Ser A-2, RB | | | | | | | | |

3.242%, 01/01/31 | | $ | 1,072,517 | | | $ | 1,032,034 | |

| | | | | | | | |

Illinois — 0.0% | |

Chicago Housing Authority, Ser B, RB | | | | | | | | |

3.822%, 01/01/26 | | | 250,000 | | | | 243,954 | |

| | | | | | | | |

Indiana — 0.1% | |

City of Fort Wayne Indiana, RB | | | | | | | | |

10.750%, 12/01/29 | | | 500,000 | | | | 499,658 | |

| | | | | | | | |

Louisiana — 0.2% | |

Louisiana Local Government Environmental Facilities & Community Development Auth, RB | | | | | | | | |

3.615%, 02/01/29 | | | 1,028,094 | | | | 1,006,311 | |

| | | | | | | | |

Montana — 0.1% | |

County of Gallatin Montana, RB | | | | | | | | |

11.500%, 09/01/27 (A) | | | 250,000 | | | | 262,542 | |

| | | | | | | | |

New Jersey — 0.4% | |

New Jersey Economic Development Authority, RB | | | | | | | | |

4.984%, 03/01/27 | | | 1,000,000 | | | | 1,007,426 | |

4.927%, 03/01/26 | | | 1,000,000 | | | | 1,002,117 | |

| | | | | | | | |

| | | | | | | 2,009,543 | |

| | | | | | | | |

New York — 0.4% | |

New York State Energy Research & Development Authority, Ser A, RB | | | | | | | | |

4.480%, 04/01/25 | | | 500,000 | | | | 494,969 | |

4.336%, 04/01/24 | | | 1,000,000 | | | | 990,583 | |

Utility Debt Securitization Authority, Ser T, RB | | | | | | | | |

3.435%, 12/15/25 | | | 653,000 | | | | 650,041 | |

| | | | | | | | |

| | | | | | | 2,135,593 | |

| | | | | | | | |

Oregon — 0.3% | |

Warm Springs Reservation Confederated Tribe, Ser G | | | | | | | | |

2.370%, 11/01/27 (A) | | | 1,000,000 | | | | 896,734 | |

2.165%, 11/01/26 (A) | | | 500,000 | | | | 455,673 | |

| | | | | | | | |

| | | | | | | 1,352,407 | |

| | | | | | | | |

South Dakota — 0.1% | |

South Dakota Housing Development Authority, Ser E, RB | | | | | | | | |

5.460%, 05/01/53 | | | 250,000 | | | | 255,193 | |

| | | | | | | | |

Total Municipal Bonds | | | | | | | | |

(Cost $13,364,866) | | | | | | | 13,376,362 | |

| | | | | | | | |

| | | | | | | | |

REPURCHASE AGREEMENT — 2.2% | |

| | | Face

Amount | | | Value | |

Socgen Triparty Tsy

4.760%, dated 04/28/23, to be repurchased on 05/01/23, repurchase price $10,104,006, collateralized by a U.S. Government obligation, par value $10,302,001, 5.000%, 12/20/2052, with a total market value of $10,263,236 | | $ | 10,100,000 | | | $ | 10,100,000 | |

| | | | | | | | |

Total Repurchase Agreements | | | | | | | | |

(Cost $10,100,000) | | | | | | | 10,100,000 | |

| | | | | | | | |

U.S. GOVERNMENT AGENCY OBLIGATIONS — 0.6% | |

| | |

| | | Face

Amount | | | Value | |

Export-Import Bank of the United States | | | | | | | | |

2.628%, 11/12/26 | | $ | 2,006,766 | | | $ | 1,960,166 | |

Export-Import Bank of the United States | | | | | | | | |

1.900%, 07/12/24 | | | 543,816 | | | | 530,360 | |

United States International Development Finance | | | | | | | | |

1.790%, 10/15/29 | | | 374,735 | | | | 342,898 | |

| | | | | | | | |

Total U.S. Government Agency Obligations | | | | | | | | |

(Cost $2,950,381) | | | | | | | 2,833,424 | |

| | | | | | | | |

Total Investments in Securities — 99.4% | | | | | |

(Cost $472,899,796) | | | | | | $ | 464,760,104 | |

| | | | | | | | |

Percentages are based on Net Assets of $467,370,226.

A list of the open futures contracts held by the Fund at April 30, 2023, is as follows:

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Type of

Contract | | Number

of

Contracts | | | Expiration