The applicable margin with respect to Term Loans is (i) in the case of any base rate loan, 3.5% per annum, and (ii) in the case of any Eurodollar rate loan, 4.25%, per annum. The applicable margin with respect to the Revolver, unused commitment fees and letter of credit fees for standby letters of credit, is (i) in the case of any base rate loan, 3.5% per annum, (ii) in the case of any Eurodollar rate loan, 4.5% per annum, (iii) for letter of credit fees, 4.5% per annum, and (iv) for unused commitment fees, 0.5% per annum. The applicable margin with respect to Incremental Term Loans is (i) in the case of any base rate loan, 11.5% per annum, and (ii) in the case of any Eurodollar rate loan, 12.5%, per annum.

The Company and its restricted subsidiaries are subject to affirmative, negative, and financial covenants, and events of default customary for facilities of this type (with customary grace periods, as applicable, and lender remedies). The covenants, among other things, restrict, subject to certain exceptions, the Company’s and each of its restricted subsidiary’s ability to (i) incur additional indebtedness, (ii) create liens on assets, (iii) make investments, loans, or advances, (iv) engage in mergers or consolidations, (v) sell assets, (vi) make certain acquisitions, (vii) pay or make restricted payments, (viii) engage in certain transactions with affiliates, (ix) change line of business or fiscal year, and (x) enter into certain restrictive agreements.

On an annual basis at year-end commencing on December 31, 2019, the Company is subject to an Excess Cash Flow (“ECF”) covenant calculation that requires prepayment of the Term Loan, without premium or penalty, of the calculated ECF amount, if any. As of January 2, 2022 and January 3, 2021, the Company did not have any ECF in accordance with the covenant calculation and no prepayments on the Term Loan were made.

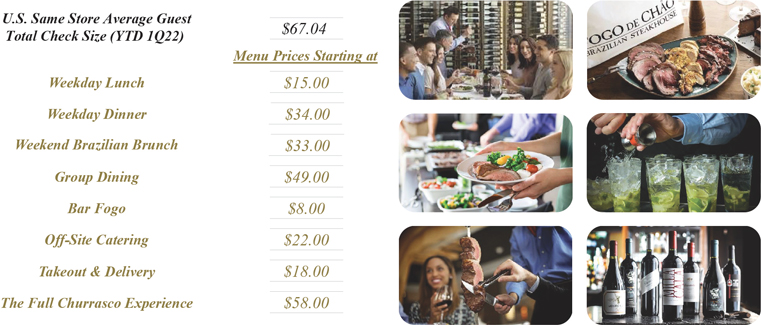

In accordance with the Term Loan, the Company is restricted from making annual distributions not to exceed the greater of (i) $20,000 and (ii) 32.5% of consolidated adjusted earnings before interest tax depreciation and amortization (“EBITDA”), among other permitted distributions.

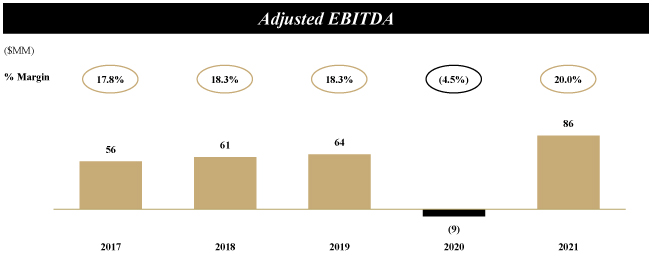

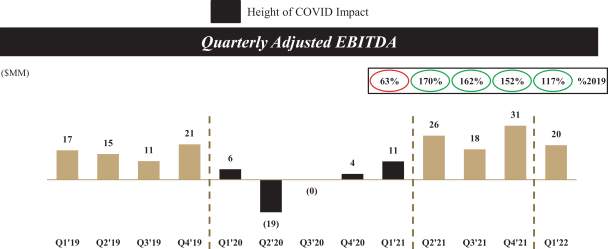

The Company is required to maintain a total net leverage ratio of not greater than 7:1.00 while the Revolver and letters of credit are greater than 35% of the aggregate revolving commitments, which is known as the covenant trigger event. On June 9, 2020, the Company entered into a second amendment of its 2018 Credit Agreement that provided covenant relief until the first quarter of 2021. The agreement allowed the company to replace 2020 March through December Adjusted EBITDA with 2019 Adjusted EBITDA for the corresponding months for its pro forma leverage ratio covenant calculation. The Company was in compliance with these covenants at January 2, 2022.

The Company is required to repay 1% of the Term Loan annually, representing $3,126. The payment was deferred for 2020 and 2021 due to the COVID-19 pandemic. Fogo de Chão, Inc. does not have scheduled repayments on the Revolver. Because Fogo de Chão, Inc. is not required to make principal payments on any outstanding balance under the Revolver, any outstanding balance is reported as noncurrent in the Company’s consolidated balance sheets as a component of long-term debt.

As of January 2, 2022, we had $4,596 in letters of credit outstanding, resulting in a total of $35,404 of available borrowing capacity under the 2018 Credit Facility. The fair value of the Company’s outstanding debt approximates its carrying value.

Woodforest Bank Loan—On November 16, 2020, we entered into and drew down a mortgage loan for $11,200 with Woodforest National Bank and provided a lien on two owned real estate assets as security. This loan matures on December 15, 2025. We repaid the loan on July 2, 2021. The loan is revolving and the full $11,200 of the loan is available for draw down until December 2025.

Debt Issuance Costs—Debt issuance costs are amortized to interest expense over the term of the debt using the straight-line method over the terms of the related instruments. Remaining unamortized debt issuance costs were $4,784 and $6,424 as of January 2, 2022 and January 3, 2021, respectively. Debt issuance costs are included as a direct deduction of long-term debt in the consolidated balance sheets.

F-34