UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| Investment Company Act file number: 811-23742 |

CONNORS FUNDS

(Exact name of registrant as specified in charter)

1210 Broadcasting Road, Suite 200

Wyomissing, Pennsylvania 19610

(Address of principal executive offices) (Zip code)

Peter Connors, President

c/o Connors Investor Services, Inc.

1210 Broadcasting Road, Suite 200

Wyomissing, Pennsylvania 19610

(Name and address of agent for service)

With copy to: Jeffrey T. Skinner, Esq.

Kilpatrick Townsend & Stockton LLP

1001 West Fourth Street

Winston-Salem, NC 27101

| Registrant’s telephone number, including area code: | (610) 376-7418 |

| Date of fiscal year end: | November 30 |

| Date of reporting period: | May 31, 2023 |

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

Connors Hedged Equity Fund

Semi-Annual Report

May 31, 2023

Fund Adviser:

Connors Investor Services, Inc.

1210 Broadcasting Road, Suite 200

Wyomissing, PA 19610

Investment Results (Unaudited)

Average Annual Total Returns* as of May 31, 2023

| | | | | | Since Inception |

| | 6 Months | | One Year | | (January 19, 2022) |

| Connors Hedged Equity Fund - Institutional Class | (0.30)% | | 2.40% | | (1.25)% |

| S&P 500® Index(a) | 3.33% | | 2.92% | | (4.17)% |

Total annual operating expenses, as disclosed in the Connors Hedged Equity Fund (the “Fund”) prospectus dated March 30, 2023, were 4.05% of average daily net assets (1.15% after fee waivers/ expense reimbursements by Connors Investor Services, Inc. (the “Adviser”)). The Adviser has contractually agreed to waive or limit its fees and to assume other expenses of the Fund until March 31, 2024, so that total annual fund operating expenses (excluding brokerage costs, taxes, interest, borrowing costs such as interest and dividend expenses on securities sold short, Acquired Fund Fees and Expenses, extraordinary expenses such as litigation and merger or reorganization costs and other expenses not incurred in the ordinary course of the Fund’s business) do not exceed 1.15% of the Fund’s average daily net assets. Management Fee reductions and expense reimbursements by the Adviser are subject to repayment by the Fund for a period of three years after the date that such fees and expenses were incurred, provided that the repayments do not cause Total Annual Fund Operating Expenses (exclusive of such reductions and reimbursements) to exceed (i) the expense limitation then in effect, if any, and (ii) the expense limitation in effect at the time the expenses to be repaid were incurred. Prior to March 31, 2024, this agreement may not be modified or terminated without the approval of the Board of Trustees (the “Board”). This agreement will terminate automatically if the Fund’s investment advisory agreement (the “Advisory Agreement”) with the Adviser is terminated. Additional information pertaining to the Fund’s expense ratios as of May 31, 2023 can be found in the financial highlights.

The performance quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Current performance of the Fund may be lower or higher than the performance quoted. The Fund’s investment objectives, risks, charges and expenses should be considered carefully before investing. Performance data current to the most recent month-end may be obtained by calling (833) 601-2676.

| * | Total return reflects any change in price per share and assume the reinvestment of all distributions. The Fund’s return reflects any fee reductions during the applicable periods. If such fee reductions had not occurred, the quoted performance would have been lower. Total returns for less than one year are not annualized. |

| (a) | The S&P 500® Index is a widely recognized unmanaged index of equity prices and is representative of a broader market and range of securities than is found in the Fund’s portfolio. The index is an unmanaged benchmark that assumes reinvestment of all distributions and excludes the effect of taxes and fees. Individuals cannot invest directly in this index; however, an individual can invest in exchange-traded funds or other investment vehicles that attempt to track the performance of a benchmark index. |

Investment Results (Unaudited) (continued)

The Fund’s investment objectives, strategies, risks, charges and expenses should be considered carefully before investing. The prospectus contains this and other important information about the Fund and may be obtained by calling (833) 601-2676 or on the Fund’s website www.connorsinvestor.com/mutual-fund. Please read it carefully before investing. The Fund is distributed by Ultimus Fund Distributors, LLC, Member FINRA/SIPC.

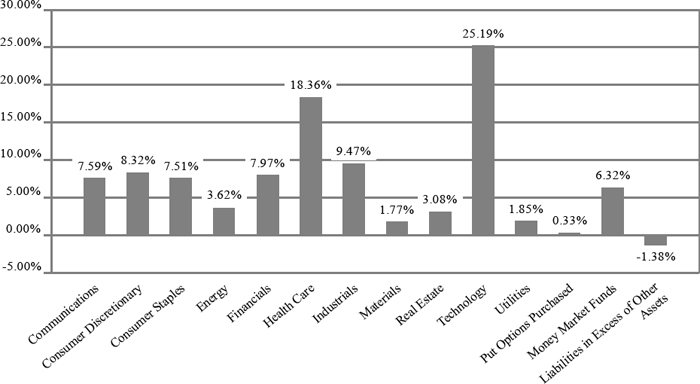

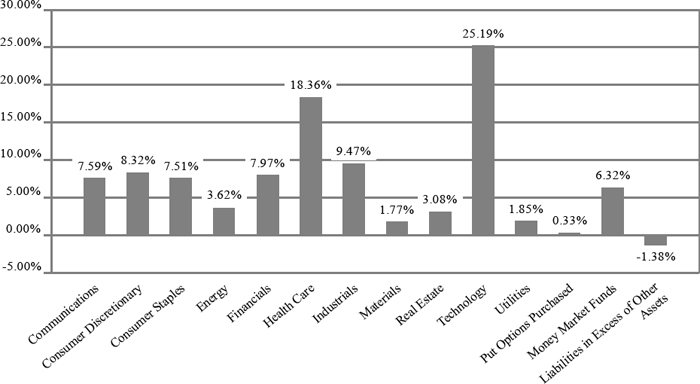

Fund Holdings (Unaudited)

Connors Hedged Equity Fund Holdings as of May 31, 2023*

| * | As a percentage of net assets. |

The investment objective of the Fund is to seek to achieve capital appreciation and secondarily income generation, with lower volatility than U.S. equity markets.

AVAILABILITY OF PORTFOLIO SCHEDULE – (Unaudited)

The Fund files its complete schedule of portfolio holdings with the Securities and Exchange Commission (the “SEC”) for the first and third quarters of each fiscal year as an exhibit to its reports on Form N-PORT. The Fund’s Form N-PORT reports are available on the SEC’s website at www. sec.gov and on the funds website at www.connorsinvestor.com/mutual-fund.

| Connors Hedged Equity Fund |

| Schedule of Investments |

| May 31, 2023 - (Unaudited) |

| COMMON STOCKS — 94.73% | | Shares | | | Fair Value | |

| Communications — 7.59% | | | | | | | | |

| Alphabet, Inc., Class A(a)(b) | | | 5,845 | | | $ | 718,175 | |

| Meta Platforms, Inc., Class A(a)(b) | | | 1,400 | | | | 370,608 | |

| Walt Disney Co. (The)(a)(b) | | | 4,075 | | | | 358,437 | |

| | | | | | | | 1,447,220 | |

| Consumer Discretionary — 8.32% | | | | | | | | |

| Amazon.com, Inc.(a)(b) | | | 4,490 | | | | 541,404 | |

| McDonald’s Corp.(b) | | | 1,235 | | | | 352,111 | |

| NIKE, Inc., Class B(b) | | | 2,950 | | | | 310,517 | |

| TJX Companies, Inc. (The)(b) | | | 4,975 | | | | 382,030 | |

| | | | | | | | 1,586,062 | |

| Consumer Staples — 7.51% | | | | | | | | |

| Coca-Cola Co. (The)(b) | | | 5,500 | | | | 328,130 | |

| Costco Wholesale Corp.(b) | | | 715 | | | | 365,765 | |

| PepsiCo, Inc.(b) | | | 2,030 | | | | 370,171 | |

| Procter & Gamble Co. (The)(b) | | | 2,580 | | | | 367,650 | |

| | | | | | | | 1,431,716 | |

| Energy — 3.62% | | | | | | | | |

| Chevron Corp.(b) | | | 2,805 | | | | 422,489 | |

| Schlumberger Ltd.(b) | | | 6,235 | | | | 267,045 | |

| | | | | | | | 689,534 | |

| Financials — 7.97% | | | | | | | | |

| American Express Co.(b) | | | 2,020 | | | | 320,291 | |

| Chubb Ltd.(b) | | | 1,970 | | | | 366,026 | |

| Goldman Sachs Group, Inc. (The) | | | 900 | | | | 291,510 | |

| Morgan Stanley(b) | | | 2,000 | | | | 163,520 | |

| Wells Fargo & Co. | | | 9,485 | | | | 377,598 | |

| | | | | | | | 1,518,945 | |

| Health Care — 18.36% | | | | | | | | |

| Abbott Laboratories(b) | | | 4,820 | | | | 491,640 | |

| AbbVie, Inc. | | | 2,550 | | | | 351,798 | |

| Eli Lilly & Co.(b) | | | 1,180 | | | | 506,763 | |

| Johnson & Johnson(b) | | | 2,890 | | | | 448,123 | |

| Merck & Co., Inc.(b) | | | 3,845 | | | | 424,526 | |

| Stryker Corp.(b) | | | 1,835 | | | | 505,689 | |

| UnitedHealth Group, Inc.(b) | | | 900 | | | | 438,516 | |

| Zoetis, Inc., Class A(b) | | | 2,050 | | | | 334,171 | |

| | | | | | | | 3,501,226 | |

| Industrials — 9.47% | | | | | | | | |

| Deere & Co.(b) | | | 515 | | | | 178,180 | |

| Eaton Corp. PLC(b) | | | 2,700 | | | | 474,930 | |

| Honeywell International, Inc. | | | 2,150 | | | | 411,940 | |

| Lockheed Martin Corp.(b) | | | 575 | | | | 255,306 | |

| Raytheon Technologies Corp.(b) | | | 5,260 | | | | 484,656 | |

| | | | | | | | 1,805,012 | |

See accompanying notes which are an integral part of these financial statements.

| Connors Hedged Equity Fund |

| Schedule of Investments (continued) |

| May 31, 2023 - (Unaudited) |

| COMMON STOCKS — 94.73% - continued | | Shares | | | Fair Value | |

| Materials — 1.77% | | | | | | | | |

| Linde PLC(b) | | | 955 | | | $ | 337,745 | |

| | | | | | | | | |

| Real Estate — 3.08% | | | | | | | | |

| American Tower Corp., Class A(b) | | | 1,525 | | | | 281,271 | |

| Realty Income Corp. | | | 5,145 | | | | 305,819 | |

| | | | | | | | 587,090 | |

| Technology — 25.19% | | | | | | | | |

| Adobe, Inc.(a)(b) | | | 1,250 | | | | 522,238 | |

| Advanced Micro Devices, Inc.(a)(b) | | | 3,800 | | | | 449,198 | |

| Analog Devices, Inc.(b) | | | 2,160 | | | | 383,810 | |

| Apple, Inc.(b) | | | 5,005 | | | | 887,137 | |

| Cisco Systems, Inc.(b) | | | 7,900 | | | | 392,393 | |

| Microsoft Corp.(b) | | | 2,700 | | | | 886,654 | |

| Oracle Corp.(b) | | | 4,560 | | | | 483,086 | |

| Palo Alto Networks, Inc.(a)(b) | | | 1,970 | | | | 420,378 | |

| Visa, Inc., Class A(b) | | | 1,710 | | | | 377,961 | |

| | | | | | | | 4,802,855 | |

| Utilities — 1.85% | | | | | | | | |

| NextEra Energy, Inc.(b) | | | 4,805 | | | | 352,975 | |

| | | | | | | | | |

| Total Common Stocks (Cost $17,264,446) | | | | | | | 18,060,380 | |

| | | Number of | | Notional | | | Exercise | | | Expiration | | | |

| Description | | Contracts | | Amount | | | Price | | | Date | | Fair Value | |

| PUT OPTIONS PURCHASED — 0.33% | | | | | | | | | | | | | | | | |

| S&P 500 Index | | 7 | | $ | 2,925,881 | | | $ | 4,000.00 | | | July 2023 | | $ | 27,195 | |

| S&P 500 Index | | 7 | | | 2,925,881 | | | | 3,950.00 | | | August 2023 | | | 35,945 | |

| | | | | | | | | | | | | | | | | |

| Total Options Purchased (Cost $129,101) | | | | | | | | | | | | | | | 63,140 | |

| | Shares | | | Fair Value | |

| MONEY MARKET FUNDS - 6.32% | | | | | | |

| First American Government Obligations Fund - Class X, 4.97% (c) | | | 1,205,755 | | | | 1,205,755 | |

| Total Money Market Funds (Cost $1,205,755) | | | | | | | 1,205,755 | |

| Total Investments — 101.38% (Cost $18,599,302) | | | | | | | 19,329,275 | |

| Liabilities in Excess of Other Assets — (1.38)% | | | | | | | (263,859 | ) |

| NET ASSETS — 100.00% | | | | | | $ | 19,065,416 | |

| (a) | Non-income producing security. |

| (b) | All or a portion of the security is held as collateral for written options. |

| (c) | Rate disclosed is the seven day effective yield as of May 31, 2023. |

See accompanying notes which are an integral part of these financial statements.

| Connors Hedged Equity Fund |

| Schedule of Open Written Option Contracts |

| May 31, 2023 - (Unaudited) |

| | | Number of | | Notional | | | Exercise | | | Expiration | | | |

| Description | | Contracts | | Amount | | | Price | | | Date | | Fair Value | |

| WRITTEN OPTIONS (1.51)% | | | | | | | | |

| WRITTEN CALL OPTIONS (1.41)% | | | | | | | | |

| Abbott Laboratories | | (28) | | $ | (285,600 | ) | | $ | 120.00 | | | August 2023 | | $ | (392 | ) |

| Adobe, Inc. | | (4) | | | (167,116 | ) | | | 410.00 | | | June 2023 | | | (8,300 | ) |

| Advanced Micro Devices, Inc. | | (23) | | | (271,883 | ) | | | 100.00 | | | June 2023 | | | (43,412 | ) |

| Alphabet, Inc. | | (5) | | | (61,435 | ) | | | 155.00 | | | June 2023 | | | (4,475 | ) |

| Alphabet, Inc. | | (17) | | | (208,879 | ) | | | 120.00 | | | July 2023 | | | (11,688 | ) |

| Alphabet, Inc. | | (10) | | | (122,870 | ) | | | 120.00 | | | September 2023 | | | (10,700 | ) |

| Amazon.com, Inc. | | (16) | | | (192,928 | ) | | | 120.00 | | | July 2023 | | | (10,040 | ) |

| Amazon.com, Inc. | | (4) | | | (48,232 | ) | | | 125.00 | | | August 2023 | | | (2,580 | ) |

| Amazon.com, Inc. | | (7) | | | (84,406 | ) | | | 130.00 | | | August 2023 | | | (3,150 | ) |

| American Express Co. | | (11) | | | (174,416 | ) | | | 180.00 | | | July 2023 | | | (572 | ) |

| American Tower Corp. | | (9) | | | (165,996 | ) | | | 230.00 | | | July 2023 | | | (113 | ) |

| Analog Devices, Inc. | | (9) | | | (159,921 | ) | | | 195.00 | | | June 2023 | | | (225 | ) |

| Analog Devices, Inc. | | (4) | | | (71,076 | ) | | | 210.00 | | | September 2023 | | | (750 | ) |

| Apple, Inc. | | (8) | | | (141,800 | ) | | | 170.00 | | | June 2023 | | | (7,240 | ) |

| Apple, Inc. | | (5) | | | (88,625 | ) | | | 165.00 | | | July 2023 | | | (7,763 | ) |

| Apple, Inc. | | (15) | | | (265,875 | ) | | | 185.00 | | | August 2023 | | | (7,763 | ) |

| Chevron Corp. | | (16) | | | (240,992 | ) | | | 175.00 | | | June 2023 | | | (104 | ) |

| Chubb Ltd. | | (3) | | | (55,740 | ) | | | 230.00 | | | June 2023 | | | (39 | ) |

| Chubb Ltd. | | (8) | | | (148,640 | ) | | | 220.00 | | | August 2023 | | | (280 | ) |

| Cisco Systems, Inc. | | (46) | | | (228,482 | ) | | | 55.00 | | | July 2023 | | | (483 | ) |

| Cisco Systems, Inc. | | (12) | | | (59,604 | ) | | | 52.50 | | | September 2023 | | | (1,482 | ) |

| Coca Cola Co. (The) | | (3) | | | (17,898 | ) | | | 65.00 | | | June 2023 | | | (5 | ) |

| Coca-Cola Co. (The) | | (20) | | | (119,320 | ) | | | 62.50 | | | June 2023 | | | (120 | ) |

| Coca-Cola Co. (The) | | (8) | | | (47,728 | ) | | | 65.00 | | | July 2023 | | | (60 | ) |

| Costco Wholesale Corp. | | (4) | | | (204,624 | ) | �� | | 535.00 | | | July 2023 | | | (2,749 | ) |

| Deere & Co. | | (4) | | | (138,392 | ) | | | 440.00 | | | June 2023 | | | (20 | ) |

| Eaton Corp. PLC | | (19) | | | (334,210 | ) | | | 175.00 | | | July 2023 | | | (15,485 | ) |

| Eli Lilly & Co. | | (1) | | | (42,946 | ) | | | 370.00 | | | June 2023 | | | (6,090 | ) |

| Eli Lilly & Co. | | (6) | | | (257,676 | ) | | | 420.00 | | | July 2023 | | | (13,964 | ) |

| Johnson & Johnson | | (12) | | | (186,072 | ) | | | 175.00 | | | June 2023 | | | (30 | ) |

See accompanying notes which are an integral part of these financial statements.

| Connors Hedged Equity Fund |

| Schedule of Open Written Option Contracts (continued) |

| May 31, 2023 - (Unaudited) |

| | | Number of | | Notional | | | Exercise | | | Expiration | | | |

| Description | | Contracts | | Amount | | | Price | | | Date | | Fair Value | |

| WRITTEN OPTIONS (1.51)% (continued) | | | | | | | | |

| WRITTEN CALL OPTIONS (1.41)% (continued) | | | | | | | | |

| Johnson & Johnson | | (1) | | $ | (15,506 | ) | | $ | 170.00 | | | July 2023 | | $ | (19 | ) |

| Linde PLC | | (2) | | | (70,732 | ) | | | 360.00 | | | June 2023 | | | (730 | ) |

| Linde PLC | | (1) | | | (35,366 | ) | | | 380.00 | | | July 2023 | | | (223 | ) |

| Linde PLC | | (2) | | | (70,732 | ) | | | 390.00 | | | July 2023 | | | (210 | ) |

| Lockheed Martin Corp. | | (3) | | | (133,203 | ) | | | 500.00 | | | June 2023 | | | (30 | ) |

| Lockheed Martin Corp. | | (1) | | | (44,401 | ) | | | 515.00 | | | June 2023 | | | (8 | ) |

| McDonald’s Corp. | | (6) | | | (171,066 | ) | | | 280.00 | | | June 2023 | | | (3,765 | ) |

| Merck & Co., Inc. | | (7) | | | (77,287 | ) | | | 120.00 | | | June 2023 | | | (60 | ) |

| Merck & Co., Inc. | | (6) | | | (66,246 | ) | | | 115.00 | | | June 2023 | | | (300 | ) |

| Merck & Co., Inc. | | (9) | | | (99,369 | ) | | | 120.00 | | | July 2023 | | | (536 | ) |

| Meta Platforms, Inc. | | (7) | | | (185,304 | ) | | | 275.00 | | | August 2023 | | | (11,829 | ) |

| Microsoft Corp. | | (4) | | | (131,356 | ) | | | 285.00 | | | June 2023 | | | (18,040 | ) |

| Microsoft Corp. | | (12) | | | (394,068 | ) | | | 330.00 | | | September 2023 | | | (24,479 | ) |

| Morgan Stanley | | (12) | | | (98,112 | ) | | | 97.50 | | | July 2023 | | | (192 | ) |

| NextEra Energy, Inc. | | (6) | | | (44,076 | ) | | | 82.50 | | | June 2023 | | | (18 | ) |

| NIKE, Inc. | | (18) | | | (189,468 | ) | | | 130.00 | | | June 2023 | | | (54 | ) |

| Oracle Corp. | | (22) | | | (233,068 | ) | | | 97.50 | | | June 2023 | | | (20,954 | ) |

| Oracle Corp. | | (1) | | | (10,594 | ) | | | 102.50 | | | July 2023 | | | (670 | ) |

| Oracle Corp. | | (2) | | | (21,188 | ) | | | 105.00 | | | August 2023 | | | (1,235 | ) |

| Oracle Corp. | | (2) | | | (21,188 | ) | | | 110.00 | | | September 2023 | | | (995 | ) |

| Palo Alto Networks, Inc. | | (3) | | | (64,017 | ) | | | 195.00 | | | June 2023 | | | (6,015 | ) |

| Palo Alto Networks, Inc. | | (6) | | | (128,034 | ) | | | 210.00 | | | June 2023 | | | (5,115 | ) |

| Palo Alto Networks, Inc. | | (2) | | | (42,678 | ) | | | 220.00 | | | June 2023 | | | (760 | ) |

| Palo Alto Networks, Inc. | | (1) | | | (21,339 | ) | | | 220.00 | | | September 2023 | | | (1,390 | ) |

| PepsiCo, Inc. | | (5) | | | (91,175 | ) | | | 190.00 | | | June 2023 | | | (180 | ) |

| PepsiCo, Inc. | | (9) | | | (164,115 | ) | | | 185.00 | | | August 2023 | | | (4,207 | ) |

| Procter & Gamble Co. (The) | | (1) | | | (14,250 | ) | | | 155.00 | | | July 2023 | | | (25 | ) |

| Procter & Gamble Co. (The) | | (11) | | | (156,750 | ) | | | 160.00 | | | October 2023 | | | (1,128 | ) |

| Raytheon Technologies Corp. | | (10) | | | (92,140 | ) | | | 105.00 | | | June 2023 | | | (20 | ) |

| Raytheon Technologies Corp. | | (21) | | | (193,494 | ) | | | 105.00 | | | August 2023 | | | (756 | ) |

See accompanying notes which are an integral part of these financial statements.

| Connors Hedged Equity Fund |

| Schedule of Open Written Option Contracts (continued) |

| May 31, 2023 - (Unaudited) |

| | | Number of | | Notional | | | Exercise | | | Expiration | | | |

| Description | | Contracts | | Amount | | | Price | | | Date | | Fair Value | |

| WRITTEN OPTIONS (1.51)% (continued) | | | | | | | | |

| WRITTEN CALL OPTIONS (1.41)% (continued) | | | | | | | | |

| Schlumberger Ltd. | | (12) | | $ | (51,396 | ) | | $ | 62.50 | | | August 2023 | | $ | (96 | ) |

| Stryker Corp. | | (9) | | | (248,022 | ) | | | 290.00 | | | June 2023 | | | (765 | ) |

| TJX Companies, Inc. (The) | | (3) | | | (23,037 | ) | | | 82.50 | | | June 2023 | | | (15 | ) |

| TJX Companies, Inc. (The) | | (30) | | | (230,370 | ) | | | 85.00 | | | July 2023 | | | (510 | ) |

| UnitedHealth Group, Inc. | | (5) | | | (243,620 | ) | | | 500.00 | | | June 2023 | | | (1,725 | ) |

| UnitedHealth Group, Inc. | | (1) | | | (48,724 | ) | | | 520.00 | | | July 2023 | | | (430 | ) |

| Visa, Inc. | | (11) | | | (243,133 | ) | | | 235.00 | | | June 2023 | | | (462 | ) |

| Visa, Inc. | | (1) | | | (22,103 | ) | | | 245.00 | | | June 2023 | | | (10 | ) |

| Walt Disney Co. (The) | | (10) | | | (87,960 | ) | | | 125.00 | | | June 2023 | | | (15 | ) |

| Zoetis, Inc. | | (10) | | | (163,010 | ) | | | 185.00 | | | June 2023 | | | (200 | ) |

| Zoetis, Inc. | | (2) | | | (32,602 | ) | | | 185.00 | | | July 2023 | | | (85 | ) |

| Total Written Call Options (Premiums Received $198,356) | | | | | | | (268,330 | ) |

| WRITTEN PUT OPTIONS (0.10)% | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| S&P 500 Index | | (7) | | | (2,925,811 | ) | | | 3,600.00 | | | July 2023 | | | (7,245 | ) |

| | | | | | | | | | | | | | | | | |

| S&P 500 Index | | (7) | | | (2,925,811 | ) | | | 3,550.00 | | | August 2023 | | | (12,390 | ) |

| | | | | | | | | | | | | | | | | |

| Total Written Put Options (Premiums Received $47,082) | | | | | | | (19,635 | ) |

| | | | | | | | | | | | | | | | | |

| Total Written Options (Premiums Received $245,438) | | | | | | $ | (287,965 | ) |

See accompanying notes which are an integral part of these financial statements.

| Connors Hedged Equity Fund |

| Statement of Assets and Liabilities |

| May 31, 2023 - (Unaudited) |

| Assets | | | |

| Investments in securities at fair value (cost $18,599,302) | | $ | 19,329,275 | |

| Receivable for investments sold | | | 4,690 | |

| Dividends and interest receivable | | | 33,703 | |

| Receivable from Adviser | | | 5,485 | |

| Deferred offering cost | | | 623 | |

| Prepaid expenses | | | 19,023 | |

| Total Assets | | | 19,392,799 | |

| Liabilities | | | | |

| Options written, at fair value (premium received $245,438) | | | 287,965 | |

| Payable for investments purchased | | | 3,933 | |

| Payable to Administrator | | | 6,172 | |

| Payable to trustees | | | 3,729 | |

| Other accrued expenses | | | 25,584 | |

| Total Liabilities | | | 327,383 | |

| Net Assets | | $ | 19,065,416 | |

| Net Assets consist of: | | | | |

| Paid-in capital | | $ | 18,773,904 | |

| Accumulated earnings | | | 291,512 | |

| Net Assets | | $ | 19,065,416 | |

| Institutional Class | | | | |

| Shares outstanding (unlimited number of shares authorized, no par value) | | | 1,949,806 | |

| Net asset value, offering and redemption price per share | | $ | 9.78 | |

See accompanying notes which are an integral part of these financial statements.

| Connors Hedged Equity Fund |

| Statement of Operations |

| For the Six Months ended May 31, 2023 |

| Investment Income | | | | |

| Dividend income | | $ | 167,121 | |

| Total investment income | | | 167,121 | |

| Expenses | | | | |

| Investment Adviser fees | | | 67,044 | |

| Administration fees | | | 35,989 | |

| Legal fees | | | 21,642 | |

| Offering cost | | | 15,264 | |

| Compliance fees | | | 13,463 | |

| Registration expenses | | | 8,022 | |

| Transfer agent fees | | | 7,863 | |

| Trustee fees | | | 7,480 | |

| Audit and tax preparation fees | | | 6,732 | |

| Custodian fees | | | 5,236 | |

| Printing and postage expenses | | | 4,079 | |

| Miscellaneous expense | | | 21,815 | |

| Total expenses | | | 214,629 | |

| Fees contractually waived and expenses reimbursed by Adviser | | | (118,253 | ) |

| Net operating expenses | | | 96,376 | |

| Net investment income | | | 70,745 | |

| Net Realized and Change in Unrealized Gain (Loss) on Investments | | | | |

| Net realized gain (loss) on: | | | | |

| Investment securities | | | (333,887 | ) |

| Written options | | | 290,877 | |

| Purchased options | | | (258,691 | ) |

| Net change in unrealized appreciation (depreciation) on: | | | | |

| Investment securities | | | 179,393 | |

| Written options | | | (10,096 | ) |

| Purchased options | | | 76,326 | |

| Net realized and change in unrealized loss on investments securities and options | | | (56,078 | ) |

| Net increase in net assets resulting from operations | | $ | 14,667 | |

See accompanying notes which are an integral part of these financial statements.

| Connors Hedged Equity Fund |

| Statement of Changes in Net Assets |

| | | | | | For the | |

| | | For the Six | | | Period Ended | |

| | | Months Ended | | | November 30, | |

| | | May 31, 2023 | | | 2022(a) | |

| | | (Unaudited) | | | | |

| Increase (Decrease) in Net Assets due to: | | | | | | | | |

| Operations | | | | | | | | |

| Net investment income | | $ | 70,745 | | | $ | 71,608 | |

| Net realized loss on investment securities and options | | | (301,701 | ) | | | (158,528 | ) |

| Net change in unrealized appreciation of investment securities and options | | | 245,623 | | | | 441,823 | |

| Net increase in net assets resulting from operations | | | 14,667 | | | | 354,903 | |

| Distributions to shareholders from Earnings | | | (78,058 | ) | | | — | |

| Total distributions | | | (78,058 | ) | | | — | |

| Capital Transactions - Institutional Class: | | | | | | | | |

| Proceeds from shares sold | | | 4,184,807 | | | | 14,622,107 | |

| Reinvestment of distributions | | | 78,058 | | | | — | |

| Amount paid for shares redeemed | | | (120,984 | ) | | | (90,084 | ) |

| Net increase in net assets resulting from capital transactions | | | 4,141,881 | | | | 14,532,023 | |

| Total Increase in Net Assets | | | 4,078,490 | | | | 14,886,926 | |

| Net Assets | | | | | | | | |

| Beginning of period | | | 14,986,926 | | | | 100,000 | |

| End of period | | $ | 19,065,416 | | | $ | 14,986,926 | |

| Share Transactions - Institutional Class: | | | | | | | | |

| Shares sold | | | 434,481 | | | | 1,529,011 | |

| Shares issued in reinvestment of distributions | | | 8,217 | | | | — | |

| Shares redeemed | | | (12,388 | ) | | | (9,515 | ) |

| Net increase in shares | | | 430,310 | | | | 1,519,496 | |

| (a) | For the period January 19, 2022 (commencement of operations) to November 30, 2022. |

See accompanying notes which are an integral part of these financial statements.

| Connors Hedged Equity Fund - Institutional Class |

| Financial Highlights |

| (For a share outstanding during the period) |

| | | For the Six | | | For the | |

| | | Months | | | Period | |

| | | Ended | | | Ended | |

| | | May 31, 2023 | | | November | |

| | | (Unaudited) | | | 30, 2022(a) | |

| Selected Per Share Data: | | | | | | | | |

| Net asset value, beginning of period | | $ | 9.86 | | | $ | 10.00 | |

| Investment operations: | | | | | | | | |

| Net investment income | | | 0.04 | | | | 0.05 | |

| Net realized and unrealized loss | | | (0.07 | ) | | | (0.19 | ) |

| Total from investment operations | | | (0.03 | ) | | | (0.14 | ) |

| Less distributions to shareholders from: | | | | | | | | |

| Net investment income | | | (0.05 | ) | | | — | |

| Total distributions | | | (0.05 | ) | | | — | |

| Net asset value, end of period | | $ | 9.78 | | | $ | 9.86 | |

| Total Return(b) | | | (0.30 | )% (c) | | | (1.40 | )% (c) |

| Ratios and Supplemental Data: | | | | | | | | |

| Net assets, end of period (000 omitted) | | $ | 19,065 | | | $ | 14,987 | |

| Ratio of net expenses to average net assets | | | 1.15 | % (d) | | | 1.15 | % (d) |

| Ratio of expenses to average net assets before waiver and reimbursement | | | 2.56 | % (d) | | | 4.05 | % (d) |

| Ratio of net investment income to average net assets | | | 0.84 | % (d) | | | 0.84 | % (d) |

| Portfolio turnover rate | | | 19 | % (c) | | | 30 | % (c) |

| (a) | For the period January 19, 2022 (commencement of operations) to November 30, 2022. |

| (b) | Total return represents the rate that the investor would have earned or lost on an investment in the Fund, assuming reinvestment of distributions. |

See accompanying notes which are an integral part of these financial statements.

| Connors Hedged Equity Fund |

| Notes to the Financial Statements |

| May 31, 2023 - (Unaudited) |

NOTE 1. ORGANIZATION

The Connors Hedged Equity Fund (the “Fund”) is a diversified series of Connors Funds (the “Trust”), which is registered under the Investment Company Act of 1940, as amended (the “1940 Act”) as an open-end management investment company. The Trust was organized as a Delaware statutory trust on September 15, 2021. The Fund currently offers one class of shares: Institutional Shares. The Fund commenced investment operations on January 19, 2022. The Fund’s investment adviser is Connors Investor Services, Inc. (the “Adviser”). The investment objective of the Fund is to seek to achieve capital appreciation and secondarily income generation, with lower volatility than U.S. equity markets.

NOTE 2. SIGNIFICANT ACCOUNTING POLICIES

The Fund is an investment company and follows accounting and reporting guidance under Financial Accounting Standards Board Accounting Standards Codification (“ASC”) Topic 946, “Financial Services-Investment Companies” including Accounting Standards Update 2013-08. The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements. These policies are in conformity with generally accepted accounting principles in the United States of America (“GAAP”).

Estimates – The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

Federal Income Taxes – The Fund makes no provision for federal income or excise tax. The Fund has qualified and intends to qualify each year as a regulated investment company (“RIC”) under subchapter M of the Internal Revenue Code of 1986, as amended, by complying with the requirements applicable to RICs and by distributing substantially all of its taxable income. The Fund also intends to distribute sufficient net investment income and net realized capital gains, if any, so that it will not be subject to excise tax on undistributed income and gains. If the required amount of net investment income or gains is not distributed, the Fund could incur a tax expense.

As of and during the six months ended May 31, 2023, the Fund did not have any liabilities for any unrecognized tax benefits. The Fund recognizes interest and penalties, if any, related to unrecognized tax benefits as income tax expense on the Statement of Operations when incurred. During the six months ended May 31, 2023, the Fund did not incur any interest or penalties. Management of the Fund has reviewed tax positions taken in tax years that remain subject to examination by all major tax jurisdictions, including federal (i.e., the

| Connors Hedged Equity Fund |

| Notes to the Financial Statements (continued) |

| May 31, 2023 - (Unaudited) |

last three tax year ends and the interim tax period since then, as applicable). Management believes that there is no tax liability resulting from unrecognized tax benefits related to uncertain tax positions taken.

Security Transactions and Related Income – The Fund follows industry practice and records security transactions on the trade date for financial reporting purposes. The specific identification method is used for determining gains or losses for financial statement and income tax purposes. Dividend income is recorded on the ex-dividend date and interest income is recorded on an accrual basis. Non-cash income, if any, is recorded at the fair market value of the securities received. Withholding taxes on foreign dividends, if any, have been provided for in accordance with the Fund’s understanding of the applicable country’s tax rules and rates.

Dividends and Distributions – The Fund intends to distribute its net investment income and net realized long-term and short-term capital gains, if any, at least annually. Dividends and distributions to shareholders, which are determined in accordance with income tax regulations, are recorded on the ex-dividend date. The treatment for financial reporting purposes of distributions made to shareholders during the period from net investment income or net realized capital gains may differ from their ultimate treatment for federal income tax purposes. These differences are caused primarily by differences in the timing of the recognition of certain components of income, expense or realized capital gain for federal income tax purposes. Where such differences are permanent in nature, they are reclassified among the components of net assets based on their ultimate characterization for federal income tax purposes. Any such reclassifications will have no effect on net assets, results of operations or net asset value (“NAV”) per share of the Fund.

Derivative Transactions – The following tables identify the location and fair value of derivative instruments on the Statement of Assets and Liabilities as of May 31, 2023 and the effect of derivative instruments on the Statement of Operations for the six months ended May 31, 2023.

As of May 31, 2023:

| Location of Derivatives on Statement of Assets and Liabilities | |

| Derivatives | | Asset Derivatives | | Liability Derivatives | | Fair Value | |

| Equity Price Risk: | | | | | | | | |

| Options Purchased | | Investments in securities at fair value | | | | $ | 63,140 | |

| Options Written | | | | Options written, at fair value | | | (287,965 | ) |

| Connors Hedged Equity Fund |

| Notes to the Financial Statements (continued) |

| May 31, 2023 - (Unaudited) |

For the six months ended May 31, 2023:

| | | | | | | | Change in Unrealized | |

| | | Location of Gain (Loss) on | | Realized Gain | | | Appreciation | |

| | | Derivatives on Statement of | | (Loss) on | | | (Depreciation) on | |

| Derivatives | | Operations | | Derivatives | | | Derivatives | |

| Equity Price Risk: | | | | | | | | | | |

| Options purchased | | Net realized gain and change in unrealized appreciation (depreciation) on investment securities | | $ | (258,691 | ) | | $ | (33,530 | ) |

| Options written | | Net realized gain and change in unrealized appreciation (depreciation) on written options | | | 290,877 | | | | 99,760 | |

The following table summarizes the average ending monthly fair value of derivatives outstanding during the six months ended May 31, 2023:

| | | Average Ending Monthly | |

| Derivatives | | Fair Value(a) | |

| Purchased Options | | $ | 59,448 | |

| Written Options | | | (192,172 | ) |

| (a) | Average based on the six months during the period that had activity. |

The following table provides a summary of offsetting financial liabilities and derivatives and the effect of derivative instruments on the Statement of Assets and Liabilities as of May 31, 2023:

| | | | | | | | | | | | Gross Amounts Not Offset | | | | |

| | | | | | | | | | | | in Statement of Assets and | | | | |

| | | | | | | | | | | | Liabilities | | | | |

| | | | | | | | | Net Amounts | | | | | | | | | | |

| | | | | | Gross Amounts | | | of Liabilities | | | | | | | | | | |

| | | | | | Offset in | | | Presented in | | | | | | | | | | |

| | | Gross Amounts | | | Statement of | | | Statement of | | | | | | | | | | |

| | | of Recognized | | | Assets and | | | Assets and | | | Financial | | | Collateral | | | Net | |

| | | Liabilities | | | liabilities | | | Liabilities | | | Instruments | | | Pledged | | | Amount | |

| Written Options | | $ | 287,965 | | | $ | — | | | $ | 287,965 | | | $ | (287,965 | ) | | $ | — | | | $ | — | |

NOTE 3. SECURITIES VALUATION AND FAIR VALUE MEASUREMENTS

The Fund values its portfolio securities at fair value as of the close of regular trading on the New York Stock Exchange (“NYSE”) (normally 4:00 p.m. Eastern Time) on each business day the NYSE is open for business. Fair value is defined as the price that the Fund would receive upon selling an investment in a timely transaction to an independent buyer in the principal or most advantageous market of the investment. GAAP establishes

| Connors Hedged Equity Fund |

| Notes to the Financial Statements (continued) |

| May 31, 2023 - (Unaudited) |

a three-tier hierarchy to maximize the use of observable market data and minimize the use of unobservable inputs and to establish classification of fair value measurements for disclosure purposes.

Inputs refer broadly to the assumptions that market participants would use in pricing the asset or liability, including assumptions about risk (the risk inherent in a particular valuation technique used to measure fair value including a pricing model and/or the risk inherent in the inputs to the valuation technique). Inputs may be observable or unobservable. Observable inputs are inputs that reflect the assumptions market participants would use in pricing the asset or liability developed based on market data obtained and available from sources independent of the reporting entity. Unobservable inputs are inputs that reflect the reporting entity’s own assumptions about the assumptions market participants would use in pricing the asset or liability developed based on the best information available in the circumstances.

Various inputs are used in determining the value of the Fund’s investments. These inputs are summarized in the three broad levels listed below.

| ● | Level 1 – unadjusted quoted prices in active markets for identical investments and/or registered investment companies where the value per share is determined and published and is the basis for current transactions for identical assets or liabilities at the valuation date |

| ● | Level 2 – other significant observable inputs (including, but not limited to, quoted prices for an identical security in an inactive market, quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.) |

| ● | Level 3 – significant unobservable inputs (including the Fund’s own assumptions in determining fair value of investments based on the best information available) |

The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy which is reported is determined based on the lowest level input that is significant to the fair value measurement in its entirety.

In computing the NAV of the Fund, fair value is based on market valuations with respect to portfolio securities for which market quotations are readily available. Pursuant to Board approved policies, the Fund relies on independent third-party pricing services to provide the current market value of securities. Those pricing services value equity securities, including exchange-traded funds, exchange-traded notes, closed-end funds and preferred stocks, traded on a securities exchange at the last reported sales price on the principal exchange. Equity securities quoted by Nasdaq are valued at the Nasdaq Official Closing Price. If

| Connors Hedged Equity Fund |

| Notes to the Financial Statements (continued) |

| May 31, 2023 - (Unaudited) |

there is no reported sale on the principal exchange, equity securities are valued at the mean between the most recent quoted bid and asked price. When using market quotations or close prices provided by the pricing service and when the market is considered active, the security will be classified as a Level 1 security. Investments in open-end mutual funds, including money market mutual funds, are generally priced at the ending NAV provided by the pricing service of the funds and are generally categorized as Level 1 securities.

In the event that market quotations are not readily available or are considered unreliable due to market or other events, securities are valued in good faith by the Adviser as “valuation designee” under the oversight of the Board. The Adviser has adopted written policies and procedures for valuing securities and other assets in circumstances where market quotes are not readily available. In the event that market quotes are not readily available, and the security or asset cannot be valued pursuant to one of the valuation methods, the value of the security or asset will be determined in good faith by the Adviser pursuant to its policies and procedures. On a quarterly basis, the Adviser’s fair valuation determinations will be reviewed by the Board. Under these policies, the securities will be classified as Level 2 or 3 within the fair value hierarchy, depending on the inputs used.

Investments in mutual funds, including money market mutual funds, are generally priced at the ending NAV. These securities are categorized as Level 1 securities.

Option contracts are generally traded on an exchange and are valued at the composite price, using the National Best Bid and Offer quotes (“NBBO”). NBBO consists of the highest bid price and lowest ask price across any of the exchanges on which an option is quoted, thus providing a view across the entire U.S. options marketplace. Composite option pricing calculates the mean of the highest bid price and lowest ask price across the exchanges where the option is traded. Expiring options may be priced at intrinsic value.

For options where market quotations are not readily available, fair value shall be determined by the Adviser. Generally, if market quotations are not readily available and the bid price or ask price is not available and, therefore, an option cannot be valued at the composite price, options may be valued at their last quoted sales price.

If the Fund decides that a price provided by the pricing service does not accurately reflect the fair value of the securities, when prices are not readily available from a pricing service, or when restricted or illiquid securities are being valued, securities are valued at fair value as determined by the Adviser, in conformity with policies adopted by the Board. These securities will generally be categorized as Level 2 or 3 within the fair value hierarchy, depending on the inputs used.

| Connors Hedged Equity Fund |

| Notes to the Financial Statements (continued) |

| May 31, 2023 - (Unaudited) |

In accordance with the Trust’s valuation policies and fair value determinations pursuant to Rule 2a-5 under the 1940 Act, the Valuation Designee is required to consider all appropriate factors relevant to the value of securities for which it has determined other pricing sources are not available or reliable as described above. No single method exists for determining fair value because fair value depends upon the circumstances of each individual case. As a general principle, the current fair value of a security being valued by the Valuation Designee would be the amount that the Fund might reasonably expect to receive upon the current sale. Methods that are in accordance with this principle may, for example, be based on (i) a multiple of earnings; (ii) a discount from market prices of a similar freely traded security (including a derivative security or a basket of securities traded on other markets, exchanges or among dealers); or (iii) yield to maturity with respect to debt issues, or a combination of these and other methods. Fair-value pricing is permitted if, in the Valuation Designee’s opinion, the validity of market quotations appears to be questionable based on factors such as evidence of a thin market in the security based on a small number of quotations, a significant event occurs after the close of a market but before the Fund’s NAV calculation that may affect a security’s value, or the Valuation Designee is aware of any other data that calls into question the reliability of market quotations.

The following is a summary of the inputs used to value the Fund’s investments as of May 31, 2023:

| Valuation Inputs |

| Assets | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Common Stocks(a) | | $ | 18,060,380 | | | $ | — | | | $ | — | | | $ | 18,060,380 | |

| Put Options Purchased | | | — | | | | 63,140 | | | | — | | | | 63,140 | |

| Money Market Funds | | | 1,205,755 | | | | — | | | | — | | | | 1,205,755 | |

| Total | | $ | 19,266,135 | | | $ | 63,140 | | | $ | — | | | $ | 19,329,275 | |

| | | | | | | | | | | | | | | | | |

| Valuation Inputs |

| Liabilities | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Written Call Options | | $ | — | | | $ | (268,330 | ) | | $ | — | | | $ | (268,330 | ) |

| Written Put Options | | | — | | | | (19,635 | ) | | | — | | | | (19,635 | ) |

| Total | | $ | — | | | $ | (287,965 | ) | | $ | — | | | $ | (287,965 | ) |

| (a) | Refer to Schedule of Investments for sector classifications. |

NOTE 4. FEES AND OTHER TRANSACTIONS WITH AFFILIATES AND OTHER SERVICE PROVIDERS

Under the terms of the investment advisory agreement, on behalf of the Fund (the “Agreement”), the Adviser manages the Fund’s investments subject to oversight of the Board. As compensation for its services, the Fund pays the Adviser a fee, computed and accrued daily and paid monthly at an annual rate of 0.80% of the average daily net assets

| Connors Hedged Equity Fund |

| Notes to the Financial Statements (continued) |

| May 31, 2023 - (Unaudited) |

of the Fund. For the six months ended May 31, 2023, the Adviser earned a fee of $67,044 from the Fund before the waivers described below. At May 31, 2023, the Adviser owed the Fund $5,485.

The Adviser has contractually agreed to waive or limit its fees and to assume other expenses of the Fund until March 31, 2024, so that total annual fund operating expenses (excluding brokerage costs, taxes, interest, borrowing costs such as interest and dividend expenses on securities sold short, Acquired Fund Fees and Expenses, extraordinary expenses such as litigation and merger or reorganization costs and other expenses not incurred in the ordinary course of the Fund’s business) do not exceed 1.15% of the Fund’s average daily net assets. This contractual arrangement may only be terminated by the Board, and it will automatically terminate upon the termination of the investment advisory agreement between the Trust and the Adviser.

Each fee waiver or expense reimbursement by the Adviser is subject to repayment by the Fund within the three years following the date the fee waiver or expense reimbursement occurred, provided that the Fund is able to make the repayment without exceeding the expense limitation that is in effect at the time of the repayment or at the time of the fee waiver or expense reimbursement, whichever is lower. For the six months ended May 31, 2023, the Adviser waived fees or reimbursed expenses totaling $118,253. As of May 31, 2023, the Adviser may seek repayment of investment advisory fee waivers and expense reimbursements as follows:

| Recoverable Through | | | | |

| November 30, 2025 | | $ | 248,401 | |

| May 31, 2026 | | | 118,253 | |

Ultimus Fund Solutions, LLC (“Ultimus”) provides administration, fund accounting and transfer agent services to the Fund. The Fund pays Ultimus fees in accordance with the agreements for such services.

Under the terms of a Distribution Agreement with the Trust, Ultimus Fund Distributors, LLC (the “Distributor”) serves as principal underwriter to the Fund. The Distributor is a wholly-owned subsidiary of Ultimus. The Distributor is compensated by the Adviser (not the Fund) for acting as principal underwriter.

Pursuant to a Compliance Consulting Agreement with Beacon Compliance Consulting, Inc. (“Beacon”), Beacon provides the Chief Compliance Officer and compliance services to the Trust.

| Connors Hedged Equity Fund |

| Notes to the Financial Statements (continued) |

| May 31, 2023 - (Unaudited) |

The Board supervises the business activities of the Trust. Each Trustee serves as a trustee until termination of the Trust unless the Trustee dies, resigns, retires, or is removed. The Trust pays each Trustee of the Trust who is not an interested person an annual retainer of $3,500 for the first fiscal year, and $5,000 for each fiscal year thereafter. The Trust also reimburses the Trustees for travel and other expenses incurred in attending meetings of the Board. Officers of the Trust and Trustees who are interested persons of the Trust do not receive any direct compensation from the Trust. No other compensation or retirement benefits are received by any Trustee or officer from the Fund.

NOTE 5. ORGANIZATIONAL AND OFFERING COSTS

The Adviser advanced some of the Fund’s organization and initial offering costs and was subsequently reimbursed by the Fund. Costs of $83,995 incurred in connection with the offering and initial registration of the Fund have been deferred and are being amortized on a straight-line basis over the first twelve months after commencement of operations. As of May 31, 2023, the amount of the offering costs remaining to amortize is $623.

NOTE 6. PURCHASES AND SALES OF SECURITIES

For the six months ended May 31, 2023, purchases and sales of investment securities, other than short-term investments, were $6,609,201 and $3,085,550, respectively.

There were no purchases or sales of long-term U.S. government obligations during the six months ended May 31, 2023.

NOTE 7. BENEFICIAL OWNERSHIP

The beneficial ownership, either directly or indirectly, of more than 25% of the voting securities of a Fund creates presumption of control of the Fund, under Section 2(a)(9) of the 1940 Act. As of May 31, 2023, Marlin Miller Jr. owned 27.08% of the Fund’s outstanding shares. As a result, Marlin Miller Jr. may be deemed to control the Fund.

NOTE 8. FEDERAL TAX INFORMATION

At May 31, 2023, the net unrealized appreciation (depreciation) and tax cost of investments, including written options, for tax purposes was as follows:

| Gross unrealized appreciation | | $ | 1,377,529 | |

| Gross unrealized depreciation | | | (741,416 | ) |

| Net unrealized appreciation on investments | | | 636,113 | |

| | | | | |

| Tax cost of investments | | $ | 18,405,197 | |

| Connors Hedged Equity Fund |

| Notes to the Financial Statements (continued) |

| May 31, 2023 - (Unaudited) |

At November 30, 2022, the components of accumulated earnings (deficit) on a tax basis were as follows:

| Undistributed ordinary income | | $ | 71,608 | |

| Accumulated capital and other losses | | $ | (107,195 | ) |

| Unrealized appreciation on investments | | | 390,490 | |

| Total accumulated earnings | | $ | 354,903 | |

As of November 30, 2022, the Fund had short-term capital loss carryforwards of $107,196. These capital loss carryforwards, which do not expire, may be utilized in future years to offset net realized capital gains, if any, prior to distributing such gains to shareholders.

NOTE 9. COMMITMENTS AND CONTINGENCIES

The Trust indemnifies its officers and Trustees for certain liabilities that may arise from their performance of their duties to the Trust or the Fund. Additionally, in the normal course of business, the Trust enters into contracts that contain a variety of representations and warranties which provide general indemnifications. The Trust’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Trust that have not yet occurred.

NOTE 10. REGULATORY UPDATES

In October 2020, the Securities and Exchange Commission (the “SEC”) adopted new regulations governing the use of derivatives by registered investment companies (“Rule 18f-4”). The Fund was required to comply with Rule 18f-4 by August 19, 2022. Rule 18f-4 imposes limits on the amount of derivatives a fund can enter into, eliminates the asset segregation framework currently used by funds to comply with Section 18 of the 1940 Act, treats derivatives as senior securities and requires funds whose us of derivatives is more than a limited specified exposure amount to establish and maintain a comprehensive derivatives risk management program and appoint a derivatives risk manager. The Fund is currently complying with Rule 18f-4.

NOTE 11. SUBSEQUENT EVENTS

Management of the Fund has evaluated the need for disclosures and/or adjustments resulting from subsequent events through the date at which these financial statements were issued. Based upon this evaluation, management has determined there were no items requiring adjustment of the financial statements or additional disclosure.

| Liquidity Risk Management Program (Unaudited) |

Connors Funds, on behalf of the Connors Hedged Equity Fund (the “Fund”), has adopted and implemented a written liquidity risk management program (the “Program”) as required by Rule 22e-4 (the “Liquidity Rule”) under the Investment Company Act of 1940, as amended. The Program is reasonably designed to assess and manage the Fund’s liquidity risk, taking into consideration, among other factors, the Fund’s investment strategy and the liquidity of its portfolio investments during normal and reasonably foreseeable stressed conditions; its short and long-term cash flow projections; and its cash holdings and access to other funding sources. The Fund’s Board of Trustees (the “Board”) approved the appointment of a committee to serve as the Liquidity Risk Management Program Administrator (the “LRMPA”), which includes representatives of the Fund’s Adviser, to be responsible for the Program’s administration and oversight and for reporting to the Board on at least an annual basis regarding the Program’s operation and effectiveness. The LRMPA maintains Program oversight and reports to the Board on at least an annual basis regarding the Program’s operational effectiveness through a written report (the “Report”). The Report outlined the operation of the Program and the adequacy and effectiveness of the Program’s implementation and was presented to the Board for consideration at its meeting held on April 11, 2023. During the review period, January 1, 2022 through December 31, 2022 (the “Review Period”), the Fund did not experience unusual stress or disruption to its operations related to purchase and redemption activity. Also, during the Review Period, the Fund held adequate levels of cash and highly liquid investments to meet shareholder redemption activities in accordance with applicable requirements. The Report concluded that (i) the Program is reasonably designed to prevent violation of the Liquidity Rule and (ii) the Program has been effectively implemented.

| Summary of Fund Expenses (Unaudited) |

As a shareholder of the Fund, you incur two types of costs: (1) transaction and (2) ongoing costs, including management fees and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other funds. The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period from December 1, 2022 through May 31, 2023.

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs. Therefore, the second line of the table below is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if transaction costs were included, your costs would have been higher.

| | | Beginning | | | Ending | | | | | | |

| | | Account | | | Account | | | Expenses | | | |

| | | Value | | | Value | | | Paid | | | Annualized |

| | | December | | | May 31, | | | During | | | Expense |

| | | 1, 2022 | | | 2023 | | | Period(a) | | | Ratio |

| Actual | | $ | 1,000.00 | | | $ | 997.00 | | | $ | 5.73 | | | 1.15% |

| Hypothetical(b) | | $ | 1,000.00 | | | $ | 1,050.00 | | | $ | 5.88 | | | 1.15% |

| (a) | Expenses are equal to the Fund’s annualized expense ratios, multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period). |

| (b) | Hypothetical assumes 5% annual return before expenses. |

Change in Independent Registered Public Accounting Firm

Effective March 6, 2023, BBD LLP (“BBD”) ceased to serve as the independent registered public accounting firm of The Connors Hedged Equity Fund (the “Fund”), a series of Connors Funds. The Audit Committee of the Board of Trustees approved the replacement of BBD as a result of Cohen & Company, Ltd.’s (“Cohen”) acquisition of BBD’s investment management group.

The report of BBD on the financial statements of the Fund as of and for the fiscal year ended 2022 did not contain an adverse opinion or a disclaimer of opinion, and were not qualified or modified as to uncertainties, audit scope or accounting principles. During the fiscal year ended 2022, and during the subsequent interim period through April 11, 2023: (i) there were no disagreements between the registrant and BBD on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure, which disagreements, if not resolved to the satisfaction of BBD, would have caused it to make reference to the subject matter of the disagreements in its report on the financial statements of the Fund for such years or interim period; and (ii) there were no “reportable events,” as defined in Item 304(a)(1)(v) of Regulation S-K under the Securities Exchange Act of 1934, as amended.

The registrant requested that BBD furnish it with a letter addressed to the U.S. Securities and Exchange Commission stating that it agrees with the above statements. A copy of such letter is filed as an exhibit 13(a)(2)(2).

On April 11, 2023, the Audit Committee of the Board of Trustees also recommended and approved the appointment of Cohen as the Fund’s independent registered public accounting firm for the fiscal year ending November 30, 2023.

During the fiscal year ended 2022, and during the subsequent interim period through April 11, 2023, neither the registrant, nor anyone acting on its behalf, consulted with Cohen on behalf of the Fund regarding the application of accounting principles to a specified transaction (either completed or proposed), the type of audit opinion that might be rendered on the Fund’s financial statements, or any matter that was either: (i) the subject of a “disagreement,” as defined in Item 304(a)(1)(iv) of Regulation S-K and the instructions thereto; or (ii) “reportable events,” as defined in Item 304(a)(1)(v) of Regulation S-K.

| FACTS | WHAT DOES CONNORS HEDGED EQUITY FUND (THE “FUND”) DO WITH YOUR PERSONAL INFORMATION? |

| |

| Why? | Financial companies choose how they share your personal information. Federal law gives consumers the right to limit some but not all sharing. Federal law also requires us to tell you how we collect, share, and protect your personal information. Please read this notice carefully to understand what we do. |

| |

| What? | The types of personal information we collect and share depend on the product or service you have with us. This information can include: ■ Social Security number ■ account balances and account transactions ■ transaction or loss history and purchase history ■ checking account information and wire transfer instructions When you are no longer our customer, we continue to share your information as described in this notice. |

| |

| How? | All financial companies need to share customers’ personal information to run their everyday business. In the section below, we list the reasons financial companies can share their customers’ personal information; the reasons the Funds choose to share; and whether you can limit this sharing. |

| Reasons we can share your personal information | Does the Fund share? |

For our everyday business purposes—

such as to process your transactions, maintain your account(s), respond to court orders and legal investigations, or report to credit bureaus | Yes |

For our marketing purposes—

to offer our products and services to you | No |

| For joint marketing with other financial companies | No |

For our affiliates’ everyday business purposes—

information about your transactions and experiences | No |

For our affiliates’ everyday business purposes—

information about your creditworthiness | No |

| For nonaffiliates to market to you | No |

| Questions? | Call (833) 601-2676 |

| Who we are |

| Who is providing this notice? | Connors Hedged Equity Fund

Ultimus Fund Distributors, LLC (Distributor)

Ultimus Fund Solutions, LLC (Administrator) |

| What we do |

| How does the Fund protect my personal information? | To protect your personal information from unauthorized access and use, we use security measures that comply with federal law. These measures include computer safeguards and secured files and buildings. Our service providers are held accountable for adhering to strict policies and procedures to prevent any misuse of your nonpublic personal information. |

| How does the Fund collect my personal information? | We collect your personal information, for example, when you ■ open an account or deposit money ■ buy securities from us or sell securities to us ■ make deposits or withdrawals from your account ■ give us your account information ■ make a wire transfer ■ tell us who receives the money ■ tell us where to send the money ■ show your government-issued ID ■ show your driver’s license |

| Why can’t I limit all sharing? | Federal law gives you the right to limit only ■ sharing for affiliates’ everyday business purposes—information about your creditworthiness ■ affiliates from using your information to market to you ■ sharing for nonaffiliates to market to you State laws and individual companies may give you additional rights to limit sharing. |

| Definitions |

| Affiliates | Companies related by common ownership or control. They can be financial and nonfinancial companies. |

| | ■ Connors Investor Services, Inc., the investment adviser to the Fund, could be deemed to be an affiliate. |

| Nonaffiliates | Companies not related by common ownership or control. They can be financial and nonfinancial companies. |

| | ■ The Fund does not share your personal information with nonaffiliates so they can market to you |

| Joint marketing | A formal agreement between nonaffiliated financial companies that together market financial products or services to you. |

| | ■ The Fund does not jointly market. |

Proxy Voting

A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to portfolio securities and information regarding how the Fund voted those proxies during the most recent twelve month period ended June 30, are available (1) without charge upon request by calling the Fund at (833) 601-2676 and (2) in Fund documents filed with the SEC on the SEC’s website at www.sec.gov.

TRUSTEES

Peter J. Connors, Chairperson

Bradford H. Barrett

Joni S. Naugle

John R. Morahan OFFICERS

Debora M. Covell, Treasurer (Principal Financial Officer)

Robert J. Cagliola, Secretary

Kyle Bubeck, Chief Compliance Officer INVESTMENT ADVISER

Connors Investor Services, Inc.

1210 Broadcasting Road, Suite 200

Wyomissing, PA 19610 DISTRIBUTOR

Ultimus Fund Distributors, LLC

225 Pictoria Drive, Suite 450

Cincinnati, OH 45246 | INDEPENDENT REGISTERED

PUBLIC ACCOUNTING FIRM

Cohen & Company, Ltd.

1835 Market street, 3rd Floor

Philadelphia, PA 19103 LEGAL COUNSEL

Kilpatrick Townsend & Stockton LLP

1001 West Forth Street

Winston-Salem, NC 27101 CUSTODIAN

U.S. Bank, N.A.

425 Walnut Street

Cincinnati, OH 45202 ADMINISTRATOR, TRANSFER

AGENT AND FUND ACCOUNTANT

Ultimus Fund Solutions, LLC

225 Pictoria Drive, Suite 450

Cincinnati, OH 45246 |

This report is intended only for the information of shareholders or those who have received the Fund’s prospectus which contains information about the Fund’s management fee and expenses. Please read the prospectus carefully before investing.

Distributed by Ultimus Fund Distributors, LLC, Member FINRA/SIPC

Connors-SAR-23

(b) NOT APPLICABLE.

Item 2. Code of Ethics.

NOT APPLICABLE – disclosed with annual report

Item 3. Audit Committee Financial Expert.

NOT APPLICABLE – disclosed with annual report

Item 4. Principal Accountant Fees and Services.

NOT APPLICABLE – disclosed with annual report

Item 5. Audit Committee of Listed Registrants.

NOT APPLICABLE – applies to listed companies only

Item 6. Schedule of Investments.

The Schedule of Investments is included in the Annual Report to Shareholders filed under Item 1 of this Form.

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

NOT APPLICABLE – applies to closed-end funds only

Item 8. Portfolio Managers of Closed-End Management Investment Companies.

NOT APPLICABLE – applies to closed-end funds only

Item 9. Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers.

NOT APPLICABLE – applies to closed-end funds only

Item 10. Submission of Matters to a Vote of Security Holders.

The guidelines applicable to shareholders desiring to submit recommendations for nominees to the Registrant's board of trustees are contained in the statement of additional information of the Trust with respect to the Fund(s) for which this Form N-CSR is being filed.

Item 11. Controls and Procedures.

(a) Based on their evaluation of the registrant’s disclosure controls and procedures (as defined in Rule 30a-3(c) under the Investment Company Act of 1940, as amended (the “Act”)) as of a date within 90 days of the filing date of this report, the registrant’s principal executive officer and principal financial officer have concluded that such disclosure controls and procedures are reasonably designed and are operating effectively to ensure that material information relating to the registrant is made known to them by others within those entities, particularly during the period in which this report is being prepared, and that the information required in filings on Form N-CSR is recorded, processed, summarized, and reported on a timely basis.

(b) There were no changes in the registrant’s internal control over financial reporting (as defined in Rule 30a-3(d) under the Investment Company Act of 1940) that occurred during the period covered by this report that have materially affected, or are reasonably likely to materially affect, the registrant’s internal control over financial reporting.

Item 12. Disclosure of Securities Lending Activities for Closed-End Management Investment Companies.

NOT APPLICABLE – applies to closed-end funds only

Item 13. Exhibits.

(a)(1) NOT APPLICABLE – disclosed with annual report.

(a)(2) Certifications by the registrant's principal executive officer and principal financial officer, pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 and required by Rule 30a-2under the Investment Company Act of 1940 are filed herewith.

(a)(3) Not applicable.

(a)(4) Change in the registrant's independent public accountant: Attached hereto

(b) Certification pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 is filed herewith.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| (Registrant) | | CONNORS FUNDS |

| By (Signature and Title) | /s/ Peter Connors | |

| | Peter Connors, President |

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

| By (Signature and Title) | /s/ Peter Connors | |

| | Peter Connors, President |

| By (Signature and Title) | /s/ Debora M. Covell | |

| | Debora M. Covell, Treasurer |