UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-Q

☒ Quarterly Report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

For the quarterly period ended March 31, 2024

☐ Transition Report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

For the transition period from __________ to __________

Registration No. 000-56532

ESG INC.

(Exact name of registrant as specified in its charter)

| Nevada | | 87-1918342 |

(State or Other Jurisdiction of

Incorporation or Organization) | | (I.R.S. Employer

Identification No.) |

| | | |

523 School House Rd. Kennett Square, PA | | 19348 |

| (Address of Principal Executive Offices) | | (Zip Code) |

267-467-5871

(Registrant’s telephone number, including area code)

(Former Name, former address and former fiscal year, if changed since last report)

Securities registered under Section 12(b) of the Exchange Act: None

Securities registered under Section 12(g) of the Exchange Act: None

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “non-accelerated filer,” “ smaller reporting company,” and “ emerging growth company ” in Rule 12b-2 of the Exchange Act. (Check all that apply):

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| Non-accelerated filer | ☒ | Smaller reporting company | ☒ |

| Emerging growth company | ☒ | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

State the number of shares outstanding of each of the issuer’s classes of common equity, as of the latest practicable date: 25,899,468 common shares issued and outstanding as of March 31, 2024.

ESG INC.

QUARTERLY REPORT ON FORM 10-Q

TABLE OF CONTENTS

Part I. Financial Information

Item 1. Financial Statements (unaudited)

ESG INC.

CONSOLIDATED BALANCE SHEET

| | | | | | | | | |

| | | March 31, | | | December 31, | |

| | | 2024 | | | 2023 | |

| | | (Unaudited) | | | | |

| Assets |

| Current Assets | | | | | | | | |

| Cash | | | 833,089 | | | | 342,342 | |

| Accounts receivable and other receivables | | | 202,665 | | | | 79,221 | |

| Advance to suppliers | | | 394,723 | | | | 166,010 | |

| Inventories | | | 718,213 | | | | 1,651,376 | |

| Total Current Assets | | | 2,148,690 | | | | 2,238,949 | |

| | | | | | | | | |

| Property, plant and equipment, net | | | 17,941,182 | | | | 18,694,969 | |

| Intangible assets, net | | | 3,016,003 | | | | 3,085,906 | |

| Value added tax receivable | | | 2,190,735 | | | | 2,211,980 | |

| Note receivable | | | 41,142 | | | | 41,848 | |

| Total Non-current Assets | | | 23,189,062 | | | | 24,034,703 | |

| | | | | | | | | |

| Total Assets | | | 25,337,752 | | | | 26,273,652 | |

| | | | | | | | | |

| Liabilities and Shareholders’ Equity | |

| Current Liabilities | | | | | | | | |

| Short-term bank loans | | | 7,201,019 | | | | 6,904,228 | |

| Accounts payable | | | 1,302,601 | | | | 1,450,405 | |

| Payable to related party | | | - | | | | 30,000 | |

| Accrued expenses and other current liabilities | | | 2,377,303 | | | | 2,312,772 | |

| Deferred income | | | 1,293,031 | | | | 1,355,552 | |

| Total Current liabilities | | | 12,173,954 | | | | 12,052,957 | |

| | | | | | | | | |

| Long-term payable | | | 1,365,851 | | | | 1,423,116 | |

| Total Non-current liabilities | | | 1,365,851 | | | | 1,423,116 | |

| | | | | | | | | |

| Total Liabilities | | | 13,539,805 | | | | 13,476,073 | |

| | | | | | | | | |

| Commitments and Contingencies | | | | | | | | |

| | | | | | | | | |

| Shareholders’ Equity (Deficit) | | | | | | | | |

| Common stock, $0.001 par value, 65,000,000 authorized, 25,899,468 issued and outstanding as of March 31,2024 and December 31, 2023. | | | 25,900 | | | | 25,900 | |

| Additional paid in capital | | | 11,152,388 | | | | 11,152,388 | |

| Accumulated comprehensive income (loss) | | | (589,786 | ) | | | (430,206 | ) |

| Accumulated deficit | | | (1,812,478 | ) | | | (1,224,811 | ) |

| Total Company stockholders’ Equity | | | 8,776,024 | | | | 9,523,271 | |

| Noncontrolling interest | | | 3,021,923 | | | | 3,274,308 | |

| Total Equity | | | 11,797,947 | | | | 12,797,579 | |

| | | | | | | | | |

| Total Liabilities and Stockholders’ Equity | | $ | 25,337,752 | | | | 26,273,652 | |

See accompanying notes to the consolidated financial statements.

ESG INC.

CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

| | | | | | | | | |

| | | For the Three Months Ended March 31, | |

| | | 2024 | | | 2023 | |

| | | | | | | |

| Revenues | | $ | 2,378,281 | | | $ | 1,808,319 | |

| Cost of goods sold | | | 2,468,914 | | | | 1,465,329 | |

| | | | | | | | | |

| Gross profit | | | (90,633 | ) | | | 342,990 | |

| | | | | | | | | |

| Operating expenses | | | | | | | | |

| Research and development cost | | | 131,088 | | | | 130,204 | |

| Selling expense | | | 199 | | | | 223 | |

| General and administrative expense | | | 318,177 | | | | 273,141 | |

| | | | | | | | | |

| Total operating expenses | | | 449,404 | | | | 403,568 | |

| | | | | | | | | |

| Loss from operations | | | (540,037 | ) | | | (60,578 | ) |

| | | | | | | | | |

| Non-operating income (expense) | | | | | | | | |

| Interest income (expense) | | | (149,487 | ) | | | (149,714 | ) |

| Other Income (expense) | | | (95,964 | ) | | | 27,844 | |

| | | | | | | | | |

| Total non-operating income (expenses), net | | | (245,451 | ) | | | (121,870 | ) |

| | | | | | | | | |

| | | | | | | | | |

| Income taxes | | | - | | | | - | |

| | | | | | | | | |

| Net loss | | | (785,488 | ) | | | (182,448 | ) |

| Less: loss attributable to noncontrolling interest | | | (197,821 | ) | | | (40,100 | ) |

| Net loss to ESG Inc. | | | (587,667 | ) | | | (142,348 | ) |

| | | | | | | | | |

| Other comprehensive item | | | | | | | | |

| Foreign currency translation gain (loss) attributable to the Company | | | (159,580 | ) | | | 43,059 | |

| Foreign currency translation gain (loss) attributable to noncontrolling interest | | | (54,564 | ) | | | 14,723 | |

| | | | | | | | | |

| Comprehensive loss attributable to the Company | | $ | (747,247 | ) | | $ | (99,289 | ) |

| Comprehensive loss attributable to noncontrolling interest | | $ | (252,385 | ) | | $ | (25,377 | ) |

| | | | | | | | | |

| Net loss per share - basic and diluted | | $ | (0.03 | ) | | $ | (0.00 | ) |

| | | | | | | | | |

| Weighted average shares outstanding - basic and diluted | | | 25,899,468 | | | | 25,899,468 | |

See accompanying notes to the consolidated financial statements.

ESG INC.

CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS’ EQUITY

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Common stock | | | Additional

paid aid-in | | | Accumulated

income | | | Accumulated

other

comprehensive | | | Total

Company’s | | | Noncontrolling | | | | |

| | | Share | | | Amount | | | capital | | | (deficit) | | | income | | | equity | | | interest | | | Total | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Balance at December 31, 2023 | | | 25,899,648 | | | $ | 25,900 | | | $ | 11,152,388 | | | $ | (1,224,811 | ) | | $ | (430,206 | ) | | $ | 9,523,271 | | | $ | 3,274,308 | | | $ | 12,797,579 | |

| Net loss | | | - | | | | - | | | | - | | | | (587,667 | ) | | | - | | | | (587,667 | ) | | | (197,821 | ) | | | (785,488 | ) |

| Foreign currency translation gain | | | - | | | | - | | | | - | | | | - | | | | (159,580 | ) | | | (159,580 | ) | | | (54,564 | ) | | | (214,144 | ) |

| Balance at March 31, 2024 | | | 25,899,648 | | | $ | 25,900 | | | $ | 11,152,388 | | | $ | (1,812,478 | ) | | $ | (589,786 | ) | | $ | 8,776,024 | | | $ | 3,021,923 | | | $ | 11,797,947 | |

| Balance at December 31, 2022 | | | 25,899,648 | | | $ | 25,900 | | | $ | 11,152,388 | | | $ | (900,098 | ) | | $ | (148,590 | ) | | $ | 10,129,600 | | | $ | 3,438,129 | | | $ | 13,567,729 | |

| Net loss | | | - | | | | - | | | | - | | | | (142,348 | ) | | | - | | | | (142,348 | ) | | | (40,100 | ) | | | (182,448 | ) |

| Foreign currency translation adjustment | | | - | | | | - | | | | - | | | | - | | | | 43,059 | | | | 43,059 | | | | 14,723 | | | | 57,782 | |

| Balance at March 31, 2024 | | | 25,899,648 | | | $ | 25,900 | | | $ | 11,152,388 | | | $ | (1,042,446 | ) | | $ | (105,531 | ) | | $ | 10,030,311 | | | $ | 3,412,752 | | | $ | 13,443,063 | |

See accompanying notes to the consolidated financial statements.

ESG INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

| | | | | | | | | |

| | | For the Three Months Ended March 31, | |

| | | 2024 | | | 2023 | |

| | | | | | | |

| Cash flows from operating activities: | | | | | | | | |

| Net loss | | $ | (785,488 | ) | | $ | (182,448 | ) |

| Adjustments to reconcile loss to net cash used in operating activities: | | | | | | | | |

| Depreciation and amortization | | | 453,295 | | | | 471,559 | |

| Changes in assets and liabilities: | | | | | | | | |

| Accounts receivable and other receivable | | | (123,444 | ) | | | (112,415 | ) |

| Advance to suppliers | | | (228,713 | ) | | | 58,452 | |

| Inventory | | | 933,163 | | | | 476,941 | |

| Value added tax receivable | | | 21,245 | | | | 8,212 | |

| Note receivable | | | 706 | | | | (250 | ) |

| Accounts payable | | | (147,801 | ) | | | (286,874 | ) |

| Payable to related party | | | (30,000 | ) | | | 30,000 | |

| Accrued expenses and other current liabilities | | | 64,532 | | | | 132,908 | |

| Deferred income | | | (62,521 | ) | | | (97,625 | ) |

| | | | | | | | | |

| Net cash used in operating activities | | | 94,973 | | | | 498,460 | |

| | | | | | | | | |

| Cash flows from financing activities: | | | | | | | | |

| Proceeds from loans | | | 138,481 | | | | - | |

| Payment of loans payable | | | - | | | | - | |

| | | | | | | | | |

| Net cash provided by financing activities | | | 138,481 | | | | - | |

| | | | | | | | | |

| Effect of exchange rate changes on cash | | | 257,292 | | | | (141,083 | ) |

| | | | | | | | | |

| Net increase (decrease) in cash | | | 490,747 | | | | 357,377 | |

| | | | | | | | | |

| Cash, beginning of year | | | 342,342 | | | | 206,621 | |

| | | | | | | | | |

| Cash, end of year | | $ | 833,089 | | | $ | 563,998 | |

| | | | | | | | | |

| Supplemental disclosures of cash flow information: | | | | | | | | |

| Cash paid for interest | | $ | 150,396 | | | $ | 142,453 | |

| Cash paid for income tax | | $ | - | | | $ | - | |

See accompanying notes to the consolidated financial statements.

ESG INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

NOTE 1 – ORGANIZATION AND DESCRIPTION OF BUSINESS

We were incorporated under the name Plasma Innovative, Inc. on July 22, 2021 as an emerging cold plasma application company. We intended to use our proprietary, cold plasma technology to treat crops and plant seeds for agriculture. However, we have decided that it is in the best interest of our shareholders to cease operations in the plasma application in the agriculture sector.

ESG Inc. (“ESG”) was incorporated in October 2022 as a Nevada holding corporation and is headquartered at Kennett Square, PA. ESG develops and operates sustainable plant-based ingredients and food production and distribution with the substantial experience of its management team, including experience and relationships in the industry of mushroom, agriculture and food in the world and the capital markets in the States.

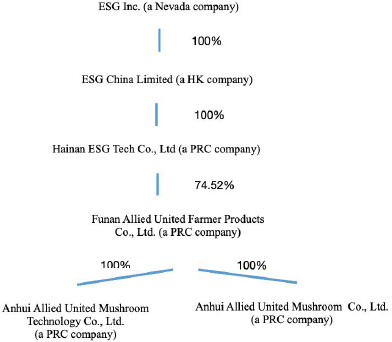

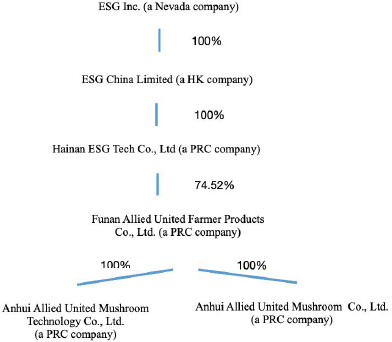

ESG incorporated ESG China Limited as ESG’s wholly owned subsidiary in Hong Kong on November 18, 2022. ESG China Limited incorporated Hainan ESG Technology Co., Ltd., a China corporation (“Hainan ESG”) with 100% of ownership on January 16, 2023. ESG, ESG China Limited and Hainan ESG have no operations or transactions.

AUFP incorporated Anhui Allied United Mushroom Technology Co., Ltd. (“AUMT”) in China in March 2018, to manufacture white button mushroom compost while AUFP incorporated Anhui Allied United Mushroom Co., Ltd. (“AUM”) in China in April, 2018, to grow fresh white button mushroom and provide mushroom growing management services. AUFP, AUMT and AUM are operating entities in China.

On September 28, 2023, ESG entered into a share exchange agreement with Funan Allied United Farmer Products Co., Ltd., a China corporation (“AUFP”), the shareholders of AUFP, (each a “Shareholder,” and collectively, the “Shareholders”), and Hainan ESG Technology Co., Ltd., a China corporation (“Hainan ESG”). Pursuant to such agreement, the Shareholders exchanged their equity of AUFP to Hainan ESG for shares of common stock of ESG. Following this transaction, AUFP became a 74.52% subsidiary of ESG through Hainan ESG.

Prior to the share exchange, Mr. Zhi Yang owned 30% of AUFP, Fuyang Zhihan Agricultural Information Co. Ltd. (“Zhihan”) owned 24.52% of AUFP and Mr. Chris Alonzo owned 10% of AUFP. ESG, after the share exchange agreement described above is completed, owns 74.52% of AUFP and its subsidiaries, AUM and AUMT in China. Mr. Zhi Yang and Zhihan transfer all of their shares into DCG China Limited ("DCG") owned by Xiayun Zhou, Zhi Yang's mother and DCG control 73.15% of ESG. Xiayun Zhou transfers voting right in DCG to Zhi Yang. Mr. Christopher Alonzo owns 13.42% of ESG.

On November 6, 2023, Plasma Innovative Inc. entered into a share exchange agreement (the “Share Exchange Agreement”) with ESG and the shareholders of ESG (the “ESG Shareholders”), whereby One Hundred Percent (100%) of the ownership interest of ESG was exchanged for 10,432,800 shares of common stock of the Company issued to the ESG Shareholders. The transaction has been accounted for as a recapitalization of the Company, whereby ESG is the accounting acquirer.

Neither the Company nor ESG are Chinese operating companies. They are Nevada holding companies that operate business through Funan Allied United Farmer Products Co., Ltd., which owns Anhui Allied United Mushroom Technology Co., Ltd. and Anhui Allied United Mushroom Co., Ltd., all of whom are Chinese operating companies.

Since the Company is effectively controlled by the same controlling shareholders before and after the share exchange agreement, it is considered under common control. Therefore the above mentioned transactions were accounted for as a recapitalization. The reorganization has been accounted for at historical cost and prepared on the basis as if the aforementioned transactions had become effective as of the beginning of the first period presented in the accompanying financial statements of the Company.

On November 22, 2023, Plasma Innovative Inc. filed Articles of Merger with the State of Nevada to merge ESG Inc. into Plasma Innovative Inc. ESG Inc. is the surviving name. Effective February 23, 2024, upon approval from FINRA, the Company’s name was changed from Plasma Innovative Inc. to ESG Inc., and its trading symbol was changed from PMIN to ESGH.

Our operating subsidiaries are involved in direct white button mushroom composting, growing, food production, distribution as well as import and export of Phase III compost and food to strategize. With the core business philosophy to develop and operate sustainable and technology-driven food businesses consistent with the principles of Environmental, Sustainable and Governance investing, we believe that the growing global demand for sustainable high quality food presents a unique opportunity to operate companies engaged in this critical area that is being paid increasing attention by global investors.

NOTE 2 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of presentation and consolidation

The accompanying consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”) and include all adjustments necessary for the fair presentation of the Company’s financial position for the periods presented.

The consolidated financial statements of the Company include the financial statements of the Company and its 74.52% owned subsidiaries in China. All inter-company transactions and balances between the Company and its subsidiaries have been eliminated upon consolidation. The Equity attributable to minority shareholders who own 25.48% of AUFP and its subsidiaries are non-controlling interest (“NCI”). The NCI were $3,021,923 and $3,274,308 as of March 31, 2024 and December 31, 2023, respectively.

Interim Financial Information

The unaudited financial statements have been prepared in accordance with generally accepted accounting principles (GAAP) applicable to interim financial information and the requirements of Form 10-Q and Rule 8-03 of Regulation S-X of the Securities and Exchange Commission. Accordingly, they do not include all of the information and disclosure required by accounting principles generally accepted in the United States of America for complete financial statements. Interim results are not necessarily indicative of results for a full year. In the opinion of management, all adjustments considered necessary for a fair presentation of the financial position and the results of operations and cash flows for the interim periods have been included. These financial statements should be read in conjunction with the audited financial statements as of and for the year ended December 31, 2023, as not all disclosures required by generally accepted accounting principles for annual financial statements are presented. The interim financial statements follow the same accounting policies and methods of computations as the audited financial statements as of and for the year ended December 31, 2023.

Use of estimates

In preparing the consolidated financial statements in conformity with U.S. GAAP, management makes estimates and assumptions that affect the reported amounts of assets and liabilities and disclosures of contingent assets and liabilities at the dates of consolidated financial statements, as well as the reported amounts of revenues and expenses during the reporting year. Significant items subject to such estimates and assumptions include allowance for doubtful accounts, advances to suppliers, valuation of inventories, useful lives of property, plant, and equipment and intangible assets.

Cash and cash equivalents

Cash and cash equivalents include demand deposits with financial institutions that are highly liquid in nature.

Accounts receivable

Accounts receivable are presented net of an allowance for doubtful accounts. The Company maintains an allowance for doubtful accounts for estimated losses. The Company reviews its accounts receivable on a periodic basis and makes general and specific allowance when there is doubt as to the collectability of individual balances. In evaluating the collectability of individual receivable balances, the Company considers many factors, including the age of the balance, customer’s payment history, its current creditworthiness and current economic trends. Accounts are written off after efforts at collection prove unsuccessful. As of March 31, 2024 and December 31, 2023, allowance for doubtful accounts was 0 nil and 0 nil, respectively.

Advances to suppliers, net

Advances to suppliers represent prepayments made to ensure continuous high-quality supplies and favorable purchase prices for premium quality. These advances are settled upon suppliers delivering raw materials to the Company when the transfer of ownership occurs. The Company review its advances to suppliers on a periodic basis and makes general and specific allowances when there is doubt as to the ability of a supplier to provide supplies to the Company or refund an advance. As of March 31, 2024 and December 31, 2023, advance to suppliers was $394,723 and $166,010, respectively and allowance for doubtful accounts was nil and nil, respectively.

Inventory

Inventory is comprised primarily of raw materials, work-in-progress and finished goods. The value of inventory is determined using the weighted average method. The Company periodically estimates an inventory allowance for estimated unmarketable inventories when necessary. Inventory amounts are reported in net of allowances. As of March 31, 2024 and December 31, 2023, inventories were $718,213 and $1,651,376.

Property, plant and equipment, net

Property, plant and equipment are stated at cost, less accumulated depreciation. Major repair and improvements that significantly extend original useful lives or improve productivity are capitalized and depreciated over the period benefited. Repair and maintenance costs are expensed as incurred. Depreciation is recorded principally by the straight-line method over the estimated useful lives of our property, plant and equipment which generally have the following ranges: buildings and improvements: 20 years; machinery and equipment: 5-10 years; office equipment: 3-5 years. Construction in progress is not depreciated until ready for service.

Intangible assets, net

Intangible assets with finite lives are amortized using the straight-line method over their estimated period of benefit. Evaluation of the recoverability of intangible assets is made to take into account events or circumstances that warrant revise estimates of useful lives or that indicate that impairment exists. All of the Company’s intangible assets are subject to amortization. No impairment of intangible assets has been identified as of the balance sheet date.

Intangible assets consist of land use rights, patent and purchased software. Intangible assets are stated at cost less accumulated amortization. The land purchased for industrial use has the right of use for 50 years. We amortized the right to use land in 50 years. Patent and software amortized using the straight-line method with estimated useful lives of 12 years and 5 years, respectively.

Revenue recognition

The Company follows Accounting Standards Codification Topic 606, Revenue from Contracts with Customers (ASC 606).

FASB ASC Topic 606 requires the use of a new five-step model to recognize revenue from customer contracts. The five-step model requires the Company (i) identify the contract with the customer, (ii) identify the performance obligations in the contract, (iii) determine the transaction price, including variable consideration to the extent that it is probable that a significant future reversal will not occur, (iv) allocate the transaction price to the respective performance obligations in the contract, and (v) recognize revenue when (or as) the Company satisfies each performance obligation.

Revenue is generated by selling fresh mushrooms to authorized distributors and wholesalers mainly in Yangzi River Delta. Contracts were signed after the communication of the price and quantities with customers. Our sales terms generally do not allow to sell without a deposit being made and do not allow for a right of return. Usually, the deposit from the customer equals or more than the sales amount. Control of the mushrooms is transferred upon receipt or loaded in the truck of carriers at our warehouse, as determined by the specific terms of the contract. Upon transfer of control to the customer, which completes our performance obligation, revenue is recognized.

Deferred income

Deferred income consists primarily of government grants. Government grants (sometimes referred to as subsidies, subventions, etc.) are as assistance by government in the form of transfers of resources to an entity in return for past or future compliance with certain conditions relating to the operating activities of the entity.

Government grants received relating to depreciable assets are recorded as deferred income and recognized in over the life of the related assets. The Company recorded income when receiving a grant which constitutes compensation for expenses or losses already incurred or for the purpose of giving immediate financial support to the entity with no future related costs.

Research and development expenses

Research and development expenses are expensed in the period when incurred. These costs primarily consist of cost of materials used, salaries paid for the Company’s development department, and fees paid to the third parties. The research and development expenses were $131,088 and $130,204, respectively for the three months ended March 31, 2024 and 2023.

Noncontrolling interests

The Company follows FASB ASC Topic 810, “Consolidation,” governing the accounting for and reporting of noncontrolling interests (“NCIs”) in partially owned consolidated subsidiaries and the loss of control of subsidiaries. Certain provisions of this standard indicate, among other things, that NCI (previously referred to as minority interests) be treated as a separate component of equity, not as a liability, that increases and decreases in the parent’s ownership interest that leave control intact be treated as equity transactions rather than as step acquisitions or dilution gains or losses, and that losses of a partially-owned consolidated subsidiary be allocated to non-controlling interests even when such allocation might result in a deficit balance.

The net income (loss) attributed to NCI was separately designated in the accompanying statements of operations and comprehensive income (loss). Losses attributable to NCI in a subsidiary may exceed a non-controlling interest’s interests in the subsidiary’s equity. The excess attributable to NCIs is attributed to those interests. NCIs shall continue to be attributed their share of losses even if that attribution results in a deficit NCI balance.

AUFP and its subsidiaries, AUM and AUMT were 25.48% owned by noncontrolling interest and $3,021,923 and $3,274,308 of equity were attributable to noncontrolling interest as of March 31, 2024 and December 31, 2023, respectively. During the three months ended March 31, 2024 and 2023, the Company had losses of $197,821 and $40,100 attributable to the noncontrolling interest, respectively.

Concentration of credit risk

The Company maintains cash in accounts with state-owned banks within the PRC. Cash in state-owned banks less than $69,241 (RMB500,000) is covered by insurance. Should any institution holding the Company’s cash become insolvent, or if the Company is unable to withdraw funds for any reason, the Company could lose the cash on deposit with that institution. The Company has not experienced any losses in such accounts and believes it is not exposed to any risks on its cash in these bank accounts. Cash denominated in RMB with a U.S. dollar equivalent of $806,593 and $317,947 as of March 31, 2024 and December 31, 2023, respectively, was held in accounts at financial institutions located in the PRC‚ which is not freely convertible into foreign currencies.

In 2023, the Company signed long-term contracts to sell mushroom to two distributors who accounted for 78% and 22% of total revenue for the three months ended March 31, 2024 comparing to 16% and 12% of total revenue for the three months ended March 31, 2023.

Foreign currency translation and comprehensive income (loss)

The accounts of the Company’s Chinese entities are maintained in Chinese Yuan (“RMB”) and the accounts of the U.S. parent company are maintained in United States dollar (“USD”). The accounts of the Chinese entities were translated into USD in accordance with FASB ASC Topic 830 “Foreign Currency Matters.” All assets and liabilities were translated at the exchange rate on the balance sheet date; stockholders’ equity is translated at historical rates and the statements of operations and cash flows are translated at the weighted average exchange rate for the period. The resulting translation adjustments are reported under other comprehensive income (loss) in accordance with FASB ASC Topic 220, “Comprehensive Income.” Gains and losses resulting from foreign currency transactions are reflected in the statements of operations.

The Company follows FASB ASC Topic 220-10, “Comprehensive Income (loss).” Comprehensive income (loss) comprises net income (loss) and all changes to the statements of changes in stockholders’ equity, except those due to investments by stockholders, changes in additional paid-in capital and distributions to stockholders.

The exchange rates used to translate amounts in RMB to USD for the purposes of preparing the CFS were as follows:

| Schedule of foreign currency exchange rates | | | | | | | | | |

| | | March 31,

2024 | | | December 31,

2023 | | | March 31, 2023 | |

| Period-end date USD: RMB exchange rate | | | 7.2212 | | | | 7.0797 | | | | 6.8688 | |

| Average USD for the reporting period: RMB exchange rate | | | 7.1589 | | | | 7.075 | | | | 6.8419 | |

Income taxes

The Company uses the asset and liability method of accounting for income taxes in accordance with FASB ASC Topic 740, “Income Taxes.” Under this method, income tax expense is recognized for the amount of: (i) tax payable or refundable for the current period and (ii) deferred tax consequences of temporary differences resulting from matters that have been recognized in an entity’s financial statements or tax returns. Deferred tax assets also include the prior year’s net operating losses carried forward.

The Company accounts for income for income taxes in accordance with ASC 740, Income Taxes. ASC 740 requires an asset and liability approach for financial accounting and reporting for income taxes and allows recognition and measurement of deferred tax assets based upon the likelihood of realization of tax benefits in future years. Under the asset and liability approach, deferred taxes are provided for the net effects of temporary difference between the carrying amounts of assets and liabilities for financial reporting purposes and the amounts used for income tax purposes. A valuation allowance is provided for deferred tax assets if it is more likely than not these items will either expire before the Company is able to realize their benefits, or not be deductible in the future.

Contingencies

Certain conditions may exist as of the date the condensed consolidated financial statements (“CFS”) are issued, which may result in a loss to the Company but which will only be resolved when one or more future events occur or fail to occur. In accordance with ASC 450, the Company’s management and legal counsel assess such contingent liabilities, and such assessment inherently involves an exercise of judgment. In assessing loss contingencies related to legal proceedings that are pending against the Company or unasserted claims that may result in such proceedings, the Company’s legal counsel evaluates the perceived merits of any legal proceedings or unasserted claims as well as the perceived merits of the amount of relief sought or expected to be sought. If the assessment of a contingency indicates that it is probable that a material loss has been incurred and the amount of the liability can be estimated, the estimated liability would be accrued in the Company’s CFS.

If the assessment indicates that a potential material loss contingency is not probable but is reasonably possible, or is probable but cannot be estimated, the nature of the contingent liability, together with an estimate of the range of possible loss if determinable and material, would be disclosed.

NOTE 3 – GOING CONCERN

The accompanying consolidated financial statements were prepared assuming the Company will continue as a going concern, which contemplates continuity of operations, realization of assets, and liquidation of liabilities in the normal course of business. For the three months ended March 31, 2024 and 2023, the Company had a net loss of approximately $587,667 and $142,348, respectively. The Company had an accumulated deficit of approximately $1,812,478 and $1,224,811 as of March 31, 2024 and December 31, 2023, respectively. The operating results indicate the Company has recurring losses from operations which raises the question related to the substantial doubt about the Company’s ability to continue as a going concern.

Historically, we have funded our operations primarily through our sale of fresh mushrooms and borrowings. Currently, all the loans are short-term borrowings. Management is working to increase long-term loans and equity investment in order to improve our capital structure. However, such additional cash resources may not be available to us on desirable terms, or at all, if and when needed by us.

To enhance our ability to continue to operate, we are dedicating resources to generate recurring revenues and sustainable operating cash flows. On one side, we improved efficiency with current facilities, on the other side, we were expanding our composting facilities to generate more revenue by selling compost to customers.

NOTE 4 – CASH, CASH EQUIVALENTS

The cash and cash equivalents were $833,089 as of March 31, 2024 and $342,342 as of December 31, 2023, respectively.

NOTE 5 – PROPERTY, PLANT AND EQUIPMENT

The following table summarizes our property, plant and equipment:

| Schedule of property and equipment | | | | | | |

| | | March 31, 2024

(unaudited) | | | December 31, 2023 | |

| Buildings and improvements | | $ | 15,996,892 | | | $ | 16,276,614 | |

| Machinery, equipment and vehicle fleet | | | 8,448,411 | | | | 8,597,430 | |

| Construction in progress | | | 21,309 | | | | 21,682 | |

| Property, plant and equipment - cost | | | 24,466,612 | | | | 24,895,726 | |

| Less: Accumulated depreciation | | | (6,525,430 | ) | | | (6,200,757 | ) |

| Property, plant and equipment - net | | $ | 17,941,182 | | | $ | 18,694,969 | |

Depreciation expenses were $436,277 and $471,559, respectively for the three months ended March 31, 2024 and 2023.

NOTE 6 – ACCOUNTS RECEIVABLE AND OTHER RECEIVABLES

Accounts receivable and other receivable consisted of the following:

| Schedule of accounts receivable | | | | | | |

| | | March 31, 2024

(unaudited) | | | December 31,

2023 | |

| Accounts receivable | | $ | 118,860 | | | $ | - | |

| Other receivable | | | 83,805 | | | | 79,221 | |

| Total | | $ | 202,665 | | | $ | 79,221 | |

NOTE 7 – INVENTORIES

Inventories consisted of the following:

| Schedule of inventories | | | | | | |

| | | March 31, 2024 | | | December 31, | |

| | | (unaudited) | | | 2023 | |

| Raw materials | | $ | 585,787 | | | $ | 1,516,634 | |

| Finished goods | | | - | | | | - | |

| Work in progress - compost | | | 88,774 | | | | 90,326 | |

| - growing mushrooms | | | 43,652 | | | | 44,416 | |

| Total | | $ | 718,213 | | | $ | 1,651,376 | |

NOTE 8 – INTANGIBLE ASSETS

Intangible assets are stated at cost or acquisition-date fair value less accumulated amortization and consist of the following:

| Schedule of intangible assets | | | | | | |

| | | March 31, 2024

(unaudited) | | | December 31, 2023 | |

| Land use right | | $ | 3,270,794 | | | $ | 3,327,987 | |

| Software | | | 7,569 | | | | 7,701 | |

| Patent | | | 6,924 | | | | 7,045 | |

| Subtotal | | | 3,285,287 | | | | 3,342,733 | |

| Less: Accumulated amortization | | | (269,284 | ) | | | (256,827 | ) |

| Total | | $ | 3,016,003 | | | $ | 3,085,906 | |

Amortization expenses for the three months ended March 31, 2024 and 2023 were $17,017 and $17,464, respectively.

NOTE 9 – BANK LOANS

Short-term bank loans consisted of the following:

| Schedule of short-term bank loans | | | | | | | | | | | | | | | | | | |

| | | March 31,

2024

(unaudited) | | | Interest

rate | | | Due date | | | December 31,

2023 | | | Interest

rate | | | Due date | |

| Agricultural Bank of China Funan Branch | | $ | 830,887 | | | | 3.70 | % | | | 4/10/24 | | | $ | 845,416 | | | | 3.70 | % | | | 4/10/24 | |

| Anhui Funan Rural Commercial Bank | | | 1,938,736 | | | | 5.90 | % | | | 12/22/24 | | | | 1,972,637 | | | | 5.90 | % | | | 12/22/24 | |

| Anhui Funan Rural Commercial Bank | | | 1,384,811 | | | | 5.60 | % | | | 3/28/25 | | | | 1,409,026 | | | | 5.90 | % | | | 3/28/24 | |

| Anhui Funan Rural Commercial Bank | | | 830,887 | | | | 5.90 | % | | | 1/25/25 | | | | 845,416 | | | | 5.90 | % | | | 1/25/24 | |

| Industrial and Commercial Bank of China, Funan (1) | | | 692,406 | | | | 3.45 | % | | | 10/12/24 | | | | 704,513 | | | | 3.45 | % | | | 10/12/24 | |

| Industrial and Commercial Bank of China, Funan (2) | | | 415,443 | | | | 3.45 | % | | | 3/24/25 | | | | - | | | | - | | | | - | |

| Bank of China Funan Branch | | | 1,107,849 | | | | 3.60 | % | | | 3/15/25 | | | | 1,127,221 | | | | 3.60 | % | | | 3/15/25 | |

| Total | | $ | 7,201,019 | | | | - | | | | - | | | $ | 6,909,229 | | | | - | | | | - | |

| (1) | The loans from Bank of China were pledged by fixed assets as of March 31, 2024 and December 31, 2023, respectively. |

| (2) | The loans from Industrial and Commercial Bank of China, Funan branch were pledged by fixed assets as of March 31, 2024. |

The difference in loan balance between March 31, 2024 and December 31, 2024 was due to foreign currency exchange.

NOTE 10 – ACCRUED EXPENSES AND OTHER CURRENT LIABILITIES

Accrued expenses and other current liabilities consisted of the following:

| Schedule of accrued expenses and other current liabilities | | | | | | |

| | | March 31, 2024

(unaudited) | | | December 31,

2023 | |

| Advances from customers | | $ | 34,498 | | | $ | 63,867 | |

| Salary payable | | | 140,444 | | | | 181,950 | |

| Tax payable | | | 14,662 | | | | 16,131 | |

| Other payables (1) | | | 2,187,699 | | | | 2,050,824 | |

| Total | | $ | 2,377,303 | | | $ | 2,312,772 | |

| (1) | Other payable was primarily comprised of loans from non-bank institutions. Loans were including $276,962 and $281,805, respectively from Funan Agricultural Investment Co. Ltd, and $1,384,811 and $1,409,026, respectively from Funan Small Business financing service center as of March 31, 2024 and December 31, 2023. |

NOTE 11 – VALUE ADDED TAX RECEIVABLE

Selling merchandise in China is generally subject to the value-added tax (“VAT”). The Company and its subsidiaries’ primary operations are classified as agriculture products and its revenue is exempt from VAT and income tax. The amount of VAT liability is determined by applying the applicable tax rate to the invoiced amount of goods sold (output VAT) less VAT paid on purchases made with the relevant supporting invoices (input VAT). VAT input was primarily due to purchase of property, plant and equipment. As of March 31, 2024 and December 31, 2023, VAT input was $2,190,735 and $2,211,980, respectively. VAT input can deduct VAT output or be refunded when selling non-exempt goods. Anhui Allied United Mushroom Technology and Anhui Allied United Mushroom are engaged in agricultural production in China, and their value-added tax are exempted. The Company plans to produce processed mushrooms in the near future to utilize VAT input to offset VAT output.

NOTE 12 – ASSET ACQUISITION

On May 11, 2021, Anhui Allied United Mushroom Co., Ltd. signed the Agreement (“Agreement”) with Suhua Yang and Hao Yan, the owners of Funan Zhihua Mushroom Co., Ltd. (“Target Company”). As the consideration of transferring 100% equity of Target Company, AUM will pay Shareholders with $2,151,383 (RMB 14,840,028), which is $25,612 (RMB176,667) per month for 84 months at the end of each month after the delivery of the growing rooms. The payments are characterized as long-term payable on the financial statement. Target Company was dissolved after the asset acquisition.

NOTE 13: COMMITMENTS AND CONTINGENCIES

Commitments

On January 5, 2022, Funan Modern Recycling Agriculture Investment Co., Ltd. (“FMRA”) signed an agreement with AUFP to fund AUFP 115 million RMB ($18.09 million) on the expansion of composting facilities including 6 bunkers and 22 tunnels. According to the agreement, AUFP transfers the land use right of 46,662 square meters which the composting facilities will be constructed on to FMRA and starts to pay rent for 10 years after AUFP uses the facilities. Once rents are paid, FMRA transfers the land use right and deed of composting facilities to AUFP. All the costs related to the transfer of land use right are paid by FMRA. The facilities were in construction as of March 31, 2024.

Legal contingencies

The Company is involved in a few legal proceedings. Management has identified certain legal matters where we believe an unfavorable outcome is reasonably estimated. Management believes that the total liabilities of the Company that may arise as a result of currently pending proceedings will not have a material adverse effect on the Company, taken as a whole.

On September 3, 2021, Anhui Daquan Construction Company (“Daquan”) filed a lawsuit against Funan Zhihua Mushroom Co., Ltd. (a merged company, “Zhihua”) on unpaid contractual price of $48,744. Zhihua has a dispute on construction quality which did not meet the requirements specified in the contract and filed a lawsuit for $26,095 of damage. On June 6, 2023, Daquan paid $26,095 to Zhihua to settle the lawsuit.

On November 10, 2022, Funan Yuanlangju Construction Co., Ltd. filed a lawsuit against AUFP for $60,147. The plaintiff sold construction materials to AUFP. AUFP had a dispute with the plaintiff over the amount of the sale. On July 7, 2023, the two parties reached a settlement that AUFP paid the plaintiff $50,740 in 2023.

On December 2, 2022, Liu Pengpeng filed a lawsuit against AUFP for $66,066. Liu Pengpeng signed a contract with AUFP on installation work and drainage construction. Liu Pengpeng breached the contract and failed to complete the construction work on time which caused a loss to AUFP. On July 7, 2023, Liu Pengpeng withdrew the lawsuit. On November 20, 2023, Liu Pengpeng filed a lawsuit for the same claim.

NOTE 14 – RELATED PARTY TRANSACTION

On October 22, 2022, Mr. Zhi Yang, the Company founder and CEO subscribed 12 million shares of common stock. Mr. Yang paid $30,000 for the 12,000,000 shares of ESG Inc. stock. The subscription was canceled on September 28, 2023, and the capital received were payable to Mr. Yang. The payable was paid off on February 5, 2024.

NOTE 15 – DEFERRED INCOME

As of March 31, 2024 and December 31, 2023, deferred income was $1,293,031 and $1,355,552, respectively. The Company recognized $94,348 and $69,169, respectively of government grants for the three months ended March 31, 2024 and 2023. Asset-based grants were $94,348 and $41,399, respectively, for the three months ended as of March 31, 2024 and 2023. Income-based grants were $0 and $27,770, respectively, for the three months ended March 31, 2024 and 2023.

NOTE 16 – INCOME TAXES

The company is subject to income taxes on an entity basis on income derived from the location in which each entity is domiciled. ESG Inc, ESG China Limited and Hainan ESG Tech are holding companies without operations.

The Company’s U.S. parent company is subject to U.S. income tax rate of 21% and files U.S. federal income tax return. As of March 31, 2024 and December 31, 2023, the U.S. entity had net operating loss (“NOL”) carry forwards for income tax purposes of $177,203 and $193,010. Management believes the realization of benefits from these losses remains uncertain. Accordingly, a 100% deferred tax asset valuation allowance was provided.

In China the Corporate Income Tax Law generally applies an income tax rate of 25% to all enterprises. In corporate income tax article 86, “Regulations for the Implementation of the Enterprise Income Tax Law” article 27(1) of stipulate: the income of an enterprise engaged in agriculture, forestry, animal husbandry, and fishery projects may be exempted or reduced from income tax. Refer to: (1) Enterprises are exempted from enterprise income tax on income derived from the following items: 1. Planting of vegetables , grains, potatoes. Funan Allied Untied Farmer Products, Anhui Allied United Mushroom Technology and Anhui Allied United Mushroom are engaged in agricultural production in China, and their income tax are exempted. Net income and net loss were not offset among the operating subsidiaries. Net income of $72,822 and $344,686 were exempt from income tax for the periods ended March 31, 2024 and 31, 2023, respectively. The estimated tax savings as the result of the tax break for the three month ended March 31, 2024 and 2023 amounted to $15,293 and $72,384, respectively. After consideration of all the information available, management believes that significant uncertainty exists with respect to future realization of the deferred tax assets and has therefore established a full valuation allowance as of March 31, 2024 and December 31, 2023.

There were no uncertain tax positions as of March 31, 2024 and December 31, 2023.

As of March 31, 2024 and December 31, 2023, the Company had net operating loss (“NOL”) carryforwards of $10,461,994 and $9,619,491, in the PRC respectively. The NOL carryforwards will begin to expire in the PRC in the calendar year 2024 through 2028, if not utilized. Management believes that it is more likely than not that the benefit from the NOL carryforwards will not be realized and thus provided a 100% valuation allowance as of March 31, 2024 and December 31, 2023 and no deferred tax asset benefit has been recorded. The Company’s management reviews this valuation allowance periodically and makes adjustments as necessary.

The following table reconciles the U.S. statutory rates to the Company’s effective tax rate for the three months ended March 31, 2024 and 2023:

| Schedule of effective tax rates | | | | | | | | |

| | | For the three months ended, | |

| | | March 31, 2024

(unaudited) | | | March 31, 2023 | |

| US federal statutory rates | | | (21 | %) | | | (21 | %) |

| Tax rate difference between PRC and U.S. | | | (4 | %) | | | (4 | %) |

| Effect of income tax exemption on certain income | | | (2 | %) | | | (24 | %) |

| Change in valuation allowance | | | 27 | % | | | 49 | % |

| Effective tax rate | | $ | - | | | $ | - | |

The provision for income tax expense (benefit) for the three month ended March 31, 2024 and 2023 consisted of the following:

| Schedule of income tax expense (benefit) | | | | | | | | |

| | | For the three months ended, | |

| | | March 31, 2024

(unaudited) | | | March 31, 2023 | |

| Income tax expense - current | | $ | - | | | $ | - | |

| Income tax benefit -deferred | | | (173,589 | ) | | | (128,384 | ) |

| Increase in valuation allowance | | | 173,589 | | | | 128,384 | |

| Total income tax expense | | $ | - | | | $ | - | |

The Company’s net deferred tax asset as of March 31, 2024 and December 31,2023 is as follows:

| Schedule of net deferred tax assets | | | | | | |

| | | March, 31 | | | December 31, | |

| | | 2024 (unaudited) | | | 2023 | |

| Deferred tax asset | | | | | | | | |

| Net operating loss | | $ | (2,704,733 | ) | | $ | (2,531,144 | ) |

| Less: valuation allowance | | | 2,704,733 | | | | 2,531,144 | |

| Net deferred tax asset | | $ | - | | | $ | - | |

NOTE 17 – EQUITY

The Company authorized 65,000,000 shares of common stock at par value of $0.001 and 10,000,000 shares of preferred stock at par value $0.001. 25,899,468 shares of common stock were issued and outstanding as of March 31, 2024 and December 31, 2023. There were no preferred stock were issued as of March 31, 2024 and December 31, 2023.

NOTE 18 – SUBSEQUENT EVENTS

On May 8, 2024, Mr. Zhi Yang, the Company's founder and CEO transferred 14,000,000 shares of our common stock held in his name to DCG China Limited, ("DCG") a company owned by his mother, Xiayun Zhou. Along with her, Mr. Yang has voting control over DCG and is considered the beneficial owner of DCG, and therefore no change in control occurred. Prior to the transfer, DCG owned 7,632,800 shares of common stock, and now owns a total of 21,632,800, representing 83.53% of the issued and outstanding shares of common stock.

The Company evaluated all events and transactions that occurred after March 31, 2024 through the date of the consolidated financial statements were available to be issued and concluded that there were no other material subsequent events.

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

Cautionary Note Regarding Forward-Looking Statements

This report contains forward-looking statements within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act. All statements other than statements of historical fact are “forward-looking statements” for purposes of federal and state securities laws, including, but not limited to, any projections of earnings, revenue or other financial items; any statements of the plans, strategies and objectives of management for future operations; any statements concerning proposed new business or developments; any statements regarding future economic conditions of performance; and statements of belief; and any statements of assumptions underlying any of the foregoing. Such forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements.

In some cases, you can identify forward looking statements by terms such as “may,” “intend,” “might,” “will,” “should,” “could,” “would,” “expect,” “believe,” “anticipate,” “estimate,” “predict,” “potential,” or the negative of these terms. These terms and similar expressions are intended to identify forward-looking statements. The forward-looking statements in this report are based upon management’s current expectations and belief, which management believes are reasonable. However, we cannot assess the impact of each factor on our business or the extent to which any factor or combination of factors, or factors we are aware of, may cause actual results to differ materially from those contained in any forward-looking statements. You are cautioned not to place undue reliance on any forward-looking statements. These statements represent our estimates and assumptions only as of the date of this report. Except to the extent required by federal securities laws, we undertake no obligation to update any forward-looking statement to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events.

You should be aware that our actual results could differ materially from those contained in the forward-looking statements due to a number of factors, including:

| ● | uncertainties relating to our ability to establish and operate our business and generate revenue; |

| ● | uncertainties relating to general economic, political and business conditions in China; |

| ● | industry trends and changes in demand for our products and services; |

| ● | uncertainties relating to customer plans and commitments and the timing of orders received from customers; |

| ● | announcements or changes in our advertising model and related pricing policies or that of our competitors; |

| ● | unanticipated delays in the development, market acceptance or installation of our products and services; |

| ● | changes in Chinese government regulations; |

| ● | availability, terms and deployment of capital, relationships with third-party equipment suppliers; and |

| ● | influences of COVID-19 on China’s economy and society. |

Overview

ESG Inc. (“ESG”) was incorporated in July 2021, a Nevada corporation and headquartered at Kennett Square, Pennsylvania, USA, and is a holding company to develop and operate sustainable plant based ingredients and food production and distribution with the substantial experience of its management team, the board of directors and the advisory board, including expertise and relationships in the industry of mushroom, agriculture and food in the world and the capital markets in the States.

With the core business philosophy to develop and operate sustainable and technology driving food businesses consistent with the principles of Environmental, Sustainable and Governance investing, ESG is devoting to contribute on feeding the world by growing, processing and distributing plant-based food ingredients mainly from all kinds of mushrooms.

As a holding company with no material operations, ESG currently conducts a majority of business through the operating entities incorporated in the People’s Republic of China, or the PRC, with the plan to expand in Asia Pacific and the rest world. Through legally 100% owned by ESG Inc. (a Nevada company) of ESG China Limited (a HK company) and Hainan ESG Technology Co., Ltd. (a PRC company), ESG Inc. currently owns 74.52% of operating subsidiaries in China including Funan Allied United Farmer Products Co., Ltd., Anhui Allied United Mushroom Technology Co., Ltd. and Anhui Allied United Mushroom Co., Ltd.

The primary operational goals are to feed the world by providing quality and safe food. Specifically, ESG currently produces 21,600 tons of Phase III compost yearly and more than 7300 tons of fresh white button mushroom yearly separately by operating composting facility including 3 bunkers and 9 tunnels and growing facility of 36 rooms. After the completion of expansion on composing facility, ESG will make 90, 000 tons of Phase III compost among which two third will be sold to third party.

Processing mushrooms including but not limited to button mushroom will be a brand-new product line by cooperating with trade houses in and out of China. The primary class of processed mushroom is canned mushroom, which is being designed and planned. The middle class of processed mushroom is instant mushroom soup, ready stirred fresh mushroom pack, and mushroom snack, which is under research and development by working with local universities. Advanced class of processed mushroom is mushroom supplement and specialty food, which is still at the early stage of discussion with related industrial players.

As a holding entity, ESG will continue to work with gourmet food experts in the United States and Europe to pick up other plant-based food and ingredients to standardize and franchise its production and distribution in Asian and Pacific area.

Plasma Innovative Inc. (“PMIN,” a publicly reporting company) entered into a share exchange agreement (the “Share Exchange Agreement”) with ESG and the shareholders of ESG in October 2023. The transaction has been accounted for as a recapitalization of the Company, whereby ESG is the accounting acquirer.

Description of Business

We were incorporated under the name Plasma Innovative, Inc. on July 22, 2021 as an emerging cold plasma application company. We intended to use our proprietary, cold plasma technology to treat crops and plant seeds for agriculture. However, we have decided that it is in the best interest of our shareholders to cease operations in the plasma application in the agriculture sector.

ESG Inc. (“ESG”) was incorporated in October 2022 as a Nevada holding corporation and is headquartered at Kennett Square, PA. ESG develops and operates sustainable plant-based ingredients and food production and distribution with the substantial experience of its management team, including experience and relationships in the industry of mushroom, agriculture and food in the world and the capital markets in the States.

ESG incorporated ESG China Limited as ESG’s wholly owned subsidiary in Hong Kong on November 18, 2022. ESG China Limited incorporated Hainan ESG Technology Co., Ltd., a China corporation (“Hainan ESG”) with 100% of ownership on January 16, 2023. ESG, ESG China Limited and Hainan ESG have no operations or transactions.

AUFP incorporated Anhui Allied United Mushroom Technology Co., Ltd. (“AUMT”) in China in March 2018, to manufacture white button mushroom compost while AUFP incorporated Anhui Allied United Mushroom Co., Ltd. (“AUM”) in China in April, 2018, to grow fresh white button mushroom and provide mushroom growing management services. AUFP, AUMT and AUM are operating entities in China.

On September 28, 2023, ESG entered into a share exchange agreement with Funan Allied United Farmer Products Co., Ltd., a China corporation (“AUFP”), the shareholders of AUFP, (each a “Shareholder,” and collectively, the “Shareholders”), and Hainan ESG Technology Co., Ltd., a China corporation (“Hainan ESG”). Pursuant to such agreement, the Shareholders exchanged their equity of AUFP to Hainan ESG for shares of common stock of ESG. Following this transaction, AUFP became a 74.52% subsidiary of ESG through Hainan ESG.

Prior to the share exchange, Mr. Zhi Yang owned 30% of AUFP, Fuyang Zhihan Agricultural Information Co. Ltd. (“Zhihan”) owned 24.52% of AUFP and Mr. Chris Alonzo owned 10% of AUFP. ESG, after the share exchange agreement described above is completed, owns 74.52% of AUFP and its subsidiaries, AUM and AUMT in China. Mr. Zhi Yang and Zhihan control 73.15% of ESG through DCG China Limited , and Mr. Christopher Alonzo owns 13.42% of ESG.

On November 6, 2023, Plasma Innovative Inc. entered into a share exchange agreement (the “Share Exchange Agreement”) with ESG and the shareholders of ESG (the “ESG Shareholders”), whereby One Hundred Percent (100%) of the ownership interest of ESG was exchanged for 10,432,800 shares of common stock of the Company issued to the ESG Shareholders. The transaction has been accounted for as a recapitalization of the Company, whereby ESG is the accounting acquirer.

Neither the Company nor ESG are Chinese operating companies. They are Nevada holding companies that operate business through Funan Allied United Farmer Products Co., Ltd., which owns Anhui Allied United Mushroom Technology Co., Ltd. and Anhui Allied United Mushroom Co., Ltd., all of whom are Chinese operating companies.

Since the Company is effectively controlled by the same controlling shareholders before and after the share exchange agreement, it is considered under common control. Therefore the above mentioned transactions were accounted for as a recapitalization. The reorganization has been accounted for at historical cost and prepared on the basis as if the aforementioned transactions had become effective as of the beginning of the first period presented in the accompanying financial statements of the Company.

On November 22, 2023, Plasma Innovative Inc. filed Articles of Merger with the State of Nevada to merge ESG Inc. into Plasma Innovative Inc. ESG Inc. is the surviving name.

Effective February 23, 2024, upon approval from FINRA, the Company’s name was changed from Plasma Innovative Inc. to ESG Inc., and its trading symbol was changed from PMIN to ESGH.

Going Concern

The accompanying consolidated financial statements were prepared assuming ESG will continue as a going concern, which contemplates continuity of operations, realization of assets, and liquidation of liabilities in the normal course of business. For the three months ended March 31, 2024 and 2023, the Company had a net loss of approximately $0.58 million and $0.14 million, respectively. The Company had an accumulated deficit of approximately $1.81 million and $1.22 million as of March 31, 2024 and December 31, 2023, respectively. The historical operating results indicate ESG has recurring losses from operations which raise the question related to ESG’s ability to continue as a going concern.

Historically, we have funded our operations primarily through our sale of fresh mushrooms and borrowings. Currently, all the loans are short-term borrowings. Management is working to increase long-term loans and equity investment in order to improve our capital structure. However, such additional cash resources may not be available to us on desirable terms, or at all, if and when needed by us.

To enhance our ability to continue to operate, we are dedicating resources to generate recurring revenues and sustainable operating cash flows. On one side, we improved efficiency with current facilities; on the other side, we use unrelated third-party funding to expand our facilities and business on high-profit margin products. On December 31, 2022, AUM, a subsidiary of ESG acquired 12 mushroom houses by assuming debt. The new operations will further increase the production of mushrooms and reduce fixed cost per unit to reach the scale effect of economics. Compost has a high profit margin. We are expanding the compost facilities by 10-year debt financing. On January 5, 2022, Funan Agricultural Reclining Investment Co. Ltd signed an agreement to fund $18.09 million (RMB115 million) for the expansion and will start to produce and sell compost to customers to further generate revenue in 2024.

Significant Accounting Policies

Please refer to our significant accounting policies in Note 2 to our Consolidated Financial Statement.

Results of Operations

Comparison of the three months ended March 31, 2024 and 2023

Revenue

We adopted American technology and food standard and imported European equipment to produce high quality mushrooms in China.

We had revenues of $2,378,281 and $1,808,319 for the three months ended March 31, 2024 and 2023, respectively, which shows a $569,962 or 31.52% increase. The revenue was from the sale of fresh mushrooms and compost, and the increased revenue was mainly attributable to the sale of compost.

Cost of Goods Sold

Total cost of goods sold was $2,468,914 and $1,465,329 for the three months ended March 31, 2024 and 2023, representing an increase of $1,003,585 or 68.49%, compared to $1,465,329 for the three months ended March 31, 2023. The increase of total cost of revenue is primarily due to increase of the cost of material.

Gross Profit

Gross profit for the three months ended March 31, 2024 was negative $90,633 compared to $342,990 for the three months ended March 31, 2023, respectively, which shows a $433,623 or 126.42% decrease.

Research and Development Expenses

Research and Development expenses were $131,088 and $130,204 for the periods ended March 31, 2024 and 2023. The Company invested heavily on research and development to improve product quality and quantity. We have 1 invention patent and 15 utility model patents since the inception in 2018.

Selling and General and Administrative Expenses

Selling expenses were $199 and $223 for the three months ended March 31, 2024 and 2023, respectively, representing a decrease of $24 or 10.69%. We sign long term contracts with distributors who will buy all the products produced on a daily basis that reduces our selling expenses.

General administration expenses increased by $44,976 to $318,117 for the three months ended March 31, 2024 from $273,142 for the three months ended March 31, 2023.

Interest Expenses

Interest expenses were $149,487 and $149,714 for the three months ended March 31, 2024 and 2023, respectively, representing a decrease of $226 or 0.15%.

Other Income

Other expense was $95,964 for the three months ended March 31, 2024 and other income was $27,844 for the three months ended March 31, 2023, representing a decrease of $123,808 or 444.65%. The decrease was mainly due to $162,069 of raw material write-off.

Net loss

We generated net losses of $785,488 and $182,449 for the three months ended March 31, 2024 and 2023, respectively, which shows a $603,040 or 330.53% decrease in loss.

Liquidity and Capital Resources

We had cash of $833,089 and $643,341 as of March 31, 2024 and 2023, respectively. As of March 31, 2024, we had working capital deficit of $10,025,265 or a current ratio of 0.17:1, and our current assets were $2,148,690. As of March 31, 2023, we had a working capital deficit of $11,079,786 or a current ratio of 0.12:1, and our current assets were $1,582,507. The debt-to-equity ratio is 1.15 and 1.05 as of March 31, 2024 and 2023, respectively. As of March 31, 2024 and 2023, the total liabilities were $13,539,805 and $14,132,710, respectively.

The high working capital deficit raised the question related to ESG’s ability to continue as a going concern. The high working capital deficit was due to the reason that we only used short-term loans to fund our operations. ESG has plans to increase long-term debt and equity investment in the future to improve our capital structure.

Cash flow summary

The following is a summary of cash provided by or used in each of the indicated types of activities during the periods ended March 31, 2024 and 2023, respectively.

| | | 2024 | | | 2023 | |

| Net cash provided by operating activities | | $ | 94,973 | | | $ | 498,460 | |

| Net cash used in investing activities | | $ | - | | | $ | - | |

| Net cash provided by financing activities | | $ | 138,481 | | | $ | - | |

Cash Flow from Operating Activities

Net cash provided by operating activities for the three months ended March 31, 2024 was $94,973, which was primarily attributable to a net loss of 785,488, adjusted for depreciation and amortization of $453,295 and adjustments for changes in assets and liabilities of negative $427,167. Net cash provided by operating activities was $498,460 for the period ended March 31, 2023.

Cash Flow from Financing Activities

Net cash provided by financing activities was $138,481 for the three months ended March 31, 2024 and zero for the three months ended March 31, 2023, respectively, which was primarily attributable to the increase of short term loans.

Off-Balance Sheet Arrangements

There were no off-balance sheet arrangements as of March 31, 2024 and March 31, 2023, or that in the opinion of management that are likely to have, a current or future material effect on our financial condition or results of operations.

Contractual Obligations

None.

Item 3. Quantitative and Qualitative Disclosures about Market Risk.

As a “smaller reporting company” as defined by Item 10 of Regulation S-K, the Company is not required to provide information required by this Item.

Item 4. Controls and Procedures.

Evaluation of Disclosure Controls and Procedures

In connection with the preparation of this quarterly report, an evaluation was carried out by the Company’s management, with the participation of the principal executive officer, of the effectiveness of the Company’s disclosure controls and procedures (as defined in Rules 13a-15(e) and 15d-15(e) under the Exchange Act (“Exchange Act”) as of March 31, 2024. Disclosure controls and procedures are designed to ensure that information required to be disclosed in reports filed or submitted under the Exchange Act is recorded, processed, summarized, and reported within the time periods specified in the Commission’s rules and forms, and that such information is accumulated and communicated to management, including the principal executive officer, to allow timely decisions regarding required disclosures.

Based on that evaluation, the Company’s management concluded, as of the end of the period covered by this report, that the Company’s disclosure controls and procedures were not effective in recording, processing, summarizing, and reporting information required to be disclosed, within the time periods specified in the Commission’s rules and forms, and that such information was not accumulated and communicated to management, including the principal executive officer and the principal financial officer, to allow timely decisions regarding required disclosures.

Change in Internal Control over Financial Reporting

During the three months ended March 31, 2024, there have been no changes in internal control over financial reporting that have materially affected or are reasonably likely to materially affect our internal control over financial reporting.

PART II. Other Information

Item 1. Legal Proceedings

The Company is involved in a few legal proceedings. Management has identified certain legal matters where we believe an unfavorable outcome is reasonably estimated. Management believes that the total liabilities of the Company that may arise as a result of currently pending proceedings will not have a material adverse effect on the Company, taken as a whole.

On September 3, 2021, Anhui Daquan Construction Company (“Daquan”) filed a lawsuit against Funan Zhihua Mushroom Co., Ltd. (a merged company “Zhihua”) on unpaid contractual price of $48,744. Zhihua has a dispute on construction quality which did not meet the requirements specified in the contract and filed a lawsuit for $26,095 of damages. On June 6, 2023, Daquan paid $26,095 to Zhihua to settle the lawsuit.

On November 10, 2022, Funan Yuanlangju Construction Co., Ltd. filed a lawsuit against AUFP for $60,147. The plaintiff sold construction materials to AUFP. AUFP had a dispute with the plaintiff over the amount of the sale. On July 7, 2023, the two parties reached a settlement that AUFP paid the plaintiff $50,740 in 2023.

On December 2, 2022, Liu Pengpeng filed a lawsuit against AUFP for $66,066. Liu Pengpeng signed a contract with AUFP on installation work and drainage construction. Liu Pengpeng breached the contract and failed to complete the construction work on time which caused a loss to AUFP. On July 7, 2023, Liu Pengpeng withdrew the lawsuit. On November 20, 2023, Liu Pengpeng filed a lawsuit for the same claim.

Item 1A. Risk Factors

As a “smaller reporting company” as defined by Item 10 of Regulation S-K, the Company is not required to provide information required by this Item.

Item 2. Unregistered Sale of Equity Securities and Use of Proceeds

None.

Item 3. Defaults Upon Senior Securities

None.

Item 4. Mine Safety Disclosures

Not applicable to our Company.

Item 5. Other Information

None.

Item 6. Exhibits

The following exhibits are included as part of this report by reference:

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | ESG INC. |

| | | |

| Date: May 14, 2024 | By: | /s/ Zhi Yang |

| | Name: | Zhi Yang |

| | Title: | President and CEO |

| | | (Principal Executive, Financial and Accounting Officer) |

| | | |