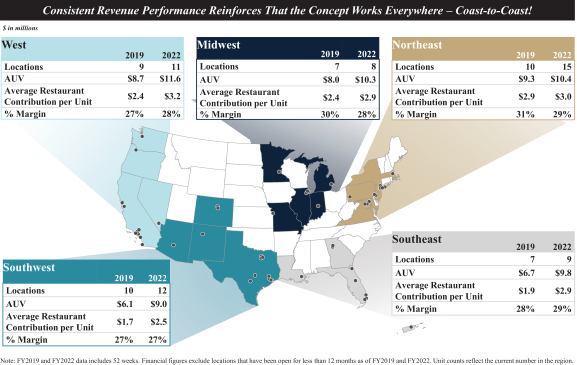

2023, we had opened 16 new U.S. units since 2019 (Bethesda, MD, Long Island, NY, Irvine, CA, White Plains, NY, Albuquerque, NM, Burlington, MA, Oak Brook, IL, Huntington Station, NY, Coral Gables, FL, El Segundo, CA, Fort Lauderdale, FL, Pasadena, CA, Friendswood, TX, Queens, NY, Reston, VA and Austin, TX). Based on actual sales weeks that these units were open for the entirety of Fiscal 2022, the average weekly sales for these 16 units exceeded our target year 3 U.S. AUV of $6.6 million by 42%. These 16 units are located in different regions of the U.S. and in various types of trade areas, which demonstrates the portability of our new units. Our three new U.S. restaurants opened since 2019 (located in Bethesda, MD, Long Island, NY and Irvine, CA) that were open during the entirety of Fiscal 2021 and Fiscal, 2022 had average weekly sales of $208,000, compared to average weekly sales of restaurants opened previously of $201,000, and exceeded the average weekly sales implied by our target year 3 U.S. AUV of $6.6 million by 64%. Additionally, these three new restaurants are approximately 14% smaller on average than those opened previously (9,100 square feet on average as opposed to 10,600 square feet on average), hence demonstrating the potential that our smaller sized units can generate comparable sales levels. Furthermore, 13 new U.S. units opened during Fiscal 2021 and Fiscal 2022 (White Plains, NY, Albuquerque, NM, and Burlington, MA, Huntington Station, NY, Oak Brook, IL, Coral Gables, FL, El Segundo, CA, Fort Lauderdale, FL, Pasadena, CA, Friendswood, TX, Queens, NY, Reston, VA and Austin, TX) had average weekly sales of $173,000, exceeding the average weekly sales implied by our target year 3 U.S. AUV of $6.6 million by 37%.

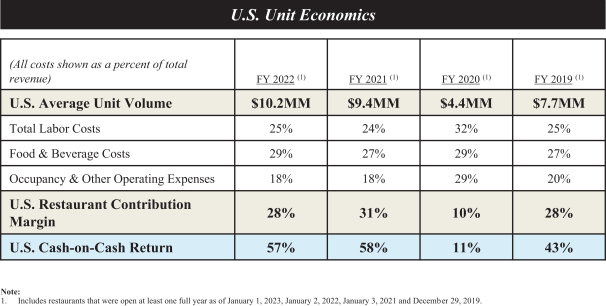

Based on strong average weekly sales of our new development model restaurants during Fiscal 2021 and Fiscal 2022, and our reduced targeted average cash investment of $3.5 million per new restaurant, we have confidence that we will achieve our targeted 40% cash-on-cash returns with our new restaurant development. In Fiscal 2021, our U.S. cash-on-cash returns were 58% and our Brazil cash-on-cash returns were 13%, and in Fiscal 2022, our U.S. cash-on-cash returns were 57% and our Brazil cash-on-cash returns were 70%.

The strength of and the thesis behind our improved development model is supported by the results of units opened thus far under it. These units are outperforming our year three targets with respect to AUV and sales per square foot.

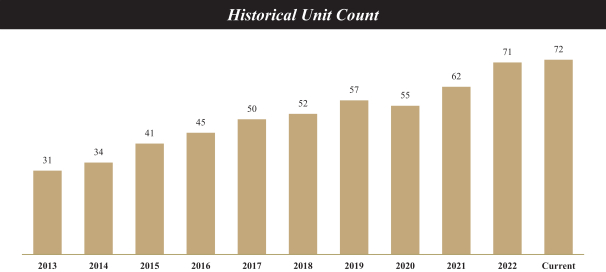

Our primary focus is a disciplined company-owned new restaurant growth strategy primarily in the United States in both new and existing markets where we believe we are capable of achieving sales volumes and restaurant contribution margins. We opened seven restaurants during Fiscal 2021, which included six company-owned restaurants, and one franchise restaurant in Mexico. In Fiscal 2022, we opened nine company-owned restaurants and two international franchise restaurants. In 2023 and beyond, we plan to maintain a company-owned unit growth of at least 15% annually while continuing to expand internationally with our franchise model. In pursuit of this goal, in 2022 we entered into development agreements to open multiple franchise locations in Canada, Costa Rica, El Salvador and the Philippines, and expect other countries to follow.

We plan to grow in international markets through our new franchise strategy, while simultaneously pursuing the opportunity to enter into airports and other non-traditional sites. We believe our high-quality food offering at an affordable price point served in an experimental setting will be received as well in international markets as it was when Fogo first expanded from Brazil to the U.S. in 1997, and as evidenced by the growth of our current franchising program in the Middle East and Mexico and the strong interest demonstrated by our franchise opportunity pipeline. We also believe both domestic U.S. and international airports represent a compelling, natural extension of our brand proposition opportunity given the immediacy of our dining model, rapid table turns, high-quality food and reputation of our brand.

Continue to Grow Our Traffic and Comparable Restaurant Sales

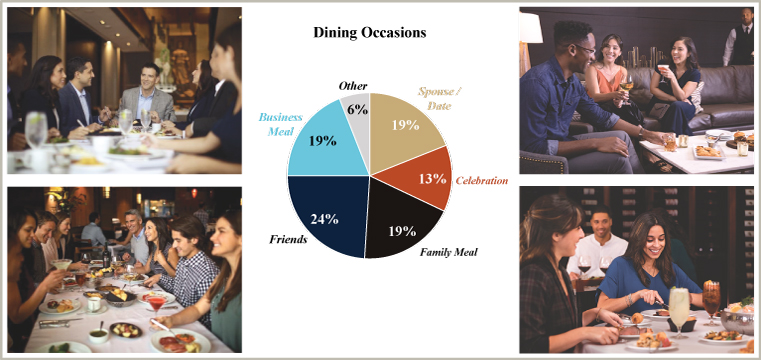

Unlike many of our peers, we consistently grew our traffic for six years through 2019. Our strategy is to build traffic with trial, new occasions through continuous culinary and bar innovation that build frequency, enhance our guest experience with add-on sales and then evaluate price increases (in line with inflation) by location to continue to maintain our strong value proposition versus our peers.

-119-