As filed with the U.S. Securities and Exchange Commission on November 18, 2022

Registration No. 333-______

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM F-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

CytoMed Therapeutics Pte. Ltd.

(Exact Name of Registrant as Specified in its Charter)

Not Applicable

(Translation of Registrant’s name into English)

Singapore | | 2834 | | Not Applicable |

(State or Other Jurisdiction of Incorporation or Organization) | | (Primary Standard Industrial Classification Code Number) | | (I.R.S. Employer Identification Number) |

1 Commonwealth Lane

#08-22

Singapore 149544

+65 6250 7738

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

Puglisi & Associates

850 Library Ave, Suite 204

Delaware, DE 19711

(302)-738-6680

(Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent for Service)

Copies to:

Richard I. Anslow, Esq. Lijia Sanchez, Esq. Ellenoff Grossman & Schole LLP 1345 Avenue of the Americas New York, NY 10105 Tel: (212) 370-1300 Fax: (212) 370-7889 | | Richard A. Friedman, Esq. Stephen A. Cohen, Esq. Sean F. Reid, Esq. Sheppard, Mullin, Richter & Hampton LLP 30 Rockefeller Plaza New York, NY 10112 Tel: (212) 653-8700 Fax: (212) 653-8701 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☐

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933:

Emerging growth company ☒

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to such Section 8(a), may determine.

The information in this Prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This Prospectus is not an offer to sell these securities and we are not soliciting offers to buy these securities in any state where the offer or sale is not permitted.

Subject to Completion dated November 18, 2022

PRELIMINARY PROSPECTUS

ORDINARY SHARES

CYTOMED THERAPEUTICS PTE. LTD.

We are offering ordinary shares. This is the initial public offering of ordinary shares of CytoMed Therapeutics Pte. Ltd. We are offering, on a firm commitment basis, [●] ordinary shares. The Selling Shareholders (as defined and named herein) are offering an aggregate of [●] ordinary shares to the underwriter pursuant to this prospectus. The offering price of our ordinary shares in this offering is expected to be between U.S.$ and U.S.$ per share. Prior to this offering, there has been no public market for our ordinary shares.

We have applied to list our ordinary shares on the Nasdaq Capital Market under the symbol “GDTC”. There is no assurance that such application will be approved, and if our application is not approved, this offering may not be completed.

We are an “emerging growth company” as defined in the Jumpstart Our Business Act of 2012, as amended, and, as such, will be subject to reduced public company reporting requirements.

Investing in our ordinary shares is highly speculative and involves a high degree of risk. Before buying any shares, you should carefully read the discussion of material risks of investing in our ordinary shares in “Risk Factors” beginning on page 26 of this Prospectus.

Neither the Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities or passed upon the accuracy or adequacy of this Prospectus. Any representation to the contrary is a criminal offense.

| | | | PER SHARE | | | | TOTAL(2) | |

| Initial public offering Price | | U.S.$ | | | | U.S.$ | | |

| Underwriting discounts and commissions(1) | | U.S.$ | | | | U.S.$ | | |

| Proceeds, before expenses, to us | | U.S.$ | | | | U.S.$ | | |

| Proceeds to the Selling Shareholders | | U.S.$ | | | | U.S.$ | | |

(1) We have agreed to issue, on the closing date of this offering, warrants, or the representative’s warrants, to the representative of the underwriters, The Benchmark Company, LLC, in an amount equal to 5% of the aggregate number of ordinary shares sold by us in this offering, excluding any shares issued pursuant to exercise of the underwriter’s over-allotment option. For a description of other terms of the representative’s warrants and a description of the other compensation to be received by the underwriters, see “Underwriting” beginning on page 181.

(2) Includes US$[●] gross proceeds from the sale of [●] ordinary shares offered by our Company and US$[●] gross proceeds from the sale of [●] ordinary shares offered by the Selling Shareholders.

We expect our total cash expenses for this offering (including cash expenses payable to our underwriters for their out-of-pocket expenses) to be approximately U.S.$ , exclusive of the above discounts. In addition, we will pay additional items of value in connection with this offering that are viewed by the Financial Industry Regulatory Authority, or FINRA, as underwriting compensation. These payments will further reduce proceeds available to us before expenses. See “Underwriting.”

This offering is being conducted on a firm commitment basis. The underwriters are obligated to take and pay for all of the shares if any such shares are taken. We have granted the underwriters an option for a period of 45 days after the closing of this offering to purchase up to 15% of the total number of our ordinary shares to be offered by us pursuant to this offering (excluding shares subject to this option), solely for the purpose of covering over-allotments, at the initial public offering price less the underwriting discounts. If the underwriters exercise the option in full, the total underwriting discounts payable will be U.S.$ based on an assumed initial public offering price of U.S.$ per ordinary share (the midpoint of the price range set forth on the cover page of this Prospectus), and the total gross proceeds to us, before underwriting discounts and expenses, will be U.S.$ .

The underwriters expect to deliver the ordinary shares against payment as set forth under the section titled “Underwriting” on or about , 2022.

| The Benchmark Company | Axiom Capital Management, Inc. |

The date of this Prospectus is , 2022.

Explanatory Note

As at the date of this Prospectus, the registrant is a private company limited by shares incorporated in Singapore, known as CytoMed Therapeutics Pte. Ltd. Prior to the consummation of this offering, we intend to convert CytoMed Therapeutics Pte. Ltd. from a private company limited by shares to a public company pursuant to the provisions of the Singapore Companies Act. Upon such conversion, the registrant will be a public company known as CytoMed Therapeutics Limited.

References to “the date of this Prospectus” in this draft Prospectus shall refer to the date of confidential submission of this draft Prospectus.

TABLE OF CONTENTS

Neither we, the Selling Shareholders nor the underwriters have authorized anyone to provide any information or to make any representations other than those contained in this Prospectus or in any free writing prospectuses prepared by or on behalf of us or to which we have referred you. We, the Selling Shareholders and the underwriters take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. This Prospectus is an offer to sell only the shares offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. The information contained in this Prospectus or in any applicable free writing prospectus is current only as of its date, regardless of its time of delivery or any sale of our ordinary shares. Our business, financial condition, results of operations and prospects may have changed since that date.

You should rely only on the information contained in this Prospectus or in any related free-writing prospectus. We have not authorized anyone to provide you with information different from that contained in this Prospectus. We are offering to sell, and seeking offers to buy, ordinary shares in our Company only in jurisdictions where such offers and sales are permitted. The information contained in this Prospectus is current only as of the date of this Prospectus, regardless of the time of delivery of this Prospectus or of any sale of the ordinary shares.

For investors outside the United States: Neither we, the Selling Shareholders nor the underwriters have done anything that would permit this offering or possession or distribution of this Prospectus in any jurisdiction, other than the United States, where action for that purpose is required. Persons outside the United States who come into possession of this Prospectus must inform themselves about, and observe any restrictions relating to, the offering of the ordinary shares and the distribution of this Prospectus outside the United States.

We are incorporated under the laws of Singapore as a company with limited liability, and as of the date of this Prospectus a majority of our outstanding securities are owned by non-U.S. residents. Under the rules of the U.S. Securities and Exchange Commission, or the SEC, we currently qualify for treatment as a “foreign private issuer.” As a foreign private issuer, we will not be required to file periodic reports and financial statements with the Securities and Exchange Commission, or the SEC, as frequently or as promptly as domestic registrants whose securities are registered under the Securities Exchange Act of 1934, as amended, or the Exchange Act.

Until , 2022 (25 days after the date of this Prospectus), all dealers that effect transactions in these securities, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to the dealer’s obligation to deliver a prospectus when acting as an underwriter and with respect to their unsold allotments or subscriptions.

ABOUT THIS PROSPECTUS

“CytoMed”, “CytoMed Therapeutics”, the “Company”, “we”, “our”, “ours”, “us”, “our Group” and similar terms refer to CytoMed Therapeutics Pte. Ltd. and/or its subsidiaries (where applicable).

For investors outside of the United States: Neither we nor the selling shareholder have done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside of the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the ordinary shares and the distribution of this prospectus outside of the United States.

For investors in Singapore: This prospectus has not been registered as a prospectus with the Monetary Authority of Singapore. Accordingly, our ordinary shares were not offered or sold or caused to be made the subject of an invitation for subscription or purchase and will not be offered or sold or caused to be made the subject of an invitation for subscription or purchase, and this prospectus or any other document or material in connection with the offer or sale, or invitation for subscription or purchase, of our ordinary shares, has not been circulated or distributed, nor will it be circulated or distributed, whether directly or indirectly, to any person in Singapore other than (i) to an institutional investor (as defined in Section 4A of the Securities and Futures Act 2001 of Singapore, as modified or amended from time to time (“SFA”)) pursuant to Section 274 of the SFA, (ii) to a relevant person (as defined in Section 275(2) of the SFA) pursuant to Section 275(1) of the SFA, or any person pursuant to Section 275(1A) of the SFA, and in accordance with the conditions specified in Section 275 of the SFA and (where applicable) Regulation 3 of the Securities and Futures (Classes of Investors) Regulations 2018, or (iii) otherwise pursuant to, and in accordance with the conditions of, any other applicable provision of the SFA.

Where our ordinary shares are subscribed or purchased under Section 275 of the SFA by a relevant person which is:

(a) a corporation (which is not an accredited investor (as defined in Section 4A of the SFA)) the sole business of which is to hold investments and the entire share capital of which is owned by one or more individuals, each of whom is an accredited investor; or

(b) a trust (where the trustee is not an accredited investor) whose sole purpose is to hold investments and each beneficiary of the trust is an individual who is an accredited investor, securities or securities-based derivatives contracts (each term as defined in Section 2(1) of the SFA) of that corporation or the beneficiaries’ rights and interest (howsoever described) in that trust shall not be transferred within six months after that corporation or that trust has acquired the ordinary shares pursuant to an offer made under Section 275 of the SFA, except:

| ● | to an institutional investor or to a relevant person, or to any person arising from an offer referred to in Section 275(1A) of the SFA or Section 276(4)(c)(ii) of the SFA; |

| ● | where no consideration is or will be given for the transfer; |

| ● | where the transfer is by operation of law; |

| ● | as specified in Section 276(7) of the SFA; or |

| ● | as specified in Regulation 37A of the Securities and Futures (Offers of Investments) (Securities and Securities-based Derivatives Contracts) Regulations 2018. |

Any reference to the SFA is a reference to the Securities and Futures Act 2001 of Singapore and a reference to any term as defined in the SFA or any provision in the SFA is a reference to that term as modified or amended from time to time including by such of its subsidiary legislation as may be applicable at the relevant time.

Notification under Section 309B(1)(c) of the SFA: The Company has determined, and hereby notifies all persons (including relevant persons (as defined in Section 309A(1) of the SFA)) that the ordinary shares are prescribed capital markets products (as defined in the Securities and Futures (Capital Markets Products) Regulations 2018) and Excluded Investment Products (as defined in MAS Notice SFA 04-N12: Notice on the Sale of Investment Products and MAS Notice FAA-N16: Notice on Recommendations on Investment Products).

By accepting this prospectus, the recipient hereof and thereof represents and warrants that such recipient is entitled to receive it in accordance with the restrictions set forth above and agrees to be bound by the limitations contained herein. Any failure to comply with these limitations may constitute a violation of law.

PRESENTATION OF FINANCIAL INFORMATION

Basis of Presentation

Unless otherwise indicated, all financial information contained in this Prospectus is prepared and presented in accordance with International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board (“IASB”). Certain differences exist between IFRS and generally accepted accounting principles in the United States (“U.S. GAAP”) which might be material to the financial information herein. We have not prepared a reconciliation of our consolidated financial statements and related footnote disclosures between IFRS and U.S. GAAP. Potential investors should consult their own professional advisers for an understanding of the differences between IFRS and U.S. GAAP and how these differences might affect the financial information herein.

All references in this Prospectus to “U.S. dollars”, “U.S.$” and “USD” refer to the currency of the United States of America, all references to “S$” or “Singapore dollars” or “SGD” refer to the currency of Singapore and all references to “RM” or “Malaysian Ringgit” or “Ringgit” refer to the currency of Malaysia.

Our financial year ends on December 31 of each year. References in this Prospectus to a financial year, such as “financial year 2020”, relate to our financial year ended on December 31 of that calendar year.

We have made rounding adjustments to some of the figures included in this Prospectus. Accordingly, numerical figures shown as totals in some tables may not be an arithmetic aggregation of the figures that precede them.

EXCHANGE RATES

All translations from Singapore dollars to U.S. dollars and from U.S. dollars to Singapore dollars in this Prospectus are made at a rate of S$1.3903 to U.S.$1.00, the exchange rate in effect as of June 30, 2022 as set forth in the H.10 statistical release of the U.S. Board of Governors of the Federal Reserve System. We make no representation that any Singapore dollars amounts or U.S. dollars amounts could have been, or could be, converted into U.S. dollars or Singapore dollars, as the case may be, at any particular rate, or at all.

MARKET AND INDUSTRY DATA

Certain market data and forecasts used throughout this Prospectus were obtained from internal company surveys, market research, consultant surveys, reports of governmental and international agencies and industry publications and surveys. Industry publications and third-party research, surveys and reports generally indicate that their information has been obtained from sources believed to be reliable. This information involves a number of assumptions and limitations, and you are cautioned not to give undue weight to such estimates. Our estimates involve risks and uncertainties and are subject to change based on various factors, including those discussed under the section titled “Risk Factors” in this Prospectus. The industry in which we operate is also subject to a high degree of uncertainty and risks due to a variety of factors, including those described under the section titled “Risk Factors” in this Prospectus. These factors could cause results to differ materially from those expressed in the estimates made by the independent parties and by us in this Prospectus.

TRADEMARKS

“CYTOMED THERAPEUTICS”, the CytoMed Therapeutics logo, and other trademarks, trade names or service marks of CytoMed Therapeutics Pte. Ltd. appearing in this Prospectus are the property of CytoMed Therapeutics Pte. Ltd. All other trademarks, trade names and service marks appearing in this Prospectus are the property of their respective owners. Solely for convenience, the trademarks and trade names in this Prospectus may be referred to without the ® and ™ symbols, but such references should not be construed as any indicator that their respective owners will not assert their rights thereto.

PROSPECTUS SUMMARY

This summary only highlights the more detailed information appearing elsewhere in this Prospectus. As this is a summary, it does not contain all of the information that you should consider in making an investment decision. You should read this entire Prospectus carefully, including the information under the section titled “Risk Factors” and our financial statements and the related notes in this Prospectus, before investing.

DEFINITIONS

Unless otherwise stated in this Prospectus or the context otherwise requires, references to:

| ● | “γδ TCR” are to gamma delta T-cell receptor; |

| | | |

| ● | “A*STAR” are to the Agency for Science, Technology and Research of Singapore; |

| | | |

| ● | “ACCA” are to the Association of Chartered Certified Accountants; |

| | | |

| ● | “ACRA” are to the Accounting and Corporate Regulatory Authority of Singapore; |

| | | |

| ● | “ACRA Code” are to the Code of Professional Conduct and Ethics for Public Accountants and Accounting Entities; |

| | | |

| ● | “ACTRIS” are to the Advanced Cell Therapy and Research Institute, Singapore; |

| | | |

| ● | “Advertisement Regulations” are to the Health Products (Advertisement of Specified Health Products) Regulations 2016 enacted under the HPA (as defined below); |

| | | |

| ● | “ANGELICA Trial” are to the Phase I trial to evaluate allogeneic NKG2DL-targeting chimeric antigen receptor-grafted gamma delta T cells (CTM-N2D) in subjects with advanced solid tumours or haematological malignancies; |

| | | |

| | ● | “ASX” are to the Australian Securities Exchange Ltd; |

| | | |

| ● | “ATPL” are to Accelerate Technologies Pte. Ltd. (formerly known as ETPL); |

| | | |

| ● | “BAS” are to building automated system; |

| | | |

| ● | “BCMA” are to B-cell maturation antigen; |

| | | |

| ● | “BMR” are to batch manufacturing records; |

| | | |

| ● | “BNM” are to the Central Bank of Malaysia or Bank Negara Malaysia; |

| | | |

| ● | “Board” or “Board of Directors” are to the board of directors of the Company; |

| | | |

| ● | “CAR” are to chimeric antigen receptor; |

| | | |

| ● | “CAR-T” are to chimeric antigen receptor-modified T cells; |

| | | |

| ● | “CDCR” are to the Control of Drugs and Cosmetics Regulations 1984 of Malaysia, as amended; |

| | | |

| ● | “cGMP” are to current good manufacturing practice, a system for ensuring that products are consistently produced and controlled according to quality standards; |

| ● | “cGMP Facility” are to the Company’s current good manufacturing practice and processing facility located at 12 Jalan Permas 9/16, Bandar Baru Permas Jaya, 81750 Johor, Malaysia; |

| | | |

| ● | “CGTP” are to Cell and Gene Therapy Products; |

| | | |

| ● | “Clean Air Regulations” are to the Environmental Quality (Clean Air) Regulations 2014 of Malaysia; |

| | | |

| ● | “Clinical Trials Regulations” are to the Health Products (Clinical Trials) Regulations of 2016 enacted under the HPA (as defined below), which governs clinical trials of therapeutic products and applicable CTGTP (as defined below) that are not observational trials within Singapore; |

| | | |

| ● | “Code” are to the Internal Revenue Code of 1986 of the United States of America; |

| | | |

| ● | “Comptroller” are to the comptroller of income tax in Singapore; |

| | | |

| ● | “Contract Manufacturing Organization” or “CMO” are to companies that provide drug development and drug manufacturing services to the companies in the pharmaceutical industry on a contract basis; |

| | | |

| ● | “Contract Research Organization” or “CRO” are to companies that provide research support to the companies in pharmaceutical and biotechnology industries on a contract basis; |

| | | |

| ● | “COVID-19” are to the worldwide novel coronavirus disease pandemic; |

| | | |

| | ● | “CRIS” are to the Consortium for Clinical Research and Innovation Singapore, a wholly-owned subsidiary of the Ministry of Health Singapore; |

| | | |

| ● | “CRM” are to clinical research materials, which refer to any registered or unregistered therapeutic product, medicinal product, medicinal device, applicable CTGTP or placebo, that is manufactured, imported or supplied for the purpose of being used in clinical research, by way of administration to a trial participant in accordance with the research protocol or for a clinical purpose; |

| | | |

| ● | “CRM Regulations” are to the Health Products (Clinical Research Materials) Regulations of 2016 enacted under the HPA (as defined below), which govern the import, manufacture and supply of clinical research materials for use in clinical research studies within Singapore; |

| | | |

| ● | “CRS” are to cytokine release syndrome; |

| | | |

| | ● | “CTA” are to Clinical Trial Authorization, which is required prior to the initiation of a clinical trial of a therapeutic product; |

| | | |

| | ● | “CTGT” are to cell, tissue and gene therapy; |

| | | |

| ● | “CTGTP” are to cell, tissue and gene therapy products; |

| | | |

| ● | “CTGTP Regulations” are to the Health Products (Cell, Tissue and Gene Therapy Products) Regulations of 2021 enacted under the HPA (as defined below), which provide for regulating the manufacture, import, supply, presentation, registration, duties, and obligations of manufacturers, importers and other persons carrying out such activities as related to CTGTP in Singapore; |

| | | |

| ● | “CTIL” are to Clinical Trial Import License in Malaysia; |

| | | |

| ● | “CTM-N2D” are to CAR-gamma delta T cell proprietary product developed by our Group; |

| | | |

| ● | “CTM-GDT” are to allogeneic gamma delta T cell proprietary product developed by our Group; |

| | | |

| ● | “CTX” are to Clinical Trial Exemption in Malaysia; |

| ● | “CytoMed Malaysia” are to CytoMed Therapeutics (Malaysia) Sdn Bhd, a company incorporated on December 18, 2013 in Malaysia (Company No. 201301044786 (1074609-M)) with its registered address at Room 503, 5th Floor, Merlin Tower, Jalan Meldrum, 80000 Johor Bahru, Johor, Malaysia, the manufacturing arm of the Group where a PIC/S GMP laboratory is located and which manufacturing capacity includes stem cells and cancer living medicine; |

| | | |

| ● | “CytoMed Therapeutics”, “CytoMed” or “Company” are to CytoMed Therapeutics Pte. Ltd., a company incorporated on March 9, 2018 in Singapore (Company Registration Number: 201808327H) with its registered address at 1 Commonwealth Lane, #08-22, Singapore 149544; |

| | | |

| ● | “Director” are to the directors of the Company; |

| | | |

| ● | “Director General” are to the Director General of Environmental Quality as referred to in the EQA; |

| | | |

| ● | “DNA” are to deoxyribonucleic acid, a large complex macromolecule containing the genetic code and which is typically found in the nucleus of a human cell; |

| | | |

| ● | “DTC” are to Depository Trust Company; |

| | | |

| ● | “ECEG 2016” are to the Ethical Code and Ethical Guidelines (2016 edition) published by the SMC; |

| | | |

| | ● | “EIS” are to the Employment Insurance System in Malaysia; |

| | | |

| ● | “EISA” are to the Employment Insurance System Act 2017 of Malaysia; |

| | | |

| ● | “EPFA” are to the Employee Provident Fund Act 1991 of Malaysia; |

| | | |

| ● | “ESSA” are to the Employees’ Social Security Act 1969 of Malaysia; |

| | | |

| ● | “ETPL” are to Exploit Technologies Pte Ltd (now known as ATPL); |

| | | |

| ● | “EQA” are to the Environmental Quality Act 1974 of Malaysia; |

| | | |

| ● | “Exchange Act” are to the Securities Exchange Act of 1934 in the United States of America, as amended; |

| | | |

| ● | “FDA” are to the United States Food and Drug Administration; |

| | | |

| ● | “Federal Reserve System” are to the central bank of the United States of America; |

| | | |

| ● | “Financial Institution” is defined in the FX Notices as a person carrying out a financial business regulated under the laws administered by BNM and any person carrying out any other financial business as may be specified by BNM; |

| | | |

| ● | “Financial Instrument” is defined in the FX Notices and FSA to include any agreement, including an option, a swap, futures or forward contract, whose market price, value, delivery or payment obligations is derived from, referenced to or based on, but not limited to, securities, commodities, assets, rates (including interest rates or exchange rates) or indices; |

| | | |

| ● | “FMA” are to the Factories and Machinery Act 1967 of Malaysia; |

| | | |

| ● | “Foreign Exchange Notices” or “FX Notices” are to the notices issued by the BNM under the FSA and IFSA, which local and foreign investors are subject to; |

| ● | “FRS” or “SFRS(I) 9” are to the Singapore Financial Reporting Standard or the Singapore Financial Reporting Standard (International) 9, respectively; |

| | | |

| ● | “FSA” are to the Financial Services Act 2013 of Malaysia; |

| | | |

| ● | “gamma delta T-iPSCs” are to gamma delta T cells converted into iPSCs; |

| | | |

| ● | “GCP” or “Good Clinical Practice” are to good clinical practice; |

| | | |

| ● | “GMP” are to good manufacturing practice; |

| | | |

| ● | “Group”, “We”, “Us” and “Our” are to the Company and its subsidiaries; |

| | | |

| ● | “GST” means goods and services tax imposed pursuant to the Goods and Services Tax Act 1993 of Singapore; |

| | | |

| ● | “Guidelines on CGTPs” are to the Guidelines For Registration of Cell and Gene Therapy Products of Malaysia, issued under regulation 29 of the CDCR and effective on January 1, 2021; |

| | | |

| ● | “GvHD” are to graft versus host disease; |

| | | |

| ● | “HCS Bill” are to the Healthcare Services Bill, which was passed in the Singapore Parliament on January 6, 2020; |

| | | |

| ● | “HCSA” are to the upcoming Healthcare Services Act of Singapore, which will be implemented in phases. As of the date of this Prospectus, the phased implementation of the HCSA is targeted to be from January 3, 2022, with all phases targeted to be implemented in Singapore by March 2023; |

| | | |

| ● | “Health Products Act” or “HPA” are to the Health Products Act 2007 of Singapore that regulates the manufacture, import, supply, presentation and advertisement of health products and of active ingredients used in the manufacture of health products within Singapore; |

| | | |

| ● | “Health Sciences Authority” or “HSA” are to the statutory board under the Ministry of Health Singapore; |

| | | |

| ● | “hESCs” are to human embryonic stem cells; |

| | | |

| ● | “HME 2016” are to the Handbook on Medical Ethics (2016 edition) issued by the SMC; |

| | | |

| ● | “HPA Order 2021” are to the Health Products Act (Amendment of First Schedule) Order 2021 of Singapore enacted under the HPA, an order in which a new category of health products, namely cell, tissue or gene therapy product, is included in the First Schedule of the HPA; |

| | | |

| ● | “hPSCs” are to human pluripotent stem cells; |

| | | |

| ● | “HSA Act” are to Health Sciences Authority Act 2001 of Singapore; |

| | | |

| | ● | “Human Biomedical Research Act” or “HBRA” are to the Human Biomedical Research Act 2015 of Singapore that regulates the conduct of human biomedical research, further regulates certain restricted human biomedical research, and prohibits certain types of human biomedical research; |

| ● | “IASB” are to International Accounting Standards Board; |

| | | |

| ● | “ICA” are to the Industrial Co-ordination Act 1975 of Malaysia, as amended; |

| | | |

| ● | “IFRS” are to the international financial reporting standards as adopted by the International Accounting Standards Board; |

| | | |

| ● | “IFSA” are to the Islamic Financial Services Act 2013 of Malaysia, as amended; |

| | | |

| ● | “IL-2” are to interleukin-2; |

| | | |

| ● | “IMCB” are to the Institute of Molecular and Cell Biology, a research institute of A*STAR launched on January 23, 1985 to develop and support the biomedical research and development capabilities in Singapore; |

| | | |

| ● | “Incentive Plan” are to the equity incentive plan that the Company expects to adopt; |

| | | |

| ● | “Income Tax Act” are to the Income Tax Act 1947 of Singapore; |

| | | |

| ● | “iPSC” are to induced pluripotent stem cells; |

| | | |

| ● | “iPSC-gdNKT” are to iPSC-derived gamma delta natural killer T cell product developed by our Group; |

| | | |

| ● | “IRAS” are to the Inland Revenue Authority of Singapore; |

| | | |

| ● | “ISAs” are to the International Standards on Auditing; |

| | | |

| ● | “ISCA” are to the Institute of Singapore Chartered Accountants; |

| | | |

| ● | “JOBS Act” are to the Jumpstart Our Business Startups Act of 2012 of the United States, as amended; |

| | | |

| ● | “Johor Bahru By-Laws” are to the Trade, License, Business and Industrial (MBJB) By-Laws 2016 of Malaysia; |

| | | |

| ● | “JSE” are to the Johannesburg Stock Exchange; |

| | | |

| ● | “K562 cells” are to the human myelogenous leukemia cell line; |

| | | |

| | ● | “K562 Cell License for NK cell expansion” are to the license granted pursuant to the license agreement entered into between the Company and ATPL in December 2020; |

| | | |

| | ● | “Know-How License” are to the license granted pursuant to the license agreement entered into between Puricell and ATPL in October 2020; |

| | | |

| | ● | “LMC” are to the Landmark Medical Centre Sdn Bhd, a licensed private hospital located in Johor Bahru, Malaysia; |

| | | |

| ● | “Lower-tier PFIC” are to an entity in which a PFIC owns equity interests in; |

| | | |

| ● | “MA” are to the Medicines Act 1975 of Singapore; |

| | | |

| ● | “Malaysian Ringgit” or “RM” or “Ringgit” are to the currency of Malaysia; |

| | | |

| ● | “Management” or our “Management Team” are to our executive officers and Directors; |

| | | |

| ● | “Marketing Authorization Application” or “MAA” are to an application submitted by a drug manufacturer seeking marketing authorization, that is permission from a medical regulatory authority to bring a medicinal product to the market; |

| | | |

| ● | “Medicare” are to the national health insurance program in the United States of America; |

| | | |

| ● | “mGFP-γδ T” are to the gamma delta T cells subjected to electroporation using mRNA encoding mGFP; |

| | | |

| ● | “Ministry of Health Malaysia” or “MOH Malaysia” are to the Ministry of Health of the Malaysian Government; |

| | | |

| ● | “Ministry of Health Singapore” or “MOH Singapore” are to the Ministry of Health of the Singapore Government; |

| | | |

| ● | “MITI” are to the Ministry of International Trade and Industry of Malaysia; |

| ● | “mRNA” are to messenger RNA, a type of RNA that acts as a messenger that is read by ribosomes to build proteins; |

| | | |

| ● | “MSCs” are to mesenchymal stem cells; |

| | | |

| ● | “Nasdaq” are to The Nasdaq Stock Market LLC; |

| | | |

| ● | “Nasdaq Listing Rules” are to the listing requirements of Nasdaq, as amended, modified or supplemented from time to time; |

| | | |

| ● | “NDA” are to the new drug application to the HSA and/or other relevant health and regulatory authorities, through which formal proposal is made to the HSA and/or other relevant health and regulatory authorities for approval of a new drug; |

| | | |

| ● | “NEOs” are to the Company’s named executive officers, being CHOO Chee Kong, Dr. Lucas LUK Tien Wee, Dr. ZENG Jieming and Dr. TAN Wee Kiat as at the date of this Prospectus; |

| | | |

| ● | “NK cells” are to natural killer cells, a type of immune cell found in the human body; |

| | | |

| ● | “NKG2D” are to natural killer group 2D receptor, a type of receptor typically found on the NK cell; |

| | | |

| ● | “NKG2DL” are to natural killer group 2D ligands, a type of ligand typically expressed by tumor cells, enabling NK cells to activate and kill tumor cells; |

| | | |

| ● | “NKG2Dz-γδT” are to gamma delta T cells grafted with NKG2DL-targeting CAR; |

| | | |

| ● | “NKT” are to natural killer T cells; |

| | | |

| | ● | “NOL” means net operating loss; |

| | | |

| ● | “NPCB” are to the National Pharmaceutical Control Bureau, Ministry of Health Malaysia; |

| | | |

| ● | “NPRA” are to the National Pharmaceutical Regulatory Authority, Ministry of Health Malaysia; |

| | | |

| ● | “Occupational Safety and Health Laws” are to the legislation, regulation and rules in respect of occupational safety and health in Malaysia; |

| | | |

| ● | “OECD” are to the Organization for Economic Co-operation and Development; |

| | | |

| | ● | “off-the-shelf” are to the manufacturing of the stated cell therapies in quantities, which utilizes either donor blood cells or iPSCs as starting materials, but not the limited patient’s own blood cells and no matching is required between such donor and recipient of the product; |

| | | |

| ● | “one-tier system” are to the one-tier corporate tax system in Singapore; |

| | | |

| ● | “OSHA” are to Occupational Safety and Health Act 1994 of Malaysia; |

| | | |

| ● | “PA 1952” are to the Poisons Act 1952 of Malaysia; |

| | | |

| ● | “PAg” are to phosphoantigen, a type of small molecule that stimulates gamma delta T cells expressing Vγ9 and Vδ2 molecules; |

| | | |

| | ● | “Patent License” are to the license granted pursuant to the license agreement entered into between the Company and ETPL in June 2018, as varied by an addendum entered into in December 2020, second addendum entered into in September 2021, and third addendum entered into effective as of October 18, 2022; |

| | | |

| ● | “PCID Regulations” are to the Prevention and Control of Infectious Diseases (Importation and Exportation of Human Remains, Human Tissues and Pathogenic Organisms or Substances) Regulations 2005 of Malaysia, as amended; |

| | | |

| ● | “PDPA Malaysia” are to the Personal Data Protection Act 2010 of Malaysia; |

| | | |

| ● | “PDPA Singapore” are to the Personal Data Protection Act 2012 of Singapore; |

| | | |

| ● | “PFIC” are to passive foreign investment company; |

| | | |

| ● | “PHFSA” are to the Private Healthcare Facilities and Services Act 1998 of Malaysia; |

| | | |

| ● | “PHMCA” are to the Private Hospitals and Medical Clinics Act 1980 of Singapore; |

| ● | “PIC/S” are to the pharmaceutical inspection co-operation scheme; |

| | | |

| ● | “Prospectus” are to this prospectus of the Company dated [●], 2022; |

| | | |

| ● | “PTAB” are to the Patent Trial and Appeal Board; |

| | | |

| ● | “Puricell” are to Puricell Lab Pte Ltd, a 95% owned subsidiary of the Company; |

| | | |

| ● | “QA” are to quality assurance; |

| | | |

| ● | “QC” are to quality control; |

| | | |

| ● | “R&D” are to research and development; |

| | | |

| | ● | “REJA” are to the Reciprocal Enforcement of Judgments Act 1958 of Malaysia; |

| | | |

| ● | “Resident” is defined in the FX Notices as, among others, a body corporate incorporated or established, or registered with or approved by any authority, in Malaysia; |

| | | |

| ● | “RNA” are to ribonucleic acid, a biological macromolecule that functions to convert the genetic information of DNA into proteins; |

| | | |

| ● | “Sarbanes-Oxley Act” are to the Sarbanes-Oxley Act of 2002, as amended; |

| | | |

| ● | “scFv” are to single-chain variable fragment, a technique used to produce a functional antigen-binding fragment on a cellular level; |

| | | |

| ● | “Scientific Advisory Board” or “SAB” are to the Company’s board of scientific advisors which provide the Company with on-going scientific advice; |

| | | |

| | ● | “SEC” are to the Securities and Exchange Commission of the United States of America; |

| | | |

| ● | “Securities Act” are to the Securities Act of 1933 of the United States of America, as amended; |

| | | |

| | ● | “Selling Shareholders” are collectively [(i) [●] as to [●] ordinary shares and (ii) [●] as to [●] ordinary shares], existing shareholders of our Company that are selling a portion of their ordinary shares pursuant to this prospectus; |

| | | |

| ● | “SFRS(I)” are to the Singapore Financial Reporting Standard (International); |

| | | |

| ● | “SGX-ST” are to the Singapore Exchange Securities Trading Limited; |

| | | |

| | ● | “SIC” are to the Securities Industry Council of Singapore; |

| | | |

| | ● | “SID” are to the Singapore Institute of Directors; |

| | | |

| | ● | “Singapore Companies Act” are to the Companies Act 1967 of Singapore; |

| | | |

| | ● | “Singapore Laboratory” are to the Company’s property located at 1 Commonwealth Lane, #08-22, Singapore 149544, with intended use as an office and research laboratory; |

| | | |

| ● | “Singapore Medical Council” or “SMC” are to the statutory board under the Ministry of Health Singapore which regulates the practice of medicine in Singapore; |

| | | |

| ● | “Singapore Take-over Code” are to the Singapore Code on Take-overs and Mergers; |

| | | |

| ● | “SOCSO” are to the Social Security Organization Fund of Malaysia; |

| | | |

| ● | “Stamp Duties Act” are to the Stamp Duties Act 1929 of Singapore; |

| | | |

| ● | “TCR” or “TCRs” are to T cell receptors; |

| | | |

| ● | “UK” are to the United Kingdom; |

| | | |

| ● | “United States” or “U.S.” are to the United States of America; |

| | | |

| ● | “VStock” are to V Stock Transfer, LLC, the transfer agent and registrar of the Company; |

| | | |

| ● | “U.S. Board of Governors” are to the governing body of the Federal Reserve System in the United States of America; |

| | | |

| ● | “U.S. GAAP” are to generally accepted accounting principles in the United States of America; and |

| ● | “U.S. Holder” are to a person that is, for U.S. federal income tax purposes, a beneficial owner of ordinary shares and a citizen or individual resident of the United States, a corporation, or other entity taxable as a corporation, created or organized in or under the laws of the United States, any state therein or the District of Columbia, or an estate or trust the income of which is subject to U.S. federal income taxation regardless of its source. |

Our Business

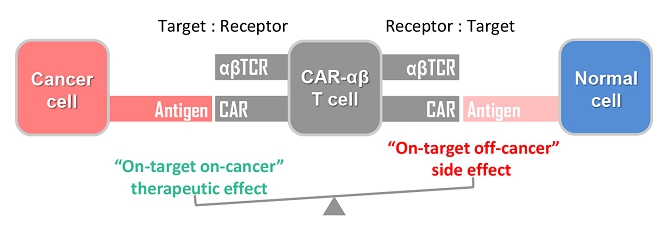

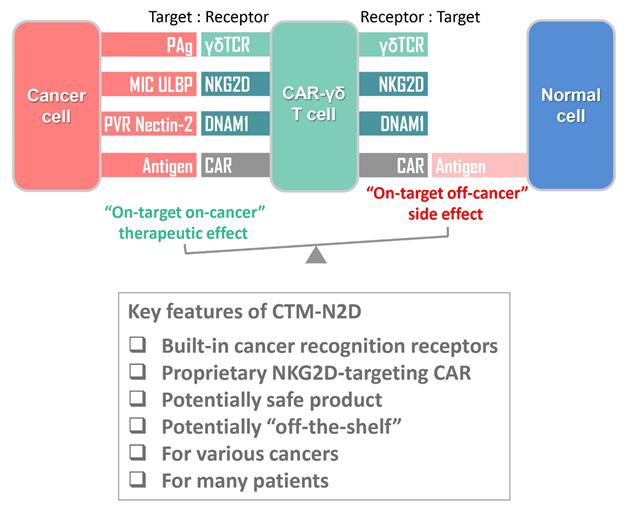

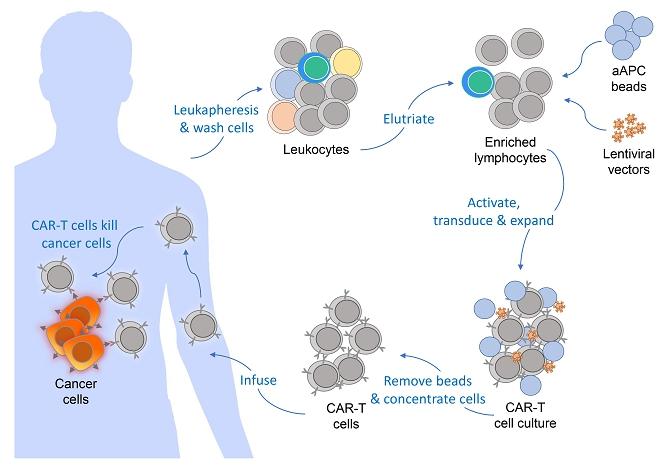

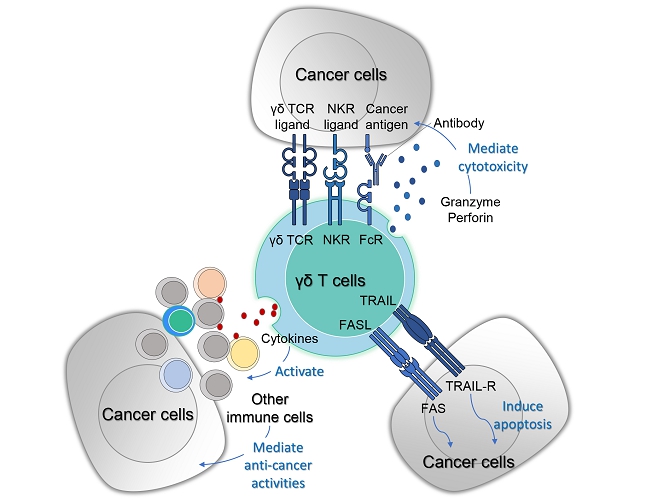

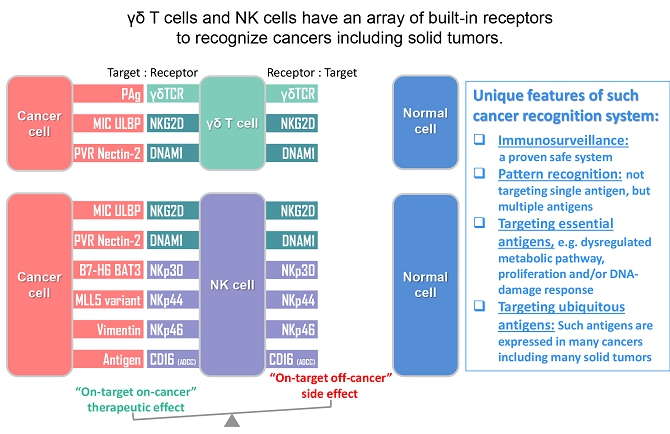

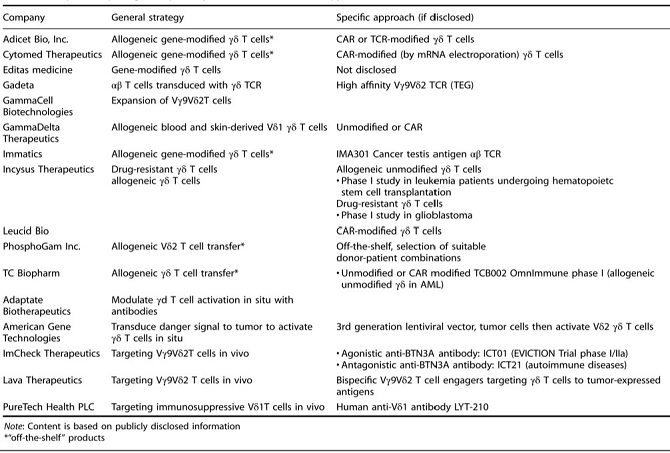

We are a pre-clinical biopharmaceutical company focused on harnessing our licensed proprietary technologies to create novel cell-based immunotherapies for the treatment of human cancers. The development of our novel technologies has been inspired by the clinical success of existing CAR-T in treating hematological malignancies as well as the current clinical limitations and commercial challenges in extrapolating the CAR-T principle into treatment of solid tumors.

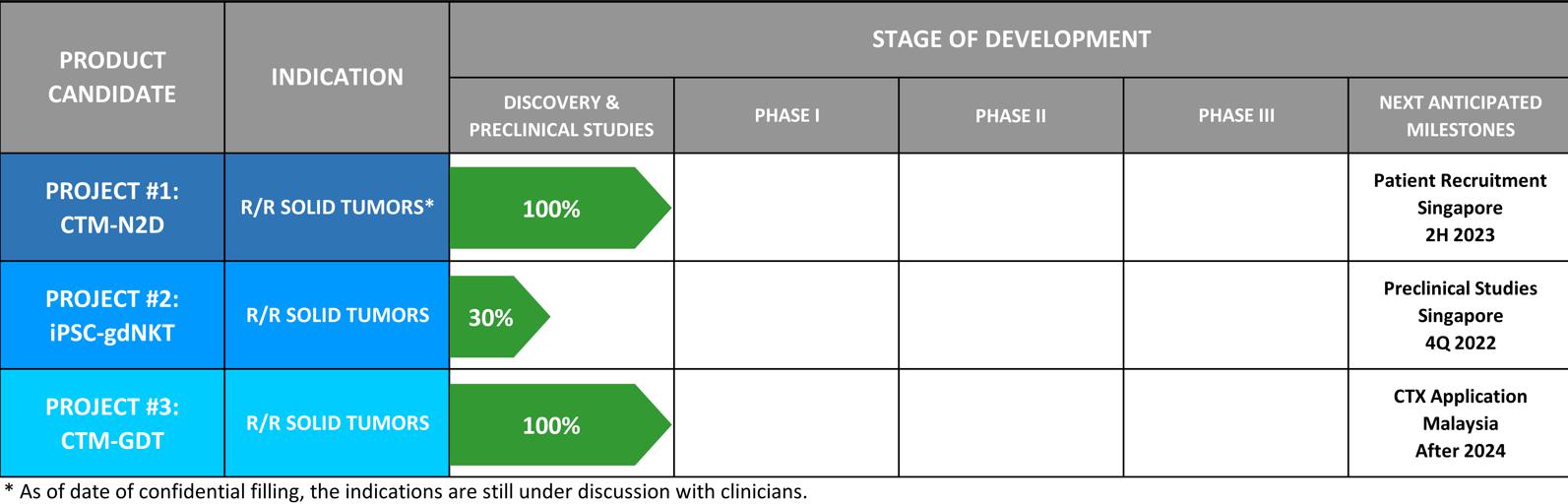

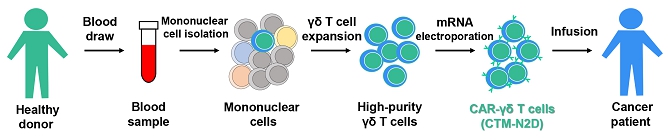

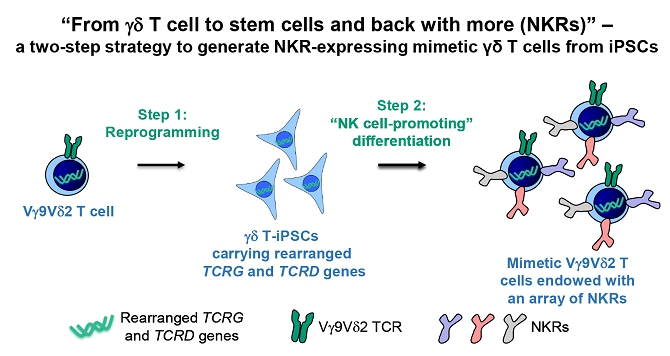

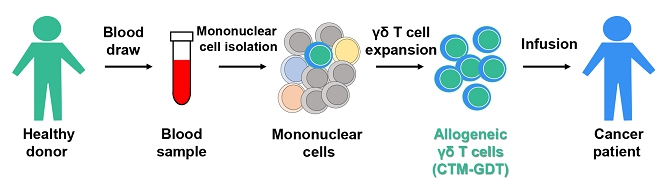

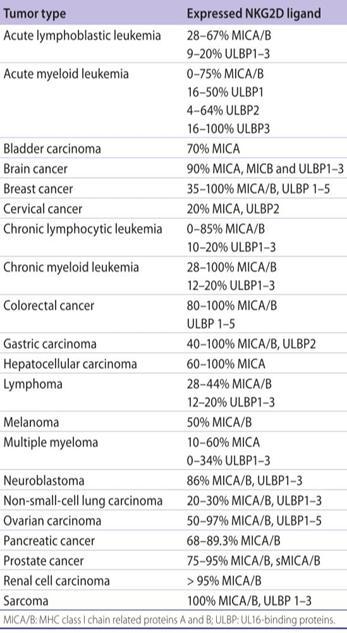

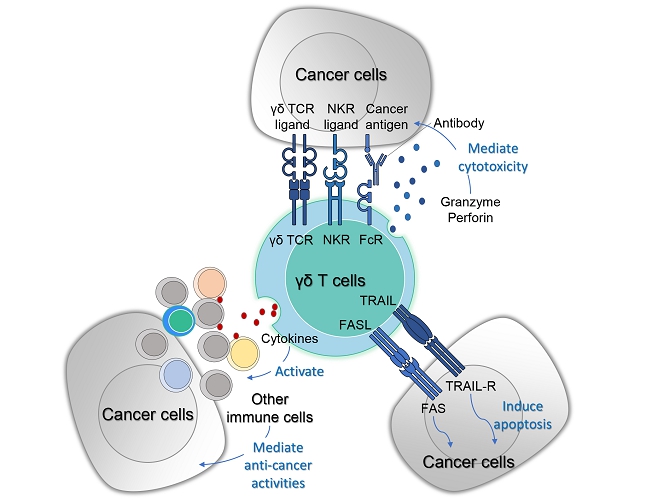

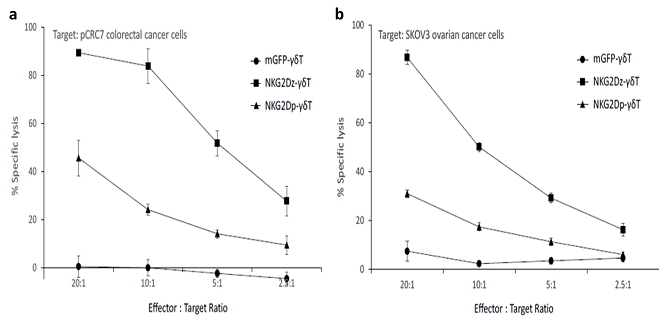

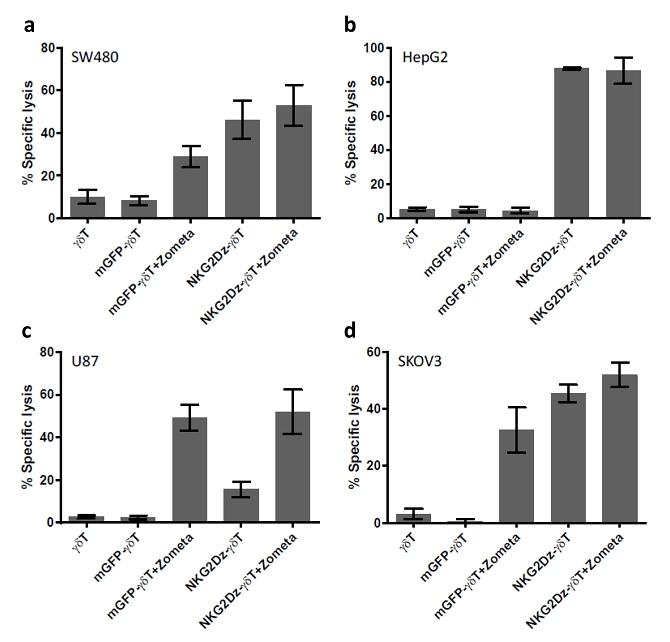

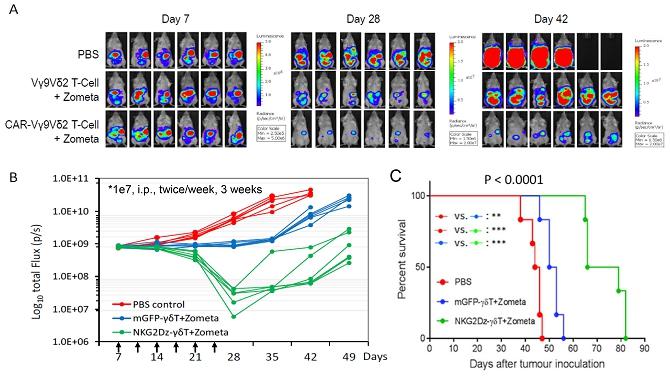

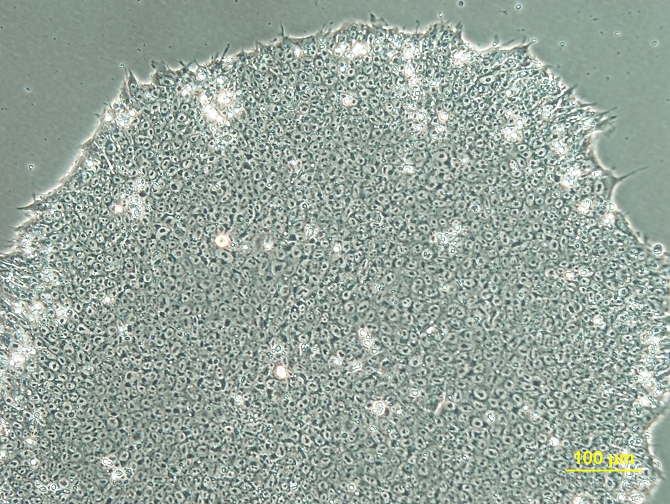

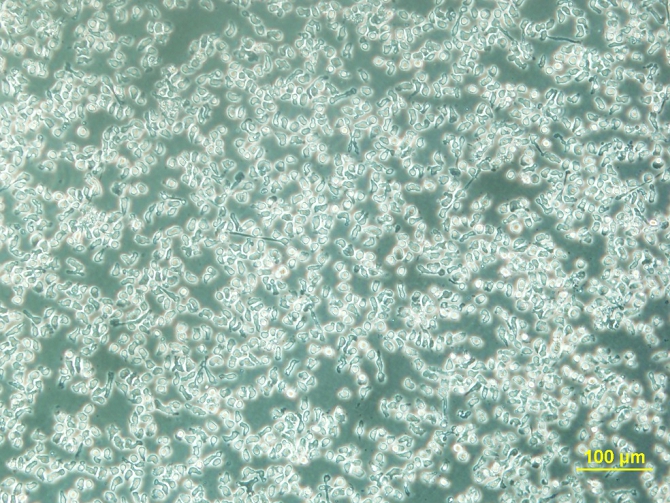

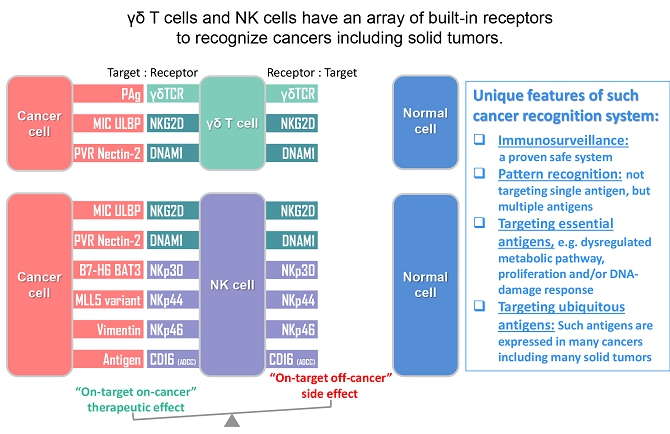

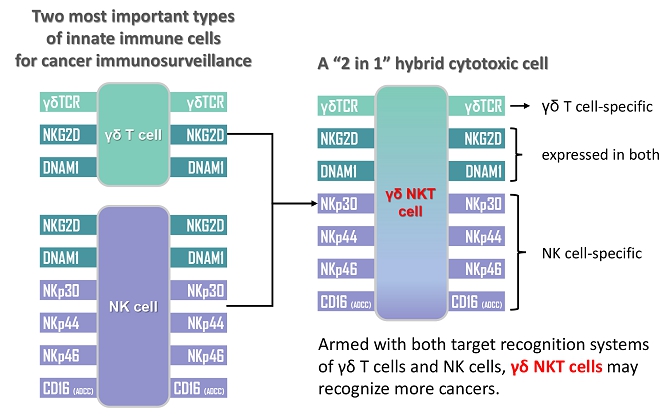

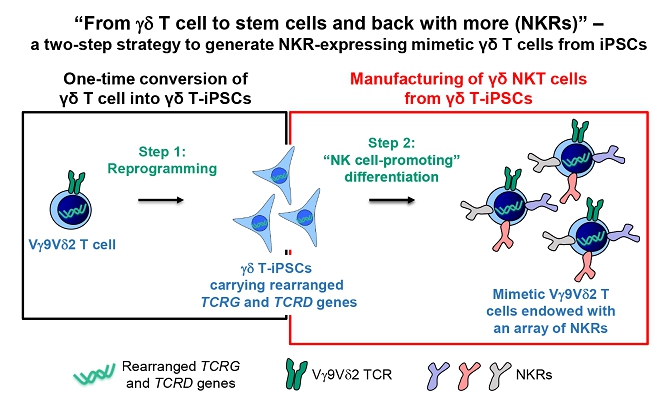

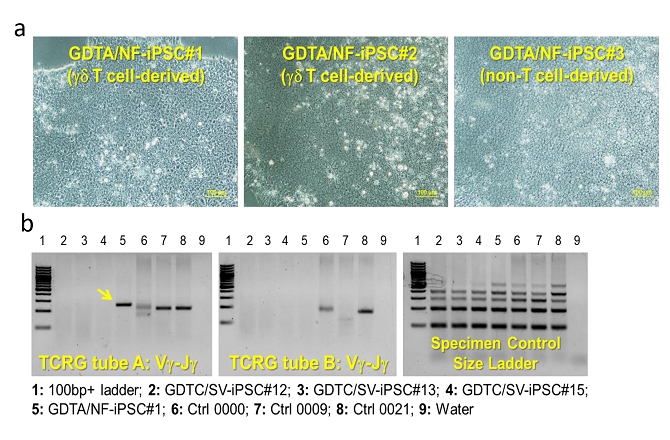

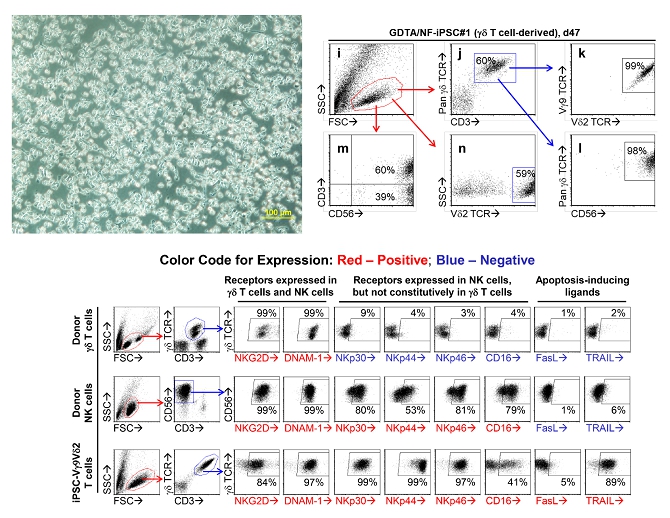

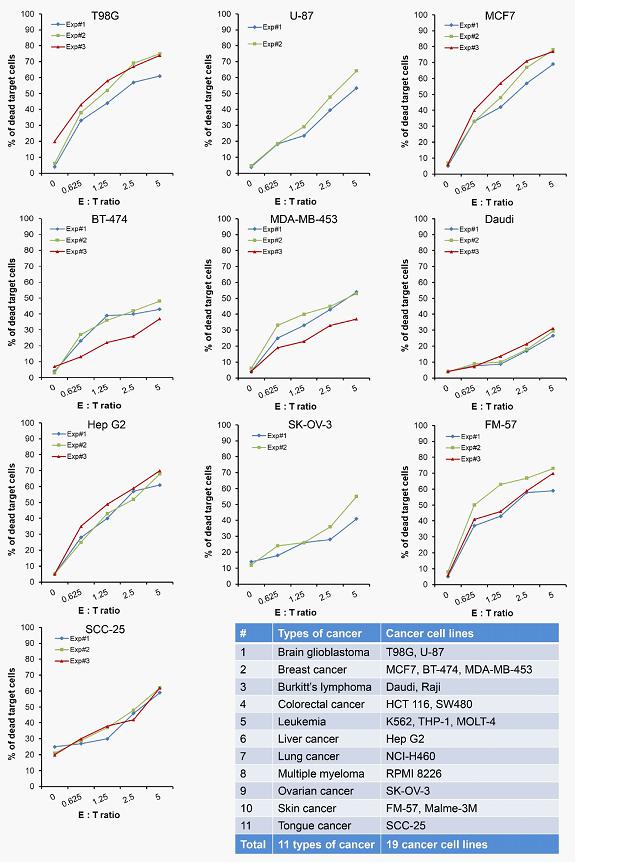

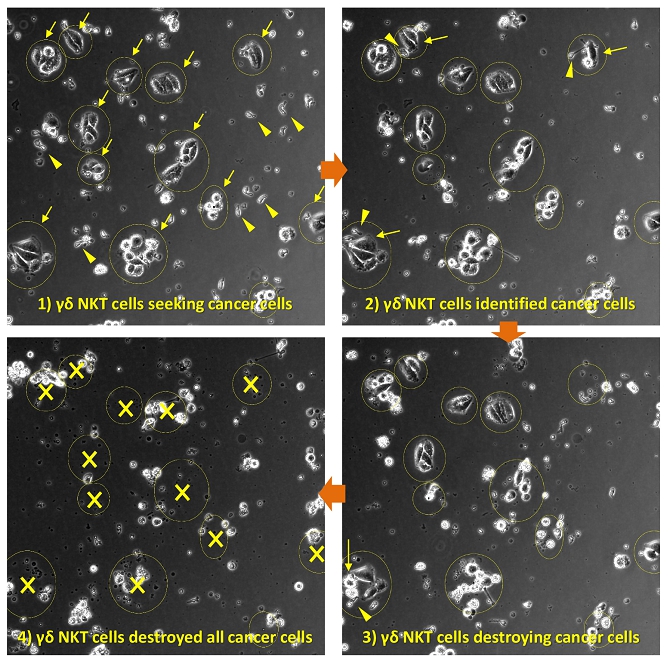

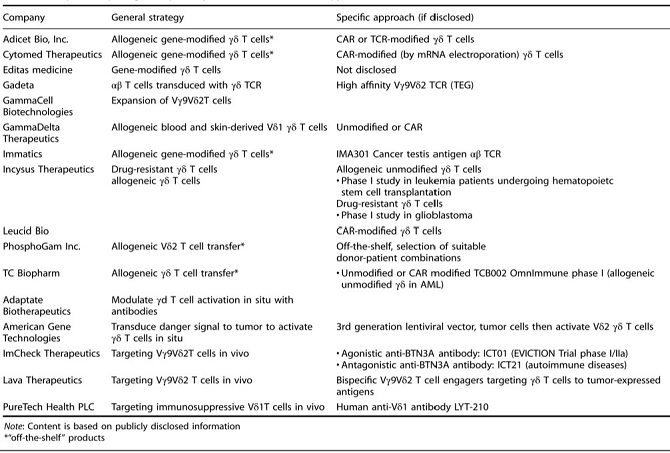

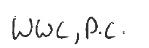

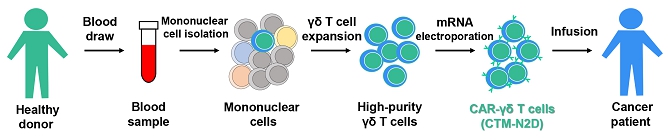

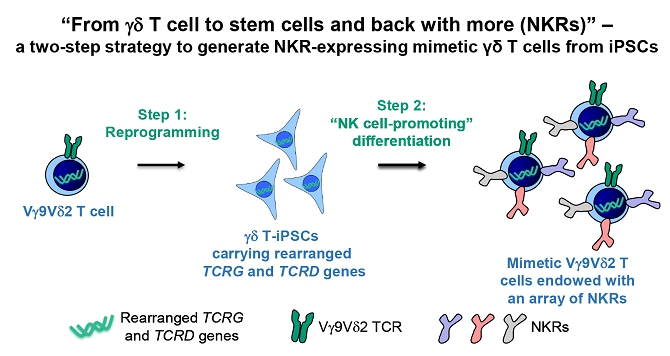

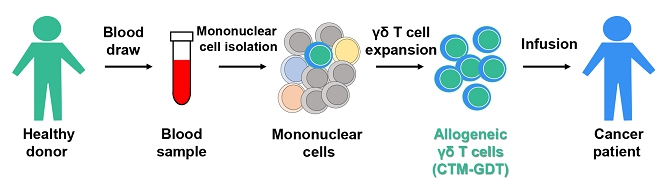

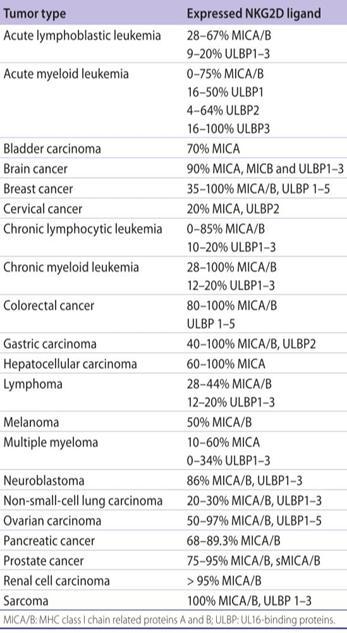

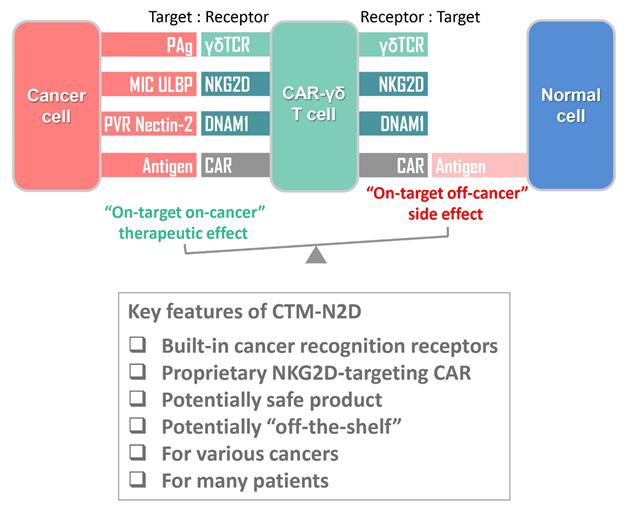

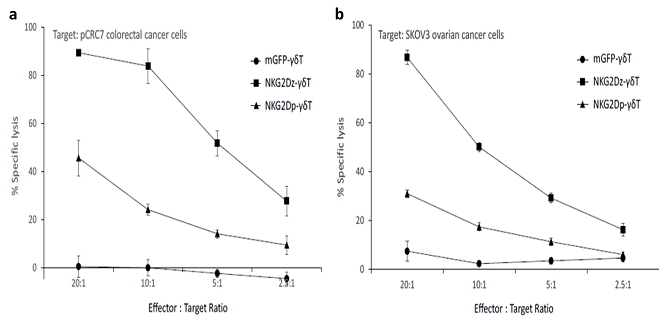

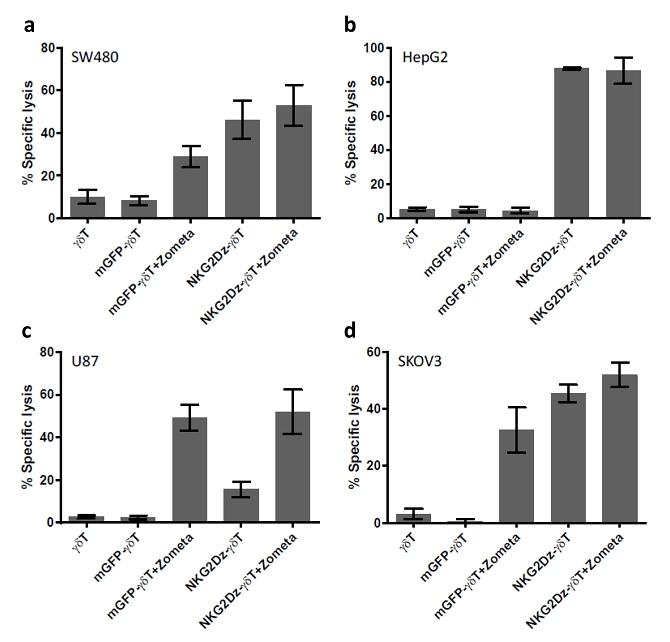

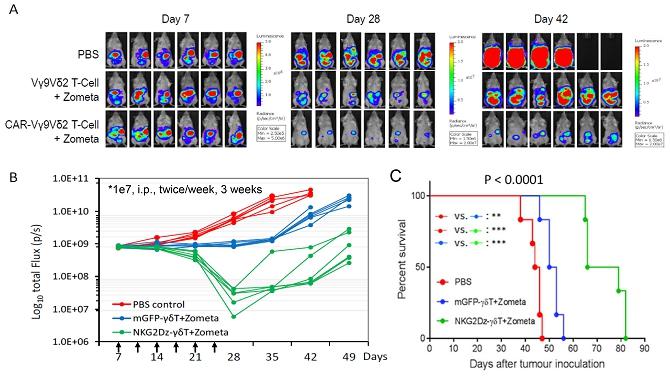

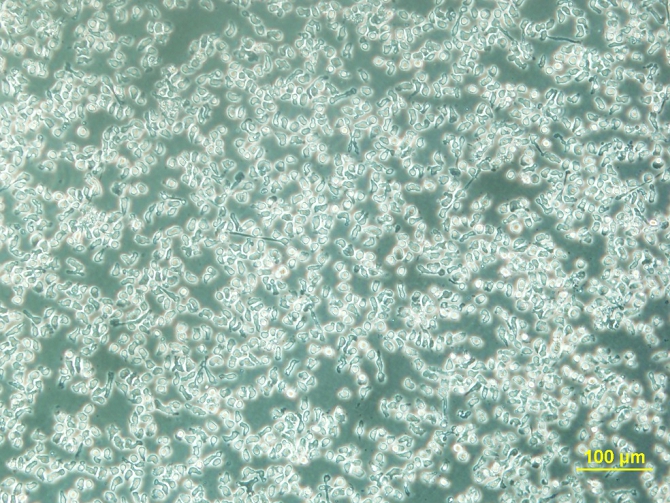

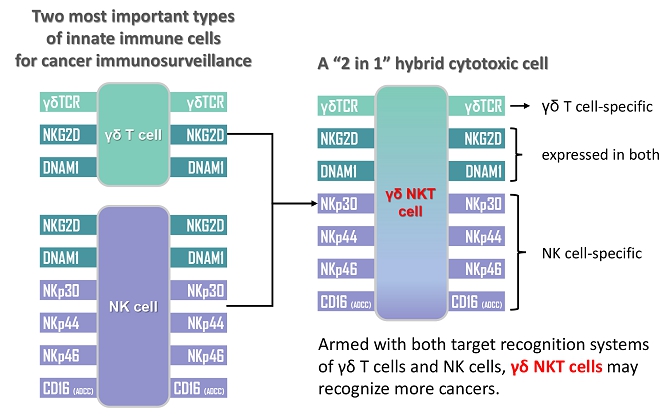

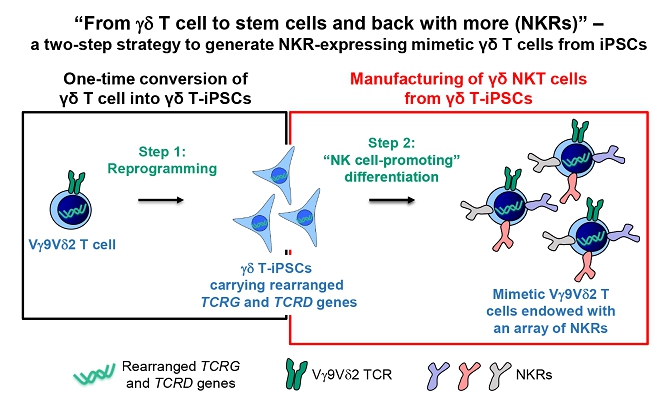

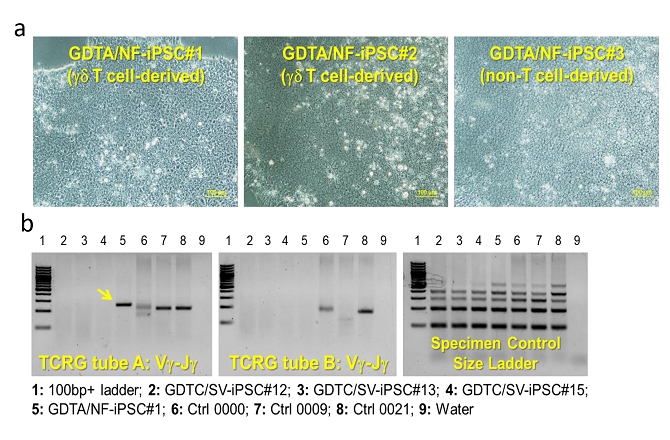

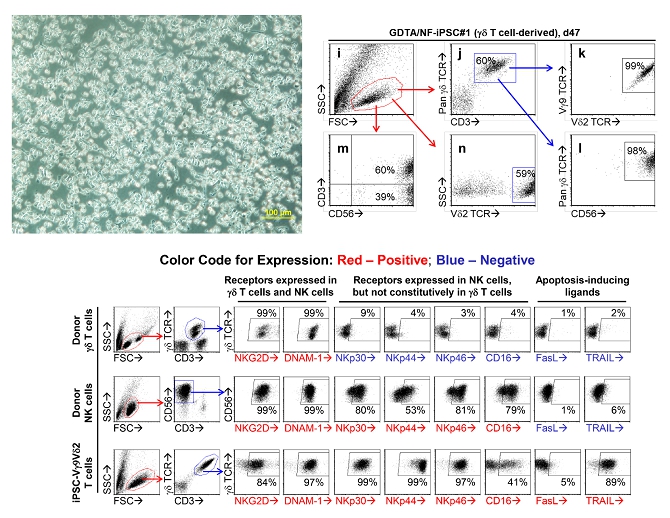

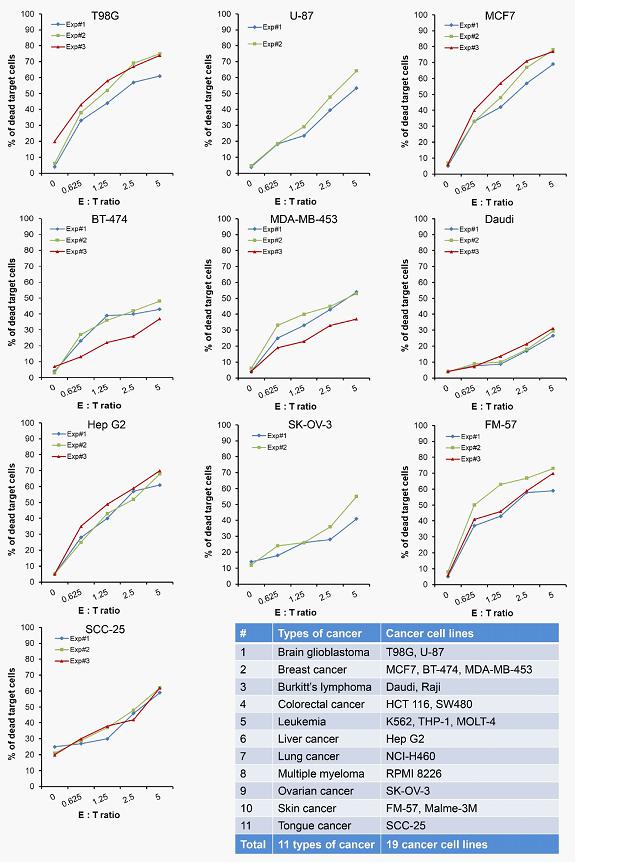

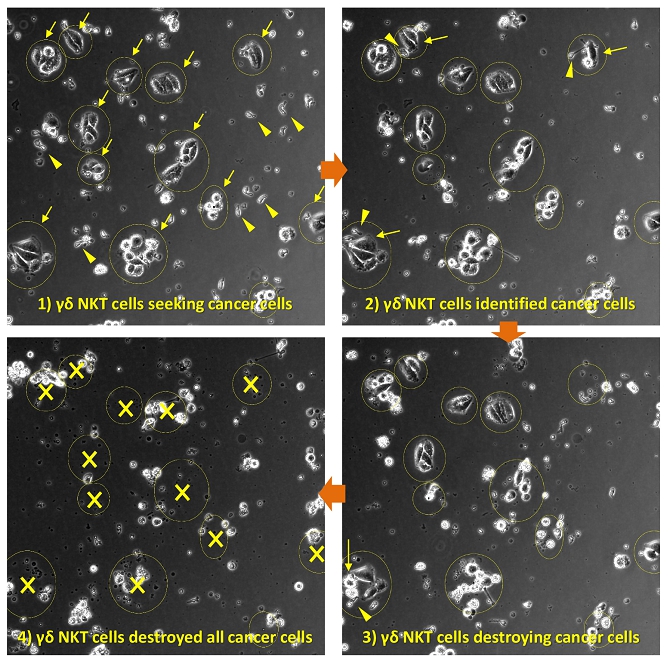

We believe that the current development of CD19-targeting CAR-T cells in treating B-cell malignancies signifies that cellular immunotherapy is becoming one of the pillars in cancer care. However, we believe that it remains challenging to apply the current CAR-T principle into treatments of other type of cancers, in particular solid tumors, due to a variety of reasons, including (i) the reliance on the limited cell quality and quantity of patients, (ii) the lack of suitable surface cancer antigens and their recognition system, and (iii) the ability of cancer to escape because of a single antigen-targeting strategy. To this end, we have established two novel patient blood cell-independent platform technologies to manufacture “off-the-shelf” cell-based cancer immunotherapies, meaning the manufacturing of the stated cell therapies in quantities, which utilizes either donor blood cells or iPSCs as starting materials, but not the limited patient’s own blood cells and no matching is required between such donor and recipient of the product. Our two novel platforms depend on healthy donor blood cells and induced pluripotent stem cells as starting material. Such platform technologies and the resulting product candidates exploit the multiple antigen recognition systems of NK cells and gamma delta T cells in the human body and so as to recognize and treat a broad range of cancers. Built on proprietary platform technologies, we are developing three product candidates: CTM-N2D, iPSC-gdNKT and CTM-GDT. CTM-N2D is our lead product candidate and it consists of expanded gamma delta T cells grafted with NKG2DL-targeting CAR to enhance anti-cancer cytotoxicity. We submitted a CTA application for Phase I clinical trial to HSA, Singapore in December 2021 and, in July 2022, were granted a CTA relating to the use of our CTM-N2D for the ANGELICA trial to be conducted with the National University Hospital Singapore, subject to conditions specified by the HSA. We expect to expand our pipeline further in Phase II trials of CTM-N2D therapy for specific cancer indications. Our second product candidate, iPSC-gdNKT, utilizes iPSC as a starting material to generate gdNKT, which is a synthetic hybrid of a gamma delta T cell and a NK cell. The hybrid cell express receptors of both cells which potentially allow the gdNKT cells to recognize and treat a broad range of cancers. This product is currently undergoing pre-clinical development. Our third product candidate, CTM-GDT, consists of expanded gamma delta T cells and exploits the multiple recognition system of gamma delta T cell to recognize and treat a broad range of cancers. We are looking to submit a CTX application for Phase I clinical trial to NPRA, Malaysia after 2024. We have also appointed an agent in the United States to prepare a Drug Master File for a potential research collaboration in the United States.

As of the date of this Prospectus, we are a holding company incorporated in Singapore which oversees our operations in Malaysia. We conduct our business activities primarily through our direct wholly-owned subsidiary in Malaysia, CytoMed Malaysia, but may be commencing more research and clinical trial activities in Singapore through CytoMed moving forward. Other than CytoMed Malaysia, our other subsidiaries have minimal operations as of the date of this Prospectus.

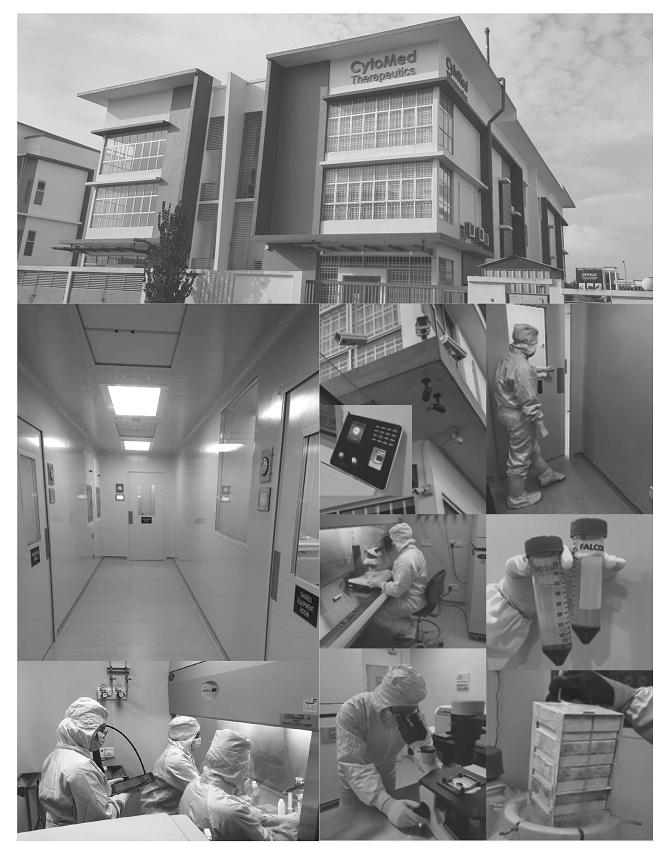

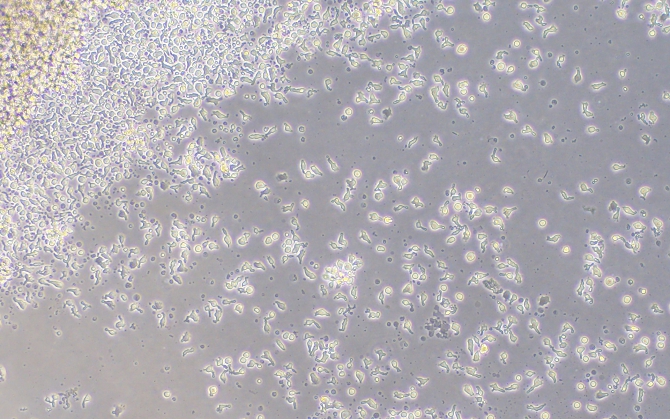

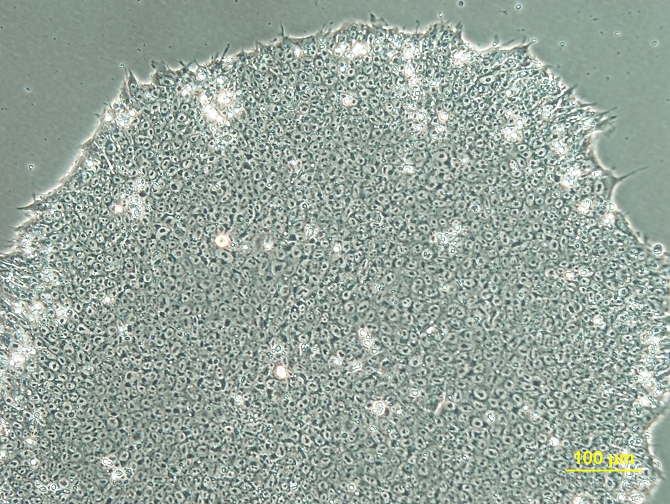

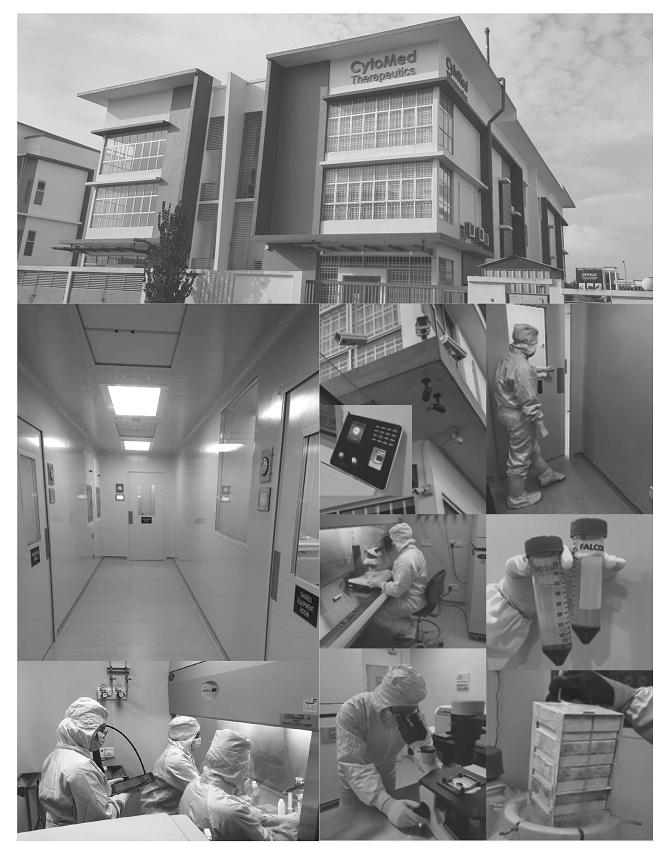

We have an operating cGMP Facility in Johor, Malaysia (which is near Singapore) which has been built in accordance with the international PIC/S GMP standards for the manufacture of cell therapy products and clinical trials. In addition, we have a well-trained operations team who conducts all essential cGMP activities including manufacture, quality control, quality assurance and documentation. We manufacture our product candidates in our cGMP Facility instead of engaging and relying on an external CMO.

Industry Overview

Our products are focused in the global immunotherapy market. Immunotherapy is the treatment of disease by promoting or inhibiting the immune responses and is gaining recognition and acceptance as an alternative therapy to treatment of cancer, in particular, in cancer patients who do not respond well to conventional cancer treatment, such as surgery, chemotherapy or radiation.

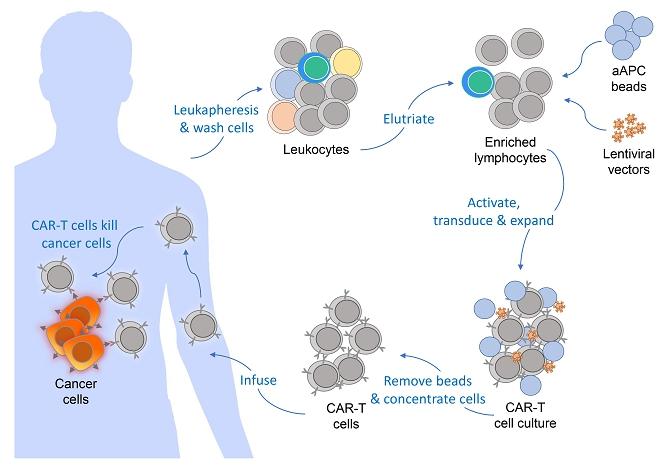

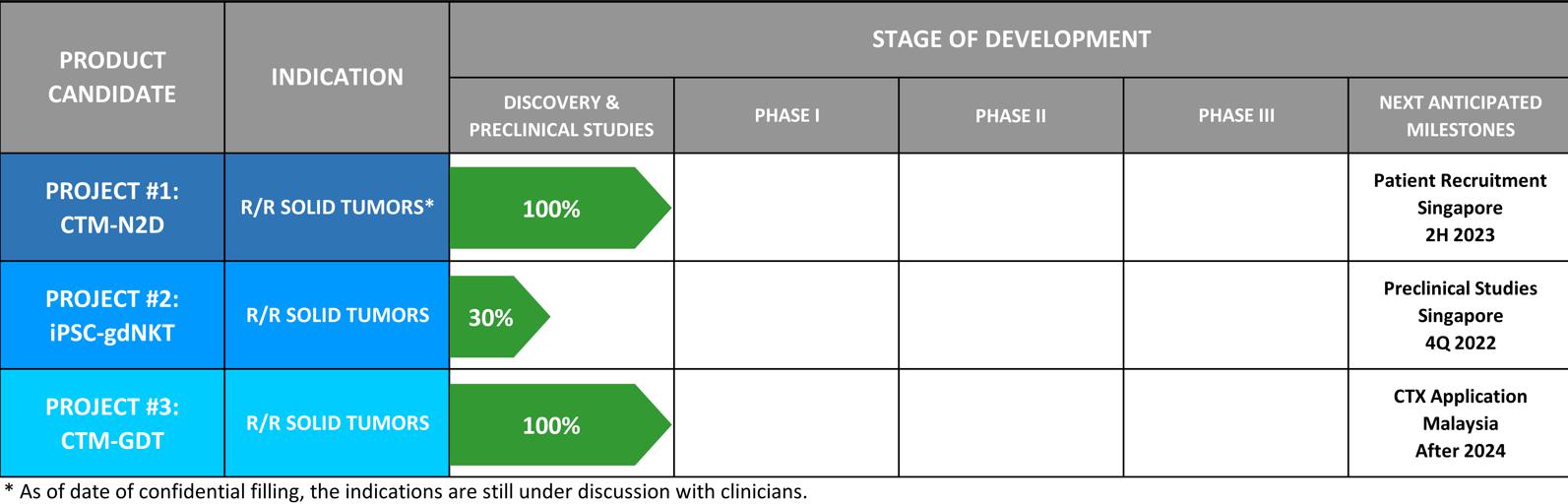

Current CAR-T cell therapy to treat cancer

Currently, CAR-T cell therapy is a type of cancer treatment in which a patient’s T cells (a type of immune system cell) are modified in the laboratory so they may attack cancer cells. Typically, T cells are extracted from the patient’s blood. Subsequently, the gene for a special receptor that binds to a certain protein on the patient’s cancer cells is added to the T cells. Such special receptor is called a chimeric antigen receptor (CAR) and such modified T cells are called CAR-T cells. Large numbers of CAR-T cells are grown in the laboratory and given to the patient by infusion. CAR-T cells are being used to treat certain blood cancers, and are being studied in the treatment of other types of cancer.

CAR-T cell therapy market

Since the approval of the first CAR-T cell therapeutic treatment in 2017 by the FDA, there has been widespread research and an exponential increase in clinical trial activity in the field of immunotherapy. Between 2017 to 2022, there have been at least six (6) CAR-T products that have entered the market, including two (2) of the earliest CAR-T products - Kymriah® by Novartis International AG (NYSE:NVS) and Yescarta® by Gilead Sciences, Inc. (NASDAQ:GILD), which received the earliest approvals and have been commercially available since 2018, and have been infused into many patients worldwide.

However, all approved CAR-T cell therapies thus far have taken an autologous treatment approach. Autologous CAR-T products are expensive to produce because they are manufactured on a patient-by-patient basis, and can be hampered by a shortage of CAR-T cells or viral vectors. Hence, current CAR-T cell therapies have been usually recommended for end-stage cancer patients who have exhausted all conventional treatment options.

CAR-T cell therapy has been a game-changer in the cancer treatment industry, creating hope that it could usher in a new era of cancer treatment. However, the success stories have typically come from targeting CD19, which is now considered an antigen that holds the key to a limited range of blood cancers. CAR-T cell therapy treatment for other types of cancers, in particular, solid tumors, has been severely limited so far.

Cell Therapy Industry in Singapore and Malaysia

The cell therapy industry in Singapore and Malaysia is at a nascent stage, with only a handful of biopharmaceutical companies within the cellular immunotherapy space in the treatment of cancer. Singapore approved the first CAR-T therapy for cancer treatment in March 2021, Kymriah® by Novartis (Singapore) Pte Ltd. This is the first and only commercially approved CAR-T therapy in Singapore and is currently in use for certain specific forms of B-cell malignancies. As of the date of this Prospectus, Malaysia has not yet approved any CAR-T therapy for treatment of cancer for commercial use.

Singapore established ACTRIS in April 2020 to meet the potential demand of cell therapy process development and product manufacturing to enable clinical utility. ACTRIS is the national center for facilitating discovery, process development and manufacturing of cellular-based therapeutics in immunotherapy and regenerative medicine in Singapore. ACTRIS works with other government agencies such as A*STAR and other industry players, such as hospitals, universities, research organizations and clinicians. ACTRIS is a business unit under the CRIS.

We intend to capitalize on our close connections with A*STAR to tap on the latest developments and advances in cell-based therapeutics in the field of cancer treatment.

Business Strategies and Future Plans

We intend to focus on developing our two (2) “off-the-shelf, allogeneic” technology platforms centered on gamma delta T cells and iPSCs, respectively.

Our aim is to be amongst the pioneers of cellular immunotherapy treatment for human cancer to serve the emerging economies within South-east Asia. We aim to strategically position ourselves as a bridge between the cutting-edge of cellular therapy in the U.S. and our origin amongst emerging economies in South-east Asia, with our headquarter in Singapore. We believe that the U.S. has the depth and breadth of expertise and experience to accelerate our R&D efforts in cellular therapy. We aim to establish our profile with like-minded biopharmaceutical companies, researchers, scientists and sources of investment capital within the U.S. In addition, we anticipate that cellular science will advance and gain more mainstream acceptance in the future. We are considering conducting research in regenerative medicine, in particular, stem cell application in an aging population in Asia. We believe we are well-placed with the necessary expertise, experience and resources to take advantage of such prospects.

Close connections with scientific and medical community

We have appointed immunotherapy industry advisors to our Scientific Advisory Board and our key executive officers have the relevant specialized technical and medical expertise in cellular therapy.

Our core technologies are licensed from A*STAR, Singapore’s lead public sector R&D agency. By working closely with research organizations and government bodies, we are continually kept abreast of the latest developments in the field of cellular therapy. We believe that our strategic positioning, experience and expertise will give us an edge to take advantage of the growing and developing cellular therapy market.

In addition, we intend to seek collaborations and/or enter into joint-ventures and out-licensing arrangements to jointly develop our two (2) novel “off-the-shelf” technology platforms with industry players using our infrastructure in Singapore and Malaysia so as to speed up commercialization of our product candidates.

Lower business and operating costs in South-east Asia

The relatively lower business and operating costs in South-east Asia should position us well to achieve our vision to develop our donor blood cell-based and iPSC-based platform technologies into “off-the-shelf” cancer immunotherapies with the ultimate goal to offer lower cost cell therapies as an alternate form of cancer treatment to patients.

We have invested in and completed construction of our own cGMP Facility which is fully equipped with state-of-the-art equipment, and which we believe is capable of handling the manufacturing for Phase I and Phase II clinical trials for our clinically-ready CAR T therapy, trade-named “CTM-N2D”. Our cGMP Facility has been audited by the NPRA in Malaysia, and the compliance standard of our cGMP Facility has been found to be satisfactory. We believe our proprietary product candidate, CTM-N2D, is clinically ready to commence clinical trials. We are now finalizing with National University Hospital Singapore the details of the ANGELICA Trial using CTM-N2D, following the grant in July 2022 of a CTA relating to the use of our CTM-N2D for the aforementioned trial, subject to conditions specified by HSA. We have already recruited a competent team of scientists and technicians and given the necessary training to manufacture the product for clinical trial. We target to recruit our first patient in second half of 2023. Our iPSC-gdNKT platform is in the pre-clinical process development stage since fourth quarter of 2022.

Summary of Risks Affecting Our Company

We are subject to numerous risks, including risks that may prevent us from achieving our business objectives or may adversely affect our business, financial condition, results of operations, cash flow and prospects. You should carefully consider the following risks, those risks described in “Risk Factors” and the other information in this Prospectus before deciding whether to invest in our ordinary shares:

| | ● | We are a global business subject to complex economic, legal, political, tax, foreign currency and other risks associated with international operations, which risks may be difficult to adequately address. |

| | | |

| | ● | We do not have a long operating history and we do not currently have any product approved for commercial sale. |

| | | |

| | ● | Our limited operating history may not provide an adequate basis to judge our future prospects and results of operation and may increase the risk of your investment. |

| | | |

| | ● | We may not be able to access the capital markets in the future. |

| | | |

| | ● | Our business depends upon the success of our CTM-N2D, iPSC-gdNKT and CTM-GDT product candidates. |

| | | |

| | ● | Our business, our industry and the economy are subject to the impact of the ongoing COVID-19 pandemic. |

| | | |

| | ● | We may not be able to obtain regulatory approval for our current or future product candidates. |

| | | |

| | ● | Our pre-clinical procedures and trials may experience delays or may not progress to clinical trials. |

| | | |

| | ● | The results of our clinical trials may not be successful. |

| | | |

| | ● | We may not be able to maintain our key personnel or attract, train and retain other highly qualified personnel. |

| | | |

| | ● | We rely on our cGMP Facility to produce our product candidates and it may not be sufficient to handle the large-scale manufacture and production of product candidates. |

| | | |

| | ● | Save for a registered trademark in relation to our name we currently own no other intellectual property rights and rely entirely on intellectual property rights we licensed from others for our main operations. |

| | | |

| | ● | We may encounter adverse developments or disputes concerning our licensed intellectual property rights or other proprietary rights. |

| | | |

| | ● | We rely on third-party intellectual property licensors and the terms of such licenses. |

| | | |

| | ● | We may not be able to successfully acquire or in-license additional product candidates on reasonable terms. |

| | | |

| | ● | We may be subject to adverse developments relating to our competitors and our industry. |

| | | |

| | ● | We may not realize market opportunities for our product candidates. |

| | | |

| | ● | We may be adversely impacted by government laws and regulations and liabilities thereunder which could impede our progress. |

| | | |

| | ● | There has been no public market for our ordinary shares prior to this offering and you may not be able to resell our ordinary shares at or above the price you paid (if at all). |

Foreign Private Issuer Status

We are a foreign private issuer within the meaning of the rules under the Exchange Act. As such, we are exempt from certain provisions applicable to United States domestic public companies. For example:

| | ● | we are permitted to follow certain home country corporate governance practices in lieu of certain requirements under the Nasdaq listing standards. This may afford less protection to holders of our ordinary shares than U.S. regulations; |

| | | |

| | ● | we are not subject to proxy rules and are not required to provide as many Exchange Act reports, or as frequently, as a domestic public company; |

| | | |

| | ● | we may lose our private foreign issuer status, which would require us to comply with the Exchange Act’s domestic reporting regime and cause us to incur additional legal, accounting and other expenses; |

| | | |

| | ● | for interim reporting, we are permitted to comply solely with our home country requirements, which are less rigorous than the rules that apply to domestic public companies; |

| | | |

| | ● | we are not required to provide the same level of disclosure on certain issues, such as executive compensation; |

| | | |

| | ● | we are exempt from provisions of Regulation FD aimed at preventing issuers from making selective disclosures of material information; |

| | | |

| | ● | we are not required to comply with the sections of the Exchange Act regulating the solicitation of proxies, consents or authorizations in respect of a security registered under the Exchange Act; and |

| | | |

| | ● | we are not required to comply with Section 16 of the Exchange Act requiring insiders to file public reports of their share ownership and trading activities and establishing insider liability for profits realized from any “short-swing” trading transaction. |

Implications of Being an Emerging Growth Company

As a company with revenue of less than U.S.$1.235 billion for the previous financial year, we qualify as an “emerging growth company” under the JOBS Act. An emerging growth company may take advantage of specified reduced reporting and other requirements that are otherwise applicable generally to public companies. These provisions include exemption from the auditor attestation requirement under Section 404 of the Sarbanes-Oxley Act, or Section 404, in the assessment of the emerging growth company’s internal control over financial reporting. The JOBS Act also provides that an emerging growth company does not need to comply with any new or revised financial accounting standards until such date that a private company is otherwise required to comply with such new or revised accounting standards.

We will remain an “emerging growth company” until the earliest of (i) the last day of our financial year during which we have total annual gross revenues of at least U.S.$1.235 billion; (ii) the last day of our financial year following the fifth anniversary of the consummation of this offering; (iii) the date on which we have, during the previous three year period, issued more than U.S.$1 billion in non-convertible debt; or (iv) the date on which we are deemed to be a “large accelerated filer” under the Exchange Act, which would occur if the market value of our ordinary shares that are held by non-affiliates exceeds U.S.$700 million as of the last business day of our most recently completed second financial quarter and we have been publicly reporting for at least 12 months. Upon ceasing to be an “emerging growth company”, we will not be entitled to the exemptions provided in the JOBS Act as set out above.

Our Corporate Information

We are a private company limited by shares incorporated in Singapore, known as CytoMed Therapeutics Pte. Ltd. Prior to the consummation of this offering, we intend to convert CytoMed Therapeutics Pte. Ltd. from a private company limited by shares to a public company pursuant to the provisions of the Singapore Companies Act. Upon such conversion, we will be a public company known as CytoMed Therapeutics Limited.

Our principal executive office in Singapore is located at 1 Commonwealth Lane, #08-22, Singapore 149544. Our telephone number is +65 6250 7738. Investors should submit any inquiries to the address and telephone number of our principal executive office. Our agent for service of process in the United States is Puglisi & Associates. Our website is located at https://www.cytomed.sg/. Information contained on, or that can be accessed through, our website is not a part of, and shall not be incorporated by reference into, this Prospectus.

THE OFFERING

Securities offered by us | | ordinary shares (or ordinary shares if the underwriters exercise in full their option to purchase additional shares). |

| | | |

| Securities offered by the Selling Shareholders | | An aggregate of ordinary shares |

| | | |

| Underwriters’ over-allotment option | | We have granted to the underwriters an option, exercisable for 45 days from the date of this Prospectus, to purchase up to additional ordinary shares at the public offering price listed on the cover page of this Prospectus, less underwriting discounts and commissions. |

| Ordinary shares to be outstanding before and after this offering | | As of the date of this Prospectus, our issued and outstanding share capital consists of 3,215,906,426 ordinary shares. Immediately after the offering, we will have ordinary shares outstanding (or ordinary shares if the underwriters exercise in full their option to purchase additional shares). |

| Listing | | We have applied to list our ordinary shares on the Nasdaq Capital Market, under the symbol “GDTC”. There is no assurance that such application will be approved, and if our application is not approved, this offering may not be completed. |

Use of Proceeds | | We estimate that the net proceeds to us from the offering will be approximately U.S.$ million, based on the assumed initial public offering price of U.S.$ per share after deducting estimated underwriting discounts and commissions and expenses of the offering that are payable by us. We intend to use the net proceeds from the offering for clinical trials, R&D, manufacturing expansion, working capital and general corporate purposes. Please refer to the section titled “Use of Proceeds”. |

| Lock-Up Agreements | | We have agreed with the underwriters, subject to certain exceptions, not to offer, pledge, sell, or dispose of, directly or indirectly, any of our ordinary shares or securities convertible into or exchangeable or exercisable for any of our ordinary shares during the 90-day period following the date of this Prospectus. Members of our Board, our executive officers and shareholders beneficially owning more than 5% of our outstanding ordinary shares as of the effective date of this Prospectus, except for the Selling Shareholders with respect to the ordinary shares sold in this Offering, have agreed during the 12-month period following the date of this Prospectus to substantially similar lock-up provisions, subject to certain exceptions. Please refer to the sections titled “Shares Eligible for Future Sale” and “Underwriting” for more information. |

| Risk Factors | | Investing in our ordinary shares involves risks. Please refer to the section titled “Risk Factors” beginning on page 26 of this Prospectus for a discussion of factors you should carefully consider before deciding to invest in our ordinary shares. |

The foregoing discussion and tables above are based on 3,215,906,426 ordinary shares outstanding as of the date hereof, and excludes:

| ● | [●] ordinary shares issuable upon the conversion of convertible loans, with a weighted-average exercise price of U.S.$[●] per share; |

| | | |

| ● | ordinary shares reserved for future issuance under our proposed Incentive Plan, which will become effective immediately prior to the execution of the underwriting agreement related to this offering, as well as any future increases in the number of ordinary shares reserved for issuance under our Incentive Plan. |

Unless otherwise indicated, all information in this Prospectus assumes:

| ● | no exercise by the underwriters of their option to purchase up to additional ordinary shares from us to cover over-allotments, if any; and |

| | | |

| | ● | an initial public offering price of U.S.$ per share. |

SUMMARY OF CONSOLIDATED FINANCIAL INFORMATION

The following summary of consolidated financial information as of December 31, 2020 and 2021 and June 30, 2022 and for the years ended December 31, 2020 and 2021 and for the six months ended June 30, 2021 and 2022 are derived from our audited consolidated financial statements and unaudited interim condensed consolidated financial statements, respectively, included elsewhere in this Prospectus. Our consolidated financial statements are prepared and presented in accordance with IFRS. Our historical results are not necessarily indicative of results expected for future periods. The following summary of consolidated financial information should be read in conjunction with the sections entitled “Presentation of Financial Information” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the consolidated financial statements of our Group, including the notes thereto, included elsewhere in this Prospectus.

The following table presents our summary of consolidated statements of profit or loss and comprehensive loss data for the financial years ended December 31, 2020 and 2021 and for the six months ended June 30, 2021 and 2022:

| | | Year Ended December 31, | | | Six Months Ended June 30, | |

| | | 2020 | | | 2021 | | | 2021 | | | 2022 | |

| | | S$ | | | S$ | | | U.S.$ | | | S$ | | | S$ | | | U.S.$ | |

| Other operating income | | | 127,456 | | | | 154,610 | | | | 111,206 | | | | 49,405 | | | | 149,570 | | | | 107,581 | |

| Other (losses)/gains - net | | | (573,856 | ) | | | 3,185 | | | | 2,291 | | | | (209,533 | ) | | | (150,136 | ) | | | (107,988 | ) |

| R&D expenses | | | (1,038,091 | ) | | | (1,090,623 | ) | | | (784,452 | ) | | | (522,881 | ) | | | (604,043 | ) | | | (434,470 | ) |

| General and administrative expenses | | | (345,616 | ) | | | (788,801 | ) | | | (567,360 | ) | | | (284,721 | ) | | | (306,457 | ) | | | (220,425 | ) |

| Finance expenses | | | (105,519 | ) | | | (117,696 | ) | | | (84,655 | ) | | | (57,668 | ) | | | (62,042 | ) | | | (44,625 | ) |

| Share of results of associate | | | - | | | | (212,578 | ) | | | (152,901 | ) | | | - | | | | (22,283 | ) | | | (16,027 | ) |

| Loss before income tax | | | (1,935,626 | ) | | | (2,051,903 | ) | | | (1,475,871 | ) | | | (1,025,398 | ) | | | (995,391 | ) | | | (715,954 | ) |

| Income tax expenses | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | |

| Loss for the year/period | | | (1,935,626 | ) | | | (2,051,903 | ) | | | (1,475,871 | ) | | | (1,025,398 | ) | | | (995,391 | ) | | | (715,954 | ) |

| Other comprehensive income: | | | | | | | | | | | | | | | | | | | | | | | | |

| Foreign currency translation loss, net of tax | | | (6,616 | ) | | | (22,628 | ) | | | (16,275 | ) | | | (25,669 | ) | | | (37,208 | ) | | | (26,763 | ) |

| Total comprehensive loss | | | (1,942,242 | ) | | | (2,074,531 | ) | | | (1,492,146 | ) | | | (1,051,067 | ) | | | (1,032,599 | ) | | | (742,717 | ) |

| Loss for the year/period attributable to equity holders of the Company | | | (1,935,440 | ) | | | (2,051,650 | ) | | | (1,475,689 | ) | | | (1,025,270 | ) | | | (995,287 | ) | | | (715,879 | ) |

| Loss per share attributable to equity holders of the Company | | | | | | | | | | | | | | | | | | | | | | | | |

| Basic and diluted | | | (0.0009 | ) | | | (0.0007 | ) | | | (0.0005 | ) | | | (0.0004 | ) | | | (0.0004 | ) | | | (0.0003 | ) |

The following table presents our summary of consolidated balance sheets data as of December 31, 2020 and 2021 and as of June 30, 2022:

| | | As of December 31, | | | As of June 30, | |

| | | 2020 | | | 2021 | | | 2022 | |

| | | S$ | | | S$ | | | U.S.$ | | | S$ | | | U.S.$ | |

| Cash and cash equivalents | | | 885,272 | | | | 2,512,768 | | | | 1,807,357 | | | | 1,487,161 | | | | 1,069,669 | |

| Property, plant and equipment | | | 2,301,025 | | | | 2,495,791 | | | | 1,795,146 | | | | 2,684,305 | | | | 1,930,738 | |

| Total assets | | | 3,815,299 | | | | 6,082,527 | | | | 4,374,974 | | | | 5,153,398 | | | | 3,706,680 | |

| Convertible loans | | | 2,323,423 | | | | 2,310,757 | | | | 1,662,056 | | | | 2,451,595 | | | | 1,763,357 | |

| Total liabilities | | | 3,339,519 | | | | 3,490,923 | | | | 2,510,914 | | | | 3,594,393 | | | | 2,585,336 | |

| Total equity | | | 475,780 | | | | 2,591,604 | | | | 1,864,060 | | | | 1,559,005 | | | | 1,121,344 | |

RISK FACTORS

An investment in our ordinary shares involves a high degree of risk. You should carefully consider the following risk factors, as well as all of the other information contained in this Prospectus, before making an investment decision. The risks described below are not the only ones facing us. The occurrence of any of the following risks, or of additional risks and uncertainties not presently known to us or that we currently believe to be immaterial, could significantly harm our business, financial condition, results of operations and growth prospects. In such case, the trading price of shares of our ordinary shares could decline, and you may lose part or all of your investment.

RISKS RELATED TO OUR FINANCIAL POSITION

We do not have a long operating history and we do not currently have any product approved for commercial sale.

We are a pre-clinical biopharmaceutical development stage company and we do not have any products approved for commercial sale as of the date of this Prospectus. We are focused on developing human cells as therapeutics and our technologies are new and unproven. Since our incorporation in 2018, we have invested most of our resources in developing our product candidates, building our intellectual property portfolio, developing our supply chain, conducting business planning, constructing our centralized cGMP Facility, hiring and training staff, raising capital and providing general and administrative support for these operations. Consequently, we do not have a meaningful operating history upon which our business and prospects may be evaluated, and predictions about our future success or viability may not be as accurate as they could be if we had a longer operating history or a history of successfully developing and commercializing drug products. We have not yet demonstrated our ability to overcome many of the risks and uncertainties frequently encountered by companies in the rapidly evolving biopharmaceutical clinical trial industry. If we do not successfully address these risks, our business, financial condition, results of operations and growth prospects will be materially and adversely affected. At present time, we manufacture limited quantities of cells for researchers and institutions on a non-profit, cost recovery basis for the purpose of research.

We have incurred losses since our incorporation and we expect to incur significant losses for the foreseeable future, which raise substantial doubt on our ability to continue as a going concern. Our ability to continue as a going concern is dependent on being able to obtain sufficient additional funding to finance our operations.

Since our incorporation in 2018, we have incurred losses. As of December 31, 2020, 2021 and June 30, 2022, we have accumulated losses of S$3.02 million, S$5.07 million and S$6.06 million (approximately U.S.$4.36 million), respectively. As the Group has accumulated losses and net cash outflows from operating activities, our certifying accountant, WWC, P.C. had raised substantial doubt about our ability to continue as a going concern. Given that we will continue to invest most of our resources in developing our product candidates, we expect to continue to incur increasing losses for the foreseeable future. In addition, we anticipate a substantial increase in our expenses if, and as, we seek to:

| | ● | initiate clinical development of our proprietary product candidates, CTM-N2D, iPSC-gdNKT and CTM-GDT; |

| | ● | advance additional product candidates to clinical trials, including CTM-N2D, iPSC-gdNKT and CTM-GDT; |

| | ● | discover and develop additional product candidates; |

| | ● | establish and validate our own clinical-scale and commercial-scale cGMP facilities; |

| | ● | initiate or develop a MAA, or equivalent in the relevant countries, for CTM-N2D, iPSC-gdNKT and CTM-GDT and/or seek marketing approvals for any of our other product candidates that successfully complete clinical trials; |

| | ● | engage, on an as needed basis, third-party contractors including CROs and CMOs to conduct clinical trials; |

| | ● | maintain, expand and protect our intellectual property portfolio; |

| | ● | acquire or in-license other product candidates and technologies; |

| | ● | incur additional costs associated with operating as a public company; and |

| | ● | increase our employee headcount and related expenses to support these activities. |

We may not be successful in any or all of these activities and even if we are successful, we may not generate revenues that are significant enough to generate profit. If we seek additional financing to fund our business activities in the future and there remains substantial doubt about our ability to continue as a going concern, investors or other financing sources may be unwilling to provide additional funding to us on commercially reasonable terms or at all. Further, if we are unable to continue as a going concern, we may have to discontinue operations and liquidate our assets and may receive less than the value at which those assets are carried on our audited financial statements, which would cause our shareholders to lose all or a part of their investment.

We will require additional capital, which, if available, may cause dilution to our shareholders, restrict our operations and/or require us to relinquish rights to our product candidates.