UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

☒ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☐ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material Pursuant to §240.14a-12

5E ADVANCED MATERIALS, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

☒ No fee required.

☐ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

(1) Title of each class of securities to which transaction applies:

(2) Aggregate number of securities to which transaction applies:

(3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

(4) Proposed maximum aggregate value of transaction:

(5) Total fee paid:

☐ Fee paid previously with preliminary materials:

☐ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

1) Amount previously paid:

2) Form, Schedule or Registration Statement No.:

3) Filing Party:

4) Filing Party:

LETTER FROM THE CHAIRMAN OF THE BOARD TO OUR STOCKHOLDERS

Dear Fellow Stockholders:

On behalf of our Board of Directors (the “Board of Directors”) and management, I am pleased to invite you to the Special Meeting of Stockholders (the “Special Meeting”) of 5E Advanced Materials, Inc. (“5E,” “we,” or the “Company”), which will be held at Central Time (being AEDT) on , as a virtual meeting, conducted via live webcast. You can attend the Special Meeting online and submit your questions during the meeting by visiting .

We are holding the Special Meeting in connection with a proposed restructuring of our outstanding senior secured convertible notes. This restructuring is a crucial step to strengthening the Company’s balance sheet, funding the Company’s next phase of growth, and commencing operations. We intend to implement the restructuring through an Out of Court Restructuring. If the conditions precedent to the Out of Court Restructuring cannot be timely satisfied, including approval by our stockholders of certain proposals at the Special Meeting as described below, we will implement the restructuring through bankruptcy in a Pre-Packaged Chapter 11 Plan. Each of the Out of Court Restructuring and the Pre-Packaged Chapter 11 Plan are defined and described in more detail in the enclosed Proxy Statement. We believe that completing the Out of Court Restructuring will allow us to advance the stated objectives of the Company and avoid possible disruptions of our business, additional expenses, and other uncertainties that would result from commencing the bankruptcy cases under the Pre-Packaged Chapter 11 Plan. Furthermore, under the Pre-Packaged Chapter 11 Plan, the equity interests of our stockholders will be extinguished in their entirety. Therefore, your vote on the proposals at the Special Meeting is very important.

The Special Meeting is being called to obtain approval from our stockholders for:

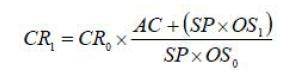

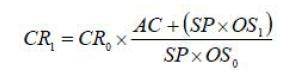

1.A proposal to approve an amendment to our certificate of incorporation to increase the number of authorized shares of our common stock, par value $0.01 per share (the “Common Stock”), from 180,000,000 to 360,000,000 (the “Charter Amendment Proposal”);

2.A proposal, for purposes of complying with the Nasdaq Listing Rules and the ASX Listing Rules, to approve the issuance of up to $35 million of shares of our Common Stock at a price per share of $1.025 (the “Securities Offering”) to the New Investors (as defined in the enclosed Proxy Statement) and Bluescape (as defined in the enclosed Proxy Statement) if it exercises its option to participate in the Securities Offering (the “Securities Offering Proposal”);

3.A proposal, for purposes of complying with the Nasdaq Listing Rules and the ASX Listing Rules, to approve the issuance of additional shares of our Common Stock upon conversion of our outstanding senior secured convertible notes in connection with an amendment to such convertible notes (the “Convertible Notes Proposal”);

4.A proposal to authorize the Board of Directors to adjourn and postpone the Special Meeting (the “Adjournment Proposal,” and together with the Charter Amendment Proposal, the Securities Offering Proposal, and the Convertible Notes Proposal, each a “Proposal,” and, collectively, the “Proposals”); and

i

5.To transact such other business as may properly come before the Special Meeting and any adjournment or postponement thereof.

Each of the Securities Offering Proposal and the Convertible Notes Proposal, (collectively, the “Condition Precedent Proposals”) is conditioned on the approval and adoption of each of the other Condition Precedent Proposals, and the Out of Court Restructuring will be consummated only if each of the Condition Precedent Proposals is approved by our stockholders. The Charter Amendment Proposal and the Adjournment Proposal are not conditioned upon the approval of any other Proposal. Each of these Proposals is more fully described in the Proxy Statement, which each stockholder is encouraged to read carefully and in its entirety.

Our Board of Directors believes that each Proposal is in the best interests of the Company and its stockholders, and, therefore, recommends that you vote “FOR” all of the Proposals.

Additional details of the business to be conducted at the Special Meeting are provided in the attached Notice of Special Meeting of Stockholders and Proxy Statement. You received these materials with a proxy card that indicates the number of votes that you will be entitled to cast at the Special Meeting according to our records or the records of your broker or other nominee. Our Board of Directors has determined that owners of record of the Company’s Common Stock at the close of business on , 2023, are entitled to notice of, and have the right to vote at the Special Meeting and any reconvened meeting following any adjournment or postponement of the meeting. Holders of CHESS Depositary Interests (“CDIs”) of the Company at that time will be entitled to receive notice of, and to attend as guests (but not vote at) the Special Meeting. Holders of CDIs can direct the Depositary Nominee to vote the common stock underlying their CDIs as detailed in the enclosed Proxy Statement.

Whether or not you attend the Special Meeting, it is important that your shares be represented and voted at the meeting. Therefore, I urge you to promptly vote using the Internet or telephone voting procedures described on the proxy card or vote and submit your proxy by signing, dating, and returning the enclosed proxy card in the enclosed envelope. If you decide to attend the Special Meeting, you will be able to vote virtually, even if you have previously submitted your proxy. The Out of Court Restructuring will be consummated only if the Condition Precedent Proposals are approved at the Special Meeting. Each of the Condition Precedent Proposals is conditioned on the approval and adoption of each of the other Condition Precedent Proposals. The Charter Amendment Proposal and the Adjournment Proposal are not conditioned on the approval of any other Proposal set forth in the Proxy Statement.

On behalf of the Board of Directors and our employees, I would like to express my appreciation for your continued support of 5E.

Sincerely,

David J. Salisbury

Chairman of the Board

, 2023

ii

PRELIMINARY COPY

SUBJECT TO COMPLETION, DATED DECEMBER 5, 2023

NOTICE OF SPECIAL MEETING OF STOCKHOLDERS

TO BE HELD ON , 2024

Notice is hereby given that the Special Meeting of Stockholders (the “Special Meeting”) of 5E Advanced Materials, Inc., a Delaware corporation (“5E,” “we,” or the “Company”), will be held as a virtual meeting, conducted via live webcast at , on , at Central Time (being AEDT), for the following purposes:

1.to approve an amendment to our certificate of incorporation to increase the number of authorized shares of our common stock, par value $0.01 per share (the “Common Stock”), from 180,000,000 to 360,000,000 (the “Charter Amendment Proposal”);

2.to approve, for purposes of complying with the Nasdaq Listing Rules and the ASX Listing Rules, and for all other purposes, the issuance of up to $35 million of shares of our common stock at a price per share of $1.025 (the “Securities Offering”) to the New Investors (as defined in the enclosed Proxy Statement) and Bluescape (as defined in the enclosed Proxy Statement) if it exercises its option to participate in the Securities Offering (the “Securities Offering Proposal”);

3.to approve, for purposes of complying with the Nasdaq Listing Rules and the ASX Listing Rules, and for all other purposes, the issuance of additional shares of our Common Stock upon conversion of our outstanding senior secured convertible notes in connection with an amendment to such convertible notes (the “Convertible Notes Proposal”);

4.to authorize the Board of Directors to adjourn and postpone the Special Meeting (the “Adjournment Proposal,” and together with the Charter Amendment Proposal, the Securities Offering Proposal, and the Convertible Notes Proposal, each a “Proposal,” and, collectively, the “Proposals”); and

5.to transact such other business as may properly come before the Special Meeting and any adjournment or postponement thereof.

Each of the Securities Offering Proposal and the Convertible Notes Proposal, (collectively, the “Condition Precedent Proposals”) is conditioned on the approval and adoption of each of the other Condition Precedent Proposals, and the Out of Court Restructuring will be consummated only if each of the Condition Precedent Proposals is approved by our stockholders. The Charter Amendment Proposal and the Adjournment Proposal are not conditioned upon the approval of any other Proposal. Each of these Proposals is more fully described in the Proxy Statement, which each stockholder is encouraged to read carefully and in its entirety.

The Company’s Board of Directors recommends that the stockholders vote “FOR” the Proposals.

We are holding the Special Meeting in connection with a proposed restructuring of our outstanding senior secured convertible notes. This restructuring is a crucial step to strengthening the Company’s balance sheet, funding the Company’s next phase of growth, and commencing operations. We intend to implement the restructuring through an Out of Court Restructuring. If the conditions precedent to the Out of Court Restructuring cannot be timely satisfied, including

iii

approval by our stockholders of certain proposals at the Special Meeting, we will implement the restructuring through bankruptcy in a Pre-Packaged Chapter 11 Plan. Each of the Out of Court Restructuring and the Pre-Packaged Chapter 11 Plan are defined and described in more detail in the enclosed Proxy Statement. We believe that completing the Out of Court Restructuring will allow us to advance the stated objectives of the Company and avoid possible disruptions of our business, additional expenses, and other uncertainties that would result from commencing the bankruptcy cases under the Pre-Packaged Chapter 11 Plan. Furthermore, under the Pre-Packaged Chapter 11 Plan, the equity interests of our stockholders will be extinguished in their entirety. Therefore, your vote on the above proposals is very important.

Only stockholders of record at the close of business on , 2023, will be entitled to notice of, and to vote at, the Special Meeting, or any adjournment or postponement thereof, notwithstanding the transfer of any shares after such date. To be admitted to the Special Meeting at , you must enter the 15-digit control number found on your proxy card. For specific voting information, see “General Information” beginning on page 1 of the enclosed Proxy Statement.

Holders of CHESS Depositary Interests (“CDIs”) of the Company at that time will be entitled to receive notice of, and to attend as guests (but not vote at) the Special Meeting. Holders of CDIs can direct the Depositary Nominee to vote the Common Stock underlying their CDIs as detailed in the enclosed Proxy Statement.

Whether or not you attend the Special Meeting, it is important that your shares be represented and voted at the meeting. Therefore, I urge you to promptly vote and submit your proxy. You may vote by telephone, Internet, mail, or virtually. Your vote is important. We urge you to review the accompanying Proxy Statement carefully and to submit your proxy as soon as possible so that your shares will be represented at the meeting. The Out of Court Restructuring will be consummated only if the Condition Precedent Proposals are approved at the Special Meeting. Each of the Condition Precedent Proposals is conditioned on the approval and adoption of each of the other Condition Precedent Proposals. The Charter Amendment Proposal and the Adjournment Proposal are not conditioned on the approval of any other Proposal set forth in the Proxy Statement.

By Order of the Board of Directors,

Paul Weibel

Chief Financial Officer and Corporate Secretary

Hesperia, California

, 2023

iv

Table of Contents

Annex A Restructuring Support Agreement

Annex B Form of Amended and Restated Certificate of Incorporation

5E ADVANCED MATERIALS, INC.

9329 Mariposa Road, Suite 210

Hesperia, CA 92344

PROXY STATEMENT

SPECIAL MEETING OF STOCKHOLDERS

THE SPECIAL MEETING

This proxy statement (the “Proxy Statement”) is solicited by and on behalf of the Board of Directors (the “Board of Directors” or “Board”) of 5E Advanced Materials, Inc. for use at the Special Meeting of Stockholders (the “Special Meeting”) to be held on , as a virtual meeting, conducted via live webcast, at Central Time (being AEDT), or at any adjournments or postponements thereof. The live webcast can be accessed on the Internet at . You will be able to vote and submit questions online through the virtual-meeting platform during the Special Meeting. Holders of CHESS Depositary Interests (“CDIs”) of the Company will be entitled to receive notice of, and to attend as guests (but not vote at) the Special Meeting. Holders of CDIs can direct the Depositary Nominee (as defined below) to vote the common stock underlying their CDIs as detailed below.

Unless the context requires otherwise, references in this Proxy Statement to “we,” “us,” “our,” and the “Company” refer to 5E Advanced Materials, Inc. The solicitation of proxies by the Board will be conducted primarily electronically and telephonically or by mail for those stockholders who sign, date, and return the enclosed proxy card in the enclosed envelope. Officers, directors, and employees of the Company may also solicit proxies personally or by telephone, e-mail, or other forms of wire or facsimile communication. These officers, directors, and employees will not receive any extra compensation for these services. The Company will reimburse brokers, custodians, nominees, and fiduciaries for reasonable expenses incurred by them in forwarding proxy materials to beneficial owners of the Company’s common stock, par value $0.01 per share (the “Common Stock”). The costs of solicitation will be borne by the Company.

Definitive copies of this Proxy Statement and related proxy card are first being sent on or about , 2023, to all stockholders of record at the close of business on , 2023 (the “record date”). On the record date, there were shares of our Common Stock outstanding and entitled to vote at the Special Meeting, which were held by approximately holders of record.

General Information

Why am I receiving these materials?

You are receiving this Proxy Statement and a proxy card from the Company, because on , 2023, the record date for the Special Meeting, you owned shares of the Company’s Common Stock or the Company’s CDIs. This Proxy Statement describes the matters that will be presented for consideration by the Company’s stockholders at the Special Meeting. It also gives you information concerning the matters to assist you in making an informed decision.

1

As discussed in greater detail below, we are calling a Special Meeting of our stockholders to approve the Charter Amendment Proposal, the Securities Offering Proposal, and the Convertible Notes Proposal. The Out of Court Restructuring cannot be consummated unless our stockholders approve the Condition Precedent Proposals set forth in this Proxy Statement.

How can I attend the Special Meeting?

Stockholders as of the record date (or their duly appointed proxy holders) may attend, vote, and submit questions virtually during the Special Meeting by logging in at . To log in, stockholders (or their authorized representatives) will need the control number provided on their proxy card. If you are not a stockholder or do not have a control number (including Holders of CDIs), you may still access the meeting as a guest, but you will not be able to submit questions or vote at the meeting. The meeting will begin promptly at Central Time on , (being AEDT on , ). We encourage you to access the meeting prior to the start time. Online access will open at Central Time, (being AEDT) and you should allow ample time to log in to the meeting webcast and test your computer audio system. We recommend that you carefully review the procedures needed to gain admission in advance. A recording of the meeting will be available at for 90 days after the meeting.

Holders of CDIs will be entitled to receive notice of, and to attend as guests (but not vote at) the Special Meeting.

Can I ask questions at the virtual Special Meeting?

Only registered stockholders as of the record date who attend and participate in our virtual Special Meeting will have an opportunity to submit questions live via the Internet during a designated portion of the meeting. We also encourage you to submit questions in advance of the meeting until 11:59 p.m. Eastern Time the day before the Special Meeting by going to and logging in with your control number. During the meeting, we will spend up to 15 minutes answering stockholder questions that comply with the meeting rules of procedure. The rules of procedure, including the types of questions that will be accepted, will be posted on the Special Meeting website. To ensure the orderly conduct of the Special Meeting, we encourage you to submit questions in advance. If we receive substantially similar questions, we will group such questions together and provide a single response to avoid repetition. Stockholders must have available their control number provided on their proxy card to ask questions during the meeting.

What if I have technical difficulties accessing the virtual Special Meeting?

We will have technicians ready to assist you with any technical difficulties you may have accessing the virtual meeting. If you encounter any difficulties accessing the virtual meeting during check-in or during the meeting, please call the technical support number that will be posted on the virtual stockholder meeting login page: .

2

What proposals will be voted on at the Special Meeting?

Stockholders will vote on up to four proposals at the Special Meeting:

1.A proposal to approve an amendment to our certificate of incorporation to increase the number of authorized shares of our Common Stock from 180,000,000 to 360,000,000 (the “Charter Amendment Proposal”);

2.A proposal, for purposes of complying with the Nasdaq Listing Rules and the ASX Listing Rules, and all other purposes, to approve the issuance of additional shares of our Common Stock at a price per share of $1.025 (the “Securities Offering”) in a placement to the New Investors (defined below) and Bluescape (defined below) if it exercises its option to participate in the Securities Offering (the “Securities Offering Proposal”);

3.A proposal, for purposes of complying with the Nasdaq Listing Rules and the ASX Listing Rules, and all other purposes, to approve the issuance of additional shares of our Common Stock upon conversion of our outstanding senior secured convertible notes in connection with an amendment to such convertible notes (the “Convertible Notes Proposal” and, together with the Charter Amendment Proposal and the Securities Offering Proposal, the “Condition Precedent Proposals”); and

4.A proposal to authorize the Board of Directors to adjourn and postpone the Special Meeting (the “Adjournment Proposal,” and together with the Charter Amendment Proposal, the Securities Offering Proposal, and the Convertible Notes Proposal, each a “Proposal,” and, collectively, the “Proposals”).

We will also consider other business, if any, that properly comes before the Special Meeting, or at any adjournments or postponements thereof.

Are the Proposals conditioned on one another?

Each Condition Precedent Proposal is conditioned on the approval and adoption of each of the other Condition Precedent Proposals, and the Out of Court Restructuring will be consummated only if each of the Condition Precedent Proposals is approved by our stockholders. The Charter Amendment Proposal and the Adjournment Proposal are not conditioned upon the approval of any other Proposal.

It is important for you to note that in the event that any of the Condition Precedent Proposals do not receive the requisite vote for approval, then the Company will not consummate the Out of Court Restructuring.

What happens if other business not discussed in the Proxy Statement comes before the meeting?

The Company does not know of any business to be presented at the Special Meeting other than the proposals discussed in this Proxy Statement. If any other matter is properly presented at the Special Meeting, the signed proxy gives the individuals named as proxies authority to vote the shares on such matters at their discretion.

3

How does the Board recommend the stockholders vote on the Proposals?

Our Board recommends that stockholders vote “FOR” the Charter Amendment Proposal, “FOR” the Securities Offering Proposal, and “FOR” the Convertible Notes Proposal, and, if presented to the Special Meeting, “FOR” the Adjournment Proposal.

Who is entitled to vote?

As of the record date, shares of Common Stock were outstanding. Only holders of record of our Common Stock as of the record date will be entitled to notice of, and to vote at, the Special Meeting or any adjournment or postponement thereof. Each stockholder is entitled to one vote for each share of our Common Stock held by such stockholder on the record date. No cumulative voting rights are authorized. Each CDI holder is entitled to direct CHESS Depositary Nominees Pty Ltd, as depositary nominee (the “Depositary Nominee”), to vote one vote for every 10 CDIs held by such holder on the record date.

What does it mean to be a holder of CDIs?

CDIs are issued by the Company through the Depositary Nominee and traded on the Australian Securities Exchange. If you own CDIs, then you are the beneficial owner of one share of Common Stock for every 10 CDIs that you own. The Depositary Nominee, or its custodian, is considered the stockholder of record for the purposes of voting at the Special Meeting. As the beneficial owner, you have the right to direct the Depositary Nominee, or its custodian, as to how to vote the shares of Common Stock underlying your CDIs. As a beneficial owner, you are invited to attend the Special Meeting. However, because you are not a stockholder, if you personally want to vote the shares of Common Stock underlying your CDIs at the Special Meeting, you must inform the Depositary Nominee via the CDI Voting Instruction Form that you wish to nominate yourself (or another person) to be appointed as the Depositary Nominee’s proxy for the purposes of virtually attending and voting at the Special Meeting.

Under the rules governing CDIs, the Depositary Nominee is not permitted to vote on your behalf on any matter to be considered at the Special Meeting unless you specifically instruct the Depositary Nominee how to vote. We encourage you to communicate your voting instructions to the Depositary Nominee in advance of the Special Meeting to ensure that your vote will be counted by completing the CDI Voting Instruction Form and returning it in accordance with the instructions specified on that form.

How do I vote in advance of the Special Meeting?

If you are a holder of record of shares of Common Stock of the Company, you may direct your vote without attending the Special Meeting by following the instructions on the proxy card to vote by Internet or by telephone, or by signing, dating, and mailing a proxy card.

If you hold your shares in street name via a broker, bank, or other nominee, you may direct your vote without attending the Special Meeting by signing, dating, and mailing your voting instruction card. Internet or telephonic voting may also be available. Please see your voting instruction card provided by your broker, bank, or other nominee for further details.

4

How do I vote during the Special Meeting?

Shares held directly in your name as the stockholder of record may be voted if you are attending the Special Meeting by entering the 15-digit control number found on your proxy card when you log in to the meeting at .

Shares held in “street name” through a brokerage account or by a broker, bank, or other nominee may only be voted at the Special Meeting by submitting voting instructions to your bank, broker or other nominee or by presenting a legal proxy, issued in your name from the record holder (your bank, broker or other nominee).

Even if you plan to attend the Special Meeting, we recommend that you vote in advance, as described above under “How do I vote in advance of the Special Meeting?” so that your vote will be counted if you are unable to attend the Special Meeting.

How do I vote if I hold CDIs?

Each CDI holder is entitled to direct the Depositary Nominee to vote one vote for every 10 CDIs held by such holder on the record date. Persons holding CDIs are entitled to receive notice of and to attend the Special Meeting as guests. Holders of CDIs may direct the Depositary Nominee to vote their underlying shares of Common Stock at the Special Meeting by completing and returning the CDI Voting Instruction Form to Computershare Australia, the agent the Company has designated for the collection and processing of voting instructions from the Company’s CDI holders. Votes must be received by Computershare Australia by no later than Central Time on , (being AEDT on , ) (two business days prior to the date of the Special Meeting) in accordance with the instructions on the CDI Voting Instruction Form.

Alternatively, CDI holders can inform the Depositary Nominee via the CDI Voting Instruction Form that they wish to nominate themselves (or another person) to be appointed as the Depositary Nominee’s proxy for the purposes of virtually attending and voting at the Special Meeting.

Can I change my vote or revoke my proxy or CDI Voting Instruction Form?

You may change your vote or revoke your proxy at any time before it is voted at the Special Meeting. If you are a stockholder of record, you may change your vote or revoke your proxy by:

•delivering to the attention of the Secretary at the address on the first page of this Proxy Statement a written notice of revocation of your proxy;

•delivering to us an authorized proxy bearing a later date (including a proxy over the Internet or by telephone); or

•attending the Special Meeting and voting electronically, as indicated above under “How do I vote during the Special Meeting?”, but note that attendance at the Special Meeting will not, by itself, revoke a proxy.

5

If your shares are held in the name of a bank, broker, or other nominee, you may change your vote by submitting new voting instructions to your bank, broker, or other nominee. Please note that if your shares are held of record by a bank, broker, or other nominee and you decide to attend and vote at the Special Meeting, your vote at the Special Meeting will not be effective unless you present a legal proxy, issued in your name from the record holder (your bank, broker, or other nominee).

If you are a holder of CDIs and you direct the Depositary Nominee to vote by completing the CDI Voting Instruction Form, you may revoke those instructions by delivering to Computershare Australia a written notice of revocation bearing a later date than the CDI Voting Instruction Form previously sent, which notice must be received by no later than Central Time on , (being AEDT on , ).

What is a broker nonvote?

Brokers, banks, or other nominees holding shares on behalf of a beneficial owner (other than the Depositary Nominee) may vote those shares in their discretion on certain “routine” matters even if they do not receive timely voting instructions from the beneficial owner. With respect to “nonroutine” matters, the broker, bank, or other nominee is not permitted to vote shares for a beneficial owner without timely received voting instructions. Each Proposal to be voted on at the Special Meeting is a nonroutine matter. Therefore, if you hold your shares in “street name,” you must instruct your broker how to vote for the Proposals in order for your shares to be voted at the Special Meeting.

What constitutes a quorum?

The presence at the Special Meeting, either in person or by proxy, of holders of a majority in voting power of the shares of the Company entitled to vote at the Special Meeting shall constitute a quorum for the transaction of business. Abstentions and broker nonvotes will be counted as present for the purpose of determining whether there is a quorum at the Special Meeting. Your shares are counted as being present if you participate virtually at the Special Meeting and cast your vote online during the meeting prior to the closing of the polls by visiting , or if you vote by proxy via the Internet, by telephone, or by returning a properly executed and dated proxy card or voting instruction form by mail.

6

What vote is required to approve each matter to be considered at the Special Meeting?

| | | | | | | | |

Proposal | | Matter | | Vote Required | | Broker Discretionary Voting Allowed | | Effect of Abstentions |

1 | | Approval of an amendment to our certificate of incorporation to increase the number of authorized shares of our Common Stock from 180,000,000 to 360,000,000 | | Affirmative vote of a majority of shares present in person or represented by proxy at the meeting and entitled to vote | | No | | Same effect as a vote against |

2 | | Approval of the issuance of additional shares of our Common Stock in a placement to the New Investors and Bluescape if it exercises its option to participate in the Securities Offering | | Affirmative vote of a majority of shares present in person or represented by proxy at the meeting and entitled to vote | | No | | Same effect as a vote against |

3 | | Approval of the issuance of additional shares of our Common Stock upon conversion of our outstanding senior secured convertible notes in connection with an amendment to such convertible notes | | Affirmative vote of a majority of shares present in person or represented by proxy at the meting and entitled to vote | | No | | Same effect as a vote against |

4 | | To authorize the Board of Directors to adjourn and postpone the Special Meeting | | Affirmative vote of a majority of shares present in person or represented by proxy at the meeting and entitled to vote | | No | | Same effect as a vote against |

Broker nonvotes are not considered shares entitled to vote on the Proposals, and thus will have no effect on any of the Proposals. Each Condition Precedent Proposal is conditioned on the approval of each of the other Condition Precedent Proposals at the Special Meeting.

Note that our stockholders do not have appraisal or dissenters’ rights under the Delaware General Corporation Law or under our Certificate of Incorporation in connection with the Proposals.

Are there any voting exclusions for any of the Proposals?

The Company will disregard any votes cast in favor of:

•the Securities Offering Proposal by or on behalf of the New Investors and Bluescape, and any other person who is expected to participate in, or who will obtain a material benefit as a result of, the Securities Offering (except a benefit solely by reason of being a stockholder) or any of their associates; and

7

•the Convertible Notes Proposal by or on behalf of Ascend and 5ECAP Debt, LLC, Bluescape, and any other person who is expected to participate in, or who will obtain a material benefit as a result of the transactions related to the Convertible Notes (except a benefit solely by reason of being a stockholder) or any of their associates.

Certain existing equity investors in the Company may participate in the Securities Offering as part of 5ECAP, LLC. If such investors elect to participate, any votes in favor of the Securities Offering Proposal or the Convertible Notes Proposal by such investors will be disregarded.

However, the Company need not disregard a vote cast in favor of any of the above Proposals by:

•a person as proxy or attorney for a person who is entitled to vote on the relevant Proposal, in accordance with directions given to the proxy or attorney to vote on the relevant Proposal in that way;

•the chair of the Special Meeting as proxy or attorney for a person who is entitled to vote on the relevant Proposal, in accordance with a direction given to the chair to vote on the relevant Proposal as the chair decides; or

•a holder acting solely in a nominee, trustee or custodial or other fiduciary capacity on behalf of a beneficiary provided the following conditions are met:

othe beneficiary provides written confirmation to the holder that the beneficiary is not excluded from voting, and is not an associate of a person excluded from voting, on the relevant Proposal; and

othe holder votes on the relevant Proposal in accordance with directions given by the beneficiary to the holder to vote in that way.

What happens if the Proposals are not approved?

Each of the Securities Offering Proposal and the Convertible Notes Proposal is conditioned on the approval and adoption of each of the other Condition Precedent Proposals, and the Out of Court Restructuring will be consummated only if each of the Condition Precedent Proposals is approved by our stockholders. If any of the Condition Precedent Proposals is not approved, the Company will commence proceedings under chapter 11 of title 11 of the United States Code and seek confirmation of the prepackaged plan as described in more detail below. In such event, the Out of Court Restructuring would not be completed, and the equity interests of our stockholders will be extinguished.

What is the deadline for submitting a proxy or CDI Voting Instruction Form?

To ensure that proxies are received in time to be counted prior to the Special Meeting, proxies submitted by Internet or by telephone should be received by 11:59 p.m. Eastern Time on , , and proxies submitted by mail should be received by the close of business on , (the day prior to the date of the Special Meeting).

8

CDI Voting Instruction Forms must be received by Computershare Australia by no later than Central Time on , (being AEDT on , ) (two business days prior to the date of the Special Meeting) in accordance with the instructions on the CDI Voting Instruction Form.

What does it mean if I receive more than one proxy card or CDI Voting Instruction Form?

If you hold your shares or CDIs in more than one account, you will receive one proxy card or CDI Voting Instruction Form for each account (as applicable). To ensure that all of your shares or CDIs are voted, please complete, sign, date, and return one proxy card or CDI Voting Instruction Form for each account or use the proxy card for each account to vote by Internet or by telephone.

How will my shares be voted if I return a blank proxy card or a blank CDI Voting Instruction Form?

If you are a holder of record of our Common Stock and you sign and return a proxy card or CDI Voting Instruction Form or otherwise submit a proxy without giving specific voting instructions, your shares will be voted:

•“FOR” the approval of the Charter Amendment Proposal;

•“FOR” the approval, for purposes of complying with the Nasdaq Listing Rules and the ASX Listing Rules, and for all other purposes, of the Securities Offering Proposal;

•“FOR” the approval, for purposes of complying with the Nasdaq Listing Rules and the ASX Listing Rules, and for all other purposes, of the Convertible Notes Proposal; and

•“FOR” the ratification and approval of the Adjournment Proposal, if presented.

If you hold your shares in street name via a broker, bank, or other nominee and do not provide the broker, bank, or other nominee with voting instructions (including by signing and returning a blank voting instruction card), your shares:

•will be counted as present for purposes of establishing a quorum; and

•will not be counted in connection with the Proposals or any other nonroutine matters that are properly presented at the Special Meeting. For each of these proposals, your shares will be treated as “broker nonvotes.” Broker nonvotes are not considered shares entitled to vote on the Proposals, and thus will have no effect on any of the Proposals.

Our Board knows of no matter to be presented at the Special Meeting other than Proposals identified in this Proxy Statement. If any other matters properly come before the Special Meeting upon which a vote properly may be taken, shares represented by all proxies received by us will be voted with respect thereto as permitted and in accordance with the judgment of the proxy holders.

What happens if the Special Meeting is adjourned or postponed?

Although it is not expected, the Special Meeting may be adjourned or postponed for the purpose of soliciting additional proxies. Any adjournment or postponement may be made without notice, other than by an announcement made at the Special Meeting, by approval of the holders of

9

a majority of the outstanding shares of our Common Stock present virtually, or represented by proxy at the Special Meeting, whether or not a quorum exists. If the adjournment is for more than 30 days, a notice of the adjourned meeting shall be given to each stockholder of record entitled to vote at the meeting. If after the adjournment a new record date is fixed for stockholders entitled to vote at the adjourned meeting, our Board of Directors shall fix a new record date for notice of the adjourned meeting and shall give notice of the adjourned meeting to each stockholder of record entitled to vote at the adjourned meeting as of the record date fixed for notice of the adjourned meeting. Any signed proxies received by the Company will be voted in favor of an adjournment or postponement in these circumstances. Any adjournment or postponement of the Special Meeting for the purpose of soliciting additional proxies will allow Company stockholders who have already sent in their proxies to revoke them at any time prior to their use.

Who is making this solicitation and who will pay the expenses?

This proxy solicitation is being made on behalf of our Board. The Company will pay the cost of soliciting proxies for the Special Meeting. In addition to solicitation by mail, our employees may solicit proxies personally or by telephone or facsimile, but they will not receive additional compensation for these services. Arrangements may be made with brokerage houses, custodians, nominees, and fiduciaries to send proxy materials to their principals, and we may reimburse them for their expenses.

Will a stockholder list be available for inspection?

A list of stockholders entitled to vote at the Special Meeting will be available for inspection by stockholders for any purpose germane to the meeting for 10 business days prior to the Special Meeting, at 5E Advanced Materials, Inc., 9329 Mariposa Road, Suite 210, Hesperia, CA 92344 between the hours of 9:00 a.m. and 5:00 p.m. Pacific Time. The stockholder list will also be available to stockholders of record for examination during the Special Meeting at . You will need the control number included on your proxy card, or voting instruction form, or otherwise provided by your bank, broker, or other nominee.

What is “householding” and how does it affect me?

We have adopted a procedure approved by the SEC called “householding.” Under this procedure, we send only one Proxy Statement to eligible stockholders who share a single address, unless we have received instructions to the contrary from any stockholder at that address. This practice is designed to eliminate duplicate mailings, conserve natural resources, and reduce our printing and mailing costs. Stockholders who participate in householding will continue to receive separate proxy cards.

If you share an address with another stockholder and receive only one set of proxy materials but would like to request a separate copy of these materials, please contact our mailing agent, Broadridge, by calling (866) 540-7095 or writing to Broadridge Householding Department, 51 Mercedes Way, Edgewood, New York 11717, and an additional copy of proxy materials will be promptly delivered to you. Similarly, if you receive multiple copies of the proxy materials and would prefer to receive a single copy in the future, you may also contact Broadridge at the above

10

telephone number or address. If you own shares through a bank, broker, or other nominee, you should contact the nominee concerning householding procedures.

How can I find out the results of the voting at the Special Meeting?

We will announce preliminary voting results at the Special Meeting. We will also disclose voting results on a Current Report on Form 8-K that we will file with the SEC within four business days after the Special Meeting.

When are stockholder proposals due for the next annual meeting of the stockholders?

We intend to hold our next annual meeting in 2024. Our stockholders are entitled to present proposals for action at a forthcoming meeting if they comply with the requirements of our Certificate of Incorporation, our Bylaws, and the rules established by the SEC.

As we expect to hold our next annual meeting on a date more than 30 days from the anniversary date of our prior annual meeting, under Rule 14a-8 under the Securities Exchange Act of 1934 (the “Exchange Act”), if you want us to include a proposal in the proxy materials for our next annual meeting of stockholders, we must receive the proposal at our executive offices at 9329 Mariposa Road, Suite 210, Hesperia, CA 92344, no later than a reasonable time before we begin to print and send our proxy materials. Furthermore, pursuant to our Bylaws, a stockholder proposal of business submitted outside of the process established in Rule 14a-8 and nominations of directors must be received no earlier than the close of business on the 120th day prior to the next annual meeting, and not later than the later of close of business on the 90th day prior to the next annual meeting and the close of business on the tenth day following the first date of public disclosure of the date of the next annual meeting. All proposals submitted outside of the process established in Rule 14a-8 and nominations of directors must comply with the requirements set forth in our Bylaws. Any proposal or nomination should be addressed to the attention of our Secretary, and we suggest that it be sent by certified mail, return receipt requested. Finally, to comply with the universal proxy rules, stockholders who intend to solicit proxies in support of director nominees other than our nominees must provide notice that sets forth the information required by Rule 14a-19 under the Exchange Act no later than the later of 60 days prior to the date of the next annual meeting or the tenth day following the date of public announcement of the date of the next annual meeting.

Whom can I contact for further information?

You may request additional copies, without charge, of this Proxy Statement and other proxy materials or ask questions about the Special Meeting, the Proposals, or the procedures for voting your shares by writing to Investor Relations at 9329 Mariposa Road, Suite 210, Hesperia, CA 92344.

11

BACKGROUND FOR OUR PROPOSALS

We are sending this Proxy Statement to you in connection with a proposed restructuring of our outstanding senior secured convertible notes (the “Convertible Notes”) issued pursuant to the Note Purchase Agreement, dated as of August 11, 2022 (the “Note Purchase Agreement”), by and among the Company, as issuer, certain subsidiaries of the Company, as guarantors, BEP Special Situations IV LLC (“Bluescape”), as purchaser, and Alter Domus (US) LLC (“Alter Domus”), as collateral agent. This restructuring is a crucial step to strengthening the Company’s balance sheet, funding the Company’s next phase of growth, and commencing the Company’s operations.

In connection with the proposed restructuring, we have entered into a Restructuring Support Agreement, dated as of December 5, 2023 (the “Restructuring Support Agreement”), with Bluescape, Alter Domus, and Ascend Global Investment Fund SPC for and on behalf of Strategic SP (“Ascend”). The Restructuring Support Agreement is attached hereto as Annex A. Pursuant to the terms of the Restructuring Support Agreement, we will implement the restructuring through either:

(i)an out of court restructuring transaction (the “Out of Court Restructuring”); or

(ii)to the extent the conditions precedent to consummating the Out of Court Restructuring cannot be timely satisfied, then as voluntary pre-packaged cases (the “Chapter 11 Cases”) under chapter 11 of title 11 of the United States Code (the “Bankruptcy Code”) to be filed in a United States Bankruptcy Court of competent jurisdiction (the “Bankruptcy Court”) pursuant to a pre-packaged plan of reorganization (the “Pre-Packaged Chapter 11 Plan”).

The proposed Out of Court Restructuring is comprised of, but not limited to, the following:

•the issuance of up to $35 million of shares of our Common Stock at a price per share of $1.025, which is equal to 50% of the 5-day VWAP preceding December 5, 2023, the date of the public announcement of the proposed Out of Court Restructuring, in a placement to Ascend and 5ECAP, LLC (the “New Investors”) and Bluescape if it exercises its option to participate in the Securities Offering;

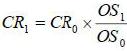

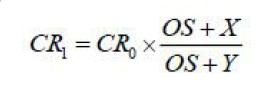

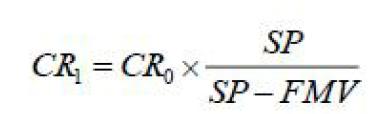

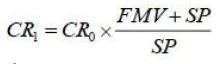

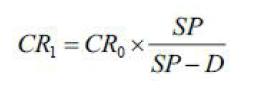

•an amendment and assignment of our Convertible Notes, consisting of, among other things: (a) an amendment to the conversion rate from 56.8182 shares to shares of Common Stock per $1,000 principal amount of Convertible Notes; (b) a waiver of the minimum cash covenant through June 28, 2024 and a reduction in such covenant thereafter from $10 million to $7.5 million; (c) deletion of the issuer conversion feature; (d) an extension of the maturity date by one year to August 15, 2028; (e) an increase in the paid-in-kind interest rate from six percent (6%) to ten percent (10%); and (f) the acquisition by the New Investors of fifty percent (50%) of the then-outstanding principal amount of the Convertible Notes from Bluescape; and

12

•subject to certain equity and Convertible Notes ownership requirements, Ascend (and any other person nominated by Ascend) and Bluescape shall each have the right to designate a director to serve on our Board of Directors.

If implemented, the Out of Court Restructuring will significantly dilute the percentage of outstanding stock owned by our current stockholders not part of the New Investors from % (before the restructuring) to %. Additionally, the maximum number of shares issuable upon conversion of our Convertible Notes (without regard to any beneficial ownership blocker provision, and assuming that we elect to pay interest accrued and due thereon in kind until the maturity date for such Convertible Notes) will increase from shares to shares.

However, if our stockholders do not approve any of the Condition Precedent Proposals at the Special Meeting, then the Company shall commence the Chapter 11 Cases and seek approval to implement the Pre-Packaged Chapter 11 Plan. Under the Pre-Packaged Chapter 11 Plan, the equity interests of our stockholders will be extinguished in their entirety.

Our Board of Directors unanimously recommends that you vote “FOR” each of the FOUR Proposals. If AnY OF THE CONDITION PRECEDENT PROPOSALs IS not approved by OUR stockholders, we will implement the Pre-Packaged Chapter 11 Plan. YOUR VOTE IS IMPORTANT.

We believe that completing the Out of Court Restructuring will allow us to advance the stated objectives of the Company and avoid possible disruptions of our business, additional expenses, and other uncertainties that would result from commencing the Chapter 11 Cases.

The Chapter 11 Cases, even if completed in a timely manner, could have a material adverse effect on our business. Among other things, it is possible that the Chapter 11 Cases could adversely affect our relationships with our key vendors and other third parties. If we cannot maintain such relationships, our viability as a going concern will be threatened. In addition, a bankruptcy proceeding will (i) involve additional expenses, (ii) divert the attention of our management team from the operation of our business, and (iii) likely delay completion of the restructuring transactions contemplated herein.

The foregoing description of the Restructuring Support Agreement, the Out of Court Restructuring, the Pre-Packaged Chapter 11 Plan, and the other transactions contemplated thereby is not complete and is subject to, and qualified in its entirety by reference to, the text of the Restructuring Support Agreement and its exhibits attached hereto as Annex A.

13

PROPOSAL NO. 1 – THE CHARTER AMENDMENT PROPOSAL

Approval of an amendment to our certificate of incorporation to increase the number of authorized shares of our Common Stock from 180,000,000 to 360,000,000

The Proposal

We are proposing to amend our certificate of incorporation to increase the number of authorized shares of our Common Stock from 180,000,000 to 360,000,000.

On December 5, 2023, our Board unanimously adopted a resolution declaring it advisable to amend our certificate of incorporation to increase the number of authorized shares that we have the authority to issue. Our Board directed that this amendment to our certificate of incorporation be submitted to consideration by our stockholders. In the event that our stockholders approve this Proposal, we will file an amendment to our certificate of incorporation with the Secretary of State of the State of Delaware. This amendment will become effective at the close of business on the date the amendment to the certificate of incorporation is accepted for filing by the Secretary of State of the State of Delaware. The amendments are redlined in the proposed Amended and Restated Certificate of Incorporation attached hereto as Annex B.

Our Board believes that it is in our best interest to increase the number of authorized but unissued shares of Common Stock in order to allow the Company to effect the Out of Court Restructuring and still have additional unissued or unreserved shares available for additional capital raising transactions. At , 2023, there were shares of our Common Stock issued and outstanding, and shares of our Common Stock reserved for issuance in connection with options, restricted stock units and other equity-based awards, and the Convertible Notes. The Out of Court Restructuring, if implemented, will require the Company to issue an additional shares of Common Stock to the New Investors and reserve an additional shares of Common Stock for any conversion of the amended Convertible Notes (for an aggregate of shares reserved for conversion).

Required Vote

Approval of this Proposal requires the affirmative vote of a majority of shares present in person or represented by proxy at the meeting and entitled to vote on the matter. Abstentions will have the same effect as a vote against the Charter Amendment Proposal. Brokers are not permitted to vote your shares on this Proposal without your specific instructions. Please provide your broker with voting instructions so that your vote can be counted.

Anti-Takeover Effects

Although the Charter Amendment Proposal is not motivated by anti-takeover concerns and is not considered by the Board to be an anti-takeover measure, the availability of additional authorized shares of Common Stock could enable our Board to issue shares defensively in response to a takeover attempt or to make an attempt to gain control of the Company more difficult or time-consuming. For example, shares of Common Stock could be issued to purchasers who might side with management in opposing a takeover bid which our Board determines is not in the best interests

14

of the Company and its stockholders, thus diluting the ownership and voting rights of the person seeking to obtain control of the Company. In certain circumstances, issuance of shares of our Common Stock without further action by the stockholders may have the effect of delaying or preventing a change of control of the Company, may discourage bids for the Company’s Common Stock at a premium over the market price of the Common Stock, and may adversely affect the market price of the Common Stock. Thus, increasing the authorized number of shares of our Common Stock could render more difficult and less likely a hostile merger, tender offer or proxy contest, assumption of control by a holder of a large block of our stock, and the possible removal of our incumbent management. We are not aware of any proposed attempt to take over the Company or of any attempt to acquire a large block of our Common Stock.

Note that the Charter Amendment Proposal, if approved, will only increase the number of authorized shares and will not alter or modify the rights, privileges or powers of our Common Stock.

Recommendation of our Board of Directors

OUR BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE “FOR” APPROVAL OF proposal no. 1 – THE CHARTER AMENDMENT PROPOSAL.

15

PROPOSAL NO. 2 – THE SECURITIES OFFERING PROPOSAL

Approval of the issuance of additional shares of our Common Stock in a placement to the New Investors

The Proposal

In connection with the closing of the Out of Court Restructuring, the Company will issue up to $35 million of Common Stock at a price per share of $1.025 (the “Securities Offering”) to the New Investors and Bluescape if it exercises its option to participate in the Securities Offering. If each of the Proposals is approved by stockholders and each of the other conditions precedent to such closing as set forth in the Restructuring Support Agreement is either satisfied or waived as provided for therein, the initial closing of the Securities Offering is expected to occur within three (3) business days of the Special Meeting.

Our Common Stock is listed on the Nasdaq Global Select Market and our CDIs are listed on the ASX, and, as such, we are subject to Nasdaq Listing Rules, including Nasdaq Listing Rule 5635, and the ASX Listing Rules.

The issuance of shares of our Common Stock in connection with the Securities Offering implicates certain of the Nasdaq listing standards requiring prior stockholder approval in order to maintain our listing on Nasdaq, as follows:

(i)Nasdaq Listing Rule 5635(b) requires stockholder approval when any issuance or potential issuance will result in a “change of control” of the issuer. Nasdaq may deem a change of control to occur when, as a result of an issuance, an investor or a group would own, or have the right to acquire, 20% or more of the outstanding shares of common stock or voting power and such ownership or voting power of an issuer would be the largest ownership position of the issuer.

For the purposes of this rule, New Investors may be deemed to be the controlling stockholder following the conversion of the Convertible Notes and closing of the Securities Offering. Stockholders should note that a “change of control” as described under Rule 5635(b) applies only with respect to the application of such rule, and does not necessarily constitute a “change of control” for purposes of Delaware law, our organizational documents, or any other purpose.

(ii)Nasdaq Listing Rule 5635(d) requires stockholder approval prior to the issuance of securities in connection with a transaction, other than in a public offering, involving the sale, issuance or potential issuance by us of more than 19.99% (the “Nasdaq 19.99% Cap”) of our outstanding shares of common stock (or securities convertible into common stock) for a price less than the “Minimum Price” (as defined in the Nasdaq Listing Rules) (the “Nasdaq 20% Rule”).

Under the Nasdaq 20% Rule, in no event may we issue shares of our Common Stock in the Securities Offering more than the Nasdaq 19.99% Cap unless (i) we obtain stockholder approval to issue shares of Common Stock in excess of the Nasdaq 19.99% Cap or (ii) the average price of all applicable issuances or sales of Common Stock in

16

the Securities Offering equals or exceeds the lesser of (i) the closing price of our Common Stock immediately prior to the date that the Securities Offering is consummated or (ii) the average closing price of our Common Stock for the five (5) trading days immediately prior to the date on which the Securities Offering is consummated, such that issuances and sales of our Common Stock in the Securities Offering would be exempt from the Nasdaq 19.99% Cap limitation under applicable Nasdaq rules.

The issuance of shares of our Common Stock in connection with the Securities Offering also implicates certain of the ASX Listing Rules. Broadly speaking, and subject to a number of exceptions, ASX Listing Rule 7.1 limits the number of equity securities that a listed entity can issue without the approval of its shareholders over any 12-month period to 15% of the number of fully paid ordinary shares it had on issue at the start of that period. The Securities Offering does not fall within any exceptions and exceeds the 15% limit in ASX Listing Rule 7.1. Approval under ASX Listing Rule 7.1 is therefore required.

If this Proposal is approved, and the Common Stock is issued pursuant to the Securities Offering, such shares of Common Stock will not count towards the Company’s placement capacity for the purposes of ASX Listing Rule 7.1, thereby increasing the Company’s ability to issue additional equity securities without shareholder approval.

We seek your approval of this Proposal in order to satisfy the requirements of the Nasdaq Listing Rule 5635 and ASX Listing Rule 7.1, with respect to the issuance of up to $35 million of shares of our Common Stock in the Securities Offering, in connection with the closing of the Out of Court Restructuring, as described above.

For a further discussion of the reasons for the Out of Court Restructuring, including the Securities Offering that is the subject of this Proposal, see “Background for Our Proposals” above. Note that if the Out of Court Restructuring is not completed and the Pre-Packaged Chapter 11 Plan is implemented, the equity interests of our stockholders will be extinguished.

Additional information required by ASX Listing Rule 7.3

Pursuant to and in accordance with ASX Listing Rule 7.3, the following information is provided in relation to this Proposal:

(i)Up to $35,000,000 of shares of Common Stock will be issued to the New Investors and Bluescape if it exercises its option to participate in the Securities Offering. The New Investors comprises Ascend and 5ECAP, LLC.

Each of the New Investor is not a related party of the Company, any member of the Company’s key management personnel, a substantial holder in the Company or any advisor to the Company (or any of their associates).

The Out of Court Restructuring will significantly dilute the percentage of outstanding stock owned by our current stockholders not part of the New Investors from % (before the restructuring) to %.

17

(ii)The Common Stock is expected to be issued within three (3) business days of the Special Meeting.

(iii)The Common Stock will be issued at a price per share of $1.025, which is equal to 50% of the 5-day VWAP preceding December 5, 2023, the date of the public announcement of the proposed Out of Court Restructuring.

(iv)Funds raised from the issue of the Common Stock will be used to strengthen the Company’s balance sheet, fund the Company’s next phase of growth, and commence operations.

(v)The Common Stock will be issued as part of the Out of Court Restructuring. For a further discussion of the reasons for the Out of Court Restructuring, including the Securities Offering that is the subject of this Proposal No. 2, see “Background for Our Proposals” above and the Restructuring Support Agreement, a copy of which is attached hereto as Annex A.

(vi)A voting exclusion applies to this Proposal as set out in the “General Information” section above.

No Preemptive Rights

Our stockholders do not have a preemptive right to purchase or subscribe for any part of any new or additional issuance of our securities.

Consequences of Not Approving this Proposal

If this Proposal is not approved, the Out of Court Restructuring will not proceed, the Common Stock the subject of the Securities Offering will not be issued and the Pre-Packaged Chapter 11 Plan (as summarized in the “Background for Our Proposals” section above) will be implemented and the equity interests of our stockholders will be extinguished.

Required Vote

The Securities Offering Proposal is conditioned on the approval of each of the Condition Precedent Proposals at the Special Meeting.

Approval of this Proposal requires the affirmative vote of a majority of shares present in person or represented by proxy at the meeting and entitled to vote on the matter. Abstentions will have the same effect as a vote against the Securities Offering Proposal. Brokers are not permitted to vote your shares on this Proposal without your specific instructions. Please provide your broker with voting instructions so that your vote can be counted.

Recommendation of our Board of Directors

OUR BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE “FOR” APPROVAL OF proposal no. 2 – THE SECURITIES OFFERING PROPOSAL.

18

PROPOSAL NO. 3 – THE CONVERTIBLE NOTES PROPOSAL

Approval of the issuance of additional shares of our Common Stock upon conversion of the Convertible Notes in connection with an amendment to such Convertible Notes

The Proposal

In connection with the closing of the Out of Court Restructuring, the Company will amend and restate the Note Purchase Agreement (the “Amended and Restated Note Purchase Agreement”), which, among other things, amends the conversion rate and thereby increases the number of shares of our Common Stock into which the Convertible Notes are convertible.

Our Common Stock is listed on the Nasdaq Global Select Market and our CDIs are listed on the ASX, and, as such, we are subject to Nasdaq Listing Rules, including Nasdaq Listing Rule 5635, and the ASX Listing Rules.

The issuance of shares of our Common Stock in connection with the Amended and Restated Note Purchase Agreement and the Convertible Notes implicates certain of the Nasdaq listing standards requiring prior stockholder approval in order to maintain our listing on Nasdaq, as follows:

(i)Nasdaq Listing Rule 5635(b) requires stockholder approval when any issuance or potential issuance will result in a “change of control” of the issuer. Nasdaq may deem a change of control to occur when, as a result of an issuance, an investor or a group would own, or have the right to acquire, 20% or more of the outstanding shares of common stock or voting power and such ownership or voting power of an issuer would be the largest ownership position of the issuer.

For the purposes of this rule, Bluescape may be deemed to be the controlling stockholder following the conversion of the Convertible Notes and/or New Investors may be deemed to be the controlling stockholder following the conversion of the Convertible Notes and closing of the Securities Offering. Stockholders should note that a “change of control” as described under Rule 5635(b) applies only with respect to the application of such rule, and does not necessarily constitute a “change of control” for purposes of Delaware law, our organizational documents, or any other purpose.

(ii)Nasdaq Listing Rule 5635(d) requires stockholder approval prior to the issuance of securities in connection with a transaction, other than in a public offering, involving the sale, issuance or potential issuance by us of more than 19.99% of our outstanding shares of common stock (or securities convertible into common stock) for a price less than the “Minimum Price” in accordance with the Nasdaq 20% Rule.

Under the Nasdaq 20% Rule, in no event may we issue shares of our Common Stock in the Securities Offering or upon conversion of the Convertible Notes under the Amended and Restated Note Purchase Agreement more than the Nasdaq 19.99% Cap unless (i) we obtain stockholder approval to issue shares of Common Stock in excess of the

19

Nasdaq 19.99% Cap or (ii) the average price of all applicable issuances or sales of Common Stock in the Securities Offering or upon conversion of the Convertible Notes under the Amended and Restated Note Purchase Agreement equals or exceeds the lesser of (i) the closing price of our Common Stock immediately prior to the date that the Amended and Restated Note Purchase Agreement is executed or (ii) the average closing price of our Common Stock for the five (5) trading days immediately prior to the date on which the Amended and Restated Note Purchase Agreement is executed, such that issuances and sales of our Common Stock upon conversion of the Convertible Notes under the Amended and Restated Note Purchase Agreement would be exempt from the Nasdaq 19.99% Cap limitation under applicable Nasdaq rules. In any event, the Amended and Restated Note Purchase Agreement specifically provides that we may not issue or sell any shares of our Common Stock under the Amended and Restated Note Purchase Agreement if such issuance or sale would breach any applicable Nasdaq rules.

The issuance of shares of our Common Stock in connection with the Amended and Restated Note Purchase Agreement and the Convertible Notes also implicates certain of the ASX Listing Rules. Broadly speaking, and subject to a number of exceptions, ASX Listing Rule 7.1 limits the number of equity securities that a listed entity can issue without the approval of its stockholders over any 12-month period to 15% of the number of fully paid ordinary shares it had on issue at the start of that period. The issue of shares of Common Stock on conversion of the Convertible Notes does not fall within any exceptions and will exceed the 15% limit in ASX Listing Rule 7.1. Approval under ASX Listing Rule 7.1. is therefore required.

If this Proposal is approved, the Convertible Notes (and the additional shares of our Common Stock issued upon conversion of the Convertible Notes in connection with the amendment to such Convertible Notes) will not count towards the Company’s placement capacity for the purposes of ASX Listing Rule 7.1, thereby increasing the Company’s ability to issue additional equity securities without stockholder approval.

Approval was obtained at the Company’s Annual General Meeting held on April 27, 2023, for the purposes of ASX Listing Rule 7.4, for the issuance of up to a maximum of 4,581,534 shares of Common Stock on conversion of the Convertible Notes (including Common Stock that may be issued on conversion if the Company elects to pay interest in kind). Given the nature of the amendments proposed to be made to the Convertible Notes, we seek your approval of this Proposal in order to satisfy the requirements of the Nasdaq Listing Rule 5635 and ASX Listing Rule 7.1, with respect to the issuance of additional shares of Common Stock upon conversion of the Convertible Notes issued pursuant to the Amended and Restated Note Purchase Agreement, in connection with the closing of the Out of Court Restructuring, as described above.

For a further discussion of the reasons for the Out of Court Restructuring, including the Amended and Restated Note Purchase Agreement that is the subject of this Proposal, see “Background for Our Proposals” above. Note that if the Out of Court Restructuring is not completed and the Pre-Packaged Chapter 11 Plan is implemented, the equity interests of our stockholders will be extinguished.

20

Additional information required by ASX Listing Rule 7.3

Pursuant to and in accordance with ASX Listing Rule 7.3, the following information is provided in relation to this Proposal:

(i)The Convertible Notes are currently held by Bluescape. However, upon implementation of the Out of Court Restructuring, fifty percent (50%) of the outstanding notional amount of the Convertible Notes will be acquired by Ascend and 5ECAP Debt, LLC from Bluescape.

Ascend and 5ECAP Debt, LLC is not a related party of the Company, a member of the Company’s key management personnel, a substantial holder in the Company or an advisor to the Company (or any of their associates).

(ii)shares of Common Stock will be issued on the conversion of the Convertible Notes. Additional Common Stock, up to a maximum of shares of Common Stock (representing approximately % of our current outstanding stock and a % increase as compared to the previous maximum of 4,581,534 shares of Common Stock) may be issued on conversion of the Convertible Notes if the Company elects to pay interest in kind.

There are 63,561 Convertible Notes currently on issue (each with a face value of $1,000). No additional Convertible Notes will be issued as a result of this Proposal.

The issue of Common Stock on conversion of the Convertible Notes will significantly dilute the percentage of outstanding stock owned by our stockholders who do not hold Convertible Notes.

(iii)The closing of the amendment and assignment of the Convertible Notes, including the conversion rate adjustment, is expected to occur within three (3) business days of the Special Meeting.

(iv)If the Out of Court Restructuring becomes effective, it will not result in the issuance of any additional Convertible Notes, and no additional funds will be raised. Rather, the terms of the existing Convertible Notes will be amended as outlined above.

(v)All of the proposed amendments to the Convertible Notes are summarized above, and a copy of the Restructuring Support Agreement is attached hereto as Annex A.

The amendment and assignment of the Convertible Notes will be made as part of the Out of Court Restructuring. For a further discussion of the reasons for the Out of Court Restructuring, including the amendments to the Convertible Notes that is the subject of this Proposal No. 3, see “Background for Our Proposals” above.

(vi)A voting exclusion applies to this Proposal as set out in the “General Information” section above.

21

Consequences of Not Approving this Proposal

If this Proposal is not approved, the Out of Court Restructuring will not proceed, the Convertible Notes will not be amended, and the Pre-Packaged Chapter 11 Plan (as summarized in the “Background for Our Proposals” section above) will be implemented.

Required Vote

The Convertible Notes Proposal is conditioned on the approval of each of the Condition Precedent Proposals at the Special Meeting.

Approval of this Proposal requires the affirmative vote of a majority of shares present in person or represented by proxy at the meeting and entitled to vote on the matter. Abstentions will have the same effect as a vote against the Convertible Notes Proposal. Brokers are not permitted to vote your shares on this Proposal without your specific instructions. Please provide your broker with voting instructions so that your vote can be counted.

Recommendation of our Board of Directors

OUR BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE “FOR” APPROVAL OF PROPOSAL NO. 3 - THE CONVERTIBLE NOTES PROPOSAL.

22

PROPOSAL NO. 4 – THE ADJOURNMENT PROPOSAL

Approval to authorize our Board of Directors to adjourn and postpone the Special Meeting

The Proposal

If holders of a majority in voting power of the shares of the Company entitled to vote at the Special Meeting are not present at the Special Meeting, in person or represented by proxy, or if one or more of the Proposals fails to receive the requisite votes in favor of such Proposal, then our Board intends to move to adjourn and postpone the Special Meeting to a later date or dates, if necessary, to enable our Board to solicit additional proxies. In that event, we will ask the Company’s stockholders to vote only upon the adjournment and postponement of the Special Meeting, as described in this Proposal, and not any of the other Proposals.

We seek your approval of this Proposal to grant discretionary authority to the holder of any proxy solicited by our Board so that such holder can vote in favor of this Proposal to adjourn and postpone the Special Meeting to a later date or dates, if necessary, so that our Board can solicit additional proxies. If you approve this Proposal, then we could adjourn the Special Meeting, and any adjourned session of the Special Meeting, and use the additional time to solicit additional proxies, including the solicitation of proxies from stockholders who have previously voted. Among other things, approval of this Proposal could mean that, even if we had received proxies representing a sufficient number of votes against any of the Proposals to defeat the proposal, we could adjourn the Special Meeting without a vote and seek to convince the holders of those shares to change their votes in favor of such Proposals.

Generally, if the Special Meeting is adjourned, no notice of the adjourned meeting is required to be given to stockholders, other than the announcement at the Special Meeting of the place, date and time to which the meeting is adjourned. However, the Company’s Bylaws provide that if the adjournment or adjournments are for more than 30 days, or if after adjournment a new record date is fixed for the adjourned meeting, a notice of the adjourned meeting will be given to each stockholder of record entitled to vote at the adjourned meeting.

Consequences of Not Approving this Proposal

If this Proposal is presented to the Special Meeting and is not approved by our stockholders, our Board may not be able to adjourn the Special Meeting to a later date or dates, if necessary or appropriate, to permit further solicitation of proxies in the event that there are insufficient votes for, or otherwise in connection with, the approval of any of the Condition Precedent Proposals. In such event, the Out of Court Restructuring would not be completed, and the Pre-Packaged Chapter 11 Plan will be implemented and the equity interests of our stockholders will be extinguished.

23

Required Vote

Approval of this Proposal requires the affirmative vote of a majority of shares present in person or represented by proxy at the meeting and entitled to vote on the matter. Abstentions will have the same effect as a vote against the Adjournment Proposal. Brokers are not permitted to vote your shares on this Proposal without your specific instructions. Please provide your broker with voting instructions so that your vote can be counted.

Recommendation of our Board of Directors

OUR Board of Directors recommends that you vote “for” approval of PROPOSAL NO. 4 – the Adjournment Proposal.

24

SECURITY OWNERSHIP

The following table sets forth information as of November 29, 2023 with regard to the beneficial ownership of our Common Stock by (1) each of our stockholders who is known to be a beneficial owner of more than 5% of our Common Stock, (2) our directors and (3) all of our current executive officers and directors as a group. Unless otherwise indicated, all of such stock is owned directly, and the indicated person or entity has sole voting and investment power.

| | | | | | |

Name and Address(1) | | Number of Shares Beneficially Owned(2) | | | Percent of Class(3) |

Stockholders owning 5% or more: | | | | | |

Virtova Capital Management Limited(4)

Room 1104, Crawford House, 70 Queen Road Central

Central, Hong Kong, SAR | | | 5,128,206 | | | 11.59% |

Atlas Precious Metals Inc.(5)

100 King Street, W#1600

Toronto, Ontario, M5X1G5, Canada | | | 4,092,000 | | | 9.25% |

Mayfair Ventures Pte Ltd(6)

62 Ubi Road 1

02-01 Oxley Bizhub 2, Singapore, 408734 | | | 3,563,954 | | | 8.06% |

BEP Special Situations IV LLC(7)

300 Crescent Court, Suite 1860

Dallas, TX 75201 | | | 3,674,638 | | | 8.31% |

Directors: | | | | | |

David Salisbury | | | 217,387 | | | * |

Stephen Hunt(8) | | | 145,131 | | | * |

H. Keith Jennings | | | 6,229 | | | * |

Sen Ming (Jimmy) Lim(9) | | | 5,135,189 | | | 11.61% |

Graham van’t Hoff | | | 9,591 | | | * |

Executive Officers: | | | | | |

Susan Brennan | | — | | | * |

Paul Weibel | | | 168,983 | | | * |

All directors and named executive officers

as a group (seven persons): | | | 5,682,510 | | | 12.85% |

*Represents beneficial ownership of less than 1% of the outstanding shares of our Common Stock. |

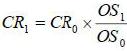

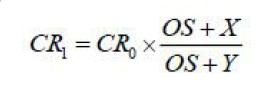

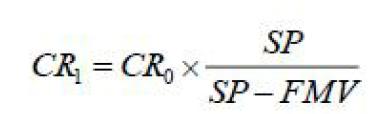

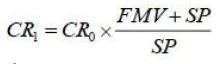

(1)Unless otherwise indicated, the address of each beneficial owner is c/o 5E Advanced Materials, Inc., 9329 Mariposa Road, Suite 210, Hesperia, CA 92344.